Abstract

We introduce an approach to trace the genesis of contagion occurring in the oil-finance nexus, which consolidates veteran non-linear oil price measures derived from the empirical oil literature, to construct a rule-based specification for filtering structural oil market shocks into calm and extreme episodes. Such identified conditions are useful to understand how changing scenarios in the international crude oil market influence the dynamic relationships between the crude oil, exchange rate, and stock markets. As we are the first to explicitly consider how the relationship between the exchange rate and stock market change under extreme oil market shocks, our applications to a small emerging oil-exporter provide novel results about this particular linkage. We find that the positive supply shocks and negative demand shocks associated with the 2014/2015 oil price crash coincide with a marked increase in the inverse exchange rate-stock market relationship. This highlights the importance of including exchange rates when analysing the dependence between oil and stock markets. Our results also show that international financial crises, such as the Asian flu and dot-com crash, are episodes of contagion in an otherwise weak oil-stock market relationship. In addition, we provide findings which are consistent with previous empirical literature that extreme demand-side oil market shocks tend to dominate the absolute increase in cross-market linkages and that the 2008/2009 global financial crisis is the most prominent contemporary event in the oil-finance nexus in a pre-COVID-19 world.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

JEL Classification

1 Introduction

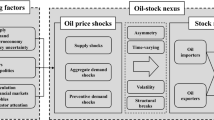

In this chapter, we posit a novel approach for tracing the sources of extreme oil market shocks to assess whether changing conditions in the international crude oil market can characterise changes in the relationships between oil, exchange rates, and the stock market. The origins of extreme shocks matter because there is convincing empirical evidence suggesting that different types of oil market shocks have different consequences for financial markets (see, e.g., Basher et al., 2018; Güntner, 2014; Kang et al., 2015b; Kilian & Park, 2009). A principal innovation of our procedure is a new rule-based specification to classify supply and demand shocks in the international crude oil market into relatively calm and extreme shock episodes. This specification consolidates non-linear oil price measures in the empirical oil economics literature to identify the most profound movements in oil market shocks over the preceding year (see, e.g., Hamilton, 1996) and deviations in oil market shocks which reside outside a normal range (see, e.g., Akram, 2004), given that such crude oil market episodes are considered to be the most consequential to the economy. Our procedure is also flexible to further filter extreme oil market shocks into positive and negative states, which facilitates the detection of asymmetric behaviours in market relationships during extreme times.

To identify the extreme shocks, the rules are applied to an off-the-shelf method to disentangle structural (i) oil supply, (ii) global aggregate demand, and (iii) oil-specific demand innovations in the international oil market. In particular, we use the structural vector autoregression (SVAR) model suggested in Kilian (2009). The identification of discrete calm and extreme conditions can be useful to understand the genesis of oil market contagion. Contagion characterises the intermittent marked increase in cross-market linkages which occur in the wake of a shock to one market, whereas interdependence refers to consistent co-movement between markets under pre- and post-shock conditions (Forbes & Rigobon, 2002). The idea behind contagion analysis is that closely linked markets are more vulnerable as negative shocks are able to propagate and proliferate more in these markets than in weakly associated markets (Kritzman et al., 2011). Energy contagion, which is pertinent to countries whose financial and macroeconomic fate are tied to hard commodity prices, refers to the deepening of energy-finance linkages under crisis periods in energy markets (Mahadeo et al., 2019).

We demonstrate the usefulness of our novel procedure by reappraising the energy contagion analysis of Mahadeo et al. (2019), who examine how the relationship between the international crude oil market and the exchange rate and stock market indices of the small open petroleum economy of Trinidad and Tobago change under oil market crises. Wang et al. (2013) argues that the relative influence of oil market shocks is based on the degree of importance of oil to national economy. Trinidad and Tobago provides an appropriate case for contagion analysis when the crude oil market is the source of adverse shocks: small open economies are particularly vulnerable to developments in the international oil market (Abeysinghe, 2001); and small resource-rich economies have a documented legacy of underachievement relative to both their larger counterparts and small resource-poor countries (see Auty, 2017 and references therein).

In addition to using our rule-based specification, we also extend the work of Mahadeo et al. (2019) by considering time-varying rather than static relationships in the oil-finance nexus. As contagion is a phenomenon which appears and disappears relatively quick, we are able to evaluate whether there is additional evidence of contagion that can be diluted in a static correlation analysis. Filis et al. (2011) use a dynamic conditional correlation (DCC) model and examine how the oil-stock market correlations for a selection of countries change during momentous episodes in the crude oil market collated from Kilian (2009) and Hamilton (2009a, 2009b). We estimate a DCC model not only to acquire the time-varying oil-stock market relationship like Filis et al. (2011), but by including exchange rates we are able to also obtain the oil-exchange rate and the exchange rate-stock market relationships. Such an inclusion is important because little is still known about the dynamic relationship between oil prices, exchange rates, and emerging market stock prices (Basher et al., 2012), in spite of the relevance of such variables in financial stabilisation policies. In fact, recent evidence suggests that exchange rates have been found to be the most significant macroeconomic fundamental in the transmission channel of oil prices on the stock market in emerging markets (see, e.g., Wei et al., 2019). Indeed, it is crucial to understand the dependence structure between several variables interacting simultaneously, since essential omissions provide incomplete information (Aloui & Aïssa, 2016), potentially misleading policymakers.

Hence, another original contribution of our work is that we are the first to explicitly consider how the exchange rate-stock market relationship evolves under alternative global crude oil market conditions. The trade flow-oriented model characterises the influence exchange rates can have on the stock market, while the portfolio balance approach establishes that stock prices affect exchange rates (see Chkili & Nguyen, 2014) and references therein), and the correlation between these two variables can be either positive or negative (Tang & Yao, 2018). Lin (2012) finds that exchange rate and stock price relationship increases during crisis episodes in comparison to tranquil periods, which is consistent with contagion between financial asset classes.

The economic significance of the oil-stock market relationship is well-established in the energy-finance literature given the impact oil price changes have on costing associated with consumption and investment, which are factors affecting stock returns. Furthermore, because stock prices are assumed to reflect all available market information, the oil-stock market relationship is considered to be a high-frequency data proxy for the oil-macroeconomy connection. Although there is no consensus on whether the relationship between oil price shocks and aggregate stock returns are positive or negative (Chen et al., 2014), a reasonable assumption held is that oil price shocks create uncertainty for firms which is reflected in higher stock market volatility (Degiannakis et al., 2018b). In particular, many studies find that oil price increases due to oil demand shocks are positive news for markets, while oil price increases due to oil supply shocks hurt the real and financial sectors (Cheema & Scrimgeour, 2019). In the case of oil-exporting economies, the empirical evidence suggests that the sign and magnitude of responses to oil market shocks are country-specific (Basher et al., 2018).

While the importance of the oil-exchange rate relationship is also well-known, how the different types of extreme crude oil market shocks influence this correlation remains unexplored. The oil-exchange rate linkage has implications for the international competitiveness of an oil-exporter via the wealth effects (see, inter alia, Basher et al., 2016; Bjørnland, 2009) and Dutch disease (see, inter alia, Corden, 1984, 2012) channels. Both such channels detail the mechanisms by which oil price increases lead to exchange rate appreciations for oil-exporters, making their exports (imports) more expensive (cheaper).

Comparing our results with Mahadeo et al. (2019), we are able to highlight the further insights gained from employing our innovative rule-based specification for filtering oil market shocks into discrete calm and extreme scenarios, as well as using dynamic rather than static correlations. Our results for the relationship between the crude oil market and the stock market of Trinidad and Tobago serve as an example. Static correlation analysis shows that this is a relatively weak relationship but dynamic correlations reveal that this market linkage strengthens intermittently during international financial crises events, such as the late 1990s Asian flu, the crash of the internet bubble in the early 2000s, and the 2008/2009 global financial crisis. Furthermore, our rule-based specification shows that, from disentangling oil market shocks and classifying them into calm and extreme conditions, it is demand-side rather than supply-side shocks which are more relevant to this small open energy economy.

The rest of this chapter is organised as follows: Sect. 5.2 details the methodology and data; Sect. 5.3 is devoted to the empirical applications; and conclusions are presented in Sect. 5.4.

2 Methods and Data

Our empirical procedures can be outlined in three parts. In the first part, we estimate global oil market shocks with a recursive SVAR model and, using our novel rule-based specification, we classify these shocks into relatively calm and extreme episodes. We also decompose crude oil prices into bull and bear market phases, similar to Mahadeo et al. (2019), to determine which extreme oil market shocks dominate periods of rising and falling oil prices. Using such a complementary tool provides a fresh way of conveying which extreme oil market shocks have tended to dominate historical booms and busts in crude oil prices.

For the second part, we estimate a DCC model to obtain three pairs of dynamic financial correlations: the oil-exchange rate, the oil-stock market, and the exchange rate-stock market relationships.

In the third part, we compare how the dynamic correlations change under these calm versus extreme and bull versus bear conditions in the crude oil market. This is accomplished by both qualitative (graphical) and quantitative (statistical) analysis of the correlations during these alternative oil market conditions.

There are a number of reasons why the contemporaneous nature of the time-varying correlations is appropriate for our analysis. First, contagion tends to appear and vanish quickly unlike interdependence and cointegrating relationships which are maintained over a much longer horizon (Reboredo et al., 2014). Second, stock prices absorb all available information relatively instantaneously including developments in international oil markets (Bjørnland, 2009), particularly in oil-dependent economies (Wang et al., 2013). Third, crude oil is mainly indexed in US dollars (Kayalar et al., 2017), implying that this commodity is likely to be affected by movements in this currency (Zhang et al., 2008). At the same time, currency markets are one of the most liquid classes of financial assets and the Trinidad and Tobago dollar is anchored to the US dollar. As such, the oil-exchange rate relationship is expected to promptly adjust to reflect the changes in this common factor.

The period under investigation is January 1996 to August 2017.Footnote 1 At each step of our methodology, we explain the data required and their respective descriptions, sources, and transformations. All data are monthly, primarily because the approach for identifying the structural oil market shocks is based on delay restrictions which are only economically plausible at this frequency (see Kilian, 2009).

2.1 Identifying Discrete Oil Market Conditions

The two complementary rule-based approaches to identify discrete oil market conditions are subsequently detailed.

2.1.1 Discrete Calm and Extreme Oil Market Shock Conditions from a Global Oil Market SVAR Model

We derive oil supply, global aggregate demand, and oil-specific demand shocks from an international oil market SVAR model postulated in Kilian (2009). This step requires monthly data from January 1994 to August 2017 on the growth rate in global oil production, which we proxy with the per cent change in world petroleum productionFootnote 2; a Kilian (2019) correction of the global index of real economic activity introduced in Kilian (2009)Footnote 3; and the log of real oil prices calculated from the European Brent crude oil spot prices deflated using the US CPI.Footnote 4 Equation (5.1) gives the Kilian (2009) SVAR representation:

where \(\varepsilon _{t}\) is a vector of serially and mutually uncorrelated structural errors; and \(A^{-1}_0\) is recursively identified so that the reduced-form errors \(e_t\) are linear combinations of the structural errors of the form \(e_t=A^{-1}_0\varepsilon _{t}\), as described in Eq. (5.2). Consistent with the empirical literature, we use a lag length of 24 months to remove residual autocorrelation and account for the possibility of delays in adjusting to shocks in the international oil market (see Kang et al., 2015a; Kilian & Park, 2009 and references therein).

The identification strategy of the SVAR assumes a vertical short-run oil supply curve. This indicates that demand innovations in the oil market are contemporaneously restricted from affecting oil supply, as implied by the zeros imposed in the \(a_{12}\) and \(a_{13}\) positions of the \(A^{-1}_0\) matrix in Eq. (5.2). Kilian (2009) argues that such a specification is reasonable, as the cost associated with adjusting oil production disincentivises oil-producers to adjust to high-frequency demand shocks. Further, aggregate demand shocks are innovations to global real activity unexplained by oil supply shocks. Another zero restriction is imposed in the position of \(a_{23}\) to delay real oil prices from affecting the aggregate demand within the same month. Lastly, oil-specific demand shocks are the unexplained innovations to the real price of oil after oil supply and aggregate demand shocks have been accounted for.

Subsequently, to classify each of the structural oil market shocks into calm and extreme disturbances, we propose a new discrete rule-based specification which consolidates two veteran measures for identifying extreme oil prices: outlier oil prices outside a normal range and net oil price increases over the preceding year. Regarding the former measure, the idea that oil prices are important if found to be atypically high or low stems from the work of Akram (2004), who constructs extrema bands based on a normal range of oil prices with lower and upper bounds of USD 14 to USD 20, respectively, where values within the band are forced to zero and values outside the band are retained. Akram (2004) and Bjørnland (2009) use this oil price band to investigate the asymmetric effects extreme oil price changes have on the Norwegian exchange rate and stock market, respectively. However, this range is an artefact of oil price behaviour during the 1990s and much has changed since this period with unprecedented oil booms and busts characterising the twenty-first-century energy markets. Therefore, we augment this approach by using the standard deviation value of the three structural oil market shocks to determine the maximum and minimum values of the band.

On the other hand, the net oil price increases measure is proposed by Hamilton (1996) as an extension of the positive and negative oil price transformation suggested in Mork (1989), in an effort to preserve the empirical importance of oil prices in the US macroeconomy. The net oil price increases measure compares the current growth rate in the price of oil with the rate over the preceding year and censors the current observation if it does not exceed the values observed over that period. It is straightforward to extend this approach beyond oil prices to consider net increases from all oil market shocks. We also invert this approach to also allow for net oil market shock decreases, which are also expected to have influential implications if, for instance, a small energy-exporting economy is being considered as is the case here.

We combine these rules to filter the oil market shocks into discrete calm and extreme oil market conditions defined in Eq. (5.3):

where i represents the oil supply, global aggregate demand, or oil-specific demand shocks derived from the oil market SVAR model. In the first rule, \(\sigma \) is the standard deviation of the structural shocks, which is equal to 0.850 across all structural oil market shocks. Any value outside this standard deviation band is characterised as an extreme shock. The second and third rules correspondingly detect the presence of net oil price positive increases and negative decreases over the previous 12 months. To acquire the extreme positive and negative oil market shocks, from the rule-based specification described by Eq. (5.3), involves a further filtering of all periods identified as 1 into episodes where \(\varepsilon _{i,t}>0\) and \(\varepsilon _{i,t}<0\), respectively. Considering both symmetric or asymmetric movements in the crude oil market are especially useful, given that the conclusions in applied studies tend to vary depending on which has been used (Degiannakis et al., 2018a). The months which are consistently identified as 0 by the rule-based specification in Eq. (5.3), across all three structural oil market shocks, form a relatively calm sample. Such a common calm sample is useful for identifying periods to compare how financial returns and the relationships between returns behave in calm times (0) to periods otherwise identified as extreme (1).

2.1.2 Classifying Bull and Bear Oil Market Phases

Much of the literature has been devoted to debating and testing the asymmetric effects of oil prices (see, inter alia, Kilian & Vigfusson, 2011a, 2011b; Cheema & Scrimgeour, 2019). A novel and interesting way to consider this issue in energy contagion analysis is with bull and bear market phases, which captures an environment when oil prices are increasing or decreasing, respectively (Mahadeo et al., 2019). Rule-based algorithms are more appropriate for in-sample identification of bear and bull market states than Markov-switching models (Kole & Dijk, 2017). We use the Pagan and Sossounov (2003) semi-parametric rule-based algorithm to identify bull and bear oil market phases, as it is one of the most popular of such approaches (Hanna, 2018). Hence, we are able to test whether an environment where oil prices are increasing influences the relationships between oil and financial variables differently when compared to a period of decreasing oil prices. An auxiliary benefit of using this procedure is that it permits us to see which types of extreme oil market shocks dominate the historical bear phases in the crude oil market over the time period under investigation.

Phases in the Pagan and Sossounov (2003) algorithm are determined based on maxima and minima in real crude oil prices with the application of various rules. A peak (trough) is based on whether the oil price in month t is above (below) other months within the interval \(t-\tau _{window}\) and \(t+\tau _{window}\). Furthermore, the turning points which trigger a switch between phases are restricted with minimum duration rules. For instance, a cycle cannot be less than 16 months and a phase cannot be less than 4 months. Additionally, a censor (\(\tau _{censor}\)) prevents extrema values towards the end of the interval from distorting the identification of market states. Moreover, the minimum duration rule is overruled if the real oil price increase or decrease is larger than 20%, which initiates a change in the market phase. We set \(\tau _{window}=8\) months and \(\tau _{censor}=6\) months, which are feasible combinations given in Pagan and Sossounov (2003). We subsequently acquire an oil price dummy variable where bear (bull) phases are coded as 1 (0).

2.2 Estimating Oil-Finance Dynamic Correlations

We specify a DCC model to obtain the three pairs of time-varying correlations between oil, exchange rate, and stock returns. The DCC model uses oil market data, as well as exchange rate and stock market indicators for Trinidad and Tobago. For crude oil prices, we again use European Brent crude oil prices in constant 2010 US dollars from the preceding section. For the exchange rate indicator we use the real effective exchange rate (REER),Footnote 5 where a rise (fall) in this index implies currency appreciation (depreciation). We also use real stock prices, which are represented by the Trinidad and Tobago Stock Exchange (TTSE) Composite Stock Price Index (CSPI) adjusted for inflation, with a 2010 base year, using the RPI.Footnote 6 These three variables are first expressed as returns.Footnote 7 In order to avoid the issue of omission of relevant variables (see, e.g., Rigobon, 2019), we pre-filter the return series before approaching the DCC model. Following Mahadeo et al. (2019), we work with residuals (\(\varepsilon _t\)) from Eqs. (5.4), (5.5), and (5.6), respectively, as our adjusted returns net of market fundamental. Our specifications for these regressions are motivated by the plausible assumption that a frontier market such as Trinidad and Tobago is a price-taker with respect to crude oil market, where prices are internationally determined. Hence, the single equation regression in Eq. (5.4) is used to obtain adjusted oil returns:

where \(\Delta \ln BR_t\) are real Brent crude oil returns, \(\gamma _0\) is a constant, \(\Delta \ln BR_{t-1}\) is the lag of the real Brent crude oil returns, and \(USIR_{t-1}\) are interest rates for the US. SBIC suggests an optimal lag length of 1 month and the LM test shows no statistically significant serial correlation in the residuals.

A VAR model, which includes exogenous regressors, is used to adjust exchange rates and stock returns for Trinidad and Tobago in order to appropriately treat with domestic endogenous and foreign exogenous variables. Therefore, we work with the residuals from Eqs. (5.5) and (5.6) to take market fundamentals into account for these two series:

where \(\Delta \ln REER_t\) is the REER returns, \(\Delta \ln TTSR_t\) are Trinidad and Tobago stock market returns, \(TTIR_{t-1}\) is a domestic interest rate variable for Trinidad and Tobago, along with exogenous variables for oil returns (\(\Delta \ln BR_{t-1}\)) and US interest rates (\(USIR_{t-1}\)). SBIC suggests a 1 month optimal lag length for the VAR system and a LM test shows no evidence of autocorrelation in the residuals.

In line with the contagion literature, interest rates are included in Eqs. (5.4), (5.5), and (5.6) to ensure returns are net of market fundamentals (see, inter alia, Forbes & Rigobon, 2002; Fry et al., 2010). To these ends, we use US shadow short rates as a foreign interest rate measure relevant to this small-island economy. US shadow short rates adjusts the conventional policy rate to accommodate for unconventional monetary authority actions characterising much of the post 2008/2009 global financial crisis era (see Krippner, 2016). The commercial banking median basic prime lending rate is used to account for activity from the real and financial sectors, as well as the policy environment in Trinidad and Tobago. Additionally, we allow exchange rate and stock returns to enter each other’s regression functions endogenously to account for possible lead-lag effects.

The DCC estimation consists of a two-step process. Step 1 involves the estimation of univariate generalised autoregressive conditional heteroskedastic (GARCH) processes for all three adjusted returns. Step 2 uses the residuals from the first stage to estimate the three pairs of conditional correlations between these three variables.

In step 1, we aim to optimally estimate each individual return series. Due to the pre-filtering of the data, the mean equation for each return series (\(r_t\)) takes the form of a constant only, as no autoregressive terms are necessary, as defined in Eq. (5.7):

To estimate the conditional variances, we commence with the parsimonious GARCH(1,1) process given by Eq. (5.8) for each series:

where \(\omega _0\) is the intercept of the variance, \(\epsilon _t\) are ARCH innovations with a conditional distribution that has a time-dependent variance \(h_t\), and \(h_{t-1}\) are lags of the conditional variance. Further, \(\epsilon _t\) follows the Student’s t-distribution and the solver used is a non-linear optimisation with augmented Lagrange method. The GARCH(1,1) models for all returns are stable in variance as the condition \(\alpha +\beta < 1\) is met (see Table 5.2). Additionally, the Ljung-Box and ARCH Lagrange multiplier (LM) tests indicate no concerns regarding autocorrelation and ARCH effects, respectively, in the residuals of the GARCH(1,1) specification for all three returns. Moreover, Engle and Ng (1993) sign bias tests provide no substantive evidence of asymmetric responses to positive and negative news in the three financial returns.Footnote 8 Hence, the parsimonious univariate GARCH(1,1) process is an optimal representation of the conditional variance for each return series.

Step 2 of the DCC model follows Engle (2002). The k x k conditional covariance matrix of returns, \(H_t\), is decomposed as:

where \(D_t\) are the standard deviation diagonal matrices derived from the GARCH(1,1) models suggested in Eq. (5.8) and \(P_t\) is the correlation evolution of the (possible) time-varying correlation matrix which takes the form:

where \(Q_t\) defined in Eq. (5.11) is a symmetric positive definite matrix whose elements follow the GARCH(1,1) specified in Eq. (5.8):

where S is the unconditional correlations matrix, and the adjustment parameters \(\lambda _{1}\) and \(\lambda _{2}\) are time-invariant non-negative scalar coefficients related to the exponential smoothing process that is used to construct the dynamic conditional correlations. The constraint \(\lambda _{1} + \lambda _{2} < 1\) indicates that the process is stationary. Finally, the time-varying correlations are estimated by:

2.3 Comparing Dynamic Correlations by Oil Market Conditions

Using the discrete oil market conditions identified with the rule-based specifications and the time-varying correlations obtained from the DCC model, it becomes straightforward to perform oil market contagion analysis. We offer complementary qualitative and quantitative perspectives for this purpose. The qualitative approach involves a visual analysis of the extreme oil market shocks and bear phases in the oil market superimposed onto the dynamic correlations. Such graphics are useful for contagion analysis as they can reveal the oil market conditions that tend to characterise any potential marked increases in the correlations, fully embracing the time-varying feature of the relationships, without having to average the correlation values over extreme conditions as this can dilute a crisis.

For a quantitative contagion test, we use the Welch (1947) two-sample t-test to compare the equality of means for the three pairs of market correlations under the relatively calm periods versus extreme structural oil market shock conditions, and bullish versus bearish oil market phases. Welch’s t-test has desirable properties over the Student’s t-test when comparing the equality of means between two samples. In particular, the former is robust to unequal variances and unequal sample sizes relative to the latter, reducing the incidence of a Type I error (Fagerland & Sandvik, 2009).

3 Application to the International Crude Oil Market and a Small Oil-Exporter

3.1 Discrete Calm and Extreme Oil Market Conditions

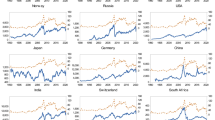

In Fig. 5.1, the blue dots show the extreme positive shocks and red stars show the extreme negative shocks identified by our novel rule-based specification, described in Eq. (5.3), for classifying oil market shocks into discrete calm and extreme conditions. Graphs (A), (B), and (C) illustrate the result of this filtering process applied to each of the structural oil supply, global aggregate demand, and oil-specific demand shocks, respectively, obtained from the global oil SVAR model described in Eq. (5.2). With reference to Fig. 5.1 (A) and (C), extreme oil supply and oil-specific demand shocks, respectively, are seen to occur intermittently over the entire sample. On the other hand, when compared to the latter half of the 1990s, extreme global aggregate demand shocks in Fig. 5.1 (B) appear to increase in frequency from the 2000s and especially so in the 2008/2009 Global Financial Crisis (GFC) and post-GFC eras.

Bear phases in the real Brent crude oil prices are shown by grey vertical panels in Fig. 5.1. Graph (D) conveys that the contemporary oil slumps identified coincide with international crises such as the Asian financial crisis (1997), the internet bubble burst and the 9/11 terrorist attacks (2001) in the US, and the GFC (2008). Additionally, Baumeister and Kilian (2016a, 2016b) find that the stark oil decline between June 2014 and January 2015 can be explained partly due to a negative oil-specific demand shock from a slowdown in the global economy, and positive oil supply shocks coming from the US shale boom and other major oil producers.

3.2 Performance of Returns Under Alternative Oil Market Conditions

Table 5.1 shows simple summary statistics which captures the behaviour of the monthly returns (adjusted for market fundamentals) under calm and extreme structural oil market shocks, and during bullish and bearish oil market phases. We provide results for two samples: a full sample and a sample where the GFC is censored.Footnote 9 The latter sample omits the main adverse events associated with GFC crisis in international markets, which incorporates the infamous collapse of Lehman Brothers in September 2008. In a study of nine episodes of turbulence in global financial markets, ranging from 1997 to 2013, Fry-McKibbin et al. (2014) find that the 2008 Great Recession is a true global financial crisis. As this is an unprecedented event in our study, we take care to account for the potential role of the GFC and understand how sensitive our results are to the effects of this global debacle.

The relatively calm oil market condition, in Table 5.1, is that time period in the international oil market where no extreme structural shock is identified by our consolidated non-linear rule-based specification. Such a common calm period can be used as a basis for comparing how financial returns from the oil, exchange rates, and stock markets and the relationships between them behave during comparatively calm oil market conditions versus periods when there are extreme oil supply, global aggregate demand, and oil-specific demand shocks. This relatively calm period is computed as the periods which are consistently identified as 0 in Eq. (5.3) across all three structural oil market shocks.

For the oil market, the highest (lowest) returns are observed under periods of extreme positive (negative) oil-specific demand shocks. Moreover, the highest market volatility occurs during extreme positive oil-specific demand shocks, while the lowest volatility is, as we might expect, in the calm oil market condition. Furthermore, we find that the mean oil returns are highly significantly different from zero under extreme positive and negative oil demand shocks, and under bearish and bullish oil market phases. Also, Welch’s t-test for the equality of means shows that average oil returns under extreme negative global aggregate demand shocks, and positive and negative oil demand shocks are significantly different from the relatively calm period, and average returns in the bearish oil market phases are statistically different to bullish oil market conditions.

Turning to the returns of the exchange rate index for Trinidad and Tobago, there are two particularly surprising observations for this small oil-exporter. First, the mean REER appreciations (depreciations) of the greatest magnitude are exhibited under extreme negative (positive) oil demand shocks and the value is significantly different from zero. Secondly, REER depreciations are noted under bullish oil market phases and appreciations occur in bearish conditions, where the latter results are significantly different from zero. Both statistical artefacts contradict the Dutch disease and positive wealth effects propositions of real exchange rate appreciations in the presence of increasing oil prices, at least from a contemporaneous perspective. Moreover, the Welch’s t-test for the equality of means conveys that there are statistically significant differences in the mean adjusted REER returns under extreme positive and negative oil demand shocks compared to relative calm periods, as well as bearish compared to bullish oil market conditions.

Considering stock returns behaviour in this frontier market, the mean returns are highest in the relatively calm period, while the lowest negative returns are in periods of extreme negative global demand shocks. However, these results are sensitive to the GFC. Once this period is censored, the highest returns are instead observed during bearish oil market phases, whereas the largest negative returns are observed under extreme positive oil demand shocks. Once again, these are results contradicting the expectations for a small intensive oil-exporter. Market volatility is highest in both the full and GFC-censored samples during conditions of extreme negative oil demand shocks. However, none of the mean adjusted stock returns are found to be statistically different from zero and the Welch’s t-test for the equality of means shows that there are no statistically significant differences in the mean stock returns in calm versus extreme oil market conditions, or in bullish versus bearish oil market phases.

3.3 Oil-Finance Time-Varying Correlations Under Alternative Oil Market Conditions

The DCC parameters are shown in Table 5.2; while the evolution of the dynamic oil-REER, oil-stock market, and REER-stock market relationships over the sample period of January 1996 to August 2017 are graphed as the solid black lines in Figs. 5.2, 5.3, and 5.4, respectively.Footnote 10 These time-varying correlations are illustrated under extreme positive (blue dots) and negative (red stars) oil supply, global aggregate demand, and oil-specific demand shocks. Bearish oil market phases are superimposed, as grey vertical bars, for reference. All three pairs of dynamic correlations exhibit contagion effects during the GFC, as all relationships deepen in this period. The GFC is hallmarked by extreme negative global aggregate demand and oil-specific demand shocks, an artefact that is well-documented in the literature (see, e.g., Baumeister & Kilian, 2016a; Kim, 2018), and is a bear phase in the crude oil market.

Figures 5.2 and 5.4, which, respectively, show the time-varying correlations between oil and the REER of Trinidad and Tobago, as well as Trinidad and Tobago’s REER and real stock returns, convey that these are both negative and relatively moderate associations across the two-decade sample period. Apart from the marked stronger negative relationship in these two DCCs during the GFC period, there is also additional observational evidence for oil market contagion as these relationships also deepen during the 2014/2015 oil market crash. In the 2014/2015 oil price plummet, the increase in the magnitude of the relationship for these pair of DCCs can be seen to coincide with multiple shocks in the international crude oil market, i.e. extreme positive oil supply, negative global aggregate demand shocks, and negative oil-specific demand shocks, which are expected to adversely impact an oil-exporter. For Trinidad and Tobago, these relationships during crisis imply that as oil prices fell due to such disturbances in the crude oil market, the currency appreciated and appreciations are associated with negative stock returns.

Graphs (A), (B), and (C) shows the oil supply, global aggregate demand, and oil-specific demand shocks, respectively, from the international crude oil market which are derived from the SVAR model specified in Eq. (5.2). For each of these three graphs, the extreme positive (blue dots) and negative (red stars) conditions for a particular shock are identified by our novel rule-based specification in Eq. (5.3). To provide an illustrative perspective of our procedure for identifying discrete calm and extreme oil market conditions, consider that the extreme positive (negative) shocks in the three structural oil market shocks in graphs (A), (B), and (C) are either values greater (less) than the standard deviation band of +0.850 (−0.850) or the largest (smallest) value over the preceding 12 months. Bear oil market phases identified by the Pagan and Sossounov (2003) algorithm are shown in grey vertical panels in graphs (A) to (D). For reference, graph (D) shows real Brent crude oil prices in US dollars per barrel

Figure 5.3 shows that the oil-stock market association is typically weak with distinct punctuated phases where the correlation strengthens. The negative oil-stock market relationship prior to 1999 is reversed thereafter to a positive association, which is in line with the inferences of Miller and Ratti (2009) who examine a selection of OECD countries. They argue that the positive association is likely due to the existence of stock and oil market bubbles which have characterised twenty-first century financial markets. Indeed, we observe that there are three distinct periods where the time-varying oil-stock market correlations increase (in absolute value) over the sample period, which coincide with the Asian financial crisis, and the dot-com and sub-prime bubbles and crashes. Extreme negative oil demand shocks occur in all three periods of international financial turmoil, where we also see that the oil-stock market relationship strengthens.

Table 5.3 conveys the average financial correlations during relatively calm and extreme structural oil market shocks, and during bullish and bearish oil market phases, in the full sample and a GFC-censored sample for robustness analysis. The relatively calm period in the crude oil market forms the sample which is used as basis for comparing each of the extreme structural shock periods. First, we observe a moderate and inverse oil-REER interdependence. This relationship suggests that oil price increases (decreases) are associated with exchange rate depreciations (appreciations), and is inconsistent with the Dutch disease conjecture and the positive wealth effect spillovers expected for an oil-exporter which implies the opposite outcome. As the US dollar is a vehicle currency and the energy sector in Trinidad and Tobago has traditionally been the main source of foreign currency for authorised dealers, the Central Bank of Trinidad and Tobago supports the local foreign exchange market with the sale of foreign reserves to authorised dealers. Such interventions maintain exchange rate stability when there is a shortfall in the inflows of foreign exchange or when the demand for foreign exchange is robust (CBTT FSR, 2019; CBTT MPR, 2019). In the full sample, we find statistically significant results that the oil-REER relationship marginally deepens during extreme global aggregate demand shocks when compared to the relatively calm period. This conforms with the findings of Atems et al. (2015) for the responses of exchange rate indexes to this demand-side shock. However, such evidence of oil market contagion in the oil-REER correlation is primarily associated with the GFC period.

Oil-REER DCC under extreme shocks and bear phases in the international crude oil market. In each graph, the black solid line is the dynamic conditional correlation (DCC) between the real Brent crude oil returns and the REER returns of Trinidad and Tobago estimated from the DCC(1,1) model with oil, exchange rates, and stock returns. Graphs (A), (B), and (C) show oil-REER DCC under periods of extreme oil supply, global aggregate demand, and oil-specific demand shocks, respectively. These extreme periods are obtained from Eq. (5.3) applied to the structural shocks estimated from the global crude oil SVAR model in Eq. (5.2). In graphs (A), (B), and (C) blue stars show the extreme positive episodes derived from each particular shock, while red stars show the extreme negative shocks. For reference, the grey vertical bars in all graphs are bear oil market phases identified from the Pagan and Sossounov (2003) rule-based algorithm

Oil-stock market DCC under extreme shocks and bear phases in the international crude oil market. In each graph, the black solid line is the dynamic conditional correlation (DCC) between the real Brent crude oil returns and the real composite stock returns of the Trinidad and Tobago Stock Exchange estimated from the DCC(1,1) model with oil, exchange rates, and stock returns. Graphs (A), (B), and (C) show oil-stock market DCC under periods of extreme oil supply, global aggregate demand, and oil-specific demand shocks, respectively. These extreme periods are obtained from Eq. (5.3) applied to the structural shocks estimated from the global crude oil SVAR model in Eq. (5.2). In graphs (A), (B), and (C) blue stars show the extreme positive episodes derived from each particular shock, while red stars show the extreme negative shocks. For reference, the grey vertical bars in all graphs are bear oil market phases identified from the Pagan and Sossounov (2003) rule-based algorithm

REER-stock market DCC under extreme shocks and bear phases in the international crude oil market. In each graph, the black solid line is the dynamic conditional correlation (DCC) between Trinidad and Tobago’s REER index returns and the real composite stock returns of the Trinidad and Tobago Stock Exchange estimated from the DCC(1,1) model with oil, exchange rates, and stock returns. Graphs (A), (B), and (C) show REER-stock market DCC under periods of extreme oil supply, global aggregate demand, and oil-specific demand shocks, respectively. These extreme periods are obtained from Eq. (5.3) applied to the structural shocks estimated from the global crude oil SVAR model in Eq. (5.2). In graphs (A), (B), and (C) blue stars imply the extreme positive episodes derived from each particular shock, while red stars imply the extreme negative shocks. For reference, the grey vertical bars in all graphs are bear oil market phases identified from the Pagan and Sossounov (2003) rule-based algorithm

Looking at the oil-stock market correlation in Table 5.3, this association is generally weak. Therefore, we find no evidence of either interdependence or contagion. We also observe that oil-stock returns correlation in bullish oil market phases becomes weaker under bearish conditions. These results can be linked to the relatively underdeveloped stock market of Trinidad and Tobago, and the fact that there is only one energy security listed on the stock exchange, which subdues the spillover effects from the international oil market. The minimal effect of the oil market on the stock market is consistent with evidence from other oil-exporting markets in the Global South such as the Gulf Cooperation Council countries (Al Janabi et al., 2010), Mexico (Basher et al., 2018), and Trinidad and Tobago (Mahadeo et al., 2019). Yet, this can be contrasted against the experience of other oil-exporters in the Global North such as Canada (Kang & Ratti, 2013), Norway (Bjørnland, 2009; Park & Ratti, 2008), and Russia (Ji et al., 2018), where a positive oil-stock market relationship is exhibited.

Turning to the REER-stock market association, the inverse interdependence suggests that an exchange rate appreciation (depreciation) is correlated with a downturn (uptick) in stock returns. This result is in contradiction with those of Delgado et al. (2018) for Mexico, also an emerging market and oil-exporter, who find that an appreciation of the exchange rate is related to an improvement in the stock market performance. It is plausible to pin down the differences in the findings to differences in exchange rate regimes between Mexico (free float) and Trinidad and Tobago (managed float). Moreover, there is also indication of the exchange rate and stock market dependence strengthening since the GFC, which is consistent with Caporale et al. (2014). It can be useful to consider this result in tandem with the aforementioned oil-REER relationship. Although the oil-stock returns relationship is weak, it is possible for crude oil to have indirect spillovers for the stock market performance through the exchange rate channel. We also find that the REER-stock returns relationship becomes somewhat stronger under the global aggregate demand shocks, but this result is sensitive to the omission of the GFC period. This is in line with Wei et al. (2019), who find that compared to other macroeconomic fundamentals, the exchange rate market plays the most significant role in transmitting the impacts of oil prices on the emerging Chinese stock market, especially in the GFC aftermath.

Altogether, Table 5.3 shows that there are some statistically significant results for differences in correlations derived from the equality of means tests. However, the average correlations generally do not convey a marked increase in cross-market linkages, to satisfy the operational definition of contagion used in this chapter, under extreme or bearish oil market conditions as these variations tend to be relatively small. Such findings, which are consistent with Mahadeo et al. (2019), might lead to an inference of no oil market contagion risk for this frontier market. Yet, the qualitative (graphical) analyses of Figs. 5.2, 5.3, and 5.4 underscore the potential consequences of overlooking the time-varying nature of correlation as we observe that the contagion phenomenon has a tendency to intermittently appear and vanish under certain extreme conditions.

In addition, correlations during the calm period versus periods of extreme oil supply shocks across all three dynamic relationships appear less sensitive when compared to correlations under demand-side shocks. This resonates with Atems et al. (2015) and Basher et al. (2016) who find limited evidence that oil supply shocks affect exchange rates, and with Filis et al. (2011) who find that supply-side oil price shocks do not influence the oil-stock market relationship. In fact, many studies are alluding to the notion that the role of oil supply shocks on the real and financial sectors is no longer consequential (see Broadstock & Filis, 2014 and references therein).

Our results also align with Antonakakis et al. (2017), who find that global aggregate demand innovations are the main source of shocks to stock market during economic turbulence, as well as Aloui and Aïssa (2016), who find that the dependence structure between oil, exchange rates, and stock returns are sensitive over the 2007–2009 GFC and Great Recession period. Indeed, we also find that shocks associated with the GFC appear to deepen cross-market linkages between these three returns more than oil market shocks outside of this period in Trinidad and Tobago.

4 Conclusion

We have put forward an original approach to trace the sources of contagion in three pairs of financial market relationships: the crude oil-exchange rate returns, crude oil-stock returns, and exchange rate-stock returns correlations. This is done by combining non-linear oil price measures to design a rule-based specification in order to filter supply and demand-side shocks originating from the international crude oil market into discrete typical and extreme episodes. Such identified episodes are then used in order to compare the time-varying financial market relationships (estimated with a dynamic conditional correlations model) under calm versus extreme, as well as bullish versus bearish, oil market conditions. Our methodology is particularly appropriate for financial stability analysis in economies vulnerable to disturbances from the international crude oil market.

Our empirical analysis is carried out on the Brent crude oil market and financial market indicators of the small petroleum intensive economy of Trinidad and Tobago. The results show a moderate interdependence in the oil-exchange rate and exchange rate-stock market linkages, as well as a generally weak oil-stock market relationship. We also find evidence of contagion in all three market relationships, the most pronounced occurring during the 2008/2009 global financial crisis. Additionally, the 2014/2015 oil crash is a source of contagion in the relationship between the exchange rate and stock market, whereas intermittent increases in correlations are observed in the oil-stock market relationship in the Asian financial crisis in the late 1990s and again in the dot-com crash in the early 2000s. By using a dynamic framework, as opposed to a static correlation approach, we have been able to detect further episodes of contagion during international financial crises. In general, we find that contagion in the nexus between the crude oil market and this frontier market tends to be driven more by extreme negative demand-side shocks in the international oil market rather than supply-side shocks.

Notes

- 1.

A switch to a dirty floating exchange rate from a fixed exchange rate regime in Trinidad and Tobago occurred in April 1993. On this grounds we start our analysis in January 1996, to allow for some time for the economy to acclimatise to the new exchange rate regime.

- 2.

The data are available from the US Energy Information Administration at www.eia.gov/international/data/world and accessed in November 2018.

- 3.

It is important to note that Hamilton (2018) points out a data transformation error in the index of nominal freight rates underlying the Kilian (2009) global real economic activity measure, where the log operator is performed twice. Kilian (2019) acknowledges this coding error and corrects the global business cycle index. We use this updated data, which are available at https://sites.google.com/site/lkilian2019/research/data-sets and accessed in November 2018.

- 4.

These data are available from the Federal Reserve Economic Data (FRED) at fred.stlouisfed.org/, accessed in November 2018. Like Broadstock and Filis (2014), we use the Brent benchmark instead of the West Texas Intermediate (WTI) to represent the global price of oil. The latter has been traded at a discounted price since 2011 due to the US shale boom (Kilian, 2016). In light of such developments, Brent oil has further fortified its prominence as global benchmark, while the WTI price increasingly reflects US-specific dynamics (Manescu & Van Robays, 2016). Moreover, Trinidad and Tobago produces water-borne crude which is pegged to the Brent crude oil price benchmark, trading at either a premium or a discount to this international reference price.

- 5.

Data are sourced from the International Monetary Fund (IMF) International Financial Statistics and retrieved via Thomson Reuters Eikon, accessed in November 2018.

- 6.

These data are calculated using data from the Central Bank of Trinidad and Tobago (CBTT), and are available from www.central-bank.org.tt/statistics/data-centre and accessed in November 2018.

- 7.

Returns are calculated as the first difference in the natural logarithm for each series, times 100.

- 8.

We find no statistically significant asymmetric responses to positive and negative news for exchange rates and stock returns. However, in the case of oil returns, the asymmetric volatility tests show that the individual sign bias tests convey no asymmetric volatility in the standardised residuals, but the joint effects test is statistically significant. Therefore, we consider asymmetric GARCH variants for this particular series to accommodate for this artefact. Yet, an EGARCH(1,1) for oil returns, which we find to be the most suitable alternative GARCH specification for this series, shows that the leverage effects term is not significant. Further, the differences in dynamic correlations estimated from a model where oil returns follows either a GARCH(1,1) or an EGARCH(1,1) specification is negligible. As such, we revert to the parsimonious GARCH(1,1) model for oil returns.

- 9.

The National Bureau of Economic Research defines the timespan of the Great Recession in the US from December 2007 to June 2009. The dating is obtained from www.nber.org/cycles, and accessed in November 2018.

- 10.

The DCC model coefficients and dynamic correlations are estimated with the rmgarch package in R (see Ghalanos, 2019).

References

Abeysinghe, T. (2001). Estimation of direct and indirect impact of oil price on growth. Economics Letters, 73(2), 147–153.

Akram, Q. F. (2004). Oil prices and exchange rates: Norwegian evidence. The Econometrics Journal, 7(2), 476–504.

Al Janabi, M. A., Hatemi-J, A., & Irandoust, M. (2010). An empirical investigation of the informational efficiency of the GCC equity markets: Evidence from bootstrap simulation. International Review of Financial Analysis, 19(1), 47–54.

Aloui, R., & Aïssa, M. S. B. (2016). Relationship between oil, stock prices and exchange rates: A vine copula based GARCH method. The North American Journal of Economics and Finance, 37, 458–471.

Antonakakis, N., Chatziantoniou, I., & Filis, G. (2017). Oil shocks and stock markets: Dynamic connectedness under the prism of recent geopolitical and economic unrest. International Review of Financial Analysis, 50, 1–26.

Atems, B., Kapper, D., & Lam, E. (2015). Do exchange rates respond asymmetrically to shocks in the crude oil market? Energy Economics, 49, 227–238.

Auty, R. M. (2017). Natural resources and small island economies: Mauritius and Trinidad and Tobago. The Journal of Development Studies, 53(2), 264–277.

Basher, S. A., Haug, A. A., & Sadorsky, P. (2012). Oil prices, exchange rates and emerging stock markets. Energy Economics, 34(1), 227–240.

Basher, S. A., Haug, A. A., & Sadorsky, P. (2016). The impact of oil shocks on exchange rates: A Markov-switching approach. Energy Economics, 54, 11–23.

Basher, S. A., Haug, A. A., & Sadorsky, P. (2018). The impact of oil-market shocks on stock returns in major oil-exporting countries. Journal of International Money and Finance, 86, 264–280.

Baumeister, C., & Kilian, L. (2016a). Forty years of oil price fluctuations: Why the price of oil may still surprise us. Journal of Economic Perspectives, 30(1), 139–60.

Baumeister, C., & Kilian, L. (2016b). Understanding the decline in the price of oil since June 2014. Journal of the Association of Environmental and Resource Economists, 3(1), 131–158.

Bjørnland, H. C. (2009). Oil price shocks and stock market booms in an oil exporting country. Scottish Journal of Political Economy, 56(2), 232–254.

Broadstock, D. C., & Filis, G. (2014). Oil price shocks and stock market returns: New evidence from the United States and China. Journal of International Financial Markets, Institutions and Money, 33, 417–433.

Caporale, G. M., Hunter, J., & Ali, F. M. (2014). On the linkages between stock prices and exchange rates: Evidence from the banking crisis of 2007–2010. International Review of Financial Analysis, 33, 87–103.

CBTT FSR. (2019). Financial stability report 2018 (Tech. Rep.). Central Bank of Trinidad and Tobago (CBTT).

CBTT MPR. (2019, November). Monetary policy report (Tech. Rep.). Vol. XXI, No. 2, Central Bank of Trinidad and Tobago (CBTT).

Cheema, M. A., & Scrimgeour, F. (2019). Oil prices and stock market anomalies. Energy Economics, 83, 578–587.

Chen, W., Hamori, S., & Kinkyo, T. (2014). Macroeconomic impacts of oil prices and underlying financial shocks. Journal of International Financial Markets, Institutions and Money, 29, 1–12.

Chkili, W., & Nguyen, D. K. (2014). Exchange rate movements and stock market returns in a regime-switching environment: Evidence for BRICS countries. Research in International Business and Finance, 31, 46–56.

Corden, W. M. (1984). Booming sector and Dutch disease economics: Survey and consolidation. Oxford Economic Papers, 36(3), 359–380.

Corden, W. M. (2012). Dutch disease in Australia: Policy options for a three-speed economy. Australian Economic Review, 45(3), 290–304.

Degiannakis, S., Filis, G., & Arora, V. (2018a). Oil prices and stock markets: A review of the theory and empirical evidence. Energy Journal, 39(5).

Degiannakis, S., Filis, G., & Panagiotakopoulou, S. (2018b). Oil price shocks and uncertainty: How stable is their relationship over time? Economic Modelling, 72, 42–53.

Delgado, N. A. B., Delgado, E. B., & Saucedo, E. (2018). The relationship between oil prices, the stock market and the exchange rate: Evidence from mexico. The North American Journal of Economics and Finance, 45, 266–275.

Engle, R. (2002). Dynamic conditional correlation. Journal of Business& Economic Statistics, 20(3), 339–350.

Engle, R. F., & Ng, V. K. (1993). Measuring and testing the impact of news on volatility. The Journal of Finance, 48(5), 1749–1778.

Fagerland, M. W., & Sandvik, L. (2009). Performance of five two-sample location tests for skewed distributions with unequal variances. Contemporary Clinical Trials, 30(5), 490–496.

Filis, G., Degiannakis, S., & Floros, C. (2011). Dynamic correlation between stock market and oil prices: The case of oil-importing and oil-exporting countries. International Review of Financial Analysis, 20(3), 152–164.

Forbes, K. J., & Rigobon, R. (2002). No contagion, only interdependence: Measuring stock market comovements. The Journal of Finance, 57(5), 2223–2261.

Fry, R., Martin, V. L., & Tang, C. (2010). A new class of tests of contagion with applications. Journal of Business & Economic Statistics, 28(3), 423–437.

Fry-McKibbin, R., Hsiao, C.Y.-L., & Tang, C. (2014). Contagion and global financial crises: Lessons from nine crisis episodes. Open Economies Review, 25(3), 521–570.

Ghalanos, A. (2019). rmgarch: Multivariate GARCH models. R package version 1.3-6.

Güntner, J. H. F. (2014). How do international stock markets respond to oil demand and supply shocks? Macroeconomic Dynamics, 18(8), 1657–1682.

Hamilton, J. D. (1996). This is what happened to the oil price-macroeconomy relationship. Journal of Monetary Economics, 38(2), 215–220.

Hamilton, J. D. (2009a). Causes and consequences of the oil shock of 2007–08. Brookings Papers on Economic Activity, 215–283.

Hamilton, J. D. (2009b). Understanding crude oil prices. The Energy Journal, 30(2), 179–207.

Hamilton, J. D. (2018). Measuring global economic activity. manuscript, University of California at San Diego.

Hanna, A. J. (2018). A top-down approach to identifying bull and bear market states. International Review of Financial Analysis, 55, 93–110.

Ji, Q., Liu, B.-Y., Zhao, W.-L., & Fan, Y. (2018). Modelling dynamic dependence and risk spillover between all oil price shocks and stock market returns in the BRICS. International Review of Financial Analysis.

Kang, W., & Ratti, R. A. (2013). Oil shocks, policy uncertainty and stock market return. Journal of International Financial Markets, Institutions and Money, 26, 305–318.

Kang, W., Ratti, R. A., & Yoon, K. H. (2015a). The impact of oil price shocks on the stock market return and volatility relationship. Journal of International Financial Markets, Institutions and Money, 34, 41–54.

Kang, W., Ratti, R. A., & Yoon, K. H. (2015b). Time-varying effect of oil market shocks on the stock market. Journal of Banking& Finance, 61, S150–S163.

Kayalar, D. E., Küçüközmen, C. C., & Selcuk-Kestel, A. S. (2017). The impact of crude oil prices on financial market indicators: Copula approach. Energy Economics, 61, 162–173.

Kilian, L. (2009). Not all oil price shocks are alike: Disentangling demand and supply shocks in the crude oil market. American Economic Review, 99(3), 1053–1069.

Kilian, L. (2016). The impact of the shale oil revolution on US oil and gasoline prices. Review of Environmental Economics and Policy, 10(2), 185–205.

Kilian, L. (2019). Measuring global real economic activity: Do recent critiques hold up to scrutiny? Economics Letters, 178, 106–110.

Kilian, L., & Park, C. (2009). The impact of oil price shocks on the US stock market. International Economic Review, 50(4), 1267–1287.

Kilian, L., & Vigfusson, R. J. (2011a). Are the responses of the US economy asymmetric in energy price increases and decreases? Quantitative Economics, 2(3), 419–453.

Kilian, L., & Vigfusson, R. J. (2011b). Nonlinearities in the oil price-output relationship. Macroeconomic Dynamics, 15(S3), 337–363.

Kim, M. S. (2018). Impacts of supply and demand factors on declining oil prices. Energy, 155, 1059–1065.

Kole, E., & Dijk, D. (2017). How to identify and forecast bull and bear markets? Journal of Applied Econometrics, 32(1), 120–139.

Krippner, L. (2016). Documentation for measures of monetary policy. Reserve Bank of New Zealand.

Kritzman, M., Li, Y., Page, S., & Rigobon, R. (2011). Principal components as a measure of systemic risk. The Journal of Portfolio Management, 37(4), 112–126.

Lin, C.-H. (2012). The comovement between exchange rates and stock prices in the Asian emerging markets. International Review of Economics & Finance, 22(1), 161–172.

Mahadeo, S. M. R., Heinlein, R., & Legrenzi, G. D. (2019). Energy contagion analysis: A new perspective with application to a small petroleum economy. Energy Economics, 80, 890–903.

Manescu, C., & Van Robays, I. (2016). Forecasting the Brent oil price: Addressing time-variation in forecast performance (Tech. Rep.). CESifo Group Munich.

Miller, J. I., & Ratti, R. A. (2009). Crude oil and stock markets: Stability, instability, and bubbles. Energy Economics, 31(4), 559–568.

Mork, K. A. (1989). Oil and the macroeconomy when prices go up and down: An extension of Hamilton’s results. Journal of Political Economy, 97(3), 740–744.

Pagan, A. R., & Sossounov, K. A. (2003). A simple framework for analysing bull and bear markets. Journal of Applied Econometrics, 18(1), 23–46.

Park, J., & Ratti, R. A. (2008). Oil price shocks and stock markets in the US and 13 European countries. Energy Economics, 30(5), 2587–2608.

Reboredo, J. C., Rivera-Castro, M. A., & Zebende, G. F. (2014). Oil and US dollar exchange rate dependence: A detrended cross-correlation approach. Energy Economics, 42, 132–139.

Rigobon, R. (2019). Contagion, spillover, and interdependence. Economía, 19(2), 69–99.

Tang, X., & Yao, X. (2018). Do financial structures affect exchange rate and stock price interaction? Evidence from emerging markets. Emerging Markets Review, 34, 64–76.

Wang, Y., Wu, C., & Yang, L. (2013). Oil price shocks and stock market activities: Evidence from oil-importing and oil-exporting countries. Journal of Comparative Economics, 41(4), 1220–1239.

Wei, Y., Qin, S., Li, X., Zhu, S., & Wei, G. (2019). Oil price fluctuation, stock market and macroeconomic fundamentals: Evidence from China before and after the financial crisis. Finance Research Letters, 30, 23–29.

Welch, B. L. (1947). The generalization of ‘student’s’ problem when several different population variances are involved. Biometrika, 34(1/2), 28–35.

Zhang, Y.-J., Fan, Y., Tsai, H.-T., & Wei, Y.-M. (2008). Spillover effect of US dollar exchange rate on oil prices. Journal of Policy Modeling, 30(6), 973–991.

Acknowledgements

Earlier versions of this chapter were presented at the 1st International Conference on Energy, Finance, and the Macroeconomy in November 2017 (Montpellier Business School, France); at the Keele Business School Economics and Finance Research Group Seminar Series in February 2019 (Keele University, UK); at the Money, Macro, and Finance Ph.D. Conference in April 2019 (City, University of London, UK); and at the INFINITI 2019 Conference on International Finance in June 2019 (Adam Smith Business School, University of Glasgow, UK). We are grateful to the participants and assigned discussants at these events for their insightful feedback, which have served to refine the research. The usual disclaimer applies. We also declare that this research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Mahadeo, S.M.R., Heinlein, R., Legrenzi, G.D. (2022). Tracing the Sources of Contagion in the Oil-Finance Nexus. In: Floros, C., Chatziantoniou, I. (eds) Applications in Energy Finance. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-030-92957-2_5

Download citation

DOI: https://doi.org/10.1007/978-3-030-92957-2_5

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-030-92956-5

Online ISBN: 978-3-030-92957-2

eBook Packages: Economics and FinanceEconomics and Finance (R0)