Abstract

India is paving its way towards a cashless society, from physical wallets to virtual (mobile) wallets. Mobile wallets are a fast growing payment method but in developing counties, like India, consumers are still using cash in their daily transactions. This paper identifies and evaluates key challenges to mobile wallet usage in India. Eleven possible challenges to mobile wallets are identified through extensive review and validated from experts’ inputs. Further, the Interpretive Structural Modeling (ISM) technique is utilized for constructing a structural framework of the identified challenges. Classification of these challenges has been done using MICMAC analysis. “Lack of adequate infrastructure (Ch4)”, “Poor Internet penetration (Ch5)”, “Highly fragmented economy (Ch9)” and “Lack of goal oriented and clearly defined mobile wallet strategy (Ch11)” have been found to be four key challenges that inhibit mobile wallet usage in India. This paper may help policymakers, regulatory bodies and banking managers in achieving effective mobile wallet usage in India.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Smartphone and electronic commerce are an integral part of the modern customer nowadays. Increased use of technology and online shopping has forced the customer to adopt or shift from cash payments to e-wallet or digital wallets for the payment mode for services availed through e-commerce web portals or mobile applications [1]. In a developing country like India, the mobile wallet is becoming popular. There are many reasons behind it. For example, the Indian government is focusing on the cashless initiative and Indian banking sector is taking several initiatives in this direction. The consumers know that going cashless is more secure [2, 3]. They know there are various advantages for use of mobile wallets including security [4].

As per recent data, it is predicted that in India, the mobile wallet market will grow to $184 billion by 2024. Consumers are also aware about benefits of cashless economy. Net penetration of Internet is increasing very fast in India as compared to other counties. As per GlobalData (leading data and analytics company), India is one of the top markets in mobile payment adoption and surpasses the US, the UK, China and Denmark. There is no doubt that mobile wallets are a fast-growing payment method but in developing countries, consumers are still using cash in their daily transactions [5]. As per deloitte.com research, in India, although about 10% of accounting transaction volume is through this technology, the consumers are still less aware about mobile wallets and are doing relatively less transactions using it. There are several challenges for mobile wallet use in India and therefore it is important to comprehend the structural framework to overcome these challenges effectively. Realising this, the current research has the following objectives:

-

1.

To systematically identify challenges to mobile wallet in India.

-

2.

To develop a structural framework to overcome these challenges effectively.

This paper aims to recognize and investigate challenges to mobile wallet use in India. An integrated Interpretive Structural Modeling (ISM) and MICMAC methodology is used to develop a structural framework of these challenges. The paper is organized as follows: We review the literature in Sect. 2, literature analysis in Sect. 3, and conclusion, limitations and future work in Sect. 4.

2 Literature Review

The presence of challenges offers a retarding effect, thereby decelerating the development of continuous improvement. Thus, it is crucial to understand key challenges to mobile wallet use in India. In order to identify the challenges, prior literature was explored. Various keywords such as “Key Challenges/Hurdles/Hindrances/Inhibitors + Mobile wallet usage or mobile wallet usage in India” were searched on Google and Google Scholar. 11 key challenges to mobile wallets usage in India were identified from a detailed review and are presented in Table 1 below.

3 Results and Data Analysis

An integrated ISM-MICMAC methodology is used in this study. Warfield first proposed the ISM in 1974. ISM helps in the modeling of the variables by allowing development of interrelationships between them [30]. ISM uses practical awareness and practices of decisions makers to construct a logical hierarchical based modeling of the variables based on the driving and depending power this can done by using cross-impact matrix multiplication applied to classification, known as MICMAC analysis, which helps in developing the binary type of relationships among the considered variables [31]. In this work, ISM-MICMAC methodology is applied through different steps as below [32,33,34,35,36,37,38,39,40,41]:

-

i.

Distinguish the variables associated with the research problem. In this research, we selected key challenges regarding the inhibition of mobile wallet usage in India.

-

ii.

Construct Structural Self-Interaction Matrix (SSIM) to assess contextual relationships of selected mobile wallet usage related challenges.

-

iii.

Transform the SSIM into Initial Reachability Matrix (RMi). Next, we developed the Final Reachability Matrix (RMf) from RMi. This transformation of RMi into RMf involves considering the transitivity relations among selected challenges.

-

iv.

Determine the dependency and driving power of each challenge. Use summation of rows and columns of values in RMf to determine dependency and driving power of each challenge.

-

v.

Draw various levels from RMf. Develop the reachability and antecedent set. Reachability and Antecedent set include the challenge itself and the other challenges influenced by it and influence the particular inhibitor. Next, a common set is produced by means of reachability and antecedent set.

-

vi.

Transform the RMf into a digraph that illustrates the real image of challenges and their interrelationships. Transform the digraph into ISM based structural model, which is comprised of various levels (as obtained in Step v) of selected challenges. vii. Form a graph of selected challenges using MICMAC.

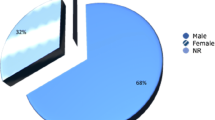

To analyse key challenges that prevent successful mobile wallets in India, initially, twenty experts related to banking systems were contacted by phone and direct visit. Twelve out of the twenty experts agreed to participate in this research. All the selected experts had experience of more than 10 years. Further, validation of identified challenges from literature review and identification of the contextual interrelationships between the challenges was established by discussions with the selected experts, for developing SSIM matrix (see Table 2). The following four denotation symbols have been used for indicating the type of relation between identified challenges in the (i, j) form:

-

V-Variable i helps achieve or has influence on Variable j;

-

A-Variable j helps achieve or has influence on Variable i; X-Variables i and j help achieve or influence each other; O-Variables i and j are not related to each other.

The initial reachability matrix (RMi) is developed from SSIM. The RMi consists of binary numbers (0 and 1) and formed using several rules [20], given as:

-

If SSIM contains V in the SSIM, then RMi should replace with entry 1 for (i, j) and 0 for (j, i);

-

If SSIM contains A in the SSIM, then RMi should replace with entry 0 for (i, j) and 1 for (j, i);

-

If SSIM contains X in the SSIM, then RMi should replace with entry 1 for both (i, j) and (j, i);

-

If SSIM contains O in the SSIM, then RMi should replace with entry 0 for both (i, j) and (j, i).

Then, the final reachability matrix (RMf) was developed from the RMi using transitivity rule (for more details see step iii and iv of methodology) as depicted in Table 3.

If the reachability set and the intersection set (for more details see step V of methodology) for any challenge was the same, then that challenge was assigned as level 1st (highest place in the ISM model). Once the level was assigned to the challenge, then that challenge was eliminated. This procedure was repeated to assign at most one level to each challenge. Final levels for the challenges are depicted in Table 4.

From the RMf (see Table 3) and final developed six levels of the challenges (Table 4), a hierarchical structural model regarding the challenges that retard mobile wallet usage in India was developed and is shown in Fig. 1.

It is clear from Fig. 1 that ‘Lack of adequate infrastructure (Ch4)’, ‘Poor internet penetration (Ch5)’, ‘Highly fragmented economy (Ch9)’ and ‘Lack of goal oriented and clearly defined mobile wallet strategy (Ch11)’ are foundational challenges in the ISM hierarchical model i.e. cluster of independent challenges, thus these are most critical hurdles that prevent mobile wallets in India. ‘Perception of customers (Ch6)’ is found the top hierarchical level in the ISM model.

In the MICMAC analysis [31], the dependence power and driving power of challenges that prevent mobile wallets in India were analysed and plotted in Fig. 2 as four different clusters.

All identified eleven challenges have an influence in implementing mobile wallets in India and are in the four clusters that are shown in Fig. 2.

Autonomous region: Nil

This cluster of challenges has low driving and dependence power. These challenges fall near origin in Fig. 2 and are almost disconnected from other challenges. These challenges are not affected by the system. In this research, no challenge is found in this cluster.

Dependent region: Ch7, Ch8, Ch10, Ch3 and Ch6

This region of challenges has high dependence and less driving power values. These challenges come under the top position of the structural model given by the ISM. They are strongly dependent on the independent and linkage region challenges to diminish the effect of these challenges in implementing mobile wallets in India.

Linkage region: Ch1 and Ch2

This cluster of challenges has high driving and dependence power values. These challenges are not stable in behaviour and any changes can affect the entire model and produce some feedback also. These challenges are positioned at the center of the structural model given by ISM.

Independent region: Ch4, Ch5, Ch9 and Ch11

This cluster of challenges has less dependence and high driving power values. They are also termed as key challenges. These challenges are positioned at the bottom of the structural model given by ISM.

4 Conclusion, Limitations and Future Work

This paper aims to identify and scrutinise challenges that prevent successful mobile wallet usage in India. A total of eleven challenges that may prevent successful implementation of mobile wallets usage have been identified through literature survey and decision makers’ knowledge and experience. This paper has illustrated contextual interrelationships among the identified challenges and has constructed a hierarchy of challenges that need to be overcome to have successful mobile wallet usage in Indian contexts.

ISM modelling combined with MICMAC has been used to fulfil the aims of this work. The challenges ‘Lack of adequate infrastructure (Ch4)’, ‘Poor internet penetration (Ch5)’, ‘Highly fragmented economy (Ch9)’ and ‘Lack of goal oriented and clearly defined mobile wallet strategy (Ch11)’ have been found to be independent challenges that prevent mobile wallet usage in India. These challenges are powerful and influential i.e. all other challenges are highly dependent on these challenges in effectively implementing mobile wallets. The findings of the present research may be important for policy makers, regulatory bodies and banking managers/practitioners in better understanding of these identified challenges removal towards effective implementation of mobile wallets system in India.

This work has presented a combined ISM-MICMAC framework that has been constructed using eleven mobile wallets usage challenges identified through literature and experts’ inputs. In future research, this work may be extended with identifying more challenges and by using a larger dataset. The developed structural model has used a small number of experts’ opinions, so we need to examine more experts’ opinions. In future works, the identified challenges may be quantified using graph theory or any other appropriate Multi Criteria Decision Making (MCDM) tools. In future research, ISM model can be extended by applying Total Interpretive Structural Modelling (TISM) in developing a knowledge base of the interpretive logic of all the interactions among and within challenges for interpreting the structure model entirely.

References

Shankar, K.G., Raju, P.: A study on opportunities and challenges of adopting digital wallet in India. Our Heritage 67(2), 127–136 (2019)

Sen, S.: Surge in cashless transactions will push digital economy, m-wallets will gain (2016). www.hindustantimes.com/business-news/surge-in-cashless-transactionswillpush-digital-economy-m-wallets-will-gain/storyo6Gc8qndqGA4kbY09KafBI.html. Accessed 17 Feb 2020

Bagla, R.K., Sancheti, V.: Gaps in customer satisfaction with digital wallets: challenge for sustainability. J. Manag. Dev. 37(6), 442–451 (2018)

Ramya, N., Sivasakthi, D., Nandhini, M.: Cashless transaction: modes, advantages and disadvantages. Int. J. Appl. Res. 3(1), 122–125 (2017)

Kang, J.: Mobile payment in fintech environment: trends, security challenges, and services. Hum.-Centric Comput. Inf. Sci. 8(1), 32 (2018)

Peters, G.W., Chapelle, A., Panayi, E.: Opening discussion on banking sector risk exposures and vulnerabilities from virtual currencies: an operational risk perspective. J. Banking Regul. 17(4), 239–272 (2016)

Le, D.N., Kumar, R., Mishra, B.K., Chatterjee, J.M., Khari, M. (eds.): Cyber Security in Parallel and Distributed Computing: Concepts, Techniques, Applications and Case Studies. Wiley (2019)

Chandrasekhar, C.P., Ghosh, J.: The financialization of finance? Demonetization and the dubious push to cashlessness in India. Dev. Change 49(2), 420–436 (2018)

Sinha, M., Majra, H., Hutchins, J., Saxena, R.: Mobile payments in India: the privacy factor. Int. J. Bank Mark. 37(1), 192–209 (2019)

Madan, K., Yadav, R.: Behavioural intention to adopt mobile wallet: a developing country perspective. J. Indian Bus. Res. 8(3), 227–244 (2016)

Routray, S., Khurana, R., Payal, R., Gupta, R.: A move towards cashless economy: a case of continuous usage of mobile wallets in India. Theor. Econ. Lett. 9(4), 1152–1166 (2019)

Singh, N., Sinha, N.: How perceived trust mediates merchant’s intention to use a mobile wallet technology. J. Retail. Consum. Serv. 52, 101894 (2020)

Kumar, N.: Growth drivers and trends of E-wallets in India. MANTHAN: J. Commer. Manag. 3(1), 65–72 (2016)

Bubna, R., Raveendran, J., Kumar, S., Duggirala, M., Malik, M.: A partially grounded agent based model on demonetisation outcomes in India. In: Sokolowski, J., Durak, U., Mustafee, N., Tolk, A. (eds.) Summer of Simulation. SFMA, pp. 247–275. Springer, Cham (2019). https://doi.org/10.1007/978-3-030-17164-3_12

Sobti, N.: Impact of demonetization on diffusion of mobile payment service in India. J. Adv. Manag. Res. 16(4), 472–497 (2019)

Goyal, A.: Conditions for inclusive innovation with application to telecom and mobile banking. Innov. Dev. 7(2), 227–248 (2017)

Goswami, K.C., Sinha, S.: Cashless economy and strategic impact on bank marketing. Sumedha J. Manag. 8(1), 131–142 (2019)

Singh, S., Rana, R.: Study of consumer perception of digital payment mode. J. Internet Banking Commer. 22(3), 1–14 (2017)

Singh, N., Srivastava, S., Sinha, N.: Consumer preference and satisfaction of M-wallets: a study on North Indian consumers. Int. J. Bank Mark. 35(6), 944–965 (2017)

Singh, S., Srivastava, R.K.: Understanding the intention to use mobile banking by existing online banking customers: an empirical study. J. Finan. Serv. Mark. 25, 86–96 (2020)

Baptista, G., Oliveira, T.: A weight and a meta-analysis on mobile banking acceptance research. Comput. Hum. Behav. 63, 480–489 (2016)

Priya, S.S.: Digital interventions for economic growth. South Asian J. Manag. 26(1), 174–177 (2019)

Singh, R., Malik, G.: Impact of digitalization on indian rural banking customer: with reference to payment systems. Emerg. Econ. Stud. 5(1), 31–41 (2019)

Reaves, B., et al.: Mo (bile) money, Mo (bile) problems: analysis of branchless banking applications. ACM Trans. Priv. Secur. (TOPS) 20(3), 1–31 (2017)

Iyer, L.: Adoption of digital wallets by petty vendors post demonetisation in India: a prediction approach. Asian J. Res. Soc. Sci. Hum. 8(6), 117–130 (2018)

Bansal, S.: Cashless economy: opportunities and challenges in India. Worldwide J. Multidiscip. Res. Dev. 3(9), 10–12 (2017)

Gupta, K., Arora, N.: Investigating consumer intention to accept mobile payment systems through unified theory of acceptance model. South Asian J. Bus. Stud. 9(1), 88–114 (2019)

Shahid, Q., Razaq, L.: Demonetisation for changing payment behaviour and building platforms. J. Payments Strategy Syst. 11(2), 158–167 (2017)

Iman, N.: Is mobile payment still relevant in the fintech era? Electron. Commer. Res. Appl. 30, 72–82 (2018)

Warfield, J.N.: Developing interconnection matrices in structural modeling. IEEE Trans. Syst. Man Cybern. 1(1), 81–87 (1974)

Luthra, S., Kumar, V., Kumar, S., Haleem, A.: Barriers to implement green supply chain management in automobile industry using interpretive structural modeling technique: an Indian perspective. J. Ind. Eng. Manag. 4(2), 231–257 (2011)

Al-Muftah, H., Weerakkody, V., Rana, N.P., Sivarajah, U., Irani, Z.: E-diplomacy implementation: exploring causal relationships using interpretive structural modelling. Gov. Inf. Q. 35(3), 502–514 (2018)

Dwivedi, Y.K., et al.: Driving innovation through Big Open Linked Data (BOLD): exploring antecedents using interpretive structural modelling. Inf. Syst. Front. 19(2), 197–212 (2017)

Janssen, M., Mangla, S., Luthra, S., Rana, N.P., Dwivedi, Y.K.: Challenges for implementing the Internet of Things (IoT) in smart cities: an integrated MICMAC Interpretive Structural Modeling (ISM) approach. Internet Res. 29(6), 1589–1616 (2019)

Janssen, M., Rana, N.P., Slade, E., Dwivedi, Y.K.: Trustworthiness of digital government services: deriving a comprehensive theory through interpretive structural modelling. Publ. Manag. Rev. 20(5), 647–671 (2018)

Hughes, D.L., Dwivedi, Y.K., Rana, N.P., Simintiras, A.C.: Information systems project failure – analysis of causal links using interpretive structural modelling. Prod. Plan. Control 27(16), 1313–1333 (2016)

Mangla, S.K., Rich, N., Luthra, S., Kumar, D., Rana, N.P., Dwivedi, Y.K.: A combined ISM-Fuzzy DEMATEL based framework for implementing sustainable initiatives in agri-food supply chains. Int. J. Prod. Econ. 203, 379–393 (2018)

Mishra, N., Singh, A., Rana, N.P., Dwivedi, Y.K.: Interpretive structural modelling and fuzzy MICMAC approaches for customer centric beef supply chain: application of a big data technique. Prod. Plan. Control 28(11–12), 945–963 (2017)

Rana, N.P., Luthra, S., Rao, H.R.: Key challenges to digital financial services in emerging economies: the Indian context. Inf. Technol. People 33(1), 198–229 (2020)

Rana, N.P., Barnard, D., Baabdullah, A., Rees, D., Roderick, S.: Exploring barriers of M-commerce adoption in SMEs in the UK: developing a framework using ISM. Int. J. Inf. Manag. 44, 141–153 (2019)

Rana, N.P., Luthra, S., Rao, H.R.: The challenges of Digital Financial Services (DFS) in India: deriving a framework using Interpretive Structural Modeling (ISM). In: PACIS 2018, Yokohama, Japan (2018)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 IFIP International Federation for Information Processing

About this paper

Cite this paper

Rana, N.P., Luthra, S., Rao, H.R. (2020). Assessing Challenges to Mobile Wallet Usage in India: An Interpretive Structural Modeling Approach. In: Sharma, S.K., Dwivedi, Y.K., Metri, B., Rana, N.P. (eds) Re-imagining Diffusion and Adoption of Information Technology and Systems: A Continuing Conversation. TDIT 2020. IFIP Advances in Information and Communication Technology, vol 618. Springer, Cham. https://doi.org/10.1007/978-3-030-64861-9_10

Download citation

DOI: https://doi.org/10.1007/978-3-030-64861-9_10

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-64860-2

Online ISBN: 978-3-030-64861-9

eBook Packages: Computer ScienceComputer Science (R0)