Abstract

Mobile financial services are widely appreciated worldwide, but a considerable fragment of the population is resisting the technology. Therefore, the purpose of this paper is to identify and analyze the contextual relationships among a set of measures that influence the adoption of mobile financial services (MFSs). The paper employed the interpretive structural modeling technique to formulate a multilevel structural model with experts' knowledge and experience. Using MICMAC analysis, the factors were classified into four clusters: autonomous, linkage, dependent, and driving based on their dependence and driving power. The outcome shows that facilitating conditions is the most crucial factor in influencing the MFS adoption and demands special attention by authorities for better implementation of the technology. The findings will help the bank managers and telecom companies to direct their resources in significant areas.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Mobile technology has been acknowledged worldwide to provide financial services. With the expansion in the coverage of mobile phone networks and accelerating growth in users, mobile financial services have become a powerful medium for banks to deliver financial services. The innovation allowed the banks to offer a wide range of services to their customers, overcoming the temporal and spatial barriers. Simultaneously, it extends the benefits of ubiquity, real-time information, mobility, affordability, and convenience to mobile phone users. Also, mobile financial services involve lower operational costs to small- and medium-sized merchants than other payment mechanisms such as credit cards (Koenig-Lewis et al. 2015a, b).

Mobile financial service (MFS) is a broad term that includes a range of financial services that can be performed on a mobile phone. The typology of mobile financial services encompasses three leading forms: mobile banking, mobile money transfer, and mobile payment (Firpo 2009). Mobile banking serves as an additional channel for existing customers to interact with the bank. It allows them to open new bank accounts, access account information, check their balance, transfer funds, block missing cards, obtain branch and ATM locations, and even make financial investments. Mobile payment, on the other hand, allows the users to make person-to-business payments for goods and services with the help of mobile phones either at the point of sale terminal or remotely. The customers are increasingly using these services as it increases their convenience by eliminating the need for coins and cash for small transactions. Mobile money refers to the service that allows users to transfer money between people who have less access to bank accounts (Kim et al. 2018). These applications extend financial services to the people who are excluded from the banking system due to long distances and inadequate funds. Mobile financial services facilitate banks to enhance their service quality, build a competitive advantage, and provide value-added services to their clientele at a reduced cost. As per Reserve Bank of India (RBI) estimates, a transaction costs around 50 rupees if performed in a bank branch, 15 rupees if conducted through ATM. In contrast, a net-based transaction costs only about 4 rupees to the bank (PricewaterhouseCoopers, 2010). The spread is primarily due to savings in the payment of building rent and personnel salary. Consequently, many banks and organizations have developed mobile financial services applications to reach out to mobile phone users to deliver financial services. By integrating the new practice (i.e., mobile financial services) into an existing structure (i.e., internet and banks), banks and other market players not only can retain current customers but also have the chance to transform the potential ones (i.e., mobile phone users) (Yen and Wu 2016). Besides, the provision of Aadhaar-enabled know your customer (KYC) norms have been leveraged for validating digital accounts and led to an exponential growth in the volume of mobile transactions in India.

The introduction of low-priced smartphones, coupled with reasonable mobile tariffs, has led to an expansion in India's internet connectivity. As of November 2019, there were approximately 64.2 crores and 1.9 crores of wireless and wireline broadband subscribers, respectively, across the country (Reserve Bank of India 2020). Despite such prevalent adoption of smartphones and internet networks, the adoption ratio of mobile financial services is comparatively low (Deb and Agrawal 2017; Behl and Pal 2016; Thakur and Srivastava 2014). Therefore, it is imperative to examine the critical factors that impact mobile financial services adoption. Research studies have been conducted in India to explore the antecedents of MFS adoption. Most of the studies have either used structural equation modeling or regression analysis to analyze the structural relationship between factors as per the proposed framework (Elhajjar and Ouaida 2019; Slade et al. 2015; Hussain et al. 2019; Farah et al. 2018; Kwateng et al. 2019; Kishore and Sequeira 2016; Changchit et al. 2017). In their literature review on mobile banking adoption, Shaikh and Karjaluoto (2015) emphasized the need to conduct qualitative studies to explore the relationship among the factors applied. In this scenario, an approach like ISM allows exploring the linkages among the factors and providing a better understanding than the common survey method that usually pursues significant factors. The ISM technique facilitates collective knowledge of the factors rather than examining every factor in isolation. Mobile financial services adoption is a complex phenomenon that requires the simultaneous understanding of various factors and a hierarchy for the successful implementation of these variables. No other method helps to understand this interconnectivity or map the hierarchy of factors in order of their importance. Hardly any research has intended to explore the interactive relationships between these variables that can impact the management of resources by managers. It is challenging for them to determine the fundamental factors that require absolute priority for the successful implementation of mobile financial services. For this reason, it is essential to uncover the dynamic structure of MFS adoption. To the best of authors’ knowledge, no study has explored the interaction between the factors using the interpretive structural modeling (ISM) technique. Accordingly, this manuscript focusses on:

-

(a)

Identifying the factors that lead customers to indicate their intention to adopt mobile financial services

-

(b)

Studying the interaction between the antecedents using imperative structural modeling (ISM) approach.

This paper makes significant contributions to the extant literature. First, based on experts’ opinion, it extends the UTAUT 2 model by incorporating perceived risk and trust factors to explain user adoption behavior. Second, this research found facilitating conditions as the most crucial factor to drive MFS adoption. Third, the extant literature mainly focuses on exploring the factors that impact MFS adoption and seldom employed the ISM approach. This research tries to fill this gap and analyze the contextual relationships among the variables. The intention is to assist managers in the decision-making process and support devising strategies corresponding to each factor based on their relevance.

Literature review

Mobile financial services adoption

Yen and Wu (2016) defined mobile financial services (MFS) as the facility provided by financial institutions that allow an individual to perform various financial transactions with the help of a mobile handset and its application function. The adoption of mobile financial services has gained substantial attention in past research, and many studies have examined the factors affecting the behavioral intention of consumers to use these services. Extensive research has applied technology adoption models to study user behavior. Notable among them are the theory of reasoned action (Fishbein and Ajzen 1975), the theory of planned behavior (Ajzen 1985), the technology acceptance model (Davis et al. 1989), the task and technology fit model (Goodhue and Thompson 1995), the diffusion of innovation theory (Rogers 2003), and the unified theory of acceptance and use of technology (Venkatesh et al. 2003). It needs to be pointed that researchers have applied these theories to study mobile financial services adoption mainly by collecting empirical data through survey questionnaires and analyzed it with the structural equation modeling method (Dahlberg et al. 2015). But, the structural equation model or any other statistical analysis does not assess the interactive relationship among the factors. Therefore, this research attempts to explore the factors affecting MFS adoption and study the contextual relationship among these factors to identify the fundamental measures. A thorough literature review was carried out to gain a deep insight into MFS adoption. The motive is to initially draw a list of enablers of mobile financial services adoption to be further discussed with experts to determine their relevance in the Indian market. It has been observed that perceived usefulness, perceived ease of use, trust, perceived risk, compatibility, social influence, facilitating conditions, perceived cost, and attitude are some of the factors that have been studied most frequently concerning MFS adoption (Dahlberg et al. 2015; Liebana-Cabanillas et al. 2019). The identified factors were discussed with eighteen renowned academicians and practitioners having experience in the field of finance, banking, information technology, and the legal environment of the Indian banking system. Based on their assessment, ten enablers were finalized out of 15 factors that impact individuals’ judgment to adopt mobile financial services. The five factors were excluded as they were deemed unsuitable or similar to other constructs by the experts. The extracted factors were analogous to the constructs of the unified theory of acceptance and use of technology 2 (UTAUT2) with two additional dimensions. Table 1 pinpoints the ten identified factors that impact the mobile financial services system in the Indian scenario. Lastly, experts were requested to suggest the interrelationship between the constructs.

Performance expectancy

In mobile financial services, performance expectancy refers to the degree to which an individual believes that using a mobile phone will help him/her perform financial activities more efficiently. It reflects their perception of performance improvements such as convenient payment mechanisms, fast responses, and service effectiveness (Zhou et al. 2010). Owing to the ubiquitous nature of mobile phones and their increasing demand, users expect mobile financial services to save their time, increase their productivity and facilitate them to complete their tasks speedily (Bhatiasevi 2016). Accordingly, Hussain et al. (2019) and Zhou et al. (2010) found performance expectancy as the most reliable antecedent to influence the behavioral intention of the individuals.

Effort expectancy

Effort expectancy refers to the degree to which an individual believes that using a mobile phone will ease his/her financial tasks. Given the distinct nature of mobile financial services that require specialized knowledge and skill, effort expectancy could play a significant role in determining consumers’ intention to use the service (Alalwan et al. 2016). Several researchers have validated the impact of effort expectancy on users’ intention to use mobile financial services (Hussain et al. 2019; Giovanis et al. 2019; Alalwan et al. 2017; Tan et al. 2010; Teo et al. 2015; Musa et al. 2015). When a person conceives mobile financial services as uncomplicated and easy to use, he/she has a high intention toward using the technology.

Social influence

Social influence refers to the degree to which persons close to the individual affect his/her judgment to adopt mobile financial services. Social elements affect an individual’s behavior through three processes, i.e., identification, internalization, and compliance (Qasim and Shanab 2016). While the former two indicate a modification in an individual's belief for potential social status gain, the compliance process prompts a transformation in an individual's intention to comply with social pressure (Venaktesh et al. 2003). The underlying assumption is that individuals tend to seek the opinion of their friends and relatives to reduce their anxiety when introduces to new technology (Slade et al. 2015). Empirical studies by Giovanis et al. (2019), Oliveira et al. (2016), Musa et al. (2015), Koenig-Lewis et al. (2015a, b), Bhatiasevi (2016), and Farah et al. (2018) indicate that social influence was a significant factor to influence people willing to adopt mobile financial services.

Facilitating conditions

Facilitating conditions refer to the availability of required resources and aiding environment to support the use of mobile financial services. When individuals are equipped with an uninterrupted internet connection, affordable mobile phones, sound regulatory policies, technical assistance, and requisite knowledge and skills, they are motivated to use the services. Chawla and Joshi (2019) stated that the ability of banks, financial institutions, and telecom companies to provide competent services could instill confidence in the user and shape their attitude. Likewise, Hussain et al. (2019), Moorthy et al. (2020a), Oliveira et al. (2014), Alalwan et al. (2017), Crabbe et al. (2009), and Teo et al. (2015) claimed a significant impact of facilitating conditions on users’ intention to use mobile financial services. An individual perceives a sense of psychological control if he possesses certain facilitating conditions (Nel et al. 2012).

Hedonic motivation

Hedonic motivation refers to the fun or pleasure derived by using mobile financial services. These services are delightful to users as it enables them to perform financial transactions in a fun way (Oliveira et al. 2016). Alalwan et al. (2017) assert that the likelihood of adopting mobile banking could reach the highest level if such novel channels are perceived as joyful, entertaining, and pleasurable by banking clients. Indeed, mobile payment services allow users to transfer money to their family members and make payments for their basic needs, thus providing a feeling of satisfaction and relaxation (Hussain et al. 2019). In the literature, hedonic motivation was found as an influential antecedent of mobile financial services adoption (Salimon et al. 2017; Alalwan et al. 2017; Farah et al. 2018).

Habit

Habit refers to the degree to which people use mobile financial services automatically due to repeatedly using mobile phones to conduct financial transactions. Venkatesh et al. (2012) suggested that the contextual environment needs to be stable to perform habitual behavior automatically. An action will only convert into a habit if the individual has some good experience working on that technology. In financial activities, people are more inclined to seek personal assistance and prefer to visit banks to solve their queries. Therefore, telecom companies and banks need to design these services to enhance their experience by incorporating comfortable and attractive features. Once the habit of using mobile financial services is developed among the users, it can be a strong determinant to derive their intention (Yen and Wu 2016; Keramati et al. 2012; Farah et al. 2018; Hussain et al. 2019).

Perceived value

Perceived value is defined as the overall difference anticipated by an individual between the perceived benefit and perceived cost incurred to use mobile financial services. If the benefits perceived by the customers are more than the perceived cost, they are encouraged to use these services (Farah et al. 2018; Kwateng et al. 2019; Amoroso and Watanabe 2012; Madan and Yadav, 2016). In the context of mobile financial services, perceived benefits consist of convenience, 24*7 h service, the privacy of transactions, no traveling time and cost, no waiting in the long queues of banks, and various rewards offered by service providers. In comparison, the cost incurred to avail these services covers internet charges, transaction fees, handset prices, agents' commission, and risk of financial as well as privacy loss. An individual is likely to adopt mobile financial services when these services are considered more valuable than traditional banking.

Trust

Trust refers to the belief that the service providers (banks, financial institutions, telecom companies, agents) will act in the best interest of the individual and will not take any unfair advantage of the user. Many authors have highlighted the importance of the trust factor in deriving the intention of individuals to use mobile financial services given the absence of face-to-face interaction and physical branch in these transactions (Teo et al. 2015; Narteh et al. 2017; Malaquias et al. 2018; Park et al. 2019; Chawla and Joshi 2019; Mallat 2007). For the success of their business, service providers are required to build trust among their customers and retain them for a long time. People will not transact via mobile phones if there is any possibility of unauthorized usage of their information. The user-friendly interface, better network quality, secured logins, and appointment of trusted agents can motivate the acceptance of these services (Tobbin 2012).

Perceived risk

Perceived risk is defined as the possibility of unfavorable outcomes while using mobile financial services. These risks include loss of mobile handset, lack of confidentiality between user and service provider for privacy, unauthorized access of data, the possibility of performing wrong transactions, and authenticity of service providers. People who have never purchased anything on the internet or lack any experience using these services are more anxious and face a higher risk than their counterparts (Black et al. 2001). A closer look at the related studies reveals perceived risk as one of the impediments to adopting mobile financial services (Koenig-Lewis et al. 2015a, b; Park et al. 2019; Ramayah et al. 2017; Yang et al. 2012; Hanafizadeh et al. 2014; Al-Jabri and Sohail 2012). The concern of people over the technical unreliability of the technology causes them to avoid using the service in the first place (Ha et al. 2012).

Interpretive structural modeling review

Interpretive structural modeling, a technique proposed by Warfield Institute, can decompose a complicated system into several subsystems and formulate a multilevel structural model with the knowledge and practical experience of experts (Warfield 1976). This method helps to convert ambiguous and poorly articulated relationships into a transparent, well-defined model by systematic and iterative application of graph theory (Sushil 2012). Accordingly, various researchers have employed this technique to establish the association between the factors influencing an issue or concern. A list of such studies is summarized in Table 2.

Research methodology

This research aimed to identify the factors that impact the adoption of mobile financial services and study the relationship between these variables using interpretive structural modeling. A comprehensive literature review and expert opinion narrow down a list of ten antecedents, which was further discussed with academicians and practitioners to understand their relevance in the Indian financial market. The experts were approached to determine the interrelationship between these variables. Ritchie and Lewis (2003) recommended that the sample size for qualitative study often lies below 50 respondents. In the present study, thirty-five experts were consulted who are conversant with the deployment of mobile financial services. Saturation occurred after these interviews as no new insights are provided by additional participants Purposive sampling was utilized to recruit experts with deep knowledge and understanding of mobile financial services. Purposive sampling was used to select participants based on their expertise and skills. Experts from various academic institutions and banks were contacted to confirm whether they have the required knowledge and experience. The expert panel is composed of 14 associate professors and professors of reputed management institutions, twelve bank managers, six chief managers, and three assistant general managers. A questionnaire was administered to collect data about the contextual relationship between the factors. A statement describing the research objective and explanation of factors was added to the questionnaire to assure the clarity of the context. The factors were denoted as M1, M2 … M10 as shown in Appendix. Experts were asked to perform a pairwise comparison between the variables to examine whether there is a relationship between these variables. Separate interviews were taken to avoid any possible influence of one's opinion on others. Each meeting lasted between 60 to 90 min. As suggested by Ma et al. (2019), consensus analysis was applied to eliminate experts’ subjectivity and validate the data. Subsequently, all the responses were reviewed, and the opinion receiving expert's consensus was used to formulate interpretive structural modeling.

Interpretive structural modeling

ISM is a decision-making tool that assists in deriving a structural model from a set of variables/barriers influencing the adoption of a particular system (Vasanthakumar et al. 2016). The theory of ISM leverages expert knowledge and the practitioner’s industrial experience to examine the interrelationships between the variables and develop the structural model. The technique is imperative as it allows the judgment of experts to explain the relationship between various components. Since the methodology links the variables directly or indirectly to form a transparent and well-articulated model, it is structural in nature. Also, the connections and structure are demonstrated in a graphical form; thus, it is a modeling procedure (Pitchaimuthu et al. 2019). The current study employs ISM because it allows studying all the factors collectively than examining them individually.

The various steps engaged in the process of interpretive structural modeling are listed below:

-

Step 1: Identify the various factors that impact the adoption of mobile financial services. Literature review and expert opinion can be utilized for this purpose.

-

Step 2: Create a structural self-interaction matrix (SSIM), which indicates the pairwise relationship between the factors.

-

Step 3: Construct the initial and final reachability matrix to ensure the transitivity of the relationship between the variables. Transitivity can be explained as: if x is related to y and y is related to z, then the rule of transitivity implies that x should be related to z.

-

Step 4: After that, partitioning is performed to rank the factors.

-

Step 5: Next, ISM-based structural model is developed by demonstrating the relationships between factors.

-

Step 6: Lastly, MICMAC analysis is performed to determine the driving and dependence power of the factors.

Structural self-interaction matrix (SSIM)

The structural self-interaction matrix depicts the pairwise relationship between the variables. Based on the opinion of academicians and industrial experts, the contextual relationship between the variables was identified. The criteria of 'X leads to Y' were chosen to indicate the relationship. This implies that experts were asked if factor ‘x’ will influence factor ‘y’ and vice versa. All the possible combinations of adoption factors were presented, and experts were asked to specify the relation between the variables (x and y) using four symbols (V, A, X, O).

-

V: When variable x will influence variable y.

-

A: When variable y will influence variable x.

-

X: When variable x and y will influence each other

-

O: When variables x and y are not related to each other

The SSIM is developed in accordance with the responses provided by the experts and presented in Table 3.

Reachability matrix

Initial reachability matrix

At this step, SSIM is converted into a binary matrix, termed as the initial reachability matrix, by replacing the original symbols (V, A, X, O) for 1 or 0. SSIM is transformed into the reachability matrix as per the following criteria:

-

If the input (x,y) in the SSIM is V, then the value of (x,y) entry in the reachability matrix will be 1, and (y,x) will be 0.

-

If the input (x,y) in the SSIM is A, then the value of (x,y) entry in the reachability matrix will be 0, and (y,x) will be 1.

-

If the input (x,y) in the SSIM is X, then the value of (x,y) entry in the reachability matrix will be 1, and (y,x) will be 1.

-

If the input (x,y) in the SSIM is O, then the value of (x,y) entry in the reachability matrix will be 0, and (y,x) will be 0.

Following the above rules, an initial reachability matrix is developed in Table 4.

Final reachability matrix

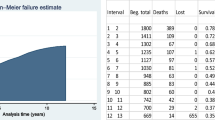

The final reachability matrix is constructed by incorporating the rule of transitivity in Table 5. The relationship between variables to confirm the transitivity rule is shown by the symbol of an asterisk (*) in Table 5. The dependence power and driving power of each variable are also provided in the table. The driving power reflects the number of variables that a given variable may help to attain. The dependence power indicates the number of variables that may help to attain the given variable. The driving and dependence power will help perform MICMAC analysis where the variables will be classified into four segments: dependent, independent, linkage, and autonomous.

Level partitions

The antecedent set and reachability set for each of the variables are derived from the final reachability matrix. The antecedent set reflects the variables (including itself) that may help to attain a specific variable, whereas the reachability set for a particular variable indicates the variables (including itself) that it may help to achieve. The intersection set for a specific variable includes the variables that are common in both the antecedent set and reachability set. Subsequently, the parameter for which the intersection set and reachability set are identical is marked as level one in the ISM ranking, as it will not help attain any other factor above their position (Azevedo et al. 2013). The top-level variables are excluded in the successive iterations, and this process is continued until the final iterations result in bottom-level variables. The iteration process, together with the reachability set, antecedent set, and intersection set, is illustrated in Tables 6, 7, 8, 9, 10, 11 and 12.

Structuring the ISM model

The structural model is developed based on the output obtained from the final reachability matrix and partition table. The relationship between the variables is illustrated with the help of an arrow. For instance, if variable 'x’ helps in attaining variable ‘y,' then an arrow pointing from x to y shows this relationship. Similarly, all the relationships are displayed in the ISM model, confirming the level of hierarchy between the variables. The variables extracted in the initial iteration level are positioned on the top of the diagram, and subsequent variables are placed downward, corresponding to the level of iteration in the partition process. The resulting diagram is known as digraph. Lastly, the digraph is converted into ISM by removing the transitivities, as illustrated in Fig. 1.

It can be inferred from the model that the facilitating condition is the pivotal driving factor for adopting mobile financial services as it is placed at the bottom-most of the structure. On the other hand, behavioral intention is the least influencing factor in the whole network. All other factors lie in the middle of these two factors.

MICMAC analysis

MICMAC analysis includes developing a graph that segregates the factors based on their driving and dependence factors. The factors are plotted on the graph by utilizing the data from the final reachability matrix. The dependence power of each factor is plotted on the x-axis and the driving factor on the y-axis. The resulting coordinates corresponding to each factor lie in one of the four clusters, i.e., autonomous, driving, linkage, or dependent. The graph deriving from MICMAC analysis is illustrated in Fig. 2.

-

1.

Autonomous factors: The factors in this cluster indicate a weak driving as well as dependent power. Hence, they do not have much influence on the system. It can be viewed from Fig. 2 that there are no autonomous factors in this research, indicating the significance of all factors in the study.

-

2.

Dependent factors: The factors in this factor reflect a weak driving power and a strong dependent power. In the present case, there are three dependent factors, namely behavioral intention, performance expectancy, and hedonic motivation.

-

3.

Linkage factors: This cluster consists of factors that have high driving power and high dependent power. These factors will influence the other factors and also have a feedback influence on themselves. Referring to Fig. 2, the four linkage factors are effort expectancy, habit, trust, and perceived risk.

-

4.

Driving factors: The fourth cluster comprises of factors that have strong driving power but weak dependence power. Three factors fall into this category, namely social influence, perceived value, and facilitating conditions. These factors help in attaining all the factors that lie in the upward direction of the ISM model.

Discussion

The perpetual proximity of mobile phones to their users makes them an appropriate medium to deliver financial services. Mobile financial services allow the user to perform almost every banking activity from the convenience of the home. From checking account balance to making payment of the bills, the services have eased people's lives by saving their time and minimizing the need to visit banks. These benefits can even be transferred to people who don't have access to the bank premises. A person having a mobile phone and SIM card can use mobile money services to conduct various transactions such as money transfer, buying goods, and paying online merchants. The utility of mobile financial service will be more if enough users adopt the services to increase the possibility of transactions via mobile phones at various platforms.

To achieve this objective, the current study identified the factors that will impact an individual to adopt mobile financial services. Initially, factors were identified by reviewing the extant literature, which was further discussed with academicians to know their significance in the Indian market. After shortlisting the ten relevant factors, experts were approached to create the interrelationship among the suggested measures. The procedure not only established the interaction among the factors but also explore the most critical factors that impact the adoption of mobile financial services. An ISM-based structural model was developed, and factors were classified into autonomous, dependent, linkage, and driving factors based on their dependence and driving power.

Autonomous factors have weak driving power as well as weak dependence power implying weak influence on other factors (Katiyar and Badola 2018). The study has not found any variable that falls in this category. This reflects the significance of every element in influencing the MFS adoption.

The factors facilitating conditions, perceived value, and social influence lie in the fourth cluster of MICMAC analysis, implying high driving power. This means that these variables are the most important for the adoption of mobile financial services as they influence the other variables. Being the bottom-most factor of the ISM model, facilitating conditions imply the most critical factor influencing the MFS adoption. Moorthy et al. (2020) also found facilitating conditions as the most important determinant of mobile payment adoption and suggest service providers ensure the stability of mobile payments to be error-free. Likewise, See and Goh (2020) indicated facilitating conditions as the strongest determinant of mobile payment adoption and recommended the support of online FAQs, video instructions, and service centers to provide rich experience to the users. Accordingly, stakeholders should invest their resources to equip people with better infrastructure facilities and a safe environment to pursue the usage of services. As exhibited by the ISM model, facilitating conditions will directly influence the perceived value of mobile financial services. Understandably, providing affordable handsets, uninterrupted internet facilities, protection against online crimes, and learning sessions will enhance the benefits of services as perceived by people. When the perceived benefit of technology exceeds its perceived cost, individuals tend to recommend it to their near ones. Bank staff, renowned personalities, and group leaders should be the focus of service providers to publicize their apps (Tran and Corner 2016). Moreover, companies can add rewarding features to encourage people to endorse their applications. Merchants are the other end in the commercial transactions, so service providers should encourage them to involve customers in the mobile payment process by offering various offers and rewards.

Service providers should concentrate on the factors that lie in the upper part of the graph since they indicate a high driving power and can influence other factors. The factors effort expectancy, habit, perceived risk, and trust are plotted in cluster III; therefore, it displays a high driving and high dependence power. These measures act as mediating factors in the ISM hierarchy and serve as a connecting role between the dependent and driving measures for the successful adoption of mobile financial services. Technologies that are easy to use and require minimum efforts gradually become a routine for the user and create trust over a period of time (Zhou 2011, 2012; Chawla and Joshi 2019). A user-friendly interface, linking credit/debit cards, large phone screens, user manuals, the customized home page, convenient navigation, and continuous assistance can enhance users' experience and simplify the process of using the applications. When an individual starts transacting via mobile phone continuously, it ultimately turns into a habit in the meanwhile (Venkatesh et al. 2012). Undoubtedly, he/she will not switch to other alternatives once they get habituated to use mobile financial services (Yen and Wu 2016). As such, service providers should introduce a consistent user promotional program in which customers who perform some specific activity on the app on a daily basis will be rewarded. This will inculcate a habit in the customers to regularly use these apps to complete their transactions. Regarding building trust among the common people, service providers should reduce the risk of uncertainty while conducting transactions on digital platforms. The provision of a virtual keyboard, Padlock symbol, double security check, stringent password requirements, mandatory logout on multiple inputs of wrong passwords, and change of login pin after a particular period can ensure customers that mobile transactions are safe and secure. To mitigate the customers' doubts regarding online fraud, they should be educated about the online safety measures and grievance redressal available to them. They should be assured that all their problems and queries will be resolved speedily. On this account, the Reserve Bank of India (RBI) should create a separate department that exclusively serves to resolve mobile financial services issues to ensure clarity among people on how these services are regulated.

There are also some dependent factors in the driver-dependence diagram. These variables including hedonic motivation, performance expectancy, and behavioral intention are situated at the top of the hierarchy structure. These measures are weak drivers but have high dependence power. This means that these factors are largely affected by other factors, such as facilitating conditions and perceived value. Service designers should add the element of fun and pleasure in the applications to retain the users. A novel and innovative technology always attracts the attention of people and motivates them to use the technology (Koenig-Lewis et al. 2015a, b). The "scratch card" feature added by various companies, namely Phonepe, Google pay, and Paytm, creates a surprise element for the users that induce them to perform transactions on these apps. To improve the performance expectancy of mobile financial services, officials should ensure effective internet connectivity so that transactions can be performed anywhere and anytime without any interruption. The applications should be designed to enable a user to conduct all the banking services on a single platform, thus eliminating the need to visit banks. Individuals have a high intention to adopt the technology that is expected to drive positive utility in the future (Alalwan et al. 2016; Hussain et al. 2019; Giovanis et al. 2019; Al-Saedi et al. 2020). Ultimately, a high degree of intention to perform a specific behavior will lead to the actual performance of the given task (Venkatesh et al. 2003; Venkatesh et al. 2012, Farah et al. 2018; Kwateng et al. 2019; Yu 2012).

These findings will help the government officials, bank managers, service providers, and software designers analyze the significant measures that will influence the adoption of mobile financial services in the Indian market. This will help them make strategies so that valuable resources can be devoted to the most crucial factors. Not only this, but the ISM model developed in this study also presents the structural relationship between these factors that will help future researchers to understand the direct as well as the indirect link between the measures.

Theoretical implications

This study makes some distinctive theoretical contributions to the existing literature on mobile financial services adoption. First, this paper incorporates perceived risk and trust to extend the UTAUT2 model to explain mobile financial services user behavior. These constructs hold a significant influence over MFS adoption considering the lack of personal attention and exchange of sensitive information on mobile applications. The use of additional variables can offer a more accurate understanding of consumer technology adoption intention and provide new insights to future researchers who intend to examine new information systems.

Second, this research not only identifies the variables that impact MFS adoption but also classifies them into autonomous, dependent, linkage, and driving factors based on their dependence and driving power. This has helped determine the strength of the relationship between dependence power and the driving power of the MFS adoption factors. Further, this study recognized facilitating conditions as the fundamental variable that ought to influence other variables for MFS adoption.

Third, the major contribution of this research is to perform a systematic analysis of the relationship among the measures. Perhaps, this is the first study to examine the contextual relationship among the factors with the experts’ assistance. The ISM-based multilevel structural model uncovers the pragmatic connection among the variables with the knowledge and skills of the experts.

Fourth, the ISM model found many new relationships among the variables, which, to the authors’ knowledge, has not been studied in the previous literature. For instance, we did not find any research examining a direct relationship between facilitating conditions and perceived value. Therefore, this study provides a theoretical overview for researchers to study the above linkages empirically in different contexts.

Managerial implications

The ISM-based structural model developed in this study provided the hierarchy of adoption factors and classified them into dependent and driving factors. This will assist the decision-makers in ranking the measures in a more realistic and constructive form. The hierarchical model reveals the sequence in which managers need to prioritize their resources to stimulate mobile financial services in the Indian market. For instance, the accessibility to affordable smartphones, high-speed internet connection, and secure mobile payment apps will impact the perceived value of these services, which will encourage users to invite their near ones to use these apps. As pointed out by Navkender Singh, Research Director, IDC India (The Economic Times 2019), the cost of ownership, the lack of digital literacy, and the rigidity of feature phones hold customers back from buying new smartphones. As a result, there are about 450 million smartphones as compared to 550 million feature phones in India. Accordingly, service providers should ensure that individuals acquire certain facilitating conditions to conduct mobile payments such as error-free transaction process, 24*7 assistance to clarify the doubts, knowledge to operate these services, inexpensive mobile phones, working internet connection, and nominal transaction charges.

The findings of this study indicate the perceived value and social influence as the significant driving factors in addition to facilitating conditions. The strong driving power of these variables suggests that the probability of adopting mobile financial services will be high if individuals perceive these technologies to be efficient, cost-effective, and worth their time and money. Promotional campaigns publicizing the feedback and opinions of early users may create positive worth-of-mouth for mobile payments, reinforcing the intention to use the technology. Banks should engage their staff in encouraging customers to adopt mobile financial services by educating the benefits of using these technologies, viz. quick payments, secure transactions, ubiquitous availability, promotional discounts, and minimum charges. Accordingly, consumers are likely to adopt mobile financial services if they believe that these services offer the best performance-to-price value and provide the most advantages compared to other banking services (Moorthy et al. 2020a).

Conclusion

The banking sector requires to evolve regularly to enhance its competitive advantage, meet customers’ ever-changing demands, and provide innovative products to their customers. Mobile financial service is one of the recent technological advancement that allows banks a modern and interactive way to engage with their customers. Also, the inherent convenience and mobility characteristics of this technology have provided individuals an exceptional approach to conduct financial activities at the convenience of their homes. Despite all these benefits, mobile financial services remain in the early stage of adoption. There have been studies that have explored the factors that influence the adoption of mobile financial studies. The originality of this research lies in the fact that it identifies a comprehensive list of such variables and establishes the contextual relationship between them. Based on the ISM structural model, facilitating conditions were found to be the most crucial factor that influences the adoption of MFS. Being the bottom-most factor of the ISM hierarchy, it can drive all other factors in the structure. Therefore, service providers should prioritize improving the primitive facilities, especially in rural areas, for the effective implementation of the technology. The MICMAC analysis classified the variables into four clusters: autonomous, dependent, linkage, and driving. Driving factors include facilitating conditions (M4), perceived value (M7), and social influence (M3), which help to drive other factors. Linkage factors consist of effort expectancy (M2), habit (M6), trust (M8), and perceived risk (M9), while the analysis found hedonic motivation(M5), performance expectancy (M1), and behavioral intention (M10) as the dependent variables. Figure 2 indicates that there is no autonomous factor; thus, all factors influence mobile financial services. The findings will help the bank managers and telecom companies to direct their resources in the most critical area.

The current study holds a few limitations. First, the ISM model is developed to identify the MFS adoption factors for the Indian financial market, limiting its applicability in other countries. Future research can perform this study elsewhere to check the relevance of these factors in different countries or different sectors. Second, ISM methodology relies on the experts' knowledge and skills to establish the contextual relationship between the variables. The proposed model is not statistically validated. Therefore, structural equation modeling can be applied in future studies to check the reliability and validity of the model.

References

Ajzen, I. 1985. From intentions to actions: A theory of planned behavior. In Action-control: From cognition to behavior, ed. J. Kuhl and J. Beckmann, 11–39. Heidelberg: Springer.

Alalwan, A.A., Y.K. Dwivedi, and N.P. Rana. 2017. Factors influencing adoption of mobile banking by Jordanian bank customers: Extending UTAUT2 with trust. International Journal of Information Management 37 (3): 99–110.

Alalwan, A.A., Y.K. Dwivedi, N.P. Rana, and M.D. Williams. 2016. Consumer adoption of mobile banking in Jordan: Examining the role of usefulness, ease of use, perceived risk and self-efficacy. Journal of Enterprise Information Management 29 (1): 118–139.

Ali, S.M., A. Arafin, M.A. Moktadir, T. Rahman, and N. Zahan. 2018. Barriers to reverse logistics in the computer supply chain using interpretive structural model. Global Journal of Flexible Systems Management 19 (1): 53–68.

Al-Jabri, I.M., and M.S. Sohail. 2012. Mobile banking adoption: Application of diffusion of innovation theory. Journal of Electronic Commerce Research 13 (4): 379–391.

Al-Saedi, K., M. Al-Emran, T. Ramayah, and E. Abusham. 2020. Developing a general extended UTAUT model for M-payment adoption. Technology in Society 62: 101293.

Amoroso, D.L., and R. Magnier-Watanabe. 2012. Building a research model for mobile wallet consumer adoption: the case of mobile Suica in Japan. Journal of Theoretical and Applied Electronic Commerce Research 7 (1): 94–110.

Azevedo, S., H. Carvalho, and V. Cruz-Machado. 2013. Using interpretive structural modelling to identify and rank performance measures. Baltic Journal of Management 8 (2): 208–230.

Behl, A., and A. Pal. 2016. Analysing the barriers towards sustainable financial inclusion using mobile banking in rural India. Indian Journal of Science and Technology 9 (15): 1–7.

Bhatiasevi, V. 2016. An extended UTAUT model to explain the adoption of mobile banking. Information Development 32 (4): 799–814.

Biswal, J.N., K. Muduli, S. Satapathy, D.K. Yadav, and J. Pumwa. 2018. Interpretive structural modeling-based framework for analysis of sustainable supply chain management enablers: Indian thermal power plant perspective. Journal of Operations and Strategic Planning 1 (1): 34–56.

Black, N., A. Lockett, H. Winklhofer, and C. Ennew. 2001. The adoption of Internet financial services: a qualitative study. International Journal of Retail and Distribution Management 29 (8): 390–398.

Bux, H., Z. Zhang, and N. Ahmad. 2020. Promoting sustainability through corporate social responsibility implementation in the manufacturing industry: An empirical analysis of barriers using the ISM-MICMAC approach. Corporate Social Responsibility and Environmental Management 27(4): 1729–1748.

Changchit, C., R. Lonkani, and J. Sampet. 2017. Mobile banking: Exploring determinants of its adoption. Journal of Organizational Computing and Electronic Commerce 27 (3): 239–261.

Chawla, D., and H. Joshi. 2019. Consumer attitude and intention to adopt mobile wallet in India—An empirical study. International Journal of Bank Marketing. 37 (7): 1590–1618.

Crabbe, M., C. Standing, S. Standing, and H. Karjaluoto. 2009. An adoption model for mobile banking in Ghana. International Journal of Mobile Communications 7 (5): 515–543.

Dahlberg, T., J. Guo, and J. Ondrus. 2015. A critical review of mobile payment research. Electronic Commerce Research and Applications 14 (5): 265–284.

Davis, F.D., R.P. Bagozzi, and P.R. Warshaw. 1989. User acceptance of computer technology: A comparison of two theoretical models. Management Science 35 (8): 982–1003.

Deb, M., and A. Agrawal. 2017. Factors impacting the adoption of m-banking: understanding brand India’s potential for financial inclusion. Journal of Asia Business Studies 11 (1): 22–40.

Digalwar, A., R.D. Raut, V.S. Yadav, B. Narkhede, B.B. Gardas, and A. Gotmare. 2020. Evaluation of critical constructs for measurement of sustainable supply chain practices in lean-agile firms of Indian origin: A hybrid ISM-ANP approach. Business Strategy and the Environment 29 (3): 1575–1596.

Elhajjar, S., and F. Ouaida. 2019. An analysis of factors affecting mobile banking adoption. International Journal of Bank Marketing 38 (2): 352–367.

Farah, M.F., M.J.S. Hasni, and A.K. Abbas. 2018. Mobile-banking adoption: empirical evidence from the banking sector in Pakistan. International Journal of Bank Marketing. 36 (7): 1386–1413.

Firpo, J. (2009). E-Money–Mobile Money–Mobile Banking–What’s the Difference? Retrieved from http://blogs.worldbank.org/psd/e-money-mobile-money-mobile-banking-what-s-the-difference.

Fishbein, M., and I. Ajzen. 1975. Belief, attitude, intention, and behavior: An introduction to theory and research. Reading, MA: Addison-Wesley.

Giovanis, A., C. Assimakopoulos, and C. Sarmaniotis. 2019. Adoption of mobile self-service retail banking technologies. International Journal of Retail and Distribution Management 47 (9): 894–914.

Goodhue, D.L., and R.L. Thompson. 1995. Task-technology fit and individual performance. MIS Quarterly 19 (2): 213–236.

Gupta, K.P., R. Manrai, and U. Goel. 2019. Factors influencing adoption of payments banks by Indian customers: Extending UTAUT with perceived credibility. Journal of Asia Business Studies 13 (2): 173–195.

Ha, K.H., A. Canedoli, A.W. Baur, and M. Bick. 2012. Mobile banking—Insights on its increasing relevance and most common drivers of adoption. Electronic Markets 22 (4): 217–227.

Hanafizadeh, P., M. Behboudi, A.A. Koshksaray, and M.J.S. Tabar. 2014. Mobile-banking adoption by Iranian bank clients. Telematics and Informatics 31 (1): 62–78.

Hsu, C.L., C.F. Wang, and J.C.C. Lin. 2011. Investigating customer adoption behaviours in mobile financial services. International Journal of Mobile Communications 9 (5): 477–494.

Hussain, M., A.T. Mollik, R. Johns, and M.S. Rahman. 2019. M-payment adoption for bottom of pyramid segment: an empirical investigation. International Journal of Bank Marketing. 37 (1): 362–381.

Kamble, S.S., A. Gunasekaran, and R.D. Raut. 2019. Analysing the implementation barriers of dual cycling in port container terminal using interpretive structural modeling-Indian context. International Journal of Logistics Research and Applications 22 (2): 119–137.

Katiyar, R., and S. Badola. 2018. Modelling the barriers to online banking in the Indian scenario: An ISM approach. Journal of Modelling in Management. 13 (3): 550–569.

Keramati, A., R. Taeb, A.M. Larijani, and N. Mojir. 2012. A combinative model of behavioural and technical factors affecting ‘Mobile’-payment services adoption: An empirical study. The Service Industries Journal 32 (9): 1489–1504.

Kim, M., H. Zoo, H. Lee, and J. Kang. 2018. Mobile financial services, financial inclusion, and development: A systematic review of academic literature. The Electronic Journal of Information Systems in Developing Countries 84 (5): e12044.

Kishore, S.K., and A.H. Sequeira. 2016. An empirical investigation on mobile banking service adoption in rural Karnataka. SAGE Open 6 (1): 2158244016633731.

Koenig-Lewis, N., M. Marquet, A. Palmer, and A.L. Zhao. 2015a. Enjoyment and social influence: predicting mobile payment adoption. The Service Industries Journal 35 (10): 537–554.

Koenig-Lewis, N., M. Marquet, A. Palmer, and A.L. Zhao. 2015b. Enjoyment and social influence: Predicting mobile payment adoption. The Service Industries Journal 35 (10): 537–554.

Koksal, M.H. 2016. The intentions of Lebanese consumers to adopt mobile banking. International Journal of Bank Marketing 34 (3): 327–346.

Kumar, D., and Z. Rahman. 2017. Analyzing enablers of sustainable supply chain: ISM and fuzzy AHP approach. Journal of Modelling in Management 12 (3): 498–524.

Kushagra, K., and S. Dhingra. 2019. Modelling the cloud adoption factors for the government organisations in India. Electronic Government, an International Journal 15 (3): 332–353.

Kwateng, K.O., K.A. Osei Atiemo, and C. Appiah. 2019. Acceptance and use of mobile banking: an application of UTAUT2. Journal of Enterprise Information Management 32 (1): 118–151.

Lara-Rubio, J., A.F. Villarejo-Ramos, and F. Liébana-Cabanillas. 2020. Explanatory and predictive model of the adoption of P2P payment systems. Behaviour and Information Technology 1–14.

Laukkanen, T. 2016. Consumer adoption versus rejection decisions in seemingly similar service innovations: The case of the Internet and mobile banking. Journal of Business Research 69 (7): 2432–2439.

Liébana-Cabanillas, F., I. García-Maroto, F. Muñoz-Leiva, and I. Ramos-de-Luna. 2020. Mobile payment adoption in the age of digital transformation: The case of Apple Pay. Sustainability 12 (13): 5443.

Liebana-Cabanillas, F., S. Molinillo, and M. Ruiz-Montanez. 2019. To use or not to use, that is the question: Analysis of the determining factors for using NFC mobile payment systems in public transportation. Technological Forecasting and Social Change 139: 266–276.

Liébana-Cabanillas, F., J. Sánchez-Fernández, and F. Muñoz-Leiva. 2014. Antecedents of the adoption of the new mobile payment systems: The moderating effect of age. Computers in Human Behavior 35: 464–478.

Ma, G., J. Jia, J. Ding, S. Shang, and S. Jiang. 2019. Interpretive structural model based factor analysis of BIM adoption in Chinese construction organizations. Sustainability 11 (7): 1982.

Madan, K., and R. Yadav. 2016. Behavioural intention to adopt mobile wallet: A developing country perspective. Journal of Indian Business Research 8 (3): 227–244.

Malaquias, F., R. Malaquias, and Y. Hwang. 2018. Understanding the determinants of mobile banking adoption: A longitudinal study in Brazil. Electronic Commerce Research and Applications 30: 1–7.

Mallat, N. 2007. Exploring consumer adoption of mobile payments—A qualitative study. The Journal of Strategic Information Systems 16 (4): 413–432.

Mathiyazhagan, K., K. Govindan, A. NoorulHaq, and Y. Geng. 2013. An ISM approach for the barrier analysis in implementing green supply chain management. Journal of Cleaner Production 47: 283–297.

Merhi, M., K. Hone, and A. Tarhini. 2019. A cross-cultural study of the intention to use mobile banking between Lebanese and British consumers: Extending UTAUT2 with security, privacy and trust. Technology in Society 59: 101151.

Moorthy, K., Chun T'ing, L., Chea Yee, K., Wen Huey, A., Joe In, L., Chyi Feng, P., and Jia Yi, T. 2020. What drives the adoption of mobile payment? A Malaysian perspective. International Journal of Finance and Economics 25 (4): 349–364.

Moorthy, K., C.S. Ling, Y.W. Fatt, C.M. Yee, E.C.K. Yin, K.S. Yee, and L.K. Wei. 2020a. Barriers of mobile commerce adoption intention: perceptions of generation X in Malaysia. Journal of Theoretical and Applied Electronic Commerce Research 12 (2): 37–53.

Mortimer, G., L. Neale, S.F.E. Hasan, and B. Dunphy. 2015. Investigating the factors influencing the adoption of m-banking: a cross cultural study. International Journal of Bank Marketing 33 (4): 545–570.

Musa, A., H.U. Khan, and K.A. AlShare. 2015. Factors influence consumers’ adoption of mobile payment devices in Qatar. International Journal of Mobile Communications 13 (6): 670–689.

Narteh, B., M.A. Mahmoud, and S. Amoh. 2017. Customer behavioural intentions towards mobile money services adoption in Ghana. The Service Industries Journal 37 (7–8): 426–447.

Nayeri, M.D., and M. Moradi. 2019. Green purchase determinants based on interpretive structural modeling: Case of Iran’s green marketing. ASEAN Marketing Journal 11 (1): 1–20.

Nel, J., T. Raleting, and C. Boshoff. 2012. Exploiting the technology cluster effect to enhance the adoption of WIG mobile banking among low-income earners. Management Dynamics 21 (1): 30–44.

Oliveira, T., M. Faria, M.A. Thomas, and A. Popovič. 2014. Extending the understanding of mobile banking adoption: When UTAUT meets TTF and ITM. International Journal of Information Management 34 (5): 689–703.

Oliveira, T., M. Thomas, G. Baptista, and F. Campos. 2016. Mobile payment: Understanding the determinants of customer adoption and intention to recommend the technology. Computers in Human Behavior 61: 404–414.

Pal, A., T. Herath, R. De’, and H.R. Rao. 2020. Contextual facilitators and barriers influencing the continued use of mobile payment services in a developing country: Insights from adopters in India. Information Technology for Development 26 (2): 394–420.

Park, J., E. Amendah, Y. Lee, and H. Hyun. 2019. M-payment service: Interplay of perceived risk, benefit, and trust in service adoption. Human Factors and Ergonomics in Manufacturing & Service Industries 29 (1): 31–43.

Pathak, P., and M.P. Singh. 2019. Barriers analysis for sustainable manufacturing implementation in indian manufacturing industries using interpretive structural modelling. Technology 10 (3): 27–35.

Pilar, E.C., I. Alegado, and M.F. Bongo. 2019. Structural relationships among critical failure factors of microbusinesses. Journal of Small Business and Enterprise Development 27 (1): 148–174.

Pitchaimuthu, S., J.J. Thakkar, and P.R.C. Gopal. 2019. Modelling of risk factors for defence aircraft industry using interpretive structural modelling, interpretive ranking process and system dynamics. Measuring Business Excellence 23 (3): 217–239.

PricewaterhouseCoopers. 2010. Mobile Financial Services A compelling solution for financial inclusion in India. Retrieved from https://www.pwc.in/assets/pdfs/publications-2010/mobile_financial_services_nov_2010.pdf.

Qasim, H., and E. Abu-Shanab. 2016. Drivers of mobile payment acceptance: The impact of network externalities. Information Systems Frontiers 18 (5): 1021–1034.

Ramayah, T., L.S. Lian, S.A. Rahman, and S.K. Taghizadeh. 2017. Modelling mobile money adoption: A Malaysian perspective. International Journal of Mobile Communications 15 (5): 491–513.

Reserve Bank of India. 2020. Assessment of the progress of digitisation from cash to electronic. Retrieved from https://www.rbi.org.in/scripts/PublicationsView.aspx?Id=19417.

Ritchie, J., and J. Lewis. 2003. Qualitative research practice. A guide for social science students and researchers. London: Sage publications.

Rogers, E.M. 2003. Diffusion of innovations, 5th ed. New York, NY: Free Press.

Salimon, M.G., R.Z.B. Yusoff, and S.S.M. Mokhtar. 2017. The mediating role of hedonic motivation on the relationship between adoption of e-banking and its determinants. International Journal of Bank Marketing. 35 (4): 558–582.

See, S.F., and Y.N. Goh. 2020. Factors affecting restaurant customer intention to adopt mobile payment. Malaysian Journal of Consumer and Family Economics. 25: 62–91.

Shaikh, A.A., and H. Karjaluoto. 2015. Mobile banking adoption: A literature review. Telematics and Informatics 32 (1): 129–142.

Slade, E., M. Williams, Y. Dwivedi, and N. Piercy. 2015. Exploring consumer adoption of proximity mobile payments. Journal of Strategic Marketing 23 (3): 209–223.

Sushil, S. 2012. Interpreting the interpretive structural model. Global Journal of Flexible Systems Management 13 (2): 87–106.

Tan, K.S., S.C. Chong, P.L. Loh, and B. Lin. 2010. An evaluation of e-banking and m-banking adoption factors and preference in Malaysia: A case study. International Journal of Mobile Communications 8 (5): 507–527.

Teo, A.C., G.W.H. Tan, K.B. Ooi, and B. Lin. 2015. Why consumers adopt mobile payment? A partial least squares structural equation modelling PLS-SEM approach. International Journal of Mobile Communications 13 (5): 478–497.

Thakur, R., and M. Srivastava. 2014. Adoption readiness, personal innovativeness, perceived risk and usage intention across customer groups for mobile payment services in India. Internet Research 24 (3): 369–392.

Tobbin, P. (2012). Towards a model of adoption in mobile banking by the unbanked: a qualitative study. info., 14(5), 74–88.

The Economic Times. 2019. Overall India handset market growth to fall in 2020. Retrieved from https://economictimes.indiatimes.com/tech/hardware/overall-india-handset-market-growth-to-fall-in-2020/articleshow/72950192.cms.

Tran, H.T.T., and J. Corner. 2016. The impact of communication channels on mobile banking adoption. International Journal of Bank Marketing 34 (1): 78–109.

Vasanthakumar, C., S. Vinodh, and K. Ramesh. 2016. Application of interpretive structural modelling for analysis of factors influencing lean remanufacturing practices. International Journal of Production Research 54 (24): 7439–7452.

Venkatesh, V., Morris, M. G., Davis, G. B., & Davis, F. D. (2003). User acceptance of information technology: Toward a unified view. MIS Quarterly 27 (3): 425–478.

Venkatesh, V., Thong, J. Y., & Xu, X. (2012). Consumer acceptance and use of information technology: extending the unified theory of acceptance and use of technology. MIS Quarterly, 36(1), 157–178.

Wang, L., and X. Dai. 2020. Exploring factors affecting the adoption of mobile payment at physical stores. International Journal of Mobile Communications 18 (1): 67–82.

Warfield, J.N. 1976. Implication structures for system interconnection matrices. Transactions on Systems, Man, and Cybernetics 6 (1): 18–24.

Yang, S., Lu, Y., Gupta, S., Cao, Y., & Zhang, R. (2012). Mobile payment services adoption across time: An empirical study of the effects of behavioral beliefs, social influences, and personal traits. Computers in Human Behavior, 28(1), 129–142.

Yen, Y.S., and F.S. Wu. 2016. Predicting the adoption of mobile financial services: The impacts of perceived mobility and personal habit. Computers in Human Behavior 65: 31–42.

Yu, C.S. 2012. Factors affecting individuals to adopt mobile banking: Empirical evidence from the UTAUT model. Journal of Electronic Commerce Research 13 (2): 104–121.

Zhao, H., S.T. Anong, and L. Zhang. 2019. Understanding the impact of financial incentives on NFC mobile payment adoption. International Journal of Bank Marketing 37 (5): 1296–1312.

Zhou, T. 2011. The effect of initial trust on user adoption of mobile payment. Information Development 27 (4): 290–300.

Zhou, T. 2012. Examining mobile banking user adoption from the perspectives of trust and flow experience. Information Technology and Management 13 (1): 27–37.

Zhou, T., Y. Lu, and B. Wang. 2010. Integrating TTF and UTAUT to explain mobile banking user adoption. Computers in Human Behavior 26 (4): 760–767.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Gupta, S., Dhingra, S. Modeling the key factors influencing the adoption of mobile financial services: an interpretive structural modeling approach. J Financ Serv Mark 27, 96–110 (2022). https://doi.org/10.1057/s41264-021-00101-4

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41264-021-00101-4