Abstract

Despite a rigorous policy drive towards financial inclusion in Nigeria, and although the country has a high tele-density ratio, the vast unbanked largely poor remain excluded from the financial sector. Adopting a mixed method approach of the supplier and consumer sides of mobile money, using documentary analysis, focus groups, interviews, and surveys; this article relies on the diffusion of innovations theoretical framework to explore the utility of mobile money with a view to not only assess its application in the enhancement of financial inclusion, but also better tailor the current applications for these low-income users. We identify 4 factors (lack of customer demand and experimenters, lack of integration in the ecosystem, lack of trust and preference for effective local savings scheme and policy short-termism resulting in mobile money operational unsustainability) that are responsible for non-diffusion of mobile money. Our paper reveals interest dynamics that can advance a more long-term mobile money regulatory policy which takes care of the concerns of the unbanked poor.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

A strong link has been established between financial access to banking services and economic development and growth (Demirgüç-Kunt et al., 2020; Asongu et al., 2018). However, in many developing countries, there is still a lack of financial inclusion, and financial exclusion is a major factor that contributes to poverty in developing countries (IFC, 2018). This led to optimism that the rapid rate of mobile telephony adoption would yield economic development in developing countries (Aker & Mbiti, 2010; Pal et al., 2020). Mobile technology can engender inclusive development (Koomson et al., 2021; Abhipsa et al., 2020; Asongu & Nwachukwu, 2016; Beuermann et al., 2012), bridge inequality gaps (Asongu, 2015) and be a source of increased income (Wijeratne & Silva, 2014). For instance, in West Africa, about 54% of the population subscribed to one mobile service or another as at the end of 2018 (GSMA, 2020). Stemming from this rapid adoption of mobile subscription and its ubiquity in developing countries (Van der Boor et al., 2014); one initiative that has been introduced to ensure the financial inclusion of the poor and unbanked is mobile money. Mobile money is a tool that allows individuals to make financial transactions using mobile phone technology.

The impact of mobile money systems on microeconomic and macroeconomic outcomes is a rich area of research, especially as these systems expand their geographic coverage and range of services (Al-Muwil et al., 2019). Mobile money impacts households risk sharing abilities and the associated transaction costs is also reduced (Jack & Suri, 2014) thereby potentially reducing poverty rates. However, while this mobile telephony adoption has led to the rise of mobile money utilization in many developing countries (IFC, 2018), it has failed to engender financial inclusion in others. In Africa, countries like Kenya and Uganda have experienced considerable levels of financial inclusion success through mobile money diffusion (Koomson et al., 2020; Lepoutre & Oguntoye, 2018). For example, M-PESA, a mobile money transfer service launched by Safaricom, in 2007, is regularly referred to in extant literature as a service that has pushed financial inclusion (Lepoutre & Oguntoye, 2018). Financial inclusion solutions are however context specific (Abor et al., 2018). This is because solutions to address financial exclusion might work in one region or country, but not necessarily work in another, due to institutional differences and country specific socio-economic conditions (Wentzel et al., 2016).

Indeed, the financial inclusion phenomenon can be influenced by the level of financial innovation, poverty levels, stability of the financial sector, state of the economy, financial literacy, and regulatory frameworks which differ across countries (Ozili, 2020). For example, in a country like Nigeria, inability to access finance adversely affects policies geared towards economic growth and poverty alleviation. Consequently, the poor are unable to accumulate savings, protect against all forms of risks including privacy risks (Akanfe et al., 2020), as well as invest in income-generating projects (Neaime & Isabelle, 2018). This is in spite of a significant growth in profitability and efficiency in the country’s relatively well-developed banking system (Guardian, 2017). Vast segments of the population, especially the underprivileged ones are still financially excluded, as bank branch expansion and the spread of microfinance institutions have not succeeded in reducing financial exclusion, poverty, and income inequality (Enhancing Financial Innovation & Access (EfinA), 2018). Thus, scant access to basic financial services remains a deprivation suffered by large segments of the population. The pursuit of financial inclusion aimed at drawing the ‘unbanked’ population into the formal financial system is therefore still a focus for policy makers in the country (David-West et al., 2020). Policy makers are increasingly recognizing that despite a significant growth in profitability and efficiency, banks have been unable to reach vast segments of the population, especially the underprivileged sections of the society (Pierce, 2011; Neaime & Isabelle, 2018; David-West et al., 2020). To compensate for the financial exclusion, policy makers in the country sought to create effective opportunities for financial inclusion through mobile money (David-West et al., 2020).

Previous studies (e.g., Arora, 2012; Adomako et al., 2016; Ghosh, 2016) focused on effects of financial inclusion on inclusive growth while other studies (e.g., Koomson et al., 2021; Abhipsa et al., 2020; Albashrawi & Motiwalla, 2017; Asongu & Nwachukwu, 2016; Beuermann et al., 2012) investigated the effect of mobile technology on inclusive growth. Other studies have focused on the short- to medium-term effect of mobile money in times of idiosyncratic shocks (Pénicaud & Katakam, 2019), search costs, market agents’ behaviors, and price dispersion (Aker & Mbiti, 2010; Tam et al., 2020), however many questions affecting mobile money diffusion and financial inclusion still remain unanswered. In particular, few empirical studies (e.g., Lashitew et al., 2019) examine mobile money adoption and innovation diffusion among the populace. Furthermore, although mobile phone technology strengthens social networks, since it allows individuals to communicate and conduct businesses more frequently, the diffusion effect of government mobile money policies on supply side (agents) and consumer side in developing countries is understudied. Also, scholars such as Mian and Rizwan (2013), Lin (2011), Kapoor et al. (2013) have relied on some aspects (i.e., relative advantage, compatibility, and complexity) of Rogers’s (1983) innovation diffusion theory in their research. However, they have not included the reasoning behind customer non-involvement in innovation diffusion. Therefore, there is a need for studies that yield a deeper understanding of the innovation dynamics that impede the development of inclusive innovation (Lashitew et al., 2019). Thus, leaning on the diffusion of innovation theory, our research question is: why has the growth in digital communication and government driven mobile money policies not delivered financial inclusion to the unbanked poor?

We examine the Nigerian empirical context to ascertain why financial inclusion has still not been achieved in some contexts, regardless of the widespread use of mobile phones. Nigeria is a useful research context given her representative characteristics in economic, political, and cultural profiling with many developing countries (Waweru, 2014). Nigeria is a country of approximately 197 million people (UN, 2018) with an adult population of 93 million (EfinA, 2018). From this population, reports indicate mutually exclusive groups comprising 36.3% (33.9 million) banked, 12.3% (11.5 million) formal other, 11.9% (11.2 million) informal other, and 39.7% (39.5 million) excluded (EfinA, 2018). This suggests that quite a sizeable proportion of the population remain unbanked or financially excluded. The phenomenon is a recurring issue with individuals and small firms alike in developing countries. According to Koomson et al. (2021), in many developing countries, the low financial inclusion means that households are vulnerable to idiosyncratic shocks while small firms frequently allude to difficulty in accessing and affording financing as a key constraint to growth. Nigeria has been identified as lagging behind some of its peers in Africa with respect to financial inclusion. This is in spite of the size of the economy and the population (EfinA, 2018). There have been efforts to improve those figures from various proposed models to address the phenomenon to various initiatives being introduced. However, there is little research to reflect whatever impact those initiatives have made so far in Nigeria. Mobile money comprises the convergence of two industries- banking and telecommunications (Jack & Suri, 2014). It therefore seems reasonable to assume that both services can be successfully converged in Nigeria as well, considering the speed of adoption and extent of mobile telecommunications penetration in the country. Mobile telephony has been widely adopted with reports of over 192 million subscriptions (Nigerian Communications Commission, (NCC), , 2021). Whilst this does not imply that there are over 192 million individual subscribers, it provides an indication of the scale of mobile telephony adoption.

This paper contributes to the empirical literature on the diffusion of mobile money. The study aims to understand the diffusion of mobile money from the perspective of unbanked poor end-users in Nigeria by exploring the applications, innovations, and limitations of mobile money use. Specifically, we do this by exploring offerings of mobile money providers and examining their agent network structures via documentary analysis and interviews, facilitating focus groups with unbanked poor end-users and a survey of mobile money utility for unbanked poor end-users. Specifically, we identify 4 major factors (lack of customer demand and experimenters, lack of integration in the ecosystem, lack of trust and preference for effective local savings scheme and policy short-termism resulting in mobile money operational unsustainability) responsible for non-diffusion of mobile money in Nigeria. Our study will help in targeting specific unbanked poor end-users for specific existing or new mobile money products and provide information which can be used by mobile money platform developers and providers to create new, innovative, and locally tailored applications of mobile money. Our findings will also help to identify specific cultural limitations that hinder the adoption and use of mobile money by the poorest segment of the population. Furthermore, although the focus of this research is to gain insights on the utility of mobile money from the perspectives of unbanked poor consumers, the research has the potential to add policy insight to two important related issues facing mobile money adoption and increased financial inclusion of the unbanked poor: 1. This study provides insights on which type of mobile money model provides better utility for the unbanked and thus, increase financial inclusion. 2. Deepen the understanding of the market failures and misuses of mobile money as identified by unbanked poor end-users that limit their current use or adoption and thus hinder financial inclusion. The rest paper is structured as follows. Section 2 provides a background literature review and the theoretical underpinning for the research. Section 3 discusses the methodology. Section 4 and 5 present our findings and discussions respectively, while section 6 discusses customer involvement in mobile money diffusion. Conclusions, limitations, and future research are provided in section 7.

1.1 Literature Review and Theoretical Background

Financial exclusion is defined as the inability, difficulty, or reluctance to access appropriate mainstream financial services (Mitton, 2008). Financial exclusion has been identified as hindrance that contributes to keeping the populace poor in developing countries (Carbó et al., 2005). Possible factors that have been identified as responsible for financial exclusion include gender, age, source of income, home ownership status, marital status, highest level of education attained, the number of dependents supported by the respondent and geographic location (Wentzel et al., 2016; Cruz-Jesus et al., 2017). In these developing countries, there is a continuous push for poverty eradication and financial inclusion (IFC, 2018). In this regard, the rapid rate of mobile telephony adoption generated a great deal of speculation and optimism regarding its effect on economic development (Aker & Mbiti, 2010; Asongu et al., 2021) and has aided the use of mobile money utilization in many parts of Africa. Consequently, mobile money has become one of the foremost tools that have been employed in the implementation of financial inclusion in developing countries (Koomson et al., 2020; Lepoutre & Oguntoye, 2018).The ubiquity of mobile technology provides a conducive avenue for conducting financial transactions in developing countries (Kingiri & Fu, 2020). The mobile money phenomenon allows people to send and receive money from anywhere they are, without physically going to the bank (Kingiri & Fu, 2020). In Afghanistan for example, 97% of the population do not have bank accounts but can save and access money using mobile money transfers through text messages (Schmidt & Cohen, 2010).

According to Aker and Mbiti (2010), as telecommunication markets mature, mobile phones in Africa are evolving from simple communication tools into service delivery platforms. This has transformed the social construction of mobile telephony from one that simply reduces communication and coordination costs to one that has the potential to transform lives through innovative applications and services. Similarly, Donner and Tellez (2008) postulate that mobile money systems may prove to be an important innovation for the developing world as they offer a way to lower the costs of moving money and a way to bring more users into contact with formal financial systems (Asongu et al., 2021). Mobile money financial systems have several benefits, which are never available through traditional payment method, some of which are: privacy, integrity, compatibility, efficiency, acceptability, convenience, mobility, low financial risk, anonymity (Kumari & Khanna, 2017). Furthermore, mobile money has had a significant impact on the ability of households to share risk, and this is attributable to the associated reduction in transaction costs (Jack & Suri, 2014). In Africa, a few countries including Kenya, Uganda and have taken steps to ensure financial inclusion and have experienced some level of success. M-PESA, a mobile money transfer service launched by Safaricom, in 2007, is a service that has been referred to in extant literature as a prime example of this push to ensure financial inclusion (IFC, 2018; Lepoutre & Oguntoye, 2018). It is also an example of a situation in which the adoption of the service was rapid. Within the first two years of its launch, six million customers registered with the service (Mas & Morawczynski, 2009) and by 2012, M-PESA had 15 million subscribers (more than a third of the population) and served as conduit for a fifth of the country’s GDP (Ogunlesi & Busari, 2012).

However, whilst there is reported success of M-PESA with banking the unbanked, there are suggestions that on the average, M-PESA users are wealthier, better educated, more likely to live within urban areas and are already banked (Aker & Mbiti, 2010). In other words, although the initiative is considered one of the success stories of reaching the financially excluded, many of its users are indeed already financially included. It is also worth bearing mind that even though some solutions to address financial exclusion work in one region, they may not necessarily work in another, considering the differences in socio-economic conditions across countries, as financial exclusion could be driven by different factors in different countries (Wentzel et al., 2016). Furthermore, Behl and Pal (2016) find that usage of mobile banking technology is driven mainly by perception of usefulness. Also, the ease of use and risk aversion plays a critical role in diffusion of mobile banking in rural areas (Behl & Pal, 2016). Hence, in spite of the many benefits identified and the proliferation of mobile telephony, financial inclusion seems to be beyond the reach of many individuals and households in many developing countries such as Nigeria.

The enthusiasm surrounding the diffusion of mobile telephony is expected to play a role in the diffusion of other mobile related services in the continent. However, despite all these recorded achievements, there is a lower rate of adoption of mobile money for financial inclusion in Nigeria. This is because products/services are not necessarily accepted equally by all consumers and some products/services are accepted quicker than others (Mütterlein et al., 2019). The characteristics of the innovation determine the speed of innovation adoption process (Rogers, 1983). Hence the application of diffusion of innovation theory was adopted to investigate how the attributes of innovation (relative advantage, compatibility, complexity, trialability and observability) influence the customers’ adoption of mobile money as the needs of the customer, is paramount in deciding the market achievement of any business (Gumel & Othman, 2013; Kotler & Amstrong, 2001). According to (Rogers, 1983), there are five characteristics of these innovations that can be used as indicators in measuring perceptions, among others: 1. Relative advantages- the degree to which an idea is considered better than the ideas that exist before and is more economically profitable. 2. Compatibility- the extent to which the past of an innovation is considered consistent with existing values, past experiences, and needs of the adopter. Therefore, innovations that are not compatible with prominent social system features will not be adopted as quickly as compatible ideas. 3. Complexity- the extent to which an innovation is considered relatively difficult to understand and use. Difficulty to understand and use will be an obstacle to the speed of adoption of an innovation. 4. Trialability- the extent to which an innovation can be experimented with, on a small scale. New ideas that can be tried on a small scale are usually adopted more quickly than innovations that cannot be tried first. 5. Observability- the extent to which an innovation can be easily seen by adopters.

The study of diffusion of innovations has been covered extensively using various theories and models (Al-Muwil et al., 2019) and has been applied in the study of the adoption of a wide range of innovations including financial inclusion. To this end, Howcroft et al. (2007) report a positive relationship between customer involvement and purchase/usage of financial products. Similarly, Sirgy et al. (2008) suggest that the involved customers tend to spend more time and energy for an event, hence customers exhibiting high level of involvement are more likely to be positively engaged compared to the uninvolved customers (Kinard & Capella, 2006; Wani et al., 2017). Tobbin and Kuwornu (2011) investigated the key factors that influence the Ghanaian consumers’ acceptance and use of mobile money transfer technology using key constructs from the Technology Acceptance Model (TAM) and Diffusion of Innovation theory. The study uses diffusion of innovation as a base-line theory to investigate factors that may influence mobile banking adoption and use. More specifically, the objective of their research was to examine the potential facilitators and inhibitors of mobile banking adoption. Using diffusion of innovation as a baseline theory, and data obtained from 330 actual mobile banking users, Al-Jabri and Sohail (2012) found that relative advantage, compatibility, and observability have a positive impact on adoption. They suggest that contrary to the findings in extant literature, trialability and complexity have no significant effect on adoption. Also, Kapoor et al. (2013) suggest that only three variables of innovation diffusion theory (relative advantage, compatibility, and complexity) affect the acceptance of online financial transactions while Lin (2011) and Mian and Rizwan (2013) apply two of the five existing innovation characteristics (relative advantages and compatibility).

Various reasons abound for the difference in the rates of diffusion of mobile money. In Kenya for example, according to Wamuyu (2014), the high rate of mobile money diffusion in Kenya can be attributed to the demographic characteristics and cultural practices which require person to person transfers. The growth of mobile money service rose alongside the adoption of mobile phones in Kenya, which may be attributed to sector reforms that encouraged competition among several mobile operators (Kingiri & Fu, 2020). The availability and high subscription rate of smartphones and mobile broadband in other African countries similarly has an impact on the diffusion of mobile money (Asongu et al., 2020). The availability of these devices also provides the potential for expanding different types of digital financial services (Lapukeni, 2015). Factors such as the social and economic environment are also worth considering (Seethamraju et al., 2018), as adoption of mobile money can be related to societal cultures and values (Wamuyu, 2014). In Ghana, mobile money uptake is low, possibly as a result of financial illiteracy or mistrust and perception of risk of the phenomenon (Osei-Assibey, 2015). However, among the susu collectors, factors influencing the adoption of mobile money were found to include educational level, age, trialability, observability, perceived risk, and relative advantage (Osei-Assibey, 2015). Similarly, Tobbin and Kuwornu (2011) and Gao and Waechter (2017) found that trialability, perceived trust and risk had an impact on the decision to adopt mobile money. Awareness of the availability of mobile money services and education about its applications is also important, to increase diffusion (Kemal, 2019). In addition, Ngugi et al. (2010) analyzed the success of M-PESA, the mobile money initiative in Kenya and identified early adopters helping to promote the product, as a major reason explaining the successful adoption of the phenomenon. Medhi et al. (2009) in their study on variations across countries in terms of adoption and usage of existing mobile banking services by low-literate, low-income individuals, and possible factors responsible for the same, the authors observed that variations are along several parameters: household type, services adopted, pace of uptake, frequency of usage, and ease of use. However, all these studies have failed to account for customer involvement in the diffusion of innovation process. Also, current research has focused on the short- to medium-term effect of mobile on search costs, market agents’ behaviors, and price dispersion (Aker & Mbiti, 2010; Tam et al., 2020), however many questions affecting mobile money diffusion still remain unanswered. In a developing country like Nigeria, it is apparent that an investigation into mobile money adoption in necessary as bank branch expansion and the spread of microfinance institutions have not succeeded in reducing financial exclusion, poverty, and income inequality (EfinA, 2018). This becomes even more pertinent when one considers the financial inclusion policy push which has yet to yield appreciable results (EfinA, 2018) as there is still scant access to basic financial services for the unbanked poor. In view of the recent history of this subject-area, answers to our research question of why has the growth in digital communication and government driven mobile money policies not delivered financial inclusion to the unbanked poor, becomes important.

2 Research Method

2.1 Introduction

This study adopts a mix of the following research methods: survey, interview, documentary analysis and focus groups. This methodology offered an in-depth and detailed perspective on mobile money diffusion Nigeria. The methodological approach was aimed at reducing sample error (Denzin & Lincoln, 2005), while at the same time allowing the research to benefit from the strengths of all methods and compensating for their individual weaknesses. In particular, the survey method provided generalization and breadth, which allowed us to capture the mobile money utility for unbanked poor end-users in Nigeria. This also helped achieve data coverage and a high number of data respondents (Braun et al., 2020). The survey method also allowed us to use findings from a representative sample to make predictions about a whole population, while the interview and focus group methods provided a deeper understanding of the subject of inquiry (Creswell, 2003). Furthermore, ethical issues and concerns were addressed, and respondents were assured of utmost confidentiality. The initial data for this study were collected between January 2013 and December 2015. In order to validate, update, as well as gather further evidence on the themes that emerged from the initial data, additional data was collected in May 2021. The additional data was in the form of interviews with two bank mobile money operators (MMO) and one non-bank independent operator (for the supply side), and two focused group interviews of 23 poor end users (for the demand side).Footnote 1 The views the interviewees expressed were consistent with the initial data gathered and were thus helpful in addressing and re-examining the research inquiry. Considering the pre-determined specific characteristics of our interviewees, and the depth of the interviews, our sample size for both the initial and additional data were adequate (Sim et al., 2018). Moreover, according to Guest et al. (2017), in focused group interviews, 80% of all themes emerge within two to three groups. Finally, the resultant data from our study which was triangulated, offered a better understanding of the subject matter as it relied on understanding processes, behaviors, and conditions (Noble & Heale, 2019).

2.2 Data Collection and Analysis

The data collection was done in three phases. In the first phase, interviews and documentary analysis was used to explore offerings of mobile money providers and examine their agent network structures. In the second phase, focus groups discussions was held with unbanked poor end-users, while in the third phase, survey was distributed to unbanked poor end-users.Footnote 2

2.2.1 Desk Research and Interviews

Knowledge of mobile money service offerings was acquired through desk research and provider interviews.

2.2.2 Desk Based Research

Secondary data of mobile money operators and operations was acquired using desk research that comprised of internet searches, provider and regulator website reviews and document analysis. This was done to validate the comments of data respondents and to ensure that the statements reflected reality. Desk research of provider offerings was conducted for the 17 licensed independent mobile money operators and 9 commercial banks.Footnote 3 Most of the mobile money operators provide across a variety of payment channels including Point of Sale Terminals (POS), Automated Teller Machines (ATM), Payment Cards, Utilities Payments, Agent network, USSD, SMS and Web services.

2.2.3 Interview

The need to minimize self-evaluation, self-selection as well as the need to have a deeper and robust understanding of the operations and functionality of mobile money for financial inclusion led to the use of the interview method. Semi-structured interviews with the mobile money operators were conducted using an interview guide. The interview guide was sent to potential respondents in order to facilitate their preparation. This also enabled respondents to broadly discuss issues which led to in-depth comments, beyond the ‘confines’ of the questions asked, thus constituting a rich data on the research topic (McGrath et al., 2019). The guide is in line with previous studies, and was pre-testedFootnote 4 to ensure their validity, reliability, and contextual relevance. Knowledge on the agent networks and operations, were acquired through interviews with active agents. The provider interviews provided more insights to the mobile money environment through the target markets and distribution networks. In-depth interviews were conducted with four banks and two licensed non-bank MMOs. The participants were promised confidentiality to encourage uninhibited responses. Therefore, codes of Bank A, Bank B, Bank C, Bank D, Operator A and Operator B have been used to anonymize their identities. Provider characteristics are highlighted in Table 1. The respondents were selected based on product popularity.

The provider interviews sought to understand confirm offerings from the desk study as well as the characteristics and organizational processes employed in the development and distribution of mobile money services.

2.2.4 Focused Group Discussions and Survey

Understanding of mobile money utility from the perspective of poor unbanked consumers was conducted in two stages – Focused Groups and Survey. Through focus group discussions, the qualitative stage gleaned insights into consumers’ access and utility of financial services and mobile money services.

2.2.5 Focus Group

The sample population for the focus group discussions was selected from the different occupation groups with financial needs and applications addressed by mobile money. The business school which is made up of different cadres of staff and visitors was used as a core data collection center. The participants selected were screened based on income. Focus group discussions conducted outside the business school were conducted at the premises of the respondents.

Five focus group interviews were conducted between July and August 2013 with different groups of individuals. Additionally, in May 2021, two more focus group interviews were conducted to re-validate our findings. Table 2 describes each focus group conducted and Table 3 presents the descriptive statistics of the participants. The size of the group was kept manageable in order to enhance efficiency and to allow members to freely discuss the topics of interest without actual or perceived intimidation, shyness, or pressures from other respondents (Creswell, 2003). Fair and balanced approach was adopted for the focus group to ensure diversity and fair representation of participants from different backgrounds and roles. This was to guarantee that the perceptions, opinions, beliefs, attitudes, and comments of participants were from different perspectives. The participants were promised confidentiality to encourage uninhibited responses. Therefore, codes have been used to anonymize their identities. The use of numerical codes further indicates the spread of responses across the entire respondents. Wide-ranging questions were asked in order to gain a set of comparable responses drawn from real life business and personal experiences free from fear or bias (Sewell, 2008).

Focus group data offered the opportunity to capture respondents’ interactions on the utility of mobile money in Nigeria. For example, during discussions, individuals differed, agreed, and sometimes modified their opinion, thus generating data with more depth. The focus group transcripts were subsequently analyzed.

2.2.6 Survey Questionnaire

The survey method helped us to achieve a widespread coverage of data and improved the generalizability power of our findings on the utility of mobile money. The survey was conducted in public areas using the street intercept technique at various locations. Due to the varying educational qualifications of the respondents, trained enumerators conducted the survey administration verbally. The random selection of participants was deliberately employed to capture a wider range of the target population – the poor unbanked. Survey participation was based on access to formal or informal savings, knowledge of mobile money, and income level. The survey instrument comprised of open and closed ended questions (survey instrument included in Appendix 1). Training on mobile money and the instrument was provided to a total of 20 survey administrators (enumerators) prior to the commencement of the survey. The training provided the interviewers a better understanding of the study objectives in addition to information on mobile money concepts and terms. Role-play demonstrations of survey cases from the mobile money user and non-user perspective were also conducted. To guard against survey fraud, four supervisors were recruited to supervise the enumerators. The supervisory team monitored the interviewers in the field and validated the use of real subjects.

A total of 2371 respondents were interviewed in this survey. These respondents constituted the sampling frame which explains the objective list of the population size (Creswell, 2003). In order to ensure that the result from the sample survey was consistent with the population, and in an attempt to improve generalization, a large sample size and high response rate of completed questionnaire was aimed at. The respondents were selected from open locations such as markets, bus stops, etc. Of the responses, 121 were unusable and thus discarded. The descriptive statistics of the survey respondents is illustrated in subsequent figures and charts (Figs. 1, 2, 3, 4).

2.3 Section Summary

Overall, the mixed-method research strategy was to allow for the collection of rich data that captures the dynamics of mobile money operations from both the supplier and consumer angles. These methods complemented one another’s strengths and weaknesses. The interpretation of data involved the constant iterative moving back and forth of the data to form the theoretical concepts (Ritchie & Lewis, 2006). A tape recorder was used to record the interviews and the focused group discussions and each of them took an average of 60 min. The analysis of the focus group data presented both challenges and opportunities when compared to interview and survey data. Particularly it presented the opportunity to observe interactions and how discussions unfolded among the various respondents. The first stage of the analysis involved starting with a small portion of the data and formulating an initial set of categories of the evidence from mobile money operations and financial inclusion in Nigeria. This formed the basis for introspection in the focused group discussions and later, comparison and validation with the questionnaire data, leading to the emerging narratives/themes of our paper (Creswell, 2003). Extracts from the data, presented in italics, have been employed to further indicate the link between the findings and discussions.

3 Findings

The findings gathered from the various methods are triangulated and discussed from the supply (provider) and demand (consumer) perspectives in this section.

3.1 Diffusion of Mobile Telephone Infrastructure in Nigeria

The usage of mobile banking technology is driven mainly by perception of usefulness (Behl & Pal, 2016). In this regard, our findings suggest that mobile telephones were deemed useful for financial inclusion when the service offerings supported mobile money wallet holders having access to a variety of payment-related services, thus, “giving people more things to do with their money” (Operator A). These service offerings require market segmentation, product and market development, business partnerships (product and distribution), and systems integration processes. The perceived usefulness of mobile money is illustrated through the keywords in the word cloud which clearly associates mobile money utility with transactions, business, buy, send, online, and so on (see Fig. 5).

We elaborate on the functionality and partnerships of mobile money in the Ecosystem.

3.1.1 Functionality and Ecosystem of Mobile Money

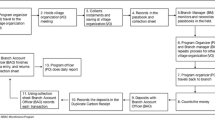

In Nigeria, in addition to providing multiple access channels to mobile money, non-mobile (web) access is also supported by the providers. This is more indicative of a generic payment platform accessible from multiple sources than a homogeneous mobile money offering confirming the geographic spread and range of services (Aker & Mbiti, 2010). The widespread development of cross-platform apps by the providers in Nigeria is indicative of the expected use of high-end smartphones. Furthermore, to facilitate general populace inclusion, mobile money products are distributed using both physical and electronic channels. The network servicing mobile money wallet holders (W) comprises of entities like service providers (SP), mobile money operators (MMO) and their depository banks (Bank), bank business partners (BP) and agent aggregators (AA) and distribution channels such as branches (BR), Agents (A), ATMs (ATM), and web portals (WWW). Figure 6 below illustrates the interconnectivity of the mobile money ecosystem in Nigeria.

Physical distribution channels employed are bank branches and agent locations. Although bank branches are typically used to service the bank-led MMOs, independent MMOs who develop partnership agreements with banks also have access to the bank branches. Independent agent locations are alternative physical channel available for the distribution of mobile money. These agent services usually exist from businesses in certain localities and thereby increasing their service offerings through mobile money services. Agents may be independent or members of a cooperative. For example, Bank B adopts a B2B agent strategy working with a more manageable sub-set:

“Our approach in terms of agents is to use what we called agents aggregators. They are people that have others under them. So, with this, we are able to manage them. That means for us, it is easy to branch out very quickly without being popped down.” (Bank B1).

In addition to conventional mobile-related mechanisms - SMS, USSD, or mobile apps, additional electronic interfaces integrated with mobile money include automated teller machines (ATMs) and online web portals. ATM integration with mobile money fulfills cash-out services where recipients of mobile money can withdraw (cash-out) from bank ATMs. Online web portals that offer a superior user interface to non-cash services like check balance, transfer to mobile wallet, etc. are also supported.

3.1.2 Partnerships in the Ecosystem

To facilitate faster and more ingrained diffusion, providers engage in compulsory and non-compulsory business partnerships. Business partnerships for mobile money distribution detail the responsibilities of the MMO and providers alongside commercial terms and conditions. First, partnership with mobile telecommunications providers who serve as infrastructure providers is mandatory for all mobile money operations. The provision of the mobile platform or infrastructure for the transmission of financial transactions, irrespective of the technology adopted, is very much dependent on these compulsory strategic partnerships. Our findings demonstrate the importance of these mobile money providers- and mobile telecommunications providers’ partnership. We find that the ownership of multiple mobile devices amongst respondents is high; with most respondents having access to multiple devices or multiple networks through dual-SIM enabled telephones. The data also demonstrates the use of non-SIM mobile phone networks such as CDMA networks (see Fig. 7). The uses of the mobile devices are predominantly for regular mobile network services such as voice calls and text messaging. The uses of data-enabled services such as internet browsing, email, and social apps (WhatsApp and Facebook) are also on the increase. However, digital financial services like electronic banking, insurance and the like polled low (see Fig. 8).

The existence of mobile money mechanisms does not necessarily translate into service utility. Beyond advertising, the distribution of agent networks is critical to raising mobile money awareness and driving adoption of mobile money. For bank MMOs, this situation is somewhat alleviated by bank branches; albeit providing limited access in non-urban locations. In the case of non-bank MMOs, the absence of retail locations warrants the need for agent-based distribution and market development. Agent development processes are an operational component of all MMOs that includes selection, registration, and capacity building activities. Agent aggregators that act as a cooperative of agents or intermediaries also conduct these activities. In Nigeria, strategies such as affiliate marketing schemes, and the use of direct sales agents that operate within bank branches or in densely populated locations like university campuses have been used. In the case of affiliate marketing, this is in collaboration with existing online businesses that facilitate mobile payment transactions. Operator A puts it thus:

“And there's also something called the affiliate marketing which is where other businesses who want their users to be able to do any transactions on their websites”.

Overall, use of mobile money in Nigeria is still far from what is expected.

3.2 Factors Responsible for Non-diffusion of Mobile Money

3.2.1 Lack of Customer Demand and Experimenters

Our data indicates that knowledge and use of mobile money services in Nigeria is low among the unbanked. A total of 2182 (97%) survey respondents either had no clue (25%) or some knowledge without firsthand experience (72%). The user community of mobile money services polled only 65 respondents representing about 3% of the survey population. Also, frequent utility or active use is relatively low as our data reports only 20 frequent users (about 31%). Interestingly, the curiosity of majority of the non-users to find out on the utility of mobile money is relatively low (see Fig. 9). Only 61 respondents sought to make further enquires and we refer to these set as experimenters. Of the 61 experimenter that made further enquiries, 48 provided additional information on their experimentation with mobile money. Although 7 respondents simply acquired additional information on operations; some inhibitors or limitations cited include operational protocols (3), product/service unfamiliarity (11), poor patronage (1), poor network (5), and trust (5). Another inhibitor amongst experimenters was the suitability of mobile money for large value transactions (2). Motivations for use include the portable use for purchases (10) and easy access to transfer services (3). Majority of the participants are vaguely aware of mobile money services in spite of marketing efforts. According to FG 13,

“Yes, they’ve been sending messages. Someone like me, I have been ignoring it.”

This lack of awareness increases caution amongst prospective users. FG1 explains her reasons as follows:

“That is the reason why I don’t want it, you know in Nigeria you have to be careful, so I don’t involve myself in sort of things that I don’t really know”

Furthermore, belief in mobile money services or the use of the mobile for financial services is quite nascent amongst some respondents. Whilst some associate the services with superstitious myths by claims like “it’s like six-six-six”Footnote 5 (FG 34), or simply by the lack of experience or trial, as respondent FG 2 explains his experience in pidgin English:

Footnote 6“that thing wey you talk, when I go xx Bank, this one man come there before me; he just go there, didn’t put card. I think he wan put card but he didn’t put anything. I just see. He just press number and money came out. I just look at the thing. He didn’t put anything, he just take money like that. I come call him ‘oga,Footnote 7 sorry to disturb you oooo. What did you use for it?’ He said...ah ah... the thing, they send the number for his phone that is why he just go there and press something. I say okay. As you talk now, I say that thing is real.”

This is in spite of the ubiquitous advertising by providers through direct and indirect mechanisms such as advertising, distribution (agent) networks, and direct customer engagement. Bank B posits that:

“The truth of the matter is that I can bang the air till tomorrow. I can sing on the radio. It doesn’t mean that people will ask for the service.”

Unfortunately, this lack of customer demand also translates to slow growth of mobile money which in turn means financial inclusion is less achieved. According to Bank A2:

“financial inclusion will not happen at this pace, rather for this to be a tool (for financial inclusion) consumers need to be the one demanding mobile money products. Right now, they are not demanding the products”.

Respondents also identified the macro-economic factors as one of the reasons for lack of experimenters. Interviewee Bank D1 highlights that:

“We see most of our mobile money transactions from among the customers with bank accounts already. The economy is bad, hence its unsurprising that there are fewer experimenters among the unbanked”.

3.2.2 Lack of Integration in the Ecosystem

Our data indicates that, in spite of the functionality and the formation of business partnerships, diffusion and adoption rate is relatively low in Nigeria. Furthermore, given the regulatory regime in Nigeria that precludes mobile network operators from leading a mobile money venture, these partnerships are somewhat fragile. However, for proper diffusion and adoption, mobile money requires product development and systems integration strategies that increase the pool of services supported by the mobile money network. As understood by Bank A1:

“the adoption rate may be low now, but we keep searching for different specific industries and specific ecosystems. Our aim is to work with these industries and the ecosystem that are serving them, to proffer solutions in that space”.

In Nigeria, for mobile money diffusion to fulfil its potential to accelerate financial inclusion, there is a need for dynamic integration in the ecosystem. The dynamic use of mobile money involves the use of the mobile money platform for the development of non-payment services addressing specific developing country issues like drug authentication in the health industry, agricultural insurance, and other extension services. These developments are however dependent on the involvement of other industry sectors that will draw potential wallet holders. Thus, according to Bank B,

“mobile money can resolve financial inclusion; however, it depends on all the different sectors getting involved not just the banks. The banks have provided the platform in terms of creating a new, innovative, products and services that can use the platform to deliver value to the lower end of the bottom of the pyramid”.

There are opportunities for integration in Nigeria. The country’s cashless policy and the use of mobile money as a payment engine have created new business opportunities within the ecosystem. Bank A2 explains as follows:

“There are conversations that the bank has never been able to have even with the corporates but by reason of introducing this mobile money concept, we begin to have those conversations.” An example of such a conversation with insurance executives about the payment of motor insurance in smaller premium installments rather than lump sum explains the depth of the inclusion issues.”

Continuing, our interviewees highlight that corporates in need of retail markets are beginning to realize the potential benefits of mobile money for installment payments or collections. In government settings, this receipt mechanism improves controls. Bank B and Operator B provide the examples below.

“the Ogun State hospitals decided that they needed a more foolproof way to collect the payments at the different hospital boards and they brought us in. And we've put a few agents there. And what they do is basically collect the money from the patients if they want to buy everything from a syringe to pay for their cards. And it goes straight into the State hospital accounts” (Bank B).

“through our platform, we participate in the distribution of conditional cash transfer in 6 Northern states (of Nigeria), thereby helping the government to reach the extremely poor people who are paid N5000.00 (approximately $12)Footnote 8 monthly” (Operator B).

3.2.3 Lack of Trust and Preference of Effective Local Savings Scheme

In Nigeria, the weak institutional environment had led to a situation where there is a systemic distrust of government led initiatives. This systemic distrust has led to the situation whereby many of the unbanked poor would rather trust local schemes they can relate with. As a result, MMOs currently use a two-prong strategy to develop the target populations. In the first instance, they target existing banked consumers by offering the alternative value propositions of “convenience, mobility, and account independence” (Operator A). The second follow on strategy is dependent on the use of mobile money for payments between existing and trusted groups. According to Operator A:

“Who does the woman in the market trust? Who does the garage driver trust? They have their own community, social circles, circles of influence and all that. They can trust that to the end of this earth. And they have ways of managing the integrity of that circle. So, it still connects this entire plan around that, without destroying what is already working for them, which is what they will resist, if It has to bring new system.”

All over rural and urban dwellings in Nigeria, there are small contributory savings schemes where daily contributions are made typically by local traders to a collective pool. These saving schemes are called Ajo by the Westerners, Adashe by the Northerners, and Esusu by the Easterners (Premium times, 2014). Many of these traders remain unbanked and financially excluded (Premium times, 2014). 71.6% of our focus group respondents utilize informal savings schemes rather than formal banking channels. Majority of our respondents had two notions of savings - bulk and incremental using Ajo or bank respectively. For bulk savings schemes, respondents mainly utilized community-based schemes (Esusu/Ajo/Adashe) that pooled monies amongst a closed group of contributors and paid each contributor the pooled funds monthly. According to FG 47 and FG58:

“The reason why we use Ajo is for us to gather the money in a bulk...” (FG47).

“I plan with my group and pay money monthly and I know when it’s my turn to collect the bulk money” (FG58).

Access to a larger money pool not only helps build the savings discipline but supports recipients to meet larger financial obligations like house rent or the purchase of household electronics. In this regard, the local savings schemes are more effective than formal banking products. For instance, some of the respondents who previously operated savings account options offered by banks chose to liquidate such investment as a result of temptation and lack of self-discipline. As described by FG11 and FG4:

“I tried it once and after that six months I had to liquidate the account because I couldn’t manage; going to look for money when I have that kind of money in a bank. So, I just removed my money and paid the bank for liquidating before time” (FG11).

“You know it’s very easy to go to the bank and withdraw the money but when you do Ajo, you know you can’t take it until a certain time” (FG4).

Hence, for the unbanked poor, these group savings serve as a source of borrowing in emergencies, a way to grow savings and a means to achieve a communal goal, etc. At the heart of every collective saving scheme is the clan nature of its members. Trust perceptions in these informal savings schemes are relatively high even with the associated risks typically associated with the collector. These risks include the loss of savings due to the collector flight, inability to pay, accident or even death. Furthermore, majority of respondents perceived mobile money services as services for the elite with access to large amounts of money. According to FG 6:

“…mobile money is for people with bulk of money” or “it’s meant for the rich”.

This perception is further enhanced by the perceived operational complexity associated with the use thereby limiting mobile money acceptance for financial transactions at markets and storefronts. FG 5 explains thus:

“we are talking about local market - selling pepper... those old women. Most of them are illiterate.”

In Nigeria, the digitization of financial services and the potential risk of loss has been an issue since the introduction of electronic banking services. In the absence of detailed cybercrime legislation, the development of the online criminal industry has warranted caution amongst prospective mobile money users. This promoted FG 4 to state thus:

“Well, why I don’t want to use it, you know Nigeria these days. You know we have 419Footnote 9 everywhere. We have all these yahoo yahooFootnote 10 guys. For me, for my own suggestion and as for my advice, I don’t like anything mobile money or online at all”.

The confidence and trust of mobile money security systems is absent. Similarly, the lack of corporate and individual protection experienced in current electronic banking services is not endearing users to mobile money. FG 23 describes the insecurity and lack of trust of electronic systems thus:

“You know some banks have lost a lot of money. For example, somebody can come in, use their flash please. Maybe you can disguise as you are a co-worker, then they can ask you say: ‘ogaFootnote 11 excuse me, can I use your system’. Then you don’t know that the flash you use, they can use it to collect information from your own system.”

Hence, there is a need to make mobile money transactions easy to use as risk aversion plays an essential role in diffusion of mobile banking in rural areas (Behl & Pal, 2016).

3.2.4 Policy Short-Termism Resulting in Mobile Money Unsustainability

According to our data, the current emphasis of mobile money policies and MMOs is not financial inclusion but rather, the focus is on transaction cost economics that will yield investment returns on license and infrastructure assets in the short-term; with mobile money markets for financial inclusion requiring longer incubation periods. This reality is better explained by a Senior Manager at Bank A2 who describes the internal competition for funds in their organization and the pressures the MMO manager encounters thus:

“The MMO is competing with investment banking business, global market business, all other business units. Fund providers are looking at him and asking themselves why they should spend a million dollars on your platform when they can take the same million dollars and put it a lucrative and safe investment and get a 3% margin? That’s what he’s competing with.”

Hence, while regulatory frameworks differ across countries (Ozili, 2020), the lack of appropriate policy support results in mobile money operators focusing more on short-term success in order to have a platform for their ultimate sustainability. According to the Operator A and Bank C:

“For us, we have not reached out to the unbanked yet. We want to capture and gain the loyalty of the banked i.e., those who have the money before they can now start flowing money to the unbanked. It’s cheaper for us to also implement and record quick success. So that we don’t die before we even grow” (Operator A).

“Many agents do not have POS because of the cost implications…..we distribute our POS (point of sale) terminals to agents who are able to consummate reasonable transactions, otherwise we withdraw the POS and redistribute” (Bank C).

In sum, we have identified 4 major factors (lack of customer demand and experimenters, lack of integration in the ecosystem, lack of trust and preference for effective local savings scheme and policy short-termism resulting in mobile money operational unsustainability) that are responsible for non-diffusion of mobile money in Nigeria. We discuss our findings next.

4 Discussions

Our findings demonstrate that the utility of mobile money, although nascent, is yet to meet expectations. From (Rogers & M., 1962) seminal theory on innovation diffusion, five characteristics (relative advantage, compatibility, complexity, trialability and observability) can be used as innovation indicators to measure perceptions. On relative advantages of mobile money to engender financial inclusion, our data reveals that in spite of Nigeria’s large population, the adoption rates of mobile money (3% of respondents surveyed) are relatively low; hence the attainment of the national objective - mobile money as a tool for financial inclusion - is yet to be reached. Although a high proportion of the respondents surveyed already indicated access to financial services, the utility of mobile money as an alternative channel was low. Thus, the use of mobile money as an alternative payment system is more consistent with the provider (bank) strategy whose objectives are to generation of high traffic volumes and utility of the platform infrastructure. In this regard, the mobile money policy and infrastructural development in Nigeria has been predicated on the expectation that mobile technology can engender inclusive development (Abhipsa et al., 2020; Asongu & Nwachukwu, 2016; Koomson et al., 2021). Nevertheless, for mobile money diffusion to gain relative advantage in the country, strategies for the wide utilization of mobile money would require more awareness amongst the unbanked. Also, the strategies require direct contact with the prospective users or a development of a last mile strategy (using agents) that takes the product closer to the marketplace.

Furthermore, our findings suggest that the development of the mobile money ecosystem needs a collaborative partnership between all participants - service providers, banks, operators, and agents. Whilst the agents serve as the channel for the last mile distribution of services, the income-generating benefits to agents must be evident. For agents that serve as the last mile distribution channel, profitability is essential. However, this is dependent on their initial outlay (agent registration and wallet balances) and projected incomes; that are dependent on MMO and number of active wallets, agent location, and commissions offered. The use of agents for services is further inhibited by the availability of multiple access channels through app or web interfaces that minimize the need of the agents. In the Nigerian ecosystem, mobile money is not perceived as the remedy for financial exclusion as demonstrated in other African countries (e.g., Kenya). In countries where mobile money diffusion has occurred, the demographic characteristics and cultural practices require person to person transfers (Wamuyu, 2014). Non-diffusion in Nigeria may be attributed to the number of licensed operators who strive for immediate profitability and have enhanced market fragmentation as opposed to building the person-to-person user base.

With regard to compatibility of mobile money with the unbanked poor in Nigeria, our findings indicate a lack of proper access, as the formal systems while available, are not always accessible. In Nigeria, majority of consumer transactions are cash-based and conducted in informal “open” markets, hence the reach of mobile money services in such environments is non-existent. Service providers currently participating in the mobile money ecosystem comprise of organized vendors and retailers like utility companies, and so on. The exclusion of the open markets tradesmen, transportation providers, hawkers, and other informal services that are utilized by a large proportion of the population may explain the low adoption rates. The phrase “cash is king” rings relatively true of digital financial services that are prone to failure. Thus, our findings suggest that the trust in cash is still relatively high among the unbanked poor as exemplified by keywords from mobile money users (fail, mess) that awarded equal trust to banks and telecommunications operators as a result of high digital service failures. Our findings support Tobbin and Kuwornu (2011) and Gao and Waechter (2017) assertion that perceived trust impacts the decision to adopt mobile money. Therefore, mobile money transactions appear as innovations that are not compatible with the largely informal social system in Nigeria. Hence, there is a lack of mobile money products diffusion. Thus, the development of innovative mechanisms that include informal markets and builds trust in the mobile money ecosystem can only aid and support financial inclusion and adoption. Furthermore, there is considerable difficulty in understanding mobile money innovations in Nigeria due to the level of complexity. Currently, MMO business models are conceptualized as a digital financial service offering convenience to users. An alternative business model may be a digital financial services platform that seeks to connect service providers and wallet holders. This platform-thinking approach will not only enhance network effects (Choudary, 2013), but will also expand the ecosystem participants to include systems engineers that develop programmatic interfaces for diverse service providers. Our findings indicate that trialability of mobile money in Nigeria occurs in phases, but policy direction has impeded ability of operators to survive and push for sustainability.

Finally, our findings show that generally, the non-banked poor have largely been unable to observe the economic value of mobile money. Overall, there is the low knowledge and awareness perceptions amongst potential users that was observed in the focus group discussions and surveys. The perception of mobile money amongst the potential user community as a tool to meet their financial needs is relatively low and can only be improved through increased engagement through advertisements and awareness generation campaigns. This perception may be fueled by the relatively few services and service providers in the ecosystem and the lack of operation in the informal sectors - open markets, street hawkers. Awareness of the availability of mobile money services and education about its applications is important to increase diffusion (Kemal, 2019). In Nigeria, without customer involvement, diffusion of mobile money will be hindered thus limiting the ability of mobile money to bring about financial inclusion.

4.1 Customer Involvement and Mobile Money Diffusion

According to Howcroft et al. (2007) diffusion of innovation is all about understanding trends and considering customer trends. When customers are very involved, then diffusion of innovation occurs (Kinard & Capella, 2006). In this study, customer involvement is defined as the interest and the general importance that the customers attached to mobile money in the financial inclusion process. When customers are involved in innovation diffusion process, it will engender a continued relationship with the service/product provider. Similarly, involved customers will devote more time to the innovation diffusion process (Sirgy et al., 2008). Therefore, one quick way to ensure diffusion of mobile money and instigate financial inclusion is by integrating the local saving scheme into the diffusion process. As Ajo/Esusu/Adashe is still operational today, both in urban and rural dwellings in Nigeria, digitalization of Ajo to e-Ajo will increase financial inclusion. The digital platform replaces the person who would normally go round to collect savings from registered customers. It will be much more effective and further strengthens acceptance and integrity. Moreover, this trend should be welcomed for the sake of social and economic development and to benefit the majority of the population, including the poor (Koomson et al., 2020; Lepoutre & Oguntoye, 2018).

Until a deployment serves a large number of customers, people will lack trust in the new system, because they know few who can vouch for it (Tobbin & Kuwornu, 2011). To overcome diffusion barriers identified in this study, mobile money deployments need to reach a critical mass of customers as quickly as possible, lest they get stuck in the ‘sub-scale trap’. To achieve customer critical mass in developing countries like Nigeria with weak institutions, the following must be done right in the ecosystem. First, operators, providers and government must create enough urgency in customers’ minds to learn about, try and use the service. Second, there must be heavy investment in above and below the line marketing to establish top of mind awareness of (and trust in) the service among a large segment of the population especially the unbanked poor. And third, there must be sustainable allowance for incurring considerable customer acquisition costs (beyond marketing and promotion) to ensure that their cash-in/out merchants are adequately incentivized to promote the service. Many deployments around the world have the potential to scale up but are stuck in the ‘sub-scale trap’, because their promoters either underestimate the investments needed to achieve scale or are reluctant to make these investments (Mas & Radcliffe, 2011).

5 Conclusion

Financial exclusion has been identified as a hindrance that contributes to keeping the populace poor in developing countries (Carbó et al., 2005). Mobile money is positioned as an innovation that can combat financial exclusion (Lepoutre & Oguntoye, 2018). Hence, there has been a considerable push for mobile money policy and infrastructural development in Nigeria, with the expectation that mobile technology can engender sustainable inclusive development (Koomson et al., 2020), bridge inequality gaps (Asongu, 2015) and be a source of increased income (Wijeratne & Silva, 2014) for the unbanked poor. However, the pursuit of financial inclusion aimed at drawing the ‘unbanked’ population into the formal financial system is still challenging and remains a focus for policymakers in many developing countries. This is because the success of innovations like mobile money in one country might not translate to success in another as financial inclusion solutions are context specific (Abor et al., 2018). Also, the adoption of mobile money can be related to societal cultures and values (Wamuyu, 2014; Wentzel et al., 2016). Rogers’s (1983) diffusion of innovation theory helps to unravel the influence of attributes of innovation (relative advantage, compatibility, complexity, trialability and observability) on mobile money for financial inclusion in Nigeria. Our study makes a theoretical contribution by incorporating customer (unbanked poor) involvement in the adoption process of innovation diffusion in a developing country, as diffusion theory is built around the notion that consumers respond to innovation trends differently.

In this study we sought to uncover factors responsible for non-diffusion of mobile money in Nigeria by exploring the dynamics of mobile money utility amongst poor unbanked users. We found that the mobile money services offered are basic and ranked at the bottom of the hierarchy of consumer financial needs. We enrich the literature on financial inclusion and mobile money diffusion by identifying 4 major factors (lack of customer demand and experimenters, lack of integration in the ecosystem, lack of trust and preference for effective local savings scheme and policy short-termism resulting in mobile money operational unsustainability) that are responsible for non-diffusion of mobile money among the unbanked poor in Nigeria. Our study also has practical implications. We postulate that although the mobile money services offered in Nigeria are supported by a myriad of value creation and delivery processes, the low adoption levels are indicative of additional efforts required in the value delivery activities like market development and segmentation. Hence, the use of informal savings schemes like Ajo that provide savers with a pool of funds to facilitate substantial payments are a popular and preferred savings method should be incorporated into the mobile money diffusion process. This way, mobile money will tie in the unbanked poor with a process they already trust and know, enhance faster mobile money adoption, and ultimately engender financial inclusion.

Finally, our study has implications for policy makers and participants in the ecosystem. Whilst maintaining the current business models, the success of mobile money services as a tool for financial inclusion requires the alignment of objectives amongst mobile money ecosystem actors. Table 4 illustrates this lack of alignment delimits attainment of the overarching objective of financial inclusion.

The regulatory regime in Nigeria precludes the independent licensing of telecoms operators, although telecoms companies may be members of a bank-led consortium. Thus, in spite of the ownership and management of the core infrastructure, the network, Nigerian telcos are unable to participate independently. The need of payment systems that aid person-to-person (P2P), person-to-business (P2B), or business-to-business (B2B) transactions cannot be underestimated. Presently, this is not entirely true of other financial services like insurance and credit with low physical and digital adoption rates. Thus, whilst some services require critical mass and growth, others are nascent and unrelated to the delivery platform. Hence, the mobile money system requires not just ecosystem development, but also contextual digital financials service innovations similar to payment on delivery (POD) services offered by e-commerce ventures.

There are some limitations for our study. We have conducted a single country study. Nigeria, though, is the largest country in Africa by population (UN, 2018) and is regarded the giant of Africa. Hence, studies conducted on this important country can be a good indicator for other developing countries. The impact of mobile money systems on microeconomic and macroeconomic outcomes is a rich area for future research, especially as these systems expand their geographic reach across countries and continents.

Notes

Studies like Zhou and Wan (2017) have also conducted interviews for post hoc analysis of their results.

To improve our research rigor, in May 2021, we conducted another round of interviews to strengthen the validity of our research findings. Also, the secondary data was updated to reflect present licensed mobile money operators’ offerings.

All Nigerian Banks have mobile banking but only 9 have dedicated mobile money (agency banking) operations.

The interview guide after being designed by one of the study’s researchers, was pre-tested by sharing with two experienced senior professors, one of which is involved in this study. Their reviews assisted in identifying issues previously not considered and ensured the validity and reliability of the interview data (Lichtman, 2013). After the review process, the proposed amendments were taken into account, and the final design was eventually developed.

666 is called the “number of the Beast” in chapter 13 of the Book of Revelation, of the New Testament, and also in popular culture.

Language used is pidgin English.

Master or boss.

USD:N = 410 as at August 19, 2021.

As used in this quote, 419 is a local slang for cybercrimes. (It should be noted that 419 is also the section of the Nigerian Criminal Code dealing with fraud).

Yahoo Yahoo is a local slang for people who participate in cyber crime

Oga is a local salutation which means Sir/Ma.

References

Abhipsa, P., Rahul, De’, & Tejaswini, H. (2020). The role of Mobile payment technology in sustainable and human-centric development: Evidence from the post-demonetization period in India. Information Systems Frontiers, 22(3), 607–631.

Abor, J. Y., Amidu, M., & Issahaku, H. (2018). Mobile telephony, financial inclusion and inclusive growth. Journal of African Business, 19(3), 430–453.

Adomako, S., Danso, A., & Ofori Damoah, J. (2016). The moderating influence of financial literacy on the relationship between access to finance and firm growth in Ghana. Venture Capital, 18(1), 43–61.

Akanfe, O., Valecha, R., & Rao, H. R. (2020). Design of an inclusive financial privacy index (INF-PIE): A financial privacy and digital financial inclusion perspective. ACM Transactions on Management Information Systems (TMIS), 12(1), 1–21.

Aker, J. C., & Mbiti, I. M. (2010). Mobile phones and economic development in Africa. The Journal of Economic Perspectives, 24(3), 207–232.

Albashrawi, M., & Motiwalla, L. (2017). Privacy and personalization in continued usage intention of mobile banking: An integrative perspective. Information Systems Frontiers, 21, 1–13. https://doi.org/10.1007/s10796-017-9814-7

Al-Jabri, I. M., & Sohail, M. S. (2012). Mobile banking adoption: Application of diffusion of innovation theory. Journal of Electronic Commerce Research, 13(4), 379–391.

Al-Muwil, A., Weerakkody, V., El-Haddadeh, R., & Dwivedi, Y. (2019). Balancing digital-by-default with inclusion: A study of the factors influencing E-inclusion in the UK. Information Systems Frontiers, 21(3), 635–659.

Arora, R. U. (2012). Financial inclusion and human capital in developing Asia: The Australian connection. Third World Quarterly, 33(1), 177–197.

Asongu, S. (2015). The impact of mobile phone penetration on African inequality. International Journal of Social Economics, 42(8), 706–716.

Asongu, S., Le Roux, S., & Biekpe, N. (2018). Enhancing ICT for environmental sustainability in sub-Saharan Africa. Technological Forecasting and Social Change, 127, 209–216.

Asongu, S., Biekpe, N., & Cassimon, D. (2020). Understanding the greater diffusion of mobile money innovations in Africa. Telecommunications Policy, 44(8), 102000.

Asongu, S., Agyemang-Mintah, P., & Nting, R. (2021). Law, mobile money drivers and mobile money innovations in developing countries. Technological Forecasting and Social Change, 168, 120776,ISSN 0040-1625. https://doi.org/10.1016/j.techfore.2021.120776

Asongu, S. A., & Nwachukwu, J. C. (2016). The role of governance in mobile phones for inclusive human development in Sub-Saharan Africa. Technovation, 55, 1–13.

Behl, A., & Pal, A. (2016). Analysing the barriers towards sustainable financial inclusion using Mobile banking in rural India. Indian Journal of Science and Technology, 9(15). https://doi.org/10.17485/ijst/2016/v9i15/92100

Beuermann, D. W., McKelvey, C., & Vakis, R. (2012). Mobile phones and economic development in rural Peru. The Journal of Development Studies, 48(11), 1617–1628.

Braun, V., Clarke, V., Boulton, E., Davey, L., & McEvoy, C. (2020). The online survey as a qualitative research tool. International Journal of Social Research Methodology, 1–14. https://doi.org/10.1080/13645579.2020.1805550

Carbó S., Gardener E.P.M., & Molyneux P. (2005). Financial exclusion in developing countries. In: Financia Exclusion. Palgrave Macmillan Studies in Banking and Financial Institutions. Palgrave Macmillan, London.

Choudary, S. P. (2013). Platform Power (pp. 1–84). [online] Available: http://platformed.info

Creswell, W. J. (2003). Research design-qualitative, quantitative and mixed methods approaches (Second ed.). Sage Publications.

Cruz-Jesus, F., Oliveira, T., & Bacao, F. (2017). Assessing the pattern between economic and digital development of countries. Information Systems Frontiers, 19(4), 835–854.

David-West, O., Iheanachor, N., & Umukoro, I. O. (2020). Sustainable business models for the creation of mobile financial services in Nigeria. Journal of Innovation & Knowledge, 5(2), 105–116.

Demirgüç-Kunt, A., Klapper, L., Singer, D., Ansar, S., & Hess, J. (2020). The global Findex database 2017: Measuring financial inclusion and opportunities to expand access to and use of financial services. The World Bank Economic Review, 34(Supplement_1), S2-S8.

Denzin, N. K., & Lincoln, Y. S. (2005). The Sage handbook of qualitative research (Third ed.). Sage Publications.

Donner, J., & Tellez, C. A. (2008). Mobile banking and economic development: Linking adoption, impact, and use. Asian Journal of Communication, 18(4), 318–332.

Enhancing Financial Innovation & Access (EfinA). (2018). EFInA Access to Financial Services in Nigeria Survey. Access to Financial Services in Nigeria survey – EFInA: Enhancing Financial Innovation and Access. Accessed 28 May 2021.

Gao, L., & Waechter, K. A. (2017). Examining the role of initial trust in user adoption of mobile payment services: An empirical investigation. Information Systems Frontiers, 19(3), 525–548.

Ghosh, S. (2016). Does mobile telephony spur growth? Evidence from Indian states. Telecommunications Policy, 40(10), 1020–1031.

GSMA. (2020). The mobile economy West Africa 2019. London, UK: Author. https://www.gsma.com/mobileeconomy/wpcontent/uploads/2020/03/GSMA_MobileEconomy2020_West_Africa_ENG.pdf. Accessed 28 May 2021.

Guardian Newspapers (2017). Fitch affirms Nigerian banks’ profitability. Guardian Newspapers, April 10, 2017. Accessed 30 May 2021.

Guest, G., Namey, E., & McKenna, K. (2017). How many focus groups are enough? Building an evidence base for nonprobability sample sizes. Field Methods, 29, 3–22. https://doi.org/10.1177/1525822X16639015

Gumel, A., & Othman, M. (2013). Reflecting customers’ innovativeness and intention to adopt islamic banking in Nigeria. Business Management Quarterly Review, 4(3 & 4), 27–37.

Howcroft, B., Hamilton, R., & Hewer, P. (2007). Customer involvement and interaction in retail banking: An examination of risk and confidence in the purchase of financial products. Journal of Services Marketing, 21(7), 481–491.

IFC (2018). Digital Access: The Future of Financial Inclusion in Africa. Available at 201805_Digital-Access_The-Future-of-Financial-Inclusion-in-Africa_v1.pdf (ifc.org). Accessed 28 May 2021.

Jack, W. & Suri, T. (2014). Risk sharing and transactions costs: Evidence from Kenya's mobile money revolution. The American Economic Review, 104(1), 183-223.