Abstract

This chapter reviews the existing experimental literature on the behavioral outcomes in dynamic common pool resource games. We categorize the contributions in three sections. The first group of contributions compares the observed behavior to different cooperative and noncooperative theoretical benchmarks. The second group covers contributions that design experiments that aim to find behavioral support for the use of specific types of strategies. Both the first and second groups exclusively use a discrete time framework. Finally, we discuss the exceptions in this literature that study behavior in continuous time.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

- Resource economics

- Environmental economics

- Experiments

- Dynamic games

- Differential games

- Common pool resources

- Tragedy of the common

1 Introduction

Environmental and natural resource economics have been fertile areas of applications of dynamic games (see, e.g., Jorgensen et al. 2010; Long 2011 or Benchekroun and Long 2012 for surveys). Inefficiencies in the management of common pool resources, such as the fisheries, forestry, grazing, water, or the climate, have been extensively used to highlight the role of absent or ill-defined property rights in the failure of the welfare theorems in economics. The payoff of each economic agent typically depends on the actions of all the other agents involved in the economic activity. Game theory is then a natural tool to model situations where the resource is exploited by a fixed number of strategic agents such as firms, municipalities, regions, or countries. Natural resource and environmental games often share another important characteristic: actions at a given date impact the future states of the game. Clearly, extracting one barrel of oil today changes the states of the future reserves of oil. On the climate change front, whether the global temperature will stay below the critical thresholds as prescribed by the UN International Panel on Climate Change (IPCC) will depend on the contemporaneous mitigation efforts undertaken by all countries. Taking these intertemporal constraints into account requires the use of a dynamic framework that captures the evolution of the states of the game and its dependence on current actions.

While there is an extensive literature on dynamic resource or environmental games, the experimental analysis of strategic behavior explicitly taking into account the intertemporal dimension of the game is scarce. We review in this chapter contributions that have examined agents behavior when facing a resource dynamics.

Game theoretic modeling makes assumptions regarding economic agent’s fundamental decision-making behavior, e.g., selfish behavior ignoring externalities caused to others. The first group of the contributions we review examines, within specific common pool resource dynamic games or dynamic pollution games, whether the observed behavior supports cooperation, typically corresponding to the Pareto optimal/first best outcome, or selfish behavior, typically corresponding to the outcome of a noncooperative equilibrium of the game. Some of these experimental studies also examine different institutional and environmental factors that can induce a cooperative behavior that mitigates the “tragedy of the commons.” In Sect. 2 we cover those studies that compare behavior to different cooperative and noncooperative benchmarks.

Another important specification of a game is the definition of the strategy set available to the players. In dynamic games, strategies can be history dependent allowing retaliation or punishment such as trigger strategies, or can consist of an action path (open-loop strategy) chosen at the start of the game or can consist of state contingent plans such as Markovian strategies (Basar and Olsder 1999; Dockner et al. 2000; Haurie et al. 2012; Basar and Zaccour 2018a,b). The equilibrium outcome of the game may vary, sometimes substantially, depending on the strategy space considered. In Sect. 3 we summarize the findings of experiments that examine behavioral support for the use of specific types of strategies.

The papers reviewed in Sects. 2 and 3 model the dynamics of the common property resource game using a discrete time framework (difference games), with the dynamics of the system described with difference equations. In Sect. 4 we cover in more detail the much less studied case where the dynamics of the resource is modeled using a continuous time framework. The implication on the experimental design is that in continuous time events evolve in an asynchronous fashion (differential games), and the dynamics are modeled with differential equations. In Sect. 4 we present experiments implemented in continuous time involving dynamic externality within the context of a common property renewable resource. Concluding remarks are offered in Sect. 5.

2 Equilibrium Prediction vs Behavior

In this section we discuss few experimental studies that compare behavior to the predictions of noncooperative game theory in the presence of dynamic externalities.

Herr et al. (1997) is one of the early experimental studies to examine behavior in the laboratory in a common-pool resource (CPR) game with and without dynamic appropriation externalities. Time-dependent externalities arise when appropriation of the resource by any player increases the cost of appropriation for all players in the current and future periods, whereas under time-independent externalities the appropriation by a player at a given time increases the cost of all players in that moment only, the appropriation externality is of a static nature. The authors compare behavior in these two settings. They consider behavioral observations to three benchmark outcomes of the game, namely the Pareto optimal, the sub-game perfect Nash equilibrium, and the outcome of myopic strategy. The myopic case corresponds to the outcome of a game where agents fail to consider the impact of their extraction on their own future costs of appropriation. Herr et al. (1997) illustrate their results using a groundwater basin as the CPR, and consider a finite time horizon dynamic where the depth-to-water is the unique state variable of the game and for each player the cost of extraction depends on the depth of the aquifer. The marginal cost of pumping a unit of water is assumed to be a linear increasing function of the depth-to-water: it increases at a constant rate with each resource unit extracted. When the depth-to-water is reset in each period the inter-temporal externality feature of the problem is muted. The myopic outcome obtains when players fail to take into account that current extraction impacts the future values of depth-to-water, this corresponds to a game where agents completely discount future payoffs. Such myopic behavior may be justified on the grounds of the difficulty to compute the solution to the dynamic optimization problem facing an agent.Footnote 1

In the experiment the resource extractors are subjects ordering “tokens.” A subject’s monetary earnings depend on her token order and her cost is based on her token order as well the group token order. The experiments delivered two important findings:

-

The cooperative outcomes are poor predictors of behavior relative to the noncooperative benchmark outcomes. This is true for the time-dependent and the time-independent settings.

-

In the time-dependent designs, the observed payoffs are significantly lower than those in the time-independent designs. This is partly explained by the presence of myopic behavior. The presence of myopic players might exacerbate the aggressive extraction of non-myopic players and result in a more severe tragedy of the commons.

Addressing myopic behavior could be an important part of policy interventions in the management of CPRs and represents a promising line of future research.

Mason and Phillips (1997) also compared behavior under static vs dynamic externality as part of their experimental study of common pool extraction. An important specificity of their model with respect to the vast CPR literature is that in addition to sharing access of an input, players, i.e., firms also share the market of output: firms are oligopolists in the market of output. In this context Cornes et al. (1986) show that the socially optimal industry size is larger than one but finite. This feature is particularly relevant for resources that have no close substitutes and therefore a substantial markup is to be expected, e.g., Gulf Coast oysters versus Pacific Coast oysters, or West Coast refiners preference for Alaskan crude oil over crude oil from the Middle East. The objective of Mason and Phillips (1997) is to study the effect of industry size on behavior in the commons, in particular the tendency of firms to collude. They ran experiments with markets (groups) of two, three, four, or five harvesters, and examined collusive behavior under a static externality only and in the presence of both a static and dynamic externality. A benchmark scenario is the optimal industry size when the players compete à la Cournot. Under a static externality only, they observed that firms tend to collude, i.e. produce less than the Cournot equilibrium quantity, and that for the benchmark case considered the empirically optimal industry size is four. However when a dynamic externality is present the observed behavior of markets is no longer consistent with a collusive behavior or cooperation between players. Then, the optimal industry size is three, the same optimal size obtained when firms play à la Cournot.

The two papers discussed above compare behavior in the presence of static externality and both static and dynamic externalities (Herr et al. 1997) or only dynamic externality (Mason and Phillips 1997). Both studies intend to test the hypothesis that dynamic externalities exacerbate the tragedy of the commons and their findings support this hypothesis. Giordana et al. (2010) also address a similar concern of whether the delayed, rather than an immediate, realization of the consequences of over exploitation exacerbates the problem of the commons. However they formulate their question differently: they test whether adding immediacy of a static externality in an otherwise dynamic environment can help mitigating the tragedy of the commons, by increasing the salience of the problem to the players. Therefore, they compare behavior in the presence of dynamic externality vs. static and dynamic externalities. The common pool resources they examine are coastal groundwater reservoirs where excessive pumping from the reservoirs increases the risk of natural seawater intrusion into the aquifers, thereby rendering them useless for agricultural and human consumption. Giordana et al. (2010) use a dynamic game with two substitutable common pool resources with different exploitation costs. In one treatment the common-pool resources generate only a dynamic externality, while in the other treatment the common-pool resources generate both static and dynamic externality. They compare behavior against three extraction paths, the sub-game perfect, myopic and Pareto optimal. Their experimental design is such that sub-game perfect and myopic benchmark extraction paths are same under both treatment. As stated above, they hypothesize that users who faces both static and dynamic externality of their exploitation of the resource are likely to be more conservative in their exploitation than users who experience only dynamic externalities. They assume that the immediacy of the static externality may enhance awareness of the consequences of their actions and encourage more socially beneficial behavior. The experimental observations do not support this hypothesis. They also find in both of their treatments behavior follow the myopic prediction more closely.

Noussair et al. (2015) test the canonical renewable resource model (Hardin 1968) in a framed field experiment where experienced recreational fishers make decision on their individual per period catch from an allowable catch for a four member group. Given that the fishermen involved are experienced, they are well aware of the negative externalities inflicted on the group when they choose to overfish. Sixteen fishermen were assigned to groups of four with fixed membership. The game repeats for four periods and each period lasts 1 h. The experiment poses a social dilemma along three dimensions: duration of the game since the game stops if the fish stock is exhausted, the number of fish caught, and the monetary benefit associated with the catch. The allowable catch for the group was affected negatively by the total catch of the group in the previous periods. The authors find no evidence of cooperation and the results of this field experiment are consistent with the predictions of noncooperative game theory which assumes selfish agents.

There have been a very few experimental studies specifically designed to represent the climate change game. The main concern of these studies has been the inherently dynamic nature of the problem and its effect on the ability of the parties to cooperate. The principal effect of the accumulation of greenhouse gases will be felt in the future and in some cases by different generations. In this context one of the behavioral concerns is that decision-makers are myopic, therefore, much worse at processing the future consequences of their actions than immediate ones (Calzolari et al. 2016). Calzolari et al. (2016) compare cooperation in three different environments with different degrees of persistence of greenhouse gas emissions. They report similar levels of cooperation (in terms of average emission) in all environments. But interestingly in the dynamic environment they find cooperation levels deteriorate for high stocks of pollution. In this dynamic externality treatments emission strategies seemed to be increasing in the stock of pollution. Based on this result the authors warn that successful climate policy may require starting early mitigation efforts while pollution stock is low enough. Otherwise too high of a pollution stock may itself work against any possible cooperation among the parties.

Sherstyuk et al. (2016) compare behavior in intragenerational and intergenerational dynamic games of climate change with pollution generating production and external cost from accumulated pollutant over time. In the intragenerational treatment, the dynamic game is played throughout by the same group of subjects, while in the intergenerational treatments, the dynamic game is played by several groups (generations) of subjects. The authors designed the later treatment to describe reality more closely where the countries’ decision-makers and citizens may care more about their immediate welfare and care only partially about the welfare of the future generations. They find while in the intragenerational treatment a significant fraction of the groups show sign of cooperation and ability to approach socially optimal outcome, behavior in the intergenerational treatment, even when caring for future generations is incentivized, resembles the noncooperative outcome of the game. They speculate, this result arises from additional strategic uncertainty imposed by different generations.

Pevnitskaya and Ryvkin (2013) present the result of a laboratory experiment on a public bad dynamic game. In this game private production generates pollutant that accumulates over time and imposes cost on all producers. This simple game captures the basic structure of many social dilemmas such as the problems of local or global pollution, and renewable or nonrenewable common pool resource exploitation. The study compares the collective behavior to the Markov perfect equilibrium and Pareto optimal solution of the game. In the laboratory the average accumulation of the public bad is less than that of the Markov Perfect Nash equilibrium though it remains above the social optimum. The authors report the effect of framing the problem within an environmental context, that is framing the public bad as pollution. In one of their treatment settings they find significant decrease in production decision therefore lower pollution when the problem is explicitly framed as a pollution game. They argue that the environmental context may have activated pro-environmental behavior in the laboratory as well as to some extent worked as a proxy for experience.

In considering the noncooperative equilibrium of a CPR game, very little to no attention is actually given to the space of strategies considered. However in dynamic game theory it is well known that the set of strategies considered can have important implications on the equilibrium of the game (see, e.g., Dockner et al. 2000 or Haurie et al. 2012). The most important sets considered in the dynamic game theory are the set of time (only)- dependent strategies (open-loop strategies), state-dependent strategies (Markovian strategies), history-dependent strategies (e.g., trigger strategies that allow for punishments depending on the history of play). There are a very few experimental studies that focus on behavioral assumption of the strategy types used to solve dynamic games. In the next section we cover contributions intended to address this issue.

3 Behavior and Strategy Types

In many occasions the set of sub-game perfect equilibria in a dynamic game can be large and varied in nature (Vespa 2011). Experimental studies can play important role in studying the issue of equilibrium selection in such games. For example, Vespa (2011) presented their experiment participants with a dynamic common pool game of two players who share a common resource that grows at an exogenous rate. The efficient outcome of the game requires the players to let the resource grow such that eventually they receive a large return from it. The game has both Markov perfect equilibria and history- dependent grim-trigger strategy equilibrium in its set of sub-game perfect Nash equilibria. While in their game the efficient outcome cannot be supported by a Markov equilibrium, it can be supported by a sub-game perfect grim-trigger strategy. They use a large state space, but to make the environment simple enough for the laboratory participants, they restrict the choice space to maximum three points. Comparing behavior with a list of possible strategies they conclude that Markov strategies can be a reasonable assumption for behavior in this environment. The modal behavior in their experiment mostly agrees with a sub-game perfect Markov equilibrium strategy. Though, if they increase the incentives for cooperation the Markov-perfect equilibrium strategy loses its popularity to some extent.

Battaglini et al. (2016) study behavior in a dynamic public good game where the public good accumulates over time. In these games again the set of sub-game perfect Nash equilibria includes both stationary Markov perfect equilibrium and non-Markovian equilibria. As Markovian strategies depend on the accumulated level of the public good, an increase in current investment by one agent results in reduction in future investment by all agents and there by leads to under provision of the public good. Cooperative outcome of the game can be achieved using some form of carrot-and-stick equilibrium strategies. The framework can be applied to issues such as pollution abatement as well as many others. Their experiment includes the case where players can make both positive or negative (reversible) contribution to the public good account as well as the case where the contribution have to be non-negative (irreversible). Theoretically in their model investment and therefore steady state public good stock is higher in the irreversible case under the assumption of symmetric Markov perfect strategy. Though under the assumption of history-dependent strategies, involving punishments and rewards for past actions, they prove that in case of reversibility the optimal investments can be achieved as a sub-game perfect equilibrium. Considering the most efficient history- dependent sub-game perfect Nash equilibrium in each case, they find that the investment and therefore steady state public good stock is higher in the reversible case than irreversible case. This stark difference in the comparative static predictions arising from the behavioral assumption in their model allows them to design an experiment to test the behavioral relevance of Markovian and history-dependent strategies. The result of the experiment at the aggregate level supports the comparative statics of the Markov perfect equilibrium that irreversible investment leads to higher public good production than reversible investment. They show that the Markov perfect equilibrium strategy they consider does not do such good job with the finer details of the individual investing behavior. Though, they find evidence that their subjects’ investment choice responds to the evolution of the stock of the public good.

4 Continuous Time Games

In all the experimental studies we discussed till now and in most of the literature, each participant takes her action on a period by period basis, as everyone has made their decision in one period, the time moves on to the next, that is, decision making happens in discrete time. In reality, decision making in dynamic settings not necessarily happens in such orderly fashion (Janssen et al. 2010). Natural social systems unfold in real time, when decisions are made in an “asynchronous fashion” with continuous updates of states and information (Huberman and Glance 1993). Implementing laboratory experiments in continuous time is quite recent and one of the focus of these studies is to compare behavior under continuous time interaction and discrete time interaction in the lab (Friedman and Oprea 2012; Calford and Oprea 2017; Oprea et al. 2014; Bigoni et al. 2015; Horstmann et al. 2016) . It is quite rare to find experimental studies studying behavior in real time/continuous time in an environment with dynamic externality. Janssen et al. (2010) and Tasneem et al. (2017) are two exceptions.

The experimental design in Janssen et al. (2010) is based on field research on governance of social-ecological systems and particularly keen to approximate the field settings. For this purpose they present the experimental subjects (in group of fives) with a 29-by-29 computer-simulated grid of cells with a shared renewable resource (experimental tokens). The players harvest tokens from this simulated resource field in real time for 4 min, where the resource’s renewal rate depends on the density of the resource and therefore the players face both spatial and temporal resource dynamics. The best collective outcome of this game can be achieved if the players thoughtfully and patiently decide where and when to harvest. Some of the experimental treatments allow costly punishment and/or written communication among the players. Without any punishment or communication possible the study replicates “tragedy of the commons” with fast resource depletion. Only availability of costly punishment could not improve welfare of the players in the game. Communication and communication paired with costly punishment improves harvesting decision significantly. One of the interesting findings of this paper is that communication by itself has a long-lasting effect on cooperative behavior but as they pair communication with punishment that cooperative behavior dissipates when communication and costly punishment is taken away.

The experimental design in Tasneem et al. (2017) is based on an infinite horizon linear quadratic differential game. As it has been presented in the theoretical literature the game admits a linear Markov-perfect equilibrium as well as a continuum of equilibria with strategies that are nonlinear functions of the state variable (see Dockner and Van Long (1993) in the context of a transboundary pollution game, Fujiwara (2008), Colombo and Labrecciosa (2013a,b), Lambertini and Mantovani (2014, 2016) or Bisceglia (2018) in the case of a renewable resource oligopoly and Kossioris et al. (2011) in the case of a shallow lake problem and Dockner and Wagener (2014) for a more general treatment). The objective of this study is to examine the empirical relevance of these linear and nonlinear equilibria in a two-player common property renewable resource game. Given that this is the first experimental study of a differential game, we describe it into a bit more detail.

The linear quadratic differential game framework is a workhorse model in economics differential game literature because of its analytical tractability. In a linear quadratic differential game the objective functions of the players are quadratic and the system of state equations are linear. In this paper two identical agents i, j share access to a renewable resource stock, denoted by S, with natural reproduction function of the stock given by F(S). The instantaneous payoff function of each player is given by

where q i(t) is the extraction by player i at time t and the stock dynamics is given by

For the sake of simplicity they consider the range of stock where reproduction function of the resource is given by \(F\left ( S\right ) =\delta S\), where δ represents the intrinsic growth rate of the resource. The instantaneous payoff function reaches its maximum when q = 1. Therefore the cooperative strategy should support extraction of 1 for each player at the steady state.

Note that in this problem there is no static externality per say, there is only a dynamic externality. Nonlinear equilibria in the presence of static externalities coming from an oligopolistic behavior (as in Mason and Phillips (1997) above) were shown to exist in this game as well (see Fujiwara (2008), Colombo and Labrecciosa (2013a,b), Lambertini and Mantovani (2014, 2016) or Bisceglia (2018)). Since the focus is to investigate behavioral support for equilibria with nonlinear strategies, the study is done in the simplest framework that generates those equilibria, i.e. without static externalities.

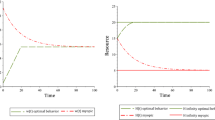

To solve the game they focus on the set of stationary Markovian strategies, such that at any point in time, the extraction decision of a player depends only on the state of the stock at that moment. Each player i takes the other player’s strategy as given and chooses a stationary Markovian strategy that maximizes the discounted sum of his instantaneous payoff over infinite horizon. The game admits a piecewise linear Markov-perfect equilibrium as well locally defined continuum of nonlinear Markov-perfect equilibria. Footnote 2 These Markovian equilibrium strategies vary in the extent of aggressiveness of exploitation of the resource and therefore support infinitely many stable steady states, varying from the best possible steady state (linear Markovian strategy) to very low steady states portraying the tragedy of the commons phenomena. We reproduce Fig. 1 from the paper that presents several examples of equilibrium strategies in this game for the parameter values chosen for the experiment. In the figure, the line called “Steady State” represents steady state extractions at different stock levels. The intersection of this line with a strategy represents the steady state corresponding to the strategy. The strategy labeled “Linear” is the noncooperative linear strategy. In this game, in case of the linear strategy, extraction of the players reaches the best possible steady state. The locally defined curves represent different nonlinear equilibrium strategies. The nonlinear Markovian strategies may sustain many possible steady states, including those that result from resource depletion. The graph also shows the cooperative linear strategy called “Cooperative.”

The experiment is implemented in real/continuous time. That is all information are updated every second and players can change their decision any time they want as many times they want. The laboratory subjects are paired randomly in a group at the beginning of the experimental session. Each group plays several rounds of simulated common pool resource games. Footnote 3 The experimenters set the initial extraction rate and the starting stock level for each simulation. Within a session there are four games for practice and six games for pay. For the practice game the initial extraction rates are set according to the linear Markov perfect strategy for both players. For the six games for pay, the first two games are set with linear strategy initial extraction rate. For next two games, the initial extraction rate is set according to the nonlinear strategy labeled “Nonlinear” in Fig. 1. And for the last two the initial extraction rate is set according to the nonlinear strategy labeled “High Stock Aggressive.” A session either belongs to the low initial stock treatment (S 0 = 7) or high initial stock treatment (S 0 = 14) . The theoretical time path predictions for these strategies are shown in their Fig. 3 (reproduced here as Fig. 2).

The paper first tests the empirical relevance of the Markovian equilibrium strategies by looking into whether any of the steady-states supported by the equilibrium strategies has been frequently reached by the players. They use an algorithm called MSER-5 commonly used in computer simulations literature to identify the time of convergence of a process for the purpose of characterizing steady states in their experimental data. For each group in each simulation of the game the algorithm identifies if a steady state exists, if so the algorithm identifies the extraction rates at the steady state. Table 3 in the paper (reproduced as Table 1 here) summarizes the findings.

According to their table, in every game in each treatment, the majority of behaviors resulted in a steady state stock management. The table categorizes the estimated steady state total extractions into those similar to linear equilibrium steady state, the steady states with total extraction approximately 2, or those similar to any of the steady states supported by nonlinear equilibrium strategies, the steady states with total extraction between 0 and 2. They also find some steady states that are not consistent with either linear or nonlinear equilibrium strategies, for example, the steady states that are significantly greater than 2.

To test the treatment effect they compare the distribution of steady state total extraction rates under initial sock of 7 and 14. Their Figure 8 (reproduced as Fig. 3 here) presents a density estimate of the distributions of steady state total extraction rates for these two experimental treatments. Theoretically, increasing the initial stock level eliminates a set of equilibrium strategies that exist at the lower initial stock level. As the authors demonstrate in Fig. 1, when starting stock is 7, one of the most aggressive strategies available is labeled “Low Stock Aggressive,” but if the starting stock is 14, one of the most aggressive strategies available is “High Stock Aggressive.” Therefore, the higher starting stock of 14 eliminates the nonlinear strategies between those two strategies. When they compare the empirical steady state distributions they find them significantly different from each other. A two-sample Kolmogorov Smirnov test indicates that steady state total extraction distribution in Treatment 2 (S 0 = 14) contains larger values than that of Treatment 1 (S 0 = 7). They conclude that starting with a healthy stock appears to improve extraction behavior in terms of the steady states achieved. Given that symmetry of the equilibrium strategies is a common assumption in the theoretical literature, they look into symmetry of extraction rates at the steady states. Out of the 270 games that reached steady state, 144 were symmetric by their criteria. The study does not find any significant effect of different initial resource extraction rates on behavior.

Next they compare the extraction behavior of the players against Markov equilibrium strategies. The theoretical strategies suggest the more aggressive the strategies are, the faster is the increase in extraction with increase in stock. Also the more and more aggressive strategies get the smaller and smaller stock levels will be subject to positive extraction. In their data actual extraction behavior varies widely and deviates quite far from theoretical suggestions. A large fraction of the play shows sign of over extraction of the resource at low level compared to even the most aggressive theoretical strategy. A good share of actual extraction behavior shows qualitative similarity with nonlinear strategies in terms of raising extraction more and more as the stock grows. Also the players seem to adjust their extraction later downward (upward) following initial over (under) extraction.

The authors also use general-to-specific modeling to find the empirical model that best fit extraction behavior of each player in each play. One of the interesting findings of this analysis is that, though most of the players condition their extraction decision on the current stock level (in a continuous manner as suggested by the Markovian strategies), in a small but significant fraction of cases, roughly 14%, extraction did not condition on the stock level at all. The authors call these behavior rule-of-thumb, as their investigation reveals that in most of these cases the player extracts at a low rate, or zero, until the stock is built up enough for maximum or high extraction rate. The average steady state extraction corresponding to these strategies is significantly higher than that in other categories. Out of the plays that reached the best steady states about 50% includes at least one player with rule-of-thumb behavior. These rule-of-thumb behavior turned out to be quite efficient as it adjusted quickly when the stock reached the level to support best extraction.

5 Conclusion

The chapter reviewed the relatively scarce literature on experiments examining the behavioral outcomes in dynamic common pool resource games. The main finding is that when the dynamics is taken into account there is even less evidence of cooperation than in settings where the dynamics of the resource is muted. There is support of myopic behavior where agents simply ignore the intertemporal constraints. This myopic behavior tends to exacerbate the tragedy of the commons. In the cases of resource extraction there is evidence that agents do cooperate more when the resource stocks, with even agents refraining from extraction until the stock reaches a certain threshold. In a differential game where the experiments allow for continuous time settings, there is support for the use of rule-of-thumb strategies, that is strategies that consist of refraining from extraction until the stock reaches a certain threshold and extract at a constant rate. These strategies share the simplicity of myopic strategies. However they do not imply an exacerbation of the tragedy of the commons, and even result in outcomes that are closer to cooperative outcomes than the noncooperative equilibrium outcome. The framing of the experimental setting can also influence the outcome of the game.

More research is needed to understand the implication of the resource dynamics in the tragedy of the commons within full-fledged continuous time experiments, including the case of more sophisticated games where agents exploit several species (Vardar and Zaccour 2018). The lessons learned from these experiments are relevant for policy making and the priorities that regulators need to have. Regulators should pay particular attention to incentives that combat myopic behavior of agents facing intertemporal constraints. Policies that set moratoriums on extraction until some stock is reached bare obvious similarities with rule-of-thumb strategies which are shown to be more conducive to cooperation. Future experiments that examine how the design of these thresholds and the duration of a harvesting season impact the cooperative behavior among players and how this impact depends on group sizes would bring valuable insights into natural resource policy modeling.

Mastering the translation of differential games in laboratory or field experiments will deliver important insights into the behavior of subjects within the context of competition and intertemporal constraints in general. Building this know-how will be very fruitful in addressing important questions in dynamic games in general such as the behavior of subjects in the presence of a leader (Stackelberg differential games), the (dis)advantage of a regulator in taking the lead, the impact of dissemination of information regarding the states of the game. The behavioral lessons learned in these important class of games will guide regulators and players in general to design institutions that are more conducive to cooperation and that reduce existing inefficiencies.

An experimental approach can be particularly useful when the theoretical analysis of strategic interactions yields inconclusive outcomes. Such situation arises when the game admits multiple equilibria, or when different behavioral assumptions in defining strategies or objective functions of the players lead to different outcomes in the game. For example, Tasneem et al. (2017) present a differential common pool resource game with multiple Markov Perfect equilibria that are Pareto ranked. Further insight into the outcome of this game can only be gained through an experiment designed to study equilibrium selection. The equilibrium outcome of a differential game typically depends on the space of strategies considered. These contexts warrant experimental studies to test the relevance of the underlying behavioral assumptions of different strategy types. Vespa (2011) and Battaglini et al. (2016) are two early examples of such attempts. Another promising line for future research is to examine the role of social status in resource games. Benchekroun and Long (2016) present a common pool renewable resource oligopoly incorporating social status in the objective function of the players. Their analysis suggests existence of social status based on relative harvest exacerbates the tragedy of the commons, while social status based on relative profit can have an opposite effect in certain conditions. It is difficult to know whether social status or relative output/payoff plays any role in common pool resource exploitation decision in real life and if it does, through what channel, output or profit. Experimental studies can shed light on the relative importance of each channel (output versus profits) and by the same token provide insights into the relevant policy interventions in the presence of status concerned harvesters. The lessons learned from the response of strategic agents facing joint intertemporal constraints can be valuable in dynamic oligopolistic games in general (Lambertini 2018; Basar and Zaccour 2018a,b), such as investment games (e.g., Huisman and Kort 2015), competition under price stickiness, branding decisions in marketing (Crettez et al. 2018; Pnevmatikos et al. 2018). These lessons can help narrow down the set of available strategies considered in a theoretical framework, based on empirical observations, which in turn can make the theoretical analysis more salient.

Notes

- 1.

The possibility of myopic playing has been explicitly included in transboundary pollution differential games (see, e.g., Benchekroun and Martín-Herrán 2016).

- 2.

A global Markov-perfect equilibrium strategy is defined over the whole state space. A local Markov-perfect Nash equilibrium strategy is defined over an interval strictly included in the state space (Tasneem et al. 2017).

- 3.

They implemented the discount rate by applying it to instantaneous payoffs every second. To implement infinite horizon each simulation of the game end with a continuation payoff for each player computed as the discounted sum of payoffs for the player out to infinity. This computation assumed that the extraction rate forever stayed the same as it was at the end of the simulation, and it took into account whether the stock level would ever go to zero.

References

Basar, T., & Olsder, G. J. (1999). Dynamic noncooperative game theory (2nd ed.). Philadelphia: SIAM.

Basar, T., & Zaccour, G. (2018a). Handbook of dynamic game theory (Vol. 1, 670 pp.). Berlin: Springer.

Basar, T., & Zaccour, G. (2018b). Handbook of dynamic game theory (Vol. 2, 670 pp.). Berlin: Springer.

Battaglini, M., Nunnari, S., & Palfrey, T. R. (2016). The dynamic free rider problem: A laboratory study. American Economic Journal: Microeconomics, 8(4), 268–308.

Benchekroun, H., & Martín-Herrán, G. (2016). The impact of foresight in a transboundary pollution game. European Journal of Operational Research, 251(1), 300–309.

Benchekroun, H., & Van Long, N. (2012). Collaborative environmental management: A review of the literature. International Game Theory Review, 14(4), 1240002.

Benchekroun, H., & Van Long, N. (2016). Status concern and the exploitation of common pool renewable resources. Ecological Economics, 125, 70–82.

Bigoni, M., Casari, M., Skrzypacz, A., & Spagnolo, G. (2015). Time horizon and cooperation in continuous time. Econometrica, 83(2), 587–616.

Bisceglia, M. (2018). Optimal Taxation in a Common Resource Oligopoly Game. Working Paper.

Calford, E., & Oprea, R. (2017). Continuity, inertia, and strategic uncertainty: A test of the theory of continuous time games. Econometrica, 85(3), 915–935.

Calzolari, G., Casari, M., & Ghidoni, R. (2016). Carbon is forever: A climate change experiment on cooperation (No. 1065). Quaderni-Working Paper DSE.

Colombo, L., & Labrecciosa, P. (2013a). Oligopoly exploitation of a private property productive asset. Journal of Economic Dynamics and Control, 37(4), 838–853.

Colombo, L., & Labrecciosa, P. (2013b). On the convergence to the Cournot equilibrium in a productive asset oligopoly. Journal of Mathematical Economics, 49(6), 441–445.

Cornes, R., Mason, C. F., & Sandler, T. (1986). The commons and the optimal number of firms. The Quarterly Journal of Economics, 101(3), 641–646.

Crettez, B., Hayek, N., & Zaccour, G. (2018). Brand imitation: A dynamic-game approach. International Journal of Production Economics, 205, 139–155.

Dockner, E. J., Jorgensen, S., Van Long, N., & Sorger, G. (2000). Differential games in economics and management science. Cambridge: Cambridge University Press.

Dockner, E. J., & Van Long, N. (1993). International pollution control: Cooperative versus noncooperative strategies. Journal of Environmental Economics and Management, 25(1), 13–29.

Dockner, E. J., & Wagener, F. (2014). Markov perfect Nash equilibria in models with a single capital stock. Economic Theory, 56(3), 585–625.

Friedman, D., & Oprea, R. (2012). A continuous dilemma. American Economic Review, 102(1), 337–363.

Fujiwara, K. (2008). Duopoly can be more anti-competitive than monopoly. Economics Letters, 101(3), 217–219.

Giordana, G. A., Montginoul, M., & Willinger, M. (2010). Do static externalities offset dynamic externalities? An experimental study of the exploitation of substitutable common-pool resources. Agricultural and Resource Economics Review, 39(2), 305–323.

Hardin, G. (1968). The tragedy of the commons. Science, 162, 1243–1248.

Haurie, A., Krawczyzk, J. B., & Zaccour, G. (2012). Games and dynamic games. Singapore: World Scientific.

Herr, A., Gardner, R., & Walker, J. M. (1997). An experimental study of time-independent and time-dependent externalities in the commons. Games and Economic Behavior, 19(1), 77–96.

Horstmann, N., Kraemer, J., & Schnurr, D. (2016). Oligopoly competition in continuous time. Available at SSRN 2630664.

Huberman, B. A., & Glance, N. S. (1993). Evolutionary games and computer simulations. Proceedings of the National Academy of Sciences, 90(16), 7716–7718.

Huisman, K. J. M., & Kort, P. M. (2015). Strategic capacity investment under uncertainty. TheRAND Journal of Economics, 46(2), 376–408.

Janssen, M. A., Holahan, R., Lee, A., & Ostrom, E. (2010). Lab experiments for the study of social-ecological systems. Science, 328(5978), 613–617.

Jorgensen, S., Martin-Herran, G., & Zaccour, G. (2010). Dynamic games in the economics and management of pollution. Environmental Modeling & Assessment, 15(6), 433–467.

Kossioris, G., Plexousakis, M., Xepapadeas, A., & de Zeeuw, A. (2011). On the optimal taxation of common-pool resources. Journal of Economic Dynamics and Control, 35(11), 1868–1879.

Lambertini, L. (2018). Differential games in industrial economics. Cambridge: Cambridge University Press. https://doi.org/10.1017/9781316691175

Lambertini, L., & Mantovani, A. (2014). Feedback equilibria in a dynamic renewable resource oligopoly: Pre-emption, voracity and exhaustion. Journal of Economic Dynamics and Control, 47(C), 115–122.

Lambertini, L., & Mantovani, A. (2016). On the (in) stability of nonlinear feedback solutions in a dynamic duopoly with renewable resource exploitation. Economics Letters, 143, 9–12.

Long, N. V. (2011). Dynamic games in the economics of natural resources: A survey. Dynamic Games and Applications, 1(1), 115–148.

Mason, C. F., & Phillips, O. R. (1997). Mitigating the tragedy of the commons through cooperation: An experimental evaluation. Journal of Environmental Economics and Management, 34(2), 148–172.

Noussair, C. N., van Soest, D., & Stoop, J. (2015). Cooperation in a dynamic fishing game: A framed field experiment. The American Economic Review, 105(5), 408.

Oprea, R., Charness, G., & Friedman, D. (2014). Continuous time and communication in a public-goods experiment. Journal of Economic Behavior & Organization, 108, 212–223.

Pevnitskaya, S., & Ryvkin, D. (2013). Environmental context and termination uncertainty in games with a dynamic public bad. Environment and Development Economics, 18(1), 27–49.

Pnevmatikos, N., Vardar, B., & Zaccour G. (2018). When should a retailer invest in brand advertising? European Journal of Operational Research, 267(2), 754–764.

Sherstyuk, K., Tarui, N., Ravago, M. L. V., & Saijo, T. (2016). Intergenerational games with dynamic externalities and climate change experiments. Journal of the Association of Environmental and Resource Economists, 3(2), 247–281.

Tasneem, D., Engle-Warnick, J., & Benchekroun, H. (2017). An experimental study of a common property renewable resource game in continuous time. Journal of Economic Behavior & Organization, 140, 91–119.

Vardar, B., & Zaccour, G. (2018). Exploitation of a productive asset in the presence of strategic behavior and pollution externalities, G-2018-43, Cahiers du GERAD.

Vespa, E. (2011). An experimental investigation of strategies in the dynamic common pool game. Available at SSRN 1961450.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 Springer Nature Switzerland AG

About this chapter

Cite this chapter

Tasneem, D., Benchekroun, H. (2020). A Review of Experiments on Dynamic Games in Environmental and Resource Economics. In: Pineau, PO., Sigué, S., Taboubi, S. (eds) Games in Management Science. International Series in Operations Research & Management Science, vol 280. Springer, Cham. https://doi.org/10.1007/978-3-030-19107-8_9

Download citation

DOI: https://doi.org/10.1007/978-3-030-19107-8_9

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-19106-1

Online ISBN: 978-3-030-19107-8

eBook Packages: Business and ManagementBusiness and Management (R0)