Abstract

The article considers the primary evaluation of the shale gas resource potential in Kazakhstan and outlines the most problematic issues for the large-scale shale gas production across the state. The authors pay special attention to the national strategy of the Kazakhstan government in the sphere of the unconventional energy production and define the likely technological and environmental problems for the shale gas extraction. It is also stressed in this chapter that application of the fracking technologies could cause both positive and negative effects on the economy of Kazakhstan. Therefore, further steps in this direction should be based on the meaningful and comprehensive geological data regarding the shale gas potential.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

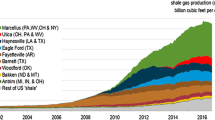

Nowadays, the world energy has entered a new phase of the technology life cycle. The emergence of revolutionary technologies and renewal of industrial infrastructure permitted to combine horizontal drilling with multistage hydraulic fracturing and proppant injection. As a result, it became possible to start the commercial production of unconventional hydrocarbons, such as shale gas. It should be noted that the very first attempts to extract unconventional gas were made in the USA in the 1980s. The first vertical shallow wells (150–750 m deep) had been drilled in the northeast of Texas. Using the hydraulic stimulation technology, the companies started extraction of gas from carboniferous shale formations. [1] However, the large-scale commercial production of shale gas began only in 2002, after the US Devon Energy pioneered a combination of directional drilling and multistage hydraulic fracturing. Over the past decade since the technological breakthrough in the development of the shale gas production, the USA became the absolute leader in the extraction of unconventional fuel and, apparently, it will hold its leadership in the medium-term perspective.

Inspired by the example of the USA, the countries with the highest natural gas consumption began to search for shale gas plays in their own territories. With time on the surveys of the gas-bearing shales have been expanding providing access to a growing number of unconventional hydrocarbon plays.

According to the second report of the Energy Information Agency (EIA) at the US Department of Energy entitled “World Shale Gas and Shale Oil Resource Assessment,”Footnote 1 which was published in July, 2013, the world recoverable reserves of the identified type of fuel are estimated at about 7,299 trillion cubic feet of shale gas and 345 billion barrels of tight oil. Comparing with the data of the first EIA report on the similar topic, the world recoverable shale gas reserves increased by 9.3%, while the volume of tight oil deposits increased 10.7 times [2].

It should be noted that by extending the coverage of the shale gas resource assessment, the US government pursued a quite pragmatic goal, namely to evaluate the possibility of the US fracturing technologies transfer to other countries, as well as to increase the volume of the US liquefied natural gas supply to the potential markets. However, the EIA report stated that ongoing studies were still far from being able to give the public a full picture on shale gas and tight oil world reserves. This was primarily due to the virtual absence of information on the amount of deposits of the identified type of energy sources in key energy producing regions like Middle East, Central Africa, Kazakhstan, etc. [3].

The lack of statistical data on total volume of unconventional hydrocarbons in the designated areas, which can be easily seen in Fig. 1, is directly related to the absence of ongoing projects for the shale gas production, because states of the following region have quit stable income from the operation of conventional oil and gas fields.

However, the sharp decline of world prices for hydrocarbons actualizes the issue of conducting more detailed study of the areas rich in natural resources in order to search for potential shale formations, which in the future could become a kind of “insurance” for the energy industries of the following states. Such approach does not require large-scale production of the potential shale gas in either short or medium term, so it is reflected on both the process of preparation for the geological exploration works and the level of funding approved by the state for such kind of energy industry development.

This statement correlates well with the national priorities of the Republic of Kazakhstan in terms of the national energy sector development.

2 National Strategy for Shale Gas Application

It should be noted that at the legislative level, the Government of Kazakhstan does not have a clear position on the prospects for large-scale production of the shale gas and tight oil, in general, and the introduction of fracking technologies, in particular. Within the framework of national laws approved by the Government, the shale gas and tight oil are mentioned only in the context of the proposed expansion of the use of the alternative energy sources (AESs), although more appropriate to use the term alternative sources of hydrocarbon materials (HM).

For example, JSC Sovereign Wealth Fund “Samruk-Kazyna”Footnote 2 has offered for consideration of the governmental agencies a program, entitled “Roadmap (Master Plan) for the Development of Alternative Energy in the Republic Kazakhstan in 2012-2030.” According to this document, the main goals of the announced “Roadmap” are implementation, management, and development of alternative energy and renewable energy in the country. Outlining its strategic vision in this matter, “Samruk-Kazyna” proposes to expand the fuel and energy base of the country by using alternative sources of hydrocarbons, including shale gas, tight gas, methane hydrates, coalbed methane, and bitumen sands.

Although this document is of a recommendatory character and cannot be used as a formal legal act, the mere inclusion of shale gas in the list of AESs shows that Astana could not ignore the recent trends in the global gas market, which are directly related to the so-called shale revolution.

It should also be noted that there is another document on the basis of which the country’s leadership could establish future legal framework for projects for exploration and development of unconventional hydrocarbon resources in the Republic of Kazakhstan – The Scientific and Technical Program (STP) “Development of Technologies for Extraction, Transportation and Processing of High-Viscosity Oil, Natural Bitumen and Oil Shale.” Approved by the Government of the Republic of Kazakhstan, the STP was launched in 2013 in the framework of the JSC National Science and Technology Holding “Parasat”Footnote 3 activities.

The desire in the nearest future to conduct geological exploration for the shale gas formations was expressed by the high-level officials. For example, Prime Minister of the Republic of Kazakhstan Massimov K. K. during his presentation at the 25th Meeting of the Energy Charter Conference, which was held in Astana in November 2014, stated that the country was going to develop deposits of shale gas. Therefore, it would allow Kazakhstan to enter the list of Top-10 world energy producers. [4]

Thus, we can conclude that in spite of the increasing rate of unconventional gas production worldwide, Kazakhstan is just at the very beginning of its way of studying the issues related to the prospects of shale fuel production.

3 Practical Issues

In order to have an opportunity to implement the declared initiatives, Kazakhstan’s authorities would have both to decide on the country’s strategic plan for the energy sector development and to make some concrete steps in the declared direction. At the initial stage, the primary challenge is to provide accurate data on possible unconventional hydrocarbon reserves located in the territory of the Republic. The systematic study of the traditional oil and gas structures remains the main feature of Kazakhstan’s geological exploration sector. Such kind of practice has its roots in the Soviet period and determined sectoral-oriented industry of the country during the indicated historical period.

Considering the need for a comprehensive study on the assessment of the proved reserves of unconventional hydrocarbons on a national scale, including the shale gas resources, there is a need for generating a clear resource ranking system based on the physical parameters of AES, which could help to determine the optimal production technology for each type of raw materials. Due to insufficient knowledge, there is no single terminological base of hydrocarbon materials in Kazakhstan, which would allow clarifying what kind of gas should be called “shale,” a “tight,” etc.

Some confusion in the classification of particular types of unconventional hydrocarbons can result from the discrepancies in the terminology used in the Western countries and the states of the former Soviet Union. In this respect, it is necessary to create a single list of terms and concepts. In particular, acceptable variant of the unconventional hydrocarbons classification is shown in Table 1.

Based on the following classification, it becomes clear that the Republic of Kazakhstan has some data on stocks of alternative sources of hydrocarbon materials.

For example, there is information about at least 60 high-viscosity oil deposits in the post-salt units of the Caspian Depression, about at least 60 structures and mineral deposits containing natural bitumen, concentrated mainly in the Mangistau oil and gas province. There is also information about more than ten deposits of oil shale, located in the east of the country [5].

However, due to some objective reasons the reliability of the preliminary data on the various sources of hydrocarbons should be called into question:

-

1.

Long standing of conducted research: All publicly available data is dated between 1970s and 1980s of the twentieth century;

-

2.

Research orientation: The geological exploration conducted on the Kazakhstan’s territory was mainly focused on searching for the oil and gas fields, so any successful results in exploration of unconventional fuels were not taken into account. Therefore, research groups have not carried out a comprehensive study on discovered deposits because of direct orders of the Soviet authorities;

-

3.

Applied technologies: Due to the lack of necessary equipment, the assessment of the discovered deposits in the most cases was made in the framework of sample calculation.

It is obvious that a contemporary list of unconventional hydrocarbons deposits should be substantially modified. After a careful investigation, some of the deposits would be excluded due to results of the economic feasibility study [6]. At the same time, the designated list should also be updated with new deposits that were discovered in the oil and gas provinces of the country since Kazakhstan gained its independence.

Due to the fact that the information on current unconventional hydrocarbon resources in Kazakhstan is nonpublic one, it would be very difficult to summarize the following statistical data. By coincidence, the foreign multinational companies, which have the exploration rights to develop oil and gas blocks in Kazakhstan, are trying to prevent disclosing confidential information on both the volume of the raw materials production as well as on the results of geological exploration. In such circumstances, it would be problematic even to make a rough estimation of the unconventional hydrocarbons reserves.

4 Shale Gas Prospective Areas

Despite the lack of primary data on the shale gas deposits in Kazakhstan, experts believe that the country’s shale gas potential is significant. At the same time, different experts point out different regions of the country, promising in terms of unconventional gas production.

Since Kazakhstan has a large number of the coalfields, some experts insist that these coal structures should be the start point of the geological exploration of the shale gas. On this basis, the prospective shale gas formations could be found in the southern and central parts of the country. For example, perspective shale gas areas could be Almaty region, namely Kenego-Tekesky and Zharkent blocks, and Karaganda region, where the most promising territories are located near to Zhezkazgan.

Comparing the potentials of the defined regions, preference should be given to the Zhezkazgan block for geological reasons, namely the region is situated at the tectonic crossroad of two major plates: Chu and Sarysu. It also should be taken into account that there are large groups of minerals formations, such as Kumkol, Amangeldy, and Pridorozhnoe gas and oil fields. Finally, according to the data from the exploration wells, which have been drilled in the Talapskaya and Sarysu blocks in 1997, there is an evidence of the unconventional gas formations in the region. This news is encouraging for Kazakhstani researchers despite the fact that the discovered formations have been classified as stranded gas [7].

Alongside with the opinion on prospects for shale gas production in the central parts of the country, there is another opinion, which stated that priority should be given to the geological structures in the western part of Kazakhstan. For example, deposits of tight oil and shale gas could be found in the Caspian Depression, which is partly supported by the results of exploration on the Eastern Akzhar structure, which is located in the eastern zone of the margin of the Caspian Depression [8].

The shale gas exploration could be conducted within the framework of the international oil project “Eurasia,” which would be implemented jointly by Kazakhstan and Russia in the Caspian basin during the 5-year period. Although this project is focused on the deep oil and gas deposits exploration,Footnote 4 experts would have to proceed geophysical data over the past four decades using the high-technology equipment. Therefore, it would be possible to build a clearer picture of possible structures for further unconventional hydrocarbons production.

As can be seen from Fig. 2, the potential shale gas resources are scattered throughout the country, which means that other gas-bearing shale plays could be discovered. However, it should be recognized that without any results of direct exploration, it is hard to provide even rough estimation of the possible shale fuel production in Kazakhstan.

5 Potential Markets for Shale Gas from Kazakhstan

Although currently in Kazakhstan there is no unconventional shale and methane-coal gas production, the governmental officials still have the opportunity to discuss what options would be better for the country. Currently, both high-ranked officials and experts agreed that the price issue would determine which direction of the shale gas distribution would be at the top of the list – external or internal.

If the shale gas price will be able to compete with the natural gas prices, there is a high probability of choosing the domestic market for shale gas distribution. Such an option will solve the gasification problem of Kazakhstan (currently the state could supply gas only to 8 of 14 regions). The shale gas reserves, which could be discovered, may provide the gas supply for the southern regions uncovered by the main gas pipelines, especially if gas stocks would be found in close proximity to these areas.

For example, there is a possibility to gasify Zhezkazgan and its satellite town Satpayev if the large shale deposits or other unconventional gas plays would be discovered at the block Talapskaya. In the middle-term perspective, Karaganda and Astana could also cover their demand in the energy sources after commencement of commercial production of the shale or coal-methane gas field located 20 km away.

However, if the cost of unconventional gas would be too high, all produced volumes should be distributed in the foreign markets. According to the First Vice-Minister of the Ministry of Energy of the Republic of Kazakhstan Urazbai Karabalin, in 2014 the total production of natural gas in Kazakhstan amounted to over 43.2 billion cubic meters. Therefore, Kazakhstan exported only 11 billion cubic meters of natural gas and 12.5 billion cubic meters of natural gas were provided for domestic needs. Remaining volumes of produced gas were used for reinjection into the reservoir to increase oil production by increasing the pressure in the reservoir [9].

6 Potential Risks and Threats

Production and use of unconvertible energy resources always increases the risks for the environment, human health, and safety. In the case of shale gas production, the likely enormous negative impact on the environment could even prevent the full-scale exploration works of the shale deposits in the countries around the world.

Production of gas from shale deposits has specific features. Due to the high density and strength of the gas-bearing shales, the only technology, which allows to liberate the gas from the reservoir, is the hydraulic fracturing (fracking). Since shale has relatively low permeability, the well has to be fracked repeatedly [10, p. 7]. Thus, the extraction of shale gas seriously affects the subsoil and the surrounding ecosystem.

As the environmental issues are critical for the regions of Kazakhstan, the possible decisions on implementing the strategy for the commercial production of the unconventional hydrocarbons of any kind should be extremely prudent.

Nowadays, the most serious environmental problems for Kazakhstan are the following:

-

Land degradation and impoverishment of landscape – At present, over 76% of the territory of Kazakhstan is affected by desertification.Footnote 5 The most heavy desertification is observed in the areas of active development of mineral resources (oil and gas production in the Caspian Sea region, coal production in the Karaganda region, etc.). Significant anthropogenic disturbance is also noted in the south regions of the country, especially, in the areas of irrigated agriculture, oil and gas production, industrial/urban agglomerations – the zonal types of landscapes of the mentioned territories have already been changed by more than 80%. There are also complex processes of impoverishment of biodiversity, and degradation of ecosystems and agricultural land in many regions of the country. At the same time, the world practice shows that the shale gas drilling and production requires great amount of specific equipment and necessary infrastructure – vehicles, frac tanks (water storages), chemicals, proppant, and others. The use of such facilities affects the environment because of the leakage of chemicals, corrosive compounds, fracturing liquid flowback.Footnote 6 Therefore, the inevitable pollution occurring during the fracking causes the increasing scale of marginalized areas, which are not suitable for agriculture;

-

Water scarcity – In terms of water availability,Footnote 7 Kazakhstan is one of the most water-scarce countries of the Eurasian continent and ranks last among the CIS countries. There is an acute shortage of water resources for the needs of both industry and agriculture, so as for domestic water supply. At the same time, the shale gas production technology supposes free access to virtually unlimited volumes of water. On the average, it can take up to 15 million liters of water to frack a single well [10, p. 32]. The shale gas production affects the water resources in two ways. On the one hand, there are fencing ponds or other sources with the huge volumes of water; on the other hand, there is the contamination of surface and groundwater with toxic gases (methane, ethane, propane, etc.)Footnote 8 and chemicals contained in the fluid flowbacks, even if these liquid flowbacks were pretreated;

-

Destruction of ecosystems – Ecologists express concern over the large number of unique environmental systems in Kazakhstan, namely the Caspian Sea region, the Aral Sea region, Baikonur Cosmodrome, and Semipalatinsk Test Site areas. Experts state that the self-purifying capacity of natural ecosystems in the Republic of Kazakhstan has been already exceeded. Therefore, the new stage of full-scale production of fossil raw materials will only make things much worse;

-

Unfavorable radiation situation – Due to the vigorous activity of the aerospace industry (Baikonur Cosmodrome), more than 400 surface and underground nuclear/thermonuclear explosions that were carried out at the Semipalatinsk Test Site, so as intensive mining of uranium (1st place in the world), the general situation with radiation and radioecological safety in Kazakhstan reached the critical point. Energy resources production, especially, the shale gas production, is always accompanied by removing of the natural radioactive radionuclides and their cleavage products during well drilling. For instance, radon gas may migrate completely to surface and can penetrate into the houses and office buildings becoming a source of radiation for employees and population;

-

High degree of air, soil, and water pollution – Kazakhstan occupied the 23rd place in the world according to the list of the countries with the highest amount of the greenhouse gas emissions, also the Republic takes the 3rd place among the CIS countries (after Russia and Ukraine) and the 1st place among the countries of Central Asia on the same indicator. Considering that the shale gas extraction leads to emissions of methane and other gases, which together cause the global warming, and also that the concentration of the mentioned gases is much higher during the fracturing comparing with the conventional gas production, it becomes clear that if Kazakhstan launches the large-scale production of the shale gas, it will affect negatively the situation with greenhouse gas emissions over the country.

Therefore, international experience shows that traditional and nontraditional gas production (gas-bearing shales and coal seams) affects significantly the environment, namely the geological structures, underground and surface water, air, soil, and land.

It should be noted that the environmental risks associated with the development of shale gas plays cause both pollution and degradation of the natural environment, and consumption of great volumes of water being the most precious natural resource.

In addition to the direct threats for environment and human health, there are also indirect risks related to the fact that the redistribution of financial supports and effort for the shale gas production industry would decelerate development of the renewable energy sector. Such processes can be easily observed in many countries worldwide.

The ill-considered attempts to develop any unconventional energy source, especially, the shale gas, which has bad environmental reputation, can greatly aggravate the environmental problems in the Republic of Kazakhstan and cause the negative effect on the economy of the country and social well-being of its citizens. After using of the fracturing technologies, there would be the need for great investments into damaged ecosystems restoration, providing medical assistance to the population and possible resettlement of the people from the areas of environmental degradation.

On the other hand, the technology is not standing still. In this regard, the further development of shale gas extraction industry on a global scale will depend on the successful addressing of the environmental and social risks associated with the shale hydrocarbons production.

7 Conclusion

Due to the lack of geological data on potential gas plays, the absence of clear legislative acts on the shale gas production issues, and the high level of environmental threats and investment risks during the shale gas technologies development, it would be rather problematic to start implementation of the state strategy that is focused on the shale gas production in Kazakhstan.

However, it does not mean that the authorities of the country will not attempt to establish production of other types of unconventional hydrocarbons. For instance, Kazakhstan’s Gas Production and Transportation Company “KazTransGas” and Saryarka social-entrepreneurial corporation signed the agreement on exploration of the coalbed methane at the Karaganda coalfield.Footnote 9

Notes

- 1.

The first report entitled “World Shale Gas and Shale Oil Resource Assessment” was prepared by the EIA in April 2011. It provided information on world shale reserves expanding on the 69 shale formations within 32 countries. The second report updates a prior assessment of shale gas resources. It assesses 137 shale formations in 41 countries outside the USA.

- 2.

Joint-Stock Company Sovereign Wealth Fund “Samruk-Kazyna” was founded in accordance with the Decree of President of the Republic of Kazakhstan dated October 13, 2008 No. 669 “Оn some measures on competitiveness and sustainability of national economy” Sovereign Wealth Fund “Samruk-Kazyna” is established in order to enhance competitiveness and sustainability of national economy and prevent any potential negative impact of changes in the world markets on economic growth of the country.

- 3.

The JSC National Scientific and Technological Holding “Parasat” with 100% state participation in the authorized capital established pursuant to the decision of the Republic of Kazakhstan Government dated July 3, 2008. However, on March 11, 2015 due to the order of the Committee of State Property and Privatization of the Ministry of Finance of the Republic of Kazakhstan, JSC “Parasat” was reorganized in the form of division into joint-stock companies National Science and Technology Center “Parasat,” “Science Fund,” and “National Center of Seismology.”

- 4.

According to the current research conducted on the 15 sedimentary basins of Kazakhstan, deep oil and gas deposits of the Caspian Depression are estimated at 67 billion tons of oil equivalent and 27 billion tons of oil equivalent are recoverable.

- 5.

Evaluation was made by the Institute of Geography of the MES.

- 6.

The part of the solution (from 10 to 90%), which returns to the earth’s surface after fracturing and requires costly disposal. At the same time, the other part of the solution, which was injected into the bowels, actually is forming a polygon of underground burial of liquid toxic industrial waste.

- 7.

Specific water supply per unit area and per capita.

- 8.

The methane concentration can greatly exceed the safe level. It can cause explosions, because methane is not explosive unless it is mixed with oxygen. For instance, there was Pennsylvania case when the water taken from local wells was on fire.

- 9.

The cooperation agreement was signed on April 3, 2015. The two companies will conduct joint exploration and research works to develop the most optimal coalbed methane production technology. Earlier this year, KazTransGas signed a memorandum of cooperation in exploration and production of coalbed methane with Gazprom Dobycha Kuznetsk, a subsidiary of Russian gas giant Gazprom.

References

Vysotskiy VI, Dmitrievskiy AN (2010) Shale gas – a new vector of development of the world hydrocarbon market. Herald RAS 2:7

Technically recoverable shale oil and shale gas resources: An assessment of 137 shale formations in 41 countries outside the United States. Anal Projections. US Energy Information Administration. http://www.eia.gov/analysis/studies/worldshalegas

Kuuskraa VA (2013) EIA/ARI world shale gas and shale oil resource assessment. Arlington, VA and Washington, DC, 17 June 2013, p 14

Masimov KK. Kazakhstan would produce shale gas. http://news.nur.kz/342529.html

Nadirov NK (2001) Highly viscous oil and natural bitumen. In: The oil fields characteristics. Principles of resources evaluation. Gylym, Almaty, p 168

Nadirov NK (2013) Unconventional hydrocarbon resources of the Republic of Kazakhstan: problems and some possible solutions. Oil Gas 4(76):58

Bulekbaev AA (2013) Unconventional tight, methane-coalbed and shale gas. Prospects for Kazakhstan? Kazenergy J 1(56):50–59

Nadirov NK (2013) Unconventional hydrocarbon resources of the Republic of Kazakhstan: problems and some possible solutions. Oil Gas 4(76):60

Kazakhstan exported 11 billion cubic meters of natural gas in 2014 – Karabalin U.S. Meta.kz, 25 Feb 2015. http://meta.kz/novosti/kazakhstan/961242-v-2014-godu-kazahstan-eksportiroval-11-mlrd-kubometrov-gaza-u-karabalin.html

Solovyanov AA (2014) Environmental impacts of shale gas development. Green Book, Moscow, pp 7, 32

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2016 Springer International Publishing Switzerland

About this chapter

Cite this chapter

Parkhomchik, L., Syrlybayeva, B. (2016). Evaluation of the Shale Gas Potential in Kazakhstan. In: Zhiltsov, S. (eds) Shale Gas: Ecology, Politics, Economy. The Handbook of Environmental Chemistry, vol 52. Springer, Cham. https://doi.org/10.1007/698_2016_83

Download citation

DOI: https://doi.org/10.1007/698_2016_83

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-50273-1

Online ISBN: 978-3-319-50275-5

eBook Packages: Earth and Environmental ScienceEarth and Environmental Science (R0)