Abstract

For an inflation targeting Central Bank, a precise estimate of the threshold inflation in the economy is important. Existing studies provide estimates without any coherent theory of growth and threshold inflation and hence suffer from several limitations about concept and measurement. The present paper attempts to develop such a theory to establish a stable steady state growth solution. It also operationalizes the theory through a model with support from the Indian data for specific components of the model to derive the required functional form. Final estimates in India with annual data from 1995–96 to 2017–18 show that the threshold inflation and associated optimal growth vary considerably as rates of fiscal deficit and current account deficit on the balance of payments vary. The current combinations of the long term four policy targets of 4% inflation; 8% growth; 6% fiscal deficit (to GDP); and 2% current account deficit (to GDP) are internally inconsistent and hence not achievable. Now that there is an opportunity to revise the inflation target for the period after March 2021, the present paper argues for choosing from the menu of internally consistent options for all these four policy targets to avoid unnecessary costs.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Context and Relevance

The Amendment of the RBI Act to introduce Flexible Inflation Targeting framework with an independent Monetary Policy Committee (MPC) in 2016 was considered as the second most important economic reform for upgrading India’s investment rating by the international rating agencies. It was hoped that this reform would ensure price stability and benefit the economy by attracting investors from all over. The term of the first MPC is for 4 years up to September 2020 and the inflation target is set for 5 years up to March 2021. If we simply consider the price stability in terms of achieving the given inflation target of 4%, the performance of the MPC may be considered reasonably good. However, in terms of attracting investors from all over, it is far from satisfactory. Thus, this is the right time to start the process of critically examining the flexible inflation targeting framework of the monetary policy in the country and make necessary corrections in the Act. Through this lecture, I intend to start the debate formally.

In my view, the Amendment of the RBI Act in 2016 was a little too hurried in that it did not consider several things it should have carefully examined. It was based on the Urjit Patel Committee Report (RBI 2014). The RBI Governor was given a term of only 3 years in 2013 and he had ambitions to make many significant changes in the sphere of money and banking in the country. The Urjit Patel Committee, for instance, got only 4 months (12th September 2013 to 21st January 2014), which is hardly adequate time! For introducing an inflation targeting framework, apart from the pure conceptual issues, several operationally critical issues also have to be carefully addressed and 4 months could not have been sufficient. For instance, while the Committee did justify its preference for the Consumer Price Index (CPI) over the hitherto used Wholesale Price Index (WPI) for measuring inflation, it did not make any comments on the method of calculating the CPI for the purpose. As a result, our headline inflation calculated with Laspeyer’s fixed weight basket with only 299 items for a distant base year (2011–12) is hardly comparable to the inflation rate calculated in developed nations such as USA where chain-base index is used with a basket of 80,000 items (Kennedy 2012, pp. 33–36). I have already raised such measurement issues for the inflation targeting framework in the recent past (Dholakia 2018).

Similarly, The Urjit Patel Committee argued for the target in terms of the headline inflation rather than the core inflation deriving support from the empirical exercise on inflation dynamics based largely on the old series of CPI for Industrial Workers (CPI-IW). It did not have the time to get the feel of the new series of the combined CPI for the rural and urban areas with 2011–12 base and hence, different weights to examine whether the inflation dynamics have remained the same or have changed. Again, I have examined this issue with my co-author in the recent past and found significant and major changes in the underlying inflation dynamics that seriously question the choice of the headline inflation over the core inflation (Dholakia and Kadiyala 2018). In the present paper, I propose to examine the Committee’s choice of the precise target numbers of 4% ± 2%.

The Committee offered two justifications for the selected inflation target. The first one was in terms of the average inflation rate with close to zero output gap observed during the seven quarters from Q3 of 2003–04 to Q1 of 2005–06, which would represent the long run equilibrium. The second one was in terms of estimates of the threshold inflation in India. Now, it is fairly clear that any observed inflation rate over time can be considered as a ‘long run equilibrium’ only after adjustments for various exogenous variables including the fiscal deficits of the Centre and States, Current Account Deficit (CAD), and exchange rates besides regular structural changes of substantial magnitude such as the structure of output, employment, capital stock, urbanization and consumption as well as life expectancy and skill composition of labor supply. The Committee did not make any adjustments for such changes in major policies and structural changes during the period under consideration. Observed inflation rate without such adjustments cannot be taken as a basis for any target for the future. This invalidates the first justification. The second justification based on estimates of the Threshold Inflation for the Indian economy can, therefore, be the only justification for the recommended target by the Committee. Such a target number for inflation has to be seriously examined because any error there would have substantial welfare costs for the economy since my research has clearly established existence of the regular inflation—output trade-off in India (Dholakia and Sapre 2012; Dholakia and Kadiyala 2017). I have also argued that deliberate disinflation in a country like India should be followed only after carefully considering its social costs and benefits (Dholakia 2014a, b). In the present paper, therefore, I would like to examine both the concept and measurement of the Threshold Inflation by first proposing a theory and then applying it in the Indian context to get estimates so that the precise inflation target can be modified if required.

The next section briefly reviews important contributions on the concept of threshold inflation and its empirical estimates with a focus on India. The third section attempts to develop a theory of growth and threshold inflation to establish stable steady state solution. The fourth section operationalizes the theory through a model with support from the literature and data on the Indian economy for specific components of the model, which would also help deriving the functional form to investigate both the concept and precise estimates of the threshold inflation. The fifth section is devoted to the final estimation of the threshold inflation in India with annual time series data, interpretation and analysis of the results. The sixth and final section concludes the paper with remarks about implications of the findings on the modifications in the RBI Act.

Literature Review

Debates on the neutrality of money in the literature may be divided into two distinct streams based on the period of impact considered. In the first stream, there are significant contributions showing why money should be neutral or non-neutral in impacting real variables such as levels of output, employment, real interest rates, and real exchange rates in the economy in the short to medium run. The other stream of contributions pertains to the consideration of neutrality of the monetary policy interventions on the real variables like growth rates of potential output, employment, real capital stock, and real factor productivities in the long run. It may be noted that the concept of ‘the long run’ in this context is not the same as the static or semi-static concept used in the theory of business cycles, but is similar to the steady state equilibrium used in the growth theory. Although there are very interesting contributions in the first stream of the literature arguing about the curvature of the Phillips curve and the optimal rate of inflation in an economy in the short to medium term, they are not very pertinent to our subject here, because the definition of the threshold inflation generally understood in the policy circles is the level of inflation that maximizes the long term growth of the economy. It is, therefore, the second stream of literature that becomes relevant.Footnote 1

Mundell (1963) was among the first to postulate a direct relationship between long term growth and inflation. According to him, inflation would reduce real wealth of people thereby forcing them to save more which would result in lower interest rates, higher capital formation, and faster growth. Tobin’s (1972) portfolio mechanism showed that increased inflation would lead people to substitute physical capital assets for money as a store of value thereby increasing the steady state capital stock. During the adjustment process from one steady state to another, both the level and the growth rate of output would increase, though the growth rate would return back to the original rate when the new steady state is reached. Sidrauski (1967) challenged this result and argued for the ‘super-neutrality’ of money by considering the money as a medium of exchange and demand for real balances driven by utility maximization. He argued that higher inflation leads to a decline in real balances and instead of channeling savings into physical capital assets, people would put it to current consumption to fend the utility decline. Therefore, inflation would neither affect the steady state capital stock, nor the level, nor the growth of output. Applying similar framework, Stockman (1981) argued that higher inflation would lower the value of money forcing households to reduce their expenditures on both consumption and capital. Thus, there would be a negative relationship between growth and inflation—a result known as the ‘Stockman Effect’. Haslag (1995) reached the same conclusion through inflation reducing the real deposit rates leading to slowdown of the bank deposit growth and hence investment growth. Haslag (1997) generalized the relationship between inflation and growth in the long run by introducing money in a neo-classical growth model. He showed that growth and inflation would be negatively related if money was a complement to capital; positively related if money was a substitute to capital; and independent if money was only a medium of exchange.

Developing a different line of argument, Milton Friedman (1977) made a seminal contribution in his Nobel lecture by introducing the concept of inflation uncertainty and hypothesizing that it would rise as the average inflation rises. This was corroborated with a game-theoretic explanation by Ball (1992). The concept of the inflation uncertainty in this context was in terms of variations in expected inflation on account of policy regimes and actions of the central banks. Some studies found this causal relationship to be negative (Pourgerami and Maskus 1987; Ungar and Zilberfarb 1993). Subsequently, several studies have tested this hypothesis for different countries and data sets by employing different methods to get different results (for a survey, see Nasr et al. 2015). A recent comprehensive study, however, lends strong support to the Friedman-Ball hypothesis of positive relationship during normal or stable periods, but a negative relationship during crisis periods (Barnett et al. 2018). This hypothesis implies that business units would irreversibly postpone their decisions to invest and hire labor when faced with high inflation and other environmental uncertainties (Pindyck 1993; Bernanke 1983; Bertola and Caballero 1994).

Endogenous growth theory that treats investment as an engine of economic growth provides a framework to investigate the impact of inflation on economic growth via the investment rate and efficiency of investment measured either through Incremental Capital Output Ratio (ICOR) or Total Factor Productivity Growth (TFPG). Several studies have directly investigated the relationship between inflation and growth through the effects on investment and investment productivity with cross country data (Fischer 1993; Bruno 1993; De Gregorio 1993; Barro 1995; Andres and Hernando 1997). Almost all of them found empirically that inflation led to reduction in investment and productivity growth and thereby in the growth of the economy. Li (2006) provided an explanation for such findings in terms of frictions in the financial markets created by the inflation. By reducing the real return on savings, inflation discourages savings limiting the availability of investment capital. This would lead to distortion in the credit market through credit rationing eventually resulting in loss of allocative efficiency of savings and investment. Li (2006), therefore, considered non-linear relationship between inflation and investment and found that it was the TFPG and not the investment rate channel through which inflation adversely and non-linearly affected economic growth. Choi et al. (1996) had argued earlier that at low inflation, credit rationing would not occur and there might not be any negative relationship between inflation and savings or investment rate. In fact, in such cases, the standard Mundell—Tobin effect could apply and higher inflation might result in lower real interest rate leading to higher investment rate and higher growth. Moreover, some studies argue that higher inflation from low base would raise the cost of investment in the economy thereby forcing the firms to reallocate the resources more efficiently to get greater TFPG (Danquah et al. 2011; Rondan and Chavez 2004).

It is evident from the debate in the literature that a unidirectional relationship between inflation and economic growth in either direction is not convincing, particularly when we stretch them to the logical extreme. If we consider a unidirectional positive relationship, it would imply that infinite inflation can generate infinite growth, which would be a fallacy! On the one hand, steady state growth is limited by factor supplies and technology and, on the other hand, very high inflation would erode all functions of money making both the outcomes infeasible. If we consider a uniformly negative relationship, the cost of inflation in terms of future growth would imply that the optimum inflation rate that would maximize the growth should be highly negative, which is not plausible in the face of downward rigidities in most prices. There are, however, strong arguments in favor of moderate inflation as a growth maximizing optimal inflation. Akerlof et al. (1996) argue that downward rigidity of nominal wages and prices of several commodities are quite common in real life. Therefore, many prices actually do not fall when they should. As a result, if the price system has to operate efficiently, some minimal inflation is required to bring about changes in real wages and relative prices to facilitate reallocation of resources among commodities and sectors so as to avoid loss of efficiency gains. Thus, even if the relationship between inflation uncertainty and inflation rate may be unidirectional and direct, its implication on the real variables when considered via changes in relative prices in the system would become non-monotonic.

In this context, many empirical studies carried out using cross country data over long periods also provide support for existence of a non-linear relationship between inflation and economic growth in the long run. A detailed survey of these studies is available in RBI (2014) and Dholakia et al. (2020). Most of these studies use annual data with CPI for measuring inflation so that long run relationships can be properly captured. Their estimates of the exact value for the threshold inflation differs widely depending upon the sample of countries whether developed or developing, method of estimation, and time periods used. General findings are that the threshold inflation level is markedly higher for the developing countries than the one for the developed countries. If the inflation rate is lower than the threshold, there is typically no significant relationship between inflation and economic growth. However, an inflation rate that is higher than the threshold adversely and statistically significantly impacts growth, though the magnitude of such adverse impact may differ considerably from negligible to substantial.

Most of the empirical studies on the relationship between inflation and economic growth suffer from lack of any theoretical framework as the basis to guide the choice of variables and the functional form for estimation. As a result, they suffer from the specification error both in terms of omitted variables and functional form that can alter their results. Moreover, as pointed out by Chaturvedi et al. (2009), they usually do not consider the relationship between growth and inflation in the simultaneous form leading to simultaneity bias in their estimates. Chaturvedi et al. (2009) not only considered the relationship through simultaneous equation model but also conducted the tests for causality direction between growth and inflation. They found the causality running only from inflation to growth and, that too, negatively. They found neither bi-directional causality nor the one running from growth to inflation for their sample of South–East and South Asian countries. Interestingly, their results show that inflation positively affects saving rate and is determined largely by past values of growth.

Empirical studies on Indian data on inflation and economic growth with a clear focus on finding the threshold inflation rate are all largely statistical exercises applying different econometric techniques for estimation, considering different time periods and based on WPI series for measuring inflation. A detailed survey of these studies with methods of estimation, time periods considered and estimates of the threshold inflation is available in RBI (2014) and Dholakia et al. (2020). All of these studies suffer from all the limitations discussed above in the case of cross-country studies using panel data. Moreover, some of the studies on the Indian data have used quarterly and monthly data to investigate steady state growth and long run equilibrium inflation rates to get an estimate of the threshold inflation, which is simply not tenable. Threshold level of inflation is, by design, a concept dealing with the long-term equilibrium economic growth or the steady state growth. It simply cannot be measured with the data frequency of a month or a quarter. Thus, the results obtained through such statistical exercises cannot be meaningfully interpreted because they suffer from the measurement error. The other studies based on annual data suffer from specification error and biases. The Urjit Patel Committee overlooked or failed to consider these limitations while using these studies to garner some support for the target inflation rate they recommended.

I would like to sum up the literature review on the threshold inflation by clearly recognizing that there are enough convincing reasons to believe that money is not neutral even in the long run. The magnitude of the long run equilibrium inflation rate in the system is most likely to have an impact on the steady state growth rate. There is, however, a complete lack of a coherent theory of growth and threshold inflation to provide guidance to its empirical investigation and estimation. Since this is an extremely important and relevant policy issue, empirical studies in the field have proliferated using the state of art statistical techniques, but with little or no meaningful interpretation or use. In the following section, therefore, I make an humble effort to fill this gap by providing a theory of growth and threshold inflation.

A Theory of Growth with Threshold Inflation

We begin with the Harrod’s (1948) growth model with all usual assumptions with a difference that we do not have a closed economy but an open economy with flexibility of factor mobility. The natural growth or the potential growth is given by:

where TFPG (Total Factor Productivity Growth) is rate of technical progress and n is rate of labor growth; n depends on population growth, labor-force participation rate and rate of migration.

The warranted growth is given by:

where sd is the desired rate of investment in the system; Cr is the required incremental capital output ratio (ICOR); and IOCR is the incremental output capital ratio or marginal product of capital, which is the reciprocal of Cr or ICOR.

The steady state growth is obtained when:

Harrod (1948) treated all the four variables (n, TFPG, sd, and Cr) as parameters because he had assumed a closed economy with fixity in technology and consumer behavior. As a result, he ended up with the famous instability theorem. In the open economies of the current times, however, cross-border movements of labor, capital, and technology are not only possible but are actually occurring. Therefore, Gn or the potential growth rate is no longer constant. In such a system, if Gw > Gn, both the growth of labor supply (n) and the TFPG would tend to increase because of the incentives created due to higher growth experienced consistently by the economy. Similarly if Gw < Gn, there would be outmigration reducing the rate of labor supply growth (n) and the TFPG declining due to outflow of capital. Thus, Gn will have tendency to change to match the Gw. In short, such a growth model will give a stable growth equilibrium and we will have the steady state growth given by G. We can rewrite (3) as:

Now, we can incorporate the rate of inflation in this model as a determining variable based on the findings of Chaturvedi et al. (2009). The literature reviewed earlier also suggests that the desired rate of investment (sd) depends on the inflation uncertainty (IU) in the system, which, in turn, depends on the long run rate of inflation (π). We can represent these relationships in Eqs. (4), (5), and (6):

We may note here that if we define the inflation uncertainties as per the Friedman–Ball hypothesis, it provides only a unidirectional inverse relation with the returns on investments and hence with the desired rate of investment in the economy. However, if we define the inflation uncertainty as reflected in the relative prices of goods and services in the economy based on the argument of Ackerlof et al. (1996), the hypothesis would provide for non-monotonic relationship between inflation uncertainty and expected returns on investments and hence the desired investment rate. Since this hypothesis is pivotal for my theory, I modify it to read as—the perceptions of the inflation uncertainties as reflected in the relative price changes are eventually inversely related to the expected returns from the private investments and thereby to the growth of real capital stock in the economy. Such a concept of inflation uncertainty (IU) in terms of changes in relative prices is highly business oriented because it considers the spread or variation in the rates of price increases across goods and services. Thus, inflation uncertainty essentially captures the changes in the structure of relative prices when inflation occurs. Business units invariably consider such uncertainties while taking their investment decisions because they determine expectations about profits. Very high uncertainty will require very high profits and very low uncertainty will lead to very low profits. Both would discourage private investments. There is, therefore, an optimum level of uncertainty in relative price variation that maximizes the private investment in the economy. Our empirical exercise based on the latest monthly CPI inflation series from January 2012 to September 2019 shows a statistically significant positive monotonic relationship (Results reported Table 3 in “Appendix” at the end). Since Eq. (4) has an inverted-U shaped relation, Eq. (6) would also have a similar relation if inflation uncertainty has a positive monotonic relationship with inflation rate.

The next step is to consider TFPG or IOCR or productivity of investment as dependent on inflation. Our literature review theoretically suggests an inverted-U shaped relationship between the productivity growth and inflation, though empirical studies on some developed countries point to a possibility of an inverse relationship. However, for a rapidly growing developing country like India where substantial structural changes occur continuously, there is a strong possibility that there may be a positive relationship between inflation and IOCR particularly when inflation rate is not very high to begin with. This gives us Eq. (7)

Considering Eqs. (6) and (7) in conjunction with Eq. (2), we obtain Eq. (8):

Therefore, Gw has a maxima with respect to inflation rate (π).

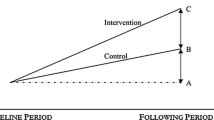

As seen in Fig. 1, the growth rate (G) is measured on the vertical axis and inflation rate (π) on the horizontal axis. The curve Gw represents Eq. (8) and is an inverted–U shape with a maximum value at π*, which is the threshold inflation in this system. If we consider any initial position away from π* like π1, we will have π1 < π*. Since inflation is quite low, saving is discouraged, and people would increase their consumption. This would lead to increased inflation, but in this range, increased inflation leads the investment rate to increase and so does the growth until it reaches the maximum value G* corresponding to π*. Similarly, if the initial position is at π2 > π*, the economy experiences high inflation thereby discouraging consumption. This would lead to a fall in the inflation and an increase in saving and investment rate. In this range, a decline in inflation would also lead to increase in the capital productivity and hence in growth. This movement would continue till it reaches the optimum value G* corresponding to π*. Thus, in this growth model, the warranted growth would always be at the threshold inflation level that maximizes the economic growth, provided there are no government interventions.

It is interesting now to see how a stable steady state growth solution emerges in this model. Consider Fig. 2 depicting Gw and Gn curves with growth rate on the vertical axis and inflation rate on the horizontal axis. The Gw curve is the same as in Fig. 1 above. The Gn curve is obtained by combining Eqs. (1) and (7) and, therefore it is initially rising when the inflation is low, reaching a maximum growth at a moderate level of inflation and then falling as inflation rises. If the initial condition is given by the Gn’ curve, the short run equilibrium will be obtained where inflation rate is at π1 as in Fig. 1. At this point, as we have seen above, the savings are discouraged, and consumption increases leading to an initial rise in inflation and investment and finally leads to higher growth. Simultaneously, low inflation implies higher real wages which attract in-migration and increasing growth attracts inflow of capital and technology. This shifts the Gn curve above till it intersects the maximum point on the Gw curve. Similar logic applies if the initial curve is Gn”. In this case, the short run equilibrium is at π2 > π* and as seen above, it discourages consumption and reduces inflation, which, in turn, encourages savings and investment rates in the economy. In this range, the reduction in inflation also raises productivity and hence growth till it reaches the optimum point of π* and G*. Simultaneously, high inflation at π2 implies lower real wages that lead to out-migration leading to shift in the Gn curve until it intersects the Gw curve at its optimum point. Thus, the proposed growth theory based on the threshold inflation provides a stable steady state growth solution at the threshold inflation rate and hence at the maximized growth rate. If the economy, as defined by our standard assumptions, is left without any external intervention, it is likely to operate in the long run at G* and π* in the steady state. This theory provides the basic justification for the monetary policy to target the threshold inflation rate. It is, therefore, imperative to obtain a reliable estimate of the threshold inflation for the Indian economy based on this theory.

A Detailed Model for Estimating Threshold Inflation

To operationalize the above theory for obtaining estimates of the threshold inflation in India (or any country, for that matter), we have to construct a simultaneous equation model based on all critical components in the basic argument. As a first step, therefore, we need to establish the direction of causality with some empirical support. Chaturvedi et al. (2009) have already found the direction of causality from inflation to growth only. Subsequently, with more recent data on India, I found support for inflation causing growth with a lag of 3–4 years (Dholakia 2014a) and with error correction model (Dholakia 2014b). We have also conducted a simple cross correlation or the lead–lag analysis using the annual data on the real GDP growth and CPI inflation and the results are reported Table 4 in “Appendix”. Our finding is that while growth leads to decline in inflation in the subsequent year, inflation itself leads to growth with a time lag of 3 years. Thus, growth impacts inflation in the short run but inflation causes growth in the long run. Therefore, for the purpose of our model of steady state growth and threshold inflation, inflation is an explanatory variable whereas growth is the dependent variable. In any case, inflation targeting framework of the monetary policy makes the long run inflation a policy parameter and not strictly a variable. Keeping this in view, we may now consider different components of the model.

The first component in the model is definition of the Annual growth rate (G), which can be represented using Eq. (9):

where s is the Investment Rate defined as a ratio of Investment to GDP. If we consider domestic (sdomestic) and foreign (sf) investment rates separately, s can be represented by Eq. (10):

where s(pvt) and s(pub) denote private investments and public or government sectors investments, respectively. It is important to consider these three components of the investment rates separately in the model for a rapidly growing developing economy like India because public investments not only form a significant part of the total investment but also create much needed infrastructure and facilities. Moreover, all the three components of the investment rates have largely different determinants as demonstrated below. The component of public investment rate is given by Eq. (11):

where Φ stands for ‘a function of’; CE is government capital expenditures; and FD and RD are respectively the Fiscal and Revenue Deficits of the states and central governments combined and may be considered as policy parameters. This equation, as expected, is supported very well for India with a highly significant fit based on the time series data from 1980–81 to 2017–18 (Results Table 5 in “Appendix” at the end).

The component of the private investment rate is given by Eq. (12):

where r is the real interest rate (nominal interest rate minus inflation rate), π is the inflation rate, and FD is the combined fiscal deficit. This functional relationship is based on the literature supporting inclusion of the determinants of private investment particularly for India. Tokuoka (2012) finds a negative impact of increased real interest rate on the corporate investment in India. IMF (2013) and RBI (2013) estimate the extent of the negative impact of increased real rate of interest on the overall investment rate in the country. There are two competing hypotheses about the possible impact of the fiscal deficit on the private sector investment. One is the famous crowding out effect of increased government expenditures as a well-accepted doctrine in macroeconomics and the other is the crowding in effect of the government expenditures in infrastructure deficient countries like India. Government expenditures may improve the infrastructure or the aggregate demand conditions that may increase the profitability of the private sector and provide incentives to invest more. Mitra (2006) finds support for the crowding out hypothesis in the short run but finds complementarity of public and private investment in the long run. However, Bahal and Raissi (2015) find support for the crowding in hypothesis in India for the period 1980–2012. While discussing Eqs. (4), (5) and (6) above, we have already considered the impact of inflation on the investment rate, which is essentially felt through the private investments. Based on the annual data on the Indian economy from 1980–81 to 2017–18, we find reasonably good support for this component of the model (Results Table 6 in “Appendix” at the end). While the real interest rate has a negative impact on private investment rate, it is not statistically significant. On the other hand, inflation has a negative short run effect on the private investments but as time passes, the effect turns positive but fails to be statistically significant. The combined fiscal deficit, however, has a strong negative impact signifying support to the hypothesis of crowding out of private investments.

The component of the foreign investment rate is given by Eq. (13):

where ∆FERe is the expected change in Foreign Exchange Rate. The general and intuitive expectation is that a higher real interest rate in the system can attract the foreign investment. However, this expectation hinges on the international capital flows being perfect, which is far from reality due to the possibility of restrictions imposed by the receiving country and also due to the problem of asymmetric information. If high real interest rate prevailing in a developing economy like India is taken as a signal for the weaknesses in the economy, the relationship can be negative. The inflation rate can also have a positive or negative impact on the foreign investment. If the high inflation is on account of external shocks like bad weather conditions or oil price shock or structural factors reflecting the supply side problems, it may encourage foreign investment. However, if the high inflation is due to macroeconomic mismanagement or demand side problems, it would be treated as macroeconomic vulnerability and would discourage foreign investment. Finally, expected depreciation of the Indian Rupee may also have a positive or negative effect on the foreign investment inflows depending on what causes the depreciation. If the depreciation of the currency is on account of serious competitive disadvantage of the country due to cost disadvantages or lower rankings in the ease of doing business or political uncertainties, the foreign investment rate would be negatively affected. However, if the depreciation is on account of external shock like natural calamity, or oil price hikes or relative inflation rates, it may have a positive effect on the capital inflows. The literature also suggests the relationship in either direction (Froot and Stein 1991; Klein and Rosengren 1994). Thus, all the three determining variables in our Eq. (13) can have effects on either direction on the foreign investment rate and the logical channel for their effects are highly overlapping.

However, before we get the empirical validation of this equation, we need to consider how we can estimate the expected change in the foreign exchange rate. We can get it from the predicted value of the ∆FER obtained from the Eq. (14) assuming adaptive expectations:

where CAD is the Current Account Deficit on the balance of payments; and ∆Poil is change in the international Price of oil. In India, expectations about the foreign exchange rate movements over time critically depend on the size of the CAD and on the changes in international price of crude oil. Since the current expectations about exchange rates are based on the observed values of these determinants, we consider 1-year lag for both the independent variables and derive the predicted value for ∆FER to feed into Eq. (13) for validation. From the time series data covering the period, 1980–81 to 2017–18, our results for Eqs. (14) and (13) are reported respectively Tables 7, 8 in “Appendix”. While the overall fit of both these regressions are statistically significant, the explanatory power is relatively low for ∆FER. Since our purpose from this equation is to obtain the predicted values of the dependent variable as an instrumental variable to replace the ∆FERe in Eq. (13) above, we may accept it because both the independent variables have the expected signs and one of them (CAD) is highly significant. The regression on the foreign investment rate, however, has serious multi-collinearity problems. Although its overall explanatory power (R2) is high at 47%, none of its estimated coefficients are statistically significant. As we had noted earlier, the independent variables in this equation have some in-built logical overlap for the channel of their impact on the dependent variable. Since our purpose here is to incorporate this component in our model to arrive at the final reduced form equation to estimate the threshold inflation, we need not insist on getting the exact estimate of the coefficient of each variable separately. The overall fit of the equation is statically highly significant, which is a good enough support for this component of the model.

Finally, the last component in our model is the equation on the incremental output capital ratio or IOCR. The definitional relationship given by the Eq. (9) above forms the basis of measuring the IOCR to ensure consistency. Given the very concept of IOCR as the capital productivity over time when everything could change, i.e., it is a total differential of output with respect to capital and not the marginal product or partial derivative of output with respect to capital, its annual measurement based on definitional equality is prone to wide fluctuations not tenable with the theoretical concept. We need, therefore, to smooth out the series by taking a 5-year moving average or define and measure the concept over the 5-year horizon. We have preferred the former. We postulate the Eq. (15) for estimating IOCR with all the independent variables also measured as 5-year moving averages:

The literature reviewed earlier and the discussion for Eq. (7) in the previous section provides justification for expecting either positive or negative impact of inflation on IOCR depending on whether the inflation is low or high. Higher fiscal deficits would lead to higher aggregate demand either through more public investment or by boosting consumption. In both the cases, the business efficiency of resource use and their productivity is likely to increase. Similarly, higher current account deficit implies higher inflow of foreign capital that generally brings better technology and management inputs which would improve the efficiency and productivity in the country. Alternatively, higher CAD would create pressure on the currency to depreciate thereby increasing costs of imported resources for businesses that may affect the capital productivity or IOCR adversely. Total Factor Productivity Growth or TFPG is an integral component of the IOCR and is expected to be positively related to IOCR. The Indian data from 1980–81 to 2016–17 provide an excellent fit on this multiple regression (Results reported Table 9 in “Appendix”). The coefficient of determination is high at 76% and all coefficients of variables except fiscal deficit are significant at 8% level. All variables including inflation but except CAD, have positive sign implying that long run inflation in the country has not been in the “high range.” Similarly, the negative sign of CAD indicates that the impact channel works through the depreciation route on IOCR.

Estimates of Threshold Inflation in India

Equations (9–15) completely define our model. Its simultaneous solution will generate the reduced form equation for growth in terms of exogenous or pre-determined variables. A closer look at these seven equations of our model shows that there are apparently six independent variables in our model, namely, Inflation Rate, Fiscal Deficit, Current Account Deficit, Price of Oil, Real Interest Rate, and Total Factor Productivity Growth. While the Price of Oil is truly an exogenous variable over which policy makers in India would not have any control, it appears only in one equation for ∆FER and our regression result shows that it does not have a significant coefficient. TFPG is used as a proxy for the rate of technical progress and is likely to be determined to a large extent by π, FD and CAD. Similarly, the Real Interest Rate (r) is defined as a difference between nominal interest rate and inflation rate. Since the nominal interest rate is used as a policy tool for the monetary policy, there are essentially only three independent variables worth considering for further analysis. Therefore, the reduced form equation to obtain the long-term Growth rate is as given in Eq. (16):

Such a quadratic functional form is clearly suggested by our model and the theory discussed in the previous two sections. This is because the growth is obtained by multiplication of investment rate and IOCR. Pure linear terms of the three variables are not justified by the model. Although the model can provide for higher order polynomials, we have kept only quadratic form to save on degrees of freedom for the estimation. Moreover, the lagged dependent variable is included in the equation to get the solution for the long run equilibrium growth rate from the equation by dividing the rest of the coefficients by (1–a0). For estimating the regression, we should consider the period when the country had less distortions due to direct interventions by the government in the functioning of markets. Market oriented reforms were introduced from 1993 in the country, and by 1995–96, they settled down. Therefore, we considered the period from 1995–96 onwards. The results of the regression are presented in Table 1 below.

These results represent a reasonably good fit considering that all our variables are rates of change. Since inflation rate has a negative sign for its square term, the equation has a maximum with respect to the inflation rate given the values of the other two variables. Such a growth maximizing value of the long run equilibrium inflation rate may be called the Threshold Inflation Rate. It always depends on the values of the CAD and Fiscal Deficit rates in the economy and, therefore, is never a unique value unlike most studies estimate. Table 2 presents the optimum values of steady state growth rate and the threshold inflation rate for alternative values of the fiscal deficit rate and the CAD rate. It shows the menu from which the policy makers can choose the long-term target values for all these important macroeconomic variables. Generally, policy makers do choose the target values of the growth, inflation, fiscal deficit and CAD rates to be achieved over a given period of time. More often than not, these target values are not chosen to ensure internal consistency because they are derived without any formal theory-based model and therefore fail to meet all the targets simultaneously. To illustrate, current targets are fixed for combined fiscal deficit at 6%, for CAD at 2%, for inflation at 4%, and for growth at 8%. These are not internally consistent targets, because with the given targets of FD, CAD and π, consistent estimate for the long run growth as seen from Fig. 3 is only 5.6%—a shortfall of whopping 2.4% points!! Moreover, it leads to sub-optimal decisions and hence performance of the economy. The values of all the variables reported in Table 2, on the other hand, are internally consistent since they are derived from a theory-based model.

Concluding Remarks and Policy Implications

From the arguments and empirical exercise presented in this paper, it is clear that money is not neutral even in the long run or the steady state. By determining the long-term inflation rate, it can impact the steady state growth rate of the economy. Thus, money does affect the real variables in the system. In this context, choosing the inflation target for long term cannot be a casual mechanical exercise. One has to be very careful while fixing the target for long-term inflation about not hurting the long-term growth in the economy. A very conservative and strict target for inflation can choke the growth impulses in a rapidly growing developing economy like India where substantial and continuous structural changes are rules rather than exception. It is through such structural shifts and changes that those countries experience a very high aggregate productivity growth and thereby a high growth rate. If the rate of inflation is unduly kept very low at comparable levels of the developed and structurally stable countries, the structural changes in the developing countries would slow down considerably leading to the lower growth equilibrium. This would have a very heavy cost in terms of income, employment, poverty and aspirations of people in those countries. The present paper dispels the view of the experts from the developed world that money is neutral in the long run and, therefore, strict control and management of inflation would not have any adverse impact on the real economy in the long run. While this could be true for structurally stable and saturated developed world with low growth, it is far from truth in the case of rapidly growing and structurally evolving developing world.

Now that we have an opportunity to revise and modify the inflation target set in the RBI Act to cover the period after March 2021, we must be extra careful to avoid the mistakes of the past. As I have been arguing, we must have a comprehensive revision of all aspects including the precise target for inflation. This paper presents various internally consistent options for choosing such targets. It must be recognized at the outset that the inflation target cannot be an independent stand-alone target. It has to be consistent with the targets for fiscal deficit, current account deficit and economic growth rate in the country. From such alternative combinations given in the Table 2 in the previous section, we have to choose the optimal combination of targets. Recognizing that the external value of our currency is highly sensitive to the CAD, its value should be pragmatically decided at around 2.5%. The other objective of achieving a $5 trillion economy by 2024–25 and $10 Trillion by 2029–30 should guide our choice of the growth target of not less than 8%. It leaves us with little choice to consider the fiscal deficit target of 6.5% to 7.0%, which is not only sustainable but also consistent with the goal of reducing the debt-GDP ratio in IndiaFootnote 2; and Threshold Inflation target accordingly to 5.4–6.0% (these are the numbers given in bold in Table 2). I hope that policy makers consider all this very seriously before deciding on the targets for the future.

Notes

It is a received doctrine that inflation in the long run is a monetary phenomenon. The second stream of literature, therefore, investigates relationships between inflation and growth of real variables in the economy.

Sustainable combined fiscal deficit in India in the long run with the growth target of 8–8.5% and inflation rate of 5.4–6% would be in the range of 9.2–9.5%, because the nominal growth would be at least 14% and effective interest rate on government debt would be 7% or less. Therefore, the Debt-GDP ratio would not increase even with Primary Deficit of 4.7% of GDP. Adding interest payment of 4.7–4.8% of GDP, the sustainable fiscal deficit comes to around 9.5%. Thus, fiscal deficit of 7% or even 7.5% would lead to a decline of Debt-GDP ratio by about 2–2.5% points per year, provided the nominal growth is around 14% per annum.

References

Akerlof, G.A., W.T. Dickens, G.L. Perry, R.J. Gordon, and N.G. Mankiw. 1996. The macroeconomics of low inflation. Brookings Papers on Economic Activity 1996 (1): 1–76.

Andres, J., and Hernando, I. 1997. Inflation and economic growth: some evidence for the OECD countries. In Monetary Policy and the Inflation Process-BIS Conference Papers (No. 4, pp. 364–383). Bank for International Settlements, Basel, Switzerland.

Bahal, R., and Raissi, M. Tulin. 2015. Crowding-out or crowding-in? Public and Private Investment in India. Working Paper WP/15/264, International Monetary Fund, Washington.

Ball, L. 1992. Why does high inflation raise inflation uncertainty? Journal of Monetary Economics 29 (3): 371–388.

Barnett, W., Ftiti, Z., and Jawadi, F. 2018. The causal relationship between Inflation and Inflation Uncertainty (WP no. 201803), Department of Economics, University of Kansas, Kansas, USA.

Barro, R.J. 1995. Inflation and economic growth (No. w5326). National bureau of economic research, Massachusetts.

Bernanke, B.S. 1983. Irreversibility, uncertainty, and cyclical investment. The Quarterly Journal of Economics 98 (1): 85–106.

Bertola, G., and R.J. Caballero. 1994. Irreversibility and aggregate investment. The Review of Economic Studies 61 (2): 223–246.

Bruno, M. 1993. Inflation and growth in an integrated approach (No. wp 4422). National Bureau of Economic Research, Massachusetts.

Chaturvedi, V., B. Kumar, and R.H. Dholakia. 2009. Inter-relationship between economic growth, savings and inflation in Asia. Journal of International Economic Studies 23: 1–22.

Choi, S., B.D. Smith, and J.H. Boyd. 1996. Inflation, financial markets, and capital formation. Federal Reserve Bank of St Louis Review 78: 9–35.

Danquah, M., Moral-Benito, E., and Ouattara, B. 2011. TFP growth and its determinants: nonparametrics and model averaging. Banco de Espana Working Paper No. 1104. Bank of Spain, Madrid, Spain.

De Gregorio, J. 1993. Inflation, taxation, and long-run growth. Journal of monetary economics 31 (3): 271–298.

Dholakia, R.H. 2014a. Sacrifice ratio and cost of inflation for the Indian economy. Working Paper Number 2014-02-04, Indian Institute of Management, Ahmedabad.

Dholakia, R.H. 2014b. Cost and benefit of disinflation policy in India. Economic and Political Weekly 49 (28): 165–169.

Dholakia, R.H. 2018. Issues in measurement of inflation targeting. Economic and Political Weekly 53 (45): 14–16.

Dholakia, R.H., and A.A. Sapre. 2012. Speed of adjustment and inflation-unemployment trade-off in developing countries-case of India. Journal of Quantitative Economics 10: 1–16.

Dholakia, R.H., and K.S. Virinchi. 2017. How costly is the deliberate disinflation in India? Estimating the sacrifice ratio. Journal of Quantitative Economics 15 (1): 27–44.

Dholakia, R.H., and V.S. Kadiyala. 2018. Changing dynamics of inflation in India. Economic and Political Weekly 53 (9): 65–73.

Dholakia, R. H., J. Chander, B. Pratap, and I. Padhi. 2020. Threshold inflation: concepts and measurement. Mumbai: Reserve Bank of India DRG Study.

Fischer, S. 1993. The role of macroeconomic factors in growth. Journal of Monetary Economics 32 (3): 485–512.

Friedman, M. 1977. Nobel lecture: inflation and unemployment. Journal of Political Economy 85 (3): 451–472.

Froot, K.A., and J.C. Stein. 1991. Exchange rates and foreign direct investment: an imperfect capital markets approach. The Quarterly Journal of Economics 106 (4): 1191–1217.

Harrod, R.F. 1948. Towards a Dynamic Economics: Some recent developments of economic theory and their application to policy. London: MacMillan and Company.

Haslag, J. 1995. Inflation and intermediation in a model with endogenous growth (No. 9502). Federal Reserve Bank of Dallas, Dallas, USA.

Haslag, J. H. 1997. Output, growth, welfare, and inflation: a survey. Economic Review-Federal Reserve Bank of Dallas, Second Quarter of 1997, 11–21.

IMF. 2013. IMF Country Report No. 13/37: India Article IV Consultation. International Monetary Fund, Washington.

Kennedy, Peter E. 2012. Macroeconomic essentials, New Delhi: PHI Learning Pvt. Limited, Eastern Economy Edition, Third Edition, India.

Klein, M.W., and E. Rosengren. 1994. The real exchange rate and foreign direct investment in the United States: relative wealth vs. relative wage effects. Journal of international Economics 36 (3–4): 373–389.

Li, M. 2006. Inflation and Economic Growth : Threshold Effects and Transmission Mechanisms. University of Alberta Working Paper, Department of Economics, University of Alberta, Alberta, Canada.

Mitra, P. 2006. Has government investment crowded out private investment in India? American Economic Review 96 (2): 337–341.

Mundell, R. 1963. Inflation and real interest. Journal of Political Economy 71 (3): 280–283.

Nasr, A.B., M. Balcilar, A.N. Ajmi, G.C. Aye, R. Gupta, and R. Van Eyden. 2015. Causality between inflation and inflation uncertainty in South Africa: evidence from a Markov-switching vector autoregressive model. Emerging Markets Review 24: 46–68.

Pindyck, R.S. 1993. A note on competitive investment under uncertainty. The American Economic Review 83 (1): 273–277.

Pourgerami, A., and K.E. Maskus. 1987. The effects of inflation on the predictability of price changes in Latin America: some estimates and policy implications. World Development 15 (2): 287–290.

RBI. 2013. Real interest rate impact on investment and growth-what the empirical evidence for India suggests?. Mumbai: RBI Project Research Study Reserve Bank of India.

RBI. 2014. Report of the expert committee to revise and strengthen the monetary policy framework (Chairman: Urjit R. Patel), Reserve Bank of India, Mumbai, India.

Rondan, N.R.R., and J.C.A. Chavez. 2004. High inflation, volatility and total factor productivity. Banco Central De Reserva Del Peru 5: 1–18.

Sidrauski, M. 1967. Inflation and economic growth. Journal of Political Economy 75 (6): 796–810.

Stockman, A.C. 1981. Anticipated inflation and the capital stock in a cash in-advance economy. Journal of Monetary Economics 8 (3): 387–393.

Tobin, J. 1972. Friedman’s theoretical framework. Journal of Political Economy 80 (5): 852–863.

Tokuoka, K. 2012. Does the Business Environment Affect Corporate Investment in India? (Working Paper No. 12/70), International Monetary Fund, Washington DC, USA.

Ungar, M., and B.Z. Zilberfarb. 1993. Inflation and its unpredictability-theory and empirical evidence. Journal of Money, Credit and Banking 25 (4): 709–720.

Acknowledgements

I am grateful to RBI for providing assistance through their Development Research Group project. I am also grateful to Prof. Kruti Lehenbauer from UIW, San Antonio, USA for going through the draft and making useful comments and suggestions. Any remaining errors and omissions are my responsibility.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

See Tables 3, 4, 5 , 6, 7, 8, 9.

Rights and permissions

About this article

Cite this article

Dholakia, R.H. A Theory of Growth and Threshold Inflation with Estimates. J. Quant. Econ. 18, 471–493 (2020). https://doi.org/10.1007/s40953-020-00215-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40953-020-00215-x