Abstract

This paper studies the relationship between the innovation performance of European regions and their resilience. By exploiting a novel dataset that includes patents and trademarks at the regional (NUTS2) level for the 2008–2016 period, the paper addresses two research questions: (1) are innovative regions more resilient? (2) which type of innovation is more conducive to resilience? We frame the relationship between resilience and innovation within the Schumpeterian notion of innovation as a ‘creative response in history’. Overall, we find that a stronger performance in innovation is associated with a better performance in employment both during and in the aftermarket of the 2008 financial crisis. We argue that learning capabilities built over time by regions make them more effective in adapting and recovering during major shocks. While the crisis may have created an opportunity for less developed regions to move ahead, this opportunity has in fact been grasped mainly by those already having a strong regional system of innovation in place.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

The European Union (EU) project has long been described as a ‘convergence machine’; yet, the recent economic crisis has halted convergence in certain dimensions, and triggered divergence in others. This phenomenon is a threat to economic progress, cohesion and political stability in Europe (Iammarino et al. 2017). Areas where regional convergence has slowed down, or even replaced by divergence, include employment, income and social protection, and working and living conditions. The economic crisis was strongly local in nature and gave rise to a ‘geography of recession’ (Martin 2012; Lagravinese 2015): the impact of the crisis varied geographically and it is expected to be embodied within the memory of European regions as a hysteretic effect (Doran and Fingleton 2014).

Understanding what has been driving the economic performance of regions, in light of these major trends, has become a major demanding and pressing imperative. This challenge has been at the centre of a growing interest in the concept of regional resilience, generally conceptualized as the capacity of a system or a region to ‘bounce back’ after a major shock. This concept has been increasingly employed to frame the territorial impact of the economic crisis. Its application to regional and local economic growth “raises a series of important questions about the performance and dynamics of local economies in times of crisis and stress” (Martin et al. 2015, p. 142) in that it helps to identify and explain how regions and small districts have responded to shocks.

The growth of the disparities across countries and, most notably, within countries, is not only the result of the crisis but also a result of the major structural changes that have characterized the global economy over the past decades. This process of structural change has been at the same time affected and amplified by a greater international integration. While the Bretton Woods age was characterized by a classical international division of labour based on comparative advantages, with trade acting as a driver of specialization and technological change, in the new globalization paradigm most of the cross-border circulation of goods and knowledge take place within the global value chains of large transnational corporations. As such, the economic performance of regions depends more and more on their capacity to attract global capital, to enter global value chains, and to exploit market niches in international markets. In brief, the new patterns of development of regional economies depend crucially on their capacity to innovate and to exploit their innovation on international markets.

By exploiting a novel dataset that includes patents and trademarks at the level of region, this paper explores the relationship between innovation and resilience, defined as the capacity of a region to react to a shock. The analysis focuses on European regions—at NUTS2 level—in the period 2008–2016. In particular, the following research questions are addressed: (1) are innovative regions more resilient? (2) which type of innovation (i.e. innovation in service versus innovation in manufacturing) is more conducive to resilience?

Following the literature, we analyse regional resilience over two different time frames, during the shock—that is, in the short-period during the economic downturn—as well as after the shock—that is, in the longer period in the aftermath of the economic downturn. During the shock, resilience is conceptualised as the capacity of a region to absorb the downturn by minimizing its negative impact on the economy; as such, this is the short-term capacity of a regional economy to navigate during a major downturn. We call this capacity resistance. In turn, after the shock, resilience is conceptualized as the capacity of a regional economy to perform into the new landscape; hence, this reflects its medium–term capacity of adapting to the new economic environment. We call this capacity response. The difference is that in the former, regions are not supposed to have time to change their economic features, as for instance their specialization. As such, the regional economic performance depends on its given economic structure. By contrast, in the response phase, regions are supposed to have been able to adapt their economic system to the new environment that has emerged out of the shock. Hence, in this case the regional economic performance depends on its capacity to adapt its economic structure.

We operationalize resilience as the economic performance of a region relative to the economic performance of other regions. In particular, we look at the employment performances of regions during the period under study. In fact, the crisis had serious consequences on the labour market. First, the level of employment has decreased substantially since the burst of the crisis, and today it is still below the pre-crisis level in several regions, mostly in the Southern European countries. Second, the impact of the crisis on the labour market has been quite asymmetric, hence aggravating regional disparities. Thus, the degree of resilience with respect to employment represents a crucial political issue.

The paper builds on a growing strand of research that has theoretically and empirically investigated the drivers of regional resilience, particularly following the great economic crisis of 2008. Most of the empirical research on regional resilience has focused on some structural characteristics of the industry, such as the industry specialisation (Palaskas et al. 2015), technological and vertical industrial relatedness (Cainelli et al. 2019a), or the related and unrelated variety in the industry mix (Xiao et al. 2018). The study of innovation as a source of resilience has been rather scant. Bristow and Healy (2018) have carried out a first explorative analysis employing the regional innovation system characterization provided by the Regional Innovation Scoreboard, finding a positive relationship between the overall index of innovation capacity and resilience. By building a characterization of different types of innovation regions in the US (districts), Clark et al. (2010) find that innovation affects resilience particularly when small firms are involved thanks to their greater level of networking within the regional economy. Xiao et al. (2018) instead, employ new industrial entry as a measure of regional resilience, and find that variety improves the entry of knowledge-intensive industries after the shock.

This paper contributes to this research by extending the role of innovation as a driver of resilience. In particular, it distinguishes between innovation activity in manufacturing and in services, most notably knowledge intensive business services (KIBS), by relying on two proxies, patents and trademarks respectively. We frame the relationship between resilience and innovation within the Schumpeterian notion of innovation as a “creative response in history” and we put forward some theoretical arguments about this relationship. This can be condensed in the idea that innovative regions have greater capacity to explore and learn, and this would strengthen their capacity to adapt to major economic changes.

This paper has also implications for policy. Indeed, innovation, and particularly region-tailored innovation, is at the root of the new European policy approach, namely the Smart Specialization Strategy (S3). The S3 implemented in the current programming period of the Cohesion policy is the quintessential of the paradigmatic shift from top-down capital-driven policies, towards place-based innovation-driven development policies. The Smart Specialisation framework has introduced new ways of thinking about local development and structural change, contributing to the redefinition of the EU regional policy (McCann and Ortega-Argilés 2013). In particular, “the concept of Smart Specialisation was defined to address the issue of specialisation in R&D and innovation and provides a basis to design effective strategies for the medium-long term development of territories. Smart Specialisation is therefore an innovation policy framework designed to support regions (and countries) in the identification of the most promising and desirable areas of specialisation, and to encourage investment in programs which may complement the local productive and knowledge assets to create future comparative advantages” (Vezzani et al. 2017, p. 5).Footnote 1 The key message of S3 is that regions have to discover themselves their way to be innovative (McCann and Ortega-Argilés 2013). This means not only to find the sources of economic growth at present, but also envisaging their “own” dynamic process to foster a long-term path of economic growth driven by innovation. As such, the S3 has inherently the concepts of change, adaptation, and innovation at its roots.

We find robust evidence that, overall, more innovative regions have been relatively outperforming less innovative ones in terms of employment, both during the 2008 financial crisis as well as in the aftermath of the crisis, up to 2016.

2 Innovation and resilience: the creative response in history

2.1 Resilience and employment in the aftermath of the crisis: the emergence of regional disparities in Europe

The study of resilience has increasingly received attention by regional scientists and economic geographers. Policy makers have also joined the debate. In a world characterised by rapid and continuous change, the capacity of the regional economic systems to manage exogenous shocks is increasingly a concern for scholars and policy makers because of the amount of social distress brought about during and after these events.

A major theme in the field of economic geography and regional science has thus become how regional and local economic systems respond to and cope with the new fast-changing and disruptive environment. This has attracted growing attention to the notion of resilience for the study of the dynamics of spatial economic systems, especially concerning how such systems respond to shocks, disturbance and perturbations (Martin 2012). Resilience has been broadly defined as the capacity of a system to cope with a shock, either by bouncing back, absorbing it, or adapting to it, and has become a new buzz-word that has often substituted the much celebrated notion of territorial competitiveness. This has also attracted the interest of policy makers, who increasingly talk about resilience as a necessary feature of regions and cities to be encouraged though policy intervention.

Research on this issue has recently revamped as a result of several factors—both of long-term and short-term nature—which have reinforced cumulative processes and imbalanced development paths leading to new and increasing disparities across regions, both between and within countries (Bassi and Durand 2018; Marzinotto 2017). Long-term factors include the intensification of global interconnections and the pace of technological change. Short-term factors include instead the recent financial crisis that has accentuated territorial inequalities, so that today we talk about a ‘geography of recession’ in that: (i) the impact of the crisis has been significantly different across regions (Crescenzi et al. 2016; Filippetti and Peyrache 2015; Lee 2014; Martin 2011), and; ii) weaker regions were hit more severely by the crisis and have found it harder to recover (Tubadji et al. 2016; Lagravinese 2014).

The great financial crisis has broadened the disparities within countries. As a result, there is significant variance across European regions in terms of economic resilience—or ability “to withstand, absorb or overcome an internal or external economic shock” (Bristow et al. 2014). This uneven response to the recession is confirmed by evidence that some EU regions have been barely affected (e.g. Luneburg or Oberbayern), others are recovering after a slump (e.g. Provence-Alpes-Cote d’Azur) while others are still stuck in the mix of low growth and high unemployment (e.g. several regions in Spain or in the south of Italy). This diversity of outcomes marks a profound restructuring of the geography of job creation.

Thus, the current pressing question is: what makes a region more (or less) resilient? Scholars who have explored the sources of regional and local resilience have mostly looked into their industrial specialization. This follows a long tradition of studies that looks at the industrial and technological specialization as a source of economic growth. More recently, the related variety concept has been added, building on intuition as that by Jane Jacob about the importance of diversity as a source of adaptation and innovation (Jacobs 1969). The crux of the matter here is whether it is better to face an economic crisis being strongly specialized, or by having some degree of diversity in the industrial structure. The argument being that in the latter case regional economic systems are better positioned to adapt and move away from industries and sectors hit by the crisis towards more profitable ones (Frenken et al. 2007).

The concept of resilience derives from the studies of ecological systems and is related to stability, more relevant when a system is exposed to a narrow range of predictable external conditions, and adaptability, more relevant when a system is affected by external and unexpected changes (Holling 1973). In general, studies more oriented towards the adaptability of regional and local systems have considered the role of the institutional environment (Hu and Hassink 2017), the possible role of the public sector (Martin 2012) or the performance of different typologies of regions to draw implications for balanced development strategies at country level (Dijkstra et al. 2015). In economics instead stability is associated with equilibrium conditions, and works trying to relate resilience with the characteristics of the economic systems have looked mainly at macroeconomic stability or market efficiency (Briguglio et al. 2009) or at the role of the industrial structure (Martin et al. 2015; Doran and Fingleton 2014) including proxies for human capital (Giannakis and Bruggeman 2017). The approach is grounded on the fact that specialization and diversity plays differentiated, but significant, roles in shaping local employment performances (Combes 2000).

However, economies are based on and driven by knowledge and its application to create new economic opportunities, innovation, to which the reallocation of resources is an adaptive response (Metcalfe and Ramlogan 2006). Therefore, the innovation capabilities of regions should be considered as a fundamental asset when considering the response to the changing external conditions. Moreover, a characteristic feature of innovation is particularly interesting in the framework of resilience studies: it is inherently related with out of equilibrium conditions (Antonelli and Scellato 2011). Therefore, an evolutionary concept of regional resilience should connect shocks to the determinants of the ability of regions to develop into new growth paths (Boschma 2015) and, more in general, to regional innovation processes.

2.2 The ‘creative response’ in history: innovation as a source of regional resilience

This paper introduces in this debate the role of innovation as a source of regional resilience. We base our hypotheses upon an argument made by Schumpeter (1947) in an article which has been relatively neglected compared to the other works of the Austrian economist (Antonelli 2015). In his article “The creative response in history”, Schumpeter makes an important distinction about the way in which economies respond to what today we could define as exogenous change, and that Schumpeter, as formal as he used to be, defined as a “change in the data”. He distinguished between adaptive response and creative response. The former is a reaction to a change “in the way that traditional theory describes”; this is some form of change that can be predicted ex-ante on the base of current economic theories.

By contrast, a creative response is when “the economy or an industry or some firms in an industry do something else, something that is outside of the range of existing practice”. According to Schumpeter, the creative response has three characteristics. Firstly, it can be understood only ex-post. Secondly, it shapes the long-run economic path. Thirdly, it has something to do with the level of human capital and its behaviour, mostly the behaviour of the entrepreneurs.

The capacity to adapt to a major shock depends crucially on the capacity of the (regional) system to learn by exploring new avenues and searching into new technological domains. Innovative regions have been also defined as learning regions (Morgan 2007). Thus our hypothesis is that innovative regions are more resilient because they have stronger capabilities that allow them to adapt. These capabilities, broadly defined, are—at the meso level—human capital and training systems (Filippetti et al. 2019), a well-established network among actors of the regional innovation system, good political and informal institutions (Crescenzi et al. 2013). At the micro level, capabilities are related to the firms’ capacity of learning and exploring.

Empirical research has shown that, at the macro level, countries with a stronger innovation system have been more resilient to the recent crisis (Filippetti and Archibugi 2011), and also that, at the micro level, innovative firms have outperformed less innovative ones during the crisis both in terms of further innovative investments (Archibugi et al. 2013; Antonioli and Montresor 2019; Antonioli et al. 2013) and labour demand (Ortiz and Salas Fumás 2020). This research suggests the presence of a link between innovation, as the result of a long-term accumulation of capabilities, and the short-term economic performance in response to a major shock. These studies have also shown that the disposition of firms to explore, in contrast to exploit—following on the categorization put forward by March (1991)—has been a significant driver of economic performance. More generally, we know that both innovative regions and innovative firms have an inherent capacity to explore new avenues as industry diversification suggests. Regions which diversify into related technological areas seem to improve their economic performance (Frenken et al. 2007), however innovative performances of traditional industries, such as textile and clothing, can benefit more by unrelated (between industry) variety (Giannini et al. 2019). Also firms, when they diversify, tend to start looking close to their technological and knowledge domain in a coherent way (Piscitello 2004).

There are important counterarguments that suggest that also innovative regions can end up in a dead end in the case of major changes. Economic geographers have long argued that local economic development unfolds in trajectories that are bound to space and historical time (Krugman 1991). One of the consequences is that once a particular direction is taken—for example the expansion or the decline of a particular industry, or the tendency to attract or lose skilled workers—a region is “locked in” that particular configuration (Martin and Sunley 2006). Regional economic systems undergo periods in which firms within the propulsive industry grow at faster rates, propagating the positive effects across firms directly and indirectly related to that industry driven by enhanced efficiency gained through innovation. These expansionary forces however do not work indefinitely, and sooner or later growth rates decline and new industries emerge due to radical innovations elsewhere (Usai 2011; Quatraro 2009). The challenge, then, is to understand how and why regional industrial and social structures are more or less resilient, i.e. how they adapt or fail to adapt to changing circumstances.

Summing up, most of the growing empirical research on resilience has focused on the mix and dynamics of the industry to explain the capacity of the regions to resist and adapt to major economic shocks. By contrast, innovation has drawn less attention.

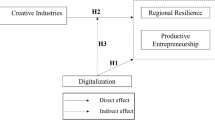

We have established a theoretical link between resilience and innovation. Innovation is the result of a long-term process which provides the regions with a stock of capabilities, both at the meso and at the micro level, involving all the actors of regional innovation systems, institutions, workers, companies. This allows regions to learn as a system. As a result, the same capabilities that sustain innovation in ordinary times might represent a crucial asset also during extra-ordinary times, as the major crisis experienced in recent years in Europe. We therefore conjecture the presence of a positive correlation between innovation performance and the resilience of a region.

3 Innovation in the European regions over the period 2008–2016

In this Section we report some figures regarding the two measures of intellectual property rights considered: patents and trademarks. In line with a well-established literature (e.g. Acs and Audretsch 1989), we are going to interpret patents as an indicator of technological innovation and trademarks as an indicator of innovation in the service sector, and particularly in the knowledge-intensive sector.

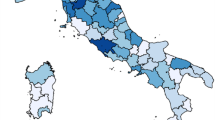

The maps reported in Fig. 1a and 1b show regional per capita statistics for 2016 (left) and changes over the years 2008–2016 (right) for patents and trademarks, respectively. By comparing the static snapshots in 2008 two facts emerge. Firstly, there is some significant degree of overlapping among the two IPRs. Several regions in the belt going from Northern Italy, to the core of the German manufacturing industry, along with Denmark and the capital regions of the UK, Sweden and France, are consistently in the higher quintile of patents and trademarks. The second fact is related to the presence of several regions that are instead characterised by having a high performance in only one of the two indicators. So, for instance the south-east of Spain scores higher in trademarks, while other regions score high only in patents, as it is the case for some regions of France.

a Patents per capita (left) and change over time (right). Source: authors’ elaboration on Regpat 2018a data. Note: rate of change is calculated as the compound average growth rate (CAGR). Regions are split in five equally populated groups (quintiles, 20%); a darker blue indicates a higher quintile. b Trademarks per capita (left) and change over time (right). Source: authors’ elaboration on EUIPO data regionalised by the JRC. Note: rate of change is calculated as the compound average growth rate (CAGR). Regions are split in five equally populated groups (quintiles, 20%); a darker blue indicates a higher quintile

Changes in patents and trademarks 2008–2016 show a different pattern. In the first place, a pattern of overall convergence does emerge at a cursory look. Regions from Eastern European countries and Portugal show systematically better performance for the two IPRs considered. Regions from the Southern Italy and from Finland instead perform better than the median EU region when considering trademarks, but not patents.

Summing up, this first series of charts illustrates the following. Firstly, there is a significant overlap in the use of patents and trademarks in several regions, thus suggesting a complementarity among the two IPRs for several innovation activities. Secondly, there are also regions that score high in just one indicator; this suggests the presence of some ‘specialization’ in the innovation activities, as for instance in only hi-tech, or service innovation. This evidence support the use of trademarks along with patents to capture the regional innovation capabilities in service innovation as well as those related to technological innovation. Thirdly, it arises an overall process of convergence of regions from Eastern Europe displaying higher rates of growth in patents and trademarks; the same holds true for Southern Europe when considering trademarks.

4 Resilience and innovation in the great depression: econometric evidence

4.1 Measuring regional resilience

This section presents an econometric exercise to investigate the role of innovation for the resilience of regions during and after the 2008 Great Depression. Consistently with previous literature, resilience is considered in terms of employment performance.

We follow Martin (2012) and Faggian et al. (2018) focusing on two dimensions of resilience: (1) the resistance of a region to a shock, proxied by the sensitivity index, and; (2) its capacity to recover from a shock, proxied by the response index. Figure 2 shows the impact of the 2008 crisis on the change in the level of employment in the EU (measured in terms of thousands of hours worked); the major drop in the average level of employment occurred in 2010. Thus, the resistance of a region—i.e. its capacity to absorb a shock—is defined as the relative performance of the region during the years 2008–2010. Instead, the economic recovery of a region is defined as the relative performance of the region during the years 2010–2016. For consistence with previous works, we focus on the employment performance, rather than the gross domestic product, because of the greater relevance of the former for policy makers and of the relative high unemployment rates in EU compared to other main economic areas (e.g. USA).

In order to measure resistance and recovery we build two indicators that are commonly employed in studies about resilience (Martin 2012; Faggian et al. 2018), where both indicators of resilience, the sensitivity index (SI) and the response index (RI), are derived from the following expression:

where E is the level of employment (measured in terms of hours worked), r is the region, and n represents the EU average; SI and the RI measure the relative performance of region r compared to the average performance of the EU. For SI we set t = 2010 and t – 1 = 2008 to reflect the capacity of a region to perform relatively better (or worse) compared to the average during the economic downturn. For the response index (RI) we set t = 2016 and t − 1 = 2010. Hence, the RI measures the pace of economic recovery of region r compared to the pace of economic recovery of the EU. This reflects the capacity of the region to perform relatively better (or worse) compared to the average after the downturn.

Figure 3 reports the SI and the RI indicators for the European regions. By looking at resistance (SI) one can observe that the more resilient regions tend to concentrate in the continental Europe, the UK and Sweden, with some cases of strong resilience found also in Eastern countries. Economic recovery (RI) provides a similar picture, but with a centre of gravity moved toward the north-east. Regions in the periphery of Europe, especially Southern Europe, are those performing relatively worse both during the economic downturn and its aftermarth while regions in the Eastern countries show a higher capacity of resistance and a greater capacity of recovery.

4.2 Econometric results

In what follows we present some econometric evidence about the correlation between innovation, as measured through patents and trademarks, and the two indexes—SI and RI—presented above.

Our left-hand-side variables are the SI and the RI, while the main explanatory variables are patents per capitaand trademarks per capita. We first estimate two cross-section OLS models for SI and RI (Sect. 4.2.1) and then a quantile model for SI (Sect. 4.2.2). In the SI estimations the explanatory variables refer to 2008, while in the RI estimations the explanatory variables are refer to 2010, the two initial years of the periods on which the indicators are calculated. We add several other control variables at the regional level. Two variables are controlling for the industry structure of the region, namely the share of workers in the manufacturing sector (data source: Eurostat), and the technological concentration, calculated as an Herfindahl index computed from patent data (using the international patent classification 4-digit level, which includes 624 classes). The former is meant to control for the broad industrial specialization (the share of manufacturing compared with that of services), while the latter is meant to capture the extent at which a regional innovation system is more (or less) concentrated on a few (or several) technological areas. Other variables at the regional level include: a dummy variable equal to one if the region belongs to the Eurozone and equal to 0 otherwise; a dummy variable equal to one if the region is the capital region of the country; the size of the region measured in terms of the population, taken in logarithm. We also include a set of country dummy variables to control for country fixed effect (characteristics) that may affect the regions’ economic performance.Footnote 2

4.2.1 OLS estimates

Table 1 reports the estimate for SI and innovation (pairwise correlations among the variables are reported in the Appendix 1 Table 4, and the list of countries included in the analysis in Table 5). The results show that innovation is positively associated with the resistance of a region. Both patents and trademarks are positively correlated with SI, suggesting that both technological innovation and KIBS-based innovation have helped regions to keep their level of employment during the economic downturn.

Table 2 reports the estimate for RI and innovation. The correlation between innovation and the performance of regions in the aftermath of the crisis is statistically strongly significant for both patents and trademarks. This suggests that both technological innovation and knowledge-intensive service innovation have helped the regional economic recovery in the aftermath of the crisis.

It is worth commenting briefly on the coefficients estimated for the variable “Share of workers in manufacturing”, both in Table 1 and Table 2. In the former, the coefficient is negative and significant, while in the latter it is not statistically significant. This reveals a negative relationship between the share of manufacturing and employment performances during the crisis, but not in its aftermath. The negative sign for the manufacturing sector can be explained by the fact that the most competitive part of it is already captured by the innovation measures included in the regression. Therefore, a tentative interpretation of this finding is that the crisis has hit stronger those regions characterised by more traditional and less competitive manufacturing firms (Sarra et al. 2019). In a number of cases these firms did not survive the crisis, and thus the negative relationship between manufacturing and employment performances does not seem to hold true anymore.

A second control variable that is worth commenting is our index of concentration capturing the concentration of regional innovation systems from a technological point of view. The related coefficient is negative and statistically significant only for the SI Index; during the crisis technologically-concentrated regional innovation systems have been hurt more than those technologically-broad regions. Hence, the concentration of innovation can be a limit for resilience, but only in the short run. It seems that when regions have time to adapt, technological concentration does not affect economic recovery (see Coniglio et al. 2016).

Finally, regions belonging to the Euro Area seem to perform much better both during the crisis and in its aftermath. Further regressions not reported here show that, concerning SI, innovation is correlated with resilience only for the Euro zone, while a more mixed picture emerges concerning RI.

4.2.2 Quantile regression estimates

In this section we further explore the relationship between innovation and resilience by means of quantile regression estimates. Some nuances emerge with respect to OLS results, but mainly regarding the sensitivity index; we therefore report results only for SI (see Table 3).

The positive correlation between innovation and the resistance to the crisis is confirmed. Moreover, with regards to technological innovation, it grows along the degree of resistance of a region. For the 25th percentile the coefficient of patents is not significant, while it becomes significant at the median 50th and strongly significant at the 75% percentile. Technological innovation was particularly relevant in guaranteeing good regional performances during the crisis.

It is also interesting to comment on the technological concentration variable. Its trend shows that the negative correlation of technological concentration decreases as resistance rises. Hence, technological concentration can hamper resilience during the crisis, but not for those regions showing the best performances. On the contrary, the share of workers in manufacturing is negative only for regions with a higher degree of resistance, while it does not matter for the median region.

With regards to recovering (RI) the results of the OLS estimations are confirmed and there are not relevant differences across the different percentiles, so we do not report the table in the paper.

Summing up, quantile regressions further qualify the previous OLS results by showing that the group of more innovative regions is performing relatively much better. The results of the technological specialization variable coupled with that of the share of manufacturing seem to suggest an important role of advanced service innovation in the highly-innovative regions.

4.2.3 Robustness checks

In the Appendix 2 we report the results from spatial models based on the same specification used for the estimates reported in Tables 1 and 2 these allow us to take into account the phenomena of spatial correlation that are typical in innovation. The results confirm that more innovative regions are more resilient, particularly when considering technological innovation. Service innovation, most notably KIBS, is not associated to resilience during the crisis, while it is positively associated to resilience in the aftermath of the crisis (see Appendix 2 Tables 6, 7, 8 and 9).

It is worth commenting the change in the sign of the coefficient Euro area, which turns negative and strongly significant for RI, contrary to the previous estimates (cf. Tables 1 and 2). This suggests that the relative good performance of lagging regions in the countries of the Euro area are driven by being close to advanced regions; once this effect is controlled for, as in Table 7, this is no longer the case, thus reflecting the relatively poor performance of lagging regions in Italy, Spain, Portugal and Greece.

We have also used different time windows to compute the RI to check the stability of the results. While in the paper we report the results using a response index calculated on the 2010–2016 interval, we have also run regressions considering shorter periods of time (2010–2015, 2010-2014, 2010–2013) to build the dependent variable The results are mostly confirmed, thus they are not reported in the paper.

5 Discussion and conclusions

This paper has investigated the relationship between innovation and resilience, measured through employment, at the regional level. The increasing interest of academics and policy makers on the capacity of regional economic systems to cope with major changes motivated our work. The evidence provided brings further elements for a deeper understanding of the mechanisms behind local resilience, or lack of resilience.

Our findings show that overall, more innovative regions have been relatively outperforming less innovative ones in terms of employment, both during and in the aftermath of the 2008 financial crisis We find that patents, a proxy for technological innovation, are associated to better employment performance both during and after the macroeconomic shock considered. In the case of innovation in services—proxied by trademarks—our robustness checks suggest that they were effective only for the recovery after the crisis. They key message concerning our research question is that innovation do increase resilience of a region both during and in the aftermath of an economic crisis.

Our evidence is grounded on the argument outlined above that innovative regions have stronger capabilities that are beneficial not only in ordinary times, but also during extra-ordinary times. A good innovative performance does not come out as a short-term accident, but it is the result of a long-term process of knowledge accumulation, organizational practices, learning capacity both at the micro level and at the meso-level. The creation of a strong regional system of innovation is thus a cumulative process that requires time. This creates the conditions which allow to cope with a major exogenous shock, like the recent financial crisis, and to recover promptly. As such, innovation generates the pre-conditions for long-term economic growth.

This provides an explanation for the widening of disparities that Europe has witnessed among regions. The relationship highlighted above suggests the presence of a source of divergence based on the strength of innovation capabilities of the regions. This also highlights the need to better articulate the functioning of creative destruction processes during major upswings, with particular attention to the territorial consequences these may have. In principle, creative destruction creates new opportunities bringing about new technological solutions, it opens up new industries, it favours start-up and more innovative entrepreneurs. However, from a geographical standpoint, this process does not seem to favour convergence; by contrast, it seems to favour further divergence, in that it rewards more innovative regions.

Our analysis is not without limitations. First, the crisis may have affected regions at different times and the diffusion of the shock may have followed patterns related to their innovative capabilities, international integration or industrial specialization. In this work we do not explore these issues, but we identify the shock with the year in which employment was the lowest on aggregate; we rely on country dummies to at least in part control for differences in timing and intensity that are common across regions of the same country. Second, differently from what is commonly done when using patents at territorial level we assign them according to applicants (owners) rather than inventors. By doing so, our measure can be more able to reflect the capability of territories to capture the returns from innovation rather than to generate new knowledge. Our approach is driven by the fact that for trademarks only information on the owner is available, for consistency we assign the two intellectual property rights according to this information. For regions relying on foreign companies to finance R&D and generate innovation we may underestimate the knowledge generation capabilities. However, there is little evidence on “what matters more” for the economic performances of a territory between generating and controlling innovation. Finally, further qualitative analysis will be necessary to have a better understanding on the relationship between innovation capacity of a region and its capacity to change and transform itself; this is crucial to uncover the very roots for long-term sustainable innovation, with key implications for policy. We do not aim at filling these gaps in our work and our findings may be read as regarding to the importance of having a vibrant and innovative industrial environment in the region.

All-in-all our findings are bad news for those who saw the crisis as an opportunity per se for lagging regions. While the crisis may have created an opportunity to move ahead in a time where turbulence was possibly reshaping power relations, this opportunity has been grasped mainly by those already having a strong regional system of innovation. This suggests that the creation of innovative capabilities is important for regions not only to spur long-term growth, but also to increase their capacity to drive on the roller coaster of the economy.

Notes

See also the European Commission Communication COM (2017) 479 final titled “Investing in a smart, innovative and sustainable Industry A renewed EU Industrial Policy Strategy”, available here.

In principle there are several other control variables that can affect our two measures of resilience, such as for instance the degree of internationalization. However, we cannot include variables that can explain at the same time innovation, which is our main explanatory variable. Part of these effects we expect to be captured by country dummies.

Actually, Bottazzi and Peri (2003) suggest that due to the tacit nature of knowledge spillover can be very localized, according to their estimations, on average, spillover operates on a range of about 300 km.

References

Acs, Z. J., & Audretsch, D. B. (1989). Patents as a measure of innovative activity. Kyklos, 42(2), 171–180.

Antonelli, C. (2015). Innovation as a creative response. A reappraisal of the Schumpeterian legacy. History of Economic Ideas, 23(2), 99–118.

Antonelli, C., & Scellato, G. (2011). Out-of-equilibrium profit and innovation. Economics of Innovation and New Technology, 20(5), 405–421.

Antonioli, D., Bianchi, A., Mazzanti, M., Montresor, S., & Pini, P. (2013). Economic crisis and innovation strategies. Evidence from Italian firm-level data. Economia politica, 1, 33–68.

Antonioli, D., & Montresor, S. (2019). Innovation persistence in times of crisis: An analysis of Italian firms. Small Business Economics, 1–26.

Archibugi, D., Filippetti, A., & Frenz, M. (2013). Economic crisis and innovation: Is destruction prevailing over accumulation? Research Policy, 42, 303–314.

Bassi, F., & Durand, C. (2018). Crisis in the European monetary union: A core-periphery perspective. Economia Politica, 35, 251–256.

Boschma, R. (2015). Towards an evolutionary perspective on regional resilience. Regional Studies, 49, 733–751.

Bottazzi, L., & Peri, G. (2003). Innovation and spillovers in regions: Evidence from European patent data. European Economic Review, 47(4), 687–710.

Briguglio, L., Cordina, G., Farrugia, N., & Vella, S. (2009). Economic vulnerability and resilience: Concepts and measurements. Oxford Development Studies, 37, 229–247.

Bristow, G., & Healy, A. (2018). Innovation and regional economic resilience: An exploratory analysis. The Annals of Regional Science, 60, 265–284.

Bristow, G.I., Healy, A., Norris, L., Wink, R., Kafkalas, G., Kakderi, C., Espenberg, K., Varblane, U., Sepp, V., Sagan, I., & Masik, G. (2014). ECR2. Economic crisis: Regional economic resilience. Final report of the ESPON 2013 programme, ESPON & Cardiff University.

Cainelli, G., Ganau, R., & Modica, M. (2019a). Industrial relatedness and regional resilience in the European union. Papers in Regional Science, 98, 755–778.

Cainelli, G., Ganau, R., & Modica, M. (2019b). Does related variety affect regional resilience? New evidence from Italy. The Annals of Regional Science, 62(3), 657–680.

Clark, J., Huang, H.-I., & Walsh, J. P. (2010). A typology of “Innovation Districts”: What it means for regional resilience. Cambridge Journal of Regions, Economy and Society, 3, 121–137.

Combes, P. P. (2000). Economic structure and local growth: France, 1984–1993. Journal of Urban Economics, 47(3), 329–355.

Coniglio, N. D., Lagravinese, R., & Vurchio, D. (2016). Production sophisticatedness and growth: Evidence from Italian provinces before and during the crisis, 1997–2013. Cambridge Journal of Regions, Economy and Society, 9, 423–442.

Crescenzi, R., Gagliardi, L., & Percoco, M. (2013). The ‘Bright’ side of social capital: How ‘Bridging’ makes Italian provinces more innovative. In R. Crescenzi & M. Percoco (Eds.), Geography, institutions and regional economic performance (pp. 143–164). Berlin, Heidelberg: Springer.

Crescenzi, R., Pietrobelli, C., & Rabellotti, R. (2016). Regional strategic assets and the location strategies of emerging countries’ multinationals in Europe. European Planning Studies, 24, 645–667.

Dijkstra, L., Garcilazo, E., & McCann, P. (2015). The effects of the global financial crisis on European regions and cities. Journal of Economic Geography, 15(5), 935–949.

Doran, J., & Fingleton, B. (2014). Economic shocks and growth: Spatio-temporal perspectives on Europe’s economies in a time of crisis. Papers in Regional Science, 93, S137–S165.

Faggian, A., Gemmiti, R., Jaquet, T., & Santini, I. (2018). Regional economic resilience: The experience of the Italian local labor systems. The Annals of Regional Science, 60, 393–410.

Filippetti, A., & Archibugi, D. (2011). ‘Innovation in times of crisis: National system of innovation. Structure and Demand’, Research Policy, 40, 179–192.

Filippetti, A., Guy, F., & Iammarino, S. (2019). Regional disparities in the effect of training on employment. Regional Studies, 53, 217–230.

Filippetti, A., & Peyrache, A. (2015). Labour productivity and technology gap in European regions: A conditional frontier approach. Regional Studies, 49, 532–554.

Frenken, K., Van Oort, F., & Verburg, T. (2007). Related variety, unrelated variety and regional economic growth. Regional Studies, 41, 685–697.

Giannakis, E., & Bruggeman, A. (2017). Determinants of regional resilience to economic crisis: A European perspective. European Planning Studies, 25, 1394–1415.

Giannini, V., Iacobucci, D., & Perugini, F. (2019). Local variety and innovation performance in the EU textile and clothing industry. Economics of Innovation and New Technology, 28(8), 841–857.

Holling, C. S. (1973). Resilience and stability of ecological system. Annual Review of Ecology and Systematics, 4(1), 1–23.

Hu, X., & Hassink, R. (2017). Exploring adaptation and adaptability in uneven economic resilience: A tale of two Chinese mining regions. Cambridge Journal of Regions, Economy and Society, 10(3), 527–541.

Iammarino, S., & McCann, P. (2006). ‘The structure and evolution of industrial clusters: Transactions technology and knowledge spillovers. Research policy, 35, 1018–1036.

Iammarino, S., Rodriguez-Pose, A., & Storper, M. (2017). Why regional development matters for Europe’s economic future. Working Papers—European Commission, WP 07/2017.

Jacobs, J. (1969). The life of cities. New York: Random House.

Jaffe, A. B., Trajtenberg, M., & Henderson, R. (1993). Geographic localization of knowledge spillovers as evidenced by patent citations. The Quarterly journal of Economics, 108, 577–598.

Krugman, P. (1991). History and industry location: The case of the manufacturing belt. The American Economic Review, 81, 80–83.

Lagravinese, R. (2014). Crisi Economiche e Resilienza Regionale. EyesReg–Giornale di Scienze Regionali, 4, 48–55.

Lagravinese, R. (2015). Economic crisis and rising gaps North–South: Evidence from the Italian regions. Cambridge Journal of Regions, Economy and Society, 8, 331–342.

Lee, N. (2014). Grim down South? The determinants of unemployment increases in british cities in the 2008–2009 recession. Regional Studies, 48, 1761–1778.

March, J. (1991). Exploration and exploitation in organizational learning. Organization Science, 2, 71–87.

Martin, R. (2011). The local geographies of the financial crisis: From the housing bubble to economic recession and beyond. Journal of Economic Geography, 11, 587–618.

Martin, R. (2012). Regional economic resilience, hysteresis and recessionary shocks. Journal of Economic Geography, 12, 1–32.

Martin, R., & Sunley, P. (2006). Path dependence and regional economic evolution. Journal of Economic Geography, 6, 395–437.

Martin, R., Sunley, P., & Tyler, P. (2015). Local growth evolutions: Recession, resilience and recovery. Cambridge Journal of Regions, Economy and Society, 8, 141–148.

Marzinotto, B. (2017). Euro area macroeconomic imbalances and their asymmetric reversal: The link between financial integration and income inequality. Economia Politica, 34, 83–104.

McCann, P., & Ortega-Argilés, R. (2013). Smart specialization, regional growth and applications to European union cohesion policy. Regional Studies, 49, 1291–1302.

Metcalfe, J. S., & Ramlogan, R. (2006). Creative destruction and the measurement of productivity change. Revue de l’OFCE, 5, 373–397.

Morgan, K. (2007). The learning region: Institutions, innovation and regional renewal. Regional Studies, 41, S147–S159.

Ortiz, J., & Salas Fumás, V. (2020). Technological innovation and the demand for labor by firms in expansion and recession. Economics of Innovation and New Technology, 29(4), 417–440.

Palaskas, T., Psycharis, Y., Rovolis, A., & Stoforos, C. (2015). The asymmetrical impact of the economic crisis on unemployment and welfare in Greek urban economies. Journal of Economic Geography, 15(5), 973–1007.

Piscitello, L. (2004). Corporate diversification, coherence and economic performance. Industrial and Corporate Change, 13, 757–787.

Quatraro, F. (2009). Innovation, structural change and productivity growth: Evidence from Italian regions, 1980–2003. Cambridge Journal of Economics, 33, 1001–1022.

Sarra, A., Di Berardino, C., & Quaglione, D. (2019). Deindustrialization and the technological intensity of manufacturing subsystems in the European Union. Economia Politica, 36, 205–243.

Schumpeter, J. A. (1947). The creative response in economic history. The Journal of Economic History, 7, 149–159.

Tubadji, A., Nijkamp, P., & Angelis, V. (2016). Cultural hysteresis, entrepreneurship and economic crisis an analysis of buffers to unemployment after economic shocks. Cambridge Journal of Regions, Economy and Society, 9, 103–136.

Usai, S. (2011). The geography of inventive activity in OECD regions. Regional Studies, 45, 711–731.

Vezzani, A., Baccan, M., Candu, A., Castelli, A., Dosso, M., & Gkotsis, P. (2017). Smart specialisation, seizing new industrial opportunities. Ispra: Joint Research Centre (Seville site).

Xiao, J., Boschma, R., & Andersson, M. (2018). Resilience in the European Union: The effect of the 2008 crisis on the ability of regions in Europe to develop new industrial specializations. Industrial and Corporate Change, 27, 15–47.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The views expressed are purely those of the authors and may not in any circumstances be regarded as stating an official position of the European Commission.

Appendices

Appendix 1

Appendix 2: Controlling for spatial correlation

A common feature of regional performance is the presence of spillovers, mostly occurring among neighbour regions.Footnote 3 Spillovers can arise from various factors, such as knowledge flows, inter-regional trade and other linkages among the different regional economic systems. Hence, the performance of a region is likely to be affected by that of neighbour regions. It can also be affected by regions that are further away as for instance through trade, the operations of multinational corporations or international collaborations. The literature has consistently found that the effect of spillover tends to decay with distance, and therefore proximity matters (Jaffe et al. 1993; Iammarino and McCann 2006). Actually, Bottazzi and Peri (2003) suggest that due to the tacit nature of knowledge spillover can be very much localized, according to their estimations, on average, spillover operates on a range of about 300 km.

As a result, we expect that the resilience of a region—hence both SI and RI—isaffected by the resilience of the other regions, with a positive effect that is maximum for continuous regions and decreases with distance.

To identify clusters of high or low resilience we have carried out a Local Indicator of Spatial Association (LISA). LISA allows to assess the similarity of each observation (region) with that of its surroundings. In this way we can identify patterns of spatial clustering for the resilience values.

The LISA identifies the basic regional patterns both for the Sensitivity Index and the Response Index. In Fig. 4, we colour only the values with a significance level of 0.05. It is possible to note that some regions in United Kingdom, Germany and Austria (high resilience) show highly significant local spatial correlations, as well as Greece, Bulgaria and Romania (low resilience).

As Cainelli et al. (2019b) suggest, there are several spatial models available (e.g. SAR model, SEM, Spatial Durbin Model (SDM) etc.). In our paper we want to know whether the dependent variables are related to those of the neighbour clusters, and we assume that the effects of the spatial lag of the dependent variables are linear and constant across observations. This brings us to consider the spatial autoregressive model (SAR), where the outcomes of a region are affected by the outcomes of “nearby” regions.

In order to take into account this feature this section presents spatial autoregressive model (SAR) based on the same model as for the estimates of Tables 1 and 2. The spatial model allows controlling for the effect of similar state in the SI and RI indexes in a given region by neighbours regions through the matrix of contiguity where the centroid of polygons (polygons are the regions) is the reference point (latitude and longitude) to calculate the geographical distance among regions. We have thus generated a matrix of spatial weights based on the distances between points obtaining the lagged dependent variable in space. In the SAR model, y is a function of observable characteristics Xβ, the spatial lags of the dependent variable ρWy and unobservable characteristics ε, producing a spatial regression relationship:

with W that represents the matrix of spatial weights. This model indicates that a region derives an advantage in terms of SI and RI that reflects a linear combination of the resilience (namely RI and SI) of the neighbour regions; B captures the effect of regional characteristics and p represents the effect of the resilience of neighbour regions (conditional on observed regional characteristics).

Tables 6 and 7 report the estimates using the same specification of the results reported in the main text and adding the spatial correlation control for SI and RI respectively. Both estimates report a strong and positive spatial correlation effect, thus confirming the important role played by proximity with other regions to explain the resilience of region i.

To test the robustness of results obtained with the SAR model, we run the estimations also using a spatially auto-correlated error model (SEM). SEM drops the assumption that outcomes are affected by spatial lags of the output variable and instead assume a SAR-type spatial autocorrelation in the error process. The SEM model (Tables 8 and 9), applied to the resilience variables, shows that our results are robust and virtually unchanged.

Turning to our variables of interest, Table 6 shows that patents are still positively correlated with SI, but this is no longer the case for trademarks. Table 7 shows that both patents and trademarks remain strongly and positively correlated with RI. To sum up, the results in this section confirm that more innovative regions are more resilient, particularly when considering technological innovation. Service innovation, most notably KIBS, is not associated to resilience during the crisis, while it is positively associated to resilience in the aftermath of the crisis.

Rights and permissions

About this article

Cite this article

Filippetti, A., Gkotsis, P., Vezzani, A. et al. Are innovative regions more resilient? Evidence from Europe in 2008–2016. Econ Polit 37, 807–832 (2020). https://doi.org/10.1007/s40888-020-00195-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40888-020-00195-4