Abstract

Existing studies have failed to reach a consensus on the impact of social capital on local innovative performance: some empirical analyses emphasize a positive effect while others speak about a ‘dark side’ of social capital. This chapter aims to shed new light on the differential role of ‘bonding’ and ‘bridging’ social capital in innovation dynamics. The spatial economic analysis of the innovative performance of the Italian provinces suggests that social capital is an important predictor of innovative performance. However, only ‘bridging’ social capital-based on weak ties-can be identified as a relevant driver of the process of innovation while ‘bonding’ social capital is shown to be non-significant for innovation.

JEL classification: O31, O33, R15

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Social capital as determinant of a successful economic outcome has received a significant attention in the past decades gaining wide acceptance in the economic literature. Standard economic theories have largely failed to explain the persistence of economic differentials among countries and regions, stimulating an in-depth analysis of “soft” factors as complementary and fundamental ingredients for growth and development (Banerjee and Duflo 2005; Bellini et al. in chapter “Cultural Diversity and Economic Performance: Evidence from European Regions” and Bauernschuster et al. in chapter “Explicitly Implicit: How Institutional Differences Influence Entrepreneurship” of this Book). In this context, social capital has emerged as an important explanation for a wide range of phenomena: from economic growth (Knack and Keefer 1997) to political participation (Di Pasquale and Glaeser 1999), development trap (Woolcock 1998), institutional performance (La Porta et al. 1997) or the spread of secondary education (Goldin and Katz 1999).

However, the analysis of the link between social capital and the generation of innovation – in its turn a crucially important driver of economic growth – has remained relatively unexplored by ‘mainstream’ economic literature. Economists of innovation and economic geographers have recently tried to fill this gap in the understanding of the impact of social capital on economic performance opening the way to new insights into the mechanics of social capital in the economy (Cohen and Fields 2000; Hauser, et al. 2007; Kallio et al. 2009; Laursen and Masciarelli 2007; Patton and Kenney 2003; Sabatini 2009; Tura and Harmaakorpi 2005).

In particular, this stream of literature has contributed to a better conceptualisation of ‘social capital’ shedding light on its ‘multidimensionality’ and suggesting that different dimensions may impact upon the economy in very different ways. It is the intensity and typology of network relations among innovative actors that matters for innovation. The characteristics of such networks and the social incentives for their formation qualify the way in which valuable knowledge is exchanged and re-combined linking together individuals, groups and geographical areas (Audretsch and Feldman 2004) further stimulating relational proximity and preventing stagnation and lock in (Boschma 2005). In this context the traditional debate regarding the optimal level of social capital seems to be less pertinent: the effectiveness of social capital doesn’t lie in the density of relationships within the network but in their intensity and in the extension of their “radius of trust” (Fukuyama 1995). The wider is the radius of trust of the network relationships among knowledgeable individuals the greater the likelihood of complementary knowledge exchange. This, in turn, implies that, in an innovation enhancing perspective, the potential negative role of social capital is mainly related to the existence of closed networks that lead to the exchange of redundant knowledge.

This chapter aims to explore the nexus between social capital and innovation by looking at the dichotomy between bonding and bridging social capital, where the first is based on strong ties and closed networks reinforced by deep emotional involvement and the second is, instead, related to weak ties linking otherwise disconnected communities. The empirical analysis looks at Italian provinces, one of the most intensively studied cases in the literature on social capital (Guiso et al. 2004; Ichino and Maggi 2000; Putnam 1993) but – to the best of our knowledge – largely unexplored in terms of the link between social capital and innovation. The existing empirical literature has made reference to a broad conceptualisation of social capital (associational activities, political participation, institutional thickness and trust) with a limited attempt to clarify the channels through which it affects the innovative performance of regions. Conversely, this chapter aims to develop a coherent definition of social capital by explicitly addressing the mechanisms behind its effect on innovation. In doing this – and in line with the conclusion reached by Hauser et al. (2007) – the chapter is focused on the network dimension of social capital, and provides some empirical evidence on its spatial patterns and its association with innovation in Italy.

The results suggest that social capital is a fundamental driver of innovation in Italian provinces if and only if it operates as a channel for the exchange of non redundant and complementary knowledge.

The chapter is organized as follows: we first provide and overview of the economic literature on the role of social capital, highlighting the specific meaning of the term with reference to innovation. In Sect. 3 we discuss the methodology and the dataset. Section 4 presents some descriptive statistics, the spatial analysis and the main results. Finally some conclusions are drawn underlining the fundamental role of social capital as a determinant of local innovative performance.

2 Social Capital as a Determinant of Innovation

The aim of this section is to look at the vast literature on the economic impact of social capital in order to develop a suitable ‘working definition’ and an appropriate conceptual framework for its analysis in relation to the process of innovation.Footnote 1

A fundamental vagueness is still characterizing the definition of social capital (Guiso et al. 2010). Coleman (1988) argued that it coincides with the social structure of a society facilitating the actions of individuals. Putnam (1993) identified social capital in terms of trust-based relations and groups. Fukuyama (1995) suggested that social capital has to be intended in terms of trust, civicness and network relations. However, none of the above definitions has made it possible neither to develop a comprehensive measure of social capital nor to overcome the traditional debate on its potential ‘dark side’ (i.e. the low innovative dynamism of some high social capital regions as emphasized by Florida 2002). From the methodological perspective, several difficulties exist in the operationalisation of the concept. As Solow (1999) emphasized in his critique to Fukuyama (1995): if social capital is something more than a fuzzy concept it has to be somehow measurable. However, we are still far from dealing with a universal measure of social capital. Different aspects were alternatively emphasized and different measures were proposed: from civic cooperation to collective action, from trust to political participation, groups and networking. The analysis of the link between social capital and innovation calls for a more rigorous definition of the term in order to single out the channels through which social capital may potentially affect innovation.

The qualification of social capital with respect to local innovative performance builds on the so called “relational turn” of economic geography (Boggs and Rantisi 2003) and challenges the under-socialized nature of the past approach to innovation that systematically neglected the social dimension of innovation processes. This drawback becomes apparent when looking at the traditional mainstream economic theory of innovation based on firm-level knowledge production function approach (Griliches 1979) in an a-spatial and atomistic fashion.

The re-discovery of the concept of social capital as a fundamental determinant of innovation followed the theoretical contributions of Granovetter (1985) and Coleman (1988). Innovation started to be progressively considered as a social process embedded in the local social environment and systematically affected by the strength and the intensity of social ties. Regions can be seen as systems of relations located within certain geographical contexts in which different economic actors are systematically engaged in interactive processes of collective learning (see chapter “Firm Capabilities and Cooperation for Innovation: Evidence from the UK Regions” by Iammarino et al. in this Book; Cooke and Morgan 1998; Kostiainen 2002).

The emphasis on the social dimension of innovation led to the definition of innovation prone regions (Rodriguez-Pose 1999), social filters (Rodríguez-Pose and Crescenzi 2008; Rodriguez-Pose and Comptour in chapter “Evaluating the role of clusters for innovation and growth in Europe” of this book) innovative milieux (Breschi and Lissoni 2001; Camagni 1995), learning regions (Florida 1995; Morgan 1997), regional systems of innovation (Cooke et al. 1997). In all these cases the focus is on the network dimension, supposed to be able to foster innovative capabilities facilitating the diffusion of valuable and non redundant knowledge and preventing stagnation and lock in (Boschma 2005).

According to the aforementioned literature, the link between social capital and innovation lies exactly in the concepts of networking and embeddedness (Granovetter 1985). Relational networks linking together individuals, groups, firms, industries with different knowledge bases are a critical precondition for knowledge creation and transfer. In this context innovation is emerging from a cumulative process embedded in the social context and systematically affected by dynamics of interactive learning, stimulating the exchange and re-combination of knowledge (Asheim 1999; Lundvall 1992). Moreover social structures, in particular in the form of social networks, systematically affect innovative outcomes since they determine the flow and quality of information exchanged (Granovetter 2005).

Social capital is then a crucial factor for community development since it stimulates inter-personal interactions and the circulation of valuable knowledge (Tura and Harmaakorpi 2005). If we accept this simple statement, then social capital can be thought to be an input into an ideal knowledge production function.

However, the idea of “relations as central units of analysis” (Boggs and Rantisi 2003) is still questionable. Significant criticisms are associated to the existence of robust empirical evidence in support to this preponderant role of relations and untraded interdependences (Markusen 1999; Overman 2004). This shortfall becomes even more relevant when looking at the mechanisms driving this potential effect. Capello and Faggian (2005) emphasized the role of relational capital as crucial ingredient in the creation and diffusion of innovation looking at knowledge spillovers as key transmission channels to account for the effect of networking and social relations on innovative performance. Kallio et al. (2009) suggested that the link between the social dimension and the emergence of an innovative outcome lies in the local absorptive capacity enabling the diffusion of knowledge within the regional system of innovation. Other authors argued that social capital has only a second order effect and that it is mediated by the increasing returns on the investments in human (Bourdieu 1986; Dakhli and De Clercq 2004; Gradstein and Justman 2000) or physical capital (Becker and Diez 2004; Cainelli et al. 2005; Fritsch and Franke 2004). Conversely, this chapter investigates at the effect of social capital on innovation by looking at the innovative potential of network exchanges (Hauser et al. 2007): the characteristics of these networks clarify the mechanisms underlying the impact of social capital on innovation. Innovation is more likely to be found “in the structural holes between dense social networks” (Burt 2004; Granovetter 2005). By looking at social capital as a fundamental component of the socio-institutional environment shaping the process of innovation, this chapter contends that differences in the nature of social networks, rather than the density of their linkages, offer a potential explanation for the non-linear relation between social capital and innovation (Hauser et al. 2007).

The so called “weak ties hypothesis” proposed by Granovetter (1973) is crucial in this context. Relationships between people can be characterized by either frequent contacts and deep emotional involvement or sporadic interactions with low emotional commitment. The former category is generally identified as ‘strong ties’ – such as the relationships within families or close friends – while the latter is associated with the definition of ‘weak ties’ linking individuals characterized by loose acquaintances. Contextualising Granovetter’s argument into the analysis of innovation, ‘weak ties’ can be seen as the source of novel information and responsible for the diffusion of ideas (Granovetter 1982; Rogers 2005), while ‘strong ties’ increase the risk of exchanging redundant knowledge simply because they connect knowledge seekers with other individuals that are more likely to deal with ‘known’/familiar information and knowledge (Levin and Cross 2004).

In other words, weak ties are fundamental in spreading information because they operate as a bridge between otherwise disconnected social groups (Ruef 2002). Weak ties serve as a bridging mechanism between communities within the same society, while strong ties function as a bonding device within homogeneous groups potentially hampering the degree of sociability outside the closed social circle (Beugelsdijk and Smulders 2003). Bonding social capital (Rodriguez-Pose and Storper 2006; Storper 2005) is likely to affect negatively innovation because it may work in favour of small groups lobbying for preferential policies and protection of the status quo hampering risky, innovative activities (Dakhli and De Clercq 2004; Knack and Keefer 1997; Portes and Landolt 1996). Conversely, bridging social capital, by lowering transaction costs, may contribute to the building of an environment congenial for innovation investment. As effectively pointed out by Putnam, the primary use of bonding social capital is to ‘get by’, while that of bridging social capital is to ‘get ahead’, implying that an over reliance on bonding social capital can generate a disincentive in creating connections “outside one’s own immediate network or social circle and into new areas of information and opportunity” (Cooke et al. 2005).

This implies that the ‘dark side of social capital’ lies in the typology of the ties and in the radius of trust of the network rather then in the intensity of the relationships among knowledgeable individuals: we need to look for the ‘right’ typology, rather than for the optimal ‘quantity’ of social capital if we aim to enhance local innovative performance.

In this chapter we focus on the relevance of social capital for the production of innovation in Italian provinces. The case of Italy is of potential interest because of both the considerable spatial variation in development and cultural traits and the availability of a large body of specific literature.

Putnam (1993) has in fact proposed the hypothesis that one of the main reasons for the persisting differences in development between North and South of Italy is due to the quality of institutions and social capital which in turn are the outcomes of historical accidents, i.e. areas in which independent city-states (the so-called Repubbliche Comunali) were more diffused are also the areas in which the level of trust and government effectiveness are higher. Recently, Guiso et al. (2008) and Percoco (2010a, b) have provided empirical support to this idea, although their main focus was on the explanation of income and productivity levels. In a similar context, Guiso et al. (2004) found a positive association between industrial development and social capital. Similarly, De Blasio and Nuzzo (2010), using microdata from the Survey of Household Income and Wealth conducted by the Bank of Italy, report that social capital increases the probability of being an entrepreneur.

The existing literature explicitly addressing the link between social capital and innovation is more limited. Some recent studies are largely qualitative (Ramella and Trigilia 2009). There are few recent papers applying a quantitative methodology to the analysis of the link between social capital and innovation in Italy. Some of them (Cainelli et al. 2005) looks at peculiar geographic areas such as the industrial districts arguing that the extensive horizontal relationships among local economic actors generate positive network externalities favouring the exchange of valuable knowledge and fostering the innovative performance of local firms. Others (Arrighetti and Lasagni 2010) adopt a firm based perspective in order to address the role of social and institutional factors on the probability of firms to innovate and their willingness to invest financial resources in innovation related activities. By analysing the effect of social conditions on the propensity to innovate of Italian firms they suggest that innovative firms tend to cluster in provinces characterized by relatively higher levels of “positive social capital” – interpreted as civicness and high social interactions – and lower levels of “negative social capital” generally associated with opportunistic behaviour due to the coexistence of groups lobbying for specific interests.

3 Methodology and Sources of Data

Our empirical analysis is based on the Knowledge Production Function (KPF), formalised by Griliches (1979, 1986) and Jaffe (1986). However, this chapter adopts a place based perspective and is focused on Italian provinces (NUTS 3 level) as units of observation. This specification, building on previous research in the field (Audretsch 2003; Audretsch and Feldman 1996; Crescenzi et al. 2007, 2012; Feldman 1994; Fritsch 2002; O’hUallachain and Leslie 2007; Ponds et al. 2010; Varga 1998), is particularly coherent with the main purpose of our analysis because it allows us to focus upon the territorial dynamics of innovation introducing social capital as a determinant of regional innovative performance.

The modified Knowledge Production Function takes the following form:

Where \( Patents_{-} growt{{h}_{{i,T - t}}} = \) \( \displaystyle\frac{1}{T}\ln \Big(\frac{{Patent{{s}_{{i,t}}}}}{{Patent{{s}_{{i,t - T}}}}}\Big) \) is the logarithmic transformation of the ratio of patent applications in region i at the two extremes of the period of analysis (t-T,t). Among the independent variables \( socca{{p}_{{i,t - T}}} \) is our variable of interest and represents the measure(s) of social capital in each province i at time (t-T); \( patent{{s}_{{i,t - T}}} \) is the log of the number of patents per million inhabitants at the beginning of the period of analysis (t-T); \( privr{{d}_{{i,t - T}}} \) is private expenditure in R&D as percentage of regional GDP at (t-T); \( gra{{d}_{{i,t - T}}} \) is the number of graduates in respect to regional population at time (t-T); \( {{X}_{{i,t - T}}} \) is the matrix of additional controls (i.e. regional sectoral composition, population density and female unemployment) at (t-T); Finally, \( {{\delta}_i} \) represents macro-regional dummies for southern, central and northern Italy and εi is the error term. A detailed description of the main variables is reported in Table A.1 in Appendix.

Regional Innovative Performance – Patents data coming from OECD are used as a proxy for innovation. We construct our measures of innovation using the log transformation of the growth rate of patents in the time interval 2001–2007. Patent statistics can be considered a good measure of innovative output providing comparable information on inventors across a broad range of technological sectors. The main limitations of this measure are the differentiated propensity to patent of different sectors and the non-patentability of many inventions (Crescenzi et al. 2007). In fact, differences in the number of patents among provinces may be an indicator for differences in industrial specialization. If sectors differ structurally in terms of propensity to innovate or to patent, then those differences will be reflected into differentials in terms of number of patents (or their growth). To overcome this limitation, in our empirical approach, we will control for the sector structure of the economy.

Initial patent intensity – The initial patent intensity in each province is used as a proxy of the existing technological capabilities and the distance from the technological frontier. It also controls for differences in the patenting propensity often related to pre-existent differences in sector specialization.

Social Capital – Building on our conceptual framework we look at social capital emphasizing the component related to the networking activity, but trying to distinguish such networks with respect to their effect on the circulation of information. As previously mentioned this implies a crucial distinction between networks based on weak ties, or bridging social capital, and networks based on strong ties, or bonding social capital.

We measure social capital by means of several variables in order to take into account both its bridging and bonding dimensions. Subsequently, through a principal component analysis, these variables are combined into a composite measure of social capital (Table 1, Column 1) and into two additional separate measures one for bonding and one for bridging social capital respectively (Table 1, Columns 2 and 3). Due to the characteristics of social capital in Italy and its specific spatial pattern, the composite indicator constructed through principal component analysis provides a preliminary evidence of the dichotomy between the bonding and bridging dimensions. In order to develop a deeper analysis of this evidence the composite indicator is then sub-divided into its bridging and bonding components.

Data on family characteristics are used as proxies for bonding social capital based on strong ties (Beugelsdijk and Smulders 2003; Levin and Cross 2004; Ruef 2002) and data on voluntary associations as a proxy for bridging social capital based on weak ties operating as forms of horizontal relations, fostering networks of civic engagement (Arrighetti and Lasagni 2010; Beugelsdijk and van Schaiik 2005). In order to capture the strength of family ties two indicators are included in the analysis: the number of families having lunch at least once per week with relatives and close friends (per 100 households) and the number of young adult individuals living with their parents (per 100 young adults).

Strong family ties are assumed to imply geographical proximity of adult children: young adults tend to stay longer with parents and the relationships within the family are particularly strong and based on repeated interactions. Family members tend to gravitate around the main core creating a system of nested families and a larger family size (Alesina and Giuliano 2010).

At this point, it should be mentioned that the characteristics of the family are at the heart of the hypothesis on the importance of social capital in Italian development since the very seminal work by Banfield (1958) who advanced the idea that low propensity to cooperate is generally associated to, among other things, the strength of family ties. In particular, Banfield (1958) argued that underdevelopment is a result of a low propensity to cooperate which, in turn, produces high transaction costs. This development trap is the outcome of strong family ties (the so-called “amoral familism”), high uncertainty and a highly unequal distribution of income and wealth. So far, we do not have conclusive empirical evidence supporting Banfield’s hypothesis, however, some pieces of evidence seem to confirm at least partially this theory. Alesina and Giuliano (2010), in fact, find that strong family ties are associated to low levels of generalized trust. Similarly, Giavazzi et al. (2010) relate family types to female labor market participation rate in European regions, whereas Duranton et al. (2009) relate past family structures to a number of contemporary outcomes.

Bridging social capital based on weak ties is instead measured using two of the traditional indicators adopted in the economic literature as proxies for social capital. Blood donations and participation in voluntary associations are assumed to be proxies for the participation of individual in activities with positive social externalities and as an indicator for altruism (Cartocci 2007).

The number of families having lunch at least once per week with relativesFootnote 2 and the number of young adults living with parentsFootnote 3 are used to define a composite indicator of bonding social capital while blood donations and voluntarism concur to define the composite indicator for bridging social capital. We further defined a comprehensive measure of social capital encompassing both the bonding and bridging dimension that is used in the first stage of the analysis in order to detect the overall effect of social capital on innovation before going into details.

We finally included a spatial lag of our composite measure of social capital in order to control for potential spillovers effect. All the spatially lagged variables are constructed based on a standard queen contiguity spatial weighting matrix.

Innovation inputs – Private R&D as a share of regional GDP and the number of graduates over the total population are used as proxies for the key inputs of the ‘standard’ regional Knowledge Production Function. On account of limited data availability our R&D measure is available only at regional level (NUTS 2) while the number of graduates is available for each province (NUTS3).

Controls – Our specification of the knowledge production function includes controls for population density at province level, labour market characteristics in terms of female unemployment rate and sector structure approximated by the Herfindhal Index.

The Herfindhal Index is defined using data on employment for three sectors: agriculture, industry and services and it is interpreted as a measure of specialization.

We further add some controls to take into account spatial correlation. In particular we defined the spatial lag of population density as a measure of accessibility. Macroregional dummies are inserted to control for time invariant characteristics and other sources of spatial correlation.

4 Empirical Results

Preliminary evidence on the potential link between the innovative performance of Italian provinces and the characteristics of the local social environment can be analyzed by looking at the descriptive statistics and the correlation between the relevant variables.

The principal components analysis (Table 1) shows that our composite measure of social capital-jointly accounting for both the bonding and bridging dimensions of the concept-attributes opposite signs to the two components. Variables used as proxies for bridging social capital enter the composite indicator with a positive weight, while the variables used as proxy for bonding social capital show a negative sign. This implies that our composite measure of social capital explicitly takes into account the characteristics of the Italian context, characterized by a predominance of strong ties (interpreted here as family ties) in Southern regions and a higher level of bridging social capital and community involvement in Central and Northern regions.

In order to clarify how this dichotomy in the characteristics of the social structure between Northern and Southern regions affects local innovative dynamism, the composite measure of social capital is sub-divided in its two main components: bonding and bridging social capital respectively (Table 1).

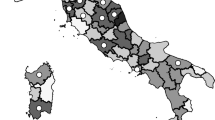

The well known North–south dichotomy in Italy is clearly reflected into the characteristics of the social environment. Figures 1 and 2 visualise the spatial distribution of bridging and bonding social capital in Italian provinces. Bridging social capital seems to be systematically higher in Northern Italy and in part of the Central regions while Southern provinces are characterized by the predominance of bonding social capital. On the other side, the geographical distribution of innovation (Fig. 3) seems to be very similar to the distribution of bridging social capital providing some preliminary support in favour of our hypothesis regarding the crucial role of weak ties as complementary preconditions for innovation.

A more in-depth analysis of the spatial structure of both bonding and bridging social capital and innovation is necessary in order to clarify this point. Figures 4, 5, and 6 report the Moran’s I spatial correlation index for innovation, bonding and bridging social capital respectively. Bonding and bridging social capital shows a clear pattern of spatial concentration. For innovation the magnitude of the coefficient is lower, but there is still evidence of a significant level of spatial concentration.

Deepening the analysis of the spatial patterns of social capital in Italy, the Local Spatial Autocorrelation Index (LISA) is reported and it generally supports the hypothesis regarding the spatial concentration of bonding and bridging social capital in Italian provinces.

Figures 7 and 8, reporting respectively the cluster map for bonding and bridging social capital, classify the areas with respect to the predominant typology of spatial correlation. Both bridging and bonding social capital are characterized by the predominance of the high-high and the low-low clusters with an opposite geographical distribution. Provinces with the highest level of bridging social capital tend to be concentrated in the North while those showing lowest scores are clustered in Southern Italy. Symmetrically, bonding social capital characterizes Southern provinces while areas showing the lowest level remain concentrated in the North. Conversely, intermediate clusters (high-low and low-high) do not show any clear pattern, confirming the strong spatial concentration of bonding and bridging social capital. The LISA index for innovation, reported in Fig. 9, shows a spatial pattern similar to bridging social capital, with provinces characterised by the most dynamic innovative performance clustered in the North and those with the lowest scores concentrated in the SouthFootnote 4.

This preliminary evidence in support of a similar spatial concentration pattern between innovation and bridging social capital and a complementary negative spatial correlation between innovation and bonding social capital seems to be further confirmed by the multivariate LISA shown in Figs. 10 and 11 respectively. Figure 10 is characterized by the predominance of the high-high and the low-low cluster suggesting that innovation is spatially concentrated in areas characterized by higher levels of bridging social capital. On the contrary, Fig. 11 shows a predominance of the high-low and low-high clusters supporting the hypothesis of a divergent spatial distribution of innovation with respect to bonding social capital.

The evidence regarding the sign and the magnitude of the correlation between innovation and bonding/bridging social capital deserves a deeper analysis.

Data reported in Table 2 suggest a substantial congruence between local innovative outcome and the bridging component of social capital as well as a systematic negative association between innovation and bonding social capital. This descriptive evidence further supports the main hypothesis of our analysis: social capital has a beneficial effect on the innovative performance of local areas when it is based on the existence of weak ties between otherwise disconnected communities. Complementary, a strong predominance of bonding social capital is associated with lower innovative performance. The two sided effect of social capital on innovation is further confirmed by the correlation matrix reported in Table 3.

The systematic correlation between bridging social capital and innovative performance in Italian provinces supports the initial hypothesis of this chapter and calls for further investigation through standard econometric analysis.

Table 4 reports the estimation results for the place based Knowledge Production Function. In the basic version we just control for capital and labour and the initial level of patenting intensity in each region (Table 4 Col.1). The initial number of patents per million of inhabitants is statistically significant at 1 % level and negatively associated to our dependent variable. The sign of the coefficient can be justified through a convergence trend in patenting due to either the crisis of traditionally successful innovative areas (such as the industrial districts) or the emergence of new successful players.

Some controls for population density, the labour market characteristics, the sector structure and the spatial lag of population density (used as proxy for accessibility) are progressively included in the model (Table 4, column 2). Neither the level of female unemployment, used as proxy for the efficiency of the local labour market, nor the Herfindhal index, used as an indicator for sector specialization, are statistically significant. Conversely, population density seems to be positively associated to innovation with a significance level of 5 %. On the contrary the spatial lag of population density shows a significant negative effect at 10 % level.

In column 3 we control for our measure of social capital which is highly significant at 1 % level and positively correlated to innovation in each province. In the interpretation of this finding it is necessary to bear in mind the characteristics of our measure of social capital. The composite indicator constructed through principal components analysis already takes into account the characteristic Italian dichotomy between bridging and bonding operationalizing it through the attribution of a negative sign to bonding social capital and a positive sign to the bridging component. The positive sign associated to social capital in our regression suggests that the bridging component plays the crucial role and that provinces characterized by significant levels of cooperation and associational activities are more prone to innovation. In the model estimates reported in column 3 the spatial lag of social capital is included in order to control for potential neighbouring effects. The regressor is not statistically significant; however its inclusion affects the estimation of other coefficients suggesting the presence of spatial autocorrelation. In order to further control for this potential neighbourhood effect and spatial correlation macro-regional dummiesFootnote 5 are included into the model. The measure of social capital remains positively associated to innovation with a significance level of 5 %.

In the final step of the analysis, the two fundamental components of social capital (i.e. bonding social capital based on strong ties, and bridging social capital based on weak ties) are assessed separately by splitting our aggregate measure of social capital into two separate regressors (Table 4, column 5). The bridging component remains statistically significant at 1 % level and positively associated to innovation while the bonding social capital is not statistically significant. These results confirm that the positive and significant impact of social capital on innovation is based on the mechanism of weak ties rather than strong ties. Weak ties make it possible to access non-redundant information, favouring the transfer and re-combination of valuable knowledge and fostering the innovative performance of Italian provinces. Conversely, bonding social capital, based on strong ties, is not a statistically significant determinant of innovation.

5 Conclusions

Soft factors – such as social capital – have gained progressive importance in the economic literature. This chapter, has focused on the link between innovation and social capital by looking at the networking and associational dimension of social capital and exploring the mechanisms for the diffusion and the circulation of valuable knowledge.

The effect of social capital on innovation is shaped by its capability to facilitate the exchange of complementary knowledge between individuals. This implies that networks and ties bridging individuals belonging to heterogeneous epistemic communities (as opposed to homogeneous like-minded groups), are conducive to innovation because they allow the access to non-redundant information.

Our results suggest that social capital based on weak ties is a fundamental determinant of innovation: it is the quality of social capital (and not its total endowment) that affects its correlation with innovation.

Further research is needed in order to deepen the understanding of the mechanisms driving the correlation between local social characteristics and innovative performance and to overcome the challenges related to the analysis of the causal link behind the effect of social capital on innovation.

Notes

- 1.

This section heavily relies on Crescenzi et al. (2012)

- 2.

Per 100 families

- 3.

Per 100 young adults

- 4.

Note that two provinces (Sondrio and Pistoia) despite being located in highly innovative areas show low innovative performance probably due to their agricultural vocation while one province (Enna) in spite of being located in a low innovative area is characterized by a good performance. This last case can be explained by the localization in this territory of the high tech cluster of the “Etna Valley”.

- 5.

Moran’s I over the residual is calculated in order to test for the existence of spatial correlation. Controlling for the spatial lag of population density and social capital and adding macroregional dummies the coefficient of the Moran I decrease, from 0.25 to 0.085, and becomes statistically insignificant. The p-value further confirms the rejection of the null of spatial correlation in the residuals.

References

Alesina A, Giuliano P (2010) The power of the family. J Econ Growth 15(2):93–125

Arrighetti A, Lasagni A (2010) Capitale sociale, contesto istituzionale e performance innovative delle imprese. Sci Reg 10:5–34

Asheim B (1999) Interactive learning and localised knowledge in globalising learning economies. GeoJournal 49:345–352

Audretsch DB (2003) Innovation and spatial externalities. Int Reg Sci Rev 26:167–174

Audretsch DB, Feldman MP (1996) R&D spillovers and the geography of innovation and production. Am Econ Rev 86:253–273

Audretsch DB, Feldman MP (2004) Knowledge spillovers and the geography of innovation. In: Henderson JV, Thisse J-F (eds) Handbook of regional and urban economics, vol 4. Elsevier, Princeton, pp 2713–2739

Banerjee AV, Duflo E (2005) Growth theory through the lens of development economics. In: Durlauf SN, Aghion P (eds) Handbook of economic growth, volume 1A. Elsevier Science, Amsterdam

Banfield EC (1958) The moral basis of a backward society. Free Press, Chicago

Becker W, Diez J (2004) R&D Cooperation and innovation activities of firms. Evidence for the German manufacturing industry. Res Policy 33:209–223

Beugelsdijk S, Smulders S (2003) Bridging and bonding social capital: which type is good for economic growth? Paper presented at European Regional Science Association, Jyvaskila

Beugelsdijk S, van Schaiik T (2005) Social capital and growth in European regions: an empirical test. Eur J Polit Econ 21:301–324

Boggs JS, Rantisi NM (2003) The ‘relational turn’ in economic geography. J Econ Geogr 3:109–116

Boschma RA (2005) Proximity and innovation: a critical assessment. Reg Stud 39(1):61–74

Bourdieu D (1986) The forms of capital. In: Richardson J (ed) Handbook of theory and research for the sociology of education. Greenwood, New York

Breschi S, Lissoni F (2001) Localised knowledge spillovers vs. innovative milieux: knowledge “tacitness” reconsidered. Pap Reg Sci 90:255–273

Burt RS (2004) Structural holes and good ideas. Am J Sociol 110:349–399

Cainelli G, Mancinelli S, Mazzanti M (2005) Social capital, R&D and industrial district, Feem working papers n 744584

Camagni RP (1995) The concept of “innovative milieu” and its relevance for public policies in European lagging regions. Pap Reg Sci 74:317–340

Capello R, Faggian A (2005) Collective learning and relational capital in local innovation processes. Reg Stud 39:75–87

Cartocci R (2007) Mappe del tesoro: atlante del capitale sociale in Italia. Il Mulino, Bologna

Cohen S, Fields G (2000) Social capital and capital gains: an examination of social capital in Silicon Valley. In: Kenney M (ed) Understanding Silicon Valley. Stanford University Press, Stanford

Coleman JS (1988) Social capital in the creation of human capital. Am J Sociol 94:S95–S120

Cooke P, Morgan K (1998) The associational economy: firms regions and innovation. Oxford Economic Press, Oxford

Cooke P, Uranga MG, Etxebarria G (1997) Regional innovation systems: institutional and organisational dimensions. Res Policy 26:475–491

Cooke P, Clifton N, Oleaga M (2005) Social capital, firm embeddedness and regional development. Reg Stud 39(8):1065–1077

Crescenzi R, Rodriguez-Pose A, Storper M (2007) The territorial dynamics of innovation: a Europe–United states comparative analysis. J Econ Geogr 7:673–709

Crescenzi R, Rodríguez-Pose A, Storper M (2012) The territorial dynamics of innovation in China and India. J Econ Geogr (forthcoming)

Dakhli M, De Clercq D (2004) Human capital, social capital and innovation: a multi-country study. Entrep Reg Dev 16(2):107–128

De Blasio G, Nuzzo G (2010) Historical traditions of civicness and local economic development. J Reg Sci 50(4):833–857

Di Pasquale D, Glaeser E (1999) Incentives and social capital: are homeowners better citizens? J Urban Econ 45(2):354–384

Duranton G, Rodriguez-Pose A, Sandall R (2009) Family types and the persistence of regional disparities in Europe. Econ Geogr 85(1):23–47

Feldman MP (1994) The geography of innovation. Kluwer, Boston

Florida R (1995) Towards the learning region. Futures 27(5):527–536

Florida R (2002) The rise of the creative class: and how it’s transforming work, leisure, community, and everyday life. Basic Books, New York

Fritsch M (2002) Measuring the quality of regional innovation systems: a knowledge production function approach. Int Reg Sci Rev 25:86–101

Fritsch M, Franke G (2004) Innovation, regional knowledge spillovers and R&D cooperation. Res Policy 33:245–255

Fukuyama F (1995) Trust: the social virtues and the creation of prosperity. Free Press, New York

Giavazzi F, Schiantarelli F, Serafinelli M (2010) Attitudes, policies and work, mimeo

Goldin C, Katz L (1999) Human capital and social capital: the rise of secondary schooling in America, 1910–1940. J Interdiscipl Hist 29:683–723

Gradstein M, Justman M (2000) Human capital social capital and public schooling. Eur Econ Rev 44:879–891

Granovetter MS (1973) The strength of weak ties. Am J Sociol 78:1360–1380

Granovetter M (1982) The strength of weak ties: a network theory revisited. In: Marsden PV, Lin N (eds) Social structure and network analysis. Sage, Beverly Hills, pp 105–130

Granovetter M (1985) Economic action and social structure: the problem of embeddedness. Am J Sociol 91(2):481–510

Granovetter M (2005) The impact of social structure on economic outcomes. J Econ Perspect 19(1):33–50

Griliches Z (1979) Issues in assessing the contribution of research and development to productivity growth. Bell J Econ 10:92–116

Griliches Z (1986) Productivity, R & D, and the basic research at the firm level in the 1970s. Am Econ Rev 76:141–154

Guiso L, Sapienza P, Zingales L (2004) The role of social capital in financial development. Am Econ Rev 94(3):526–556

Guiso L, Sapienza P, Zingales L (2008) Long term persistence, mimeo

Guiso L, Sapienza P, Zingales L (2010) Civil capital as the missing link, NBER Working Paper 15845

Hauser C, Tappeiner G, Walde J (2007) The leraning region: the impact of social capital and weak ties on innovation. Reg Stud 41(1):75–88

Ichino A, Maggi G (2000) Work environment and individual background: explaining regional shirking differentials in a large Italian firm. Q J Econ 115:1057–1090

Jaffe A (1986) Technological opportunity and spillovers of R&D: evidence from firms’ patents, profits and market value. Am Econ Rev 76:984–1001

Kallio A, Harmaakoorpi V, Pihkala T (2009) Absorptive capacity and social capital in regional innovation system: the case of the Lahti region in Finland. Urban Stud 47:303–319

Knack S, Keefer P (1997) Does social capital have an economic payoff? A cross-country investigation. Q J Econ 112(4):1252–1288

Kostiainen J (2002) Urban economic development policy in the network society. Tekniikan akateemisten liitto, Tampere

La Porta R, Lopez de Silanes F, Shleifer A, Vishny RW (1997) Trust in large organizations. Am Econ Rev 87(2):333–338

Laursen K, Masciarelli F (2007) The effect of regional social capital and external knowledge acquisition on process and product innovation, DRUID working paper

Levin D, Cross R (2004) The strength of weak ties you can trust: the mediating role of trust in effective knowledge transfer. Manage Sci 50:1477–1490

Lundvall B (1992) Introduction. In: Lundvall B-Å (ed) National systems of innovation. Towards a theory of innovation and interactive learning. Pinter Publishers, London

Markusen A (1999) Fuzzy concepts scanty evidence, policy distance: the case for rigour and policy relevance in critical regional studies. Reg Stud 33:869–884

Morgan K (1997) The learning region: institutions innovation and regional renewal. Reg Stud 31:491–504

O’huallachain B, Leslie T (2007) Rethinking the regional knowledge production function. J Econ Geo 7(6):737–752

Overman H (2004) Can we learn anything from economic geography proper? J Econ Geogr 4:501–516

Patton D, Kenney M (2003) Innovation and social capital in Silicon Valley, BRIE Working Paper 155

Percoco M (2010a) Path dependence, institutions and the density of economic activities: evidence from Italian cities, FEEM Working Paper N. 110

Percoco M (2010b) Geography, institutions and urban development: Italian cities 1300–1861, Università Bocconi, mimeo

Ponds R, van Oort F, Frenken K (2010) Innovation, spillovers and university–industry collaboration: an extended knowledge production function approach. J Econ Geogr 10(2):231–255

Portes A, Landolt P (1996) The downside of social capital. Am Prospect 94(26):18–21

Putnam R (1993) Making democracy work: civic traditions in modern Italy. Princeton University Press, Princeton

Ramella F, Trigilia C (2009) Le strategie dell’innovazione. Indagine sui brevetti europei delle imprese italiane. Econ Polit Ind 36(2):199–213

Rodriguez-Pose A (1999) Innovation prone and innovation averse societies: economic performance in Europe. Growth Change 30:75–105

Rodríguez-Pose A, Crescenzi R (2008) R&D, spillovers, innovation systems and the genesis of regional growth in Europe. Reg Stud 42(1):51–67

Rodriguez-Pose A, Storper M (2006) Better rules or stronger communities? On the social foundations of institutional change and its economic effects. Econ Geogr 82(1):1–25

Rogers EM (1995) Diffusion of innovations, 4th edn. The Free Press, New York

Ruef M (2002) Strong ties, weak ties and Islands: structural and cultural predictors of organizational innovation. Ind Corp Change 11:427–449

Sabatini F (2009) Il Capitale Sociale nelle Regioni Italiane: un’Analisi Comparata. Rev Polit Econ 99:167–220

Solow R (1999) Notes on social capital and economic performance. In: Dasgupta P, Serageldin I (eds) Social capital: a multifaceted perspective. World Bank, Washington, DC

Storper M (2005) Society, community and economic development. Stud Comp Econ Dev 39(4):30–57

Tura T, Harmaakorpi V (2005) Social capital in building regional innovative capability. Reg Stud 39:1111–1125

Varga A (1998) University research and regional innovation. Kluwer, Boston

Woolcock M (1998) Social capital and economic development: toward a theoretical synthesis and policy framework. Theor Soc 27(2):151–20

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendix

Appendix

Rights and permissions

Copyright information

© 2013 Springer-Verlag Berlin Heidelberg

About this chapter

Cite this chapter

Crescenzi, R., Gagliardi, L., Percoco, M. (2013). The ‘Bright’ Side of Social Capital: How ‘Bridging’ Makes Italian Provinces More Innovative. In: Crescenzi, R., Percoco, M. (eds) Geography, Institutions and Regional Economic Performance. Advances in Spatial Science. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-33395-8_8

Download citation

DOI: https://doi.org/10.1007/978-3-642-33395-8_8

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-33394-1

Online ISBN: 978-3-642-33395-8

eBook Packages: Business and EconomicsEconomics and Finance (R0)