Abstract

This paper deals with the classical backorder economic order quantity inventory model under cloudy fuzzy environment. The traditional concepts on fuzziness of the fuzzy parameters remains the same in all the time, but in practice, due to the human experience and precision the fuzziness began to remove from the system over time. However, we take the crisp model first, then fuzzifying the model to get a decision under the cloudy fuzzy (extension of dense fuzzy) demand rate followed by its practical application. A new defuzzification method has been utilized for ranking the fuzzy numbers. Finally, comparative analysis between the crisp, general fuzzy as well as cloudy fuzzy solutions are done extensively. The graphical illustrations and numerical examples are studied to justify the usefulness of the new approach in the model itself.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In any production process especially on the classical economic order quantity (EOQ) model, the constancy on demand rate has been threatened by modern thinkers. Harris [21] developed the concept of modeling in the inventory management problems. Hariga [20] studied an EOQ model for deteriorating items with time-varying demand. In deterministic world, numerous research articles have been studied yet in the literature.

Zadeh [41] first introduced the concept of fuzzy sets. After that it has been applied by Bellman and Zadeh [5] in decision making for industrial management problems. Researchers like Kaufmann and Gupta [23], Mahata et al. [30], Mahata and Goswami [31], Mahata and Mahata [32], Báez-Sáncheza et al. [2], Mahata and Goswami [33], Milenkovic et al. [35], Ban and Coroianu [3] and De and Sana [13] have studied extensively over the subject. In fuzzy EOQ model with backorder an analytical solution is made by Bjork [4]. Kazemi et al. [25] studied with the same model for fuzzy decision variables. Kao and Hsu [22] developed a lot size—reorder point inventory model with fuzzy demands. De et al. [9, 10] studied the inventory model considering fuzzy demand rate, fuzzy deterioration rate and fuzzy cost co-efficient respectively. Researchers like Kumar et al. [29], De [11], De and Sana [12] etc. have tried to develop fuzzy models with backorders under promotional efforts sensitive demand. De and Sana [14] developed a hill type fuzzy stochastic model using Bonferroni mean operator and they have solved this problem by a fuzzy schematic algorithm via score functions of the fuzzy numbers.

In another study, Mahata [34] investigated the learning effect of the unit production time on optimal lot size for the imperfect production process with partial backlogging of shortage quantity in fuzzy random environments. He assumed that the setup cost, the average holding cost, the backorder cost, the raw material cost and the labor cost are characterized as fuzzy variables and the elapsed time until the machine shifts from “in-control” state to “out-of-control” state is characterized as a fuzzy random variable. Another such characterization developed by Goetschel and Voxman [18] considering eigen fuzzy number sets.

Recently, Kazemi et al. [24, 26, 27] discussed the learning and forgatting effects on fuzzy parameters for the backorder EOQ model considering imperfect quality items in their models. Through their works they basically use Wright’s [37] learning curve in estimating the several cost parameters that involved in the model. According to them, learning can be improved from one shipment to another and it might have the range 50–100 %. (for details see “Appendix”) . In addition, they did not take the learning performance as the decision variable and solved the model using simple differential calculus. But, in practical use, the decision variable, we see the cycle time plays a vital role in forming the knowledge through learning over passing time instead of how many shipments taking place. Again, their model fails if the learning rate assumes values in between [0–50 %). Thus in this study we have developed a cloudy fuzzy model such that the fuzziness is directly depends upon the decision variable in which no restrictions could be imposed on learning rate and defuzzify the fuzzy problem with a new defuzzification method.

In defuzzification analysis, specially on ranking fuzzy numbers, after Yager [39], some other recent researchers like Allahviranloo and Saneifard [1], Ezzati et al. [17], Deng [16] and Zhang et al. [42] etc. have adopted the methods for ranking fuzzy numbers based on center of gravity as well. Using deviation degree, the extensive works over L-R fuzzy numbers made by Wang et al. [36], Kumar et al. [28], Hajjari and Abbasbandy [19], Xu et al. [38], etc. have kept a new milestone in the subject. Yu et al. [40] developed fuzzy ranking generalized fuzzy numbers in fuzzy decision making based on the left and right transfer coefficients and areas of the corresponding membership functions. Das et al. [7] were able to develop an backlogging EOQ model using step order fuzzy approach, while De and Sana [15] gave an alternative fuzzy approach for backlogging model using promotional effort sensitive demand. Moreover, De and Beg [8] and De and Sana [14] invented new defuzzification methods for triangular dense fuzzy set. They are also able to apply this concept in the Neutrosophic sets, by hosting the method not only in manufacturing engineering but for environmental risk analysis, assessment and disaster management, even crime research also. Here we have utilized the extension of triangular dense fuzzy into triangular cloudy fuzzy to rank the fuzzy objective value. We have incorporated the implications of cloudy fuzzy environment in inventory management problems in a separate section along with a practical example. The findings explore that, a cloud indicator exists and it cannot be removed in any inventory process. Thus we solve the model by crisp, general fuzzy and cloudy fuzzy environments also. A numerical study followed a comparative graphical illustrations and a sensitivity analysis as well. Finally decision is made over the applicable region by realistic feasibility of the model itself.

Preliminary Concept

Normalized General Triangular Fuzzy Number (NGTFN)

Let D be a NGTFN having the form \(\tilde{D}=(D_{1},D_{2},D_{3})\). Then its membership function is defined by

Now, the left and right \(\alpha -\)cuts of \(\mu \left( \tilde{D} \right) \) are given by

Note that the measures of fuzziness can be obtained from the following formula:

Yager’s [39] Ranking Index

If \(L(\alpha )\) and \(R(\alpha )\) are the left and right \(\alpha -\)cuts of a fuzzy number \(\tilde{D}\) then the defuzzification rule under Yager’s ranking index is given by

Note that the measures of fuzziness (degree of fuzziness \(d_{f}\)) can be obtained from the formula \(d_{f}=\frac{U_{b}-L_{b}}{2m}\), where \(L_{b}\) and \(U_{b}\) are the lower bounds and upper bounds of the fuzzy numbers respectively and m being their respective mode.

Cloudy Normalized Triangular Fuzzy Number (CNTFN) (extension of De and Beg [6])

A fuzzy number of the form \(\tilde{A}=\langle a_1, a_2, a_3 \rangle \) is said to be cloudy triangular fuzzy number if after an infinite time the set itself converges to a crisp singleton. This means that, as time t tends to infinity, both \(a_{1},a_{3}\rightarrow a_{2}\).

Let us consider the fuzzy number

Note that \(\hbox {lim}_{t\rightarrow \infty }{a_{2}\left( 1-\frac{\rho }{1+t} \right) =a_{2}}\) and \(\hbox {lim}_{t\rightarrow \infty }{a_{2}\left( 1+\frac{\sigma }{1+t} \right) =a_{2}}\), so \(\tilde{A}\rightarrow \left\{ a_{2} \right\} \).

Then the membership functions for \(0\le t\) is as follows:

The graphical representation of CNTFN (Fig. 1) can be obtained as follows:

Extended De and Beg’s [6] Ranking Index on CNTFN

Let us take left and right \(\alpha -\)cuts of \(\mu \left( x,t \right) \) from (5) noted as \(L(\alpha ,t)\) and \(R(\alpha ,t)\) respectively. Then the defuzzification formula under time extension of Yager’s ranking index is given by

Note that, \(\alpha \;\hbox {and} \; t\) are independent variables.

Let \(\tilde{A}\) be a CNTFN stated in (4). Then we have its membership function (5). Now taking the left and right \(\alpha \)-cuts of \(\mu \left( x,t \right) \) from (5) we get

Thus using (6), we have

Again (8) can be rewritten as \(I(\tilde{A )}=a_{2}\left[ 1+\frac{\sigma -\rho }{4}\frac{\log \left( 1+T \right) }{T} \right] \).

Obviously, \(\hbox {lim}_{T\rightarrow \infty }{\frac{\log {(1+T)}}{T}=0}\) and therefore \(I(\tilde{A )}\rightarrow a_{2}\) as \(T\rightarrow \infty \).

And the time T is measured by days in practice. The nature of cloud index is shown in Fig. 2.

Classical backorder EOQ Model

To develop the proposed model, we assume the following notations and assumptions:

Notation:

The notation used in this paper is as follows:

- D :

-

Demand rate per unit time (days)

- Q :

-

Lot size (decision variable)

- q(t):

-

Instantaneous inventory level

- S :

-

Shortage level (decision variable)

- K :

-

Ordering cost of inventory per order

- \(c_{1}\) :

-

Holding cost per unit per unit time ($)

- p :

-

Unit purchase cost ($)

- \(c_{2}\) :

-

Shortage cost per unit ($)

- T :

-

Length of the replenishment cycle (days)

- \(t_{1}\) :

-

Time when inventory level comes down to zero, \(0\le t_{1}<T\)

- \(t_{2}\) :

-

The shortage period (days)

- \(Z(t_{1},T)\) :

-

Average total inventory cost per unit time

Assumptions:

In the model, the primary assumptions are:

-

(1)

The inventory system involves only one item.

-

(2)

Replenishment occurs instantaneously on ordering i.e. lead-time is zero.

-

(3)

Demand rate D(t) is deterministic and given by \(D\left( t \right) =D; 0<t<T\).

-

(4)

Shortages are allowed and completely backlogged.

-

(5)

The planning period is of infinite length. The planning horizon is divided into sub-intervals of length T units. Orders are placed at time points \(0, T, 2T, 3T,\ldots \) the order quantity at each reorder point being just sufficient to bring the stock height to a certain maximum level S.

Model Formulation

Let the amount of stock for the item be R at time \( t=0\). In the interval \( (0,T(=t_{1}+t_{2}))\), the inventory level gradually decreases to meet demands. By this process the inventory level reaches zero at time \(t_{1}\) and then shortages are allowed to occur in the interval \((t_{1},T)\). The cycle then repeats itself.

The differential equation for the instantaneous inventory q(t) at time t in (0, T) is given by

with the initial conditions \(q\left( 0 \right) =R\left( =Q-S \right) , q\left( T \right) =-S, q\left( t_{1} \right) =0\).

For each period a fixed amount of shortage is allowed and there is a penalty cost \(c_{2}\) per item of unsatisfied demand per unit time.

From (10)

So \(Dt_{1}=R, S=Dt_{2}, Q=DT\).

In the interval \((0,t_{1})\), expected holding cost \(HC=c_{1}\int _0^{t_{1}} {q\left( t \right) dt=\frac{c_{1}Dt_{1}^{2}}{2}} \).

Over the interval \((t_{1},T)\), expected shortage cost \(SC=c_{2}\int _{t_{1}}^T {-q(t)dt=c_{2}D\frac{{(T-t_{1})}^{2}}{2}} \).

Therefore the total average cost is

Thus our problem is given by

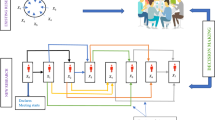

The graphical representation of the model is shown in Fig. 3.

Formulation of Fuzzy Mathematical Model

Let the demand rate follows the general fuzzy and cloudy fuzzy over the inventory run time. Then considering \(\tilde{D}\) as follows

And the corresponding fuzzy problem is given by

Therefore, using (3) the membership function for the fuzzy objective, order quantity and shortage quantity under NGTFN are given by

Using (2) and (3) the index values of fuzzy objective, fuzzy order quantity and fuzzy shortage quantity are respectively obtained as

Particular Cases:

-

i)

If \(D_{1}\rightarrow D_{2}\; and \; D_{3}\rightarrow D_{2}\rightarrow D\) then \(I( \tilde{Z} )\rightarrow ( p+\frac{c_{1}t_{1}^{2}}{2T}+c_{2}\frac{( T-t_{1} )^{2}}{2T} )D+\frac{K}{T}\), \(I( \tilde{Q} )\rightarrow DT \; and\; I( \tilde{S} )\rightarrow D(T- t_{1})\) , it is the classical backorder EOQ model.

-

ii)

If \(t_{1}\rightarrow T\), \(I( \tilde{Z} )\rightarrow ( pD+\frac{c_{1}DT}{2}+\frac{K}{T} )\), it is the classical EOQ model

However, using (5) the membership function for the fuzzy objective, fuzzy order quantity, and fuzzy shortage quantity under the cloudy fuzzy model are givenby

Using (6) the index values of cloudy fuzzy objective, cloudy fuzzy order quantity, and cloudy fuzzy shortage quantity are respectively given by

Stability analysis and particular cases:

-

i)

If \(\sigma -\rho \rightarrow 0\) then \(J\left( \tilde{ Z } \right) \rightarrow pD+\frac{Dln(\frac{\tau }{\varepsilon })}{2\tau }\left\{ \left( c_{1}+c_{2} \right) t_{1}^{2}+\frac{2k}{D} \right\} +\frac{c_{2}D}{4}\left( {\tau -4t}_{1} \right) \) , \(J\left( \tilde{Q } \right) \rightarrow \frac{D\tau }{2}\) and \(J\left( \tilde{S } \right) \rightarrow \frac{D}{2}\left( \tau -2t_{1} \right) \).

-

ii)

If \(\sigma \rightarrow 0 \leftarrow \rho \) then the model reduces to (i). But it is the case of classical backorder EOQ model. Thus we choose \(\varepsilon \) in such a way that the above reduces to the classical model. Thus we take

$$\begin{aligned} pD+\frac{Dln\left( \frac{\tau }{\varepsilon }\right) }{2\tau }\left\{ \left( c_{1}+c_{2} \right) t_{1}^{2}+\frac{2k}{D} \right\} +\frac{c_{2}D}{4}\left( {\tau -4t}_{1} \right) \equiv \left( p+\frac{c_{1}t_{1}^{2}}{2T}+c_{2}\frac{\left( T-t_{1} \right) ^{2}}{2T} \right) D+\frac{K}{T} \end{aligned}$$

Comparing we get, \(\frac{ln(\frac{\tau }{\varepsilon })}{\tau }=\frac{1}{T}\) and \({\frac{ln(\frac{\tau }{\varepsilon })}{\tau }t_{1}^{2}+\frac{\left( {\tau -4t}_{1} \right) }{4}=\left( T-t_{1} \right) }^{2}\) giving \(\tau =2 \; and \; T=1\Rightarrow \varepsilon \rightarrow 2e^{-2}\ll 1\)

Thus the model is stable and in this case we write, \(\tau =2T\) and hence, \(J\left( \tilde{Q } \right) \rightarrow DT\) and \(J\left( \tilde{S } \right) \rightarrow D\left( T-t_{1} \right) \) which corresponds the results of classical backorder model.

Implication of Cloudy Fuzzy Environment in Inventory Process

Suppose x is a crisp number then under non-randomly uncertainties it will be ‘around x’. Our focus of attentions is that such uncertainty basically depends upon the time variable. This kind of fuzzy variation is generally called the variation due to learning effect in decision making problems. In practice, for any inventory process, when it begins, the uncertainties viewed are high and as the time progresses the total ambiguities began to disappear from the system.

For instance, if we think of demand rate then at the beginning the ambiguity is high for any inventory setup because, the decision maker (DM) has no information how many people are accepting their items or how much will the demand rate be. As the time (it may be cycle time) progresses the DM will began to gather more information over the nature of expected demand through the run of inventory and learn whether it is below expected or over expected (usually mean below crisp or above crisp value). People will usually take much time (no matter what offers have been declared or how attractive the getup of the system or commodities are) to accept and adopt the process. According to public opinion, the shorter cycle time inventory treated as “less reliable’ because of the fact that the inventory practitioner (DM) is hesitating to run the process for a longer cycle time so as the customers to buy the items as well. As soon as the uncertain region (cloud) getting thinner (fuzziness near zero) to the DM’s mind the cycle time will be fix up and (s)he will be order the commodities accordingly.

Numerical Example

Let us consider \(k=\$ 300\) per cycle, \(c_{1}=\$ 1.5\) per unit, \(p=\$ 25\) per unit, \(c_{2}=\$ 5.\) per unit, \(D=500\) units for Crisp model; for fuzzy model let the demand rate \(\langle D_1, D_2, D_3 \rangle =\langle 450,500,600 \rangle \) units keeping the other parameters same as crisp and that for cloudy fuzzy model we assume \(\sigma =0.15\), \(\rho =0.13\). \(\epsilon =0.001\) for numerical illustration of the model. Therefore, from Eqs. (11), (17), and (21–22), we get the following results:

Note that, we need to calculate the mode of the fuzzy demand rate for the computation of fuzziness; and this can be calculated as follows: \(\hbox {Mean of}\; (450,500,600) =516.67, \hbox {Median}=500\), So, Mode \((m)=3\times \) Median - \(2\times \hbox {Mean} = 466.67\), \(U_{b}\) and \(L_{b}\) are the upper and lower bounds of the fuzzy demand components respectively, then apply degree of fuzziness \(d_{f}=\frac{U_{b}-L_{b}}{2m}\) .

Discussion on Numerical Results of Tables (1, 2, 3)

Table 1 shows in crisp environment, for the 7 days (approx) cycle time with 1.5 days shortage time the average optimum inventory cost assumes the value $13088.35, but the fuzzy solution becomes more costly keeping the total average value $13408.16 per cycle. Moreover, it is astonished that, whenever we are thinking of cloudy fuzzy environment the average inventory cost reduces to $10295.81 per cycle time by just increasing the length of the cycle time to 19.6 days alone. By this time, we also observe that, the degree of fuzziness has been reduced from 0.321 to 0.154.

Tables 2 and 3 shows, within the time span of cycle time 16–23 days, the crisp model as well as general fuzzy model giving the value of the average inventory cost such that they began to increase with cycle time duration but the objective function of the cloudy fuzzy model assumes a ‘U-shaped curve ’ at 20 days cycle time keeping the global minimum of the average inventory cost. Also our observation reveals that, at the cycle time below 16 days, the solution of the cloudy fuzzy model is infeasible.

In cloudy fuzzy model, the order quantity and shortage quantity becomes high with respect to the findings obtained in crisp as well as fuzzy environment. Although, if we consider the trend values of the order quantity and shortage quantity which they take we see that they are increasing in nature for all environments.

Sensitivity Analysis of the Cloudy Fuzzy Model

We consider a sensitivity analysis for the parametric changes from \(-50\,\; \hbox {to}\; +50{\,\%}\) of the parameters \(c_{1}\), \(c_{2}, d, k, p,\varepsilon \; \rho \;\hbox {and}\;\sigma \) respectively and this can be shown in Table 4.

Comments on Sensitivity Analysis

From the above Table 4 we see, the parameters d and p are highly sensitive, for the changes of demand rate at \(-30\) and \(-50{\,\%}\) the average inventory cost reduces to −43.08 and \(-57.73{\,\%}\) respectively. Moreover, the changes of unit purchasing price at \(+50{\,\%}\) the objective function giving no feasible solution, but at \(+30{\,\%}\) changes it assumes little more variation. Also, at \(-30\) and \(-50\) % changes of the unit purchasing price the objective value reduces to \(-42.45\) and \(-55.76{\,\%}\) respectively. Again, for any kind of variations (positive or negative) of the parameters \(c_{1}, c_{2}, k\) and \(\varepsilon \) we always have moderately reduced amount of average inventory cost and that reduction is being ranging from 15.01 to 24.97 %. In the case of fuzzy variability parameters \(\rho \) , for the changes of (\(+50, +30{\,\%}\)) and that of \(\sigma \) at the changes of (\(-30 , -50 {\,\%}\)) respectively the average inventory cost getting no feasible solution. For the other changes of (\(\rho , \sigma \)) , the inventory cost began to reduce moderately. Throughout the whole table we see, the inventory cost assumes maximum value (\(+14.61{\,\%}\)) whenever \(+50{\,\%}\) change is made for the demand rate and that gets minimum value at \(-50{\,\%}\) change of the same demand parameter exclusively. Furthermore, the amount of shortage quantity getting very near to one third of the order quantity. The order quantity reaches its maximum value for the \(-50{\,\%}\) change of the shortage cost parameter. The sensitivity table also explores that for any kind of changes the range of the shortage time is being limited to (1–9) days for maximum duration of cycle time 28 days approximately. The observations are more practicable and hence the model is realistic one.

Graphical Illustrations of the Model

We shall draw the graphs of the cloudy fuzzy model for better justifications of the newly introduced method.

Discussion on the Graphs (Figs. 4, 5, 6)

From the Fig. 4, we see that a large difference has been taken place in between the average inventory costs of the crisp as well as general fuzzy model with respect to the cloudy fuzzy model. Moreover, we have observed that, the general fuzzy model giving the highest value and the cloudy fuzzy model giving the lowest value of the objective function everywhere. Therefore, the solution under cloudy fuzzy environment is a better choice for the inventory practitioner especially for a decision maker (DM). Figure 5 shows a ‘U-tern’ of the cloudy fuzzy objective function occurs at 20 days cycle time and hence it is convex. However, Fig. 6 reveals that the backorder quantity curves for all the cases of the model meet at near 21 days cycle time giving the shortage quantity near 325 units of the model. The backorder curve of crisp and general fuzzy model is likely to be overlapped lines of smaller gradient but that for cloudy fuzzy model it is a straight line getting higher gradient values always.

Conclusion

In this paper we have discussed a backorder EOQ model under cloudy fuzzy environment. In the literature, all inventory models are studied by crisp, general fuzzy, intuitionistic fuzzy or fuzzy stochastic environment. But the concept of cloudy fuzzy is quite new in decision making problems. However we see, as the cycle time assumes larger values, the degree of fuzziness, the cloud index becomes lesser values. Lesser fuzziness does not mean lower inventory cost. Because, lesser fuzziness of the fuzzy parameters might gradually began to converge into a crisp number at its optimum. As the crisp minimization problem giving larger value and it is unrealistic in practice so incorporating parametric flexibilities we are intending to study the model under cloudy fuzzy environment. Thus if we enhance the cycle time more than its global optimum then the average inventory cost likely to be converge with the cost that obtained from the crisp model exclusively. So within a considerable fuzziness we are searching the model minimum which is the main focus of attention of the model. Thus for any DM it is quite easy to understand and to make a decision accordingly.

References

Allahviranloo, T., Saneifard, R.: Defuzzification method for ranking fuzzy numbers based on center of gravity. Iran. J. Fuzzy Syst. 9(6), 57–67 (2012)

Báez-Sáncheza, A.D., Morettib, A.C., Rojas-Medarc, M.A.: On polygonal fuzzy sets and numbers. Fuzzy Sets Syst. 209, 54–65 (2012)

Ban, A.I., Coroianu, L.: Existence, uniqueness and continuity of trapezoidal approximations of fuzzy numbers under a general condition. Fuzzy Sets Syst. 257, 3–22 (2014)

Bjork, K.-M.: An analytical solution to a fuzzy economic order quantity problem. Int. J. Approx. Reason. 50(3), 485–493 (2009)

Bellman, R.E., Zadeh, L.A.: Decision making in a fuzzy environment. Manag. Sci. 17, B141–B164 (1970)

De, S.K., Beg, I.: Triangular dense fuzzy sets and new defuzzification methods. J. Intell. Fuzzy Syst. 31, 469–477 (2016)

Das, P., De, S.K., Sana, S.S.: An EOQ model for time dependent backlogging over idle time: a step order fuzzy approach. Int. J. Appl. Comput. Math. 1(2), 1–17 (2014). doi:10.1007/s40819-014-0001-y

De, S.K., Beg, I.: Triangular dense fuzzy Neutrosophic sets. Neutrosophic Sets Syst. 13, 1–12 (2016)

De, S.K., Kundu, P.K., Goswami, A.: Economic ordering policy of deteriorated items with shortage and fuzzy cost co-efficients for vendor and buyer. Int. J. Fuzzy Syst. Rough Syst. 1(2), 69–76 (2008)

De, S.K., Kundu, P.K., Goswami, A.: An economic production quantity inventory model involving fuzzy demand rate and fuzzy deterioration rate. J. Appl. Math. Comput. 12(1), 251–260 (2003)

De, S.K.: EOQ model with natural idle time and wrongly measured demand rate. Int. J. Inventory Control Manag. 3(1–2), 329–354 (2013)

De, S.K., Sana, S.S.: Fuzzy order quantity inventory model with fuzzy shortage quantity and fuzzy promotional index. Econ. Model. 31, 351–358 (2013)

De, S.K., Sana, S.S.: An EOQ model with backlogging. Int. J. Manag. Sci. Eng. Manag. (2015). doi:10.1080/17509653.2014.995736

De, S.K., Sana, S.S.: The (p, q, r, l) model for stochastic demand under intuitionistic fuzzy aggregation with Bonferroni mean. J. Intell. Manuf. (2016). doi:10.1007/s10845-016-1213-2

De, S.K., Sana, S.S.: An alternative fuzzy EOQ model with backlogging for selling price and promotional effort sensitive demand. Int. J. Appl. Comput. Math. (2014). doi:10.1007/s40819-014-0010-x

Deng, H.: Comparing and ranking fuzzy numbers using ideal solutions. Appl. Math. Model. 38, 1638–1646 (2014)

Ezzati, R., Allahviranloo, T., Khezerloo, S., Khezerloo, M.: An approach for ranking of fuzzy numbers. Expert Syst. Appl. 39, 690–695 (2012)

Goetschel, R., Voxman, J.W.: Eigen fuzzy number sets. Fuzzy Sets Syst. 16, 75–85 (1985)

Hajjari, T., Abbasbandy, S.: A note on “The revised method of ranking LR fuzzy number based on deviation degree”. Expert Syst. Appl. 39, 13491–13492 (2011)

Hariga, M.A.: Optimal EOQ models for deteriorating items with time-varying demand. J. Oper. Res. Soc. 47(10), 1228–1246 (1996)

Harris, F.: Operations and Cost. Factory Management Series, Chicago (1915)

Kao, C., Hsu, W.K.: Lot size reorder point inventory model with fuzzy demands. Comput. Math. Appl. 43, 1291–1302 (2002)

Kauffman, A., Gupta, M.M.: Introduction to Fuzzy Arithmetic Theory and Applications. Van Nostrand Reinhold, New York (1992)

Kazemi, N., Shekarian, E., Cárdenas-Barrón, L.E., Olugu, E.U.: Incorporating human learning into a fuzzy EOQ inventory model with backorders. Comput. Ind. Eng. 87, 540–542 (2015)

Kazemi, N., Ehsani, E., Jaber, M.: An inventory models with backorders with fuzzy parameters and decision variables. Int. J. Approx. Reason. 51(8), 964–972 (2010)

Kazemi, N., Olugu, E.U., Salwa Hanim, A.-R., Ghazilla, R.A.B.R.: Development of a fuzzy economic order quantity model for imperfect quality items using the learning effect on fuzzy parameters. J. Intell. Fuzzy Syst. 28(5), 2377–2389 (2015)

Kazemi, N., Olugu, E.U., Salwa Hanim, A.-R., Ghazilla, R.A.B.R.: A fuzzy EOQ model with backorders and forgetting effect on fuzzy parameters: an emperical study. Comput. Ind. Eng. 96, 140–148 (2016)

Kumar, A., Singh, P., Kaur, P., Kaur, A.: A new approach for ranking of L-R type generalized fuzzy numbers. Expert Syst. Appl. 38, 10906–10910 (2011)

Kumar, R.S., De, S.K., Goswami, A.: Fuzzy EOQ models with ramp type demand rate, partial backlogging and time dependent deterioration rate. Int. J. Math. Oper. Res. 4, 473–502 (2012)

Mahata, G., Goswami, A., Gupta, D.K.: A joint economic-lot-size model for purchaser and vendor in fuzzy sense. Comput. Math. Appl. 50, 1767–1790 (2005)

Mahata, G., Goswami, A.: An EOQ model for deteriorating items under trade credit financing in the fuzzy sense. Prod. Plann. Control 18, 681–692 (2007)

Mahata, G.C., Mahata, P.: Analysis of a fuzzy economic order quantity model for deteriorating items under retailer partial trade credit financing in a supply chain. Math. Comput. Model. 53, 1621–1636 (2011)

Mahata, G.C., Goswami, A.: Fuzzy inventory models for items with imperfect quality and shortage backordering under crisp and fuzzy decision variables. Comput. Ind. Eng. 64, 190–199 (2013)

Mahata, G.C.: A production-inventory model with imperfect production process and partial backlogging under learning considerations in fuzzy random environments. J. Intell. Manuf. (2015). doi:10.1007/s10845-014-1024-2

Milenkovic, M., Bojovic, N.: Fuzzy modelling approach to the rail freight car inventoryproblem. Transp. Plann. Technol. 37(2), 119–137 (2014)

Wang, Z.X., Liu, Y.J., Fan, Z.P., Feng, B.: Ranking L-R fuzzy number based on deviation degree. Inf. Sci. 179, 2070–2077 (2009)

Wright, I.P.: Factors affecting the cost of airplanes. J. Aeronaut. Sci. 3, 122–128 (1936)

Xu, P., Su, X., Wu, J., Sun, X., Zhang, Y., Deng, Y.: A note on ranking generalized fuzzy numbers. Expert Syst. Appl. 39, 6454–6457 (2012)

Yager, R.R.: A procedure for ordering fuzzy subsets of the unit interval. Inf. Sci. 24, 143–161 (1981)

Yu, V.F., Chi, H.T.X., Dat, L.Q., Phuc, P.N.K., Shen, C.W.: Ranking generalized fuzzy numbers in fuzzy decision making based on the left and right transfer coefficients and areas. Appl. Math. Model. 37, 8106–8117 (2013)

Zadeh, L.A.: Fuzzy sets. Inf. Control 8, 338–356 (1965)

Zhang, F., Ignatius, J., Lim, C.P., Zhao, Y.: A new method for ranking fuzzy numbers and its application to group decision making. Appl. Math. Model. 38, 1563–1582 (2014)

Acknowledgments

The authors are thankful to the reverend editor, reverend associate editor and potential reviewers for their valuable comments and suggestions to improve the presentation of this article.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Wright [37]: Let \(Y_{i}\) be the learning performance at the time of i-th shipment, \(Y_{1}\) is the performance at the beginning of the planning period, i -is the number of shipments and \(\beta \) is the learning exponent with \(\beta =-log\;(\delta )/log \; 2\) , \(\delta \) being the learning rate taking values within 50–100 % then the learning performance can be stated as \(Y_{i}=Y_{1}i^{-\beta }\).

Rights and permissions

About this article

Cite this article

De, S.K., Mahata, G.C. Decision of a Fuzzy Inventory with Fuzzy Backorder Model Under Cloudy Fuzzy Demand Rate. Int. J. Appl. Comput. Math 3, 2593–2609 (2017). https://doi.org/10.1007/s40819-016-0258-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40819-016-0258-4