Abstract

We provide new evidence on the long-term impact of divorce on work disability among U.S. men. Using data from the 2004 Survey of Income and Program Participation linked to U.S. Social Security Administration records, we assess the relationship between divorce and subsequent self-reports of work limitations and the receipt of federal disability benefits. The examination of self-reports and administrative records of medically qualified benefits provides dual confirmation of key relationships. We compare men who experienced a marital dissolution between 1975 and 1984 with continuously married men for 20 years following divorce using fixed-effects and propensity score matching models, and choose a sample to help control for selection into divorce. On average, we find that divorce is not associated with an increased probability of self-reported work limitations or receipt of disability benefits over the long run. However, among those who do not remarry, we do find that divorce increases men’s long-term probability of both self-reported work limitations and federal disability benefit receipt. Lack of marital resources may drive this relationship. Alternative estimates that do not control for selection into divorce demonstrate that selection bias can substantially alter findings regarding the relationship between marital status changes and subsequent health.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

This article examines the long-term relationship between divorce and subsequent work-limiting health among men using both self-reports and matched administrative records of receipt of disability benefits for the same individuals. This dual examination allows us to confirm findings based on self-reports with administrative records of medically qualified benefit receipt. Additionally, the analysis is based on a research design intended to begin disentangling the impacts of selection into divorce by the less healthy from impacts on health caused by marital dissolution. The study’s findings speak to the importance of a commonly occurring life course transition, divorce (and remarriage), on both health problems and receipt of social insurance benefits.

There are good reasons to investigate the relationship between divorce and work disability. Interest in work disability is fueled by population aging (Elo et al. 2011) and the detrimental effects of work-limiting health for individual well-being. Disability is a driver of health care expenditures (Fried et al. 2002) and national social insurance program costs (Autor and Duggan 2006). In the United States, Social Security disability rolls have grown rapidly since the early 1980s, from 2.2 % of individuals aged 25–64 in 1985 to 4.1 % in 2005 (Autor and Duggan 2006). In 2013, 4.8 % of the population aged 18–64 received Social Security Disability Insurance (SSDI) benefits (Social Security Administration 2014: table 8).

Divorce, in turn, is a common demographic transition that may affect health (Amato 2010). From a social causation perspective, divorce may increase health risks by severing resources of marriage (Hughes and Waite 2009) or raising stress (Amato 2000; Williams and Umberson 2004). Consistent with this view, studies have documented a positive association between divorce and functional limitations (Hughes and Waite 2009; Liu and Zhang 2013; Pienta et al. 2000), chronic illnesses (Molloy et al. 2009), self-assessed health (Williams and Umberson 2004), and mortality (Dupre et al. 2009; Hu and Goldman 1990; Lillard and Waite 1995; Rendall et al. 2011; Shor et al. 2012).

However, attributing health problems to divorce per se is difficult. Social selection arguments (Goldman 1993; Wood et al. 2007) have posited causal links between poor health and divorce. Consistent with this view, studies have shown increased divorce risks among men experiencing a work limitation (Singleton 2012; Teachman 2010). Most prior studies have not provided direct evidence on the relative roles of selection versus the impact of divorce on subsequent health.

In this study, we evaluate the long-term impact of divorce on work disability using a nationally representative data set linking respondents in the 2004 Survey of Income and Program Participation (SIPP) with Social Security Administration (SSA) longitudinal administrative records. SIPP topical modules provide self-reported marital and work disability histories. Linked administrative data provide earnings and disability benefit receipt from 1975–2004 through the SSDI and Supplemental Security Income (SSI) programs. We focus on men because they are more likely than women to be qualified for federal disability benefits, as discussed later in the article.

The study makes several contributions to the literature on marital disruption and health. The linked SIPP-SSA data allow us to examine a cohort of American men who experienced a divorce (between 1975 and 1984) and their self-reports of work limitations and administrative records of receipt of disability benefits for 20 years. This unusually long time frame allows for work disabilities to present themselves. The data also allow for confirmation of key findings based on both self-reports and medically screened benefits. Further, few studies on marital disruption and health have examined work disability as an outcome, and no study to our knowledge has examined the life-course sequencing of divorce and receipt of federal disability benefits or how patterns vary over time conditional on remarriage.

The study also takes steps to account for selection issues. This includes examining a sample of all married persons, removing those who received disability benefits or reported the onset of their work-limiting condition prior to the marital dissolution, and using individual fixed-effects models to remove selection bias due to time-invariant factors. To illustrate the importance of these choices, we present alternative estimates without the fixed effects and sample screens. We further assess robustness by including several measures of earnings in the models and by providing propensity score matching estimates.

A Life Course Perspective on Disability

A life course perspective is a useful starting point for linking later-life health disparities to earlier experiences (Ben-Shlomo and Kuh 2002; Corna 2013). A central life-course tenet is that life transitions and their timing shape individual trajectories (Elder and Giele 2009; Elder et al. 2003). From this viewpoint, divorce can be seen as a transition that potentially shapes the economic, social, and health trajectories of individuals.

Cumulative advantage/disadvantage (CAD) is an important concept for understanding how divorce may influence long-term work disability risks. CAD theory posits that the accumulation of (dis)advantages associated with life events can have important impacts on health (Dannefer 2003; Dupre 2007; O’Rand 1996; Willson et al. 2007). If divorce results in cumulative health disadvantages, work disability risks should vary by marital biography and widen with age and longer exposure to singlehood. By contrast, the “age-as-leveler” (AAL) perspective (House et al. 1994) suggests that disparities in work disability by marital biography may attenuate as people age, in part because of mortality selection.

Disability can also be seen as a life course process (Heller and Harris 2012) given the relationship between age and health decline (Liu 2012). Age-related increases in work disability are well documented. Men are more than twice as likely to receive SSDI benefits at ages 55–64 (10.9 %) than at ages 40–54 (4.3 %) (Autor and Duggan 2006: table 3). Beneficiaries ages 60–64 make up the largest share of federal disability benefit recipients (Social Security Administration 2014: table 4).Footnote 1

Pathways Linking Divorce and Work Disability: Social Causation or Selection?

Previous research has tended to find a higher prevalence of functional and mobility limitations among older divorced adults relative to older married adults.Footnote 2 In a study of the effects of marital biography on health using the Health and Retirement Study (HRS), Hughes and Waite (2009) reported a positive association between divorce and mobility limitations among persons ages 51–62. Using the National Health Interview Survey (NHIS), Liu and Zhang (2013) found a positive link between divorce and disability, as measured by activities of daily living (ADLs) or instrumental activities of daily living (IADLs), among men at advanced older ages (see also Grundy and Holt (2000) and Pienta et al. (2000)). Albeit useful, the prior literature has not focused on work disability. Moreover, few empirical efforts have been made to establish the life course sequencing of divorce and disability. Typically, selection is mentioned as an additional analytical concern.

Longitudinal analysis can help establish the temporal ordering of changes in marital and work disability status. However, the few longitudinal studies have been primarily conducted in Scandinavian countries, have generated mixed findings, and are limited by short follow-up periods. Eriksen et al. (1999) reported a positive relationship between marital dissolution and work disability in Norway over a four-year follow-up period. Blekesaune and Barrett (2005) found more limited evidence over a five-year period. A more complete understanding of divorce and work disability may require a longer time frame given that conditions responsible for work-limiting health may take years to manifest.

Conceptually, links between divorce and work disability among men can be understood from social causation and selection perspectives. Arguments rooted in a social causation approach—resource and strain models—posit that divorce can have meaningful impacts on health. The marriage resource model (Waite 1995; Waite and Gallagher 2000) emphasizes the protective (economic and social psychological) effects of marriage. For example, research has shown that divorce may result in reductions in not only women’s economic status but also men’s (McManus and DiPrete 2001). There is, in turn, a strong positive connection between income and health (Alwin and Wray 2005; Marmot 2002; O’Rand and Hamil-Luker 2005; Subramanyam et al. 2009).

Another protective channel is social control and monitoring, with wives attempting to mitigate risky behaviors of their partners and to care for them when ill (Umberson 1992; Williams 2004). Indeed, evidence shows that unmarried persons, particularly men, are more likely to engage in unhealthy behaviors (Duncan et al. 2006; Green et al. 2012; Molloy et al. 2009). These behavioral factors, in turn, elevate the risks of chronic illness, such as diabetes and disability (Cawley and Ruhm 2012; Umberson and Montez 2010). Marriage may also protect health by providing social and psychological resources (Amato 2010; Cohen 2004; Taylor et al. 1997).

The strain model emphasizes the stress of divorce (Amato 2000) and its association with worse self-reported physical (Liu 2012; Williams and Umberson 2004) and mental health (Blekesaune 2008; Booth and Amato 1991; Wade and Pevalin 2004). This perspective often emphasizes shorter-term health consequences of divorce; however, if divorce triggers chronic strain, it may have longer-term consequences (Johnson and Wu 2002; Lorenz et al. 2006).

A complication is that divorce may have health benefits for some. Marriage can be a source of stress (Amato and Hohmann-Marriott 2007; Blekesaune 2008). In such cases, divorce can enhance health and subjective well-being (Gardner and Oswald 2006). Recent analysis of U.S. panel data has shown negative links between divorce and body weight among men, for example (Teachman 2013).

Another complication is remarriage, which may reintroduce the health-enhancing resources of marriage. Remarriage may increase men’s economic resources and reestablish household specialization. It may also restore spousal monitoring of health behaviors (Bachman et al. 1997; Umberson and Montez 2010). Evidence is mixed regarding whether the marital resource argument can be applied to remarriage (Carr and Springer 2010). Hughes and Waite (2009) provided cross-sectional evidence of better health among individuals in later life who remarried relative to divorced individuals remaining unmarried. Johnson and Wu (2002) found improved stress levels of divorced persons upon marital reentry. Blekesaune and Barrett (2005), however, found no differences in receipt of health-related benefits between men who remarried (within three years) and those who did not.

Concerns about sample selection temper conclusions about divorce being causal in driving health. The primary argument is that worse health outcomes among the divorced reflect elevated divorce risks among individuals with worse health (Blekesaune and Barrett 2005; Goldman 1993; Joung et al. 1998; Karraker and Latham 2015; Murray 2000; Wade and Pevalin 2004). Reinforcing this point, Teachman (2010) found that work-limiting health, particularly among men, increases divorce risks. Other studies report correlations between poor health habits and divorce (Collins et al. 2007), and separately, between risky health behaviors and chronic conditions (Cawley and Ruhm 2012). The relationship between remarriage and health similarly could be influenced by selectivity.

Both social causation and selection likely help explain health differences by marital status, but most prior studies have not explicitly tried to disentangle the relative contributions of each. Here, we examine whether divorce increases men’s long-term probability of reporting a work-limiting condition or receiving federal disability benefits net of selection. Because a work disability may take many years to develop, we use data that allow us to examine impacts long after the initial divorce. We expect that remarriage will moderate the association between divorce and disability. Divorced men who do not remarry and therefore lack marital resources are expected to exhibit the greatest increased probability of a work disability later in life. We also provide alternative estimates in which we do not control for selection to demonstrate how choices in research design influence our findings.

Measurement of Work Limitations and Disability Benefit Receipt

Burkhauser et al. (2013) documented the history of measurement of work-activity limitations and disability. They conceptualized, consistent with the schema in the International Classification of Functioning, Disability and Health developed by the World Health Organization (WHO), that functional limitations related to work are a subset of all health problems. Those who receive federal disability benefits are a subset of those with work limitations, presumably those with the most severe problems conditional on their social circumstances and physical surroundings (Reville et al. 2001).

To capture individuals with some work-limiting condition, we use the SIPP Work Disability History topical module, which asks respondents about health problems that limit the type or amount of work they can do and the year the conditions began. To identify those with the most severe work disabilities, we use linked SSA administrative data on disability benefit receipt through the SSDI and SSI programs. These two national programs provide income support for working-age persons unable to work because of severe impairment. Both programs use the same medical and administrative process for disability determination: a person is unable to undertake substantial gainful activity (SGA) because of a medically determined physical or mental condition expected to last at least 12 months or to result in death (Social Security Administration 2014).Footnote 3 Individuals can qualify for both programs.

An advantage of using administrative records of disability benefit receipt contingent on external medical criteria as a measure of health is that self-evaluative survey measures might measure the severity of health impairment inconsistently or inaccurately. Self-reported work limitation measures may also reflect justification bias: that is, a tendency of non-employed persons to overstate work limitations to rationalize not working (Bound 1991; Kapteyn et al. 2011). Other studies examining self-reports of work limitations and disability benefit receipt have suggested the use of multiple measurements of disability to demonstrate robustness (Benítez-Silva et al. 2004).

A complication of using disability benefit receipt as a proxy for poor health relates to the program’s nonhealth eligibility criteria. For the SSDI program, entitlement requires having sufficient length and recency of work. For SSI, a means-tested program, entitlement is contingent on income and resource levels (Rupp and Riley 2011; Rupp et al. 2008).

Although the vast majority of men meet the work eligibility criteria for either the SSDI or SSI programs, coverage is not universal (Rupp et al. 2008: table 1). More than 80 % of working-age men have SSDI-eligible work histories (Mitchell and Phillips 2001). Among those who are not SSDI-eligible, slightly more than one-half are eligible for SSI. In combination, around 90 % of working-age men are covered by one or both of the disability programs (Rupp et al. 2008). In contrast, women have lower eligibility because of intermittent work histories. Mitchell and Phillips (2001) reported SSDI-eligibility rates of around 60 % for married women and 70 % for unmarried women in their 50s. Although a woman’s resources alone might leave her eligible for SSI disability benefits, their combination with other household sources may be too high to qualify, particularly when she is married. The evidence of lower program eligibility among women and differential eligibility by marital status lead us to focus on men in this analysis.

Another issue is medical/vocational guidelines for disability determination. To determine the applicant’s ability to adjust to other types of work, vocational factors are considered—age, past work, education, and “residual functional capacity.”Footnote 4 The guidelines are based on the view that the ability to adapt to other types of work declines as individuals age. Because these vocational guidelines could affect life course patterns of disability benefit receipt (Chen and van der Klaauw 2008), we introduce controls (splines with nodes at 50 and 55 years) to account for age as a factor in disability determination.

Methods

Data

Data come from the 2004 panel of the SIPP matched to SSA administrative records. The SIPP is a national panel study of the U.S. population administered by the U.S. Census Bureau. The survey fields a core questionnaire every four months (waves) for 2.5 or more years, depending on the panel. Topical modules are administered at particular waves. This study focuses on modules from Wave 2, which provide retrospective marital, work disability, and educational histories.

We use linked data for SIPP respondents and their Social Security records.Footnote 5 Longitudinal information on disability benefits comes from the Master Beneficiary Record (MBR) for the SSDI program and the Supplemental Security Record (SSR) for the SSI program. The Summary Earnings Record (SER) provides respondents’ annual Social Security–covered earnings. These administrative files have been used in numerous studies (Couch et al. 2013; Rendall et al. 2011; Rupp and Davies 2004; von Wachter et al. 2011).

Linked SIPP-SSA data have several advantages. Most prominently, the administrative data provide repeated measurements (monthly) of respondents’ receipt of disability benefits over the study period (1975–2004). Combining these data with SIPP retrospective data, we can follow the work disability trajectory of the same individual before and after marital dissolution for as long as 20 years after the event, taking into account age, educational level, and subsequent marital transitions. The data also allow us to contrast results from self-reports with those based on disability benefit receipt and to examine how well self-reported work limits help explain receipt of benefits.

One possible drawback is unsuccessful matching of SIPP respondents with the administrative data, but our match rate is high at around 80 % (McNabb et al. 2009), and the overall match bias is small (Czajka et al. 2008; Davis and Mazumder 2011).Footnote 6 Nonetheless, all analyses presented here use a modified weight to correct for possible bias.Footnote 7 Also, our estimates should be seen as conservative given that disability has a predictive association with mortality (Rendall et al. 2011) and that respondents had to survive until 2004 to be included in our sample.

Sample

We start assembling our sample by dating men’s lifetime marital transitions using the SIPP Marital History module. To allow for a long follow-up, we selected men in their first marriage in 1974. These men, in turn, faced the risk of marital dissolution over a 10-year window between 1975 and 1984. Respondents who reported separation (ending in divorce) in this window make up our divorced sample. Those who remained continuously married during the entire observation period constitute the comparison group. Men in the divorced group were also at risk of remarriage and widowhood over the 20-year follow-up. Those who experienced widowhood are excluded. We do not examine whether subsequent remarriages dissolved because this would not allow a long-term perspective consistent with our study design.

We confine the sample to men aged 18–38 in 1975, the first year of the at-risk divorce window. Thus, by 2004, the youngest individuals in our sample were age 47 (born in 1957) and the oldest were age 67 (born in 1937). This age range allows us to consistently use the SIPP work disability histories, which were collected for respondents aged 67 or younger. It also helps moderate mortality selection.

To align the continuously married comparison group with the divorced sample, we randomly select a year from 1975 through 1984 to use as their starting year. The distribution of the assignment reflects the probability of divorce in each year. For instance, because 13 % of our divorced sample separated in 1975, we randomly assign 13 % of the continuously married a starting year of 1975.

To address the concern that a health problem could precede divorce, we apply two sample screens. First, we use SIPP retrospective data to exclude individuals who reported that their work limitation began during or prior to the year of marital dissolution (or the assigned starting year for the married). Second, we exclude individuals who received a federal disability benefit during or prior to the year of marital dissolution (or the assigned starting year for the married). These conditions result in the removal of 34 divorced men (3.7 % of the sample) and 59 continuously married men (2.1 % of the sample). The final sample consists of 926 divorced and 2,810 continuously married men who contribute to 92,125 unweighted person-year observations in the interval 1975–2004.

Main Estimation Strategy

Our main estimation method is a linear probability model with individual fixed effects. This approach has been used in the literatures examining the impact of divorce—and, similarly, the impact of job loss—on health insurance (Gruber and Madrian 1997; Lavelle and Smock 2012; Peters et al. 2014). Fixed effects control for person-specific time-invariant unobserved heterogeneity (Halaby 2004), which, if not addressed, may lead to spurious correlations between divorce and work disability.

The model can be written as follows:

where Y it is a (0, 1) indicator of whether a person i is receiving disability (SSDI or SSI) benefits in year t (or reported that their work-limiting health condition began by year t). X it contains regressors related to the outcome for individual i at time t. β is a set of parameters capturing the impact of the observable characteristics, X, on the outcome Y. k indexes time relative to the separation, where 0 is the year of the separation and positive values follow afterward. The variables d k it are a set of (0, 1) indicators of whether a particular observation occurs k periods after the separation. The key parameters in the equation, γ k , measure the difference in the probability of receiving disability benefits between divorced and continuously married individuals. When the outcome is self-reported work limitation, these parameters capture the difference in the cumulative probability of work-limiting health between divorced and continuously married individuals. φ i is the individual fixed effect. ε it is a random error term across i and t.

We provide separate estimates for three sets of divorced men relative to continuously married men: (1) all divorced, (2) divorced who do not remarry, and (3) divorced who do remarry. We restrict age in each year to be younger than 65 because individuals cannot claim SSDI benefits when they reach full retirement age (Social Security Administration 2014). The fixed-effects models use the STATA command areg, and our standard errors adjust for clustering across individuals. The cluster option corrects for correlated errors within persons and is robust to heteroskedasticity (Stock and Watson 2008). All estimates are weighted using SIPP weights adjusted for nonmatches. Results are similar using unadjusted weights.

Measures

Dependent Variables

We examine two dependent variables: self-reported work disability in the SIPP, and receipt of disability benefits in the administrative records. The SIPP asks respondents, Does some “health or condition limit the type or amount of work . . . [you] can do?” or “prevent . . . [you] from working at a job or business?” If affirmative, the SIPP asks the year when this condition began. Using this information, we construct a binary variable indicating whether the health condition that limits or prevents work began by the person-year being observed (1 = yes; 0 = no). Men who do not report a work limitation in 2004 or who report that their condition began after the twentieth follow-up year have a value of 0 in each person-year, as would respondents who recovered from a work limitation spell by 2004.

Using the administrative records, we construct a binary variable indicating whether the respondent received a SSDI-SSI disability benefit in the person-year being observed (1 = yes; 0 = no). The repeated measurement of this variable allows for the possibility of moving from receiving benefits to not receiving them, although this is not common.

Independent Variables

The main independent variables capture the timing of marital dissolution. Specifically, dichotomous variables, d k it , measure the timing of each year relative to the initial separation for the 20 follow-up years. We refer to the parameter γ0 as Post0 (k = 0), to γ10 as Post10 (k = 10), and so on. Each estimated parameter measures the difference in the probability of disability benefit receipt (or cumulative probability of work limitation) between the divorced and continuously married, net of controls and individual fixed effects. This longitudinal framework is similar to studies of other discrete life course events (Gruber and Madrian 1997; Lavelle and Smock 2012).Footnote 8

Time-varying controls include age, additional educational attainment, and the calendar year. We use continuous piecewise age splines because of the nonlinear association between age and work disability. The spline has two nodes, at 50 and 55 years, and thus three slopes (18–49, 50–55, and 56–65). These points are consistent with age-disability profiles and changes in age as a factor in disability determination. Dichotomous variables indicate the attainment of a bachelor’s or advanced degree over the follow-up period—information derived from the SIPP Education History module. The models also include dichotomous variables for year (1975–2004).

Additionally, we use the indicator of self-reported work limitations as a control variable in one of the models to gauge the extent to which disability benefit receipt is explained by work-limiting health. As described later, supplementary models also use respondents’ earnings.

Robustness Checks

To clarify the importance of the choices we made in our research design to control for selection, we present additional estimates without screening for prior work limitations or disability benefit receipt and without using fixed effects. We also check the robustness of our results to the inclusion of Social Security–covered earnings as a control variable. Because earnings can be affected by health limitations, we use a one-year lagged value. We also construct alternative measures of earnings by averaging the respondents’ annual Social Security–covered earnings over 5- and 10-year intervals preceding the current year of data. Conceptually, this averaging allows for the spreading of resources over time (e.g., through savings) and further reduces the simultaneous endogeneity between earnings and health.Footnote 9

As a final robustness check, we provide propensity score matching estimates using nearest-neighbor and kernel density methods. Propensity score matching models remove bias based on observable characteristics prior to the event being studied; in this case, by equating the distributions of observable characteristics across the divorced and married groups. We estimate models for self-reported work limitations and disability benefit receipt at 10, 15, and 20 years after marital dissolution (the year of separation) using the pscore procedure in STATA (Becker and Ichino 2002). We use similar controls to the fixed-effects models, but all covariates here are measured one year prior to the at-risk divorce window: age, age squared, race/ethnicity, foreign-born, earnings, and educational attainment, all as of 1974. Using earnings prior to onset provides another view of the role of economic resources in determination of subsequent health limits. The means of these characteristics can be found in Online Resource 2, Table S2.5. We tested balancing properties and applied the common support condition. Means of covariates between the divorced and married groups are not significantly different after matching.

Main Results

Table 1 presents weighted sample characteristics at baseline (1974), one year prior to the at-risk divorce window, by marital group. The average age was 27 for the divorced and 29 for the continuously married. The majority of men who divorced remarried over their 20-year follow-up (85 %). Men who divorced were more likely to be high school graduates and less likely to hold an advanced degree than the continuously married (p < .05). We observe similar proportions of white non-Hispanics across groups, but higher proportions of blacks and lower proportions of Hispanics/other in the divorced group than the continuously married (p < .05). Average earnings were somewhat lower among men who divorced than the continuously married (p < .05). These differences underscore the usefulness of using a fixed-effects estimator, which removes constant person-level heterogeneity (e.g., race/ethnicity) while allowing time-varying covariates (e.g., additional educational attainment) to enter the model.

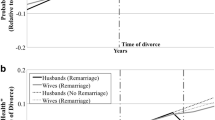

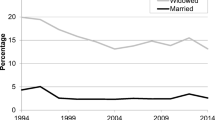

Figure 1 plots the cumulative prevalence of self-reported work limitations over the 20-year follow-up relative to the timing of marital dissolution across the marital groups. Visually, the likelihood of the onset of a work limitation rises over the retrospective period for all groups but does not exceed 4 % until at least 10 years after the dissolution. Twenty years after the marital dissolution, the cumulative prevalence is higher for all groups with small but statistically insignificant differences between all divorced and the continuously married. Among continuously divorced men, however, the cumulative prevalence of a work limitation is substantially (and statistically) higher than the other groups: estimates range from about 20 % for continuously divorced men to 12 % for all divorced, 9.5 % for the divorced and remarried, and 10 % for the continuously married. The greatest difference is between continuously divorced and married men (9.5 percentage points), which is statistically different at the .01 level (t test).

Figure 2 plots the longitudinal patterns of federal disability benefit (SSDI-SSI) receipt across the marital groups. The percentage receiving benefits rises over time, but the prevalence is attenuated relative to self-reported work limits, as might be expected. The proportion receiving benefits does not exceed 4 % for any group prior to the 13th year. From that point onward, the prevalence rises. Twenty years after marital dissolution, the percentages receiving federal disability benefits range from 16 % for the continuously divorced to 6.5 % for all divorced men, 5.0 % for the divorced and remarried, and 6.0 % for the continuously married. Again, the largest difference (10 percentage points) lies between the continuously divorced and married (p < .01).

Fixed-Effects Estimates of Work Limits and Disability Benefit Receipt

The descriptive patterns do not account for covariates that might influence these outcomes. Figure 3 displays the results from the fixed-effects linear probability model regressing self-reported work limitations on time-varying controls for age splines, additional education, and calendar year. The figure plots the parameters γ k from Eq. (1) and reflects the differences in the cumulative probabilities for divorced and continuously married men in each year. Separate models were fitted for divorced men by remarriage (all divorced, divorced–remarried, and divorced–not remarried). Detailed results are available in Online Resource 1 (Table S1.1).

Fixed-effects models of cumulative probability of onset of self-reported work limitation for men with marital dissolution (1975–1984), by remarriage status. The baseline group is continuously married men. Models control for additional educational attainment, age (spline), and calendar year. Standard errors are robust and clustered by individual. Data use SIPP person weights adjusted for nonmatches. Coefficients are found in Online Resource 1, Table S1.1

The differential cumulative probability of a work limitation rises slightly for all divorced and for the subgroup who remarried late in the follow-up period, relative to the continuously married, although only one parameter (at 18 years for all divorced) is statistically significant at the .05 level. However, for divorced men who do not remarry, we observe a strong, positive, and statistically significant (p < .05) association from the 16th through 20th follow-up years. In the final year (Post20), the cumulative probability is 8.5 percentage points higher than for the continuously married. Similar models (not shown) directly comparing divorced men who do and do not remarry also reveal significant differences (at the .05 and .10 levels) by remarriage from Post16 through Post20.

Figure 4 plots the long-term effect of divorce on SSDI-SSI disability benefit receipt. As in Fig. 3, the point estimates reflect the parameters γ k from Eq. (1) and capture, in this case, differences in the probability of receiving a disability benefit between the divorced and the continuously married in each year. Separate models were fitted by remarriage. Full results are shown in Online Resource 1 (Table S1.2).

Fixed-effects models of probability of receipt of SSDI–SSI benefits for men with marital dissolution (1975–1984), by remarriage status. The baseline group is continuously married men. Models control for additional educational attainment, age (spline), and calendar year. Standard errors are robust and clustered by individual. Data use SIPP person weights adjusted for nonmatches. Coefficients are found in Online Resource 1, Table S1.2

The probability of receiving disability benefits does not appear to differ between all divorced and the continuously married until near the end of the follow-up, and even then the estimates are not significantly different than 0. However, this dynamic differs sharply by remarriage. For divorced men who remarry, we find no meaningful association between divorce and disability benefit receipt. In contrast, for the continuously divorced, the probability of disability benefit receipt starts to climb appreciably about 15 years after the marital dissolution. By the 20th year, the probability is 10 percentage points higher for continuously divorced men relative to the continuously married, net of controls. These effects are statistically significant (p < .05) from Post18 to Post20. Similar models (not shown) also show a significantly higher probability of disability benefit receipt among continuously divorced men relative to those who remarried, from Post18 through Post20 (p < .05).

In sum, the basic patterns of disability benefit receipt across groups (Fig. 4) are similar to those of self-reported work limitations (Fig. 3). In both cases, divorced men who do not remarry had increased work disability risks of similar magnitude relative to the continuously married toward the end of the follow-up period.

Figure 5 contains estimates similar to Fig. 4 but adds the self-reported work limit as a control variable. To recall, receipt of SSDI-SSI benefits may reflect both underlying health conditions as well as the social and physical environments. Thus, controlling for a work-limiting condition would allow us to see how much of the increase in receipt of SSDI-SSI benefits can be accounted for by this factor. Detailed estimates are contained in Online Resource 1 (Table S1.3).

Fixed-effects models of probability of receipt of SSDI–SSI benefits for men with marital dissolution (1975–1984), controlling for self-reported work limitation, by remarriage status. The baseline group is continuously married men. Models control for self-reported work limitation, additional educational attainment, age (spline), and calendar year. Standard errors are robust and clustered by individual. Data use SIPP person weights adjusted for nonmatches. Coefficients are found in Online Resource 1, Table S1.3

Figure 5 appears only slightly different from Fig. 4. Benefit receipt among all divorced men and the remarried subgroup is never statistically different than for the continuously married. For the subgroup of continuously divorced men, the probability of receiving disability benefits rises sharply late in the follow-up period so that by the twentieth year, the probability is 6.9 percentage points higher than for the continuously married. The estimates for Post19 and Post20 are statistically significant (p < .05). Thus, controlling for self-reported work limitations dampens, but does not eliminate, the finding that continuously divorced men are more likely to receive working-age disability benefits. This suggests that deficits in the social or physical environment contribute to the likelihood of receipt of disability benefits conditional on self-reported health.

That said, the results conditioned on remarriage should be treated with caution in terms of causal inference because our primary efforts to control for selection were made at the point of divorce, not remarriage. This analysis does not directly disentangle whether the elevated prevalence of work disability 20 years following a divorce among men who do not remarry is driven by a process whereby less-healthy divorced men are less attractive as marital partners, or alternatively, continuously divorced men experience a poor evolution of their health because of time spent outside marriage. We note that the probability of work disability using either measure becomes meaningfully different across groups only late in the follow-up period, well after the normal timing of remarriage. This suggests that time out of marriage is important in driving cross-group differences. Moreover, we also find strong, significant differences between men who do and do not remarry 20 years following the dissolution of the first marriage, net of the individual fixed effects.

Robustness

Research Design

In the results presented, we made two adjustments to control for selection into divorce. One was to remove those who reported work limits or received disability benefits prior to marital dissolution. The other was to control for individual heterogeneity through fixed effects. To clarify the impact of these choices, we present additional estimates of the effect of divorce on federal disability benefit receipt (1) without screening for prior work disability, (2) screening for prior work disability but omitting the fixed effects, and (3) omitting both the screen for prior work disability and the fixed effects. The results, contained in Table 2, report the parameters Post10 through Post20 because none of the estimates before that period were statistically significant in our main models. We estimated similar models where the dependent variable was self-reported work limitations (i.e., Fig. 3) and disability benefit receipt controlling for work limitation (i.e., Fig. 5). To conserve space, these estimates are presented in Online Resource 2, Tables S2.1 and S2.2.

Compared with Fig. 4, Table 2 shows that for all divorced men (column 1), with the screens for prior work disability removed along with the fixed effects (panel C), we now find a statistically significant relationship at Post18, Post19, and Post20. Even if one thought that the original lack of statistical significance was due to sample size, the implied bias of the parameter estimates presented here is about 50 % relative to the estimates in Fig. 4 (see Online Resource 1, Table S1.2).

For the continuously divorced (column 2), when both the work disability filters and the fixed effects are removed (panel C), coefficients for Post13 through Post20 become statistically significant (p < .05). Considering only Post18 through Post20 in the estimates underlying Fig. 4, the implied bias ranges from 24 % to 53 %. Finally, dropping either the screens or the fixed effects did not substantially alter the relationship between divorce and disability benefit receipt among men who remarried (column 3).

In sum, not controlling for selection of the types examined here can lead to findings of statistically significant patterns that likely are not attributable to the events being studied. It also results in a sizable upward bias in the strength and timing of associations because of the misattribution of selection bias to impacts of divorce.

Alternative Measures of Earnings

Respondents’ longitudinal Social Security–covered earnings are available from the matched administrative records. Whether earnings should be included as a proxy of available resources is unclear, largely due to endogeneity between earnings and work disability. One possibility to mitigate this endogeneity is to lag earnings by a year and construct measures of long-term earnings to capture access to resources that might be used to smooth consumption in the event of a health problem. However, individuals’ earnings levels, at best, are an inaccurate proxy for access to resources.Footnote 10 The data do not allow for construction of household measures.

Nonetheless, to provide some sense of the influence of resource levels, we provide a series of fixed-effects estimates that (1) exclude earnings, as was the case for Figs. 3–5; (2) include lagged annual earnings; and (3) include a lagged average of long-term earnings over 5- and 10-year rolling intervals up through each person-year. Table 3 presents models in which the dependent variable was disability benefit receipt. To conserve space, we present estimates only for Post15–Post20. Similar estimations were made for the other models; see Online Resource 2, Tables S2.3 and S2.4.

Table 3 shows that the point estimates and statistical significance are not impacted in meaningful ways by including these measures of respondents’ earnings. Similar models contrasting the continuously divorced with divorced men who remarried (not shown) also reveal patterns consistent with our main results. Thus, the exclusion or inclusion of the measures of earnings considered does not impact any of the inferences drawn here regarding the long-term association among divorce, disability benefit receipt, and self-reported work limitations.

Propensity Score Matching Models

We also conducted propensity score matching models that estimate the effects of divorce on self-reported work limitations and disability benefit receipt in the 10th, 15th, and 20th years after marital dissolution. We use a framework similar to that of Figs. 3–5 but adjust for observable characteristics one-year prior to the at-risk divorce window (1974). Covariates include age, age squared, race/ethnicity, foreign-born, Social Security–covered earnings, and educational attainment. As Couch and Placzek (2010) discussed, these matching methods help remove differences in the possibility of selection into an event conditional on baseline characteristics.

Estimates of the models predicting divorce that satisfied standard balancing tests are contained in Online Resource 2, Table S2.6. Table 4 presents the nearest-neighbor and kernel-density estimates of the relationship between divorce and the two dependent variables (self-reported work limitations and disability benefit receipt). In short, across all estimates, patterns of statistical significance found in the linear-probability fixed-effects models are duplicated. No statistically significant coefficients are found for all divorced men or those who remarry. In contrast, statistically significant estimates are found for the continuously divorced both in terms of self-reported work limitations and receipt of disability benefits.

Discussion and Conclusions

Using a unique data set that matches national survey data with longitudinal administrative records, this study examines the long-term impact of divorce on the probability of reporting a work-limiting condition and receiving federal disability benefits among U.S. men over a 20-year follow-up period. The use of both self-reported work limitations and medically qualified disability benefit receipt in administrative records is the first examination of this type in the U.S. literature.

Overall, the study advances our understanding of the role of early and midlife transitions to divorce in shaping men’s health over the life course. An increasing number of studies within the marriage-health literature have turned toward examining the effects of marital biography, rather than current marital status, on health (Brockmann and Klein 2004; Dupre et al. 2009; Hughes and Waite 2009). The results provided here support and extend this approach.

Our findings indicate that for the average man, the dissolution of a first marriage between the mid-1970s and mid-1980s did not significantly impact work disability risks over a 20-year follow-up period. This finding may challenge the notion that divorce has consistent negative impacts on men’s health. However, we also find significant increases in the probability of work limitations and of federal disability benefit receipt following divorce among continuously divorced men. Previous cross-sectional studies found higher rates of mobility limitations among older divorced men (i.e., Hughes and Waite 2009; Liu and Zhang 2013). Our findings show that divorce has long-term negative health impacts for men who remain single that manifest in higher prevalence of work disability many years after the initial divorce.

This study also helps clarify the temporal ordering of changes in marital status and in work disability status among men. We demonstrate that the increased work disability risks among continuously divorced men emerged only late in the 20-year follow-up period. The timing of this divergence suggests that divorce exerts cumulative health disadvantages that manifest with age and longer exposure to singlehood in contrast to age acting as a leveler of differences (Dannefer 2003; O’Rand 1996). The findings help establish the relevance of earlier life events for health pathologies later in life (Ben-Shlomo and Kuh 2002).

Although our data do not allow us to tease out the mechanisms driving the main results, we suspect that one source of cumulative disadvantage for continuously divorced men is the loss of marital resources over time. Losses of household economies of scale and income following divorce (McManus and DiPrete 2001), in combination with losing the health regulation role of marriage (Umberson 1992), are likely related to the elevated probability of work disability 20 years after divorce. We also cannot discount the possible effects of chronic stress associated with remaining single for multiple decades.

Reinforcing this view, we find no significant differences in the work-disability trajectories between the subgroup of divorced men who remarried and the continuously married. However, we find substantial differences between divorced men who remarried versus the continuously divorced. Although not conclusive, this pattern provides support for a positive remarriage effect on men’s long-term health (Carr and Springer 2010; Hughes and Waite 2009). This finding for the United States is also contrary to that of Blekesaune and Barrett (2005), who found no differences in men’s work disability prevalence by remarriage using Norwegian administrative data over a shorter time frame.

Furthermore, the relationship between federal disability benefits and divorce among those who do not remarry is attenuated by controlling for self-reported health problems that limit work but remains statistically significant and meaningful. This points to the important role of social environment among those who never remarry, consistent with the role of spousal monitoring within social causation theory (Umberson 1992; Williams 2004) and the construct of disability, which includes the interaction of health with social environment (Burkhauser et al. 2013).

Because our main results come from individual fixed-effects models, they are unlikely to be driven by time-invariant differences between the average man who divorces and one who remains married, including differences in childhood experiences or health stock. Moreover, by excluding respondents with work limitations or receipt of disability benefits before the marital dissolution, we reduce potential influence of contamination due to the association between poor health and subsequent divorce. Propensity score estimates confirm the robustness of the long-term patterns estimated net of selection. We find similar results with the inclusion of respondents’ earnings.

The similarity of findings using self-reported and administrative measures strengthens conclusions drawn from the study. Although self-reported work limitations could be biased (Bound 1991; Livermore et al. 2011), we find long-term associations between divorce and work disability of similar magnitude using the two measures. The cumulative probability of a reported work limitation 20 years after a man’s first divorce is 8.5 percentage points higher for those who do not remarry relative to the continuously married. The comparable differential risk for federal disability benefits is 10 percentage points higher.

In addition, alternative estimates that remove the individual fixed effects and sample screens that filtered out work-disabled respondents prior to the divorce underscore the importance of the selection perspective in the marriage–health literature (e.g., Wade and Pevalin 2004). In these models (Table 2), we find strong, statistically significant associations where they previously were not observed, as well as differences in the timing and magnitude of the divorce–work disability association over the follow-up period. This is consistent with other studies that have found elevated risk of divorce following a work disability or illness onset among couples (Blekesaune and Barrett 2005; Karraker and Latham 2015; Teachman 2010). Although the literature has generally acknowledged the idea that those who divorce are a group characterized by worse health, relatively few studies have attempted to directly control for selection into divorce to help strengthen causal inferences about the health impacts of divorce. Our results highlight that future research should, when possible, control for selection bias in some manner. No doubt, other researchers will find useful ways to extend this analysis and strengthen causal inferences regarding changes in relationship status and subsequent health outcomes.

The current study suggests several possible avenues for further research. Our findings are consistent with a long-term protective effect of remarriage but may be driven by selection bias to the extent that less-healthy divorced men have more difficulty remarrying. The social and economic context, moreover, has changed greatly over the past three decades, and the long-term relationship between divorce and work disability may be different for more recent cohorts. Potential differences by gender, age at divorce, and health indicator are also worthy of additional attention. A further question is whether the types of health conditions responsible for men’s work disability later in life vary by marital biography.

Notes

Age-related increases in SSDI benefit receipt could also be influenced by medical-vocational guidelines that account for age.

The divorce–health relationship and the mediating mechanisms may vary across outcomes and gender (Williams and Umberson 2004; Zhang and Hayward 2006). Men appear to derive more longevity gains from marriage than women (Brockmann and Klein 2004; Lillard and Waite 1995). Men benefit from the health regulation role of marriage more than women (Umberson 1992). Selection processes may be gendered (Teachman 2010).

For details on a five-step sequential evaluation process for disability determination, see Wixon and Strand (2013).

For more details, see the Code of Federal Regulations on the SSA website (http://www.socialsecurity.gov/OP_Home/cfr20/404/404-1563.htm and http://www.socialsecurity.gov/OP_Home/cfr20/404/404-1562.htm).

Potentially identifying information is removed from the linked data. The U.S. Census Bureau must approve all users. For researchers with access to these data, our programs are available upon request.

If a respondent is successfully matched, then that respondent is matched to all administrative files equally.

We estimated a logistic regression of a match across key characteristics. Using the results, we multiply the inverse of the match probability given the characteristics by SIPP person weights.

Estimates using analogous measures of earnings through the current year of data yield similar results.

Equivalized measures are common in studies of household well-being (Bayaz-Ozturk et al. 2014).

References

Alwin, D. F., & Wray, L. A. (2005). A life-span developmental perspective on social status and health. Journals of Gerontology, Series B: Psychological Sciences and Social Sciences, 60, S7–S14.

Amato, P. R. (2000). The consequences of divorce for adults and children. Journal of Marriage and the Family, 62, 1269–1287.

Amato, P. R. (2010). Research on divorce: Continuing trends and new developments. Journal of Marriage and Family, 72, 650–666.

Amato, P. R., & Hohmann-Marriott, B. (2007). A comparison of high and low-distress marriages that end in divorce. Journal of Marriage and Family, 69, 621–638.

Autor, D., & Duggan, M. (2006). The growth in the Social Security disability rolls: A fiscal crisis unfolding. Journal of Economic Perspectives, 20(3), 71–96.

Bachman, J. G., Wadsworth, K. N., O’Malley, P. M., Johnston, L. D., & Schulenberg, J. E. (1997). Smoking, drinking, and drug use in young adulthood: The impacts of new freedoms and new responsibilities. Mahwah, NJ: Lawrence Erlbaum Associates.

Bayaz-Ozturk, G., Burkhauser, R. V., & Couch, K. A. (2014). Consolidating the evidence on income mobility in the western states of Germany and the United States from 1984 to 2006. Economic Inquiry, 52, 431–443.

Becker, S., & Ichino, A. (2002). Estimation of average treatment effects based on propensity scores. Stata Journal, 2, 358–377.

Benítez-Silva, H., Buchinsky, M., Man Chan, H., Cheidvasser, S., & Rust, J. (2004). How large is the bias in self-reported disability? Journal of Applied Econometrics, 19, 649–670.

Ben-Shlomo, Y., & Kuh, D. (2002). A life course approach to chronic disease epidemiology: Conceptual models, empirical challenges and interdisciplinary perspectives. International Journal of Epidemiology, 31, 285–293.

Blekesaune, M. (2008). Partnership transitions and mental distress: Investigating temporal order. Journal of Marriage and Family, 70, 879–890.

Blekesaune, M., & Barrett, A. E. (2005). Marital dissolution and work disability: A longitudinal study of administrative data. European Sociological Review, 21, 259–271.

Booth, A., & Amato, P. (1991). Divorce and psychological stress. Journal of Health and Social Behavior, 32, 396–407.

Bound, J. (1991). Self-reported versus objective measures of health in retirement models. Journal of Human Resources, 26, 106–138.

Brockmann, H., & Klein, T. (2004). Love and death in Germany: The marital biography and its effect on mortality. Journal of Marriage and Family, 66, 567–581.

Burkhauser, R. V., Houtenville, A., & Tennant, J. (2013). Measuring the population with disabilities for policy analysis. In K. A. Couch, M. Daly, & J. Zissimopoulos (Eds.), Lifecycle events and their consequences: Job loss, family change, and declines in health (pp. 215–239). Palo Alto, CA: Stanford University Press.

Carr, D., & Springer, K. W. (2010). Advances in families and health research in the 21st century. Journal of Marriage and Family, 72, 743–761.

Cawley, J., & Ruhm, C. J. (2012). The economics of risky health behaviors. In T. G. McGuire, M. V. Pauly, & P. P. Barros (Eds.), Handbook of health economics (Vol. 2, pp. 95–199). New York, NY: Elsevier.

Chen, S., & van der Klaauw, W. (2008). The work disincentive effects of the Disability Insurance Program in the 1990s. Journal of Econometrics, 142, 757–784.

Cohen, S. (2004). Social relationships and health. American Psychologist, 59, 676–684.

Collins, R. L., Ellickson, P. L., & Klein, D. J. (2007). The role of substance use in young adult divorce. Addiction, 102, 786–794.

Corna, L. M. (2013). A life course perspective on socioeconomic inequalities in health: A critical review of conceptual frameworks. Advances in Life Course Research, 18, 150–159.

Couch, K. A., & Placzek, D. (2010). Earnings losses of displaced workers revisited. American Economic Review, 100(1), 572–589.

Couch, K. A., Jolly, N., & Placzek, D. (2009). Earnings losses of older displaced workers: A detailed analysis using administrative data. Research on Aging, 21, 17–40.

Couch, K. A., Jolly, N., & Placzek, D. (2011). Earnings losses of displaced workers and the business cycle. Economics Letters, 111, 16–19.

Couch, K. A., Reznik, G. L., Tamborini, C. R., & Iams, H. M. (2013). Economic and health implications of long-term unemployment: Earnings, disability benefits, and mortality. Research in Labor Economics, 38, 259–305.

Czajka, J. L., Mabli, J., & Cody, S. (2008). Sample loss and survey bias in estimates of social security beneficiaries: A tale of two surveys (Final Report, contract no. 0600-01-60121). Washington, DC: Mathematica Policy Research, Inc.

Dannefer, D. (2003). Cumulative advantage/disadvantage and the life course: Cross-fertilizing age and social science theory. Journals of Gerontology, Series B: Psychological Sciences and Social Sciences, 58, S327–S337.

Davis, J. M., & Mazumder, B. (2011). An analysis of sample selection and the reliability of using short-term earnings averages in SIPP-SSA matched data (Center for Economic Studies Paper No. CES-WP-11-39). Washington, DC: U.S. Census Bureau.

Duncan, G., Wilkerson, B., & England, P. (2006). Cleaning up their act: The effects of marriage and cohabitation on licit and illicit drug use. Demography, 43, 691–710.

Dupre, M. E. (2007). Educational differences in age-related patterns of disease: Reconsidering the cumulative disadvantage and age-as-leveler hypotheses. Journal of Health and Social Behavior, 48, 1–15.

Dupre, M. E., Beck, A. N., & Meadows, S. O. (2009). Marital trajectories and mortality among US adults. American Journal of Epidemiology, 170, 546–555.

Elder, G. H., Jr., & Giele, J. Z. (2009). The craft of life course research. New York, NY: The Guilford Press.

Elder, G. H., Jr., Johnson, M. K., & Crosnoe, R. (2003). The emergence and development of life course theory. In J. T. Mortimer & M. J. Shanahan (Eds.), Handbook of the life course (pp. 3–19). New York, NY: Springer.

Elo, I. T., Mehta, N. K., & Huang, C. (2011). Disability among native-born and foreign-born blacks in the United States. Demography, 48, 241–265.

Eriksen, W., Natvig, B., & Bruusgaard, D. (1999). Marital disruption and long-term work disability: A four-year prospective study. Scandinavian Journal of Public Health, 27, 196–202.

Fried, T. R., Bradley, E. H., Williams, C. S., & Tinetti, M. E. (2002). Functional disability and health care expenditures for older persons. Archives of Internal Medicine, 161, 2602–2607.

Gardner, J., & Oswald, A. J. (2006). Do divorcing couples become happier by breaking up? Journal of the Royal Statistical Society: Series A, 169, 319–336.

Goldman, N. (1993). Marriage selection and mortality patterns: Inferences and fallacies. Demography, 30, 189–208.

Green, K. M., Doherty, E. E., Fothergill, K. E., & Ensminger, M. E. (2012). Marriage trajectories and health risk behaviors throughout adulthood among urban African Americans. Journal of Family Issues, 33, 1595–1618.

Gruber, J., & Madrian, B. C. (1997). Employment separation and health insurance coverage. Journal of Public Economics, 66, 349–382.

Grundy, E., & Holt, G. (2000). Adult life experiences and health in early old age in Great Britain. Social Science & Medicine, 51, 1061–1074.

Halaby, C. N. (2004). Panel models in sociological research: Theory into practice. Annual Review of Sociology, 30, 507–544.

Heller, T., & Harris, S. P. (2012). Disability through the life course. Thousands Oaks, CA: Sage Publications, Inc.

House, J. S., Lepkowski, J. M., Kinney, A. M., Mero, R. P., Kessler, R. C., & Herzog, A. R. (1994). The social stratification of aging and health. Journal of Health and Social Behavior, 35, 213–234.

Hu, Y., & Goldman, N. (1990). Mortality differentials by marital status: An international comparison. Demography, 27, 233–250.

Hughes, M. H., & Waite, L. J. (2009). Marital biography and health at mid-life. Journal of Health and Social Behavior, 50, 344–358.

Johnson, D. R., & Wu, J. (2002). An empirical test of crisis, social selection, and role explanations of the relationship between marital disruption and psychological distress: A pooled time-series analysis of four-wave panel data. Journal of Marriage and Family, 64, 211–224.

Joung, I. M., van de Mheen, H. D., Stronks, K., van Poppel, F. W., & Mackenbach, J. P. (1998). A longitudinal study of health selection in marital transitions. Social Science & Medicine, 46, 425–435.

Kapteyn, A., Smith, J. P., & Van Soest, A. (2011). Work disability, work, and justification bias in Europe and the United States. In D. A. Wise (Ed.), Explorations in the economics of aging (pp. 269–312). Chicago, IL: University of Chicago Press.

Karraker, A., & Latham, K. (2015). In sickness and in health? Physical illness as a risk factor for marital dissolution in later life. Journal of Health and Social Behavior, 56, 59–73.

Lavelle, B., & Smock, P. (2012). Divorce and women’s risk of health insurance loss. Journal of Health and Social Behavior, 53, 413–431.

Lillard, L. A., & Waite, L. J. (1995). ’Til death do us part: Marital disruption and mortality. American Journal of Sociology, 100, 1131–1156.

Liu, H. (2012). Marital dissolution and self-rated health: Age trajectories and birth cohort variations. Social Science & Medicine, 74, 1107–1116.

Liu, H., & Zhang, Z. (2013). Disability trends by marital status among older Americans, 1997–2010: An examination by gender and race. Population Research and Policy Review, 32, 103–127.

Livermore, G., Whalen, D., & Stapleton, D. C. (2011). Assessing the need for a national disability survey: Final report. Washington, DC: U.S. Department of Health & Human Services & Mathematica Policy Research. Retrieved from http://aspe.hhs.gov/daltcp/reports/2011/NatlDS.pdf

Lorenz, F. O., Wickrama, K. A. S., Conger, R. D., & Elder, G. H. (2006). The short-term and decade-long effects of divorce on women’s midlife health. Journal of Health and Social Behavior, 47, 111–125.

Marmot, M. (2002). The influence of income on health: The views of an epidemiologist. Health Affairs, 21, 31–46.

McManus, P. A., & DiPrete, T. A. (2001). Losers and winners: The financial consequences of divorce for men. American Sociological Review, 66, 246–268.

McNabb, J., Timmons, D., Song, J., & Puckett, C. (2009). Uses of administrative data at the Social Security Administration. Social Security Bulletin, 69, 75–84.

Mitchell, O. S., & Phillips, J. W. R. (2001). Eligibility for Social Security Disability Insurance (Pension Research Council Working Paper No. 2001–11). Philadelphia, PA: Wharton School of the University of Pennsylvania.

Molloy, G. J., Stamatakis, E., Randall, G., & Hamer, M. (2009). Marital status, gender and cardiovascular mortality: Behavioural, psychological distress and metabolic explanations. Social Science & Medicine, 69, 223–228.

Murray, J. E. (2000). Marital protection and marital selection: Evidence from a historical-prospective sample of American men. Demography, 37, 511–521.

O’Rand, A. M. (1996). The precious and the precocious: Understanding cumulative disadvantage and cumulative advantage over the life course. Gerontologist, 36, 230–238.

O’Rand, A. M., & Hamil-Luker, J. (2005). Processes of cumulative adversity linking childhood disadvantage to increased risk of heart attack across the life course. Journals of Gerontology, Series B: Psychological Sciences and Social Sciences, 60, S117–S124.

Peters, H. E., Simon, K., & Taber, J. R. (2014). Marital disruption and health insurance. Demography, 51, 1397–1421.

Pienta, A. M., Hayward, M. D., & Jenkins, K. R. (2000). Health consequences of marriage for the retirement years. Journal of Family Issues, 21, 559–586.

Rendall, M. S., Weden, M. M., Favreault, M. M., & Waldron, H. (2011). The protective effect of marriage for survival: A review and update. Demography, 48, 481–506.

Reville, R. T., Bhattacharya, J., & Sager Weinstein, L. R. (2001). New methods and data sources for measuring economic consequences of workplace injuries. American Journal of Industrial Medicine, 40, 452–463.

Rupp, K., & Davies, P. S. (2004). A long-term view of health status, disabilities, mortality, and participation in the DI and SSI Disability Programs. Research in Labor Economics, 23, 119–183.

Rupp, K., Davies, P. S., & Strand, A. (2008). Disability benefit coverage and program interactions in the working-age population. Social Security Bulletin, 68(1), 1–30.

Rupp, K., & Riley, G. F. (2011). Longitudinal patterns of participation in the Social Security Disability Insurance and Supplemental Security Income Programs for people with disabilities. Social Security Bulletin, 71(2), 25–51.

Shor, E., Roelfs, D. J., Bugyi, P., & Schwartz, J. E. (2012). Meta-analysis of marital dissolution and mortality: Reevaluating the intersection of gender and age. Social Science & Medicine, 75, 46–59.

Singleton, P. (2012). Insult to injury disability, earnings, and divorce. Journal of Human Resources, 47, 972–990.

Social Security Administration (SSA). (2014). Annual statistical report on the Social Security Disability Insurance program, 2013. Washington, DC: Office of Retirement and Disability.

Stock, J. H., & Watson, M. W. (2008). Heteroskedasticity-robust standard errors for fixed effects panel data regression. Econometrica, 76, 155–174.

Subramanyam, M., Kawachi, I., Berkman, L., & Subramanian, S. V. (2009). Relative deprivation in income and self-rated health in the United States. Social Science & Medicine, 69, 327–334.

Taylor, S. E., Repetti, R. L., & Seeman, T. (1997). Health psychology: What is an unhealthy environment and how does it get under the skin? Annual Review of Psychology, 48, 411–447.

Teachman, J. (2010). Work-related health limitations, education, and the risk of marital disruption. Journal of Marriage and Family, 72, 919–932.

Teachman, J. (2013). Body weight, marital status, and changes in marital status. Journal of Family Issues. Advance online publication. doi:10.1177/0192513X13508404.

Umberson, D. (1992). Gender, marital status, and the social control of health behavior. Social Science & Medicine, 34, 907–917.

Umberson, D., & Montez, J. K. (2010). Social relationships and health: A flashpoint for health policy. Journal of Health and Social Behavior, 51, 54–66.

von Wachter, T., Song, J., & Manchester, J. (2011). Trends in employment and earnings of allowed and rejected applicants to the Social Security Disability Insurance program. American Economic Review, 101, 3308–3329.

Wade, T. J., & Pevalin, D. J. (2004). Marital transitions and mental health. Journal of Health and Social Behavior, 45, 155–170.

Waite, L. J. (1995). Does marriage matter? Demography, 32, 483–508.

Waite, L. J., & Gallagher, M. (2000). The case for marriage: Why married people are happier, healthier, and better off financially. New York, NY: Doubleday.

Williams, K. (2004). The transition to widowhood and the social regulation of health: Consequences for health and health risk behavior. Journals of Gerontology, Series B: Psychological Sciences and Social Sciences, 59, S343–S349.

Williams, K., & Umberson, D. (2004). Marital status, marital transitions, and health: A gendered life course perspective. Journal of Health and Social Behavior, 45, 81–98.

Willson, A. E., Shuey, K. M., & Elder, G. H., Jr. (2007). Cumulative advantage processes as mechanisms of inequality in life course health. American Journal of Sociology, 112, 1886–1924.

Wixon, B., & Strand, A. (2013). Identifying SSA’s sequential disability determination steps using administrative data (Research and Statistics Note No. 2013-01). Washington, DC: Social Security Administration.

Wood, R. G., Goesling, B., & Avellar, S. (2007). The effects of marriage on health: A synthesis of recent research evidence. Washington, DC: Mathematica Policy Research, Inc. Retrieved from http://aspe.hhs.gov/hsp/07/marriageonhealth/index.htm

Zhang, Z., & Hayward, M. (2006). Gender, the marital life course, and cardiovascular diseases in late midlife. Journal of Marriage and Family, 68, 639–657.

Acknowledgments

The views expressed in this article are those of the authors and do not represent the views of the Social Security Administration (SSA) or any federal agency. The administrative data used in this article are restricted-use and undergo disclosure review before their release. For researchers with access to these data, our programs used in this analysis are available upon request. Kenneth Couch was an IPA (Intergovernmental Personnel Act) scholar at the U.S. Social Security Administration while working on this article. We thank the Editor and the anonymous reviewers of Demography for helpful comments. Thanks also to Lynn Fisher, Kevin Whitman, Manasi Deshpande, Lakshmi Raut, and seminar participants at Cornell and Yale Universities for providing useful comments. All remaining errors are our own.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Online Resource 1

(DOCX 45.2 kb)

Online Resource 2

(DOCX 65.2 kb)

Rights and permissions

About this article

Cite this article

Couch, K.A., Tamborini, C.R. & Reznik, G.L. The Long-Term Health Implications of Marital Disruption: Divorce, Work Limits, and Social Security Disability Benefits Among Men. Demography 52, 1487–1512 (2015). https://doi.org/10.1007/s13524-015-0424-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13524-015-0424-z