Abstract

Historically, women in widowhood in the United States have been vulnerable, with high rates of poverty. However, over the past several decades, their poverty rate has fallen considerably. In this article, we look at why this decline occurred and whether it will continue. Using data from the Health and Retirement Study linked to Social Security administrative earnings and benefit records, we address these questions by exploring three factors that could have contributed to this decline: (1) women’s rising levels of education; (2) their increased attachment to the labor force; and (3) increasing marital selection, reflecting that whereas marriage used to be equally distributed, it is becoming less common among those with lower socioeconomic status. The project decomposes the share of the decline in poverty into contributions by each of these factors and also projects the role of these factors in the future. The results indicate that increases in education and work experience have driven most of the decline in widows’ poverty to date, but that marital selection will likely play a large role in a continuing decline in the future. Still, even after these effects play out, poverty among widows will remain well above that of married women.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Increasing life expectancy, declining fertility, and the aging of the Baby Boom generation have driven population aging and will continue to do so over the next 30 years (e.g., Bloom et al. 2011; Preston et al. 1989). According to the U.S. Census Bureau (2017), the number of people aged 65 and older is projected to increase from about 55 million in 2020 to over 85 million in 2050, increasing as a share of the total U.S. population from about 17% to 22%. The economic well-being of this growing group of older individuals is, therefore, an important part of the U.S. economy’s prospects in the coming decades.

The good news is that in general, individuals aged 65 and older have similar or slightly lower rates of poverty compared with the overall adult population (e.g., Mirowsky and Ross 1999). For example, data from the Current Population Survey (CPS) show that in 2017, the official poverty rate for individuals aged 65 and older was very close to that of those aged 25–64, at 9.2% and 10.3%, respectively.Footnote 1 This similarity in poverty rates is a fairly recent phenomenon because elder poverty was widespread historically. During the Great Depression, the poverty rate among people aged 65 and older was estimated to have been greater than 50% (Altman 2005). After Social Security was introduced in 1935, and as more people who paid into the system started receiving benefits, poverty among this age group started to decline (e.g., Preston 1984). Furthermore, increases in the generosity of Social Security benefits, especially those that occurred between the mid-1960s and late-1970s, narrowed the poverty gap between older and younger people (see Engelhardt and Gruber 2006). Moreover, the introduction of the Supplemental Security Income program in 1972 provided a national cost of living–adjusted income floor for all those aged 65 and older, improving the well-being of those with little income and assets.

However, even as overall elder poverty rates have fallen, an important subgroup of the elderly population continues to have elevated rates of poverty: widows. With poverty rates that were two to three times higher than that of married women, this vulnerable group—compared with widowers, who today have poverty rates similar to married men—continued to be a primary concern of policymakers (e.g., Entmacher 2009; Estes et al. 2012; Ghilarducci et al. 2018; Munnell and Eschtruth 2018; Weller 2010).

The economic well-being of widows has also drawn considerable interest among researchers, who have focused on understanding the causes and timing of poverty. A large literature has documented potential risk factors for poverty in widowhood: economic preparedness of married couples, expenses related to a husband’s death, and declining economic status with the duration of widowhood (e.g., Burkhauser et al. 1991; Diebold et al. 2017; Gillen and Kim 2009; Holden et al. 1988; Hurd and Wise 1989; McGarry and Schoeni 2005; McLaughlin and Jensen 2000; Morgan 1981; Sevak et al. 2003/2004; Zick and Holden 2000; Zick and Smith 1991).

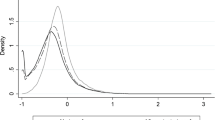

Although the literature to date has tended to focus on why widows’ poverty is so high, another trend has been developing: a decline in widows’ poverty. Poverty among widows fell from 20% in 1994 to 13% in 2014, slightly below that of 18- to 64-year-olds and well below that of children. This drop also narrowed the poverty gap between widows and married women by 5 percentage points (see Fig. 1), although widows still maintain significantly higher rates. We explore why the decline in widows’ poverty has occurred and whether it will continue. Specifically, our study focuses on three factors that could have contributed to the decline in widows’ poverty observed to date and that could have implications for the future: (1) increased female educational attainment, (2) increased female labor force participation (LFP), and (3) marital selection.

First, over the course of the twentieth century, the United States experienced an overall rise in educational attainment. For example, high school graduation rates rose from 25% for those aged 25 and older in 1940 to 90% in 2018 (U.S. Census Bureau 2019). College graduation rates increased as well, from 5% to 35% for the same age ranges (U.S. Census Bureau 2019). However, the timing of these changes was not uniform across the sexes. As male college graduation rates rose steeply in the 1930s, 1940s, and 1950s, women’s college graduation rates initially remained low. In 1980, females aged 25 and older were still only half as likely as same-aged men to have a college education.

However, as societal norms shifted over the next decades, women caught up, and more recently surpassed men in terms of college attendance and graduation (e.g., Ryan and Bauman 2016). The women at the frontier of this rise in female educational attainment were those born in the 1930s and particularly in the late 1940s and later, the same cohorts of women who experienced the decline in widows’ poverty in old age (Goldin et al. 2006). Given the strong relationship between poverty and education, the female educational upgrading is likely one key to the decline in widows’ poverty (e.g., McLaughlin and Jensen 2000; Rank and Hirschl 1999), although no one to our knowledge has looked at the relationship directly.

The second factor in declining widows’ poverty that we examine is increasing female LFP. As Goldin et al. (2006) described, during the first half of the twentieth century, women generally worked only while they were young and unmarried. As society would dictate, but also due to regulations that banned the hiring of married women, they exited the labor force upon marriage to take up the traditional role of homemaker. Indeed, as recently as 1977, more than two-thirds of men and nearly two-thirds of women said that they agreed with the statement, “It is better for men to work and women to tend home.”Footnote 2

Societal norms shifted: by 2016, less than 30% of men and women agreed with the preceding statement about men as breadwinner and women as homemaker. Marriage bars on employment were eliminated in the second half of the century, and married women spent a larger portion of their lives in the labor force.Footnote 3 As gender norms continued to change through the late 1970s, women started to hold jobs not merely to supplement household income but also to build careers. Taken together, this led to a long-running rise in female LFP from 34% in 1950 to a peak of 60% in 1999, before slowing more recently (Krueger 2017; Toossi and Morisi 2017).Footnote 4 Although the relationship between female LFP and widows’ poverty has not yet been established, others have associated the rise in LFP increased with retirement preparedness among women aged 55–64, in particular through increased participation in retirement plans (e.g., Iams et al. 2008).

The third cause of falling widows’ poverty that we examine—marital selection—requires considering first the labor market for men. Since 1950, LFP among working-age men has been falling, particularly among those with less education (Krueger 2017). At the same time, the real wages of men with less than a college education have also fallen, especially during the late 1970s through the mid-1990s (e.g., Autor et al. 2008; Levy and Murnane 1992).

The connection between the decline in labor market prospects for men and our focus here is that falling male LFP and earnings made men with less education less marriageable and more susceptible to divorce (e.g., Autor et al. 2019; Kearney and Wilson 2018; Reeves et al. 2016; Sawhill and Venator 2015; Wilson 1987, 1996; Wilson and Neckerman 1986).Footnote 5 Men and women with less education have become much less likely to marry relative to those with more education and more likely to divorce if they do marry (Aughinbaugh et al. 2013; Stevenson and Wolfers 2007).

Moreover, this differential decline in marriage has been accompanied by greater marital homogamy (assortative mating) with declining intermarriage between different educational groups and with college graduates, in particular, increasingly likely to marry each other (Greenwood et al. 2014; Schwartz and Mare 2005). Combined, these trends have changed marriage from something of an equal opportunity social institution to the domain of the highly educated (see Aughinbaugh et al. 2013; Stevenson and Wolfers 2007). These marital selection processes could result in a population of widows that over time is becoming even more increasingly educated and with even more LFP than would have occurred due to the overall rise in the population alone.Footnote 6 The net effect could be a decline in widows’ poverty beyond what one would expect from the first two trends alone.

In this study, we aim to see how these three trends—increases in female education, female LFP, and marital selection—have affected widows’ poverty to date and will continue to affect it into the future. We use data from the Health and Retirement Study (HRS) (Health and Retirement Study 2018; RAND Corporation 2014) linked to restricted geographic information, and U.S. Social Security Administration (SSA) earnings and benefits records. We decompose the change in poverty rates among widows into the portions explained by population-wide increases in women’s education and LFP as well as the portion explained by the changing probability of being married at retirement. Finally, we project what continued changes in these factors will mean for widows’ poverty in the future.

The results indicate that the large decline in widows’ average poverty over the past two decades is explained mostly by population-wide changes in education and LFP; marital selection did not play a role. However, projection results show that widows’ poverty will continue to decline over the next 15 years, from 13% in 2014 to 9% in 2029, and that close to half of this predicted decline will be driven by marital selection. The results also show that this will be accompanied by an increase in poverty rates among divorced and never-married women.

Background on Widows’ Poverty

Outside of the trends discussed in the introduction, researchers have long studied widows’ poverty (e.g., Burkhauser et al. 1991; Diebold et al. 2017; Gillen and Kim 2009; Holden et al. 1988; Hurd and Wise 1989; Karamcheva and Munnell 2007; McGarry and Schoeni 2005; Morgan 1981; Sevak et al. 2003/2004; Zick and Holden 2000; Zick and Smith 1991).Footnote 7 These studies have focused on a range of topics, from the economic impact of becoming a widow in midlife (Morgan 1981), to the wealth holdings of recent widows (Zick and Holden 2000), and to the effect of husbands’ claiming behavior on widows’ poverty (Diebold et al. 2017). However, none of these studies focused on the recent trend in widows’ poverty discussed in the introduction or on the roles of increases in female education, LFP, and marital selection in that decline.

Historically, women tended to be homemakers while their husbands were the breadwinners, making wives among earlier generations financially dependent on their husband’s income (e.g., Olivetti and Rotz 2018). Upon a husband’s death, widows saw their Social Security benefits decline, their husband’s pension reduced or lost completely, and their assets depleted due to expenses related to the husbands’ illness, putting them at risk of falling into poverty (e.g., Burkhauser et al. 1986, 1988; Hurd and Wise 1989; McGarry and Schoeni 2005; Sevak et al. 2003/2004). In short, women’s lack of education and their lack of LFP were two drivers of their dependence on their husbands and, ultimately, their high likelihood of falling into poverty after the death of a husband.

Indeed, a substantial literature has documented that the first trend discussed in the Introduction—higher female education—is associated with characteristics likely to lead to lower poverty in widowhood. For example, better-educated women have higher pay and more access to jobs that offer retirement plans than women with less education (Goldin and Katz 2018; Munnell et al. 2016; Tamborini and Kim 2017). The second trend—the increase in LFP—has a similar effect. Researchers have shown that women who work more are also less reliant on their husband’s income in retirement (Burkhauser et al. 1991; McLaughlin and Jensen 2000). Indeed, researchers have established a direct link between female education, LFP, and poverty in later life (e.g., Burkhauser et al. 1991; Holden et al. 1988; Hurd and Wise 1989; McLaughlin and Jensen 2000). The question we ask is not whether these population-wide changes are associated with lower poverty in the cross-section—they are—but the extent to which they can help explain the observed drop in widows’ poverty that has occurred over the last several decades and to establish whether those trends are likely to continue.

The other trend we investigate is marital selection, which effectively results in increases in education and LFP for married women at older ages that would exceed those of the average women in the population. After all, never-married women and women who divorce earlier in life and remain divorced cannot become widows in retirement.Footnote 8 One would expect, then, that as the pool of married women becomes more select, poverty rates would drop. Indeed, widows’ poverty was often a continuation of disparities in economic status prior to the loss of the husband (McGarry and Schoeni 2005; Sevak et al. 2003/2004), and women who fall into poverty due to the loss of a spouse tend to be from households that earned and saved less prior to widowhood and are less likely to have life insurance (Hurd and Wise 1989). These findings would suggest that if current and future widows are of higher socioeconomic status, they will be at a lower risk of falling into poverty.

All three factors—increased educational attainment, higher LFP, and changing composition of the widow population—could have decreased widows’ poverty. Because these trends are likely to continue beyond the generation of women reaching retirement today, widows’ poverty may be less of a problem in the future.Footnote 9 Understanding the extent to which each of these factors explains the decline in widows’ poverty is important for projecting widows’ poverty going forward. It is also important for public policy: policymakers seeking to place Social Security on firm financial footing must understand how various groups, including widows, would be affected by cuts.

Data and Methodology

We use the 1994–2014 waves of the HRS, a longitudinal study that surveys Americans ages 50 and older biennially about their labor market outcomes, family structure, public benefit receipt, and other characteristics.Footnote 10 The public-use HRS is linked to restricted geographic information, for the state of residence, and to the SSA’s administrative earnings and benefit records to provide accurate information on women’s earnings histories and their late spouses’ age at death.Footnote 11 To facilitate the selection of cohorts of future widows in 2029, we chose an initial sample of widows ages 65–85, although the analysis examining possible future outcomes focuses exclusively on married individuals under age 65. Respondents are excluded if they were living in a nursing home or if their spousal information was missing. The key outcome of interest is the poverty rate. A widow is determined to be in poverty if her income is below the official poverty thresholds that the Census Bureau publishes for people older than 65 (U.S. Census Bureau 2018).Footnote 12

To determine the reasons for declining widows’ poverty, we first estimate how much of the drop in the poverty rate between 1994 and 2014 was due to increases in education and LFP. Next, we estimate how much of the change from these combined effects is due to marital selection, given that selection into marriage could have led to a group of widows who are even more educated and have more labor market experience than they would have had if marriage patterns had remained unchanged.

We first use a linear regression model to assess the relationship between widows’ poverty and two key independent variables: (1) years of education and (2) years in the labor force. The regression includes controls for other factors that may be associated with poverty, such as the widow’s age, the age difference between her and her late spouse, the spouses’ Social Security claiming age, indicators for race/ethnicity, an indicator for whether the spouse was alive at age 65, a linear control for time, and state of residence fixed effects. Because the regression includes multiple observations for each widow, the standard errors are clustered at the individual level to adjust for serial correlation of the error terms over time. The regression to be estimated is as follows:

where pi,s,t is an indicator for poverty for widow i in state s at time t; Edi is the widow’s total years of education; LFPi is her total years in the labor force; Xi,t is a vector of the other characteristics mentioned; t is the control for time, and Ss represents a vector of state fixed effects.Footnote 13,Footnote 14

The second step is to use the coefficients from Eq. (1) on education and LFP, γ and θ, to predict the decline in poverty between 1994 and 2014 that would have occurred if only those two factors had changed. This calculation is accomplished by replacing widows’ average years of education and average years in the labor force in 1994 with those of the widows in 2014. If these two factors are negatively related to poverty, as expected, then the predicted drop in the poverty rate will provide an estimate of the combined effect of these two factors, with other variables held constant.

However, widows’ years of education and LFP in 2014 reflect both the general trends and their selection into marriage. Therefore, determining whether the change is due to these two factors or is partly due to a third factor—marital selection between 1994 and 2014—requires a second set of calculations. To determine what role changing selection into marriage has played in the decline in widows’ poverty, we first decompose the increases in education and LFP experienced by women over this period into the share due to changing marital composition and the share due to general improvements. The second step is to determine how much of the poverty change is due to each of these shares.

For education, the first step in this decomposition is to separate women into three educational groups: less than high school, high school degree or some college, and bachelor’s degree or more. The next step is to tabulate separately for 1994 and 2014 (1) the share of all women in each education group, ej, t, and (2) the share of each group that is widowed, wj,t. The average years of education of widows in period t is as follows:

where yj,t is the average years of education in each group j in period t. Between 1994 and 2014, two things changed: (1) women became more educated, and (2) marital selection increased such that fewer women in lower educational groups were widowed. To calculate what the average education in 2014 would have been with no marital selection, we calculate a weighted average using the shares of widows in 1994:

The analysis can now use the counterfactual average years of education, \( {E}_{widow,2014}^{NS} \), and the regression coefficients from Eq. (1) to predict how poverty would have dropped if only marital composition had changed between 1994 and 2014. This process can be repeated for LFP.

Once this decomposition exercise is completed for the period 1994–2014, an analysis of the future period will estimate how much poverty among widows should be expected to drop by 2029 as well as what role education, LFP, and marital selection each play. To perform this calculation, we focus on a group of women who have the potential to be widowed in the future—those ages 50–70 and married in 2014—and proceed in three steps. First, a linear regression is estimated on women who entered the HRS at ages 50–70 as married and who were observed 15 years later. In this regression, the dependent variable is an indicator for whether they were widowed at the end of the 15-year period. The independent variables included are the woman’s age; the woman’s own health at her entry into the HRS; her husband’s health at his HRS entry; years of education; years in the labor force; the spousal age gap; indicators for Black, Hispanic, and of another race; and a linear control for time. The regression to be estimated is as follows:Footnote 15

where wi, s, t + 15 is an indicator for widowhood 15 years after initial observation, and Zi,t is a vector for the controls not related to education or LFP.

We then use the coefficients from the widowhood regression to predict who in the sample of married women ages 50–70 in 2014 will likely be widowed in 2029.Footnote 16 Finally, we use the regression coefficients from the poverty regression to predict how this group will likely be faring in 2029.Footnote 17 This time, the calculation starts with the 2014 widows’ poverty rate and replaces average years of education and average years in the labor force of widows in 2014 with the predicted future widows’ average years of education and LFP.Footnote 18 As before, the predicted decline is then broken down into the part due to general increases in education and LFP and the part due to the changing selection into marriage only.

Although the changing selection into marriage is expected to lead to lower poverty rates among widows, it is expected to offset poverty rates in the opposite direction among divorced and never-married women at those ages. We assess whether changing marital selection will also lead to corresponding higher poverty rates among divorced and never-married women at those ages.

Results

Descriptive Results

Figure 1 shows that widows’ poverty has dropped from 19.9% in 1994 to 13.2% in 2014. The tremendous gain in education and labor market experience over the second half of the past century is likely to have contributed to this decline. Indeed, Table 1 shows that widows’ education increased by 1.4 years, and their time spent in the labor force increased by 10.5 years between 1994 and 2014. Other changes in widows’ characteristics also likely contributed to the decline in poverty, such as spouses claiming their Social Security benefits later and living longer.Footnote 19

Although higher education and more labor market experience are likely important factors behind the decline in widows’ poverty, these factors could have improved among widows for two different reasons. First, average education and work experience among widows could have increased simply because they increased for women generally. Second, they could have increased due to declining marriage rates (see Fig. 2), which have been more associated with individuals who have lower socioeconomic status. This selection into marriage would drive up the average education and work experience of widows who reach retirement.

Indeed, Fig. 3 shows that marital selection is changing the socioeconomic composition of women who become widowed over time, although this change is somewhat recent. Among older cohorts, women of all socioeconomic backgrounds married at similar rates. Figure 3 shows that marital selection likely has not played much of a role in the drop in widows’ poverty from 1994 through 2014: both lower- and higher-educated retired women were similarly likely to be married at age 50 among women born before 1944, which represents the majority of those ages 65–85 between 1994 and 2014. However, this is starting to change for younger women. Higher-educated women in the youngest cohorts were as likely as slightly older cohorts to be married at age 50, but lower-educated women were less likely to be married, suggesting that marital selection will start playing a larger role in explaining widows’ poverty in the future as these women’s husbands pass away.

OLS Regression and Decomposition of the Decline in Widows’ Poverty

The descriptive analysis is suggestive of a correlation between falling poverty and rising education and LFP. However, without more analysis, it is difficult to determine how much of the decline is due to these factors and how much of the decline is due to population-wide increases in these variables that occurred for all women versus marital selection.

As mentioned earlier, answering the first question involves a two-step process. The first step is to estimate an OLS regression. The results of this regression, presented in Table 2, show that years of education, years in the labor force, the deceased spouse’s Social Security claiming age, and whether the spouse was alive at age 65 are all negatively associated with poverty and are statistically significant at the 1% level. Having a larger age gap with one’s late spouse, as well as being Black, Hispanic, or of another race (with White as the omitted category) are positively associated with being in poverty.

The next step is to use these coefficients to see how much of the decline in widows’ poverty rate was due to increases in education and LFP. One concern with this exercise is that, as shown in Table 2, the R2 of the regression is just .17, meaning that the regression explains just 17% of the variance in widows’ poverty at the individual level: 83% is explained by unobserved factors. However, the question here regards the share of the reduction in average poverty between 1994 and 2014 that can be explained by these two factors. This effect could be larger than 17% to the extent that unobserved factors played similar roles in 2014 and 1994.

Indeed, Fig. 4 shows that education and years in the labor force explain almost all the decline in widows’ average poverty over this period. The solid black bar shows that in 1994, the poverty rate of widows aged 65–85 was 19.9%. The next three bars show the effect of “one-off” changes—that is, how much poverty would have changed because of one of the three factors being examined, with all else held constant. With just the increases in population-wide education or LFP over the period 1994–2014 (the first two dashed bars), poverty would have dropped to 16.5% and 17.5%, respectively. But, as mentioned earlier, it is unlikely that selection would have had as large of an effect so far because in the current generation of widows, women in all socioeconomic groups were getting married. The final striped bar in Fig. 4 confirms that marital selection did not play a role in the decline in widows’ poverty to date. The solid gray bar therefore shows that education and LFP explain much of the overall decline in widows’ poverty in this period, with the predicted poverty rate in 2014 due to the change in the three factors sitting at 14% compared with 13.2% in actuality (the rightmost solid black bar).

Actual and predicted widows’ poverty rates at ages 65–85 in 1994 and 2014. The 2014 projected poverty rate starts with the 1994 poverty rate and projects what poverty would be with widows’ education and LFP levels in 2014 when other characteristics are held constant (gray solid bar). The striped bars show how much poverty would be given only the change in the factor indicated. Source: Authors’ calculations from the HRS, 1994–2014.

However, times are changing. Figure 3 suggests that marital selection is becoming increasingly important among younger cohorts. What does this mean for the future of widows’ poverty? To answer this question, we turn to the group of women who will likely make up the sample of widows in 2029: married women who are aged 50–70 today.Footnote 20 To determine who in this sample is likely to become widowed, we first use the regression model for widowhood from Eq. (4). Table 3 shows that women who are older, who are Black, and whose husbands were older or in bad health at their first HRS interview were more likely to be widowed 15 years later. Hispanic women, women who were in good health at their first interview, and women who were better educated were less likely to be widowed.

The coefficients in Table 3 are then used to predict who among married women ages 50–70 today are likely to be widowed in 2029. Fig. 5 shows that this group of future widows is expected to have higher education and labor market experience than widows in 2014 and, therefore, likely lower poverty.Footnote 21

Following a similar prediction method as the method used earlier, Fig. 6 shows that widows’ poverty is predicted to decline from 13.2% in 2014 to 9.3% in 2029 (solid gray bar). Again, the drop is decomposed to one-off changes, although the implications are quite different this time. Had only education changed, poverty rates would have fallen by 1.5 percentage points, or about 38% of the total drop. Had only LFP changed, poverty rates for widows would have fallen by just 0.6 percentage points, or about 15% of the overall drop. That means that selection accounts for the remaining 47%, accounting for the biggest drop of the three.

Actual and predicted widows’ poverty rates at ages 65–85 in 1994, 2014, and 2029. Notes: The 2029 projected poverty rate combines the 2014 poverty rate with education and LFP of married women ages 50–70 in 2014 adjusted for the likelihood of becoming widowed (gray solid bar). The striped bars show how much poverty would be given only the change in the factor indicated. Source: Authors’ calculations from the HRS, 1994–2014.

By definition, if marital selection is pushing widows (one group of single women) toward lower poverty, it must be pushing the never-married and divorced women (the other two groups of single women) to higher rates. To assess the extent to which this is occurring, we also predict the poverty rate of those single women in 2029. Fig. 7 shows that the poverty rate of divorced and never-married women is predicted to remain roughly constant between 2014 and 2029, actually increasing slightly from 21.3% to 22.0% (second solid black bar and far-right solid gray bar).Footnote 22 The one-off effects suggest that even though education and LFP work toward lower poverty, the selection effect more than offsets these reductions. In other words, selection works in the opposite direction for these women as for widows and leads to higher poverty rates.

Actual and predicted divorced/never-married poverty rates for those aged 65–85 in 1994, 2014, and 2029. The 2029 projected poverty rate combines the 2014 poverty rate with education and LFP of divorced and never-married women ages 50–70 in 2014 (gray solid bar). The striped bars show how much poverty would be given only the change in the factor indicated. Source: Authors’ calculations from the HRS, 1994–2014.

Conclusion

As the share of the population over age 65 increases—rising from 17% in 2020 to a projected 22% in 2050 (U.S. Census, 2017)—the well-being of older Americans is becoming an increasingly important focus. Compared with younger Americans, those who are older have similar or even slightly lower poverty rates, but widows are different (e.g., Mirowsky and Ross 1999; Preston 1984). Historically, their poverty rates have been quite high. The literature to date has examined why these high rates occur but with little attention to trends in widows’ poverty over time (e.g., Burkhauser et al. 1991; Diebold et al. 2017; Gillen and Kim 2009; Holden et al. 1988; Hurd and Wise 1989; Karamcheva and Munnell 2007; McGarry and Schoeni 2005; Morgan 1981; Sevak et al. 2003/2004; Zick and Holden 2000; Zick and Smith 1991). Yet, the issue of trends is important. Since 1994, widows’ poverty has declined substantially. To our knowledge, our study is the first to examine why widows’ poverty has fallen, exploring the roles of three factors: (1) increased female educational attainment, (2) increased female LFP, and (3) increased marital selection. Importantly, we explore how these three trends have affected widows’ poverty to date and what they mean for the near future.

We first examined how trends in education and LFP contributed to the decline in widows’ poverty. Starting with cohorts born in the 1930s, women’s college graduation rates have soared, catching up with and surpassing college graduation among men today (e.g., Ryan and Bauman 2016). LFP also increased across these cohorts. Women born in the early twentieth century tended to drop out of the labor force upon marriage, but women today tend to have careers, leading to a long-running increase in female LFP from 30% in 1950 to a peak of 60% in 1999 (e.g., Blau and Kahn 2007; Goldin 2006). Given the links among education, LFP, and poverty in late life, trends in education and LFP were expected to contribute to the drop in widows’ poverty (e.g., Burkhauser et al. 1991; McLaughlin and Jensen 2000). It is therefore not particularly surprising that the results show that the population-wide rise in women’s education and LFP almost fully explain the decline in widows’ poverty over the past two decades, with education playing a slightly larger role than LFP.

We next turned to the role of marital selection. Changing societal roles, the decline in male marriageability, and increased marital homogamy have shifted the composition of the married women toward those with higher education (Aughinbaugh et al. 2013; Reeves et al. 2016; Sawhill and Venator 2015; Schwartz and Mare 2005; Stevenson and Wolfers 2007). The question is whether this third trend could also have contributed to the documented decline in widows’ poverty.

Our findings show that marital selection has not played much of a role in the decline in widows’ poverty to date. It will, however, become important for the cohort of married women who will be ages 65–85 in 2029. Our projections suggest that widows’ poverty will likely continue its decline from 13.2% in 2014 to about 9% by 2029. Almost one-half of that decline is projected to be driven by the change in the marital composition of widows. This finding is consistent with previous work showing that many poor widows were either already poor prior to widowhood or had low earnings and savings (McGarry and Schoeni 2005; Sevak et al. 2003/2004). Thus, marital selection should reduce married women’s risk of becoming poor in (retirement and) widowhood. Nonetheless, widows’ poverty is projected to be about twice that of married women today.

These estimates and projections come with some caveats. Our study is descriptive, and the results may not reflect entirely the causal effects of education and LFP on poverty. For example, women with high education may have had better access to jobs with good benefits through their parents’ networks, meaning that this effect and not their education per se could drive lower rates of poverty. If a relationship like this exists, then as education spreads to women without these connections, the relationship to poverty will weaken. Because the current regression analyses do not account for these kinds of effects explicitly, it may overstate the effects of education and LFP on poverty. The results in this article, therefore, should be interpreted with some caution.

In light of this caveat, one might want to view our results as somewhat of an upper bound on the decline in widows’ poverty to be expected over the next decade. Despite this, the projected rate of poverty among widows is still likely to be higher than that of married women. So, what can public policy do for widows? Some policymakers have suggested increasing the surviving spouse’s Social Security benefit to 75% of the couple’s combined monthly benefit when both spouses were alive.Footnote 23 Currently, the amount ranges between 50% and 66%, depending on the spouse’s relative earnings.Footnote 24 To avoid raising benefits to high-income married couples, the dollar amount could be capped.

However, one can also view the results in this article within the public policy context of single women writ large, a group of which widows are one subgroup but that also includes divorced and never-married women. In particular, the necessary flip side of marital selection toward higher education and LFP for widows is the reverse for single and never-married women. These women will experience the bad edge of the selection knife. Although not a focus here, our calculations applied to these groups of single women in Fig. 7 suggest that because they will not see as much of the secular increases in education and LFP, they are not predicted to see any reductions in poverty over the following 15 years. In other words, all single women will be expected to have higher poverty rates than married women in 2029, with never-married and divorced women even worse off than widows.

Fortunately, public policy options exist that could benefit all three groups of single women. A policy that could be valuable for married/widowed, divorced, and never-married women alike are so-called caregiver credits that would offset benefit reductions due to low earnings that occurred when children were young.Footnote 25 Such a policy could be implemented either (1) by increasing the number of work years excluded from the Social Security benefit calculation (i.e., discarding some years with zero or very low earnings when mothers had young children) or (2) by providing earnings credits for the years that parents had a child under age 6. Caregiving credits may be an especially attractive option for policymakers to consider, given that even married women are becoming less and less dependent on husband’s benefits and more dependent on benefits calculated from their own earnings history. Policies that could enhance Social Security benefits for divorced women specifically include those that lower the minimum marital duration for eligibility for spousal benefits from 10 to 5 years.Footnote 26

Whatever option policymakers pursue, our findings show that although trends in female education, LFP, and marital selection are likely to drive down widows’ poverty rates, without policy intervention, those rates are likely to remain above corresponding rates for married women. Furthermore, the benefit accrued to married women in the form of marital selection will by definition increase the poverty rates of other single women. In other words, the decline in widows’ poverty should not make policymakers complacent about the well-being of older single women.

Data Availability

Data for this analysis include HRS restricted data, including administrative data from the Social Security Administration and therefore are not publicly available. Code is available upon request.

Notes

Authors’ calculations from the March Supplement to the Current Population Survey, 2018 (see Flood et al. 2018 for the data). If instead the Supplemental Poverty Measures are used, poverty rates are even more similar: 15.3% for those 65 and older and 15.1% for those ages 18–64. See Wimer et al. (2016).

Authors’ calculation from the General Social Survey, 1972–2010 (Smith et al. 2011).

For example, only one-half of married women aged 25–54 were in the labor force in 1975 compared with 75% in 2017 (based on our calculations from the CPS).

Labor force participation among working-age men has been falling since the middle of the twentieth century, particularly among those with a high school degree or less (Krueger 2017). Among men aged 55–64, the general decline—attributed to the growth of the Social Security program—started to reverse in the mid-1980s because of factors such as changes to the earnings test, the delayed retirement credit, the shift from defined benefit to defined contribution pensions, improved health and longevity, and the decline of retiree health insurance (e.g., Coile 2019; Diamond and Gruber 1999; Munnell 2015). Among women aged 55–64, the long-running rise in participation has slowed since the Great Recession (e.g., Black et al. 2017; Krueger 2017).

The theoretical underpinnings of this research go back to Becker (1974).

This hypothesis is consistent with the literature on marriage premiums, which has consistently found that documented marriage wage premiums are mostly driven by selection or by the co-occurrence with transition to adulthood (Dougherty 2006; Killewald and Lundberg 2017; Ludwig and Brüderl 2018). The hypothesis would, however, also be consistent with the causal marriage wage premium hypothesis (e.g., Cheng 2016; Killewald and Gough 2013; Korenman and Neumark 1991).

The literature has documented that widows experience significant losses of wealth upon husbands’ death due to medical and funeral expenses (Hurd and Wise 1989; McGarry and Schoeni 2005), and that a substantial share of poor widows were already poor prior to the death of their spouse (McGarry and Schoeni 2005; Sevak et al. 2003/2004).

Ex-spouses are eligible for Social Security survivor benefits if the marriage lasted for 10 or more years.

Goldin and Mitchell (2017) identified the increase in women’s labor force participation early in the life cycle and the prolonged phase-out at the end of the life cycle, leading to more work experience for the cohorts of women reaching retirement in the next few decades.

The first wave of the HRS included only respondents born between 1931 and 1941, the oldest of whom were 61 in 1992. Widows ages 65–85 were first observed with the addition of the AHEAD cohort, born before 1924, in Wave 2.

Specifically, the data are linked to the Cross-Wave Geographic Information (State) file, the Respondent Cross-Year Summary Earnings files, the Respondent Cross-Year Benefit file, and the Deceased Spouse Cross-Year Benefits file.

Poverty is based on the prior year’s income and Census Bureau poverty thresholds. HRS records only total household income, which for a widow living by herself, equals her own income. The RAND codebook indicates that this measure minus food stamps is close to the census definition of income, with the exception of income from resident family members besides the respondent and spouse. Therefore, the HRS income measure would be higher than the census measure if a woman receives food stamps and would be lower if she lives with other adults who contribute to the household income (HRS includes only income from the respondent and spouse). However, because the HRS poverty rates closely track the widows’ poverty rate calculated from the CPS, this discrepancy likely has minimal effects on the estimates.

A major shift that has taken place, and affects many retirees, is the change from defined benefit (DB) to defined contribution (DC) pensions. However, it is likely less of a factor for poverty. Although DCs are often less generous than DBs, workers in jobs that provide a DC benefit are still relatively well-off. Indeed, calculations in the HRS show that poverty rates among those that hold a DB or a DC are very low, while those that have neither have higher poverty rates. We test the hypothesis that the shift to DC retirement plans does not greatly affect the results, by also estimating models that include controls for whether the woman receives pension income from a DB or a DC. The coefficients on these variables are not statistically significant and do not affect the point estimates of the coefficients on the key variables of interest.

As a robustness check, we also estimate alternative models that include controls for the late husbands’ years of education and years in the labor force. Including these controls does not change the results substantively. These results are available upon request. Controlling for calendar year implicitly controls for any secular increase or decrease in retirement ages occurring over this time period.

The fact that some variables in this widowhood regression also appear in the initial poverty regression may seem problematic but is in fact a desired feature of the approach. For example, if married individuals who become widowed spent less time in the labor force or had lower education, on average—for instance, because their husbands had lower socioeconomic status and therefore higher mortality—then this should be reflected in the sample of women likely to be widows. Failing to control for education and labor force participation in Eq. (4) would lead to omitted variable bias and likely lead to a predicted sample of future widows who have higher education and labor force participation.

To do this, we calculate the predicted values of the probability of widowhood using the coefficients from the widowhood regression and the younger married women’s characteristics. We then draw a random number between 0 and 1, the minimum and maximum probability of being a widow; if this number is smaller than the predicted value, she is included in the sample of future widows. A simpler approach would be to just assign anyone with a predicted probability of being a widow over .5 to the group of future widows. However, this approach would ignore the fact that some people who are unlikely to become widows will become widowed anyway, biasing the final sample toward women with lower socioeconomic status who are more likely to become widows.

To test how well this model predicts out of sample poverty rates that are 15 years in the future, we predicted poverty rates for the years 2010–2014 using data from 1994 through t – 16 years (t – 8 waves) for predictions in year t. For instance, the poverty rate in year 2010 was predicted using a model estimated on a sample of widows in 1994. The predicted poverty rate in year 2012 used a sample of widows from 1994–1996, and so forth. The predicted poverty rates were close to the actual poverty rates. The results are available upon request.

To determine the years in the labor force of the future widows, we assume that women retire at age 65. The SSA full retirement age (FRA) will be 67 for women reaching age 65 in 2029, but the average retirement age of women generally lags a few years behind the FRA. For example, see Munnell (2015).

Some of these changes might be driven by an improvement in data quality over time. In the first waves of the HRS, less information on deceased spouses was available because they had passed away before the start of the HRS.

As described in the Data and Methodology section, this sample is adjusted for the probability of being widowed. Table 3 shows the regression coefficients from the widowhood model used for this adjustment.

Women are assumed to work until age 65. See footnote 18.

Education is expected to go up only by 0.25 year, and LPF is expected to go up by 1.25 years (not shown).

The 66% number reflects a situation in which the household received the husband’s benefit plus a 50% spousal benefit prior to his death and just his benefit after his death (100 / 150 = 66%). The 50% reflects a situation in which the household received two equally sized benefits prior to the husband’s death (as is the case for couples with similar earnings) and only the wife’s after his death.

These benefits would be slightly less likely to apply to widows because many widows rely on husbands’ benefits. Still, because women increasingly rely on their own benefits, such a change could benefit even widows.

The SSA actuaries evaluated a 2014 proposal with this feature from Senators Begich and Murray (Social Security Administration 2014).

References

Altman, N. J. (2005). The battle for Social Security: From FDR’s vision to Bush’s gamble. Hoboken, NJ: John Wiley & Sons, Inc..

Aughinbaugh, A., Robles, O., & Sun, H. (2013). Marriage and divorce: Patterns by gender, race, and educational attainment. Monthly Labor Review. https://doi.org/10.21916/mlr.2013.32

Autor, D., Dorn, D., & Hanson, G. (2019). When work disappears: Manufacturing decline and the falling marriage market value of young men. American Economic Review: Insights, 1, 161–178.

Autor, D. H., Katz, L. F., & Kearney, M. S. (2008). Trends in U.S. wage inequality: Revising the revisionists. Review of Economics and Statistics, 90, 300–323.

Becker, G. S. (1974). A theory of marriage. In T. W. Schultz (Ed.), Economics of the family: Marriage, children, and human capital (pp. 299–351). Chicago, IL: University of Chicago Press.

Black, S. E., Schanzenbach, D. W., & Breiwieser, A. (2017). The recent decline in women’s labor force participation. Washington, DC: The Brookings Institution.

Blau, F. D., & Kahn, L. M. (2007). Changes in the labor supply behavior of married women: 1980–2000. Journal of Labor Economics, 25, 393–438.

Bloom, D. E., Boersch-Supan, A., McGee, P., & Seike, A. (2011). Population aging: Facts, challenges, and responses (PGDA Working Paper No. 7111). Boston, MA: Program on the Global Demography of Aging.

Burkhauser, R., Holden, K. C., & Myers, D. A. (1986). Marital disruption and poverty: The role of survey procedures in artificially creating poverty. Demography, 23, 621–631.

Burkhauser, R. V., Butler, J. S., & Holden, K. C. (1991). How the death of a spouse affects economic well-being after retirement: A hazard model approach. Social Science Quarterly, 72, 504–519.

Burkhauser, R. V., Holden, K. C., & Feaster, D. (1988). Incidence, timing, and events associated with poverty: A dynamic view of poverty in retirement. Journal of Gerontology, 43, S46–S52.

Cheng, S. (2016). The accumulation of (dis)advantage: The intersection of gender and race in the long-term wage effect of marriage. American Sociological Review, 81, 29–56.

Coile, C. C. (2019). Working longer in the United States: Trends and explanations. In C. C. Coile, K. Milligan, & D. A. Wise (Eds.), Social Security and retirement around the world: Working longer (pp. 299–324). Chicago, IL: University of Chicago Press.

Diamond, P., & Gruber, J. (1999). Social Security and retirement in the United States. In J. Gruber & D. A. Wise (Eds.), Social Security and retirement around the world (pp. 437–473). Chicago, IL: University of Chicago Press.

Diebold, J., Moulton, J., & Scott, J. (2017). Early claiming of higher-earning husbands, the survivor benefit, and the incidence of poverty among recent widows. Journal of Pension Economics and Finance, 16, 485–508.

Dougherty, C. (2006). The marriage earnings premium as a distributed fixed effect. Journal of Human Resources, 41, 433–443.

Engelhardt, G. V., & Gruber, J. (2006). Social Security and the evolution of elderly poverty. In A. J. Auerbach, D. Card, & J. M. Quigley (Eds.), Public policy and the income distribution (pp. 259–287). New York, NY: Russell Sage Foundation.

Entmacher, J. (2009). Strengthening social security benefits for widow(er)s: The 75-percent solution. In V. P. Reno & J. Lavery (Eds.), Strengthening Social Security for vulnerable groups (pp. 23–26). Washington, DC: National Academy of Social Insurance.

Estes, C. L., O’Neill, O., & Hartmann, H. (2012). Breaking the Social Security glass ceiling: A proposal to modernize women’s benefits (Report). Washington, DC: Institute for Women’s Policy Research.

Flood, S., King, M., Rodgers, R., Ruggles, S., & Warren, J. R. (2018). Integrated Public Use Microdata Series, Current Population Survey: Version 6.0 [Data Set]. Minneapolis, MN: IPUMS. https://doi.org/10.18128/D030.V6.0

Ghilarducci, T., Jaimes, M. S., & Webb, A. (2018). Old-age poverty: Single women & widows & a lack of retirement security (Policy Note). New York, NY: Schwartz Center for Economic Policy Analysis and Department of Economics, The New School for Social Research.

Gillen, M., & Kim, H. (2009). Older women and poverty transition: Consequences of income source changes from widowhood. Journal of Applied Gerontology, 28, 320–341.

Goldin, C. (2006). The quiet revolution that transformed women’s employment, education, and family. American Economic Review, 96(2), 1–21.

Goldin, C., & Katz, L. F. (2018). Women working longer: Facts and some explanations. In C. Goldin & L. F. Katz (Eds.), Women working longer: Increased employment at older ages (pp. 11–53). Chicago, IL: University of Chicago Press.

Goldin, C., Katz, L. F., & Kuziemko, I. (2006). The homecoming of American college women: The reversal of the college gender gap. Journal of Economic Perspectives, 20(4), 133–156.

Goldin, C., & Mitchell, J. (2017). The new life cycle of women’s employment: Disappearing humps, sagging middles, expanding tops. Journal of Economic Perspectives, 31(1), 161–182.

Greenwood, J., Guner, N., Kocharkov, G., & Santos, C. (2014). Marry your like: Assortative mating and income inequality. American Economic Review: Papers and Proceedings, 104, 348–353.

Health and Retirement Study. (2018). HRS Public and Restricted Data and RAND Contributions public use data set. Produced and distributed by the University of Michigan with funding from the National Institute on Aging (grant number NIA U01AG009740).

Holden, K. C., Burkhauser, R. V., & Feaster, D. J. (1988). The timing of falls into poverty after retirement and widowhood. Demography, 25, 405–414.

Hurd, M. D., & Wise, D. A. (1989). The wealth and poverty of widows: Assets before and after the husband’s death. In D. A. Wise (Ed.), The economics of aging (pp. 177–200). Chicago, IL: University of Chicago Press.

Iams, H. M., Phillips, J. W. R., Robinson, K., Deang, L., & Dushi, I. (2008). Cohort changes in the retirement resources of older women. Social Security Bulletin, 68(4), 1–13.

Karamcheva, N., & Munnell, A. H. (2007). Why are widows so poor? (Issue in Brief No. 7-9). Chestnut Hill, MA: Center for Retirement Research at Boston College.

Kearney, M. S., & Wilson, R. (2018). Male earnings, marriageable men, and nonmarital fertility: Evidence from the fracking boom. Review of Economics and Statistics, 100, 678–690.

Killewald, A., & Gough, M. (2013). Does specialization explain marriage penalties and premiums? American Sociological Review, 78, 477–502.

Killewald, A., & Lundberg, I. (2017). New evidence against a causal marriage wage premium. Demography, 54, 1007–1028.

Korenman, S., & Neumark, D. (1991). Does marriage really make men more productive? Journal of Human Resources, 26, 282–307.

Krueger, A. B. (2017). Where have all the workers gone? An inquiry into the decline of the US labor force participation rate. Brookings Papers on Economic Activity, 2017(2).

Levy, F., & Murnane, R. J. (1992). U.S. earnings levels and earnings inequality: A review of recent trends and proposed explanations. Journal of Economic Literature, 30, 1333–1381.

Ludwig, V., & Brüderl, J. (2018). Is there a male marital wage premium? New evidence from the United States. American Sociological Review, 83, 744–770.

McGarry, K., & Schoeni, R. F. (2005). Widow(er) poverty and out-of-pocket medical expenditures near the end of life. Journals of Gerontology, Series B: Social Sciences, 60, S160–S168.

McLaughlin, D. K., & Jensen, L. (2000). Work history and U.S. elders’ transitions into poverty. The Gerontologist, 40, 469–479.

Mirowsky, J., & Ross, C. E. (1999). Economic hardship across the life course. American Sociological Review, 64, 548–569.

Morgan, L. A. (1981). Economic change at mid-life widowhood: A longitudinal analysis. Journal of Marriage and the Family, 43, 899–907.

Munnell, A. H. (2015). The average retirement age – An update (Issue in Brief No. 15-4). Chestnut Hill, MA: Center for Retirement Research at Boston College.

Munnell, A. H., & Eschtruth, A. D. (2018). Modernizing Social Security: Widow benefits (Issue in Brief No. 18-17). Chestnut Hill, MA: Center for Retirement Research at Boston College.

Munnell, A. H., Hou, W., Webb, A., & Li, Y. (2016). Pension participation, wealth, and income: 1992–2010 (Working Paper No. 2016-3). Chestnut Hill, MA: Center for Retirement Research at Boston College.

Olivetti, C., & Rotz, D. (2018). Changes in marriage and divorce as drivers of employment and retirement of older women. In C. Goldin & L. F. Katz (Eds.), Women working longer: Increased employment at older ages (pp. 113–155). Chicago, IL: University of Chicago Press.

Preston, S. H. (1984). Children and the elderly: Divergent paths for America’s dependents. Demography, 21, 435–457.

Preston, S. H., Himes, C., & Eggers, M. (1989). Demographic conditions responsible for population aging. Demography, 26, 691–704.

RAND Corporation HRS Data, Version P. (2014). Santa Monica, CA: Produced by the RAND Center for the Study of Aging, with funding from the National Institute on Aging and the Social Security Administration.

Rank, M. R., & Hirschl, T. A. (1999). The likelihood of poverty across the American adult life span. Social Work, 44, 201–216.

Reeves, R. V., Sawhill, I. V., & Krause, E. (2016). The most educated women are the most likely to be married (Social Mobility Memos). Washington, DC: Brookings Institution.

Ryan, C. L., & Bauman, K. (2016). Educational attainment in the United States: 2015 (Current Population Reports No. P20–578). Washington, DC: U.S. Census Bureau.

Sawhill, I. V., & Venator, J. (2015). Is there a shortage of marriageable men? (Center on Children and Families Policy Brief 56). Washington, DC: Brookings Institution.

Schwartz, C. R., & Mare, R. D. (2005). Trends in educational assortative marriage from 1940 to 2003. Demography, 42, 621–646.

Sevak, P., Weir, D. R., & Willis, R. J. (2003/2004). The economic consequences of a husband’s death: Evidence from the HRS and AHEAD. Social Security Bulletin, 65(3), 31–44.

Smith, T. W., Marsden, P. V., & Hout, M. (2011). General Social Survey, 1972–2010 cumulative file (ICPSR31521-v1) [Data file and codebook]. Chicago, IL: National Opinion Research Center [producer]. Ann Arbor, MI: Inter-university Consortium for Political and Social Research [distributor]. https://doi.org/10.3886/ICPSR31521.v1

Social Security Administration (SSA). (2014). Financial effects of the “Retirement and Income Security Enhancement Acts.” Retrieved from https://www.ssa.gov/oact/solvency/BegichMurray_20140610.pdf

Stevenson, B., & Wolfers, J. (2007). Marriage and divorce: Changes and their driving forces. Journal of Economic Perspectives, 21(2), 27–52.

Tamborini, C., & Kim, C. (2017). Education and contributory pensions at work: Disadvantages of the less educated. Social Forces, 95, 1577–1606.

Toossi, M., & Morisi, T. L. (2017). BLS spotlight on statistics: Women in the workforce before, during, and after the Great Recession. Washington, DC: U.S. Department of Labor, Bureau of Labor Statistics.

Weller, C. E. (2010). Building it up, not tearing it down: A progressive approach to strengthening Social Security. Washington, DC: Center for American Progress.

Wilson, W. J. (1987). The truly disadvantaged: The inner city, the underclass, and public policy. Chicago, IL: University of Chicago Press.

Wilson, W. J. (1996). When work disappears: The world of the new urban poor. New York, NY: Alfred A. Knopf.

Wilson, W. J., & Neckerman, K. M. (1986). Poverty and family structure: The widening gap between evidence and public policy issues. In S. H. Danziger & D. H. Weinberg (Eds.), Fighting poverty: What works and what doesn’t (pp. 232–259). Cambridge, MA: Harvard University Press.

Wimer, C., Fox, L., Garfinkel, I., Kaushal, N., & Waldfogel, J. (2016). Progress on poverty? New estimates of historic trends using an anchored supplemental poverty measure. Demography, 53, 1207–1218.

U.S. Census Bureau. (2017). Projections for the United States: 2017–2060. Retrieved from https://www.census.gov/data/tables/2017/demo/popproj/2017-summary-tables.html

U.S. Census Bureau. (2018). Poverty thresholds [Resource document]. Retrieved from https://www.census.gov/data/tables/time-series/demo/income-poverty/historical-poverty-thresholds.html

U.S. Census Bureau. (2019). CPS historical time series tables. Retrieved from https://www.census.gov/data/tables/time-series/demo/educational-attainment/cps-historical-time-series.html

Zick, C., & Holden, K. (2000). An assessment of the wealth holdings of recent widows. Journals of Gerontology, Series B: Psychological Sciences and Social Sciences, 55, S90–S97.

Zick, C., & Smith, K. (1991). Patterns of economic change surrounding the death of a spouse. Journal of Gerontology, 46, S310–S320.

Acknowledgments

We are grateful for helpful comments from three anonymous reviewers, participants at the Retirement Research Consortium’s annual conference, and guidance from Christopher Tamborini and Sanders Korenman. The research reported herein was performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement Research Consortium. The opinions and conclusions expressed are solely those of the authors and do not represent the opinions or policy of SSA, any agency of the federal government, or Boston College. Neither the United States Government nor any agency thereof, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.

Funding

The research reported herein was performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement Research Consortium.

Author information

Authors and Affiliations

Contributions

Alice Zulkarnain performed the econometric analysis. Geoffrey Sanzenbacher and Alicia Munnell assisted Alice Zulkarnain in writing the draft, designing the analysis, and performing background research.

Corresponding author

Ethics declarations

Ethics and Consent

All authors provided consent to submit.

Conflict of Interest

The authors declare that they have no conflict of interest.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Munnell, A.H., Sanzenbacher, G. & Zulkarnain, A. What Factors Explain the Decline in Widowed Women’s Poverty?. Demography 57, 1881–1902 (2020). https://doi.org/10.1007/s13524-020-00915-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13524-020-00915-2