Abstract

The 2008–2009 Global Financial Crisis (GFC) has swayed regulators to set forth the Solvency II agreement for determining Solvency Capital Requirement (SCR) for insurance companies. In this paper, we apply novel internal models to investigate whether the latest version of the Solvency II standard model demands sufficient capital charges, both in normal and stressed times, for the different risk categories included in bond and stock portfolios. Because the GFC has shown that extreme events on the tail of probability distributions can occur quite often, our empirical findings indicate that the magnitude of the equity risk using the GJR–EVT–Copula method requires insurers to keep more SCR for stock portfolios than the Solvency II standard model. In the case of a bond portfolio, we conclude that the Solvency II standard model requires approximately the same SCR as our internal model for the higher quality and longer maturity bonds, whereas the standard model overestimates SCR for the lower quality and shorter maturity bonds. At the same time, the standard model underestimates interest-rate risk and overestimates spread risk. Overall, the discrepancies in the estimated SCRs between the Solvency II standard technique and our internal models increase as the level of the risks rise for both stock and bond markets. Our empirical results are in line with other competing internal modeling techniques regarding stock market investment and bond portfolios with the higher quality and longer maturity bonds, while for the lower quality and shorter maturity bonds, the results contradict other modeling procedures. The obtained empirical results are interesting in terms of theory and practical applications and have important implication for compliance with the Solvency II capital requirements. Likewise, it can be of interest to insurance regulators, policymakers, actuaries, and researchers within the field of insurance and risk management.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The 2008–2009 Global Financial Crisis (GFC) is largely considered as a banking crisis, and hence the solvency of the insurance sector as a whole appeared not to be threatened, at least as the initial events of bankruptcies in the financial sector started to unfold. Nonetheless, the GFC had a major impact on the insurance industry as well, primarily through their investment’s portfolios, as the crisis spread and financial markets entered a pronounced decline [40]. In order to ensure the financial stability of insurance companies and to protect policyholders, insurance undertakings are required to hold a certain amount of additional assets as a buffer capital against unforeseen market events. This cushion capital is called the Solvency Capital Requirement (hereafter, SCR).

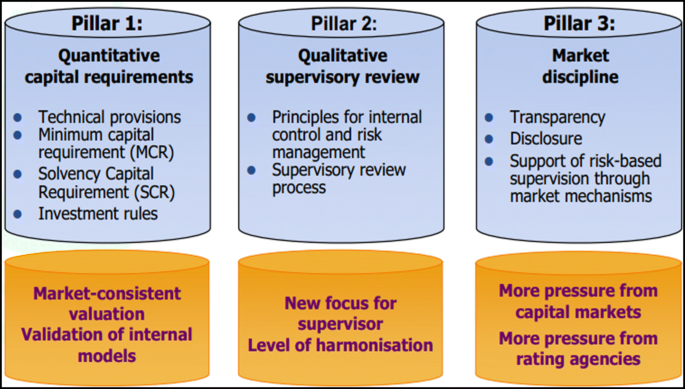

The Solvency II three-pillar approach, as the latest insurance industry directive, is supposed to provide the supervisory authorities with appropriate qualitative and quantitative tools to assess the overall solvency of an insurance undertaking (Fig. 1) [19]. As such, Pillar 1 is grounded on a risk-based approach and involves two regulatory capital requirements: (1) A Solvency Capital Requirement (SCR), reflecting the economic capital of an insurance undertaking that would need to operate with a low probability of failure, and indicate the total risk exposure the entity has in its different investment portfolios; (2) A Minimum Capital Requirement (MCR) or a safety net that should be established to constitute a basic trigger level for the ultimate supervisory action [38]. The computations of the SCR buffer capital for stock and bond portfolios, using both the Solvency II standard and robust internal models, are the key objectives of this paper.

To calculate the SCR, Solvency II offers a standard model and an alternative option of using a full internal model that requires the approval of regulatory supervisors before its implementation. The standard approach is divided into six different risk modules for determining the SCR as shown in Fig. 2, including life, non-life, health, market, and default risk as well as intangibles.

(Source: QIS5 (Fifth Quantitative Impact Studies document [19]))

Overall structure of the SCR

Since the Solvency II capital requirements had a significant impact on the European insurance industry, a large number of papers have already been published on this topic. For example, Eling et al. [16] provide an overview and critical analysis of the Solvency II, while Doff [14] recommends a more balanced framework between Pillar I, II and III. Filipović [21] compares Solvency II standard model and a genuine bottom-up approach to risk aggregation, and Holzmüller [25] discloses that the European Union (EU) Solvency II framework and the Swiss Solvency Test (SST) score are significantly better than the U.S. Risk-Based Capital (RBC) formula. Christiansen et al. [10] examine the calibration of the square-root aggregation formula used to derive the life underwriting risk in the Solvency II standard model. Santomil et al. [39] establish various backtesting simulations and show their applications to equity risk in Solvency II.

As a measure of market risk, Value-at-Risk (VaR) technique is chosen as the relevant risk measure by the EU to calculate the SCR. Thus, the SCR is defined as “the Value-at-Risk of the basic own funds subject to a confidence level of 99.5% over a 1-year period” (see, European Parliament and of the Council [20] Article 101, no. 3). In fact, VaR is a risk measure strongly dependent on the tail of a probability distribution, and hence accurate modeling of the tail of probability distribution is essential in the estimation of VaR. Indeed, empirical studies (see, for instance, [3, 4, 7, 13, 15]) have shown that the normality assumption for returns in financial markets is inaccurate and misleading for the assessment of market risk. This claim is supported by the fact that the time-series of financial returns are characterized by extreme events with negative skewness and high kurtosis.

Next, determining the true structure of dependence between financial assets is an important yet a challenging task for calculating VaR of multiple-asset portfolios. Many researchers (see for example, [3, 7, 27, 34]) have identified extreme asymmetric dependence between financial variables returns, such as, that the stock markets crash together, however they do not boom at the same time. As such, copula functions as a technique to investigate the dependence of multivariate assets have received a large interest in the last few years. Embrechts et al. [17] show the first application of copula functions in finance, while Cherubini et al. [9] address the mathematics of copula functions with several concrete applications to finance.

In a similar vein, Hotta et al. [26] use a mixed model consisting of conditional copula and multivariate GARCH to estimate the VaR of a portfolio composed of NASDAQ and S&P 500 indices, while Rockinger and Jondeau [37] apply the Normal GARCH-based copula for the estimation of VaR for a portfolio composed of international equity indices. On the other hand, Lourme and Maurer [33] introduce a semi-parametric framework for selecting either a Gaussian or a Student’s t-copula in a d-dimensional setting; and demonstrate that VaR results confirm that the t-based copula model is a better alternative to the Gaussian approach. Other authors (e.g., [1,2,3, 5, 7, 15, 43]) have investigated the construction and implementation of different types of copulas (such as, pair copula, dynamic conditional correlation (DCC) t-copula and vine copula) for the setting of nonlinear optimization algorithms and for the measurement of dependence structure with direct applications to the financial and insurance sectors.

With respect to bonds that are rating-sensitive assets, the risk-neutral probabilities of future rating migrations as well as the default probabilities are required in order to consider spread risk and counterparty default risk. To deal with this problem, a risk adjustment is needed to obtain the risk-neutral probabilities from historical rating transition matrices published by rating agencies. Fons [22] develops a reduced form model to derive credit spreads using historical default rates and a recovery rate. As such, Fons [22] provides a link between the rating of a company and the observed credit spreads in bond markets. The model developed by Fons [22] concentrates on default event, time to default, and loss given default and does not consider any changes to the credit quality. As an extension, Jarrow et al. [28], [Jarrow–Lando–Turnbull, (JLT) model, henceforth], model default and transition probabilities by using a discrete time-homogeneous Markov chain on a finite state space. A key issue with the JLT model is the assumption of complete markets with no arbitrage opportunities.

In this backdrop, none of the above empirical studies examined the assessments of risk for stock and bond markets, using both the standard and internal models as outlined by the Solvency II framework. Nevertheless, the paper by Gatzert and Martin [23] is the most related study to our paper as it uses the standard and internal models to quantify inherent risks in stock and bond portfolios. However, in quantifying equity risk, Gatzert and Martin [23] assume in their internal model that stocks follow a geometric Brownian motion process. With respect to credit risk, Gatzert and Martin [23] use the reduced-form model by Jarrow et al. [28], which is based on the credit transition method. On the other hand, the JLT model [28] has some disadvantages (see, Uhring-Homburg [42], for further details). One critical point refers to the fact that each entry in a row of the historical transition matrix is multiplied by the calculated risk premium, which makes this method infeasible. Second, as pointed out by Lando [31], even small changes in the uncertain empirical estimates of the high-grade default probabilities may lead to extremely high changes in the risk adjustments with this method. To overcome these shortcomings, Kijima and Komoribayashi [29], (KK model, henceforth), proposed an alternative procedure to calculate the martingale probabilities. The procedure suggested by the KK model guarantees numerical stability. However, it adjusts the default and all other entries in opposite directions. Furthermore, Lando and Mortensen [32] conducted an adjustment based on an economic theory to overcome the numerical problems of the JLT method, and thus to make it economically intuitive in contrast to the KK model.

Overall, this paper contributes to regulatory capital, equity risk, interest-rate risk and spread risk on several fronts. First, it develops and implements a model using the GJR–EVT–CopulaFootnote 1 (GEC) approach for calculating SCR as the regulatory capital for stocks from diverse developed and emerging markets, and with different levels of risk. Second, it incorporates the Lando and Mortensen [32] approach for the valuation of interest-rate risk, spread risk and credit risk for government and corporate bonds.Footnote 2 Third, our study is among very few studies (e.g., [23]) that compare the calculated solvency capital with the Solvency II standard approach (SCR) for a given portfolio of stocks and bonds, which are the two largest components of investment portfolios across insurance companies.

Our empirical results confirm the large discrepancies between the estimated SCRs using both the Solvency II standard approach and our robust multifaceted internal modeling techniques. In particular, the results of the standard approach in the equity risk sub-module show slight differences with the parametric VaR, whereas the empirical results from the proposed GJR–EVT–Copula approach are quite higher than the standard approach. This empirical outcome is because the GJR–EVT–Copula model strongly rejects the normality assumption for returns in financial markets, as well as the way it tackles the impact of extreme asymmetric dependence between financial assets [34]. In addition, this empirical analysis indicates that considering only two risk factors of “Global” and “Other” for investment classes in the Solvency II standard approach is not an accurate technique because international stock markets have distinctive distributional patterns and unique risk parameters. Finally, as to government and corporate bonds, we conclude that the Solvency II standard model requires approximately the same SCR as our proposed internal model for the higher quality and longer maturity bonds, whereas the standard model overestimates SCR for the lower quality and shorter maturity bonds. At the same time, the standard model underestimates interest-rate risk and overestimates the spread risk.Footnote 3 Overall, the discrepancies in the estimated SCRs between the Solvency II standard technique and our proposed internal models increase as the levels of the risk rise for both stock and bond markets.

Finally, our empirical results for the comparison between the Solvency II standard approach and internal models are in line with other competing internal modeling techniques (e.g., [23]) regarding stock portfolios and bond portfolios with the higher quality and longer maturity bonds. However, for the lower quality and shorter maturity bonds, our empirical results for the comparison between the two approaches contradict the Gatzert and Martin [23] modeling technique.

The remainder of this paper is structured as follows. Section 2 provides a general overview and introduction to Solvency II and the standard approach with a focus on equity risk, interest-rate, and spread risk modules. Section 3 presents the quantitative framework of the alternative internal modeling techniques for stock and bond markets. The results of the empirical analysis are discussed in Sect. 4. Section 5 provides robustness and validation tests, and Sect. 6 concludes the paper.

2 Solvency II standard model

2.1 SCR in the equity risk sub-module

The SCR for equity risk is calculated based on the market value MVeq,i(0) for investment exposure i; and the shock scenario differentiates between two investment classes to determine the SCR in this sub-module. First, the risk class “Global” includes all transactional exposures in countries that are members of the European Economic Area (EEA) or the Organization for Economic Cooperation and Development (OECD) (see, [19], p. 113). In this case, the scenario approach assumes a decrease in equity by 30% based on the market value MVeq,i(0) at time t = 0, thus the SCR for the risk class “Global”, \(SCR_{eq,Global}^{II}\), is obtained from:

Second, “Other” is defined as the class of higher risks, which contains all other equity price sensitive assets, such as, hedge funds, alternative investments, and non-listed equities as well as transactional exposures in emerging markets. Here, the shock scenario is given by a drop of 40%, implying:

2.2 SCR in the interest-rate risk sub-module

The calibration of the standard formula for interest-rate capital charge is based on the concept of Principal Component Analysis (PCA). The analysis indicates that four principal components of level, slope, curvature, and twist are common across all datasets; and these components explain 99.98% of the variability of the annual percentage rate change in each of the maturities in the underlying datasets. Thus, from the PCA analysis, the following stressed rates at the 99.5% level are obtained (Table 1).

2.3 SCR in the spread risk sub-module

The spread risk reflects the change in the value of net assets due to a move in the yield of an asset relative to the risk-free interest-rate term structure. The spread risk sub-module should address changes in both the level and volatility of the spreads. In this paper, the spread risk sub-module does not explicitly model the migration and the default risks. Instead, these risks are addressed implicitly, both in the calibration of the factors and in the movements in credit spreads. As such, the capital charge for spread risk of bond j is determined by multiplying the amount of invested capital, AB,j, with its modified duration, MDj, and a function Fup of the rating class of the bond:

The modified duration of bond j, denoted by MDj, is the weighted average time to maturity divided by the yield to maturity as follows:

with the risk-free interest term structure rf provided by the European Commission. Furthermore, \(F^{up} \left( {rating_{j} } \right)\) is a rating-specific stress parameter. As such, Table 2 below summarizes the spread shocks for different rating classes and according to the maturity buckets of bonds.

3 Internal models framework

3.1 Construction of GJR–EVT–Copula (GEC) internal model

In this section, we design a robust internal model to calculate VaR for a given stock portfolio; as the main difference between VaR methods is related to estimating the distribution of portfolio returns.

In line with [35] approach we first use the Glosten–Jagannathan–Runkle (GJR) model [24] to fit the assets return series and then apply the Extreme Value Theory (EVT) to the innovations rather than to the assets return series. While the GJR-EVT model is applied to draw the marginal distributions, student’s t-copula function is used to model the multivariate dependence structure between stock markets. The combined GJR–EVT–Copula framework thus becomes the natural choice for estimating the VaR of a multiple-assets portfolio.

The conditional mean and conditional variance, as the two most important statistical features of a time series, are modeled as ARMA and GARCH models respectively. Thus, a general ARMA(p,q) model is defined in the following form:

where It is the information set at time t, {εt} is a white noise process and p and q are non-negative integers. Therefore, we employ a GARCH family approach to model the conditional variance and to capture some of the stylized characteristics such as volatility clustering and heteroscedastic volatility [8, 18]. The GARCH(r,s) model specifies the conditional variance of the process, and defined as:

where \(\varepsilon_{t} = \sigma_{t} z_{t}\) and zt is a Gaussian white noise. Another volatility model commonly used to handle leverage effects is the threshold GARCH (or TGARCH) model (see, [24]). A TGARCH(m, s) model assumes the following form:

where Nt−k is an indicator for negative εt−k, that is:

From this model, it is seen that a positive εt−k contributes \(a_{k} \varepsilon_{t - k}^{2}\) to \(V\left( {\varepsilon_{t} |I_{t} } \right)\), whereas a negative εt−k has a larger impact \(\left( {a_{k} + \gamma_{k} } \right)\varepsilon_{t - k}^{2}\) with γk> 0. In fact, formula (6) is also called the GJR model because Glosten et al. [24] proposed essentially the same model.

In relation to Extreme Value Theory, the Pickands-Balkema-de Hann theorem [6, 36] is known as the second theorem of EVT. The theorem states that for a sequence of identically independent distributed X1, X2,…, Xn, and for a large threshold, μ, the exceedances, (X-μ), follow a Generalized Pareto Distribution (GPD). The GPD can be written as:

where \(\xi\), σ and μ are the shape, scale, and threshold parameters respectively. Then, we can use the GPD to model the innovation ɛi,t in the lower and upper tails and the empirical distribution in the remaining part. Thus, the marginal distribution of each innovation is given by:

where \(u_{i}^{L}\) and \(u_{i}^{R}\) are the lower and upper thresholds respectively, φ(zi) is the empirical distribution on the interval [\(u_{i}^{L} ,u_{i}^{R}\)], T is the number of zi, and \(T_{{u_{i}^{L} }}\) is the number of innovations whose value is less than \(u_{i}^{L}\), and \(T_{{u_{i}^{R} }}\)++- is the number of innovations whose value is greater than \(u_{i}^{R}\).

In addition, we use the Mean Square Error (MSE) as an objective function to determine the most relevant threshold. As such, the objective function for threshold ui can be formulated as:

Every single exceeding data has two amounts: an empirical cumulative distribution amount (\(F_{k}\)), and the estimated cumulative distribution amount from the GPD (\(\hat{F}_{k} )\). In addition, \(n_{{u_{i} }}\) is the number of exceeding data from \(u_{i}\). To illustrate this case, we show in Fig. 3 how the MSE is calculated.

After modeling the marginal distributions of every single asset in the portfolio, using the hybrid approach of the GJR-EVT model, we can measure the overall risk of a multiple-asset portfolio using the VaR method. In doing so, we need to know the dependence structure or the market co-movements between the entire components of the multiple-asset portfolio.

For this purpose, Sklar’s theorem [41] indicates that for given n random variables \(\left\{ {x_{i} | i = 1,2, \ldots ,n} \right\}\) with marginal functions Fi(xi), we can express the joint distribution as a multivariate function coupling the marginal distribution functions to represent the joint distribution function as:

where \(C\{\cdot\}\) is an n-dimensional copula that is uniquely determined when the margins are continuous. In addition, the joint density can be obtained from the copula density \(c_{1 \ldots n} \{\cdot\}\) as:

where \(f_{i} \left( {x_{i} } \right)\) are the marginal density functions. Finally, the SCR for a stock portfolio is calculated using VaR as the maximum loss that can occur with α % confidence over a holding period of h days:

3.2 Internal model for the valuation of bonds

Investing in bonds entails interest-rate risk, spread risk, and credit risk. To measure the real magnitude of risks, we first examine the value of a non-defaultable zero-coupon bond at time t that pays one monetary unit at time T:

The zero coupon bond price is defined through the short rate r (t) on the probability space \(\left( {\varOmega_{r} ,{\mathcal{F}}_{r} ,{\mathbb{Q}}} \right)\) where \(\varOmega_{r}\) is the sample space, \({\mathcal{F}}_{r}\) is the filtration generated by the Brownian motion under the risk-neutral probability measure \({\mathbb{Q}}\). By taking the relevant expectation, the zero-coupon bond price can be obtained from:

where

Furthermore, the short rate r(t), which is defined in Eq. (13), is given by the Cox–Ingersoll–Ross (CIR) model [12] as:

For k, θ > 0, this corresponds to a continuous time first-order autoregressive process where the randomly moving interest-rate is elastically pulled toward a central location or a long-term mean, θ. The parameter k determines the speed of adjustment and the condition \(2k\theta\ge \sigma^2\) implies that interest-rate can never take a negative value.

In order to integrate spread risk into the internal model, in line with Lando and Mortensen [32], we assume that all insurance companies have utility from (consuming) wealth according to the power utility function \(U\left( w \right) = w^{(1-\theta)}/(1-\theta)\), implying a constant relative risk aversion of θ. Moreover, we assume a constant riskless interest-rate, r, and constant credit spreads si, in each of the rating classes i = 1,…,K. Then, the risky T-period zero-coupon bond price is \(V_{i} \left( t \right) = e^{{ - \left( {r + s_{i} } \right)\left( {T - t} \right)}}\) with credit rating i at time t.

It is well known that the first-order condition for utility-maximizing agents is an Euler equation implying that the state price density is proportional to the marginal utility given an optimal investment. In our setting, this means:

where the variables \(p_{ij} \left( {t,t + 1} \right)\) and \(\tilde{q}_{ij} \left( {t,t + 1} \right)\) represent the actual and martingale probability of moving in one time step from the initial rating i to state j respectively. In addition, the wealth in state j at time t + 1 is

Thus,

Finally, \(SCR_{b}^{IM}\) for a bond with credit state i, maturity T and recovery rateFootnote 4\(\varphi\) is calculated using the valuation formula for a risky zero-coupon debt, which can be expressed as follows:

As such, interest-rate, default and spread risks can be described by Eq. (21) and subsequently the SCR for a bond is integrated into it, whereas the SCR in the standard model has different modules for interest-rate and spread risks (i.e., the counterparty default risk is implicitly addressed in the Solvency II standard model), therefore, they are calculated separately.

4 Data and empirical analysis

4.1 Data and stochastic properties of equity markets

In this section, we discuss the dataset and then analyze the stochastic properties of the stock and bond markets. The input data consists of 3304 daily observations that span from 03-Jan-2005 to 31-August-2017. The sampling period is from 2005 through 2017, such that to include the effects of the Global Financial Crisis (GFC). Then, we split the time series data into evaluation and validation datasets as follows: (1) the evaluation dataset period is from 2005 through 2013, and it matches the evolution of financial markets in the pre-crisis, crisis, and post-crisis periods; (2) the validation dataset period consists of observations from the 2014–2017 period.

Furthermore, our equity portfolio contains twelve stock market indices, which are selected from both developed and developing countries. In this paper, we exclude foreign exchange risk in calculating the SCR so that we can obtain consistent comparison between the standard approach and the GEC model. To that end, we use the MSCI indices, which are indicated in US dollars: USA, Germany, France, UK, Japan, BRICS,Footnote 5 Indonesia, and Mexico.

Table 3 presents the stochastic properties of the log return series. The first column indicates the Augmented Dickey–Fuller test, i.e., ADF-stat before, and provides a compelling evidence that the time series of data are non-stationary for all stock market indices. As a result, the price return series are needed in order to implement the GJR-GARCH approach. Thus, in this study, the price returns are defined as \(R_{i,t} = \ln \left( {P_{i,t} } \right) - ln\left( {P_{i,t - 1} } \right)\), where Ri,t is the daily return of index i, ln is the natural logarithm, Pi,t is the current day value, and Pi,t-1 is the previous day value. After calculating the logarithmic returns, our time series turn to be stationary, which is confirmed by the second column results (i.e., ADF-stat after).

The daily average returns are close to zero for all stock markets under consideration. Moreover, the stock markets of Brazil, Russia, South Africa, and Indonesia exhibit the highest volatility in terms of standard deviation. Moreover, all the return distributions are skewed to the left, with the exception of the French and Indian stock markets. The whole stock markets display fatter tails than the corresponding normal distributions since all the kurtosis coefficients have values greater than three. These statistics indicate that the return distributions depart from normality, which is also confirmed by the Jarque–Bera testing results. Furthermore, the evidence from the ARCH-LM(1) and Ljung-Box [LBQ (20)] statistics for the squared returns suggests the presence of time-varying volatility (i.e., ARCH effects) and serial correlations. As a result, the stochastic properties of the time-series of the log-returns justify our choice of the GJR-GARCH-based approach to model the conditional volatility under the assumption of t-distributed returns.

4.2 Data and stochastic properties of bond markets

Tables 4 and 5 include all the corporate and government bonds considered in this paper. All corporate bonds are from the USA, and the markets of issuance are international; and they differ by maturity (i.e., 3, 5, 7, 10, 20, and 25 years), coupon rate,Footnote 6 and credit rating. Moreover, all corporate bonds are senior unsecured with the same recovery rate of 0.51. On the other hand, the government bonds (Table 5) that are issued in developed countries (i.e., USA, UK, Germany, and Japan) are ratedFootnote 7 AAA and A and with lower coupon rates, whereas bonds issued in developing countries (i.e., BRICS, Mexico, and Indonesia) are mostly rated BB and with higher coupon rates.

Furthermore, the Maximum Likelihood Estimation (MLE) is applied as a method for estimating the parameters of the Cox–Ingersoll–Ross (CIR) model [12] using daily observations of one-year treasury yield curve, spanning from 01/2007 to 12/2014. As a result, the parameters of long-term mean level, the speed of mean reversion and standard deviation are estimated as θ = 0.0022, k = 1.8181, and σ = 0.4338, while the initial value of r0 is set to 0.04. Moreover, Monte Carlo simulation is used to model interest-rate patterns.

4.3 SCR for stocks

This section shows how to model the market risk of a global equity index portfolio with Monte Carlo simulation method using Student’s t-copula and EVT techniques. To that end, the simulation process extracts first the filtered residuals from each return series with the aid of an asymmetric GJR-GARCH model, and then constructs the sample marginal cumulative distribution function (CDF) of each asset using a Gaussian kernel estimate for the interior, and a Generalized Pareto Distribution (GPD) estimate for the upper and lower tails. The Student’s t-copula is then fitted to the dataset and used to induce the correlation between the simulated residuals of each asset. Finally, the simulation algorithm assesses the VaR of the global equity portfolio over a 1-year horizon.

Table 6 presents the estimation results from the GJR-GARCH model with t-distribution. As a result, all the parameters of the GJR-GARCH model are significant and the entire return series are characterized by a strong degree of persistence (i.e., the β varies around 0.9 for all stock markets). In addition, the UK and Indian stock markets display the largest α values, indicating that the conditional volatility of both markets reacts more sharply to market shocks. Furthermore, it is evident from γk results that all return series show leverage effects, with the exception of the UK, Russia, Mexico, and Indonesia.

Table 7 displays the t-copula correlation parameters for each pair of stocks in our representative portfolio. The strongest and the weakest correlations occur between the European Union countries (i.e., the UK, Germany, and France) and between the USA and Japan respectively, while the Japanese MSCI index returns display a weak correlation with all other markets. Table 7 also shows that the cross-correlations among stock markets are affected by the geographical position of countries.

In Table 8, we compare the empirical results of VaR calculations between the GJR–EVT–Copula (GEC) model, the Solvency II standard approach and the parametric VaR technique. Moreover, Table 8 includes the degrees of freedom for the fitted t-distribution and the semi-deviationFootnote 8 as a measure of risk instead of the standard deviation because the latter assumes normal distributions of the asset returns. Therefore, we can observe from Table 8 that the SCR simulation results of the Solvency II standard approach (\(SCR_{eq}^{II}\)) are much closer to the parametric VaR technique than to the GEC model (\(SCR_{GEC}^{IM}\)). While all stock markets display fat tails, Japan and USA markets demonstrate the highest and lowest degrees of freedom respectively.

Figure 4 illustrates the capital requirements from parametric VaR,Footnote 9 Solvency II standard model, and the GEC model. As such, the \(SCR_{GEC}^{IM}\) simulation results are considerably higher than the outcomes of both \(SCR_{eq}^{II}\) and parametric VaR, especially for stocks with higher risk factors and heavier tails as evidenced by the semi-deviation and degrees of freedom of the fitted t-distribution respectively. Similarly, the skewness and kurtosis values for the distributions of returns (see, Table 3) justify the large discrepancies between the \(SCR_{GEC}^{IM}\) and both the \(SCR_{eq}^{II}\) and the parametric VaR technique. These empirical results are in line with the competing internal modeling technique and empirical analysis of Gatzert and Martin [23]. In agreement with our empirical results, Gatzert and Martin [23] concluded that the Solvency II standard model estimated lower SCRs for all stock market indices considered in their study (i.e., Germany, UK, USA, India, and the MSCI world index).

Using the degree of freedom as a parameter for heavy tails, Fig. 5 illustrates the divergence from the normality assumption for the distribution of returns for both the GEC and the parametric VaR modeling techniques. This is also evidenced from Table 8, which indicates that the lower the degrees of freedom of the stocks, the higher the differences in the simulated SCRs between our robust GEC internal model and the parametric VaR technique. Therefore, as discussed earlier, the assumption of normality for the distribution of stock returns is not always an accurate and reliable supposition.

Using semi-deviation as a risk measure, Fig. 6 shows that the difference between the GEC model and the Solvency II standard approach rises as the level of semi-deviation increases. In fact, having a higher level of semi-deviation, as an effective measure of downside risk, means that the pattern of loss is more volatile. Therefore, the underestimation of SCR in the Solvency II standard approach is more significant for stocks with a higher level of risk. Thus, all simulation results have consistently shown that the discrepancies in the estimated SCRs, between the Solvency II standard technique and our internal GEC model, increase as the level of risk rises for all stock markets under consideration.

Apart from the individual stock investment, we can benefit from the diversification effect when building a stock portfolio. As such, after comparing our results in the equally-weighted portfolio case (see, Fig. 4) with the averaged SCR values of twelve stocks (i.e., 33.28$, 35.83$, 59.85$ for the parametric VaR technique, the Solvency II standard approach and the GEC model respectively), we can deduce a significant reduction in the averaged SCRs. This, indeed, is a result of the considerably higher diversification benefits that is fully accounted for when using the GEC model in contrast to the Solvency II standard model (that is, − 37.5% for the GEC model versus − 27.1% for the Solvency II and − 26.4% for the parametric VaR).

In relation to the two investment classes of “Global” and “Other” in the Solvency II standard approach, Figs. 4, 5 and 6 show that the MSCI index of every country in our representative portfolio has a distinctive distributional pattern and a different level of risk. As a result, this analysis indicates that considering only two risk factors of “Global” and “Other” for investment classes in the Solvency II standard approach is not an accurate technique because international stock markets have distinctive distributional patterns and unique risk parameters. Furthermore, developed countries (i.e., USA, UK, Germany, France, and Japan) show more of similar behavior than developing countries (i.e., BRICS, Mexico, and Indonesia) (see Figs. 4, 5 and 6). For instance, the case of South Africa, which is considered in the “Other” investment class, nevertheless, it has a lower level of risk with respect to the GEC simulation results than other developing countries.

In conclusion, this empirical study emphasizes one of the key contributions of our paper for the estimation of SRC for stock markets by confirming the large discrepancies between the predicted SCRs using both the Solvency II standard approach and our robust multilayered internal modeling algorithm. In particular, the outcomes of the standard approach in the equity risk sub-module indicate slight discrepancies with the parametric VaR, whereas the empirical results from our implemented GEC method are higher than the standard approach. This phenomenon is because our novel GEC modeling technique strongly rejects the assumption of normality in financial assets returns. Furthermore, the employed GEC technique can tackle the impact of extreme asymmetric dependence between financial assets returns [34].

4.4 SCR for bonds

As discussed earlier in the methodology section of internal models, we use the Lando and Mortensen [32] approach to obtain the risk-neutral transition probabilities. In doing so, we calibrate the AAA, AA, A, BBB, BB, B and C rated bonds to the implied 1-year default probability of 0.003%, 0.04%, 0.1%, 0.9%, 2.1%, 6.8%, and 39.5% respectively. The results of the risk-neutral transition probabilities (qij) are reported in Table 9. In addition, real-world rating transition probabilities (pij) are drawn from Standard and Poor’s, and the credit spreads are in line with the historical average levels. The parameter θ is set to fit the implied default probability.

In this section, we analyze the SCRs for both corporate and government bonds. In the case of corporate bonds, we assess the effect of time to maturity and credit rating on the SCRs separately. To that end, we consider two scenarios: for the first case, there are four BBB-rated bonds with different maturities, and for the second case, there are four 10-year bonds with different credit ratings. Besides, we analyze the SCRs for government bonds that are issued in both developed countries (i.e., USA, UK, Germany, and Japan) and developing countries (i.e., BRICS, Mexico, and Indonesia). In addition, in calculating the SCRs, we assume an investment of $100 million in each bond.

Starting with corporate bonds, Fig. 7 displays the SCR for bonds of different maturities and a BBB rating. As shown in Fig. 7a, there is a direct relationship between the total SCR and bond maturities, indicating that longer maturity bonds require insurance companies to hold larger SCRs. In addition, bonds with longer maturity are more sensitive to interest-rate fluctuations. However, the data in Fig. 7b suggest that higher coupon rates for longer maturity bonds negate this effect because the duration risk factor takes into consideration both the maturity and the coupon rate of bonds. Therefore, there is not a definite relationship between maturity and the \(SCR_{b,int}^{IM}\),Footnote 10 whereas a direct relationship between the \(SCR_{b,sp}^{IM}\) and maturity can be found in Fig. 7b because bonds with longer maturity are more likely to default in the long run. In addition, it is evident that the \(SCR_{b,sp}^{II}\)Footnote 11 is an integral part of the \(SCR_{b}^{II}\), whereas the major part of the \(SCR_{b}^{IM}\) is mainly related to the \(SCR_{b, sp}^{IM}\) and only for long maturity bonds.

Figure 8 illustrates the SCRs for bonds with different credit ratings, i.e., AA, A, BBB and B. For the case of moving from AA to B credit ratings, the amount of both the \(SCR_{b}^{IM}\) and the \(SCR_{b}^{II}\) clearly rise, however the rising speed is higher for the \(SCR_{b}^{II}\) (see, Fig. 8a). As such, from Fig. 8b it can be seen that the amount of both the \(SCR_{b,int}^{IM}\) and the \(SCR_{b,int}^{II}\) are steady for all credit ratings, whereas the \(SCR_{b, sp}^{IM}\) and the \(SCR_{b, sp}^{II}\) have an exponential rise from AA to B credit ratings.

Figure 9a shows that in the case of developed countries, where government bonds are AAA-rated, the differences between the Solvency II standard approach and the internal model almost vanish as credit and spread risks are the major risk drivers. The \(SCR_{b}^{II}\) and the \(SCR_{b}^{IM}\) (see Fig. 9a) have interesting subtle differences of 0.17%, 0.73%, and 0.68% for USA, UK, and Germany markets respectively.

The SCR data in Fig. 10a indicate that the Solvency II standard model requires more regulatory capital than the internal model for all developing countries. In addition, we can observe from Fig. 10a that the discrepancy between the two models is minor for the high-rated government bonds that are issued in Mexico, China and Indonesia (that is, 19.43%, 25.73% and 33.78% respectively), whereas the low-rated government bonds of Brazil, South Africa, India and Russia show the highest level of differences (i.e., 39.46%, 41.11%, 49.87%, and 64.31% respectively).

Solvency Capital Requirement for government bonds that are issued in developing countries: (1) Brazil, r = BB, c = 20%, m = 11 (2) Russia, r = BB, c = 14.8%, m = 5 (3) India, r = BB, c = 13.68%, m = 6 (4) China, r = A, c = 7.64%, m = 10 (5) South Africa, r = BB, c = 15.5%, m = 11 (6) Mexico, r = A, c = 16%, m = 10 (7) Indonesia, r = BBB, c = 11.25%, m = 11

For the case of bond markets, we can emphasize the contribution of our research study and conclude that the Solvency II standard model requires approximately the same SCR as our proposed internal model for the higher quality and longer maturity bonds, whereas the standard model overestimates the SCR for the lower quality and shorter maturity bonds. At the same time, the standard model underestimates interest-rate risk and overestimates the spread risk. Moreover, all simulation outcomes have consistently shown that the discrepancies in the estimated SCRs, between the Solvency II standard technique and our internal model of bonds, rise as the level of risk increases for all bond markets under consideration.

In fact, these significant empirical findings, resultant from this key contribution of our proposed internal modeling algorithm, are in contradiction to the competing paper of Gatzert and Martin [23] because they have indicated that lower-rated bonds may be severely underestimated in the standard model. Nevertheless, for the higher quality and longer maturity bonds, our results are in line with the Gatzert and Martin [23] internal modeling technique.

5 Robustness and validation tests

The Kupiec’s Proportion of Failures (POF) test (1995) is a statistical analysis to study whether the number of exceedances (x) has a significant difference from the selected confidence level (p) or not. Let T be the total number of observations, then we can define the failure rate as \({x}/{T}\), which in an ideal situation it reflects the selected confidence level. Next, according to Kupiec [30], the POF test is best conducted as a likelihood ratio (LR) test. Accordingly, the test statistic takes the following form:

Christoffersen [11] uses the same likelihood-testing framework as Kupiec [30], but extends the test to include a separate statistic for the independence of exceedances. The test is carried out by defining two states (0,1), where 0 means no exceedance can occur and 1 means that exceedance can arise. The relevant test statistic for the independence of exceedance is a likelihood ratio, as follows:

where πi is the probability of observing an exceedance on the state i on the previous day, and nij is the number of days when the state j occurred assuming that the state i occurred on the previous day. By combining this independence statistic test with Kupiec’s POF test, we obtain a joint test that examines both properties of a good VaR model, the correct failure rate and the independence of exceedances or the conditional coverage, as follows:

Set against this background, the empirical backtesting results based on the GEC model, the parametric VaR, and the Solvency II standard approach for the stock portfolio are summarized in Table 10.

Table 10 shows that the GEC model leads to a lower number of exceedances, which is a result of higher SCR. This level of SCR helps insurance companies to cover unexpected losses as they happen independently. Similarly to the stock portfolio case, we backtest the accuracy of the VaR for a bond portfolio using the Christoffersen [11] technique. To that end, we consider government and corporate bonds in two different portfolios as shown in Tables 11 and 12 respectively. Although both the internal model and the Solvency II standard approach have been accepted for the Kupiec’s POF, the independence of failures and the conditional coverage tests, it can be observed from Tables 11 and 12 that our proposed internal model has a higher number of exceedances than the Solvency II standard model.

6 Conclusions

In this paper, we focus on measuring the real magnitude of financial risks for insurance companies from investing in bond and stock markets, using the VaR technique. In fact, there is not any unique approach to calculate VaR, so the Solvency Capital Requirement (SCR) may be underestimated in a way that institutions may have not enough capital cushion to cover investment risks. On the other hand, overestimating SCR can cause a capital surplus. Given the time value of money and opportunity cost notions, capital surplus is unfavorable although it requires insurance companies to optimize their portfolios in order to reduce capital charges. This can lead to unnecessary shifts in asset allocations, having widely diversified portfolios, focusing on high-quality investments and bearing a lower level of risk.

The 2008–2009 Global Financial Crisis (GFC) has shown that extreme events on the tail of probability distributions can happen in reality, and hence a rigorous assessment of investment risks is needed for insurance companies. This is where this research paper comes in, as we attempt to explain the notions of SRC for Solvency II requirements, present an unambiguous description of the subject matter and propose robust internal modeling techniques for its evaluation and forecasting for bond and stock markets. To that end, this research study contributes to regulatory capital, equity risk, interest-rate risk and spread risk on different levels. First, it proposes a novel internal model for the computation of SCR for stock portfolios using the GJR–EVT–Copula (GEC) technique. Second, it integrates the Lando and Mortensen [32] approach for the computation of interest-rate risk, spread risk and credit risk for both government and corporate bonds. Third, this research study is one of very few known empirical attempts (e.g., [23]) that compute and compare the estimated solvency capital with the Solvency II standard approach (SCR) for a given portfolio of stocks and bonds, which are the two main components of investment portfolios across insurance companies.

As such, the empirical findings reported in this paper indicate that measuring the magnitude of the equity risk using the GJR–EVT–Copula (GEC) method requires insurance companies to keep more SCR than the Solvency II standard model for stock portfolios. In the case of bond portfolios, we conclude that the Solvency II standard model requires approximately the same SCR as our internal model for the higher quality and longer maturity bonds, whereas the standard model overestimates SCR for the lower quality and shorter maturity bonds. At the same time, the standard model underestimates interest-rate risk and overestimates the spread risk.Footnote 12 Overall, the discrepancies in the estimated SCRs between the Solvency II standard technique and our proposed internal models increase as the levels of risk rise for both stock and bond markets. Moreover, our empirical results from the comparison between the Solvency II standard approach and internal models are in line with other competing internal modeling techniques (e.g., [23]) regarding stock portfolios and bond portfolios with the higher quality and longer maturity bonds. However, for the lower quality and shorter maturity bonds, our empirical results from the comparison between the two approaches contradict the Gatzert and Martin [23] modeling technique.

One of the key contributions of this empirical study is that despite the simplicity of the Solvency II standard approach, it does not reflect the actual risk exposure of insurance companies, because under certain circumstances it can underestimate the risk associated with investment portfolios and vice versa. For instance, in the case of equity risk considering only two investment classes of “Global” and “Other” in the Solvency II standard approach is not an accurate procedure, because international stock markets have distinctive distributional patterns and unique risk parameters. To that end, comparing the SCR results for distinctive countries can reveal key differences in the distributional patterns, such as heavy-tail behavior. Therefore, we need to assign different risk factors to various countries in order to grasp full perceptions of the actual risk exposures.

Finally, the obtained empirical results are interesting in terms of theory and practical applications and have important implication for compliance with the Solvency II capital requirements. Likewise, it can be of interest to insurance regulators, policymakers, actuaries, and researchers in the discipline of insurance and risk management.

Notes

GJR stands for the Glosten–Jagannathan–Runkle model (for further details, see [24], and EVT denotes Extreme Value Theory.

Financial time series have typical non-normal properties, such as leptokurtosis, fat tails, volatility clustering and leverage effect. In addition, calculating regulatory capital for a portfolio requires modeling the tail of the joint distribution. To that end, it is possible to describe the time series effectively using the GJR–GARCH–EVT–Copula technique, and for this reason, this paper applies the GEC approach to fit the portfolio return series. On the other hand, a bond portfolio has different types of risks, and as indicated in the empirical literature the technique of Lando and Mortensen [32] addresses those risks.

It is important to emphasize that counterparty default risk is implicitly addressed in both the Solvency II standard model and our robust internal models.

The percentage of interest and principal that a firm is paid back, according to seniority, is called the recovery rate. Thus, bonds’ recovery rate is considered to assess counterparty default risk.

BRICS is the acronym for the association of five major emerging countries: Brazil, Russia, India, China, and South Africa.

The coupon payment frequency for all corporate bonds is annual.

Credit ratings are on the scale of Standard and Poor’s (S&P).

The semi-deviation \(\sqrt {\frac{{\mathop \sum \nolimits_{r < mean}^{n} \left( {mean - r_{t} } \right)^{2} }}{n}}\) provides an effective measure of the downside risk, which evaluates the dispersion for the values of a dataset below the mean.

The parametric VaR is also known as the linear VaR. This VaR approach is parametric in the sense that it assumes that the probability distribution is normal; and thus it requires the calculation of the variance and covariance parameters. For example, assume there is a portfolio that consists of two stocks. The VaR for that portfolio is calculated as follows: \(R = V_{p} \times Z_{\alpha } \times \sigma_{p}\), where, Vp, Zα, σp are the amount of invested capital, the inverse of the standard normal cumulative distribution and the standard deviation of portfolio respectively. Next, the standard deviation of the portfolio is calculated as \(\sigma_{p} = \sqrt {w_{1}^{2} \sigma_{1}^{2} + w_{2}^{2} \sigma_{2}^{2} + 2w_{1} w_{2} \sigma_{1} \sigma_{2} \rho }\), where, ρ, σ2 and w are the Pearson correlation coefficient, the variance and the corresponding weights of investment in each individual stock.

\(SCR_{b,int}^{IM}\), \(SCR_{b, sp}^{IM}\) and \(SCR_{b}^{IM}\) stand for the Solvency Capital Requirement derived from the internal model for interest-rate risk, spread risk and the bond total risk respectively.

\(SCR_{b,int}^{II}\), \(SCR_{b, sp}^{II}\) and \(SCR_{b}^{II}\) stand for the Solvency Capital Requirement derived from the standard model for interest-rate risk, spread risk and the bond total risk respectively.

It is important to note that counterparty default risk is implicitly addressed in both the Solvency II standard model and our proposed internal models.

References

Aas K, Czado C, Frigessi A, Bakken H (2009) Pair-copula constructions of multiple dependence. Insur Math Econ 44:182–198

Al Janabi MAM, Ferrer R, Shahzad SJH (2019) Liquidity-adjusted value-at-risk optimization of a multi-asset portfolio using a vine copula approach. Phys A Stat Mech Appl 536(122579):1–17

Al Janabi MAM, Hernandez JA, Berger T, Nguyen DK (2017) Multivariate dependence and portfolio optimization algorithms under illiquid market scenarios. Eur J Oper Res 259(3):1121–1131

Arreola-Hernandez J, Al Janabi MAM (2020) Forecasting of dependence, market and investment risks of a global index portfolio. J Forecast 39(3):512–532

Arreola-Hernandez J, Hammoudeh S, Khuong ND, Al Janabi MAM, Reboredo JC (2017) Global financial crisis and dependence risk analysis of sector portfolios: a vine copula approach. Appl Econ 49(25):2409–2427

Balkema A, De Haan L (1974) Residual life time at great age. Ann Probabil 2:792–804

BenSaïda A, Boubaker S, Nguyen DK (2018) The shifting dependence dynamics between the G7 stock markets. Quant Fin 18:801–812

Bollerslev T (1986) Generalized autoregressive conditional heteroskedasticity. Econometrics 31:307–327

Cherubini U, Luciano E, Vecchiato W (2004) Copula methods in finance. Wiley, New York

Christiansen M, Denuit M, Lazar D (2012) The solvency II square-root formula for systematic biometric risk. Insur Math Econ 50:257–265

Christoffersen P (1998) Evaluating interval forecasts. Int Econ Rev 39(4):841–862

Cox J, Ingersoll J, Ross S (1985) A theory of the term structure of interest rates. Econometrica 53(2):385–407

Danielsson J, de Varies CG (2000) Value-at-risk and extreme returns. Ann Econ Stat 1:239–270

Doff R (2008) A critical analysis of the solvency II proposals. Geneva Pap Risk Insur Issues Prac 33:193–206

Eling M, Jung K (2018) Copula approaches for modeling cross-sectional dependence of data breach losses. Ins Math Econ 82(C):167–180

Eling M, Schmeiser H, Schmit J (2007) The solvency II process: overview and critical analysis. Risk Manag Insur Rev 10:69–85

Embrechts P, McNeil A, Straumann D (1999) Correlation: pitfalls and alternatives. In: RISK magazine, pp 69–71

Engle R (1982) Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econometrica 50(4):987–1007

European Insurance and Occupational Pensions Authority (2010) QIS5 technical specifications. European Commission, Brussels

European Parliament and of the Council (2009) Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of insurance and reinsurance (Solvency II)

Filipović D (2009) Multi-level risk aggregation. Astin Bull 39:565–575

Fons J (1994) Using default rates to model the term structure of credit risk. Financ Anal J 50:25–32

Gatzert N, Martin M (2012) Quantifying credit and market risk under Solvency II: standard approach versus internal model. Math Econ 51:649–666

Glosten L, Runkle D, Jagannathan R (1993) On the relation between the expected value and the volatility of the nominal excess return on stocks. J Finance 48(5):1779–1801

Holzmüller I (2009) The United States RBC standards, solvency II and the swiss solvency test: a comparative assessment. Geneva Pap Risk Insur Issues Pract 34:56–77

Hotta LK, Lucas EC, Palaro HP (2008) Estimation of VaR using copula and extreme value theory. Multinatl Finance J 12(3/4):35–47

Hu L (2006) Dependence patterns across financial markets: a mixed copula approach. Appl Financ Econ 16:717–729

Jarrow R, Lando D, Turnbull S (1997) A Markov model for the term structure of credit risk spreads. Rev Financ Stud 10:481–523

Kijima M, Komoribayashi K (1998) A Markov chain model for valuing credit risk derivatives. J Deriv 6:97–108

Kupiec P (1995) Techniques for verifying the accuracy of risk management models. J Deriv 3:73–84

Lando D (2004) Credit risk modeling: theory and applications. Princeton University Press, New Jersey

Lando D, Mortensen A (2005) On the pricing of step-up bonds in the European telecom sector. J Credit Risk 1(1):71–110

Lourme A, Maurer F (2017) Testing the Gaussian and Student’s t copulas in a risk management framework. Econ Model 67:203–214

Mashal R, Zeevi A (2002) Beyond correlation: extreme co-movements between financial assets. Working Paper, Columbia Business School. https://doi.org/10.2139/ssrn.317122

McNeil A, Frey R (2000) Estimation of tail-related risk measures for heteroskedasticity financial time series: an extreme value approach. J Emp Finance 7:271–300

Pickands J (1975) Statistical reference using extreme order statistics. Ann Stat 3:119–131

Rockinger M, Jondeau E (2006) The copula-GARCH model of conditional dependencies: an international stock market application. J Int Money Finance 25(3):827–853

Sandström A (2006) Solvency: models, assessment and regulation. Taylor & Fransis Group, Boca Raton

Santomil PD, González LO, Cunill OM, Lindahl JM (2018) Backtesting an equity risk model under solvency II. J Bus Res 89:216–222

Schich S (2010) Insurance companies and the financial crisis. OECD J Financ Mark Trends 30:123–151

Sklar A (1959) Fonctions de répartition à n dimensions et leurs marges. Publications de l’Institut de Statistique de l’UniversitÚ de Paris, pp 229–231

Uhrig-Homburg M (2002) Valuation of defaultable claims—a survey. Schmalenbach Bus Rev 54(1):24–57

Weiß GNF, Supper H (2013) Forecasting liquidity-adjusted intraday Value-at-Risk with vine copulas. J Bank Fin 37(9):3334–3350

Funding

This study did not receive any funding from any entity or organization.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Asadi, S., Al Janabi, M.A.M. Measuring market and credit risk under Solvency II: evaluation of the standard technique versus internal models for stock and bond markets. Eur. Actuar. J. 10, 425–456 (2020). https://doi.org/10.1007/s13385-020-00235-0

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13385-020-00235-0

Keywords

- Insurance

- Internal models

- Credit risk

- Market risk

- Standard models

- Solvency II

- GJR–EVT–copula

- Spread risk

- Equity risk

- Bond risk

- Risk management