Abstract

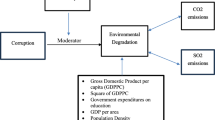

The impact of corruption on environment quality is a challenge for both developed and developing countries. Using the panel quantile regression approach and the generalized method of moments (GMM), this paper examines the linkers between corruption and CO2 emissions in African countries. Empirical results show that the corruption level is high for all African economies. Also, the effect of corruption on CO2 emissions is negative in lower emissions countries. But, this effect becomes insignificant for higher emissions countries. However, its indirect effect on CO2 emissions is positive. But, the positive effect of corruption on environment quality dominates the negative effect. The end result is a total positive effect, i.e., African countries suffer from higher level of corruptability which eventually causes many serious ecological problems.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Over the two last decades, the issue of climate change has gained greater attention with the considerable degradation of air quality. Many studies articulated by (Ang 2007; Shahbaz et al. 2012; Kanjilal and Ghosh 2013; Apergis and Payne 2009; Alam et al. 2016; Baek and Pride 2014; Begum et al. 2015), the trade openness (Al-Mulali et al. 2015; Jebli and Youssef 2015; Arouri et al. 2014; Basarir and Arman 2014; Saboori et al. 2012), the population (Borhan et al. 2012; Ahmed and Long 2012) incorporated new factors expected to determine the environment quality, such as taking into account the energy consumption. By combining the corruption issue in the political field together with environmental issue in the economic field, many auteurs (Shleifer and Vishny (1993), Jain (2001) and Walter and Luebke (2013)) proposed new ways to consider the expected factor that affect the environmental quality. The corruption was a common issue in both developed and developing countries. According to a survey conducted by the Organization for Economic Cooperation and Development (OECD)Footnote 1 the corruption appears with a greater effect on CO2 emissions in developing countries compared to the more developed countries. The corruption may spread in most governmental and legislative department and could potentially lead to the destruction and deterioration of the ecological system and environment quality due to worst environment regulations and high complexity of the environment issues.

The impact of corruption on environment quality is becoming a substantial challenge for more sustainable economic development (Seldadyo and De Haan 2011; Wang et al. 2015; and Zhang and Da 2015). Corruption accompanied with various other institutional inefficiencies is commonly expected in the literature to crucially affect the country’s total factor productivity as well as the government’s concerns and the control for environmental quality. Lopez and Mitra (2000) attributed the real emission level far away beyond the socially acceptable limits of GDP per capita to suboptimal government decisions. A higher degree of corruption results in a greater deviation from socially acceptable standards. Moreover, the corruption could induce the degradation of the environment quality through the trade policies channel. Damiana et al. (2003) found that the level of corruption may likely affect the impact of trade liberalization on environmental policies stringency. A higher level of corruption results in a reduction of environmental policies stringency. Moreover, there is broad evidence that in many countries the impact of corruption on natural resources results in degradation in the environment quality. Hafner (1998) showed in this vein that, in many countries, the corruption stills a main driver of misappropriate use of land, forest resources, and tropical forest destruction. In the developing countries, the natural resources used such as the use of lands may be affected by inappropriate government policies driven under the pressure of special interest lobby groups. On the other hand, the corruption affects the most vulnerable firms by reducing their chance to access to several services and different investment. In this perspective, Paunov (2016) conducted a comparative study to examine the impacts of corruption on smaller and larger sized firms adoption of quality certificates and patents using firm level data for a set of developing and emerging countries. His results showed the existence of strong evidence that smaller firm’s exhibit higher sensitivity to corruption. He founded, also, that while corruption does not affect patenting, it induces a lower machinery investments for innovation. According to Chimeli and Braden (2005), there is a critical value for total factor productivity (TFP) (which follows from the country’s regulatory and legal constraints, cultural values, and corruption, among others). They showed that higher TFP means better environmental quality. However, empirical assessments of the impact of corruption on the environment in African countries are not significant, leading to some uncertainty regarding the magnitude and significance of any such impact.

The aim of this paper is to improve the existing literature from three aspects. First, it provides a rigorous examination of the linkers between corruption and environmental quality in African countries. Second, it employs the simultaneous dynamics panel data, which may provide more complete results compared to the commonly used ordinary least squares (OLS) regression approach. Third, it quantitatively assesses the direct and indirect impacting mechanisms of corruption on CO2 emissions.

The remainder of this paper is as follows. The second section overviews the literature reviews on the corruption-environment quality connections. The third section describes the data and the methodology. “Empirical Results” summarizes the main results. Concluding remarks are given in the end of the manuscript.

Literature Review

Defined as any action against the legal system leading to inappropriate business practices, corruption affects nearly all aspects of social and economic life (Kaufmann and Kraay 2008). Available studies indicate clearly that corruption represents a challenge not only for many emerging economies but also for many wealthy countries (Bellos and Subasat 2012). So, with its presence in all levels of society, corruption can found to inhibit economic growth (Mauro 1995), to affect political and societal stability (Abed and Gupta 2002), to reduce the legitimacy of government (Anderson and Tverdova 2003), and to affect the environmental quality (Cole 2007). According to the Guardian report of 2015,Footnote 2 around 600 million tons of carbon was wrongly emitted under the Joint Implementation (JI) scheme of the United Nations Framework Convention on Climate Change (UNFCCC), which was hutted by serious corruption allegations involving organized crime in Russia and Ukraine. To analyze the effect of corruption on CO2 emissions, we can divide the previous research into two aspects, i.e., the direct and indirect effects. Corruption can directly affect the environmental quality through the leakage of Polluters from the payment of taxes on the environmental quality. Also, corruption can affect the environmental quality through its effect on growth. So, corruption contributes to the destruction of the economy, which in turn affects the environmental quality. Corruption can also affect the environmental quality through its effect on energy consumption. Indeed, the leakage of the payment of taxes on second hand, cars that consumes more energy causes more pollution.

Indirect Effects of Corruption on the Environmental Quality

The indirect effects of corruption on environmental quality can be analyzed by the effect of corruption on growth. Several studies have analyzed the corruption effect on economic growth. Using the OLS and 2SLS methods, Mauro (1995) has concluded that the corruption may reduce economic growth by decreasing investment. To capture the impact of corruption on investment and growth in developing countries, Rock and Bonnett (2004) have created several new corruption variables and have used the OLS regression. The authors founded that corruption slows growth and/or reduces investment in most developing countries, particularly small developing countries, but increases growth in the large East Asian newly industrializing economies. Fisman and Svensson (2007) have analyzed the relationship between bribe payments, taxes and growth in 176 Ugandan firms. The results show that a one percentage point increases in the bribery rate is associated with a reduction in firm growth of 3% points, an effect that is about three times greater than that of taxation. Hakkala et al. (2008) have examined the effect of corruption on foreign direct investment (FDI) using causal effect analysis for the Swedish firm level data. The authors have concluded that corruption can reduce the probability that a firm will invest in a country, and the horizontal investments were deterred by corruption to a larger extent than vertical investments. Huang (2016) used the bootstrap panel Granger causality approach. Based on data from 13 Asian Pacific countries over the 1997–2013 periods, to investigate whether corruption negatively affects economic growth. The findings were mixed, i.e., there is a significantly positive causality running from corruption to economic growth in South Korea, a significantly positive causality running from economic growth to corruption in China and no significant causality between corruption and economic growth for the remaining countries. Cooraya et al. (2017) have investigated the relationship between corruption, the shadow economy, and public debt. The authors have used the ordinary least squares (OLS), Fixed effects, system generalized method of moments (GMM) and instrumental variable estimation for 126 countries over 1996–2012. Obtained results confirm that increased corruption and a larger shadow economy lead to an increase in public debt. It indicated also that the shadow economy magnifies the effect of corruption on public debt suggesting that they act as complements.

Alongside its indirect effect through the economic growth, corruption can affect the quality of the environment through its effect on natural resources (especially energy consumption). Indeed, the energy sector, with its complex mixture of public and private actors and often centers of monopoly power, is prone to corruption. The statistics for the corruption perceptions index (CPI) presented by the transparency international (2015) indicated that of the 32 leading mining countries where extraction of coal, oil, natural gas, and uranium takes place, only nine have a score above 5.0 and the remaining 23 have scores of 4.8 or below. In this perspective, Fredriksson et al. (2004) have used dynamic panel data on sector energy intensity (energy used per unit of value added) in OECD countries for the years 1982–1996. They concluded that corruption can affect the energy policies through three axes. First, greater corruptibility reduces the stringency of energy policies. Second, increasing costs of coordinating bribery leads to more stringent energy policies. Third, the distribution of the worker and capital owner lobby’s political pressures depends on how energy policies affect the lobby group member’s income. Rabah and Markus (2011) have examined the relationship between oil rents, corruption, and state stability. They concluded that an increase in oil rents significantly increases corruption.

The Direct Effects of Corruption on the Environmental Quality

Many studies have considered the direct effect of corruption on the levels of CO2 emissions by means of environmental regulations. In this perspective, Ozturk and Al-Mulali (2015) have analyzed the corruption effect on CO2 emissions using the generalized method of moments and two-stage least squares (2SLS) in Cambodia for the period of 1996–2012. The results confirm that the control of corruption could reduce CO2 emissions.

Pellegrini and Gerlagh (2006) have used the OLS estimation for analyzing the effect of corruption on environmental policies. The authors have concluded that the corruption levels were the most important factor in explaining the variance in environmental policies in the enlarged European Union (EU) countries. Using data for 94 countries covering the period 1987–2000, Cole (2007) has analyzed both direct and indirect impacts of corruption on air pollution emissions. He concluded that for both pollutant (i.e., sulfur dioxide and carbon dioxide), corruption has a positive direct impact on per capita emissions. He also showed that the indirect effects are found to be negative and larger in absolute value than direct effects for the majority of the sample income range. Therefore, the total effect of corruption on emissions is negative for all except the highest income countries in the sample. Biswas et al. (2012) have used a reduced form econometric model and panel data covering the period from 1999 to 2005 in more than 100 countries. Their goal is to test the mechanism through which the shadow economy feeds environmental degradation. They concluded that in the different regressions, the marginal impact of the shadow economy on local and global air pollution is positive. However, this destructive effect can be significantly reduced by lowering the levels of corruption.

Sekrafi and Sghaier (2016) have examined the relationship between corruption, economic growth, environmental degradation, and energy consumption for the 13 Middle East and North African (MENA) countries over the period 1984–2012. The authors have used the dynamic (Diff-GMM and Sys-GMM) panel data approaches. The results show that the increased corruption directly affects economic growth, environmental quality, and energy consumption. However, corruption has an indirect effect on economic growth through energy consumption and environmental quality, an indirect effect on environmental quality through economic growth and an indirect effect on energy consumption through CO2 emissions and GDP. Indeed, energy consumption and CO2 emissions affected the economic growth. Meanwhile, economic growth effected CO2 emissions and energy consumption. Finally, CO2 emissions affected economic growth. Ozturk and Al-Mulali (2015) have analyzed the effect of better governess and corruption control on the environmental degradation in Cambodia for the period of 1996–2012. The authors used the generalized method of moments (GMM) and the two-stage least squares (TSLS) regressions. The results confirmed that GDP, urbanization, energy consumption, and trade openness increase CO2 emission while the control of corruption and governess can reduce CO2 emission. However, most relevant studies considered the topic in a single country or the whole world, but few focused on that in the Africans countries. Moreover, the use of the traditional ordinary least squares (OLS) regression approach can give biased results, which do not reflect the complete picture of the effect on different levels of CO2 emissions. In order to obtain the total effect of corruption on environmental quality, we use in this paper the GMM method for the simultaneous equations on panel data.

Empirical Analysis

Data Descriptions

In our paper, we analyze the total effect of corruption on the environmental quality for the Africans countries for the period from 1992 to 2013. In total, 18 countries are included, (i.e., Tunisia, South Africa, Congo, Dem. Rep., Zambia, Zimbabwe, Tanzania, Senegal, Sudan, Nigeria, Morocco, Kenya, Ghana, Egypt, Algeria, Congo, Rep., Benin, Burundi, and Angola). We use the data of per capita CO2 emissions and primary Energy Consumption (EC) which are obtained from the energy information administration (EIA). We use the corruption index published by the PRS group to evaluate the degree of corruption where the original range of corruption is from zero to 6. The zero value refers to the highest level of corruption. Besides, GDP, Pop, OP, and UR represent logarithm of per capita GDP (constant 2005 US$), Logarithm of the total population size, trade openness measuring by the sum of exports and imports of goods and services measured as a share of GDP and urbanization, respectively, which are all from the world development indicators (WDI) database of the World Bank. We introduced the INFOR variable, which represents the fraction of the informal sector in GDP. However, the use of such a variable in empirical studies presents a challenge given the relative lack of information on the size of the informal economy, especially in developing countries. Very few authors have been able to estimate the fraction of the informal sector. Especially, Schneider et al. (2010) who recently updated and widely used dataset, which estimates the size of the shadow economy as a percentage of GDP for162 countries from 1999 to 2007.

Methodologies

In order to analyze the relationship between corruption, energy consumption, economic growth, and CO2 emissions, we used two methods in our studies. The first investigation checks the heterogeneity of the effect of corruption on different levels of CO2 emissions. In order to investigate this relationship, we used the panel quantile regression model. The quantile regression model may be presented by Eq. (1).

Where, the subscripts i and t denote country and year, respectively, αi stands for the unobservable individual effect, τ the number of quantile of the conditional distribution, and (CO2, GDP, GDP, COR, IMP, EXP, POP, UR) are our variables. Furthermore, to estimate the coefficients for the τth quantile of the conditional distribution, Eq. (2) was used.

Where, \( {\rho}_{\tau }(u)=u\left(\tau -I\left(u<0\right)\right),I\left(u<0\right)=\Big\{{\displaystyle \begin{array}{c}1,u<0\\ {}0,u>0\end{array}} \) denotes the check function,

and I(•) is an indicator function.

Following the fixation of the different weights τ and 1 - τ with positive and negative noise, the Eq. (2), can represents the quantile regression which is in the form of weighted regression. However, this representation does not take the country heterogeneity into account. In order to solve this problem, we apply the estimation method proposed by Koenker (2004), in which the unobservable individual effect αi acts as one of the regression parameters. Indeed, Koenker (2004) takes a different approach and treats \( {\left\{{\alpha}_i\right\}}_{i=1}^n \) as parameters to be jointly estimated with β(τ) for q different quantiles. He proposed the penalized estimator, given in Eq. (3).

Where, wq is the weight of the qth quantile, λ is a tuning parameter for the individual effect (Koenker 2004). In this paper, we use the equal weights (i.e. wq = 1/ Q) as in the case of Alexander et al. (2011) and Lamarche (2011). Also, we set λ = 1 according to Damette and Delacote (2012) and Lee et al. (2012). Through these results, we can conclude that if β2τ > 0 and β3τ < 0 in the Eq. (1), the environmental kuznets curve (EKC) is checked at the τ quantile.

After identifying the relationship between corruption, energy consumption, economic growth, and environmental quality, we proceed to estimate the direct and indirect effect of corruption on energy consumption and environmental quality. We apply the GMM method to estimate Eqs. (4) and (5). The GMM method is the most commonly estimation method used in models with panel data and in the multiple way linkages between some variables. GMM based estimation is a technique for instrumental variable estimation and has several advantages over conventional estimators 2SLS. GMM makes use of the orthogonality conditions to allow for efficient estimation in the presence of heteroscedasticity of unknown form (Hansen and Østerhus (2000) and Hayashi (2000)). We have used a two-step Arellano Bond estimator.

By referring to the studies of Cole (2007), Leitao (2010) and Sekrafi and Sghaier (2016), the effects of corruption on CO2 emissions, economic growth and energy consumption can be expressed in Table 1.

Empirical Results

Before starting the discussions of the results of our modeling, an overview of descriptive statistics can inform us about the trend of our variables. Table 2 illustrates the descriptive statistics of the concerned variables. We can conclude that different quantiles can describe different distribution trends. In fact, the values presented by the Kurtosis test show that the different percentiles admit a positive flattening excess, corresponded to a sharp distribution. Thus, we can find that the distributions of these variables are distinct. The variables have an excess of flattening. The skewness test will allow us to analyze the symmetry. In fact, if the value of the skewness statistic is more or less high and positive, we can conclude that the distribution is skewed left. If the value of the skewness statistic is more or less high and negative we say that the distribution is skewed right. From the results, we can therefore conclude the distribution of our variables is not symmetric. Therefore, by referring to these two tests, we can conclude that the OLS regression approach may bring some biased results. Also, we find that all variables are skewed, which gives another proof to encourage us to use the quantile regression approach to detect the effect of corruption on CO2 emissions.

After identifying the distribution of our variables, we proceed in the next step to analyze the stationarity of these variables. The use of the IPS and LLC tests allows us to obtain the results presented in Table 3.

The results presented in Table 3 show that the level series of export (lnexp) and import (lnimp) are stationary, so they have their first order differenced series. However, the other variables are I(1) series at the 1% significance level during the sample period. The analysis of the stationarity of our variables will enable us in a second step to resort to quantile regression in order to detect the heterogeneity of the effect of corruption on carbon dioxide emissions.

Table 4 illustrates the quantile regression results based on Eq. (1). These results indicate several important findings. The first is that the effect of corruption on the environmental quality, and more precisely, on carbon dioxide emissions. The results indicate that the negative effect of corruption on environmental quality for the lower quantiles. However, the absence of effect of corruption on the environmental quality for the higher quantiles. Specifically, we find that the effect of corruption on CO2 emissions is significantly negative in the lower CO2 emission countries (Burundi Congo, Dem. Rep., Congo, Rep., Tanzania, Zambia, Kenya, Sudan, Nigeria, Ghana, Benin, Senegal, Zimbabwe). At higher quantiles, namely countries that are characterized by high CO2 emissions (Angola, Morocco, Egypt, Arab Rep., Tunisia, Algeria, South Africa) the effect is not significant any more. In fact, we can conclude that the states with a long-run prevalence of corruption might.

Lead to a large decrease in the violation rate. This result seems to be similar to that of Desai (1998); Grooms (2015) and Zhang et al. (2016).

We also, show that the effect of informal sector on CO2 emissions is heterogeneous, unlike that per capita GDP and energy consumption. The informal sector negatively and significantly affects the environmental quality for the lower quantile but the effect becomes positive and not significant for the higher quantiles. For the GDP and energy consumption, we showed that they have positively and significantly affected the environmental quality. The third finding that can be drawn from our results is the nature of the relationship between the level of GDP and the environmental quality. In fact, the results indicate that the coefficient associated with GDP is positively significant, but its quadratic coefficient is negatively significant, which proves the existence of the EKC. The EKCs verified in our studies take the form of an inverted U whose values of the return point increase with increasing CO2; The return point having passed from 1467.02074 for the first quantile to 9610.66853 for the 9th quantile. Then, we find that during the sample period, GDP per capita in most African countries is still below the turning point, with the exception of South Africa. The African countries are still in the growing phase where any increase in GDP leads to increasing CO2 emissions. Our result is conformed with Imran et al. (2017) and it a little different from that of Shahbaz et al. (2016). Indeed, most previous related studies use the OLS approach to obtain the average estimation results. In this paper, we apply the quantile regression approach, so that we may get more complete results under different conditional distributions.

After identifying the relationship between corruption, energy consumption, economic growth, and environmental quality, we proceed to estimate the direct and indirect effect of corruption on energy consumption and environmental quality. The estimation of Eqs (4) and (5) are presented in Table 5.

Before proceeding with the analysis of the results, we have to check two tests: the autocorrelation and instrument validity. AR(2) is the Arellano and Bond (1991) tests of second-order autocorrelation in the first differenced errors. When the regression errors are independent and identically distributed, the first differenced errors are, by construction, auto-correlated. Autocorrelation in the first differenced errors at orders is higher than the one that suggests that the GMM moment conditions may not be valid. The Sargan test (Arellano and Bond (1991)) is a test of over identifying restrictions. A rejection from this test indicates that the model or instruments may be miss-specified. The lower panel of Table5 includes the estimated results. The AR(2) tests show that there is no evidence of autocorrelation at conventional levels of significance. Sargan tests show no evidence of miss-specification at conventional significance levels. These results indicate that the dynamic panel models give good specifications.

From the regression results of Eqs (4) and (5), presented in Table 5, we can obtain the following several findings. Then, the GDP is positively affected by energy consumption. In fact any increase in the energy consumption of one point generates an increase in the level of

GDP of 0.7506 point. Energy is one of the pillars of economic growth. This finding is in line with the work of Esso and Keho (2016), Olugbenga and Oluwole (2013) and Loesse and Yaya (2016). Also, from the first regression, we can see that corruption negatively affects economic growth. The reduction in the level of corruption of a point generates a 0.877 point increase in economic growth. Similar results are given by Rock and Bonnett (2004) and Mauro (1995). From the second equation, we can see that the level of GDP positively affects the consumption of energy. An increase in the level of GDP by one point increases the energy consumption by 0.128 point. The last important costing we can draw from our results is the negative effect of corruption on energy consumption.

The corruption can affect the energy policies through three axes. First, greater corruptibility reduces the stringency of energy policies. Second, increasing costs of coordinating bribery leads to a more stringent energy policies. Third, the distribution of the worker and capital owner lobby’s political pressures depends on how energy policies affects the lobby group member’s income. This results is confirmed by Hanifa and Gago-de-Santos (2017) and Sekrafi and Sghaier (2016), which have shown that reducing the level of corruption stimulates energy saving.

After analyzing the direct effect of corruption on growth, energy consumption, and environmental quality, we can proceed to computing the indirect and the total effect by referring to the decomposition presented in Table 1. The direct, indirect and total effects of corruption on CO2 emissions are shown in Table 6.

By referring to the results of Table 5, we can recognize that the effect of corruption on CO2 emissions may be different among African countries because of different levels of corruption. In the first step, we can find that corruption may directly affect CO2 negatively. However, the indirect effect of corruption on CO2 emission is positive. Thus, the positive effect of corruption on energy consumption dominates the negative effect of corruption on growth. On the other hand, we can observe that whenever the value of the corruption variable moves away from zero (i.e., a lower level of corruption), the negative effect of corruption on the environmental quality decreases. In a second step, we can see that the total effect of corruption on the quality of the environment is positive. Indeed, any increase in the levels of corruption by one point is followed by an increase of 2.9 points of CO2 in the very corrupted countries, associated with the first quantile (10%). For the 9th quantile, the increase of one point of the levels of the corruption generates an increase of 0, 28 point of CO2. The positive total effect for all quantiles shows that all countries in Africa suffer from higher levels of corruptibility. This result can be explained by the sensitivity of African economies to the market economy. Indeed these countries without in the first phase of growth, and in this circumstance, the prevalence of corruption may rapidly break the immature economic system, which may eventually cause CO2 emissions to become more serious. Also, high levels of corruption encourage large-scale enterprises to settle in African countries since they do not to pay the taxes imposed on the quality of the environment. This finding is well justified by the “Havre pollution” hypothesis.

Conclusion

The determination of the total effect of corruption on the environmental quality appears complicated with the interdependence between growth, energy consumption, and environmental quality on the one hand and the different value of corruption, which fluctuate from one country to another. To solve these problems, we used quantile regression analysis to take into account different levels of corruption. In addition, we used the GMM method to solve endogeneity problems between variables.

While our results confirm the negatively direct effect of corruption on environmental quality, the total effect indicates a positive effect. In addition to its direct effect, corruption affects environmental quality through two channels: the economic growth and energy consumption. The positive indirect effect through the two channels dominates the direct effect. Then, corruption has a positive direct effect on energy consumption. Finally, it is suitable to extend the database. However, it is extremely difficult to get estimations of the shadow economy especially in African countries.

References

Abed, G. T. & Gupta, S. (2002) Governance, corruption, and economic performance. International Monetary Fund. https://doi.org/10.5089/9781589061163.071

Ahmed, K., & Long, W. (2012). Environmental Kuznets curve and Pakistan: an empirical analysis. Procedia Economics and Finance, 1, 4–13.

Alam, M. M., Murad, M. W., Noman, A. H. M., & Ozturk, I. (2016). Relationships among carbon emissions, economic growth, energy consumption and population growth: Testing environmental Kuznets curve hypothesis for Brazil, China, India and Indonesia. Ecological Indicators, 70, 466–479.

Alexander, M., Harding, M., & Lamarche, C. (2011). Quantile regression for time-series-crosssection data. International Journal of Statistics & Management Systems, 6(1–2), 47–72.

Al-Mulali, U., Saboori, B., & Ozturk, I. (2015). Investigating the environmental Kuznets curve hypothesis in Vietnam. Energy Policies, 76(2015), 123–131.

Anderson, C. J., & Tverdova, Y. V. (2003). Corruption, political allegiances, and attitudes toward government in contemporary democracies. American Journal of Political Science, 47(1), 91–109.

Ang, J. B. (2007). CO2 emissions, energy consumption, and output in France. Energy Policies, 35(10), 4772–4778.

Apergis, N., & Payne, J. E. (2009). CO2 emissions, energy usage, and output in Central America. Energy Policies, 37, 3282–3286.

Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies, 58, 277–297.

Arouri M., Shahbaz M., Onchang R., Islam F. & Teulon F. (2014) Environmental Kuznets curve in Thailand: cointegration and causality analysis, Working Paper, 2014- 204; 2014.

Baek, J., & Pride, D. (2014). On the income-nuclear energy-CO2 emissions nexus revisited. Energy Economics, 43, 6–10.

Basarir, A., & Arman, H. (2014). The effects of economic growth on environment: an application of environmental Kuznets curve in United Arab Emirates. Online Journal of Science and Technology, 4(1), 53–59.

Begum, R. A., Sohag, K., Abdullah, S. M. S., & Jaafar, M. (2015). CO2 emissions, energy consumption, economic and population growth in Malaysia. Renewable and Sustainable Energy Reviews, 41, 594–601.

Bellos, S., & Subasat, T. (2012). Corruption and foreign direct investment: a panel gravity model approach. Bulletin of Economic Research, 64(4), 565–574.

Biswas, A. K., Farzanegan, M. R., & Thum, M. (2012). Pollution, shadow economy and corruption: Theory and evidence. Ecological Economics, 75, 114–125.

Borhan H. B., Hitam M. B., Mohamed R. N. & Muda M. (2012) Income and CO2 in China and Malaysia from environmental Kuznets curve perspective. In: Proceedings of the Cambridge Business & Economics Conference Cambridge, UK, June 27–28.

Chimeli, A. B., & Braden, J. B. (2005). Total factor productivity and the environmental Kuznets curve. Journal of Environmental Economics and Management, 49(2), 366–380.

Cole, M. A. (2007). Corruption, income and the environment: an empirical analysis. Ecological Economics, 62(3), 637–647.

Cooraya, A., Dzhumashevb, R., & Schneiderc, F. (2017). How does corruption affect public debt?An Empirical Analysis. World Development, 90, 115–127.

Damette, O., & Delacote, P. (2012). On the economic factors of deforestation: what can we learn from quantile analysis? Economic Modelling, 29(6), 2427–2434.

Damiana, et al. (2003). Trade liberalization, corruption, and environmental policies formation: Theory and evidence. Journal of Environmental Economics and Management, 46(3), 490–512.

Desai, U. (1998). Ecological policies and politics in developing countries: growth, democracy and environment. Albany: State University of New York Press.

Esso, L. J., & Keho, Y. (2016). Energy consumption, economic growth and carbon emissions: cointegration and causality evidence from selected African countries. Energy, 114, 492–497.

Fisman, R., & Svensson, J. (2007). Are corruption and taxation really harmful to growth? Firm level evidence. Journal of Development Economics, 83(1), 63–75.

Fredriksson, et al. (2004). Corruption and energy efficiency in OECD countries: theory and evidence. Journal of Environmental Economics and Management, 47, 207–231.

Grooms, K. K. (2015). Enforcing the clean water act: the effect of state-level corruption on compliance. Journal of Environmental Economics and Management, 73, 50–78.

Hafner O. (1998). The role of corruption in the misappropriation of tropical forest resources and in tropical forest destruction. Transparency International Working Paper.

Hakkala, K. N., Norbäck, P. J., & Svaleryd, H. (2008). Asymmetric effects of corruption on FDI: evidence from Swedish multinational firms. The Review of Economics and Statistics, 90(4), 627–642.

Hanifa, I., & Gago-de-Santos, P. (2017). The importance of population control and macroeconomic stability to reducing environmental degradation: An empirical test of the environmental Kuznets curve for developing countries. Environmental Development., 23, 1–9. https://doi.org/10.1016/j.envdev.2016.12.003.

Hansen, B., & Østerhus, S. (2000). North Atlantic Nordic seas exchanges. Progress in Oceanography, 45(2), 109–208.

Hayashi. (2000). “Econometrics”, is published by Princeton University Press and copyrighted, 2000, by Princeton University Press, Princeton.

Huang, C. J. (2016). Is corruption bad for economic growth? Evidence from Asia-Pacific countries. The North American Journal of Economics and Finance., 35(1), 247–256.

Imran, A. B., Roshan, A., Naeem, A., Zulfiqar, A. (2017). Traditional rice farming accelerate CH4 & N2O emissions functioning as a stronger contributors of climate change. Agri Res & Tech J, 9(3), 555765. https://doi.org/10.19080/ARTOAJ.2017.09.555765.

Jain, A. K. (2001). Corruption: a review. Journal of Economic Surveys, 15(1), 71–121.

Jebli, M. B., & Youssef, S. B. (2015). The environmental Kuznets curve, economic growth, renewable and non-renewable energy, and trade in Tunisia. Renewable and Sustainable Energy Reviews, 47(2015), 173–185.

Kanjilal, K., & Ghosh, S. (2013). Environmental Kuznet’s curve for India: evidence from tests for cointegration with unknown structural breaks. Energy Policies, 56, 509–515.

Kaufmann, D., & Kraay, A. (2008). Governance indicators: where are we, where should we be going? The World Bank Research Observer, 23(1), 1–30.

Koenker, R. (2004). Quantile regression for longitudinal data. Journal of Multivariate Analysis, 91(1), 74–89.

Lamarche, C. (2011). Measuring the incentives to learn in Colombia using new quantile regression approaches. Journal of Development Economics, 96(2), 278–288.

Lee, J. S., Huang, G. L., Kuo, C. T., & Lee, L. C. (2012). The momentum effect on Chinese real estate stocks: evidence from firm performance levels. Economic Modelling, 29(6), 2392–2406.

Leitao, A. (2010). Corruption and the environmental Kuznets Curve: empirical evidence for sulfur. Ecological Economics, 69(11), 2191–2201.

Loesse, J. E., & Yaya, K. (2016). Energy consumption, economic growth and carbon emissions: cointegration and causality evidence from selected African countries. Energy, 114, 492–497.

Lopez, R., & Mitra, S. (2000). Corruption, pollution, and the Kuznets environment curve. Journal of Environmental Economics and Management, 40(2), 137–150.

Mauro, P. (1995). Corruption and growth. Quarterly Journal of Economics, 110(3), 681–713.

Olugbenga, A. O., & Oluwole, O. (2013). Carbon emissions and income trajectory in eight heterogeneous countries: the role of trade openness, energy consumption and population dynamics. Journal of Global Economy, 9, 85e122.

Ozturk, I., & Al-Mulali, U. (2015). Investigating the validity of the environmental Kuznets curve hypothesis in Cambodia. Ecological Indicators, 57, 324–330.

Paunov C. (2016). Corruption’s asymmetric impacts on firm innovation. Journal of Development Economics, 118, 216–231.

Pellegrini, L., & Gerlagh, R. (2006). Corruption and environmental policies: what are the implications for the enlarged EU. European Environment, 16(3), 139–154.

Rabah, A., & Markus, B. (2011). Oil rents, corruption, and state stability: evidence from panel data regressions. European Economic Review, 55(2011), 955–963.

Rock, M. T., & Bonnett, H. (2004). The comparative politics of corruption: accounting for the East Asian paradox in empirical studies of corruption, growth and investment. World Development, 32(6), 999–1017.

Saboori, B., Sulaiman, J., & Mohd, S. (2012). An empirical analysis of the environmental Kuznets curve for CO2 emissions in Indonesia: the role of energy consumption and foreign trade. International Journal of Economics and Finance, 4(2), 243–251.

Schneider, F., Buehn, A., & Montenegro, C.E.( 2010) Shadow economies all over the world new estimates for 162 countries from 1999 to 2007. The World Bank Policy Research working paper 5356, The World Bank, Washington, D.C.

Sekrafi, H., & Sghaier, A. (2016). Examining the relationship between corruption, economic growth, environmental degradation, and energy consumption: a panel analysis in MENA region. Journal of the Knowledge Economy, 9, 963–979. https://doi.org/10.1007/s13132-016-0384-6.

Seldadyo, H., & De Haan, J. (2011). Is corruption really persistent? Pacific Economic Review, 16(2), 192–206.

Shahbaz, M., Lean, H. H., & Shabbir, M. S. (2012). Environmental kuznets curve hypothesis in Pakistan: cointegration and granger causality. Renewable and Sustainable Energy Reviews, 16(5), 2947–2953.

Shahbaz, M., Solarin, S. A., & Ozturk, I. (2016). Environmental Kuznets curve hypothesis and the role of globalization in selected African countries. Ecological Indicators, 67, 623–636.

Shleifer, A., & Vishny, R. W. (1993). Corruption. Quarterly Journal of Economics, 108(3), 599–617.

Transparency International. (2015). https://www.transparency.org/cpi2015. Accessed 2017.

Walter, M., & Luebke, M. A. (2013). The impact of corruption on climate change: threatening emissions trading mechanisms. Environmental Development., 7, 128–138.

Wang, Q., Zhao, Z., Shen, N., & Liu, T. (2015). Have Chinese cities achieved the win-win between environmental protection and economic development? From the perspective of environmental efficiency. Ecological Indicators, 51, 151–158.

Zhang, Y. J., & Da, Y. B. (2015). The decomposition of energy-related carbon emission and its decoupling with economic growth in China. Renewable and Sustainable Energy Reviews, 41, 1255–1266.

Zhang, Y.-J., Jin, Y.-L., Chevallier, J., & Shen, B. (2016). The effect of corruption on carbon dioxide emissions in APEC countries: A panel quantile regression analysis. Technological Forecasting and Social Change, 112, 220–227.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Habib, S., Abdelmonen, S. & Khaled, M. The Effect of Corruption on the Environmental Quality in African Countries: a Panel Quantile Regression Analysis. J Knowl Econ 11, 788–804 (2020). https://doi.org/10.1007/s13132-018-0571-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13132-018-0571-8