Abstract

This article aims to develop elements of answers to the effect of adequate entrepreneurial activity that would have effects on economic growth. This work analyzes the relationship between entrepreneurship and economic growth for a panel of developing countries over the 2004–2011 periods. In this study, we used two measures of entrepreneurship: the new density and the potential of innovation. We estimated a growth function using the method of static and dynamic panel data. Our results show that the new density and growth are significantly and positively correlated. Our results also show that if the short-term impact of technological innovation on growth is negative, this effect is positive in the long term. This result confirms the theoretical predictions, namely the theory of spillage.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

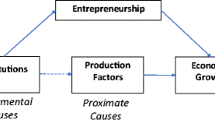

Entrepreneurship is linked to innovation and competitive advantage. Its importance is manifested not only in public policy initiatives that promote the development of new businesses, but also within established organizations that encourage developing and seeking new opportunities.

Entrepreneurship is considered as a key instrument for the improvement of competitiveness among nations, promote economic growth, and increase employment opportunities. The three major trends of thought of entrepreneurship theory are those of Schumpeter (1934), who defines entrepreneurship as the ability to introduce innovations, Baumol (1968), who considers that productive entrepreneurship is encouraged by incentives for entrepreneurs to focus on productive innovation, and finally Kirzner (1973), who admits that the discovery of an opportunity is the central element of entrepreneurship.

Furthermore, Cipolla (1981) argues that entrepreneurship is a long-term driver of economic growth. By penetrating new markets, entrepreneurship provides new opportunities, adopts new production techniques, diversified production, and intensified competitions. However, in recent years, empirical studies testing the relationship between entrepreneurship and economic growth have multiplied (Carree and Thurik 1999; Carree et al. 2004; Salgado-Banda 2004; Audretsch 2007; Afolabi 2015). These studies are facing the problem of measuring entrepreneurship and data availability.

In fact, entrepreneurship is relatively difficult to measure. Several studies based on data about self-employment, surveys, and specialized interviews discussed entrepreneurship. Self-employment is often used as a measure of entrepreneurship (Storey 1991; Hamilton 2004); however, it may not adequately reflect the nuances of entrepreneurship in the developing countries. Self-employment can be measured based on official data of self-reported job and probably left unreported respondents (informal). Other approaches to the measurement of entrepreneurship focus on the GEM (Global Entrepreneurship Monitor) approach and WBGES approach (World Bank Group Entrepreneurship Survey).

The GEM project is an effort to produce data that can be comparable across countries; it is mainly based on surveys and specialist interviews. The GEM surveys a random sample of people to produce the index “Total Entrepreneurial Activity” for each country. The TEA index is the sum of start-ups (people trying to start a business) and new business. This index measures the interest investigation by the workforce brings to business creation. Surveys of the WBGES are also designed to compare countries and measure entrepreneurship in the formal sector and the number of new limited liability companies (LLC) officially registered. By definition, WBGES does not include the informal sector, counting only “economic units in the formal sector incorporated and registered in a public register, which is capable of incurring liabilities and engaging in economic activities and transactions with other entities.”

Acs et al. (2014) have built an empirical framework, Global Entrepreneurship and Development Index (GEDI), to measure National Entrepreneurial Ecosystem (NEE) and its consequences for economic growth. They explain not just why some people choose to become entrepreneurs while others do not, but also how and why their performance differs in the aggregate across counties. They develop a new index methodology characterizing national systems of entrepreneurship recognizing interactions between different components and in particular identifying bottleneck factors that hold back entrepreneurial performance. In addition, other indicators, such as spending on R&D, the number of patents can be used (Hsu and Ziedonis 2008; Salgado-Banda 2007). These indicators are significantly greater than self-employment.

Thus, to study the effect of entrepreneurial activity on economic growth, we used two measures of entrepreneurship: the new businesses density proposed by the Doing Business Project of the World Bank where data from developing countries are available and the potential of the innovation measured by the number of patents filed to study the relationship between entrepreneurship, innovation, and growth. To this end, this paper is organized as follows: In a first section, we present the literature review on the importance of entrepreneurship and the relationship between entrepreneurship, technology innovation, and growth. In a second section, we move to the empirical validation. Empirical studies on the developing countries are very few. To enrich this research, we focus on a sample of developing countries. We propose our econometric results and economic interpretation with variables, data, and model. Based on the technique of static and dynamic panel data, the main results are first, new business density and growth are significantly and positively correlated, then, the effect of technological innovations on economic growth is positive and significant only in the long term.

Literature Review

Importance of Entrepreneurship

Although interest in entrepreneurship is not new, the term entrepreneur was used for the first time in an economic context in 1755 and attributed to Richard Cantillon. Therefore, many books and articles have been written on subjects related to entrepreneurship. As a result of the increasing attention of the subject, entrepreneurship was studied by using psychological, sociological, anthropological, and of course economic approaches. This reflects the complexity of the definition of entrepreneurship, and then the concept is clearly open to research based on various grounds. We use, as a starting point, the contributions and ideas of three economists: Joseph A. Schumpeter (1934), William J. Baumol (1968) and Israel M. Kirzner (1973).

For Schumpeter, entrepreneurship occurs when there is innovation in the introduction of a new product or a new organization. Therefore, understanding an entrepreneur was a conceptual abstraction characterized by the creation of new combinations. More precisely:

The introduction [of new products] is achieved by founding new businesses, whether for production or for employment or for both. What have the individuals under consideration contributed to this? Only the will and the action; not the concrete goods, for they bought these either from others or from themselves; not the purchasing power with which they bought, for they borrowed this from others or, if we also take account of acquisition in earlier periods, from themselves. (Schumpeter 1934 p.78).

And what have they done? They have not accumulated any kind of good; they have created no original means of production, but have employed existing means of production differently, and more appropriately, more advantageously. They have carried out new combinations. They are entrepreneurs. And their profit, the surplus, to which no liability corresponds, is an entrepreneurial profit. (Schumpeter 1934 p.132).

Thus, when an entrepreneur ceases to innovate, he ceases to be an entrepreneur. In addition, for Schumpeter, entrepreneurship and innovation of the entrepreneur lead to a “creative destruction” in the markets and sectors of the economy because of new products and business models which come to replace the old ones. Thus, the “creative destruction” is at the origin of the long term economic growth.

Taking the work of Joseph Schumpeter on innovation, William Baumol insists on the role of innovation in competition between firms. The entrepreneur is an innovator who is always engaged to do something that has never been done before.

Baumol shows that while the total number of entrepreneurs (entrepreneurial intensity) varies among companies, their contribution to growth varies more according to their more or less productive allocation over time and the studied cultures (1990). For him, the bottom line is that the distinction between good and bad entrepreneurs depends on their relative returns. Therefore, the right incentives and strong institutions that raise the reward in relation to productive entrepreneurship should be designed.

According to Baumol, (2002, p.5) productive entrepreneurship is favored «by incentives for entrepreneurs to devote themselves to productive innovation rather than to innovative rent-seeking (the nonproductive pursuit of economic profit such as occurs in inter-business lawsuits), or even to destructive occupations, such as criminal activities.»

In fact, Baumol distinguishes between entrepreneurs and emphasizes the intrinsic relevance of the economic context in determining the productive entrepreneurship. Finally, for him, the entrepreneur is an innovator. More precisely, “who constantly seeks the opportunity to introduce new products and new procedures, to invade new markets, and to create new organizational forms” (Baumol 2002, p.57). Kirzner emphasizes the crucial role of the entrepreneur in balancing the markets. For him, entrepreneurial profit is a pure profit that is not linked to the use of production factors. It comes from a simultaneous purchase decision and sale following the discovery of differences of advantageous prices, the existence of which is based on the ignorance of the agents about the accurate demand and supply. So far, economic agents have ignored the profit opportunities that cannot be discovered only by the establishment of specific investments which depend primarily on the capacity of individuals and on their in particular “vigilance.”

Therefore, Kirzner argues that opportunities exist because the actors of the market and the entrepreneurs are the rare individuals who will benefit from these market deficiencies. Indeed, opportunities exist all around us in space and time; however, it is only the individuals, with what Kirzner calls “vigilance,” can identify them. The perceived profit opportunities depend on the vigilance of the contractor to the differential in staffing information of individuals on the market.

Entrepreneurship, Technological Innovation, and Economic Growth

Solow (1956) discovered a large “residual” when considering the determinants of growth, which reflects technological progress. The Solow model assumes that technical progress is exogenous, which for Solow is a basket fallen from the sky because its action is automatic and independent from the economic circumstances. The goal is to improve the measurement quality of the variables included in the growth estimates and to reduce the size of the residue. The central feature of these growth models is the treatment of exogenous technical progress. Technology remains a black box with a little effort to present its determinants. Exogenous growth models are based on the decreasing returns (Krugman 1991).

The new growth theory is beyond the assumption of diminishing returns and exogenous technological innovation. According to this new theory, technological progress is the result of economic activity. Knowledge and technology are products arising from investments of the human capital (education and training), specialized labor employment (R&D staff), and equipment. This is the endogenous growth theory since it internalizes technological innovation in a market operating model. Thus, growth is related to the incentive to invest in physical and human capital.

The new theories of economic growth (Lucas 1988; Romer 1986) have therefore exceeded the limits of exogenous technological innovation that was the basis of the work of Solow, since they consider the accumulation of human capital as a decisive source of economic growth. Currently, it is assumed that new technologies constitute the leading force to long-term productivity growth. Technological innovation is one of the main drivers of economic growth. Spending on R&D corresponds to the adoption of technology and contributes to economic growth (OECD 2004; Belitz et al. 2015.

Innovation and technology adaptation are the drivers of productivity growth and therefore of long-term growth. These innovations depend on the level of the human capital. Indeed, the stock of the human capital determines the capacity of a country to innovate and catch up with the more developed countries. The new theoretical approach, called new growth theory, highlights the links between investment in the human capital, technological innovation, and economic growth. This approach has helped to renew the transition from a resource-based economy to a knowledge-based economy (Cortright 2001; Tocan 2012).

Indeed, the basic idea of the growth theory is to endogenize the rate of economic growth in the long term. Baumol (1993, p.259–260) suggests: «… That so far as capital investment, education, and the like are concerned, one can best proceed by treating them as endogenous variables in a sequential process–in other words, these variables affect productivity growth, but productivity growth, in turn, itself influences the value of these variables, after some lag. These endogenous influences are, then, critical workings of a feedback process».

To some degree, the same story can be told about the exercise of entrepreneurship, investment in innovation, and the magnitude of activity directed to the transfer of technology. These too, clearly, are influenced by past productivity growth achievements and they also, in their turn, influence future growth. Yet it would seem plausible that there is a strong streak of erogeneity in these variables, which can help to account for the outbreak and spread of industrial revolutions and for the relative decline and even for the ruin of economies that formerly were models of success.

The relationship between entrepreneurship, technological innovation, and economic growth has been the subject of numerous studies over the last decade. Using the GEM 2002 database of 37 countries, Autio et al. (2005) started from a Cobb-Douglas production function to explain that entrepreneurship and technological innovation are key factors for growth. They concluded that the rapid growth of new companies generates job creation in small and medium enterprises in the developed countries. To analyze the impact of entrepreneurship on economic growth, Li et al. (2008)) used the technique of panel data for 29 regions in China over a 20-year period. By combining the theoretical definition of entrepreneurship with the characteristics of Chinese entrepreneurs, their results suggested a positive impact of entrepreneurship on economic growth.

This result is more robust when the institutional and demographic variables are controlled. Likewise, Salgado-Banda (2007) used a new proxy for entrepreneurship, such as the number of patent next to self-employment. He found that self-employment is negatively correlated with the real GDP per capita in 22 OECD countries over the 1980–1995 periods, while innovation measured by the number of patents is positively correlated with economic growth. Panagiotis and Spyridon (2013) show that entrepreneurship exerts a strong positive impact on the economic growth. It is implied that entrepreneurship is more productive compared with the innovation in Greece. Several authors have even downplayed the importance of innovation for developing countries. Furthermore, other authors interested in the relationship among entrepreneurship, innovation (knowledge capital), and economic growth, in general (Naudé 2008), and in developing countries, in specific (Naudé 2010). Also, Szirmai et al. (2011) focus a better understanding of the relationship between entrepreneurship, innovation, and growth in developing countries.

However, Van Stel et al. (2005) show that the impact of entrepreneurial activity on economic growth is higher in developed countries than in developing countries. Moreover, if youth engagement (18–24 years) in entrepreneurial activity is important for the growth of developed countries; these are older entrepreneurs (45–64 years) who make the greatest contribution to growth in developing countries (Verheul and Van Stel 2010). Indeed, in developing countries, many of the new businesses are primarily motivated by low wages and the desire to create their own jobs. In this case, the managerial skills are not necessarily present. Older entrepreneurs are more likely to entrepreneurial success.

Developing countries are countries with strong entrepreneurial intensity for several reasons. The weight of the agricultural sector and the functioning of the informal economy reinforce the presence of small businesses. On the other hand, since the real wage in developing countries is low, the occupational choice in favor of entrepreneurship is more favorable; this is sometimes the only opportunity that possess individuals to receive remuneration.

From a continuous distribution in managerial skills in the working population, Lucas (1978) then shows that with the development of many small individual entrepreneurs with low staffing managerial skills prefer to hire as employees in an existing company since the real wage level increases and becomes more important than their compensation as an entrepreneur. There would be thus a reduction in the entrepreneurial activity according to the development of the countries. According to the GEM (2006, 2009), the propensity to undertake shows large differences between regions with a U-shaped relationship between entrepreneurship and economic development level. In total, the comparison in terms of entrepreneurial intensity therefore makes sense that between substantially similar geographic areas in terms of development levels (Bonnet 2012).

Empirical Analysis

Our objective in this part is to empirically study the link between entrepreneurship, technological innovation, and economic growth for a sample of 35 developing countries using data over the 2004–2011 periods. Our study is performed using the method of the data of static and dynamic panel. Therefore, we carry out estimates on a model with individual effects, which focus on the dynamic model where we introduce the delayed endogenous variable as an explanatory one.

Econometric Model Specification

Like in the work of Mankiw et al. (1992), Demetriades and Law (2004), the objective of our empirical study is to add other determinants of economic growth to the equation of the growth model in order to treat the relationship between entrepreneurship, innovation, and economic growth. Therefore, two equations are estimated:

where i and t, respectively, indicate the country and the time.

For i = 1,............, 35; t = 2004,......, 2011.

With α i is the individual specific effect, β1, β2, β3, β4, and β5 are the parameters to be estimated and εi is the error term.

Presentation of the Variables

Variables of Entrepreneurship

In this study, we use two different measures of entrepreneurship: Entrepreneurial activity is measured by the new businesses density (ND). The Doing Business Project of the World Bank proposes a new database on the density of enterprises and entrepreneurship. To measure entrepreneurial activity, annual data are obtained directly from the 139 companies on the number of new businesses created during the period 2004–2012.

Another measure that takes into account the degree of innovation is approximated by the number of patents filed by residents and non-residents (PAT). The data on variables measuring the entrepreneurial activity are collected from the Doing Business report of the World Bank Group, whereas those related to the potential for innovation are drawn from the database of the World Bank (WDI). All the data are transformed into a natural logarithm.

The Control Variables

The variables of the model are collected for a panel of 35 developing countries during 2004–2011 periods. The dependent variable is the real GDP per capita (Y), and the explanatory variables are the capital stock (Ki) measured by the rate of investment in physical capita, the share of government consumption in real GDP per capita (Kg), the population (POP), the level of consumer prices (PC), and economic openness measured by the rate of exports plus imports to GDP (EO). All the data are derived from Penn World Tables (Heston, Summers, and Aten 2012) version 7.1 and (Feenstra, Inklaar, and Timmer 2013) version 8.0. Table 1 presents the descriptive statistics of all the variables.

Method of Estimation and Interpretation of Results

In this section, we present the results of the estimates of the model represented by Eqs. [1] and [2]. Thus, we use two estimation methods. The first method is the static panel data method, which allows taking into account unobserved heterogeneity of the sample countries. The individual characteristics can be of deterministic or random nature. The specification test of Hausman (1978) makes it possible to choose either of these specifications. The fixed effects models (FEM) will be retained if the probability attached to the Hausman test statistic is less than 10 %; otherwise, the random effects models is retained (REM). The second followed econometric method is the general method of moments (GMM) in which the growth rate from one period is delayed among the explanatory variables.

Entrepreneurial Activity Measured by the New Businesses Density (Eq. [1])

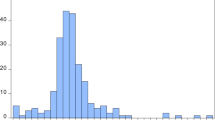

Using the static panel data method for 35 developing countries over the 2004–2011 periods, we obtained the results presented in Table 2.

According to the estimation results, we find that the calculated Fisher statistics is superior to that of the statistical Table 2. This leads us to conclude that we must reject the null hypothesis of interindividual homogeneity. In other words, we must favor a model taking into account individual specificities.

For the regression (1), the realization of the statistics of the Hausman test is of 13.49. Since the model has two explanatory variables (K = 2), this statistics follows a chi-squared with two degrees of freedom and the threshold is 5.992. We therefore reject the null hypothesis of no correlation between the individual effects and the explanatory variables. Thus, we must prioritize the adoption of fixed effects models and retain the one within the estimator. Regression (1) shows that the variable measuring entrepreneurial activity, namely the new businesses density, has a positive and significant coefficient. The R-square is low (0.32), which is explained by the fact that entrepreneurial activity cannot be considered only as a factor of production.

Regression (2) shows the regression results following the introduction of other control variables. The realization of the Hausman test statistics is (46.39). Model (2) includes five explanatory variables (K = 5); this statistic follows a chi-squared with five degrees of freedom with a threshold of 11.071. We find that the estimates made will be those of individual fixed effects models. Entrepreneurship measured by the new businesses density has a positive and significant impact on economic growth. This finding is consistent with the theoretical and empirical literature shown below. Moreover, the control variables have expected signs and are very significant. Public expenditures represent a negative sign in the sense that an increase in the weight of the state stifles economic activity. In the developing countries, population growth has serious negative effects on economic development. Therefore, the sign obtained for the population can be explained by the possibility of the existence of this effect in the opposite direction for the country at the beginning of demographic transition. Finally, the explanatory power of the model is acceptable (R-square = 0.81), which indicates a good specification.

Entrepreneurial Activity Measured by the Number of Patents (Eq. [2])

After using the new businesses density as a measure of entrepreneurship, we used another measure that takes into account the degree of innovation approximated by the number of patents filed by residents and non-residents. Estimates of innovation were performed using the individual effects and Arellano-Bond GMM estimators. The individual effects suppose the existence of identical coefficients for all individuals and specific constants. Thus, the economic relationship evidenced through this type of modeling is supposed to be different for all individuals at the level of the constants introduced in the model provided that there is no endogeneity problem.

The GMM analysis includes country fixed effects and produces consistent estimators in the presence of the lagged dependent variable. In addition, by including the lagged dependent variable in the analysis, the GMM method takes into account the endogeneity problem. This explains the exponential use of dynamic panel data in the recent studies on growth.

On the basis of the compensation theory, we, first of all, chose to measure the short-term effects of the diffusion of technological innovation on economic growth. Then, we will propose a dynamic modeling approach that will aim to estimate the impact of technological innovation on long-term economic growth. A rigorous measurement of the effects of technological innovation on growth requires a distinction between the short term and the long term. To do this, we used the general specifications of the timely panel data models. In the short term, technical progress can have a negative effect on growth. However, innovation is the main driver of long-term growth, which largely compensates for short-term losses which proves the theory of spillage of Alfred Sauvy.

Short-Term effects

First, we start by studying the short-term effect of the diffusion of technological innovation on economic growth. The results are represented in Table 3.

The result of the Fisher test leads us to reject the null hypothesis of interindividual homogeneity. It is therefore prefer able to use a model taking into account individual specificities. According to the results of estimating the regression (1), specifically, the statistics of Hausman test, we find that the estimates will be those of the random effects models. The realization of the Hausman test statistics is 0.72. Since the model has two explanatory variables (K = 2), this statistics follows a chi-squared with two degrees of freedom at the threshold of 5.992.

Regression (1) of Table 3 shows that the variable measuring entrepreneurial activity, namely the degree of innovation, has a negative and insignificant coefficient. Model (2) shows the regression results following the introduction of other control variables. The realization of the Hausman test statistics is (96.79).

Regression (2) includes five explanatory variables (K = 5), where this statistics follows a chi-squared with five degrees of freedom and a threshold of 11.071. We find that the estimates will be those of individual fixed effects models. Technological innovation has a negative and insignificant impact on economic growth. This finding is consistent with the theory of spillage. This economic theory is based on the idea that technical progress creates jobs more than they eliminate. The destruction of jobs, and subsequently the economic downturn, is visible in the short term (capital/labor substitution), whereas in the long term, it generates jobs and therefore stimulates growth.

Generally, the estimator “between” is a good estimator in the long term (Pirotte 1994, 1996), whereas the estimated coefficients of interindividual regression seem insignificant. To overcome this problem, we use the dynamic panel approach.

Long-Term effects

Starting from Eq. [2], the estimates were made using the dynamic panel system GMM method by introducing the delayed endogenous variable as an explanatory variable. This is showed in Eq. [3]:

A dynamic model is a model in which one or more delays of the dependent variables are included as explanatory variables. This method solves the problems of simultaneity bias, reverse causality, and omitted variables that weaken the earlier results. It also helps treat the problem of endogeneity of all the explanatory variables. There are two variants of the GMM estimator in dynamic panel: the first is the “difference GMM” estimator and the second is “system GMM” estimator. The system GMM combines into a single system a difference in regression and a regression in levels (Arellano and Bover 1995; Blundell and Bond 1998); therefore, it is the most suitable for our empirical test. Both tests are associated with the dynamic panel GMM: the over-identification test Sargan/Hansen, which can test the validity of the lagged variables as instruments, and the Arellano and Bond (1991) test for autocorrelation where the null hypothesis is the absence of autocorrelation of the first order errors in the level equation. In our regressions, the results of both tests are in line with our expectations. Indeed, the statistics does not reject Ho hypothesis of the validity of the lagged variables as instruments. The results are presented in Table 4.

According to the estimation results, we find that for the system GMM estimator, diagnostic statistics are favorable. The over-identification Sargan test does not indicate any problem concerning the validity of the instrumental variables. Furthermore, non-rejection of the null hypothesis of no autocorrelation of second order attested by a non-significant statistic provides a new justification for the model specification.

Regression (1) shows that the variable measuring entrepreneurial activity: the number of patents has a positive and significant coefficient. Regression (2) presents the regression results after the introduction of other control variables. The two regressions confirm the positive and significant long-term effect of technological innovation on economic growth. Wong, Ho, and Auto (2005) found similar results for the cross-sectional data. However, this effect is significant only when the delay corresponds to four periods. According to the results presented in the Table 4, it is easy to notice that in both columns, the estimated coefficients are significant and in agreement with theoretical predictions. The coefficient on technological innovation is more interesting in regression (2); it becomes significant at the 5 % level. This means that the potential for innovation can generate additional growth in the presence of a more favorable institutional framework. However, if our estimation results indicate that the effect of technological innovation is negative in the short term (Table 3), the results presented in Table 4 show that this effect is positive in the long term. This result is consistent with the theory of spillage. The negative effect of short-term innovation is offset in the long term.

In conclusion, we can say that entrepreneurship has a positive effect on economic growth for our sample of developing countries. By against, technological innovation, its positive impact is manifested only in the long term. In the short term, the effect of innovation on growth is negative for developing countries. Our result confirms the theory of compensation where the long-term technological innovation, through the existence of economic forces, can compensate short-term growth losses. Moreover, for a sample of developing countries, technological innovation is beneficial to the long-term growth. This can be explained by the immediate effect of innovation on the increase in the unemployment rate especially for developing countries. The jobs lost because of the new machines are replaced later by jobs created in areas where these new machines are produced. Also, technologies are often imported by developing countries, which require a period of adjustment in these countries.

Conclusion

The purpose of this study is to highlight the potential role of entrepreneurship in economic growth. In this context, we have summarized the relationship between entrepreneurship, innovation, and economic growth. There are several studies that establish a direct link between entrepreneurship and economic growth. Other empirical studies attempt to analyze the relationship between the level of entrepreneurship and economic growth of the countries or regions of a country. They try to explain how entrepreneurship is an important factor in explaining higher levels of economic growth.

The importance of entrepreneurship manifests itself not only in public policy initiatives that promote the development of new businesses but also within established organizations that actively encourage the development and seeking new opportunities. In this sense, entrepreneurship which is considered a key instrument for improving competitiveness among nations, promote economic growth and increase employment opportunities, is related to innovation and competitive advantage.

Therefore, a positive relationship is expected between entrepreneurship and economic growth. If entrepreneurial activity is seen as a factor promoting economic growth, innovation also has a positive effect on long-term economic growth. To test these hypotheses, we conducted an empirical study based on the technique of panel data (35 developing countries over the 2004–2011 periods). The results confirm the key assumptions. Entrepreneurial activity measured by the new businesses density stimulates economic growth. On the other hand, technological innovation promotes economic growth in the long term. We also demonstrated that the indicators used to measure entrepreneurship take amplitudes more and become more significant in the presence of a favorable institutional framework. These results should encourage governments to give more importance to the promotion of entrepreneurial activities by raising awareness of entrepreneurship culture since school education and the reduction of administrative procedures sufficient when creating new businesses.

Ultimately developing countries should promote a society and an entrepreneurial culture. Integrating entrepreneurship at all levels of the formal system and ensure access of the adult population to information, skills, and knowledge specialized relating to entrepreneurship through learning programs throughout life. Entrepreneurship must be the engine of economic growth in developing countries.

To conclude, the main limitation of this study concerns the period of the study is limited to 7 years. In addition, the lack of data does not allow testing the impact of entrepreneurial activity on economic growth for a wide sample of countries especially in the developing world.

References

Acs, Z. J., Autio, E., & Szerb, L. (2014). National systems of entrepreneurship: measurement issues and policy implications. Research Policy, 43(3), 476–494.

Afolabi, A. (2015). The effect of entrepreneurship on economy growth and development in Nigeria. International Journal of Development and Economic Sustainability, 3(2), 49–65.

Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Review of Economic Studies, 58(2), 277–297.

Arellano, M., & Bover, O. (1995). Another look at the instrumental-variable estimation of error-components models. Journal of Econometrics, 68(1), 29–51.

Audretsch, D. B. (2007). Entrepreneurship capital and economic growth. Oxford Review of Economic Policy, 23(1), 63–78.

Autio, E., Ho, Y. P., & Wong, P. K. (2005). Entrepreneurship, innovation and economic growth: evidence from GEM data. Small Business Economics, 24, 335–350.

Baumol, W. J. (1968). Entrepreneurship in economic theory. American Economic Review, 58, 64–71.

Baumol, W. J. (1993). Formal Entrepreneurship Theory in Economics: Existence and Bounds, Journal of Business Venturing, 8, 197–210.

Baumol, W. J. (2002). Entrepreneurship, Innovation and Growth: the David-Goliath Symbiosis. Journal of Entrepreneurial Finance and Business Ventures, 7(2), 1–10.

Belitz, H., Junker, S., Podstawski, M., & Schiesch, A. (2015). R&D as a growth driver. Economic Bullettin, 35.

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87, 115–143.

Bonnet J. (2012). Entrepreneurship and economic development, working paper, University of Caen Basse-Normandie, CREM-CNRS, UMR 6211.

Carree, M. A., & Thurik, A. R. (1999). Industrial structure and economic growth. In D. B. Audretsch & A. R. Thurik (Eds.), Innovation, industry evolution and employment (pp. 86–110). Cambridge: Cambridge University Press.

Carree, M., Stel, A. V., Thurik, R., & Wennekers, S. (2004). The effect of entrepreneurship activity on national economic growth. Small Business Economics, 24(3), 311–321.

Cipolla, C. M. (1981). Before the industrial revolution, European society and economy (2nd ed., pp. 1000–1700). Cambridge: Cambridge University Press.

Cortright, J. (2001). New growth theory, technology and learning: a practitioner’s guide, review of economic development literature and practice (4th ed.). Washington, DC: U.S. Economic Development Administration.

Demetriades, P., & Law, S. (2004). Finance, Institutions and Economic Growth. London: University of Leicester wp.

Feenstra, R. C., Inklaar, R., & Timmer, M. P. (2013). The Penn World Tables (Mark 8.0). Center for International Comparisons of Production, Income and Prices, CIC.

GEM (Global Entrepreneurship Monitor) (2006). Summary Results, Bosma N. and Harding R., Babson College and London Business School.

GEM (Global Entrepreneurship Monitor). (2009). Executive report, Bosma N. and Levie J., with contributions from Bygrave W. D., Justo R., Lepoutre J. and Terjesen S., Founding and Sponsoring Institutions. Babson Park: Babson College.

Hamilton, B. H. (2004). Does entrepreneurship pay? An empirical analysis of the returns of self-employment. The Journal of Political Economy, 108(3), 604–631.

Hausman, J. (1978). Specification tests in econometrics. Econometrica, 46, 1251–1271.

Heston, A., Summers, R., & Aten, B. (2012). The Penn World Tables (Mark 7.1). Center for International Comparisons of Production, Income and Prices, CIC.

Hsu, D. H., & Ziedonis, R. H. (2008). Patents as quality signals for entrepreneurial ventures. Academy of Management, 1, 1–9.

Kirzner, I. M. (1973). Competition and entrepreneurship. Chicago and London: University of Chicago Press.

Krugman, P. (1991). Increasing returns and economic geography. Journal of Political Economy, 99(3), 483–499.

Li, Y., Guo, H., Liu, Y., & Li, M. (2008). Incentive mechanisms, entrepreneurial orientation, and technology commercialization: evidence from China’s transitional economy. Journal of Product Innovation Management, 25(1), 63–78.

Lucas, R. E. (1978). On the size distribution of business firms. Bell Journal of Economics, 9, 508–523.

Lucas, R. E. (1988). On the mechanics of economic development. Journal of Monetary Economics, 22, 3–42.

Mankiw, G., Romer, D., & Weil, D. (1992). A contribution to the empirics of economic growth. Quarterly Journal of Economics, 107(2), 407–437.

Naudé, W. (2008). Entrepreneurship in economic development, UNU-WIDER research paper no. 2008/20. Helsinki: United Nations University.

Naudé, W. (2010). Entrepreneurship, developing countries, and development economics: new approaches and insights. Small Business Economics, 34, 1–12.

Panagiotis, L., & Spyridon, R. (2013). Development paths in the knowledge economy: innovation and entrepreneurship in Greece. Journal of the Knowledge Economy, 6(1).

Pirotte, A. (1994). Court terme et long terme en économétrie : l’apport de la cointégration aux données de panel, thèse de doctorat, Université Paris XH-Val de Marne.

Pirotte, A. (1996). Estimation de relations de long terme sur données de panel: nouveaux résultats. Economie et Prévision, 126(5), 143–146.

Romer, P. (1986). Increasing returns and long run growth. Journal of Political Economy, 94(5), 1002–1037.

Salgado-Banda, H. (2004). Measures and Determinants of Entrepreneurship: An Empirical Analysis, Chapter 3, PhD Thesis. London: University of London.

Salgado-Banda, H. (2007). Entrepreneurship and economic growth: an empirical analysis. Journal of Developmental Entrepreneurship, 12(1), 3–29.

Schumpeter, J. (1934). The theory of economic development. Cambridge Mass: Harvard University Press.

Solow, R. (1956). A contribution to the theory of economic growth. Quarterly Journal of Economics, 70, 65–94.

Storey, D. J. (1991). The birth of new enterprises—does unemployment matter? A review of the evidence. Small Business Economics, 3, 167–178.

Szirmai, A., Naudé, W., & Goedhuys, M. (2011). Entrepreneurship, innovation, and economic development. Oxford: Oxford University Press.

Tocan M. C. (2012). Knowledge based economy assessment, Journal of Knowledge Management, Economics and Information Technology, (5).

Van Stel, A., Carree, M., & Thurik, R. (2005). The effect of entrepreneurial activity on national economic growth. Small Business Economics, 24(3), 311–321.

Verheul, I. & van Stel, A. (2010). Entrepreneurial diversity and economic growth, pp. 17–36 in The Entrepreneurial society: how to fill the gap between knowledge and innovation, Edited by Jean Bonnet, Domingo García-Pérez-de-Lema, Howard Van Auken, 260 pages, Edward Elgar Publishing.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

The authors declare that they have no conflict of interest.

Additional information

List of countries

Argentina, Armenia, Bangladesh, Belarus, Brazil, Chile, Colombia, Croatia, Cyprus, Czech Republic, Georgia, Guatemala, China, Hungary, India, Indonesia, Jamaica, Jordan, Kazakhstan, Malaysia, Malta, Morocco, Pakistan, Panama, Philippines, Romania, Singapore, South Africa, Tajikistan, Thailand, Tunisia, Turkey, Ukraine, Uruguay, Zambia

Rights and permissions

About this article

Cite this article

Feki, C., Mnif, S. Entrepreneurship, Technological Innovation, and Economic Growth: Empirical Analysis of Panel Data. J Knowl Econ 7, 984–999 (2016). https://doi.org/10.1007/s13132-016-0413-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13132-016-0413-5