Abstract

This study examines the effect of entrepreneurial activity on economic growth in MENA countries. Following the endogenous growth model, we included human capital and technology spillover variables into the analysis. Due to limited data of entrepreneurship measures in MENA countries this study employed self-employment rate as a proxy. As the level of education increases, absorptive capacity and innovation capacity of the entrepreneurs’ increase. In order to adjust for human capital, the interaction variable of self-employment and average years of schooling are used. The fixed- effect panel regression estimates that the effect of self-employment on economic growth is negative in all specifications. However, the interaction estimate of self-employment and average years of schooling are positive and significant. Our results suggest that the driving force of entrepreneurship in MENA countries is also affected by the economic necessities. On the other hand, the level of education accelerates the effect of entrepreneurial activity on economic growth.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

After the emergence of endogenous growth theory -unlike the neoclassical growth model that takes technological progress as being exogenous- the role of entrepreneurship in economic development gained emphasis in the 1980s. The relationship between entrepreneurship and growth theory has been analysed in a few of the studies in the literature (Carree and Thurik 2002; Audretsch and Thurik 2000; Carlsson 1992). Schumpeterian development is characterized by the simultaneous interplay of growth and qualitative transformations of the economic system. Central to Schumpeter’s (1942) process of ‘creative destruction’ is the entrepreneur who has an important role in economic growth. The incentives and barriers that the entrepreneurs come across are crucial for economic growth, provided that the technological progress depends on the innovations made by the entrepreneurs. Schumpeter (1942) described entrepreneurs as daring individualists who create technical and financial innovations in the face of competition and declining profits. He focused on the institutions that guided the activities of entrepreneurs.

Most of the literature on the relationship between entrepreneurship and economic growth focuses on the developed countries whereas this study examines the effect of entrepreneurial activity on economic growth of the MENA countries. Due to data restrictions in MENA countries we used self-employment rate as a proxy for entrepreneurial activity. Following the Schumpeterian view of an entrepreneur as an innovator who diffuses knowledge we adjust self-employment rate with the level of education. This study contributes to the literature by employing human capital adjusted entrepreneurship for the MENA countries which is measured by the interaction variable of average years of schooling and self-employment rate that reflects the positive and significant effect on economic development.

This study uses the World Bank data to estimate the impact of entrepreneurship on economic growth for 20 MENA countries over the 1971–2014 periods. Next section covers the literature review. Data and methodology are explained in section three. The fourth section presents the results. Section five ends up with conclusion.

2 Literature Review

Schumpeter (1934) in ‘The Theory of Economic Development’ treated innovation, entrepreneurship and credit as the essential elements that bring about economic growth. He emphasized that innovation was crucial and that the change in population and savings occurred slowly and generated a smooth growth of the system which was different from the development caused by innovations that assume a cyclical nature. According to Schumpeter, an entrepreneur is an innovator receiving profits for his innovations. Continuous profit and economic growth are the outcomes of continuous innovations.

As of the 1980s, the literature on the effects of entrepreneurship on economic growth has expanded with the endogenous growth theory that sheds light on the emphasis of the role of the entrepreneur in economic growth. The approaches put forward by Aghion and Howitt (1998) opened the way to analysing the long run growth influenced by the organizations and institutions on the innovative activities engaged in by the agent. Carree and Thurik (2002) state that most of the endogenous growth models exclude entrepreneurship’s influence on technology and economic development which is expected to increase standard of living.

Globalization led to an increase in technological improvements. Knowledge investment, spillovers, innovation and research increased the number of entrepreneurs and hence, the number of newly established small businesses. Audretsch and Thurik (2000) and Carlsson (1992) indicate that technological development changed the preferences of entrepreneurs from large to small businesses. In order to examine the effects of technology spillovers in MENA countries, our study uses openness and foreign direct investment in panel regressions.

According to Acs (1992) entrepreneurship, innovation and new employment opportunities increased the importance given to small firms. The influence of firm scale on entrepreneurship has also been analysed in the literature by Acs and Audretsch (1990), Cohen and Klepper (1992), and Audretsch (1995).

The willingness to become an entrepreneur rises as the years of schooling increases. In other words, as the level of education extends further the level of human capital also progresses. As the level of education increases, absorptive capacity and innovation capacity of the entrepreneurs’ increase. Human capital theory suggests that knowledge and skills of an individual or a group increase through higher education (Ployhart and Moliterno 2011). Education and work experience are important aspects of human capital in the sense that they may grow into nascent entrepreneurship and start-up businesses (Kim et al. 2006).

Üçbaşaran et al. (2008) define two types of human capital: (i) general human capital which refers to education and (ii) entrepreneurship-specific human capital which includes business ownership experience and capabilities. Many studies in the literature explore the relationship between education, human capital, and entrepreneurship or self-employment (Brüderl et al. 1992; Gimeno et al. 1997; Bates 1990; Wiklund and Shepherd 2003; Bosma et al. 2004).

Amaghouss and Ibourk (2013) analyse the relationship between entrepreneurship and economic growth for the 19 OECD countries over 2001–2009 period by utilizing entrepreneurial activities and potential innovation in assessing entrepreneurship. Authors indicate that panel data analysis of both measures affect economic growth positively and the results are significant as well.

Two Stage Least Squares (2SLS) estimation technique is employed by Acs et al. (2005) to interpret the relationship between per capita GDP growth and self-employment rate that denotes entrepreneurship. The estimation results reflect that entrepreneurship affects economic growth positively for both of the models.

Berthold and Gründler (2012) evaluated the influence of entrepreneurship on economic growth for 188 countries between 1980 and 2010 with the Three Least Squares (3SLS) estimation technique and observed that entrepreneurship’s effect on economic growth is significantly positive.

Wennekers et al. (2005) maintain that at higher levels of economic development the negative relationship between real income and self-employment ameliorates. Authors employ the GEM data for 36 countries and find a U-shaped relationship between nascent entrepreneurship and economic development.

Twenty two OECD countries are examined by Salgado-Banda (2004) to predict entrepreneurship’s role in economic growth. The results reflect that self-employment and economic growth are negatively correlated to each other. On the contrary, the studies of Holmes and Schmitz (1990), Thurik (1996), Carree and Thurik (1999), and Wong et al. (2005) underline the positive impact of entrepreneurship on economic growth.

A vast literature rests upon the Global Entrepreneurship Monitor (GEM) data for different years (Frederick and Monsen 2011; Alvarez et al. 2014; Wong et al. 2005; Lekovic and Maric 2015; Prieger et al. 2016; Valliere and Peterson 2009; Ferreira et al. 2016). Total Entrepreneurial Activity Index (TEA) of GEM (2004) has been used to explain entrepreneurship in many studies (van Stel et al. 2005; Wong et al. 2005).

3 Methodology and Empirical Analysis

3.1 Data

The data set used in this study was acquired from the World Bank for the period between 1971 and 2014. There are two main measures of entrepreneurship used in the literature: self-employment rate of World Bank data set and total early-stage entrepreneurial activity (TEA) of Global Entrepreneurship Monitor (GEM). This study employs self-employment rate for the econometric analysis, since the GEM data for the period 1971–2014 was not available for the all countries in the sample.

The descriptive statistics of the variables employed in this paper are also presented. The data set of this study includes 20 countries for the time period between 1971 and 2014. An unbalanced data set is used for panel data analysis due to the unavailability of data for the countries that are covered in this study.

3.2 Model

This study employs a linear Cobb-Douglas production function

where y it denotes the logarithm of real GDP per capita for country i at time t, h it is the human capital per person for country i at the time t, and Z comprises an array of control and environmental variables. In our regression, we used the control variables aside from the entrepreneurship to control for environmental country-specific effects and to avoid significance of the desired entrepreneurship coefficient due to omitted variables or multi-collinearity.

Taking the output Eq. (1) in per capita terms, the variables in logarithmic form can be stated as:

where log(GDPC) is the natural logarithm of GDP per capita in real terms as a proxy for economic growth used as the dependent variable for all specifications.

This study argues that entrepreneurship alone does not account for economic growth; rather human capital adjusted entrepreneurship is important for economic growth especially in developing countries where entrepreneurship is not only a choice but also a necessity. Based on the literature (Bates 1990; Carree and Thurik 2002; Ployhart and Moliterno 2011; Thurik 1996) about the influence of entrepreneurship on economic growth, two hypotheses are tested in this study:

Hypothesis 1

Entrepreneurship has a positive effect on economic growth in the MENA countries. The coefficient of self-employment is positive and significant.

Hypothesis 2

Human capital adjusted entrepreneurship activity has a positive effect on economic growth in the MENA countries. The β 8 coefficient of log(selfemp ∗ schl) is positive and significant. In other words, this study tests whether the effect of self-employment on economic performance increases with the nation’s overall level of education. In order to test these two hypotheses, the following model is run in such a way to control other variables which are defined below explicitly.

As in the standard growth model, this study includes the measure of physical capital in the production function. log (inv) is the natural logarithm of gross capital formation as a percentage of GDP per capita. Gross capital formation (formerly gross domestic investment) consists of outlays on additions to the fixed assets of the economy plus net changes in the level of inventories.

The negative effect of population on economic performance is captured by the fertility rate. log(fer) is the natural logarithm of fertility rate total per woman. Total fertility rate (births per woman) represents the number of children that would be born to a woman if she were to live to the end of her childbearing years and bear children in accordance with age-specific fertility rates of the specified year. We expect the effect to be negative as in the neoclassical model.

Human capital is proxied with life expectancy and level of education. Log(lifexp) is life expectancy at birth that also accounts for a proxy of human capital. Life expectancy at birth indicates the number of years a new born infant would live if prevailing patterns of mortality at the time of its birth were to stay the same throughout its life. Log(schl) is the log average years of total schooling of the population age 15 and older (Barro and Lee 2013).

Endogenous growth theory is based on the assumption of innovation driven economic economic growth that depends on the technological spillovers across countries. In order to measure the effect of technological diffusion we used openness and FDI as separate proxies. log(open) is the degree of openness measured as the natural logarithm of percentage of trade to GDP. Trade is the sum of exports and imports of goods and services measured as a share of gross domestic product. FDI is the net inflows of investment to acquire a lasting management interest (10% or more of voting stock) in an enterprise operating in an economy other than that of the investor. This series shows net inflows (new investment inflows less disinvestment) in the reporting economy from foreign investors and is divided by GDP.

log(govcon) is the natural logarithm of government consumption as a share of GDP. General government final consumption expenditure (formerly general government consumption) includes all government current expenditures for purchases of goods and services (including compensation of employees). It also includes most expenditure on national defence and security, but excludes government military expenditures that are a part of government capital formation.

The main entrepreneurship proxy in this study is the self-employment rate. Although self-employment rate does not capture all the characteristics of innovative entrepreneurship, data availability for MENA countries makes it the best option. log(selfemp) is the natural logarithm of self-employment rate. Self-employed workers are those workers who work on their own account or with one or a few partners or cooperative and hold the type of jobs defined as a “self-employment jobs.” i.e. jobs where the remuneration is directly dependent upon the profits derived from the goods and services produced. Self-employed workers include four sub-categories: employers, own-account workers, members of producers’ cooperatives, and contributing family workers.

log(selfemp*schl) is the natural logarithm of the multiplication of self-employment rate and average years of schooling. This interaction variable captures the effect of education adjusted level of self-employment on economic growth.

log(unemp) is the logarithm of unemployment, total (% of total labor force). Controlling for unemployment allows us to examine the separate effect of entrepreneurship on economic growth (Table 1).

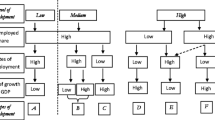

To separate the effect of independent variables on growth-rather than the opposite- we used lagged values of the independent variables in the analysis (Figs. 1, 2 and 3).

4 Regression Results

The following table gives the results of the estimates of panel equation of the Cobb-Douglas model with country fixed effects. The Hausman test (1978) is applied to all specifications. Test results indicate that fixed- effect model is significant for all regressions. Lagged independent variables are employed as instruments in all specifications (Table 2).

Column (1) estimates the basic model. The effect of entrepreneurship is significantly negative in all of the specifications. This finding is in line with Schumpeter’s view of entrepreneurship, which states economic entrepreneurs’ role as an innovator who absorbs technology through knowledge. In developing countries, self-employment rates are determined not only by choice, but also restrictions in the labor market and incentives of the entrepreneurs are not solely driven by innovation. On the other hand, level of human capital as measured by the average years of schooling has a positive and significant effect on economic growth. 1% increase in the average years of schooling results in 1.3% increase in the level of GDP.

The interaction term is positive and significant in all specifications. Human capital adjusted entrepreneurship accelerates economic development in developing countries. This is the main finding of this paper.

Fertility rate has significantly negative effect on growth in developing countries as expected. Physical capital is an important determinant of economic growth in developing countries. Government consumption has a negative and significant effect as suggested by the scholars such as Barro (2003) only when unemployment is controlled. In all other specifications, the effect is positive but insignificant.

Life expectancy does not have a significant effect on our regressions. Although, the literature clearly proves the importance of health for economic development, a significant relationship for developing MENA countries was not found in this study. One possible explanation could be that the period does not capture the required level of change in the life expectancy. Barro and Sala-i-Martin (2004) found significant and positive effect of life expectancy on economic growth for MENA countries in their analyses of longer time spans.

As pointed by Reynolds et al. (1994) unemployment forces individuals to self-employment and thus stimulates the entrepreneurial activity. This effect is more important in developing countries which suffer higher unemployment rates. For this reason, we also control for the rate of unemployment in column 5. Although not significant, the effect is negative as expected. Furthermore, controlling for unemployment yields the highest estimate for the effect of human capital adjusted self-employment.

5 Conclusion

In this paper, the effect of entrepreneurship on the economic growth of the MENA countries between 1971 and 2014 is analysed. This study contributes to the literature by adjusting entrepreneurship with human capital. In all specifications, the level of human capital adjusted entrepreneurship measured by interaction variable of average years of schooling and self-employment rate has positive and significant effect on economic development of the sample countries. As the years of schooling increases, absorptive capacity and innovation capacity of the entrepreneurs’ increase as well.

In order to boost the economic growth in MENA countries, this study suggests that entrepreneurial policies should also focus on increasing the level of education. As laid out by Schumpeterian theory, technology enhanced entrepreneurship is the engine for growth and technology accelerates with the level of education of the entrepreneurs. In that respect, policies promoting and subsidizing entrepreneurial activities and on the job training for the educated individuals would clearly benefit the economic growth of the MENA countries.

Our findings suggest that the policy makers should focus on increasing the opportunities for the higher educated entrepreneurs in the MENA region. One of the main limitations of this study is that not much GEM data is available for longer periods for the MENA countries. Surely the inclusion of the micro dynamics of entrepreneurship in these countries would enrich the economic development analysis.

References

Acs ZJ (1992) Small business economics: a global perspective. Challenge 35(6):38–44

Acs ZJ, Audretsch DB (1990) Innovation and small firms. MIT Press, Cambridge

Acs ZJ, Audretsch DB, Braunerhjelm P, Carlsson B (2005, Dec), Growth and entrepreneurship: an empirical assessment. Case Western Reserve University discussion paper no. 5409

Aghion P, Howitt P (1998) Endogenous growth theory. MIT Press, Cambridge

Alvarez C, Urbano D, Amoros JE (2014) GEM research: achievements and challenges. Small Bus Econ 42:445–465

Amaghouss J, Ibourk A (2013) Entrepreneurial activities, innovation and economic growth: the role of cyclical factors: evidence from OECD countries for the period 2001–2009. Int Bus Res 6(1). https://doi.org/10.5539/ibr.v6n1p153

Audretsch DB (1995) Innovation and industry evolution. MIT Press, Cambridge

Audretsch DB, Thurik AR (2000) Capitalism and democracy in the 21st century: from the managed to the entrepreneurial economy. J Evol Econ 10:17–34

Barro RJ (2003) Determinants of economic growth in a panel of countries. Ann Econ Financ 4(2):231–274

Barro RJ, Lee JW (2013) A new data set of educational attainment in the world, 1950–2010. J Dev Econ 104:184–198

Barro RJ, Sala-i-Martin X (2004) Economic growth, 2nd edn. MIT Press, Cambridge

Bates T (1990) Entrepreneur human capital inputs and small business longevity. Rev Econ Stat 72:551–559

Berthold N, Gründler K (2012) Entrepreneurship and economic growth in a panel of countries. Leibniz Information Centre for economics working paper no. 118

Bosma N, van Praag M, Thurik R, de Wit G (2004) The value of human and social capital investments for the business performance of startups. Small Bus Econ 23:227–236

Brüderl J, Preisendorfer P, Zeigler R (1992) Survival chances of newly founded business organizations. Am Sociol Rev 57:227–242

Carlsson B (1992) The rise of small business; causes and consequences. In: Adams WJ (ed) Singular Europe, economy and policy of the European community after 1992. University of Michigan Press, Ann Arbor, pp 145–169

Carree MA, Thurik AR (1999) In: Audretsch DB, Thurik AR (eds) Industrial structure and economic growth. Cambridge University Press, Cambridge

Carree MA, Thurik AR (2002) Chapter 20: The impact of entrepreneurship on economic growth. In: Acs Z, Audretsch D (eds) International handbook of entrepreneurship research. Springer, Boston

Cohen WM, Klepper S (1992) The trade-off between firm size and diversity in the pursuit of technological progress. Small Bus Econ 4:1–14

Ferreira JJ, Fayolle A, Fernanded C, Raposo M (2016) Effects of Schumpeterian and Kirznerian entrepreneurship on economic growth: panel data evidence. Entrep Reg Dev 29(1–2):27–50

Frederick H, Monsen E (2011) New Zealand’s perfect storm of entrepreneurship and economic development. Small Bus Econ 37:187–204

GEM (2004) Global entrepreneurship monitor database, London

Gimeno J, Folta TB, Cooper AC, Woo CY (1997) Survival of the fittest? Entrepreneurial human capital and the persistence of underperforming firms. Adm Sci Q 42:750–783

Hausman J (1978) Specification tests in econometrics. Econometrica 46:1251–1271

Holmes T, Schmitz J (1990) A theory of entrepreneurship and its application to the study of business transfers. J Polit Econ 98(2):265–294

Kim PH, Aldrich HE, Keister LA (2006) Access (not) denied: the impact of financial, human, and cultural capital on entrepreneurial entry in the United States. Small Bus Econ 27:5–22

Lekovic B, Maric S (2015) Economic crises and the nature of entrepreneurial and management activities. Econ Themes 54(1):21–40

Ployhart RE, Moliterno TP (2011) Emergence of the human capital resource: a multilevel model. Acad Manag Rev 36(1):127–150

Prieger JE, Bampoky C, Blanco LR, Liu A (2016) Economic growth and the optimal level of entrepreneurship. World Dev 82:95–109

Reynolds PD, Storey DJ, Westhead P (1994) Cross-national comparisons of the variation in new firm formation rates. Reg Stud 28(4):443–456

Salgado-Banda H (2004) Measures and determinants of entrepreneurship: an empirical analysis, Chapter 3. PhD thesis, University of London

Schumpeter JA (1934) The theory of economic development. Harvard, Cambridge

Schumpeter J (1942) Capitalism socialism and democracy. Harper & Brothers, New York

Thurik AR (1996) Small firms, entrepreneurship and economic growth. In: Admiraal PH (ed) Small business in the modern economy, De Vries lectures in economics. Blackwell Publishers, Oxford

Üçbaşaran D, Westhead P, Wright M (2008) Opportunity identification and pursuit: does an Entrepreneur’s human capital matter? Small Bus Econ 30:153–173

Valliere D, Peterson R (2009) Entrepreneurship and economic growth: evidence from emerging and developed countries. Entrep Reg Dev 21(5–6):459–480

Van Stel A, Carree M, Thurik R (2005, January) The effect of entrepreneurial activity on national economic growth. Discussion papers on entrepreneurship, growth and public policy no. 0405

Wennekers S, van Stel A, Thurik R, Reynolds P (2005) Nascent entrepreneurship and the level of economic development. Small Bus Econ 24:293–309

Wiklund J, Shepherd D (2003) Aspiring for and achieving growth: the moderating role of resources and opportunities. J Manag Stud 40:1919–1941

Wong PK, Ho YP, Autio E (2005) Entrepreneurship, innovation and economic growth: evidence from GEM data. Small Bus Econ 24(3):335–350

World Bank (2016) World development indicators

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer International Publishing AG, part of Springer Nature

About this chapter

Cite this chapter

Aydoğan, E.T., Sevencan, A. (2018). The Effect of Entrepreneurship on Economic Growth: A Panel Approach in MENA Countries. In: Faghih, N., Zali, M. (eds) Entrepreneurship Ecosystem in the Middle East and North Africa (MENA). Contributions to Management Science. Springer, Cham. https://doi.org/10.1007/978-3-319-75913-5_17

Download citation

DOI: https://doi.org/10.1007/978-3-319-75913-5_17

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-75912-8

Online ISBN: 978-3-319-75913-5

eBook Packages: Business and ManagementBusiness and Management (R0)