Abstract

This paper extends the shift-contagion concept to housing price returns in order to examine co-movements between pairs of regional housing markets in the US. It associates nonlinearities of housing prices with the monetary policy criteria at disaggregate levels. The framework with Markov-switching volatility in Gravelle et al. (Journal of International Economics 68:409–423, 2006) is utilized to investigate housing contagion phenomena which are defined as the switches in the structural transmission of common shocks across regional housing markets. The empirical results suggest that interactions between regional and nationwide housing markets switch across low-volatility and high-volatility regimes of common shocks for the Northeast and the West whose housing price returns are nonlinear. In addition, there is the significantly time-varying interdependence between the West and each of the other three regional housing markets. The estimated indicator of the monetary policy effectiveness implies that monetary policies can be effective in the Northeast and the West because they are more closely linked with other regional housing markets in volatile phases which are subject to housing crises. Noticeably, the broken interrelationships between regional housing markets and real economies in the 2001 recession imply high vulnerability to housing bubbles for regional markets, while short-term monetary policies can be effective in stabilizing the housing market turmoil around 2007.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The recent financial and economic crises have reignited intensive discussions over characteristics of housing asset markets. The growing literature suggests that the investigations into local housing markets can shed light on housing booms and busts, while analyses at aggregate levels provide limited implications. For example, the recent US housing cycle displays the spillover phenomenon across regional housing markets—the recent housing boom starts with a housing price surge in the West, quickly spreads to the Northeast, and to a milder extent to the Midwest and the South. Motivated by the recent dramatic fluctuations in the housing sector, this paper investigates the US housing market at disaggregate levels, with the aim of addressing the interdependence across four specific regional housing markets (the Northeast, the Midwest, the South and the West), and the monetary policy implications of cross-market co-movements.

The interdependence across regional housing markets can be investigated in various dimensions. This study focuses on the “shift-contagion” interdependence under the framework in Gravelle et al. (hereafter GKM) (2006), which is distinguished from the normal co-movement. Namely, the interdependence across different markets tends to be closer during the crisis periods, and it lies in the structural transmission of common shocks across different markets—how a shock hits one market and then spreads over the others.

Numerous studies discuss contagion phenomena “across different countries” because financial and currency markets are independent within a domestic market. However, the issue concerning whether or not contagion patterns exist in housing markets “within a single country” was hardly documented previously. It is expected to attract growing attention owing to the recent remarkable housing boom-bust cycle which displays a spillover pattern across local markets in the US. Since there is no argument which limits contagion phenomena to stock, bond and exchange rate markets, the paper extends the contagion concept to the housing asset market in the US. Further, as highlighted above, it focuses on the structural transmission of common shocks across different housing markets, or their contagion-type interdependence. Although the definition of housing contagion requires more delicate and formal analyses, the differences between housing and other financial assets support the proposal of housing shift-contagion in the US. The local housing markets are highly segmented, and they are quite different from stock, bond and currency markets. Furthermore, the housing asset is heterogeneous, durable and immobile, and the location of houses plays a dominant role in the evaluation of housing assets. Local economic and demographic conditions, local construction costs, and local regulations all significantly influence housing prices. Therefore, each local housing market can be regarded as an independent market, and different regions can have substantially divergent dynamics of housing prices.

Extending GKM’s framework, this study examines co-movements across national and regional US housing markets, as well as those across the four regional housing markets. Specifically, it investigates whether interactions across these regional housing markets switch across low-volatility and high-volatility regimes of their common shocks. Noticeably, two concerns arise in this study. The first concern is about housing market segmentation. In other words, how can we determine the “unit” of local housing markets in the US—at MSA (Metropolitan Statistical Area), state or regional levels? There is no clear guideline because the literature which addresses housing contagion and the disaggregate-level determination of housing markets is very thin. The study analyzes housing contagion at the regional levels based on the definition of contagion. Contagion refers to a spillover phenomenon across independent economic sectors. Therefore, compared with regional markets, MSA and state-level housing markets are quite subject to spatial dependence owing to contiguity. Also, they can be considered dependent sectors for many reasons, such as their geographical substitution, similar housing market regulations, etc. Thus, it is arguable to regard MSA and state-level housing markets as different and independent bodies of markets, and questionable to interpret their interactions as contagion phenomena. The choice of regional markets significantly mitigates this concern although more discussions leave further research. Following the intuition behind the contagion concept, this paper uses a regional market as the unit of the housing market analyzed.

The second concern is the choice of the housing market proxy. Each housing price time series has both advantages and disadvantages. In this paper, quarterly “median sales prices of houses” are taken from the US Census Bureau to proxy for the nationwide and the four regional housing markets during 1963 to 2008. The quarterly data are based on surveys for single-family homes, and are available from 1963 onwards. Thus, they deliver more complete patterns of national and regional US housing markets compared to other data sources whose time horizons are shorter, such as the Case-Shiller Home Price indices (from 1987), the housing indexes of Federal Housing Finance Administration (FHFA, from 1975), and the Conventional Mortgage Home Price Indexes (CMHPIs, from 1975).

In the extended framework, the housing volatility shock is partitioned into two unobservable components: common and idiosyncratic shocks. Empirically, common shocks to the regional housing markets are items such as interest rates or the nationwide business cycle, and idiosyncratic shocks are items such as local regulations of housing construction, the local employment condition, the housing demand change, and so on. Noticeably, this model allows each shock to follow different and independent states of regime-switching, and the two types of shocks are assumed to be uncorrelated. This assumption enables us to investigate if the interactions across regional housing markets are dependent on volatility regimes of their common shocks. Furthermore, mean housing price returns are assumed to be more or less predictable because they display the high serial correlation. Thus, they are assumed to switch with the volatility regimes of common shocks which are uncorrelated with those of highly-unpredictable idiosyncratic shocks. The empirical results support this assumption since high-volatility regimes display negative and lower mean housing price returns than low-volatility phases.

The interactions across regional markets further provide us with the important monetary policy criteria. Monetary policies can be effective to some extent if common shocks are channeled across the two regional housing markets only during highly-volatile periods which empirically correspond to the low-growth, and even crisis periods. It implies that the temporary interdependence between two local housing markets is possibly influenced by stabilizing monetary policies. On the other hand, if there is no regime-switching common shock across regional housing markets, it suggests that they have a long-term linkage which short-term monetary policies fail to influence effectively.

The main contribution of this paper lies in the integrated discussion of housing markets and the roles of monetary policies at disaggregate levels. Specifically, it delivers a fresh concept of housing shift-contagion, which refers to a regime-switching co-movement across regional housing markets. In addition, it associates nonlinearities of housing price returns in the Northeast and the West with the monetary policy effectiveness. Furthermore, the estimated high-volatility regimes of cross-market common shocks enable us to link housing market dynamics with real economies. Specifically, the study examines whether volatile periods of regional housing markets are highly connected with NBER-dated recessions, and spotlights their connections in the two most recent recessions in 2001 and 2007.

The paper is organized as follows. Section 2 reviews the related literature which motivates this study. Section 3 introduces the data and the model extended to observe housing shift-contagion. Section 4 presents the main empirical results and their monetary policy implications, hypothesis tests for the presence of housing shift-contagion, and the associations between high-volatility regimes of common shocks and real economies in the 2001 and 2007 recessions. Section 5 makes concluding remarks.

2 Literature review

There are lasting debates over the definition and the presence of “contagion”. For example, Masson (1999) documents three macroeconomic linkages underlying contagion: monsoonal effects of the global economy, spillover effects of fundamentals, and residual causes. Rigobon (1999) proposes three economic definitions of contagion: the occurrence of the crisis, the transmission of volatility, and a significant rise in the cross-market linkage after a shock to an individual market. Claessens et al. (2001) classify contagion into two categories: fundamental-caused contagion and a phenomenon of irrational-behaviors. Forbes and Rigobon (2001a) provide two competing theories of contagion: crisis-contingent and non-crisis-contingent types of contagion. The former includes three models—multiple-equilibria with sunspots, the liquidity shock, and the political economy; the latter refers to the “real” linkage which contains trade and policy coordination across different markets. Forbes and Rigobon (2001b) define “shift contagion” as a significant increase in cross-market linkages during a crisis.

Motivated by the above literature, the paper extends the contagion concept, specifically “shift contagion” as Forbes and Rigobon (2001b) define, to four regional housing markets in the US. Conventional analyses of the contagion phenomenon focus on cross-country contagion in a single-sector market, typically covering stock, bond and exchange rate (currency) markets. Some representative studies are Forbes and Rigobon (2001a, b, 2002), Ghosh et al. (1998), GKM, King and Wadhwani (1990), Rigobon (2001, 2003a, b), and so on. Recently, Guo et al. (2011) propose a Markov regime-switching vector autoregressive (VAR) framework to study contagion among various markets: the stock market, the real estate market, the credit default market and the energy market.

Noticeably, several studies discuss similar concepts to “contagion” across housing markets, although they hardly specify it. Among the limited literature, Fry (2009) describes the term of “contagion” in the study on the housing market interdependence, using bubble models in an attempt to observe the spillover of a nationwide housing bubble at a regional level in the UK. Oikarinen(2006) suggests the diffusion pattern which refers to the lead-lag dynamic interactions between central and surrounding housing markets in Finland, and Stevenson (2004) studies the phenomenon of the house price diffusion in Ireland. Recently, Riddel (2011) documents a contagion hypothesis by examining a contagious pattern of a housing bubble from Los Angeles to Las Vegas.

However, aside from Riddel (2011), few studies provide analyses regarding housing contagious patterns in the US. Hence, the research is devoted to contributing to the thin literature on housing contagion by means of examining the structural transmissions of common shocks across the housing markets in the Northeast, the Midwest, the South and the West, as well as those between the regional and nationwide markets. Discussions on housing markets at aggregate levels are unable to provide fresh implications which can be extracted from disaggregate analyses. Particularly, significant differences across local housing markets are discussed more intensively recently due to the remarkable housing boom-bust cycle in the 2000s.Footnote 1

Some recent studies, such as Fadiga and Wang (2009), Kim and Bhattacharya (2009) and Ng and Moench (2011), investigate the US housing markets at regional levels. They provide us with interesting characteristics of regional housing markets, nonlinearities of housing price dynamics especially. For instance, Fadiga and Wang (2009) explore four regional housing markets during 1973Q1 to 2006Q2 by a multivariate state-space model. They argue that their dynamics are mainly determined by two types of unobserved components, two common trends and three common cycles, and suggest that different regions display divergent housing market dynamics.Footnote 2 In addition, Kim and Bhattacharya (2009) apply a smooth transition autoregressive (STAR) model to examine nonlinear properties of housing prices during 1969–2004 in national and regional US housing markets. They find that except for the Midwest, the aggregate US and the other three regional housing markets (especially the Northeast and the West) have nonlinear price dynamics. Besides, causalities from housing prices to employment and those from mortgage rates to housing prices are weaker in nonlinear housing markets than linear ones, implying that regional housing markets with nonlinear dynamics display more remarkable housing cycles and are more likely to experience housing bubbles than those without nonlinearities. More recently, Ng and Moench (2011) apply a multi-level dynamic hierarchical factor model to extract regional and national housing factors in the US housing market. Moreover, their study distinguishes the “housing price cycle” from the “housing market cycle”, and the latter consists of both housing prices and volumes. It finds that the two cycles are largely different in the Midwest and the South, while they are comparable in the Northeast and the West. Noticeably, regional variations in the West are much higher than national fluctuations and are the largest among all regions.

Regarding the shocks to housing markets, Clayton et al. (2010), Fadiga and Wang (2009), Negro and Otrok (2007), Ng and Moench (2011) and Vansteenkiste (2007) discuss both common and idiosyncratic shocks in the US housing market.Footnote 3 Other studies only discuss either the common or the idiosyncratic shock. For instance, Wheaton and Nechayev (2008) solely discuss the common shockFootnote 4; Goodman and Thibodeau (2008) only emphasize idiosyncratic shocks.Footnote 5

Finally, the studies which regard the monetary effectiveness criteria in the local housing markets include Hasan and Taghavi (2002), Lastrapes and Potts (2006), Vansteenkiste (2007), Vargas-Silva (2008), Wheeler and Chowdhury (1993), and Xu et al. (2012), among others. For example, Vargas-Silva (2008) adopts a VAR model with sign restrictions on the response of non-housing variables to examine the impact of monetary policies. The results suggest a stronger impact of policies on the Midwestern housing market than the other regional markets. In addition, Xu et al. (2012) argue that regional mortgage rates respond to monetary policy surprises differently because regional housing markets have heterogeneous housing vacancy conditions. Motivated by the above literature, the paper examines whether the empirical results correspond to the findings of the previous studies, and enriches the literature on the co-movements across regional housing dynamics.

3 Data & model

3.1 Data

The housing price return (r it ) in the paper is defined as the percentage of the first difference of log in the real housing price as below:

where y it is the real housing price at time t in each of the two housing markets (i = 1,2) whose pair-wise co-movements are analyzed. The pairs of housing markets consist of two regional housing markets, or include one regional housing market and the nationwide US housing market.

The US aggregate housing price and four regional housing prices (the Northeast, the Midwest, the South and the West) are quarterly median sales prices of houses in the US. The data are collected from the US Census Bureau, and span from 1963Q1 to 2008Q4. The US housing price index is employed to represent the nationwide housing market, and the four regional housing price indexes are used to reflect the dynamics of local housing markets. The consumer price index for all urban consumers which contain all items less food & energy (the core CPI) is used as the deflator of the housing prices, and is collected from the US Department of Labor in Bureau of Labor Statistics (BLS). The real housing price is the nominal median sales price divided by the core CPI.

3.2 Model

The study extends the framework developed in GKM, which discuss the international bond and currency markets, to the investigations into the US regional housing markets. It examines whether structural transmissions of common shocks between pairs of regional housing markets or those between regional and nationwide housing markets fundamentally change across low-volatility and high-volatility regimes of common shocks. It is illustrated as follows:

where r it is the real housing price return for each of the two housing markets i = 1,2. It is decomposed into the expected housing price return μ it , and the forecast error u it .

Importantly, forecast errors across markets are contemporaneously correlated (i.e., \( E\left[ {{u_{{1t}}}{u_{{2t}}}} \right] \ne 0 \)) due to the presence of common structural shocks to the housing markets analyzed. The forecast error is decomposed into the common shock and the idiosyncratic shock as follows:

where z ct is the common shock, and σ cit is the influence coefficient of the common shock (c denotes the common shock) to the housing price return. z it is the idiosyncratic shock, and σ it is the influence coefficient of the idiosyncratic shock to the housing price return of the housing market i at time t.

Both shocks are assumed to have zero means, and they are uncorrelated with each other over time:

Based on GKM, two types of shocks are assumed to switch between low-volatility and high-volatility regimes, which can be represented as follows:

where S jt = {0,1} and |σ * | > |σ| for both common (c) and idiosyncratic shocks(i). Regime 1 refers to the high-volatility regime, and regime 0 refers to the low-volatility regime.

Markov-switching volatility of each shock in the framework allows the timing of volatility shifts to be endogenously-determined:

where j = c,1,2

Due to its serial correlation, the expected housing price return (μ it ) is assumed to vary over time and switch with the regime of the common shock:

The moments of structural shocks in the high-volatility regimes are the followings:

Based on the above setup, there are eight states totally (23 = 8). For example, the variance-covariance matrix in the “low-volatility regimes of both shocks” is represented as follows:

And the matrix in the “high-volatility regimes of both shocks” is represented as follows:

As emphasized in GKM, the ratio established by the estimated influence coefficients of shocks, denoted γ, is computed to examine transmission mechanisms of common shocks between pairs of regional housing markets or those between regional and nationwide housing markets. It is defined as the impact coefficient ratio in the high-volatility regimes over the ratio in the low-volatility regime. As γ is equal or close to unity (i.e., γ ≈ 1), it reflects that only the size of common shocks change across volatility regimes and implies that there is no shift-contagion across housing markets analyzed. In other words, unity γ suggests that price volatility increases in high-volatility regimes of common shocks, and declines in low-volatility ones in a proportionate manner. Otherwise, as γ is larger than unity, it implies that the impact coefficients are significantly disproportionate across different volatility phases of common shocks. Hence, the transmission mechanism of common shocks economically switches between low-volatility and high-volatility regimes. Hence, the parameter γ, which can be regarded as the indicator of the monetary policy effectiveness, is of the following form:

4 Empirical results

This section presents the main empirical results and compares them with those in the literature, aiming to deliver interesting monetary policy implications of cross-market interactions. Moreover, contagion tests are adopted to support shift-contagion phenomena across housing markets analyzed. Finally, the linkages between regional housing markets and real economies in the two most recent recessions are addressed.

4.1 Properties of regional housing price returns

Table 1 summarizes the descriptive statistics of nationwide and regional housing price returns. Among the regional markets, the Northeast is the most volatile (with the largest standard deviation), the most negatively-skewed, and has the highest kurtosis. For each region, the maximum housing price return is positive, and the minimum return is negative.

Table 2 indicates that there is a serial correlation in housing price returns for most regions, especially if we apply the test up to 4 lags by means of Q-statistics (the Ljung-Box test) and LM statistics (the Lagrange Multiplier test). Further, the ARCH test indicates regime-switching heteroskedasticity which is an essential feature for the application of the GKM framework.

4.2 Monetary policy effectiveness

The estimated monetary policy effectiveness indicator (γ) provides us important information about housing shift-contagion. If it is significantly higher than unity, it implies that the transmission mechanism of common shocks economically switches between low-volatility and high-volatility regimes. In other words, higher-than-unity γ suggests that the interdependence between two housing markets is not permanent. Hence, short-term monetary policies can be effective in stabilizing contagion phenomena across regional housing markets during highly-volatile periods.

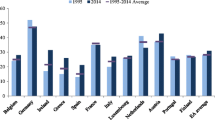

Two main findings in Table 3 are worth emphasizing. To begin with, regarding linkages between regional and nationwide housing markets, the indicator γ is significantly larger than unity for Northeast/USA and West/USA (about 18.5 and 16.6, respectively), while it is much smaller for Midwest/USA (2.95) and South/USA (1.15). Interestingly, in some respects, the empirical results of the study correspond to the findings in the existing literature. For instance, the study shows that the structural transmissions of common shocks between local and nationwide housing market fundamentally differ across low-volatility and high-volatility regimes in the Northeast and the West. Correspondingly, Kim and Bhattacharya (2009) emphasize that the Northeast and the West display nonlinear housing price dynamics. Additionally, the study finds that the linkages between regional and nationwide housing markets for the Midwest and the South do not switch across volatility regimes of common shocks. Interestingly, as Fadiga and Wang (2009) suggest, the housing prices in the South and the Midwest follow dynamics of their own in the long run. Inspired by the related studies, the paper associates nonlinearities with the monetary policy effectiveness. Specifically, the findings suggest that monetary policies can have an impact on regional housing markets with nonlinear price dynamics, the Northeast and the West. On the other hand, monetary policies cannot effectively influence the South and the Midwest whose housing prices display the linear dynamics.

Regarding the linkages between pairs of regional housing markets, the indicator of the monetary policy effectiveness γ is higher than unity for four pairs: Northeast/Midwest, Northeast/West, Midwest/West, and South/West. Noticeably, three out of the four pairs whose γ is larger than unity include the West, and it reflects the time-varying interdependence between the West and each of the other three local housing markets. The housing price in the West has some interesting features as discussed in Fadiga and Wang (2009), Kim and Bhattacharya (2009) and Ng and Moench (2011). Particularly, Ng and Moench (2011) propose that the West has the largest regional variation among all regions. On the opposite end of the spectrum, the South has similar co-movements with the Northeast and the Midwest across volatility regimes of common shocks since the monetary effectiveness indicator (γ) is very close to unity for the pairs of Northeast/South and Midwest/South.

There are some other interesting results which are worthy of our closer observations. First, common and idiosyncratic shocks are of similar magnitudes (Table 4).

In low-volatility regimes of the two shocks, the averages of the impact coefficients are about 1.5, and the maximums are about 4.5. In high-volatility regimes, the averages are about 4 for both common and idiosyncratic shocks; their maximums are about 15 and 10, respectively. It implies that the two varieties of shocks play proportionately important roles in regional housing booms and busts. Second, some pairs exhibit higher impact coefficients of idiosyncratic shocks than common shocks, particularly for Northeast/West. Finally, for each pair of regional housing markets, the estimated mean housing price returns in the high-volatility regimes are negative (except for the insignificant estimates of Northeast/West), while they are positive in the low-volatility regimes. This result, as shown in Table 5, is consistent with existing studies which adopt models with Markov-switching price volatility of housing markets. For instance, Ceron and Suarez (2006) argue that housing market volatility is larger in cold phases of low housing price growths than hot phases of high growths. Also, based on Schaller and van Norden’s (1997) framework, Roche (2001) establishes a model to analyze the housing market in Dublin, and assumes that a bad state of low growth is associated with high variance, and vice versa. Consistent with the previous research, the results of this study support the regime-switching nature of housing price dynamics.

Noticeably, standard deviations are quite large for Northeast/USA and Northeast/West although the two pairs display higher-than-unity indicator γ. Thus, it is possible that their shift-contagion patterns are insignificant. Thus, Section 4.3 provides formal hypothesis tests which deliver more evident facts of shift-contagion in the four regional housing markets.

4.3 Hypothesis test

This section discusses the results of the hypothesis test by a likelihood ratio statistic (LR) whose distribution is χ 2 (1):

Shown in Table 6, the tests provide consistent results with those of the monetary effective indicator γ, supporting the existence of housing shift-contagion for the Northeast and the West. Specifically, the null hypothesis of no shift-contagion is rejected for pairs of Northeast/USA and West/USA, suggesting that the structural transmissions of the common shocks between the regional and national housing markets are volatility-regime dependent for the Northeast and the West. Also, Northeast/Midwest, Northeast/West, Midwest/West and South/West all display shift-contagion co-movements between the pairs of regional markets since the null hypotheses are rejected. Overall, the testing results confirm the presence of housing shift-contagion across regional housing markets in the US.

4.4 High-volatility regimes and NBER-dated recessions

The filtered probabilities of the common shocks in the high-volatility regimes are shown in Fig. 1. In general, high-volatility regimes of cross-market common shocks are closely associated with all NBER-dated recessions, with some leads and lags, except the recessions during 1973–75 and 2001 which have different characteristics from the other recessions. Specifically, the 1973–75 recession was caused by the oil shock, and the 2001 recession resulted from a sharp cut in business investments (especially information technology).

Filtered probabilities of the common shocks in the high-volatility regimes. (1-1) Cross-region housing markets. (1-2) Regional housing market vs. nationwide housing market. Notes: The red-lines show filter probabilities of high-volatility regimes for cross-market common shocks; the blue lines indicate the NBER-dated recessions

Noticeably, Northeast/South displays the most lost association with recessions among the pairs of regional markets. This pattern can be explained by the value of the indicator γ. As shown in Table 3, for Northeast/South, common shocks in the low-volatility regimes (i.e., σ c1(2.92) and σ c2 (0.29)) are almost the same as those in the high-volatility phases (i.e., \( \sigma_{{c1}}^{ * } \) and \( \sigma_{{c2}}^{ * } \)). It suggests that the common shock to housing markets in the Northeast and the South does not switch across volatility regimes. Therefore, not surprisingly, the pair fails to capture recessions through the high-volatility regimes because the common shock lacks the regime-switching feature.

Particularly, the US housing market dynamics around the 2001 recession have attracted more attention recently owing to the broken linkage between housing and real sectors as Huang (2012)Footnote 6 addresses. Intuitively, real housing prices decline as the real economy is in bad condition, primarily because low real incomes in recessions lead to the weak demand of housing assets. However, all regional real housing indexes remained upward movements while the corresponding regional unemployment ratesFootnote 7 increased considerably in the 2001 recessionFootnote 8 as shown in Fig. 2. Importantly, based on the housing bubble definition in the literature, it implies the possible presence of a housing bubble since the economic fundamental fails to explain housing price dynamics. For instance, Case and Shiller (2003) regard a housing bubble as a temporary price climb which is mainly driven by peoples’ over-optimistic expectations of future housing price appreciation. Similarly, as Himmelberg et al. (2005) document, a housing bubble refers to a high price surge which is primarily caused by investors’ unrealistic beliefs in even higher selling prices in the future rather than the economic fundamentals. Thus, the missed associations between the housing markets and the economic fundamentals at the regional levels since the 2001 recession imply vulnerability to housing bubbles for the regional housing markets during the recent decade.

Corresponding to the implications extracted from the unemployment rate data, the estimated high-volatility regimes of common shocks to regional housing markets suggest the missed connections between housing markets and real economies in the 2001 recession. Particularly, we are able to obtain the monetary policy implications during the recent housing crisis by examining volatility regime-switching patterns of cross-market common shocks in the two most recent recessions since 2001 and 2007. Noticeably, the high-volatility regimes of common shocks for most pairs of housing markets generally fail to coincide with the 2001 recession, while they succeed in capturing many of the NBER-dated recessions (including the most recent recession since the late-2007). The results suggest that regional housing markets did not experience turbulent phases around the 2001 recession which was followed by the bubble-like housing boom-bust cycleFootnote 9 in a global scope. On the other hand, common shocks to regional housing markets experience high-volatility regimes around the recession which started in 2007Q4 except for Northeast/South (shown in Fig. 1-1). The findings about shift-contagion suggest that short-term monetary policies can effectively stabilize regional housing markets by means of lessening their vulnerability to cross-region contagion in the recession since the late-2007.

In short, the empirical findings provide us with important monetary policy implications during the recent housing crisis. The estimated high-volatility regimes of common shocks to regional housing markets indicate the lost connections between regional housing price dynamics and real economies in the 2001 recession. Otherwise, the results support the potential effectiveness of monetary policies in the most recent recession since the end of 2007.

5 Conclusion

This paper delivers the fresh investigation into housing shift-contagion, which is defined as the fundamental switch in the structural transmission of the common shock across regional housing markets in low-volatility and high-volatility periods. It applies the GKM framework which incorporates Markov-switching components in volatility of housing price returns.

This study finds that regions with nonlinear housing price dynamics, the Northeast and the West, have regime-switching transmission mechanisms of common shocks between local and nationwide housing markets. Besides, there exists the time-varying interdependence between the West and each of the other three regional housing markets. The results suggest that monetary policies can effectively influence the housing markets in the Northeast and the West because they are linked with each other more closely in the volatile periods than calm phases.

In general, high-volatility regimes of cross-market common shocks are highly associated with most of the NBER-dated recessions, with some leads and lags, except for the recessions during 1973–75 and 2001. Particularly, in the 2001 recession, regional real housing prices which remained strong upward movements were not in line with real activities. Noticeably, common shocks to regional housing markets did not experience a high-volatility regime around the year 2001 which was followed by the recent bubble-like housing boom-bust cycle. Otherwise, aside from Northeast/South, common shocks across regional housing markets were transmitted through the crisis-contingent channel during the recent housing crisis since 2007. The empirical results suggest the limited power of monetary policies in 2001, and the potential effectiveness of monetary policies in stabilizing the housing market turmoil at regional levels around 2007.

There are some avenues for future research. First of all, this paper inspires extended studies on monetary policy implications of international housing contagion, particularly during the recent housing crisis. Next, the literature which analyzes the housing crisis through investigations into linkages between the housing market and the real economy is thin. Hence, whether there are other empirical facts regarding broken interrelationships between housing market dynamics and macroeconomic aggregates around the 2001 recession are worthy of our further studies. Finally, the fresh concept, “housing shift-contagion”, introduced in this study is expected to contribute to the literature and intrigue more studies on co-movements across housing markets.

Notes

For instance, Clayton et al. (2010), Goodman and Thibodeau (2008), Wheaton and Lee (2008), and Wheaton and Nechayev (2008) investigate housing markets at the metropolitan levels; Negro and Otrok (2007), Rapach and Strauss (2009) and Vansteenkiste (2007) address housing market issues at the state levels.

Fadiga and Wang (2009) suggest that in the long run, housing prices in the South and the Midwest follow dynamics of their own, while in the short run, only the housing prices in the South follow specific dynamics. They also suggest that the housing prices in the West show higher permanent variability and lower cyclical volatility. In addition, housing prices in the Northeast and the South show equal variability of permanent and transitory components, and the price in the Midwest shows higher cyclical disturbance volatility.

Clayton et al. (2010) consider three exogenous variables—labor employment rates, mortgage interest rates, and the stock index—in a bivariate panel VAR model in order to analyze housing markets in 114 metropolitan areas in the US during 1990–2002, and argue that supply elasticity is a noticeable feature of local housing markets. Ng and Moench (2011) incorporate the common components into a factor-augmented vector autoregression (FAVAR) in order to quantify the response of consumption to regional and national housing shocks, and to examine whether or not the impacts of these shocks are significantly different. Utilizing a dynamic factor model, Negro and Otrok (2007) introduce both the latent national factor and the local (state-level) factor in an attempt to investigate the relative importance of national and local components in house prices during 1986 to 2005. They argue that explanatory powers of two factors in terms of the fluctuation in house prices are different between the pre- and post-2001 periods. Vansteenkiste (2007) adopts a global VAR to address heterogeneity and interdependence across 31 state-level housing markets during 1986–2005. The study uses generalized impulse response functions (GIRFs) to examine responses to four different shocks which allow us to investigate the dynamics of the shock transmissions. They find that a 10 % shock to house prices in California and New York can have a strong spillover effect on house prices of other states, while a 10 % shock to the house price in Texas has a low impact on those of other states. These findings support a discrepancy in spillovers of housing prices across states.

Wheaton and Nechayev (2008) explore the main reasons for the sharp appreciation of US housing prices in 59 MSAs during 1998 to 2005. They find two common shocks which explain the price surge: the prevalent speculative housing investment (2nd home buying) and the active sub-prime mortgage market.

Goodman and Thibodeau (2008) propose that the appreciation of housing prices reflects significant spatial variation. They argue that some local housing markets, such as those in the East Coast and California, experience a greater rise in housing prices due to the inelastic supply of owner-occupied housing, which acts as an idiosyncratic shock in local housing markets.

Huang (2012) advocates that there is a broken linkage between the business cycle and the housing cycle during the period of 2001–2004. The housing cycle is represented by the estimated high-volatility regime of the US housing price.

The unemployment rate data are taken from US Department of Labor: Bureau of Labor Statistics, and they are available since 1976. Other than unemployment, the economic fundamentals which are discussed in the existing literature on housing markets consist of GDP(output), personal income, employment, housing rent, population(demographic factors), the construction cost, stock prices, and so on.

Groshen and Potter (2003) documented that the 2001 recession was followed by a period of “jobless recovery” during which job losses were permanent and employers spent longer time searching for skilled labors than before. Thus, regional unemployment rates are chosen to represent regional economic fundamentals in the analysis.

The Michigan Survey of Consumers separates the recent housing boom into two phases: the early-boom stage during 2002–2003 and the second stage during 2004–2005.

References

Case KE, Shiller RJ (2003) Is there a bubble in the housing market? Brookings PapEcon Act 2:299–362

Ceron J, Suarez J (2006) Hot and cold housing market: international evidence. CEMFI Working Paper No. 0603

Claessens S, Dornbusch R, Park YC (2001) Contagion: why crises spread and how this can be stopped. In: Claessens S, Forbes K (eds) International financial contagion. Kluwer, Boston

Clayton JF, Miller NG, Peng L (2010) Price-volume correlation in the housing market: causality and co-movements. J Real Estate Financ Econ 40:14–40

Fadiga ML, Wang YA (2009) A multivariate unobserved component analysis of US housing market. J Econ Financ 33:13–26

Forbes K, Rigobon R (2001a) Measuring contagion: conceptual and empirical issues. In: Claessens S, Forbes K (eds) International financial contagion. Kluwer, Boston, pp 43–67

Forbes K, Rigobon R (2001b) Contagion in Latin America: definitions, measurement, and policy implications. J Lat Am Carib Econ Assoc 1:1–35

Forbes K, Rigobon R (2002) No contagion, only interdependence: measuring stock market co-movements. J Finance 57:2223–2261

Fry JM (2009) Bubbles and contagion in English house prices. The University of Manchester, UK, Working paper

Ghosh C, Guttery RS, Sirmans CF (1998) Contagion and REIT stock prices. J Real Estate Res 16:389–400

Goodman AC, Thibodeau TG (2008) Where are the speculative bubbles in US housing market? J Hous Econ 17:117–137

Gravelle T, Kichian M, Morley J (2006) Detecting shift-contagion in currency and bond markets. J Int Econ 68:409–423

Groshen EL, Potter S (2003) Has structural change contributed to a jobless recovery? Current Issues in Economics and Finance 9, no. 8. Federal Reserve Bank of New York

Guo F, Chen CR, Huang YS (2011) Markets contagion during financial crisis: a regime-switching approach. Int Rev Econ Finance 20:95–109

Hasan MS, Taghavi M (2002) Residential investment, macroeconomic activity and financial deregulation in the UK: an empirical investigation. J Econ Bus 54:447–462

Himmelberg C, Mayer C, Sinai T (2005) Assessing high house prices: bubbles, fundamentals, and misperceptions. J Econ Perspect 19:67–92

Huang MC (2012) The role of people’s expectation in the recent US housing boom and bust. J Real Estate Financ Econ. doi:10.1007/s11146-011-9341-0

Kim SW, Bhattacharya B (2009) Regional housing prices in the USA: an empirical investigation of non-linearity. J Real Estate Financ Econ 38:443–460

King MA, Wadhwani S (1990) Transmission of volatility between stock markets. Rev Financ Stud 3:5–33

Lastrapes W, Potts T (2006) Durable goods and the forward-looking theory of consumption: estimates implied by the dynamic effects of money. J Econ Dyn Control 30:1409–1430

Masson P (1999) Contagion macroeconomic models with multiple. J Int Money Finance 18:587–602

Negro MD, Otrok C (2007) 99 Luftballons: monetary policy and the house price booms across US states. J Monet Econ 54:1962–1985

Ng S, Moench E (2011) A hierarchical factor analysis of US housing market dynamics. Econ J 14:C1–C24

Oikarinen E (2006) The diffusion of housing price movements from center to surrounding areas. J Hous Res 15:3–28

Rapach DE, Strauss JK (2009) Differences in housing price forecastability across US states. Int J Forecast 25:351–372

Riddel M (2011) Are housing bubbles contagious? A case study of Las Vegas and Los Angeles home prices. Land Econ 87:126–144

Rigobon R (1999) Does contagion exist? The Investment Strategy Pack, Banking Department of the BIS

Rigobon R (2001) Contagion: How to measure it? In: Edwards S, Frankel J (eds) Preventing currency crises in emerging markets. University of Chicago Press, pp 269–334

Rigobon R (2003a) Identification through heteroskedasticity. Rev Econ Stat 85:777–792

Rigobon R (2003b) On the measurement of the international propagation of shocks: is the transmission stable? Journal of International Economics 61:261–283

Roche MJ (2001) The rise in house prices in Dublin: bubble, fad or just fundamentals. Econ Model 18:281–295

Schaller H, van Norden S (1997) Fads or bubbles? Bank of Canada Working Paper No. 97-2

Stevenson S (2004) House price diffusion and inter-regional and cross-border house price dynamics. J Prop Res 21:301–320

Vansteenkiste I (2007) Regional housing market spillover in the US: lessons from regional divergences in a common monetary policy setting. ECB Working Paper 708

Vargas-Silva C (2008) Monetary policy and the US housing market: A VAR Analysis Imposing Sign Restrictions. J Macroecon 30:977–990

Wheaton WC, Lee NJ (2008) Do housing sales drive housing prices or the converse. MIT Dep. of Economics Working Paper No. 08-01

Wheaton WC, Nechayev G (2008) The 1998–2005 housing ‘bubble’ and the current ‘correction’: what’s different this time. J Real Estate Res 30:1–26

Wheeler M, Chowdhury A (1993) The housing market, macroeconomic activity and financial innovation: an empirical analysis of US data. Appl Econ 25:1385–1395

Xu T, Han Y, Yang J (2012) US Monetary policy surprises and mortgage rates. Real Estate Econ. doi:10.1111/j.1540-6229.2011.00325.x

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Huang, M. Monetary policy implications of housing shift-contagion across regional markets. J Econ Finan 38, 589–608 (2014). https://doi.org/10.1007/s12197-012-9237-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-012-9237-8

Keywords

- Housing Shift-Contagion

- Regional Housing Market

- Monetary Policy

- Markov-Switching

- Structural Transmission

- Nonlinear