Abstract

This study explores price dynamics and price relationships in the US housing market with a focus on four regions: Northeast, Midwest, South, and West. It applies a multivariate state-space model to identify the common trends and common cycles in US regional markets. The study finds that the principal source of secular price variability in the Northeast and West markets is due to two common stochastic trends, while a large share of transitional price variability in the Northeast, West and Midwest originates from three common stochastic cycles. The study estimates the relationships between the common unobserved components and economic variables and finds that unemployment, federal funds rate, corporate default risk, economic expansion, unanticipated inflation in the construction market are significant underlying economic phenomena that impact the evolution of the common movements in both the short run and the long run housing dynamics.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Background

There is a great concern about the deterioration of the US housing market because of its potential impact on the US economy. This is particularly pronounced in areas such as part of California, Florida, Arizona, Washington DC, and Massachusetts, which experienced a strong housing boom in the last five years. The Office of Federal Housing Enterprise Oversight housing price index indicates that the US housing prices, on average, increased by 58% between 2001 and 2005. During the boom, high prices lead many to purchase homes requiring longer commuting time, including areas across regional boundaries where real estates were perceived more affordable.

Stevenson (2004) and Oikarinen (2006) discuss how changes in property prices in one place spillover into cross-border and surrounding areas. The appreciation of property value spreads across regions thereby forcing the local housing markets to deviate from their original market fundamentals. Moreover, a large amount of “speculative” funds from speculators and average people such as retirees, who were looking for a second home, moved from one area to another. This added pressure to the housing markets and connected markets across regions in an unusual way and partly contributed to higher level of inventory and falling housing prices across regions.

Clearly, there are major interactions between US regions, which may or may not be observable. The unobservable factors are embedded in the regional house price trends and cycles whose evolutions are shaped by economic phenomena such as local economic conditions and national monetary policies. Identifying these unobserved components is the main goal of this study. In that regard, we propose a multivariate structural time-series approach, which is a departure from the traditional approaches used in studies with similar focus. Those approaches generally analyze each region individually when applying a state-space approach or use systematic methods such as vector autoregressive (VAR) models, which provide no information with respect to the underlying unobserved components.

While there is a well established hypothesis about the prevailing role of local factors as principal determinants of real estate market dynamics, this study argues that the behaviors of house prices are also shaped by broader economic phenomena stemming from national policies. The effects of these policies are embedded in the trend and cycle components of housing prices. These unobservable components exhibit some degree of communality between them not captured by modeling the regions individually or by using VAR models.

House prices and housing market have been widely studied at the city, metropolitan statistical area (MSA), regional, and national level. Jones et al. (2004) and Clayton (1996) focus on markets within a city. Jones et al. (2004) investigates the role of submarkets in analyzing intra-city housing market dynamics in Glasgow, UK. The study highlights the relationship between the observed migration patterns within an urban area and the identified submarkets evidenced by high degrees of self-containment, indicating that movements in one submarket have limited impact on another. Clayton (1996) study the single-detached housing prices in the city of Vancouver, British Columbia, using a forward-looking rational expectation model and identified a transitory deviation of housing prices from market fundamentals. While the model does not capture the two real estate booms in Vancouver, it depicts the evolution of price in less volatile periods and illustrates the temporary deviation of housing prices from supply and demand fundamentals.

Studies at the MSA level include Miller and Peng (2006) which explore house price volatility in the US MSA using generalized autoregressive conditional heteroskedasticity (GARCH) and Panel VAR models. The study finds time-varying volatilities in 17% of the 277 MSA studied. Jud and Winkler (2002) investigate house price appreciation in 130 US metropolitan areas using cross-sectional and fixed-effects panel models to show the role of location in price appreciation. The study showed that location, population growth, real increase in income, after-tax mortgage rate, and construction cost lead to price appreciation.

Some studies used more aggregated data at the regional and/or national level. For example, Baffoe-Bonnie (1998) study regional and national housing market responses to shocks in macroeconomic aggregates based on impulse response functions derived from VAR model. While the study establishes that house prices respond to employment growth and national mortgage rates, it also recognizes the limitations of using aggregate economic variables to explain the fluctuations of real estate values. Guirguis et al. (2005) shows the merits of rolling GARCH and Kalman filter with an Autoregressive representation in forecast US national housing prices. This procedure accounts for the sub-sample parameter instability, which improves its forecasting accuracy.

In general, the above studies investigate housing markets for different areas without consideration of common movements among them. The hidden linkage among regional markets could be a key element to help craft sound policy decisions. As for the procedure, some studies analyze the dynamic of price variability, but do not account for the underlying unobserved heterogeneity that shapes the evolution of housing prices. A multivariate unobserved component model circumvents these procedural limitations. It is based on a state-space model with the diffuse Kalman filtering algorithm, which can identify, filter, and estimate the unobserved components while assessing their shared features.

2 Structural time series model of the US housing market

We follow Harvey (1990) and Koopman et al. (2000) general framework of stochastic component formulation for our modeling approach. The stochastic component formulation can be slightly modified to account for common factors between the trend and cyclical components of the four US regional housing prices between 1973:1 and 2006:2. Models of this type are known as structural time series and they can be cast into a state-space form and estimated efficiently by maximum likelihood procedure using the Kalman filtering process (Harvey 1990; Koopman et al. 2000). The state-space approach with the Kalman filter is well-suited to handle specifications in which the underlying stochastic processes are governed by observable and unobservable components (Lo and Wang 1995; Pindyck 1999).

A casual observation of their graphical representations (available upon request) shows that housing price in each region trends up throughout the sample period following a relatively steady path. Thus we specify each trend as a stochastic level with a fixed slope. In structural time series terminology, this is referred to as a local level with drift (Koopman et al. 2000). Following Koopman et al. (2000), a state-space representation of a multivariate local level with drift was specified as

where Y t is an n × 1 vector of endogenous US regional housing prices for the Northeast, Midwest, South, and West; I an n × n identity matrix, n = 4 (to account for the four regions), α t is the state vector with an n × 1 vector of level (μ t ) which corresponds to the trend, an n × 1 vector of slope (β t ) which is the growth rate of the trend, and two n × 1 vectors of cyclical components (ψ t ) and (\(\overline {\mathbf{\psi }} {\mathbf{t}}\)). The stochastic properties of the irregular, level, slope, and cyclical components are driven by ɛ t , η t , ξ t , ω t , and, \(\overline {\mathbf{\omega }}_{\mathbf{t}}\) which are n × 1 vectors. The disturbances are assumed normally distributed with mean 0 and variance \({\mathbf{\Sigma \varepsilon }}\), \({\mathbf{\Sigma \eta }}\), \({\mathbf{\Sigma \xi }}\), and \({\mathbf{\Sigma \omega }}\). The parameters \({\mathbf{\Gamma \varepsilon }}\), \({\mathbf{\Gamma \eta }}\), and \({\mathbf{\Gamma \omega }}\) such that \({\mathbf{\Sigma \varepsilon }} = {\mathbf{\Gamma \varepsilon \Gamma }}\prime {\mathbf{\varepsilon }}\), \({\mathbf{\Sigma \eta }} = {\mathbf{\Gamma \eta \Gamma }}\prime {\mathbf{\eta }}\), and \({\mathbf{\Sigma \omega }} = {\mathbf{\Gamma \omega \Gamma }}\prime {\mathbf{\omega }}\) are, respectively, the lower triangles of the Choleski decomposition of the variance–covariance matrix of the irregular, secular, and cyclical components. The remaining parameters are a damping factor \(\rho \in \left[ {0,1} \right]\) and a frequency \(\lambda c \in \left[ {0,\pi } \right]\) common to the four prices.

As previously stated, the state-space representations (Eqs. 1 and 2) can be modified to account for common factors. Common factors are present whenever the variance matrices of the trend and/or cycle innovations are less than full ranks. In which case, the linear combinations that account for the presence of common factors among the respective components are as follows \({\mathbf{\mu t}} = {\mathbf{\Theta \mu }}\widetilde{\mathbf{\mu }}{\mathbf{t + }}\widetilde{\mathbf{\mu }}{\mathbf{\theta }}\) and \({\mathbf{\psi t}} = {\mathbf{\Theta \psi }}\widetilde{\mathbf{\psi }}{\mathbf{t}}\), \({\mathbf{\Sigma \eta }} = {\mathbf{\Theta \mu D\Theta }}\prime {\mathbf{\mu }}\), \({\mathbf{\Sigma \omega }} = {\mathbf{\Theta \psi D\Theta }}\prime {\mathbf{\psi }}\), \({\mathbf{\Gamma \eta }} = {\mathbf{\Theta \mu D}}_{\mathbf{\eta }}^{^{{\raise0.7ex\hbox{${\mathbf{1}}$} \!\mathord{\left/ {\vphantom {{\mathbf{1}} {\mathbf{2}}}}\right.\kern-\nulldelimiterspace}\!\lower0.7ex\hbox{${\mathbf{2}}$}}} } \), and \({\mathbf{\Gamma \omega }} = {\mathbf{\Theta \psi D}}_{\mathbf{\omega }}^{{\raise0.7ex\hbox{${\mathbf{1}}$} \!\mathord{\left/ {\vphantom {{\mathbf{1}} {\mathbf{2}}}}\right.\kern-\nulldelimiterspace}\!\lower0.7ex\hbox{${\mathbf{2}}$}}} \) with \({\mathbf{D\eta }}\) and \({\mathbf{D\omega }}\) the diagonal matrices with diagonal elements corresponding to the eigenvalues of the trend and cycle innovations’ variance matrices. The coefficient matrices \({\mathbf{\Theta \mu }}\) and \({\mathbf{\Theta \psi }}\) are, respectively, n × k and n × s factor loading matrices with the elements θ ij constrained to zero for i > j to satisfy the identification condition, \(\widetilde{\mathbf{\mu }}{\mathbf{t}}\) is an \(n - k \times 1\) vector of common levels, \(\widetilde{\mathbf{\mu }}_{\mathbf{\theta }}\) an n × 1 vector of constant terms with the first k elements equal to zero, and \(\widetilde{\mathbf{\psi }}{\mathbf{t}}\) an \(n - s \times 1\) vector of common cycles. The factor loading matrices measure the degree to which the k common trends and s common cycles contribute to the variability of each observed price. The common trends and cycles are identified using the generalized multivariate unobserved component approach (Harvey, Ruiz, and Shephard, 1994). Application of this approach includes recent studies by Luginbuhl and Koopman (2004) and Fadiga and Misra (2007). The method is a multivariate factor analysis of the variance covariance matrices of the unobserved components; it determines the number of non-zero elements in \({\mathbf{D\eta }}\) and \({\mathbf{D\omega }}\), which also corresponds to the number of non-zero columns in the variance matrices. Harvey et al. (1994) found the method more reliable and more tractable than methods based on autoregressive approximations. The unobserved state vector and variance parameters along with the factor loading matrices, the damping factor, and the frequency of the cycle are jointly estimated by maximum likelihood procedure using the Kalman filtering technique.

3 Data and preliminary analysis

This study uses quarterly median US regional housing prices between 1973:01 and 2006:02. The US housing market follows the same regional division used by the US Census Bureau consisting of four regions: Northeast, Midwest, West, and South, which covers the entire US. While city or MSA data may provide a more refined picture of housing price movements, we used regional level data to ease the computational difficulties. It is computationally impossible to handle all the US MSA in a multivariate framework because of the size of the matrix of unobserved features involved. We chose these four regions as they have been used in the past and continue to be the focus of investigation of house price dynamics nationwide. Leamer (2007) used the same regional housing prices in his recent study of housing market and business cycle.

Table 1 provides a summary statistics of US real regional median house prices. Median housing prices are the lowest in the South ($138,170.4) and the highest in the Northeast ($207,491.4). The Midwest and the South have kurtosis value below 3.0. Higher kurtosis values were noted for the West (3.95) and the northeast (3.22). High kurtosis value implies that the distribution has more probability mass in the tails than the normal distribution (Diebold 2004) and is also evidence of large price movements associated with time-varying volatility. The instability index defined as the ratio of the standard deviation of housing price to its mean indicates a certain degree of instability over the sample period. As Table 1 illustrates, house prices in the Northeast and the West exhibit a relatively high degree of instability, above 20%, while prices in the Midwest and the South show low instability, slightly above 10%. The entire data used in this study are retrieved from Economagic, which compiles economic data from reliable sources, including the Federal Reserve Banks, the US Census Bureau, and American Association of Realtors. The data were seasonally adjusted to remove the impacts of any underlying seasonal components.

4 Empirical analysis

4.1 Common trends and cycles identification

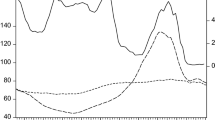

First, the unrestricted multivariate model under the specification of local level with drift is applied to the four US regional housing prices. It yielded the eigenvalues of the variance matrices of trend, cyclical, and irregular components summarized in Table 2. The eigenvalues of the variance-covariance matrix of secular components converges to zero in the South and the Midwest and that of the cyclical components converges to zero in the South. Thus, the long run and short run dynamics of the US regional housing market are mainly determined by two common trends and three common cycles (Figs. 1 and 2). We also conducted a likelihood ratio (LR) test to ascertain the validity of the rank restrictions using the likelihood values in Table 2 and 3 under the unrestricted and restricted models. The calculated LR amounted to 2.6 and was less than \(\chi ^2 \left( 3 \right)\) at 5% significance level, indicating that the restrictions with two common trends and three common cycles are adequate. The presence of common features such as common trends and cycles could be the results of national economic policy, mainly monetary policy, economic growth, or the overall inflationary pressure in the US construction industry.

Common stochastic trends of regional house prices (in thousand): 1973:1–2006:2. Subpanels (a) and (b) correspond to \(\widetilde{\mu}_{1t} \) and \(\widetilde{\mu}_{2t} \), respectively. They are the elements of \(\widetilde\mu _t \) and were obtained by solving the equation \(\widetilde\mu _t = \Theta _u \widetilde\mu _t + \widetilde\mu _\theta {\kern 1pt} for{\kern 1pt} \widetilde\mu _t \)

Common stochastic cycles of regional house prices (in thousand): 1973:1–2006:2. Subpanels (a), (b), and (c) correspond to \(\tilde \psi _{1t} ,\tilde \psi _{2t} ,\) and \(\tilde \psi _{3t} \), respectively. They are the elements of \(\tilde \psi _t \) and were obtained by solving the equation \(\tilde \psi _t = \Theta _\psi \widetilde\psi _t \) for \(\tilde \psi _t \)

The estimates that follow from this point forward are based on the multivariate local level with drift restricted to two common trends and three common cycles. The relationship between the derived common unobserved components and the variability of price in each region can therefore be established as follows

Where \(y_{1t} \), \(y_{2t} \), \(y_{3t} \), and \(y_{4t} \) are respectively house prices in the Northeast, West, South, and Midwest, \(\tilde \mu _{1t} \) and \(\tilde \mu _{2t} \) are their common trends, and \(\tilde \psi _{1t} \), \(\tilde \psi _{2t} \), and \(\tilde \psi _{3t} \) their common cycles. Figures 1 and 2 illustrate the common stochastic trends and cycles of the regional housing market. The estimated factors in the above relationship are standardized factor loading matrices (Table 3 and 4). Then, these derived factors were unstandardized and rotated by orthogonal transformations. The rotated factors were squared and summed to derive the communality scores, which measure the contribution of the two common trends or three common cycles cycle to the variability of each regional housing price. As Table 3 shows, Northeast house price loads heavily on the first common trend and West house price loads equally on both common trends. The calculated communality scores indicate that the first and second common trends contribute up to 72.4% and 82.7% of price variability in the Northeast and West. As for the cycles, Northeast house price loads primarily on the first common cycle, West house price loads on the second and third common cycles, while Midwest house price loads equally on all three common cycles. The results further indicate that the three common cycles account for 84.7% of the cyclical variability of price in the Northeast, 97.5% in the West, 95.5% in the Midwest, and 22.4% in the South (Table 4). The low communality scores of the cyclical variability of price in the South and the secular variability of price in the South and Midwest are indications that in the long run, the South and Midwest markets follow dynamics of their own while in the short run only the South follows a separate path. Thus, uniform policies alone cannot bring about short or long term corrections to ensure market vitality. In addition to national strategies, corrective measures specifically designed for each region are necessary. This is especially true for the South and the Midwest for long run solutions and the South for short term solutions.

4.2 Stochastic component and final state vector analysis

The maximum likelihood estimates of the final state vector are provided in Table 5. The parameter estimate \(\mu _T \) is the level of the trend and \(\beta T\) its growth rate at the steady state point (i.e., \(t = T\)). The estimated value of the slope parameter indicates at steady state, median price appreciated by 2.39% a year in real terms in the Northeast, 2.57% in the West, 1.14% in the South, and 1.09% in the Midwest. With regard to the cycle, the estimated state parameters \(\psi _T \) and \(\bar \psi _T \) determine the amplitude. The remaining parameters are a cycle period of 7.38 years with a frequency of 0.205 and a damping factor of 0.953. The results indicate that the amplitude of the cycle as a percentage of the trend was estimated at 5.42% in the Northeast, 3.59% in the West, 3.57% in the South and 7.76% in the Midwest.

The stochastic nature of the Northeast, West, South, and Midwest regional prices are embedded in their irregular, trend, and cyclical components (Table 5). The trend and cycle decompositions showed higher permanent variability and lower cyclical volatility in the West. For the Midwest, transitory disturbance volatility was higher than its secular counterpart. While for the Northeast and South, transitory and secular disturbance volatilities were about the same. Cyclical disturbance volatility is lower in the West than in any other region. As for the Midwest, the cyclical disturbance volatility estimate is two times higher than the trend disturbances volatility. We computed the innovation variance ratios by comparing trend disturbance variance with cycle disturbance variance and found the permanent component relatively more important than the transitory component in the West. Thus, shocks in this region last longer than shocks in the Midwest region. Moreover, for the West especially, the permanent component accounts for most of the variability of housing prices. This explains the small magnitude of the amplitude of the cycle relative to the trend as previously stated. Overall, there are clear indications the secular and transitory components contribute equally to the house price forecast variances in the Northeast and the South. In the West, however, the contribution of the secular component is higher while in the Midwest it is that of the transitory component.

4.3 What economic factors shape the evolution of the unobserved components?

To answer this question, we extracted the smoothed trends and cycles from the multivariate unobserved components. The smoothed trends and cycles of the four regions considered were used to derive the common trends and cycles, which were utilized to estimate a series of regressions to sort out which economic variables explained the evolution of the common unobserved components in the US housing market. Our approach is similar to Carlino and Sill (2001) with the exception that their regressions were based on the individual trends and cycles instead of the common trends and cycles as we are proposing. Moreover, their trend/cycle decomposition was based on the Beveridge and Nelson (1981) approach while ours utilized the unobserved component method. The model is specified as follows:

where y is the derived common trend or common cycle component. The regressors are mainly one-quarter lag economic variables such as unemployment rate, corporate default risk, fed funds rate, GDP growth rate, and change in construction price index as indicated earlier. We included the unemployment rate variable because wages are the primary factor explaining people movements because of better paying jobs, which consequently fuel housing demand; hence is considered a determinant of house price dynamics. We used the fed funds rate for its role in determining mortgage rate. Because houses are alternatives to other investment instruments such as corporate bonds and stocks, we used corporate default risk to measure the inherent risk in the overall economy. It is constructed as the difference between the rates on low grade and high grade corporate bonds using Moody’s seasoned Baa and Aaa indices. The GDP growth rate was considered to measure the effects of economic growth on the evolution of house price.

The structural relationship estimation in Table 6 shows the responses of each common trend and common cycle to external shocks. A rise in unemployment rate has a significantly negative impact on the evolution of both common trends and no effects on the common cycles. While house prices do not respond to change in unemployment rate in the short run, the long run effect of unemployment may be explained by contraction in demand because of reduced income following rise in unemployment and the subsequent wage loss. As a result, house demand curve shifts inward, leading to lower house price. One percent drop on the unemployment rate could make housing value appreciate about 0.8%.

Risk mitigation and portfolio diversification are the key elements that attract investor into the real estate market. At any given level of return, investors are always looking for a low-risk shelter for their money. An increase in corporate default risk has a significant and positive effect on the first common trend and no effect on the second common trend. There is no evidence that corporate default risk induces short-term movements of house prices. Our finding is consistent with Ewing and Wang (2005) study, which found a positive long term impact of default risk on housing starts. The results showed that housing could be a shelter for investment when other financial instruments present risky prospects in the long run. For instance, in times of higher uncertainty in the economy, stocks and bonds markets are less likely to perform up to the expectations of investors. Under such circumstances, house purchases may be a more viable option for long term investments.

The results presented in Table 6 also showed close connections between housing market and monetary policy. According to the Federal Reserve Act, one may argue that the role of the Fed is to maintain low unemployment and price stability, not to influence housing market. However, our findings suggest this is more complex than stated. Housing market is a unique sector which the Fed has to pay close attention to in order to realize its ultimate mission. The decisions of Federal Open Market Committee on interest rate clearly impacted the housing market in both the short run and the long run. With tightened monetary policy, i.e. increases of interest rate, housing market suffered property value depreciation as illustrated by the negative impacts on the common trends and common cycles. We found a significant and negative impact of the federal funds rate on all the common trends and common cycles. It is the only variable in this study that has a significant impact on all trends and cycles. This is an indication of the importance of monetary policy to housing market both in the short run and the long run. The federal funds rate determines the effective mortgage rate, therefore has an important impact on homebuyers’ decision. An increase in fed funds rate leads to higher effective mortgage rate and reduced affordability for houses, leading to rise in inventory. Since prices tend to adjust to inventory levels, inventory build-up leads to lower price. This highlights the significant impact of real estate speculators and sellers whose functions in the market are to absorb the excess of supply or to accommodate the excess of demand depending on market conditions. Conversely, a cut in fed funds rate is expected to engender the opposite effect by stimulating demand, leading to reduced inventory and higher prices. In the analysis, one point drop of fed funds rate has less than a third of a point impact on the housing price in the long run and less than a quarter point impact in the short run. This might imply that the Federal Reserve currently is doing the right thing: dropping the federal funds rate with the hope to ease the pressure on the housing market. The problem is how much the Fed needs to cut these rates to make a noticeable difference in the housing market. With a recent 75 basis point cut, clearly, the Fed has already stepped up on the magnitude of its policy in order to play a bigger role on the current housing crisis. The purpose is not to boost housing price, but to prevent a landslide of home equity which is the largest asset for many home owners.

A positive real output shock leads to positive long lasting effect on house price and no effect in the short run. The results also indicate a positive and direct impact of economic expansion on housing market in all regions. This is an indication that housing market is less sensitive to the general growth of the economy unlike other variables in the model. Moreover, the responses of housing market to supply factors were modest, which indicates that housing market was more demand-driven.

5 Conclusion

This study explored price dynamics and price relationships in the US housing market with a focus on the Northeast, Midwest, South, and West. The tenants of this study were that the behaviors of house prices are driven by economic phenomena embedded in their trends and cycles components. These components are stochastic and have common features shaped by monetary policy and market fundamentals. The study showed that the US regional house prices share two common stochastic trends and three common stochastic cycles. These common components account for a large fraction of secular price variability in the Northeast and West and transitory price variability in the Northeast, the West and the Midwest.

The findings also revealed that while prices in the Northeast and West share the same source of variability in the long run, housing markets in the South and Midwest appear to follow a dynamic of their own given the low communality score pertaining to their trend disturbances. This underscores the importance of targeted strategies in addition to national policy instruments when designing policies to improve the real estate market. The study found unemployment, Federal Funds rate, corporate default risk, economic expansion, unanticipated inflation in the construction market are the underlying economic phenomena that impact the common movements in both the short run and the long run regional housing dynamics. Furthermore, among all the economic factors considered, the Federal Funds rate is one that impacted all common trends and cycles, thus, highlighting the importance of monetary policy to housing market.

References

Baffoe-Bonnie J (1998) The dynamic impact of macroeconomic aggregates on housing prices and stock of houses: A national and regional analysis. J Real Estate Finance Econ 17(2):179–197

Beveridge S, Nelson C (1981) A new approach to decomposition of economic time series into permanent and transitory components with particular attention to measurement of the business cycle. J Monet Econ 7(2):151–174

Carlino G, Sill K (2001) Regional income fluctuations: Common trends and common cycles. Rev Econ Stat 83(3):446–456

Clayton J (1996) Rational expectations, market fundamentals and housing price volatility. Real Estate Econ 24(4):441–470

Diebold FX (2004) Elements of forecasting. Third edition, South-Western and Thompson Publication.

Ewing BT, Wang Y (2005) Single housing starts and macroeconomic activity: an application of generalized impulse response analysis. Appl Econ Lett 12:187–190

Fadiga ML, Misra SK (2007) Common trends, common cycles, and price relationships in the international fiber market. J Agric Resour Econ 32(1):154–168

Guirguis HS, Giannikos CI, Anderson RI (2005) The US housing market: Asset Pricing Forecasts Using Time Varying Coefficients. J Real Estate Finance Econ 30(1):33–53

Harvey AC (1990) Forecasting structural time series and the Kalman filter. Cambridge University Press, Cambridge

Harvey AC, Ruiz E, Shephard N (1994) Multivariate stochastic variance models. Rev Econ Stud 61(2):247–264

Jones C, Leishman C, Watkins C (2004) Intra-urban Migration and Housing Submarkets: Theory and Evidence. Hous Stud 19(2):269–283

Jud GD, Winkler DT (2002) The dynamics of metropolitan housing prices. J Real Estate Res 23(1–2):29–45

Koopman SJ, Harvey AC, Doornik JA, Shephard N (2000) STAMP: Structural Time Series Analyser, Modeller, and Predictor. Timberlake Consultant Press, London

Leamer E (2007) Housing is the business cycle. NBER Working Paper No. 13428Issued in September 2007

Lo AW, Wang J (1995) Implementing option pricing models when asset returns are predictable. J Finance 50:87–129

Luginbuhl R, Koopman SJ (2004) Convergence in European GDP Series: A multivariate common converging trend-cycle decomposition. J Appl Econ 19:611–636

Miller N, Peng L (2006) Exploring metropolitan housing price volatility. J Real Estate Finance Econ 33(1):5–18

Oikarinen E (2006) The diffusion of housing price movements from center to surrounding areas. J Hous Res 15(1):3–28

Pindyck RS (1999) The long-run evolution of energy prices. Energy J 20(2):1–27

Stevenson S (2004) Housing price diffusion and inter-regional and cross-border house price dynamics. J Prop Res 21(4):301–320

Acknowledgements

We thank the discussants at the 2007 Eastern Economic Association Annual Conference in New York, NY and the 2007 American Real Estate and Urban Economics Association International Conference in Macau, China for helpful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Additional information

Authorship is equally shared between the authors.

Rights and permissions

About this article

Cite this article

Fadiga, M.L., Wang, Y. A multivariate unobserved component analysis of US housing market. J Econ Finance 33, 13–26 (2009). https://doi.org/10.1007/s12197-008-9027-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-008-9027-5