Abstract

This paper tests the Environmental Kuznets Curve (EKC) hypothesis for four local (SO\(_{x}\), NO\(_{x}\), CO, VOC) and two global (CO\(_{2}\), GHG) air pollutants. Using a panel data set of thirty OECD countries, the paper finds that the postulated inverted U-shaped relationship between income and pollution does not hold for all gases. A meaningful EKC exists only for CO, VOC and NO\(_{x}\), where for CO\(_{2}\) the curve is monotonically increasing. For GHG there is indication of EKC, but most countries are still on the increasing path of the curve. SO\(_{x }\)emissions follow a U-shaped curve.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In the last 15 years a sizeable amount of empirical evidence has been produced on the relationship between economic growth and the environment. Many scientists have questioned whether the ever growing economic activity is also sustainable in the future, and how it fits into the environmental limits of System Earth. First to raise these concerns were Meadows et al. (1972) in their controversial work Limits to Growth. Meadows et al. (1972) argue that growing economic activity goes along with larger inputs of materials and energy and generates larger quantities of waste. The increased extraction of natural resources, waste accumulation and concentration of pollutants would overwhelm the carrying capacity of the biosphere and in turn lead to environmental degradation.

Yet, at the other extreme, are those scientists who advocate that economic growth is good for the environment. As Beckerman (1992) puts it, the most certain way to improve environmental quality is to become rich. Higher incomes result in demands for a clean environment and the adoption of environmental policies. Bartlett (1994) goes even further by claiming that hindering of economic growth, by imposing environmental regulation, may in fact reduce environmental quality.

Other researchers (Grossman and Krueger 1991, 1995; Panayotou 1997; Cole 2003; Bates et al. 1997; Selden and Song 1994), find that the relationship between economic growth and the environment is not fixed (either negative or positive), but rather it can be described by an inverted U-shaped curve. At low levels of development economic growth is harmful for the environment, but it turns beneficial once countries reach higher income levels. This inverted U-shaped relationship between economic growth and the environment is known in the literature as Environmental Kuznets Curve (EKC hereafter). The EKC hypothesis has been extensively examined in the empirical literature of the last 15 years and it is also a subject of this analysis.

The present paper makes a modest attempt to contribute to the existing empirical evidence, by examining the relationship between economic growth and six environmental indicators: Sulphur oxides (SO\(_{x})\), Nitrogen oxides (NO\(_{x})\), Carbon monoxide (CO), Volatile organic compounds (VOC), Carbon dioxide (CO\(_{2})\) and Greenhouse gases (GHG). Differently from previous research, which mainly uses GEMSFootnote 1 data before 1990, this paper employs an OECD data set from 1990 onwards. The objective of the paper is to test the Environmental Kuznets Curve hypothesis for OECD countries and to examine whether there is an Environmental Kuznets Curve for the six studied environmental indicators.

2 Theoretical framework and empirical evidence

In his seminal work from 1955, Simon Kuznets examines the relationship between economic growth and income distribution. According to the author, countries with low economic development exhibit low inequality in the distribution of income. As countries move towards higher level of economic development their incomes begin to increase and so does the inequality. This process goes on until some critical point, at which income inequality stops rising further with income and starts declining. Graphically this relationship can be represented by an inverted U-shaped curve and it is known as a Kuznets curve.

In the early 1990’s, two other prominent researchers (Grossman and Krueger 1991) found that similar relationship exist also between some air pollutants and income level. In the light of the North American Free Trade Area agreement, environmentalists were concerned that low environmental standards and bad enforceability in Mexico will attract pollution intensive industries from US and Canada, which in turn will worsen the already bad air quality in Mexico. Performing a rigorous statistical analysis Grossman and Krueger (1991) showed that there is a systematic relationship between income and air pollution, and this relationship can be described by an inverted U shaped curve. Although the authors do not mark this relationship as a Kuznets curve yet, their paper gives a new impulse. Followed by Shafik and Bandyopadhyay (1992) and Panayotou (1997) these three seminal papers give birth of what today is known as an Enviromnetal Kuznets Curve. Figure 1 presents a theoretical EKC.

The EKC is an inverted U-shaped curve with income level plotted on the x-axis and environmental degradation plotted on the y-axis. Countries which find themselves in the left part of the graph have low level of economic development. At this stage the rate of recourse regeneration exceeds the rate of resource depletion. The generated hazardous waste and by-products are negligible and so is the environmental awareness. As countries increase their economic activity, the extraction of resources becomes more intensive, and production shifts towards the industrial sector. This results in a more energy intensive production with higher emission of pollutants and by-products. This shift in production is represented by the upward sloping part of the curve. This is the stage at which economic growth is associated with environmental deterioration. At a more advanced level of development countries move further right. They specialize in services and production of knowledge based goods. At this stage people realise that natural resources are a limited and “luxury good” (Dinda 2004). This environmental awareness, coupled with a shift in production and tighter environmental regulation, results in a levelling-off and gradual decline of environmental deterioration. Hence, in this part of the curve further growth is associated with a better environmental quality. This stage is represented by the downward sloping part of the curve. The critical point at which the U-shaped curve changes its direction is called the income turning point.

Surveying the empirical literature on EKC shows that besides the postulated inverted U-shaped curve a number of other paths of environmental development are found along with economic growth. For different local and global air quality indicators, such as CO, NO\(_{x}\), SO\(_{x}\), suspended particulate matters, CO\(_{2}\), GHG, the relationship between economic growth and environmental degradation can be described by: an inverted U-shaped curve, an U-shaped curve, a monotonically increasing (decreasing) curve. Comprehensive surveys of the EKC literature are presented by Barbier (1997); Dinda (2004); Yandle et al. (2004); Kijima et al. (2010); Pasten and Figueroa (2012) and Figueroa and Pasten (2013). These studies extensively discuss the factors explaining the shape of the EKC curve as well as some methodological issues arising with the estimation of the environment-income relation.

This paper shortly discusses some of these factors, in particular: income elasticity of demand for environmental quality (preferences for environmental quality and regulation and policy), technological effects of economic activity and international trade. Although all these factors interact with each other and are interdependent, here they are briefly discussed in a ceteris paribus context, i.e. keeping all other factors equal.

2.1 Factors explaining the EKC

A number of studies have emphasized the importance of income elasticity as a theoretical underpinning of the shape of EKC (Pasten and Figueroa 2012; Panayotou 2003; Beckerman 1992; Antle and Heidebrink 1995; Chaudhuri et al. 2004). The general idea is that a clean and preserved environment is a “luxury good” (Dinda 2004). Before certain level of development is achieved this luxury good is too expensive and poor people attach low value to it. However, as income increases people start attaching increasing value to the environment (Selden and Song 1994). Moreover, after a certain level of income is reached the readiness to pay for preserved environment rises by a greater fraction than income (Roca 2003). Consumers with high incomes are not only willing to spend more on green products, but also make demands for environmental protection through regulation and sanctions. In particular, removing of harmful subsidies on energy and transport, internalizing externalities (e.g. paying for environmental damage), full cost pricing of natural resources to reflect increasing scarcities etc. are suggested as proper policies towards limiting of environmental damages. Another implication of economic growth is that more wealth is accumulated. More accumulated wealth means that the countries have more funds to spend on research and development, which results into new technologies and production processes. Replacing the dirty and obsolete technologies with new and clean technologies is expected to have a positive impact on the environmental quality (Grossman and Krueger 1991). Also advances in production processes may lead to a decrease in the amount of inputs needed to produce one unit of output. In this respect, the technological effects of economic growth are positively associated with environmental quality, and hence explaining the occurrence of the EKC. Pasten and Figueroa (2012) and Figueroa and Pasten (2013) show that all theoretical models justifying the occurrence of inverted U shape EKC, based either on preferences for environmental quality or technological change, share a common origin and can be framed in terms of the comparison between these two elasticities. Figueroa and Pasten (2013) further conclude that for explaining the empirical existence of the EKC, theoretical models based on preferences require use of weaker restrictions than those based on technology.

Another factor considered as a major cause of EKC is international trade (Cole 2003; Dinda 2004; Copeland and Taylor 1994, 2003). International trade brings changes in the composition of economic activity. The compositional changes depend on the sources of comparative advantage which countries have, e.g. relative factor endowments and pollution taxation (Antweiler et al. 2001; Cole 2003; Copeland and Taylor 2003). As a result of international trade countries will export (and hence increase the production of) those products that are intensive in the factor which is their comparative advantage. If we assume that rich countries are abundant in capital and skilled-labour and poor countries in unskilled–skilled labour, then rich countries will export relatively more capital intensive products and poor countries will export relatively more labour intensive products. Assuming that capital intensive production generates more pollution than labour intensive production, it follows that environmental quality will deteriorate in rich countries as a result of trade.

The second source of comparative advantage is the pollution tax. Let’s assume that the pollution tax is a positive function of income. Keeping all other factors equal, this means that pollution taxes will be on average lower in low income countries (because of the low demand for environmental regulation). From that point, low income countries will have a comparative advantage in pollution intensive industries and will attract those industries from the high income countries with high environmental regulations (Eskeland and Harrison 2003; Friedl and Getzner 2003; Copeland and Taylor 2003). This is the so called Pollution haven hypothesis (PHH hereafter). Basically this hypothesis suggests that the downward sloping part of the EKC is not a result of pollution reduction, but rather reallocation of dirty industries to low income countriesFootnote 2. The net composition effect of trade on the environment depends thus on both factor endowments and pollution taxation. In another paper we examined the PHH for three dirty and three clean industriesFootnote 3 for all OECD countries (Georgiev 2011). Using a panel of 30 OECD countries over the period 1990–2005 we find evidence in support of the PHH for two of the six industries. Environmental regulations are found to exhibit a negative impact on exports from the Chemicals industry and a positive impact on exports from the Electrical machinery industry.

2.2 Empirical evidence

Stern and Common (2001); Grossman and Krueger (1995); Selden and Song (1994); Shafik (1994); List and Gallet (1999); Roca (2003); Bates et al. (1997) and Galeotti et al. (2006) find that some air pollutants generally reveal the postulated inverted U-shaped relationship with income. Harbaugh et al. (2002); Stern and Common (2001) and Cole (2003) however, question the existence of the postulated relationship, and further test the robustness of the EKC. The authors conclude that the inverted U-shaped EKC is fragile and depends on the applied estimation techniques, functional forms and data sets.

Yet, other studies find that the relationship between income and emissions of NO\(_{x}\), SO\(_{2}\) and ambient concentration of NO\(_{x}\) can be described by an U-shaped curve (List and Gallet 1999; Kaufmann et al. 1998; Khanna 2002). At low income levels environmental quality improves as a result of economic growth, whereas this trend is reversed after a certain level of development and thereafter environmental quality starts deteriorating with economic growth. Panayotou (1997) finds the relationship between income and SO\(_{2}\) follows a rotated J-shaped curve. The rotated J curve indicates that concentrations are a decreasing function of income until some critical point, whereas after this point they become an increasing function of income.

Finally, some studies show that there is no reason to expect that air pollutants will follow the same path (Galeotti and Lanza 1999; Bates et al. 1997; Shafik 1994; Holtz and Selden 1995). The emissions of global air pollutants, such as CO\(_{2}\) and GHG are generally found to be monotonically rising with income. The authors suggest that a meaningful EKC might exist only for local air pollutants (e.g. NO\(_{2}\), SO\(_{2}\), CO, suspended particulate matters, NO\(_{3}\)-concentrations) while environmental indicators with global or indirect impact on the environment are an increasing function of income. A possible explanation of this result is that it is easier to reduce concentration of local pollutants in urban areas than global emissions, because local air pollutants have direct negative impact on human health. On the contrary, CO\(_{2}\) is an invisible and odourless gas with no direct negative impact on human health.

In summary, the relationship between income and air pollution can take on many shapes. It depends upon a number of factors such as the used data set, estimation technique, variables included in the regression and others.

3 Methodology

Majority of the studies discussed in the previous section estimate the relation between environmental development and income via a simple reduced-form model of the form: Y = \(f\)(X, D), where Y stands for pollution, X for income and D for population density. Income enters this equation either in a quadratic or a cubic form, in levels or in logs.

Besides this simple specification, there might be also other factors which affect pollution. Some of these factors are difficult to observe as they are country specific and not qualitatively measurable (e.g. different attitudes towards clean and preserved environment). In this respect, cross country differences in pollution can not be explained only by the income and population density variables. Failing to control for these country specific factors will lead to biased results. In this paper, following the empirical literature, both Fixed and Random effects models are estimated, which allow controlling for country and time specific effects, without having to observe them:

whereas i indicates country and t time period, Y is an environmental indicator, X is income level, D is population density, \(\alpha _{i}\)’s and \(\gamma _{t}\)’s are respectively country and time specific intercepts, and \(\varepsilon \) is the disturbance term. The coefficient \(\beta _{1}\) measures the effect of an increase in income on environmental degradation for a low income country; \(\beta _{2}\) measures the effect of an increase in income on the environment for a middle-high income country. \(\beta _{3}\) indicates how the income-environment relationship develops at very high income levelsFootnote 4. The coefficient \(\beta _{4 }\) captures the effect of population density on emission of air pollutants. Finally, the coefficients of \(\gamma \) (year dummies) will show how emissions change over time.

One implication of Eq. (1) is that the interpretation of the coefficients as causality effects is only valid when the explanatory variables are exogenous. One concern is that there may be reversed causality going also from pollution to income. If this is the case, then the estimates will be biased and this will require finding an instrument for the endogenous variable. To address these concerns a Hausman simultaneity test was perform and it was found that in none of the specifications the income variable is endogenousFootnote 5.

Another methodological issue is the calculation of income turning points, i.e. the income at which the curve peaks (assuming it is an EKC). This is done in the following way:

-

1.

Equation (1) is partially differentiated with respect to income. This yields: \(\partial Y{/}\partial X= \, \beta _1 +\,2*\beta _2 X_{it} +\,3*\beta _3 X^2_{it} \)

-

2.

Making \(\partial Y{/}\partial X\) equal to zero and solving for X\(_{1}\) and X\(_{2}\).

This yields: \(\beta _1 +\,2*\beta _2 X_{it} +\,3*\beta _3 X^2_{it} =\,0\,=>\,X_{1,2} =\,( -\,\beta _2 \pm \,\surd \,( ( {\beta _2 })^2-3*\,\beta _1 *\,\beta _3 ))/3*\beta _3 \)

where \(\beta _{1}\), \(\beta _{2}\) and \(\beta _{3}\) are the coefficients of the estimated function. X\(_{1}\) and X\(_{2}\) are the two turning points of the function.

4 Data description

Data for these gases is provided by OECD Environmental Data Compendium 2006/2007 (OECD 2007) and it is in emissions. The data for SO\(_{x}\), NO\(_{x}\), CO and VOC are from total man-made emissions, which include mobile sources (e.g. motor vehicles), stationary sources (e.g. power stations, fuel combustion), industrial processes (pollutants emitted in manufacturing) and miscellaneous sources (such as waste incineration and agricultural burning). The data for CO\(_{2 }\) is constructed on bases of emissions from energy use and refers to fossil fuel combustion. Oil and gas for non-energy purposes and the use of biomass fuels are excluded. Peat is included. CO\(_{2 }\)emissions from other human activities (e.g. cement production) are not included. The data for GHG refers to total emissions of: CO\(_{2}\) emissions from energy use and industrial processes (e.g. cement production); CH\(_{4 }\) emissions from solid waste, livestock, mining of hard coal and lignite, agriculture and leaks from natural gas pipelines; N\(_{2}\)O; HFC; PFC and SF\(_{6}\). The data for the GHG excludes emissions or removals from land-use change and forestry (OECD 2007).

The data for all gases was converted from total emissions (as reported by OECD) into emissions per capita. It covers 30 OECD countriesFootnote 6 over the period 1990–2005.

Data for Gross domestic product per capita (GDP) is readily provided by OECD. The data is converted to US dollars, using Purchasing power parities (PPP).

The data for population density is calculated by dividing population data (provided by OECD) on country area data [provided by United Nations Statistics Division (2005)].

The data used for the calculation of the spatial weight matrix for the spatial Durbin model is provided by GeoDist database on distances (Mayer and Zignago 2011). GeoDist provides country-specific geographical coordinates of capital cities for 225 countries worldwide.

Table 1 presents some descriptive statistics of the data.

5 Empirical results

5.1 Empirical results of the income-gas emissions relationship

This paragraph presents the estimation results. The Hausman test indicates that the Random effects is the preferred model for all pollutants. Therefore only the results of the Random effects are discussed. Table 2 shows the estimates for CO, VOC and NOx emissions. For CO and VOC, the relationship between income and emissions can be described by an inverted U-shaped curve, which eventually turns into an N-shaped curve at very high income levels. As indicated by the coefficients of GDP and GDP-squared, emissions appear to rise with GDP at low levels of income, reaching a peak, and then fall with GDP at higher levels of income. The coefficient of GDP—cubic indicates that emissions will eventually increase again with GDP at very high income levels. All GDP terms are statistically significant at 1 %. The F-test on the three GDP terms show that they are also jointly significant. Although the estimates of the three GDP terms show high level of statistical significance, in absolute value they are rather small, especially GDP-squared and GDP-cubic.

The estimated income turning points at which CO and VOC emissions peak are respectively 24,552 and 26,732 USD. The second income turning point is around 75,256 and 57,984 USD, respectively for CO and VOC. These numbers however, should not be read as exact estimates, but rather as an indication of the income level around which the curve levels off.

The coefficient of the population density variable indicates that everything else equal, more densely populated countries are associated with lower emissions per capita. One possible explanation of this result, as suggested by Selden and Song (1994), is that densely populated countries (at all levels of income) are likely to be more concerned about reducing their per capita emissions than more sparsely populated countries. Also, emission sourcing from transportation are likely to be lower when people live closer together.

The negative sign of the year-dummy variables shows that relative to 1990, CO and VOC emissions per capita have decreased over time. After controlling for the effects of GDP and population density, this decline can be possibly attributed to exogenous (non-income induced) shifts in technology and/or environmental policy.

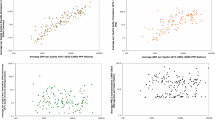

How do these results incorporate with the existing empirical evidence? Similarly, many empirical studies (that estimate cubic functions) find that the relationship between income and pollution follows an N-curve. Grossman and Krueger (1995) find such an N-curve relationship for SO\(_{2}\). However, the authors suggest, that the last part of this N-curve is not very reliable as it is based on a few observations. Therefore, the authors interpret it as an inverted U-shaped relationship. Looking at the turning points in Table 2, we see that also in our case the second turning points for CO and VOC are very high. We also suspect that only a few of the OECD countries have GDP per capita around these levels. To control for this, the estimated function of CO and VOC is plotted in Fig. 2a.

As evident from Fig. 2a, the argument of Grossman and Krueger (1995) is supported by the data. There are only few observations in the upper tail of the income distribution, hence it is uncertain whether emissions will increase again at very high income levels. Therefore, no big importance is attached to the coefficient of GDP-cubic and the second income turning point. Moreover, the graphs show that both, CO and VOC, exhibit a classical EKC relationship with GDP.

Estimation results for NO\(_{x}\) are also reported in Table 2. For NO\(_{x}\) a similar picture to the previous results emerges from the table. As indicated by the three GDP coefficients, emissions per capita are an increasing function of GDP at low levels of income, then turn into a negative function of GDP at high levels of income and eventually turn again into a positive function of GDP at very high income levels. The three GDP terms are also jointly significant as indicated by the F-test. The population density variable is again negatively associated with emissions, however at 10 % significance level.

Estimation results for SO\(_{x}\) are reported in Table 3. For SO\(_{x}\) the relationship between income and emissions follows an U-shaped curve. At low levels of income emissions of SO\(_{x}\) decrease with GDP. After reaching GDP per capita of approximately 20,223 USD, emissions start to rise with GDP. The GDP—cubic term indicate that emissions will eventually fall again with GDP at very high income levels. Population density is again negatively associated with emissions, but it is not significant at conventional significance levels. In both, NO\(_{x}\) and SO\(_{x}\), regressions the year dummies indicate a significant decrease in emissions between 1990 and 2005. Figure 2b presents a plot of the estimated functions of NO\(_{x}\) and SO\(_{x}\).

For NO\(_{x}\) the first income turning point is estimated to be around 32,284 USD, when the curve peaks and further growth is associated with environmental improvement. For SO\(_{x}\) the income turning point is around 20,223 USD and further growth is associated with deterioration of the environmental. Again as with the previous two gases, the coefficient of the GDP—cubic term and the second income turning points seem to be of minor importance, as they are based of very few observations.

Table 3 reports also the estimation results for CO\(_{2}\) and GHG. As expected, the coefficient of GDP is positive and very large in absolute value (compared to the previous regressions). The coefficient of GDP–squared is negative and statistically significant, but it is negligible, compared to the first coefficient. Population density is negatively correlated with emissions and it significant only for GHG. Interestingly, for CO\(_{2}\), it was found that emissions do not peak, while for GHG they peak at income level around 38,545 USD. Figure 2c plots the estimated functions against GDP.

Looking at the graph of CO\(_{2}\), it is evident that for OECD countries rising income is associated with an increase in emissions. No income turning points are found for the observed sample of countries. Hence, CO\(_{2}\) emissions are monotonically increasing. This result is however, in accordance with previous empirical works, which either found that the CO\(_{2}\) curve is monotonically increasing with GDP (Bates et al. 1997) or that income turning points are out of sample (Holtz and Selden 1995). A similar picture emerges also for GHG. Although it was found that the curve peaks at 38,545 USD, the significance of these turning point is uncertain. Very few OECD countries have GDP per capita higher than 38,545 USD.

5.2 Spatial econometric analysis: sensitivity analysis

Until now the analysis implicitly assumed that gas emissions in one country are independent of emissions, explanatory variables and non-observed factors in neighbouring countries. This is a strong assumption, especially when it comes to the emission of gasses where spatial spill-overs can be present. In order to account for spatial interdependencies between countries we extend the empirical model in (1) by including spatial lags of the dependent and independent variables. The resulting model represents the spatial Durbin model (SDM):

where \(X\) is our set of explanatory variables, Wy and WX stand for the spatial lag of \(Y\) and X, respectively. In order to save space, the time effect \(\gamma _{t}\) is modelled here as a linear time trend (taking on values 1 \(\div \) 16), instead of \(t-1\) year dummies. \(W\) is a spatial connectivity matrix. It is created on the basis of countries’ coordinates (longitude and latitude) and hence it represents geographic connectivityFootnote 7.

As Elhorst (2010) points, one advantage of SDM is that it produces unbiased estimates even when the true model is a spatial lag or spatial error model (which are restricted versions of SDM). Another advantage of SDM is that the model does not impose any prior restrictions on the spatial spill-over effects—these can be local or global and also can be different for each explanatory variableFootnote 8.

Equation (2) is estimated with spatial fixed and random effects using the user-written xsmle Stata procedure (Belotti et al. 2013). Xsmle requires strongly balanced panel data without missing observations. As evident from the descriptive statistics in Table 1, our data contains eight missing values for \(\text {SO}_{x}\), \(\text {NO}_{x}\), CO, VOC and nine missing values for GHG. In order to make the data xsmle ready, we first imputed the missing observations using the Predictive mean matching imputation method. Predictive mean matching matches missing values to the observed values that have the closest predicted mean (Stata 2013)Footnote 9.

Table 4 shows the estimation results for CO\(_{2}\), GHG and \(\text {SO}_{x}\). For all three gases the Hausman test rejects the null hypothesis of non-systematic differences between the fixed and random effects estimates. Therefore, the table reports only the results of the spatial fixed model. A first glance at the table shows that SDM provides three effects—direct, indirect and total.

The first effect represents the marginal effect of a unit change in country \(i\)’s explanatory variables on its own gas emissions plus the feedback effect. The feedback effect arises through the effect that country \(i\)’s explanatory variables have on gas emissions in neighboring countries, which in turn affect emissions in country \(i\). The indirect effect, or spatial spill-over, measures the effect of a unit change in foreign GDP and population density on country \(i\)’s gas emissions. The total effect is the sum of the previous two (see LeSage 2008 for an extensive discussion). As Romero and Burkey (2011) note, one needs to be very cautious when discussing the coefficients of SDM, because they cannot be interpreted as marginal effects. Xsmle computes by default both coefficients and marginal effects. Table 4 reports the estimated marginal effects.

Looking first at the direct effect, the estimates of GDP, GDP-squared and GDP-cubic are very similar (in terms of sign, significance and magnitude) to the results in Table 3. The effect of population density has turned into significant for all three gases (in the previous estimation this effect was insignificant for CO\(_{2}\) and \(\text {SO}_{x}\)). Interestingly, the time effect is no longer significant at 5 % level, while it still has a negative sign. Looking at the indirect effect, only GDP-cubic and population density are significant at 5 %. In the CO\(_{2}\) model GDP and GDP-cubic are significant only at 10 %.

Turning to the total effect, the SDM estimates show that the relationship between income and CO\(_{2}\) and GHG emissions follows an N-curve. The estimated total marginal effects are very close to the marginal effects in Table 3. In the \(\text {SO}_{x}\) equation all three GDP terms are non-significantly different from zero indicating that these is no relationship between income and \(\text {SO}_{x}\) emissions.

In his paper, Elhorst (2010) develops a kind of flow-chart for decision making and choosing among different spatial models. Starting from the spatial Durbin model, we followed his flow-chart and tested whether our model can be simplified to a spatial lag (H\(_{0}\): \(\theta \) = 0) or spatial error model (H\(_{0}\): \(\theta +\rho \)*\(\beta \) = 0). The Wald test rejected both null hypotheses indicating that SDM is the preferred model. The coefficient of \(\rho \) (the spatial lag of Y) is also statistically significant favoring SDM over a spatial lag of X model (SLX).

The estimated marginal effects for \(\text {NO}_{x}\), CO and VOC are presented in Table 5. The direct effects are very similar to the coefficients in Table 2. One exception is population density in the \(\text {NO}_{x}\) model where the effect turns from significantly negative (10 % significance level) in Table 2 into significantly positive. The time effect is negative and significant at 1 % in all three specifications indicating that, all else being equal, emissions have decline over time. Looking at the indirect effect, foreign GDP has a positive (negative) effect on domestic emissions of \(\text {NO}_{x}\) and VOC in low (high) income countries. At very high income levels (GDP-cubic) foreign GDP has again positive and significant impact on domestic emissions of \(\text {NO}_{x}\), CO and VOC.

The null hypothesis that the unrestricted model can be simplified to a spatial lag or spatial error model is rejected again in favour of SDM. The coefficient of the spatial \(\rho \) is not significant meaning that the spatial Durbin model can be further simplified to SLX. Due to space consideration and the features of SDM (produces unbiased estimates), we chose not to go further with the estimation of SLX.

6 Concluding remarks

By examining four local and two global air pollutants, this paper has assessed whether the EKC exists for these pollutants. The analysis showed that a meaningful EKC exists only for three of the local air pollutants, CO, VOC and NO\(_{x}\). It was found that for SO\(_{x}\) the relationship between income and emissions follows an U-shaped line, hence the EKC does not hold. It was also found for CO\(_{2}\) that the EKC does not hold. The estimated function between income and CO\(_{2}\) showed that emissions are an increasing function of income and do not have a turning point even at high income levels. For GHG it was found that per emissions peak around 38,545 USD, however little confidence can be attached to such turning point as the most countries have income per capita lower than 38,545 USD. Hence, it is uncertain whether at higher income level the curve will turn into an EKC or will continue into a monotonically increasing curve.

Based on the empirical results it can be concluded that the inverted U-shaped relationship between income and pollution does not hold for all gases, and that the EKC relationship is rather an empirical artefact than regularity.

7 Discussion and recommendation

Surveying the empirical evidence shows that most EKC papers, including this analysis, estimate simple reduced-form equations, where pollution is related to income and population density. GDP is one surrogate variable, capturing both the direct and indirect (e.g. via trade, technology) effects of income on the environment. While this is a useful first step showing in a simple way the relationship between economic growth and the environment, it does not say why this relationship exists. Hence, it is recommended in further research to try to disentangle the direct from the indirect impacts of economic growth on the environment. One approach could be to include in the regression separate variables for all factors, suggested in Sect. 2, as explanatory for the shape of EKC. In particular, of interest would be the effect of environmental policy on the income-environment relationship. Also, another recommendation is to test whether there is evidence for the Pollution haven hypothesis. If the Pollution haven hypothesis holds, this essentially means that pollution is not abated, but replaced to low income countries. As presented in Sect. 2, we examined in another paper the existence of the PHH for the 30 OECD countries (Georgiev 2011). Using a panel of 30 OECD countries over the period 1990–2005 we find evidence in support of the PHH for two industries. Hence, in this respect, it is important to study how pollution in low income countries will develop in the future, when there will be no more low income countries where pollution can be “exported”.

One methodological concern is the use of panel and cross-section, instead of time-series data. De Bruyn et al. (1998) show that when considering individual countries different results are obtained than when considering a panel of countries. This is a plausible result, as there is no reason to expect that different countries follow similar gas emissions and reduction patterns. It might be the case that the income-environment relationship, estimated for a panel of countries is not existing, when considering particular countries of this panel. However, this approach has one limitation: time-series are rarely available over long periods. For example, De Bruyn et al. (1998) base their time-series analysis on 17 yearly observations for the Netherlands, West Germany, UK and USA. Although time-series is superior to panel data, here it was decided not to use it, because of the short time span of the time-series data.

Finally, the results of this analysis should not be extrapolated to other samples of data and countries. As Stern and Common (2001) argue, the estimated parameters of the model are conditional on the country and time effects in the specific sample of data. In this particular case, it means that the estimated EKC (which is based on data for OECD countries, most of which are developed nations) might say little about the future path of development in less developed countries.

Notes

Global Environmental Monitoring System.

Closely related to the Pollution haven hypothesis is the Displacement hypothesis, which suggests that if consumption patterns do not follow the same shift as production patterns, that means that the consumption is still burdensome for the environment. The only difference is that the environmental effects are displaced to another country (Panayotou 2003).

The dirty industries are Iron and steel, Chemicals and Paper and paperboard and the three clean industries are Electrical machinery, Machinery transport equipment and Textile.

This coefficient however, is not as important as the other two. The reason is that there are a very few countries in the upper tail of the income distribution (e.g. Luxembourg) and therefore the estimate is based on a few observations and is thus unreliable.

The results of the test are reported in the next section, together with the main estimation results.

Australia, Austria, Belgium, Canada, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Japan, Korea, Luxembourg, Mexico, Netherlands, Norway, New Zealand, Poland, Portugal, Slovak Republic, Spain, Sweden, Switzerland, Turkey, UK, USA.

Other types of connectivity are also thinkable such as economic, cultural, political and historical connectivity. See LeSage and Pace (2011) for a discussion on the sensitivity of spatial regression estimates and inferences to alternative approaches to specifying \(W\).

As a sensitivity check we applied also other imputation methods such as linear regression and truncated regression with a restricted range. One limitation of the linear regression method was that some of the imputed values had a negative sign. Overall, the spatial Durbin model estimates were quite robust to the chosen imputation method (which is probably due to the very small number of imputed observations).

References

Antle, M.John, Heidebrink, Greeg: Environment and development: theory and international evidence. Econ. Dev. Cul. Change. 43(31), 603–625 (1995)

Antweiler, Werner, Copeland, R.Brian, Taylor, M.Scott: Is free trade good for the environment? Amer. Econ. Rev. 91(4), 877–908 (2001)

Barbier Edward, B.: Introduction to the environmental Kuznets curve special issue. Environ. Dev. Econ. 2, 369–381 (1997)

Bartlett, B.: The high cost of turning green, Wall Str. J. (September 14) Sec. A: 18 (1994)

Bates, John M., Cole, A.Matthew, Rayner, J.Anthony: The environmental Kuznets curve: an empirical analysis. Environ. Dev. Econ. 2, 401–416 (1997)

Beckerman, Wilfred: Economic growth and the environment: whose growth? Whose environment? World Dev. 20, 481–496 (1992)

Belotti, F., Hughes, G., Piano Mortari, A.: XSMLE: Stata module for spatial panel data models estimation, statistical software components S457610. Boston College Department of Economics, Boston (2013)

Bruce, Yandle, Bhattarai, Madhusudan, Maya, Vijayaraghavan: Environmental Kuznets curves: a review of findings, methods, and policy implications. Res. Study 2, 1–16 (2004)

Chaudhuri, Shubham, Pfaff, Alexander, Nye, Howard: Household production and environmental Kuznets Curves: examining the desirability and feasibility of substitution. Environ. Res. Econ. 27, 187–200 (2004)

Cole, Matthew A.: Theory and applications: development, trade, and the environment: how robust is the environmental Kuznets Curve? Environ. Dev. Econ. 8, 557–580 (2003)

Copeland, R.Brian, Taylor, M.Scott: North–South trade and the environment. Quarter. J. Econ. 109(3), 755–787 (1994)

Copeland, R.Brian, Taylor, M.Scott: Trade and the environment: theory and evidence. Princeton University Press, Princeton (2003)

De Bruyn, S., van der Bergh, C.J.M., Opschoor, J.H.: Economic growth and emissions: reconsidering the empirical basis of environmental Kuznets Curves. Ecol. Econ. 25, 161–175 (1988)

Dinda, Soumyananda: Environmental Kuznets Curve hypothesis: a survey. Ecol. Econ. 49, 431–455 (2004)

Elhorst, Paul: Applied spatial econometrics: raising the bar. Spat. Econ. Anal. 5(1), 9–28 (2010)

Eskeland, S.Gunnar, Harrison, E.Ann: Moving to greener pastures? Multinationals and the pollution haven hypothesis. J. Dev. Econ. 70(1), 1–23 (2003)

Figueroa, Eugenio, Pasten, Roberto: A tale of two elasticities: a general theoretical framework for the environmental Kuznets curve analysis. Econ. Lett. 119(1), 85–88 (2013)

Friedl, Brigit, Getzner, Michael: Determinants of CO\(^{2}\) emissions in a small open economy. Ecol. Econ. 45(1), 133–148 (2003)

Galeotti, M., Lanza, A.: Richer and cleaner? A study on carbon dioxide emissions in developing countries, In: University of Bergamo and Fondazione Eni Enrico Mattei, International Energy Agency, Paper presented at 22nd IAEE Annual International Conference, Rome, (1999)

Galeotti, Marzio, Lanza, Alessandro, Pauli, Francesco: Reassessing the environmental Kuznets curve for CO2 emissions: a robustness exercise. Ecol. Econ. 57, 153–163 (2006)

Georgiev, E.: De Milieu-Kuznets curve: een empirische analyse voor OESO-landen (The Environmental Kuznetz Curve: an empirical analysis for OECD countries), Nieuwsbrief Milieu en Economie. 24(4):15–16, Institute for Environmental Studies, VU University Amsterdam, (2010)

Georgiev, E.: De Pollution Haven Hypothese: een empirische analyse van het effect van streng milieubeleid op de export (The Pollution Haven hypothesis: an empirical analysis of the impact of strict environmental regulations on export), Nieuwsbrief Milieu en Economie. 25(1), Institute for Environmental Studies, VU University Amsterdam, (2011)

Grossman, M.G., Krueger, B.A.: Environmental impact of a North American free trade agreement, In: Working paper No. 3914, November 1991, National Bureau of Economic Research, Cambridge (NBER), USA (1991)

Grossman, M.Gene, Krueger, B.Alan: Economic growth and the environment. Quarter. J. Econ. 110(2), 353–377 (1995)

Haaleck, V.S., Elhorst, P.: On spatial econometric models, spillover effects, and W, mimeo. University of Groningen, Netherlands (2013)

Harbaugh, William T., Levinson, Arik, Wilson, M.David: Re-examining the empirical evidence for an environmental Kuznets Curve. Rev. Econ. Stat. 84(3), 541–551 (2002)

Holtz-Eakin, Douglas, Selden, M.Thomas: Stoking the fires?: CO\(_{2}\) emissions and economic growth. J. Public Econ. 57, 85–101 (1995)

Kaufmann, Robert K., Davidsdottir, Brynhildur, Garnham, Sophie, Pauly, Peter: The determinants of atmospheric SO\(_{2}\) concentrations: reconsidering the environmental Kuznets curve. Ecol. Econ. 25, 209–220 (1998)

Khanna, Neha: The income elasticity of non-point source air pollutants: revisiting the environmental Kuznets curve. Econ. Lett. 77, 387–392 (2002)

Kijima, Masaaki, Katsumasa, Nishide, Atsuyuki, Ohyama: Economic models for the environmental Kuznets curve: a survey. J. Econ. Dyn. Contr. 34(7), 1187–1201 (2010)

LeSage, James: An introduction to spatial econometrics. Revue d’économie industrielle 3, 19–44 (2008)

LeSage, James, Pace, Kelley: Pitfalls in higher order model extensions of basic spatial regression methodology. Rev. Reg. Studies 41(1), 13–26 (2011)

List, A.John, Gallet, A.Craig: The environmental Kuznets Curve: does one size fit all? Ecol. Econ. 31, 409–423 (1999)

Mayer, T., Zignago, S.: Notes on CEPII’s distances measures: The GeoDist database, CEPII Working Paper 2011–25, December 2011, Le Centre d’Etudes Prospectives et d’Informations Internationals (CEPII), Paris, France. Available at: http://www.cepii.fr/CEPII/en/publications/wp/abstract.asp?NoDoc=3877 (Accessed on January 21, 2014) (2011)

Meadows, D.H., Meadows, D.L., Randers, J., Behrens, W.W.: :The limits to growth : a report for the club of Rome’s project on the predicament of mankind. New York Universe Books, New York (1972)

Organisation for Economic Co-operation and Development (OECD): Environmental data compendium 2006/2007. OECD Publishing, Paris (2007)

Panayotou, Theodore: Demystifying the environmental Kuznets curve: turning a black box into a policy tool. Environ. Dev. Econ. 2, 465–484 (1997)

Panayotou, T.: Economic Growth and the Environment, In: Harvard University and Cyprus International Institute of Management, Paper prepared for and presented at the Spring Seminar of the United Nations Economic Commission for Europe, Geneva, (2003)

Pasten, Roberto, Figueroa, Eugenio: The environmental Kuznets curve: a survey of the theoretical literature. Intern. Rev. Environ. Res. Econ. 6(3), 195–224 (2012)

Roca, Jordi: Do individual preferences explain environmental Kuznets Curve? Ecol. Econ. 45(1), 3–10 (2003)

Romero, Alfredo, Burkey, Mark: Debt overhang in the Eurozone: a spatial panel analysis. Rev. Reg. Studies 41(1), 49–63 (2011)

Selden, M.Thomas, Song, Daqing: Environmental quality and development: is there a Kuznets Curve for air pollution emissions? J. Environ. Econ. Manag. 27, 147–162 (1994)

Shafik, Nemat, Bandyopadhyay, Sushenjit: Economic Growth and Environmental Quality Time-Series and Cross-Country Evidence. The World Bank Publications, Washington (1992). Background Paper for the World Development Report

Shafik, Nemat: Economic development and environmental quality: an econometric analysis. Oxford Econ. Papers 46, 757–773 (1994)

Stata, : Stata multiple imputation reference manual release 13. StataCorp LP, Statistical Software, College Station, TX (2013)

Stern, I.David, Common, S.Michael: Is there an environmental Kuznets Curve for sulfur? J. Environ. Econ. Manag. 41, 162–178 (2001)

United Nations Statistics Division: Demographic yearbook. The World Bank Publications, Washington (2005)

Acknowledgments

This research is partially based on the thesis of E. Georgiev. A summary of the results in Sect. 5.1 have been presented in Nieuwsbrief Milieu & Economie (in Dutch), see Georgiev (2010). We would like to thank the Editor-in-Chief Prof. Henk Folmer and two anonymous referees for very helpful comments and suggestions. We wish to thank also Prof. Paul Elhorst, Prof. Gordon Hughes and Dr. Federico Belotti.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Georgiev, E., Mihaylov, E. Economic growth and the environment: reassessing the environmental Kuznets Curve for air pollution emissions in OECD countries. Lett Spat Resour Sci 8, 29–47 (2015). https://doi.org/10.1007/s12076-014-0114-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12076-014-0114-2