Abstract

The environmental Kuznets curve (EKC) has been the dominant approach among economists to modeling aggregate pollution emissions and ambient concentrations over the last quarter century. Despite this, the EKC was criticized almost from the start and decomposition approaches have been more popular in other disciplines working on global climate change. More recently, convergence approaches to modeling emissions have become popular. This paper reviews the history of the EKC and alternative approaches. Applying an approach that synthesizes the EKC and convergence approaches, I show that convergence is important for explaining both pollution emissions and concentrations. On the other hand, economic growth has a strong positive effect on carbon dioxide, sulfur dioxide, and industrial greenhouse gas (GHG) emissions, but weaker effects on non-industrial GHG emissions and concentrations of particulates. Negative time effects are important for sulfur and industrial and non-industrial GHG emissions. Even for particulate concentrations, economic growth only reduces pollution at very high income levels. Future research should focus on developing and testing alternative theoretical models and investigating the non-growth drivers of pollution reduction.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The environmental Kuznets curve (EKC) is a hypothesized relationship between various indicators of environmental degradation and income per capita. In the early stages of economic growth, pollution emissions increase and environmental quality declines, but beyond some level of income per capita (which will vary for different indicators) the trend reverses, so that at high income levels economic growth leads to environmental improvement. This implies that environmental impacts or emissions per capita are an inverted U-shaped function of income per capita. The EKC has been the dominant approach among economists to modeling ambient pollution concentrations and aggregate emissions since Grossman and Krueger (1991) introduced it a quarter of a century ago. The EKC has been applied to a wide range of issues from threatened species (McPherson and Nieswiadomy 2005) to nitrogen fertilizers (Zhang et al. 2015), and is even found in introductory textbooks (e.g. Frank et al. 2012), yet debate continues in the academic literature (e.g. Carson 2010; Kaika and Zervas 2013; Chow and Li 2014; Wagner 2015). Though the EKC is an essentially empirical phenomenon, most estimates of EKC models are not statistically robust. While concentrations of some local pollutants have clearly declined in developed countries and so have emissions of some pollutants, there is still no consensus on the drivers of changes in emissions.

This article critically reviews the EKC, discusses alternative approaches, and provides some empirical evidence that synthesizes the various approaches to modeling pollution emissions and concentrations avoiding various statistical pitfalls. This evidence shows that per capita emissions of pollutants rise with increasing income per capita when other factors are held constant. However, changes in these other factors may be sufficient to reduce pollution. In rapidly growing middle-income countries, the effect of growth overwhelms these other effects. In wealthy countries, growth is slower, and pollution reduction efforts can overcome the growth effect. On the other hand, growth might reduce the ambient concentrations of some pollutants after a turning point is reached. Understanding the nature of the factors that are not related to economic growth will be important for understanding what actually reduces pollution. Other recent reviews of the EKC literature (e.g. Carson 2010; Pasten and Figueroa 2012; Kaika and Zervas 2013) do not cover the recent empirical and theoretical developments reviewed in this paper that fundamentally change our understanding of the income-pollution relationship.

The following section sets the scene by reviewing the origin and history of the EKC and the debate that ensued on its policy implications. This is followed by reviews of theoretical models of the EKC and econometric techniques and evidence. I then turn to look at the main alternative approaches and a possible synthesis between them and the EKC. The final sections of the article present my own empirical evidence and conclusions.

2 Background

Prior to the introduction of the concept of sustainable development in the 1980s, the mainstream environmental view was that environmental impacts increase with the scale of economic activity, though either more or less environmentally friendly technology can be chosen. This approach is represented by the IPAT identity (Ehrlich and Holdren 1971), which is given by impact \(\equiv \) population*affluence*technology. If affluence is income per capita, then the technology term is impact or emissions per dollar of income. By contrast, a popular view of sustainable development was that development is not necessarily damaging to the environment and that poverty reduction is essential for environmental protection (WCED 1987). In line with this sustainable development idea, Grossman and Krueger (1991) introduced the EKC concept in their seminal study of the potential impacts of the North American Free Trade Agreement (NAFTA). Environmentalist critics of NAFTA claimed that the economic growth that would result from introducing free trade would damage the environment in Mexico (e.g. Daly 1993). Grossman and Krueger (1991) argued instead that increased income would improve environmental quality in Mexico. To support this argument, they carried out an empirical analysis of the relationship between ambient pollution levels in many cities around the world and income per capita. They found that the concentrations of various pollutants peaked when a country reached roughly the level of Mexico’s per capita income at the time.

The World Bank’s 1992 World Development Report (WDR) popularized the EKC, arguing that: “The view that greater economic activity inevitably hurts the environment is based on static assumptions about technology, tastes, and environmental investments” (p. 38) and that “As incomes rise, the demand for improvements in environmental quality will increase, as will the resources available for investment” (p. 39). Beckerman (1992) made this argument even more forcefully, claiming that “there is clear evidence that, although economic growth usually leads to environmental degradation in the early stages of the process, in the end the best—and probably the only—way to attain a decent environment in most countries is to become rich” (p. 482). Arrow et al. (1995) criticized this approach because it assumes that environmental damage does not reduce economic activity sufficiently to stop the growth process and that any irreversibility is not too severe to reduce the level of income in the future. In other words, there is an assumption that growth is sustainable.

Shafik’s (1994) research, which the WDR was based on, in fact showed that not all environmental impacts declined at high income levels. She found that both urban waste and carbon dioxide (\(\hbox {CO}_{2}\)) emissions rose monotonically with income per capita. Subsequent research confirmed the results for \(\hbox {CO}_{2}\) and has cast doubt on the validity of the EKC hypothesis for emissions of other pollutants too. The ambient concentrations of many pollutants have declined in developed countries over time with increasingly stringent environmental regulations and technological innovations. However, the mix of air pollution, for example, has shifted from particulate pollution to sulfur dioxide (SO\(_2\)) and nitrogen oxides (\(\hbox {NO}_{\mathrm{x}}\)) to \(\hbox {CO}_{2}\). Economic activity is inevitably environmentally disruptive in some way. Therefore, an effort to reduce some environmental impacts may just aggravate other problems.

Some early EKC studies showed that a number of indicators, including \(\hbox {SO}_{2}\) concentrations and deforestation, peaked at income levels around the then current world mean per capita income. The WDR implied that this meant that growth would reduce these impacts going forward. However, income is not normally distributed but very skewed, with much larger numbers of people below mean income per capita than above it. Therefore, it is median rather than mean income that is the relevant variable. Selden and Song (1994) and Stern et al. (1996) performed simulations that, assuming that the EKC relationship is valid, showed that global environmental degradation was set to rise for a long time to come. More recent estimates including those in this paper show that the pollution turning point is at much higher income levels and, therefore, there should no longer be confusion on this issue.

There has also been much debate about why some environmental impacts appear to follow an inverted U-shape curve. I address these questions in the next section.

3 Theory

If there were no change in the structure or technology of the economy, pure growth in the scale of the economy would result in proportional growth in pollution and other environmental impacts. This is called the scale effect. The traditional view that economic development and environmental quality are conflicting goals reflects the scale effect alone. Panayotou (1993) provided an early rationale for the existence of an EKC arguing that: “At higher levels of development, structural change towards information-intensive industries and services, coupled with increased environmental awareness, enforcement of environmental regulations, better technology and higher environmental expenditures, result in leveling off and gradual decline of environmental degradation.” (p. 1)

Therefore, the EKC can be explained by the following ‘proximate factors’:

-

1.

An increase in the scale of production.

-

2.

Different industries have different pollution intensities and typically, over the course of economic development the output mix changes. This is often referred to as the composition effect (e.g. Copeland and Taylor 2004).

-

3.

Changes in input mix involve the substitution of less environmentally damaging inputs to production for more damaging inputs and vice versa.

-

4.

Improvements in the state of technology involve changes in both:

-

a.

Production efficiency in terms of using less, ceteris paribus, of the polluting inputs per unit of output.

-

b.

Emissions specific changes in process result in less pollutant being emitted per unit of potentially polluting input.

-

a.

The third and fourth factors are together often referred to as the technique effect (e.g. Copeland and Taylor 2004). These proximate factors may in turn be driven by changes in variables such as environmental regulation or innovation policy, which themselves may be driven by other more fundamental underlying variables. For example, the composition effect might be partly driven by comparative advantage. Developing countries are expected to specialize in the production of goods that are intensive in labor and natural resources, while developed countries would specialize in human capital and manufactured capital-intensive activities. Environmental regulation in developed countries might further encourage polluting activities to gravitate towards developing countries (Stern et al. 1996).Footnote 1

Various theoretical models attempt to explain how preferences and technology might interact to result in different time paths of environmental quality. There are two main approaches in this literature—static models that treat economic growth as simply shifts in the level of output and dynamic models that model the economic growth process as well as the evolution of emissions or environmental quality (Kijima et al. 2010).

In the typical static model, a representative consumer maximizes a utility function that depends on consumption and the level of pollution. Pollution is also treated as an input to the production of consumer goods. These models assume that there are no un-internalized externalities or equivalently that there is a socially efficient price for pollution. Pasten and Figueroa (2012) show that under the simplifying assumption of additive preferences:

where P is pollution, K is “capital”—all other inputs to production apart from pollution—\(\sigma \) is the elasticity of substitution between K and P in production, and \(\eta \) is the (absolute value of the) elasticity of the marginal utility of consumption with respect to consumption. The smaller \(\sigma \) is, the harder it is to reduce pollution by substituting other inputs for pollution. The larger \(\eta \) is, the harder it is to increase utility with more consumption. So, in other words, pollution is more likely to increase as the economy expands, the harder it is to substitute other inputs for pollution and the easier it is to increase utility with more consumption. This result also implies that, if either of these parameters is constant, then there cannot be an EKC where pollution first increases and then decreases. There are two main types of static theoretical models: those where the EKC is driven by changes in the elasticity of substitution as the economy grows and those where the EKC is primarily driven by changes in the elasticity of marginal utility (Pasten and Figueroa 2012).

Additive preferences imply that the marginal utility of consumption does not depend on the level of environmental quality. If preferences are non-additive but homothetic, the elasticity of substitution between consumption and environmental quality in the utility function, \(\phi \), becomes the critical parameter in place of \(\eta \) (Figueroa and Pasten 2015). The second inequality in (1) then becomes \(\phi \ge \sigma \).Footnote 2

Dynamic models of the EKC vary in their assumptions about how institutions govern environmental quality and there is no simple way to summarize their results. For example, in Jones and Manuelli’s (2001) model, the young can choose to tax the pollution that will exist when they are older, while Stokey (1998) assumes that countries do not adopt any environmental policies until they reach a threshold income level.Footnote 3

Brock and Taylor’s (2010) Green Solow Model is notable for taking into account more features of the data, such as abatement costs and the decline over time in emissions intensity, than previous research does. The model builds on Solow’s (1956) economic growth model by adding the assumptions that production generates pollution but that allocating some final production to pollution abatement can reduce pollution. It makes no explicit assumption about either consumer preferences or the pricing of pollution, assuming that a constant share of economic output is spent on abating pollution. The model implies that countries’ level of emissions will converge over time, though emissions may rise initially in poorer countries due to rapid economic growth. While the predictions of the Green Solow Model seem plausible given the recent empirical evidence, discussed below, it is not a very satisfying model of the evolution of the economy and emissions. First, it leaves assumptions such as the constant share of abatement in the costs of production unexplained. Second, there is actually little correlation between countries’ initial levels of income per capita and their subsequent growth rates, which is the mechanism that is supposed to drive convergence of income in the Solow model (Durlauf et al. 2005; Stefanski 2013).Footnote 4

Ordás Criado et al. (2011) also develop a neoclassical growth model, which finds that along the optimal path, pollution growth rates are positively related to the growth rate of output and negatively related to emission levels. The latter arises because utility is a function of both the consumption of goods and the level of pollution, and defensive expenditures can be used to reduce pollution. Econometrically, this model reduces to a beta convergence equation with the addition of an economic growth effect. This is a more elegant theoretical model than the Green Solow model, and empirically the model explains more of the variation in the data.

Both Brock and Taylor’s and Ordás Criado et al.’s dynamic models depart from the EKC hypothesis that growth itself eventually reduces pollution. Lopez and Yoon (2014) develop a dynamic model with endogenous growth with multiple outputs that does generate more traditional EKC predictions by allowing for a composition effect. To overcome this increase in complexity, the model makes many strong assumptions. The clean sector consists of an AK endogenous growth model, while the dirty sector consists of a constant elasticity of substitution (CES) production function that uses capital and pollution inputs and constant total factor productivity. The consumer also has CES preferences over the dirty and clean good but pollution damage enters welfare additively. The government internalizes the pollution externality with a pollution tax. As a result of the two different technologies in the two production sectors, the elasticity of substitution between pollution and capital will vary over time and, depending on the value of the elasticity of substitution in dirty production, the elasticity of substitution between the dirty and clean good in consumption, and the elasticity of marginal utility, an EKC may or may not be generated.

4 Econometric methods and evidence

The standard EKC regression model is:

where E is the natural logarithm of either ambient environmental quality or emissions per person, Y is the natural logarithm of gross domestic product per capita, and \(\upvarepsilon \) is a random error term. i indexes countries and t time. Use of logarithms constrains projections of the dependent variable to be non-zero, which is appropriate except in the case of net rates of change of the stock of renewable resources, where, for example, afforestation can occur. The first two terms on the right-hand side of the equation are country and time effects. The country effects imply that, though the level of emissions per capita may differ over countries at any particular income level, the elasticity of emissions with respect to income is the same in all countries at a given income level. The time effects are intended to account for time varying omitted variables and stochastic shocks that are common to all countries. We can find the “turning point” level of income, \(\tau \), where emissions or concentrations are at a maximum, using:

Usually the model is estimated with panel data, most commonly using the fixed effects estimator. But time-series and cross-section data have also been used, and a very large number of estimation methods have been tried including non-parametric methods (e.g. Carson et al. 1997; Azomahou et al. 2006; Tsurumi and Managi 2015), though these do not generally produce radically different results from parametric estimates.

Grossman and Krueger (1991) estimated the first EKC models as part of a study of the potential environmental impacts of NAFTA. They estimated EKCs for SO\(_2\), dark matter (fine smoke), and suspended particulate matter (SPM) using the GEMS dataset. This dataset is a panel of ambient measurements from a number of locations in cities around the world. They regressed each indicator on a cubic function in levels (not logarithms) of PPP (Purchasing Power Parity adjusted) per capita GDP, various site-related variables, a time trend, and a trade intensity variable. The turning points for SO\(_2\) and dark matter were at around $4000–5000 while SPM appeared to decline even at low income levels.

Shafik’s (1994) study was particularly influential, as the results were used in the 1992 WDR. Shafik estimated EKCs for ten different indicators using three different functional forms. She found that lack of clean water and lack of urban sanitation declined with increasing income and over time. Deforestation regressions showed no relation between income and deforestation. Local air pollutant concentrations, however, conformed to the EKC hypothesis with turning points between $3,000 and $4,000. Finally, river quality, municipal waste, and \(\hbox {CO}_{2}\) emissions per capita increased with rising income. Holtz-Eakin and Selden (1995) confirmed this result for \(\hbox {CO}_{2}\), which has stood the test of time despite a minority of contrary findings (Dobes et al. 2014).

Selden and Song (1994) estimated EKCs for four emissions series: SO\(_2\), NOx, SPM, and carbon monoxide (CO). The estimated turning points were all very high compared to the two earlier studies. For the fixed effects version of their model they are (in 1990 US dollars): SO\(_2\), $10,391; NOx, $13,383; SPM, $12,275; and CO, $7114. This showed that the turning points for emissions were likely to be higher than for ambient concentrations. In the initial stages of economic development, urban and industrial development tends to become more concentrated in a smaller number of cities, which also have rising central population densities, with the reverse happening in the later stages of development. So, it is possible for ambient pollution concentrations in urban areas to fall as income rises, even if total national emissions are rising (Stern et al. 1996).

There are several econometric problems that affect interpretation of EKC estimates. The most important of these are: omitted variables bias, integrated variables and the problem of spurious regression, and the identification of time effects. There is plenty of evidence that Eq. (2) is too simple a model and that other variables are also important in explaining the level of emissions. Early studies used data that was mostly from developed countries. Subsequent studies that used data sets with greater income variation found increasingly higher turning points (Stern 2004). Using an emissions database produced for the US Department of Energy (Lefohn et al. 1999) that covered a greater range of income levels than any previous SO\(_2\) EKC studies, Stern and Common (2001) estimated the turning point for SO\(_2\) emissions at over $100,000. Stern and Common (2001) showed that estimates of the EKC for SO\(_2\) emissions were very sensitive to the choice of sample. For OECD countries alone, the turning point was at $9000. Both Harbaugh et al. (2002) and Stern and Common found using Hausman test statistics that there is a significant difference in the regression parameter estimates when equation (2) is estimated using the random effects estimator and the fixed effects estimator. This indicates that the regressors are correlated with the country effects and time effects, which indicates that the regressors are likely correlated with omitted variables. Harbaugh et al. (2002) re-examined an updated version of Grossman and Krueger’s data. They found that the locations of the turning points for the various pollutants, as well as even their existence, were sensitive both to variations in the data sampled and to reasonable changes in the econometric specification.

Tests for integrated variables designed for use with panel data usually find that SO\(_2\) and \(\hbox {CO}_{2}\) emissions and GDP per capita are integrated variables. This means that we can only rely on regression estimates of (2) using panel (or time series) data if the regression exhibits cointegration.Footnote 5 Otherwise, the model must be estimated using another approach such as first differencing the data or the between estimator, which first averages the data over time (Stern 2010). Otherwise, the EKC estimate will be a spurious regression. As an illustration of this point, Verbeke and Clerq (2006) carried out a Monte Carlo analysis where they generated large numbers of artificial integrated time series and then tested for an inverted U-shape relationship between the series. They found an “EKC” in 40% of cases despite using entirely arbitrary and unrelated data series.

Using data on SO\(_2\) emissions in 74 countries from 1960 to 1990, Perman and Stern (2003) found that around half the individual country EKC regressions cointegrate using standard time series cointegration tests but that many of these had parameters with “incorrect signs”. Some panel cointegration tests indicated cointegration in all countries and some could not reject the non-cointegration hypothesis. But even when cointegration was found, the form of the EKC relationship varies radically across countries with many countries having U-shaped EKCs and a common cointegrating vector for all countries was strongly rejected. These results also suggest that the simple EKC model omits important factors.

Wagner (2008) noted that first generation panel cointegration tests are not appropriate when there are nonlinear functions of unit root variables or cross-sectional dependence in the data. Wagner (2008) uses de-factored regressions and so-called second-generation panel unit root tests to address these two issues. Wagner (2015) uses time series tests for nonlinear cointegration finding cointegration in only a subset of the 19 countries tested.

Vollebergh et al. (2009) pointed out that time, income, or other effects are not uniquely identified in reduced form models such as the EKC and that existing EKC regression results depend on the specific identifying assumptions that are implicitly imposed. Equation (2) assumes that the time effect is common to all countries. Vollebergh et al. instead assume that there is a common time effect in each pair of most similar countries. They argue that this imposes the minimum restrictions on the nature of the time effect. Instead, Stern (2010) uses the between estimator—a regression using the cross-section of time-averaged variables—to estimate the effect of income. This model is then used to predict the effect of income on emissions using the time series of income in each country. The difference between the prediction and reality is the individual time effect for that country. This approach is, though, particularly vulnerable to omitted variables bias. Chow and Li (2014) estimate a set of simple cross-section \(\hbox {CO}_{2}\) EKC regressions for 132 countries in each year from 1992 to 2004. Though they find a highly significant negative coefficient on the square of the log of GDP per capita (t = −22.9), the mean turning point in their sample is, in fact, $378,000, and, therefore, the emissions-income relationship is again effectively monotonic.

These recent studies find that the relationship between the levels of both SO\(_2\) and \(\hbox {CO}_{2}\) emissions and income per capita is monotonic when the effect of the passage of time is controlled for (Wagner 2008; Vollebergh et al. 2009; Stern 2010). Both Vollebergh et al. (2009) and Stern (2010) find very large negative time effects for SO\(_2\) and smaller negative time effects for \(\hbox {CO}_{2}\) since the mid-1970s.Footnote 6

Many studies extend the basic EKC model by introducing additional explanatory variables intended to model underlying or proximate factors such as political freedom (e.g. Torras and Boyce 1998), output structure (e.g. Panayotou 1997), or trade (e.g. Suri and Chapman 1998). On the whole, the included variables turn out to be significant at traditional significance levels (Stern 1998). However, testing different variables individually is subject to the problem of potential omitted variables bias and there do not appear to be robust conclusions that can be drawn from these studies (Carson 2010).

A popular view is that trade and the offshoring of pollution intensive activities from developed to developing countries might drive the EKC (e.g. Peters and Hertwich 2008). However, testing whether offshoring drives emissions reductions is not simple. The popular consumption based emissions approach does not answer this question. Developed countries might be net importers of emissions because developing countries use more emissions intensive technologies than do developed countries to produce the same products (Kander et al. 2015). Research has found a weak role if any for offshoring of production in reducing emissions in developed countries (Cole 2004; Stern 2007; Levinson 2010) though trade in electricity among U.S. states might have allowed a reduction in \(\hbox {CO}_{2}\) emissions in the richer states (Aldy 2005).

5 Alternative approaches

There are several alternative approaches to modeling the income-emissions relationship. The most prominent of these are decomposition analysis and convergence analysis.

Decomposition analysis breaks down emissions into the proximate sources of emissions changes listed in Sect. 3. The usual approach is to utilize index numbers and detailed sectoral information on fuel use, production, emissions etc. Stern (2002) and Antweiler et al. (2001) develop econometric decomposition models that require less detailed data, and cruder decompositions can employ the Kaya identity (e.g. Raupach et al. 2007). These studies find that the main means by which emissions of pollutants can be reduced are time-related technique effects and in particular those directed specifically at emissions reduction. General productivity growth or declining energy intensity has a role to play, particularly in the case of \(\hbox {CO}_{2}\) emissions where specific emissions reduction technologies are not yet implemented (Stern 2004). Though the contributions of structural change in the output mix of the economy and shifts in fuel composition may be important in some countries at some times, their average effect across countries seems less important quantitatively.

Those studies that include developing countries, find that changes in technology occur in both developing and developed countries. Innovations may be adopted first in higher income countries but seem to be adopted in developing countries with relatively short lags (Stern 2004). This is seen for example for lead in gasoline where most developed countries had substantially reduced the average lead content of gasoline by the early 1990s but many poorer countries also had low lead contents (Hilton and Levinson 1998). Lead content was much more variable at low income levels than at high income levels.

The convergence hypothesis proposes that pollution falls faster in countries with high levels of pollution than in countries with low levels of pollution or that it falls in the former and rises in the latter. If initially rich countries have high levels of pollution and poor countries low levels, then the outcome could resemble the EKC, but this is not necessarily the case. Also, under the convergence hypothesis, change in pollution is not necessarily dependent on economic growth. Pettersson et al. (2013) provide a review of the literature on convergence of \(\hbox {CO}_{2}\) emissions. There are three main approaches to testing for convergence: sigma convergence, which tests whether the dispersion of the variable in question declines over time using either just the variance or the full distribution (e.g. Ezcurra 2007); stochastic convergence, which tests whether the time series for different countries cointegrate; and beta convergence, which tests whether the growth rate of a variable is negatively correlated to the initial level. Using beta and stochastic convergence tests, Strazicich and List (2003) found convergence among the developed economies. Brock and Taylor (2010) find beta convergence across 165 countries between 1960 and 1998. However, using sigma convergence approaches, Aldy (2006) found convergence for the developed economies but not for the world as a whole. Using stochastic convergence, Westerlund and Basher (2008) reported convergence for a panel of 28 developed and developing countries over a very long period, but recent research using stochastic convergence finds evidence of club convergence rather than global convergence (Herrerias 2013; Pettersson et al. 2013).

The beta convergence approach has been heavily criticized (e.g. Quah 1993; Evans 1996; Evans and Karras 1996) because dependence of the growth rate on the initial level of the variable is insufficient, though necessary (Pettersson et al. 2013), for sigma convergence. Beta convergence could also be purely due to regression to the mean (Friedman 1992; Quah 1993). However, it is hard to believe that, for example, the high levels of emissions intensity in formerly centrally planned economies are simply random fluctuations. In any case, economic theory suggests that the initial level of emissions should be a factor in explaining emissions growth. Two models that do so are Brock and Taylor’s (2010) Green Solow model and Ordás Criado et al.’s (2011) model.

In Brock and Taylor’s empirical analysis, the growth rate of emissions is a function of initial emissions per capita and there is convergence in emissions per capita across countries over time. Depending on the specification chosen, this model explains 14–42% of the variance in average national 1960–1998 \(\hbox {CO}_{2}\) emissions growth rates. Ordás Criado et al.’s (2011) model reduces econometrically to a beta convergence equation with the addition of an economic growth effect. They estimate the model for a panel of 25 European countries from 1980 to 2005 using 5-year period averages. Parametric estimates for \(\hbox {SO}_{2}\) emissions find that the rate of convergence is −0.021, the emissions-income elasticity is 0.653, and that there are strong negative time effects, particularly in countries with initially high levels of income. For \(\hbox {NO}_{\mathrm{x}}\) the rate of convergence is −0.036 and there are again strong negative time effects, but the initial level of income has only a small and not very significant effect. Non-parametric estimates largely confirm their parametric estimates.

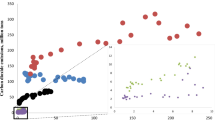

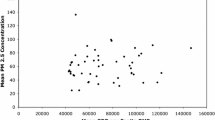

6 Testing alternative explanations

So, is the environmental Kuznets curve still a valuable approach to modeling the relationship between economic growth and environmental impacts or are the alternative approaches introduced in the previous section more powerful explanations? In this section, I describe a modeling approach that integrates the EKC and convergence approaches and present some recent results obtained by myself and coauthors using this model. This model is similar to the Ordás Criado et al. (2011) model with the addition of control variables and a term to test or measure the EKC effect. Figures 1 and 2 present the data used in these analyses.

Figure 1 plots mean values by country for a few decades for each of the variables against GDP per capita in 2005 PPP dollars. Per capita \(\hbox {CO}_{2}\) emissions from fossil fuel combustion and cement production (Boden et al. 2013) are almost linear in GDP per capita when plotted on log scales. There is little sign of an EKC effect in this raw data. On the other hand it does look like SO\(_2\) emissions (Smith et al. 2011) flatten out with increasing income but there is little sign of an inverted U shape curve. Both non-industrial GHG emissions (Sanchez and Stern 2016) and PM 2.5 (Particulate matter smaller than \(2.5 \upmu \)m diameter) concentrations (World Bank Development Indicators) show little relationship with income per capita. Clearly, additional variables or country effects would be needed to tease out any relationship.

An alternative way of visualizing the data, first used in Blanco et al. (2014), plots the growth rate of emissions per capita against the growth rate of income per capita. Figure 2 presents this alternative view. The three emissions series show some positive correlation between the growth rates of the two variables. Clearly the distribution of data is shifted downwards for SO\(_2\) and non-industrial emissions relative to \(\hbox {CO}_{2}\). This implies that the intercept of a simple regression is negative and so for a country with zero economic growth emissions will be declining. This indicates that there is a negative time effect. There does not seem to be much relationship between the growth rate of PM 2.5 concentrations and the rate of economic growth.

This growth rates representation of the data is used in the regression analysis. The general formFootnote 7 of the regression model is:

where \({\hat{E}}_i =\left( {E_{iT} -E_{i0} } \right) /T\) and \({\hat{Y}}_i =\left( {Y_{iT} -Y_{i0} } \right) /T\). \(T+1\) is the time dimension of the data, the initial year is normalized to 0 so that T indicates the final year, and i indexes countries. E is the log of emissions per capita and Yis the log of GDP per capita. \(\mathbf{X}_{i0} =\left[ {X_{1i0} ,\ldots ,X_{Ji0} } \right] ^{\prime }\) is a vector of control variables, which are observed in the initial year. We deduct the sample mean from all the continuous levels variables prior to estimation. \(\beta _0 \) is, therefore, an estimate of the mean of \({\hat{E}}_i \) for countries with zero economic growth, the continuous levels variables at their sample means, and the dummy variables at their default value of zero. This is equivalent to the average change in the time effect in traditional panel data EKC models. If \(\beta _0 <0\), then in the absence of economic growth (and when the other variables are at their mean or default values) there is on average a reduction in emissions over time, and vice versa. Similarly, \(\beta _1 \) is an estimate of the emissions-income elasticity at the sample mean initial log income when all other continuous variables are at their sample mean and dummies are set to zero.

The third term on the RHS,\({\hat{Y}}_i Y_{i0} \), is the interaction between the rate of economic growth and the initial level of log income. This term is intended to test the EKC hypothesis that there is a level of income, the “turning point”, so that, ceteris paribus, economic growth is associated with a decline in emissions when income increases above this threshold.Footnote 8 For the EKC hypothesis to hold, \(\beta _2 \) must be significantly less than zero.

In order to estimate the EKC turning point we re-estimate (4) without demeaning \(Y_{i0} \). We then compute \(\mu =\hbox {exp}\big ( {-{\tilde{\beta }} _1 /{\tilde{\beta }} _2 } \big )\), where the tildes indicate the estimates from this non-demeaned model. If \({\tilde{\beta }} _1 >0\) and \({\tilde{\beta }} _2 <0\), then this will be the income turning point for maximum pollution. We use the delta method to compute the standard error of this turning point. If \(\beta _2 \) is significantly less than zero but the EKC turning point is statistically insignificant, we can conclude that while the emissions-income elasticity is lower for countries with higher GDP per capita, it does not become negative as would be required for an EKC downturn.

The fourth and fifth terms are the initial levels of emissions and income, which are intended to test convergence-type theories. If \(\beta _3 <0\) then there is beta convergence in the level of emissions per capita. If \(\beta _4 =-\beta _3 \) then there is beta convergence in emissions intensity without an additional effect of the initial level of income on the emissions growth rate.

We only use control variables that will be unaffected by the rate of economic growth so that we can measure the full effect of growth on emissions. The control variables used in each studyFootnote 9 reported here vary a little but fall into the following categories:

-

Legal and political organization: Dummy variables for non-English legal origin and centrally planned economies.

-

Climate and geography: Country averages of temperatures over the three summer months and the three winter months, annual precipitation, mean elevation, landlocked status.

-

Energy resource endowments: Fossil fuel endowments (Norman 2009), freshwater per capita, and forest area per capita.

-

Population density.

These control variables as well as the initial levels of emissions and income effectively allow the time effects to vary across countries as in Vollebergh et al. (2009). The combined term \(\beta _1 {\hat{Y}}_i +\beta _2 {\hat{Y}}_i Y_{i0} \) is then the growth effect and \(\beta _0 +\beta _3 E_{i0} +\beta _4 Y_{i0} +\sum _{j=1}^K \beta _{j+4} X_{ji0} \) is the time effect.

Table 1 reports results for the following variables from three papers that I have coauthored:

-

Anjum et al. (2014): 1971–2010 \(\hbox {CO}_{2}\) emissions from fossil fuel combustion and cement production (Boden et al. 2013) and 1971–2005 SO\(_2\) emissions (Smith et al. 2011).

-

Sanchez and Stern (2016): 1971–2010 industrial (energy use and industrial processes) greenhouse gas (GHG) emissions and non-industrial (agriculture, forestry, land-use change etc.) GHG emissions from the EDGAR database (version 4.2). Sanchez and Stern aggregated the various sources and gases using 100-year global warming potential coefficients.

-

Stern and Van Dijk (2016): 1990–2010 population weighted concentrations of PM 2.5 pollution (World Bank Development Indicators).

Anjum et al. and Sanchez and Stern use GDP per capita data from the Penn World Table version 8.0 (Feenstra et al. 2015), whereas Stern and van Dijk use World Bank GDP data. Both use 2005 prices.

The elasticity of pollution with respect to GDP at the sample mean is positive for all pollutants. It is smallest for PM 2.5 concentrations (0.2) and highest for the various industrial and energy related emissions (0.85–0.9). The elasticity for non-industrial GHG emissions is 0.45. The point estimate of the turning point is either out-of-sample (\(\hbox {CO}_{2}\) and SO\(_2\) emissions), very high (PM 2.5), or there is no turning point (industrial and non-industrial GHG emisions). In each case, the turning point is very imprecisely estimated. Pollution grows more slowly in countries with high initial levels of pollution or emissions intensity. This effect is strongest for SO\(_2\) and weakest for PM 2.5.

There are strong negative time effects for SO\(_2\) and industrial and non-industrial GHG emissions, ranging from 1.0 to 1.5% p.a. in a country with mean income and other variables and English legal origin. Time effects are insignificant for \(\hbox {CO}_{2}\) and PM 2.5. Among the control variables (not reported), non-English legal origin has significant negative effects for SO\(_2\) emissions. Effects on GHG emissions are insignificant or positive despite Fredriksson and Wollscheid’s (2015) finding that non-OECD French legal origin countries have stricter climate change policies than British legal origin countries.

Early findings (Selden and Song 1994; Stern et al. 1996) that concentrations of pollution were likely to have a lower income turning point than emissions are not strictly confirmed by these results, but clearly economic growth has much weaker effects on concentrations of pollution than on emissions. The results confirm later findings (Stern and Common 2001) that the effect of growth on emissions is monotonic. Like Ordás Criado et al. (2011), these results show that both economic growth and initial emissions or concentration levels are needed to explain pollution growth and that negative time effects are important for some pollutants. Stern (2004) argued that negative time effects might overcome the scale effect of growth in slower-growing higher income countries, while in faster-growing middle-income countries the scale effect dominated and emissions rose. This seems to be the case for SO\(_2\) and GHG emissions but not for \(\hbox {CO}_{2}\) or PM 2.5.

7 Conclusions and future research directions

The evidence presented in this article shows that over recent decades economic growth has increased both pollution emissions and concentrations, ceteris paribus. Negative time effects may be important for some pollutants such as SO\(_2\). Convergence is also important—higher initial levels of pollution are generally associated with slower growth in pollution.

How can these results best be used by policy-makers? The findings of this and other recent studies (e.g. Vollebergh et al. 2009; Ordás Criado et al. 2011) that the effect of economic growth on pollution is generally positive, reinforces the early concerns of Stern et al. (1996) and Arrow et al. (1995) that the EKC literature might encourage policy-makers to incorrectly de-emphasize environmental policy and pursue growth as a solution instead. On the other hand, the results show that pollution can be reduced over time and for some pollutants the effect of growth is less in richer countries. The best positive use of these results is to inform business as usual projections of pollution that are used as baselines to assess climate and other environmental policies (e.g. Clarke et al. 2014; Riahi et al. 2016).

On the theoretical front, the assumption of most static models that pollution externalities are optimally internalized over the course of economic development does not seem very plausible. There is still scope for developing more complete dynamic models of the evolution of the economy and pollution emissions. Empirical research so far has not provided very sharp tests of alternative theoretical models, so that there is still scope for work of this sort too. Therefore, I expect that in coming years this will continue to be an active area of research interest. New related topics also continue to emerge. One that has emerged in the wake of the great recession in North America and Europe is the question of what happens to emissions in the short run over the course of the business cycle. York (2012) found that \(\hbox {CO}_{2}\) emissions rise faster with economic growth than they fall in recessions but Burke et al. (2015) conclude that there is no strong evidence that the emissions-income elasticity is larger during individual years of economic expansion as compared to recession but that significant evidence of asymmetry emerges when effects over longer periods are considered. Emissions tend to grow more quickly after booms and more slowly after recessions.

Twenty-five years on, is the EKC still a useful model? The effects of growth on pollution diminish with increasing income for some pollutants and especially for the pollution concentration data that Grossman and Krueger (1991) first applied the EKC to. But it is generally other factors that actually reduce pollution. The naïve econometric approaches used in much of the literature are also problematic. Convergence effects are important for most pollutants and time effects are important for many. These effects and others should get more attention than the EKC effect as opposing forces to the scale effect when modeling aggregate pollution emissions. As these are the factors that actually reduce pollution more research into what actually drives these effects is needed.

Notes

As discussed below, this does not actually seem to be an important factor in explaining reductions in emissions intensities in developed countries.

Under additive preferences \(\phi =1/\eta \). Under non-homotheticity a more complex expression determines whether there is an EKC or not. Homotheticity implies that the ratio of the marginal utility of consumption and the marginal utility of environmental quality is a function of the ratio of consumption and environmental quality alone.

This is despite the findings of Sala-i-Martin et al. (2004) and Rockey and Temple (2016) that initial GDP should be included in a growth regression. In the sample of 136 countries used by Anjum et al. (2014) and discussed in Sect. 4, below, the R\(^{2}\) for a regression of the growth rate of GDP per capita from 1971 to 2010 on log GDP per capita in 1971 has an R\(^{2}\) of 0.0025.

As the cross-sectional dimension of a panel increases relative to its time series dimension, the regression coefficient estimators become increasingly “classical” and the spurious regression problem diminishes. However, most EKC studies do not have a sufficiently large cross-sectional dimension to allow researchers to ignore cointegration (Entorf 1997).

By negative time effect, I mean that emissions fall over time, ceteris paribus.

Sanchez and Stern (2016) use the mean of log GDP per capita over the period rather than initial GDP per capita and initial emissions intensity rather than initial emissions.

For details of the data sources and coefficient estimates for the controls, please see the original papers. Other variables can be considered and some of these were tested such as regional dummies, which are emphasized by Rockey and Temple (2016) in the growth regression context. We did not find that the latter had systematically significant effects.

References

Aldy, J. E. (2005). An environmental Kuznets curve analysis of U.S. state-level carbon dioxide emissions. Journal of Environment and Development, 14, 48–72.

Aldy, J. E. (2006). Per capita carbon dioxide emissions: Convergence or divergence? Environmental and Resource Economics, 33(4), 533–555.

Anjum, Z., Burke, P. J., Gerlagh, R., & Stern, D. I. (2014). Modeling the emissions-income relationship using long-run growth rates. CCEP Working Papers, 1403.

Antweiler, W., Copeland, B. R., & Taylor, M. S. (2001). Is free trade good for the environment? American Economic Review, 91, 877–908.

Arrow, K., Bolin, B., Costanza, R., Dasgupta, P., Folke, C., Holling, C. S., Jansson, B-O., Levin, S., Mäler, K.-G., Perrings, C., & Pimentel, D. (1995). Economic growth, carrying capacity, and the environment. Science, 268, 520–521.

Azomahou, T., Laisney, F., & Van Nguyen, P. (2006). Economic development and \({\rm CO}_{2}\) emissions: A nonparametric panel approach. Journal of Public Economics, 90(6–7), 1347–1363.

Beckerman, W. (1992). Economic growth and the environment: Whose growth? Whose environment? World Development, 20, 481–496.

Blanco, G., Gerlagh, R., Suh, S., Barrett, J., de Coninck, H., Diaz Morejon, C. F., Mathur, R., Nakicenovic, N., Ahenkorah, A. O., Pan, J., Pathak, H., Rice, J., Richels, R., Smith, S. J., Stern, D. I., Toth, F. L., & Zhou, P. (2014). Drivers, trends and mitigation. In Edenhofer, O., R. Pichs-Madruga, Y. Sokona, E. Farahani, S. Kadner, K. Seyboth, A. Adler, I. Baum, S. Brunner, P. Eickemeier, B. Kriemann, J. Savolainen, S. Schlömer, C. von Stechow, T. Zwickel, & J. C. Minx (Eds.), Climate change 2014: Mitigation of climate change. contribution of Working Group III to the fifth assessment report of the intergovernmental panel on climate change. Cambridge UK: Cambridge University Press.

Boden, T. A., Marland, G., & Andres, R. J., (2013). Global, regional, and national fossil-fuel \(CO_{2}\) Emissions. Oak Ridge, TN: Carbon Dioxide Information Analysis Center, Oak Ridge National Laboratory, U.S. Department of Energy.

Brock, W. A., & Taylor, M. S. (2010). The green Solow model. Journal of Economic Growth, 15, 127–153.

Burke, P. J., Shahiduzzaman, M., & Stern, D. I. (2015). Carbon dioxide emissions in the short run: The rate and sources of economic growth matter. Global Environmental Change, 33, 109–121.

Carson, R. T. (2010). The environmental Kuznets curve: Seeking empirical regularity and theoretical structure. Review of Environmental Economics and Policy, 4(1), 3–23.

Carson, R. T., Jeon, Y., & McCubbin, D. R. (1997). The relationship between air pollution and emissions: U.S. data. Environment and Development Economics, 2, 433–450.

Chen, W.-J. (2016). Is the Green Solow Model valid for \({\rm CO}_{2}\) emissions in the European Union? Environmental and Resource Economics. doi:10.1007/s10640-015-9975-0.

Chow, G. C., & Li, J. (2014). Environmental Kuznets curve: Conclusive econometric evidence for \({\rm CO}_{2}\). Pacific Economic Review, 19(1), 1–7.

Clarke, L., Jiang, K., Akimoto, K., Babiker, M., Blanford, G., Fisher-Vanden, K., Hourcade, J.-C., Krey, V., Kriegler, E., Löschel, A., McCollum, D., Paltsev, S., Rose, S., Shukla, P. R., Tavoni, M., van der Zwaan, B. C. C., & van Vuuren, D. P. (2014). Assessing Transformation Pathways. In Edenhofer, O., R. Pichs-Madruga, Y. Sokona, E. Farahani, S. Kadner, K. Seyboth, A. Adler, I. Baum, S. Brunner, P. Eickemeier, B. Kriemann, J. Savolainen, S. Schlömer, C. von Stechow, T. Zwickel, & J. C. Minx (Eds.), Climate change 2014: Mitigation of climate change. contribution of Working Group III to the fifth assessment report of the intergovernmental panel on climate change. Cambridge, UK: Cambridge University Press.

Cole, M. (2004). Trade, the pollution haven hypothesis and environmental Kuznets Curve: Examining the linkages. Ecological Economics, 48, 71–81.

Copeland, B. R., & Taylor, M. S. (2004). Trade, growth, and the environment. Journal of Economic Literature, 42, 7–71.

Daly, H. E. (1993). The perils of free trade. Scientific American, 269, 50–57.

Dasgupta, S., Laplante, B., Wang, H., & Wheeler, D. (2002). Confronting the environmental Kuznets curve. Journal of Economic Perspectives, 16, 147–168.

Dobes, L., Jotzo, F., & Stern, D. I. (2014). The economics of global climate change: A historical literature review. Review of Economics, 65, 281–320.

Durlauf, S. N., Johnson, P. A., & Temple, J. R. W. (2005). Growth econometrics. In P. Aghion & S. N. Durlauf (Eds.), Handbook of economic growth (Vol. 1A, pp. 555–677). Amsterdam: North Holland.

Ehrlich, P. R., & Holdren, J. P. (1971). Impact of population growth. Science, 171(3977), 1212–1217.

Entorf, H. (1997). Random walks with drifts: Nonsense regression and spurious fixed-effect estimation. Journal of Econometrics, 80(2), 287–296.

Evans, P. (1996). Using cross-country variances to evaluate growth theories. Journal of Economic Dynamics and Control, 20(6–7), 1027–1049.

Evans, P., & Karras, G. (1996). Convergence revisited. Journal of Monetary Economics, 37(2), 249–265.

Ezcurra, R. (2007). Is there cross-country convergence in carbon dioxide emissions? Energy Policy, 35, 1363–1372.

Feenstra, R. C., Inklaar, R., & Timmer, M. P. (2015). The next generation of the Penn World Table. American Economic Review, 105(10), 3150–3182.

Figueroa, E., & Pasten, R. (2015). Beyond additive preferences: Economic behavior and the income pollution path. Resource and Energy Economics, 41, 91–102.

Frank, R. H., Jennings, S., & Bernanke, B. S. (2012). Principles of microeconomics. North Ryde: McGraw-Hill.

Fredriksson, P. G., & Wollscheid, J. R. (2015). Legal origins and climate change policies in former colonies. Environmental and Resource Economics, 62, 309–327.

Friedman, M. (1992). Do old fallacies ever die? Journal of Economic Literature, 30(4), 2129–2132.

Grossman, G. M. & Krueger, A. B. (1991). Environmental impacts of a North American Free Trade Agreement. NBER Working Papers, 3914.

Harbaugh, W., Levinson, A., & Wilson, D. (2002). Re-examining the empirical evidence for an environmental Kuznets curve. Review of Economics and Statistics, 84(3), 541–551.

Herrerias, M. J. (2013). The environmental convergence hypothesis: Carbon dioxide emissions according to the source of energy. Energy Policy, 61, 1140–1150.

Hilton, F. G. H., & Levinson, A. M. (1998). Factoring the environmental Kuznets curve: Evidence from automotive lead emissions. Journal of Environmental Economics and Management, 35, 126–141.

Holtz-Eakin, D., & Selden, T. M. (1995). Stoking the fires? \({\rm CO}_{2}\) emissions and economic growth. Journal of Public Economics, 57(1), 85–101.

Jones, L. E., & Manuelli, R. E. (2001). Endogenous policy choice: The case of pollution and growth. Review of Economic Dynamics, 4, 369–405.

Kaika, D., & Zervas, E. (2013). The environmental Kuznets curve (EKC) theory. Part B: Critical issues. Energy Policy, 62, 1403–1411.

Kander, A., Jiborn, M., Moran, D. D., & Wiedmann, T. O. (2015). National greenhouse-gas accounting for effective climate policy on international trade. Nature Climate Change, 5, 431–435.

Kijima, M., Nishide, K., & Ohyama, A. (2010). Economic models for the environmental Kuznets curve: A survey. Journal of Economic Dynamics and Control, 34, 1187–1201.

Lefohn, A. S., Husar, J. D., & Husar, R. B. (1999). Estimating historical anthropogenic global sulfur emission patterns for the period 1850–1990. Atmospheric Environment, 33, 3435–3444.

Levinson, A. (2010). Offshoring pollution: Is the United States increasingly importing polluting goods? Review of Environmental Economics and Policy, 4(1), 63–83.

Lopez, R. E., & Yoon, S. W. (2014). Pollution-income dynamics. Economics Letters, 124(3), 504–507.

McPherson, M. A., & Nieswiadomy, M. L. (2005). Environmental Kuznets curve: Threatened species and spatial effects. Ecological Economics, 55(3), 395–407.

Norman, C. S. (2009). Rule of law and the resource curse: Abundance versus intensity. Environmental and Resource Economics, 43, 183–207.

Ordás Criado, C., Valente, S., & Stengos, T. (2011). Growth and pollution convergence: Theory and evidence. Journal of Environmental Economics and Management, 62, 199–214.

Panayotou, T. (1993). Empirical tests and policy analysis of environmental degradation at different stages of economic development. Working Paper, Technology and Employment Programme, International Labour Office, Geneva, WP238.

Panayotou, T. (1997). Demystifying the environmental Kuznets curve: Turning a black box into a policy tool. Environment and Development Economics, 2, 465–484.

Pasten, R., & Figueroa, E. (2012). The environmental Kuznets curve: A survey of the theoretical literature. International Review of Environmental and Resource Economics, 6, 195–224.

Perman, R., & Stern, D. I. (2003). Evidence from panel unit root and cointegration tests that the environmental Kuznets curve does not exist. Australian Journal of Agricultural and Resource Economics, 47, 325–347.

Peters, G. P., & Hertwich, E. G. (2008). \({\rm CO}_{2}\) embodied in international trade with implications for global climate policy. Environmental Science and Technology, 42(5), 1401–1407.

Pettersson, F., Maddison, D., Acar, S., & Söderholm, P. (2013). Convergence of carbon dioxide emissions: A review of the literature. International Review of Environmental and Resource Economics, 7, 141–178.

Quah, D. (1993). Galton’s fallacy and the tests of the convergence hypothesis. Scandinavian Journal of Economics, 95(4), 427–443.

Raupach, M. R., Marland, G., Ciais, P., Le Quéré, C., Canadell, J. G., Klepper, G., et al. (2007). Global and regional drivers of accelerating \({\rm CO}_{2}\) emissions. Proceedings of the National Academy of Sciences, 104(24), 10288–10293.

Riahi, K., van Vuuren, D. P., Kriegler, E., Edmonds, J., O’Neill, B. C., Fujimori, S., Bauer, N., Calvin, K., Dellink, R., Fricko, O., Lutz, W., Popp, A., Crespo-Cuaresma, J., Samir, K. C., Leimbach, M., Jiang, L., Kram, T., Rao, S., Emmerling, J., Ebi, K., Hasegawa, T., Havlik, P., Humpenöder, F., Alelui Da Silva, L., Smith, S., Stehfest, E., Bosetti, V., Eom, J., Gernaat, D., Masui, T., Rogelj, J., Strefler, J., Drouet, L., Krey, V., Luderer, G., Harmsen, M., Takahashi, K., Baumstark, L., Doelman, J. C., Kainuma, M., Klimont, Z., Marangoni, G., Lotze-Campen, H., Obersteiner, M., Tabeau, A., & Tavoni, M. (2016). The Shared Socioeconomic Pathways and their energy, land use, and greenhouse gas emissions implications: An overview. Global Environmental Change. doi:10.1016/j.gloenvcha.2016.05.009.

Rockey, J., & Temple, J. (2016). Growth econometrics for agnostics and true believers. European Economic Review, 81, 86–102.

Sala-i-Martin, X., Doppelhofer, G., & Miller, R. I. (2004). Determinants of long-term growth: A Bayesian averaging of classical estimates (BACE) approach. American Economic Review, 94(4), 813–835.

Sanchez, L. F., & Stern, D. I. (2016). Drivers of industrial and non-industrial greenhouse gas emissions. Ecological Economics, 124, 17–24.

Selden, T. M., & Song, D. (1994). Environmental quality and development: Is there a Kuznets curve for air pollution? Journal of Environmental Economics and Environmental Management, 27, 147–162.

Shafik, N. (1994). Economic development and environmental quality: An econometric analysis. Oxford Economic Papers, 46, 757–773.

Smith, S. J., van Ardenne, J., Klimont, Z., Andres, R. J., Volke, A., & Delgado, Arias S. (2011). Anthropogenic sulfur dioxide emissions: 1850–2005. Atmospheric Chemistry and Physics, 11, 1101–1116.

Solow, R. M. (1956). A contribution to the theory of economic growth. Quarterly Journal of Economics, 70, 65–94.

Stefanski, R. (2013). On the mechanics of the ‘Green Solow Model’. OxCarre Research Paper, 47.

Stern, D. I. (1998). Progress on the environmental Kuznets curve? Environment and Development Economics, 3, 173–196.

Stern, D. I. (2002). Explaining changes in global sulfur emissions: An econometric decomposition approach. Ecological Economics, 42, 201–220.

Stern, D. I. (2004). The rise and fall of the environmental Kuznets curve. World Development, 32(8), 1419–1439.

Stern, D. I. (2007). The effect of NAFTA on energy and environmental efficiency in Mexico. Policy Studies Journal, 35(2), 291–322.

Stern, D. I. (2010). Between estimates of the emissions-income elasticity. Ecological Economics, 69, 2173–2182.

Stern, D. I., & Common, M. S. (2001). Is there an environmental Kuznets curve for sulfur? Journal of Environmental Economics and Environmental Management, 41, 162–178.

Stern, D. I., Common, M. S., & Barbier, E. B. (1996). Economic growth and environmental degradation: The environmental Kuznets curve and sustainable development. World Development, 24, 1151–1160.

Stern, D. I., & Jotzo, F. (2010). How ambitious are China and India’s emissions intensity targets? Energy Policy, 38(11), 6776–6783.

Stern, D. I., & Van Dijk, J. (2016). Economic growth and global particulate pollutant concentrations. CCEP Working Papers 1604.

Stokey, N. L. (1998). Are there limits to growth? International Economic Review, 39(1), 1–31.

Strazicich, M. C., & List, J. A. (2003). Are \({\rm CO}_{2}\) emission levels converging among industrial countries? Environmental and Resource Economics, 24(3), 263–271.

Suri, V., & Chapman, D. (1998). Economic growth, trade and the energy: Implications for the environmental Kuznets curve. Ecological Economics, 25, 195–208.

Torras, M., & Boyce, J. K. (1998). Income, inequality, and pollution: A reassessment of the environmental Kuznets curve. Ecological Economics, 25, 147–160.

Tsurumi, T., & Managi, S. (2015). Environmental Kuznets curve: Economic growth and emission reduction. In S. Managi (Ed.), The economics of green growth: New indicators for sustainable societies (pp. 49–70). New York: Routledge.

Verbeke, T., & de Clerq, M. (2006). The EKC: Some really disturbing Monte Carlo evidence. Environmental Modelling & Software, 21, 1447–1454.

Vollebergh, H. R. J., Melenberg, B., & Dijkgraaf, E. (2009). Identifying reduced-form relations with panel data: The case of pollution and income. Journal of Environmental Economics and Management, 58, 27–42.

Wagner, M. (2008). The carbon Kuznets curve: A cloudy picture emitted by bad econometrics. Resource and Energy Economics, 30, 388–408.

Wagner, M. (2015). The environmental Kuznets curve, cointegration and nonlinearity. Journal of Applied Econometrics, 30(6), 948–967.

Westerlund, J., & Basher, S. A. (2008). Testing for convergence in carbon dioxide emissions using a century of panel data. Environmental and Resource Economics, 40, 109–120.

World Bank. (1992). World development report 1992: Development and the environment. New York: Oxford University Press.

World Commission on Environment and Development. (1987). Our common future. Oxford: Oxford University Press.

York, R. (2012). Asymmetric effects of economic growth and decline on \({\rm CO}_{2}\) emissions. Nature Climate Change, 2, 762–764.

Zhang, X., Davidson, E. A., Mauzerall, D. L., Searchinger, T. D., Dumas, P., & Shen, Y. (2015). Managing nitrogen for sustainable development. Nature, 528, 51–59.

Zhao, Y., Zhang, J., & Nielsen, C. P. (2013). The effects of recent control policies on trends in emissions of anthropogenic atmospheric pollutants and \({\rm CO}_{2}\) in China. Atmospheric Chemistry and Physics, 13, 487–508.

Acknowledgements

I thank my colleagues and students who collaborated on the empirical studies discussed in this paper: Reyer Gerlagh, Paul Burke, Luis Sanchez, Jeremy van Dijk, and Zeba Anjum. I also thank two anonymous referees for useful comments and Andreas Chai for inviting me to contribute to this special issue and participate in the workshop: ‘Managing the Transition to a Sustainable Economy’ at Griffith University.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Stern, D.I. The environmental Kuznets curve after 25 years. J Bioecon 19, 7–28 (2017). https://doi.org/10.1007/s10818-017-9243-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10818-017-9243-1