Abstract

The extant literature on corporate political activities has extensively examined whether and how political connections help in improving performance. We extend this literature by examining whether and how political connections help in profit persistence, a fundamental concern for firms. Using a unique panel dataset of politicians who were elected at either the national or state level in India and examining their membership on the board of directors of firms, we find that firms with political connections demonstrate higher profit persistence. Further, we report that connections with state-level politicians have a larger effect on persistence compared to connections with national-level politicians. This finding emphasizes the importance of micro and recurring benefits in emerging economies such as India, in the form of help with acquiring licenses, permits, land and infrastructure, which are usually provided by state-level politicians relative to policy-related benefits, which are typically provided by national-level politicians. Our results also show that political connections have a greater effect on profit persistence for firms that are affiliated to business groups. Our results suggest that political connections seem to operate as higher-order resources, defined as resources that do not contribute to profits directly but can affect other resources that in turn affect profits over time.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

The extant literature on corporate political activities (CPA) has examined if and how CPA improve firm performance (Ahuja & Yayavaram, 2011). Prior research has suggested that CPA provide firms with several benefits such as access to government and public policy-related information (Hillman et al., 2004; Lux, 2016), enhanced IPO performance (Rudy & Cavich, 2020), preferential access to finance (Khwaja & Mian, 2005), higher participation in foreign trade missions (Schuler et al., 2002), blocking rivals’ use of substitute resources (McWilliams et al., 2002), and corporate bailouts (Faccio et al., 2006). Some prior studies have also reported no effect or a detrimental effect of CPA (e.g., Hadani & Schuler, 2013; Okhmatovskiy, 2010; Sun et al., 2010, 2015; Tihanyi et al., 2019). Prior studies investigating how CPA affects firm performance addressed a fundamental question in the strategy field (Barney, 1991; Porter, 1985; Rumelt et al., 1994): why does heterogeneity exist in firm performance? However, to the best of our knowledge, no prior work has empirically examined the role of CPA in sustaining profits. Firms that enjoy a sustained competitive advantage will have profits that persist over time and hence what leads to profit persistence is also a fundamental question in strategy (McGahan & Porter, 1999; Villalonga, 2004). In this study, we seek to understand how CPA affects profit persistence.

Firm profit persistence – defined as “the percentage of firm-specific profits in any period before period t that remains in period t” (Villalonga, 2004) – depends on several factors such as market imperfections (Chacar & Vissa, 2005), formal institutions in the product, financial, and labor markets (Chacar et al., 2010), introduction of pro-market reforms (Chari & David, 2012), and firm-specific resources such as marketing intensity (Jacobsen, 1988), corporate reputation (Roberts & Dowling, 2002), intangible resources (Villalonga, 2004) and stakeholder relations (Choi & Wang, 2009). The significance of CPA is greater if they lead to persistent profits than if they lead to profits that are transient (Ahuja & Yayavaram, 2011). The factors that lead to profit existence may be different from those that lead to profit persistence (Villalonga, 2004). Even if CPA have no direct effect on profits (for example, if the positive effects are cancelled out by the negative effects), they can have an effect on profit persistence and can therefore be a valid option for firms pursuing sustained competitive advantage.Footnote 1 Thus, the distinction that we make between the effect of CPA on profits and the effect they have on profit persistence can shed light on the additional ways in which CPA can benefit firms.

In this study, we focus on political connections—a widely used form of CPA—and empirically examine their role in profit persistence. We argue that political connections can help in profit persistence by minimizing competition that can lead to dissipation of profits or by protecting resources from imitation and substitution. This is especially likely in emerging economies where pro-market institutions are still evolving (Li et al., 2013; Marquis & Raynard, 2015; Rajwani & Liedong, 2015). The lack of well-defined institutions in such economies increases the role and discretion that governments have in economic activity. Their economic and industrial policies can have a significant effect on whether or not the business environment is favorable to firms. In such a context, political connections can help firms in protecting the competitive advantage that they possess.

We chose India as the context of our study, which in many ways is representative of a typical large emerging economy (Ayyagari et al., 2013). India opened its economy in 1991 and subsequently introduced several market-oriented reforms such as removal of industrial licensing in many sectors, reduction in import duties, privatization, and allowing the entry of foreign firms. These reforms have made entry into several markets easier for both domestic and foreign firm leading to higher competition in product, financial and labor markets. Such increases in competition can lead to a decline in profit persistence (Hermelo & Vassolo, 2010). In line with these arguments, Chari and David (2012) found that economic reforms in India led to a decline in profit persistence. In this paper, we argue that the potential for profit persistence continues to exist despite economic reforms since political connections can reign in competition and give politically connected firms differential access to physical and infrastructural resources.

In order to investigate the role of CPA in profit persistence, we used a rich and unique database from the Association for Democratic Reforms (ADR), which has comprehensive data on all electoral candidates for all national (federal) and state (provincial) elections held in India during the period 2004–2013. We combined this data on elected representatives with the data on corporate boards from CMIE Prowess to identify political connections at the board level. Our results broadly show that firms with political connections demonstrate higher profit persistence, providing support for our principal hypothesis. Our study focuses on only politically connected board directors and does not consider the numerous other ways in which firms engage in CPA (such as lobbying, purchasing electoral bonds, informal connections) and non-market strategies (such as stakeholder value maximization and socially responsible corporate activities). Thus, the effects that we find are likely to underestimate the true effects of CPA and non-market strategies.

Our focus on the Indian context allowed us to explore interesting nuances associated with when and where political connections matter more for profit persistence. Prior studies have emphasized the policy-related benefits that political connections bring to firms (Bonardi, 2011; Bonardi et al., 2005; Hillman & Hitt, 1999) while overlooking the benefits that help firms in starting a business and managing it on a day-to-day basis. In emerging economies such as India, the latter set of benefits might be more important than the former. These micro and recurring benefits that firms can obtain through their political connections include assistance with obtaining industry licenses, obtaining approvals for construction activity, obtaining clearances related to the health, safety, and welfare of workers and the environment, and securing basic infrastructure such as roads, electricity, and water for their new and existing establishments. These benefits are not limited to startups since firms need these clearances and approvals for their existing businesses as well as new projects that they embark on while pursuing growth opportunities. These clearances and approvals are often under the purview of state governments rather than the national government, and we therefore argue that state-level politicians are more likely than national-level politicians to provide such benefits. In support of this hypothesis, we find that connections to politicians elected at the state level have a bigger impact on profit persistence than connections to national-level politicians.

In several emerging economies, particularly India, business groups are an important organizational feature. The institutional voids perspective (e.g., Khanna & Palepu, 1997) contends that business groups are a prominent organizational form in economies where institutional deficiencies exist, and that the business group organizational form helps in bridging these deficiencies. In this study, we extend this argument by examining whether the effect of political connections on the sustenance of profits is higher for firms that belong to business groups than for other firms. Our results show that political connections have a greater effect on profit persistence for firms affiliated to business groups.

This study contributes to the literature on CPA in several ways. First, prior work on CPA has found both positive, negative, and null effects of CPA on corporate performance, raising important questions about whether CPA is a useful non-market strategy. As Hadani et al. (2017) note, CPA may not always be beneficial to firms due to the uncertainties associated with both the process of influencing policies and the impact of policies that are being targeted. In this study, we identify another important way in which CPA can affect firm profits. Our findings suggest that even when political connections do not directly lead to superior profits (Hadani & Schuler, 2013; Mellahi et al., 2016; Siegel, 2007; Sun et al., 2010), they may still be important since they can help in sustaining profits that have been achieved through other means. At a broader level, these findings also suggest that even though firms may or may not use non-market strategies to obtain superior performance, they may need to use such strategies to sustain their superior performance. Thus, in the context that we examine, political connections may function as higher-order resources, defined as “resources that do not affect profit directly, but can affect other resources that in turn affect profit over time” (Wibbens, 2019).

Second, our work also emphasizes that the goal of CPA can extend beyond influencing policies. We highlight an underexamined source of advantage in the form of the micro and recurring benefits that political connections provide to firms on a regular basis. The problems that firms confront while starting or managing a business may seem mundane or trivial in developed economies, but they can be burdensome and difficult to resolve in emerging economies. Further, unlike policy benefits, micro and recurring benefits are firm specific, more tangible, less uncertain and provide better justification for CPA. Building on this idea of micro and recurring benefits, we uncover the differential effects of political connections depending on whether the connections are at the national level or state level. We find that in India, state-level political connections that provide micro and recurring benefits are more helpful compared to national-level political connections that typically provide policy-related benefits. This finding adds to prior work in the CPA domain that highlights the importance of aligning a firm’s corporate political strategy with the underlying characteristics of the institutional environment (e.g., Lux, 2016; Marquis & Raynard, 2015).

Lastly, we also contribute to the literature on business groups and profit persistence. Business groups have a dominant presence in several emerging economies (Khanna & Rivkin, 2001) and exhibit profit persistence but this persistence reduces as an economy liberalizes (Chari & David, 2012). Our findings show that business group-affiliated firms are able to halt this decline and achieve a higher profit persistence when they are politically connected.

Theory & Hypothesis

Corporate Political Activities (CPA)

The extant literature recognizes the importance of CPA in creating influence rents, which are defined as “the extra profit earned by an economic actor because the rules of the game of business are designed or changed to suit an economic actor or a group of economic actors” (Ahuja & Yayavaram, 2011: pg. 1631). Firms undertake CPA to manage their relationships with the government and minimize the risk associated with external dependencies. These CPA include funding elections, constituting political action committees (PACs), lobbying, and forming formal and informal connections with government officials.

Among the various forms of CPA, political connections at the board level are a highly prevalent form of CPA (El Nayal et al., 2021), especially in larger firms (Goldman et al., 2009) and have received the most attention in the existing literature (Rajwani & Liedong, 2015). These connections can be direct and indirect, as well as formal and informal. For example, a politician who is a board member represents a direct and formal connection. Conversely, a politician’s relative (spouse or sibling) who is a board member represents an indirect but formal connection. Similarly, a tie between a manager and a politician through club membership is an informal connection, which could be both direct and indirect. In this study, we focus on political connections through the board membership of politicians, which is a direct-formal connection as well as the most visible form of CPA (Rajwani & Liedong, 2015).

In many firms, board members play an important role in resource provisioning. When board members are also politically connected, they can provide critical resources in the form of influence capital (Awasthi & George, 2021). A major aim of having a political connection at the board level is to influence the government and receive favorable treatement in the form of beneficial policies, legislation and enforcement. Politicians who are serving as directors can also potentially benefit the firm through unique and early infromation about public policies, channels of communication to poltical decision makers, preferential access to political decision makers and increased legitamacy (Hillman, 2005). They can provide private knowledge of the inner workings of the government and loopholes in the bureaucracy that can be exploited (El Nayal et al., 2021). Specifically, they help in obtaining government procurement contracts (Goldman et al, 2013), government subsidies (Wu & Cheng, 2011), government bailouts (Faccio et al., 2006), preferential access to finance (Boubakri et al., 2012; Khwaja & Mian, 2005; Li et al., 2008), more favorable treatment from regulators when accused of fraud (Kuvvet & Maskara, 2018), avoding regulatory delay or denial during acquisitions (Ferris et al., 2016) and countering socially oriented investor activism (Hadani et al., 2018).

Given the many ways in which politically connected directors can benefit firms, one can expect that such connections improve overall firm performance. Prior work has provided ample empirical evidence for such an expectation. For example, establishing political connections at the board level increases firm value (Faccio, 2006; Goldman et al., 2009; Hillman et al., 1999). Hillman (2005) found that the number of politicians on a firm’s board is positively related to market-based measures of performance, especially in heavily regulated environments. Cheng (2018) found that the sudden deaths of politically connected directors leads to a reduction in value for Chinese firms. The effect of politically connected directors on firm performance is more pronounced in countries with weak institutions (Carney et al., 2020) or high levels of perceived corruption (El Nayal et al., 2021).

At the same time, other studies have also documented null or detrimental effects of politically connected directors on firm performance (Hadani & Schuler, 2013; Okhmatovskiy, 2010; Sun et al., 2015). Firms may not obtain the desired policy outcomes due to uncertainty about the public policy process itself and uncertainty about how a desired policy may affect the firm (Hadani et al., 2017). Political directors may also expect to gain benefits from a firm on a quid-pro-quo basis (Faccio, 2006). Prior research has shown that politically connected firms increase employment (Bertrand et al., 2018; Faccio & Hsu, 2017), weaken the pay-performance link for top executives (Chizema et al., 2015), facilitate blockholder rent appropriation (Sun et al., 2016), are less likely to internationalize (Du & Luo, 2016), and are under pressure to make donations to charitable causes (Li et al., 2015; Zhang et al., 2016). Such actions can neutralize or negate the benefits that a firm might expect to gain from its political connections.

While the effects of politically connected directors on firm performance has been studied in great detail, no prior studies have examined whether political connections at the board level (or CPA in general) help firms in sustaining their profits. This is a glaring omission in the literature since the study of persistence in performance is central to understanding the drivers of firm performance and sustained competitive advantage (McGahan & Porter, 1999, 2003; Villalonga, 2004). The significance of political connections is greater if they lead to persistent profits than if they lead to profits that are transient (Ahuja & Yayavaram, 2011). Importantly, even when political connections do not have a direct effect—either because the effect is weak or because the positive and negative effects cancel out each other (Tihanyi et al., 2019—such connections can increase profit persistence whereby an advantage that is created through other means can be sustained. Further, given that the benefits that a firm can procure through a political director may be limited, it seems more plausible that political connections can be used to sustain an advantage that the firm already possesses rather than create a new source of advantage.

Profit Persistence

According to neo-classical theory, all firms in a competitive market should ideally converge toward a median profit in the long run (Chacar & Vissa, 2005), leading to a market of firms that have nearly equivalent performance. However, a related stream of literature examining the long run sustainability of profits has suggested that firms might be able to sustain their superior profits over a long period due to imperfect competition (e.g., high industry concentration), market frictions (lower speed of information dissemination), firm-specific resources (e.g., patents, intangible knowledge, corporate reputation, stakeholder relations), and specific characteristics of the institutions (e.g., emerging economies) in which the firms are embedded (Chacar & Vissa, 2005; Chacar et al., 2010; Choi & Wang, 2009; Jacobsen, 1988; McGahan & Porter, 2003; Mueller, 1986; Roberts & Dowling, 2002; Villalonga, 2004). Such market and non-market conditions thus provide the possibility of profit persistence, defined as “the percentage of firm-specific profits in any period before period t that remains in period t” (Villalonga, 2004).

It is important to note that the factors that lead to the existence of profits may differ from those that lead to profit persistence (Madsen & Leiblein, 2015; Villalonga, 2004). For example, Roberts and Dowling (2002) find that while reputation leads to profit persistence in their sample of high-performance firms, it does not have a positive and significant effect on profits. Jacobsen (1988) finds that market share leads to both high profits and high persistence in profits, while intense marketing expenditures lead to low profits and high persistence in profits. Choi and Wang (2009) find that stakeholder relations have an effect on profit persistence but not profits.

Building on this idea that the factors that affect profits may be different from those that affect profit persistence, Wibbens (2019) identifies higher order resources that “do not affect profits directly, but allow firms to obtain superior operating resources over time”. He suggests that strategic planning, M&A capabilities, and superior forecasts can be considered as higher order resources whereas brands, patents, captive customers, or specialized plants can be considered as operating resources. We build on this study and argue that political connections can play the role of both operating resources and higher order resources. As an operating resource, political connections can lead to profits directly by restricting competition (for example, preventing entry of foreign firms or imposing taxes on imports) or providing access to valuable resources (for example, natural resources such as coal, oil, and spectrum for airwaves or intangible resources such as IP by invalidating foreign patents). However, prior literature has not provided explicit or the necessary attention to the role that political connections play as higher-order resources, and this is the focus of our study. We posit that political connections may help in accentuating the benefits from market imperfections (Porter, 1980) or firm-specific resources (Barney, 1991) by exploiting the institutional characteristics in favor of a firm. This is likely to result in the persistence of influence rents (Ahuja & Yayavaram, 2011).

Political connections can be used to increase profit persistence in several ways. First, political connections at the board level can be used to restrict rivalry on an ongoing basis by creating barriers to entry (Baron, 1997; Dean et al., 1998) and reducing the threat of substitute products (Oliver & Holzinger, 2008). Political connections can also be used to maintain a favorable competitive landscape by changing the rules in the buyer and supplier industries related to restrictions on price and quantity produced, taxes, and consumption and production standards (Hillman & Hitt, 1999; Rehbein & Lenway, 1994). Politically connected directors can achieve these benefits of a better industry structure (lower threat of entry, lower threat of substitutes, lower bargaining power of buyers and suppliers, and ultimately lower rivalry) by influencing policies, legislation, regulation and enforcement of laws and rules.Footnote 2

Second, when firms earn abnormal profits through access to natural resources such as coal, oil, and telecom spectrum or from resources developed over time such as firm-specific capabilities and knowledge, political connections at the board level can be used to ensure that such resources remain scarce, inimitable, and difficult to substitute. In the Indian context, the Indian government has control over natural resources such as coal and telecom spectrum and infrastructural resources such as ports and airports leading to the possibility that political directors can provide preferential access to such resources or early information about such resources. The scarceness of such resources can lead to sustained profits for the firms that manage to acquire them. Political connections can also be leveraged to increase the inimitability of resources, for example, by facilitating an appropriability regime that provides protection to intellectual property rights. Finally, political connections can be used to block the use of substitute resources such that the costs of a firm’s rivals are raised (McWilliams et al., 2002). Thus, political connections can lead to profit persistence by ensuring that a firm’s resources remain scarce and are protected from imitation and substitution.

A political connection at the board level is itself one of the resources that a firm possesses (Bonardi et al., 2005). However, for this resource to enable sustained advantage, it needs to fulfill the conditions of the resource being valuable, rare, inimitable, and difficult to substitute (Barney, 1991; Hillman & Hitt, 1999). Bonardi (2011) notes that the Resource-Based View logic needs to be applied with care when examining the market for political resources since such markets differ from typical product markets in the roles that suppliers and buyers play. Given the limited supply of politicians, and the fact that a politician is unlikely to be connected to more than one firm from the same industry as a board member, a political connection as a resource is quasi-fixed in supply, making it a scarce resource (Mellahi et al., 2016). Further, to obtain sustainability-related advantages from a political connection, the firm needs to maintain a continuous exchange between itself and a politician (Hillman & Hitt, 1999; Oliver & Holzinger, 2008). This is more likely to happen when the connection is through board membership. This continuous exchange between the firm and the politician embeds the political connection, makes it “relational” in character (Boddewyn & Buckley, 2017; Hillman & Hitt, 1999), builds path dependencies, and limits its tradability, thereby rendering the political connection imperfectly imitable. In an emerging economy context, political connections as resources are also difficult to substitute (Lawton et al., 2013; Peng et al., 2009) because the benefits that political connections provide—such as influence over regulatory legislations and industrial policies, privileged access to policy-related information, access to critical resources, and social legitimacy—cannot be obtained through other means.

In short, politically connected directors can help a firm in maintaining a favorable position with respect to competitors, suppliers and buyers and ensuring that the resources that lead to a favorable competitive position are rare, difficult to imitate and difficult to substitute. As resources themselves, political connections are scarce, inimitable, and non-substitutable. Therefore, we argue that the profits that accrue to firms with political connections are likely to persist more.

Hypothesis 1

The presence of political connections through the board of directors enhances a firm’s profit persistence.

CPA in the Indian Context

While prior research has explored the role of CPA in Western contexts in some detail, and, more recently, in the Chinese context, studies in other contexts have been relatively rare. Extending CPA research to new contexts, such as India, can reveal interesting aspects of CPA that have been hitherto understudied. Unlike in Western economies, there is still significant government control over economic activities in emerging economies such as India, thus increasing the dependence that firms have on the government (Sun et al., 2012). While this control constrains firm behavior, it also offers opportunities for improving performance through CPA. The main channel though which Indian firms undertake CPA is through connections or personal ties unlike in the US, where lobbying and political donations are the dominant mode of CPA (Rajwani & Liedong, 2015). This emphasis on personal ties translates into a relational approach to political strategy (Hillman & Hitt, 1999). The other important characteristics of the Indian context that affect CPA are the federal governance structure (national vs. state) and the dominant presence of business groups. We explore these characteristics next.

Moderating Effect of the National Governance Structure

While proposing a global theory of CPA, Windsor (2007) argued for the importance of examining the multiple tiers of governance (i.e., at the national/federal and the sub-national/state levels) when strategizing and allocating resources across CPA. A major dimension along which national governance structure varies across countries is the presence (or lack) of a federal structure. It is important to examine the impact of the federal structure on CPA since it can affect the locus of CPA, its expected benefits, and its effectiveness (Lawton et al., 2013). However, prior work on the implications of a federal structure on CPA is sparse (Rajwani & Liedong, 2015). In the US, for example, even though state governments can enact legislations and formulate policies that have implications for firms, the existing CPA literature has primarily focused on the federal government (Rajwani & Liedong, 2015).

Several aspects of a federal structure can impact the nature and effectiveness of CPA. Multiple sub-national government tiers can lead to more veto points and reduce the effectiveness of CPA (Choi et al., 2015). The relative influence of the national government over policies can determine whether CPA should be directed at the national government or at the state governments. In China, for example, where the national government is powerful, CEOs’ political connections with the Chinese central government matter more for IPO performance than their political connections with the regional governments (Wu et al., 2013). However, even when the national government has a higher influence compared to the state governments, CPA at the state level can be effective because it might be easier to influence state-level politicians. In the United States, for example, state-level elections do not receive the same amount of media and public attention as national-level elections. Hence, it is easier for special interests to have a greater influence on state elections (Werner, 2017). We argue that, even in India, state-level connections may be more important than national-level connections. We thus provide an alternative, context-specific rationale that is based on distinguishing the type of benefits provided by state-level political connections from those provided by national-level connections.

India has a federal structure of governance with a fair degree of decentralization. The government has multiple tiers, but only the top two are relevant to most economic activity. The central (national) government is the top tier of this system and takes overarching decisions on economic policies and matters of national importance such as defense and foreign affairs. The second tier of government is at the level of states and union territories (28 and 8 in number, respectively). State governments have their own heads and budgets, and they can enact laws and set policies in areas such as taxes of various kinds, utilities, public order, public health, jurisdiction of courts within the state, trade, commerce, and regulation of industries. State governments wield considerable power in granting various approvals, permits, and licenses that are critical for businesses (see Appendix 1 for a list of these requirements under the state and central jurisdictions for starting and managing businesses in India). In India, state governments are involved in a variety of activities such as acquiring land, approving construction activity and building plans, ensuring the health, safety, and welfare of workers and the environment, setting up infrastructure such as roads, electricity, and water, and safeguarding assets. Political connections with the state government can benefit firms in performing better at these activities. In contrast, as can be seen from Appendix 1, the role of the central government in enabling the ease of doing business is limited when compared to the role of state governments.

We term these benefits that help firms in starting a business and managing the business on a day-to-day basis as “micro and recurring benefits”. These benefits, while critical to business even in developed economies, are especially important in emerging economies that have weak or missing institutions. These weaknesses are characterized in the literature as institutional voids (e.g., Khanna & Palepu, 1997; Peng, 2002). To start a new project,Footnote 3 firms need access to infrastructure such as roads, electricity, and water. Access to these fundamental services is not automatic or simple. In addition, any firm that starts a new project has to obtain approvals for construction activity and building plans, and clearances related to the health, safety, and welfare of workers and the environment. Again, these are difficult to obtain because they necessitate working with a multitude of government agencies. Many of these issues exist for running current operations as well, since firms need to renew their approvals and obtain certifications that they have complied with the laws related to labor and quality control. The infamous “licensing raj” in India has morphed into a permit raj, in which firms face innumerable hurdles to get through the bureaucratic maze.

The World Bank introduced the ease of doing business ranking to assess the extent to which a country’s regulatory environment is conducive to the starting and operation of local firms. The ranking scores each country on 10 topics: starting a business, dealing with construction permits, getting electricity, registering property, getting credit, protecting minority investors, paying taxes, trading across borders, enforcing contracts, and resolving insolvency. Each topic further consists of several indicators. For example, registering property consists of the following indicators: procedures (number), time (days), cost, and quality of land administration index. The aggregate scores are then used to rank countries. India’s low rankings in the World Bank’s Doing Business 2016 report (155 in “starting a business,” 138 in “registering property,” and 178 in “enforcing contracts”) indicate the difficulties that firms in India face in starting a business and managing it on a day-to-day basis (World Bank, 2016).Footnote 4

Though these decisions are handled by bureaucrats, political board connections can help reduce the time taken for the decisions to be made. Political board connections can help firms in navigating this permit raj by cutting through red tape, meeting compliance requirements in a timely manner (Sen, 2017) and building helpful political resources (Peng, 2002). This is possible because politicians exercise substantial control over bureaucrats and direct their day-to-day activity.Footnote 5 Furthermore, unlike policy and legislative benefits that may require multiple connections with the government and the ruling party, micro and recurring benefits can be provided by a single elected politician on the board. Given that a majority of the permits, approvals, and no-objection certificates that are required to achieve compliance are mandated by either state or local governments (or municipalities), a state-level politician is more likely to be helpful in obtaining these than a national-level politician.Footnote 6

Securing these permits and approvals are often required for continuing operations as well. For example, the success of Amara Raja, one of the largest battery manufacturers in India, is based on its superior marketing, sales and manufacturing, as well as advanced technology sourced from its JV partner. The firm requires approval from the Pollution Control Board to continue its operations and without such approvals, the firm will be unable to maintain its strong position in the industry. Furthermore, in an emerging economy such as India, which grows at higher rates than developed economies, firms often have to continually pursue growth opportunities through new projects to maintain their existing position relative to their competitors. Thus, the micro and recurring benefits that political connections provide can help a firm in sustaining its profits.

Moreover, a connection to state-level politicians provides firms with additional entry points (Choi et al., 2015) when they are attempting to gain influence rents (Ahuja & Yayavaram, 2011). These entry points may increase political risk in terms of policy outcomes (Lawton et al., 2013), but can also be helpful in obtaining micro and recurring benefits. In India, the total number of elected representatives at the national level is 790, while the total number of elected representatives at the state level is over 4,500. These high number of possible entry points for CPA provide a supply-side rationale for forming political connections with state-level politicians (Werner, 2017). The presence of a large number of sub-national elected representatives may also imply a lower search cost of finding political connections, and a better bargaining position with politicians. Furthermore, state-level politicians are more accessible and can devote more time to a firm. National-level politicians may be occupied with federal issues related to the entire country and may be unable to devote sufficient time to a single firm on a regular basis. Thus, we hypothesize:

Hypothesis 2

Political connections with state-level politicians (members of state legislative assemblies or councils) through the board of directors will have a greater effect on a firm’s profit persistence compared to political connections with national-level politicians (members of parliament).

Moderating Effect of Business Group Affiliation

Another major feature of the Indian economic and political context is the dominant presence of business groups. Douma et al. (2006) report that in their sample of over 1,000 listed firms, close to 40% of the firms are affiliated to business groups. Sarkar (2010) notes that group affiliates account for around 70% of the total assets of the corporates in India in their sample of firms from the Prowess database in 2006. Khanna and Rivkin (2001) define a business group as “a set of firms which though legally independent are bound together by a constellation of formal and informal ties that are accustomed to taking coordinated action” (pp. 47–48). Prior research has argued and found evidence that the collective sharing of financial, organizational, and reputational resources provides advantages to firms that are affiliated to business groups and has reported on the role of business groups in mitigating “institutional voids” (e.g., Khanna & Palepu, 2000). These advantages manifest in superior performance for firms that are affiliated to business groups compared to their non-business group counterparts owing to the reduced costs of capital, superior access to markets (both domestically and internationally), and beneficial knowledge flows among business group firms (George & Kabir, 2012; Khanna & Palepu, 2000; Ramachandran et al., 2013). Thus, the business group has been found to be an effective organizational form that bridges several institutional deficiencies. In contrast, there is also evidence that business groups are prone to tunneling and the expropriation of private benefits of control when the controlling owners of the business groups exploit minority shareholders (e.g., Bertrand et al., 2002).

Studies in India have largely reported net benefits for firms affiliated with business groups. These benefits accrue in particular to the larger and more diversified business groups that are professionally run, and to those business groups that have managed to adapt well to the opening of the Indian economy post liberalization (George & Kabir, 2012; Khanna & Palepu, 2000). Business groups also have the necessary resources to sustain the profits that they earn. Supporting this point, Chari and David (2012) find that business groups in India have higher profit persistence. At the same time, they also find that profit persistence is going down due to reforms and business group-affiliated firms do not have any advantage over non-affiliated firms in resisting this decline.

Business groups are also often connected politically, particularly in emerging economies (Carney, 2008; Chung & Zhu, 2021; Mukherjee et al., 2018; Tan & Meyer, 2010). Business groups are typically more adept at benefiting from political connections compared to other organizational forms (Chung & Zhu, 2021; Sun et al., 2012). In his work on connected firms and groups in Indonesia, Fisman (2001) finds that a large percentage of a firm’s value might be derived from political connections. Additionally, scholars have documented issues pertaining to lending practices that favor politically connected business groups (Khwaja & Mian, 2005). Peng (2002) argues that business groups are able to leverage their political contacts by presenting the common interests associated with the diverse industries in which a group is present, thereby enhancing the efficiency of the activities and not overloading the bureaucracy.

While the effect of political connections on the financial performance of business groups has been explored in the extant literature (Guillen, 2000; Kedia et al., 2006; Zhu & Chung, 2014), how business groups specifically leverage political connections to sustain their profits remains unexplored. We build on this literature and argue that business groups are better placed than non-affiliated firms in using their political connections to enhance their profit persistence. Since the advantage of business groups lies in filling institutional voids, they are more vulnerable to competition that is brought on by the reform process (Chittoor et al., 2015; Khanna & Rivkin, 2001). As Peng (2003) argues, economic reforms decrease relationship-based advantages relative to market-asset based advantages. Since business groups rely more on relationship-based advantages, their political connections can help them in sustaining such advantages. Compared to non-affiliated domestic firms or MNEs, the advantages that business groups possess are based less on their market-based advantages such as superior management capabilities or technological resources. As such, their capabilities are more likely to be susceptible to threats of imitation or substitution and hence they are more likely to benefit from political connections that can protect their resources.

Business group affiliated firms are also in a better position than non-affiliated firms at procuring natural and infrastructural resources due to their large size and capacity to raise funds and thereby benefit from the advantages that these scarce resources provide for profit persistence. Since political connections are important for gaining access to scarce natural and infrastructural resources, political connections are more important to business group affiliated firms than non-affiliated firms. Finally, the relationships that business groups possess can complement their political connections in procuring micro and recurring benefits. One could potentially argue that relationships and political connections are substitutes than complements. However, given that firms have to obtain several clearances and even one non-approval can hold back a firm in its operations, the more relationships and connections that a firm has, the more it is likely to succeed in getting all the required permits and approvals. Hence, the relationships and political connections act as complements rather than as substitutes. Even if the kind of benefits that firms receive from political connections are not different from what they receive through their larger group relationships, having a political connection can help them obtain more of such benefits. We therefore expect the political connections of business groups to provide a measure of defense against the erosion of sustainability that is brought on by the reform process.

Hypothesis 3

Political connections through the board of directors will have a greater effect on a firm’s profit persistence if it is affiliated to a business group than if it is not affiliated to a business group.

Data and Methodology

Data

We chose India as the empirical context for testing our hypotheses. To identify political connections, i.e., directors who are elected representatives, we combined two different datasets. The first dataset, compiled by the Association for Democratic Reforms (ADR)—a non-government, not-for-profit organization—has data on the candidates who contested in parliamentary and state legislative elections from 2004 up to June 2013.Footnote 7 This data collection effort was initiated in 2004 following an election reform that required all contesting candidates to submit an affidavit about their property and criminal records to the Election Commission of India. This dataset covers two national elections for the lower house of the parliament (Lok Sabha) and 52 elections to state assemblies (Vidhan Sabha). A representative elected to the national parliament is called a Member of Parliament (MP), and a representative elected to a state assembly is called a Member of Legislative Assembly (MLA). This dataset also covers members elected to the upper houses of the national parliament and state assemblies (known as Rajya Sabha and Vidhan Parishad, respectively). This dataset includes 62,847 observations. We considered only the winners (i.e., the elected representatives) from this list, which reduced the number of observations to 8,791.

The second dataset contains year-wise data on the board of directors of all companies in the CMIE Prowess Database.Footnote 8 This data consists of 505,064 firm-board member-year observations across 80,824 firm-years. We matched the data on elected representatives and board members using several name-matching procedures. Name matching has to be done carefully because of multiple issues such as variations in writing names in different records (e.g., there are no uniformly used naming conventions in India such as “first name followed by last name” or “family name followed by given name” that are common across the country; middle names are sometimes left out; initials are sometimes used instead of spelled-out names), and the high frequency of common names in India. We used several string-matching algorithms that are available in R (such as pmatch and agrep), and we also matched different components of each name to generate the maximum number of possible matched pairs. Using these matching techniques, we generated a list of 512,413 possible matched pairs. For each pair we calculated the string distance and then removed pairs that had string distance above a threshold. To minimize the chance of missing actual matches (i.e., false negatives) we used a high threshold value. However, this resulted in a large number of potential matches (179,389) with possibly many false positives. We therefore removed the obvious mismatches (144,890) by manually examining each pair before examining the remaining pairs (34,499) in detail to confirm whether a political connection exists.

To confirm a political connection, we used databases such as Corporate Directory, Bloomberg Business Week, and Capitaline, company websites, annual reports, newspaper articles, and profiles on Wikipedia, LinkedIn, and Facebook. Given the paucity and lack of reliability of confirmation indicators, we chose to confirm a match only if we were able to triangulate the information from multiple sources. We counted a matched pair as a political connection when we came across a direct source confirming affiliation details, or when two names matched exactly and there was a match with regard to education, age, or father’s name (wherever available). Given the conservative nature of our inclusion criteria, our final list of confirmed political directors is downward-biased, resulting in a possible under-counting of political directors.

We excluded government-owned firms from our main analysis because the benefits and costs of political connections might be very different for such firms. We also excluded firms from the banking and financial sector because their profitability measures might not be comparable to those of firms from other sectors (Berger & Ofek, 1995). Our empirical analysis is at the firm-year level. After eliminating observations for which financial data is missing, we were finally able to confirm that 340 firm-year observations had a political connection out of the final sample of 29,742 observations. The low number of political connections in our sample is clearly an underestimate of the extent of political connections in India. This low number makes it less likely that we will find support for our hypotheses. Data on control variables was obtained from CMIE Prowess.

Measures

Dependent variable

Following recent work on profit persistence (Madsen & Walker, 2017) and corporate political activities (Chizema et al., 2015; Hadani & Schuler, 2013), we used Return on Sales (ROS) as the primary measure of profitability. We calculated Return on Sales as Profit before Depreciation, Interest, Tax and Amortization (PBDITA) divided by Total Sales.

Independent variables

For testing Hypothesis 1 about profit persistence, we included the first-order lagged dependent variable in the regression models (Chacar & Vissa, 2005; Chari & David, 2012). We measured political connections using a dummy variable (Political Director) that takes the value 1 if a firm has one or more elected representatives as directors on its board in a particular year, and 0 otherwise. For testing Hypothesis 2 about the relative effects of national-level vs. state-level political connections, we used two additional dummy variables, MP_Director and MLA_Director, corresponding to whether a board member was elected at the national level or the state level, respectively. For testing Hypothesis 3 about the persistence in a firm’s profits among business group-affiliated firms, we created a dummy variable Business Group that takes the value 1 if a firm is a business group affiliate, and 0 otherwise.

Control variables

We used several control variables that can affect firm profits such as firm size (log of total assets), firm age, ownership of major groups (promoter,Footnote 9 domestic financial institutions, domestic corporates, foreign financial institutions, and government), board size, and debt-equity ratio (Chizema et al., 2015; Hadani & Schuler, 2013; Hillman, 2005). We also included several industry controls such as Industry Growth (percentage growth in industry sales), Industry Concentration (Herfindahl measure), Industry R& D Intensity (total R&D in the industry divided by total industry sales) and Industry Advertising Intensity (total advertising expenses in the industry divided by total industry sales). We did not include industry dummies as our models include firm fixed effects.

The Prowess data on Indian firms has many outliers. In line with prior research, we winsorized all the variables except Political Director and ownership by 3% in both tails to minimize the effect of outliers on the mean (Acharya et al., 2011; Berger & Ofek, 1995; Douma et al., 2006).

Model specification and estimation

We use the following model as is common in the literature on profit persistence (Chacar & Vissa, 2005; Chari & David, 2012; Choi & Wang, 2009; Roberts & Dowling, 2002; Villalonga, 2004):

The dependent variable Pi,t is the firm profitability (ROS) at time t and PD is a dummy that represents the presence of political board connections. The coefficient of the lagged dependent variable (β0) indicates the extent to which firm profits persist. A coefficient that is positive but less than 1 suggests that profits persist while a coefficient that is negative but greater than -1 indicates that profits converge to a common level (Madsen & Walker, 2017). A large value for the coefficient suggests that profits persist for a longer time, whereas a smaller value suggests that profits are transient. The coefficient of the political director dummy (β1) is the direct effect of a political connection on firm profits. The coefficient of the interaction term (β2) indicates the extent to which a political connection increases profit persistence.

Including the lagged dependent variable makes our model a dynamic panel model. Several econometric issues need to be addressed while estimating dynamic panel data models. First, in dynamic panel data models, the fixed effects might be correlated with the lagged dependent variable, which makes the lagged dependent variable endogenous (Arellano & Bond, 1991; Nickell, 1981; Roodman, 2009a, b). Second, autocorrelation becomes a concern because of the presence of the lagged dependent variable. Third, our key explanatory variable of political connections is also potentially endogenous because politicians might choose to get on the boards of firms that are likely to have profit persistence. Finally, because our model includes the interaction term of the political connections dummy with the lagged dependent variable, there is a likelihood of high correlation between the dependent variable and two of the independent variables (lagged profitability and the interaction of lagged profitability with the political connection dummy).

To address these issues, we used the System Generalized Method of Moments (GMM) estimator (Arellano & Bond, 1991) for estimation. These models provide estimates of variables taking into account the presence of the lagged dependent variable as one of the independent variables, control for unobserved firm-specific heterogeneity (Oehmichen et al., 2017), and are superior to standard estimations using fixed-effect panel data models (Roodman, 2009a). The Arellano-Bond dynamic panel models use the lagged values of endogenous variables as instruments (Greene, 2008). This approach involves differencing the regression equation and reducing the possible correlation between the key independent variables and the error term, thereby controlling for endogeneity. We used the STATA command xtabond2 for our analysis (Roodman, 2009a).

Results

Table 1 reports the summary statistics and correlations among the variables. While many of the pairwise correlations are statistically significant, most of them are small. Therefore, we do not expect multicollinearity to be a major concern. Table 2 reports the results for the hypotheses tests, with the first and second lag as the instrument in the dynamic panel models. Model 1 in Table 2 includes only the control variables and the lagged profitability variable. This model shows that the coefficient of the lagged profitability variable is significant (β = .248; p < .01), thus suggesting that firms exhibit profit persistence, in general. We introduced the Political Director dummy in Model 2. This model shows that the coefficient of the Political Director dummy is negative (β = -.117) but not significant.

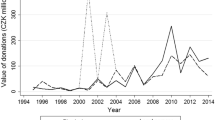

Next, we introduced the interaction term between the Political Director dummy and lagged profitability in Model 3. This model shows that the coefficient of the interaction term between the Political Director dummy and the lagged profitability variable is positive and significant (β = .440; p < .001), lending support to Hypothesis 1, which predicts that political directors enhance profit persistence. We confirm this finding by plotting the interaction effect between political connections and profit persistence (Fig. 1). The presence of a political director increases the effect of lagged profitability from .248 to .745 (= .305 + .440).

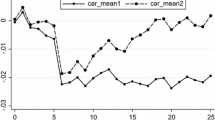

Model 4 shows that the coefficient of the interaction variable between MP_Director (dummy for a national-level elected representative serving as a board member) and the lagged profitability variable is significant (β = .237; p < .01). Similarly, the coefficient of the interaction variable between MLA_Director (dummy for a state-level elected representative serving as a board member) and the lagged profitability variable is positive and significant (β = .523; p < .001). Further, the plot of the interactions (Fig. 2) shows that MLA_Director enhances profit persistence more than MP_Director does. A test of the differences shows that the coefficient of the interaction term involving MLA_Director is significantly higher than that of the interaction term involving MP_Director (Chi Squared = 9.36; p < .01). This supports Hypothesis 2, which predicted that a state-level political connection (MLA_Director) would increase a firm’s profit persistence more than a national-level political connection does (MP_Director).

Model 5 shows that the coefficient of the interaction variable among Business Group (dummy for business group-affiliated firms), the political connection dummy, and the lagged profitability variable is significant (β = .307; p < .05). Figure 3 shows the plot of the interaction effect. This supports Hypothesis 3, which predicted that political connections would be more beneficial to a business group-affiliated firm than to a standalone firm for profit persistence.

We verified the validity of the System GMM estimator using several diagnostic checks. The Arellano–Bond test checks for autocorrelation, with the null hypothesis being that there is no autocorrelation. The test of second-order correlation in differences (AR(2)) is more informative than the test of first-order serial correlation (Roodman, 2009a). Table 2 shows that the AR(2) statistics are not significant in any of the models, implying that the null hypothesis of no autocorrelation holds. Further, as shown in Table 2, the statistics for the Hansen test of overidentification and the Hansen test of exogeneity are not significant in any of the models, which implies that our models satisfy the standard exogeneity criteria for instrument validity (i.e., overidentification of restrictions, and instruments not correlated with the errors).

Post-hoc Analysis

Our data enabled us to perform several post-hoc tests to understand other aspects of our hypotheses that could not be theorized a priori. We report these findings here.

Regulated industries

In regulated industries, firms have opportunities to earn monopoly profits because regulations can limit rivalry by creating entry barriers in product markets. Firms can use their political connections to create a favorable regulatory environment. Political connections can also be used to navigate the government procurement process when the government is an important customer, and this is more likely to be the case in regulated industries. Therefore, the number of opportunities to earn influence rents through political connections is higher in highly regulated industries (Hadani & Schuler, 2013; Hillman, 2005). The persistence of these influence rents or the rents created through other means is also likely to be higher in regulated industries because political connections can be used not only to create a favorable regulatory environment but also to maintain such an environment. Firms can block reforms that change the regulatory environment and threaten to lower their profits. To examine this interaction, we test for the effect of regulation on a firm’s profit persistence. Model 1 in Table 3 shows that the effect of the interaction of the dummy for highly regulated industries (HRI) (Awasthi et al., 2019),Footnote 10 the Political Director dummy, and the lagged profitability variable is positive and significant (β = .501; p < .01). Thus, the effect of political connections on a firm’s profit persistence is higher in highly regulated industries compared to other industries.

Relative prior performance

Profit persistence implies that while superior performing firms see a persistence in their above-average profits, inferior performing firms see a persistence in their below-average profits. Thus, Hypothesis 1 implies that political connections could increase profit persistence of both superior and inferior performing firms. However, political connections could have an asymmetric effect because the benefits that superior performing firms obtain through their political connections might be different from the benefits that inferior performing firms obtain through their political connections. While superior performing firms seek to sustain their profits, inferior performing firms often tend to lack distinctive heterogeneous resources that have rent-creating potential (McGahan & Porter, 2003). Consequently, superior performing firms with political connections are likely to show higher persistence (in the superior performing category), while inferior performing firms with political connections are unlikely to show persistence (in the inferior performing category).

To test these ideas, we examine the profit persistence of a sub-sample of superior performing firms (for which the lagged industry-adjusted profitability is higher than or equal to the industry mean) (Model 1 in Table 4) and another sub-sample of inferior performing firms (for which the lagged industry-adjusted profitability is lower than the industry mean) (Model 2 in Table 4). The results in Model 1 are qualitatively similar to those in the full sample. The coefficient of the interaction term between the Political Director dummy and the lagged profitability variable is positive and significant (β = .479; p < .01), indicating higher profit persistence for politically connected superior performing firms. Model 2 shows that the interaction term between the Political Director dummy and lagged profitability is positive (β = .602) but not significant, suggesting that political connections do not affect the profit persistence of inferior performing firms. This is in line with our expectations that political connections are associated with the persistence of superior performance but not with inferior performance.

Order of connection formation

Another important question that might need attention is whether it makes any difference if a person was a board member first and then contested an election, or if they were first elected as a representative and then appointed to a board. In our sample, 340 political board connections exist at the firm-year level. Of these, 168 are instances where an elected politician joined the board and 172 are instances where a board member became an elected politician. The results with this distinction between elected politicians joining boards and board members becoming elected politicians are presented in Table 5 in the Appendix. These results indicate that appointing an elected representative to the board is more useful for the sustenance of profits compared to a board member becoming an elected representative. In 147 instances, the connection predates our sample time period. For these cases, we manually collected information from publicly available sources in order to determine the order of connection formation. Since this data is from prior to 2003 and was collected from multiple sources, it may not be completely reliable. Therefore, we are cautious in interpreting these results. It is also important to note that the sequence of events – whether a person became a board member before or after an election – does not affect our theoretical arguments and empirical findings on how political connections affect profit persistence.

Additional robustness checks

We also verified the robustness of our primary findings in several ways. Tables 6 and 7 (Appendix 2) show the results for alternative lag structures for the dynamic panel data models. In the models in Table 6, we used first to third (1–3) lags as instruments, and in the models in Table 7, we included all the lags as instruments. The results are largely similar to our primary results in all these cases.

We also included several additional control variables in a robustness check. A politician on a firm’s board may have more impact on a firm if he or she is also the Chairman or the CEO. We collected additional data from the Prowess database and created the variable Political Director – Board Chairman for each firm-year that is set to 1 if any of the political board directors is also the firm’s Chairman and 0, otherwise. Similarly, we also coded a dummy variable Political Director—CEO for each firm-year that is set to 1 if any of the political board directors is also the firm’s CEO, and 0, otherwise. Since tenure can impact the effectiveness of board members, we included Political Director – Tenure, which is measured as the average tenure of politically connected board members. Firms can benefit from political connections of firms that they are affiliated with. So, we created a control variable “Political Director – Business Group affiliate”, which is a count of the number of other firms in a business group that have political connections. Politicians can serve on several corporate boards simultaneously, and this may affect their impact on a firm. So, we controlled for Political Director – Other board positions, which is the sum of the number of other board positions across all politically connected board members for each firm-year. The results with the inclusion of these additional control variables are provided in Table 8 (Appendix 2). Including these additional control variables did not change our main results. We also checked robustness of the results by several subsample analyses. In Table 9 we divide the sample into highly regulated and non-regulated industries; in Table 10 we divide the sample into manufacturing and non-manufacturing sector firms; and in Table 11 we divide the sample into business group affiliated and non-business group affiliated firms. As these results show, the effects of political directors on profit persistence are mainly observed for firms that are in regulated industries and in non-manufacturing industries. While both business group affiliated firms and non-business group affiliated firms showed the effect of political directors on firm profit persistence, the effect was weaker for non-business group affiliated firms.

Discussion and Conclusion

In this study, we explored the role of political connections in a firm’s profit persistence. Our results suggest that firms with political connections demonstrate higher profit persistence. Further, our results show that the effect of connections to state-level politicians on profit persistence is greater than that of connections to national-level politicians. Moreover, the profit persistence of politically connected firms is greater when the firms are affiliated to a business group.

Our study advances the literature on CPA and profit persistence in several ways. First, we contribute to the core debate of management scholars and a primary concern of practitioners—how to sustain profits (Barney et al., 2001)—by introducing an important factor for achieving profit persistence: CPA, in general, and political connections, in particular. Our study emphasizes the positive effects of political connections, which is in line with several prior studies that have uncovered the positive benefits of CPA (for example, Faccio, 2006; Goldman et al., 2009; Hillman, 2005; Hillman et al., 1999). However, prior research has indicated that CPA could also have a deleterious effect on performance (Hadani & Schuler, 2013; Siegel, 2007; Sun et al., 2010). Our findings add another layer to the debate about whether the benefits of political connections outweigh their costs. While we did not find any negative effect of political connections on performance, we also did not find any positive effect on performance. Instead, we find that firms with political connections demonstrate higher profit persistence. Thus, our study highlights the importance of looking beyond the direct influence of political connections on performance to examine whether political connections can increase persistence in performance. Further, our study raises the intriguing possibility that, whether firms use non-market strategies to obtain influence rents or not, they may need to adopt such strategies to sustain their superior performance achieved through other means. The experiences of firms such as Microsoft and Google show that while they might shun non-market strategies during their growth stage, they need them to sustain their performance at later stages. We thus add to the recent work on higher-order resources (Wibbens, 2019) by suggesting that political connections can be an important type of higher-order resource.

Second, our work highlights the important distinction between policy-related benefits and the micro and recurring benefits of political connections. Our results suggest that in the context of an emerging economy, political connections are more important for gaining micro and recurring benefits than for gaining policy-related benefits. Prior work on CPA has focused on the policy-related benefits of CPA, such as formulation of policies that are favorable to the connected firm and early intimation of policy changes (Bonardi et al., 2005; Hillman et al., 1999, 2004). However, for many firms, the benefits obtained through compliance with the current set of legislations may be more relevant than the benefits obtained through influence on policies. The magnitude of resources (e.g., financial resources, time) required for influencing macro-level policy might not be justified by the benefits achieved, because a policy-level change could benefit all the firms in the industry, thus diluting the benefits that a single firm can achieve for itself. These benefits are also associated with two types of uncertainty: uncertainty due to the complexity associated with the legislative or executive processes, and uncertainty about the outcome of the policy on a firm’s performance (Hadani et al., 2017). The multitude of players involved in public policy processes—on the demand side as well as the supply side (Bonardi et al., 2005)—may result in a policy that is at variance with the desired policy. Further, it is difficult to anticipate how even a desired policy might affect a firm’s performance (Ingram & Clay, 2000). In contrast, micro and recurring benefits are often specific to a firm. The costs incurred in seeking micro and recurring benefits are likely to be much more in line with the benefits that can be accrued. In addition, micro and recurring benefits are tangible, are less uncertain, typically have a lower gestation time, and are more amenable to a cost–benefit analysis.

The significance of these micro and recurring benefits of CPA is likely to be context dependent. In developed economies where the ease of doing business is high, firms typically do not need to use their political connections for their routine operations. Therefore, in such economies, the micro and recurring benefits of political connections are less relevant. This could explain why most prior studies, which are typically set in the context of developed economies, have paid little attention to these benefits. In emerging economies, which rank lower in terms of the ease of doing business, micro and recurring benefits may be more important to firms. This study thus emphasizes the need for further research on the micro and recurring benefits of political connections, which have so far received scant attention in comparison to the policy-related benefits of political connections. The study of these benefits provides a more holistic perspective on the variety of influence rents that can be obtained through political connections. Thus, our study expands on the concept of influence rents (Ahuja & Yayavaram, 2011) by categorizing them into macro and micro types of influence rents.

Furthermore, the value of political connections changes over time as institutions evolve. For example, Haveman et al. (2017) found that the effect of political connections on a firm’s performance increased over time in China. We speculate that when institutions evolve, the type of politicians required by a firm would change as well. For example, as institutions develop, Schumpeterian profits may become more important than monopoly profits. Therefore, firms may need an appropriability regime that could ensure the sustenance of these types of profits. Further, as institutions develop, the micro and recurring benefits provided by state-level politicians may become less important. In such cases, the connections with national-level politicians who can influence policy related to appropriability would become more important than the connections with state-level politicians.

Third, we add to the growing body of research on how the benefits of CPA differ depending on whether the political connections are at the national or state level (Choi et al., 2015; Kozhikode & Li, 2012; Ring et al., 2005; Windsor, 2007). Political connections at the national level may provide benefits that differ from those provided by political connections at the state level. Typically, state-level political connections are more likely to provide micro and recurring benefits, while national-level political connections are more likely to provide policy-related benefits. We do not explicitly measure the kind of benefits that national-level and state-level politicians provide or the effectiveness of different types of CPA at the national and state levels. However, our finding that state-level political connections have a larger effect than national-level political connections lends credence to our claim that in emerging economies micro and recurring benefits are more important than policy-related benefits. We also build on the study by Choi et al. (2015) and Werner (2017) and posit that the entry points for engaging in CPA increase manifold when strong and decentralized sub-national governance structures exist. Thus, decentralized economies are a better context for garnering influence rents, particularly those that are micro and recurring in nature. Our finding that state-level political connections are more helpful than national-level political connections for sustaining profits in India also highlights the importance of aligning corporate political strategy with the underlying institutional characteristics (Du & Luo, 2016; Marquis & Raynard, 2015).

Fourth, our work highlights the importance of organizational characteristics such as business group affiliation in enhancing a firm’s profit persistence. This supports the institutional voids perspective that business groups are typically more adept at benefiting from these political connections, and that these organizational structures appear to afford a measure of defense against the erosion of sustainability that is brought on by reform processes. While further research is required to unpack the heterogeneity among business groups and to delineate the mechanisms through which these organizational structures yield advantages in a firm’s profit persistence, the present study provides some initial triggers for examining this phenomenon further.

This study is not without limitations. Firstly, we have examined the role of political connections in profit persistence. However, there are other types of direct and indirect mechanisms of extracting influence rents, such as appointing close relatives of politicians to the board of directors, informal ties of the top management team to politicians, and industry lobbying. Though measuring these indirect and informal ties is important, it is difficult to get data for these linkages, especially in a longitudinal setting. Since we are unable to capture indirect ties, our results might be downward biased in capturing the quantum of influence rents (Faccio et al., 2006). The lack of support for a direct effect of political connections may also be due to the limited nature of our measure. Similarly, the duration and strength of political connections can have important implications for value creation or loss through political connections (Sun et al., 2015). Analyzing indirect political connections and their strength and duration is a promising area for future work. Secondly, we are unable to distinguish between the creation and the sustenance of profits because our modelling setup does not allow us to make a distinction between the creation and the sustenance of profits. Future work that distinguishes between the two could help us understand whether political connections help in creating profits, sustaining profits, or both. Our modelling setup also does not allow us to determine whether it is the same profit that is being sustained from one year to the next, or whether profits are extinguishing every year and new ones are being created though political connections. However, given the broad persistence in profits that has been observed (McGahan & Porter, 2003) and the difficulty that firms may face in identifying and successfully exploiting new sources of profit every year, we believe that this is not a serious concern.

In conclusion, this study provides a fine-grained understanding of the role played by political connections in profit persistence, and the consequent implications for sustaining a firm’s performance. It highlights the importance of the micro and recurring benefits that political connections provide in emerging economies. The distinction that we draw between national-level and state-level politicians as well as between business group-affiliated and standalone firms highlights the heterogeneous ways in which CPA is associated with a firm’s performance.

Notes

It may seem counter-intuitive to argue that CPA can lead to profit persistence even when they do not have a direct effect on profits. A simple example can demonstrate why this is not contradictory. Consider the sustained profits that Coca-Cola and PepsiCo earn in the soft drinks industry. These can be attributed to limited rivalry (monopoly rents), or to their marketing capabilities in building and sustaining a brand (Ricardian rents) (Peteraf, 1993). In addition, to sustain their profits, these firms lobbied the US Congress to pass a legislation that preserved their right to grant exclusive territories to their bottlers (Yoffie, 2009). This political lobbying activity did not directly create profits; rather, it sustained the profits that these two companies were already making through limited rivalry and their marketing capabilities. Thus, the factors that lead to firm profits (such as limited rivalry or marketing capabilities) can be different from those (such as CPA) that lead to profit persistence, a point that we will discuss in more detail later in the paper.

Given the nature of CPA—it can be secretive and may attract penalties if revealed—it is difficult to provide direct and concrete evidence that political directors can influence government actions (Hadani and Schuler, 2013; Hillman et al., 1999; Lester et al, 2008). However, prior literature provides several anecdotal examples of how political directors can influence legislation and regulation (for example, see Hillman et al., 1999). The collective evidence from the broad literature on CPA (for example Baron, 1997; Frynas, Mellahi and Pigman, 2006; Hillman et al, 2004; Lux, 2016; Marvel, 1977; Rajwani and Liedong, 2015) is also in line with our claim that political directors can influence policies, legislation, regulation, and enforcement.

It is important to note that new projects are initiated by established companies as well. In fact, data from the Prowess Capex database shows that a large fraction of new projects in India (over 90%) are announced by firms that are more than 5 years old.