Abstract

Although marketers often introduce product innovations using line extensions, extant research provides little empirical evidence on whether and how this product strategy pays off. The objective of this study is to examine the effects of innovation and the relative roles of brand and marketing mix variables in the success of new line extensions. Using data from 196 new line extensions across 23 consumer packaged goods categories, the authors employ a two-stage approach to assess how innovation and parent brand strength impact line extension trial purchase. The authors find that innovative line extensions tend to have a higher level of average trial probability. The strongest marketing driver for successful innovative line extension introductions is parent brand strength. Non-innovative line extensions gain higher trial from greater distribution. The results offer guidance on how managers can better utilize brand strength and the marketing mix when employing a line extension strategy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Line extensions reflect an existing brand’s new product offerings within the same product class or product category (Keller 2013; Reddy et al. 1994). Within supermarket consumer packaged goods (CPG) categories, approximately 90% of new products introduced annually are line extensions (Neff 2005; Times and Trends 2010). The advantages of a line extension strategy include relatively lower costs and lower risk arising from leveraging the parent brand (Loken et al. 2010), and the ability to increase sales quickly and inexpensively (Quelch and Kenny 1994). While most line extensions involve minor changes from the parent brand (Desai and Keller 2002), there are line extensions that offer innovative features into the category (Ambler and Styles 1997; Loken et al. 2010). Indeed, introducing innovations through line extensions has become an increasingly important strategy. In consumer packaged goods categories, approximately 20–25% of new product extensions introduce new benefits or new features (Times and Trends 2004). On the one hand, an innovative line extension strategy can be an advantageous method to introduce a new feature or benefit, given positive associations with the parent brand (Loken et al. 2010). The returns from such innovative extensions are typically higher than “me-too” extensions according to anecdotal evidence (Times and Trends 2004 and 2010). On the other hand, it can be costly and risky to introduce innovations with an established brand due to negative spillovers if the new line extension fails (Bloodgood and McFarland 2004), thus mitigating the potential benefits of a line extension strategy. For example, Gatorade’s “G Series Fit” products were dropped after failing to appeal to a new target group of athletic consumers (Watson 2013). Alienating core customers continues to be cited as a key risk of line extension failure in such examples (Watson 2013).

The question remains as to whether and how an innovative line extension strategy can pay off. We address two main research issues in this study: (1) Does innovation and parent brand strength both independently and interactively improve or reduce the likelihood of consumer trial of a new line extension? (2) What are the relative roles of the marketing mix variables in the successful introduction of innovative new line extensions? These issues relate to existing gaps in the literature on the important interplay between innovation and brand extension strategy. Most extension studies focus on the role of parent brand and category specific factors (e.g., Aaker and Keller 1990; Dacin and Smith 1994; Völckner and Sattler 2006), the conditions that permit extending the parent brand to related or unrelated categories (e.g., Batra et al. 2010; Bambauer-Sachse et al. 2011; Carter and Curry 2013; Cutright et al. 2013; Heath et al. 2011; Keller and Aaker 1992; Kim and Roedder John 2008; Monga and Roedder John 2010), and the reciprocal relationship between the parent brand and its extensions (e.g., Balachander and Ghose 2003; Dens and De Pelsmacker 2010; Knapp et al. 2014; Sood and Keller 2012; Zimmer and Bhat 2004). Other research focuses on the role of parent brand experience in consumer adoption decisions (Kim and Sullivan 1998; Swaminathan et al. 2001, 2003; Völckner and Sattler 2006). While this stream of brand research provides important insights about brand extension strategy, the role of innovation in this line of inquiry is under-researched.

In particular, while an innovative extension may help broaden or revitalize the brand associations held by consumers (Loken et al. 2010), prior research does not connect parent brand strength to innovative line extension success. While studies find that product innovativeness is not a significant driver of new product performance (Evanschitzky et al. 2012; Henard and Szymanski 2001), these results may not hold useful guidance for innovations introduced under an existing brand as is common in CPG categories. For instance, innovation effects may be contingent on parent brand strength (Gielens and Steenkamp 2007; Steenkamp and Gielens 2003) and consumer experience with the parent brand (Kim and Sullivan 1998). If these contingency factors are not accounted for, the resulting innovation effects could be misleading.

When considering the additional effects of multiple marketing mix variables, the relative impacts of brand, innovation and the marketing mix instruments have not been examined in an integrated study of line extension performance. While there are empirical studies that examine the interaction between innovation and select marketing mix instruments (e.g., Bowman and Gatignon 1996; Slotegraaf and Pauwels 2008), the findings are limited by the scope of marketing variables examined. Considering marketing mix variables in isolation may cloud their relative roles in new product success (Ataman et al. 2008, 2010). More importantly, marketing mix variables are likely to be correlated with parent brand strength in the context of new line extensions. If such endogeneity is unaccounted for, it could introduce bias in the estimation of the relative impact of marketing mix variables on the purchase of a new extension product.

This study extends the extant literature in multiple ways. First, we highlight the role of innovation in line extension strategy by examining innovation’s main and moderating effects with brand and marketing mix variables. By integrating theories on brand signaling, innovation, and consumer information processing, we provide new insights to the brand extension and innovation literature. Empirically, we study consumer trial purchases across multiple product categories and thereby develop generalized findings about the effects of innovative line extension strategy in consumer packaged goods. The first, or trial, purchase is an important indicator of a new product’s market success (Steenkamp and Gielens 2003). The empirical analysis is based on a two-stage approach using data on 196 new line extensions from 23 consumer packaged goods categories. The two-stage approach entails a first stage to control for important consumer characteristics on trial purchase, while the second stage models the product-level analysis of the innovation, brand, and marketing mix effects. A two-stage approach is necessary since consumer characteristics vary within a given new line extension, whereas marketing mix variables pertain to a given new line extension but vary between new line extensions (Steenkamp and Gielens 2003). Second, unlike the previous innovation research which is limited to select marketing mix variables, we are able to study innovation interacting with all the marketing mix elements, and thus offer a more integrated perspective on the relative importance of marketing mix instruments to innovation’s advantages. Our analysis controls for potential endogeneity of marketing mix variables with parent brand strength and innovation.

Our empirical results allow us to identify different strategic drivers of new line extension trial purchase between innovative and non-innovative products. We find an innovation–brand link via the enhanced effects of parent brand strength on innovative line extensions trials. In addition, we find that distribution has smaller relative importance among innovative line extensions compared to non-innovative. By measuring the relative impact of brand, innovation and other marketing mix instruments, we offer guidance on how managers can better utilize the marketing mix when employing a line extension strategy.

Theoretical background

In this study we focus on innovative line extensions in consumer packaged goods, given the ubiquity of line extensions in CPG categories. Most innovations in the CPG industry relate to providing additional benefits and features to consumers through such avenues as packaging or formulation, and may therefore tend to be more incremental (Sorescu and Spanjol 2008). Although the CPG context in this study does not allow careful consideration of more radical innovation, the prevalence of CPG line extensions—many involving the introduction of innovative features and benefits—permits a careful examination of brand and innovation effects, as well as the impact of marketing mix activities.

To theorize the effects of brand and innovation on line extension success, we draw on theories of brand signaling and relevant consumer theories of innovation adoption. Since an innovative line extension is defined by the introduction of a new feature or benefit under a parent brand, consumers may respond not only to the parent brand effect, but also to their perception of an innovative product that first introduces a particular feature or benefit. Perceptions of the parent brand and innovative product benefits may also interact, such as a strong brand preference being able to overcome any uncertainty arising from an innovative feature.

Line extensions are introduced with the benefit of their parent brand’s support. Previous research suggests that extensions of strong brands have a greater tendency to be adopted because of the parent brand’s reputation (Loken et al. 2010). Strong brands signal high quality and have greater awareness, familiarity, and positive associations in the minds of consumers (Keller 2013). A strong brand’s reputation reduces perceived risk and acts as a form of insurance for consumers even if they have limited or no experience with the parent brand (Wernerfelt 1988, 1991). A brand name makes claims credible and reduces the risks perceived by the consumer (Erdem and Swait 1998; Miklos-Thal 2012). Indeed, previous empirical research shows that brand strength increases the trial probability of new products (Gielens and Steenkamp 2007; Steenkamp and Gielens 2003).

When addressing the brand and innovation effects, an additional source of innovation advantage may lie in the increased effectiveness of marketing mix activities (Bowman and Gatignon 1996). Ataman et al. (2008) demonstrate the importance of considering a full array of marketing mix effects on the growth of new brand introductions in CPG categories. However, Ataman et al. (2008) do not consider innovative line extensions that may leverage parent brand strength. We next review theories related to the effects of distribution, advertising and promotion on new product trial purchase. The relevant literature includes retailer adoption theory and consumer theories of information processing. Pricing aspects (which we discuss in the hypotheses) relate to well-known economic theories, where an innovative and differentiated product can allow for higher prices (D’Aspremont et al. 1979; Shaked and Sutton 1982).

The availability of new products in stores affects the chance for consumers to find and thus try new products (Jones and Ritz 1991; Wilbur and Farris 2014). Among the marketing mix variables, access to distribution is often the most influential factor to the success of new products according to empirical studies (Ataman et al. 2008; Völckner and Sattler 2006). Previous research demonstrates a positive effect of increased distribution on new product trial (Kalyanaram and Urban 1992; Steenkamp and Gielens 2003).

Many retailers strategically limit their assortments (Wilbur and Farris 2014). New products face challenges in gaining retail distribution (i.e., the number of stores willing to carry the new product), due to a surplus of new products and limited shelf space (Achrol 2012). According to the retailer adoption literature, retailers favor new products that enhance the product assortment portfolio and generate low cannibalization of private labels (van Everdingen et al. 2011). Thus, innovative line extensions should find favor among retailers and gain greater retail access, which is generally supported in the innovation literature (Alpert et al. 1992; Robinson and Fornell 1985).

Advertising and non-price promotional messages (such as through in-store feature promotions and retail displays) provide information about a new extension to consumers. Categorization theory suggests that consumers employ categorization to process information and evaluate line extensions (Keaveney et al. 2012). In other words, their cognitive categories are organized in a hierarchical way, where the parent brand is considered as the highest level category and line extensions represent lower-level sub-categories. Because line extensions are introduced in the same product category as the parent brand, they run the risk of lack of product differentiation that causes confusion among consumers (Quelch and Kenny 1994). When a new extension is overly similar to the brand’s existing products in the same product line, the categorization theory posits that consumers are likely to make mistakes in categorizing the new line extension leading to potentially negative evaluations (Keaveney et al. 2012).

The accessibility–diagnosticity theory provides a useful perspective to understand how consumers use information when evaluating extension products (Feldman and Lynch 1988). According to this theory, the likelihood that a piece of information is used by consumers as a basis of response depends on: (1) its accessibility (i.e., saliency) and the accessibility of other available pieces of information in memory, and (2) its diagnosticity (i.e., usefulness) for judgment. The model predicts that more accessible and diagnostic information is utilized more than other pieces of information. As a line extension uses an existing brand, consumers retain strong brand associations and experience in memory. The familiar brand represents a salient and diagnostic cue the consumer can utilize when evaluating a new product (Richardson et al. 1994).

Advertising and promotion thus provide consumers exposure to information about brands through two mechanisms: brand differentiation and brand salience. Advertising and promotion can help differentiate a new extension from its parent brand and mitigate the above categorization problem. Extension specific advertising provides information about the uniqueness of the new line extension’s message (Nijssen 1999), therefore reducing the risks of consumer confusion arising from categorization mistakes. Feature and display can reduce consumer cognitive efforts and the size of their consideration set (Mitra and Lynch 1995). Consequently, a displayed or featured extension would become more prominent, and aid in differentiation from other products (Shankar and Krishnamurthi 1996; Zhang 2006).

Advertising and sales promotion can also increase brand salience of a new line extension (Miller and Berry 1998). Drawing on the theory of hierarchy of effects in advertising, Martinez et al. (2009) argue that a goal of extension specific advertising is to increase brand awareness of extension products. Similarly, retailer promotion activities can increase consumer attention toward a new extension, thus encouraging trial purchase. For instance, researchers find evidence that the design characteristics of promotions affect sales via attention (e.g., Pieters et al. 2007; Zhang et al. 2009).

While this literature speaks to the positive effects of brand and marketing mix effects on new product purchase, the extant research is unclear on how these effects may differ for innovative and non-innovative line extensions. Consistent with our research questions, we develop hypotheses that examine how the brand and marketing mix effects on trial purchase are impacted by extension innovativeness.

Hypotheses

We develop hypotheses in two areas. First, we examine how an innovative line extension may influence trial purchase relative to introducing a non-innovative line extension. We consider both the main effect of innovative introduction and its interaction with parent brand strength. The line extension context leads to utilizing theories on umbrella branding and brand signaling. An innovative line extension in consumer packaged goods entails being the first to introduce a new feature or benefit, so adoption theories on how consumers respond to an innovation are also relevant. Second, we examine the effects of marketing mix variables on trial purchase of innovative line extensions. We focus on the trial purchase of a new product by consumers, since the trial purchase decision is associated with higher risks and limited knowledge of the product (Steenkamp and Gielens 2003). Repeat purchases are contingent on trial and influenced by satisfaction and other factors (Kim and Sullivan 1998) that are outside the scope of this study.

Innovation and brand effects on trial purchase

Previous research documents the use of line extensions as a means to introduce innovative benefits and features (Ambler and Styles 1997; Loken et al. 2010). While these innovations are relatively incremental (e.g., adding lime to carbonated beverage), a line extension is often novel in that it offers attributes never before seen in the category (e.g., Coke with Lime). In the consumer packaged goods industry, innovations introduced are typically marketing innovations related to packaging or formulation (Sorescu and Spanjol 2008), as opposed to technological innovations prevalent in consumer durables. Regardless, marketing innovations can still introduce a high level of complexity or novelty relative to existing products (Gielens and Steenkamp 2007).

The innovative and novel features introduced in a line extension can improve product evaluation and differentiate a brand from its competitors (Mukherjee and Hoyer 2001), and provide stimulation and a change from established patterns (Steenkamp and Gielens 2003). A more incremental innovation, particularly one that may relate to a familiar brand or product category such as in a line extension, may help a consumer positively perceive the new benefits that are introduced (Moreau et al. 2001). Being perceived as innovative may strengthen the attachment a consumer has toward a brand (Aaker and Jacobson 2001). In addition, when an innovative feature is introduced in an attempt to attract new customers, consumers may view the new line extension favorably. This effect may arise from the new feature or benefit providing an incentive for new customers to switch or try the innovative extension, and the use of a line extension approach generally allows the parent brand to signal the product benefits (Wernerfelt 1988, 1991). Indeed, a line extension that can serve new or evolving customer needs can strengthen customer loyalty (Chen and Hitt 2002). Certainly, the switching costs a customer encounters in a new innovation may inhibit trial in some cases, especially if the innovation is difficult to understand or radical (see Burnham et al. 2003 for an overview). However, recent evidence suggests that switching costs do not impede marketing innovations (Stanko et al. 2013) that tend to be prevalent in CPG line extensions. We therefore propose:

-

H1:

The average trial purchase probability is higher for an innovative line extension than a non-innovative extension.

Although H1 speaks somewhat generally to the effectiveness of a line extension strategy for introducing an innovative feature, the innovation–brand link will be stronger if the parent brand is stronger. The signaling effects of a strong brand may play a more important role with innovative line extensions. Innovative line extensions introduce a higher level of complexity relative to existing products (Gielens and Steenkamp 2007) and introduce new features which increase the uncertainty for consumers. In contrast, non-innovative line extensions offer attributes that consumers see in other brands. When consumers are uncertain about new features, firms can use their brand names to make their claims credible and reduce the risks perceived by the consumer (Erdem and Swait 1998). The stronger the parent brand, the more effectively it can communicate the advantages of the innovative feature or benefit (Chen and Hitt 2002; Wernerfelt 1991). Consumers attached to a strong brand may also increase their trial of an innovative product given the perceived value of being part of the brand base and a fear of being left out if they forgo trial (Farrell and Saloner 1986). We therefore propose:

-

H2:

The positive effects of an innovative line extension on trial purchase probability are greater for stronger brands.

Marketing mix effects on trial purchase for innovative line extensions

In developing marketing mix hypotheses for innovative line extensions, we are interested in whether consumer response (in the form of trial purchase) to the marketing efforts of a new product is different for an innovative line extension relative to a non-innovative extension. The relevant question is therefore whether the marginal marketing mix effects on trial purchase differ for innovative line extensions. Examining the interaction effects allows us to understand whether an innovative line extension somehow amplifies (or dampens) marketing mix effects on trial likelihood.

An implication of the retailer adoption literature is that a more innovative line extension will gain greater retail acceptance. While an innovative line extension may therefore receive increased levels of distribution relative to a non-innovative extension (a result we observe in our data sample), the interesting question is whether an innovative extension can better leverage the distribution support it receives. In other words, is there an interaction effect between innovation and distribution? We hypothesize an effect based on the expected behavior of consumers toward a line extension and the strategic behavior of retailers. When a preferred product is not available in the store, consumers could engage in search behavior and either buy another available product viewed as similar, or switch stores to find the preferred product (Ailawadi et al. 2006). As noted earlier in H1, consumers may prefer innovative line extensions due to novelty. The new benefits or features may influence consumer preference structure (Carpenter and Nakamoto 1989; Niedrich and Swain 2003) and enhance their favorability toward the new extension. Relative to a non-innovative extension, if a consumer finds that the innovative extension product is not in the store, the stronger preference would result in a greater likelihood to try another store rather than buy a different product. This is less likely for a non-innovative line extension that is out of stock, because consumers may simply purchase another product offering similar features. At the store level, an innovative line extension will generate stronger pull to stores and therefore receive greater distribution so the store does not lose the sale. At the product level, a stock-out is more likely to result in a lost purchase to another product for a non-innovative extension. Therefore, an increase in distribution would be more beneficial for non-innovative line extensions in order to reduce the chance of losing a purchase to another product. Thus, consumer response (in the form of trial purchase) to changes in distribution should be less sensitive for an innovative new extension relative to a non-innovative one. We therefore propose:

-

H3:

The positive effects of increased distribution on trial probability are smaller among innovative line extensions.

Although advertising and promotion play an important role in the introduction of new line extensions, the way consumers respond to information provided by these tools may depend on the innovativeness of a new product. On the one hand, an innovative extension has the memory accessibility advantage (Kardes et al. 1993) and results in less consumer confusion or categorization mistakes (Desai and Hoyer 1993). Therefore, additional advertising and promotion for innovative line extensions may generate little additional differentiation effects in the minds of consumers, thus limiting their effects on increased trial response. On the other hand, the brand salience effects of advertising and promotion can be complemented by the distinct features of an innovative extension (Slotegraaf and Pauwels 2008); such synergistic effects can further increase consumer attention and generate higher consumer trial.

We believe the limited differentiation effect for an innovative extension will prevail, based on the accessibility–diagnosticity perspective. Information or cues about the new product will be used or interpreted in a way that is consistent with any memory-based brand evaluations (Dick et al. 1990). The issue is how strongly the existing memory-based brand cues will be considered relative to advertising and promotional cues about new features when the new product is innovative. Because a non-innovative product extension has lower salience than an innovative extension, it decreases the accessibility and the use of the new product information provided by advertising and promotion relative to the memory-based brand cues. In contrast, an innovative extension is more salient; therefore, the detailed messages about the new features from advertising and promotion activities will become more accessible and diagnostic and thus processed compared to the brand information present in memory. However, such effects will be considered in relation to brand evaluations, and will possibly be negative since the consumer may generate counterarguments to the information being presented about a familiar brand but unfamiliar features (Campbell et al. 2003). For an innovative extension, the result is that (1) advertising and display information will have little additional differentiation effect, and (2) any processing of the advertising and display informational cues by a consumer may lead to negative evaluations, dampening the positive effects of advertising and promotion.

Thus, we propose the following hypotheses:

-

H4:

The positive effects of increased advertising on trial probability are smaller among innovative line extensions.

-

H5:

The positive effects of increased promotion on trial probability are smaller among innovative line extensions.

Economic theory suggests that high prices reduce trial probabilities of any new product. The industrial organization literature suggests product differentiation weakens price competition (D’Aspremont et al. 1979; Shaked and Sutton 1982). Innovative features can differentiate a brand from its competitors (Mukherjee and Hoyer 2001). As a result, innovative line extensions tend to have lower price elasticities (Ghosh et al. 1983). Extant research also suggests that new product innovation can lead to decreased differentiation and increased cross-brand price elasticities among already existing brands (van Heerde et al. 2004). Hence, we expect that the negative effects of price on trial purchase should be smaller among innovative extensions.

-

H6:

The negative effects of price on trial probability are smaller among innovative line extensions.

Data and methodology

The data for this study come from multiple sources: the 2008 IRI Marketing Data Set, ProductScan, and Ad Summary. The IRI Marketing Dataset provides UPCs, product descriptions, brand names, a list of products in a category, and consumer panel data which contain purchase histories and demographic information of IRI panelists in two BehaviorScan markets from 2001 to 2005 (Bronnenberg et al. 2008). The ProductScan database provides product descriptions and innovation ratings for new supermarket packaged goods introduced in the United States (e.g., Sorescu and Spanjol 2008). Ad Summary provides national advertising expenditures in the United States.

The data collection process starts by identifying new line extensions from 23 product categories represented in both the IRI and ProductScan datasets. The sample is limited to line extensions whose first sales occurred between Years 3 and 5 of the IRI dataset (December 30, 2002–December 25, 2005). Following Kim and Sullivan (1998), we pick line extensions introduced mid-sample in order to obtain consumer panel purchase observations before and after introduction. Observations prior to a line extension’s introduction are necessary to obtain reliable purchase histories, and observations after a line extension’s introduction are necessary to obtain measures of trial (Kim and Sullivan 1998). Building on previous research we use a one-year time frame to establish purchase histories (Swaminathan et al. 2001), and limit the trial observation period to the line extension’s first 52 weeks in the market (Steenkamp and Gielens 2003). The time frame is limited to the first year as the window for product acceptance is estimated to remain open for only 6 to 12 months (Gielens and Steenkamp 2007). To designate brand parentage, product descriptions are used to determine the lineage of a line extension. Table 1 lists the product categories and example line extensions from each category. Our sample contains 196 new line extensions.

Panelist selection

For each new line extension identified, we create a consumer panel from the IRI panel data. Our consumer panel includes only panelists who are good reporters as determined by IRI (Kruger and Pagni 2008). Consumer panels range from 3908 to 6053 panelists for each category. The variation in size is due to some panelists not purchasing in certain categories and other panelists dropping out or intermittently reporting. Specifically, the analysis excludes panelists who drop out or fail to report during a new line extension’s first year. Inclusion in the consumer panel is not determined by trial (or lack of trial) of the new line extension; a panelist is eliminated if he has no purchase of any product in the entire category during the relevant 52-week period.

Two-stage model and variable definitions

Modeling trial in the line extension’s first year using disaggregate consumer-level data requires two stages of estimation: a within product analysis in the first stage and a between products analysis in the second. The first stage analysis allows us to control for important consumer characteristics in trial purchase. The second stage analysis allows us to examine the effects of innovative versus non-innovative line extensions and test the hypotheses.

In the first stage, trial is modeled as a function of consumer-level characteristics identified in previous research (e.g., Steenkamp and Gielens 2003) and other control variables. If we let Tij = 1 denote the event that panelist i purchases the new line extension j, then

where, i = 1, 2, …, Nj number of households in the panel, j = 1, 2,…, J number of new line extension introductions, and Zi is the matrix of consumer characteristics.

In the context of line extensions, previous research finds parent brand experience (PBE), variety seeking (VS), and category experience (CEXP) as predictors of line extension trial (Kim and Sullivan 1998; Swaminathan et al. 2001, 2003). Parent brand users are more likely to try its new line extension because they transfer quality perceptions of the parent brand to the new product (Kim and Sullivan 1998). Variety seeking consumers are likely to try new extensions (Swaminathan et al. 2003). Consumers with experience in the category may react differently to new line extensions than consumers who are novices (Swaminathan et al. 2003). This is because frequency of purchasing from the category indicates knowledge or expertise in the category (Alba and Hutchinson 1987).

In addition, we control for prior innovative behavior (IB), price importance (PI), promotion sensitivity (PS), and consumer demographics. Innovative consumers seek products that make them unique and different (Burns 2007), and have lower perceived risks for new product trial (Cowart et al. 2008). We control for the panelists’ price importance and promotion sensitivity because line extensions are typically introduced with significant promotional activity (Swaminathan et al. 2003). Since our hypotheses relate to effects on innovative new line extensions, we control for consumer characteristics that relate to trying a new product more generally.

Consumer demographic control variables are household income (INC), household age (AGE), household education (EDU), and family size (SIZE). Previous research shows that those more willing to try a new product tend to be young, have high levels of income and education, and have large families (Bartels and Reinders 2011). Table 2 lists the consumer characteristics. All consumer characteristic variables are mean-centered in the analysis.

With the exception of prior innovative behavior, all consumer characteristic variables are obtained by using the panelist’s purchase history in the year prior to the introduction of the line extension. Parent brand experience equals the number of parent brand purchases divided by the total number of category purchases (Swaminathan et al. 2001). Variety seeking equals the number of unique brands that the panelist purchased in the category (Swaminathan et al. 2001). To account for variety seeking differences across categories, the panelist’s number of unique brands purchased is divided by the average number of unique brands purchased in the sample. Category experience equals the number of purchases from the category (Swaminathan et al. 2001). Price importance equals the average difference between the brand purchased and the price of the brand with the lowest unit price (Bawa et al. 1989). Promotion sensitivity equals the volume share of the panelist’s purchases that were purchased with a display, feature, or price promotion (Bawa et al. 1989).

Prior innovative behavior equals the number of innovative line extensions purchased by the panelist in the first 2 years of the dataset. Unlike parent brand experience or variety seeking purchases, purchases specific to an innovative extension occur less frequently. Therefore to more comprehensively capture innovative behavior, we use a two-year instead of a one-year prior period. Cognizant of the ongoing debate on measuring consumer innovativeness (Roehrich 2004), we use a measure that can be obtained retroactively. Our measure captures innovative behavior rather than innate innovativeness or domain specific innovativeness, although prior research has shown that all three measures correlate (Bartels and Reinders 2011).

Because all the independent variables in Eq. 1 are mean-centered, the estimated probability at the mean of explanatory variables equals exp(βoj)/(1+ exp(βoj)). Equivalently, the log of the odds ratio, log [Pr(Tij = 1) / Pr(Tij = 0)], equals βoj, which is the average probability of trial. In the second stage analysis for hypothesis testing, product innovativeness, marketing mix variables, and product category characteristics are regressed on the βo estimates for the new line extension to estimate their effects on average trial likelihood. Specifically,

where, j = 1, 2,…, J number of new line extension introductions, Ij, is an innovation dummy, Sj is parent brand’s strength, Dj is the line extension’s distribution support, Aj is the line extension’s advertising, FDj is the line extension’s feature and display, and RPj is the line extension’s relative price. Xj are category level control variables listed in Table 3.

Product innovativeness (I) equals 1 if ProductScan rates the line extension as being innovative, 0 otherwise. ProductScan rates a product according to six innovativeness dimensions: formulation, packaging, technology, positioning, merchandising, markets (see Table 2 in Sorescu and Spanjol 2008 for a discussion of this innovative dimensions). In our study, 86% of the innovative new line extensions are new formulations, 9% are innovative packaging, 3% are innovative merchandising, and 3% are innovative positioning. Because a preponderance of the innovative line extensions are of a single type (formulation), we measure product innovativeness on a 0–1 scale. All the innovative line extensions embody marketing innovations, which increase consumer benefits substantially compared with existing products either through new formulation or new packaging, and do not reflect technological innovations which tend to disrupt an industry (Sorescu and Spanjol 2008). Eighteen percent of new line extensions in our sample are innovative, a rate consistent with prior studies (Times and Trends 2004).

The parent brand strength (S) and marketing mix variables (D, A, FD, RP) are constructed using IRI weekly sales data in the panel data markets. Parent brand strength (S) equals the parent brand’s dollar market share in the year prior to line extension introduction (Reddy et al.1994). Distribution support (D) equals the line extension’s average weekly all commodity volume (ACV) weighted distribution (Ataman et al. 2008; Bronnenberg et al. 2000) in the first year. To illustrate, an 80% ACV-weighted distribution means that the line extension is sold in stores that account for 80% of all volume sold. The ACV weights give more distribution credit to a large volume store than a small volume store (Ataman et al. 2010). Store ACV weights are obtained from the IRI dataset.

To calculate the line extension’s first year feature and display (FD), we average the weekly ACV-weighted feature and display over the first 52 weeks. For any store in any given week, store-level feature and display equals one if at least one of the line extension’s SKU is on feature or display. The weekly ACV-weighted feature and display equals the weighted average of all store-level feature and display with store ACV as weights (Ataman et al. 2008).

Advertising (A) equals logarithm of 1 plus the advertising dollars in the line extension’s first year. Advertising dollars are obtained from Ad Summary. Ad Summary lists advertising dollars for line extensions as well as other brands belonging to the brand family. We count only the advertising dollars when only the line extension is listed, i.e., extension specific advertising (Nijssen 1999). This approach potentially underestimates the total advertising dollars for a new line extension, but it is impossible to verify whether a line extension is included in parent brand advertising. Finally, Relative Price (RP) equals the line extension’s price divided by the category price where line extension price and category price are weighted by volume shares.

The second stage analysis controls for category specific factors including number of brands in the category (BCAT), category purchase cycle (PC), price reduction rate (PRR) and deal rate (DR) in the category. Further, we define dummy variables for medium perishability (MP), high perishability (HP), medium stockpilability (MS), high stockability (HS), Food and Beverage category (FB), and Health and Beauty Aids category (HBA). Bronnenberg et al. (2008) provide these category specific values. Except for dummy variables, variables in the second stage analysis have been mean-centered.

Endogeneity in Eq. 2 may be present as marketing mix variables are influenced by innovativeness and parent brand strength. For this reason, we conduct a seemingly-unrelated regression estimation where Dj, Aj, FDj, and RPj are endogenous, and Sj, and Ij are exogenous variables. Thus,

where Dj, Aj, FDj, RPj, Sj, and Ij are as defined above, and PAj is the parent brand’s advertising. Parent brand advertising equals the logarithm of 1 plus advertising dollars for all products carrying the parent brand’s name. We use the residuals for Dj, Aj, FDj, and RPj obtained from Eq. 3 in the estimation of Eq. 2. We employ weighted least squares estimation using the inverse of the dependent variable’s estimated standard error as weights (Narasimhan et al. 1996; Steenkamp and Gielens 2003).

Results

Before running a logistic regression model for the 196 line extensions in the sample, we checked for multicollinearity among the independent variables listed in Table 2. The VIF values of these variables are all less than 2.5 for all 196 logistic regression models. This suggests that multicollinearity is not a problem with our stage 1 independent variables. To assess model fit, McFadden’s R-Square was calculated, and these range from 0.03 to 0.70 for the 196 stage 1 regressions. In addition, we calculated the percentage of correctly predicted responses using a 50% cut-off. These percentages range from 79 to 99%.

For the second stage analysis, the VIF of all the variables of interest are less than 2.10. Several of the control variables do have VIF exceeding 10; food dummy (13.28), purchase cycle (13.03), medium perishability (10.03), medium stockability (11.35), and high stockability (12.02). These variables do not pose a problem since they are all control variables and the VIF of the variables of interest are below 2.5 (Allison 2012). The second stage R2 equals .93.

Our second stage estimation results are shown in Table 4. Innovative line extensions tend to have higher average trial probabilities (γ1 = .35, p < .05) in support of H1. Brand strength is positive and significant (γ2 = .15, p < .01) and its effect is higher for innovative line extensions (γ7 = .28, p < .01) in support of H2. Distribution is positive and significant (γ3 = .54, p < .01), and its effect is lower among innovative line extensions (γ8 = -.30, p < .05) in support of H3. Advertising is positive and significant (γ4 = .15, p < .01) and its interaction with innovativeness is negative but not significant (γ9 = -.15, p = .11). Thus, H4 is not supported. Feature and display is positive and significant (γ5 = .20, p < .01) but its interaction with innovativeness is not significant (γ10 = .02, p > .90). As expected, Relative Price is negative (γ6 = -.17, p < .01), but its interaction with innovativeness is not significant (γ11 = -.03, p > .70). H5 and H6 are not supported.

We find distribution to have considerably stronger effects on purchase than advertising, promotion, and pricing, results consistent with prior empirical findings (Ataman et al. 2008, 2010). The lack of support for the advertising and promotion hypotheses could be due to the conflicting influences of brand differentiation and salience for an innovative extension. In addition, the insignificance concerning the price interaction effects may be attributed to the nature of innovations in the CPG industry not being sufficient for dramatically higher prices.

Empirical application

To illustrate the managerial relevance of our findings, we applied our estimated model to several hypothetical decisions through additional analyses. To decide whether to introduce an innovative extension and evaluate the cost of waiting, managers need information to quantify the potential gains of an innovation in terms of incremental trials. To evaluate the extent of innovation’s impact on trial, we use the estimated coefficients in Table 4 and compute the average difference in odds of trial purchase between innovative and non-innovative line extensions. We find that innovation increases the odds of line extension trial by 42%. This is because the product innovation estimated coefficient equals .35, which implies that the increase in trial odds due to innovation equals 100*(e.35-1) (Allison 1999).

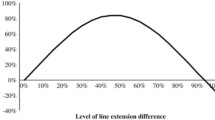

Another important question to a manager practicing the line extension strategy is the relative effects of brand strength on innovative products. This could be helpful to calculate profit implications. Our estimation results suggest that a one unit increase in brand strength increases an innovative line extension’s odds of trial by 53% (100*(e.15+.28-1)), whereas the same unit increase in brand strength increases a non-innovative line extension’s odds of trial by only 16% (100*(e.15-1)). Figure 1 illustrates the effects of brand strength on trial of innovative versus non-innovative line extensions.

Similar to brand strength, increasing distribution support increases the odds of trial for both innovative and non-innovative line extensions. In contrast to brand strength, and consistent with our hypothesis, distribution’s effects are greater for non-innovative line extensions. Before deciding on the extent of retail push, managers need to evaluate the marginal impact of distribution. Therefore we undertake a similar analysis as done previously. A one unit increase in distribution support for a non-innovative line extension increases its odds of trial by 76% (100*(e.54-1)), whereas the same unit increase in distribution support increases an innovative line extension’s odds of trial by only 27% (100*(e.54-.30-1)). These effects are depicted in Fig. 2. Note that at some level of distribution support (shown in Fig. 2 at 82% distribution support), the odds of trial are lower for innovative line extensions than non-innovative extensions, when other variables are held to their mean values. Distribution support can therefore be a powerful boost to trial purchase for non-innovative extensions.

The relative effect sizes of the marketing mix variables are shown in Fig. 3. Brand strength is the most important marketing mix instrument in an innovative line extension’s trial purchase (relative effect of 45%), while distribution is the most important marketing mix instrument in a non-innovative line extension’s trial (relative effect of 45%). The relative effect sizes speak to the need for a strong brand to successfully introduce an innovative line extension, perhaps due to a strong brand’s risk reduction mechanism. The support offered by a strong brand appears to be relatively unimportant to non-innovative line extensions, which by their very nature pose relatively low risk to the consumer. Instead, a high distribution support is relatively more critical because of the non-innovative line extension’s lack of differentiation and potential for cannibalization of existing products. Stock-outs for a non-innovative extension can also lead to purchase of an alternative product, reducing the trial purchase rate for the new extension. The relatively smaller effect sizes for the other marketing mix variables are generally consistent with past research (Ataman et al. 2008). Unlike past studies, we are able to demonstrate the effects of innovation and parent brand strength, in addition to the marketing mix effects.

Discussion

By studying the interactions between brand and innovation, our study brings the two streams of research closer by integrating brand signaling, retailer and consumer adoption theories, and information processing. Specifically, we theorize and demonstrate that parent brand strength supports innovation. CPG line extensions provide a rich context for us to empirically test the brand–innovation interdependency. Our findings suggest the importance of the signaling effects of a brand in introducing innovations. Innovations introduce a relatively high level of complexity and uncertainty for consumers, which can be mitigated by a strong brand’s credibility. Our results show that parent brand strength enhances the positive effects of innovation on consumer trial. In contrast, non-innovative line extensions draw relatively weaker advantages from a strong parent brand. Having the highest relative effect size on line extension trial, in comparison to other marketing mix variables, demonstrates the importance of parent brand strength for innovative extensions.

Product innovation is viewed as a key source of competitive advantage and value creation (Mizik and Jacobson 2003). The results of this research provide support for innovation advantages in the context of consumer packaged goods categories, where innovations are often introduced as line extensions that provide new benefits and features. Using a line extension strategy to introduce innovations brings potential benefits to the parent brand, such as revitalizing the parent brand, creating long range opportunities, and securing first mover advantages for that brand (Loken et al. 2010). Our findings show that the parent brand brings advantages to an innovative extension. In particular, an advantage of innovation is to increase the trial likelihood of new line extensions, and this innovative advantage is larger with greater parent brand strength. Given the numerous product categories in our analysis, our research contributes to the extant empirical generalizations of innovation’s direct positive effects in the performance of new consumer packaged goods.

By studying the interplay of innovation with the entire marketing mix, we are able to provide a broader and more integrated perspective on the relative advantages of innovation. While distribution support is the second most important driver of trial for innovative line extensions, its influence is much smaller compared to distribution’s effect for non-innovative line extensions. That is, the marginal returns of increased distribution for non-innovative line extensions are more substantial. This improves our understanding about how non-innovative line extensions can “catch up” or compensate for a lack of innovative features. Non-innovative extensions can achieve greater effectiveness from increased distribution efforts.

Previous research in repeat-purchase product categories finds that distribution strongly influences category market shares and even plays the greatest role in brand success (Ataman et al. 2008; Bronnenberg et al. 2000; Kalyanaram and Urban 1992; Völckner and Sattler 2006). Its strong effect is demonstrated in studies that use aggregate measures of new products success (e.g., sales and category market shares) as well as experiments. With the use of both consumer-level purchase data and aggregate market-level data, our study complements this previous research by supporting the claim that distribution is a significant predictor of new product trial. More importantly, distribution’s effect is strongest compared to the rest of the marketing mix elements on trial purchase for new non-innovative line extensions.

We extend the line extension literature by proving a finer-grained understanding on the role of parent brand in line extension strategy. Most extension studies focus on the relationship between the parent brand and its extension, and the benefits of strong and high equity brands are well documented in extension literature (see Loken et al. 2010 for a review). Evidence supports the assumption that new extensions succeed because of consumer’s familiarity and experience with the parent brand (Loken et al. 2010). Consistent with previous line extension literature (Aaker and Keller 1990; Dacin and Smith 1994; Reddy et al. 1994), parent brand strength has a significant positive effect in our study. We expand the extant line extension research by empirically demonstrating that parent brand strength has a greater role when line extensions are innovative. Our empirical study is the first to comprehensively integrate innovation, brand strength, and marketing mix effects for new line extensions.

Managerial implications

Our findings provide important guidance for managers in the areas of brand and product management. Innovations are a critical factor driving brand growth and brands represent an important platform to launch innovations. Concerning the latter aspect, our research provides additional insights into how to introduce innovations with a line extension strategy. First, compared to other marketing mix elements, brand strength has the largest effect (45%) on introductions of innovative line extensions. While it may appear intuitive to use a strong brand to introduce an innovative line extension, managers need to know the extent of the brand impact on trials to better plan a new product’s marketing mix expenditures. Furthermore, our empirical application illustrates that the trial benefits of a brand may diminish significantly for a non-innovative line extension (from 53 to 16%). This implies that when practicing a line extension strategy, non-innovative introductions (even with strong brands) can be potentially disadvantaged due to the limited ability to leverage their brand equity. Additionally, while previous study indicates that distribution is the most important factor for new product introductions, we find that the distribution effect is contingent on the innovativeness of new line extensions. Greater distribution benefits non-innovative extensions more, helping to prevent lost trial sales due to stock-outs. Lastly, managers should avoid the temptation to overprice innovative line extensions relative to their non-innovative counterparts. Our results show that price and innovation interaction effects are absent, which suggests that line extension innovations may not fully justify higher relative prices. In fact, Gatorade Fit’s price premium was a major flaw in its introduction and was cited as one reason for its failure (Watson 2013).

For managers practicing a non-innovative line extension strategy, we offer several suggestions. First, compared to other marketing mix elements, the parent brand factor appears to be less critical as suggested by conventional wisdom and literature in the non-innovative case. This implies that the disadvantages faced by weaker brands can be compensated by greater marketing expenditures such as distribution and promotion. In our study, we find that distribution support is the strongest driver of consumer trials for non-innovative line extensions. The relative gains on expanding distribution outlets are disproportionally higher for a non-innovative product. In addition, feature and display represent the second-most important factor. Although our study does not find an interaction effect with innovation, the significant main effect indicates that managers allocate more resources toward the promotion tools in order to increase the differentiation and salience of the new line extensions.

Limitations

The findings in this study are subject to several limitations and potential extensions for future research. First, this study does not have a direct measure of psychological factors that previous studies have shown to influence the tendency to adopt new products. Such measures are impossible to obtain retroactively. We mitigate this problem by including previous innovative behavior as a predictor in our model. Previous research has shown that behavioral measures serve as alternative predictors to attitudinal measures (Steenkamp and Gielens 2003), and our study consistently uses behavior-based variables such as past purchases and trial purchase. Future studies may consider using survey instruments to better understand consumer adoption decisions concerning innovative line extensions.

Second, previous research shows that an innovation’s relative advantage and complexity are significant drivers of adoption behavior (Arts et al. 2011; Rogers 2003). In the context of our study, the sample did not allow a detailed analysis of various types or magnitude of innovation. Incorporating multiple dimensions of an innovation may offer additional insights into the effects of marketing mix variables on line extension trial. Relative advantage and complexity may play a bigger role in technological innovations than in the marketing innovations used in this study. Future research can investigate the moderating effects of these factors on marketing mix effectiveness in product markets where new introductions offer a higher degree of complexity and technological advantage relative to existing products.

Third, because we use market share as a proxy for brand strength, the innovation–brand link is limited to the market outcome dimension of brand strength. Brand strength can also reside within the consumer mindset (Ailawadi et al. 2003; Hoeffler and Keller 2003). These mindset measures are not obtainable due to our use of historical data. Nevertheless, market share can serve as a proxy since previous studies use it as a measure of brand strength (e.g., Chaudhuri and Holbrook 2001; Ho-Dac et al. 2013; Reddy et al. 1994) and the results are limited to the market outcome dimension (Houston 2004). Future studies that accommodate brand strength’s multi-dimensionality can explore the innovation–brand link.

Fourth, this study uses advertising expenditures to determine advertising’s impact on consumer trial. Our results show that the conflicting influences of brand differentiation and salience for an innovative extension may cancel each other out. Future research can investigate the impact of advertising content to determine which of the two effects dominate.

Finally, this study does not include competitive reactions to new product entry, which may reduce the new product’s marketing mix effectiveness. Robinson (1988) finds that marketing mix reactions to entry are limited. However, the ability of an innovative line extension to leverage its marketing efforts beyond trial purchase may reveal interesting long-term effects that we do not address. We hope that the brand–innovation effects on trial purchase we demonstrate in this study, and the associated marketing mix effects, will motivate additional research on the important role of brands on innovative product introductions.

References

Aaker, D. A., & Jacobson, R. (2001). The value relevance of brand attitude in high-technology markets. Journal of Marketing Research, 38(4), 485–493.

Aaker, D. A., & Keller, K. L. (1990). Consumer evaluations of brand extensions. Journal of Marketing, 54(1), 27–41.

Achrol, R. S. (2012). Slotting allowances: a time series analysis of aggregate effects over three decades. Journal of the Academy of Marketing Science, 40(5), 673–694.

Ailawadi, K. L., Lehmann, D. R., & Neslin, S. A. (2003). Revenue premium as an outcome measure of brand equity. Journal of Marketing, 67(4), 1–17.

Ailawadi, K. L., Harlam, B. A., Cesar, J., & Trounce, D. (2006). Promotion profitability for a retailer: the role of promotion, brand, category, and store characteristics. Journal of Marketing Research, 53(4), 518–535.

Alba, J., & Hutchinson, W. J. (1987). Dimensions of consumer expertise. Journal of Consumer Research, 13(4), 411–454.

Allison, P. D. (1999). Logistic regression using the SAS system: theory and application. Cary: SAS Institute Inc.

Allison, P. D. (2012). When can you safely ignore multicollinearity. Retrieved from http://www.statisticalhorizons.com/multicollinearity.

Alpert, F., Kamins, M. H., & Graham, J. L. (1992). An examination of reseller buyer attitudes toward order of brand entry. Journal of Marketing, 56(3), 25–37.

Ambler, T., & Styles, C. (1997). Brand development versus new product development: towards a process of model extension decision. Journal of Product and Brand Management, 6(4), 13–26.

Arts, J. W. C., Frambach, R. T., & Bijmolt, T. H. A. (2011). Generalizations on consumer innovation adoption: a meta-analysis on drivers of intention and behavior. International Journal of Research in Marketing, 28(2), 134–144.

Ataman, M. B., Mela, C. F., & van Heerde, H. J. (2008). Building brands. Marketing Science, 27(6), 1036–1054.

Ataman, M. B., van Heerde, H. J., & Mela, C. F. (2010). The long term effect of marketing strategy on brand sales. Journal of Marketing Research, 47(5), 866–882.

Balachander, S., & Ghose, S. (2003). Reciprocal spillover effects: a strategic benefit of brand extensions. Journal of Marketing, 67(1), 4–13.

Bambauer-Sachse, S., Huttl, V., & Gierl, H. (2011). Can advertising elements improve consumer evaluations of brand extensions with a moderate or low fit. Psychology and Marketing, 28(2), 205–218.

Bartels, J., & Reinders, M. J. (2011). Consumer innovativeness and its correlates: a propositional inventory for future research. Journal of Business Research, 64(6), 601–609.

Batra, R., Lenk, P., & Wedel, M. (2010). Brand extension strategy planning: empirical estimation of brand-category personality fit and atypicality. Journal of Marketing Research, 47(2), 335–347.

Bawa, K., Landwehr, J. T., & Krishna, A. (1989). Consumer response to retailer’s marketing environments: an analysis of coffee purchase data. Journal of Retailing, 65(4), 471–495.

Bloodgood, J. M., & McFarland, R. G. (2004). New product innovation: a comparison of the risks and rewards of offering new products and brand extensions. Journal of Business and Entrepreneurship, 16(2), 23–36.

Bowman, D., & Gatignon, H. (1996). Order of entry as a moderator of the effect of marketing mix on market share. Marketing Science, 15(3), 222–242.

Bronnenberg, B. J., Mahajan, V., & Vanhonacker, W. R. (2000). The emergence of market structure in new repeat purchase categories: the interplay of market share and retailer distribution. Journal of Marketing Research, 37(1), 16–31.

Bronnenberg, B. J., Kruger, M. W., & Mela, C. F. (2008). Database paper: the IRI marketing data set. Marketing Science, 27(4), 745–748.

Burnham, T. A., Frels, J. K., & Mahajan, V. (2003). Consumer switching costs: a typology, antecedents, and consequences. Journal of the Academy of Marketing Science, 31(2), 109–126.

Burns, D. J. (2007). Toward an explanatory model of innovative behavior. Journal of Business and Psychology, 21(4), 461–488.

Campbell, M. C., Keller, K. L., Mick, D. G., & Hoyer, W. D. (2003). Brand familiarity and advertising repetition effects. Journal of Consumer Research, 30(2), 292–304.

Carpenter, G. S., & Nakamoto, K. (1989). Consumer preference formation and pioneering advantage. Journal of Marketing Research, 26(3), 285–298.

Carter, R., & Curry, D. (2013). Perceptions versus performance when managing extensions: new evidence about the role of fit between a parent brand and an extension. Journal of the Academy of Marketing Science, 41(2), 253–269.

Chaudhuri, A., & Holbrook, M. B. (2001). The chain of effects from brand trust and brand affect to brand performance: the role of brand loyalty. Journal of Marketing, 65(2), 81–93.

Chen, P.-Y., & Hitt, L. M. (2002). Measuring switching costs and the determinants of customer retention in internet-enabled businesses: a study of the online brokerage industry. Information Systems Research, 13(3), 255–274.

Cowart, K. O., Fox, G. L., & Wilson, A. E. (2008). A structural look at consumer innovativeness and self-congruence in new product purchases. Psychology and Marketing, 25(12), 1111–1130.

Cutright, K. M., Bettman, J. R., & Fitzsimons, G. J. (2013). Putting brands in their place: how a lack of control keeps brands contained. Journal of Marketing Research, 50(3), 365–377.

D’Aspremont, C., Gabszewicz, J. J., & Thisse, J.-F. (1979). On Hotelling’s ‘stability in competition’. Econometrica, 47(5), 1145–1150.

Dacin, P., & Smith, D. C. (1994). The effect of brand portfolio characteristics on consumer evaluations of brand extensions. Journal of Marketing Research, 31(2), 229–242.

Dens, N., & de Pelsmacker, P. (2010). Attitudes toward the extension and parent brand in response to extension advertising. Journal of Business Research, 63(11), 1237–1244.

Desai, K. K., & Hoyer, W. D. (1993). Line extensions: a categorization and an information processing perspective. Advances in Consumer Research, 20(1), 599–606.

Desai, K. K., & Keller, K. L. (2002). The effects of ingredient branding strategies on host brand extendibility. Journal of Marketing, 66(1), 73–92.

Dick, A., Chakravarti, D., & Beihal, G. (1990). Memory-based inferences during choice. Journal of Consumer Research, 17(1), 82–93.

Erdem, T., & Swait, J. (1998). Brand equity as a signaling phenomenon. Journal of Consumer Psychology, 7(2), 131–157.

Evanschitzky, H., Eisend, M., Calantone, R., & Jiang, Y. (2012). Success factors of product innovation: an updated meta-analysis. Journal of Product Innovation Management, 29(S1), 21–37.

Farrell, J., & Saloner, G. (1986). Installed base and compatibility: innovation, product preannouncements, and predation. American Economic Review, 76(5), 940–955.

Feldman, J. M., & Lynch, J. G. (1988). Self-generated validity and other effects of measurement on belief, attitude, intention, and behavior. Journal of Applied Psychology, 73(3), 421–435.

Ghosh, A., Neslin, S., & Shoemaker, R. (1983). A comparison of market share models and estimation procedures. Journal of Marketing Research, 21(2), 202–210.

Gielens, K., & Steenkamp, J.-B. E. M. (2007). Drivers of consumer acceptance of new packaged goods: an investigation across products and countries. International Journal of Research in Marketing, 24(2), 97–111.

Heath, T. B., DelVecchio, D., & McCarthy, M. S. (2011). The asymmetric effects of extending brands to lower and higher quality. Journal of Marketing, 75(4), 3–20.

Henard, D. H., & Szymanski, D. M. (2001). Why some new products are more successful than others. Journal of Marketing Research, 38(3), 362–375.

Ho-Dac, N. N., Carson, S. J., & Moore, W. L. (2013). The effects of positive and negative online customer reviews: do brand strength and category maturity matter? Journal of Marketing, 77(6), 37–53.

Hoeffler, S., & Keller, K. L. (2003). The marketing advantages of strong brands. Journal of Brand Management, 10(6), 421–445.

Houston, M. B. (2004). Assessing the validity of secondary data proxies for marketing constructs. Journal of Business Research, 57(2), 154–161.

Jones, M. J., & Ritz, C. J. (1991). Incorporating distribution into new product diffusion models. International Journal of Research in Marketing, 8(2), 91–112.

Kalyanaram, G., & Urban, G. (1992). Dynamic effects of the order of entry on market share, trial penetration, and repeat purchases for frequently purchased consumer goods. Marketing Science, 11(3), 235–250.

Kardes, F. R., Kalyanaram, G., Chandrashekaran, M., & Dornoff, R. J. (1993). Brand retrieval, consideration set composition, consumer choice, and the pioneering advantage. Journal of Consumer Research, 20(1), 62–75.

Keaveney, S. M., Herrmann, A., Befurt, R., & Landwehr, J. R. (2012). The eyes have it: how a car’s face influences consumer categorization and evaluation of product line extensions. Psychology and Marketing, 29(1), 36–51.

Keller, K. L. (2013). Strategic brand management: Building, measuring and managing brand equity. Upper Saddle River: Prentice Hall.

Keller, K. L., & Aaker, D. A. (1992). The effects of sequential introduction of brand extensions. Journal of Marketing Research, 29(1), 35–60.

Kim, H., & Roedder John, D. (2008). Consumer response to brand extensions: construal level as a moderator of the importance of perceived fit. Journal of Consumer Psychology, 18(2), 116–126.

Kim, B. D., & Sullivan, M. W. (1998). The effect of parent brand experience on line extension trial and repeat purchase. Marketing Letters, 9(2), 181–193.

Knapp, A., Hennig-Thurau, T., & Mathys, J. (2014). The importance of reciprocal spillover effects for the valuation of bestseller brands: introducing and testing a contingency model. Journal of the Academy of Marketing Science, 42(2), 205–221.

Kruger, M. W., & Pagni, D. (2008). IRI academic data set description, version 1.311. Chicago: Information Resources Incorporated.

Loken, B., Joiner, C., & Houston, M. (2010). Leveraging a brand through brand extensions: a review of two decades of research. In B. Loken, R. Ahluwalia, & M. Houston (Eds.), Brands and brand management: contemporary research perspectives (pp. 11–37). New York: Routledge.

Martínez, E., Montaner, T., & Pina, J. M. (2009). Brand extension feedback: the role of advertising. Journal of Business Research, 62(3), 305–313.

Miklos-Thal, J. (2012). Linking reputations through umbrella branding. Quantitative Marketing and Economics, 10(3), 335–374.

Miller, S., & Berry, L. (1998). Brand salience versus brand image: two theories of advertising effectiveness. Journal of Advertising Research, 38(5), 77–82.

Mitra, A., & Lynch, J. G., Jr. (1995). Toward a reconciliation of market power and information theories of advertising effects on price elasticity. Journal of Consumer Research, 21(4), 644–659.

Mizik, N., & Jacobson, R. (2003). Trading off between value creation and value appropriation: the financial implications of shifts in strategic emphasis. Journal of Marketing, 67(1), 63–76.

Monga, A. B., & Roedder John, D. (2010). What makes brands elastic? The influence of brand concept and styles of thinking on brand extension evaluation. Journal of Marketing, 74(3), 80–92.

Moreau, C. P., Lehmann, D. R., & Markman, A. B. (2001). Entrenched knowledge structures and consumer response to new products. Journal of Marketing Research, 38(1), 14–29.

Mukherjee, A., & Hoyer, W. D. (2001). The effects of novel attributes on product evaluation. Journal of Consumer Research, 28(3), 462–472.

Narasimhan, C., Neslin, S. A., & Sen, S. K. (1996). Promotional elasticities and category characteristics. Journal of Marketing, 60(2), 17–30.

Neff, J. (2005). Small ball: marketers rely on line extensions. Advertising Age, 76(15), 10–11.

Niedrich, R. W., & Swain, S. D. (2003). The influence of pioneer status and experience order on consumer brand preference: a mediated effects model. Journal of the Academy of Marketing Science, 31(4), 468–480.

Nijssen, E. J. (1999). Success factors of line extensions of fast moving consumer goods. European Journal of Marketing, 33(5/6), 450–469.

Pieters, R., Wedel, M., & Zhang, J. (2007). Optimal feature advertising design under competitive clutter. Management Science, 53(11), 1815–1828.

Quelch, J. A., & Kenny, D. (1994). Extend profits not product lines. Harvard Business Review, 72(5), 153–160.

Reddy, S. K., Holak, S., & Bhat, S. (1994). To extend or not to extend: success determinants of line extensions. Journal of Marketing Research, 31(2), 243–262.

Richardson, P. S., Dick, A. S., & Jain, A. K. (1994). Extrinsic and intrinsic cue effects on perceptions of store brand quality. Journal of Marketing, 58(4), 28–36.

Robinson, W. T. (1988). Marketing mix reactions to entry. Marketing Science, 7(4), 368–385.

Robinson, W. T., & Fornell, C. (1985). Sources of market pioneer advantages in consumer goods industries. Journal of Marketing Research, 22(3), 305–317.

Roehrich, G. (2004). Consumer innovativeness: concepts and measurements. Journal of Business Research, 57(6), 671–677.

Rogers, E. M. (2003). Diffusion of innovations. New York: Free Press.

Shaked, A., & Sutton, J. (1982). Relaxing price competition through product differentiation. Review of Economic Studies, 49(1), 3–13.

Shankar, V., & Krishnamurthi, L. (1996). Relating price sensitivity to retailer promotional variables and pricing policy: an empirical analysis. Journal of Retailing, 72(3), 249–272.

Slotegraaf, R. J., & Pauwels, K. (2008). The impact of brand equity and innovation on the long-term effectiveness of promotions. Journal of Marketing Research, 45(3), 293–306.

Sood, S., & Keller, K. L. (2012). The effects of brand name structure on brand extension evaluations and parent brand dilution. Journal of Marketing Research, 49(3), 373–382.

Sorescu, A. B., & Spanjol, J. (2008). Innovation’s effect on firm value and risk: insights from consumer packaged goods. Journal of Marketing, 72(2), 114–132.

Stanko, M. A., Bohlmann, J. D., & Molina-Castillo, F. (2013). Demand-side inertia factors and their benefits for innovativeness. Journal of the Academy of Marketing Science, 41(6), 649–668.

Steenkamp, J.-B. E. M., & Gielens, K. (2003). Consumer and market drivers of the trial probability of new consumer packaged goods. Journal of Consumer Research, 30(3), 368–384.

Swaminathan, V., Fox, R. J., & Reddy, S. K. (2001). The impact of brand extension introduction on choice. Journal of Marketing, 65(4), 1–15.

Swaminathan, V., Fox, R. J., & Reddy, S. K. (2003). Sequential brand extensions and brand choice behavior. Journal of Business Research, 56(6), 431–442.

Times and Trends. (2004). Innovative benefits drive superior sales. Chicago: Information Resources, Inc.

Times and Trends. (2010). 15 years of new product pacesetters: Excellence in innovation drives CPG to the next level. Chicago: Information Resources, Inc.

van Everdingen, Y. M., Sloot, L. M., van Nierop, E., & Verhoef, P. C. (2011). Towards a further understanding of the antecedents of retailer new product adoption. Journal of Retailing, 87(4), 579–597.

van Heerde, H. J., Mela, C. F., & Manchanda, P. (2004). The dynamic effect of innovation on market structure. Journal of Marketing Research, 41(2), 166–183.

Völckner, F., & Sattler, H. (2006). Drivers of brand extension success. Journal of Marketing, 70(2), 1–34.

Watson, E. (2013). Gatorade G Series Fit failed because it offered ‘entry level products to advanced users at high prices’ says Euromonitor. Retrieved from http://www.nutraingredients-usa.com/Manufacturers/Gatorade-G-Series-Fit-failed-because-it-offered-entry-level-products-to-advanced-users-at-high-prices-says-Euromonitor.

Wernerfelt, B. (1988). Umbrella branding as a signal of new product quality: an example of signaling by posting a bond. Rand Journal of Economics, 19(3), 458–466.

Wernerfelt, B. (1991). Brand loyalty and market equilibrium. Marketing Science, 10(3), 229–245.

Wilbur, K. C., & Farris, P. W. (2014). Distribution and market share. Journal of Retailing, 90(2), 154–167.

Zhang, J. (2006). An integrated choice model incorporating alternative mechanisms for consumers’ reactions to in-store display and feature advertising. Marketing Science, 25(3), 278–290.

Zhang, J., Wedel, M., & Pieters, R. (2009). Sales effects of attention to feature advertisements: a Bayesian mediation analysis. Journal of Marketing Research, 46(5), 669–681.

Zimmer, M. R., & Bhat, S. (2004). The reciprocal effects of extension quality and fit on parent brand attitude. Journal of Product and Brand Management, 13(1), 37–46.

Author information

Authors and Affiliations

Corresponding author

Additional information

Authors’ Note

All estimates and analyses in this paper based on IRI data are by the authors and not by IRI.

Rights and permissions

About this article

Cite this article

Sinapuelas, I.C.S., Wang, HM.D. & Bohlmann, J.D. The interplay of innovation, brand, and marketing mix variables in line extensions. J. of the Acad. Mark. Sci. 43, 558–573 (2015). https://doi.org/10.1007/s11747-015-0437-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11747-015-0437-6