Abstract

Slotting fees and related discounts are important but controversial mechanisms for obtaining shelf space in marketing channels for consumer packaged goods. The theoretical field is divided between the efficient market and the market power schools of thought. Results from empirical studies and analytical models point in different directions. This paper analyzes trends in key macro economic variables to see if the patterns are more consistent with an underlying market efficiency model vs. a market power one. The data span 30+ years and focus on retailers in the marketing channel for food and kindred products. The variables studied include new product introductions, retail selling area, consumer price indices, profitability, cost of goods sold and selling expenditures. Efficient market explanations do not fare well in the analyses in comparison with market power explanations for practically all the variables studied. The paper conlcudes with recommendations for regulators and retail management.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Slotting fees emerged around 1982 as modest charges levied by retailers for introducing new products into distribution. They proliferated rapidly and soon became a topic of academic debate (Bloom et al. 2000; Desrochers and Wilkie 2003). By the turn of the century a study by the FTC estimated the average slotting allowance paid per item per retailer ranged between $2,300 and $21,800 (FTC 2003). For the grocery industry as a whole, slotting amounts to an estimated $9 billion, representing 2% of sales and 13% of trade promotion spending (Cannondale 2002; FASB 2001).

Initial criticism of slotting fees came from many quarters—small and large manufacturers, small retailers, public policy and regulatory agents, as well as academic scholars. On the other hand a number of theories see them as an efficient market mechanism. The lack of any policy statement from federal regulators appears to have legitimized the fees, though the exception seems to be in the distribution of products that have potential for consumer abuse and social harm. In 1995 the Bureau of Alcohol, Tobacco and Firearms (BATF) banned the payment of all kinds of promotions akin to slotting fees in the distribution of alcoholic beverages. The role of the fees in promoting access to tobacco products by minors is strongly criticized in the medical literature (Rabin 2007). Of late, slotting fees are getting more critical press and scholarly scrutiny in Europe, where they are called “listing charges,” than in the U.S. (e.g., Allain and Chambolle 2005; Foros and Kind 2007; Rey et al. 2006).

Despite much interest from academic researchers and regulators, it has been difficult to measure the fees directly. Studies have relied on aggregate or proximal data and secondary and tertiary effects to draw their inferences. Inherent difficulties posed by the research environment have resulted in conflicting findings and interpretations in the literature. Thus there is a continuing need for studies that approach the subject from different vantage points.

This study approaches the problem from a macro economic perspective (e.g., Ailawadi et al. 1995; Farris and Ailawadi 1992; Messinger and Narasimhan 1995; Sullivan 1997). It asks the question, what has been the aggregate impact of slotting type allowances on important marketing indicators over time? The indicators studied are of interest to marketers in understanding the effects on market competitiveness (as measured by new product introductions, prices and profits at retail) and to policy makers in assessing the effect of the fees on consumer welfare. The study acknowledges there may be a number of managerial possibilities behind the use of slotting fees, and that these may have changed from time to time. But like the invisible hand, the management decisions of individual firms add and subtract to a net effect which may be efficient or inefficient for the market as a whole. Some theoretical alternatives to conventional explanations are offered in the conclusion.

Background

The term slotting fee or allowance originally meant a one-time payment by manufacturers for the slot that had to be created in a retailer’s warehouse for pallets when a new product was introduced into distribution. Since their inception the fees have grown rapidly in magnitude, prevalence and kind. They include upfront and recurring payments, which are paid in cash, free product and off-invoice discounts, and are known by various trade names such as market or product development allowances, pay to stay fees, etc. Reflecting their widening scope, in 2002 the Financial Accounting Standards Board (FASB) broadened the definition of slotting allowances to include all payments and discounts to retailers that did not involve a measurable marketing quid pro quo on the part of the retailer. Accordingly, slotting fees now include vendor consideration for other types of product placement arrangements such as brand development or new product introduction allowances, favorable in-store positioning, end-cap placement or additional shelf space. They may be incurred before the vendor sells any of the product to the reseller, on a regular schedule to maintain shelf space or continue as a vendor, or periodically as negotiated (FASB, EITF 02-16, 2002, pp. 27–28). Because this study is aimed at understanding the broad socio-economic impact of the fees rather than their micro managerial uses, the broad FASB/BATF definitionFootnote 1 of slotting fees is adopted in the meaning and interpretations of the phenomena described in this study (see also Kuksov and Pazgal 2007).

Slotting fees have caught the attention of many scholars who have offered explanations such as cost recovery and risk sharing and more complex arguments invoking market power, downstream exclusion and market clearing mechanisms (Ailawadi et al. 1995; Marx and Shaffer 2006; Messinger and Narasimhan 1995; Shaffer 1991; Sullivan 1997). The theoretical repertoire has evolved in sophistication to concepts like signaling, screening, moral hazard and rent shifting (Chu 1992; Desai 2000; Desiraju 2001; Kim and Staelin 1999; Lariviere and Padmanabhan 1997; Marx and Shaffer 2004a; Messinger and Chu 1995; Rao and Mahi 2003; Sudhir and Rao 2006). Bloom et al. (2000) reviewed the literature and grouped the theoretical explanations into two schools of thought—the market power school and the efficient market school.

The early literature argued the fees were the product of the increasing power of retailers who control access to the marketplace (Bloom et al. 2000; Rao and Mahi 2003; Siguaw and Hoffman 1992) and stand in a position to negotiate terms favorable to their operating and financial goals. Trade studies point to the increasing clout of resellers at the bargaining table (AC Nielsen 2005; Andersen Consulting 1997; Business Week 1992; Cannondale 2003; FASB 2001). Critics of slotting contend it is a thinly veiled mechanism for increasing prices, limiting consumer choice and garnering a larger share of the economic rents of exchange (Chu 1992; Marx and Shaffer 2004a). On the other hand large retailers and small manufacturers contend the fees are originating from aggressive manufacturer trade promotion strategies. The fees raise barriers to entry and moderate brand competition in downstream markets by foreclosing distribution for some competitors. They are seen as a deterrent to small businesses’ ability to gain distribution in an environment dominated by large consumer packaged goods manufacturers with deep marketing pockets and brand power. A recent article in the Financial Times (Gapper 2007) and online discussions by industry analysts (Anderson 2007) argue that slotting fees are causing assortments across retail chains to be dominated by the same major brands. Whether their origins are in exercise of market power by large retailers or large manufacturers, the outcome is the same—the fees create economic frictions, are exclusionary and discriminatory, and they are thus anti-competitive in nature.

The second wave of literature leans more toward efficient market arguments. Theorists posit that slotting type payments result in the efficient allocation of scarce retail shelf space in the face of imperfect information and a deluge of new products, the vast majority of which fail. The payments serve as signaling and screening devices (Chu 1992; Messinger and Chu 1995; Sudhir and Rao 2006) that separate the economically strong marketing offers from the weak, and they help allocate the supply of scarce retail shelf space to its optimal use. Suppliers have superior idiosyncratic market information about the potential for the new products they develop, and the amount of fees they are willing to pay is a signal of this potential. A corollary to the signaling hypothesis is that slotting fees act as a market clearing mechanism for a scarce market resource—shelf space. Slotting is thus akin to price bidding and equates demand and supply (Bloom et al. 2000; Hall 1988; Shaffer 1991; Sullivan 1997). In either argument, the result is a pro-competitive effect that leads to efficient market outcomes.

A study that received considerable publicity in recent years is Sudhir and Rao (2006). It was published in 2006, but the data were collected over 9 months in 1986–1987 from one regional retail chain in the Northeast U.S., and pertain to fewer than half the new products offered to it. The study uses single-item dichotomous proxy measures to measure key constructs and interaction terms to draw key inferences. The authors caution that the study is a “historical snapshot” since “the intensity of slotting has been rising over the past 15 years.” Nevertheless, the study concludes with a strong endorsement of the efficiency explanations that “slotting allowances efficiently allocate scarce retail shelf space,” “help balance risk” by shifting it from “retailers toward manufacturers,” “mitigate retail competition” but are “not anticompetitive,” are consistent with “signaling theory” but do not support the “retailer power rationale” (p. 152).

This author argues it is premature to draw such conclusions. The literature is characterized by conflicting findings and interpretations (e.g., Kuksov and Pazgal 2007). It may well be that slotting fees are used for different managerial purposes and have different outcomes in different exchange relationships. But the important question remains—what is the sum total effect in the marketplace of these management decisions made in the interest of individual firms in their unique situations? That is the scope and purpose of this study. The study uses aggregate objective data spanning three decades, a quasi-experimental type research design and advanced time series models to test whether the data patterns are more consistent with a latent efficient market process or a latent market power process.

Research propositions

The event period corresponding to slotting fees begins in 1982 (Smith 1989; Sudhir and Rao 2006; Supermarket News 1984). The phenomenon is native to the channel for food and kindred products (Sullivan 1997). In this study longitudinal time-series data are collected at the retail level to cover the before-slotting period 1972–1981 (t1) and the after-slotting period 1982–2004 (t2). The channel for food and kindred products (grocery channel) represents the “treatment” group, and the channels for other consumer goods serve as a comparison “control” group. The propositions are framed to describe what can be expected in the data time series of a variable over the period t2 compared to the period t1 and compared to the control group, if the underlying process generating the data conforms to an exercise of market power vs. an efficient market process. The prominent questions in the debate over the economic rationale and welfare effects of slotting fees revolve around the effects on new products, prices and profits (the key literature is referenced in the sections below).

New products and shelf space

A common explanation for the emergence of slotting fees involves the spiraling numbers, costs and risks of new product introductions. Survey research shows that retailers and manufacturers agree that an oversupply of new products was a major factor in the emergence of slotting fees (Bloom et al. 2000). Slotting fees serve to cover the operating and opportunity costs of introducing new products (Sudhir and Rao 2006). Because of the inherent uncertainties and risk, the fees act as a signaling and screening device for allocating scarce shelf space. Empirical support for this line of reasoning is provided by Bloom et al. (2000), Hall (1988), Shaffer (1991) and Sullivan (1997).

It follows, if slotting fees are the product of an imbalance in the demand for and supply of retail selling space, the rate of growth of new products (NP) should be greater in t1 than the growth of retail selling area (SA). Next, if slotting functions to harmonize the two, the rate of introduction of new products should diminish in the post-slotting period t2 and/or the availability of shelf space should increase in response to the profit opportunity.Footnote 2 The two variables should converge (relatively) toward each other as rising market access fees discourage all but the strongest contenders.

-

P1a:

If slotting fees are a market clearing mechanism tending to harmonize a shortage of shelf space and surplus of new products, then (a) the rate of introduction of new products should decrease in t2 relative to t1, and (b) the rate of increase in selling area should increase in t2 relative to t1.

Thus the efficient market argument is that slotting is a price bidding mechanism that clears the market and equates the demand and supply for shelf space (Hall 1988; Shaffer 1991; Sullivan 1997). Manufacturers have considerable knowledge of their brand markets and the resources to study the market potential for their new products. The process by which the fees are negotiated is like a silent auction that efficiently allocates scarce retail shelf space to the highest bidder. Presumably the bid monetizes the superiority and market potential of the offer. Slotting should improve the quality of market introductions, and the payments should work to screen superior product innovations from weaker ones. This can be tested by contrasting the rate of growth of innovative new products (INP) introduced subsequent to the emergence of slotting fees. Specifically the ratio of innovative new products relative to all new products should show an increasing trend over the post-slotting period t2.

-

P1b:

If slotting fees are an efficient market signal that screen for stronger new products, then the proportion of innovative new products to all new products should increase over the post-slotting period t2.

Rejecting P1a and P1b would suggest that slotting fees failed to clear the market for retail shelf space or serve as an effective screening mechanism and thus would weaken the efficient market argument. Studies by Bloom et al. (2000) and the Norwegian Competition Authority (NCA 2005) show that neither manufacturers nor retailers believe that slotting fees serve as signals or screens for new products. Rao and McLaughlin (1989) found that slotting fees and related incentives did not influence the decision to accept or reject a new product.

Thus the market power argument is that slotting fees result from the exercise of bargaining power and monopoly rights. The owners of scarce resources, e.g., shelf space, enjoy market power and can command economic premiums for it. Shelf space is a resource that is in limited supply, especially in the short run, and premium shelf space (e.g., eye-level shelves) is limited even in the long run. The owners of the scarce resource are motivated to enjoy the benefits of scarcity and may very well perpetuate a certain level of it. In this scenario the payment of slotting fees is unlikely to affect the imbalance in supply much. Indeed, as shown by Marx and Shaffer (2004b) the fees may even contribute to the imbalance—i.e., retailers are motivated to restrict shelf space so that they can charge slotting fees. Retailers will increase supply of shelf space to the extent it increases their monopoly returns, but not beyond that. The competition among manufacturers for the limited space is like a vicious cycle that will bid up its price every round of negotiations. Manufacturers may be willing or unwilling participants in this game. It is also arguable that they will continue over-supplying new products so long as they believe they can buy access to shelf space.

-

P2a:

If firms are likely to preserve a power advantage (scarcity of retail shelf space), then: (a) the rate of growth of shelf space in the period t2 will be no more than in the period t1, and (b) the emergence of slotting fees will not have an attenuating effect on the rate of introduction of new products in t2.

The effect of market power is to moderate the intensity of competition and dampen the drive for innovation. Slotting fees are said to be exclusionary and result in some amount of foreclosure of shelf space to competitors. Competition in the category is reduced, and manufacturers are tempted to rely on product modifications rather than more expensive and risky innovations. Further, if manufacturers feel that they can buy distribution and do not need to compete aggressively on innovation, the rate of innovative new products entering the market will tend to decline in the post-slotting period.

-

P2b:

If slotting reflects market power it will reduce the incentive for innovation, thus the proportion of innovative new products to all new products will decrease over the post-slotting period t2.

The effect of slotting discounts on product innovation has important implications for consumer choice. Equally important in the literature are the effects on consumer prices.

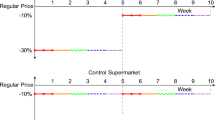

Prices

The effect of slotting fees and promotional discounts on retail prices is arguably the most important socio-economic question from a public policy and consumer welfare perspective. There is some evidence that manufacturers are adding the high costs of slotting into their prices (Stanton and Herbst 2006). This study analyzes prices in the food products channel employing three Consumer Price Indices. First, the index for food consumed at home (CPI-f) is studied across the pre- and post-slotting time periods t1 and t2. Of course, the food channel is subject to inflationary trends in the economy as a whole. Any reasonable inference about food prices has to take into account price trends in general. For this the price index for consumer nondurables other than food, i.e., the CPI-nd, serves as a comparison or “control” index. Second, the BATF banned the use of slotting type payments in the distribution of alcoholic beverages in 1995. Thus the CPI-f can be compared to the CPI-ab (alcoholic beverages consumed at home) pre and post 1995. In this way, in addition to the before-and-after tests there are two control data series against which to test the underlying processes.

If slotting fees serve as economic signals that reflect impacted information (e.g., information privy to manufacturers about the success and profit potential of new products) and work to establish a market price for scarce shelf space, the outcomes will be pro-competitive (Chu 1992; Messinger and Chu 1995; Sudhir and Rao 2006). Weaker products will be self-screened, improving the flow of more competitive products to the market. Shelf space is allocated to its most efficient and productive uses. As a summary market measure of value and potential, the fees reduce the costs of negotiation, selling, inventories and managerial errors. The results are reduced cost of distribution, stronger competition between stronger brands and an enhanced ability of retailers to compete aggressively.

Being market efficient, slotting fees should be price efficient. Prices are known to rise over time. The effect of an efficient market intervention should be to slow the rate of increase in price. Hence whereas prices in the treatment and control series should be increasing at about the same rate over the pre-slotting period t1, the rate of increase in food prices should be significantly lower than that of consumer nondurables in t2 due to the efficiencies introduced by slotting. The same result holds for the prices of food vs. alcoholic beverages, albeit under a different set of circumstances. These two product categories experienced the same channel environment (including slotting) until 1995; thereafter alcoholic beverages were distributed without the “benefits” of slotting fees. The research propositions follow:

-

P3a:

If slotting fees are efficiency enhancing, the CPI-f is expected to grow at a slower rate than the CPI-nd in the period t2 in contrast to t1 when both should grow at the same pace.

-

P3b:

If slotting fees are efficiency enhancing, the CPI-f is expected to grow at a slower rate than the CPI-ab in the post-1995 period t2 in contrast to t1 when both should grow at the same pace.

According to the critics of slotting, the fees are a temptation for overt or covert vertical channel collusion to reduce market access and deny competitors a level playing field. Larger firms gradually push out weaker ones and foreclose downstream markets for those with fewer resources. The fees (which are privately negotiated and not subject to a transparent market process) introduce market frictions that can lead to higher wholesale and retail prices (Shaffer 1991). Marx and Shaffer’s (2004b, 2006) analyses show that slotting fees can motivate retailers to restrict shelf space; product variety and consumer choice are likely to suffer as a consequence, and the incentive for price competition between brands and between stores is reduced. The result is upward pressure on consumer prices (Foros and Kind 2007; Shaffer 1991). There is some evidence that manufacturers are adding the high costs of slotting into their wholesale prices (Stanton and Herbst 2006) presumably further increasing the pressure on final consumer prices. Bloom et al.’s (2000) study indicates many retailers and manufacturers share the belief that slotting results in consumers paying higher prices. The market power predictions follow:

-

P4a:

If slotting fees are exclusionary and anti-competitive, the CPI-f is expected to grow at a faster rate than the CPI-nd in the period t2 in contrast to t1 when both should grow at the same pace.

-

P4b:

If slotting fees are exclusionary and anti-competitive, the CPI-f is expected to grow at a faster rate than the CPI-ab in the post-1995 period t2 in contrast to t1 when both should grow at the same pace.

The effect on prices is important in itself vis-à-vis consumer welfare, but theoretically prices and firm profits go hand in hand in explaining the competitive behavior of firms and thus the long term impact. Financial effects are discussed next.

Financial Performance

The question of how slotting fees affect profits and their distribution among channel members is of interest to practically all schools of thought (Marx and Shaffer 2004a). Numerous reports in the trade press indicate a substantial part of manufacturer promotional discounts are trickling directly to retailer bottom lines. Indications are that grocery retail profits may have doubled from their historical rate of 1% of sales to 2% (Sullivan 1997).Footnote 3 Market power theory is most readily consistent with the trade reports. It predicts that slotting fees are likely to result in profit shifting to the powerful (Ailawadi et al. 1995; Marx and Shaffer 2004b; Messinger and Narasimhan 1995). The higher profits arise from a number of related factors. First, powerful retailers are able to bargain away excess returns from manufacturers. Consistent with this is the finding by Rao and Mahi (2003) that slotting fees are higher when the retailer has better information on the likelihood of new product success and lower when the manufacturer has better information. Second, competition for limited shelf space in a category allows retailers to claim a premium from manufacturers. Third, manufacturers with limited resources get outbid in the competition for shelf space. Thus the fees foreclose parts of the market and moderate price competition, leading to higher profits.

In contrast, if slotting fees are a market adjustment to structural imbalances in resources or information, the aggregate effect should be to distribute rewards in a manner that is commensurate with economic costs and risk—i.e., in the direction of normal profits. Over time the profitability of grocery retailers should reflect the overall profit opportunity in the retail economy. Indeed, the evidence cited against market power explanations by advocates of the market efficiency argument (e.g., Lariviere and Padmanabhan 1997; Sudhir and Rao 2006) is that longitudinal analyses of profitability by Farris and Ailawadi (1992) and Messinger and Narasimhan (1995) do not reveal any pattern of abnormal returns among manufacturers or retailers.

Thus, per the efficient market argument, there should be no difference in relative operating profit between grocery retailers and retailers of consumer goods in general—it may differ in magnitude due to industry and channel differences (as it has historically), but the trends should remain the same across the periods t1 and t2. Alternatively, if slotting is an exercise of market power, then grocery retailers should see a positive trend in operating profit in t2 relative to t1, as well as relative to retailers in general.

-

P5:

If slotting fees are an efficient market mechanism, profit will be efficiently distributed, and operating profit in the grocery channel will not differ between grocery retailers and all other retailers in t1 as well as t2.

-

P6:

If slotting fees are due to the exercise of market power by grocery retailers, their operating profits will increase at a greater rate in t2 compared to t1, and this trend will be greater relative to all other retailers.

A problem with P6 is that an improvement in retailer profitability is also derived from some market efficiency models (Chu 1992; Messinger and Chu 1995).Footnote 4 As efficient market signals that mediate channel information and resources, the fees increase managerial and resource allocation efficiency, reduce costs and increase returns. Retailer bottom lines should improve some, relative to the past and relative to other retailers who do not enjoy the benefit of this market mechanism.

One way to untangle market power from market efficiency effects is to look at what is underlying the profit effect, i.e., the effect on operating costs. The behavior of different types of costs provides a basis for testing whether a profit effect is more likely due to underlying processes of retailer market power vs. market efficiency. Two standard measures of cost reported in the financial statement of firms are the Cost of Goods Sold (COGS) and Selling, General and Administrative Expenses (SGA). The behavior of these costs over time provides corollary evidence on whether an improvement in profitability is being driven by retailer power or is due to efficiencies in selling and administration of the firm’s exchanges.

First consider market efficiency and retailer costs. If manufacturers are privy to impacted information about the success potential of new products, and slotting type payments serve as signals of this information, then over time the fees should lower the management and transaction costs of retailers. Promotional fees that work to screen out weak products should result in less time-consuming negotiations, less need for management oversight and better decision making. Retailers stand to reduce the risks and costs of new product failures, minimize opportunity costs, maximize their utilization of shelf space allocating prime space to the more profitable brands, and manage their inventories more efficiently. The resulting assortments should be more readily accepted by consumers. There should be less need for price discounts to consumers and less selling and promotional expenses to move volume. These efficiencies together should have a discernable negative effect on selling and administrative expenses over time—grocery store SGA (as a ratio of sales) should be decreasing over t2 relative to t1. This inference is strengthened if we do not see a similar effect in the SGA of the rest of the retail industry.

-

P7:

If slotting fees act as an efficient mechanism reducing managerial, promotional, opportunity and transaction costs, then the SGA/Sales for grocery retailers should be declining (a) over the period t2 compared to t1, and (b) compared to all other retailers.

Next consider the effect of market power on retailer costs. COGS for retailers consist predominantly of the purchase price of the products they resell.Footnote 5 If retailers dominate the bargaining process it is likely to result in downward pressure on the cost of the goods they purchase from manufacturers. Then a valid inference in favor of the market power argument requires that grocery retailer profits are improving (P6 is supported), and the ratio of their cost of goods to sales is decreasing over t2. This inference is strengthened if at the same time there is no similar decline in COGS for the rest of the retail industry.

-

P8:

If grocery retailers have the bargaining advantage in negotiating the terms of trade, then their COGS/Sales should decline (a) over t2 compared to t1, and (b) compared to all other retailers.

The propositions above describe the patterns of data that are likely to be observed for key dependent variables if a given underlying process (market power vs. efficiency) is at work over a period of time. The processes give rise to contrasting predictions that are tested against one another in the manner of strong inference (i.e., if one is true the other cannot be true). The predictions are tested against the control period 1972–1981, during which the explanatory variable is known to be absent, and then they are tested against a control population of firms largely shielded from the independent variable. This triangulation of theory and empirical tests does much to reduce the problems of inference from indirect observations. The inferences from individual hypotheses thus set the stage for the important question—i.e., do the findings taken together weigh in favor of one explanation over the other?

Method

Data and sources

This study uses longitudinal data from reliable secondary sources to test its hypotheses. The data are monthly or quarterly observations over the 32 years 1972–2004. The data are divided into a pre- and a post-slotting period, and a control group, providing the inferential advantages associated with quasi-experimental research designs.

Slotting fees are native to the marketing channel for food, grocery and related consumer products (for simplicity this is called the grocery channel). Thus the “treatment” group consists of all non-internet U.S. retailer firms in the four digit SIC group 5411 (NAICS 4451) Grocery Stores—i.e., retail establishments like supermarkets primarily engaged in retailing a general line of food and kindred products.

There is a control group for the analyses of prices and profits (but none is available for new products). For prices the control series are the CPI-U for consumer nondurables and alcoholic beverages. For the profit and cost analyses the control group is all other retail stores.Footnote 6 The data sources are highly regarded and reliable sources such as the Bureau of Labor Statistics, COMPUSAT, New Product News and the Food Marketing Institute.

The number of new products introduced monthly in all 30 product categories in the grocery channel are reported by New Product News and widely cited in trade publications such as ProductScan Online, Marketing Intelligence, Food Institute Report, etc. New Product News employs exhaustive collection methods for its data, including store data, manufacturer press releases, conventions and some 100 publications. The analyzed data consist of 396 observations, and the average number of new products introduced each month is 487 (for innovative new products N. Obs = 240, average = 37 per month).

Data on retail space represent the median selling area for supermarket type stores (conventional supermarkets, superstores and combination) calculated from studies by the Food Marketing Institute published annually in The Supermarket Industry Speaks. The Food Marketing Institute collects its data every year via industry surveys that include the majority of firms in the industry. The average number of companies in the FMI sample was 233 over the 33 years of the study period, but these companies report for multiple units they operate. For example in 1980 the 256 companies in the sample reported for 5,271 stores, and in 2004 the 144 companies in the sample reported for 10,127 stores. (N. Obs. for the data series = 33.)

The historical record on prices is studied via monthly Consumer Price Indices published by the Bureau of Labor Statistics (BLS). All indices are CPI-U (for urban consumers). The price performance of the grocery channel is measured with the CPI for “food at home” (CPI-f), i.e., for food related consumer products bought at grocery stores. The control price series is the CPI for “nondurables less food and beverages” (CPI-nd). This index represents cost and inflationary trends in the broader consumer goods economy. In addition, the CPI for “alcoholic beverages consumed at home” (i.e., purchased at stores) is used as a secondary control (CPI-ab). Starting May 26, 1995, the BATF banned the use of slotting type promotions in the distribution of alcoholic beverages (note that monthly data for the CPI-ab at home were published starting December 1977). The opportunity to study the behavior of the CPI-f in relation to two different control series and event dates, one in which the “treatment” is added after the event and the other in which the treatment is removed after the event, mimics the classic experimental design in which the effects of a treatment are shown and then reversed. The BLS computes CPI via a statistical sample from 200 categories of goods and services, from a sample of thousands of retail locations, at sample locations and sample times (the methodology is described at www.bls.gov). The analyzed data is monthly. (N. Obs. for CPI-f and CP-nd=396, and for CPI-ab=325.)

The financial performance of firms is studied using one measure of profit (Operating Income before Interest, Taxes and DepreciationFootnote 7 [OP]) and two measures of cost (Selling, General and Administrative expenses [SGA] and Cost of Goods Sold [COGS]). The three variables are expressed as a percent of Net Sales for each firm for each quarter, and averaged for each quarter of 1972–2004. OP, SGA, COGS and Net Sales are standard accounting items published in the quarterly financial statements of firms. The data were collected from COMPUSTAT via the Wharton Research Data Service for all retail firms in the treatment and control groups. The sample size for the treatment series averaged 33.9; for the control series the average is 171. The samples represent all firms reporting quarterly data to COMPUSTAT in the respective SIC groups for any given year. The analyzed data are quarterly; N. Obs.=121 for all the financial series.

Analytical method

The research design underlying the analyses in this study is the “before-after with control group” time series quasi-experiment (Campbell and Stanley 1966), which can be represented as:

where Oi are observations in the time series of T realizations, and T B is an event, intervention or structural change in the environment—in our case the emergence of slotting fees. It is generally acknowledged that slotting began to exert a presence in the grocery channel from 1982 (Smith 1989; Sudhir and Rao 2006; Sullivan 1997; Supermarket News 1984). Thus T B = 1982, and the data are organized and analyzed around this year with 1972–1981 representing the pre–slotting period t1, and 1982–2004 the slotting period t2.

The data are analyzed using the interrupted time series model (variously called impact assessment or structural break models) in the Box-Jenkins ARIMA methodology (Box and Tiao 1975). The ARIMA(p,d,q) model incorporating the effects of an event or intervention is expressed as follows:

Where

- Y t :

-

data series of interest

- ∆d Y t :

-

Y t −Y t-d , where d = 0 is no differencing, d = 1 first differences, and so on

- μ :

-

intercept or mean of the series

- t :

-

time (T the sample size, T B the event date) and β the trend coefficient

- \( {\phi_{{1}}}{Y_{{{\text{t}} - {1}}}} + \ldots + {\phi_{\text{p}}}{Y_{{{\text{t}} - {\text{p}}}}} \) :

-

is an autoregressive component of p th order

- ε t :

-

is the innovation or residual series

- \( {\alpha_{{1}}}{\varepsilon_{{{\text{t}} - {1}}}} + { } \ldots { } + {\alpha_{\text{q}}}{\varepsilon_{{{\text{t}} - {\text{q}}}}} \) :

-

is a moving average component of q th order.

- θDU t + γDT t :

-

are the intervention assessment dummies defined as:

- DU t :

-

is a step effect due to the event and estimates the difference in the mean or “level” of the series pre and post the event date T B. DU t = 1 when t ≥ T B and 0 otherwise;

- DT t :

-

is a ramp or slope dummy which estimates the difference in growth rate (trend) pre and post T B. \( {\text{D}}{{\text{T}}_t} = {\text{t}} - {T_{\text{B}}} + {1} \) when t ≥ T B and 0 otherwise.

An analytical issue with time series data is testing for the presence of unit roots. In ordinary time series, the augmented Dickey-Fuller (ADF) model is commonly used to test for the presence of a unit root. Perron’s (1989) influential study extends the Dickey-Fuller methodology to incorporate interruptions or structural breaks in the model, and derives the asymptotic distributions for determining the critical values of the associated t statistic. Perron’s modelsFootnote 8 nesting the null and alternative hypotheses are:

Where the augmented terms are defined as follows:

-

Σc i ΔY t-i is the sum of the effects of lagged first differences where i = 1…k. The truncation parameter k is determined starting backward from k such that k is significant but k + 1 is not. It is common to start with k = 8 for annual data. Here k = 24 is used for monthly data and k = 12 for quarterly.

-

Ση s SD st where s = 2…S captures significant seasonal (e.g., monthly or quarterly) effects.

-

D(TB) t = is the point effect dummy (also called a pulse or break dummy). D(TB) t =1 when t = TB and 0 otherwise. It is included to ensure ρ is invariant to changes in the intercept under the null hypothesis (Deleersnyder et al. 2002). δ has no substantive interpretation.

If /ρ/<1 using the test values derived by Perron, and β, γ, θ ≠ 0, and δ is close to 0, the unit root hypotheses is rejected (Perron 1989, p. 1381). The data generating process (DGP) is trend stationary and the theoretical hypotheses tests can proceed using conventional t and F tests (Ben-David and Papell 1995; Deleersnyder et al. 2002). However, if ρ = 1, β = γ = θ = 0 and δ ≠ 0, then the null hypotheses of a unit root model cannot be rejected. The DGP is difference stationary and is estimated in first differences of \( {Y_t},\left( {\Delta {Y_t} = {Y_t} - {Y_t}_{{ - {1}}}} \right) \) as follows:

This paper follows the Maddala, Kim and McCallum (Maddala and Kim 1998; McCallum 1993) analysis procedures and treats the first task as one of model selection. The methodology consists of the following steps.

-

1.

Model selection for hypotheses tests is assessed by analyses of the residual corellograms using Eq. 1.

- 2.

-

3.

If the unit root hypothesis is rejected, the best model for Eq. 1 is used to test the hypotheses.

-

4.

If the unit root null is not rejected the DSP model of Eq. 3 is applied.

-

5.

If the unit root test is not conclusive (e.g., if ρ = 1 but β, γ, θ ≠ 0 and δ ≈ 0) the models of Eqs. 1 and 3 are compared to see which has the better statistical properties (i.e., the error series are white noise). This model is used for the hypotheses tests.

Because the diagnostic criteria can seem involved for readers less familiar with time series models, an explanatory note is provided in Appendix 1.

Alternative explanations

The interrupted time series methodology tests the hypotheses that a structural event had the predicted positive or negative effect on the “growth rate” and/or “level” of the post vs. pre data series, after all systematic and random effects are accounted for. The models account for immediate and long term trend/drift, cyclical and seasonal effects, as well as autocorrelation in the data or error series (often caused by omitted variables), so that what is left is random variation or “white noise.” Two things follow. First, the effects of all other variables that may cause systematic, cyclical or seasonal before/after effects on the observations are eliminated from the inference. The only events not eliminated are those which are largely coincidental and contemporaneous (as opposed to episodic) with the event under investigation. Because of this, longer periods of time before and after the event are an advantage in testing since there are few unknown/omitted/unmeasured variables that can cause coincidental effects over an extended observation period.

Further, in the quasi-experimental method coincidental effects can be eliminated either (1) by comparison with a control (a parallel data series in which the phenomenon of interest is known to be largely absent) or (2) by logical elimination. Parallel control series are employed in this study for the price, profit and cost hypotheses. This is shown as the series Oc1, Oc2,…Ocn, in the representation of the research design above. In addition an effort was made to identify plausible coincidental or colinear variables in interviews with experts and practitioners. Only three possibilities were raised—the effects of competition, labor costs and the cost of added retail services on prices and costs. These can be ruled out by reference to the control data series but also on logical grounds discussed in the concluding section of this paper. None of the three possible confounds should affect the two data series which do not have parallel control series to compare against—i.e., new product introductions and retail selling area—and no other competing explanations emerged in the discussions.

Results

In the discussion below an ARIMA model is said to fit the data when auto and partial correlation functions decay appropriately, and the Ljung-Box χ2 and Breusch-Godfrey Obs*R2 are insignificant to lags L. For unit roots, the Perron test using Eq. 2A is employed. In the one case where no structural break is involved in the data and model, the standard ADF and PP (Augmented Dickey-Fuller and Phillips-Perron) tests are used. To keep the discussion simple, the statistics are reported in the Tables (χ2 and Obs*R2 in the lower panel for each model and unit roots in the right column) but not discussed in the text. See Appendix for details.

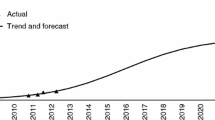

New products

To test the P1 and P2 sets of propositions this study examines data on three variables—the number of new products and innovative new products introduced in the grocery channel and the median selling area for grocery stores. The data are graphed in Fig. 1a and b. New product (NP) data is monthly. Monthly innovative new product (INP) data is available from 1985. Selling area (SA) is available only annually. For analyses the NP and SA data are standardized so coefficients can be compared. INP data are expressed as a ratio of NP. The statistical models and results are reported in Table 1.

Visually the data do not reflect efficient market corrections at work. SA is increasing at a greater pace than NP in t1. There is no apparent increasing pressure from the latter on the former. In contrast, after 1982 there is a remarkable jump in NP levels and a serious increase in volatility. This is accompanied by a leveling off in the SA series. The ratio INP/NP drops off from about 12% in 1985 to a low of 3% in 1993 to about 5% thereafter. The patterns are more consistent with market power predictions and are supported by the statistical analysis of latent processes.

For new product introductions an ARMA(1,1) with k = 5 augmented terms results in a stationary series, and the unit root null is rejected. For the innovation ratio INP the data are available only from 1985, hence there are no intervention effects. An ARMA(1,1) k = 0 model is stationary and fits best. There are no unit roots applying standard ADF and PP tests.

According to P1a the data generating process (DGP) underlying the NP realizations should decline in t2 relative to t1—i.e., μ 2 < μ 1 and β 2 < β 1. This is not supported. The positive growth rate in t1 (β 1 = 0.003) increases further in t2 (β 2 = 0.006). The increase in growth is significant because the growth shift parameter γ = 0.003 is positive and significant (t = 2.89, p = .004). Even the level of the series increases significantly: μ 2 = −0.84 is significantly higher than μ 1 = −1.34 since the level shift parameter θ = 0.508 is positive and significant (t = 7.22, p = .0000). P1a also predicts the DGP for SA should increase in t2 relative to t1. But the rate of growth in SA decreased in t2: β 2 = 0.046 is significantly less than β 1 = 0.15 since the growth shift parameter γ = −0.104 is negative and significant (t = −2.88, p = .008). However the level of SA did increase in t2, μ 2 = −1.51 is significantly greater than μ 1 = −2.13 (the level shift parameter θ = 0.63 is positive and significant t = 3.68, p = .001).

Next consider the new product innovation ratio. P1b predicts an increasing trend in innovative new products due to screening effects, whereas P2b predicts a declining trend. β = −0.0003 is not significantly different from 0 (t = 0.097, p = .923), thus neither P1b nor its alternative P2b are supported. However, the linear trend is probably affected by nonlinearity in the data (see Fig. 1b).

In sum, the analyses of the new product and selling area data do not suggest any market efficiencies and on balance support the market power argument.

Prices

The effect on prices is studied by contrasting the CPI-f for “food at home” with the control series CPI-nd for “nondurables excluding food and beverages.” A second control series is provided by the price index for “alcoholic beverages at home” CPI-ab analyzed from December 1977 to December 2004, with June 1995 as the “interruption” date when the BATF banned slotting. All indices are monthly.

Figure 2 graphs the data series for the CPI-f vs. CPI-nd, and Fig. 3 the CPI-f vs. CPI-ab. The visual effects are striking. The CPI-f follows practically the same path as the CPI-nd until about 1982. Thereafter the two diverge with food prices growing at a rate noticeably greater than prices for other nondurables. This divergence in path is repeated in Fig. 3. Here food and alcoholic beverages experienced the same market environment characterized by slotting fees, until May 1995, after which slotting is absent for the CPI-ab. On the face of the data, it seems that the presence of slotting fess resists downward pressures on prices, thus leaning away from market efficiency and favoring market power explanations.

The visual impressions are supported by the statistical analyses reported in Tables 2 and 3. ARMA(1,1) models fit the data best for both the CPI-f and the CPI-nd (with k = 10 and k = 8 augmented terms respectively). For the CPI-f v. CPI-ab analysis ARMA(1,1) k = 2, and ARMA(2,2) k = 0 models fit best.

All four models fit the data well and the errors are white noise, but the unit root tests are inconclusive for all series.Footnote 9 The corollary condition for unit roots and DSP β = γ = θ = 0, δ ≠ 0, are not met for any model. Nevertheless, all series were modeled using Eq. 3 after differencing—i.e., ΔCPI-f, ΔCPI-nd, and ΔCPI-ab, as endogenous variables. The analysis of residuals and diagnostic data indicate the differenced models are not stationary.Footnote 10 The overall outcome favors the ARMA models estimated in levels; consequently they are used to test the hypotheses.

Because the series have significant unit roots (all four are I(1)), it is useful to test for cointegration. Johansen tests were run for each pair including trend and break dummies as exogenous variables. The test for no cointegration is rejected for CPI-f and CPI-nd (trace statistic = 29.13, p = .019) as well as for CPI-f and CPI-ab (trace = 31.08, p = .027). This gives confidence the observed relations between the indices are not spurious. First there are no level change effects—the level shift dummies are insignificant in both series, so we focus on the rates of change.

The base line expectation is that prices in the treatment and control series should be increasing at the same rate over the pre intervention period t1. This is the case: \( {\beta_{{{1}f}}} - {\beta_{{{1}nd}}} = - 0.{1}0 \) is not significant (\( {t_{\Delta }} = - {1}.{33} \), p = .09). If slotting fees are market efficient, they should be price efficient, and have an attenuating effect on the rate of increase in prices. In t2 the rate of growth of CPI-f should be slower than the control CPI-nd. Both indices show a decrease in the rate of growth in the post 1982 period, but the CPI-f slows down much less (γ f = −0.10, t = −2.69, p = .008) than the CPI-nd (γ nd = −0.26, t = −4.90, p < .0001). The difference γ f−γ nd = −.216 is significant (\( {t_{\Delta }} = - {2}.{4}0 \), p = .008). Prices for the treatment group trended significantly higher than the control group in the post slotting period. The statistical analyses support the graphic evidence and reject P3a in favor of its alternative P4a.

Next consider the behavior of food prices contrasted with the prices of alcoholic beverages pre and post May 1995 (Table 3). The baseline for P3b and P4b is that the CPI-f and CPI-ab grew at the same pace in t1. This is the case: β 1f − β 1ab = 0.006, \( {t_{\Delta }} = - 0.{24} \), p = .406. In t2 the CPI-f should track at a lower pace than CPI-ab (if slotting is market efficient) after slotting was banned. But in fact the opposite happens—the rate of growth of the CPI-f continues as before (γ f = 0.002 is insignificant), in contrast to the drop in growth rate of the CPI-ab (γ ab = −0.135, t = −10.56, p = .0000). In sum, both P3a and its companion hypothesis P3b derived from the market efficiency argument are rejected in favor of the market power based alternatives P4a and P4b.

Financial performance

In this study firm financial performance is measured by quarterly operating profits (OP). All grocery retail firms are the treatment series, and all other retail firms are the control series. Figure 4 graphs the OP/Net Sales for both. Here the question is about the relative change in the ratios and not their magnitude (the latter is a function of the economic characteristics of different industries and channels).

The graph shows an increase in profits of grocery retailers soon after slotting fees began to proliferate. In contrast, operating profit for all other retailers cycles around a more or less constant level (there is a marked quarterly cycle due to the holiday season effect). Together the visual patterns favor a market power argument over a market efficiency one. This is corroborated by the statistical analyses.

For grocery stores, an AR(1) k = 3 fits the data well. For all other retailers the best model is an AR(1) k = 7. The level shift dummy is insignificant for both series and is dropped. Thus Eq. 2B applies for the unit root test; the null is rejected for both series (critical value = −28.61, λ = 0.3, Perron Table V.A). Results are reported in Table 4.

Both profit series are flat and do not show a significant trend in t1 (β 1 are insignificant). In t2 the rate of profit for the control group continues to be flat (γ OR = 0.07, t = 0.48, p = .634); however, grocery store profits show a significant increase in growth rate (γ G = 0.023, t = 2.28, p = .024). Thus there is an indication that slotting fees are a product of market power and allowed grocery retailers to improve their operating profits. However, this inference is stronger if it is supported by the behavior of selling and general administration expenses (SGA) and cost of goods sold (COGS) as predicted by the corollary propositions P7 and P8.

P7 predicts that if slotting fees are market efficient, then SGA for grocery retailers should decline in t2 relative to t1, and relative to all other retailers. On the other hand P8 proposes if the fees are driven by retailer power then this should result in a similar pattern of declining COGS for grocery retailers. Figures 5 and 6 graph SGA and COGS as ratios of Net Sales for grocery and non-grocery retailers. SGA for grocery is level for t1 but begins to trend up soon after 1982, whereas SGA for the control group shows a steady downward trend from 1972 to 2004. In contrast COGS for grocery trends down in t2 from being level in t1. For the control group, COGS is steadily down trending across t1 and t2. Hence the visual evidence rejects P7 and supports P8.

The statistical analyses are reported in Tables 5 and 6. The SGA series for grocery is efficiently represented by an AR(1) k = 5 model, and the control series of all other retailers by a model without any ARIMA terms and k = 5 lags. There is no linear trend in t1 for both series. In the control series the level shift and growth change parameters are also insignificant, but retained for model consistency with the grocery series where they are significant. The unit root test using Eq. 2C rejects the null for both series.

As noted there are no significant changes for the control series across t1 and t2. In contrast SGA for grocery shows a significant increase in level as well as growth rate in t2—θ = 0.24, t = 2.81, p < .0061, and γ = 0.043, t = 6.07, p = .0000. P7 is rejected.

If slotting fees do not show evidence of cost efficiencies in selling, managing assortments and exchange relationships, do they show evidence of market power? The DGP for COGS for grocery retailers is efficiently represented by an AR(1) k = 10 model. For the control series the best model is an ARMA(1,1). The level change dummy is insignificant in both series and was dropped. The unit root hypothesis is rejected for both series.

For both series β 1 is insignificant in t1, i.e., there is no trend. In t2 grocery COGS shows a significant negative trend (decline in rate), γ G = −0.073, t = −25.69, p = .0000, whereas for all other retailers there is an increase in the rate of growth, γ OR = 0.037, t = 3.23, p = .0016. The result supports P8, which in conjunction with the rejection of P7, suggests that slotting fees are an instrument of retailer market power rather than the product of efficiency considerations in exchange.

Discussion and conclusion

Slotting fees pose questions that are difficult to study, and the situation is compounded by the unavailability of direct measurements. This study analyzes secondary data as a reflection of underlying processes. Keeping in mind the limitations of the study, the overall results for new product introductions, prices and profits all lean toward market power explanations rather than market efficiency ones.

New product introductions increased post slotting, in conjunction with a tapering off in the availability of shelf space. There was no positive effect on the percentage of innovative new products. Likewise food prices increased at a significantly higher rate after slotting than did prices for other consumer nondurables. In addition, the rate of growth in prices of alcoholic beverage declined relative to food prices after slotting was banned for the former. Finally, grocery store profits increased significantly after 1982, whereas the profits of all other retailers remained unchanged.

The findings for new products and shelf space imply that the fees may not reflect an efficient market function and that retailers control the availability of shelf space in a manner that maximizes the rents the market is willing to pay for it (Marx and Shaffer 2004b). Likewise, the finding for operating profit in conjunction with that for prices, points to market power at work. The canon of antitrust law regarding monopoly power is the ability to raise prices resulting in above normal profit. This inference is furthered by the results for two key operating costs. Grocery retailers paid less in cost of goods post slotting, whereas all other retailers paid more. On the other hand their selling and general expenses increased post 1982, whereas they remained unchanged for all other retailers.

Limitations

Some of the strengths of this study are also its weaknesses. It relies on objective secondary data to study patterns of change in key explanatory and dependant variables over a 32 year period. Objective data are not subject to the large measurement and perceptual biases known to exist in survey data. But secondary data are often a step removed from underlying theoretical processes. For example, the pressure of new product introductions on shelf space should ideally be studied by measures of actual shelf space rather than selling area (even if the two are likely to be highly correlated). Selling area is a reflective indicator for shelf space. Other variables like COGS and SGA are also imperfect measures to the extent they include other costs. However, the key components driving the propositions (such as prices paid for merchandise in COGS, and marketing and transactional expenses in SGA) represent a very sizeable proportion of the measures. Thus one limitation is that some of the data are objective but are single indicators of a latent construct. Another limitation stems from alternative explanations. Some plausible ones are considered next.

One plausible explanation for the continuing increase in new product introductions, notwithstanding slotting and a leveling off in available retail selling area, is the growth of the Internet and e-sales. Publicity surrounding marketing on the Internet has created an exaggerated sense of its pervasiveness. The data show impressive growth rates, but the overall share remains small. According to U.S. Census Bureau data, at the end of the period of this study in 2004, total e-business sales amounted to 2% of all retail (it is currently 4% in 2010). AC Nielsen data show that in 2004 the CPG category accounted for only 3.5% of total e-business sales (the percentage has held steady at that number since then [www.emarketer.com, May 12, 2010]). It is unlikely that the Internet represented a significant market channel for new products over the period of this study.

A limitation of the “new product” measures used in this study is that they do not reflect all aspects of new product success. They largely reflect the primary argument vis-à-vis slotting, i.e., it is a managerial reaction to the number of introductions. The analysis of “innovative new products” adds an additional dimension testing the screening argument that slotting should encourage better quality products (and thus lower failure rates), but it would be useful if data were available to study the success ratio before and after slotting. In general, published studies suggest that the failure rate of new products in the grocery industry continues at historically high levels. The classic figure in marketing text books has been the old 80% failure rate from Booz-Allen & Hamilton studies in the 1960s and 1970s, well before slotting. A study conducted in 1995 (well after slotting) reports the failure rate for new product introduction in the retail grocery industry to be 70–80% (Linton, Matysiak & Wilkes Inc. 1997). A 2004 report from ACNieslen’s BASES and Homescan (probably the most complete source of data on new products) states “about 80% of new products will fail within the first 3 years of introduction” (Wilke and Sorvillo 2004). [Note: There is a large variation in these numbers from 50% to 95% depending on the company, type of new product, and definition of “success.” See reports from Deloitte and Touche (1998) and AC Nielsen (1999)]. These high failure rates are especially surprising given all the advances in marketing analytical techniques since then, but it appears improbable that slotting helped improve success rates much if at all.

A related variable is the effect of technology. It is possible that an increase in new technologies changed the opportunities for new products in the post-1982 period relative to the pre period. The major technological changes in the period are related to consumer electronics and information products. The majority of products sold via grocery channels are not technology intensive. The categories most likely to be affected by technology are Health & Beauty Aids and Household Supplies. Unfortunately category-wise new product data are not available prior to 1984, and after 1999 a new classification system makes it difficult to compare with previous categories. Looking at the year to year growth of Health & Beauty Aids and Household Supplies relative to All Categories shows no systematic pattern indicating a technology effect on new product introductions during 1984–1998. Further, in general it can be expected that new technologies also result in an increase in the number of innovative new products. The analyses in this paper of the proportion of “innovative new products” introduced after 1984 do not support any increase in innovativeness.

No doubt variables like prices have complex causal and correlational relationships with other variables. Three plausible explanations for higher grocery prices can be ruled out logically, or with reference to the control series for nondurables. First, if increasing labor costs were behind higher grocery prices they would affect the prices for all consumer nondurables as much. Similarly, supermarkets have expanded their services mix but so have all types of retailers as the U.S. economy becomes more service oriented. One can expect these effects will be reflected in the control price indices. Third, prices could increase due to reduced competition in an industry. Over the study period, concentration in grocery retailing has increased sharply but so has competition due to the entry of new and larger formats and competitors—notable among these are the new superstores replacing the older supermarkets, i.e., combination stores, wholesale clubs, and extended formats by Wal Mart, Target and others. This important issue is evaluated further in the following section.

Besides alternative explanations that need to be plausibly ruled out, there are unknown events that occur at various points in the study. However, when the focus is on analyzing long-term trends in time series data, short term events that affect the variables studied are eliminated in the autocorrelation, integration, moving average, cyclical and error components of ARIMA models.

Further, many of the effects of unmeasured variables on inference are reduced because of the two control data series: (1) the pre-slotting data series 1972–1981 and (2) contemporaneous data from firms which are largely free of the slotting phenomenon. Some spillover effects are unavoidable between the series. Thus the CPI-U for food contains some data from Mom & Pop stores that typically are not powerful enough to charge slotting fees. But this is a more or less constant effect on the data series. Constant and systematic effects are eliminated from the inferences via Interrupted Time Series ARIMA models in the Constant and Trend parameters. Likewise, the non-grocery retail comparison group (i.e., the CPI-U nondurables) is also affected by a gradual spill over of slotting to non-grocery channels. References to this begin appearing in the trade press in the early 2000s and it is unlikely the gradual spill over meaningfully affected the control data used in this study. There are no indications that the data patterns for the control series are different over the last years of the series.

Finally, the pre-slotting date is not crisp and clear (like the enactment of new legislation in an event study). This was tested by a rolling intervention date starting from 1980 to 1984. The fit of the pre and post data series does not improve with any alternate date. A second test used to eliminate 5 years of data around 1982 (1980–1984) and then run the models. This did not change any of the inferences.

Conclusion

The practice of slotting is not endeared to many in the trade other than the large retail chains. Lariviere and Padmanabhan (1997) phrase it thus: “The rapid growth of slotting allowances should not be confused with popularity. They are among the most contested and controversial of trade practices.” This study shows a triangulation of findings favoring the market power explanation behind the growth of slotting in the marketing channel for food and kindred products. There is little evidence of an efficient market process at work. So the question can be asked—do the results of this study, added to widespread negative sentiments in the trades, favor a BATF type ban on the fees? Conversely, is slotting a tolerable business friction and imperfection in the working of markets? Indeed, regulatory solutions introduce market imperfections of their own. A valid perspective on the phenomenon can be phrased thus: “That market power explains channel behavior and pricing is no real surprise. That markets are not completely efficient and that firms earn abnormal profits in the form of quasi-rents, is no surprise either.”Footnote 11

It is argued here that regulation directed to cure market imperfections is less effective than regulation directed to improving market competition. The policy response should consider slotting in the context of the larger competitive situation. It is noteworthy that while the cost of goods sold has trended downward and selling and general expenditures have trended upward for grocery retailers, these trends are actually converging to what they are for all other retailers. Even operating profits are converging upward to levels for the retail industry (the historically low margins in the grocery business are often commented upon).

The argument can be made that slotting is a phenomenon that is contributing to the economic viability of grocery retailing, without which continuing investment in the industry may be at risk. Recall that a quasi rent is paid to factors of production which represent past sunk investment.Footnote 12 In the short run the factor would not disappear if payments decreased, but in the long run they would be insufficient to induce continuing investment, for example in modernization of systems and facilities. It seems then that the question of whether the rising prices and profits in the grocery retailing pose a matter of concern for public policy should be evaluated in the context of the state of competition in the industry as a whole.

In marketing channels there are two major competitive factors to be considered—inter channel and intra channel. Both kinds of competition are moderated if concentration in the retail industry is increasing relative to concentration at the manufacturer level. On the other hand, inter channel competition is enhanced by new retail formats that are aggressive price competitors.

The venerable wheel-of-retailing argues that often the strongest competition emerges from non-traditional formats. An analysis of market share by type of grocery format for the period under study shows robust competitive pressure from new retail formats. Between 1972 and 1981 conventional supermarkets accounted for roughly 71–79% of distribution in the grocery channel. New formats began to have an impact around 1981. By 1991 the new formats (extended superstores, combination stores and discount stores) had pulled ahead, accounting for 37.9% of sales compared to 36.7% for conventional supermarkets. By 2002 the share of conventional supermarkets had dropped to 27.1%, whereas extended formats accounted for 38.3% and discount formats 16.6%. Thus intertype competition reveals a robust competitive picture. The dynamics of change serve to renew investment and competition, and surely work to counterbalance the power of individual retail chains. However, it is important to keep in mind that the large chains adopt new formats pretty quickly, and notwithstanding the initial boost in investment, the long term drift of industries dominated by a few large firms, is to copy one another and rationalize competition.

Indeed, analyses of concentration in the grocery channel show a significant increase at the retail level coinciding with the slotting phenomenon. The share of market of the top 20 retail firms was steady between the 1972 census (34.8%) and 1982 census (34.9%). By 1992 it had increased to 37% and thereafter steadily increased to 54.5% by the 2002 census. In comparison, the 4-firm concentration ratio for manufacturers in the grocery industries (averaged across industries) increased more gradually from 46.2% in 1972 to 54.3% in 2002.Footnote 13 Other indicators of retailer power also point in the above directions. Annual surveys from 1988 to 2001 by Progressive Grocer show 71–93% of manufacturers stating that power has shifted to retailers. Similar surveys of retail chains over 1984–2003 show 47% to 83% believed the same.

Thus there is reason to believe that the balance of power in the grocery channel is such that it affords retailers the ability to bargain terms to their advantage, and it could be related to the growth in slotting and increase in prices and operating profit. There is a small literature on the effects of reducing the number of SKUs carried in each category on consumer satisfaction, category sales and profits. Some show negative effects while others show positive or neutral effects (see, for example, Sloot et al. 2006). Focusing on the profit advantage of retailers is a myopic view of the channel as a whole and certainly should not represent a principal criterion from a public policy perspective. Practices that curtail competition do typically lead to higher profits. The danger is that over time these restrictive practices that limit the availability of shelf space and market access to suppliers will weaken competition at the manufacturer level.

Of late there has been much talk in the trade literature about retailers reducing the number of competing brands offered in each category.Footnote 14 There is reason to believe this rationalization is driven by the practice of retail assortments effectively managed by dominant suppliers under the “category captain” model (Desrochers et al. 2003). The end effect is reduced competition at the retail shelf. Today’s market is characterized by retail concentration, growing private labels, and preference for one-stop shopping by time-poor consumers. Competition at the retail shelf (intra-type) may well be more important than inter-type. The FTC’s demonstrated predilection for waiting for irrefutable proof that a practice is harmful to competition before taking action probably should revert to the doctrine of “does the practice have any redeeming value?” The results of this study suggest that slotting does not. Waiting too long can have the drastic consequence of waiting till it’s too late (e.g., the recent financial crisis).

What are the plausible options? As stated above, this author believes that regulation directed at eliminating market imperfections (e.g., a BATF type ban on slotting) creates new imperfections and is less effective than regulation directed to improving market competition. The largest market imperfection side effects of slotting are due to the fact the payments are an invisible market mechanism (privately negotiated). Allain and Chambolle (2005) show that on average 88% of the margins earned by French supermarkets on grocery products in 1999 were of the hidden kind (slotting fees and conditional rebates), compared to observable rebates and margins, which are stated in the invoice. Markets function efficiently the closer they come to perfect information. Improving transparency may be the better solution. There are two avenues in this direction.

First, FASB type rules requiring disclosure can make a big difference in promoting transparency, and through it, competitive self-regulation. FASB rules were designed to correct the accounting treatment of slotting fees, they involved gross numbers and the disclosures have become invisible post correction. As per FASB criteria, retailers did not need to disclose even the gross numbers involved. New regulation might require annual reporting to the FTC the amount received by retailers in slotting like fees (as defined by FASB)—but by category. Likewise manufacturers should be required to report how much they pay in each category. Of course, for competitive reasons the reports would be aggregate payments by category, but that might be sufficient to act as a moderating influence.

Second, if an interventionist stance is favored (and this author believes it should be) the provisions of the Robinson-Patman Act can be used to regulate slotting type payments. The avowed intent of Robinson-Patman is to maintain a level playing field at retail. The Act’s prohibition of price discrimination by sellers to buyers in the same market (Section 13(A)) is well known. After extensive analysis and hearings, FASB determined that all slotting type payments amount to a discount in the wholesale price of products. As such, variation in slotting payments to retailers in the same market are a prima facie violation of the price discrimination clause. Less publicized is the prohibition of discrimination in services, commissions, allowances and discounts, and the fact that the Act applies to the conduct of sellers as well as preferential terms coerced by resellers (Section 13(C)).Footnote 15 Enforcement of Robinson-Patman has been moribund for a while. Nevertheless, it seems that the regulatory framework already exists, in the spirit and letter of the law, that requires resellers to offer sellers an open and level playing field. In other words, if resellers are pricing shelf space according to a certain slotting metric, they are legally bound to offer the same terms to potential suppliers in their retail market (the market boundary definition problem here raises interesting questions). The Act may need amendment to add clarity and deterrence.

From the perspective of retail management, slotting allowances do not help abate the deluge of new products, improve their innovativeness nor (most likely) their success ratio. They seem to have protected retail prices and increased operating profit, probably by moderating retail competition in a concentrated environment (the growth of new formats notwithstanding). Grocery retailing may be financially healthier than it ever was. But there seems less and less justification for the continuing escalation in slotting payments. The time may be approaching where it risks killing the goose that lays the golden egg. If competition and innovation in supplier industries are irretrievably damaged, a key engine of retail sales growth will become choked. The marketers of national brands also spend large amounts on advertising and sales promotion that support category demand. Without that, the free ride that retailer private labels enjoy may also be lost. It is in the interest of retailers to begin seriously considering what managerial goals slotting fees are expected to play beyond testing the limits of what manufacturers are willing to pay. A more open slotting allowances regime that envisages specific tradeoffs and synergies between manufacturer advertising, consumer promotions, product innovations, absorption of distribution functions (such as direct store delivery, consignment selling or guaranteed profit margins) and retailer bottom lines is overdue.

This paper has analyzed a broad sweep of data to draw broad generalizations about underlying processes characterizing the nature and evolution of slotting allowances in grocery retailing. No single study in social science research can be said to be conclusive. The author hopes, limitations notwithstanding, that there is sufficient substance to the analyses of data patterns and the regulatory and managerial pros and cons discussed, to reenergize debate in an area of competition which seems strangely transfixed in an atmosphere of ennui. If the power and concentration of retailers is allowed to constrain the opportunities for suppliers to compete, it may riddle their ranks and investments in innovation. Soon it may be too late to act.

Notes

The BATF likened slotting to a consignment sale, noting “that the practical effect of slotting allowances is to refund, in whole or in part, the purchase price of a product that has not been sold, in proportion to the period of time that it remains unsold” (Federal Register 1995).

Data on new products and selling area for “all other retailers” (to form a parallel control group) are not available, consequently the hypotheses here are framed only in the context of differences across t1 and t2. Further, data for innovative new products are available only for t2 starting in 1985.