Abstract

Building on social capital theory, we view the marketing and sales interface as a set of inter-group ties and investigate how cross-functional relationships may facilitate the development of social capital associated with value creation. Our findings suggest that social capital embedded in marketing and sales relationships can inhibit a firm’s performance depending on the characteristics of its customers. Our results also demonstrate that managing the marketing and sales interface at different levels of customer concentration is critical to the success of a firm’s performance.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

The idea that cross-functional interactions have a strong impact on the successful implementation of strategies is widely recognized (e.g., Wind and Robertson 1983). Given that many cross-functional interactions are informal (Ruekert and Walker 1987), the lack of research attention to networks of social relationships between marketing and sales is surprising. Indeed, work to date has focused on typologies of marketing and sales organizational forms (Homburg et al. 2008; Workman et al. 1998), the respective influence of marketing and sales groups within a firm (Homburg et al. 1999), their cross-functional dispersion (Krohmer et al. 2002), their interface with other functional areas (Hughes et al. 2012), the planning of their activities (Strahle et al. 1996), their mindsets (Homburg and Jensen 2007), and the influence of organizational justice on their relationship effectiveness (Hulland et al. 2012).

This study expands upon the above work by taking marketing and sales research beyond formal organizational charts, considering explicitly the social networks existing between marketing and sales and their associated assets (i.e., social capital). Our primary contribution is to critically assess the utilization of organizational mechanisms (e.g., reward policies) through the lens of how they impact the development and deployment of marketing and sales social capital. Building on the idea that cognitive, structural, and relational constituents of social capital have unique effects on firm performance (Moran 2005; Nahapiet and Ghoshal 1998), we combine both antecedents and consequences of those social capital constituents.

Based on a sample of marketing and sales executives drawn from companies in the consumer goods industry, we propose that sales and marketing integration may not always pay off. More specifically, we present evidence indicating that organizational mechanisms affect the dynamics of firms’ social capital and performance depending on their customers’ characteristics.

The marketing and sales interface: a conceptual framework

Numerous authors have studied social capital at various levels, including the individual (Burt 1997), group (Burt 2000), national (Fukuyama 1995), organizational (Leana and Van Buren 1999), interorganizational (Chung et al. 2000), and industry network levels (Walker et al. 1997). For example, Leana and Van Buren (1999) define “organizational social capital as a resource reflecting the character of social relations within the organization, realized through members’ levels of collective goal orientation and shared trust” (p. 540, emphasis added). Further, Oh et al. (2006) introduce the concept of “group social capital—the set of resources made available to a group through members’ social relationships within the social structure of the group and in the broader formal and informal structure of the organization” (p. 569, emphasis added). Given that functional units (e.g., marketing, sales) can be conceptualized as a nexus of relationships, we introduce the concept of marketing and sales social capital in this same spirit.

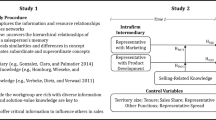

Our model includes three key sets of relationships. The first set of relationships describes the effect of social capital on performance. The importance of this dimension is based on growing evidence that social capital can enhance firm performance by providing access to information and resources (e.g., Adler and Kwon 2002; Ahearne et al. 2013; Birley 1985; McEvily and Zaheer 1999; Powell et al. 1996).

The second set of relationships examines the moderating effect of customer account concentration on the links between social capital and firm performance. We are guided here by a number of studies investigating moderating factors in the context of marketing organization (e.g., Aldrich 1979; Pfeffer 1994; Rouziès et al. 2005; Workman et al. 1998).

The third set of relationships examines how firms manage social capital residing in marketing and sales relationships through use of bridging and closure mechanisms (Leana and Van Buren 1999; Oh et al. 2006; Zou and Ingram 2013). Bridging mechanisms help firms develop social capital by encouraging connections (i.e., “bridges”) between previously disconnected individuals, providing them with access to new information and ideas (Burt 2000; Granovetter 1973). Closure mechanisms can also help firms improve social capital by enriching the interactions between people who are already connected, thereby facilitating greater cooperation and efficiency (Coleman 1988; Gargiulo et al. 2009).

In addition to these three key sets of relationships, we control for the effects of three potentially important environmental variables that have been used in past strategic marketing research—market turbulence, technological turbulence, and competitive intensity. We discuss each part of the model next and present our formal hypotheses (Fig. 1).

Social capital impact on performance

Various models of social capital have been advanced, but one of the most widely accepted frameworks is that of Nahapiet and Ghoshal (1998). Their framework draws important distinctions between the structural, relational, and cognitive dimensions of social capital. The structural dimension refers to the configuration of linkages between groups. The relational dimension involves other assets that derive from interactions such as trust, norms, and reciprocity. Finally, the cognitive dimension of social capital deals with shared languages, codes, or meanings by network members. We examine each of these dimensions in greater detail below.

Structural dimension of social capital

Homburg et al. (2008) empirically demonstrate that the most successful relationships between sales and marketing groups are the result of intense usage of structural linkages between the two. Marketing and sales personnel sharing strong ties can support each other while carrying out coordinated and congruent activities. In such networks, more information is shared, a stronger agreement on expectations develops, and a greater mutual interdependence forms (Sparrowe et al. 2001). This allows marketers to more accurately address the needs of potential clients using inputs from salespeople, and marketing research enables more confident selling through dissemination of market insights (e.g., see Hughes et al. 2013; Steward et al. 2010; Üstüner and Iacobucci 2012). Previous research confirms that dense, highly connected networks enhance communication efficiency (Rowley 1997; Walker et al. 1997) and firm performance (Zou and Ingram 2013). Thus, the structural dimension of social capital, manifesting as tie strength (Tsai and Ghoshal 1998), facilitates superior firm performance.

Relational dimension of social capital

A salesperson’s visit to a customer to introduce a new product is all the more efficient when it is coordinated with marketing’s launch of an associated advertising campaign. Both activities are consistent in that they have the same goal, and they support each other in that each activity makes the other one more effective. In this example, salespeople have been given access to the right information, and that enables them to do a better sales job (Üstuner and Godes 2006). Trust facilitates this kind of resource exchange as it increases people’s willingness to cooperate, building a reputation of trustworthiness and attracting other members into the network (Tsai and Ghoshal 1998). In turn, it has been well documented that trust and cooperation increase relationship performance (e.g., Crosby et al. 1990; Doney and Cannon 1997; Fang et al. 2008; Morgan and Hunt 1994; Nahapiet and Ghoshal 1998). Against this background, we argue that trust and cooperation, two key facets of relational social capital, lead to organizational success. This proposition is consistent with extant literature looking at the effect of relationship quality on firm performance (Crosby et al. 1990; DeWulf et al. 2001; Palmatier 2008; Palmatier et al. 2006; Sigaw et al. 1998).

Cognitive dimension of social capital

When marketing and sales personnel are on the same wavelength, they should improve firm performance (Homburg and Jensen 2007). In such cases they understand the other function’s point of view and can better handle conflicts. Such an understanding is important, because many marketing and sales decisions can be made on the basis of very different grounds. For example, the sales team may feel it is necessary to increase the level of satisfaction of a large account and request some product improvement, which, from the marketers’ point of view, might not make economic sense for only one account. Typically, both points of view need to be considered. As Dougherty (1992) points out: “Departments can develop different perspectives through which they might separate rather than combine information, including cognitive orientations such as goals, time frames, and formality (Lawrence and Lorsch 1967), languages (Tushman 1978), perceptions (Dearborn and Simon 1958), occupational cultures (Van Maanen and Barley 1984), or power (Riley 1983)” (p. 181). In other words, people need to invest in learning and understanding, and shared understandings and cognitive schemes enable them to better understand and use information and other resources held by members in their social networks (Maurer and Ebers 2006). This conjecture is further supported by the work of Gulati (1995) and Tsai and Ghoshal (1998), who show how shared visions enhance organizational performance. All of the above observations imply that there is a positive effect of the cognitive dimension of social capital, manifesting as shared vision on organizational performance.

Summarizing the above:

-

H1:

Organizational performance is positively associated with the (a) tie strength; (b) trust and cooperation; and (c) shared vision characterizing the marketing and sales interface within an organization.

The moderating effect of customer concentration

Customer relationships are crucial to business success, and their dependence structure has significant outcomes for a firm. Indeed, when firms have dominant customers, previous research has documented a number of risks, including customer opportunistic behavior, reduced survival likelihood for young supplier firms, and constrained innovation strategy for supplier firms (e.g., Fischer and Reuber 2004; Jap and Anderson 2003; Venkataraman et al. 1990; Yli-Renko and Janakiraman 2008). The extent to which a small number of customer firms account for a large proportion of a supplier firm’s revenue is an important variable to take into account when investigating the impact of the marketing and sales interface (two key functions for customer relationships) on a firm’s performance (Homburg et al. 2008). (Throughout the balance of this paper we refer to the phenomenon of customers concentrating their business in the hands of a small number of suppliers as customer concentration, representing supplier account rationalization on the part of the customer.) Thus, we address the moderating effects of customer concentration and argue that the influence of a firm’s marketing and sales social capital on its performance depends on its customer portfolio concentration.

Structural dimension of social capital

Tie strength is likely to matter more to firm performance when customer concentration is high. In essence, the necessity to meet a key customer’s needs and objectives will become pressing, since the supplier depends heavily on its significant share of revenue. Because a dominant customer can influence a firm’s decisions (Yli-Renko and Janakiraman 2008) and can therefore exert its power over marketing and sales policies, marketing and sales executives are likely to face increased demands from and develop a strong feeling of responsibility toward such customers. Consequently, they will intensify the use of their interactional processes (e.g., sharing and coordinating information and resources) to meet their key customer’s objectives, thereby placing a premium on tie strength since stronger ties enable these new patterns of interactions. Thus, higher customer concentration will require more intense forms of interaction between marketing and sales executives, and it will heighten the effects of tie strength on firm performance.

Relational dimension of social capital

In dealing with a small number of large, powerful customers, marketing and sales groups’ trust and cooperation are likely to become more salient. This is because the necessity to understand those customers’ needs, objectives, and routines is likely to become acute as the supplier cannot afford to lose such a big share of revenue. Since trust and cooperation have been found to increase relationship performance (e.g., Fang et al. 2008; Morgan and Hunt 1994; Nahapiet and Ghoshal 1998), we expect sales and marketing managers to mandate all possible resources and information sources in order to anticipate and meet their dominant customers’ needs. Trust and cooperation developed between sales and marketing managers will thus become crucial to improving a firm’s knowledge and understanding of its dominant customers in order to provide them with unique benefits and better services, thereby increasing their level of performance. This implies that greater customer concentration should moderate the positive relationship between trust and cooperation (key facets of relational social capital) and firm performance.

Cognitive dimension of social capital

Prior research has shown that firms often become dependent on their dominant customers and consequently need to take them into account in all their major decisions (e.g., Venkataraman et al. 1990; Yli-Renko and Janakiraman 2008). More specifically, when customers are very powerful, employees face pressure to adopt their dominant viewpoint. In general, powerful customers yield implicit knowledge that represents how things “ought to be.” This is partly because a powerful customer threatens the judgment of marketing and sales teams, dampens their independent efforts, and exerts its will and preferences. Indeed sales and marketing managers are likely to develop visions that are influenced by those of their powerful customers (e.g., Gargiulo and Benassi 2000), thereby decreasing the likelihood of contradicting customers’ expectations or pursuing marketing opportunities and innovation policies that are not in line with customers’ policies (e.g., Fang et al. 2008; Maurer and Ebers 2006).

When marketing and sales executive attention are tied up by a powerful customer (Yli-Renko and Janakiraman 2008), they will be more likely to neglect other valuable sources of information or downplay information cues contradicting their key customer’s situational analysis. As a result, the very reason why marketing and sales executives’ shared visions have a positive effect on firm performance (i.e., shared understandings and cognitive schemes allowing the choice of the best strategies to reach the firm’s goals) turns out to be detrimental when customer concentration is high because marketing and sales executives’ shared visions will then espouse that of their key customer (i.e., shared understandings and cognitive schemes allowing the choice of the best strategies to reach the key customer’s goals). Taken together, these arguments imply that visions shared by sales and marketing are more likely to impede organizational performance when customer concentration is high than when it is low. This conclusion is consistent with Li and Calantone (1998) and Morgan et al. (2005), who point to a firm’s risk of opportunistic behavior depending on its customers’ concentration. Summarizing the above:

-

H2:

A higher degree of customer concentration will be associated with (a) a strengthening of the tie strength–firm performance relationship; (b) a strengthening of the trust and cooperation–firm performance relationship; and (c) a weakening of the shared vision–firm performance relationship.

Bridging and closure mechanisms

Given the importance of social capital for firm success (e.g., Adler and Kwon 2002), a key question that arises is what steps managers should take to foster marketing–sales social capital within their firms. Bridging and closure relationships are the main conduits of social capital (Burt 2000). They emphasize (respectively) mechanisms that either bridge gaps between disconnected people or encourage denser connection networks between people (Oh et al. 2004, 2006). In the following subsections, we discuss two types of mechanisms that can facilitate either bridging or closure: (1) human resource policies and (2) political mechanisms.

Human resource policies: rewards

Leana and Van Buren (1999) theorize that human resource policies strongly affect organizational social capital. By way of analogy, we argue that reward policies support marketing and sales social capital. According to social interdependence theory (Deutsch 1949), people’s beliefs about how their goals are related determine how they interact and ultimately how they perform (Johnson et al. 2006). A central tenet of this theory is that reward structure (e.g., cooperative) is a driver of group interactions. In organizations using non-cooperative rewards, employees place their own goals above those of the organization. The reverse is true for cooperative rewards (Beersma et al. 2003). In the context of our study, non-cooperative rewards are likely to (1) prevent managers from cooperating with their functional counterparts and (2) engage into the pursuit of local goals, ignoring company goals or the other departments. Such behaviors will weaken ties between functions (Ketokivi and Castaner 2004), a core facet of structural capital. Relatedly, the willingness to subordinate individual goals to company goals will also be associated with lower trust and cooperation levels, central to cognitive capital. This is because the lack of connectivity between the functions will impede the development of trust and cooperation between marketing and sales over time. Finally, managers responding to non-cooperative reward structures tend to keep information proprietary, and they potentially try to gain personal advantages at the expense of the superordinate group (Beersma et al. 2003), it is unlikely that their behaviors will foster information exchange and resource sharing. Instead, such behaviors are likely to enhance misunderstandings through an absence of communication resulting from their lack of solidarity. Consequently, by emphasizing the salience of individual goals, non-cooperative rewards will hinder shared understandings, representations, and interpretations or shared vision (a crucial dimension of cognitive capital). Thus:

-

H3:

Non-cooperative rewards have a negative association with the (a) tie strength; (b) trust and cooperation; and (c) shared vision characterizing the marketing and sales interface within an organization.

When these rewards are contingent upon attainment of company goals, employees are motivated to expand effort to realize those goals (Menon et al. 1997). This suggests that they will engage in mutually supportive behaviors and teamwork, thereby resulting in stronger ties between individuals. For this reason, cooperative rewards are positively associated with structural social capital. They are also positively associated with relational social capital since trust and cooperation—core facets of relational social capital (Leana and Van Buren 1999)—are likely to develop from this increased number of interactions. In addition to teamwork and helping, cooperative rewards promote information sharing (Beersma et al. 2003). This virtuous activity then adds to the stock of cognitive social capital since a shared vision is likely to develop through information sharing. Consequently, we posit that a cooperative rewards positively drive social capital levels (all three dimensions).

-

H4:

Cooperative rewards have a positive association with the (a) tie strength; (b) trust and cooperation; and (c) shared vision characterizing the marketing and sales interface within an organization.

Political mechanisms: functional power imbalance

Given that cross-functional relationships occur within the context of the power relations among functions, we examine how the distribution of functional power affects the development of social capital. As functional power hierarchies vary across firms and change over time (Homburg et al. 2008; Pfeffer 1994; Workman et al. 1998), this issue appears to be central in understanding how firms manage social capital.

Functional organizational structures are examples of group-based hierarchies described by Sidanius and Pratto (1999) as being driven by a number of intergroup processes characterized in part by distrust and lack of cooperation (Rosenblatt 2012). This is because power, manifesting as coercion, does not trigger trust and voluntary cooperation (key facets of relational capital). Consequently, interaction frequency between functions is likely to decrease, thereby weakening ties. Moreover, when power is clearly tipped in favor of one function over another (versus a situation where power is more equitably distributed), functional managers are not likely to share information since their level of trust is low. Therefore, they are not likely to develop common understandings and shared vision. Thus:

-

H5:

Functional power imbalance has a negative association with the (a) tie strength; (b) trust and cooperation; and (c) shared vision characterizing the marketing and sales interface within an organization.

Political mechanisms: justice

Hulland et al. (2012) theorize that perceptions of organizational justice play a key role in building interdepartmental relationships. In our study, sales and marketing managers’ perceptions about the fairness of organizational decisions represent distributive justice, while perceptions of the fairness of organizational policies and procedures represent procedural justice.

These notions support the view that marketing and sales social capital will be engendered when functional members perceive that both the process through which allocations of resources are made to their functional unit (i.e., procedural justice) and the outcomes of these allocations (i.e., distributive justice) are fair. Thus, perceptions of procedural justice will strengthen sales and marketing ties, enhancing structural social capital. This is because when managers perceive that they have some input into decision-making processes and that decision processes are consistent, unbiased, adaptable, ethical, accessible—that is, when they perceive organizational procedural justice (e.g., Colquitt et al. 2001; Tax et al. 1998)—they are likely to behave reciprocally by rewarding the organization they deem fair (Bosse et al. 2009). In other words, we expect stronger links to develop between sales and marketing when managers perceive procedural fairness.

Similarly, a procedural justice climate will increase a core element of relational capital, trust, and cooperation (Leana and Van Buren 1999). Prior research has demonstrated that perceived procedural justice tends to create climates of cohesiveness, harmony, and loyalty (Thibaut and Walker 1975; Tyler et al. 1996), typically related to trust and resulting in cooperation.

Finally, since procedural justice is associated with greater interconnectedness as explained above, perceptual agreement will rise (Klein et al. 2001), and values, norms, and knowledge will diffuse more easily (Rulke and Galaskiewicz 2000). In other words, a shared vision by marketing and sales is likely to develop, resulting in enhanced cognitive social capital. Consequently:

-

H6:

Procedural justice has a positive association with the (a) tie strength; (b) trust and cooperation; and (c) shared vision characterizing the marketing and sales interface within an organization.

Extending this logic to distributive justice, we argue that perceptions of distributive justice (which is focused on outcomes) will trigger higher levels of structural capital. It has been positively associated with higher levels of happiness, pride, and effort (Cohen-Charash and Spector 2001; Greenberg 1988), and reciprocal behavior (Bosse et al. 2009). In other words, distributive fairness is consistent with the development of mutually supportive behaviors, positive interactions resulting in stronger agreements on expectations and interdependence (i.e., the development of stronger ties within organizational units). Further, distributive justice also enhances trust and cooperation (Cohen-Charash and Spector 2001). Given that trust and cooperation have been linked to willingness to engage in social exchange (Nahapiet and Ghoshal 1998), we argue there is a positive relationship between distributive justice and relational capital. Finally, given that distributive justice has been positively associated with reciprocal behavior (Bosse et al. 2009), we surmise that shared cognitions will develop because more information will be shared, better understandings of the other function’s point of view will emerge and stronger agreements on expectations will appear. The resulting shared cognitions will facilitate access to information and people. Therefore, marketing (or sales) managers who perceive outcome fairness will develop capabilities to understand and communicate with sales (or marketing) managers. As a result, distributive justice will promote cognitive capital. Consequently:

-

H7:

Distributive justice has a positive association with the (a) tie strength; (b) trust and cooperation; and (c) shared vision characterizing the marketing and sales interface within an organization.

Baseline influences on firm performance

Our premise is that cross-functional relationships may facilitate the development of social capital associated with value creation. To control for the effects of exogenous factors, we initially included three of the most frequently studied market-level covariates that have been found to influence firm performance in similar research contexts: market turbulence, technological turbulence, and competitive intensity (e.g., Homburg and Jensen 2007; Jaworski and Kohli 1993; Vorhies et al. 2009). All three controls were measured empirically in our study. However, only technological turbulence was found to have a significant impact on the relationships studied here. Thus, in the interests of clarity and parsimony we subsequently discuss only the technological turbulence control variable in our empirical section.

Empirical study and model estimation

Design: survey context and data collection

We surveyed multiple key informants within both sales and marketing departments of the same firms, asking them about their perceptions of how their department as a whole was treated, as well as questions relating to their business unit. More specifically, we surveyed employees of supplier firms in the consumer packaged goods (CPG) industry. Typical customers in this industry (i.e., the intermediaries who buy suppliers’ products and then sell them to end consumers) are large food retailers, franchised restaurant chains, and contract caterers that expect their suppliers to develop unique offers and tailored packaging (Dewsnap and Jobber 2000). Cespedes (1995) suggests that such expectations can be met only through effective interdepartmental relationships within a supplier. Social capital can play a large role in facilitating or inhibiting effective interactions.

Initially, senior managers (i.e., VPs of sales) in the business units of organizations that were members of a North American CPG trade association were sent covering letters soliciting cooperation for the study. Thirty eight companies agreed to participate, including Kraft, Procter & Gamble, and Quaker. The senior managers then identified key contacts in both their marketing and sales departments (e.g., regional sales managers), who were in turn called and asked for the names of potential informants in each department. Survey packages were sent via mail to these informants (n = 292), with an average of 7.1 surveys sent to each organization. Separate questionnaires were created for sales and marketing informants. The same measurement items were used in both versions, but appropriate wording changes were made. Senior managers with each firm mentioned our survey to their subordinates, and encouraged them to participate in the study. Two follow-up waves were employed (one by letter, one by e-mail or telephone) to encourage maximum response (Dillman 2000).

Ultimately, 203 usable surveys were received, for an overall response rate of 70% (203/292). Four percent of the informants withdrew during survey completion, and the remaining 26% did not reply. No significant differences were noted in the responses from early versus late informants. On average, 5.34 responses were received from the 38 participating firms, ranging from three to twelve. Roughly half of these responses were from marketing personnel (mean = 2.68) and half from sales personnel (mean = 2.66). Thus, for a typical firm, multiple responses from both marketing and sales were received.

Measures

Business unit performance was assessed using eight items. (Appendix lists all measurement items employed in our study.) Informants were asked to indicate the extent to which various business unit outcomes had occurred over the past six months, based on 7-point scales (anchors: “none”, “a lot”). The eight items show high convergence (alpha = .90).

Non-cooperative rewards was assessed using four items (α = 0.76) measuring the dimension of an organization’s reward system that encourages departments to focus on their own goals, compete with other departments, and optimize local performance (Walton et al. 1969; Litwin and Stringer 1968). These measures (drawn from Walton et al. 1969) capture the degree to which a functional orientation has been fostered by the responding organization through a functional reward emphasis within the firm.

Cooperative rewards was measured by the extent to which employees achieve outcomes that benefit their organizations, while avoiding activities that “game the system,” as suggested by Jaworski and Kohli (1993). These measures assess the extent to which rewards are based on external variables such as customer relations or customer satisfaction (α = 0.71). The four measures we employ reflect the firm’s support for a market-based reward orientation, and should be closely related to common goals.

Functional power imbalance was measured using three items that assess the relative power of marketing and sales (α = 0.72). The three items (adopted from Smith and Barclay 1997) were averaged, and the absolute deviation of this average from 3 (equal power) was then calculated. We use a linear measure for functional power imbalance in our models. We also examined the effects using a quadratic measure; the results were very similar.

Distributive and procedural justice were both assessed using a subset of the justice items developed by Tax et al. (1998). Distributive justice was measured with four items (α = 0.85) reflecting the fairness of decision outcomes and the allocation of benefits and costs among departments. For procedural justice we used six items (α = 0.79) designed to measure the perceived fairness of policies and procedures used to allocate costs and benefits across departments. (Subsets of items for both constructs were used because preliminary factor analyses revealed multi-dimensional structures when the original full sets were employed.)

Customer concentration (moderator) was measured using three items reflecting customers’ greater emphasis on supplier rationalization, consolidation, and supply chain management (α = 0.67). This scale is new to our study.

Measures for all three controls were drawn from Jaworski and Kohli (1993). Technological turbulence, representing the rate of technological change, was assessed using five items (α = 0.75). Market turbulence—the rate of change in the composition of customers and their preferences—was evaluated using four measures (α = 0.53). Finally, competitive intensity was measured using five items (α = 0.63).

Structural dimension of social capital

Given that the marketing and sales interface is characterized here by tie strength relationships between the two groups, the structural dimension of social capital is operationally defined as perceived extent of integration (since the dense networks that result from integration facilitate the exchange of information). A total of four items drawn from Cespedes (1995) that capture the firm’s use of structural integrating mechanisms between marketing and sales were used to measure this dimension of social capital (α = 0.70).

Relational dimension of social capital

In keeping with Nahapiet and Ghoshal (1998), we focus on two important facets of the relational dimension of social capital: trust and cooperation. Eight measures of mutual trust and seven measures of cooperation proposed by Smith and Barclay (1997) were used for the relational dimension (α = 0.94).

Cognitive dimension of social capital

Operationally, we focus on shared vision as a proxy for the cognitive dimension of social capital, following Tsai and Ghoshal (1998). To assess the extent to which shared thought vision exists within the firm, we used a total of 17 items (α = 0.72). Four measures of shared organizational identity were used from the work of Mael and Ashforth (1992). Organizational identification reflects a common perspective on the importance of organizational goals and activities (Maurer and Ebers 2006). Further, 13 items demonstrating diversity in the perspectives of marketing and sales groups (reverse coded) drawn from Cespedes (1995) were employed. Because marketing and sales feature different thought worlds (Cespedes 1995; Homburg and Jensen 2007; Ruekert and Walker 1987; Smith et al. 2006), diversity in perspectives exist and signal the absence of shared understandings and cognitive schemes (i.e., lack of a shared vision).

Analysis and results

Table 1 reports means and standard deviations, by construct. It also shows the correlations between constructs. Coefficient alphas are reported in the diagonal of the correlation matrix. Nunnally (1978) suggested 0.7 as a benchmark for internal consistency for reflective constructs. Virtually all of our measures of Cronbach’s alpha are above 0.7, with a few falling slightly below this threshold, indicating reasonable composite reliability for our constructs. Further, the constructs appear to be adequately discriminated from one another. A few of the correlations in Table 1 are somewhat high, indicating that there may be issues with multicollinearity. However, all variance inflation factors were below 2.3, suggesting multicollinearity is not a problem (Hair et al. 2010).

Analysis and model development

Our study uses responses from multiple individuals within the same firm, so it is necessary to account for a correlated error structure across individual respondents. Since individuals are nested in firms, use of a hierarchical linear modelling (HLM) approach is appropriate here (Raudenbush and Bryk 2002). The unit of analysis we employ to test our hypotheses (which are specified at the firm level) are individual perceptions of organizational constructs. Thus, these individual measures must be aggregated to firm-level equivalents. HLM allows for this type of aggregation while also retaining individual-level information; the second level of an HLM model accounts for firm-specific heterogeneity, whereas the first level accounts for individual-specific heterogeneity. Preliminary analysis using HLM indicated that marketing and sales managers’ perceptions of the constructs in our study are consistent once firm (and individual) differences are accounted for (i.e., addition of a third level in the HLM model to account for departmental differences was not significantly better than a two-level model).

Two sets of analyses were conducted to test the hypotheses advanced earlier. The first set examines the relationships between the three dimensions of social capital and perceived business unit performance, while the second examines the effects of the various organizational bridging and closure mechanisms on all three social capital facets.

Social capital impact on business unit performance

To test Hypotheses 1 and 2, we estimated the following HLM model. Note that while all of the construct measures are perceptions collected at the individual level (and are subscripted ij to indicate that the measure is from individual i who works in firm j), the β coefficients themselves are firm-specific (i.e., they only have a j subscript). However, as will be seen below, aside from the intercept term (which varies by firm), we model the other coefficients as fixed effects. (Thus, the HLM model does not include random slopes, reducing it to a variance components model.) We use the estimated β values to test our hypotheses.

Level 1 (Individual)

Level 2 (Firm)

Equation 2 describes the coefficient β0j as a function of γ00 (the average conditional value of BUPerf across all informants, conditional on all of the independent variables), and a firm-specific random error component. This means that the mean value of BUPerf varies by firm, allowing us to control for the effects of firm heterogeneity. Equations 3a–3g indicate that the slopes for the effects of the remaining variables are the same for all individuals and firms. (HLM can accommodate differences in slopes across firms by adding a random error term to any or all of these equations, but we found empirically that such additions were not significant.)

Combining the above equations results in an estimation model that includes both an individual-specific variance term (rij) and a firm-specific variance term (u0j). An individual’s perception of firm performance (BUPerf) is influenced by both an idiosyncratic personal error component and a firm-specific variance component. Thus, the effects of the three social capital dimensions, customer concentration, the three interactions, and the control variable on BUPerf are estimated while taking into account both individual- and firm-specific differences.

Because all of our measures are perceptual and collected from the same informants, there may be a concern that our findings can be attributed to single-source bias. To address this concern, we approached the senior contacts within each firm, and asked them to complete a second questionnaire that focused on marketing/sales performance and eight organizational outcomes (new product success, market share growth, sales growth, increased profits, greater customer focus, customer satisfaction, customer relations, and customer value) over the preceding six-month period. (These individuals did not participate in the original survey.)

A total of 28 senior managers completed this second survey, one respondent per firm. We examined the new data by comparing them to an aggregated measure of business unit success (calculated using the average across all participants in the original survey from that company). First, we separated the eight new items into two groups using factor analysis (variance explained = 78%; eigenvalues 4.7, 1.6), with the first three items listed above belonging to one factor (“growth”; alpha = .90) and the remaining five items to the second (“customer success”; alpha = .89). These factors were then used in two separate regression analyses, with aggregate business unit success as the independent variable in both models and the two factor scores as the dependent measures (one in each model). The effect of business unit success on the “growth” factor is significant (F(1,27) = 11.48, p < .01), while its effect on “customer success” is not (F(1, 27) = 0.81, n.s.). These results indicate that the individual respondents’ (averaged) perceptions of business unit success are significantly related to positive business outcomes (as judged by a different set of senior managers) and suggest that single-source bias is not a major issue in our data.

Bridging and closure mechanisms impact on social capital

To test Hypotheses 3 through 7, we estimated a second set of HLM models. The equations below describe the HLM model for the structural dimension of social capital. In the interests of space, we do not specify the other two social capital models, but they are identical in form. These three HLM models are estimated independently, and we assume that the errors across equations are independent. To test this assumption, we estimated corresponding regression models, calculated the residuals, and then looked at their correlations. None of these correlations were greater than 0.3.

Level 1 (Individual)

Level 2 (Firm)

Tests of hypotheses

Social capital impact on business unit performance

The HLM-estimated effects of structural (tie strength), relationship (trust/cooperation), and cognitive (shared vision) capital on business unit performance, in conjunction with customer concentration and technological turbulence, are reported in Table 2. In addition to the path coefficients (and the degree to which they are significant), this table also reports deviance (−2 times the value of the log-likelihood function), σ2 (the within-firm variability), and τ (the between-firm variability). The results for this model are compared to those obtained by estimating a corresponding null model (equivalent to a one-way ANOVA with random effects), with the improvement in the proportion of variance explained for both the first and second levels indicated at the bottom of the table (individual and firm, respectively). “Full Model” reports results for the fully specified model. This model represents a significantly better fit to the data than the null model (χ2 = 27.04; df = 8; p < .001), leading to a 15.0% improvement in within-firm explained variance, and a 36.7% improvement in the explanation of between-firm variance versus the null model. Note that this means that nearly 40% of the original variance across firms is now accounted for by the model variables. All of these effects are at the firm (and not individual respondent) level, consistent with the level stated in our hypotheses.

As shown in Table 2 (“Full Model”), both tie strength (β = .089, p < .05) and shared vision (β = .214, p < .01) have a significant, positive effect on performance, while the effect of trust/cooperation is non-significant (β = .025, ns) (H1a, H1c and H1b respectively). Technological turbulence (β = .123, p < .05) and customer concentration (β = .239, p < .01) also have significant, positive effects. The interaction between trust/cooperation and customer concentration (β = .479, p < .01) is significant and positive, as predicted (H2b), and the interaction between shared vision and customer concentration (β = −.268, p < .05) is significant and negative, also as predicted (H2c). However, the interaction between tie strength and customer concentration (β = −.019, n.s.) is not significant, counter to H2a. (Both the hypotheses and the results of our tests are summarized in the final columns of Table 2.)

Bridging and closure mechanisms impact on social capital

Results for three HLM models are reported in Table 3. (For the sake of brevity, the null model results are not separately reported in this table. However, following Raudenbush and Bryk (2002), all model fit comparisons are made to these null models.)

For tie strength, the model reported in Table 3 represents a significantly better fit to the data than the null model (Δ deviance = 25.32; this is χ 2 distributed with 5 df; p < .001). This results in an 18.7% reduction in the within-firm variance, and a 52.9% reduction in between-firm variance (as noted at the bottom of Table 3). As hypothesized, distributive justice (β = .168, p < .05) has a significant and positive effect on tie strength (H7a), while non-cooperative rewards (β = −.213, p < .01) and functional power imbalance (β = −.169, p < .05) have a significant, negative effect (H3a and H5a respectively). However, neither cooperative rewards (H4a) nor procedural justice (H6a) have a significant effect.

The model for trust/cooperation reported in Table 3 again represents a significantly better fit to the data than the null model (χ2 = 23.46; df = 5; p < .001), resulting in a 12.2% reduction in within-firm variance and a 68.0% reduction in between-firm variance. Both non-cooperative rewards (β = −.154, p < .01) and functional power imbalance (β = −.175, p < .01) have a significant and negative effect on trust/cooperation (supporting H3b and H5b), while cooperative rewards (β = .095, p < .05) has a significant, positive effect (H4b). However, neither procedural justice nor distributive justice has a significant effect (H6b and H7b).

Finally, the shared vision model shown in Table 3 is significantly better than its corresponding null model (χ2 = 35.41;df = 5; p < .001), yielding a 29.3% reduction in within-firm variance and a 48.5% reduction in between-firm variance. Both procedural justice (β = .129, p < .05) and distributive justice (β = .187, p < .01) have a significant and positive effect on shared vision (H6c and H7c respectively), while non-cooperative rewards (β = −.176, p < .01) and functional power imbalance (β = −.112, p < .05) have a significant, negative effect (H3c and H5c respectively). The effect of cooperative rewards (H4c) is not significant.

Discussion and managerial implications

This study focuses on marketing and sales because these two functions have the most direct contact with customers. They play a central role in managing the firm–client interface. Therefore, social relationships between sales managers and marketing managers are key features of this environment. Our results show that a firm’s performance reflects an apparent balancing of two conflicting pressures: the integration imperative (to better serve customers) and the differentiation pressure (to exploit the learning and cooperation benefits that have been shown to exist in cohesive groups). Because firms simultaneously pursue these seemingly contradictory goals, we posit that they use specific organizational mechanisms to influence relationships between marketing and sales groups. A fundamental and related issue is how firms can generate value from the social capital embedded in these relationships. Our findings suggest that social capital enhances but also limits a firm’s performance depending on customers’ characteristics. More specifically, we observe that marketing and sales integration can become a liability to a firm’s performance when customer concentration is high.

First, we find that social capital embedded in the relationships between marketing and sales managers is nurtured by firms through organizational mechanisms. These include how employees are rewarded and who is assigned power. Independent, specialized functional units can develop a high level of competence, but because of their narrow focus they often become highly interdependent on other specialized units (March and Simon 1958). Too much specialization among independent functional units therefore becomes potentially problematic for the firm if there are not enough relationships tying units together to maintain effective and useful communication flows. In our study, we show that one way to encourage inter-unit linkages resulting in the development of social capital is to use bridging mechanisms. These mechanisms might be as simple as adapting the compensation structure to reward cooperation. In extremely competitive internal environments, it may be necessary to modify the reward allocation process so that it is more transparent and procedurally fair. If a firm is able to create an environment where rewards are equitably distributed, managers from specialized units will develop social networks, building more social capital in the process. Similarly, if a firm is able to balance power between the marketing and sales functions, managers will trust their functional counterparts more and cooperate more with them, thereby developing stronger social capital. This is reflected in consumer goods industries where powerful brand managers interact with sales and key account managers whose power is rising as customer business development, efficient consumer response, and category management are implemented (Cespedes 1995; Homburg et al. 2002, 2008).

Second, we find a condition that turns social capital into a potential liability for the firm. This occurs when a firm has a small number of clients who make up the bulk of its sales. When a firm’s customer concentration reaches high levels, we show that marketing and sales teams focus more on each other in a way that can potentially hinder organizational performance. Indeed, when firms manage powerful customers, relational assets of social capital (i.e., trust/cooperation) help managers to mobilize more resources, maintain a tight customer focus, and ultimately increase performance. However, we find that while customer concentration enhances the impact of the relational dimension of social capital on performance (i.e., they are more likely to trust and cooperate with one another), it also hinders the impact of the cognitive dimension of social capital on performance (i.e., an over-emphasis on shared vision). Simply put, our results provide evidence for the notion that marketing and sales managers adopt cognitive schemes that tend to espouse those of their powerful customers. This can stifle innovation and inhibit rapid responses to changing market conditions because managers cannot access knowledge necessary to identify market opportunities (as their attention is tied up by key customers). Serving the needs of the most critical accounts may drive managers to ignore outside information and hinder a firm’s monitoring of the business environment. Further, the development of social ties with other groups may be delayed or ignored. Consequently, marketing opportunities may be lost and the adaptability to environmental changes may diminish (Fang et al. 2008; Van Knippenberg et al. 2004). In the same vein, Homburg and Jensen (2007) conclude that what is good for harmony between marketing and sales may not necessarily be good for firm performance. Thus, they encourage firms to install internal role structures to ensure that more relevant information and more arguments enter into market-related decisions.

This finding is also consistent with earlier accounts of cognitive lock-in experienced by managers embedded in dense networks (e.g., Gargiulo and Benassi 2000; Maurer and Ebers 2006). This raises a new and interesting issue related to key account management. Customers with a power advantage often demand higher levels of service. As a response, firms focus on developing partnering relationships with their key customers (Jones et al. 2005; Weitz and Bradford 1999) and strive to set up an appropriate key account management structure. Issues related to key account management are highly pertinent for marketing and sales managers (Homburg et al. 2002).

Thus, contrary to conventional wisdom, we do not advise marketing and sales managers to stay excessively focused on improving their relationships with powerful key accounts. Our analysis shows that when customers have a power advantage, they are likely to have a negative impact on social capital cognitive assets performance. Marketing and sales manager think alike, operate in a vacuum, and fail to sense changes in the market because they remain too focused on serving their key accounts. They experience cognitive lock-in. Overall, without a broader perspective on the evolution of the market, suppliers may lose track of what is commercially acceptable and eventually put their firm in jeopardy.

Limitations and avenues for further research

As with all research, the present study has certain limitations that provide avenues for future research. First, because our analysis rests on survey data provided by firms operating in the consumer goods industry, the applicability of our findings to other industries needs to be assessed. We found that customer concentration enhanced the magnitude of the effect of relational social capital assets on organizational performance and simultaneously lowered the impact of cognitive social capital assets. Future studies, using better measures of customer power, might yield more nuanced insights into why these differences exist. Further, all of our data are survey responses, leading to potential concern about methods bias. Use of alternative methodological approaches could help eliminate this concern.

Second, given that firms frequently use account teams (including functional specialists) to better serve their key customers, understanding the mechanisms that give rise to social capital in those teams will be particularly important. For example, Murtha et al. (2011) provided evidence for internal blocking of team members by their own account manager. In this way, the phenomenon they have identified at the level of the account team is in line with the one we find for the marketing and sales group interaction. Correspondingly, future research could explore how firms serve their powerful customers.

Third, we selected only two dimensions of justice. In the justice arena, researchers have often done so (e.g., Erdogan et al. 2006; Roberson 2006; Roberson and Williamson 2012; Tekleab et al. 2005; Wiesenfeld et al. 2007). Furthermore, we primarily focused on firm-level phenomena in this paper, and both distributive and procedural justice are defined at this level. In contrast, international justice—the interpersonal treatment received from other employees in the organization (e.g., Bies 1986; Tax et al. 1998; Tyler and Bies 1990)—is more relevant at the individual employee level. As a result, we did not include it in our study. However, a more complete conceptualization of justice might include its effects. For example, Hulland et al. (2012) found that interactional justice played an important role in affecting the effectiveness of working relationships between marketing and sales employees.

Fourth, future research could examine other moderators. For example, Xiao and Tsui (2007) call for more research on the way mechanisms of social capital operate with different cultural norms and market mechanisms. Multilevel models could also be considered in this context, as suggested by Oh et al. (2006). Relatedly, it may be worth examining whether the antecedents to social capital that we use here have a direct impact on business performance. In our models we assume only indirect effects through the three social capital dimensions; however, both direct and direct effects may exist.

A fifth limitation stemming from the measurement scales used in the survey is our inability to validate the existence of a relationship between relational capital (trust/cooperation) and firm performance (i.e., H1b), and between procedural and distributive justice and relational capital (i.e., H6b and H7b respectively). Better measures of relational capital may need to be identified in future work.

Despite these limitations, our study is the first to apply the social capital lens to the marketing and sales interface. This novel theoretical perspective provides insights on a very interesting issue: that of marketing and sales interactions in the presence of powerful customers. In this context, our findings suggest that the chief challenge for senior executives managing the value of social capital is to make sure—by using both bridging and closure mechanisms—that marketing and sales teams do not get “locked in” when dealing with these customers.

References

Adler, P. S., & Kwon, S.-W. (2002). Social capital: prospects for a new concept. Academy of Management Review, 27(1), 17–40.

Ahearne, M., Lam, S. K, Kraus, F. (2013). Performance impact of middle managers’ adaptive strategy implementation: the role of social capital. Strategic Management Journal, in press.

Aldrich, H. E. (1979). Organizations and environments. Englewood Cliffs: Prentice Hall.

Beersma, B., Hollenbeck, J. R., Humphrey, S. E., Moon, H., Conlon, D. E., & Ilgen, D. R. (2003). Cooperation, competition, and team performance: towards a contingency approach. Academy of Management Journal, 46, 572–590.

Bies, R. J. (1986). Identifying principles of interactional justice: The case of corporate recruiting. In R. J. Bies (Ed.), Moving Beyond Equity Theory: New Directions in Research on Justice in Organizations. Symposium conducted at the meeting of the Academy of Management: Chicago, IL.

Birley, S. (1985). The role of networks in the entrepreneurial process. Journal of Business Venturing, 1, 107–117.

Bosse, D. A., Philips, R. A., & Harrison, J. S. (2009). Stakeholders, reciprocity, and firm performance. Strategic Management Journal, 30, 447–456.

Burt, R.S. (1997). The contingent value of social capital. Administrative Science Quarterly, 42(2), 339–365.

Burt, R. S. (2000). The network structure of social capital. In R. I. Sutton, B. M. Staw (eds.), Research in Organizational Behaviour (pp. 345–423) Greenwich: JAI Press, CT, 22.

Cespedes, F. V. (1995). Concurrent marketing: Integrating product, sales, and service. Boston: Harvard Business School Press.

Chung, S., Singh, H. & Lee, K.(2000). Complementarity, status similarity and social capital as drivers of alliance formation. Strategic Management Journal, 21, 1-22.

Cohen-Charash, Y., & Spector, P. E. (2001). The role of justice in organizations: a meta-analysis. Organizational Behavior and Human Decision Processes, 86, 278–321.

Coleman, J. S. (1988). Social capital in the creation of human capital. The American Journal of Sociology, 94, S95–S120.

Colquitt, J. A., Conlon, D. E., Wesson, M. J., Cohl, P., & Ky, N. (2001). Justice at the millennium: a metaanalytic review of 25 years of justice research. Journal of Applied Psychology, 86(3), 424–445.

Crosby, L. A., Evans, K. R., & Cowles, D. (1990). Relationship quality in services selling: an interpersonal influence perspective. Journal of Marketing, 54, 68–81.

Dearborn, D., & Simon, H. (1958). Selective perception: a note on the departmental identification of executives. Sociometry, 140–144.

Deutsch, M. (1949). A theory of cooperation and competition. Human Relations, 2, 129–152.

Dewsnap, B., & Jobber, D. (2000). The sales-marketing interface in consumer packaged-goods companies: a conceptual framework. Journal of Personal Selling & Sales Management, XX(2), 109–119.

DeWulf, K., Odeberken-Schröder, G., & Iacobucci, D. (2001). Investments in consumer relationships: a cross-country and cross-industry exploration. Journal of Marketing, 65(October), 33–50.

Dillman, D. A. (2000). Mail and internet surveys: The tailored design method. John Wiley & Sons.

Doney, P. M., & Cannon, J. P. (1997). An examination of the nature of trust in buyer-seller relationships. Journal of Marketing, 61(2), 35–52.

Dougherty, D. (1992). Interpretive barriers to successful product innovation in large firms. Organization Science, 3(2), 179–202.

Erdogan, B., Liden, R. C., & Kraimer, M. L. (2006). Justice and leader-member exchange: the moderating role of organizational culture. Academy of Management Journal, 49(2), 395–406.

Fang, E. (Er), Palmatier, R. W., Scheer, L. K., Li, N. (2008). Trust at different organizational levels. Journal of Marketing, March, 72, 2, 80–98.

Fischer, E., & Reuber, A. R. (2004). Contextual antecedents and consequences of relationships between young firms and distinct types of dominant exchange partners. Journal of Business Venturing, 19(5), 681–706.

Fukuyama, F. (1995). Social capital and the global economy. Foreign Affairs, 74(5), 89–103.

Gargiulo, M., & Benassi, M. (2000). Trapped in your own net? Network cohesion, structural holes, and the adaptations of social capital. Organization Science, 11(2), 183–196.

Gargiulo, M., Ertug, G., & Galunic, C. (2009). The two faces of control: network closure and individual performance among knowledge workers. Administrative Science Quarterly, 54(2), 299–333.

Granovetter, M. S. (1973). The strength of weak ties. American Journal of Sociology, 78, 1360–1380.

Greenberg, J. (1988). Equity and workplace status: a field experiment. Journal of Applied Psychology, 73, 606–613.

Gulati, R. (1995). Social structure and alliance formation patterns: a longitudinal analysis. Administrative Science Quarterly, 40(4), 619–652.

Hair, J. F., Jr., Black, W. C., Babin, B. J., & Anderson, R. E. (2010). Multivariate data analysis (7th ed.). Upper Saddle River: Prentice Hall.

Homburg, C., & Jensen, O. (2007). The thought worlds of marketing and sales: which differences make a difference? Journal of Marketing, 71(3), 124–142.

Homburg, C., Workman, J.P., & Krohmer, H. (1999). Marketing's influence within the firm. Journal of Marketing, 63(2), 1–17.

Homburg, C., Workman, J. P., Jr., & Jensen, O. (2002). A configurational perspective on key account management. Journal of Marketing, 66(2), 38–60.

Homburg, C., Jensen, O., & Krohmer, H. (2008). Configurations of marketing and sales: a taxonomy. Journal of Marketing, 72(2), 133–154.

Hughes, D. E., Le Bon, J., & Malshe, A. (2012). The marketing-sales interface at the interface: creating market-based capabilities through organizational synergies. Journal of Personal Selling & Sales Management, 32, 57–72.

Hughes, D. E., Le Bon, J., & Rapp, A. (2013). Gaining and leveraging customer-based competitive intelligence: the pivotal role of social capital and salesperson adaptive selling skills. Journal of the Academy of Marketing Science, 41(1), 91–110.

Hulland, J., Nenkov, G., & Barclay, D. W. (2012). Perceived marketing-sales relationship effectives: a matter of justice. Journal of the Academy of Marketing Science, 40(3), 450–467.

Jap, S., & Anderson, E. (2003). Safeguarding interorganizational performance and continuity under ex post opportunism. Management Science, 49(12), 1684–1701.

Jaworski, B. J., & Kohli, A. K. (1993). Market orientation: antecedents and consequences. Journal of Marketing, 57, 53–70.

Johnson, M. D., Hollenbeck, J. R., Humphrey, S. E., Ilgen, D. R., Jundt, D., & Meyer, C. J. (2006). Cutthroat cooperation: asymmetrical adaptation of team reward structures. Academy of Management Journal, 49, 103–119.

Jones, E., Brown, S. P., Zoltners, A. A., & Weitz, B. A. (2005). The changing environment of selling and sales management. Journal of Personal Selling & Sales Management, 25(2), 105–111.

Ketokivi, M., & Castaner, X. (2004). Strategic planning as an integrative device. Administrative Science Quarterly, 49, 337–365.

Klein, K. J., Conn, A. B., Brent Smith, D., & Sorra, J. S. (2001). Is everyone in agreement? An exploration of within-group agreement in employee perceptions of the work environment. Journal of Applied Psychology, 86, 3–16.

Krohmer, H., Homburg, C., & Workman, J. P. (2002). Should marketing be cross-functional? Conceptual development and international empirical evidence. Journal of Business Research, 55(6), 451–465.

Lawrence, P. R., & Lorsch, J. W. (1967). Differentiation and integration in complex organizations. Administrative Science Quarterly, 12, 1–47.

Leana, C. R., & Van Buren, H. J., III. (1999). Organizational social capital and employment practices. Academy of Management Review, 24(3), 538–555.

Li, T., & Calantone, R. J. (1998). The impact of market knowledge competence on new product advantage: conceptualization and empirical examination. Journal of Marketing, 62(4), 13–29.

Litwin, G. H., & Stringer, R. A. (1968). Motivation and organizational climate. Boston: Harvard University Press.

Mael, F. A., & Ashforth, B. E. (1992). Alumni and their alma mater: a partial test of the reformulated model of organizational identification. Journal of Organizational Behavior, 13(2), 103–123.

March, J. G., & Simon, H. A. (1958). Organizations. Oxford: Blackwell.

Maurer, I., & Ebers, M. (2006). Dynamics of social capital and their performance implications: lessons from biotechnology start-ups. Administrative Science Quarterly, 51, 262–292.

McEvily, B., & Zaheer, A. (1999). Bridging ties: a source of firm heterogeneity in competitive capabilitites. Strategic Management Journal, 20, 1133–1156.

Menon, A., Jaworski, B. J., & Kohli, A. K. (1997). Product quality: impact of interdepartmental interactions. Journal of the Academy of Marketing Science, 25(3), 187–200.

Moran, P. (2005). Structural vs. relational embeddedness: social capital and managerial performance. Strategic Management Journal, 26, 1129–1151.

Morgan, R. M., & Hunt, S. D. (1994). The commitment-trust theory of relationship marketing. Journal of Marketing, 58(3), 20–39.

Morgan, N. A., Anderson, E. W., & Mittal, V. (2005). Understanding firms’ customer satisfaction information usage. Journal of Marketing, 69(3), 131–151.

Murtha, B. R., Challagalla, G., & Kohli, A. K. (2011). The threat from within: account managers’ concern about opportunism by their own team members. Management Science, 57(9), 1580–1593.

Nahapiet, J., & Ghoshal, S. (1998). Social capital, intellectual capital, and the organizational advantage. Academy of Management Review, 23(2), 242–266.

Nunnally, J. C. (1978). Psychometric theory (2nd ed.). New York: McGraw-Hill.

Oh, H., Chung, M.-H., & Labianca, G. (2004). Group social capital and group effectiveness: the role of informal socializing ties. Academy of Management Journal, 47(6), 860–875.

Oh, H., Labianca, G., & Chung, M.-H. (2006). A multilevel model of group social capital. Academy of Management Journal, 31(3), 569–582.

Palmatier, R. W. (2008). Interfirm relational drivers of customer value. Journal of Marketing, 72, 76–89.

Palmatier, R. W., Dant, R. P., & Evans, K. R. (2006). Factors influencing the effectiveness of relationship marketing: a meta-analysis. Journal of Marketing, 70, 136–153.

Pfeffer, J. (1994). Managing with power: Politics and influence in organizations. Boston: Harvard Business School Press.

Powell, W. W., Kogut, K. W., & Smith-Doerr, L. (1996). Interorganizational collaboration and the locus of innovation: networks of learning in biotechnology. Administrative Science Quarterly, 41, 116–145.

Raudenbush, S. W., & Bryk, A. S. (2002). Hierarchical linear models: Applications and data analysis methods (2nd ed.). Newbury Park: Sage.

Riley, P. (1983). A structurationist account of political culture. Administrative Science Quarterly, 28, 414–437.

Roberson, Q. (2006). Justice in teams: the activation and role of sensemaking in the emergence of justice climates. Organizational Behavior and Human Decision Processes, 100, 177–192.

Roberson, Q. M., & Williamson, I. O. (2012). Justice in self-managing teams: the role of social networks in the emergence of procedural justice climates. Academy of Management Journal, 55(3), 685–701.

Rosenblatt, V. (2012). Hierarchies, power inequalities, and organizational corruption. Journal of Business Ethics, 111, 237–251.

Rouziès, D., Anderson, E., Kohli, A. K., Michaels, R. E., Weitz, B. A., & Zoltners, A. A. (2005). Sales and marketing integration: a proposed framework. Journal of Personal Selling & Sales Management, 25(2), 113–122.

Rowley, T. (1997). Moving beyond dyadic ties: a network theory of stakeholder influences. Academy of Management Review, 22(4), 887–911.

Ruekert, R. W., & Walker, O. C. (1987). Marketing’s interaction with other functional units: a conceptual framework and empirical evidence. Journal of Marketing, 51(1), 1–19.

Rulke, D. L., & Galaskiewicz, J. (2000). Distribution of knowledge, group network structure, and group performance. Management Science, 46, 612–625.

Sidanius, J., & Pratto, F. (1999). Social dominance: An intergroup theory of social hierarchy and oppression. Cambridge: Cambridge University Press.

Sigaw, J. A., Simpson, P. M., & Baker, T. L. (1998). Effects of supplier market orientation on distributor market orientation and the channel relationship: the distributor perspective. Journal of Marketing, 62(July), 99–111.

Smith, J. B., & Barclay, D. W. (1997). The effects of organizational differences and trust on the effectiveness of selling partner relationships. Journal of Marketing, 61, 3–21.

Smith, T. M., Gopalakrishna, S., & Chatterjee, R. (2006). A three-stage model of integrated marketing communications at the marketing–sales interface. Journal of Marketing Research, 43(4), 564–579.

Sparrowe, R. T., Liden, R. C., Wayne, S. J., & Kraimer, M. L. (2001). Social networks and the performance of individuals and groups. Academy of Management Journal, 44(2), 316–325.

Steward, M. D., Walker, B. A., Hutt, M. D., & Kumar, A. (2010). The coordination strategies of high-performing salespeople: internal working relationships that drive success. Journal of the Academy Marketing Science, 38, 550–566.

Strahle, W. M., Spiro, R. L., & Acito, F. (1996). Marketing and sales: strategic alignment and functional implementation. Journal of Personal Selling & Sales Management, 16(1), 1–20.

Tax, S. S., Brown, S. W., & Chandrashekaran, M. (1998). Customer evaluations of service complaint experiences: implications for relationship marketing. Journal of Marketing, 62(2), 60–76.

Tekleab, A. G., Takeuchi, R., & Taylor, M. (2005). Extending the chain of relationships among organizational justice, social exchange, and employee reactions: the role of contract violations. Academy of Management Journal, 48(1), 146–157.

Thibaut, J., & Walker, L. (1975). Procedural justice: A psychological analysis. Hillsdale: Lawrence Erlbaum Associates.

Tsai, W., & Ghoshal, S. (1998). Social capital and value creation: the role of intrafirm networks. Academy of Management Journal, 41(4), 464–476.

Tushman, M. (1978). Technical communication in r&d laboratories: the impact of project work characteristics. Academy of Management Journal, 21, 624–645.

Tyler, T. R., & Bies, R. J. (1990). Beyond formal procedures: The interpersonal context of procedural justice. In J. S. Carroll (Ed.), Applied social psychology and organizational settings (pp. 77–98). Hillsdale: Lawrence Erlbaum Associates, Inc.

Tyler, T., Degoey, P., & Smith, H. (1996). Understanding why the justice of group procedures matters: a test of the psychological dynamics of the group-value model. Journal of Personality and Social Psychology, 70, 913–930.

Üstuner, T., & Godes, D. (2006). Better sales networks. Harvard Business Review, 84(7–8), 1–10.

Üstüner, T., & Iacobucci, D. (2012). Does intraorganizational network embeddedness improve salespeople’s effectiveness? A task contingency perspective. Journal of Personal Selling & Sales Management, XXXII(2), 187–205. Spring.

Van Knippenberg, D., De Dreu, C. K. W., & Homan, A. C. (2004). Work group diversity and group performance: an integrative model and research agenda. Journal of Applied Psychology, 89(6), 1008–1022.

Van Maanen, J., & Barley, S. R. (1984). Occupational communities: culture and control in organizations. Research in Organizational Behavior, 6. Greenwich, CT: JAI Press, 287–365.

Venkataraman, S., Van de Ven, A. H., Buckeye, J., & Hudson, R. (1990). Starting up in a turbulent environment: a process model of failure among firms with high customer dependence. Journal of Business Venturing, 5(5), 277–295.

Vorhies, D. W., Morgan, R. E., & Autry, C. W. (2009). Product-market strategy and the marketing capabilities of the firm: impact on market effectiveness and cash flow performance. Strategic Management Journal, 30(12), 1310–1334.

Walker, G., Kogut, B., & Shan, W. (1997). Social capital, structural holes and the formation of an industry network. Organization Science, 8(2), 109–125.

Walton, R. E., Dutton, J. M., & Cafferty, T. (1969). Organizational context and interdepartmental conflict. Administrative Science Quarterly, 14(4), 522–543.

Weitz, B. A., & Bradford, K. D. (1999). Personal selling and sales management: a relationship marketing perspective. Journal of the Academy of Marketing Science, 27(2), 241–254.

Wiesenfeld, B. M., Swann, W. B., Jr., Brockner, J., & Bartel, C. A. (2007). Is more fairness always preferred? Self-esteem moderates reactions to procedural justice. Academy of Management Journal, 50(5), 1235–1253.

Wind, Y., & Robertson, T. (1983). Marketing strategy: new directions for theory and research. Journal of Marketing, 47(2), 12–26.

Workman, Jr., John, P., Homburg, C., & Gruner, K. (1998). Marketing organization: an integrative framework of dimensions and determinants. Journal of Marketing, 62(3), 21–41.

Xiao, Z., & Tsui, A. S. (2007). When brokers may not work: the cultural contingency of social capital in Chinese high-tech firms. Administrative Science Quarterly, 52(1), 1–31.

Yli-Renko, H., & Janakiraman, R. (2008). How customer portfolio affects new product development in technology-based entrepreneurial firms. Journal of Marketing, 72, 131–148.

Zou, X., & Ingram, P. (2013). Bonds and boundaries: network structure, organizational boundaries, and job performance. Organizational Behavior and Human Decision Processes, 120, 98–109.

Acknowledgments

We thank Don Barclay, Rodolphe Durand, Carrie Leana, Michael Segalla, Tomas Hult, and three anonymous JAMS reviewers for their helpful comments on earlier drafts of this paper. We also appreciate the comments of participants in seminars at the 2008 Erin Anderson’s Research Conference and at the 2010 AMA Winter’s Educators Conference. The authors acknowledge the support of the Social Sciences and Humanities Council of Canada and the HEC Foundation.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Study measures

Business unit performance

-

Market share growth.

-

Sales growth.

-

Increased customer satisfaction.

-

Increased customer value.

-

Increased profits.

-

A greater focus on customers.

-

Success compared to competition.

-

Stronger relationships with its customers.

(7-point Likert scale; “In the past 6 months, our business has had …”; 1 = “None”, 7 = “A lot”)

Non-cooperative rewards

-

Evidence of cooperation between departments is acknowledged by superiors in my business unit. (reverse-coded)

-

There is little recognition given for considering another department’s problems.

-

People pretty well look out for their own interests.

-

My business unit blames departments for errors rather than seeking the causes of the errors.

(7-point Likert scale; 1 = “Strongly disagree”, 7 = “strongly agree”)

Cooperative rewards

-

No matter which department they are in, people in this business unit get recognized for being sensitive to competitive moves.

-

Customer satisfaction assessments influence senior managers’ pay in this business unit.

-

Formal rewards (i.e., pay raises, promotions) are forthcoming to anyone who consistently provides good market intelligence.

-

Salespeople’s performance in this business unit is measured by the strength of the relationships they build with customers.

(7-point Likert scale; 1 = “Strongly disagree”, 7 = “strongly agree”)

Functional power

-

Power within the business unit.

-

Influence within the business unit.

-

Leadership within the business unit.

(7-point scale; “Who has …”; 1 = “Marketing is much stronger”, 4 = “Both are equal”, 7 = “Sales is much stronger”)

Distributive justice

-

Marketing and Sales both get what they deserve in this business unit.

-

Resources are allocated fairly across Marketing and Sales.

-

Sales and Marketing are equitably rewarded and recognized for their successes.

-

Sales and Marketing equally share the glory if good things happen.

(7-point Likert scale; 1 = “Strongly disagree”, 7 = “strongly agree”)

Procedural justice

-

Our department has little say in how resources are allocated. (reverse-coded)

-

Resource allocation decisions are determined entirely outside our department. (reverse-coded)

-

Resource allocations are made in a timely fashion in this company.

-

Many of the budget decisions that are made here seem arbitrary. (reverse-coded)

-

We are often not given much of a chance to explain our resource needs. (reverse-coded)

-

The business unit’s resource allocation process is very flexible.

(7-point Likert scale; 1 = “Strongly disagree”, 7 = “strongly agree”)

Customer concentration

-

Our customers are committed to rationalizing their supplier base over time.

-

Customers in our business are gaining power through consolidation.

-

Our customers are placing more emphasis on supply chain management.

(7-point Likert scale; 1 = “Strongly disagree”, 7 = “strongly agree”)

Technological turbulence

-

Our direct customers (accounts) are placing more emphasis on technology as they deal with suppliers.

-

The technology in our industry is changing rapidly.

-

Technology changes provide big opportunities in our industry.

-

A large number of new product ideas have been made possible through technological breakthroughs in our industry.

-

Technological developments in our industry are relatively minor. (reverse-coded)

(7-point Likert scale; 1 = “Strongly disagree”, 7 = “strongly agree”)

Market turbulence

-

Our customers’ preferences change quite a bit over time.

-

Our customers tend to look for new products all the time.

-