Abstract

This paper examines risk-taking in tournaments experimentally. More precisely, we investigate two potential drivers of risk-taking in tournaments. The first driver is the proportion of tournament winners, which is a design parameter and therefore endogenous for firms. We find that a lower proportion of winners encourages employees to take more risk. The second potential driver is exogenous. We investigate the reliance on simplified decision rules as a behavioral bias of employees working under tournament incentives. Tournaments require employees to use strategic optimization, which means considering the behavior of other contestants. Though much of the analytical literature builds on this assumption, we find that employees instead rely on simplified decision rules. If a particular strategy appears more attractive based on such simplified decision rules, employees are more likely to choose this strategy even if it implies taking more risk. We also find significant interaction between the proportion of winners and the use of simplified decision rules. Our results confirm that employees reduce risk-taking over time in a setting where each unit of risk is excessive. However, this appears to result from trial-and-error learning rather than understanding the strategic character of tournaments, because, though reduced, the level of risk-taking remains too high.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

An organization’s incentive system is a vital part of its managerial control system (Hopwood 1976) and is intended to induce organizationally desirable employee behavior. Among the compensation systems available, tournaments are often regarded as favorable. Therefore, today one-third of U.S. firms and one-fourth of Fortune 500 firms employ tournaments (Grothe 2005). In tournaments, employees are paid according to relative performance compared with their peers (Lazear and Rosen 1981). The prizes employees compete for include bonuses and promotions, but also rewards such as luxury trips (Backes-Gellner and Pull 2013).

While the effort and performance effects of tournaments have garnered much attention in the literature (Harbring and Irlenbusch 2003; Orrison et al. 2004; Hannan et al. 2008; Harbring and Irlenbusch 2008; Lim et al. 2009; Lim 2010; Sheremeta 2011), the effects on employee risk-taking in tournaments remain largely unexplored. This is surprising, because tournaments are particularly popular in the financial services industry, where risk plays a crucial role (Kempf and Ruenzi 2008). An important reason why risk matters is that employees might compete on risk when competing on effort is infeasible or too costly. Consequently, tournament schemes need to be considered from a risk management and risk governance perspective.

We examine the impact on risk-taking in tournaments of one endogenous factor that can be determined by the firm and one exogenous factor that is out of the firm’s control. For the endogenous parameter, we focus on the proportion of tournament winners, or the proportion of employees who are rewarded, because this is one of the most influential parameters in tournament design (Harbring and Irlenbusch 2003; Dechenaux et al. 2012). In practice, proportions of winners differ in a broad range. Grothe (2005) reports proportions of winners of only 20 and 10 %, while Ariga et al. (1999) describe the case of a Japanese company with a promotion rate of 97 %. Backes-Gellner and Pull (2013) report the case of a company rewarding 96.8 % of its supervisors with travel incentives. In the studies just mentioned, the proportion of winners determines the number of winners—receiving, for example, higher bonuses—and simultaneously the number of losers who receive no or lower bonuses. However, other systems with more than two different prizes also exist, either represented by different prizes for each rank (Freeman and Gelber 2010) or more than two groups of ranks with different prizes (Newman and Tafkov 2014). We focus on tournaments that make a binary separation between winners and losers, because these systems are widespread and require less sophisticated information systems.

We now shift our attention to the exogenous factor. An important feature of tournaments is that ordinal and not cardinal performance matters (Rankin and Sayre 2011). Hence, a slight difference in the (cardinal) performance of two employees is sufficient to assign two different (ordinal) ranks with, for example, one employee rewarded or promoted and the other not. If, for example, more effort by one employee leads to higher cardinal performance but is answered by the other contestants with an equal increase in effort, ranking positions remain the same. Since effort is costly, strategic optimization would lead employees to leave effort unchanged. Hence, tournaments require employees to consider strategic behavior. In fact, Lazear and Rosen (1981), the first to show the positive-effort-inducing effects of tournaments, relied on the assumption that employees act based on strategic optimization. In the context of risk governance, van Asselt and Renn (2011) state that decisions on risk are usually characterized by an interplay of multiple actors. This is particularly true for tournaments and results in strategic optimization. Consequently, employees should judge project attractiveness based on the ordinal ranks achievable through this pick considering the choice of the other contestants. They should thus employ strategic optimization and not cardinal measures like the expected value of investment proceeds to maximize their compensation under tournament schemes. Yet, the findings of prior research cast doubt on whether employees in tournaments make use of strategic optimization (Rankin and Sayre 2011) or instead rely on simplified decision rules like the expected value just mentioned. Indeed, expected values are the probably most prominent example of a simplified decision rule in tournaments (Rankin and Sayre 2011). In our experimental investment task, participants must allocate an endowment to two alternative projects. When we elaborate more on the experimental setting used to test our hypotheses, we further describe that subjects in one of our treatment groups could invest in a risk-free project (100 % payback of the investment) or a risky project (expected value of 110 % payback of the investment), while the other treatment group could also invest in the same risk-free project but a different risky project with an expected value of 60 % payback of the investment. Given the experimental setting choosing the safe alternative always maximizes employees’ compensation as the result of strategic optimization regardless of the expected values. If the risky project exceeds the safe alternative in expected value though, employees would likely decide using the expected values as their simplified decision rule which does not maximize employees’ tournament compensation and lead to additional risk-taking. However, strategic behavior is not per se desirable for a firm, as firms would usually advocate employees’ decision to maximize expected values. Importantly though, employee reliance on (non-strategic) simplified decision rules—like the expected value concept in the situation described above—make at least some features of the compensation scheme obsolete. Hence, we also investigate whether an exogenous factor, employee reliance on simplified decision rules, that is, expected values, instead of strategic optimization, drives employee risk-taking.

In this study we predict first that tournaments with a lower proportion of winners lead to more risk-taking—even if higher risk-taking is irrational and reduces employee payoffs. The rationale here is that attaining the goal of receiving a relatively scarce winner prize is perceived as particularly challenging. Hence, many contestants expect to fall short of this goal and experience a loss. This, in turn, induces risk-seeking behavior. Thus, behavior is influenced by individual perceptions of risk (Bromiley et al. 2015). This prediction addresses the endogenous design factor.

Second, with respect to the exogenous factor we predict that risk-taking is more pronounced if the perceived attractiveness based on higher expected values of a risky alternative is higher compared to a risk-free alternative. Again, we argue this relationship holds even if the increase in perceived attractiveness comes with a reduction in employee expected payoff. We expect that employees ignore strategic optimization and prefer the expected value concept as a simplified decision rule.

Third, we predict that the impact of the expected value decision rule on risk-taking is stronger if the proportion of winners is high. Our fourth hypothesis focuses on learning in tournaments over time in a setting where each unit of risk is excessive. More precisely, we posit that risk-taking is reduced if employees participate in multiple tournaments. In additional analyses, we strive to illuminate whether this is driven by complex analytical processes or trial-and-error learning.

Prior research on how the proportion of winners or employee reliance on simplified decision rules affects risk-taking is scarce. With respect to the proportion of winners, Eriksen and Kvaløy (2015) find that more competitive tournaments—entailing a lower proportion of winners—lead to more risk-taking. However, these authors vary the proportion of tournament winners not by changing the proportion itself for a fixed number of participants, but by adding participants to adjust the proportions.Footnote 1 Thus, the manipulation of the proportion of winners coincides with a change in the tournament size. Although there is only limited support for the impact of tournament size on effort (Harbring and Irlenbusch 2003; Orrison et al. 2004; Harbring and Irlenbusch 2008),Footnote 2 a significant impact has been found regarding the destructive effects of sabotage (Harbring and Irlenbusch 2008). Tournament size thus matters for at least some outcome measures. Consequently, an effect of tournament size on risk-taking cannot be ruled out. In contrast to the tournament winner proportion, Eriksen and Kvaløy (2015) find no support that differing expected values (as the simplified decision rule) matter or that they interact with the proportion of winners. Also Rankin and Sayre (2011), in their experimental study, fail to find support for the hypothesis that employees competing in tournaments rely on the expected value concept as the simplified decision rule.

To test our predictions, we conduct a 2 × 2 × 15 mixed experiment where participants decide how much of their endowment to invest in a safe versus a risky project. We manipulate the proportion of winners between subjects at two levels, low and high, with one (three) out of four participants receiving a winner prize in the low (high) condition. Our second between-subjects manipulation is the already introduced simplified (non-strategic) decision rule, which is manipulated through expected values of the risky project being either above or below 100 % of the sum invested (which would be the expected value for the safe alternative). Importantly, strategic optimization would always lead subjects to invest 100 % in the safe project irrespective of the expected value or the proportion of winners. Hence, each unit of risk is excessive, which allows unambiguous conclusions. To examine risk-taking over time, we conduct 15 rounds in which results from one round do not carry over to any other round. Hence, time is our third factor manipulated within subjects.

We find that risk-taking is higher for a low proportion of winners than for a high proportion. In addition, we show an initially significant, but over time declining, impact of the differing expected values as the perceived attractiveness signaled by simplified decision rules. We also find a significant interaction effect between the proportion of winners and the manipulated expected values. Finally, we document that risk-taking decreases over time. Additional analyses reveal that either up-front analytical insight, that is, immediate identification of the optimal alternative, or trial-and-error learning prevail. It is noteworthy that a considerable 39 % of our participants still took excessive risk in the last round of the experiment. This underlines the necessity of shedding light on incentives from a risk management and risk governance point of view.

Our study contributes to accounting theory and practice in at least four ways: First, we are the first to provide evidence for an isolated effect of the proportion of winners on risk-taking in tournaments. Employees are willing to take more risk if the proportion of winners is low. Hence, firms should consider risk effects in tournament design. Put differently, firms (for example, in the finance industry) that employ tournaments with a low proportion of winners could foster excessive risk-taking.Footnote 3 Second, our results underline the importance of employees understanding the features of the incentive system. Though the tournament in our case could have limited risk-taking if employees considered strategic optimization, this feature was ineffective because of bounded rationality. Third, we are the first to show that the perceived attractiveness signaled by a simplified decision rule affects employees’ decisions. Fourth, we contribute to unravelling the learning processes in such compensation systems.

This paper proceeds as follows: Sect. 2 provides the background for the development of hypotheses in Sect. 3. Section 4 describes the experimental method, while Sect. 5 sets forth the results. Section 6 concludes.

2 Theoretical background and empirical evidence

2.1 Tournaments

Lazear and Rosen (1981) introduce a theoretical model for the behavior of homogeneous contestants in tournaments. Employees compete for two prizes, a winner prize W 1 and a loser prize W 2, with W 1 > W 2 and the difference between the prizes is termed prize spread. Depending on the proportion of winners, a pre-defined proportion of employees receives a winner prize, the others a loser prize. An important advantage of tournaments compared to piece-rate systems is that environmental risk is neutralized (Nalebuff and Stiglitz 1983).

Economic theory argues that individuals act according to their preferences and strive to maximize their utility (Kirchgässner 2008). Usually, increasing compensation has a positive effect on utility. Traditional piece-rate schemes pay individuals according to their absolute performance. Therefore, performance is directly linked to payoffs. Individuals would therefore choose the degree of risk that matches their individual risk preferences. Tournaments, however, measure performance relative to others and are therefore more complex, since actions and decisions are linked only indirectly to payoffs: Performance determines only the rank, which again is linked to a specific payoff (Osborne 2004). In the case of two different types of prizes in tournaments, rational individuals maximize their chance of receiving a winner prize, which can be determined through a game-theoretic approach. If effort is constant for all participants and they decide only on risk, rational individuals choose the amount of risk that maximizes their chances of receiving a winner prize while considering other contestants’ behavior according to game theory. Bull et al. (1987) find a large variance in individual behavior for tournaments compared to piece rates, and attribute this to the game-theoretic character of tournaments.Footnote 4

2.2 Proportion of tournament winners

One of the most important design parameters in tournaments is the proportion of winners. According to economic theory, the proportion of tournament winners should have no effect on risk-taking if the optimal choice of action determined by game theory does not depend on the proportion of winners. However, psychological theory suggests that changing the proportion of winners can have an effect even in such cases. This occurs if different proportions of winners are perceived as goals with differing difficulty. As goals serve as reference points (Heath et al. 1999), risk-taking is influenced by these differing goals (Larrick et al. 2009). The reasoning behind this stems from prospect theory, which states that individuals are risk averse for gains but risk-seeking for losses (Kahneman and Tversky 1979). If receiving a winner prize (i.e., the goal) is considered as a reference point, individuals in a tournament with a low proportion of winners are more likely to face a loss, and therefore are risk-seeking, and vice versa.

Prior research in this field focuses almost exclusively on effort and performance effects and provides mixed results. For example, Orrison et al. (2004) observe a decrease in effort when the proportion of winners increases. Further research supports this finding, showing a (non-significant) decrease for a high compared to a medium proportion of winners (Harbring and Irlenbusch 2008). However, in the latter study, effort is even lower if the proportion of winners is low. Further support is provided by Sheremeta (2011) indicating that, for a tournament with a low proportion of winners, effort is higher than for a medium proportion of winners. On the contrary, Harbring and Irlenbusch (2003) document an increase in effort for high proportions of winners. Similar findings are provided by Lim et al. (2009) and Lim (2010), who introduce social pressure as a mediator, and Knauer et al. (2015), who focus on the psychological mechanisms activated by the proportion of winners in tournaments.

Experimental research investigating the influence of the proportion of winners on risk-taking is at an early stage, with Gaba and Kalra (1999) showing a higher proportion of winners leading to lower risk-taking in a setting where this kind of behavior is rational. More recently, Eriksen and Kvaløy (2015) show that higher competitiveness induced by a combination of a lower proportion of winners and an increase in tournament size leads to more risk-taking. Related to our study, Gaba et al. (2004) show theoretically that a lower proportion of winners motivates employees to strive for high variability of outcomes and vice versa.

2.3 Decision rules in tournaments

Facing a tournament situation is complex for individuals compared to piece-rate systems. The reason for this is that finding the optimal solution in tournaments is not an independent maximization problem but requires strategic optimization. Economic theory and classical game-theoretic models assume that individuals are able to process all information and incorporate possible actions of their competitors, again leading to the amount of risk that maximizes the chances of receiving a winner prize. In contrast, behavioral game theory allows for deviations from the rational choice of action (Stahl and Wilson 1994). One possible reason for these deviations is wrong assumptions about competitor behavior (Camerer et al. 2004), hence decision-makers are aware of all information but make erroneous conclusions. Contrary to this explanation, other literature proposes that individuals do not incorporate all available information. Rather, their information acquisition behavior is already influenced by “mental shortcuts” when facing certain situations. That is, people rely on more familiar but simplified decision heuristics (Luft and Shields 2009). In so doing, individuals compare current situations they face to familiar situations they experienced before, and act according to known strategies they used in the past. Therefore, they actively retrieve only the information they need to make their decision in these familiar situations. Thus, not all possible information is processed and decisions are made based on incomplete information.

Prior research provides little evidence on how the use of simplified decision rules in tournaments affects decision-making quality. For example, Hannan et al. (2008) find that providing employees with precise feedback about their relative performance during the decision-making process has a negative effect on subsequent performance. This negative effect results from employees who are worried about their chance of winning and choose ineffective task strategies. In other words, pressure on employees, often regarded as an important driver of effort in tournaments, has detrimental effects on decision-making quality. Yet, there is no indication whether this negative effect results from simplified decision rules. In their experimental study, Rankin and Sayre (2011) examine the use of simplified decision rules in a tournament context. These authors document that most participants (71 %) are not significantly affected by these rules such that they would lead to excessive risk-taking. Similar evidence is provided by Eriksen and Kvaløy (2015). In developing our hypotheses, we again refer to these studies and explain that the level of the proportion of winners affects whether simplified decision rules are used.

3 Hypotheses

3.1 Hypothesis 1

Following the theoretical underpinnings from the last section, we argue that goals serve as reference points. If the desired goal in a tournament compensation system is the winner prize, then the monetary value of the winner prize serves as a reference point for framing the compensation either as a gain or a loss. Compensation is either perceived as a gain if the goal is met (by receiving a winner prize) or as a loss if not. As stated above, individuals act risk averse for gains and risk-seeking for losses (Kahneman and Tversky 1979).

Under a low proportion of winners, the chance of receiving a winner prize, that is, achieving the goal, is significantly smaller than in high proportion of winners tournaments. Therefore, concerns over not winning the tournament are more pronounced. If individuals expect not to win the tournament, they act in a risk-seeking manner and are therefore willing to take more risk.

Previous research confirms that lowering the proportion of tournament winners demotivates employees, who then exert less effort (Knauer et al. 2015). This occurs because employees expect not to win the tournament if the proportion of winners is low. Though analytical modeling shows that, under certain assumptions, this conclusion is not necessarily true (Orrison et al. 2004), it is in line with findings showing that employees not expecting to win a tournament give up (Berger et al. 2013). An alternative strategy would be to take higher risk, if this comes at no cost. As there are only two types of prizes, employees expecting not to win expect to receive a loser prize, and therefore face internal pressure to take high risks to possibly receive a winner prize by chance without the negative consequences of risk-taking.

H1:

Risk-taking in tournaments is higher if the proportion of winners is low rather than high.

3.2 Hypothesis 2

Decision-making under tournament incentive schemes is complex, leading to bounded rationality according to behavioral game theory. This is because rational decision-making in tournaments requires assessing various parameters and considering the strategic behavior of all other contestants (Bull et al. 1987; Rankin and Sayre 2011). When decisions are complex, people often rely on more familiar but simplified decision heuristics (Luft and Shields 2009). More precisely, employees facing complex decisions act according to known and well-established but not necessarily suitable decision rules. This is termed the similarity heuristic, as introduced by Rozin and Nemeroff (2009). One pitfall of using familiar decision rules is reliance on information that is required in a similar situation but misleading for the decision at hand.

As stated above, compensation systems are designed to direct employee behavior, because employees usually consider the compensation consequences of their decisions. Hence, it is assumed that rational decision-makers select a strategy or decision that maximizes their payoff. When higher output automatically translates into higher compensation, as is the case in piece-rate contracts, employees need only identify the strategy with the highest expected output. If employees apply the same decision rule under a tournament incentive system because the decision context appears similar, the outcome might be less favorable. This might occur because strategic optimization is not reflected by the decision rule. In H2, we predict that employees would even be willing to take more risk if taking more risk is perceived as attractive based on a simplified decision rule that ignores the strategic components of the tournament setting.

H2:

Risk-taking in tournaments is higher if the perceived attractiveness of risk-taking signaled by a simplified decision rule is high instead of low.

3.3 Hypothesis 3

H3 sets forth an interaction effect between the proportion of winners and the perceived attractiveness of a risky strategy signaled by a simplified decision rule. Based on our development of H1, it follows that increasing the proportion of winners leads to more people achieving their goal of a winner prize. Thus, this goal is perceived as less difficult, which in turn makes it more likely for employees to experience a gain. This is reflected in decreased concerns about receiving a winner prize compared to a low proportion of winners. This decreased internal pressure makes employees take less risk according to prospect theory, as they are framed to act in a domain of gains. Larrick et al. (2009) show that “[b]y changing the frame of reference, goals change risk preference” (p. 343) and further that the goal-induced risk-taking overrides ex ante risk preferences. This override is likely to offset other stimuli, like the perceived attractiveness addressed in H2. As a consequence, when the proportion of winners is low, the internal pressure is consistently high, such that the perceived attractiveness signaled by a simplified decision rule (in our case the expected value stimulus) does not matter. As introduced in H1, we predict less risk-taking under higher winner proportions given less internal pressure. In this case, we do not predict an override of the perceived attractiveness when the simplified decision rule signals a lower attractiveness of risk-taking. This is also in line with findings of Rankin and Sayre (2011) and Eriksen and Kvaløy (2015), who focus solely on low proportions of winners and find no significant impact of the perceived attractiveness of a risky strategy. Our third hypothesis is formally stated below.

H3:

If the proportion of winners is high rather than low, the decrease in risk-taking is stronger if the perceived attractiveness of risk-taking signaled by a simplified decision rule is low rather than high.

3.4 Hypothesis 4

Finally, we predict that employees learn in the course of time. This could occur through two mechanisms: One is that employees analyze the situation and engage in strategic optimization, hence they learn through analytical insight. In this case, employees should change their investment strategy exactly once, from high risk-taking to low-risk-taking, and stick to the low-risk strategy afterwards. The second possibility is that employees learn by trial-and-error instead of analytical insight. Trial-and-error learning results from employees’ experiences and employees’ information gain about the environment over the course of time (Ashby 1970). These experiences can lead to a change in behavior (Thorndike 1898). Theory suggests that employees test different strategies (trial) and observe their outcome. If the outcome is satisfying, the strategy remains unchanged. If it is not (error), another strategy is tried. Strategy experimentation continues until a successful strategy is identified. Trial-and-error learning hence does not require that employees comprehend strategic optimization in tournaments. Rather, it is based on actions and observed outcomes. Employees who neglect strategic optimization and are instead misled by simplified decision rules or low proportions of winners to take high risks, are less likely to win the tournament. In the course of time, these employees will change their strategies of taking more or less risk more frequently than others who already incorporated the behavior of their peers. If trial-and-error learning is prevalent, employees should vary their investment strategy more often compared to learning through analytical insight. Another difference would be that analytical learning requires more mental processing, since a simple “U-turn” in terms of completely changing the investment strategy without further thought, for example, from 1000 lira to 0 lira or from 0 lira to 1000 lira, is considerably quicker to do. Consequently, strategic optimization would, in direction, coincide with a larger proportion of time used before arriving at the low-risk investment strategy.

However, both learning alternatives would lead to the same result of lower risk-taking over time. We therefore posit that risk-taking converges closer to the optimal level of risk, and therefore declines in the course of time if it is optimal to take no risk.

H4:

Risk-taking converges to the rational amount of risk in a series of tournaments.

As we are further interested in illuminating the kind of learning process prevalent, we additionally posit the following research question:

RQ:

Does analytical insight or trial-and-error learning lead to the proposed reduction in risk-taking?

4 Method

4.1 Experimental design

To test our predictions, we conduct a 2 × 2 × 15 mixed experiment where participants make investment decisions and are compensated using a tournament structure. More precisely, participants must decide how much of their endowment to invest in a risky and a safe investment project in 15 independent rounds. Hence, round is a within-subjects factor.

The first variable manipulated between subjects is the proportion of tournament winners, with two levels, low and high. If the proportion of winners is low (high), one (three) out of four participants receives (receive) a winner prize, while all remaining participants receive loser prizes. In line with prior research, the total bonus pool is held constant, that is, the values of the winner and loser prizes are reduced when more winner prizes are awarded (Freeman and Gelber 2010; Knauer et al. 2015). Moreover, the prize spread, that is, the difference between winner and loser prizes, remains unchanged. Given a total bonus pool of 500 lira per round, with lira as our experimental currency,Footnote 5 and a constant prize spread of 100 lira, the winner prize is 200 (150) lira and the loser prize is 100 (50) lira in the low (high) proportion of winners condition. Table 1, Panel A summarizes the first manipulation. We refrain from using the wording “winner prize” and “loser prize” in the experimental materials to avoid framing effects (e.g., Luft 1994; Hannan et al. 2005); rather, we refer to these bonuses as “Bonus A” and “Bonus B,” respectively.

Our second variable is perceived attractiveness based on a simplified decision rule, which is also manipulated between subjects at two levels, low and high. As a simplified decision rule that does not incorporate strategic optimization, we use the expected value of the risky project that participants can invest in. Though we expect that subjects rely on expected values, note that such a decision rule is insufficient for a rational employee interested in maximizing personal payoff, as it ignores the behavior of the other contestants. We elaborate more on this issue below.

For the safe project, each lira invested is returned but with no interest; that is, the return is 100 % of the amount invested. In the low condition, the risky project either returns 300 % of the amount invested with a probability of 20 % or it returns 0 % of the investment with a probability of 80 %, that is, the expected value of the risky project is 60 % of the investment. In the high condition, the risky project either returns 350 % of the amount invested with a probability of 20 % or it returns 50 % of the investment with a probability of 80 %, that is, the expected value of the risky project is 110 % of the amount invested. Table 1, Panel B, contains the different payoffs from the risky project as a result of the second manipulation.

In each round, participants must split their entire endowment of 1000 lira between the safe and the risky projects. At the end of each round, participants learn their rank and the realized payoff that determines their rank. Using strategic optimization, it can be shown that for both levels of the proportions of winners and for both levels of the expected value of the risky investment, it is always the best choice to invest the total budget in the safe project and nothing in the risky project.Footnote 6 Hence, each lira invested in the risky project means accepting excessive risk. Therefore, we use the amount invested in the risky project as our proxy for risk-taking. Whether risk-taking is considered excessive is not critical to our interpretation. Rather, it serves as a means to rule out the alternative explanation that additional risk-taking might be beneficial.

4.2 Experimental procedure

Upon arrival in the laboratory, subjects were allowed 10 min to read the instructions.Footnote 7 The instructions explained the experimental procedure and that subjects were to compete in groups of four over 15 rounds. Moreover, participants were informed that the results from one round do not carry over to the next or any other round, and that the composition of the groups randomly changes after each round (stranger matching). Thus, participants could not learn competitors’ behavior through the experiment. To ensure that participants understood the experimental procedures correctly, especially the compensation, they had to complete a quiz. Only if all questions were answered correctly could participants proceed. The experiment was conducted on computers using z-Tree software (Fischbacher 2007).

We employed a risk preference elicitation instrument before the investment task. This instrument is commonly used in experimental accounting research to measure risk preferences (for example, Sprinkle et al. 2008). Participants had to choose between a safe payment of 160 lira and a lottery that paid either 320 lira with probability π or 0 lira with probability 1 − π for 15 different states of nature. Probability π decreases from 85 % (state of nature 1) to 15 % (state of nature 15) in 5 % increments. Subjects could proceed after making choices for all states of nature. They did not learn about the payment received from the lottery before the end of the experiment. At the end of the experiment, a random draw determined the payoff from the lottery and the outcome (320 lira vs. 0 lira) was displayed.

The main part of the experiment started with the first round of the investment task. In each of the 15 identical rounds, subjects had 60 s to decide how many lira of their total endowment of 1000 lira to invest in the risky versus the safe investment project.Footnote 8 If the total amount invested did not add up to 1000 lira, subjects were notified. If no investment decision was made after 60 s, subjects were automatically assigned the last rank. After each investment decision, participants were asked how many competitors they believed to have outperformed. Afterwards, subjects were informed about the payoff of the risky project, their rank within the group, and whether they received a winner or a loser bonus. Subsequently, participants were asked to rate how satisfied they were with their investment decision in retrospect. Before the next round started, subjects had a 30-second break for recreation.

After completion of the last round, subjects learned their payoff from the initial lottery and their total compensation. Compensation consisted of a show-up fee of 400 lira, the payout from the lottery, and the compensation earned during the 15 tournament rounds. Finally, participants were asked to answer a post-experimental questionnaire before they were dismissed.

4.3 Participants

Participants comprised 124 undergraduate business students from a large West European university. We recruited subjects that were at least in their fourth semester and therefore had the required knowledge to successfully complete the experiment. Twenty-five subjects were dropped from the analysis because in at least one of the rounds these subjects either made no investment decision within the 60 s allotted or invested less than the required 1000 lira. For conservativeness, we report the results based primarily on the smaller sample, although the initial quiz clearly indicated that all participants had fully understood the experimental task. Importantly, the results are inferentially identical when using the data for the full 124 subjects. Thus, our primary analysis is based on 99 subjects, while the results for the 124 subjects are presented as additional analyses for each hypothesis.

Participants were on average 22.25 years old, 63 % men and 37 % women. Since our task requires probability calculation, we asked participants about their college-level statistics classes. Subjects reported they had previously attended an average of 2.10 statistics classes. Therefore, familiarity with expected values is ensured and is further discussed below. We find no significant differences across conditions concerning age, gender, prior experience in lab experiments, familiarity with expected values, and familiarity with strategic optimization (measured on a scale from (1) no knowledge to (7) very good knowledge), as well as ex ante risk preferencesFootnote 9 (all p-values > 0.40, two-tailed). Hence, we conclude that randomization was successful.

5 Experimental results

5.1 Descriptive statistics

Our main dependent variable is risk-taking, which is measured by the amount invested in the risky project. Subjects could invest between 0 lira and 1000 lira in the risky project in each of the 15 rounds. As stated above, investing in the risky project is never the optimal strategy. Hence, each unit invested in this project signals excessive risk-taking. Table 2 reports descriptive statistics for our dependent variable.

Results suggest that subjects are willing to take more risk when the proportion of winners is low compared to high, as predicted by H1. In the high proportion of winners condition, subjects invest on average 1838.67 lira in the risky project over all rounds, while this figure is 4677.51 in the low-proportion condition (Table 2, Panel B). This result appears stable over the 15 rounds conducted (Table 2, Panel A). In line with H2, we also find that when the perceived attractiveness of the risky project is higher, that is, the expected value is higher, subjects invest more in the risky project. More precisely, when the expected value is high, participants invest 3951.69 lira while they invest only 2218.89 lira if the expected value is low. However, if we look at the individual rounds, the effect of expected value on risk-taking decreases over time.

Additionally, the impact of expected values seems to depend on the proportion of winners. For the low proportion of winners, risk-taking increases by 21.4 % from the low (4180.65 lira) to the high expected value treatment (5075.00 lira). In the high proportion of winners condition, however, risk-taking almost quadruples from the low (765.74 lira) to the high expected value (2911.59 lira).

Over the course of the experiment, risk-taking decreases in all treatment conditions. However, this effect is more pronounced if expected values are high compared to low. In addition, the decrease in risk-taking is more pronounced under the high proportion of winners condition, in contrast to the low proportion of winners condition.

5.2 Tests of hypotheses

5.2.1 Hypotheses 1, 2, and 4

To formally test H1, H2, and H4, we conduct a repeated-measures analysis of variance (RM-ANOVA) with the amount invested in the risky project over rounds 1 to 15 as the dependent variable.Footnote 10 Since H3 requires different testing, we discuss the results for H3 in the next subsection.

H1 states that risk-taking is higher if the proportion of winners is low instead of high. In line with this hypothesis, RM-ANOVA results in Table 3 confirm that lowering the proportion of winners fosters risk-taking (F = 22.09, p < 0.01, two-tailed).Footnote 11 Importantly, this effect does not vanish over time, as implied by the insignificant interaction between round and proportion of winners (F = 1.14, p = 0.33, two-tailed). Hence, firms employing tournaments with a high proportion of winners are less likely to suffer from excessive risk-taking.

H2 posits that employees are willing to invest more in the risky project if this project is perceived as more attractive based on a simplified decision rule. This pattern is reflected in the descriptive analysis and is confirmed by the RM-ANOVA result (F = 7.06, p < 0.01, two-tailed).Footnote 12 Hence, H2 is supported. Yet, since the interaction “Round × Expected value” is significant (F = 2.16, p = 0.02, two-tailed), this effect is reduced over the course of time.

According to H4, risk-taking should decrease over time. In line with this hypothesis, we find that the between-subjects factor “Round” is significant (F = 3.81, p < 0.01, two-tailed).Footnote 13 Hence, participants learn over the course of 15 rounds. We provide a deeper discussion of learning in tournaments to address the corresponding research question after testing H3.

5.2.2 Hypothesis 3

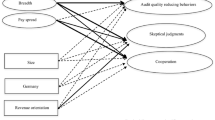

H3 predicts an interaction effect between the proportion of winners and the perceived attractiveness of the risky project. More precisely, H3 posits that if the proportion of winners increases from low to high, the decrease in risk-taking is stronger the less attractive a risky strategy appears based on a simplified decision rule. Figure 1 summarizes the experimental results.

Effect of proportion of winners and expected value investment on risk-taking. Risk-taking is measured as the investment in the risky alternative (Investment A). This figure depicts the joint effect of the proportion of winners and the expected value of the alternative investment over 15 rounds (pooled observations)

The pattern predicted in H3 reflects an ordinal interaction mainly driven by variation in one experimental cell. Buckless and Ravenscroft (1990) emphasize that ANOVA or RM-ANOVA is well-suited for disordinal, but inappropriate for ordinal interactions. Even in the presence of an ordinal interaction, ANOVA might not be able to identify this interaction. This allows us to disregard the insignificant interaction effect in Table 3. Consequently, we use planned contrasts to formally test H3, as Buckless and Ravenscroft (1990) suggest “rely[ing] on contrast coding instead of conventional ANOVA” for the pattern predicted by H3, that is, the ordinal interaction (Buckless and Ravenscroft 1990, 937). The results, described in Table 4, confirm the predicted pattern (F = 29.54, p < 0.01, two-tailed).Footnote 14 Hence, H3 is supported.

5.3 Research question: learning in tournaments

After confirming H4, which predicts a decline in excessive risk-taking over time, the mechanism leading to this reduction still needs to be illuminated to answer RQ. Hence, this section sheds light on whether analytical learning or trial-and-error learning drive our results.

If trial-and-error learning is present, participants should change their behavior in a case of failure but not in a case of success. In the context of tournaments, failure means receiving a loser prize. To measure the change in behavior, we calculate the absolute difference between the amount invested in the risky project in the current and in the subsequent round. For trial-and-error learning, the characteristic pattern would be greater (absolute) changes for subjects who have received a loser prize in the previous round compared to those who received a winner prize. Table 5, Panel A, shows the results aggregated over the 15 rounds.

While winners change their investment by only 368.38 lira, losers make greater adjustments on average (1431.55 lira). Table 5, Panel A, also suggests that the difference between winners and losers is more pronounced for a low proportion of winners.Footnote 15 This pattern is also reflected by Fig. 2, which separately depicts changes in risky investment in the low and high proportion of winners conditions. Changes fluctuate more for the low proportion of winners. This observation also points at trial-and-error learning, since the number of losers, that is, people who are likely to change their behavior, is greater in the low proportion of winners condition.

To further substantiate the trial-and-error pattern, we need to rule out the alternative explanation that participants’ behavior is the result of time constraints (i.e., 60 s per round) for the strategic optimization task. An analysis of the time used by participants is provided in Table 5, Panel B. Participants used on average 40.37 % of the time they were allowed over all rounds (363.36 s out of 900 s). The time used decreased over time from an average of 45.48 s (75.80 % of 60 s) in the first round to an average of 14.98 s (24.97 % of 60 s) in the last round. Additional analyses (untabulated) reveal that 75 % of the participants utilized less than 50 % of the allowed time (48.16 %), and that the maximum time used is 69.98 %. Hence, additional time could have been used, especially in later rounds of the experiment. Consequently, time constraints seem to be non-binding.

If participants followed analytical learning patterns, more time to think about the solution should lead to better decisions (i.e., less risk-taking) and less changes in investment behavior, since, after identifying the correct solution, any change would be needless. Interestingly, Table 5, Panel B, does not reflect this pattern. Over all rounds, time used is neither correlated with risk-taking (p = 0.56, two-tailed) nor with the absolute investment changes (p = 0.53, two-tailed).Footnote 16 Over the first rounds, even the opposite occurred, with more time leading to more risk-taking and more intense trial-and-error patterns reflected by the absolute investment change. No significantly negative coefficient can be found in any round. This finding is particularly interesting, because within the “microcosm of 60 s” more thinking does not lead to better decisions. Given the amount of unused time, it appears questionable whether additional time would have been helpful, as additional time does also not diminish trial-and-error behavior.

To further scrutinize participants’ behavior over time, we take a deeper look at the participants who change their behavior over time. For this reason, we define low-risk-takers as participants who accept less than 5 % of maximum risk over the first five rounds (rounds 1–5) and over the last five rounds (rounds 11–15).Footnote 17 This would be the optimal behavior, and this is why all other participants are deemed “non-low-risk-takers.” Table 5, Panel C, reflects that 27 out of 99 participants are low-risk-takers both at the beginning and the end of the experiment. We can assume that these participants immediately identified and followed the optimal solution. Notably, participants’ evaluation of their knowledge in game theory (using a 7-point Likert scale, 1 = not familiar at all, 7 = very familiar) is not significantly associated with the propensity of being a low-risk-taker at the beginning (p = 0.91, two-tailed) or the end (p = 0.51, two-tailed). Some 44 participants did not follow the optimal course of action at the beginning and the end.Footnote 18 Twenty-five of the participants can be considered the “learning group,” accepting low risk levels at the end starting from higher risk levels at the beginning. If these participants showed forms of analytical learning, used time should be positively correlated with being a “learner.” However, this is not the case (p = 0.82, two-tailed),Footnote 19 why we conclude that additional time is not likely to be the driver of learning.Footnote 20 Rather, participants stick to the strategy initially chosen. This is reflected by a Spearman correlation coefficient between being a low-risk-taker at the beginning and being a low-risk-taker at the end of 0.50 (p < 0.01, two-tailed).

Overall, these results suggest that some participants immediately identified the optimal solution. Although there is no ultimate proof, we conclude that the behavior of the “learning group” is described best by trial-and-error.

To exclude that time usage interferes with the experimental manipulations, we conduct RM-ANOVAs as in Table 3, but inserting used time as the dependent variable. None of the independent variables shows significant influence (all p-values >0.14, two-tailed, untabulated). As the smallest p-value comes close to the conventional threshold of 10 %, we included time used as a covariate for the analysis reported in Table 3. The results remain inferentially identical, and time used is insignificant (p = 0.92, two-tailed, untabulated).Footnote 21

Finally, the complexity of tournament incentive schemes is emphasized by the fact that even in the last round, 39.4 % of participants did not choose the optimal solution (untabulated).

5.4 Additional analysis

In this subsection, three sets of additional analyses are reported. First, we conduct analyses to further tie the experimental results to the psychological mechanisms proposed. Second, we discuss potential alternative explanations. And third, we investigate whether alternative statistical configurations still support our conclusions.

5.4.1 Psychological mechanisms

For the first set of tests, our aim is to substantiate that it is the proposed psychological mechanisms that lead to our experimental results. If our reasoning for H1 holds true, participants under a low proportion of winners should feel more internal pressure, as they perceive the goal of achieving the winner prize as less likely. This would coincide with participants being more concerned. We therefore asked participants how often they thought about their chance to receive Bonus A (the winner prize) compared to their competitors, using a 7-point Likert scale (1 = never, 7 = very often). Subjects responded with an average of 5.96 in the low-proportion condition and 5.06 in the high proportion condition. The difference indicates significantly higher concerns about achieving the bonus in the low-proportion condition (t = −3.72, p < 0.01, two-tailed). Hence, the reasoning is supported.

The critical assumption for H2 is that participants are more familiar with expected value calculations than with strategic optimization. Otherwise, expected values could not serve as a simplified decision rule. The post-experimental questionnaire asked participants how familiar they are with (a) game theory and (b) expected values, using a 7-point Likert scale (1 = not familiar at all, 7 = very familiar). Subjects responded with an average of 3.24 for game theory and 5.18 for expected values. The difference indicates significantly better knowledge of expected values (t = 8.67, p < 0.01, two-tailed). Importantly, this result is constant among treatment groups (F = 0.23, p = 0.88, two-tailed). Thus, the critical precondition for the theory underlying H2 is met.

5.4.2 Alternative explanations

To rule out alternative explanations, we concentrate on four key questions: First, can the results be explained by ex ante risk preferences rather than our manipulation? Second, can the effects of anchoring or salience explain the results for H2? Third, do fairness perceptions matter? And fourth, can the results for the differences between the high and the low proportion of winners be explained by the different magnitudes of the winner prize?

To address the first question, that is, whether our results are driven by risk preferences, we explicitly consider participants’ ex ante risk preferences. To do so, we include risk preferences in our RM-ANOVA as a covariate (untabulated). The results, however, remain unaffected. Moreover, risk preferences (F = 0.00, p = 0.99, two-tailed) as well as the interaction effect of round and risk preferences (F = 1.36, p = 0.20, two-tailed) are insignificant. Hence, we conclude that risk preferences cannot explain our results.

Second, if the perceived attractiveness based on a simplified decision rule is high, the risky investment offers payoffs of either 350 or 50 lira, while the payoffs are 300 or 0 lira under the low expected value. The possibility of receiving 0 lira in the low expected value condition initially seems to equal a total loss. Given the incentive system, investment proceeds of zero lead to a loser prize greater than zero. During the quiz, participants had proven their understanding that it is the relative rank that matters for their compensation, not the absolute investment outcomes. Consequently, equaling an investment return of zero with a total loss of compensation would be irrational. However, participants in the experiment have clearly been subject to bounded rationality, and this is why this line of thought should be illuminated further. This salience of the total loss through an anchor valueFootnote 22 of zero could provoke social loss aversionFootnote 23 and thus lead to less risk-taking in this condition. Hence, this would pose an alternative explanation to the theory offered for H2, as it points in the same direction. We use data from the post-experimental questionnaire to rule out this alternative explanation. People who are in a state of higher loss aversion should think more about the possibility of winning or losing and should be more nervous regarding the outcome. This nervousness might even interfere with their concentration on the task itself. As the high expected value condition does not have the anchor of zero implying a total loss and all else is equal, it serves as the natural benchmark. We asked participants to rate on 7-point Likert scales, how often they had thought about their chance of receiving Bonus A compared to their competitors (as above for the different proportions of winners: 1 = never, 7 = very often), how nervous or concerned they were regarding the chances of receiving Bonus A (1 = absolutely not nervous/concerned, 7 = very nervous/concerned), and to what degree thinking about the chance of receiving Bonus A impacted their concentration on the task (1 = not at all, 7 = very strongly). We find no differences between the groups with low and high expected values. Neither did they think more often about the chance of receiving Bonus A (t = 0.89, p = 0.38, two-tailed), nor were they more nervous or concerned (t = 1.13, p = 0.26, two-tailed). In addition, thinking about the probability of receiving Bonus A did not interfere with their concentration on the task in a significantly different manner (t = −0.97, p = 0.34, two-tailed).

Third, we examine whether our results are caused by differences in the perceived fairness of the two tournament schemes. Prior research concludes that contracts perceived as fairer induce greater effort and performance (for example, Hannan et al. 2005). Thus, fairer contracts are likely to provoke organizationally desirable outcomes. In our setting, taking no risk, that is, investing only in the safe project, is the desirable strategy. We find that perceived fairness does not significantly differ between the low and high proportions of winner tournaments (t = 1.62, p = 0.11, two-tailed). However, since the p-value is close to the common threshold of 10 %, we include the fairness measure in our RM-ANOVA as a robustness check. The results (untabulated) remain inferentially identical and fairness is insignificant (F = 1.01, p = 0.43, two-tailed). Hence, fairness is not an alternative explanation.

Fourth, to hold both bonus pool and prize spread constant, the winner prize varies between the proportions of winners. For the high proportion, the winner prize is 150 and 200 lira for the low proportion. Thus, the winner prize in the low proportion could be considered more attractive in terms of monetary value. Hence, winning Bonus A for monetary reasons could be more important to subjects in the low-proportion condition, which could potentially explain additional risk-taking to receive this prize. In our post-experimental questionnaire, we asked subjects “How important was increasing your compensation by achieving Bonus A to you?” The answers to this question (on a 7-point Likert scale, 1 = not important at all, 7 = very important) do not differ significantly between subjects in the high and the low proportion of winners (t = −0.96, p = 0.34, two-tailed). Consequently, the higher monetary value of the winner prize does not pose an alternative explanation.

5.4.3 Statistical configuration

To challenge the robustness of our results to various statistical configurations, we run two categories of alternative models. In the first category, we follow the reasoning that participants might have been initially overstrained. As a robustness check, we thus exclude the first round in one model and the first two rounds in another model, both with inferentially identical results (untabulated). In the second category, we switch from the RM-ANOVA model—fully incorporating the dependency between same-subject observations—to a pooled model, thus neglecting the dependencies (Table 7). Our results are also robust to this technical variation.

6 Conclusion

Though tournaments are widespread in practice, little is known about the effects on risk-taking caused by this incentive scheme. We examine the impact of two potential drivers in an experimental study, the proportion of tournament winners (endogenous factor) and the attractiveness of a risky strategy signaled by a simplified decision rule (exogenous factor).

We find that a low proportion of winners leads to more risk-taking compared to a high proportion. This is because tournaments with only a few winners are more likely to be framed as having the potential of creating a loss instead of a gain for employees, who then become risk-seeking according to prospect theory. This finding is surprising, because we use a scenario where the rational solution is to take no risk. From a practical perspective, we thus advise firms to employ tournaments with a higher proportion of winners to avoid excessive risk-taking. However, from another perspective, our results also suggest that tournaments with a low proportion of winners could be used to incentivize higher risk-taking, if desired. This finding is of particular interest when comparing tournaments with piece-rate systems, where employees choose an amount of risk matching their ex ante preferences, which are typically assumed to be risk averse on average. Therefore, under piece-rate systems firms have to compensate employees for taking additional risk. Tournaments, especially those with a low proportion of winners already entail this feature as part of the existing system without any premium. Another important finding is that the risk-taking impact of the proportion of winners does not diminish over time.

Our results also confirm that employees working under tournament incentives are likely to be misled by simplified decision rules. More precisely, we find that though tournament compensation schemes require strategic optimization, employees rather rely on the familiar expected value concept. Participants are even willing to take more risk if a risky project appears more attractive based on expected values. Yet, this effect declines over time. Therefore, we advise training employees under tournament incentives (that is, through complex learning) to mitigate the unintended consequences of risk-taking. Further, the impact of the proportion of winners on risk-taking is weaker when the perceived attractiveness of a risky project signaled by simplified decision rules, expected values, is low.

We also document that excessive risk-taking decreases over time. We consider this good news in general. However, for those participants who did not immediately identify the optimal solution, our analyses reveal that the decrease in risk-taking is not driven by complex learning mechanisms, that is, analytical processes, but rather by trial-and-error mechanisms. A considerable 39 % of our subjects still took excessive risk in the last round. We therefore encourage firms to reconsider the use of tournament incentive systems in situations that entail substantial risk levels. If tournaments are used, for example, due to their positive effects on effort and performance, it seems advisable for firms to foster analytical learning, that is, complex learning mechanisms, to avoid excessive risk-taking. From a research perspective, this calls for further investigation of learning processes under tournament incentive schemes.

There remain fruitful areas for further research. Future research could investigate other potential drivers of risk-taking in tournaments, such as the nature of the task. A potential limitation of our experiment is that every unit of risk taken is excessive. From a corporate real-world perspective though, taking no risk at all may be detrimental to innovation and consequently business success. Thus, a logical next step would be to modify the task to allow for desirable risk-taking as well. In this vein, instruments should be developed to adjust employee risk-taking to the level intended by the firm through its incentive systems. A further extension is possible by investigating the risk-taking effects of tournaments with different prize structures, that is, multiple winner prizes of varying values.

Another area for further research is comparison of tournaments with other incentive systems. As the goal of this study was to compare different tournament designs, we found that risk-taking can be increased through specific setting of design parameters. Studies on risk-taking in other incentive systems so far basically investigate design parameters that are costly (e.g., option-based compensation). One possible research question is whether the integration of some tournament parameters (e.g., a piece-rate system with an additional ranking that is not linked to compensation) can increase risk-taking in such systems without producing further costs.

Notes

Eriksen and Kvaløy (2015) hold the absolute number of winners constant at 1 (winner-take-all tournament). In their high proportion of winners tournament (50 %), they add one participant. For the low proportion of winners tournament (25 %), three participants are added.

While Orrison et al. (2004) and Harbring and Irlenbusch (2008) cannot confirm an effect of tournament size on effort, Harbring and Irlenbusch (2003) find that effort is significantly lower in a two-person tournament compared to a six-person tournament, both with the possibility of allowing collusion. An additional effort effect is reported by Orrison et al. (2004), who find that tournament size can reduce the inefficiency effects of discrimination in promotion tournaments. Discrimination in this context means that some agents must deliver significantly higher output to be considered for promotion.

We acknowledge that these findings do not necessarily generalize to situations with an extremely high or low proportion of winners. For an extremely high proportion of winners, the reduction in risk-taking is likely though. As discussed later, our theory for H1 suggests that employees are more prone to gambling if they expect not to win. Hence, increasing the winner proportion to almost 100 % (i.e., a quasi-flat fee) should further reduce risk-taking. For increasingly low proportions, the assumption of a monotonic increase in risk-taking is less convincing. In case of extremely low winning odds, increasing relative attractiveness of the risk-free alternative could offset the proposed effect. This should, however, be the case only for extremely small winner proportions of for example, 1 %. Hence, our predictions apply to situations where the probability of winning is neither miniscule nor very large (For a similar line of thought, see Knauer et al. 2015).

The influence of compensation systems on risk-taking, mainly executive risk-taking, has also been investigated using archival studies. In this context, the effect of CEO wealth sensitivity to stock volatility on risky policy choices (Coles et al. 2006), the effect of CEO contract design regulation on risk-taking (Sauset et al. 2015), the impact of equity-based compensation on risk-taking (Low 2009), the degree of option-based manager compensation on risk-taking (Gormley et al. 2013), and the effect of severance pay on risk-taking (Brown et al. 2015) have been investigated. In the experimental domain, Sprinkle et al. (2008) investigate the effect of budget levels on effort and risk-taking. However, as this paper focuses on design parameters on tournament compensation systems, we do not include this stream of research in our hypothesis development.

All payments in the experiment are denominated in the lira and converted into euros at the end of the experiment, using an exchange rate of 160 lira per euro.

Table 6, Panel A shows the probability of winning the tournament if the proportion of winners is low and the risky versus the safe project is chosen. If, for example, all participants decide to invest their total endowment in the risky project, payoffs generated by the projects would be identical. More precisely, participants receive either 300 % versus 0 % of the amount invested if the expected value is low, or 350 % versus 50 % if the expected value is high. Since there is only one winner in the low proportions of winner condition, a tie-breaking rule randomly determines the winner, i.e., the probability of winning is 25 % (see first row in Panel A). If, however, one participant decides for the safe payment, that participant’s probability of winning increases to 80 %. This is because the risky project results in a lower payoff (0 % of the amount invested) in 4 out of 5 cases. Hence, the rational choice is to select the safe project. The other scenarios presented in Panel A are calculated in a similar way. As a result, it is always rational to choose the safe project, and the expected value of the risky projects does not matter. Table 6, Panel B implies the same conclusion for the high proportion of winners.

The time necessary to read the instructions was validated in pretests.

To avoid framing effects, the risky project was referred to as investment A while the safe project was denominated investment B.

Subjects were asked to complete the risk lottery choices at the beginning of the experiment using an instrument frequently applied in accounting studies (for example, Sprinkle et al. 2008). Ten subjects revealed inconsistent or unclear risk preferences. Seven subjects chose erratic patterns. Three subjects were consistent in such a way that they shifted between the safe payment and the lottery only once. However, these three subjects opted for the risky lottery for low values of π while choosing the safe payment in states with high values of π. Thus, the test of randomization was conducted with only 90 observations. We re-ran all subsequent analyses excluding these subjects. The results are inferentially identical.

To further substantiate our results, we pooled all observations per subject and conducted a simple ANOVA with inferentially identical results for H1 and H2 (Table 7, Panel A). Since H4 relies on a within-subject measurement, the pooled ANOVA cannot be employed. Hence, we compare the investment in the risky project in the second half of the rounds (rounds 8 to 15) to the investment in the first half of the rounds (rounds 1 to 7), which we refer to as partial pooling.

For all 124 subjects, the result remains inferentially identical (F = 22.48, p < 0.01, two-tailed) in a pooled ANOVA analysis. We use a pooled ANOVA instead of RM-ANOVA because the latter analysis usually requires observations for all participants in each round. As explained above, some participants failed to enter valid investment sums in some of the first rounds; RM-ANOVA cannot be employed when using all 124 subjects. A direct comparison of the reported test values can be drawn from comparing Panels A and B in Table 7.

If all 124 subjects are considered, this result remains significant (F = 9.18, p < 0.01, two-tailed) in a pooled ANOVA analysis.

The result remains inferentially identical in an additional analysis with partial pooling of observations. The investment in the risky alternative drops by 430.12 lira on average (t = 3.17, p < 0.01, two-tailed).

We employ contrast weights of 2 (proportion of winners low, expected value low), −4 (proportion of winners high, expected value low), 3 (proportion of winners low, expected value high), and −1 (proportion of winners high, expected value high). Additional tests employing other contrast weights reflecting the predicted pattern further confirm our findings. The results are inferentially identical with contrast weights of 1, −3, 4, −2 (F = 27.07, p < 0.01); 2, −5, 4, −1 (F = 25.66, p < 0.01); 3, −5, 5, −3 (F = 24.18, p < 0.01), and 1, −5, 3, 1 (F = 28.21, p < 0.01). Further, the number of observations in the four cells is not identical. The Levene test does not reject equality of variances, hence no adjustment is necessary. To further underline the robustness of the results, we multiplied each factor weight with the proportion of the cell in the sample. The results remain inferentially identical.

Untabulated ANOVA results confirm significant differences at the 1 % level.

Given violation of the normal distribution assumption, Spearman rank correlations are computed.

The results remain qualitatively identical when low-risk-takers are defined as participants accepting less than 10 % or 1 % of maximal risk. Some 36 of the 99 participants followed a high-risk strategy throughout, i.e., investing more than 5 % in the risky alternative in rounds 1–5, rounds 6–10, and rounds 11–15.

Three participants changed from the desirable low-risk strategy to a higher-risk strategy. Although this behavior is difficult to explain, it represents only 3 % of participants.

Given violation of the normal distribution assumption, Spearman rank correlations are computed.

As an additional robustness check, Spearman correlations between the time used in the first ten rounds and risk-taking in the last five rounds are calculated to capture a potential longer-horizon learning effect. Although the effect is insignificant (p = 0.13, two-tailed) the positive direction of the coefficient (0.16) rather points at more risk-taking as a consequence of more time used.

The only change is that the time effect reported within-subjects becomes insignificant, because it is explicitly captured.

An anchor means an initial value or starting point that typically impacts the final decision through insufficient adjustment (Tversky and Kahneman 1974). Anchors have been found relevant in probabilistic decisions if information was presented sequentially (Cohen et al. 1972). Given the simultaneous presentation of the two alternatives in our setting, the anchor itself seems to be of minor relevance.

Loss aversion implies a gain–loss distinction such that “losses are disliked more than equal-sized gains are liked” (Camerer 2005, p. 129). This refers primarily to monetary gains or losses. Social loss aversion, in contrast, highlights the “psychological distaste for being perceived as a loser relative to others” (Lim 2010, p. 778). Given our theoretical underpinnings, we consider both loss aversion and social loss aversion as relevant; however, in the “heat of the moment,” social loss aversion might even be more important.

References

Ariga K, Ohkusa Y, Brunello G (1999) Fast track: is it in the genes? The promotion policy of a large Japanese firm. J Econ Behav Organ 38:385–402

Ashby WR (1970) Design for a brain: the origin of adaptive behaviour, 2nd edn. Chapman & Hall, London

Backes-Gellner U, Pull K (2013) Tournament compensation systems, employee heterogeneity, and firm performance. Hum Resour Manag 52:375–398

Berger L, Klassen K, Libby T, Webb A (2013) Complacency and giving up across repeated tournaments: evidence from the field. J Manag Acc Res 25:143–167

Bromiley P, McShane M, Nair A, Rustambekov E (2015) Enterprise risk management: review, critique, and research directions. Long Range Plann 48:265–276

Brown K, Jha R, Pacharn P (2015) Ex ante CEO severance pay and risk-taking in the financial services sector. J Bank Financ 59:111–126

Buckless FA, Ravenscroft SP (1990) Contrast coding: a refinement of ANOVA in behavioral analysis. Acc Rev 65:933–945

Bull C, Schotter A, Weigelt K (1987) Tournaments and piece rates: an experimental study. J Polit Econ 95:1–33

Camerer CF (2005) Three cheers—psychological, theoretical, empirical—for loss aversion. J Mark Res 42:129–133

Camerer CF, Chong JK, Ho TH (2004) A cognitive hierarchy model of games. Q J Econ 119:861–898

Cohen J, Chesnick EI, Haran D (1972) A confirmation of the interial-ψ effect in sequential choice and decision. Brit J Psychol 63:41–46

Coles JL, Daniel ND, Naveen L (2006) Managerial incentives and risk-taking. J Financ Econ 79:431–468

Dechenaux E, Kovenock D, Sheremeta RM (2012) A survey of experimental research on contests, all-pay auctions and tournaments. Social Science Research Center, Berlin

Eriksen KW, Kvaløy O (2015) No guts, no glory: an experiment on excessive risk-taking. Working paper, University of Stavanger

Fischbacher U (2007) Z-Tree: Zurich toolbox for ready-made economic experiments. Exp Econ 10:171–178

Freeman RB, Gelber AM (2010) Prize structure and information in tournaments: experimental evidence. Am Econ J Appl Econ 2:149–164

Gaba A, Kalra A (1999) Risk behavior in response to quotas and contests. Market Sci 18:417–434

Gaba A, Tsetlin I, Winkler RL (2004) Modifying variability and correlations in winner-take-all contests. Oper Res 52:384–395

Gormley TA, Matsa DA, Milbourn T (2013) CEO compensation and corporate risk: evidence from a natural experiment. J Acc Econ 56:79–101

Grothe D (2005) Forced ranking: making performance management work. Harvard Business School Press, Boston

Hannan RL, Hoffman VB, Moser DV (2005) Bonus versus penalty: Does contract frame affect employee effort? In: Rapoport A, Zwick R (eds) Experimental business research: economic and managerial perspectives, vol 2. Springer, Dordrecht and New York, pp 151–169

Hannan RL, Krishnan R, Newman AH (2008) The effects of disseminating relative performance feedback in tournament and individual performance compensation plans. Acc Rev 83:893–913

Harbring C, Irlenbusch B (2003) An experimental study on tournament design. Labour Econ 10:443–464

Harbring C, Irlenbusch B (2008) How many winners are good to have? On tournaments with sabotage. J Econ Behav Organ 65:682–702

Heath C, Larrick RP, Wu G (1999) Goals as reference points. Cognit Psychol 38:79–109

Hopwood AG (1976) Accounting and human behaviour. Prentice-Hall, Englewood Cliffs

Kahneman D, Tversky A (1979) Prospect theory: an analysis of decision under risk. Econometrica 47:263–292

Kempf A, Ruenzi S (2008) Tournaments in mutual-fund families. Rev Financ Stud 21:1013–1036

Kirchgässner G (2008) Homo oeconomicus: the economic model of behaviour and its applications in economics and other social sciences. Springer, New York

Knauer T, Sommer F, Wöhrmann A (2015) Tournament winner proportion and its effect on effort: “More bang for the buck”. Working paper, University of Bayreuth, University of Muenster. Available at SSRN: http://ssrn.com/abstract=2677701 (verified 23/10/2015)

Larrick RP, Heath C, Wu G (2009) Goal-induced risk taking in negotiation and decision making. Soc Cognit 27:342–364

Lazear EP, Rosen S (1981) Rank-order tournaments as optimum labor contracts. J Polit Econ 89:841–864

Lim N (2010) Social loss aversion and optimal contest design. J Mark Res 47:777–787

Lim N, Ahearne MJ, Ham SH (2009) Designing sales contests: does the prize structure matter? J Mark Res 46:356–371

Low A (2009) Managerial risk-taking behavior and equity-based compensation. J Financ Econ 92:470–490

Luft J (1994) Bonus and penalty incentives contract choice by employees. J Acc Econ 18:181–206

Luft J, Shields MD (2009) Psychology models of management accounting. Found Trends Acc 4:199–345

Nalebuff BJ, Stiglitz JE (1983) Prizes and incentives: towards a general theory of compensation and competition. Bell J Econ 14:21–43

Newman AH, Tafkov ID (2014) Relative performance information in tournaments with different prize structures. Acc Org Soc 39:348–361

Orrison A, Schotter A, Weigelt K (2004) Multiperson tournaments: an experimental examination. Manag Sci 50:268–279

Osborne MJ (2004) An introduction to game theory. Oxford University Press, New York

Rankin FW, Sayre TL (2011) Responses to risk in tournaments. Acc Org Soc 36:53–62

Rozin P, Nemeroff C (2009) Sympathetic magical thinking: the contagion and similarity “heuristics”. In: Gilovich T, Griffin D, Kahneman D (eds) Heuristics and biases: the psychology of intuitive judgment, 8th edn. Cambridge University Press, New York, pp 201–216

Sauset J, Waller P, Wolff M (2015) CEO contract design regulation and risk-taking. Eur Acc Rev 24:685–725

Sheremeta RM (2011) Contest design: an experimental investigation. Econ Inq 49:573–590

Sprinkle GB, Williamson MG, Upton DR (2008) The effort and risk-taking effects of budget-based contracts. Acc Org Soc 33:436–452

Stahl DO, Wilson PW (1994) Experimental evidence on players’ models of other players. J Econ Behav Org 25:309–327

Thorndike EL (1898) Animal intelligence: an experimental study of the associative processes in animals. Psychol Rev 2:1–109

Tversky A, Kahneman D (1974) Judgment under uncertainty: heuristics and biases. Science 185:1124–1131

van Asselt MBA, Renn O (2011) Risk governance. J Risk Res 14:431–449

Author information

Authors and Affiliations

Corresponding author

Additional information

Data are available from the corresponding author upon request.