Abstract

The primary purpose of this study was to investigate how top manager attributes account for the implementation of risk-averse strategy by applying a conceptual framework based on upper echelons theory. We selected franchising as a representative risk-averse strategy based on resource scarcity, agency, and risk-sharing theories. We chose the top management team (TMT) as a proxy for the upper echelon to examine the theoretical argument. The study period was from 2000 to 2013, and 29 restaurant companies were included in the research. Related data were derived from EXECUCOMP, COMPUSTAT, Annual 10-K, and publicly accessible resources (e.g., LinkedIn and Business Week). Feasible generalized least squares and random effect regression models were used to analyze the data. The results suggested that the formal education levels of top managers negatively affected franchising implementation, whereas the tenure of TMT members positively influenced restaurant franchising.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The value and cognitive characteristics of top managers influence organizations’ strategic directions, which ultimately affect organizational outcomes (Hambrick 2007). Because of these valid connections, Weiner and Mahoney (1981) focused on top managers’ value and cognitive base and their association with strategic execution based on the argument of stewardship theory. Hambrick and Mason (1984) theorized the above connection in the form of upper echelons theory, contending that the precise measurement of such value and cognitive base is so complex that the observable attributes of managers—including age, education, tenure, and characteristics of compensation packages—can substitute for the psychometric properties and eventually affect organizational direction. In particular, follow-up studies have demonstrated that the level of share ownership, age, and tenure of top managers are negatively associated with strategic risk-taking, whereas their educational levels and levels of stock options are positively associated with strategic risk-taking (Zhang 2006; Sanders and Hambrick 2007; Matta and Beamish 2008; Karaevli and Zajac 2013; Alessandri and Seth 2014). That is, although numerous studies have examined top managers’ characteristics and their possible connection with risky strategic execution (e.g., capital expenditure, mergers and acquisitions, and international operation decisions), few studies have empirically tested the influence of top managers’ characteristics on risk-averse strategy, while concerns about risk-averse strategic action have arisen as the severity of the global financial crisis increased (Combs et al. 2004; International Franchise Association 2013).

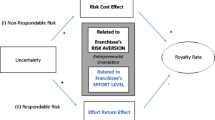

Scholars have argued that franchising is regarded as a risk-averse strategy based on multiple theoretical perspectives (Roh 2002; Combs et al. 2004). According to risk-sharing theory, franchising allows franchisors to share their operational risks with franchisees (Combs et al. 2011; Lee et al. 2015). Resource scarcity theory also supports risk-sharing theory, contending that franchising enables franchisors to depend on the resources of franchisees (Carney and Gedajlovic 1991; Lafontaine 1992). Resource constraints are considered a substantial business risk from the perspective of top managers, and franchising can reduce this risk from the perspective of managers. Finally, agency theory claims that franchising minimizes agency problems between franchisors (principals) and franchisees (agents) (Brickley et al. 1991; Lafontaine 1992). The agency problem—efforts to maximize agencies’ benefits over those of principals—is deemed risky by principals (Lafontaine and Shaw 1999; Combs et al. 2004); however, franchising has been recognized as an efficient instrument to monitor agents and thus to minimize agency costs (Jensen 1986; Brickley and Dark 1987). Given these theoretical arguments, franchising is likely to be regarded as a risk-averse strategy.

We chose the restaurant industry as the research context because this industry is a focal area for franchising research (Pittaway 2001) and strongly contributes to the US economy (accounting for approximately $210 billion) (International Franchise Association 2013). Hambrick and Mason (1984) also claimed that the fate of an organization is likely to be decided by multiple individuals rather than a single powerful person. Hence, the top management team (TMT) is more likely to meet the need for superior accountability for strategic execution than a single top manager (e.g., chief executive officer and chief financial officer) would. In this vein, this research employed TMTs consisting of multiple decision-makers who have a stronger influence on the strategic direction of their businesses.

Given that franchising is a representative risk-averse strategy and the superior accountability of TMTs for strategic execution, the main purpose of this study is to determine whether the theoretical framework of upper echelons theory explains risk-averse strategic execution by employing TMT members’ observable information (e.g., age, tenure, level of formal education, and compensation package). To achieve the research goal, in Sect. 2, we build the theoretical foundation of the study based on resource scarcity, agency, risk-sharing, and upper echelons theory. In Sects. 3 and 4, we formulate research hypotheses and describe study methods, including data collection, the measurement of variables, and statistical analysis. Finally, Sects. 5, 6, and 7 present study results, discussions, and implications/contributions, respectively.

2 Theoretical foundations

2.1 Franchising and multiple theoretical perspectives

Franchising is defined as the practice of renting the right to use a firm’s business model and brand for a certain contract period (Carney and Gedajlovic 1991; De Castro et al. 2009). Specifically, franchising is a form of brand marketing in which a franchisor grants franchisees the right to use a franchisor’s trade name and quality standards over a defined period of time in a specific location (Castrogiovanni et al. 2006; Combs et al. 2011; Rodríguez et al. 2011). In another sense, franchising is a systematic model to screen or choose the best partner for the long-term success of a business through franchising fees and contract arrangements (Lafontaine 1992; Hsu and Jang 2009).

Three theoretical perspectives have characterized franchising as a representative risk-averse business strategy: resource scarcity theory, agency theory, and risk-sharing theory. First, resource scarcity theory argues that constrained resources can limit business expansion; however, franchising can be one way to overcome resource constraints (Peteraf 1993; Westhead et al. 2001). According to Carney and Gedajlovic (1991), the franchisor operates its business using franchisees’ capital instead of its own capital so that it can expand more rapidly through the franchising system. Moreover, numerous studies have asserted that franchising allows franchisors to assimilate franchisees’ knowledge of local markets, which enables franchisors to attain a greater competitive advantage and minimize business risk (March and Shapira 1987; Roh and Choi 2010; Rodríguez et al. 2011).

Second, agency theory provides a theoretical background on how franchising is close to risk-averse strategy. According to agency theory, agents who are more informed regarding a firm’s condition are more likely to work for their own benefit than maximize the wealth of the principals (Jensen and Meckling 1976; Combs et al. 2004). In this respect, the principals must observe managers’ behavior; this observation, in turn, incurs monitoring costs (Jensen 1986; Lafontaine 1992). Scholars have observed that excessive monitoring costs depreciate firms’ value because of the required business resources (Jensen 1986; Fama and French 2001; Castrogiovanni et al. 2006). In the franchising system, franchisees are considered agents because the principals (franchisors) do not have sufficient information regarding the capability of the agents (franchisees) (De Castro et al. 2009; Koh et al. 2009; Hsu et al. 2010). Poorly performing franchisees can impair the reputation and value of the franchisors (Lafontaine and Shaw 1999; Lee et al. 2015). This situation leads franchisors to monitor franchisees further to prevent value destruction. Franchisors thus need a mechanism that forces franchisees to create wealth for principals. A residual claim is a representative instrument that solves the agency problem in a franchising system (Roh 2002; Combs et al. 2004). This claim refers to franchisees’ guaranteed income after paying all financial obligations in full to the franchisor (e.g., franchising fee and royalty fees) (Brickley and Dark 1987; Brickley et al. 1991). Scholars have stated that residual claims play an important role in aligning the interests of franchisors and franchisees by stimulating the franchisees’ desire to perform well, which in turn reduces the need for the franchisors to monitor the franchisees (Castrogiovanni et al. 2006; Roh et al. 2013).

Third, risk-sharing theory supports the assertion that franchising is a risk-averse strategy. Businesses use franchising to operate in remote regions (Combs et al. 2004; Ramírez-Hurtado et al. 2011). Remote business operations are likely to entail risk because businesses are less informed with regard to the cultural, economic, and political conditions of the local markets (Hsu et al. 2010; Lee et al. 2015). This phenomenon leads businesses to adopt franchising, thereby reducing operational risk by sharing this risk with franchisees. Scholars have claimed that franchisors can use franchisees’ capital (e.g., buildings, equipment, and land) when they enter a new market, which in turn reduces the franchisors’ business risk (Lafontaine 1992; Safón and Escribá-Esteve 2011).

2.2 Upper echelons theory

The upper echelon refers to people in higher social strata (Finkelstein et al. 2009). In the business context, individuals in top management positions—such as chief executive officers and TMTs—are regarded as situated in the upper echelon. Hambrick and Mason (1984) proposed upper echelons theory, which claims that an organization’s outcomes are a reflection of the powerful individuals in the organization. Bounded rationality, the core underlying notion of upper echelons theory, implies that top managers’ rationality for integrating all information around them is imperfect (Simon 1972). Therefore, the cognitive abilities of top executives are constrained in assimilating information from every aspect of their environment (Simon 1972; Hambrick and Mason 1984). This limited capability for integrating information results in a limited field of vision, selective perception, and individual interpretations of processed information. This limitation influences managerial perception, which is regarded as the need to assess, examine, and understand the information to apply it to business outcomes as illustrated in Fig. 1 (Hambrick 2007).

Strategic choice under the condition of bounded rationality. Source Hambrick and Mason (1984)

Initially, stewardship theory described the role of managers’ values and cognitive base in explaining business outcomes (Weiner and Mahoney 1981). However, Hambrick and Mason (1984) later argued that the cognitive base and values of top managers are difficult to measure, which is regarded as a main limitation of stewardship theory. Hambrick (2007) suggested demographic indicators as alternatives because these factors reflect people’s cognitive base and values and are easily observable. Following Hambrick and Mason’s argument (1984), subsequent studies have demonstrated that demographic indicators play a significant role in explaining strategic choices (Wiersema and Bantel 1992; Barkema and Shvyrkov 2007).

Another important premise of upper echelons theory is its emphasis on TMT characteristics rather than CEO characteristics. According to Hambrick and Mason (1984), the TMT is likely to show more accountability for organizational outcomes (e.g., strategic direction and financial performance) because the organizational direction is decided by multiple players rather than a single player (Finkelstein et al. 2009). Given the TMT’s importance in explaining organizational outcomes, some scholars have examined TMTs’ effects on these outcomes. For example, Hambrick et al. (1996) demonstrated the critical effect of the TMT on organizational performance in the airline industry. Similarly, Nadolska and Barkema (2013) concluded that TMTs play an essential role in the success of acquisitions.

3 Hypothesis development

3.1 Age and franchising

Hambrick and Mason (1984) asserted that older top managers have less physical and mental energy for integrating new information. Scholars have also contended that older top managers consider career security a more important aspect than younger top managers do, which leads older top managers to defend their strategic behavior (Miles and Snow 1978; Matta and Beamish 2008). Previous research has found that strategic change is negatively correlated with the age of top managers because strategic change entails processing complex information (Wiersema and Bantel 1992; Zhang 2006). Consistent with these findings, Herrmann and Datta (2006) examined the association between the CEO’s age and strategic risk-taking in the US manufacturing sector and verified the negative association between top managers’ age and strategic risk-taking. Researchers also found that risk-taking in human resource management (Larraza-Kintana et al. 2007) and bank acquisition (Hagendorff and Vallascas 2011) is negatively associated with the age of top managers. Given these defensive management behaviors, we anticipated that older top managers are likely to prefer franchising because franchising reduces operational risk (Hsu et al. 2010). Therefore, we hypothesize as follows:

H1

The average age of TMT members has a positive impact on franchising.

3.2 Tenure and franchising

The second domain of upper echelons is tenure, referring to the length of time that one has served as a top manager in a business. Upper echelons theory suggests that longer-tenured TMT members assign greater value to their career stability (Finkelstein et al. 2009). These TMT members are likely to become defenders (placing an emphasis on stability and protection) rather than prospectors (emphasizing innovation and risk-taking) (Miles and Snow 1978). Longer-tenured top managers seek to defend their careers and reputations and thus take fewer operating risks because of their preference for stability (Wiersema and Bantel 1992). In the same vein, numerous scholars have confirmed that strategic variation is negatively associated with top managers’ tenure. For example, Coles et al. (2006) demonstrated that longer-tenured top managers avoid taking risks in their strategic decisions using firms listed in the S&P 500. Examining data from member firms of the National Federation of Independent Business, Simsek (2007) found that longer-tenured TMT members attempted to reduce risks in their strategic actions. Similarly, Gray and Cannella (1997) found a negative association between the tenure of top managers and risk-taking behavior in large firms traded on the NYSE, NASDAQ, and AMEX. Considering the theoretical support defining franchising as a risk-averse strategy, franchising is likely to be favored by longer-tenured top managers who prioritize career stability because franchising allows top managers to share operational risk with franchisees (Finkelstein et al. 2009; Lee et al. 2015). Hence, the following hypothesis is proposed:

H2

The average tenure of TMT members has a positive impact on franchising.

3.3 Formal education level and franchising

TMT members’ level of formal education can be another determinant of strategic risk-taking. According to Li and Tang (2010), highly educated top managers are more confident in their knowledge, leading them to choose more complicated options (riskier strategies). That is, top managers’ confidence regarding their knowledge through formal education encourages them to take more strategic risks, and this likely leads to lower dependence on franchising (Karami et al. 2006; Finkelstein et al. 2009; Karaevli and Zajac 2013; Lee et al. 2015). Scholars have demonstrated the positive association between top managers’ formal education levels and execution of risky strategies. Barker and Mueller (2002), for example, examined firms on Business Week’s top 1000 and provided evidence that more highly educated top managers took more strategic risks. Similarly, Nadkarni and Herrmann (2010) verified a positive association between the education of top managers and strategic risk-taking by analyzing the top managers of Indian companies. Given the literature review and the risk-averse nature of franchising, a third hypothesis is presented as follows:

H3

The average formal education level of TMT members has a negative impact on franchising.

3.4 Share ownership and franchising

The value of share ownership possessed by TMT members—namely the amount of equity owned by top managers—can be a determinant of strategic execution. The extant literature asserts that top managers are more risk averse when they hold more share ownership because poor organizational performance decreases the value of their shares (Wright et al. 1996; Pendleton et al. 1998). Numerous studies have found a negative association between strategic risk-taking and the level of share ownership. As representative examples, Alessandri and Seth (2014) showed a negative relation between managerial ownership and international diversification (which is considered a risky strategy) using a sample of S&P 500 firms. Sanders (2001) also found that share ownership by top managers deterred top managers from employing risky strategies (e.g., internationalization, diversification, and acquisition). Given the empirical evidence and the risk-averse features of franchising, share ownership is likely to increase top managers’ dependence on franchising because top managers seek to avoid losing their wealth through strategic risk-taking (Wu and Tu 2007; Lee et al. 2015). This research thus proposes the following hypothesis:

H4

TMT members’ value of share ownership has a positive impact on franchising.

3.5 Stock options and franchising

Stock options may be another domain that explains strategic execution by top managers. Stock options award top managers the right to gain without imposing any penalty for the failure of strategic decisions (Sanders and Hambrick 2007). Therefore, stock options enable top managers to implement more aggressive strategies (Yermack 1997; Aboody and Kasznik 2000). Scholars have also stated that larger portions of stock options in compensation packages encourage top managers to actively take strategic risks due to the lack of obligation arising from and penalty for the results of their strategic decisions (Wu and Tu 2007). That is, top managers who receive a larger percentage of stock options are more likely to become prospectors who prioritize innovation in their strategic decisions because they are free of responsibility regarding corporations’ decisions (Miles and Snow 1978; Sanders 2001). Previous research has verified the positive association between strategic risk-taking and stock options. For example, Rajgopal and Shevlin (2002) presented evidence of a positive association between executive stock options and implementation of risky strategies using oil and gas producers as their study subjects. Such a relation was shown by Sanders and Hambrick (2007), who observed that stock options enable top managers in the US to implement risky strategies (e.g., R&D, capital, and acquisition investment). Given the role of stock options and the intrinsic properties of franchising, we hypothesize as follows:

H5

TMT members’ stock option value has a negative impact on franchising.

4 Methodologies

4.1 Data and sample

We used a sample of publicly traded US restaurant firms (e.g., AMEX, NASDAQ, and NYSE). Data such as accounting information, age, tenure, and financial status of the TMTs were also obtained using the Standard Industrial Classification code 5812 from both COMPUSTAT and EXECUCOMP. Moreover, information regarding TMT members’ education and franchising data was collected from each company’s annual Form 10-K and other public sources such as LinkedIn (http://www.linkedin.com). Because franchising data were severely limited before annual Form 10-K reports were required beginning in 1999, a study period of 1999–2013 was selected. Cook’s distance was used to detect and eliminate outliers with 1 as the cutoff value. Using the statistics of Cook’s distance test, we detected and eliminated four outliers from the 328 original observations. Therefore, the total number of observations was 324.Footnote 1 The profile of the restaurant companies is presented in Table 1.

4.2 Description of variables

The degree of franchising (DOF), the dependent variable in the study, was measured as the number of franchising stores divided by the total number of stores by following the approach of prior research (Roh 2002; Hsu and Jang 2009; Koh et al. 2009; Sun and Lee 2013). Because numerous studies have defined the TMT as all executives above the vice-president level (e.g., chief executive officer, chief finance officer, chief marketing officer, and executive vice president) (Geletkanycz and Hambrick 1997; Carpenter et al. 2004), this study used the same definition and approach in collecting data. This study had the following main independent variables: the average age of the TMT (AGE), average tenure of the TMT (TEN), average formal education level of the TMT (EDU), value of share ownership by the TMT (OWN), and the value of stock options awarded to the TMT (STOP). In accordance with the previous studies’ measurement of TMTs (Wiersema and Bantel 1992; Geletkanycz and Hambrick 1997; Carpenter et al. 2004), we used the average of the TMT members’ attributes (e.g., age, tenure, and education). Specifically, AGE and TEN are the average physical age of TMT members and the average number of years served as TMT members in the firm, respectively. In terms of the measurement of TEN, we coded 1 in the year shown. For example, if a TMT member began his or her service in 2004, the value was coded as 1 in 2004 and coded as 3 in 2006. After computing each of the TMT members’ number of years served in the company, we calculated the average tenure of the TMT members. EDU for each member was also measured as an ordinal variable. If a TMT member held a graduate degree (e.g., MBA, MS, JD, or PhD), the member was coded as 3. If a TMT member held a bachelor’s degree as his or her terminal degree, then that member was coded as 2. If a TMT member held a degree below the bachelor’s level, the case was coded as 1. After aggregating the coding for education, we computed the mean value to measure the average TMT educational level. OWN refers to the sum of the value of share ownership by all TMT members. For STOP, we computed the sum of the value of the stock options possessed by all TMT members.

This study adopted eight control variables: the gender of the top managers (GEN), size of the TMT (STMT), degree of internationalization (DOI), annual sales growth (GRO), investment opportunity (IO), financial leverage (DEBT), firm size (SIZE), and status of the business as a limited-service restaurant (LSR). Previous studies have found that females are more likely to be risk averse than males (Jianakoplos and Bernasek 1998; Wu and Tu 2007; Seo and Sharma 2013). Consequently, this study controlled for the effect of gender, and we measured it as a binary variable with female top managers coded as 1 and male top managers as 0. After coding each TMT member’s gender, we computed the average for the gender of TMT members as an aggregate variable. STMT was the second control variable based on the literature, which argues that the size of the TMT is likely to affect strategic decisions (Hambrick et al. 1996; Finkelstein et al. 2009). Third, DOI was measured as the number of stores operating in the international market over the total number of stores in a company’s business portfolio (Sun and Lee 2013). The purpose of using DOI as a control variable was to capture the agency problem between restaurant franchisors and franchisees that are located in remote areas, as done by Hsu et al. (2010). GRO, IO, and DEBT were additional control variables used to capture the resource conditions. Because firms in the growth stage require more resources, we employed firm growth as a control variable. Delmar et al. (2003) suggested that annual changes in sales could serve as the measurement of growth; hence, GRO was calculated as the change in revenue from the previous period to the current period. IO was measured as the ratio of market–book value as performed by Fama and French (2001) because businesses with more IOs are likely to experience greater resource constraints as a result of pursuing those opportunities. DEBT represented the debt dependency of a company, suggesting that financial leverage can capture the resource constraints of a business, which were measured by the debt-to-asset ratio (Jensen and Meckling 1976; Jensen 1986). SIZE aimed to capture resource availability given the resource-based view, which asserts that a firm is a bundle of resources (Wernerfelt 1984; Peteraf 1993). Finally, we used LSR as a control variable and measured it with a binary variable (0 = full-service restaurant and 1 = LSR) given the literature support from Hsu et al. (2010). Table 2 presents the details of the variables.

4.3 Statistical analysis

This study used an econometric approach to analyze the data because the characteristics of the panel data consisted of multiple firms and years. To check the basic assumptions of the model, we performed the modified Wald test (for heteroskedasticity) and the Wooldridge test (for autocorrelation) (Baltagi 2008). Baum (2001) suggested the modified Wald test as a group-wise heteroskedasticity test for panel data that tests residuals, given the Wald statistics. The null hypothesis of the modified Wald test for group-wise heteroskedasticity is as follows:

where N g stands for the number of cross-sectional units, and the significance of the Wald statistics indicates the presence of heteroskedasticity that may affect the standard error of estimation. Therefore, the estimated standard error is not valid if the estimation is influenced by heteroskedasticity (Greene 2003; Gujarati and Porter 2009).

We also tested for serial correlation using the Wooldridge test for autocorrelation in the panel data. Autocorrelation occurs when the error terms from different observations are correlated with one another (Baltagi 2008; Wooldridge 2009). Because autocorrelation affects the standard error, the estimated statistics are not valid in the model with autocorrelation because presuming them to be valid could result in bias for the estimated coefficient. The null hypothesis of the Wooldridge test for autocorrelation is that there is no autocorrelation in the model as follows:

where u t is the residual in a given period t, u j is the residual in a given period j, and the significance of the Wooldridge test for autocorrelation statistics stands for the autocorrelation in the model. Therefore, the estimated standard error is not valid if the estimation is influenced by autocorrelation (Drukker 2003; Wooldridge 2009).

We chose a panel feasible generalized least squares (FGLS) regression to conduct the data analysis because the modified Wald statistics (F = 4.45, p = 0.9921) and the Wooldridge test (F = 50.23, p < 0.01) detected autocorrelation (Baum 2001; Hoechle 2007) in the study data collected. The FGLS model transforms the equations to obtain equal variance by weighting the estimators (Greene 2003). Scholars argue that FGLS regression is performed when ordinary least squares (OLS) regression is inefficient, and therefore FGLS enhances the estimations given the presence of heteroskedasticity and serial correlation (Gujarati and Porter 2009; Wooldridge 2009). We also performed the Hausman test for the analysis of panel data. According to Gujarati and Porter (2009), the Hausman test is used regardless of whether a random effect model or a fixed effect model is more appropriate. Random effect regression refers to a model that incorporates unobserved effects into the regression to minimize omitted variable bias in the estimation, while a fixed effect model incorporates dummy variables to capture both firm and year effects in the panel data analysis (Baltagi 2008; Wooldridge 2009). In this vein, we performed the Hausman test, and the results (Hausman test χ 2 = 4.00, p value = 0.9472) indicated that the random effect model is more appropriate for analyzing the data. Given this method, this study proposes the following regression equation:

where DOF is the degree of franchising (number of franchising stores/total number of stores), AGE is the average age of TMT members, TEN is the average length of time serving as TMT members, EDU is the average formal education level of TMT members, OWN is the value of share ownership by TMT members, STOP is the value of stock options awarded to TMT members, GEN is the average gender of top managers, STMT is the size of the TMT (number of top managers in a TMT), DOI is the degree of internationalization (number of international stores/total number of stores), GRO is the annual sales growth [(Sales t − Sales t−1)/Sales t−1], IO is the investment opportunity (market–book value), DEBT is the financial leverage (total debt/total assets), SIZE indicates the firm size (total assets), and LSR indicates limited-service restaurant (0 = full-service restaurant, 1 = LSR).

5 Results

5.1 Descriptive statistics and correlation matrix

Table 3 presents the results of the descriptive statistics. The mean value of DOF was 0.42, and the standard deviation was 0.32, with a range from 0 to 0.99. The mean values and standard deviations of AGE and TEN were 50.85 and 3.49 and 7.92 and 3.25, respectively. The descriptive statistics also provided information about OWN (mean = 2533.52 thousands of dollars, SD = 4771.59 thousands of dollars) and STOP (mean = 23,156.26 thousands of dollars, SD = 52,645.72 thousands of dollars). The average of STMT was 5.50, and the standard deviation was 1.06, implying that the average size of the TMT employed in the study was 5.5. Information about the control variables is also presented in Table 3: IO (mean = 1.67, SD = 1.38), GRO (mean = 0.08, SD = 0.23), DEBT (mean = 0.62, SD = 0.47), SIZE (mean = 2119.23, SD = 4545.21), and LSR (mean = 0.28, SD = 0.45).

Table 4 presents the correlation matrix. AGE was positively correlated with TEN (r = 0.26), whereas AGE was negatively correlated with GRO (r = −0.13). These results imply that older top managers had more tenure; however, older top managers saw lower sales growth. TEN was negatively correlated with GEN (r = −0.15). It can be inferred that a large proportion of female top managers had shorter tenure. EDU was negatively correlated with GEN (r = −0.35), implying that members of TMTs with a larger proportion of female top managers were less educated. OWN was positively correlated with STOP (r = 0.28). STOP was positively correlated with GRO (r = 0.11) and IO (r = 0.47), which means that top managers possessing more stock options achieved higher market-to-book value and more sales growth. In contrast, STOP was negatively correlated with GEN (r = −0.21), indicating that restaurant companies granted fewer stock options to female top managers. Furthermore, STMT was positively correlated with SIZE (r = 0.11), which means that more TMT members participated in the business administration of large companies. LSR was positively correlated with OWN (r = 0.33), STOP (r = 0.42), and IO (r = 0.36). It can be inferred that LSR companies not only granted more shares and stock options to top managers but also had more IOs. Finally, SIZE was positively correlated with LSR (r = 0.37), implying that LSRs were larger organizations.

5.2 Results of regression analysis Footnote 2

Table 5 presents the panel FGLS results, which showed a positive and significant coefficient with regard to TEN (β = 0.0107, p < 0.05). Consistent with the proposed hypotheses, EDU presented a negative coefficient (β = −0.2713, p < 0.01). Regarding the control variables, DOF was significantly affected by GEN (β = 0.2038, p < 0.05), DOI (β = 0.3941, p < 0.01), IO (β = 0.0479, p < 0.01), DEBT (β = 0.1238, p < 0.01), SIZE (β = −0.0001, p < 0.05), and LSR (β = 0.3891, p < 0.01). The model was statistically significant given the value of the Wald χ 2 statistic (Wald χ 2 = 219.09, p < 0.01) and accounted for 37.26 percent of the variance.

Table 6 shows the results of the random effect regression analysis. The results showed a positive and significant coefficient with regard to TEN (β = 0.0106, p < 0.05). Consistent with the proposed hypotheses, EDU presented a negative coefficient (β = −0.2713, p < 0.01). Regarding the control variables, DOF was significantly affected by GEN (β = 0.2038, p < 0.05), DOI (β = 0.3941, p < 0.01), IO (β = 0.0479, p < 0.01), DEBT (β = 0.1238, p < 0.01), SIZE (β = −0.0001, p < 0.05), and LSR (β = 0.3891, p < 0.01). The model was statistically significant given the value of the Wald χ 2 statistic (Wald χ 2 = 209.63, p < 0.01) and accounted for 40.34 percent of the variance.

The overall results of the tested hypotheses are presented in Table 7. The results support hypotheses 2 and 3, indicating that the tenure and formal education level of top managers essentially explained restaurant companies’ franchising decisions. More specifically, longer-tenured TMTs of restaurant companies depended more on franchising; however, the levels of formal education of TMT members negatively affected the franchising of restaurants.

6 Discussion

We examined the determinants of franchising in the context of the restaurant industry. This research used three theories (agency, resource scarcity, and risk-sharing) as the theoretical underpinning for franchising as a risk-averse strategy. Upper echelons theory also provided a theoretical framework for the attributes to account for franchising. Given the theoretical foundation of upper echelons theory, five attributes were hypothesized to account for the franchising of restaurant companies. This study examined information from 29 publicly traded restaurant companies for the 1999–2013 period.

This study found that the tenure and formal education level of TMTs significantly accounted for the franchising of restaurants. Specifically, longer-tenured TMTs are more likely to depend on franchising. According to Finkelstein et al. (2009), longer-tenured top managers prioritize career stability and reputation, and they are likely to avoid strategic directions that could threaten their career stability and reputations. Previous research has validated their decision-making tendencies, which can cause them to become more risk averse in their strategic actions (Coles et al. 2006; Zhang 2006). Another critical attribute that accounts for franchising is the formal education level of top managers. Our results indicated that more highly educated TMTs made fewer executions to franchise, possibly because the knowledge of top managers conferred by formal education led TMTs to operate company-owned stores rather than depend on franchising; similar results were generated in previous studies (Karami et al. 2006; Li and Tang 2010).

With regard to control variables, this study found a positive association between the gender of TMTs and the DOF, implying that female top managers of restaurants become more risk averse in their strategic execution. The DOI significantly accounted for the franchising of restaurant companies. Scholars have asserted that residual claims play an important role in the franchisee exerting greater effort to maximize its own financial benefits, which can minimize the agency problem (Combs et al. 2004; Castrogiovanni et al. 2006). Given the reduced agency problem between franchisors and franchisees, restaurant companies operating in the international markets are more dependent on franchising. We also found that more IOs and higher financial leverage (debt-to-asset ratio) encouraged restaurant companies to franchise more often. Previous studies have contended that higher financial leverage and more IOs can cause resource constraints (Jensen and Meckling 1976; Fama and French 2001). Given that franchisors can use franchisees’ resources, companies implementing franchising can reduce resource constraints in accordance with resource scarcity theory (Combs et al. 2004; Lee et al. 2015). Moreover, the results indicated that LSRs depended more on franchising. Hsu et al. (2010) contended that the operations of LSRs are more homogeneous. This characteristic allows restaurants to train their employees uniformly, which in turn makes managing franchises easier for restaurants. Our results, which were similar to the findings of prior research, validate the theoretical argument of resource scarcity theory.

7 Concluding remarks

This study examined how upper echelons theory explains risk-averse strategy. Most previous studies have accounted for risky strategies using upper echelons theory rather than risk-averse strategies despite the increased favoring of risk-averse strategies in the current economic downturn (Wiersema and Bantel 1992; Larraza-Kintana et al. 2007; Seo and Sharma 2013). According to Combs et al. (2004), it is essential to research the connection between franchising and upper echelon attributes; however, little research has examined this link. Hence, extending upper echelons theory to account for risk-averse strategies was a main goal of this study. We thus applied upper echelons theory to explain risk-averse strategic execution (franchising) and provided empirical evidence on franchising. Moreover, scholars have contended that TMTs account for strategic execution more than individual influencers (e.g., chief executive officers and founders) because the decisions of multiple players are more likely to influence the organizational direction than the decisions of a single player (Finkelstein et al. 2009). Despite the importance of TMTs, few studies in the restaurant industry have used TMTs to explain strategic implementation (Madanoglu and Karadag 2008; Guillet et al. 2013). Given the scant previous efforts in this regard, this study chose TMTs as upper echelon subjects to explain the strategic behavior of restaurants, extending the restaurant-related literature to TMTs.

This study has practical implications for industry practitioners. Previous research has claimed that companies that can predict the strategic patterns of their competitors have advantages (e.g., efficient resource allocation and reevaluation of their own strategic decisions) (Hsu et al. 2010; Sun and Lee 2013). In this respect, our results can provide industry players with valuable information about the likelihood of future franchising by other players. That is, given the results of this study, top managers of restaurant companies could predict the behavior of other companies using their competitors’ TMT profiles (e.g., tenure, education, and gender of top managers, organizational size, debt ratio, IOs, and LSR business). By doing so, they may not only maintain an adequate franchising portfolio but also allocate resources more efficiently. The results of this study could also help boards of directors better discipline their agents (TMTs). In particular, boards of directors can manage the strategic direction of agents through the TMTs’ profiles. For example, if a board of directors prefers a risk-averse strategic direction to a risk-seeking one, it may hire longer-tenured and female managers. In contrast, if the board wishes to reduce franchising dependence in its business portfolio, it can select highly educated top managers.

We acknowledge the limitations of this research. First, the sample is restricted to publicly traded restaurant companies (e.g., the McDonald’s Corporation and Starbucks Corporation) given the nature of the data available in EXECUCOMP and COMPUSTAT. Moreover, the sample contained only the US companies. These two sampling limitations may make it more difficult to generalize the results. That is, the implications of this study are likely to apply only to restaurant companies in the US. If a similar study was conducted in a different geographical context (e.g., Asian, European, or African countries) or was implemented using the information of private companies, its results could improve the generalizability and validity of this study. Hence, future studies could pursue these avenues of research to enhance the generalizability and validity of these results.

Notes

The number of companies was 29, and the data appeared as an unbalanced panel.

In this study, regression analysis was only performed for 2008 because the sample period includes the 2008 financial crisis, with OLS used for 27 observations. We found that no upper echelon attributes were significant in accounting for the degree of franchising.

References

Aboody D, Kasznik R (2000) CEO stock option awards and the timing of corporate voluntary disclosures. J Account Econ 29:73–100

Alessandri TM, Seth A (2014) The effects of managerial ownership on international and business diversification: balancing incentives and risks. Strateg Manag J 35:2064–2075

Baltagi B (2008) Econometric analysis of panel data, 4th edn. Wiley, New York

Barkema HG, Shvyrkov O (2007) Does top management team diversity promote or hamper foreign expansion? Strateg Manag J 28:663–680

Barker VL, Mueller GC (2002) CEO characteristics and firm R&D spending. Manag Sci 48:782–801

Baum CF (2001) Residual diagnostics for cross-section time series regression models. STATA J 1:101–104

Brickley JA, Dark FH (1987) The choice of organizational form: the case of franchising. J Financ Econ 18:401–420

Brickley JA, Dark FH, Weisbach MS (1991) An agency perspective on franchising. Financ Manag 20:27–35

Carney M, Gedajlovic E (1991) Vertical integration in franchise systems: agency theory and resource explanations. Strateg Manag J 12:607–629

Carpenter M, Geletkanycz M, Sanders W (2004) Upper echelons research revisited: antecedents, elements, and consequences of top management team composition. J Manag 30:749–778

Castrogiovanni G, Combs J, Justis R (2006) Resource scarcity and agency theory predictions concerning the continued use of franchising in multi-outlet networks. J Small Bus Manag 44:27–44

Coles J, Daniel N, Naveen L (2006) Managerial incentives and risk-taking. J Financ Econ 79:431–468

Combs J, Michael S, Castrogiovanni G (2004) Franchising: a review and avenues to greater theoretical diversity. J Manag 30:907–931

Combs J, Ketchen D, Short J (2011) Franchising research: major milestones, new directions and its future within entrepreneurship. Entrep Theory Pract 35:413–425

De Castro LM, Mota J, Marnoto S (2009) Toward a relational perspective of franchising chains. Serv Bus 3:15–30

Delmar F, Davidsson P, Gartner WB (2003) Arriving at the high-growth firm. J Bus Ventur 18:189–216

Drukker D (2003) Testing for serial correlation in linear panel-data models. STATA J 3:168–177

Fama E, French K (2001) Disappearing dividends: changing firm characteristics or lower propensity to pay? J Financ Econ 60:3–43

Finkelstein S, Hambrick DC, Cannella AA (2009) Strategic leadership: theory and research on executives, top management teams, and boards. Oxford University Press, Oxford

Geletkanycz MA, Hambrick DC (1997) The external ties of top executives: for strategic choice and performance. Adm Sci Q 42:654–681

Gray SR, Cannella AA (1997) The role of risk in executive compensation. J Manag 23:517–540

Greene W (2003) Econometric analysis, 5th edn. Prentice Hall, Upper Saddle River

Guillet BD, Seo K, Kucukusta D, Lee S (2013) CEO duality and firm performance in the US restaurant industry: moderating role of restaurant type. Int J Hosp Manag 33:339–346

Gujarati D, Porter D (2009) Basic econometrics. McGraw-Hill, Boston

Hagendorff J, Vallascas F (2011) CEO pay incentives and risk-taking: evidence from bank acquisitions. J Corp Financ 17:1078–1109

Hambrick DC (2007) Upper echelons theory: an update. Acad Manag Rev 32:334–343

Hambrick DC, Mason PA (1984) Upper echelons: the organization as a reflection of its top managers. Acad Manag Rev 9:193–206

Hambrick DC, Cho TS, Chen M (1996) The influence of top management team heterogeneity on firms’ competitive moves. Adm Sci Q 41:659–684

Herrmann P, Datta DK (2006) CEO experiences: effects on the choice of FDI entry mode. J Manag Stud 43:755–778

Hoechle D (2007) Robust standard errors for panel regressions with cross-sectional dependence. STATA J 7:281

Hsu L, Jang S (2009) Effects of restaurant franchising: does an optimal franchise proportion exist? Int J Hosp Manag 28:204–211

Hsu L, Jang S, Canter DD (2010) Factors affecting franchise decisions in the restaurant industry. J Hosp Tour Res 34:440–454

International Franchise Association (2013) Franchise business economic outlook. http://www.franchise.org. Accessed 21 Nov 2014

Jensen MC (1986) Agency cost of free cash flow, corporate finance, and takeovers. Am Econ Rev 76:323–329

Jensen MC, Meckling WH (1976) Theory of the firm: managerial behavior, agency costs, and ownership structure. J Financ Econ 3:305–360

Jianakoplos NA, Bernasek A (1998) Are women more risk averse? Econ Inq 36:620–630

Karaevli A, Zajac EJ (2013) When do outsider CEOs generate strategic change? The enabling role of corporate stability. J Manag Stud 50:1267–1294

Karami A, Analoui F, Korak Kakabadse N (2006) The CEOs’ characteristics and their strategy development in the UK SME sector: an empirical study. J Manag Dev 25:316–324

Koh Y, Lee S, Boo S (2009) Does franchising help restaurant firm value? Int J Hosp Manag 28:289–296

Lafontaine F (1992) Agency theory and franchising: some empirical results. RAND J Econ 23:263–283

Lafontaine F, Shaw K (1999) The dynamics of franchise contracting: evidence from panel data. J Polit Econ 107(5):1041–1080

Larraza-Kintana M, Wiseman RM, Gomez-Mejia LR, Welbourne TM (2007) Disentangling compensation and employment risks using the behavioral agency model. Strateg Manag J 28:1001–1019

Lee YK, Kim SH, Seo MK, Hight SK (2015) Market orientation and business performance evidence from franchising industry. Int J Hosp Manag 44:28–37

Li J, Tang YI (2010) CEO hubris and firm risk taking in China: the moderating role of managerial discretion. Acad Manag J 53:45–68

Madanoglu M, Karadag E (2008) CEO pay for performance sensitivity in the restaurant industry: What makes it move? J Food Bus Res 11:160–177

March JG, Shapira Z (1987) Managerial perspectives on risk and risk taking. Manag Sci 33:1404–1418

Matta E, Beamish PW (2008) The accentuated CEO career horizon problem: evidence from international acquisitions. Strateg Manag J 29:683–700

Miles RE, Snow CC (1978) Organizational strategy, structure and process. McGraw-Hill, New York

Nadkarni S, Herrmann P (2010) CEO personality, strategic flexibility, and firm performance: the case of the Indian business process outsourcing industry. Acad Manag J 53:1050–1073

Nadolska S, Barkema HG (2013) Good learners: how top management teams affect the success and frequency of acquisitions. Strateg Manag J 35:1483–1507

Pendleton A, Wilson N, Wright M (1998) The perception and effects of share ownership empirical evidence from employee buy-outs. Br J Ind Relat 36:99–123

Peteraf MA (1993) The cornerstones of competitive advantage: a resource-based view. Strateg Manag J 14:179–191

Pittaway L (2001) Book review: franchising hospitality services. Int J Hosp Manag 20:227–230

Rajgopal S, Shevlin T (2002) Empirical evidence on the relation between stock option compensation and risk taking. J Account Econ 33:145–171

Ramírez-Hurtado JM, Guerrero-Casas FM, Rondán-Cataluña FJ (2011) Criteria used in the selection of franchisees: an application in the service industry. Serv Bus 5:47–67

Rodríguez A, Caballer V, Guadalajara N (2011) Assessing the intangibles transferred in restaurants. Int J Hosp Manag 21:43–56

Roh YS (2002) Size, growth rate and risk sharing as the determinants of propensity in chain on company risk taking and performance. Acad Manag J 50:1055–1078

Roh EY, Choi K (2010) Efficiency comparison of multiple brands within the same franchise data envelopment analysis approach. Int J Hosp Manag 29:92–98

Roh EY, Tarasi CO, Popa EM (2013) An empirical examination of financial differences franchise businesses. Serv Bus 5:29–46

Safón V, Escribá-Esteve A (2011) Antecedents and consequences of external risk perception between franchised and non-franchised restaurant firms. J Food Bus Res 16:1–19

Sanders WG (2001) Behavioral responses of CEOs to stock ownership and stock option pay. Acad Manag J 44:477–492

Sanders WG, Hambrick DC (2007) Swinging for the fences: the effects of CEO stock options in franchising: evidence from the hospitality industry. Serv Bus 5:237–257

Seo K, Sharma A (2013) Does executive equity-based compensation encourage strategic risk-taking? Examining the effects of equity-based compensation in the US restaurant industry. Int J Tour Sci 13:76–101

Simon H (1972) Theories of bounded rationality. In: McGuire CB, Radner R (eds) Decision and organization. North-Holland, Amsterdam, pp 161–176

Simsek Z (2007) CEO tenure and organizational performance: an intervening model. Strateg Manag J 28:653–662

Sun K, Lee S (2013) Determinants of degree of internationalization for U.S. restaurant firms. Int J Hosp Manag 33:465–474

Weiner N, Mahoney TA (1981) A model of corporate performance as a function of environmental, organizational, and leadership influences. Acad Manag J 24:453–470

Wernerfelt B (1984) A resource-based view of the firm. Strateg Manag J 5:171–180

Westhead P, Wright M, Ucbasaran D (2001) The internationalization of new and small firms a resource-based view. J Bus Ventur 16:333–358

Wiersema MF, Bantel KA (1992) Top management team demography and corporate strategic change. Acad Manag J 35:91–121

Wooldridge J (2009) Introductory econometrics: a modern approach. Cengage Learning, George Mason University, Mason

Wright P, Ferris SP, Sarin A, Awasthi V (1996) Impact of corporate insider, blockholder, and institutional equity ownership on firm risk taking. Acad Manag J 39:441–458

Wu J, Tu R (2007) CEO stock option pay and R&D spending: a behavioral agency explanation. J Bus Res 60:482–492

Yermack D (1997) Good timing: CEO stock option awards and company news announcements. J Financ 52:449–476

Zhang Y (2006) The presence of a separate COO/president and its impact on strategic change and CEO dismissal. Strateg Manag J 27:283–300

Acknowledgments

This study was supported by 2016 Research Grant from Kangwon National University.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Moon, J., Sharma, A. & Lee, W.S. Restaurant franchising and top management team. Serv Bus 11, 299–319 (2017). https://doi.org/10.1007/s11628-016-0310-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11628-016-0310-9