Abstract

The paper shows that the economic forecasts of the IMF are frequently distorted by political bias. Longer-term growth forecasts for the industrial countries reveal an absolute as well as relative optimism bias and a significant correlation with election dates in the US. Furthermore, the IMF projections for the developing regions are strongly biased toward optimism. The significant relationship between forecast errors and IMF net credit flows to a region supports the hypothesis that the IMF staff tries to legitimize its lending activities with overly optimistic forecasts.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

The International Monetary Fund (IMF) publishes a large number and variety of forecasts for industrial as well as developing countries. Forecasts attract public attention and may influence the way voters evaluate the policy performance of their governments. Since the IMF staff depends on the support of its member governments, it might be tempted to produce forecasts that are biased in their favor. Optimistic IMF forecasts may help incumbent governments to be re-elected.

IMF projections may also be biased in favor of member governments which have received, or are on the verge of receiving, IMF credits. They could serve as justification for granting such subsidized loans.

The following analysis tests three hypotheses: 1. Are IMF forecasts generally biased toward optimism (Section 4.1)? 2. Are the forecast errors correlated with the timing of general elections in the countries for which the forecast is made (Section 4.2)? 3. Do the forecast errors depend on whether the country has recently received, or is receiving, a loan from the IMF (Section 4.3)? To motivate these analyses, Section 2 develops the political economy of IMF forecasting in some detail. Section 3 explains the IMF data and the estimation procedure.

2 The Political Economy of the IMF: Three Hypotheses About its Economic Forecasts

At a first glance, forecasting certain economic variables seems to be a purely economic problem: the question is which (econometric) model is the most appropriate to make an accurate forecast. The model or method that the IMF uses to make its forecasts is not published (this applies to many other professional forecasters).Footnote 1 Thus, there exists a strong information asymmetry between the provider and the recipients of the forecasts which creates room for political influences and strategic behavior and raises the interesting issue whether these forecasts are politically or bureaucratically adjusted.

The theory of public choice (or political economy) is most powerful as a critical tool where political institutions are not, or only weakly, exposed to the attention and control of the public (See Vaubel 1991: 204). This is especially the case with international organizations (IOs) like the IMF since the voter as principal is far removed from the political agent (Fig. 1). There exist several stages of political delegation between the citizen at the one end and the IO at the other but the voter can only determine the composition of national and possibly international parliaments.

The staff of IOs might have other interests than the citizen. It can be assumed that the IO staff is predominantly interested in the survival and growth of its organization (even if the original reason for the foundation does not exist anymore). Other personal objectives might be increasing competences as well as prestige and income.

If at all, the IMF is controlled by the governments of the member states and the Board of Executive Directors. The latter is composed of functionaries who are nominated by their member governments. However, their potential for control is limited by the agenda-setting-power of the IMF staff, and their incentives to control vary with the probability of reappointment and the individual prospects after the term (see Vaubel 2006). Only the member countries having the five largest quotas are allowed to nominate one director. The other countries are represented in groups and their directors have a much lower incentive to control the Fund’s operations. Moreover, the activities of the Board are not transparent to the public (See Gerster 1993: 101). Thus, the principal-agent-problem can hardly be expected to be solved by the Board of Executive Directors. Turning to the national governments, each of them appoints one representative to the “Board of Governors,” the highest authority of the IMF. The Board decides about the most fundamental issues such as the IMF quotas which determine the distribution of voting rights and the Fund’s overall credit potential. Once again, the incentives to control the Fund’s activities are likely to be weak. The incentive to monitor weakens as more states join and their voting shares decline.Footnote 2

But there may exist a stronger reason why the incentive to monitor is weak: the IMF staff can reciprocate to its principals in exchange for weak control. In particular, it could help the member governments to be re-elected. Dreher and Vaubel (2004) provide evidence for a political business cycle in IMF funding: before the election the member state stimulates the economy by drawing on new or existing IMF credit lines. After the poll it may use the IMF as a scapegoat for unpopular restrictive fiscal or monetary policies because the Fund usually attaches conditions to its credits (IMF-conditionality).

The IMF may also help the incumbent governments by making overly optimistic economic forecasts. This hypothesis has been suggested for all IOs by Fratianni and Pattison (1982) and especially for the IMF by Vaubel (1990, 1991), who drew attention to the available studies of IMF forecasts.Footnote 3 It can be left open whether the IMF staff voluntarily (opportunistically) chooses too optimistic predictions (“agent collusion”) or whether it is put under pressure by the governments of the member states and their executive directors.

If the forecasts relate to recipient countries, they may also serve to deceive the governments of the donor countries. Such attempts have already been identified in another context: both the IMF and the World Bank practice “hurry-up-lending,” i.e. they increase the use of their credit potential faster at the time of quota reviews and International Development Agency (IDA) allocations (Vaubel 1990, 1991, 1996). Similarly, an overly optimistic outlook for economic conditions in the recipient countries would help to persuade the donor countries that the Fund’s credits are justified. The underlying assumption is that the IMF is interested in extending its lending activities (in terms of the number and volume of credit agreements) to raise its power and prestige. In order to assert its interest, the IMF might use the economic forecasts to show that its financial help and the accompanying reforms (as conditions) will improve the economic situation in the recipient countries. Optimistic forecasts support the current credit programs and suggest further activities for other countries. If the forecast turns out to have been too optimistic, the IMF could blame the debtor country for not having followed the conditions attached to the credit. In this way, the lending countries might be misled in their decisions about financial allocations to the Fund. This is also in the interest of the debtor countries because IMF credits are granted at reduced rates of interest (below market levels) and because they may be drawn before the next election. Before the negotiations the IMF would be interested in pessimistic forecasts to underline the necessity of financial help (vis-à-vis the creditors) and reforms (vis-à-vis the debtors). Owing to data problems, this last hypothesis cannot be tested yet,Footnote 4 however, analyzing only the IMF spring forecasts for the current year, Beach, Schavey, and Isidro (1999) found some first evidence that the IMF forecasts are likely to support the Fund’s policies. For instance, IMF credits have a significant influence on the forecast error in the case of the growth forecasts for the Western Hemisphere and the pooled regions.

Needless to add, there is a limit to the bias which the IMF might wish. If the bias is obvious, it detracts from the IMF’s prestige. But the Fund may also hope that to some extent its forecasts are self-fulfilling.

Having reflected on the potential strategic behavior of the IMF, the following three hypotheses will be tested in this paper:

-

1.

The economic forecasts of the IMF show a general bias in favor of optimism (hypothesis of a “general quid pro quo”).

-

2.

The optimism bias is distinctively stronger before general elections (hypothesis of a “political forecasting cycle”).

-

3.

The IMF supports its lending activities with a forecasting bias in favor of optimism (hypothesis of “credit legitimation”).

Figure 1 also illustrates the role of IMF economic forecasts in the principal-agent framework.

In principle, the above stated hypotheses apply to all international organizations, including e.g., the Organisation for Economic Cooperation and Development (OECD). Fratianni and Pattison (1976) report that the OECD country reports have to be cleared by the governments concerned and that critical remarks are frequently removed in the process. Thus, the OECD might also adjust its economic forecasts in the direction of optimism. Its bias could even be stronger than the Fund’s because the particular member countries have larger voting weights. However, the OECD has a much smaller budget and is not as reliant on funding as the IMF.

Forecast bias is also to be expected from national research institutes which are state-aided or even state-controlled. By contrast, private providers of forecasts do not have political incentives to systematically bias their forecasts because they are not (directly) dependent on member countries’ policy-makers. Thus, the forecast errors of private institutions are good indicators for the influence of external shocks (like oil price changes, natural disasters or wars) which were really unpredictable. Especially the comparison of IMF projections with private forecasts should be helpful in isolating the strategic behavior of the IMF staff.

Such comparisons with private sector forecasts have been presented by Artis (1996), Batchelor (2000) and Loungani (2000), who used the forecasts of Consensus Economics, an international economic survey organization in London, as a benchmark. Whereas Artis and Loungani find little difference between the IMF and Consensus prediction errors, Batchelor’s pooled estimations for the G7-countries show that the IMF (and OECD) growth and unemployment forecasts are more biased toward optimism and that IMF inflation forecasts are less biased toward pessimism than the Consensus Economics forecasts. A forecast comparison with non-private institutions for Germany is presented by Döpke and Fritsche (2004). Only in the case of the IMF and the German Council of Economic Advisors, the growth forecasts for the following year reveal a significant optimism bias. However, IMF inflation forecasts turned out to be too pessimistic.

3 Data and Methods of Estimation

3.1 Data and Definitions

In this study, the forecasts of the IMF will be compared with those of the OECD, the British National Institute for Economic and Social Research (NIESR), the six (formerly five) “leading” German economic research institutes (Joint German Forecast—JF) and the German Council of Economic Advisors (CEA). Additionally, the Consensus Forecasts of the weekly magazine “The Economist” are included, which have been regularly published as a forecast average of several private investment banks and insurance companies since the beginning of the nineties.Footnote 5

I concentrate on three macroeconomic variables: real growth (GNP/GDP), inflation (change in the GDP deflator, private consumption deflator or consumer price index) and the unemployment rate. The reason for this choice is the underlying public choice approach: all three variables play an important role in public discussions and are easily interpreted. Forecasts of developments within the balance of payments, which are assessed in a few other analyses, are not taken into account here because the balance of payments is exposed to many influences that can hardly be controlled or anticipated and because its changes are barely perceived by the public.Footnote 6

Three different forecast horizons will be examined. The World Economic Outlook (WEO) of the IMF provides forecasts for the current and following year in its spring as well as in its autumn issues. However, the autumn forecasts for the actual year will not be considered because of their very short horizon. To match the forecast horizons of the different institutes as closely as possible, the autumn forecasts for the following year must be published in the fourth quarter and the spring forecasts for the current year need to be published within the first six months of the current year.Footnote 7

As for the outturn (or realizations), one can either use the latest available figures or the statistics that were published after the fact. I prefer the second alternative because it is less vulnerable to changes in definitions.Footnote 8 Thus, the outturn data for a certain year t are the figures reported in the respective forecast source that was published in autumn of the following year t + 1.

3.2 Methods of Estimation

To test for a potential optimism bias in the forecasts, the properties of the mean error (ME) will be examined:

Here, the forecast error e is defined as the difference between the forecast (F) for year t and the realization (R) in t. A positive (negative) value of the mean error indicates an overestimation (underestimation) of the predicted variable. The forecast error is regressed on a constant term to check whether the mean error is significantly larger or smaller than zero depending on the variable under examination:

As for growth forecasts, if the hypothesis H 0: μ ≤ 0 can be rejected, then the forecast is considered to be biased in favor of optimism. In case of inflation and unemployment projections the critical region lies in the left tail. A forecast is considered to be unbiased if the mean error does not significantly differ from zero. Holden and Peel (1990) show that this condition is necessary and sufficient for unbiasedness. Furthermore, a forecast is said to be efficient if there are no variables which help to explain the errors.Footnote 9 Otherwise the forecast could be systematically improved. A test for autocorrelation will show whether past forecast errors are presently repeated. This is often referred to as a test for weak efficiency and can be executed, for instance, by making use of either Durbin–Watson–Tests, Ljung–Box Q Statistics or Breusch–Godfrey–Tests within the scope of regression 2. Here, the latter option will be applied, testing for up to third-order autocorrelation.Footnote 10

It might be very useful to examine whether the MEs of different institutions differ at a significant level. This can be tested by simply regressing the difference of errors (D t) again on a constant term, which is a modified form of the Diebold–Mariano Test (Diebold & Mariano, 1995):

The test procedure along the lines of regression 2 will then provide the desired information whether the ME of institution A is significantly larger than the ME of institution B.

To analyse a possible correlation between the (signed) forecast errors with election dates and/or IMF credits, the errors—relating to the year in which the projection was made and released—are regressed on a dummy (D e) that takes a value of 1 if there is an election in the respective year and on the credit volume (measured as either flows or stocks) or the number of new credit arrangements (C):

Rejection of H 0: α 1 ≤ 0 or α 2 ≤ 0 in case of growth forecasts would support hypotheses 2 and 3 accordingly. Again, the other tail would be relevant for projections on inflation and unemployment.

In the case of the single country estimations, the Newey–West–procedure is used to correct for autocorrelation and/or heteroscedasticity when at least one of the two could not be rejected at a significance level of 10%. Regarding pooled estimations, significance levels are based on White’s heteroscedacity-consistent standard errors, and fixed country effects are allowed for.Footnote 11

4 An Empirical Assessment of the IMF’s Economic Forecasts

4.1 Are IMF Economic Forecasts Generally Biased in Favor of Optimism?

4.1.1 Industrial Countries

First, the economic forecasts for industrial countries are examined. Most forecasters provide estimations for the members of the G7. Table 1 lists the Pooled-G7 Mean Errors and their respective significance levels for all institutions subdivided with respect to the underlying variables, forecast horizons and observation periods. Significant forecast optimism (up to 10%) is highlighted by shaded areas.

Looking at the short-term spring forecasts for the current year on the left side of the table, it becomes evident that only the IMF (over the whole period studied) and the OECD (during the “1990s,” 1990–2004) have overestimated real growth to a significant extent (at the 10% level). But the results from Regression 3, which are not reported, show that MEs of the IMF differ significantly (at the 1 and 2% level, respectively), only from those of the German Joint Forecast (JF). In the case of single country estimations, only economic growth in Italy is significantly overestimated by the IMF and the OECD but also by NIESR. Therefore it seems that this bias is due to external, i.e., country specific factors. Turning to inflation and unemployment, projections of all institutions were also mostly on the high side in relation to realized values, indicating forecast pessimism for these two variables. Especially the OECD has overestimated consumer prices and unemployment rates for most countries. Altogether, there is little evidence of strategic behavior of the IMF in its spring forecasts. But this impression changes when the analysis turns to the autumn forecasts for the following year.

The growth forecasts of all institutions seem to have suffered from a certain degree of optimism bias but here the IMF projections clearly stand out. For every period examined, the MEs of the Fund are significant at the 1% level and also significantly larger than the MEs of the other forecasters at the 1 or 5% level. Forecasts for Germany, France and Italy were strongly biased toward optimism. This applies particularly to the nineties, whereas the bias during the 1980s was much weaker (as already reported by Barrionuevo 1993, and Artis 1996). Once again, economic growth in Italy was significantly overestimated by all institutes during the 1990s—however, significantly more strongly by the IMF. In addition, forecasts of the IMF turned out to be highly inefficient in absolute as well as relative terms according to the tests of autocorrelation and the Mincer–Zarnowitz regression. Exceptions from these findings are the figures for the United States, which display slightly pessimistic tendencies. But all other forecasters were even more negative on real growth in the US. Also very striking is the fact that the Economist Consensus shows the lowest ME for its only available period (since the beginning of the nineties), differing significantly (at the 1 or 5% level) from all others. This supports our hypothesis that forecasts from private institutions might be a benchmark for political unbiasedness. In contrast, growth optimism in OECD projections is relatively low and not present at all in the country estimations (with Italy as the only exception as stated above). This is not what we would expect on the basis of public choice theory, given its smaller number of member states. Apparently, the OECD staff is under less pressure than its IMF counterpart.

With respect to the inflation and unemployment projections, the autumn forecasts suffered from an even stronger pessimism bias than the spring forecasts. But it should be noted that the IMF forecasts are not as pessimistic as its counterparts and even differ significantly at the 1 or 5% level if regression 3 is once again applied (the OECD inflation forecasts between 1985 and 2004 being the only exception).

These results raise three important questions. First, why do IMF growth forecasts for the following year exhibit a much stronger optimism bias (absolutely and relatively) than those for the actual year? A possible answer from public choice is that there is more room for discretionary forecasting if the time horizon is long. The bias will be less striking at the time of forecasting and the forecast is less likely to be remembered by the voters at the time of the realization. This impression is reinforced by an analysis of the IMF spring forecasts for the following year, which have not been available before 1985. The pooled estimation for real growth projections shows a ME of 0.48 percentage points for the period from 1986 until 2004, which is significant at the 1% level, and a high degree of inefficiency.

Second, why do the MEs of all institutions for the longer forecast horizon mostly point into the same direction even though there are significant differences between them? The IMF publishes its autumn forecasts slightly before the other institutions included in this study. According to a possible “forecast clustering,” the IMF, which can be considered as the most important international organization in the area of financial policies, might set the trend for all upcoming forecasts of the different institutions.Footnote 12

Third, why are growth forecasts too optimistic while the projections for inflation and unemployment tend to be on the pessimistic side? Growth forecasts usually obtain more public attention than other projections. For example, in the case of the autumn forecasts of the IMF and JF in 2005, only the growth forecast was reported on the front pages and in the head lines of German daily newspapers (“Frankfurter Allgemeine Zeitung”: 10/20/06, 01/18/06; “Handelsblatt”: 10/20/06).

4.1.2 Developing Countries

Unfortunately, forecasts for developing countries are not as readily available as those for industrial countries. This is true for the IMF which published projections only for development regions until recently but also for other governmental and private institutions. Hence, the analysis is much more limited than in the case of industrial countries.

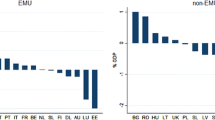

Table 2 shows the MEs of the IMF for the different developing regions. The high number of highlighted significance levels visually demonstrates a very high degree of optimism bias in the IMF’s growth as well as inflation forecasts. With regard to Africa, the Western Hemisphere, Central and Eastern Europe and—to a lesser extent—also to the Middle East, the IMF is clearly too optimistic. This applies particularly to the longer-term projections for the following year. For instance, the IMF overestimates real growth in Africa 1.5 years ahead by 1.37 percentage points and underestimates inflation by 9 1/2 percentage points on average—both errors are significant at the 1% level. Inflation of consumer prices is underestimated even more strongly in case of the Western Hemisphere. Exceptions are the growth forecasts for Asia which are mainly on the low side compared to the realizations. Moreover, tests of weak efficiency show that the errors are autocorrelated. Pooled estimates yield highly significant optimism biases for almost all horizons and variables.

Are the IMF projections also more optimistic than the predictions of other forecasters? The available data permit a comparison only with the German Joint Forecast (JF) and only for Latin America in 2000–04.

In addition to the two forecast horizons considered so far, Table 3 also incorporates the very short-term autumn forecasts for the current year (autumn t, t). The result of this comparison is not very impressive but unambiguous: the MEs with respect to forecast horizons (ME) as well as single years (Ø-R) are almost always larger for the IMF than for the JF (2003 being the only exception). This applies particularly for the longer-term forecasts and reinforces the impression that IMF forecasts may be affected by political motivations and influences.

4.2 Industrial Countries: Are IMF Economic Forecasts Correlated with Public Elections?

A positive economic outlook may have a favorable effect on how voters evaluate their government’s performance and thereby on the outcomes of elections. “Good news,” which has been released shortly before the poll, could help the current government in power to be re-elected. Table 4 reports the results of regression 4, with the election dummy as the only regressor. Thus, the entire period for which data are available is taken into account (as in Table 1). Nine coefficients produce evidence for hypothesis 2, signalling stronger forecast optimism in election years.

Starting with the growth forecasts, a strongly positive coefficient is standing out for the United States. More precisely, the mean forecast error of the IMF’s spring forecasts for the following year is about one percentage point larger in election years than it is in non-election years, significant at the 5% level. Even though we had found no general optimism bias for the US, projections are significantly too optimistic during election times.Footnote 13 This finding is especially noteworthy because the US is the biggest and most powerful member and creditor of the Fund. Furthermore, forecasts on the CPI become more optimistic by half a percentage point, significant at the 10% level.

There are also strong optimistic tendencies with respect to unemployment in Italy and inflation (measured by the GDP deflator) in the UK and Canada. However, forecasts for Germany’s inflation (CPI) reveal strong pessimism.

So far, except for the US, there is not much evidence in favor of the hypothesis of a “political forecasting cycle.” However, the hypothesis may require a more differentiated analysis since political pressures might vary over time. Such an analysis is now undertaken for Germany in Table 5. Here, only those forecasts count which have been published shortly before the election date.

Most elections of Germany’s Bundestag have taken place at the beginning or within the fourth quarter of the respective election years. Thus, autumn forecasts for the following year are particularly relevant. Two elections were held in the first quarter (1983 and 1987) but prior to the IMF’s spring forecasts. Again, the autumn forecasts are used. There are three “proxies” to measure the external political pressure or internal incentive for opportunistic behavior: the turnout, changes in government and the margin between the two main parties. However, the turnout should not be very important for Germany because there has been a negative trend over the past years. Additionally, forecast errors in the pre- and post-election years are reported as well as election year errors of the OECD which provides comparable forecasts for these variables and periods.

From a public choice perspective, we would expect that the forecasts of the IMF show a much stronger bias before hard-fought and close polls. The proxies indicate that the outcomes of the 1980, 1998 and 2002 elections were especially close.Footnote 14 In 1980, the IMF overestimated real growth by 2.3 percentage points, whereas the OECD figure indicates a slight underestimation. Moreover, the error of the German JF is much lower (+0.3). The IMF’s forecast error is about one percentage point higher than in the pre-election year. But the forecast of the GDP deflator is marginally too pessimistic. In 1998, the election took place at the end of September. Only the spring forecasts of that year could have had any influence on the outcome since the autumn forecasts were presented on September 30th by the IMF (the publication date of the WEO was October 1st). The growth forecast error for the following year is again positive (1.2 percentage points) but so is the one of the OECD (and the JF) to a comparable extent. Projections for inflation and unemployment do not indicate any evidence of further optimism (an exception is the short-term spring forecast of the GDP deflator). In 2002, the IMF’s growth forecast is strongly biased in favor of optimism (+2.1), not only compared to pre- and post-election years but also to the other institutes (the error of the Economist Consensus amounts only to +1.2 percentage points). The prediction error of unemployment also points toward optimism (as it is true for the OECD), but the inflation outlook turns out to be too pessimistic.

Hence, whereas the general test presented in Table 4 did not produce any evidence for a positive correlation between errors and public elections in the IMF’s growth forecasts for Germany (the coefficient was −0.11 in the case of the autumn forecasts for the following year), the more detailed analysis does indicate a “political forecasting cycle” for growth. However, this is not the case for the other macroeconomic variables.

4.3 Developing Countries: Are the Economic Forecasts of the IMF Correlated with its Lending Activities?

Forecast optimism might be related to elections also in developing countries. But this cannot be checked because, as already mentioned, the Fund has until very recently released projections only for developing regions (as an average weighted by GDPs).

With respect to lending, the IMF itself declared in its WEO (May 1990, p. 49) that its projections premise the success of certain policy reforms in the context of IMF conditionality.Footnote 15 According to Regression 4, errors might be regressed on either credit stocks or (net) credit flows.

Table 6 shows the effect of net credit flows per year and region (in billion SDRs) on the forecast errors. There is a large number of significant coefficients which support the third hypothesis. Starting with the estimates for Africa, the influence of lending on the forecast errors is predominantly positive but not significant. Also the inflation outlook shows a stronger bias toward optimism as the region receives credit. In its spring forecasts for the following year, the IMF underestimates inflation by 7.62 percentage points over the whole period, significant at the 5% level, as net credit flows to Africa increase about one billion SDRs. In addition, all inflation forecasts show strong optimistic influences during the 1990s. In the case of Asia, growth forecasts are affected by new credit programs with respect to all forecast horizons. But this is not true for the inflation forecasts. In the Western Hemisphere, net credit flows have a highly significant influence on the errors of growth forecasts for the current year. If the analysis is confined to the period from 1995 to 2004, thus ignoring the outliers at the beginning of the nineties, inflation is more strongly underestimated—in the case of the spring forecasts for the following year even significantly (at the 5% level). However, the coefficients for the Middle East and Central/Eastern Europe do not provide any support to the hypothesis of “credit legitimation.” Whereas for developing Europe the table still reports the expected signs, this is not the case for the Middle East. But these findings are limited in their explanatory power due to the fact that regional compositions changed several times. For instance, Turkey as one of the main recent borrowers was assigned to Europe (until 1992), then to the Middle East (until 2002) and finally to Central/Eastern Europe. Thus, up to 5 years (1992–94, 2003–4) could not be included in the analysis. As for the Middle East, the Fund may lack a strong incentive because its activities are quite marginal in this region considering credit flows as well as stocks.Footnote 16

However, credit stocks held by the regions do not support the public choice hypothesis as much as the net credit inflows. If the errors are regressed on stocks of credit only a few coefficients are significant. The figures for the Middle East and Central/Eastern Europe even reveal strong pessimism in some cases.

Therefore, the above findings lead to the conclusion that the IMF’s forecasts in fact become too optimistic as new credit transfers to a region are granted but that existing credit stocks do not matter systematically. This result is confirmed by the forecasts for all developing countries (as a weighted average). In its Annual Report, the Board of Executive Directors publishes the number and amounts of total new credit arrangements which the Fund has concluded during the financial years (FYs) ending April 30th of the respective years. Thus, the autumn forecasts for the following year might be relevant for funding during the current as well as the already completed FYs. Autumn forecasts of year t − 1 for the following year t then take early credits into consideration, whereas those in year t for t + 1 could be important to legitimate funds that have been issued relatively late in the FY.

In Table 7, the coefficients of the total number of new arrangements during the FYs—as the only regressor in regression 4—show predominantly the expected signs, indicating stronger forecast optimism for real growth and inflation. In case of the growth projections, even five coefficients are significant at the 10% level at least. In the autumn forecasts for the following year (autumn t, t + 1), e.g., the IMF overestimates real growth on average by 0.14 percentage points, significant at the 5% level, as one additional credit contract is placed with a member country. In contrast to these results, the regression of the errors on total amounts of new credit arrangements does not support the theory.Footnote 17

5 Conclusion

The analysis has shown that the economic forecasts of the IMF are frequently distorted by political bias. What implications can be drawn for the Fund’s practical policies?

First, since the longer-term growth forecasts for the industrial countries show an absolute as well as relative optimism bias and a significant correlation with elections in the US, such “agent collusion” should be reduced by raising the costs and reducing the benefits of political bias. Institutionalized forecast comparisons with other organizations and detailed analyses of their errors might be helpful in this matter.

But even if this bias could be removed, the IMF might mislead the member states. As the analysis has shown, the optimism bias in the IMF’s projections gets stronger as net credit flows to a region increase. This type of optimism bias could be reduced by institutionalized forecast comparisons as well. However, the most effective solution would be for the IMF to discontinue forecasting completely. Creditors should not rely on internally but rather on externally provided information. Fratianni and Pattison (1991: 119) draw an analogy to “integrated investment houses” at the beginning of the 1990s, when investment managers acted directly on the basis of information that had been supplied by their own stock brokers. Due to obvious conflicts of interests, these two functions were later split again, and managers were free to buy research services from third parties.

In conclusion, I wish to emphasize that it has not been the purpose of this study to discredit the technical expertise of the IMF staff who is doing the forecasting. However, since the breakdown of the Bretton Woods System, the IMF leadership has been fighting for the Fund’s survival and is exposed to political pressures. Therefore, it is likely to use its discretionary margin to protect its own interests. Such behavior seems rational but it is against the public interest.

Notes

Kenen and Schwartz (1986: 2) describe the IMF’s procedure as follows: “The Fund’s forecasts do not come from one large model. They are generated by an iterative process within the institution, involving consultations between those responsible for compiling the forecasts and members of the various area departments who follow developments in individual countries and frequently have access to official and other outside forecasts for those countries.”

First analyses were presented by Artis (1988) and Kenen and Schwartz (1986), which not only focus on the bias but mainly on the accuracy of the forecasts. These investigations were not motivated by public choice considerations. They show a strong optimism bias for most industrial countries particularly during the 1970s (regarding real growth as well as inflation), whereas forecasts for developing countries turn out to be even more optimistic over the whole period studied.

Unfortunately, the IMF does neither provide sufficient information on its credit negotiations with the potential recipient countries in the World Economic Outlook nor its Annual Report.

Details on publication sources and dates are given in the Appendix. The data can be supplied upon request.

See Frey (1984: 206): One such factor [emerging from the international sphere] is the state of the balance of payments among the indicators of economic conditions. [...] it has to be concluded that even in countries with seemingly permanent and serious balance-of-payments troubles the voters either do not perceive them or do not directly punish the government for them to any significant extent.”

As a result, the dates of the forecast usually do not differ by more than two months. However, there are a few exceptions to this rule since the dates of publication vary quite frequently over time.

A citation from Artis (1988: 8) clarifies this matter: These choices of outturn data had certain specific advantages over the use of latest available estimates: [...], the definition of some of the aggregates were changed over the course of the time, and the use of these outturn data enabled the resultant inconsistencies to be minimized or even eliminated in a way which would not have been so straightforward with latest available data.”

Likewise, the so-called Mincer–Zarnowitz equation (Mincer & Zarnowitz 1969) can be thought of as a weak efficiency test. Regressing the realization on a constant and the forecast, the two desirable restrictions are zero and one, respectively. This test is sometimes interpreted as a test for bias, but this is misleading. Unbiasedness might even be existent if the two coefficients do not have the desired values. See Holden and Peel (1990: 126) for proof.

For the two procedures, see Newey and West (1987) and White (1980). However, it should be noted that both procedures require sufficiently large samples to provide undistorted test statistics. Therefore, in case of single-country estimations, the Newey–West method is only used if autocorrelation and/or heteroscedasticity turn out to be a severe problem.

Under the motto “Great minds think alike” or perhaps only due to simple risk aversion, some institutes may find it difficult to stand against its scientific guild and the “common sense.” Thus, a strong concordance in forecasts does not necessarily signify a high clarity of forecasts (see Grömling 2005: 13). In fact, this implies that the forecasts are on average very unreliable.

This cannot be seen from the table but results if the constant and the slope parameter are added. If only US presidential elections are considered, the coefficient is not significant. But in France, there is a stronger tendency of growth optimism if the electoral dummy is confined to presidential elections (autumn forecasts for the following year, +1.09 [0.06]).

The election of 1983 should be ignored because it was called at short notice and no IMF forecast intervened.

The staff’s projections are generally based on the assumption of broadly unchanged policies. However, in certain cases where significant policy changes are considered likely—for example, in the context of Fund- or Bank-supported adjustment programs—policies are projected to improve in line with program objectives. In view of the slippages that have repeatedly occurred in a number of countries, this assumption could entail considerable downside risk for some of the projections.”

See International Financial Statistics of the IMF. Between 1977 and 1999 the average net credit allocation to the Middle East was only about 35 Mio. SDRs per year, which is the lowest value of all regions. Only in the years 2000–2002 there was a distinct increase in lending in the course of the Turkey-crisis.

This could be due to the fact that number and amounts of new credit arrangements are not necessarily positively correlated. There were a few years in which only a low number of arrangements was fixed, comprehending high volumes (and vice versa). But if only a few countries receive (high) funding, then an optimism bias will be low in the aggregated forecast.

References

Artis, M. J. (1988). How accurate is the World Economic Outlook? (pp. 1–49). Staff Studies for the World Economic Outlook, Washington D.C., July.

Artis, M. J. (1996). How accurate are the IMF’s short-term forecasts/another examination of the World Economic Outlook. IMF Working Paper no. 89, August.

Barrionuevo, J. M. (1993). How accurate are the World Economic Outlook projections? (pp. 28–46). Staff Studies for the World Economic Outlook. Washington D.C., December.

Batchelor, R. (2000). The IMF and OECD versus Consensus Forecasts. London: City University Business School, August.

Beach, W. W., Schavey, A. B., & Isidro, I. M. (1999). How reliable are IMF economic forecasts? Working Paper CDA99-05. Washington, DC: The Heritage Foundation, August.

Beck, T., Clarke, G., Groff, A., Keefer, P., & Walsh, P. (2001). New tools in comparative political economy: The database of political institutions. World Bank Economic Review, 15(1), 165–176.

Diebold, F. X. (2001). Elements of forecasting (2nd ed.). South Western, Cincinnati.

Diebold, F. X., & Mariano, R. S. (1995). Comparing predictive accuracy. Journal of Business & Economic Statistics, 13(3), 253–263.

Döpke, J., & Fritsche, U. (2004). Growth and inflation forecasts for Germany—an assessment of accuracy and dispersion. Discussion Paper of the German Institute for Economic Research (DIW Berlin) no. 399.

Dreher, A., & Vaubel, R. (2004). Do IMF and IBRD cause moral hazard and political business cycles? Evidence from panel data. Open Economies Review, 15(1), 5–22.

Fratianni, M., & Pattison, J. (1976). The economics of the OECD. In K. Brunner & A. Meltzer (Eds.), Institutions, policies and economic performance, Carnegie-Rochester conference series on public policy (pp. 75–128). Amsterdam.

Fratianni, M., & Pattison, J. (1982). The economics of international organizations. Kyklos, 35(2), 244–262.

Fratianni, M., & Pattison, J. (1991). International institutions and the market for information. In R. Vaubel & T. D. Willett (Eds.), The political economy of international organizations: A public-choice approach (pp. 204–244). Boulder: Westview.

Frey, B. (1984). The public-choice view of international political economy. International Organization, 38(1), 199–223.

Gerster, R. (1993). Accountability of the executive directors in Bretton Woods Institutions. Journal of World Trade, 27(1), 88–116.

Gorvin, I. (1989). Elections since 1945: A worldwide reference compendium. Essex: Longman.

Grömling, M. (2005). Konjunkturprognosen—Verfahren, Erfolgskontrolle und Prognosefehler. IW-Diskussionsbeitrag Nr. 123, Institut der Deutschen Wirtschaft, Köln.

Holden, K., & Peel, D. A. (1990). On testing for unbiasedness and efficiency of forecasts. Manchester School of Economic and Social Studies, 58, 120–127, June.

Kenen, P. B., & Schwartz, S. B. (1986). The assessment of macroeconomic forecasts in the International Monetary Fund’s World Economic Outlook. Working Papers in International Economics, no. G-86-40, Princeton University.

Loungani, P. (2000). How accurate are private sector forecasts? Cross-country evidence from consensus forecasts of output growth. IMF Working Paper 00/77, International Monetary Fund, Washington D.C.

Mincer, J., & Zarnowitz, V. (1969). The evaluation of economic forecasts. In J. Mincer (Ed.), Economic forecasts and expectations: Analyses of forecasting behavior and performance, NBER Studies in Business Cycles, 19, 3–46. New York.

Newey, W. K., & West, K. D. (1987). A simple positive semi-definite, heteroskedasticity and autocorrelation consistent covariance matrix. Econometrica, 55(3), 703–708.

Pons, J. (2000). The accuracy of IMF and OECD Forecasts for G7 countries. Journal of Forecasting, 19(1), 53–63.

Vaubel, R. (1990). Die Politische Ökonomie des Internationalen Währungsfonds: Eine Public-Choice-Analyse. Jahrbuch für Neue Politische Ökonomie, 9, 258–281.

Vaubel, R. (1991). The political economy of the International Monetary Fund: A public-choice approach. In R. Vaubel & T. D. Willett (Eds.), The political economy of international organizations: A public-choice approach (pp. 204–244). Boulder: Westview.

Vaubel, R. (1996). Bureaucracy at the IMF and the World Bank: A comparison of the evidence. World Economy, 19(2), 195–210.

Vaubel, R. (2006). Principal-agent problems in international organizations. The Review of International Organizations, 1(2), 125–138.

Wallis, K. F. (1989). Macroeconomic forecasting: A survey. Economic Journal, 99, 28–61 (March).

White, H. (1980). A heteroscedasticity-consistent covariance matrix estimator and a direct test for heteroscedasticity. Econometrica, 48(4), 817–838.

Acknowledgements

I thank Thorsten Saadma and Roland Vaubel for helpful comments on an earlier version of this paper.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Data Sources

1.1.1 Forecasts and realizations

CEA | The Council of Economic Advisors (the “five wise men”) publish their annual report in early November. The source for forecasts and realizations is “Sachverständigenrat zur Begutachtung der gesamtwirtschaftlichen Entwicklung,” various issues, Wiesbaden. |

Economist | The journal “The Economist” (London) publishes an average forecast of several private financial institutions on a regular quarterly (now monthly) basis since 1992. Forecasts are taken from the May and December poll. Forecasts for 1990–1992 are collected from Artis (1996: 29), which have been released by “Consensus Economics,” an international economic survey organization in London. Source for the realizations is the IMF Economic Outlook, various issues. |

IMF | The “World Economic Outlook” is published twice a year providing forecasts and realizations in spring and autumn. The concrete dates of publications vary quite frequently, but early May and early October are fairly common publication dates. However, some of the projections (during the 1970s) have not been published and are collected from Artis (1996). |

JF | The Joint Forecast of the six (formerly five) “leading” German economic research institutes is released twice a year, in spring and autumn. Dates of Publications vary, but middle of April and middle of October are quite common. The source for all figures is the report from “Arbeitsgemeinschaft deutscher wirtschaftswissenschaftlicher Forschungsinstitute“, various issues, Berlin. |

NIESR | The National Institute for Economic and Social Research releases forecasts four times a year. Spring forecasts are taken from the second issue and autumn forecasts are collected from the fourth issue (typically published in early May and early November, respectively), of the “National Institute Economic Review,” various issues, London. |

OECD | The OECD Economic Outlook is published twice a year. Usual publication dates are early June and early December. |

1.1.2 Public election dates

1971–1974 | Gorvin, Ian (1989). |

1975–2000 | Beck, Clarke, Groff, Keefer, & Walsh (2001). |

2001–2004 | CNN Election Watch [http://edition.cnn.com/WORLD/election.watch, January 16, 2006]. |

1.1.3 IMF credits

Regions | International Financial Statistics, various yearbooks, IMF, Washington D.C.: “Total Fund Credit & Loans Outstdg.” |

New Arrangements | Annual Report of the Executive Board 2005, IMF, Washington D.C.: “Arrangements approved during financial years ended April 30, 1953–2005.” |

Rights and permissions

About this article

Cite this article

Aldenhoff, FO. Are economic forecasts of the International Monetary Fund politically biased? A public choice analysis. Rev Int Org 2, 239–260 (2007). https://doi.org/10.1007/s11558-006-9010-x

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11558-006-9010-x