Abstract

After reviewing literature on knowledge-based antecedents of the internationalization of SMEs, one could conclude that knowledge-based capabilities of the firm and external spillovers are influential factors equally valid for leading a firm to decide becoming an exporter or becoming a born global. Since these decisions are conceptually different, and so are those potentially influential factors, one at the micro and the other at the macro level of antecedents, this research work assumes the opposite thesis. For hypotheses testing, we examined the case of young Spanish manufacturing SMEs combining firm-level data with territorial data at the autonomous community level in Spain. Applying binomial logistic regression models, which estimate the probability of an event happening, results from a sample of 242 young Spanish manufacturing SMEs corroborate that knowledge spillovers rather than firm’s capabilities influence a young SME’s propensity to export, while firm’s capabilities rather than knowledge spillovers influence a new venture propensity to become a born-global firm.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Literature on internationalisation has recently been devoted to explaining why some firms internationalise quickly after inception, the so-called ‘born globals’. Born globals are a sub-set of international entrepreneurial firms with the distinct feature of early and fast international expansion (Gabrielsson et al. 2008). Some of them are SMEs established and managed by an entrepreneur (Zahra et al. 2000), thus they assume the high risk associated with fast and early market-seeking internationalisation (Gabrielsson et al. 2008). These firms are often not integrated into a corporate group, nor are they spin-offs from large multinational companies, so they lack parental resources and decision-making support (Spence and Crick 2006). This paper is interested in this particular group of young SMEs that usually approach their business activities without parental knowledge guidance.

Yet knowledge resources are relevant to entrepreneurial activity (e.g., Álvarez and Busenitz 2001; West and Noel 2009) and also to internationalisation (e.g., Gassmann and Keupp 2007; Knight and Cavusgil 2004). From the literature regarding entrepreneurship, a firm’s ability to recognise promising opportunities and to exploit them depends on its capabilities to acquire, create, and utilise knowledge (Jantunen et al. 2008). From traditional international business literature, knowledge is also considered a critical determinant of international expansion. For instance, the lack of knowledge about foreign markets means that most SMEs, but not all of them, first establish a solid home market to acquire knowledge resources and, eventually, go abroad during later stages of their life cycle (Johanson and Vahlne 1977), the so-called traditional internationalising SMEs (Gabrielsson et al. 2008). Consequently, in most of the sectors in a given territory, local firms, traditional internationalisers, and born globals coexist.

According to Cavusgil and Knight (2015) the issue as to why some firms internationalise early, others late in their evolution, and still others choose to remain local, is a fundamental question for international business scholarship. The thesis of this paper is that both the decision to become an exporter and the one related to the approach used to internationalise through exports – i.e., to be a born global vs. a traditional internationaliser – could be explained by micro and macro-level variables related to firms’ capabilities and knowledge spillovers, respectively. On the one hand, firms can focus on market and technological internal capabilities to successfully compete in foreign markets (e.g., Amorós et al. 2016; Baronchelli and Cassia 2014; Bortoluzzi et al. 2014), particularly by making use of their knowledge resources in order to properly commercialise competitive products in different markets (Park et al. 2015). On the other hand, firms can try to ground themselves on knowledge vicariously acquired from the experience of others in order to operate abroad (Fletcher and Harris 2012), for instance by imitating incumbents’ strategies and practices related to their approach to internationalisation. This can be so because of so-called knowledge spillovers, which refer to public knowledge available in certain locations that firms situated there can freely use (Acs et al. 1994). Recent literature has focused on export spillovers stemming from sources such as well-established companies involved in international trade and investment – i.e., knowledge about foreign markets, export procedures and paperwork, etc. – (De Clercq et al. 2008; Kneller and Pisu 2007). In this study we introduce and examine an additional source of knowledge spillover with a potential positive effect on young SMEs’ internationalisation: those spillovers stemming from previous new ventures (NVs) funded by opportunity-driven entrepreneurs – i.e., knowledge about how to identify, assess and exploit high-growth opportunities, etc. Thus, we could also find out whether or not this specific knowledge from previous entrepreneurs is more suitable for young SMEs than the knowledge from well-established companies with international business in the region.

Based on the above, we can expect that young firms can complementarily ground themselves on micro-level internal capabilities and macro-level external spillovers in order to successfully internationalise. Accordingly, this study aims to analyse the relative importance of firms’ capabilities and knowledge spillovers on young SMEs’ propensity to become an exporter and to become a born global. The distinction between these two decisions is relevant because, having a young SME decide to be an exporter, early internationalisation promises faster growth and higher profits than the slow path to going abroad, but it also involves stronger challenges that can threaten the new firm’s survival (Sapienza et al. 2006). However, there exists scarce literature combining both firms’ capabilities and knowledge spillovers as antecedents of either the export decision or the export approach (e.g., Fernhaber et al. 2009; Giovannetti et al. 2013). In addition, research works are mainly focused on the antecedents of one out of the two decisions – i.e., becoming an exporter (e.g., Becker and Egger 2013; Yi and Wang 2012) or becoming a born global (e.g., Olejnik and Swoboda 2012; Pla-Barber and Escribá-Esteve 2006). Based on these clearly focused studies, one could reach the conclusion that both – firms’ capabilities and knowledge spillovers – are equally valid as antecedents of both decisions. This is neither the thesis nor the finding of this paper.

Thus, although previous literature has highly showed the relevance of market and technological capabilities as antecedents of SMEs’ internationalization, no evidence has been given on their potential different effect on the two mentioned decisions. This assertion can be extended to the effect of sources of knowledge spillovers.

Finally, the literature that has studied knowledge spillovers has mainly approached the analysis from a cross-national perspective, assuming spatial homogeneity of the variables under study at a national level (e.g., De Clercq et al. 2008). However, sub-national differences exist and may be relevant. Actually, as younger ventures are influenced more by international exposure from geographically proximate firms (Fernhaber and Li 2013) – i.e., a source of knowledge spillovers –, for the purpose of this study, spillovers will be more appropriately analysed at a subnational level rather than at a national one. Thus, empirical work is focused on the subnational level of a country, Spain. Spain is a decentralised country structured by regions called autonomous communities, each of them having a high level of autonomy in their decision making and an idiosyncratic socio-cultural and economic context; thus, allowing for the analysis of external knowledge sources at the sub-national level. Besides, Spain is, like the US and UK, at a medium position in terms of the percentage of born globals among young firms, 15 to 20% (Eurofound 2012).

Export decision and the approach to export: differentiating traditional internationalisers and born globals

The export decision of young SMEs is limited by the availability of resources, knowledge resources being especially relevant as they include any information the organisation may apply to their international operations (Fletcher and Harris 2012; Prashantham 2005), so likely influencing its success in international markets (Gassmann and Keupp 2007; Zahra et al. 2000). In this respect, previous research has highlighted that internationalisation is facilitated by market knowledge (e.g., Fletcher and Harris 2012; Johanson and Vahlne 1977, 2009; Moini 1995; Villar et al. 2014) and technological knowledge (e.g., Fletcher and Harris 2012; Kylaheiko et al. 2011; Lefebvre et al. 1998). Market knowledge refers to information about institutional frameworks, rules and norms, local suppliers, competitors, and clients’ behaviour in the host markets. Technological knowledge refers to what is needed to design and/or adapt products to new markets. Both types of knowledge are relevant for developing a competitive advantage in international markets (Weerawardena et al. 2007).

Coherently with the relevance of knowledge, Gabrielsson et al. (2008) agree to distinguish between two different types of venture with respect to the way knowledge is acquired in order to face their internationalisation processes, leading to two approaches to the market-seeking internationalisation of young SMEs: traditional internationalisers and born globals.

Traditional internationalisers follow the model based on the offer of a range of products at inception aimed at, and adapted to, a local market to achieve business consolidation at home in order to undertake international expansion later on. These firms usually conceive of foreign markets as places where they can exploit a knowledge base and a competitive advantage that was previously developed at home (Gabrielsson et al. 2008; Kuemmerle 2002). Later on, knowledge is gained by resolving problems in the international market place (Zhou 2007). This classic view of internationalisation, depicted by Johanson and Vahlne (1977), is based on the accumulated experience that results in incremental and sequential learning. These firms usually start with occasional exports before committing resources to any foreign market.

Born globals are entrepreneurial firms that internationalise shortly after start-up (McDougall and Oviatt 2000). These ventures are conceived of from inception as projects with the capacity to offer products targeting international markets (Karra et al. 2008) due to their high level of commitment to such markets (Gabrielsson et al. 2008). For this sub-set of entrepreneurial SMEs, size and age are no longer prerequisites for doing international business (Gabrielsson et al. 2008) as they internationalise in a fashion that is inconsistent with the gradualist approach (Rialp et al. 2005). According to Zhou (2007), born globals gain knowledge by exploring opportunities in the opportunity recognition stage, not just by solving problems generated in the opportunity exploitation stage, as traditional internationalisers do. In fact, born globals usually conceive of foreign markets as places where they can explore and create new knowledge (Gabrielsson et al. 2008; Kuemmerle 2002).

Firms’ capabilities and knowledge spillovers as antecedents of young SMEs’ internationalisation

Literature on international business agrees that firms’ capabilities and knowledge spillovers are two relevant internal and external factors, respectively, that can help young SMEs to internationalise through exports, either traditionally or as a born global (e.g., De Clercq et al. 2008; Gassmann and Keupp 2007; Knight and Cavusgil 2004).

With respect to firms’ capabilities, market-related and technological-related capabilities are highlighted (e.g., Amorós et al. 2016; Baronchelli and Cassia 2014; Bortoluzzi et al. 2014; Knight and Cavusgil 2004). First, market-related capabilities involve firms’ abilities to understand the characteristics of foreign markets and to conceive of a way to reach competitive positioning in different markets, so properly using the knowledge resources acquired about foreign markets, either along the time, soon after inception, or even inherited due to preexisting knowledge and background of the founders (Cavusgil and Knight 2015). These capabilities relate to firms’ abilities to either develop tailor made products, or identify homogeneous needs in external markets with the aim thereby of positioning standard products (Weerawardena et al. 2007). Second, technology-related capabilities refer to the application of technological knowledge and its materialisation in order to create new and unique products (Nonaka and Takeuchi 1995). Therefore, a firm’s innovation has been considered as a measure of those capabilities because it represents the application of acquired and generated knowledge and its materialisation in new products (Díaz-Díaz et al. 2008). Thus, market and technological capabilities refer to the proper use by young SMEs’ of market and technological knowledge resources that are available within the venture (Grant 1996). Extant literature has shown how these firms’ capabilities influence young SMEs’ internationalisation. Table 1 summarises the main arguments used by authors to justify such influences, which are split into two categories: factors explaining young SMEs’ propensity to export and those elucidating young SMEs’ propensity to become a born global.

Concerning knowledge spillovers, young SMEs can also ground themselves on macro-level spillovers in order to find support when starting to export. Indeed, these firms are likely more prone to export activities if they are exposed to other economic actors’ international activities (Greenaway et al. 2004). In particular, they can try to acquire market and technological knowledge from these external sources of spillovers, such as importers, exporters, and multinational companies in the region. Spillovers refer to the transfer of knowledge across economic players (De Clercq et al. 2008) geographically proximate (Fernhaber and Li 2013) and without having to pay for it in a formal market transaction (Acs et al. 1994). Spillovers occur due to various channels including, among others, informal interactions, demonstration and imitation effects (De Clercq et al. 2008; Fernhaber et al. 2009), or labour mobility (Masso et al. 2015; Mion and Opromolla 2014). In particular, extant literature on firms’ internationalisation has highlighted the free transfer of knowledge about foreign markets and operations – export spillovers (Greenaway et al. 2004; Kneller and Pisu 2007). These spillovers are relevant for young SMEs, which often lack internal export knowledge or experience (Acs et al. 1994), especially in the case of those firms that lack the capability to develop that type of knowledge internally. Particularly, and according to Requena-Silvente and Castillo-Giménez (2007), young SMEs use interpersonal relationships as a channel to acquire information due to the spillover effect.

Additionally, the free transfer of knowledge on international opportunity recognition and exploitation from previously founded NVs – i.e., individuals who are starting businesses – could also be relevant to young SMEs’ internationalisation; and this is what we call “opportunity entrepreneurship spillovers”. Specifically, opportunity entrepreneurship implies pull motives to start up a NV such as high income and wealth. In particular, opportunity-driven entrepreneurs expect their ventures to reach a higher level of income, which is usually positively related to their ambitions for growth. Therefore, opportunity-driven entrepreneurs may be more committed to international activities (Hessels et al. 2008; Karra et al. 2008). At a macro level, countries with a higher incidence of wealth-increase-driven entrepreneurs tend to have a higher prevalence of export-oriented entrepreneurs (Hessels et al. 2008). Exploring this new type of spillover is important not just because it provides additional knowledge in terms of content – e.g., how to assess high-growth opportunities – that can be relevant for internationalisation, but because we can investigate whether those previous NVs may serve as a better role model than well-established firms for young SMEs, as they have more in common.

Because previous literature offer relevant arguments that clarify how knowledge spillovers may condition SMEs’ internationalisation, being possible the distinction of those explaining young SMEs’ propensity to export and those justifying young SMEs’ propensity to become a born global, we summarised these arguments in Table 2.

Thus, according to the arguments showed in Tables 1 and 2, it can be said that firms’ capabilities and knowledge spillovers are relevant for young and independent SMEs when making the decisions of being an exporter and becoming a born global. So, when analysing these external and internal factors in isolation, all the variables that explain why young SMEs decide to become an exporter seem also to be valid in terms of explaining why SMEs decide to become a born global. This reasoning could also apply to the new source of spillovers introduced in this study – opportunity entrepreneurship spillovers. However, it is feasible that a study which jointly considers factors related to these two levels could provide evidence about a different rationale behind the role that firms’ capabilities and knowledge spillovers play when SMEs face these two decisions, and consequently their relevance for each one.

On the one hand, concerning a young SME’s decision to become an exporter, it must be highlighted that this type of firms would benefit from market and technological capabilities based on knowledge that can be acquired through internal and external sources (Fletcher and Harris 2012). Nonetheless, independent and young SMEs will not always possess the capabilities needed to obtain the technological and market knowledge required to develop sustainable competitive products in foreign markets by themselves. If this is the case, vicarious learning becomes essential for ventures’ internationalisation. In fact, young SMEs can reduce uncertainty and guarantee their success by observing the actions of other geographically proximate firms (Fernhaber and Li 2013; Hessels and Terjesen 2010). This way they can learn from their local environment and/or imitate the successful practices and strategies of other local firms. Thus, the existence of export spillovers and opportunity entrepreneurship spillovers within a territory should be at least as influential on a young SMEs’ decision to internationalise through exports as a firm’s own capabilities that allow it to create new and unique products and reach competitive positioning in different markets.

-

H1.

A young SME’s propensity to export will be positively influenced by firm’s market capabilities (H1a), firm’s technological capabilities (H1b), export spillovers (H1c) and opportunity entrepreneurship spillovers (H1d).

On the other hand, and focusing on the approach followed by a young SME to internationalise, it is relevant to differentiate between the methods and speed of knowledge accumulation of born globals and those of traditional internationalisers (Zhou 2007). Born globals must quickly gain knowledge while innovating in new products, methods of productions and even reinventing firm’s operations to serve markets optimally (Knight and Cavusgil 2004), as well as by exploring opportunities in the international markets (Zhou 2007), not just sequentially and gradually solving problems faced in the local market and later on overseas, as traditional internationalisers do (Johanson and Vahlne 1977). Indeed, according to Autio et al. (2000) the key issue for a born global is the pace of learning to adapt to its environment, which is obtained through developing and maintaining a valuable, current knowledge base. Therefore, learning through export spillovers and/or opportunity entrepreneurship spillovers, since it relates to someone else’s past experience, would be less influential on the choice of a born-global approach than firms’ capabilities that, in the case of these firms, must be related to an early emphasis on knowledge generation. In this respect, having market and technological knowledge-related capabilities that permit the development of innovative products (which in turn generates new knowledge needed for subsequent technology development) that are valuable to foreign markets, could be the prerequisite of an early and fast internationalisation (Knight and Cavusgil 2004).

Moreover, the technological capabilities of young SMEs needed for product innovation could be relevant to carrying out export activities quickly and soon after inception, since young SMEs need unique products nurtured with sources of competitive advantage to be successfully sold abroad (Knight and Cavusgil 2004). Although any firm could take advantage of these technological capabilities to export, in the case of born globals these are a requirement. In the early phases when firms face the liability of newness (Fernhaber et al. 2009; Zahra et al. 2000), the availability of innovative and/or unique products to a young SME may be a necessary condition for a fast and extensive entry into multiple foreign markets. In addition, a firm’s capability to offer homogeneous products can be also a prerequisite for the choice of a born-global approach. Specifically, a young SME’s capability to understand the characteristics of global market segments, and so to design, manufacture, and position homogeneous products in multiple markets is a key factor in spreading operations over many countries soon after inception. That is so because young SMEs lack the tangible, financial, and knowledge resources needed to tailor products adapted to the specific needs of various countries. So this market capability becomes a relevant prerequisite for a young SME to internationalise early, fast, and with commitment.

-

H2.

A young SME’s propensity to become a born global will be positively influenced by firm’s market capabilities (H2a), firm’s technological capabilities (H2b), export spillovers (H2c) and opportunity entrepreneurship spillovers (H2d), albeit firm’s capabilities will have more influence on the likelihood of choosing to be a born global than knowledge spillovers (H2e).

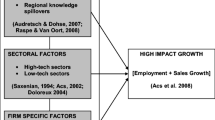

All these arguments can be summarized and depicted in Fig. 1.

Methodology

Data and sample

For hypotheses testing, we examined the case of young Spanish manufacturing SMEs combining firm-level data with territorial data at the autonomous community (AC) level. Firm-level data was obtained from the Survey on Business Strategies (SBS) conducted by Fundación SEPI. This is a yearly survey that covers the whole population of Spanish manufacturing firms with 200 or more employees and a representative sample of firms with 10 employees or more. It is an unbalanced panel of data that allows a longitudinal follow-up of firms. We focused on the period of 1996 to 2009.

Specifically, we analysed the firms that responded to the SBS in 2006 (2023 firms), but considering all available data from each firm back to 1996 and the follow up until 2009. Later updates have been excluded in order to avoid the effect of the Spanish deep economic crisis on our data, as the severe consequences of it were not evident until 2010 (Durán-Herrera and García-Cabrera 2013). Because crises cause governments to perceive the need for urgent changes in their policies (Courvisanos 2009) and firms to perceive poor economic performance unless corrective actions are taken (Dutton 1986), both due the negative effect of crisis on demand, credit, capital flows, unemployment, and so on (Moon et al. 2011), conditions are exceptionally different from economic stable contexts. Thus, it expectedly will affect the results of a research that aim at identifying antecedents of SMEs’ internationalisation. For instance, and according to Durán-Herrera and García-Cabrera (2013), Spanish firms’ strategies to face the crisis included the strength of technological capabilities to increase innovation, greater attention to customers’ needs, and the quest for better brand reputation in order at reaching a position based on high value-added products in the international markets to increase operations abroad. These circumstances could hamper the identification of the standard factors that condition young SMEs’ propensity to export or to become a born global. So in order to avoid any potential misleading based on data, we focus on the period 1996–2009, before the Spanish firms were affected by the severe consequences if the crisis. This decision is also based on the fact that the post-crisis period is still too short to offer a long period to evaluate young SMEs’ behaviour in the international area.

We examined the subsample that met the following criteria in 2006: (1) SMEs – firms with less than 250 employees; (2) young firms – firms up to ten years of age, as firms with 12 years have survived the liability of newness (Zahra et al. 2000); and (3) independent firms – firms not integrated in a corporate group, with an equity on the firm by other Spanish companies lower than 50% and with no equity on the firm by any foreign company. Thus, our final sample is 242 young, independent, Spanish, manufacturing SMEs. Concerning the distribution of firms by AC, the 17 Spanish ACs are represented in our sample, being this distribution correlated with the size of the region. There are significant differences among ACs in terms of the population’s level of education (F = 79.888, p < .0001), import level (F = 210.333, p < .0001), export level (F = 302.971, p < .0001), and opportunity-driven entrepreneurial activity (F = 6.537E30, p < .0001). Considering distribution by type of industry, only 16.5% of the firms were competing in high or medium to high-tech industries, while the majority were involved in more traditional industries.

Measures

Dependent variables

Propensity to export is captured by a binary variable coded “1” for exporters and “0” for non-exporters, and propensity to become born global by the binary variable coded “1” for born globals and “0” for traditional exporters. Thus, all firms in the sample were classified in one out of three categories: non-exporters, traditional exporters, and born globals. These categories were carefully determined by analysing the history of each firm (1996–2005), its current situation (2006), and its following evolution (2007–2009), as Jantunen et al. (2008) recommend. Following these authors, non-exporters are those firms in the sample which had never exported and those which, having done so, had not exported in the last three years. The rest of the firms are considered exporters. A born global is defined as an exporter that has started exporting within three years or less from inception, with its exports as a percentage of total sales being higher than 25%, this scale being reached within 3 years from inception. Thus, and as an example, a firms in the sample that has started export activity in 2 years from inception but a very low scale under 25% is not considered a born global. Following the above criteria, we obtained 153 non-exporters (63.2%), 68 traditional exporters (28.1%), and 21 born globals (8.7%) – i.e., 89 exporters (36.8%). Therefore, propensity to export is a dichotomous variable being 1 the desired state of exporter with a frequency of 89 out of 242 SMEs in the sample, and propensity to become born global is also a dichotomous variable being 1 the desired state of born global with a frequency of 21 out of 89 exporting firms in the sample. Thus, each SME only ranks in one out of three categories: non-exporters, traditional exporters, and born globals. Table 3 shows how these three categories are significantly different in terms of the three dimensions of internationalisation suggested by Oviatt and McDougall (1994) and considered in the literature (e.g., Kuivalainen et al. 2007): speed, scale, and scope.

Independent variables

Concerning firms’ capabilities (firm data), homogeneous products is the proxy for measuring market capabilities. It is a dummy variable based on a question from the survey in which the firm must choose one out of two possibilities, “firm’s products are highly standardised, mostly the same for all buyers” and “firm’s products are mostly designed specifically for each client”. In cases where young SMEs are internationalised, this item provides information about the marketing capabilities of firms to position homogeneous products in multiple markets. Homogeneous products is coded “1″ in the first case and “0″ if the second option is chosen. Product innovation is the proxy for measuring technological capabilities, approached in terms of the outputs flow, instead of the inputs flow perspective based on R&D expenditure (Díaz-Díaz et al. 2008). This approach allows a measurement to be taken regarding whether young SMEs have the ability to use technological knowledge and materialise it in terms of creating new or enhanced products. Product innovation is a dummy variable coded “1″ if the firm has obtained, in any of the years analysed, any new or significantly improved product, and “0″ otherwise. In the case of exporters, either traditional or born-global, all firm-level variables were lagged one year from the first year of exports to identify causal relations.

Concerning knowledge spillovers (territorial data), on the one hand, and following De Clercq et al. (2008), exports and imports in the region are the proxies for measuring sources of export spillovers. Exports (imports) are measured as the percentage of the AC’s exports (imports) of goods and services relative to their gross domestic product (GDP). Exports (imports) data were obtained from DATACOMEX provided by the Spanish Foreign Trade State Secretariat and GDP data from the National Statistics Institute (INE). Because knowledge spillovers may take some time before they materialise and because exports and imports fluctuate heavily over time (De Clercq et al. 2008), we average the two variables over the 3 years that span the period ti-1 to ti-3, ti being the year of firm’s foundation. On the other hand, Opportunity TEA is the proxy for measuring Opportunity Entrepreneurship spillovers. It is measured through the relative prevalence of Opportunity Entrepreneurial Activity based on GEM’s Total Early-stage Entrepreneurial Activity (TEA) index (proportion of 18–64 population who are either a nascent entrepreneur or owner-manager of a business that is less than 42 months of age). Specifically, this measurement represents the percentage of those involved in early-stage entrepreneurial activity (as defined above) who (i) claim to be driven by opportunity as opposed to finding no other option for work; and (ii) who indicate that the main driver for getting involved in this opportunity is being independent or increasing their income. Each firm in our sample has the value for opportunity TEA of its AC in 2006 as no representative data is available for all ACs before that year. This should not be a problem since entrepreneurial motivation (i.e., opportunity versus necessity) in a territory does not change significantly from one year to the next.

Control variables

We have controlled a priori for key potential influencing factors on internationalisation, such as a firms’ independence (sample firms do not belong to a corporate group), and the years of experience (they are all less than ten years of age). Nevertheless, we controlled for the firm’s size and industry as they have traditionally been considered as factors that may have an impact on internationalisation (Pla-Barber and Escribá-Esteve 2006). Previous size, logged to adjust for non-normality, is measured using the total number of employees in the year before the firm’s first export sales. For non-exporters, we assigned the total number of employees in 2006. Concerning industry effects, previous studies suggest that NVs in high-tech industries typically internationalise more rapidly that those operating in low-tech markets (Chorev and Anderson 2006; Spence and Crick 2006). Industry is a dummy coded “1″ if the firm’s industry is a high-tech or a medium to high-tech industry and “0″ otherwise, following OECD’s (1999) classification of industries based on technology. Finally, we also controlled for other possible territorial-level explanations, such as the level of education of the population. Education reflects the percentage of population over 16 years of age in each AC that has completed studies beyond compulsory education (data obtained from INE).

Data analysis

We tested our hypotheses using binomial logistic regression models, which estimate the probability of an event happening. We analysed two events: (a) selection into exporters versus non-exporters – i.e., propensity to export of the 242 SMEs; and (b) selection into born globals versus traditional exporters – i.e., propensity to become a born global of 89 exporters. For both dependent variables, we estimate a series of models with different sets of independent variables: firms’ capabilities in Models 1 and 4, knowledge spillovers in Models 2 and 5, and both sets of variables in Models 3 and 6.

Following Hilbe (2009), we assessed the overall model using the Model Chi-square test. The Model Chi-square is the difference between the -2LL (minus two times the log likelihood) of the fitted model and the -2LL of the null hypothesis model. In order to test whether the addition of the predictor variables led to a significant improvement of the model, we examined the Block Chi-square test. The Block Chi-square is the difference between the -2LL (minus two times the log likelihood) of the full model and the -2LL of the control model. In particular, a significant Chi-square test of the final model indicates that a significant relationship exists between the entire set of independent variables and the dependent variable (Andersson et al. 2004). The statistic tests the null hypothesis that an intercept-only model is correct. When the model chi-square is significant, the null hypothesis can be rejected. Thus, the model has a high explanatory power if a high and highly significant chi-square is obtained (Harzing 2002). This fact allows researchers analyse the improvement in Chi-square that results from including a certain group of variables in the regressions estimated, as it is done by Kuemmerle (1999). Furthermore, we report for each model the Nagelkerke pseudo R square, which indicates the variance explained by our models; sensitivity rate, percentage of exporters (Models 1–3) or born globals (Models 4–6) correctly classified; and, the overall rate of correct classification.

Results

Table 4 shows the basic statistics of the variables and the correlations between them. Regarding multicollinearity of the data, the general rule of thumb is that correlation should not exceed 0.75 (Tsui et al. 1995). In our sample, the highest correlation was between Imports and Education at .638. Multicollinearity was also dismissed as standard errors for the Beta coefficients were all lower than 2.0, as Naderi et al. (2009) recommend, and also because the scores of the variance inflation factor (VIF) lie between 1.006 and 3.762, under the recommended cut-off point of 10 pointed by Hair et al. (1992) –see Table 5. Table 5 shows the logistic regression models for propensity to export (Models 1–3), and for propensity to become a born global (Models 4–6). Taking into account the statistics for goodness of fit of the 3 models for each dependent variable, we can affirm that all the models fit, but the best models are, in both cases, the combined ones that include both sets of predictors: firms’ capabilities and sources of knowledge spillovers (Models 3 and 6).

Getting into hypotheses testing, and concerning firms’ capabilities, we can confirm the following influential effects. First, a firm’s capability to offer homogeneous products has a significant and positive effect on the likelihood of selecting into born globals vs. traditional exporters (Models 4 and 6), but is not significantly related to selecting into exporters vs. non-exporters (Models 1 and 3). Therefore, H1a is rejected while H2a is supported. Second, a firm’s capability for product innovation is significantly and positively related to both decisions (Models 1, 3, 4, and 6). Therefore, H1b and H2b are supported.

Concerning sources of knowledge spillovers, on the one hand, our results confirm that exports in the firm’s region has a significant and positive effect on a firm’s likelihood of selecting into exporters, among all firms analysed (Models 2 and 3), and selecting into born globals, among exporters (Models 5 and 6). However, imports has no significant influence on any of the analysed decisions. Thus, H1c and H2c are partially supported. On the other hand, our results indicate that opportunity TEA is significant, and positively related to the selection into exporters (Models 2 and 3), but not into born globals (Models 5 and 6). Therefore, H1d is supported while H2d is rejected.

Finally, H2e proposes that firms’ capabilities will have more influence on young SMEs’ likelihood of choosing to be a born global than knowledge spillovers. With respect to it, partial Model 4, based on firms’ capabilities, is appreciably better than Model 5, based on knowledge spillovers, in terms of Block chi-square test (χ 2 = 14.452 at p < .01 vs. χ 2 = 6.820 at p < .1), Pseudo R-square (.293 vs. .185), sensitivity (42.9% vs. 23.8%), and the percentage of born globals correctly classified (83.1% vs. 80.9%). Also, the combined model of propensity to become a born global (Model 6) shows that only one out of three variables that capture sources of knowledge spillovers, exports, is significant in a firm’s self-selection into born globals, while both variables analysed to capture firms’ capabilities, homogeneous products and product innovation, are significant in young SMEs selecting into born globals. Therefore, all this information points at supporting H2e.

This last hypothesis confirmation could be reinforce if we look at the set of independent variables that are significant in the regression model for the dependent variable propensity to export. The combined model of propensity to export, Model 3, shows that two out of three variables that capture sources of knowledge spillovers, exports and opportunity TEA, are significant in a firm’s self-selection into exporters, as so is product innovation that influences young SMEs’ propensity to export. Besides, comparing partial Models 1 and 2 of propensity to export, we obtain a better model with sources of knowledge spillovers (Model 2) than with firm’s capabilities (Model 1) in terms of chi-square test, Pseudo R-square, sensitivity, and the percentage of exporting firms correctly classified by the model. So, comparing Models 1–3 with respect to Models 4–6, it can be observed the increased influence of firm’s capabilities, and the decreased influence of knowledge spillovers when studying antecedents of born-global firms.

Discussion

Our study contributes to the literature on young SMEs’ internationalisation by introducing in the same empirical study firms’ capabilities and knowledge spillovers in their home region as antecedents of two strategic decisions: becoming an exporter, and becoming a born global as opposed to following a traditional internationalisation process. With regard to technological-related capabilities, our results support the assertion that a firm’s ability to innovate in terms of products clearly determines both decisions. These results are consistent with previous literature that highlights the positive influence that capabilities related to innovation have on the possibility that, eventually, an SME could gain access to foreign markets (Autio et al. 2000), especially in the early phases of their development (Jin et al. 2015; Knight and Cavusgil 2004). Concerning market-related capabilities, our study indicates that a firm’s ability to offer homogeneous products determines the selection of a born-global approach among exporter, but not the choice to become an exporter. Hence, young SMEs’ capabilities to understand the characteristics of global market segments increase the firm’s propensity to become a born global – the selection of the approach to internationalise – but not the internationalisation decision itself. Thus, our study confirms the relevant influence that firms’ capabilities related to market and technological knowledge, and focused on the generation of unique knowledge within the firm, have on the possibility that a young and independent SME will become a born global.

Our results also indicate that export activity in the territory represents a great source of export spillovers, as a high level of exports by Spanish firms in their region increases the likelihood of young SMEs in that region selecting into exporters vs. non-exporters and also to become a born global among exporters. This result may indicate that, as those exporters are born and developed in the same sub-national territory and face the same institutional conditions, they are a good and easily understandable role model and, therefore, a good source of information for young SMEs, reducing their risk perception regarding the uncertainty associated with exporting. As a second source of export spillovers, imports turned out to be independent of an SME’s decision to internationalise and to become a born global. De Clercq et al. (2008) hypothesised that spillover effects from imports related to technology transfer between foreign suppliers and domestic producers may induce export activities. Nevertheless, they could not confirm this effect empirically. However, considering the mimetic effect suggested by Powell and DiMaggio (1991), it might be expected that knowledge from local importing firms could induce import activities by the transfer of relevant information related to import activities – e.g., import formalities. In our opinion, the absence of a significant relationship between imports and the propensity of SMEs to internationalise could be due to the existence of a mixed effect of this particular type of knowledge spillovers.

Finally, opportunity entrepreneurship spillovers increase the likelihood of a young SME selecting into exporters. This may be because in territories with high levels of opportunity-driven entrepreneurship, knowledge and the demonstration effect of previous entrepreneurs may positively influence the decision of would-be entrepreneurs who start up a venture to internationalise, as reaching foreign markets could be a good choice for obtaining high growth objectives. Hence, our study corroborates that the nature of a NV’s early-stage activity itself can be an important source of spillovers that help the internationalisation activity in a particular region. Since only spillovers from export activity out of the three types analysed has a positive influence on the decision of young exporting SMEs to internationalise as born globals, our study suggests that knowledge spillovers mainly influence the decision to internationalise, but not the approach followed in order to achieve it.

In summary, concerning the relative importance of macro-level spillovers and micro-level firms’ capabilities on young SMEs’ internationalisation, our study makes some interesting contributions to the literature. First, knowledge spillovers are necessary, although not sufficient to guarantee the decision to internationalise. Our results confirm a second condition: young SMEs must develop capabilities that permit innovation in new products that are unique and distinctive in foreign markets. Second, the existence of capabilities that permit product innovation and the positioning of homogeneous products in international markets are not only necessary, but almost a sufficient condition for those SMEs that want to internationalise in a fast and committed manner (notice that there is also a significant and positive effect of spillovers from others exporters on born globals). So, it could be asserted that an early internationalisation is more likely facilitated by micro-level internal capabilities than by macro-level external spillovers.

Knowledge spillovers play a relevant role in the traditional internationalisation of SMEs. As knowledge spillovers involve an atmosphere favourable to internationalisation – e.g. providing successful role models to boost ventures’ motivation to internationalise, suitable information to better understand business in foreign markets, and reducing the fear of foreign operations –, these spillovers become the driving and triggering factor of an SME’s intention to reach international markets, albeit they may start exporting just to try their luck. As traditional internationalisers conceive of foreign markets as places where they can exploit a knowledge base and a competitive advantage that was previously developed at home, especially with innovative and unique products, the “momentum effect” due to knowledge spillovers can be enough for SMEs with innovative products to make the decision to face the export challenge. Later on, SMEs’ international operations will gradually increase as they gain knowledge and experience in the international arena. On the contrary, it is firms’ capabilities that play a relevant role in triggering fast and early internationalisation. Although knowledge spillovers provide the territory with an atmosphere favourable to internationalisation, only when young SMEs enjoy market and technological capabilities can they internationalise quickly and soon after their inception. This is so because born globals must be able to successfully design unique, innovative and homogeneous products and also to position them in multiple foreign markets simultaneously. Therefore, the mere will to enter foreign markets is not enough to successfully implement such a challenge right after inception. Thus, compared to firms’ capabilities that generate innovative products suitably positioned to compete in multiple foreign markets, public knowledge from spillovers is less relevant to young SMEs’ early internationalisation.

Theoretical and practical implications

In Zhou’s (2007) opinion, the driving mechanism of early internationalisation, a phenomenon that challenges the dominant logic of time-based experience, remains an interesting puzzle. We have carried out this research work to contribute towards unravelling that puzzle by analysing the specific role of firms’ capabilities and knowledge spillovers on early and committed internationalisation and differentiate this decision from the mere choice to become an exporter. We found several pieces of evidence. First, firms’ capabilities are relevant since they allow young SMEs to offer innovative and unique products and reach a competitive positioning in external markets. Second, a firm’s geographic location is also a key factor since it provides relevant information usually unavailable to start-ups; besides, it provides models of success that may serve as reference for young SMEs. Based on our results, we can affirm that knowledge spillovers are relevant explanatory factors, especially for the decision to internationalise, while firms’ capabilities are relevant for predicting the strategic choice for that internationalisation in terms of pace and scope. These findings are in line with those of Hessels and Terjesen (2010). They found that, although export spillovers are important influential factors in an SME’s decision to start exporting, they have little relevance in explaining the choice for a specific internationalisation model – in their study, direct versus indirect exporting.

Our findings can be useful for policymakers. As opportunity-driven entrepreneurship in a territory has a positive effect on the propensity of its firms to export, when a particular country desires to boost its growth by promoting exports, policymakers should focus on improving the quality of entrepreneurship, rather than seeking to increase the quantity of the entrepreneurial activity, as Hessels et al. (2008) and European Commission suggest. Besides, the existence in a territory of a high proportion of established companies doing business abroad, rather than importing firms, is what positively influences the establishment of SMEs that internationalise soon after their inception. Thus, policymakers should be aware that trade promotion programmes have a positive effect beyond the direct effect on the supported SMEs, as their internationalisation will eventually push other geographically proximate young SMEs to internationalise. Although capabilities are firm-specific, policy makers should try to increase SMEs’ innovation by stimulating a culture of innovation and a vision of long-term future development (Schienstock 2010).

Also of interest for new entrepreneurs may be our findings on firms’ capabilities, as those denote that a firm’s ability to sense and seize opportunities (Teece 2000) and to exploit them (Jantunen et al. 2008) represents a key entrepreneurial facet of management (Teece 2003). In fact, capabilities are developed consciously and systematically by the willful choices and actions of firms’ leaders (Grant 1996) who are free to decide on the extent of such efforts, so entrepreneurial decisions result in distinct capabilities (Lefebvre et al. 1998). Our study provides a set of capabilities that young SMEs must develop to achieve fast internationalisation: product innovation and positioning homogenous products in global markets. Additionally, since geographical location matters, because of knowledge spillovers, entrepreneurs need to view the choice of geographic location as a key strategic decision.

Limitations and future research

All the firms in our sample have survived the start-up stage. Thus, firms that did not survive were not taken into account, so there may be a “survival bias” in our sample, as Kuivalainen et al. (2007) warn. Future research should include both successful firms and those firms that did not survive. Another limitation concerns the context of analysis, which is limited to a single country: Spain. Thus, the results could be conditioned by the characteristics of this geographical context. For example, as the national culture of Spain is characterized by relatively high levels of uncertainty avoidance values, as showed by Hofstede’s studies (Hofstede 1984), such specific culture may have an effect on managers’ decisions that involve a high level of risk, such as the international expansion. Consequently, the authors recommend that these results be examined in and compared to other geographical locations. Additionally, although strategy is fundamentally about making a difference in firm performance (Sapienza et al. 2006), we have refrained from theorising on the relationship between internationalisation and performance. Future research should aim at analysing the consequences of the decision by SMEs to internationalise on their performance.

References

Acs, Z. J., Audretsch, D. B., & Feldman, M. (1994). R&D spillovers and recipient firm size. The Review of Economics and Statistics, 76(2), 336–340.

Álvarez, S. A., & Busenitz, L. W. (2001). The entrepreneurship of resource-based theory. Journal of Management, 27, 755–775.

Amorós, J. E., Basco, R., & Romaní, G. (2016). Determinants of early internationalization of new firms: the case of Chile. International Entrepreneurship and Management Journal, 12(1), 283–307.

Andersson, S., Gabrielsson, J., & Wictor, I. (2004). International activities in small firms: examining factors influencing the internationalization and export growth of small firms. Canadian Journal of Administrative Sciences, 21(1), 22–34.

Autio, E., Sapienza, H. J., & Almeida, J. G. (2000). Effects of age at entry, knowledge intensity, and imitability on international growth. The Academy of Management Journal, 43(5), 909–924.

Baronchelli, G., & Cassia, F. (2014). Exploring the antecedents of born-global companies’ international development. International Entrepreneurship and Management Journal, 10(1), 67–79.

Becker, S. O., & Egger, P. H. (2013). Endogenous product versus process innovation and a firm’s propensity to export. Empirical Economics, 43, 329–354.

Bortoluzzi, G., Chiarvesio, M., Di, M. E., & Tabacco, R. (2014). Exporters moving toward emerging markets: a resource-based approach. International Marketing Review, 31(5), 506–525.

Burpitt, W. J., & Rondinelli, D. A. (2000). Small firms’ motivations for exporting: to earn and learn? Journal of Small Business Management, 38(4), 1–14.

Cavusgil, S. T., & Knight, G. (2015). The born global firm: an entrepreneurial and capabilities perspective on early and rapid internationalization. Journal of International Business Studies, 46(1), 3–16.

Cavusgil, S. T., & Zou, S. (1994). Marketing strategy performance relationship: an investigation of the empirical link in export market ventures. Journal of Marketing, 58, 1–21.

Chorev, S., & Anderson, A. R. (2006). Success in Israeli high-tech start-ups: critical factors and process. Technovation, 26, 162–174.

Courvisanos, J. (2009). Political aspects of innovation. Research Policy, 38(7), 1117–1124.

De Clercq, D., Hessels, J., & van Stel, A. (2008). Knowledge spillovers and NVs’ export orientation. Small Business Economics, 31, 283–303.

Díaz-Díaz, N. L., Aguiar-Díaz, I., & De Saá-Pérez, P. (2008). The effect of technological knowledge assets on performance: the innovative choice in Spanish firms. Research Policy, 37, 1515–1529.

Durán-Herrera, J.J., & García-Cabrera, A.M. (2013). Crisis and MNEs as institutional entrepreneurs: an analysis from a co-evolutionary perspective. Paper presented at 9th Iberian International Business Conference, Braga.

Dutton, J. E. (1986). The processing of crisis and non-crisis strategic issues. Journal of Management Studies, 23(5), 501–517.

Eurofound. (2012). Born global: the potential of job creation in new international businesses. Luxembourg: Publications Office of the European Union.

Fernhaber, S. A., & Li, D. (2013). International exposure through network relations: Implications for new venture internationalization. Journal of Business Venturing, 28(2), 316–334.

Fernhaber, S. A., McDougall-Covin, P. P., & Shepherd, D. A. (2009). International entrepreneurship: Leveraging internal and external knowledge sources. Strategic Entrepreneurship Journal, 3, 297–320.

Fletcher, D., & Harris, S. (2012). Knowledge acquisition for the internationalization of the smaller firm: Content and sources. International Business Review, 21, 631–647.

Gabrielsson, M., Kirpalani, V. H. M., Dimitratos, P., Solberg, C. A., & Zucchella, A. (2008). Born globals: propositions to help advance the theory. International Business Review, 17(4), 385–401.

Gassmann, O., & Keupp, M. M. (2007). The competitive advantage of early and rapidly internationalizing in the biotechnology industry: a knowledge-based view. Journal of World Business, 42, 350–366.

Giovannetti, G., Ricchiuti, G., & Velucchi, M. (2013). Location, internationalization and performance of firms in Italy: a multilevel approach. Applied Economics, 45(18), 2665–2673.

Golovko, E., & Valentini, G. (2011). Exploring the complementarity between innovation and export for SMEs’ growth. Journal of International Business Studies, 42(3), 362–380.

Grant, R. M. (1996). Toward a knowledge-based theory of the firm. Strategic Management Journal, 17, 109–122.

Greenaway, D., Sousa, N., & Wakelin, K. (2004). Do domestic firms learn to export form multinationals? European Journal of Political Economy, 20(4), 1027–1043.

Hair, J. E., Anderson, R. E., Tatham, R. L., & Black, W. C. (1992). Multivariate data analysis with readings. New York: MacMillan.

Harzing, A. W. (2002). Acquisitions versus greenfield investments: international strategy and management of entry modes. Strategic Management Journal, 23(3), 211–227.

Hessels, J., & Terjesen, S. (2010). Resource dependency and institutional theory perspectives on direct and indirect export choices. Small Business Economics, 34, 203–220.

Hessels, J., van Gelderen, M. W., & Thurik, A. R. (2008). Drivers of entrepreneurial aspirations at the country level: the role of start-up motivations and social security. International Entrepreneurship and Management Journal, 4(4), 401–417.

Hilbe, J. M. (2009). Logistic regression models. New York: Taylor & Francis Group.

Hofstede, G. (1984). Cultural dimensions in management and planning. Asia Pacific Journal of Management, 1(2), 81–99.

Jantunen, A., Nummela, N., Puumalainen, K., & Saarenketo, S. (2008). Strategic orientation of born globals - do they really matter? Journal of World Business, 43, 158–170.

Jin, B., Woo, H., & Chung, J. E. (2015). How are born globals different from non-born global firms? Evidence from Korean small- and medium-sized enterprises. Journal of Korea Trade, 19(3), 1–19.

Johanson, J., & Vahlne, J. E. (1977). The internationalization of the firm - a model of knowledge development and increasing foreign market commitments. Journal of International Business Studies, 8(1), 23–32.

Johanson, J., & Vahlne, J. E. (2009). The Uppsala internationalization process model revisited: From liability of foreignness to liability of outsidership. Journal of International Business Studies, 40(9), 1411–1431.

Karra, N., Phillips, N., & Tracey, P. (2008). Building the born global firm. Developing entrepreneurial capabilities for international NV success. Long Range Planning, 41, 440–458.

Kneller, R., & Pisu, M. (2007). Industrial linkages and export spillovers from FDI. The World Economy, 30(1), 105–134.

Knight, G. A., & Cavusgil, S. T. (2004). Innovation, organizational capabilities, and the born-global firm. Journal of International Business Studies, 35, 124–141.

Kuemmerle, W. (1999). The drivers of foreign direct investment into research and development: an empirical investigation. Journal of International Business Studies, 30(1), 1–24.

Kuemmerle, W. (2002). Home base and knowledge management in international ventures. Journal of Business Venturing, 17, 99–122.

Kuivalainen, O., Sundqvist, S., & Servais, P. (2007). Firm’s degree of born-globalness, international entrepreneurial orientation and export performance. Journal of World Business, 42, 253–267.

Kylaheiko, K., Jantunen, A., Puumalainen, K., Saarenketo, S., & Tuppura, A. (2011). Innovation and internationalization as growth strategies: the role of technological capabilities and appropriability. International Business Review, 20(5), 508–520.

Lefebvre, E., Lefebvre, L. A., & Bourgault, M. (1998). R&D-related capabilities as determinants of export performance. Small Business Economics, 10, 365–377.

Levie, J., & Autio, E. (2008). A theoretical grounding and test of the GEM model. Small Business Economics, 31, 235–263.

Lu, J. W. (2002). Intra and inter-organizational imitative behaviour: institutional influences on Japanese firms’ entry mode choice. Journal of International Business Studies, 33(1), 19–37.

Masso, J., Roigas, K., & Vahter, P. (2015). Foreign market experience, learning by hiring and firm export performance. Review of World Economics, 151(4), 659–686.

McDougall, P. P., & Oviatt, B. M. (2000). International entrepreneurship: The intersection of two research paths. The Academy of Management Journal, 43(5), 902–906.

Mion, G., & Opromolla, L. D. (2014). Managers’ mobility, trade performance, and wages. Journal of International Economics, 94(1), 85–101.

Moini, A. H. (1995). An inquiry into successful exporting: an empirical investigation using a three-stage model. Journal of Small Business Management, 33(3), 9–25.

Moon, H. C., Cheng, J. L. C., Kim, M. Y., & Kim, J. U. (2011). FDI, economic decline and recovery: lessons from the Asian financial crisis. Multinational Business Review, 19(2), 120–132.

Naderi, H., Abdullah, R., Aizan, H. T., Sharir, J., & Kumar, V. (2009). Self-esteem, gender and academic achievement of undergraduate students. American Journal of Scientific Research, 3, 26–37.

Nonaka, I., & Takeuchi, H. (1995). The knowledge creating company: how Japanese companies create the dynamics of innovation. New York: Oxford University Press.

OECD (1999). OECD science, technology and industry scoreboard 1999. Benchamarking knowledge-based economies. http://www.oecd-ilibrary.org/industry-and-services/oecd-science-technology-and-industry-scoreboard-1999_sti_scoreboard-1999-en;jsessionid=10trqm9kl7wqa.x-oecd-live-03. Accessed 12 Feb 2010.

Olejnik, E., & Swoboda, B. (2012). SMEs’ internationalisation patterns: descriptives, dynamics and determinants. International Marketing Review, 29(5), 466–495.

Oviatt, B., & McDougall, P. (1994). Toward a theory of international NVs. Journal of International Business Studies, 25(1), 45–64.

Park, S., LiPuma, J. A., & Prange, C. (2015). Venture capitalist and entrepreneur knowledge of new venture internationalization: a review of knowledge components. International Small Business Journal, 33(8), 901–928.

Pla-Barber, J., & Escribá-Esteve, A. (2006). Accelerated internationalization: evidence from a late investor country. International Marketing Review, 23(3), 255–278.

Powell, W. W., & DiMaggio, P. J. (1991). The new institutionalism in organizational analysis. Chicago: University of Chicago Press.

Prashantham, S. (2005). Toward a knowledge-based conceptualization of internationalization. Journal of International Entrepreneurship, 3, 37–52.

Requena-Silvente, F., & Castillo-Giménez, J. (2007). Information spillovers and the choice of export destination: a multinational logit analysis of Spanish young SMEs. Small Business Economics, 28, 69–86.

Rialp, A., Rialp, J., Urbano, D., & Vilant, Y. (2005). The born-global phenomenon: a comparative case study research. Journal of International Entrepreneurship, 3, 133–171.

Sapienza, H. J., Autio, E., George, G., & Zahra, S. A. (2006). A capabilities perspective on the effects of early internationalization on firm survival and growth. Academy of Management Review, 31, 914–933.

Schienstock, G. (2010). Organizational capabilities and innovations: Some conceptual considerations. In M. Molddaschl & N. Stehr (Eds.), Wissensokönomie und innovation. Beiträge zur Öknomie der Wissensgesellschaft (pp. 293–329). Marburg: Ed. Metropolis-Verlag.

Spence, M., & Crick, D. (2006). A comparative investigation into the internationalisation of Canadian and UK high-tech SMEs. International Marketing Review, 23(5), 524–548.

Teece, D. J. (2000). Strategies for managing knowledge assets: the roles of firm structure and industrial context. Long Range Planning, 33(1), 35–54.

Teece, D. J. (2003). Expert talent and the design of (professional services) enterprises. Industrial and Corporate Change, 12(4), 895–916.

Tsui, A. S., Ashford, S. J., StClair, L., & Xin, K. R. (1995). Dealing with discrepant expectations: response strategies and managerial effectiveness. Academy of Management Journal, 38, 1515–1543.

Villar, C., Alegre, J., & Pla-Barber, J. (2014). Exploring the role of knowledge management practice on exports: a dynamic capabilities view. International Business Review, 23, 38–44.

Weerawardena, J., Mort, G. S., Liesch, P. W., & Knight, G. (2007). Conceptualizing accelerated internationalization in the born global firm: a dynamic capabilities perspective. Journal of World Business, 42, 294–306.

West III, G. P., & Noel, T. W. (2009). The impact of knowledge resources on NV performance. Journal of Small Business Management, 47(1), 1–22.

Yi, J., & Wang, C. (2012). The decision to export: firm heterogeneity, sunk costs, and spatial concentration. International Business Review, 21(5), 766–781.

Zahra, S. A., Ireland, R. D., & Hitt, M. A. (2000). International expansion by NVs firms: international diversity, mode of market entry, technological learning, and performance. Academy of Management Journal, 43, 925–950.

Zahra, S. A., Korri, J. S., & Yu, J. (2005). Cognition and international entrepreneurship: implications for research on international opportunity recognition and exploitation. International Business Review, 14(2), 129–146.

Zhou, L. (2007). The effects of entrepreneurial proclivity and foreign market knowledge on early internationalization. Journal of World Business, 42, 281–293.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Funding

This work was supported by the Spanish Ministry of Economy and Competitiveness [ECO2016–80518-R].

Rights and permissions

About this article

Cite this article

García-Cabrera, A.M., García-Soto, M.G. & Suárez-Ortega, S.M. Macro-level spillovers and micro-level capabilities as antecedents of young SMEs’ propensity to export and to become a born global. Int Entrep Manag J 13, 1199–1220 (2017). https://doi.org/10.1007/s11365-017-0451-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11365-017-0451-x