Abstract

The study of top economic growth with the goal of Sustainable Development Goals (SDGs) has become an important issue in the world, and scholars have analyzed high-quality economic development(HED) influencing factors from many perspectives, but there are few studies on green finance(GF) and high-quality economic development(HED). we examine the logical link between green financing and high-quality economic development, as well as the transmission mechanism behind this relationship. Using data from 30 Chinese regions from 2011 to 2021, our empirical study shows that green financing may improve high-quality economic development. Several robustness tests show that this association exists. Furthermore, our findings indicate that more robust government governance and market synergy may promote green finance for high-quality economic development. Green finance can enhance high-quality economic development by minimizing resource mismatch and encouraging green technology advancement. Simultaneously, green finance for high-quality economic development is significantly heterogeneous. Green credit and green insurance are important forms of support for promoting high-quality economic development, with significantly higher impacts in the eastern regions than in the central and western regions. Our research offers policymakers insights on encouraging green finance growth in China.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Sustainable development is defined by the United Nations World Commission on Environment and Development as “development that meets the needs of the present without compromising the capacity of future generations to meet their needs.” All nations now agree that achieving sustainable development is the best way to advance economic growth and safeguard the environment on a global scale. In general, sustainable development is separated into “external response” and “internal response (Hák et al. 2016; Sachs et al. 2019; Vinuesa et al. 2020).” From the standpoint of “external response,” it is necessary to address the human-nature relationship, because human survival and development cannot be separated from the supply of natural resources and ecological services, as well as the challenges and pressures brought by natural evolutionary processes. Regarding “internal response,” the ability to foster social order, organization, logical cognition, social harmony, and the capacity to deal with varied social interactions are key components of sustainable development as a new stage of human civilization. These abilities are necessary to accomplish overall sustainable advancement (Ding et al. 2021; Henderson and Loreau 2023).

The Chinese government also stated explicitly in Agenda 21 the objective of “establishing a sustainable economic and social system and maintaining a sustainable resource and environmental base.” China’s economy has risen at a rapid rate since its reform and opening up, but it has also caused considerable environmental harm (Lu et al. 2019; Xu et al. 2021;). How to deepen the practice of scientific development with Chinese characteristics; how to actively transform the development mode; how to further improve the national innovation capacity; how to build a resource-saving and environment-friendly society; how to achieve a harmonious socialist society; and how to avoid the “growth stagnation” and China’s economic development needs to prevent getting caught in the “Latin American trap development loop”.

Environmental hazards are increasingly being considered by financial institutions in the context of sustainable economic growth goals. In particular, following the well-known Love River incident in the United States in the late 1970s, financial institutions clarified their environmental responsibilities, and in 2003, several global multinational financial institutions jointly launched the Equator Principles as a common benchmark and risk management framework for financial institutions to identify, assess, and manage environmental and social risks when financing projects. Although academic study on themes linked to green finance has increased in recent years, there is still no single accounting standard for the sector, which is the key finding of this paper’s investigation.

The growth of green finance has become an essential national plan and an unavoidable trend for the development of China’s financial industry, with the objective of carbon peaking and carbon neutrality (Zhao et al. 2022a, b; Qin et al. 2023). Green finance may help high-quality economic development in a variety of ways.

First, optimize financial capital allocation. Green finance has the potential to attract financial resources to green businesses, minimize investment in polluting industries, optimize industrial structure, and promote low-carbon economic growth(Sun and Chen 2022; Ran et al. 2023). Second, to promote green technical advancement. technical advancement is an essential driving factor for high-quality economic development, and green financing plays a significant role in supporting innovation and technical progress. It can safeguard the environment while also promoting economic growth by promoting green technologies (Zhang et al. 2021a, b; Yu et al. 2021). Third, it minimizes the asymmetry of information. Because various investors have varying preferences and affordability for environmental risks, the more open the information on business environmental hazards, the more efficient the decision-making of investors (Muganyi et al. 2021; Xu et al. 2022). By giving knowledge on environmental concerns, green finance may increase market efficiency and support economic development. There are market failures such as externalities, public goods, and information asymmetries in the process of green finance creation that cannot be handled only by the market’s spontaneous mechanism. Therefore, we chose two factors to examine the influence of green financing on high-quality economic development: government governance and market index.

This paper’s minor contributions are mostly the following three: First, the green finance development index is measured; second, the high-quality economic development index is re-measured; and third, green finance, government governance, market index, and high-quality economic development are all integrated in the same study framework, with an emphasis on the interaction between the variables.

The remainder of this article is divided into: the second part is a literature review; the third part is the data description and model construction; the fourth part is the analysis of empirical results; the fifth part is the mechanism test; the sixth part is heterogeneity analysis the seventh part is conclusions, policy recommendations, research shortcomings, and prospects.

Literature review

Green finance

Scholars from both home and abroad have contributed to the development of green finance from a variety of angles. Green finance is derived from environmental finance and sustainable finance, and it is the use of various financial mechanisms to safeguard the environment (White 1996; Gray 2002; Linnenluecke et al. 2016; Cunha et al. 2021; Kumar et al. 2022; Setyowati 2023). The essence of finance is to pool idle wealth to support and assist the actual economy’s development. Environmental finance was created to maintain a balanced relationship between human development and the natural environment, as well as to solve the problem of environmental externalities that the traditional economic system cannot solve, so that economic activities with positive externalities are effectively allocated resources and economic activities with negative externalities are not financially supported.

Hence, the essence of environmental finance is to function as the foundation of economic resource allocation. The G20 agreed that “green finance” refers to investment and financing activities that generate environmental benefits to support sustainable economic development in 2016, at the Chinese government’s initiative, and for the first time as a core topic. These environmental advantages include lowered greenhouse gas emissions, improved resource efficiency, decreased air, water, and soil pollution, and synergistic climate mitigation and adaptation.

Presently, there are two primary categories for green financing. One is environmental protection through green investing operations. According to the UN Sustainable Finance Expert Report, the world must invest $5 trillion to $7 trillion yearly in order to reach the 2030 UN Sustainable Development Goals. However, individual nations do not have enough financial resources to fill this enormous financing gap. In order to invest in green sectors and increase the leverage of financial resources, green finance can function as private sector funds. Second, green finance takes into consideration the information asymmetry brought on by environmental threats (Zhang et al. 2021a, b), includes environmental costs and risks into evaluation judgments, and directs diverse capital into green businesses.

Green finance is viewed by Chinese academics as a type of financial service that primarily supports risk management, investment, and financing services for green businesses and fosters the synergistic promotion of both economic growth and environmental protection. For instance, Wang and Wang (2021) hrough investment and financing practices, green finance directs the flow of financial capital to green sectors. The measurement of environmental value and its application to the distribution and assessment of financial resources are seen to be the key to green finance. In order to internalize the externalities of green development, quantify environmental costs and benefits, increase the financial sector’s preference for green projects, and decrease the financing of actual economic activities or assets that have a negative impact on the environment, financial instruments are thought to be necessary (Gao 1998; Wang et al. 2016; Liu and Wen 2019). Ma (2015) gave the first definition of green finance from the standpoint of policy tools, contending that it is a collection of institutional and policy arrangements for allocating social capital to the growth of green industries like environmental protection, energy conservation, clean energy, and transportation through financial services like goods, private equity funds, the issuance of bonds and stocks, and insurance.

High-quality economic development

Economic development has long been a contentious issue in economics. With GDP output as a measure and maximization of material wealth production and consumption as the primary goal, neoclassical economics exaggerates the role of material goods and marketing services on well-being without fully accounting for the opportunity costs and benefits of production and consumption on social and environmental aspects and fails to properly articulate or understand the environmental pressures, threats to public health, and social welfare posed by the traditional development paradigm (Guzman et al. 2018). Nordhaus (2019) argues that conventional means and policies may be used to control environmental challenges caused by economic expansion. According to Marxist political economics, the conflicting movement of productive forces and production relations is the basic driving force of human social progress. Economic development, on the other hand, is the process of constantly liberating and developing productive forces, resolving the ever-changing contradiction between productive forces and production relations, and creating new modes of production, which results in economic growth, increased wealth, and social progress. Specifically, technical advancement and increased exploitation of production factors enable the expansion of production scale.

Under the goal of carbon peaking and carbon neutrality, we believe that high-quality economic development is a new paradigm of green development that balances human capital, physical capital, natural capital, social capital, and other factors of production, aiming for “harmonious coexistence between man and nature.” From a macro viewpoint, high-quality economic development implies that supply and demand attain dynamic equilibrium in mutual impact, meaning economic growth stability, balanced development, environmental coordination, and social equality (Zhao et al. 2022a, b). From a meso viewpoint. high-quality economic development is represented in the industrial and regional industrial structure, as well as regional coordination (Zhu and Zhang 2021). From a micro viewpoint, high-quality economic development is manifested not only in the kind, quantity, and quality of products, but also in the growth of first-class companies, the creation of brand impact, and the happiness index of the people, among other things (Hwang and Hyun 2017).

Green finance and high-quality economic development

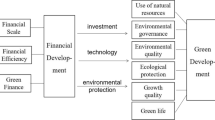

Green finance primarily impacts the high-quality economic development through processes such as financial support, resource allocation, and green technology creation. Green finance gives capital assistance to firms with low energy consumption, low pollution, and low emissions, whereas credit limits are imposed on enterprises with high energy consumption, high pollution, and high emissions. In terms of resource allocation, green finance may direct the flow of financial resources away from high-energy-consuming sectors and toward low-carbon businesses, therefore helping to improve the industrial structure. Zhang et al. (2022a, b) found that green credit policies can improve the efficiency of overseas investment by state-owned enterprises and firms in regions with low environmental regulations In terms of technical innovation, green finance may provide financial capital services for technological innovation, enhance energy use efficiency, and so support green industrial growth and minimize environmental pollution. Zhang et al. (2022a, b) found that green bonds can enhance enterprises’ ability to innovate green technology by increasing the proportion of long-term loans and improving their debt structure. Figure 1 depicts the link between green financing and high-quality economic development.

Empirical model and methodology

Econometric models

We create fundamental economic models to analyze the connection between green financing and high-quality economic development.

Formula (1), the high-quality economic development index (HED), the green financial index (GFI), and other elements impacting the high-quality economic development are denoted by the letters X. Additionally, the temporal and distinct fixed effects are regulated individually. \({\varepsilon }_{it}\) represents the phrase for random disruption.

We employ a one-period lag of green financing as an explanatory variable without taking into consideration the omitted factors or endogeneity. It is crucial that the explanatory variable has a one-period lag since there is a time lag involved in the process of how green financing affects the top economic. In the endogeneity test, we used the model listed below.

We used two variables, the government’s management and market index, to create a novel econometric model to examine the function of government management and market in green finance for high-quality economic development.

Where GM stands for government’s management and MI stands for market index, a significant coefficient shows that government governance and the market may support green financing for high-quality economic development.

Variable descriptions and data sources

High-quality economic development

The academic community is still divided on how to quantify and assess the extent of high-quality economic development effectively. Single and comprehensive indicators are primarily measured in two ways: total factor productivity, green total factor productivity, real GDP per capita, the contribution of technological progress to economic growth and welfare, and ecological intensity as a substitute for economic quality development. However, economic growth considers not only inputs and outputs to assess the quality of economic growth, but also economic development, ecological civilization, and human health.

Based on scholarly perspective, we choose five secondary indicators: industrial structure, inclusive TFP, technical innovation, residents’ living, and ecological environment, to create a complete assessment index of high-quality economic development (HED). Table 1 provides a more detailed description of the factors used to define HED.

Green finance

There is no universal definition of green finance. In the available literature, there are primarily two sorts of methodologies for measuring green finance: comprehensive index systems and capital allocation indexes. Capital allocation statistics cannot fully capture green financing. In theory, a complete indicator system can track the evolution of green finance in more depth. As a result, the green finance indicator (GFI) system is measured using green credit, green securities, green investment, and green insurance. Table 2 provides a more detailed description of the factors used to define GFI.

Government management and market

The government plays a critical role in the advancement of green finance. For example, enterprise carbon information disclosure is woefully inadequate, and there are high polluting firms bleaching green, which has a negative impact on the efficiency of green financial investment. Through fiscal investment, the government may leverage additional social capital, for as by establishing a green sector development fund. To eliminate information asymmetry, provide public products and build a green project bank. There are few existing green financial goods on the market, and the market mechanism is not flawless, thus a perfect carbon trading market and green financial market must be established. As a result, we selected two variables, governance government, and market index, to examine the influence of green financing on high-quality economic development in the context of the synergistic effect of government management and market.

Control variables

As control variables, we select R&D investment(RD), GDP per capita(PGDP), industrial structure(IS), foreign investment(FI), urbanization level(UL), and technology level(TL). R&D investment, for example, is based on the actual input value; GDP per capita is based on the ratio of total population to GDP; industrial organization is based on the ratio of tertiary industry output to GDP; foreign investment is based on the ratio of actual foreign investment utilized by each province to GDP; urbanization is based on the ratio of urban population to total population; and science and technology is based on the ratio of government science and technology expenditure to total expenditure. Table 3 reports standard descriptive statistics of our variables.

Data source

Data for this article were obtained from the EPS database, the China Statistical Yearbook, and the China Environmental Statistical Yearbook. From 2010 to 2021, the indicators of green finance and high-quality economic development in 30 Chinese provinces and regions were chosen.

Results and discussion

Baseline regression analysis

Table 4 shows the results of the benchmark regression. Three different methodologies are employed to empirically examine the effect of green financing on high-quality economic development. Model (1) solely accounts for fixed effects. Since green finance’s regression coefficient is positive and significant at the level of 1%, it can successfully encourage the growth of high-quality economic development. Model (2) includes control variables to lessen the endogeneity bias brought on by leaving out elements linked to the significant explanatory variables. The coefficient of green finance stays positive and passes the 1% level test. Following Bai (2009) methodology, individual and time interaction terms are added to the model as substitutes for the multidimensional omitted variables. Both individual and time effects are added to the model in a unidimensional form, resulting in individual heterogeneity that may affect individuals over time.Green finance can continue promoting high-quality economic development in Model (3), with the addition of the province and time interaction conditions. According to the three models discussed above, green finance may effectively encourage the growth of high-quality economic development for the following three reasons. Firstly, green finance has a capital guidance role that only supports green businesses, such as the environmental protection and high-tech sectors, and the interest rate is low, which lowers the cost of financing for green industries. Second, green finance may encourage the complementary growth of businesses and create a scale effect, improving enterprises’ competitiveness in the green market. Third, green financing may reflect market capitalization rates, fostering industry growth while fostering brand and green technology development, all contributing to the high-quality economic development.

Endogeneity test

Although the benchmark regression tests the association between green financing and high-quality economic development in a different way, endogeneity between the two cannot be ruled out. The endogeneity problem must be tested using the instrumental variables technique. The instrumental variable is the distance from each province’s capital city to the port (Du et al. 2023). The greater the distance between the capital city and the port, the more skewed it is toward the central and western regions, the slower the economic development and the less developed the green finance, and the closer the distance to the port, the more skewed it is toward the eastern region, the better the green finance development.In reality, the growth of green finance in China is marked by a developed green financial system in the east and a slower development of the green financial system in the center and west. Additionally, the distance between the port and the province capital city is consistent and satisfies the exogenous requirement. We test using 2SLS.

Table 5 shows the regression results using the 2SLS method.In the first stage, there was a significant negative correlation between port distance and green finance, indicating that the farther the port is, the less developed the green financial system is.In the second stage, green finance and high-quality economic development showed a significant positive correlation, indicating that green finance can effectively promote high-quality economic development.It can show that the use of the distance from the capital city to the port can solve the endogenous problem between green finance and high-quality economic development.

Robustness tests

Table 6 displays the results of the robustness tests. Model (1) employs a one-period lag of green finance as an explanatory variable, and the findings demonstrate that the coefficient is positive and significant at the 5% level, successfully contributing to high-quality economic development.Model (2) applies a shrinkage treatment to eliminate the detrimental impact of outliers and variable non-randomness on the outcomes. Green financing coefficient is positive and 1% significant.Model (3) eliminates four Chinese cities due to their distinct policies: Beijing, Tianjin, Shanghai, and Chongqing. The study re-estimates the data and concludes that green financing is vital for high-quality economic development.

Function of market indices and governmental governance

Green finance plays an essential role in improving capital allocation efficiency. Hence, we must develop a solid green system.The government must play an important role, government should develop necessary supporting policies, such as fiscal and subsidy programs. Create more environmentally friendly financial products and data centers and information platforms for financial institutions and businesses.At the same time, the market mechanism must play a crucial role. Thus, the market index is critical to the advancement of green finance. This part of the data comes from the digital government development index report published by the data governance research center of tsinghua university.

Table 7 depicts the importance of government governance and market indicators in the development of green finance and high-quality economic development. Model (1) estimates the outcomes of government governance. At the 5% level, the coefficient is positive and significant, indicating that improved government governance would assist to boost the role of green financing in high-quality economic development. Model (2) provides the projected market index findings. The coefficient is positive and significant at the 10% level, demonstrating that the market is essential in top-notch growth and green finance. Model (3) presents the predicted outcomes of combining government governance and a market index. At 5%, the coefficient is positive and significant. The combination of the two can help to advance green finance’s role in high-quality economic development.

Mechanism test

We used capital mismatch (CM), trade export (TE), and green technology (TE) as mechanism variables to examine the influence mechanism between green finance and high-quality economic development. The capital mismatch is chosen as a mediating variable in this work to reflect the status of capital allocation, which is one of the dangers of financial institutions, and the capital mismatch index of each province is assessed. Regarding trade export, trade export is chosen as a mediating variable to reflect each province’s total exports. Green technology is chosen as a moderating variable to represent the number of green technology inventions in each province. In order to fully test the influence mechanism, the following model is set for testing in this paper.

Equation (6) tests whether the mechanism exists, focusing on the coefficient of β1. If β1 passes the significance level test, it indicates that green finance can promote high-quality economic development through capital allocation, export trade and green technology. Equation (7) is to test whether the joint influence mechanism of green finance with government governance and market index exists. It is important to pay attention to, if passing the significance level test, it indicates that green finance synergistically promotes economic high-quality economic development with government governance and market indexes.

The findings of the mechanism test are shown in Table 8. The coefficient of green financing is negative significant at the 10% level, suggesting that green finance lowers capital mismatch, according to the data in column 1. Green finance development directs the flow of financial capital to green industries, while the flow of capital to heavy polluting industries gradually decreases; heavy polluting industries do not meet the requirements of high-quality economic development and are gradually banned, and capital flows to heavy polluting industries will result in capital bad debts. Column 4 results show that the coefficient of synergy between green finance and government governance and market index is negative and significant at the 1% level, indicating that government governance and market can significantly improve green finance to reduce capital mismatch and strengthen the function of green finance to guide the flow of financial capital.

The data in column 2 reveal that green finance has little influence on trade exports. The results in column 5 reveal that green financing does not pass the significance test for trade exports when government governance and market are combined. This suggests that green finance has a large “cost effect,” which raises company production costs and reduces the competitiveness of export products under the strain of environmental regulation.

Column 3 data demonstrate that the green finance coefficient is positive and significant at the 10% level, demonstrating that green financing can boost the development of green technology. Column 6 data suggest that green financing is more important in fostering green technology due to the synergistic effect of government governance and the market. It suggests that government governance and the market can accelerate the advancement of green technology and that the advancement of green technology can better foster high-quality economic development.

Heterogeneity test

Because of the considerable disparities in resource endowment, green finance development status, and economic base development level among Chinese provinces, green finance development may have a heterogeneous influence. As a result, we examine the diverse impact of green finance primarily at two levels: distinct characteristics of green finance development and geographical location.

Table 9 displays the effects of several characteristics of green financing on high-quality economic development. Green finance is made up of four components: green credit, green securities, green investment, and green insurance. Column 1 demonstrates that the green credit coefficient is positive and significant at the 1% level, implying that green credit may foster high-quality economic development. Indeed, green credit is an important component of green finance, and various financial institutions have launched green credit businesses, primarily investing in green industries, as the economy’s green and low-carbon transformation has broadened the green credit business for financial institutions.

The impacts of green securities in column 2 and green investment in column 3 on high-quality economic development fail the significance test. At the moment, the development level of green finance in China is not high, the mechanism of the green finance market is not flawless, and the operation efficiency of the green finance market is poor, limiting the market’s development to some extent. Simultaneously, certain green businesses have long investment cycles and certain dangers, resulting in a lack of enthusiasm for the growth of green investment and green securities.

The coefficient of green insurance is positive and significant at the 1% level, showing that green insurance is vital for high-quality economic development, according to the data in column 4. Indeed, green insurance, as a risk protection mechanism for the growth of green sectors, plays a critical role in assisting the green transformation and low carbon development of the economy and society.

Table 10 shows the consequences of regional disparities in green financing on high-quality economic development. The results in column 1 demonstrate that the coefficient of green finance is positive and significant at the 1% level, demonstrating that green finance is essential in the eastern region’s economic development. Indeed, eastern China’s economic and industrial basis is stronger, demand for green financing is high, and green finance and low-carbon economies have a good dynamic promotion link. Column 2 demonstrates how green financing aids economic development in the center area, which has a less established and stable banking system than the East. Column 3 demonstrates that green finance fails the significance level test on the economic development of the Western region, which has a lower level of economic development, a fragile ecological environment, a less developed green financial system, and a lack of talent and technology.

Conclusion and policy recommendations

We focused on the mechanism of green finance’s influence on high-quality economic development in the context of economically sustainable development goals. Based on that, we created a complete index of high-quality economic development. The study uses panel data from 30 Chinese provinces from 2010 to 2021 to build an econometric model that experimentally examines the influence of green finance on high-quality economic development. The results demonstrate that (1) green financing may considerably support high-quality economic development, and that this influence is magnified by the interaction between market forces and governmental regulation. The instrumental variables and endogeneity tests confirm that green financing influences high-quality economic development. (2) Green finance primarily supports green technologies and high-quality economic development by allocating financial resources efficiently. Its effects are amplified by market and governmental regulation. (3) The impact of green finance on high-quality economic development is heterogeneous, and green credit and green insurance are the key ways in which it manifests itself. Regarding regional variations, eastern areas greatly outperform central and western regions in terms of the manner in which green money affects high-quality economic development.We suggest the following policy recommendations based on the aforementioned research findings.

First, prioritize the overall and coordinated growth of green finance, and support green finance development in all Chinese provinces. Second, it plays an important role in government governance by creating a directory of green sector growth, reducing information asymmetry, and actively promoting the development of green securities and green investments. Implement rules and regulations that require financial institutions and businesses to report their carbon intensity, carbon footprint, and high-carbon assets in order to stimulate low-carbon investments. Third, market-oriented reforms should be maintained to encourage private sector investment in green sectors, increase market competitiveness, and optimize resource allocation. At the same time, there is still a need for innovative green financial regulation to prevent the negative repercussions of excessive green finance development.

This work examines the link between green financing and high-quality economic development at the provincial level. Future research should examine this relationship at the enterprise county and enterprise levels. With the growth of green finance, it will be possible to investigate the relationship between green finance and high-quality economic development on a wider scale.

Data availability

The datasets analyzed in the study can be obtained from the corresponding author on reasonable request.

References

Cunha FAFS, Meira E, Orsato RJ (2021) Sustainable finance and investment: Review and research agenda. Bus Strat Environ 30.8:3821–3838

Ding X, Cai Z, Fu Z (2021) Does the new-type urbanization construction improve the efficiency of agricultural green water utilization in the Yangtze River Economic Belt? Environ Sci Pollut Res 28:64103–64112. https://doi.org/10.1007/s11356-021-14280-z

Du J, Shen Z, Song M, Vardanyan M (2023) The role of green financing in facilitating renewable energy transition in China: Perspectives from energy governance, environmental regulation, and market reforms. Energy Econ 120:106595. https://doi.org/10.1016/j.eneco.2023.106595

Gao J (1998) Green finance and sustainable development of finance. Financial Theory and Teaching 4:20–22 (in China)

Gray R (2002) Of messiness, systems and sustainability: towards a more social and environmental finance and accounting. Br Account Rev 34(4):357–386

Guzman M, Ocampo JA, Stiglitz JE (2018) Real exchange rate policies for economic development. World Dev 110:51–62

Hák T, Janoušková S, Moldan B (2016) Sustainable development goals: a need for relevant indicators. Ecol Ind 60:565–573

Henderson K, Loreau M (2023) A model of sustainable development goals: challenges and opportunities in promoting human well-being and environmental sustainability. Ecol Model 475:110164

Hwang J, Hyun SS (2017) First-class airline travellers’ perception of luxury goods and its effect on loyalty formation. Curr Issues Tour 20.5:497–520

Kumar S, Sharma D, Rao S, Lim WM, Mangla SK (2022) Past, present, and future of sustainable finance: insights from big data analytics through machine learning of scholarly research. Ann Oper Res. https://doi.org/10.1007/s10479-021-04410-8

Linnenluecke MK, Smith T, McKnight B (2016) Environmental finance: A research agenda for interdisciplinary finance research. Econ Model 59:124–130

Liu X, Wen S (2019) Should financial institutions in China bear environmental responsibility? –Basic facts, theoretical models and empirical tests. Econ Res 54.03:38–54

Lu Y et al (2019) Forty years of reform and opening up: China’s progress toward a sustainable path. Sci Adv 5.8:eaau9413

Ma J (2015) On building China’s green financial system. Financ Forum 20.05:18–27

Muganyi T, Yan L, Sun H-P (2021) Green finance, fintech and environmental protection: evidence from China. Environ Sci Ecotechnol 7:100107

Nordhaus W (2019) Climate change: The ultimate challenge for economics. Am Econ Rev 109(6):1991–2014

Qin M et al (2023) Blockchain market and green finance: The enablers of carbon neutrality in China. Energy Econ 118:106501

Ran Q, Liu L, Razzaq A, Meng Y, Yang X (2023) Does green finance improve carbon emission efficiency? Experimental evidence from China. Environ Sci Pollut Res 30(16):48288–48299. https://doi.org/10.1007/s11356-023-25571-y

Sachs JD et al (2019) Six transformations to achieve the sustainable development goals. Nat Sustain 2.9:805–814

Setyowati AB (2023) Governing sustainable finance: insights from Indonesia. Climate Policy 23(1):108–121

Sun H, Chen F (2022) The impact of green finance on China’s regional energy consumption structure based on system GMM. Resour Policy 76:102588

Vinuesa R et al (2020) The role of artificial intelligence in achieving the Sustainable Development Goals. Nat Commun 11.1:233

Wang X, Wang Y (2021) A study on green credit policies to enhance green innovation. Manage World 37.06:173–188+11

Wang Y, Pan D, Zhang X (2016) A Study on the contribution of green finance to China’s economic development. Comp Econ Soc Syst .06:33–42

White MA (1996) Environmental finance: value and risk in an age of ecology. Bus Strat Environ 5(3):198–206

Xu C et al (2021) Pollution haven or halo? The role of the energy transition in the impact of FDI on SO2 emissions. Sci Total Environ 763:143002

Xu Y et al (2022) How environmental regulations affect the development of green finance: Recent evidence from polluting firms in China. Renew Energy 189:917–926

Yu C-H et al (2021) Demand for green finance: Resolving financing constraints on green innovation in China. Energy Policy 153:112255

Zhang D et al (2021a) Public spending and green economic growth in BRI region: mediating role of green finance. Energy Policy 153:112256

Zhang S et al (2021b) Fostering green development with green finance: An empirical study on the environmental effect of green credit policy in China. J Environ Manage 296:113159

Zhang J, Yang G, Ding X et al (2022a) Can green bonds empower green technology innovation of enterprises? Environ Sci Pollut Res. https://doi.org/10.1007/s11356-022-23192-5

Zhang J, Luo Y, Ding X (2022b) Can green credit policy improve the overseas investment efficiency of enterprises in China? J Clean Prod 340:130785

Zhao Xin et al (2022a) Challenges toward carbon neutrality in China: StraHEDies and countermeasures. Resour Conserv Recycl 176:105959

Zhao Xin et al (2022b) Does green innovation induce green total factor productivity? Novel findings from Chinese city level data. Technol Forecast Soc Change 185:122021

Zhu B, Zhang T (2021) The impact of cross-region industrial structure optimization on economy, carbon emissions and energy consumption: A case of the Yangtze River Delta. Sci Total Environ 778:146089

Funding

This work was supported by the following funding:

This research is supported by the Applied research Project on Humanities and Social Sciences in Shandong Province (2021-YYJJ-01).

Author information

Authors and Affiliations

Contributions

JH: Methodology; conceptualization; administration; writing originalmanuscript; QL: Writing original manuscript; validation; formal analysis DX: Writing; editing; reviewing; writing original manuscript; visualization AS: Writing original manuscript; data curation: CI: Writing, review and editing; corrections.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

NA.

Consent for publication

NA.

Conflicts of interest

The authors declare no conflict of interest.

Additional information

Responsible Editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Han, J., Zheng, Q., Xie, D. et al. The construction of green finance and high-quality economic development under China’s SDGs target. Environ Sci Pollut Res 30, 111891–111902 (2023). https://doi.org/10.1007/s11356-023-28977-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-28977-w