Abstract

We investigate volatility contagion across G7 stock markets and the market for crude oil for the period between 2007 and 2021. Following the work of Balcilar et al. (2021), we utilise the TVP-VAR extended joint connectedness method and compare results to the standard TVP-VAR method that predicates upon the normalisation approach by Diebold and Yılmaz (2009, 2012, 2014). Both methods provide qualitatively similar results. Overall, findings suggest that connectedness in this network is highly responsive to events that greatly affect international financial markets and assume large values across the sample period. Prominent among our results is that the crude oil market is an important net transmitter of volatility shocks across the network during the 2014 oil collapse period. In addition, the period from the beginning of 2018 and until mid-2019 is a rather turbulent period for stock markets a fact which is reflected upon the net receiving character of the market for crude oil. Finally, we show that the Canadian stock market is a persistent net transmitter of volatility in recent years, following developments in international trade and the outbreak of the COVID-19 crisis.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

JEL codes

1 Introduction

The link between crude oil and financial markets is a well-researched topic in the relevant empirical literature. Over the years, researchers have focused on various aspects of this interaction considering the importance and the repercussions of developments in crude oil for financial markets. What is more, the examination of this interaction has become more crucial in the light of the increased financialisation of the market for crude oil which was initially reflected upon huge investment activity in commodity exchanges around 2004 (see Silvennoinen & Thorp, 2013).

Some of the most popular strands of the relevant literature include studies that investigate (i) whether stock market responses to developments in the market for crude oil depend on the nature of the economy under examination and more particularly, on whether the stock market response involves either a net oil exporting or a net oil importing country and (ii) whether stock market responses are triggered by either demand-side or supply-side developments in the market for crude oil. As far as the first strand is concerned, the basic argument is that net oil exporting countries enjoy increased revenue when oil prices rise—a fact that, mitigates the negative impact from higher oil prices on cost push inflation and could even be suggestive of a positive reaction from the stock market. Relevant studies in this line of research which considers the distinction between net oil importing and net oil exporting countries include, among others, Filis et al. (2011), Filis and Chatziantoniou (2014), Lee et al. (2017), Degiannakis and Filis (2018), Chkir et al. (2020), Jiang and Yoon (2020).

In turn, the basic argument of the second popular strand in existing relevant literature is that a shock in the price of oil may differ in its outcome depending on whether the shock originates in either the demand or the supply side. For example, it may be the case that hikes in the price of oil due to disruptions in oil production (i.e., supply-side shock) may indeed act as the bellwether for bad news in global financial markets. Nonetheless, an increase in the price of oil that occurs due to higher demand for oil in a period of rapid economic growth might actually be perceived as good news. For a more thorough analysis with regard to this strand, the reader is directed to the seminal work by Hamilton (2009a, 2009b) and Kilian (2009), but also to authors such as Antonakakis et al. (2014, 2017), Kang et al. (2017), as well as, Kwon (2020).

Following these two important strands that we mention above, another related strand in existing literature is the distinction between the effects of oil shocks on stock market volatility and the effects on stock market returns. The crucial point here is to highlight the inverse relation; that is, to note that when an oil price shock increases stock market volatility then it should have a diminishing impact on stock market returns and vice versa. Authors who have considered the difference between stock market returns and volatility include, among others, Degiannakis et al. (2014), Kang et al. (2015), and Antonakakis et al. (2017).

Nonetheless, there are factors that affect the volatility in the market for crude oil as well. In this regard, aspects that affect the latter have also been investigated in existing literature. Relevant studies include, among others, Efimova and Serletis (2014), Phan et al. (2016), Chatziantoniou et al. (2019). Among other factors, the impact from uncertainty in international financial markets has been stressed by authors such as Chatziantoniou et al. (2021a). Besides, the correlation between volatility in the market for oil and volatility in various stock markets has been investigated in the work by Boldanov et al. (2016) who document that the nature of the correlation is rather dynamic and depends on the ensuing events of each period. It follows that, there clearly is a link between the market for oil and the stock market and thus, the investigation of the potential for volatility contagion becomes crucial in order to better understand developments in these markets.

With these in mind, the objective of this study is to shed additional light upon the linkages between volatility in the market for crude oil and stock market volatility in G7 countries. Recent developments such as the decision by the US to revise tariffs—which affected bilateral trade with countries such as Canada or China, or the outbreak of the COVID-19 pandemic—which resulted in a remarkable drop in global demand (i.e., including demand for oil), make this topic particularly timely for the countries under investigation which are substantially exposed to international trade.

In this study we are particularly interested in the investigation of possible channels of volatility transmission across the markets of interest. To this end, we employ connectedness as the means to accomplish our research objective. More particularly, we focus on the time-varying parameter vector autoregressive (TVP-VAR) extended joint connectedness method (see Balcilar et al., 2021) which constitutes an augmented version of the standard TVP-VAR connectedness method (see Antonakakis et al., 2020; Chatziantoniou & Gabauer, 2021; Gabauer & Gupta, 2018). At this point, it should be noted that standard connectedness methods originate in the work of Diebold and Yılmaz (2009, 2012, 2014). In these studies, dynamic connectedness is obtained through the popular rolling-windows approach. Nonetheless, the development of the TVP-VAR presents certain advantages over the standard rolling-windows approach. More particularly, the TVP-VAR method ensures that (i) there is no arbitrary choice either of the forecast horizon or of the window-length, (ii) there is no distortion due to outlier values, and (iii) no observations are being left out (i.e., as is inevitably the case when we use rolling windows). In turn, the Balcilar et al. (2021) TVP-VAR extended joint connectedness approach further refines existing TVP-VAR methods by considering an alternative way of normalising connectedness measures (see also the description of the method in Sect. 6.3 of the present study). It would also be instructive at this point to note that in the interests of robustness, in this study we present results both for the standard TVP-VAR method (i.e., which predicates upon the initial normalisation approach by Diebold and Yılmaz (2014) and from the TVP-VAR extended joint connectedness approach which predicates on the normalisation approach by Lastrapes and Wiesen (2021). In this respect, the contribution of this study rests mainly with its empirical application. That is, we consider two closely related connectedness methods to the effect that we obtain robust results and be more confident in our conclusions about the underlying relations.

Turning to the main findings of the study, first and foremost, we should highlight that we obtain qualitatively similar results from both methods (i.e., considering the direction of connectedness and the distinction of the variables of the network between net transmitters and net recipients) with only minor differences associated with the magnitude of connectedness. This fact adds to the robustness of our approach and lends additional gravity to the relevant arguments. Findings further suggest that volatility connectedness in this network fluctuates around relatively high levels over time—which is indicative of the increased contagion potential across the variables of the network. What is more, total dynamic connectedness appears to be highly responsive to major events that affected international financial markets throughout the sample period. In addition, we find that some of the variables of the network may shift from dominant net transmitters to major net recipients of uncertainty shocks within the network. The market for crude oil is a striking example of this finding, considering that it assumes an important role as a net transmitter of spillover shocks around the time of the oil price collapse in 2014 while, it clearly receives shocks, on net terms, from capital markets between 2018 and 2019. In line with the discussion above, the period around 2019 was a very turbulent period for international financial markets reflecting to a great extent development on international trade. This is also a period when the French stock market switches into a net transmitting position. The stock markets of Germany, Italy, and Japan remain for the most part on the receiving end of spillover uncertainty shocks while the UK stock market assumes a considerable net transmitting role around the time of the EU referendum. The US stock market is a principal net transmitter of uncertainty in the system almost throughout the entire period of study until early 2018. From then on—during a period that was severely marked by trade rearrangements and the outbreak of the COVID pandemic, the Canadian stock market becomes the dominant net transmitter in this network; a fact that further highlights the importance of this major export economy for volatility in international financial markets.

Investigating the linkages and the contagion potential across a network of variables helps attain a better understanding of the relevant transmission channels through which uncertainty propagates a system and fuels reactions. By examining dynamic connectedness within this specific network, policymakers may draw additional information which could prove particularly useful when considering, for example, the negative effects of turbulent crude oil markets. Furthermore, in view of the recent financialisation of commodity markets, the investigation of the mechanisms through which volatility affects performance could further facilitate portfolio managers to develop appropriate diversification strategies especially during times of financial turmoil. In this regard, dynamic connectedness measures constitute a crucial tool for the arsenal of decision making.

The remainder of this chapter is organised as follows. In Sect. 6.2, we set out the data and the market proxies that we have included in the study. Then, in Sect. 6.3 we describe the employed methods highlighting the main difference between the standard TVP-VAR approach and the TVP-VAR approach which predicates upon the extended joint connectedness approach. In turn, we present the findings of the study and proceed with a relevant discussion of the main findings in Sect. 6.4. Finally, Sect. 6.5 concludes the chapter.

2 Data

This study employs a daily dataset retrieved from yahoo finance comprising crude oil and stock market indices of all G7 countries. In more details, we cover the American S&P 500, Canadian S&P/TSX, British FTSE 100, German DAX 30, French CAC 40, Italian FTSE MIB, and Japanese Nikkei 225 index. Our data spans over the period from 2nd January 2007 to 30th April 2021. We calculate daily annualised daily per cent standard deviation in the spirit of Parkinson (1980):

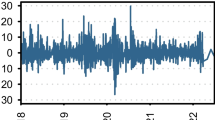

where \(x_{it}^{max}\) and \(x_{it}^{min}\) are the highest and lowest price of variable i on day t, respectively. The transformed series are shown in Fig. 6.1.

(Notes Series are calculated based on Parkinson [1980])

Crude oil and stock market returns

Table 6.1 shows that crude oil has by far the highest average variance among all series, followed by the Italian and German stock market indices. All transformed series are significantly non-normally distributed according to the Jarque and Bera (1980) normality test which is also supported by the fact that all series appear to be right skewed and leptokurtic distributed on the 1% significance level. Furthermore, all variables are significantly autocorrelated, exhibit ARCH errors, and are stationary according to the Elliott et al. (1996) unit-root test on the 1% significance level. Those results are suggestive that modeling the volatility transmission mechanism between crude oil and the G7 stock market indices applying a TVP-VAR model is appropriate.

3 Methodology

The connectedness approach proposed by Diebold and Yılmaz (2009, 2012, 2014) allows to monitor and evaluate the transmission mechanism within a predetermined network. This supports in general policymakers to adequately adjust economic and political strategies in order to mitigate adverse effects that propagate from shocks in specific variables/sectors. Therefore, it is of essential importance that spillovers and the relative strength of shocks are accurately measured and investigated.

The relevance and applicability of this framework already led to multiple improvements and extensions overcoming two major shortcomings which are that (i) the original dynamic approach rests on a rolling-window VAR—that requires to choose a rolling-window size—and (ii) that the GFEVD normalization is suboptimal (Caloia et al., 2019). The first issue has been tackled by Antonakakis et al. (2020) who propose a TVP-VAR based connectedness approach to (i) overcome the arbitrarily chosen VAR window size, (ii) be less sensitive to outliers, (iii) to monitor more accurately the parameter changes, and (iv) avoid the loss of observations. A solution for the second shortcoming has been suggested by Lastrapes and Wiesen (2021) who derived a normalization method based upon the goodness-of-fit measure \(R^2\). Their so-called joint spillover index leads to a more natural interpretation of connectedness measures and also to a more accurate illustration of the propagation mechanism at hand. These two concepts have been combined and extended in Balcilar et al. (2021) who even allowed to examine the net pairwise directional connectedness measure in a joint connectedness setting which has previously not been possible. Additionally, the TVP-VAR based extended joint connectedness approach includes all aforementioned advantages over the original connectedness approach of Diebold and Yılmaz (2009, 2012, 2014).

To explore the volatility propagation mechanism between crude oil and the G7 stock market indices, we first estimate a TVP-VARFootnote 1—with a lag length of order one as suggested by the Bayesian information criterion (BIC)—which can be outlined as follows,

where \(\boldsymbol{y}_t\), \(\boldsymbol{y}_{t-1}\) and \(\boldsymbol{\epsilon }_t\) are \(K \times 1\) dimensional vector and \(\boldsymbol{B}_t\) and \(\boldsymbol{\Sigma }_t\) are \(K\times K\) dimensional matrices. \(vec(\boldsymbol{B}_t)\) and \(\boldsymbol{v}_t\) are \(K^2 \times 1\) dimensional vectors whereas \(\boldsymbol{R}_t\) is a \(K^2\times K^2\) dimensional matrix. Subsequently, the TVP-VAR is transformed to a TVP-VMA according to the Wold representation theorem: \(\boldsymbol{y}_t = \sum ^{\infty }_{h=0}\boldsymbol{A}_{h,t} \boldsymbol{\epsilon }_{t-i}\) where \(\boldsymbol{A}_{0}=\boldsymbol{I}_K\).

3.1 TVP-VAR Based Connectedness Approach

We start with the TVP-VAR based connectedness approach as some prior knowledge and definitions are required for better understanding the TVP-VAR extended joint connectedness approach. The TVP-VAR based connectedness approach (Antonakakis et al., 2020) is based upon the H-step ahead generalised forecast error variance decomposition (GFEVD) (Koop et al., 1996; Pesaran & Shin, 1998) which represents the effect a shock in series j has on series i. This can be mathematically formulated as follows:

where \(\boldsymbol{e}_i\) is a \(K \times 1\) zero selection vector with unity on its ith position and \(\phi ^{gen}_{ij,t}(H)\) is the unscaled GFEVD (\(\sum ^K_{j=1} \zeta ^{gen}_{ij,t}(H) \ne 1\)). Based upon the work of Diebold and Yılmaz (2009, 2012, 2014) the unscaled GFEVD is normalised to unity by dividing it by the row sum which leads to the scaled GFEVD, \(gSOT_{ij,t}\).

The scaled GFEVD is the fundament on which all other connectedness measures can be calculated. The total directional connectedness from all others to series i and the total directional connectedness to all others from a shock in series i which represents by how much the network influences series i and how much series i influences the predetermined network, respectively, can be computed as follows:

Based upon the previous two measures the net total directional connectedness of series i can be calculated which can be interpreted as the net influence of series i on the network,

If \(S^{gen,net}_{i,t}>0\) (\(S^{gen,net}_{i,t}<0\)), series i is influencing (influenced by) all others more than being influenced by (influencing) them and thus is considered as a net transmitter (receiver) of shocks indicating that series i is driving (driven by) the network.

At the core of the connectedness approach is the total connectedness index (TCI) which highlights the degree of network interconnectedness and hence its market risk. The TCI is equal to the average total directional connectedness from (to) others and can be outlined by the following:

A high (low) value implies that the market risk is high (low).

Finally, the connectedness approach supplies also information on the bilateral level. The net pairwise directional connectedness illustrates the bilateral power between series i and j,

If \(S^{gen,net}_{ij,t}>0\) (\(S^{gen,net}_{ij,t}<0\)), series i dominates (is dominated) series j which means that series i influences (is influenced by) series j more than being influenced by it.

3.2 TVP-VAR Based Extended Joint Connectedness Approach

The main difference between the joint and the original connectedness approach is that the normalization method is not chosen arbitrarily but derived from the popular \(R^2\) goodness-of-fit measure.Footnote 2 \(S^{jnt,from}_{i \leftarrow \bullet ,t}\) represents the impact all variables in the network have on variable i. This can be mathematically formulated by:

where \(\boldsymbol{M}_i\) is a \(K \times K-1\) rectangular matrix that equals the identity matrix with the ith column eliminated, and \(\boldsymbol{\epsilon } \forall \ne i\), \(t+1\) denotes the \(K-1\)-dimensional vector of shocks at time \(t+1\) for all variables except variable i. In the next step, the joint total connectedness index is calculated as follows,

which is within zero and unity opposed to the TCI of the originally proposed approach as shown in Chatziantoniou and Gabauer (2021) and Gabauer (2021).

An important extension of Balcilar et al. (2021) is that multiple scaling factors are used to link gSOT to jSOT:

Based upon this equality, the total directional connectedness from variable i to all others, the net total directional and the net pairwise directional connectedness measures can be calculated as well:

4 Results and Discussion

In this section, we set out the main findings of the study based on extended joint connectedness and elaborate on the corresponding implications. In the interests of comparison, we also include the results from the standard TVP-VAR connectedness approach. Please be reminded that the TVP-VAR extended joint connectedness approach practically constitutes a refined version of the standard TVP-VAR connectedness approach. In this regard, we expect findings to be qualitatively similar across the two different approaches; with the joint connectedness method though, offering more adequately justified (and in this respect, more accurate) results.

Furthermore, in order to highlight the dynamic character of the study, we focus mainly on dynamic results; namely, total dynamic connectedness, net directional connectedness, as well as, pairwise connectedness.

4.1 Average Connectedness Results

We begin by considering average results; that are, results that emerge when we consider the entire sample period as a whole. These results are given by Table 6.2. Please note that the main diagonal element which corresponds to each variable in our network reflects each variable’s idiosyncratic effect (i.e., own contribution to uncertainty) while, off diagonal elements represent the contribution of uncertainty to this variable from others.

Furthermore, according to the average value of the total connectedness index (TCI) for the period, 67.93% of the forecast error variance in each one of the variables of our network can be attributed to innovations in all other variables. This practically implies that average variable co-movement is rather moderate-to-high and therefore we should not neglect the potential for volatility contagion within the network.

A closer look at Table 6.2 further allows for a distinction (i.e., always on average net terms) of the variables of the network between net transmitters and net recipients of uncertainty shocks. In this regard, we note that Canada appears to be the major net transmitter in the network with an average net connectedness value of 16.67%, followed by the US (14.78%), and the UK (5.31%). By contrast, all other variables in our network assume a rather net receiving position with Japan (−14.64%) and Italy (−8.53%) being the main average net recipients of the network.

Although the averaged results do provide a generic picture of the interaction among the variables of the network, we should be able to draw safer conclusions by decomposing the sample period into shorter intervals and by considering a rather dynamic investigation of the interaction among the variables. The reason being that average results may mask major economic developments and events that transpired during the sample period and had a profound impact on the network under investigation. In this regard, in the sections that follow, we proceed with such a dynamic investigation of the results that we obtained from both alternative empirical methods.

4.2 Total Dynamic Connectedness

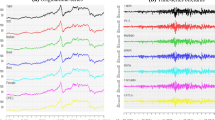

In turn, we consider total connectedness across time. Findings are given by Fig. 6.2 which illustrates the evolution of the total value of connectedness within the system/network under investigation. For illustration purposes, the black-shaded area corresponds to extended joint connectedness results while the red solid line represents the results from the standard TVP-VAR connectedness approach.

First, we notice that—as was in fact expected, results obtained from both of these methods remain qualitatively similar and differences are practically limited to the magnitude of connectedness across the sample period. Apparently, both methods are capable of identifying the relevant peaks and troughs of connectedness within this particular network of variables.

In turn, focusing primarily on the extended joint connectedness results, we note that, connectedness within this network of variables is relatively high; that is, connectedness is persistently greater than 55% and from time to time it reaches peaks greater than 75% and—more recently, as high as approximately 90%. These findings are indicative of the very strong association between the variables of this system. Findings also highlight the strong linkages across international financial markets and reflect—to some extent, the importance of the financialisation of the oil market. To give an example, a connectedness value in the region of 55% practically implies that for a particular point in time, 55% (on average) of the evolution within this particular system of variables can be attributed to developments within the network itself. To put differently, if connectedness is in this particular region, then approximately 55% of the forecast error variance in one of the constituents/variables of the network can be attributed to innovations that occur in all other constituents.

The practical implication is that, researchers by looking into connectedness have an additional source of information regarding the feedback that each variable receives within a specified network. In this regard, connectedness becomes a useful tool towards identifying potential sources of contagion within a given network. More importantly, under a dynamic framework of study, that is, a framework that investigates the extent of connectedness through time, researchers can effectively identify patterns of the responses of this network not only to major developments in financial markets and the broader economy but also to major crisis episodes that affect societies the world over.

It follows that increased levels of connectedness during specific points in time (e.g., in the light of major crisis episodes) suggest that the variables of the network move closely together. In fact, if such patterns of increased connectedness systematically occur during similar events then connectedness in the network rather is event-dependent. Being highly responsive to such events, practically causes connectedness to fluctuate across time (as evidenced in Fig. 6.2) exhibiting periodical peaks and troughs.

By contrast, lower levels of connectedness are suggestive of weak interrelations within the network. Weak connectedness could in some cases be associated with rather tranquil periods of time; or—particularly during turbulent periods, it could be suggestive of decoupling. The latter case would no doubt be very interesting (and useful) from the standpoint of investments and active portfolio management considering that differing behaviours during turbulent times could potentially offer opportunities for diversification. As we shall discuss later on in this section, distinguishing the constituents of the network between net transmitters and net receivers of shocks could provide additional information regarding the dynamic behaviour of the relevant variables.

In turn, results are suggestive of specific periods whereby connectedness in this network was rather pronounced. Apparently, connectedness reached very high levels in the beginning of 2009, 2012, and 2018 while its highest value can be located around the first quarter of 2020. In the section that follows we shed additional light on these relationships by considering net total connectedness.

4.3 Net Total Directional Connectedness

We now focus on Fig. 6.3 which illustrates the specific position of each variable of the network over time. To put differently, Fig. 6.3 depicts whether any variable of the particular network assumes either a net transmitting or net receiving role across the sample period. For the purposes of illustration, please note that values above zero suggest a net transmitter of shocks into the system while values below zero, a net recipient.

Understandably, during the sample period, it is not uncommon for a variable to switch between roles. Notice for example that oil is mostly a recipient of shocks with a notable exception around 2014. It follows that the adopted empirical method allows for making a distinction between variables which—for their most part, have acted as net transmitters and variables which—for their most part, have rather positioned themselves on the receiving end. The practical implication of distinguishing between net transmitters and net receivers in this particular network of variables which focuses on volatility is that it improves our understanding of potential sources of uncertainty within the network.

Furthermore, given that the empirical method allows for a dynamic analysis of the issue at hand, we are also able to isolate specific periods whereby a variable classifies as either a net transmitter or net receiver in the light of some specific event. For instance, following on from the point that we made earlier about the position of oil around 2014, we could further acknowledge that this period largely coincides with the unprecedented collapse in the price of oil which was particularly evident between June and December 2014. Within the framework of our model, this could be interpreted as oil being an important source of uncertainty for the entire network during these specific months. In other words, during that period, oil—on net terms, was not so much a receiver of uncertainty shocks from other variables in the network as it was a transmitter of these shocks.

If we interpret the findings presented in Fig. 6.3 in this way then, we can draw some useful initial conclusions about the interaction among the variables of the network. More particularly, we note that most variables assume both roles across time with the exception perhaps of both the Italian and the Japanese stock market who both appear to be on the receiving end. Furthermore, the German stock market is also a rather persistent net receiver of uncertainty shocks, with only one or two exceptions throughout the period of study; nonetheless, the magnitude of transmission from the German stock market during these exceptional intervals was rather negligible.

Despite those findings in connection with the UK indicate that the extent of the transmission of this particular stock market is rather low, there clearly exists a period between the beginning of 2015 and the end of 2016 whereby the UK stock market appears to have a key role to play as a net transmitter of uncertainty shocks to the remaining variables of the network. It is perhaps no surprise that this particular interval coincides with developments associated with the EU membership referendum which eventually took place in the UK on the 23rd of June 2016.

The French stock market is mainly a net recipient of uncertainty shocks from all other variables of the network. Nonetheless, there is an interval between the beginning of 2018 and mid-2019 when the French stock market injects uncertainty into the system. This particular period was marked by high volatility in international financial markets following events such as the escalating trade war between China and the US and rising interest rates in the US. An interesting aspect that makes these developments pertinent for the French index and potentially justifies these findings is that stocks listed on CAC 40 are largely owned by multinational corporations and overseas investors who were greatly affected by these developments.

In turn, results suggest that the US stock market is a persistent net transmitter of uncertainty shocks, a fact that most likely underscores the importance of developments in the particular market for the global economy. Interestingly enough though, the US stock market switches to a net recipient role around the beginning of 2019, which is exactly the period in which the Canadian stock market becomes an important net transmitter. The latter begs the question of whether this finding is entirely random or not, suggesting that there may be a common story between the two markets that lies behind this particular development. To answer this question (and similar ones) we have to look into net pairwise spillovers—which is the focal point of the following section.

4.4 Net Pairwise Dynamic Connectedness

We turn to Fig. 6.4 which illustrates the pairwise dimension of the results. In line with previous analysis, positive values are indicative of net recipient variables in the network. In effect, the pairwise dimension verifies previously reported results and also offers a more complete picture with regard to uncertainty spillover shocks within this particular network.

Focusing on the findings presented in the first column of Fig. 6.4, we notice that in all cases, oil consistently contributes shocks to the system around the period of the oil price collapse. In point of fact, results remain qualitatively similar irrespectively of whether the country is a net oil importer (e.g., Germany) or a net oil exporter (e.g., Canada). The episode of the oil price collapse and its effect on financial markets has been well documented in existing literature (see Balli et al., 2019; Chatziantoniou et al., 2021a, 2021b; Degiannakis & Filis, 2018).

Furthermore, with the exception of Japan, it is also evident that the oil market receives considerable uncertainty shocks from all stock markets around 2018. As aforementioned, the period around 2018 was a very turbulent period for global stock markets. To be more explicit, 2018 was mostly marked by the escalation of the trade war between China and the US with the unprecedented measures of the period (e.g., increased tariffs) having a profound impact both on international trade, investments, and financial markets (see Egger & Zhu, 2020; He et al., 2020; Xu & Lien, 2020). It follows that the economic environment during 2018 was rather discouraging for investments (resulting for instance in a slowdown in demand for oil) and international tensions had a strong impact on the market for oil (see Bouoiyour et al., 2019; Li et al., 2020). At the same time, the rather uncertain economic environment of 2018 also affected the oil market through financial markets—considering the relatively recent financialisation of commodity markets (see Silvennoinen & Thorp, 2013; Zhang, 2017).

If we then turn our attention to the remaining panels in Fig. 6.4, we can find out more about the relevant bilateral relationships of the network. For example, looking down the results presented in the second column (with the exception of the last panel in that column), we can see the pairwise connectedness between the US stock market and all other G7 stock markets. Following on from our discussion above, it seems that the period around 2018 was a period when the US stock market assumed a dominant role as a net transmitter of uncertainty shocks in the system. There is indeed a strong link between the US economy and other economies around the globe and therefore developments affecting the US could cause a chain reaction to other countries. Apart from developments in relation to the recent US-China trade war that was previously discussed, evidence also suggests that contractionary monetary policy in the US (i.e., higher interest rates)—such as the one we experienced around 2018, could negatively affect GDP in other countries (see Iacoviello & Navarro, 2019).

Interestingly enough, findings with regard to the Canadian stock market reveal that volatility in this particular market greatly affected almost all other stock markets in the network, around the onset of the COVID-19 pandemic. This finding is closely linked to our discussion above relating to the slowdown of investment in recent years; however, in this case, results should be viewed from the standpoint of Canada being a major exporting country during a period when the prospects of manufacturing, energy, and the financial sector were rather gloomy and unfavourable. Given Canada’s reliance on international trade, authors such as Talbot and Ordonez-Ponce (2020) stress that the COVID-19 pandemic affected the Canadian economy in a profound way. Considering these prospects, the Toronto Stock Exchange suffered its most severe decline between February and March 2020 subsequently affecting major stock markets in the world—including the US stock market; a fact which stands to reason considering that Canada and the US are very close trade partners. In this regard, the developments of the period affecting bilateral trade between Canada and the US; that is, particularly in connection with the increased tariffs of the period (see Cavallo et al., 2021) was also struck from developments associated with the COVID-19 pandemic. At the same time, authors such as Xu (2021) point out that uncertainty in connection with COVID-19 had a profound impact on the Canadian stock market relative to the US.

In retrospect, the main findings of this study indicate that, as far as this particular network of variables is concerned, volatility connectedness was mostly affected around three specific periods; that is, around 2014, during 2018, and in the beginning of 2020. All these periods could be linked with certain major events such as the oil price collapse, stock market unrest, as well as, the outbreak of the COVID-19 pandemic. Distinguishing the variables of the network into net transmitters and net receivers of spillover shocks improves our understanding of the underlying dynamics that propagate our system and determine the direction of contagion across the variables of interest. Understanding these dynamics could be useful to policy and decision-makers who—in order to restore tranquillity during periods of economic turbulence, require information on the interaction among several macroeconomic and financial variables.

5 Conclusion

In this study we focused on a specific network of variables in order to examine the interrelation between volatility in G7 stock markets and volatility in the market for crude oil. By looking into this network, we shed additional light into the potential sources of uncertainty contagion afflicting the relevant markets.

To this end, we collected monthly data for the period between 2007 and 2021 and utilised appropriate proxies. To the effect that we predicated results upon a robust empirical approach, we employed the extended joint TVP-VAR connectedness method (Balcilar et al., 2021) which augments the standard connectedness index initially developed by Diebold and Yılmaz (2009, 2012, 2014). For the purposes of illustration and in the interests of comparison we provided results from both methods. Results were qualitatively similar between the two, exhibiting mainly differences with regard to the magnitude of connectedness.

Overall, we found that total dynamic connectedness assumed large values over time which is indicative of the great extent of interrelation among the variables of the network. In fact, connectedness persistently remained above the 55% mark across time while, during the most recent months of the sample period, connectedness was as high as approximately 90%. In turn, findings regarding net total dynamic connectedness helped us distinguish between net transmitters and net receivers of uncertainty shocks within the network. In point of fact, we were able to identify specific periods when each variable assumed either role in the light of events that had a profound impact on international financial markets.

More particularly, we found that crude oil did have an important net transmitting role during the 2014 oil price collapse. In turn, crude oil rather assumed a noteworthy net receiving position around 2018 which admittedly was a very turbulent period for stock markets around the globe. What is more, the UK stock market also assumed a net transmitting role for a short period around the events of the EU referendum.

Furthermore, on net terms, the stock markets of Germany, Italy, and Japan rather remained on the receiving end of this network. The US stock market on the other hand constantly acted as a net transmitter of uncertainty shocks within the network with the exception of the more recent period starting in the beginning of 2019. With reference to this particular finding, net pairwise analysis suggested that the US stock market mainly received uncertainty from the Canadian stock market which—considering its role as a major exporting economy, apparently affected volatility in many stock markets around the world in a period marked by turbulence with regard to international terms of trade and the COVID-19 crisis.

To conclude, in this chapter we highlighted the importance for considering a variety of empirical approaches in order to reach more robust conclusions. We found that both the standard TVP-VAR connectedness approach and the TVP-VAR extended joint connectedness approach provided qualitatively similar results in relation to the direction of connectedness and the distinction between net transmitting and net receiving variables within the network. We maintained that findings are important for policymakers and decision-makers in general who wish to better understand the interactions across stock markets and the market for crude oil in order to formulate and implement the necessary policies.

Notes

- 1.

Since the detailed algorithm of the TVP-VAR model with heteroscedastic variance-covariances is beyond the scope of this study interested readers are referred to Antonakakis et al. (2020).

- 2.

For the detailed mathematical derivations interested readers are referred to the technical appendix of original study of Lastrapes and Wiesen (2021).

References

Anscombe, F. J., & Glynn, W. J. (1983). Distribution of the kurtosis statistic b2 for normal samples. Biometrika, 70(1), 227–234.

Antonakakis, N., Chatziantoniou, I., & Filis, G. (2014). Dynamic spillovers of oil price shocks and economic policy uncertainty. Energy Economics, 44, 433–447.

Antonakakis, N., Chatziantoniou, I., & Filis, G. (2017). Oil shocks and stock markets: Dynamic connectedness under the prism of recent geopolitical and economic unrest. International Review of Financial Analysis, 50, 1–26.

Antonakakis, N., Chatziantoniou, I., & Gabauer, D. (2020). Refined measures of dynamic connectedness based on time-varying parameter vector autoregressions. Journal of Risk and Financial Management, 13(4), 84.

Balcilar, M., Gabauer, D., & Umar, Z. (2021). Crude oil futures contracts and commodity markets: New evidence from. Resources Policy, 73, 102219.

Balli, F., Naeem, M. A., Shahzad, S. J. H., & de Bruin, A. (2019). Spillover network of commodity uncertainties. Energy Economics, 81, 914–927.

Boldanov, R., Degiannakis, S., & Filis, G. (2016). Time-varying correlation between oil and stock market volatilities: Evidence from oil-importing and oil-exporting countries. International Review of Financial Analysis, 48, 209–220.

Bouoiyour, J., Selmi, R., Hammoudeh, S., & Wohar, M. E. (2019). What are the categories of geopolitical risks that could drive oil prices higher? Acts or threats? Energy Economics, 84, 104523.

Caloia, F. G., Cipollini, A., & Muzzioli, S. (2019). How do normalization schemes affect net spillovers? A replication of the Diebold and Yilmaz (2012) study. Energy Economics, 84, 104536.

Cavallo, A., Gopinath, G., Neiman, B., & Tang, J. (2021). Tariff pass-through at the border and at the store: Evidence from US trade policy. American Economic Review: Insights, 3(1), 19–34.

Chatziantoniou, I., Degiannakis, S., & Filis, G. (2019). Futures-based forecasts: How useful are they for oil price volatility forecasting? Energy Economics, 81, 639–649.

Chatziantoniou, I., Degiannakis, S., Filis, G., & Lloyd, T. (2021a). Oil price volatility is effective in predicting food price volatility: Or is it? The Energy Journal, 42(6). https://doi.org/10.5547/01956574.42.6.icha

Chatziantoniou, I., Filippidis, M., Filis, G., & Gabauer, D. (2021b). A closer look into the global determinants of oil price volatility. Energy Economics, 95, 105092.

Chatziantoniou, I., & Gabauer, D. (2021). EMU risk-synchronisation and financial fragility through the prism of dynamic connectedness. The Quarterly Review of Economics and Finance, 79, 1–14.

Chkir, I., Guesmi, K., Brayek, A. B., & Naoui, K. (2020). Modelling the nonlinear relationship between oil prices, stock markets, and exchange rates in oil-exporting and oil-importing countries. Research in International Business and Finance, 54, 101274.

D’Agostino, R. B. (1970). Transformation to normality of the null distribution of g1. Biometrika, 57(3), 679–681.

Degiannakis, S., & Filis, G. (2018). Forecasting oil prices: High-frequency financial data are indeed useful. Energy Economics, 76, 388–402.

Degiannakis, S., Filis, G., & Kizys, R. (2014). The effects of oil price shocks on stock market volatility: Evidence from European data. The Energy Journal, 35(1), 35–56.

Diebold, F. X., & Yılmaz, K. (2009). Measuring financial asset return and volatility spillovers, with application to global equity markets. The Economic Journal, 119(534), 158–171.

Diebold, F. X., & Yılmaz, K. (2012). Better to give than to receive: Predictive directional measurement of volatility spillovers. International Journal of Forecasting, 28(1), 57–66.

Diebold, F. X., & Yılmaz, K. (2014). On the network topology of variance decompositions: Measuring the connectedness of financial firms. Journal of Econometrics, 182(1), 119–134.

Efimova, O., & Serletis, A. (2014). Energy markets volatility modelling using GARCH. Energy Economics, 43, 264–273.

Egger, P. H., & Zhu, J. (2020). The US–Chinese trade war: An event study of stock-market responses. Economic Policy, 35(103), 519–559.

Elliott, G., Rothenberg, T. J., & Stock, J. H. (1996). Efficient tests for an autoregressive unit root. Econometrica, 64(4), 813–836.

Filis, G., & Chatziantoniou, I. (2014). Financial and monetary policy responses to oil price shocks: Evidence from oil-importing and oil-exporting countries. Review of Quantitative Finance and Accounting, 42(4), 709–729.

Filis, G., Degiannakis, S., & Floros, C. (2011). Dynamic correlation between stock market and oil prices: The case of oil-importing and oil-exporting countries. International Review of Financial Analysis, 20(3), 152–164.

Fisher, T. J., & Gallagher, C. M. (2012). New weighted portmanteau statistics for time series goodness of fit testing. Journal of the American Statistical Association, 107(498), 777–787.

Gabauer, D. (2021). Dynamic measures of asymmetric and pairwise connectedness within an optimal currency area: Evidence from the ERMI system. Journal of Multinational Financial Management, 60, 100680.

Gabauer, D., & Gupta, R. (2018). On the transmission mechanism of country-specific and international economic uncertainty spillovers: Evidence from a TVP-VAR connectedness decomposition approach. Economics Letters, 171, 63–71.

Hamilton, J. D. (2009a). Causes and consequences of the oil shock of 2007–08. National Bureau of Economic Research: Technical report.

Hamilton, J. D. (2009b). Understanding crude oil prices. The Energy Journal, 30(2), 179–206.

He, F., Lucey, B., & Wang, Z. (2020). Trade policy uncertainty and its impact on the stock market-evidence from China–US trade conflict. Finance Research Letters, 40, 101753.

Iacoviello, M., & Navarro, G. (2019). Foreign effects of higher US interest rates. Journal of International Money and Finance, 95, 232–250.

Jarque, C. M., & Bera, A. K. (1980). Efficient tests for normality, homoscedasticity and serial independence of regression residuals. Economics Letters, 6(3), 255–259.

Jiang, Z., & Yoon, S.-M. (2020). Dynamic co-movement between oil and stock markets in oil-importing and oil-exporting countries: Two types of wavelet analysis. Energy Economics, 90, 104835.

Kang, W., de Gracia, F. P., & Ratti, R. A. (2017). Oil price shocks, policy uncertainty, and stock returns of oil and gas corporations. Journal of International Money and Finance, 70, 344–359.

Kang, W., Ratti, R. A., & Yoon, K. H. (2015). The impact of oil price shocks on the stock market return and volatility relationship. Journal of International Financial Markets, Institutions and Money, 34, 41–54.

Kilian, L. (2009). Not all oil price shocks are alike: Disentangling demand and supply shocks in the crude oil market. American Economic Review, 99(3), 1053–1069.

Koop, G., Pesaran, M. H., & Potter, S. M. (1996). Impulse response analysis in nonlinear multivariate models. Journal of Econometrics, 74(1), 119–147.

Kwon, D. (2020). The impacts of oil price shocks and United States economic uncertainty on global stock markets. International Journal of Finance & Economics. https://doi.org/10.1002/ijfe.2232

Lastrapes, W. D., & Wiesen, T. F. (2021). The joint spillover index. Economic Modelling, 94, 681–691.

Lee, C.-C., Lee, C.-C., & Ning, S.-L. (2017). Dynamic relationship of oil price shocks and country risks. Energy Economics, 66, 571–581.

Li, Y., Chen, B., Li, C., Li, Z., & Chen, G. (2020). Energy perspective of Sino-US trade imbalance in global supply chains. Energy Economics, 92, 104959.

Parkinson, M. (1980). The extreme value method for estimating the variance of the rate of return. Journal of Business, 53(1), 61–65.

Pesaran, H. H., & Shin, Y. (1998). Generalized impulse response analysis in linear multivariate models. Economics Letters, 58(1), 17–29.

Phan, D. H. B., Sharma, S. S., & Narayan, P. K. (2016). Intraday volatility interaction between the crude oil and equity markets. Journal of International Financial Markets, Institutions and Money, 40, 1–13.

Silvennoinen, A., & Thorp, S. (2013). Financialization, crisis and commodity correlation dynamics. Journal of International Financial Markets, Institutions and Money, 24, 42–65.

Talbot, D., & Ordonez-Ponce, E. (2020). Canadian banks’ responses to COVID-19: A strategic positioning analysis. Journal of Sustainable Finance & Investment, 1–8. https://doi.org/10.1080/20430795.2020.1771982

Xu, L. (2021). Stock return and the covid-19 pandemic: Evidence from canada and the us. Finance Research Letters, 38, 101872.

Xu, Y., & Lien, D. (2020). Dynamic exchange rate dependences: The effect of the US–China trade war. Journal of International Financial Markets, Institutions and Money, 68, 101238.

Zhang, D. (2017). Oil shocks and stock markets revisited: Measuring connectedness from a global perspective. Energy Economics, 62, 323–333.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Chatziantoniou, I., Floros, C., Gabauer, D. (2022). Volatility Contagion Between Crude Oil and G7 Stock Markets in the Light of Trade Wars and COVID-19: A TVP-VAR Extended Joint Connectedness Approach. In: Floros, C., Chatziantoniou, I. (eds) Applications in Energy Finance. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-030-92957-2_6

Download citation

DOI: https://doi.org/10.1007/978-3-030-92957-2_6

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-030-92956-5

Online ISBN: 978-3-030-92957-2

eBook Packages: Economics and FinanceEconomics and Finance (R0)