Abstract

The primary objective of this study is to explore the links between fossil fuel energy consumption, industrial value-added, and carbon emissions in G20 countries over the period 1990–2020. Panel unit root test, co-integration test, and CS-ARDL estimator were used to determine the relationship among variables. The empirical results suggest that the driving force of carbon emissions in G20 countries varies significantly in advanced versus emerging economies. Evidence in a whole sample of G20 countries and advanced economies supports environmental Kuznets curve (EKC) hypothesis, while no evidence emerging economies supports EKC hypothesis. Apart from this, the empirical results show trade opens, FDI, government expenditures on health and education, research and development, and information and communication technology are other determinators of carbon emissions in G20 countries. Our results suggest that countries upgrade industrial structures by shifting their energy structures away from fossil fuels toward renewable energy sources in order to achieve sustainable environmental goals.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Over the last two decades, fossil fuel energy consumption and carbon emissions have become the subject of debate and discussion among academia and policymakers. The fundamental goal of this debate and discussion is to determine the primary causes of global warming and climate change. Among these, fossil fuel energy consumption and industrialization are considered important sources of greenhouse gas emissions which contribute to global warming and climate change (Balint et al. 2017. According to the NASA (2020) report on global climate, the global temperature has risen by 1.4 °F, causing major hazards to human life and biodiversity on the earth. However, reducing energy use, particularly fossil fuel energy consumption, may provide the ultimate answer to the carbon emission problem and climate change. On the other hand, energy consumption remains one of the active forces of social and economic progress (Balint et al. 2017). In today’s world, industrialization, population growth, infrastructure development, and economic growth create excessive demand for fossil fuel energy consumption. Thus, energy has played an important critical role in human life as well as global, social, economic, and environmental transformation. According to studies, inefficient energy would have a negative impact on the performance of various sectors of the economy, such as transportation and the social life of the country. However, from ecological point of view, excessive use of energy resources poses a major threat to the global ecological environment. Some studies found that continued high carbon emissions will result in 1.5 °C warming between 2030 and 2050. Thus, cutting emissions requires efforts and further investigations to enable the economies to achieve prospective sustainable environment goals.

To address the environmental issues, several agreements were signed industrialized and developing governments, international organizations, and private stockholders. For example, the “Kyoto Protocol was signed in 1997, and the Paris Climate” Agreement (PCA) was signed in 2015, with the aim of limiting the rise of future global temperatures no more than 1.5 °C, and reducing CO2 emissions and fossil fuel energy use. However, in order to ameliorate climate change and minimize carbon emissions, one of the best solutions is to replace current fossil-fuel-based energy generation with renewable-based energy generation. In the long run, clean and renewable energy resources have the potential to aid the elimination of environmental damage and climate change ways to control carbon emissions. The first way is reducing usage of fossil fuels, but it is contradictory to the development because consumption of energy is expected to increase along with the overall development of the economy. The second way is to change the energy consumption structure, and the third is to improve the energy efficiency. The latter two ways are a possible solution to reduce carbon and satisfy the goals of energy supply. For instance, The consumption of coal in electricity generation is the main carbon emission source in most emerging and developing economies. Therefore, it is important to generate electricity using renewable technologies, such as hydropower, wind power, and solar PV, instead of thermal power with coal.

This paper attempts to analyze the links between fossil fuel energy consumption, industrial value-added, and carbon emissions in G20 countries over the period of 1990–2020. Furthermore, we check the validity of EKC hypothesis in different group of countries. Previous studies considered some macroeconomic factors, such as trade openness, consumption of non-renewable energy and technological innovation etc. However, investigating these factors along with industrial value-added, government spending on health and education, and investment in renewable energy resources will help to draw a unique feature, which will benefit policymakers to develop new policies in order to reduce the carbon emission. Therefore, we identify some macroeconomic factors, which are likely to have an impact on carbon emissions in G20 nations. Based on the previous literature, we include trade openness, net inflows of foreign direct investment, information and communication technology, government expenditures on education, health, and social welfare, and investment in renewable energy resources as key factors influencing carbon emissions. Above all, investigating the linkages between fossil fuel consumption, industrial value-added, and carbon emissions in G20 countries is notable for many reasons. First, G20 countries are major world economies comprising 75% of global trade, more than 80% of world GDP, and 60% of the world population (Ajide and Mesagan 2022). Rapid industrialization, trade openness, and development pattern demand for overutilization of energy resources. Second, manufacturing and industrial sector heavily depends on energy, which consumes more than 80% of fossil fuel energy. The 74 % of global carbon emissions are produced by the G20 countries (IEA 2020). G20 countries also consume 95% of coal and 70% of gas and oil. Third, less attention has been paid on the impact linkages between fossil fuel consumption, industrial value-added, and renewable consumption. More specifically, to our knowledge, there is no evidence on the aforementioned variables in case of G20 countries. Thus, overabundant fossil fuel energy consumption is a more critical and worrying situation in global environmental pollution. This situation has attracted scholars and policymakers to establish the long-term mechanism for optimization of energy consumption pattern and reduction of carbon emission intensity in G20 countries.

The findings of this study manifest that the driving force of carbon emissions in G20 countries varies significantly in advanced versus emerging economies. There is dire need for the policy intervention to control the carbon emissions in G20 countries and make sustainable environmental policy to mitigate adverse impact. The current study adds to the existing literature on the relationship between fossil fuel consumption, industrial value-added, and carbon emissions in a variety of ways. First, the study examines the impact of fossil fuel and renewable energy consumption on carbon emissions. Second, this study considers the impact of macroeconomic factors such as trade openness, inward FDI, ICT, government spending on education, health, and social services, and investment in renewable energy development on G20 countries’ carbon emissions. Third, the current study provides aggregate and disaggregate evidence for whole sample countries as well as emerging and advanced economies, which brings insight for the policy implication and formation.

Apart from the introductory part of the paper, this study has the following sections. The second section is about the survey of related literature. The econometric model and technique are presented in the third section. The empirical results are discussed in the fourth section. The main findings and policy recommendations are summarized in the conclusion section.

Literature review of related literature

The studies on energy consumption and energy related carbon emissions can be traced back to 1970s. Earlier research used datasets from the International Energy Agency (IEA) and the World Bank to better understand energy consumption patterns and carbon emissions across countries and regions. Several studies have linked the increase in global carbon emissions to a variety of factors, such as industrialization, population growth, fossil fuel energy consumption, financial inclusion, renewable energy, trade openness, urbanization, and infrastructure development (Tufail et al. 2022). Various studies have examined the relationship between fossil fuel use, carbon emissions, and industrialization, and the results have been varied for various regions, such as E-7(developing) and G-7(developed) countries (Huang et al. 2022a), five Asean countries (Huang et al. 2022b), Asia (Usman et al. 2021b), OECD countries(Huang et al. 2022c), Gulf countries (Yang et al. 2021), and Artic countries (Usman et al. 2021a). Earlier study used the Environmental Kuznets Curve (EKC) hypothesis to estimate the relationship between economic growth and CO2 emissions. The EKC hypothesis explains different stages of industrialization with relation to the environment. According to the well-known EKC theory, there is a U-shaped link between environmental quality and industrial growth. Environmental contamination and pollution are more common in the early phases of development. After reaching a certain level of development, both environmental degradation and pollution decrease. This implies that demand for environmental quality increases with income level, in other words, income level leads to improved environmental conditions in the long run. The EKC hypothesis has become widely popular in the early 1990s, and many authors tested the validity of the hypothesis. Several studies supported and confirmed the existence of nexus between variables in the long run; industrial growth led to improve the environmental condition (Apergis and Ozturk 2015;Azam and Khan 2016).

Apergis and Ozturk (2015) tested the EKC hypothesis for the 14 Asian countries using the panel data from 1990 to 2011. They found that CO2 emissions and income level have an inverted U-shaped connection. Similarly, Huang et al.(2021a) examined impact of green investment, renewable energy consumption, and technological innovation on CO2 emission of 30 sample provinces of China from 1995-2019, and confirmed EKC for provincial data of China. Also, Huang et al.(2022a) scrutinized the nexus between information and communication technologies (ICT), renewable energy, economic complexity, human capital, financial development and ecological footprint for E-7 and G-7 countries over the period from 1995-2018, and observed that there is a wide discrepancy in the two groups of countries.

Azam and Khan (2016) empirically estimated the EKC hypothesis for low-, middle-, and high-income countries from 1975 to 2014. Over the sample period, the study results support the EKC hypothesis for low- and lower-middle-income nations, but fail to support the hypothesis for upper-middle and high-income countries. Furthermore, energy consumption has a strong positive link with trade openness and CO2 emissions, but a strong negative relationship with urbanization and economic growth.

Huang et al.(2022b) manifested that trade openness, environmental degradation and urbanization have considerably decreased the use of renewable energy while an increase in FDI and the quality of governance leads to a rise in renewable energy consumption in five selected ASEAN countries.

The link between CO2 emissions and trade openness, FDI, urbanization, and renewable energy has been intensively investigated, and the results are mixed. The study of Shahbaz et al. (2019) and Ansari et al. (2020) showed that trade openness has three kind of environmental effects such as technical effect, scale effect, and composition effect. In technical effect, trade boosts technological efficiency, which improves production and cuts carbon emissions. In scale effect, free trade upsurges the mobility of capital, goods and services, increasing trade volume and output level. Therefore, trade openness might have a subsequently harmful impact on environmental quality. In composition effect, most of the intensive-pollution industries and firms move to developing countries, as a result eventually contributes to deterioration of environmental quality (Zeng et al. 2021). Thus, it is concluded that scale and composition effects on the environment are significantly negative, while technical effect is positive. Huang et al.(2022c) confirmed that eco-innovation, human capital and energy price play positive roles in increasing the consumption of renewable energy while economic growth and trade openness still promote non-renewable energy consumption in OECD countries. Using the two-steps generalized method of moments (GMM) estimator, the result of Huang et al.(2021b) suggested that renewable energy has a significant negative effect on CO2 emission in a sample of major renewable energy-consuming countries for the period of 2000-2015.

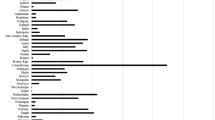

In the case of G20 countries, several studies investigated the relationship between carbon emissions and influencing factors (Yao et al. 2015; Mardani et al. 2018) and have diverse outcomes. Yao et al. (2015) discussed the main driving force of carbon emissions in G20 countries. Accordingly, economic growth and industrial structure are the dominant drivers in all emerging and developed economies of G20 countries. Population growth is another important driving factor in South Africa, Mexico, and China. In Indonesia and Saudi Arabia, carbon emissions are driven by total emissions and energy structure. Furthermore, the study suggested that improving energy intensity is the main downward driving factor in carbon emissions.

Despite the fact that the EKC hypothesis existed in developing countries, there is no evidence to support it in advanced countries. Mardani et al. (2018) used the adaptive neuro-fuzzy inference system (ANFIS) model to check the link between energy consumption, economic development, and CO2 emissions in G20 countries from 1962 to 2016. According to the estimation results, there is direct relationship between carbon emissions, energy consumption, and economic growth.

In the above literatures, the links between fossil fuel energy, industrial value-added, and carbon emission were studied in terms of the relationship between energy, economic growth, and environmental quality. Several studies were conducted using data set of different regions and countries and using diverse econometric approaches and different proxy variables. Most of the earlier studies focused on testing the cogency of the environmental Kuznets curve. These studies used CO2 emission as a dependent variable and GDP per capita and other relative factors such as urbanization, energy consumption, trade openness, population growth, and capital as explanatory variables. However, these findings were mixed and controversy. Some studies reported positive effect of industrial growth on CO2 emission, while some reported negative. Moreover, relatively a few studies, especially in G20 countries, have highlighted the role of trade openness, ICT, R&D expenditures, FDI, and renewable energy development. There is a need to understand the driving force of changes in carbon emission with trade openness, ICT, and R&D expenditures, particularly focusing on the industrial value-added in more detail in G20 countries . The reason lies in industrial sector is responsible for more than one-third of global primary energy and energy-related CO2 emissions.

Methodology and Data

Data and variables

The data for this paper are obtained from the World Development Indicators (WDI). The choice of countries and period is based on the data availability. Most of the countries in this study are G20 countries, which consist of twelve emerging economies (China, Australia, South Korea, Argentina, Brazil, Mexico, India, Indonesia, Russia, Turkey, South Africa, and Saudi Arabia), seven developed economies (the USA, the UK, Canada, Germany, France, Italy, and Japan). This paper select nineteen countries, seven from advanced and twelve from emerging economies, for the period 1990–2020. The dependent variable is carbon emissions (kt). The data on carbon emissions (CE) are taken from the World Bank Indicators (WDI). We use two independent variables: (1) the first is the industrial value-added (constant 2010 US$), it comprises value added from mining, electricity, manufacturing, construction, gas, and water. Based on the previous studies, we further add the square of industrial value-added in a regression model to test the EKC hypothesis. (2) the second is the aggregate energy consumption in the economy, which is the sum of fossil fuel and renewable energy consumption. For disaggregate analysis, we separate both fossil fuel energy consumption (FEC) and renewable energy consumption (REC).

Furthermore, to assess the strength of the relationship between carbon emissions, industrial value-added, and fossil fuel energy consumption, we control other potential determinators. Five control variables are identified and incorporated in the regression model:(1) the first one is the trade openness which is the sum of exports and imports (constant 2010 US$). (2) The second one is the net inflow of foreign direct investment (% of GDP) which is the sum of equity, reinvestment of earnings, and other short- and long-term capital recorded in the balance of payment in the reporting economy from foreign investors. (3) The third one is the information and communication technology (ICT). In this study, we use the sum of imports and exports of information and communication technology goods as a proxy variable for ICT. It includes the exports and imports of computer and peripheral equipment, communication equipment, consumer electronic equipment, and electronic components of ICT miscellaneous.(4) The fourth one is the general government expenditures, including health, education, and social service. (5) The fifth one is the research and development expenditures (% of GDP) which are used as the proxy for renewable energy development. The data on all variables are from the World Bank database. Table 1 describes variables and sources of data.

The descriptive statistics, correlations among variables, and data normality tests are reported in Table 2 and Table 3. The summary statistics of CE is between 99,840 and 10,904,840 with positive skewness (3.19) that is greater than zero. This indicates that the distribution has a positive long right tail. The kurtosis value of CE is 13.67, which is greater than three, indicating distribution peaked. Moreover, all the variables indicate positive skewness except total energy consumption (TEC) and fossil fuel energy consumption (FEC). Carbon emissions (CE) have a long right tail. The kurtosis values are also positive and greater than three (normal distribution for Kurtosis stands at 3) which indicate distribution peaked. However, the overall results of Table 2 indicate that data is not normally distributed.

Table 3 reveals the correlation among variables used in this study. The correlation results indicate that industrial value-added (INVA=0.115**, p<0.05), total energy consumption (TEC=0.039***, p<0.01), fossil fuel energy consumption (FEC=0.122***, p<0.01), and other control variables are significant strong positive relation with carbon emissions (CE). In contrast, renewable energy consumption (REC=-0.078*, p<0.05) is negative with CE.VIF denotes Variance Inflation Factor.

Model specification and estimation methods

Model specification

This study uses the theoretical model adopted by Ozturk and Acaravci (2016) for the long-run relationship between fossil fuel energy, industrial growth, and carbon emissions. The current study extends the model by adding macroeconomic factors which influence carbon emission. The linear relationship between CO2 emissions, industrial value-added, aggregate, and disaggregate energy consumption is defined as follows:

where CE denotes CO2 emissions, INVA is industrial value-added, TEC shows aggregate energy consumption (sum of fossil fuel and renewable energy consumption) in the economy, and X denote control variables. Furthermore, aggregate energy consumption is divided into fossil fuel energy consumption (FEC) and renewable energy consumption (REC). The linear relationship among the variables is expressed as;

To reduce heteroscedasticity and linearized parameters, all of the model’s chosen variables (1) and (2) are converted into natural logarithms. In addition, to test the validity of the environmental Kuznets curve (EKC) hypothesis, this analysis incorporates a square of industrial value-added (lnINVA2it).

where i denotes countries (i = 1, 2……19) and t is the time (t = 1990, 1991, ….2020). lnCEit indicates the natural log of CO2 emissions, lnINVAit is the natural log of industrial value-added, ln TECit denotes natural log aggregate energy consumption in the economy, ln FECit shows a natural log of fossil fuel energy consumption, ln RECit is a natural log of renewable energy consumption. Xit denotes control variables including trade openness (TOP), net inflow of foreign direct investment (FDI), information and communication technology (ICT), government expenditures (GEX), and renewable energy development (RED). β0 is constant parameters, which differ between countrie i and time t. The coefficients ω1, ω2, ω3, and ω4 indicate the elasticity of carbon emissions with respect to industrial value-added, aggregate energy consumption in the economy, fossil fuel energy consumption, and renewable energy consumption, respectively. If ω1 > 0 and ω2 < 0, both coefficients are statistically significant. This implies that there exists an inverted U-shape curve and evidence that support to EKC hypothesis. If ω3 > 0 and ω4 > 0, it means that carbon emissions increase with energy consumption, and both are complemented otherwise substitute. If ω4 < 0, it means that carbon emissions decrease with renewable energy consumption. So, we expected ω1 > 0 and ω2 < 0, implying that industrial development will decrease carbon emissions and improve the environmental condition in the long run. For ω3 and ω3, we expect mixed signs, if ω3 < 0 and ω4 > 0 means that countries at a certain level of development decreased the production of pollution-intensive and fossil fuel energy-based commodities and support renewable energy consumption.

Estimation methods

The study’s main goal is to investigate the relationships between fossil fuel energy consumption, industrial value-added, and carbon emissions in G20 countries. In order to estimate model (3), we follow the standard econometric panel methodology suited to large T and small N (T > N) panels. This study uses cross-sectional dependency (CD) test, panel unit root test, panel co-integration, and CS-ARDL method.

The first step towards the model estimation is to test cross-sectional dependency among countries/units. In economic analysis, the cross-sectional arises when one country depends on another. The dependency of countries occurs due to a high degree of globalization, strong inter-economic relations, and integration of finance and trade (Munir et al. 2020). The main drawback of traditional econometric methods is that they ignore cross-sectional dependency (CSD); when they ignore it, the results obtained from estimation can be biased and misleading (Aydin 2019). This study uses Pesaran (2004) CD test and Pesaran et al. (2008) LM test of error cross-sectional independence. The CD test proposed by Pesaran (2004) is written as follows:

Pesaran et al. (2008) Lagrange Multiplier (LM) bias-adjusted version of CD test is written as follows:

where \({\hat{\rho}}_{ij}\) is the sample estimate of the pairwise correlation of residuals obtained by OLS. We test the null hypothesis of no cross-sectional dependency against the alternative hypothesis cross-sectional dependency. Table 4 reports the CD test results.

After testing cross-section dependency, the next step is to check the order of integration of variables. This study uses cross-section augmented Dickey-Fuller (CADF), Im, Pesaran and Shin (Im et al. 2003), and cross-sectional IPS (CIPS) panel unit root tests. The former two tests are first-generation panel unit root tests, while the last one is second-generation panel unit root test. However, in the presence of cross-sectional dependency, the first-generation panel unit test proves misleading results. Im et al. (2003) suggested that both CIPS and CADF are robust and accurate, so, to avoid biased results, we apply both first-generation and second-generation panel unit root tests. CADF equation is given as follows:

where ∆ denotes first difference operator, Yit denotes study variable, and νit is the error term. Based on Equation (6), CIPS equation is written as follows:

where \(\overline{Y}\) is average cross-sectional unit and is illustrated as:

The CIPS test statistics is written as:

where CADF is cross-sectional augmented Dickey-Fuller.

In the third step, we apply CSD robust Westerlund (2007) co-integration tests. This test handles cross-sectional error terms and provides robust empirical results. The test statistics verify the null hypothesis of no co-integration between cross-sectional units against the alternative hypothesis of co-integration among the variables. Thus, the baseline equation for the WU test is specified as follows:

where ai denotes the co-integration vector between study variables x and y. ϕ represents an error correction coefficient. The test statistics are written as follows:

where Gt and Ga represent the group mean statistics, while PT and Pa represent panel statistics. In the next step, estimating the co-integrating vectors to examine the long-run relationship between fossil fuel energy consumption, industrial value-added, and other influencing factors in G20 countries. Most past studies used first-generation econometric techniques and conventional panel econometric approaches such as FMOLS, ARDL, and DOLS, by assuming cross-sectional independence. However, several studies criticized those traditional methods produced inconsistent and biased results (Aydin 2019; Behera and Mishra 2020). These studies argued that countries are integrating due to a higher degree of globalization, economics and trade relations, etc.

After testing cross-sectional dependency, panel unit root, and co-integration, the final step is to estimate coefficients of Eq. (3) to check whether they are robust to cross-sectional dependency. We use the CS-ARDL method; this method has more power and deals with slope heterogeneity, cross-sectional dependency, and endogeneity (Nathaniel et al. 2021). Moreover, this method provides precise results in the case of small sample size. Since the unobserved factors are correlated with explanatory variables, this may cause inconsistent and biased results. Therefore, CS-ARDL is more powerful to tackle these issues. The equation of CS-ARDL is given as:

where \({\overline{Z}}_{it}=\overline{\Big(\Delta {CE}_t},{\overline{X}}_t\Big)\) and Xit = (INVAit, INVA2it, FECit, RECit, Cit). Xit is the set of our main variables and control variables. Furthermore, for robustness, this study uses the Augmented Mean Group (AMG) method. AMG method is a two-step procedure to estimate the unobserved common dynamic effects by allowing the cross-sectional dependency. First, it estimates regression model with time dummies using first difference OLS. Second, the group-specific regression model is augmented either with an implicit variable or a unit coefficient imposed on each group member. The imposition of the unit coefficient is implemented by subtracting AMG estimation from the dependent variable. Moreover, AGM is more essential due to its acceptability for slope heterogeneity. It provides results in the presence of cross-sectional dependency, non-stationarity, and endogeneity problem (Pesaran et al. 1999).

Results and discussion

The first step toward the empirical investigation of the study is to check the cross-sectional dependency (CD) among the countries. The CD test results show that cross sections are dependent, which is evident from the statistical significance of both tests (Pesaran CD and LM test) at a level of 1%, 5%, and 10%, respectively, as shown in Table 4. The test statistics reject the null hypothesis of no cross-sectional dependency and accept the alternative hypothesis of cross-sectional dependency among countries. This indicates that any shocks in G20 countries tend to be spreading to other countries.

Furthermore, to check the order of integration of variables, this study employes panel unit root tests, as shown in Table 5. The results indicate different orders of integration. However, CIPS test considers the cross-sectional dependency. Furthermore, the first lag is included for removing serial correlation and test performed for both trend and drift. The unit root test shows the presence of unit root except for LnTOP, FDI, RED, and LnICT at 1% and 5% levels of significance. This implies that there exists long-run co-integration among study variables.

For the presence of co-integration among the study variables, we employ Westerlund (2007) test. The results of WU are reported in Table 6 for the whole sample and sub-samples (advance and emerging economies). The first two columns (Gt, Ga) represent group mean statistics for overall co-integration, while the last two columns (PT, Pa) represent the panel statistics. The results of both columns confirm a stable long-run relationship among the variables presented in the models (1) and (2). This implies that there exists long-run equilibrium between carbon emissions (CE), industrial value-added (INVA), fossil fuel and renewable energy consumption, and other determinators, namely, trade openness (LnTOP), net foreign direct investment (FDI), government expenditures on education, health, and social welfare (LnGEX), renewable energy resource development(RED), and information and communication technology (LnICT).

After confirming co-integration among the variables, there is further estimation of the coefficients of the models (1) and (2) for the whole and sub-sample countries. For this purpose, we use two different methods, namely, CS-ARDL and AMG estimator, as shown in Tables 7 and 8.

In Table 7, we use two different specifications: the first is total energy consumption and the second is fossil fuel and renewable energy consumption. According to empirical results, the CS-ARDL estimator strongly validates the environmental Kuznets curve (EKC) hypothesis for the whole sample and advanced countries. No evidence supports EKC for emerging economies, as shown in Table 7. Accordingly, industrial value-added (LnINVA) has a significant positive impact on CE, while the square of industrial value-added (LnINVA2) has a significant negative effect on CE. The total energy consumption (lnTEC) has a significant positive impact on CE for the whole sample and emerging countries while the negative impact on CE for advanced countries. This implies that advanced countries switched to produce pollution-intensive commodities. On the other hand, emerging economies turned to produce less pollution-intensive commodities. Our empirical results are consistent with the previous studies, such as Wu et al. 2020. The disaggregated analysis divides total aggregate energy consumption into fossil fuel energy consumption (LnFEC) and renewable energy consumption (LnREC). The estimated coefficient of LnFEC is significantly positive, which means that CE increases with fossil fuel energy consumption. Similarly, the estimated coefficients of renewable energy consumption (LnREC) are significantly negative, which suggests that renewable energy resources help to reduce carbon emissions and contribute to environmental quality.

The coefficients of trade openness (LnTOP) are significantly positive at a 1% level of significance for the whole sample and emerging economies while negative for advanced countries. Our results are consistent with previous studies, such as Shahbaz et al. 2017. These studies explain three effects due to trade openness, i.e., scale, composition, and technical effects. In the scale effect, expansion of economy is due to trade openness and has a worse effect on the overall environment. The composition effect is owing to change in the production process based on the comparative advantage, and countries produce pollution-intensive goods. Finally, the technical effect explains environmental impact due to knowledge and innovative production methods. However, our results demonstrate all three effects; scale and composition effect exist in case of emerging countries where trade openness worsen than the environmental quality. While in advanced countries, the composition effect exists, where environmental friendly technologies and high energy-efficient techniques are transferred through trade openness. Similarly, the coefficients of net foreign direct investment inflows (FDI) are significantly positive with CE in the whole sample and emerging countries, while negative and significant in advanced countries. This indicates that FDI is one of the major channels for acquiring environmental quality through green technologies and knowledge transfer. Our results manifest that in advanced countries, the environmental cost of pollution is high, and firms and industries move to emerging economies where the cost of pollution is low. Thus, FDI increases carbon emissions directly in emerging economies.

The other factors include research and development (RED) and government expenditures on education, health, and social welfare (Ln GEX) which are negatively related to CE. This indicates that investment in renewable resources infrastructure, education, health, and other social welfare can help to reduce carbon emissions across the G20 countries. The improvement in human and social capital helps to reduce CE and demand for a clean and quality environment. In addition, the coefficient of information and communication technology(LnICT) is significant and positively related to CE for the whole sample while negative for advanced and emerging countries.

Furthermore, this study uses AGM method to check the robustness of CS-ARDL results as shown in Table 8. It is evident that the sign of long-run coefficients by AGM and CS-ARDL are similar. The main difference between AMG and CS-ARDL estimators is the long- and short-run coefficients. The estimated coefficients of industrial value-added and square of industrial value-added also support the validity of the EKC hypothesis for whole sample and advanced countries, while no evidence supports to EKC hypothesis for emerging countries. The coefficient of total energy consumption (LnTEC) is positive in the long run for the whole sample and emerging economies while significantly negative for advanced countries. The short-run coefficient of LnTEC is also positive and significant for all cases. Similarly, the coefficient of fossil fuel energy is significantly positive for the whole sample and emerging countries in the long run while significant negative for advanced countries. Other estimated CS-ARDL coefficients are the same sign as AMG. In the long run, the coefficient of (LnTOP) is positive while negative in the short run for advanced countries. In addition, the significant and negative error correction coefficient (EC) shows a stable long-run relationship among the study variables.

Conclusion

This study was designed to investigate the links between fossil fuel energy consumption, industrial value-added, and carbon emissions in G20 countries. Trade openness, net inflow of foreign direct investment, renewable energy development, and information and communication technology are major determinators of carbon emissions in G20 countries. Several panel econometric methods were employed to achieve the study’s objective, for instance, cross-sectional dependency, first- and second-generation unit root test, WU co-integration test, AMG, and CS-ARDL estimators. The panel co-integration approach was applied to check the existence of stable long-run co-integration among study variables. These latest and recently developed panel econometric methods help to address the problem of cross-sectional dependency and retrieve unbiased empirical results from panel data.

We concluded that (1) the environmental Kuznets curve (EKC) hypothesis is valid for advanced countries, and no evidence supports to EKC hypothesis for emerging countries. There exists inverted U-shaped relationship between carbon emissions and industrial value-added. This implies that industrial value-added increases and then decreases carbon emissions. (2) Total energy consumption increases carbon emissions in emerging countries while decreases carbon emissions in advanced countries. This indicates that advanced countries produce environmental friendly commodities while emerging countries produce pollution-intensive commodities. (3) Fossil fuel energy directly increases carbon emissions while renewable energy consumption reduces carbon emissions. (4) Trade openness and net foreign direct investment inflow significantly decrease carbon emissions in advanced countries while increasing in emerging countries. (5) The other significant factors influencing carbon emissions include government expenditures on education, health, social welfare, investment in renewable energy resources, and information and communication technology.

This study has the following significances for sustainable development policy. First, renewable energy resources development helps to decrease carbon emission in all samples of group. It is strongly recommended that governments should make efforts to stimulate the development of renewable energy. Second, industrial structure matters the consumption of energy. Countries should upgrade their industrial structure to shift the energy demand from fossil fuel energy to renewable energy sources. Third, the EKC does not exist for all countries. Countries should employ flexible policies with the consideration of their own situations.

References

Ajide KB, Mesagan EP (2022) Heterogeneous analysis of pollution abatement via renewable and non-renewable energy: lessons from investment in G20 nations. Environmental Science and Pollution Research:1-14

Ansari MA, Haider S, Khan N (2020) Does trade openness affects global carbon dioxide emissions: evidence from the top CO2 emitters. Management of Environmental Quality: An International Journal, 31(1):32–53

Apergis N, Ozturk I (2015) Testing environmental Kuznets curve hypothesis in Asian countries. Ecological indicators 52:16–22

Aydin M (2019) The effect of biomass energy consumption on economic growth in BRICS countries: a country-specific panel data analysis. Renewable energy 138:620–627

Azam M, Khan AQ (2016) Testing the Environmental Kuznets Curve hypothesis: a comparative empirical study for low, lower middle, upper middle and high income countries. Renewable and sustainable energy reviews 63:556–567

Balint T, Lamperti F, Mandel A, Napoletano M, Roventini A, Sapio A (2017) Complexity and the economics of climate change: a survey and a look forward. Ecological Economics 138:252–265

Behera J, Mishra AK (2020) Renewable and non-renewable energy consumption and economic growth in G7 countries: evidence from panel autoregressive distributed lag (P-ARDL) model. International Economics and Economic Policy 17(1):241–258

Huang Y, Xue L, Khan Z (2021a) What abates Carbon Emissions in China: Examining the Impact of Renewable Energy and Green Investment. Sustainable Development (2):1–12. https://doi.org/10.1002/sd.2177

Huang Y, Kuldasheva Z, Salahodjaev R (2021b) Renewable energy and CO2 emissions: empirical evidence from major energy-consuming countries. Energies 14(22):7504. https://doi.org/10.3390/en14227504

Huang Y, Haseeb M, Muhammad Usman M, Ozturk I (2022a) Dynamic association between ICT, renewable energy, economic complexity and ecological footprint: Is there any difference between E-7 (developing) and G-7 (developed) countries?. Technol Soc 68:101853. https://doi.org/10.1016/j.techsoc.2021.101853

Huang Y, Maaz Ahmad, Sher Ali (2022b) The impact of trade, environmental degradation and governance on renewable energy consumption: Evidence from selected ASEAN countries. Renewable energy 197:1144-1150. https://doi.org/10.1016/j.renene.2022.07.042

Huang Y, Maaz Ahmad, Sher Ali, Dervis Kirikkaleli (2022c) Does eco-innovation promote cleaner energy? Analyzing the role of energy price and human capital. Energy 239(Part D):122268. https://doi.org/10.1016/j.energy.2021.122268

IEA (2020) World Energy Outlook Retrieved from https://www.iea.org/reports/world-energy-outlook-2020

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. Journal of econometrics 115(1):53–74

Mardani A, Streimikiene D, Nilashi M, Arias Aranda D, Loganathan N, Jusoh A (2018) Energy consumption, economic growth, and CO2 emissions in G20 countries: application of adaptive neuro-fuzzy inference system. Energies 11(10):2771

Munir Q, Lean HH, Smyth R (2020) CO2 emissions, energy consumption and economic growth in the ASEAN-5 countries: a cross-sectional dependence approach. Energy Economics 85:104571

Nathaniel SP, Murshed M, Bassim M (2021) The nexus between economic growth, energy use, international trade and ecological footprints: the role of environmental regulations in N11 countries. Energy Ecol Environ 1–17

NASA (2020) Global Climate Change: Retrieved from NASA Global Climate Change Web site: https://climate.nasa.gov/

Ozturk I, Acaravci A (2016) Energy consumption, CO2 emissions, economic growth, and foreign trade relationship in Cyprus and Malta. Energy Sources, Part B: Economics, Planning, and Policy 11(4):321–327

Pesaran MH, Shin Y, Smith RP (1999) Pooled mean group estimation of dynamic heterogeneous panels. Journal of the American statistical Association 94(446):621–634

Pesaran MH (2004) General diagnostic tests for cross-sectional dependence in panels. CESifo Working Paper Series No. 1229; IZA Discussion Paper No. 1240. Available at https://ssrn.com/abstract=572504 60:13-50

Pesaran MH, Ullah A, Yamagata T (2008) A bias-adjusted LM test of error cross-section independence. The Econometrics Journal 11(1):105–127

Shahbaz M, Nasreen S, Ahmed K, Hammoudeh S (2017) Trade openness–carbon emissions nexus: the importance of turning points of trade openness for country panels. Energy Economics 61:221–232

Shahbaz M, Gozgor G, Adom PK, Hammoudeh S (2019) The technical decomposition of carbon emissions and the concerns about FDI and trade openness effects in the United States. International Economics 159:56–73

Tufail M, Song L, Umut A, Ismailova N, Kuldasheva Z (2022) Does financial inclusion promote a green economic system? Evaluating the role of energy efficiency. Economic Research-Ekonomska Istraživanja. https://doi.org/10.1080/1331677X.2022.2053363

Usman M, Jahanger A, Makhdum MSA, Balsalobre-Lorente D, Bashir A (2021a) How do financial development, energy consumption, natural resources, and globalization affect Arctic countries' economic growth and environmental quality? An advanced panel data simulation. Energy:122515

Usman M, Khalid K, Mehdi MA (2021b) What determines environmental deficit in Asia? Embossing the role of renewable and non-renewable energy utilization. Renewable energy 168:1165–1176

Westerlund J (2007) Testing for error correction in panel data. Oxford Bulletin of Economics and statistics 69(6):709–748

Wu H, Xu L, Ren S, Hao Y, Yan G (2020) How do energy consumption and environmental regulation affect carbon emissions in China? New evidence from a dynamic threshold panel model. Resources Policy 67:101678

Yang B, Jahanger A, Usman M, Khan MA (2021) The dynamic linkage between globalization, financial development, energy utilization, and environmental sustainability in GCC countries. Environmental Science and Pollution Research 28(13):16568–16588

Yao C, Feng K, Hubacek K (2015) Driving forces of CO2 emissions in the G20 countries: an index decomposition analysis from 1971 to 2010. Ecological informatics 26:93–100

Zeng C, Stringer LC, Lv T (2021) The spatial spillover effect of fossil fuel energy trade on CO2 emissions. Energy 223:120038

Availability of data and materials

The dataset used during the current study are available from corresponding author on reasonable request.

Funding

This work is supported by the Chinese National Funding of Social Sciences (No. 21BJL008).

Author information

Authors and Affiliations

Contributions

Yongming Huang: Conceptualization, Policy recommendation, Revision, Supervision. Zebo Kuldasheva: Data collection and analysis. Shakhrukh Bobojanov: Methodology, Data collection. Bekhzod Djalilov: Introduction, Literature review. Raufhon Salahodjaev: Introduction, Literature review. Shah Abbas: Interpretation. All the authors read and approve the final manuscript. ORCID: Yongming Huang https://orcid.org/0000-0003-0033-9277

Corresponding author

Ethics declarations

Ethical approval

This study follows all ethical practices during writing. We confirmed that this manuscript has not been published elsewhere and is not under consideration in any journal. Ethical approval and consent do not applicable for this study.

Consent to participate

Not applicable

Consent for publication

Not applicable.

Competing interest

The authors declare no competing interest.

Additional information

Responsible Editor: Roula Inglesi-Lotz

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Huang, Y., Kuldasheva, Z., Bobojanov, S. et al. Exploring the links between fossil fuel energy consumption, industrial value-added, and carbon emissions in G20 countries. Environ Sci Pollut Res 30, 10854–10866 (2023). https://doi.org/10.1007/s11356-022-22605-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-22605-9