Abstract

With urgent desire of promoting sustainable development, this study explored the impact and affecting mechanism of green credit on green economy efficiency through spatial lag model. Panel data from 2008 to 2019 of 30 selected provinces and cities in China were collected to portray the green economy efficiency with application of Sup-SBM DEA including unexpected outputs. The results show that (1) green credit had significant promoting effect on green economy efficiency, while time–space inconsistency existed. (2) During the promoting process, level of marketization and environmental regulation generated threshold effects, which were positively correlated with regional green economy efficiency. (3) Industrial structure upgrading and environmental investment played positive intermediary roles between green credit and green economy efficiency. (4) Considering endogenous issues, the positive effect still existed though the promotion effect was weakened. This study further enriches the literature and provides deep insights into the policy design when formulating the green economy path.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The factor-driven and investment-driven extensive economy has generated serious negative environmental impacts especially for developing countries such as China (Wu et al., 2020). For instance, frequent domestic environmental pollution incidents, including Yangzonghai arsenic pollution in Yunnan and water pollution of Songhua River, have associated with extensive economy growth, which have seriously threatened human health and sustainable development (Yuan et al. 2020; Cheng and Ge 2020). In this context, the concept of ecological civilization construction and green development are of increasing concerns among political and academic circles. In 2015, the Central Committee of the Communist Party of China and the State Council issued the “Opinions on Accelerating the Construction of Ecological Civilization,” which for the first time promoted the importance of “green development” to the same status as “new-type industrialization, urbanization, informatization, and agricultural modernization.” The existing literature suggests that green development refers to replacing environmental and natural capital with artificial capital according to the carrying capacity of resources and environment, which eventually improve the production efficiency and gradually transform the economy towards low energy consumption (Lyytimki et al 2018; Stoknes, 2018). In particular, green development seeks an optimal balance among resources, environment, and economy, where the evaluation of mutual quantitative relationship among economic output, resource, and environmental input remains the crucial essence. Therefore, evaluation of green development essentially refers to the green economy efficiency (Xie and Liu, 2019).

In recent years, with urgent requirements of ecological civilization construction and economic transformation, researches on green economic efficiency have gradually emerged, among which concepts such as ecological efficiency, energy efficiency, and resource allocation efficiency reflect certain aspects of green economic efficiency (Wang and Yi, 2021). Regarding the impact of green economy efficiency, the existing literature generally believes that factors such as urban innovation investment, economic agglomeration, industrial agglomeration, and environmental regulation are influential factors to improve the efficiency of regional green economy (Ma and Liu, 2021; Wang et. al., 2020; Hu et. al., 2020). Nevertheless, the development of green economy requires the finance tilt of funds. Therefore, in 2021, in order to ensure the steady development of the green economy, the State Council of China issued guidelines and proposed the development of green credit to promote green transformation, emphasizing the role of green finance in the modern green development system. Theoretically, green credit applies differentiated monetary and financial policies to increase fund provision and form environmental investment through credit tilt and interest rate floating, which reduces corporate financial costs and promotes economic structure, and thus improving green economic efficiency (He et al. 2018; He et al. 2019; Liu et al. 2019). However, the existing literature exist deficiencies regarding empirical analysis, where the impact path of green credit on the green economy development should be clarified. Therefore, the following questions have been proposed: (1) May green credit effectively support the development of green economy? (2) May green credit have threshold characteristics during the promoting process? What is the transmission mechanism? (3) Whether there exists heterogeneity in the promoting effects in different regions and time dimensions.

In order to fill the academic gap and answer the aforementioned questions, this study employed panel data from 2008 to 2019 in 30 cities and provinces in China, and introduced Sup-SBM data envelopment analysis (DEA) of unexpected output to calculate China’s green economy efficiency. Subsequently, a spatial lag model was applied to portray the impact mechanism of green credit on green economy efficiency as well as its heterogeneity. This research further enriches the literature and detects the promoting path of green credit on green economy efficiency. The rest of this study is outlined as follows: theory and hypotheses are elaborated in the “Theory and hypotheses” section, while methods are indicted in the “Methods” section. The “Empirical analysis” and “Expansion analysis” sections present the empirical analysis and expansion analysis, respectively. The “Conclusions” section draws the conclusions.

Theory and hypotheses

Green credit and green economic efficiency

Green credit is one of the most important green financial instruments in China (Yang et al. 2020). With rapid development of green credit, as of June 2020, the balance of green credit has exceeded 11 trillion yuan, which has become the key support to achieve the green economy (An et al. 2021). Jeucken (2001) regarded green credit as sustainable financing, where banks provided financing facilities for green projects to achieve the purpose of guiding green development. Maeda et al. (2001) and Hu et al. (2011) qualitatively confirmed that the development of green credit could promote green economic growth. Other literature indicated that green credit policies achieved in promoting industrial upgrading and environmental quality as well as green economic efficiency (Cai et al. 2019; Sun et al. 2019; Hu et al., 2020). In addition, Xie and Liu (2019) believed that green credit could improve the efficiency of regional green economy through changing the structure of green consumption and promoting the innovation efficiency. Therefore, the following hypothesis is proposed:

-

H1: Green credit can effectively elevate the green economy efficiency.

Threshold effect of environmental regulation

The balance between profitability and security remains the crucial target pursued by financial institutions (Chen and Xu, 2015). In the short term, under environmental regulations, green credit tends to have a negative impact on the efficiency of China’s green economy, among which heavy-polluting industries bear the brunt (Wang and Chen, 2018). Therefore, there exists high credit risk when financial institutions issue funds to heavily polluting companies. Although in the long run, environmental regulations can promote green innovation and accelerate the transformation and upgrading of enterprises, both innovation and transformation in the short term will aggravate the uncertainty of enterprises and also increase the difficulty of credit risk management. Hence, with strengthening on regional environmental regulations and policies, financial institutions will actively respond to green credit policies due to the need of risk aversion. For instance, efforts can be made in reducing credit to heavily polluting companies while turning to green industries, and thus improving the efficiency of regional green economy (Guo et al. 2019; Wang and Qi, 2021; Tong et. al., 2016). Therefore, the following hypothesis is proposed:

-

H2: Environmental regulation generates threshold effect during the promoting process of green credit on green economy efficiency.

Threshold effect of the degree of marketization

Development of green credit is indispensable from market promotion. High degree of marketization can facilitate green credit policies and guide the entry of financial capital, and thus promoting the development of regional green economy. Further development of the market can accelerate the circulation of green credit resources, optimize the efficiency of resource allocation, promote the development of green industries, and improve the efficiency of green economy. In addition, with the development of regional marketization, enterprises enjoy broader financing channels and regional financial institutions participate in green credit more actively, which creates the improved environment for green credit policies and indirectly boost regional green economy (Zhang et al. 2021). Therefore, H3 is proposed as follows:

-

H3: Degree of marketization has threshold effect during the promoting process of green credit on green economy efficiency.

The intermediary transmission effect of environmental investment

Environmental investment essentially refers to the capital investment, which requires the source of funds as a guarantee. In practical, green credit remains the major funding source for industrial pollution control, energy conservation, and environmental protection projects. Green credit directly affects the level of environmental investment through the allocation of credit resources and the guidance of consumer investment behavior. Regarding the path of environmental investment to green economic efficiency, environmental investment involves environmental protection and economic development, which will affect energy consumption and economic growth. Subsequently, the effects are reflected in promoting economic growth, optimizing environmental quality, and reducing energy consumption. On the whole, environmental investment ultimately affects the development of the green economy. Hence, the following hypothesis is proposed:

-

H4: Environmental investment plays an intermediary role between green credit and green economy efficiency.

The intermediary transmission effect of industrial structure upgrading

The promotion of green economic efficiency through green credit is associated with the level of industrial structure upgrading. Green credit regards green capital as the core (Hu et al. 2020), through which social capital is guided to flow into low-carbon and environmental-friendly green industries, thus promoting industrial upgrading, reducing resource waste and environmental pollution, and enhancing green economy (Cheng and Ge, 2020; Wen et al., 2021). Yin and Wang (2016) argued that while developing green credit, attention should be paid to environmental protection and pollution control in order to accelerate the economic transformation, promote the industrial structure upgrading, and achieve efficient green economy. In addition, Long and Chen (2018) conducted the empirical research and concluded that green credit can facilitate capital flow into green industries and thus enhancing economic transformation. Therefore, H5 is proposed as follows:

-

H5: Industrial structure upgrading plays an intermediary role between green credit and green economy efficiency.

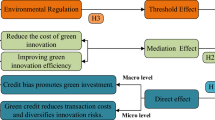

Theoretical mechanism model

With reference to the existing literature, this study built a theoretical mechanism model, portraying the impact path of green credit policy on the efficiency of green economy based on the abovementioned hypotheses, which is shown in Fig. 1.

Methods

Model and methodology

Selection and construction of spatial measurement model

Since the SDM (spatial Dubin model) model combines the advantages of SAR (spatial lag model) and SEM (spatial error model) models, it can not only analyze the spatial correlation between green credit and green economic efficiency, but also explore the spatial impact of random shocks. Therefore, with application of SDM model, this study constructed the modified model to capture the affecting mechanism of green credit on green economy efficiency, which is shown as follows:

In particular, \(GE{E}_{it},G{C}_{it}\) refer to the green economic efficiency and green credit in the tth year in i region respectively, \({X}_{it}\) is the control variable, W indicates the spatial weight matrix, and \({\varepsilon }_{\text{it}}\) represents the random disturbance item. When \({\theta }_{\text{i}}\)=0, the SDM model will degenerate into a SAR model while the SDM model will degenerate into an SEM model if \({\theta }_{\text{i}}=-{\beta }_{\text{i}}\).

Exploratory spatial analysis

Before application of spatial measurement model, this study employed Moran’s index to analyze the spatial dependence of green credit and green economy efficiency variables among different provinces. In detail, the Global Moran’s I falls between − 1 and 1. In particular, 0 to − 1 indicates negative correlation, while 0 to 1 implies positive correlation.

Spatial matrix

Based on the panel data model, a spatial weight matrix was incorporated to clarify the positional relationship among individuals. The mainstream weights include geographic weight matrix, economic weight matrix, and neighbor weight matrix. Due to the competition among regional governments, the development of green economy in neighboring regions also promotes the efficiency of local green economy. Therefore, the relationship among the variables should be discussed taking geographical weight distance into account.

Geographic distance

Threshold model

In order to detect the impact path of green credit and clarify the prerequisites, this study considered green credit, environmental regulations, and the degree of marketization as threshold variables to formulate the threshold model. In addition, scenarios with different levels of threshold values were concerned to capture the threshold effect of green credit.

Data and index selection

Considering the availability of data and representativeness of the research, panel data of 30 selected provinces and cities in China from 2008 to 2019 were collected from published data sources such as China Statistical Yearbook, China Environment Statistical Yearbook, and China Financial Statistics Yearbook.

Explained variable

This study considered green economic efficiency (GEE) as explained variable. Unlike green GDP, green economy refers to the production method that takes the coordinated development of ecological economy as the core and achieves resource utilization efficiency through technological progress (Liu et al., 2019). In essence, green economic development refers to a net positive effect of national economic growth. According to the existing literature (Ma et. al., 2019), GEE was measured as follows: taking capital stock, labor, and energy as input elements; GDP as the expected output; effluent, waste gas, and solid waste are the undesired outputs. Each variable is treated as shown in Table 1. In detail, fixed capital is represented by investment in fixed assets of the whole society in the current year. The fixed asset investment price index is deflated to the constant price in 2007, with the unit of 100 million yuan. The labor input is measured by the number of employees in the whole society at the end of the year, with the unit of 10,000. Taking into account the structural differences in energy utilization between regions and dynamic change characteristics, energy input is measured through total energy consumption with the unit of 10,000 tons of standard coal. Expected output was represented by regional GDP of current year. Besides, the descriptive statistics of following variables are listed in Table 1.

Core explanatory variable

Green credit (GC) is the core explanatory variable in this study. At present, the academic measurements of green credit mainly include the ratio of green credit, the proportion of loans for energy-saving and environmental protection projects, the “bank loan” in industrial pollution control investment, and the inverse indicator of six energy-intensive industries (Hu and Li, 2015; Xie and Liu, 2019). The data on the proportion of green credit and the proportion of loans for energy conservation and environmental protection projects mainly derive from the “Social Responsibility Report” of five large commercial banks and some joint-stock banks in China. However, the above imitation method cannot be applied since the data on bank loan in the industrial pollution control investment were no longer counted since 2010. Therefore, this study applied the ratio of the interest expenditure of the six major energy-intensive industries in the provinces to the total industrial industry interest expenditure as the inverse indicator to measure green credit.

Threshold variables

Environmental regulation (ER)

ER refers to a series of policy and institutional measures carried out by government to force companies to promote technological innovation-structural upgrades and thus green economy. With reference to the research conducted by Kang and Ru (2020), this study characterized the strength of regional environmental regulation with relationship between regional GDP and total regional energy consumption.

The degree of marketization (DM)

Market-oriented development can promote the capital flow of green credit and thus invisibly improving the efficiency of the green economy. Therefore, the article applied marketization indexes constructed by Fan et al. (2003) to characterize the degree of marketization.

Control variables

Foreign direct investment (FDI)

Foreign direct investment has been argued to have two side effects, which are inextricably linked to the efficiency of China’s green economy. In this study, FDI was measured by the logarithm of the actual total amount of foreign investment.

Industrial structure upgrading (ISU)

Industrial structure upgrading refers to the evolution of industries from low-end industries to high-end industries. In order to scientifically characterize the degree of industrial structure upgrading, this study constructed an industrial structure-upgrading index according to Wang et al.’s (2015) industrial structure upgrading method. The specific formula is as follows:

In particular, W1, W2, and W3 represent the proportions of the three major industries, while 1, 2, and 3 are the weights of three industries. The higher the comprehensive index, the more significant the upgrading of the industrial structure.

Industrial level (ID)

Industrialization and regional green development are complicatedly related. The traditional industrial system is considered the main polluting source of regional environment. However, with the development of industrial intelligence, whether the modern industrialization level alleviates regional environmental pollution thus promoting green development remains the question. Hence, industrial level was measured by the ratio of secondary industry to regional GDP in current study.

Urbanization level (URB)

During the process of urbanization expansion, a large number of energy-intensive products such as steel and cement are consumed for infrastructure construction and housing construction, resulting in a large amount of pollutant emissions. Therefore, urbanization is another reason that hinders the development of green economy (Liu and Xie, 2017). This study employed the proportion of urban population to total population at the end of the year to characterize the level of urbanization.

Empirical analysis

Analysis of direct effects

Correlation and multicollinearity analysis

In order to avoid serious multicollinearity problems among variables, the correlation and multicollinearity were tested. The results are listed in Table 2. The results show that the VIF values are all less than 5, indicating no serious multicollinearity problem.

Spatial correlation analysis

In order to verify the spatial correlation between green credit and green economic efficiency, this study constructed a weighted distance matrix based on geographic distance and calculated the Moran’s I regarding GC and GEE. As shown in Table 3, Moran’s I of GC and GEE is both positive, passing the significance level test. Therefore, there exists a certain spatial agglomeration effect of GC and GEE, which provides a scientific basis for the following research.

On the other hand, this study drew the Moran’s I scatter plot based on the geographical weight matrix and selected data through STATA12 software to further analyze the spatial relevance of green credit and green economic efficiency. As shown in Figs. 2 and 3, the green credit and green economic efficiency of various provinces and cities are mainly concentrated in the first and third quadrants, indicating a strong spatial aggregation effect, which verifies the spatial correlation of green credit and green economic efficiency in the selected areas.

Spatial model selection

This study introduced a variety of spatial measurement models for empirical analysis. With reference to Anselin’s (1988) research, the p value of Hausman test of current research model is 0, passing the significance test, which verified fixed effects model to be more valid than the random effects model. At the same time, with the references to LM and R-LM tests (Table 4), the SAR model is argued to be superior to the SEM model; while from the WALD and LR tests, it can be concluded that the SDM model fails the significance test and can be degraded to SAR and SEM. With additional application of R-sq and Log-L (Table 5), SAR model was further verified. Thus, the subsequent analysis was conducted based on SAR model.

Direct effect relationship

As can be seen from Table 5, W*GEE in the spatial measurement model is significantly non-zero at the 5% significance level, indicating that there exists certain spatial spillover effect in the green economic efficiency among China’s provinces and cities. Regarding Table 4, it can be seen that the effect path of green credit on the efficiency of the green economy is 0.2439***, which passes the test at the 5% significance level. Therefore, green credit tends to be the key foundation and guarantee for the development of green economy efficiency. In detail, green credit facilitates funds gathering through credit tilt and interest rate floating with differentiated monetary and financial policies. In addition, green credit restricts provision of loans for high-pollution and high-energy-consuming projects, and provides green support for energy conservation and environmental protections, which reduce the financing costs of green enterprises, promote industry-economy-energy structure upgrading, and eventually improve the efficiency of green economy. Therefore, hypothesis 1 is accepted.

Regarding the control variables, the industrial structure upgrade has significantly improved the green economic efficiency (the coefficient equals to 0.7545***). The reasons may include the transferring to low-carbon economy, elimination of backward production capacity, funding on green technology research and development, and green transformation of traditional industries. In addition, foreign direct investment (with coefficient of 0.0188***) and urbanization (with coefficient of 0.0001***) remain the factors influencing green economy efficiency. In particular, the competition among regional governments promotes the regulation of FDI and construction of new urbanization. However, the impact of industrialization is not significant since the coefficient equals to 0.0018.

Threshold effect analysis

The promoting effect of green credit on the efficiency of regional green economic development has been verified, but there exists prerequisites. Regarding the current economic development in China, government’s environmental regulations and degree of marketization tend to be the indispensable prerequisite of green economic development. Therefore, the threshold value of environmental regulation and degree of marketization were examined during the promoting process.

Degree of marketization

The market can reduce the negative impact caused by government regulations, and thus promoting innovation, optimizing the credit resources, and improving the efficiency of social green economy. However, the development of marketization is a dynamic evolution process with regional differences, while the research on the extent to which green credit affects the efficiency of green economy is insufficient (Zhang et al. 2021). Hence, this study discussed the threshold effect of marketization under the synergy of Hansen’s (1999) threshold model. The results are shown in Table 6.

As can be seen from Table 6, considering the degree of marketization as the threshold variable, the single threshold value of the degree of marketization passes the 1% significance level, while the double threshold value is insignificant. Hence, green credit is concluded to have single threshold effect on the improvement of green economic efficiency. In addition, Fig. 4 indicates the relationship between estimated threshold value and LR. The threshold value of 7.600 falls into the confidence interval (7.285–7.700). Thus, the threshold effect of the degree of marketization can be verified.

On the other hand, the panel threshold model was further introduced for comprehensive analysis, of which the results are shown in Table 7. When degree of marketization is lower than the single threshold value of 7.600, green credit has insignificant positive effect on green economic efficiency, while the positive effect becomes significant (rising from 0.098 to 0.232) when single threshold value is greater than 7.600. Therefore, when regional marketization has reached a certain level, efficiency of the regional green economy can be improved through funding resource optimization, industrial transformation, and so on. Subsequently, hypothesis 2 is accepted.

Environmental regulations

The degree of marketization can optimize the rational allocation of credit factors. However, China is geographically vast and there exists inconsistency in the degree of regional marketization. In the regions with low degree of marketization, environmental regulations remain the core driving factor for the development of green credit. Particularly, environmental regulations can effectively avoid the barriers faced by green economy resulted from market failure (Guo et al. 2019). With application of Hansen’s threshold model (Hansen 1999), the results of threshold effect of environmental regulation are shown in Table 6. In detail, considering environmental regulation as the threshold variable, the single threshold value passes the test at the 1% significance level. Thus, there exists single threshold effect of environmental regulation. Figure 5 indicates the relationship between estimated threshold value and LR. The threshold value of 2.496 falls into the confidence interval (2.341–2.592). Hence, the threshold effect of the environmental regulation can be verified.

In addition to the above tests, the regression analysis of panel threshold model was further carried out. The regression results are shown in Table 7. When the threshold value of environmental regulations exceeds 2.406, the improvement path of green credit rises from 0.044 to 0.296***, passing the significance level test. Therefore, there exists significant synergy effect between environmental regulations and green credit. In order to comply with government regulations, financial institutions may increase green credit investment and strengthen green economic output, thus forming an innovative compensation effect. Subsequently, hypothesis 3 can be verified.

Quantile regression analysis

Application of fixed-effect SAR model to analyze the impact path can only partially reflect the relationship, failing to focus on the role of green credit under different efficiencies of regional green economic. Therefore, panel quantile regression was introduced to effectively solve the abovementioned defect as well as overcome the heteroscedasticity. Table 8 shows the regression results with nine selected quantile points (0.1–0.9). Comparing the results listed in Table 8 with the results listed in Table 5, there exist different impact paths under different quantiles of green economic efficiency. On the whole, the direction of path coefficient of panel quantile regression is consistent with the previous promotion effect. Under different quantiles, the promotion effect of green credit presents an upward trend with increase in quantiles, indicating the positive correlation, which further verifies hypothesis 1.

Expansion analysis

Endogenous test

Due to two-way causality or omitted variables, there may exist certain endogenous problems, leading to deviations in research. Therefore, endogenous analysis is desirable. This study applied SYS-GMM and treated lag period of green economic efficiency as an instrumental variable to explore the endogenous problem, which resolves the inconsistent and biased dilemmas of model estimation as well as weakness associated with DIF-GMM (Arellano and Bond 1991; Blundell and Bond 1995). With reference to research conducted by Jing and Zhang (2014), this study considered lag period of green credit as the explanatory variable and integrated it into the regression model to deal with endogenous problem caused by omitted variables. Therefore, the dynamic characteristics of environmental pollution can be described and other factors affecting environmental pollution can be involved into the model, which eventually reduce the deviation of conclusions.

The results of endogenous test are presented in Table 9. The path coefficient of green economy efficiency lag phase one (L.GEE) is significantly positive, which verifies the rationality of the research results and shows that the green economy efficiency has a certain degree of accumulation. According to the regression results, AR (2) fails to pass the significance test, indicating that the second-order serial correlation of the random error term does not exist. Furthermore, Sargan test shows that the instrumental variables selected are valid. Thus, the regression results of this research are concluded to be reliable. As shown in Table 9, the impact path refers to 0.1128, passing significant test at 1% level. Therefore, considering the endogenous problems, the promoting effect of green credit can still be verified.

Heterogeneity test

The marginal benefit of green credit to green economy efficiency may depend on the specific socio-economic environment and national industrial policies. In order to accurately explore the marginal benefit, an extended analysis in time and space was conducted.

Temporal and spatial heterogeneity

In 2013, China began to upgrade the construction of ecological civilization at national strategic level with relative regulations promulgated, and green economy has become the core target. Thus, the year of 2013 was selected as time node, and attention was made on the relationship between green credit and green economic efficiency in the 6 years before and after 2013 (namely from 2008 to 2019).

As shown in Table 10, from 2008 to 2013, the path coefficient of green credit refers to 0.1007 failing to pass the significance test, while the path coefficient regarding 2013–2018 equals to 0.1104***, passing the significance test at 1% level. In detail, the reason is that before 2013, the factor input-driven economic growth model was still the main melody of national development, where the green credit system was incomplete under the drive of government competition and economic interests, and could not be regarded as the key factor to improve the efficiency of regional green economy. After 2013, the green development gradually became the national strategy. Subsequently, green financial system kept modifying and thus promoting green economy efficiency.

Regional heterogeneity

Coastal areas are increasingly becoming the demonstration area of intelligent manufacturing, open economic construction, and green development, which possess the typical characteristics of green economic development and can effectively drive and shape a green pattern of regional coordinated development. Regarding inland areas, which serve as the carrier of industrial transfer from coastal provinces, high pollution industries still play the important part of economic growth implying deficient industrial structure. Considering the differential development, this study divided the selected provinces and cities into coastal economic zones and inland economic zones in order to verify regional heterogeneity and strive for synchronous development. As can be seen from Table 10, green credit serves as key factor in improving the green economy efficiency regardless of regional differences. However, the promoting effect in coastal areas (with coefficient of 0.3589***) is significantly greater than that of the inland areas (with coefficient of 0.1259**). Possible reasons may include more comprehensive green credit system and benefits from the national industrial policy in coastal areas. Yet, inland areas bear inadequate market mechanisms, ineffective government interventions, and inefficient allocation of credit resources, which eventually hinder the promoting effect.

Analysis of transmission mechanism

Although the promoting effect of green credit on green economy efficiency has been verified, exploration of transmission mechanism remains absent. Therefore, this study treated industrial structure upgrading and environmental investment as intermediary variables to detect the mediating effects and thus the transmission mechanism implied. The results are presented in Tables 11 and 12.

The mediating effect of environmental investment

Table 11 indicates the results of mediating effect analysis, where the coefficient of indirect effect of environmental investment equals to 0.0500**, passing the significance test with the confidence interval not covering zero. Therefore, environmental investment is verified to have mediating effect during the promoting process. In detail, green credit provides financial support for environmental investment and thus improving the efficiency of green economy. Hence, hypothesis 4 is accepted.

The mediating effect of industrial structure upgrading

Table 12 presents the results of mediating effect of industrial structure upgrading, where the coefficient of indirect effect equals to 0.1042***, passing the significance test with the confidence interval not covering zero. Hence, industrial structure upgrading is concluded to have mediating effect. The transmission mechanism implied can be shown as follows: Green credit provides the financial support to industries; and promotes the transfer from low value-added and heavily polluting industries to high value-added and environmentally friendly industries. Subsequently, the proportion of pollution-intensive industries can be reduced and efficiency of green economy can be improved. Thus, hypothesis 5 is accepted.

Conclusions

With increasing pursuit of sustainable development and green economy, this study detected the impact and transmission mechanism of green credit on green economy efficiency in order to enrich the literature and provide deep insights into the promoting policy design. Panel data from 2008 to 2019 in 30 selected provinces and cities in China were collected to portray the green economy efficiency with application of Sup-SBM DEA including unexpected outputs. Subsequently, a spatial lag model was applied to portray the relationships as well as implied heterogeneity. The results verified the promoting impact of green credit on green economy efficiency, and the conclusion and policy implications are drawn as follows.

-

(1)

The green credit system should be improved to promote the green economy efficiency. Regional governments should take the green development as target and improve the green credit system. Differentiated monetary and financial policies can be applied through credit tilt and interest rate floating to accumulate funds and stimulate environmental investment with lower credit costs. Eventually, economic structure can be optimized and thus improving green economy efficiency.

-

(2)

Since marketization degree and environmental regulation have threshold effect, which are positively correlated with regional green economy efficiency, the scope of the threshold effect should be defined to consolidate the regional promotion path. Regional government should strengthen the prerequisites of promoting effect, scientifically clarify the intensity of environmental regulation as well as the degree of marketization, and steadily improve the efficiency of the green economy.

-

(3)

Industrial structure upgrading and environmental investment played positive intermediary role during the promoting process, which should be clarified as core transmission mechanism. Thus, rational environmental investment mechanism should be constructed and industrial structure upgrading should be optimized to amplify the intermediary transmission effect. In detail, measures including formulation of stricter environmental regulations, coordination with green credit, accelerating industrial structure upgrading, and reducing energy rebound can promote the green economy development.

-

(4)

Regarding regional development differences, promotion path should be differentiated. According to regional political-economic-cultural characteristics, the green economy targets should be clarified. Regional supervision mechanism should be established to adjust the level of green credit regarding the heterogeneity of promoting effect. Subsequently, in-depth transformation of economic and energy structure can be promoted and thus enhancing the regional green economy efficiency.

Data Availability

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

References

An S, Li B, Song D, Chen X (2021) Green credit financing versus trade credit financing in a supply chain with carbon emission limits. Eur J Oper Res 292(1):125–142

Anselin L (1988) The scope of spatial econometrics. Spatial econometrics: methods and models. Springer Netherlands. https://doi.org/10.1007/978-94-015-7799-1_2

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations[J]. Rev Econ Stud 1991:58

Blundell R, Bond S (1995) Initial conditions and moment restrictions in dynamic panel data models. J Econ 87(1):115–143. https://doi.org/10.1016/S0304-4076(98)00009-8

Cai H, Wang X, Tan C (2019) Green credit policy, incremental bank loans and environmental protection effect. Account Res 3:88–95

Cheng C, Ge C (2020) Green development assessment for countries along the belt and road[J]. Journal of Environmental Management 263:110344

Chen X, Xu ST (2015) Environmental regulation and corporate value of listed companies. Fd of Accounting 21:54–58

Fan G, Wang XL, Zhang LW, Zhu HP (2003) Relative progress of marketization in various regions of China. Economic Research Journal (03):9–18–89

Guo Q, Zhou M, Liu N et al (2019) Spatial effects of environmental regulation and green credits on green technology innovation under low-carbon economy background conditions. International Journal of Environmental Research and Public Health 16(17):3027. https://doi.org/10.3390/ijerph16173027

He et al. (2018) Corporate social responsibility, green credit, and corporate performance: an empirical analysis based on the mining, power, and steel industries of China [J]. Natural Hazards, 2018, 95:1-17

He et al. (2019) Green credit, renewable energy investment and green economy development: empirical analysis based on 150 listed companies of China [J]. Journal of Cleaner Production, 2019, 208:363-372

Hu et al. (2020) Impact of green credit on industrial structure in China: theoretical mechanism and empirical analysis [J]. Environmental Science and Pollution Research,2020, 27: 10506 - 10519

Hu M, Li W (2015) A comparative study on environment credit risk management of commercial banks in the Asia-Pacific Region [J]. Bus Strateg Environ 24(3):159–174

Hu MZ, Li W, Zhang B (2011) Analysis of China’s green credit policy towards green economic growth. IEEE. https://doi.org/10.1109/APPEEC.2011.5747733

Hansen BE (1999) Threshold effects in non-dynamic panels: estimation, testing, and inference. J Econ 93(2):345–368. https://doi.org/10.1016/S0304-4076(99)00025-1

Jeucken M (2001) Sustainable finance and banking: the financial sector and the future of the planet. Earthscan Publications Ltd, UK

Bárcena-Ruiz JC, Garzón MB (2013) Multiproduct firms and environmental policy coordination. Environ Resource Econ 59(3):407–431

Jing WM, Zhang L (2014) Environmental regulation, economic opening and China’s industrial green technology progress. Econ Res J 9:34–47

Kang PH, Ru SF (2020) Bilateral effects of environmental regulation on green innovation. China Popul Resour Environ 10:93–104

Liu MF, Xie HJ (2017) Analysis of the double threshold effect of industrialization and urbanization in proceed of environment economic aggregation. Business Review 29(10):21–33

Liu et al (2019) (2019) Green credit policy, property rights and debt financing: quasi-natural experimental evidence from China [J]. Financ Res Lett 29:129–135

Long YA, Chen GQ (2018) China’s green finance development and industrial structure optimization under the background of “beautiful China.” Enterprise Econ 37(4):11–18

Lyytimki et al (2018) (2018) Developing key indicators of green growth [J]. Sustain Dev 26(1):51–64

Maeda A, Shishime N, Nishioka S (2001) Green credit mechanism: economics and practical schemes Conference Proceedings-Japan Society of Energy and Resources, 20

Ma L, Long H, Chen K (2019) (2019) Green growth efficiency of Chinese cities and its spatio-temporal pattern [J]. Resour Conserv Recycl 146:441–451

Ma YR, Liu Q (2021) Research on mechanism and effect of industrial agglomeration on green economic efficiency. Inquiry into Economic Issues 07:101–111

Stoknes PE (2018) Rockstrm J (2018) Redefining green growth within planetary boundaries [J]. Energy Res Soc Sci 44:4–49

Sun J, Wang F, Yin H, Zhang B (2019) Money talks: the environmental impact of China’s green credit policy. J Policy Anal Manage 38(3):653–680

Tong J, Liu W, Xue J (2016) Environmental regulation, factor input structure and industrial transformation. Econ Res J 7:43–57

Wang BB, Qi SZ(2016) The effect of market-oriented and command-and-control policy tools on emissions reduction innovation——an empirical analysis based on China’s industrial patents data. China Industrial Economics (6):91-108

Wang H, Qi S, Zhou C, Zhou J, Huang X (2022) Green credit policy government behavior and green innovation quality of enterprises. J Clean Prod 331129834. https://doi.org/10.1016/j.jclepro.2021.129834

Wang SY, Chen ZH (2018) The derivation and industrial effect of corporate financial risk: a scenario analysis based on regulation and competition. Journal of Accounting Studies 11:56–62

Wang W, Liu YF, Peng DD (2015) Research on effects of population aging on industrial upgrading. China Industrial Economics (11):47–61

Wang ZJ, Wei J, Ren BP (2020) Influence of two-way FDI on green economy efficiency under the background of heterogeneous environmental regulation. Finance and Trade Research 31(03):1–16

Wang Q, Yi H (2021) New energy demonstration program and China’s urban green economic growth: do regional characteristics make a difference?[J]. Energy Policy 2021:151

Wen H, Lee C-C, Zhou F (2021) Green credit policy credit allocation efficiency and upgrade of energy-intensive enterprises. Energy Econ 94105099. https://doi.org/10.1016/j.eneco.2021.105099

Wu FF, Tong YM, Huang LC (2020) Research on the mechanism of quadruple helix innovation driven factors from the perspective of configuration: a fuzzy-set qualitative comparative analysis of China’s 30 provinces high-tech industries. Science of Science and Management of S.&.T 41(07):62–77

Xie TT, Liu JH (2019) How does green credit affect China’s green economy growth? China Popul Resour Environ 29(09):83–90

Yang X, He L, Zhong Z, Wang D (2020) How does China’s green institutional environment affect renewable energy investments? The Nonlinear Perspective Sci Total Environ 727(13):86–89

Yin JF, Wang ZW (2016) China’s green financial road. Comp Econ Soc Syst 6:49–56

Yuan H, Feng Y, Lee C-C, Cen Y (2020) How does manufacturing agglomeration affect green economic efficiency? Energy Econ 92104944. https://doi.org/10.1016/j.eneco.2020.104944

Zhang K, Li Y, Qi Y, Shao S (2021) Can green credit policy improve environmental quality? Evidence from China. J Environ Manag 298:113445. https://doi.org/10.1016/j.jenvman.2021.113445

Funding

This study was supported by grants from National Natural Science Foundation of China (72064009) and the National Social Science Fund of GuangXi Province (20FJL003).

Author information

Authors and Affiliations

Contributions

LG and YX conceived and designed the study. LG and WT conducted the modeling. LG and YX wrote the paper. LG, YX, and WT reviewed and edited the manuscript. LG and WT raised fund. All authors read and approved the manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Guo, L., Tan, W. & Xu, Y. Impact of green credit on green economy efficiency in China. Environ Sci Pollut Res 29, 35124–35137 (2022). https://doi.org/10.1007/s11356-021-18444-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-18444-9