Abstract

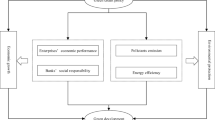

Economic green transition is the change of economic development mode under environmental constraints; this process will generate huge demand for credit financing. Understanding the connection between credit allocation and environmental performance is crucial for the coordinated development of the economy and environment. Utilizing the Chinese Industrial Enterprises Database, I constructed a city-level green credit index and compiled panel data from 2006 to 2013 for 282 selected cities in China. A spatial model was employed to explore the influence of green credit on the economic green transition. The findings reveal a positive relationship between green credit and economic green transition during the study period. Green credit not only enhances local green total factor productivity but also exerts beneficial impacts on adjacent areas though demonstration effects. Additionally, the reallocation of credit resources and the innovation of clean technologies are identified as key mechanisms through which green credit fosters a greener economy. However, the study also finds that the impact of green credit is moderated by factors such as a high reliance on natural resources, the underdevelopment of market intermediaries, and excessive governmental intervention, which can undermine its effectiveness. Furthermore, the efficacy of green credit exhibits regional heterogeneity; it has a significant positive impact in the eastern regions of China, while its influence appears to be non-significantly positive in the central and western regions. This study enriches the research on the macroeconomic impacts of green credit, offering practical evidence and theoretical support for the implementation of green credit policies by local governments in China.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The green economy is intimately linked with enhanced living standards, reduced environmental risks, and diminished resource scarcity. However, historically, achieving a balance between environmental protection and economic growth has been challenging. As Wang et al. (2021) indicate, much of China is still on the upward slope of the environmental Kuznets curve, suggesting that pollution levels continue to rise with economic growth. The 14th Five-Year Plan aims to reduce energy consumption per unit of GDP by 13.5% and carbon emissions per unit of GDP by 18% by 2025, compared to 2020 levels. Consequently, exploring strategies that promote economic growth while considering environmental protection is both urgent and necessary.

Recent research has investigated various factors that can aid the transition towards a green economy, including urbanization (Shao and Wang 2023; Pan et al. 2024), economic agglomeration (Guo and Sun 2023; Du and Zhang 2023), globalization (Li and Fan 2019; Hernández Soto 2024), environmental regulation (Li et al. 2019; Shuai and Fan 2020), and the financing environment (Zhang et al. 2021; Yang et al. 2021), among others. Among these factors, the financing environment proves to be a crucial driver. Both corporate clean-tech innovation and regional green industry development require significant external financing. However, green projects typically face more considerable financing constraints due to high capital requirements, long investment cycles, and uncertain returns. Therefore, policy support and financial incentives are necessary to complement pure market mechanisms. In this context, the role of green credit becomes increasingly significant.

Green credit, adhering to the Equator Principles, requires financial institutions to thoroughly assess the environmental and social impacts of their investments. In theory, green credit can influence technological innovation within companies (Hong et al. 2021; Chen et al. 2022) and reallocate credit resources across enterprises (Zhou et al. 2021; Ding et al. 2022) by setting environmental thresholds for credit access and managing credit distribution through quotas. China began its green credit practices in 2006, and from 2006 to 2007, the government introduced a series of policies to foster its development. Over time, green credit has become a significant part of China’s financial sector, with green loan values reaching 30.08 trillion yuan by the end of 2023, accounting for 12.66% of all loans by financial institutions.

Although green credit plays a strategic role and has experienced rapid growth, its practical effectiveness is contingent on various factors, including the robustness and practicality of the policies implemented and the ability of commercial banks to accurately identify green enterprises. Moreover, the effectiveness of green credit also depends on whether enterprises utilize the green loans they receive in accordance with established standards and regulations, ensuring that the funds are indeed directed towards eco-friendly projects and practices. This leads to the following key questions: Has green credit been effective in creating a mutually beneficial situation for the environment and the economy in China? Does the impact of green credit vary in Chinese regions with different market characteristics? Is the effect of green credit consistent across all geographic regions within China? What are the potential pathways for green credit to drive regional economies toward green transformation?

To address these questions, this paper utilizes the China Industrial Enterprises Database to create a city-level green credit index for the years 2006 to 2013. The SBM-DEA method with unexpected outputs is employed to calculate Green Total Factor Productivity (GTFP) as a measure of economic green transition. Panel data from 282 selected cities in China are collected, and a spatial model is used to investigate the relationship between green credit and economic green transition. Through this research, I aim to delve into the urban level to more comprehensively assess the impact of green credit, understand its underlying mechanisms, and explore its heterogeneous effects. Furthermore, by evaluating the historical performance of green credit, I seek to identify and understand deviations in the implementation process of green credit policies, thereby providing a theoretical foundation for their formulation and adjustment. This has significant theoretical and practical importance for pursuing balanced development between environmental governance and economic growth in the new era.

Literature review

Green credit refers to the funds provided by commercial banks to support the growth of green businesses, offering preferential lending conditions based on environmental protection and social responsibility (Wang et al. 2020). Current research on green credit focuses on three main areas.

Firstly, the impact of green credit on commercial banks themselves. Researchers agree that green credit can improve the quality of bank assets (Umar et al. 2021) and enhance core competence (Luo et al. 2021), thereby reducing credit risk, default risk, and the risk of stock price crashes (Umar et al. 2021; Del Gaudio et al. 2022; Mirza et al. 2023; Chen et al. 2023). However, the effects of green credit on bank profitability are less clear. Research by Lian et al. (2022) on Chinese banks indicates that green credit can lead to higher profits, as these operations typically yield a greater return on interest-earning assets. Yin et al. (2021a) found similar results, reporting that green loans enhance the financial performance of privately-owned banks. On the other hand, Del Gaudio et al. (2022) identified a contrary trend in their international study, suggesting that while green lending can reduce a bank’s risk exposure, it may also decrease profitability, leading to a lower Return on Average Assets (ROAA). Galán and Tan (2024) support this view, arguing that the revenue from green lending does not adequately cover the higher associated costs, which can negatively affect banks’ financial performance. In summary, there is a consensus that green credit reduces bank risk, but its impact on profitability remains uncertain.

Secondly, the impact of green credit on enterprises. Earlier research finds that the development of green credit has a “financing penalty effect,” which significantly reduces the debt financing capacity of heavily polluting enterprises (Liu et al. 2019), and increases their debt financing costs (Xu and Li 2020). The increased difficulties and costs of debt financing have influenced firms’ green behaviors, curbing the growth of polluting businesses (Wang et al. 2020), and impacting both Research and Development (R&D) investment and technological innovation (Chen et al. 2022; Wen et al. 2021; Tang et al. 2023). Chen et al. (2022) found that green credit policies encourage green innovation in enterprises by increasing R&D investment. Similarly, Yu et al. (2021) proposed that green credit could alleviate financing constraints on green innovation, although they observed that the capacity for green innovation can be compromised when firms face higher financing constraints. For heavily polluting enterprises, the impact of green credit on green innovation remains debated. Zhang et al. (2022c) reported improved technological innovation under green credit constraints, yet others argue that green credit policies may obstruct innovation due to increased debt costs and reduced R&D investment (Wen et al. 2021; Zhang et al. 2022d; Ma et al. 2023). Further research indicates that green credit contributes to emission reductions. Sun et al. (2019) found that firms relying more on external financing experience a more significant emission reduction benefit from green credit. The effectiveness of green credit in lowering emissions is linked to a decrease in total energy intensity, advancements in green innovation, and more robust environmental regulation (Lee et al. 2022; Zhang et al. 2022a; Tang et al. 2022; Xu et al. 2023). Additionally, Fan et al. (2021) discovered that green credit regulation affects small and large firms differently; larger firms tended to cut their emission levels by investing in pollution control facilities, whereas smaller firms responded by scaling back production.

Thirdly, from a macroeconomic perspective, green credit can reduce the credit resources available to heavy polluters (Ding et al. 2022) and direct credit resources to green enterprises (Zhou et al. 2021), thus reallocating credit resources and optimizing the industrial structure (Hu et al. 2020; Cheng et al. 2022; Zhang et al. 2023). In discussing the economic green transition, the findings are inconclusive. Lei et al. (2021) suggest that green credit contributes to economic greening by fostering innovation efficiency and energy structure optimization. However, research by Liu et al. (2020) and Yin et al. (2021b) indicates that this impact is not linear but exhibits a ‘U’-shaped relationship. Their studies, using panel data from 30 Chinese provinces, find that green credit must surpass a certain threshold to have a positive influence on the economy’s green transformation. Shi and Shi (2022) support this finding, adding that the level of climate finance in most provinces in China is below the threshold value, resulting in a small and statistically insignificant effect on GTFP. Other studies have considered geographical differences and found that the effect of green credit is not uniform across different regions. The study by Li et al. (2023) points out that green credit significantly boosts GTFP in eastern China, but its effect is minimal in other areas.

While there has been significant research on green credit, several areas have received less attention. First, the macroeconomic effects of green credit are underexplored. Current research mainly focuses on the relationship between green credit and corporate indicators, thoroughly examining its effects on enterprise risk management, financial performance, technical innovation, and emission reduction. However, there is a relative lack of research on how green credit contributes to the green transformation of regional economies, and there is no widespread agreement on this issue. Second, there is a significant gap in the use of city-level data when analyzing the impact of green credit on economic green development. Most research has relied on provincial-level data, which may not accurately reflect the regional differences. Some studies have attempted to assess the development of green credit at the city level by using an interaction term that combines provincial green credit indices with the weights of urban commercial bank branches. This method might be more effective in identifying the marginal effects of green credit alongside urban financial development, rather than isolating the impact of green credit itself, which could affect the accuracy of the research conclusions. Third, discussions on the heterogeneity of green credit are limited in the existing literature, and there is not enough discussion on how the behavior of local governments, economic development patterns, and the level of financial market development affect the effectiveness of green credit. Fourth, most existing research neglects the potential spatial dependence of economic green transformation. Given that environmental issues transcend borders, incorporating spatial considerations into empirical research can increase the robustness of the analytical results.

This paper aims to enrich the current literature in several ways. Firstly, it introduces an innovative research perspective. Green credit has developed rapidly since China started its green credit business in 2006. However, the question of whether green credit has effectively promoted the green transformation of regional economies remains unanswered. To address this, the study calculates the GTFP of 282 Chinese cities using the SBM-DEA method that includes undesirable outputs. This method takes into account both economic benefits and environmental performance, thereby providing a more accurate reflection of the shift in economic growth patterns under environmental constraints. By using city-level GTFP data, the study precisely evaluates the impact of green credit on the green transformation of regional economies, thereby adding depth to the macroeconomic analysis of green credit. Secondly, it innovates in data selection. Unlike previous province-level analyses by Lei et al. (2021) and Shi and Shi (2022), this study constructs a city-level green credit index using the Chinese Industrial Enterprises Database. This approach allows for a nuanced examination of green credit’s economic and environmental impacts at a more granular level, offering a precise assessment of its effects across different cities. Thirdly, this research goes beyond geographic heterogeneity analyses found in studies like those by Yin et al. (2021b) and Li et al. (2023). Instead, it delves into the heterogeneous impact of green credit, demonstrating that green credit’s positive effects are more evident in regions characterized by lower dependence on natural resources, reduced government intervention, and more developed market intermediary organizations. This suggests that green credit is more effective in certain types of market characteristics. Fourthly, the model used in this work differs from some previous studies. Specifically, Wang et al. (2019b) and Liu et al. (2023) utilized the DSGE model to assess the impact of green credit, Liu et al. (2020) applied the OLS method in their analysis, and a number of studies have utilized the DID approach to evaluate the effects of green credit policies (Wen et al. 2021; Ma et al. 2023). Considering the potential spatial spillover effects of economic green development and its determinants, a spatial model is chosen for this work. The findings show that there is a significant correlation between green economic transitions in different regions, green credit not only enhances local GTFP but also exerts beneficial impacts on adjacent areas. By employing spatial econometrics, this study provides a more comprehensive analysis of regional economic integration and the dynamics of green growth.

The remainder of this paper is organized as follows: “Theoretical analysis” presents theoretical analysis and research hypotheses. “Model building and variable description” describes the econometric model construction and data. “Empirical results and analysis” discusses the findings, and “Research conclusions and policy implications” concludes with a summary and policy implications.

Theoretical analysis

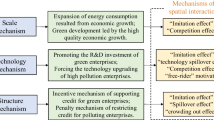

Green credit drives the economic green transition through three main channels. The first channel is credit resource allocation. Under the traditional credit allocation model, the basic principles of bank lending are to ensure the safety, liquidity, and profitability of the loan. For this reason, commercial banks tend to provide loans to large enterprises and industries with higher profitability. Green projects, which rely heavily on technological innovation, often face greater financing constraints due to a lack of collateral, uncertain expected returns, and imperfect information disclosure. Chang et al. (2016) found that, influenced by bank collateral policies and information asymmetry, financial resources in China are heavily concentrated in highly polluting enterprises. Heavily polluting industries, such as thermal power, petroleum, and steel, account for 60 to 80% of total industrial emissions and are the most important sources of pollution (Wen and Liu 2019). Credit capital continues to be tilted toward polluting industries, crowding out the financial resources needed for green development. Green credit is intrinsically an allocation of credit that prioritizes environmental considerations. This strategy helps to reduce commercial banks’ preference for heavy-polluting industries and large state-owned enterprises and directs credit resources to flow into the clean sector as a priority. As a result, green projects that are difficult to obtain financial support under the traditional financial framework will have a higher probability of receiving external funds in a timely manner. Meanwhile, heavy-polluting industries will face fewer financing opportunities and higher investment costs, some enterprises with low productivity may choose to cut production or simply exit the market. This reallocation of credit resources can relieve the over-concentration of financial resources and enhance the financing capacity of eco-friendly companies. Thus, the originally suppressed demand for green investment is released and transformed into new green productivity, which helps to promote the economic green transition.

The second channel is clean technology innovation. Local governments have traditionally been under pressure to maintain economic growth. For a long time, highly polluting enterprises tended to ‘capture’ local governments by contributing economic outputs such as taxes and employment. Consequently, the environmental toll caused by their production process is likely to be tacitly accepted by local governments. However, polluting enterprises damage the local environment, and environmental regulations are necessary. The balance of economic development and environment protection leads to emission reduction efforts being tightened 1 year and loosened the next. As a result, the green economic growth rates within cities are fluctuating (Li and Xu 2018). Green credit can internalize the negative externalities associated with excessive emissions, thereby inducing enterprises to invest in technological innovation and voluntarily shift to cleaner production. Specifically, the “Equator Principles” of green credit policy require financial institutions to prudently assess the environmental performance and social impact of investment projects and to cut, suspend, or withdraw loans from businesses that fail to meet environmental standards. The financing penalty effect reduces the willingness of polluting enterprises to ‘capture’ the government; these enterprises are more inclined to mitigate environmental risks through other means, such as technological innovation. Technological innovation can enhance business performance by improving product quality and creating higher added value. Some clean technology innovations can achieve the substitution of traditional energy sources, thus reducing energy intensity and improving ecological performance. Besides, green credit enhances the accessibility and ease of obtaining financial support for clean businesses. By obtaining additional funds for clean technology development and production process improvement, enterprises can improve business performance, reduce environmental pollution, and contribute to the economic green transition.

The third channel is the regional demonstration effect. Bai and Nie (2018) argue that there is a competitive mechanism of economic development among regions; regions with faster changes in economic development mode tend to have a demonstration effect on neighboring areas. Supported by green financing, local enterprises alleviate the financing constraints faced by green projects, increase the incentive to innovate, and accelerate the economic green transition. If neighboring governments do not take action to accelerate the green transition of their economy, regional development disparities are likely to increase further. Due to factors such as officials’ performance assessment, local investment promotion, and enterprises’ market competitiveness, neighboring regions will increase the share of green credit and decrease funding for polluting projects; this helps to form a synergistic development model among regions and amplifies the impact of green credit. Additionally, geographical convenience between cities allows workers to communicate with each other formally and informally, so advanced technology can flow freely in a larger region. Neighboring companies can keep abreast of the latest technologies, enhance learning and imitation, which in turn will improve enterprise productivity and reduce pollutant emissions. In summary, I propose the following hypotheses:

-

Hypothesis 1: Green credit supports the shift towards a green economy.

-

Hypothesis 2: Green credit drives the economic green transition through credit resource allocation, clean technology innovation, and the regional demonstration effect.

Model building and variable description

Model building

To fully understand how green credit affects the green transformation of the economy, I proceed to select a model that links the two variables and discuss the specific impact paths empirically. There are objective economic, technological, and environmental links among cities, and the green transition in one region is likely to drive sustainable development in neighboring areas. In view of this, the spatial model is considered for empirical tests, the typical structure of a spatial panel model is:

where Y is the dependent variable; X is a series of independent variables; \(\rho\) and \(\lambda\) are the spatial auto-regressive and spatial auto-correlation coefficients, respectively; \({u}_{i}, {v}_{t}\) and \({\varepsilon }_{it}\) denote the regional effect, time effect, and residuals, respectively. \({W}_{ij}\) is the spatial weight matrix, taken as \({e}^{{-ad}_{ij}}\) if \(i\ne j\), otherwise 0. \({d}_{ij}\) is the geographic distance between spatial unit i and spatial unit j. \(\alpha\) is the coefficient, measured as the inverse of the shortest distance between cities. If \(\lambda =0\), Eq. (1) is simplified to spatial Durbin model (SDM); if \(\lambda =0\) and \(\theta =0\), it is simplified to spatial lag model (SAR); if \(\rho =0\) and \(\theta =0\), it is simplified to spatial error model (SEM).

Variable descriptions

Explained variable

Green total factor productivity (GTFP) is used to measure the level of economic green transition. Chung et al. (1997) argued that “bad” outputs should be considered when measuring productivity, and estimated the Malmquist-Luenberger (ML) productivity index based on the data envelopment analysis (DEA) method under environmental constraints. However, traditional DEA models are constructed from radial and angular considerations, which tend to overestimate the efficiency of decision units, and the ML index may face an infeasibility problem for cross-period analyses. To solve these problems, Tone (2001) proposed an SBM-DEA model that avoids bias due to subjective selection of radials and angles; Oh (2010) constructed the Global Malmquist-Luenberger (GML) index, which is circular and free from the infeasibility problem.

The SBM-GML index with undesirable outputs is constructed as follows. Supposing there are k decision-making units (DMU), each consumes n inputs, denoted as \({x}_{n}\); produces m desirable outputs, denoted as ym, and i undesirable outputs, denoted as \({b}_{i}\). The global production possibility set can be described as:

where z denotes the weight of each cross-sectional observation and t denotes time period. For each DMU, the SBM directional distance function at time t can be expressed as:

where (\({x}^{t, {k}{\prime}},{y}^{t, {k}{\prime}},{b}^{t, {k}{\prime}}\)) denote the vectors of inputs, desirable outputs and undesirable outputs of the k′th DMU in period t, respectively. (\({g}^{x},{g}^{y},{g}^{b}\)) denote the directional vectors of inputs, desirable outputs, and undesirable outputs, respectively. \(({s}_{n}^{x},{s}_{m}^{y},{s}_{i}^{b})\) denote the vectors of slack variables of inputs, desirable outputs, and undesirable outputs, respectively. The SBM-GML index can be computed by solving:

In this work, considering each city as a decision-making unit, three factors are assumed to be inputs in production, including labor, capital, and energy, to produce both expected and unexpected outputs. Following existing literature, labor input is expressed as the number of employed people in each city; capital input is estimated using the perpetual inventory method, with a base period of 2006 and a depreciation rate of 9.6%; energy consumption is measured following Jiang et al. (2022), using the simulation of satellite nightlight data. For output indicators, the desirable output is the constant-price GDP of the cities using 2006 as the base period; the undesirable outputs comprise SO2 and CO2 emissions of each city. The GML index from 2006 to 2013 of 282 cities in China can be computed by solving Eq. (3). Following Chen and Wang (2022), I use the year 2006 as the base period and assume a GML index of 1 for each city, the GTFP of each year from 2007 to 2013 is derived by multiplying the GML of the current year by the previous year’s GML.

Core explanatory variable

Green credit development

Green credit (GC) is a differentiated lending strategy that suspends, cherishes, or withdraws loans from highly polluting enterprises while enhancing financial support for environmentally friendly enterprises. Since interest expenses can serve as an indicator of the amount of loans extended, the interest expense ratio of polluting industries can reflect the development of green credit to some extent. This work constructs a city-level green credit index based on the Chinese Industrial Enterprises Database. Sample companies in the database are first grouped by city, and interest expenditures of sample enterprises in each city are summed up by industry. Then, the share of interest expenditure of heavy-polluting industries in each city is calculated and used as a proxy for GC. This ratio is an inverse indicator, so it is converted into GC = 1 − PIEit/TIEit, where TIEit stands for the total interest expenditure of industrial sectors in city i, and PIEit stands for the interest expenditure of heavy-polluting sectors in city i. Since SO2 emissions are the main source of air pollutants, and industrial SO2 emission reduction is an important goal of pollution prevention and control in China, the top 10 SO2 emitting industries are identified as highly polluting sectors in this work.Footnote 1 In the robustness test, following Xie and Liu (2019), six high-energy-consuming industries are classified as heavy-polluting sectors, and GC are recalculated accordingly.

For various reasons, the information provided by some enterprises in the Chinese Industrial Enterprises Database is not accurate, and some information is missing. Referring to Ni and Wang (2022), the following data screening procedures are conducted: (1) eliminating the samples of enterprises with missing sales, number of employees, total assets, or net fixed assets; (2) eliminating the samples of enterprises with fewer than 8 employees; (3) eliminating the samples of enterprises where total assets are less than current assets; total assets are less than net fixed assets; or accumulated depreciation is less than current depreciation; (4) excluding the samples of enterprises with sales less than 5 million CNY; and (5) excluding the samples of enterprises with an interest expense of less than 0. Since the data quality of 2010 is poor, the interest expense data for 2010 are made up using the linear interpolation method.

Mediator variables

Credit resource allocation (QCR)

The location entropy method is used following Zhang et al. (2022b). A larger location entropy index indicates a higher concentration of regional credit resources and a more inequitable allocation of credit resources. As this index is an inverse indicator, I take the reciprocal of it: \({QCR}_{i}=1/[({D}_{i}/{P}_{i})/(D/P)]\). Where \({D}_{i}\) is the year-end deposit balance of financial institutions within region i, \({P}_{i}\) is the resident population count for the same region; D and P are the year-end deposit balance of financial institutions and the total resident population in the country, respectively.

Clean technology innovation (GI)

Following Xie et al. (2015), I use SO2 generation intensity (SO2 generation/regional industrial output) as a proxy for clean technology innovation. SO2 generation intensity is related to equipment modification or innovation, which can reflect the effectiveness of technological improvement in the front-end production process. Higher SO2 generation intensity is associated with lower level of clean technology innovation; therefore, this is an inverse indicator, and the reciprocal of it is taken for analysis in this paper.

Control variables

A set of variables affecting the regional economy and green development are controlled in the study, including (1) industrial structure (SH), referring to Liu and Zhang (2008), is measured by: \({SH}_{i}=\sum\limits_{j=1}^{3}({Y}_{ij}/{Y}_{i}){LP}_{ij}^{N}\). \({Y}_{ij}/{Y}_{i}\) is the ratio of output of industry j in city i to the total output of the city; \({LP}_{ij}^{N}\) is the standardized labor productivity in the same period. In general, the output share is a dimensionless ratio, while labor productivity is not. To eliminate the effect of dimensionality, \({LP}_{ij}^{N}\) is standardized following Chenery et al. (1986). (2) Population density (DEN) is reflected by dividing the population of each city by the size of the corresponding administrative area. (3) Foreign direct investment (FDI) is measured by the amount of foreign direct investment as a percentage of GDP. (4) Environmental regulation intensity (ER) is a comprehensive index computed by assessing the emissions of industrial wastewater, SO2, and soot per unit of production output. This is an inverse indicator, with larger values indicating more pollutant emissions and weaker environmental regulation. (5) R&D investment (RE) is reflected by the proportion of fiscal expenditure on science and technology to total fiscal expenditure. (6) Digital infrastructure (INT) is measured by the amount of internet hosts per 10,000 people.

Data sources

Since the Chinese Industrial Enterprises Database is updated to 2013, the sample interval of this study is 2006–2013. Balanced panel data of 282 Chinese cities are collected, resulting in a total of 2256 observations. The data are obtained from the China City Statistical Yearbook, China Industrial Enterprise Database, and China Environmental Statistical Yearbook. Some missing data are supplemented by the linear interpolation method. The descriptive statistics of the variables are shown in Table 1.

Empirical results and analysis

Model specification

Following Elhorst (2014), the Lagrange Multiplier (LM) test, likelihood ratio (LR) test, and Wald test are used for model specification. Test results are presented in Table 2. I begin with the LM test to assess whether there is spatial correlation in the data. The LM Lag and LM Error values are 465.268 and 442.563, respectively, surpassing the 1% significance level. This suggests that the spatial model outperforms the OLS model. The Robust LM Test also rejects the hypothesis of no spatial dependence, further affirming that the spatial model is more suitable.

Next, the LR test and Wald test are adopted to see if the SDM is more appropriate than SEM or SAR. The LR Lag and LR Error values are significant at the 1% level, indicating the SDM cannot be reduced to either SEM or SAR. The Wald test also supports the notion that the SDM is more suitable. Finally, a Hausman test is performed on the SDM, and the result (50.51) is significant, suggesting that the SDM should have fixed effects. Therefore, the SDM with two-way fixed effects is selected for this study. For comparison, I also report the estimations of the SAR and SEM.

Baseline results

Table 3 shows that the coefficient of green credit is 0.0248, and it is significant at the 1% level, suggesting that green credit has a notable positive impact on the economic green transition. This supports the validation of Hypothesis 1. On the one hand, for polluting industries, green credit increases the cost of debt financing, compelling them to incorporate environmental risks into their operating costs, thereby internalizing the negative externalities of excessive emissions. At the same time, the heightened difficulty in obtaining debt financing also constrains the investment and expansion of these polluting enterprises, effectively limiting their growth. On the other hand, by offering more favorable loan terms for environmentally friendly projects, green credit reduces the cost for enterprises to adopt green technologies, thereby fostering improvements in production technology and enhancing productivity. Overall, green credit aids businesses in factoring environmental considerations into their economic decisions, thus contributing to the greening of the economy.

The estimates of the control variables are basically in line with expectations. Industrial structure optimization contributes to the reallocation of resources toward modern service industries, which are distinguished by their lower energy consumption and reduced emissions. This transition promotes the emergence of a more environmentally friendly economy. Population agglomeration helps in the more effective use of idle resources, leading to higher urban eco-efficiency. As for FDI, on the one hand, the inflow of foreign capital brings advanced environmental concepts and technological tools; on the other hand, during the sample period, developed countries shifted polluting industries to China to avoid strict environmental regulations and high emission costs in their own countries. Hence, the effect of FDI is uncertain, and the corresponding coefficient is not significant. Environmental regulation intensity negatively affects the economic green transition. A possible explanation is that, in the short term, environmental regulation increases the production costs of firms, leading to lower output, which in turn acts negatively on GTFP. R&D investment primarily drives the economy’s green transformation by advancing technology. The coefficient of digital infrastructure development is negative, probably because digitization consumes a large amount of energy, and therefore negatively affects GTFP.

Further, the positive coefficient of Wx × GC indicates that local development of green credit has a significant beneficial effect on the eco-friendly economic growth in neighboring regions. There is the advantage of geospatial convenience in neighboring cities, and proximity facilitates all types of formal and informal communication, so neighboring companies can keep abreast of the latest cleaning technologies, enhance learning and imitation, thus strengthening the role of green credit. The spatial spillover estimate \(\rho\) is positively significant, implying a strong positive spatial correlation in the shift towards a new economic development mode. This may be because local enterprises with green credit support can alleviate their financing constraints, increase market competitiveness, and improve regional environmental performance, which has a demonstration effect on surrounding areas.

Robustness of baseline results

Alternative measures

To test the reliability of baseline results, two alternative measures are chosen: (1) replacement of the matrix, constructing an integrated weight matrix that connects geographic position with economic progress, and re-running the regression. The new matrix takes the form of diagonal elements with 0 and non-diagonal elements with \({W}_{ij}^{e}=({\overline{Y} }_{i}\times {\overline{Y} }_{j})/{d}_{ij}^{2}\), where \({\overline{Y} }_{i}\) and \({\overline{Y} }_{j}\) are the average values of GDP per capita for cities i and j, respectively. (2) Replacement of the core explanatory variable, six high-energy-consuming industriesFootnote 2 are marked as heavy-polluting sectors and green credit indexes are recalculated, again running the regression. Table 4 presents that the green credit coefficients are positively significant in both cases, aligning with the baseline results and confirming the reliability of the earlier findings.

Endogeneity issues

-

1.

Reverse causation: the test results do not change significantly from the baseline results by re-regressing green credit with a one-period lag to control for possible reverse causation.

-

2.

Omission bias: “economic development,” “government intervention,” and “urbanization level,” which may affect GTFP, are controlled to mitigate possible omission bias. The results show that the direction and significance of the green credit coefficients align with the baseline; the empirical results of this work are reasonable.

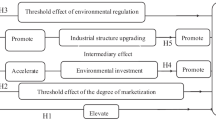

Heterogeneous effects

Differences in resource dependency

China has a vast territory with varying resource endowments among regions, leading to divergent development paths between cities with abundant resources and those without. This disparity could markedly influence the effects of green credit. Based on the division of the National Sustainable Development Plan for Resource-based Cities (2013–2020), 282 sample cities are classified into two groups: 112 cities are identified as resource-dependent, while the remaining 170 are not. The regression outcomes presented in Table 5 indicate that green credit has a more pronounced effect on green economic transition within non-resource-dependent cities. In contrast, for resource-based cities, the transition towards a greener economy faces more obstacles. As Li and Xu (2018) suggested, areas with abundant resources tend to have a competitive advantage in extraction industries, which promotes the growth of resource-intensive sectors and creates a path dependency. This makes the shift to a greener economy more difficult and slower for such areas. Furthermore, the abundant natural resources in the region mean it is less constrained by resource shortages, which leads to insufficient incentives to pursue technological innovation or to improve energy efficiency, even with financial incentives. This may reduce the effectiveness of green credit.

Differences in the degree of government intervention

Excessive government intervention may distort the market mechanism and limit the effect of green credit. In this paper, the index of “Reducing government intervention in enterprises” from the Report on Marketization Index of China by Provinces compiled by Wang et al. (2019a) is used to assess the extent of government intervention. Since the index only has data for even-numbered years, this paper uses 2012 as the evaluation criterion to group the sample cities. If a city is located in a province that is higher than the sample median, it is considered as “low government intervention;” if not, it is considered “high government intervention.” Research shows that green credit is more effective in promoting green economic transformation in cities with less government intervention. Chai et al. (2022) find that while China’s green credit policy does limit illiquid debt financing for polluting firms, it does not effectively guide capital flows as firms seek other ways to finance their operations. Government fiscal subsidies are one potential source of funding. Under the traditional economic development model, high energy consumption, high pollution, and overproduction enterprises have a large contribution to local tax revenue and employment, so local governments have the incentive to provide support to these enterprises. Fiscal subsidies and bailout actions alleviate the market pressures faced by enterprises, leading to a lack of motivation to invest in greener technologies. This mitigates the “financing penalty effect” of green credit. Therefore, in cities with heavier government intervention, the positive impact of green credit on green economic transformation is diminished.

Differences in market intermediary organizations

Green credit relies on the technical support of third-party certifiers, green rating agencies, and other intermediaries. These market intermediaries collect, quantify, and monitor the environmental information of enterprises in a unified manner, providing services like green credit ratings, environmental risk assessments, and green audits. This improves investors’ ability to identify high-tech and knowledge-intensive industries. Without robust regional intermediary organizations and sufficient green credit support services, financial institutions may incorrectly evaluate green credit applications, potentially granting loans to businesses with hidden environmental risks, thus weakening the effect of green credit. This paper selects the index of “market intermediary organization development and legal system environment” in the China Marketization Index Report by Province to measure the degree of development of market intermediary organizations. If the province where the city is located is above the sample median, it is considered as “good intermediary organization environment;” if not, it is considered “poor intermediary organization environment.” The results show that cities with relatively well-developed intermediary organizations have a greater contribution of green credit to green economic development. In contrast, in cities lacking robust intermediary organizations, the evaluation of corporate environmental impacts tends to be inadequate. Companies might secure loans through ‘greenwashing,’ thereby reducing the quality of green credit assets. Furthermore, asymmetric information regarding corporate environmental practices can lead to credit discrimination by commercial banks. This, in turn, can create significant financing obstacles, stifling technological innovation, and hindering progress toward green development.

Regional heterogeneity

Using the economic belt classification standard of the National Bureau of Statistics, this study categorizes 282 cities into three geographical zones: eastern, central, and western. According to the findings presented in Table 5, green credit has a notably positive impact on GTFP in the eastern region. However, while the influence of green credit on GTFP in the central and western regions is positive, it is not statistically significant. This discrepancy may stem from the advanced and sophisticated financial systems in the east, which facilitate the adoption and utilization of green credit by businesses. This, in turn, promotes technological innovation and investment in environmental protection, leading to improved production efficiency and environmental performance. In contrast, the financial systems in the central and western regions are relatively less developed, resulting in limited availability of green credit products and services, making it more challenging for enterprises to access green financing. Particularly in the western region, there is a heavy reliance on natural resources, and the economic structure is more monolithic. Resource-based enterprises may focus more on resource exploitation rather than the application of green technologies, leading to a weaker demand and response to green credit.

Mechanism testing

To further explore how green credit affects the green transition of regional economy, mechanism variables and their interaction terms with the core explanatory variable are added to the baseline model to conduct mechanism tests:

where QCR and GI represent credit resource allocation and clean technology innovation, respectively. As shown in the first two columns of Table 6, the coefficients of QCR are significantly positive, suggesting that a rational allocation of credit resources is conducive to economic green growth. The coefficient of the interaction term \(\text{ln}GC\times QCR\) is 0.0116, which is significant at the 5% level. This indicates that the marginal effect of credit resource allocation on economic green growth increases by 0.0116 units for every 1-unit increase in the proportion of green credit. In other words, green credit promotes the green transformation of the economy through the rationalization of credit resource allocation. Green credit combines the resource allocation function of financial institutions with environmental responsibility. Through differentiated credit policies, it restrains the expansion of polluting enterprises and supports enterprises with outstanding environmental performance. This strategy reduces excessive capital flow to environmentally damaging industries, thus ensuring a more efficient distribution of credit within a region. The rational allocation of resources increases regional productivity and eases environmental pressure in the process of economic growth.

The last two columns in Table 6 reveal that the coefficients for \(\text{ln}GI\) and \(\text{ln}GC\times \text{ln}GI\) are both significantly positive at the 1% level. Specifically, the interaction term \(\text{n}GC\times \text{ln}GI\) coefficient is 0.0104, implying that the marginal effect of clean technology innovation on economic green growth increases by 0.0104 units with each 1-unit increase in the share of green credit. Green credit facilitates the green transition of the economy through the support of technological innovation. Key environmental technology innovations, such as the improvement of production process and the upgrade of manufacturing equipment, are unattainable without the support of capital investment. Green credit eases the financial constraints that enterprises face, reduces the risks associated with research and development, bolsters innovation incentives, and thus aids in the economic green transition. Hypothesis 2 is thereby confirmed.

Research conclusions and policy implications

The green transformation of the economy is a primary goal of China’s 14th Five-Year Plan. Achieving this goal heavily relies on the financial sector’s support. In the context of China’s bank-centric financing structure, exploring how green credit affects economic green transition and identifying deviations in the implementation of green credit policies are of great significance in fostering a greener economy. Existing research on green credit focuses on the enterprise or provincial level, with less emphasis on city-level data. This study uses the China Industrial Enterprise Database to establish a city-level green credit index. It also calculates GTFP for 282 Chinese cities from 2006 to 2013, using this index as an indicator of economic green transition. Findings reveal that the development of green credit effectively enhances regional GTFP. Clean technology innovation and the allocation of credit resources are two important drivers in this process. Green credit development facilitates financing for R&D investment, encouraging the adoption of advanced technology and enhancing productivity. Concurrently, it increases the credit cost and difficulty for polluting industries, deterring their expansion and leading to the elimination of outdated capacity. In addition, due to the demonstration effect among regions, GTFP demonstrates a strong positive spatial correlation between different areas. The green development of one area can drive green growth in the surrounding regions. Heterogeneity analysis suggests that factors such as low resource dependence, the presence of developed market intermediary organizations, and reduced government intervention contribute to the favorable effects of green credit. These characteristics may explain why the impact of green credit on economic green transition is more pronounced in China’s eastern regions. Here, due to the presence of developed market intermediary organizations, transparency of enterprise environmental information is higher, and the economy is less reliant on natural resources, enhancing the effectiveness of green credit. In contrast, in the central and western regions, the economy is still significantly tied to resource dependence, making the green transformation more challenging and costly. The financial market and market intermediary organizations in these regions might not be as developed as in the eastern regions, and the role of the government might be more significant. These factors result in a less pronounced positive effect of green credit.

In terms of policy impact, green credit is the largest and most mature component of China’s green financial system, and is an important source of funds for green economic development. The government should consider strengthening policy support for green credit, improving the legal framework related to green credit, and lowering the threshold for market access and operating costs, thereby accelerating the green transformation of the economy. In addition, the existence of spatial spillover effects suggests that regional economic integration should not only focus on maximizing economic benefits, but should also take into account environmental protection. As environmental issues are transboundary in nature, regions need to work together to address these issues. Finally, the heterogeneity analysis shows that there are significant differences in the industrial structure and financial market development of different regions, which directly affect the effectiveness of green credit. Therefore, it is necessary to provide differentiated policy solutions. For the eastern regions, which have relatively developed financial markets, lower dependence on resources, and abundant clean technologies, it is advisable to set clear assessment targets in areas such as green production efficiency to enhance the performance of green credit policies. For the central and western regions, which have a higher reliance on resources, the positive impact of green credit policies on the transformation of regional production methods is not yet significant. Thus, when formulating policies, complementary technology transfer services should also be provided to assist high-pollution enterprises in transitioning and upgrading.

While this paper takes into account the heterogeneity of green credit at the city level, it does not examine the impact of green credit loan tenure. The term of funding determines its liquidity and risk-bearing capacity, which in turn influences investment decisions. The financial data of Chinese A-share listed companies in the energy conservation and environmental protection sectors could be utilized to calculate the volumes of long-term and short-term green credit funding, and to explore their respective impacts. This may be a potential direction for future research.

Data availability

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

Notes

According to the China Environmental Statistics Yearbook, the SO2 heavy-polluting sectors in this paper are “13 agricultural and sideline food processing, 14 food manufacturing, 17 textile industry, 22 paper and paper products industry, 25 petroleum processing, coking and nuclear fuel processing industry, 26 chemical fuels and chemical products industry, 31 non-metallic mineral products industry, 32 ferrous metal smelting and rolling processing industry, 33 non-ferrous metal smelting and rolling processing industry, and 44 electricity and heat production and supply industry.”.

According to the 2010 National Economic and Social Development Statistical Report, the six high-energy-consuming sectors are “25 petroleum processing, coking and nuclear fuel processing industry, 26 chemical fuel and chemical products industry, 31 non-metallic mineral products industry, 32 ferrous metal smelting and rolling processing industry, 33 non-ferrous metal smelting and rolling processing industry, and 44 electricity and heat production and supply industry.”.

References

Bai J, Nie L (2018) Energy efficiency, environmental pollution and the transformation of China’s economic development mode. J Financ Res 10:1–18

Chai S, Zhang K, Wei W, Ma W, Abedin MZ (2022) The impact of green credit policy on enterprises’ financing behavior: evidence from Chinese heavily-polluting listed companies. J Clean Prod 363:132458

Chang C, Chen K, Waggoner DF, Zha T (2016) Trends and cycles in China’s macroeconomy. NBER Macroecon Annu 30(1):1–84

Chen N, Wang L (2022) Interactive contribution of technology spillover and independent innovation of improving the production efficiency of Chinese manufacturing industry. J Quant Tech Econ 39(05):84–103

Chen Z, Zhang Y, Wang H, Ouyang X, Xie Y (2022) Can green credit policy promote low-carbon technology innovation? J Clean Prod 359:132061

Chen J, Liu X, Ou F, Lu M, Wang P (2023) Green lending and stock price crash risk: evidence from the green credit reform in China. J Int Money Financ 130:102770

Chenery H, Robinson S, Syrquin M (1986) Industrialization and growth: a comparative study. Oxford Univ Press 71–78

Cheng Q, Lai X, Liu Y, Yang Z, Liu J (2022) The influence of green credit on China’s industrial structure upgrade: evidence from industrial sector panel data exploration. Environ Sci Pollut Res 29(15):22439–22453

Chung YH, Färe R, Grosskopf S (1997) Productivity and undesirable outputs: a directional distance function approach. J Environ Manage 51(3):229–240

Del Gaudio BL, Previtali D, Sampagnaro G, Verdoliva V, Vigne S (2022) Syndicated green lending and lead bank performance. J Int Financ Manag Acc 33(3):412–427

Ding X, Jing R, Wu K et al (2022) The impact mechanism of green credit policy on the sustainability performance of heavily polluting enterprises-based on the perspectives of technological innovation level and credit resource allocation. Int J Environ Res Public Health 19(21):14518

Du M, Zhang Y (2023) The impact of producer services agglomeration on green economic development: evidence from 278 Chinese cities. Energy Econ 124:106769

Elhorst JP (2014) Matlab software for spatial panels. Int Reg Sci Rev 37(3):389–405

Fan H, Peng Y, Wang H, Xu Z (2021) Greening through finance? J Dev Econ 152:102683

Galán JE, Tan Y (2024) Green light for green credit? Evidence from its impact on bank efficiency. Int J Finance Econ 29(1):531–550

Guo J, Sun Z (2023) How does manufacturing agglomeration affect high-quality economic development in China? Econ Anal Policy 78:673–691

Hernández Soto G (2024) The role of foreign direct investment and green technologies in facilitating the transition toward green economies in Latin America. Energy 288:129933

Hong M, Li Z, Drakeford B (2021) Do the Green Credit Guidelines affect corporate green technology innovation? Empirical research from China. Int J Environ Res Public Health 18(4):1682

Hu Y, Jiang H, Zhong Z (2020) Impact of green credit on industrial structure in China: theoretical mechanism and empirical analysis. Environ Sci Pollut Res 27(10):10506–10519

Jiang H, Li J, Li Q (2022) Government development expenditure, industrial agglomeration and green energy efficiency. J Technol Econ 41(01):53–65

Lee C-C, Chang Y-F, Wang E-Z (2022) Crossing the rivers by feeling the stones: the effect of China’s green credit policy on manufacturing firms’ carbon emission intensity. Energy Econ 116:106413

Lei X, Wang Y, Zhao D, Chen Q (2021) The local-neighborhood effect of green credit on green economy: a spatial econometric investigation. Environ Sci Pollut Res 28(46):65776–65790

Li J, Xu B (2018) Curse or blessing: how does natural resource abundance affect green economic growth in China. Econ Res J 53(09):151–167

Li H, Zhu X, Chen J, Jiang F (2019) Environmental regulations, environmental governance efficiency and the green transformation of China’s iron and steel enterprises. Ecol Econ 165:106397

Li BY, Zhang JW, Shen Y, Du Q (2023) Can green credit policy promote green total factor productivity? Evidence from China. Environ Sci Pollut Res 30(3):6891–6905

Li G, Fan X (2019) Trade opening, foreign direct investment and green total factor productivity. J Nanjing Audit Univ 16(4):103–111

Lian YH, Gao JY, Ye T (2022) How does green credit affect the financial performance of commercial banks? Evidence from China J Clean Prod 344:131069

Liu W, Zhang H (2008) Structural change and technical advance in China’s economic growth. Econ Res J 43(11):4–15

Liu X, Wang E, Cai D (2019) Green credit policy, property rights and debt financing: quasi-natural experimental evidence from China. Financ Res Lett 29:129–135

Liu H, Wang D, Shang J (2020) From the perspective of green low-carbon technological progress: can green credit help promote sustainable economic development? Jilin Univ J Soc Sci Ed 60(03):96–105+237

Liu H, Liu Z, Zhang C, Li T (2023) Transformational insurance and green credit incentive policies as financial mechanisms for green energy transitions and low-carbon economic development. Energy Econ 126:107016

Luo S, Yu S, Zhou G (2021) Does green credit improve the core competence of commercial banks? Based on quasi-natural experiments in China. Energy Econ 100:105335

Ma Y, Sha Y, Wang Z, Zhang W (2023) The effect of the policy mix of green credit and government subsidy on environmental innovation. Energy Econ 118:106512

Mirza N, Afzal A, Umar M, Skare M (2023) The impact of green lending on banking performance: evidence from SME credit portfolios in the BRIC. Econ Anal Policy 77:843–850

Ni T, Wang Y (2022) Regional administrative integration, factors’ marketization and firms’ resource allocation efficiency. J Quant Tech Econ 39(11):136–156

Oh D-h (2010) A metafrontier approach for measuring an environmentally sensitive productivity growth index. Energy Econ 32(1):146–157

Pan Y, Teng T, Wang S, Wang T (2024) Impact and mechanism of urbanization on urban green development in the Yangtze River Economic Belt. Ecol Indic 158:111612

Shao J, Wang L (2023) Can new-type urbanization improve the green total factor energy efficiency? Evidence from China Energy 262:125499

Shi D, Shi X (2022) Green finance and high-quality economic development: mechanism, characteristics and empirical study. Stat Res 39(01):31–48

Shuai S, Fan Z (2020) Modeling the role of environmental regulations in regional green economy efficiency of China: empirical evidence from super efficiency DEA-Tobit model. J Environ Manage 261:110227

Sun J, Wang F, Yin H, Zhang B (2019) Money talks: the environmental impact of China’s green credit policy. J Policy Anal Manage 38(3):653–680

Tang DC, Zhong H, Zhang JY, Dai YG, Boamah V (2022) The effect of green finance on the ecological and environmental quality of the Yangtze River Economic Belt. Int J Environ Res Public Health 19(19):12492

Tang D, Fu B, Boamah V (2023) Implementation effect of China’s green finance pilot policy based on synthetic control method: a green innovation perspective. Environ Sci Pollut Res 30(18):51711–51725

Tone K (2001) A slacks-based measure of efficiency in data envelopment analysis. Eur J Oper Res 130(3):498–509

Umar M, Ji X, Mirza N, Naqvi B (2021) Carbon neutrality, bank lending, and credit risk: evidence from the Eurozone. J Environ Manage 296:113156

Wang X, Fan G, Hu L (2019) Report on marketization index of China by province. Soc Sci Lit Pub House, Beijing, China

Wang Y, Pan D, Yu P, Liang X (2019) China’s incentive policies for green loans: a DSGE approach. J Financ Res 11:1–18

Wang Y, Lei X, Long R, Zhao J (2020) Green credit, financial constraint, and capital investment: evidence from China’s energy-intensive enterprises. Environ Manage 66(6):1059–1071

Wang K, Zhao B, Ding L, Wu G (2021) Fiscal decentralization, government innovation preference and haze pollution. China Popul Resour Environ 31(05):97–108

Wen S, Liu X (2019) Financial misallocation, pollution, and sustainable growth. Res Econ Manag 40(03):3–20

Wen H, Lee C-C, Zhou F (2021) Green credit policy, credit allocation efficiency and upgrade of energy-intensive enterprises. Energy Econ 94:105099

Xie T, Liu J (2019) How does green credit affect China’s green economy growth. China Popul Resour Environ 29(9):83–90

Xie X, Huo J, Qi G, Zhu KX (2015) Green process innovation and financial performance in emerging economies: moderating effects of absorptive capacity and green subsidies. IEEE Trans Eng Manag 63(1):101–112

Xu X, Li J (2020) Asymmetric impacts of the policy and development of green credit on the debt financing cost and maturity of different types of enterprises in China. J Clean Prod 264:121574

Xu P, Ye P, Jahanger A, Huang S, Zhao F (2023) Can green credit policy reduce corporate carbon emission intensity: evidence from China’s listed firms. Corp Soc Responsib Environ Manag 30(5):2623–2638

Yang Y, Su X, Yao S (2021) Nexus between green finance, fintech, and high-quality economic development: empirical evidence from China. Resour Policy 74:102445

Yin W, Zhu ZY, Kirkulak-Uludag B, Zhu YP (2021) The determinants of green credit and its impact on the performance of Chinese banks. J Clean Prod 286:124991

Yin Z, Sun X, Xing M (2021) Research on the impact of green finance development on green total factor productivity. Stat Decis 37(03):139–144

Yu C-H, Wu X, Zhang D, Chen S, Zhao J (2021) Demand for green finance: resolving financing constraints on green innovation in China. Energy Policy 153:112255

Zhang D, Mohsin M, Rasheed AK, Chang Y, Taghizadeh-Hesary F (2021) Public spending and green economic growth in BRI region: mediating role of green finance. Energy Policy 153:112256

Zhang A, Deng R, Wu Y (2022) Does the green credit policy reduce the carbon emission intensity of heavily polluting industries? Evidence from China’s industrial sectors. J Environ Manage 311:114815

Zhang K, Li Y, Zhao J (2022) Can green credit promote energy conservation and emission reduction. Finance Econ 01:15–30

Zhang S, Wu Z, He Y, Hao Y (2022) How does the green credit policy affect the technological innovation of enterprises? Evidence from China Energy Econ 113:106236

Zhang Z, Duan H, Shan S, Liu Q, Geng W (2022) The impact of green credit on the green innovation level of heavy-polluting enterprises-evidence from China. Int J Environ Res Public Health 19(2):650

Zhang N, Sun JH, Tang Y et al (2023) How do green finance and green technology innovation impact the Yangtze River Economic Belt’s industrial structure upgrading in China? A moderated mediation effect model based on provincial panel data. Sustainability 15(3):2289

Zhou G, Liu C, Luo S (2021) Resource allocation effect of green credit policy: based on DID model. Mathematics 9(2):159

Author information

Authors and Affiliations

Contributions

Shuyang Zhu conceived and designed the study, performed the research, analyzed the data, and wrote the paper. The author has read and agreed to the published version of the manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The author declares no competing interests.

Additional information

Responsible Editor: Eyup Dogan

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Zhu, S. Transitioning to a green economy in China: The environmental and economic impacts of green credit. Environ Sci Pollut Res 31, 53193–53205 (2024). https://doi.org/10.1007/s11356-024-34740-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-024-34740-6