Abstract

In sub-Saharan Africa, economic expansion and its environmental implications have become major problems. The banking system has been described as a mechanism for decoupling economic expansion from environmental implications. However, the function of bank financing in the growth-environmental consequences in SSA remains undeveloped. This study investigated the role of bank financing in economic growth and environmental outcomes in SSA over the period 1990–2018. We implemented the novel panel quantile regression and panel vector autoregressive models in a generalized method of moments’ framework to investigate the influence of bank financing on economic growth and carbon emissions, and the moderating effect of bank financing in growth-environmental consequences among the four regional economies in SSA. The empirical results revealed that bank financing (1) increases economic growth and carbon emissions across quantiles; (2) positively influences economic growth and carbon emissions of East and Central African regions but negatively influences economic growth and carbon emissions of the West African region; (3) mitigates growth-emissions outcomes of low-emission countries but worsens growth-emissions outcomes of median and high emission countries; and (4) worsens growth-emissions outcomes of East and Central African regions but mitigates growth-emissions outcomes of Southern and West African sub-regions. The variance decomposition and impulse response results discovered that the role of bank financing in growth-environmental challenges varies in terms of magnitude and elasticities across the sub-regions over the sampled period. The study also revealed mixed findings regarding the existence of the EKC hypothesis for the sub-regional economies in SSA.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

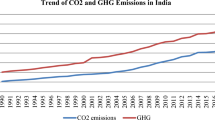

The dynamics between growth-environmental outcomes have posed threats to the future of the sub-Saharan African (SSA) region. According to Modern Jazz and Hard Rock Scenarios, carbon emissions (CO2) in SSA are expected to quadruple by 2060 (1.9–2.6 Gt CO2) due to several factors notably economic growth (GDP) and affordable modern energy (World Energy Council 2017). Globally, the financial system particularly the banking system has been identified as a critical strategy to mitigate growth-environmental challenges (Schmidt-Traub and Shah 2015; World Energy Council 2017; Dafermos et al. 2018). Currently, integrating environmental risk into the banks’ business strategies and decision-making process so that institutions can support environmentally viable projects and innovative technology is vital (Nieto 2017). Theoretically, ecological modernization theory (EMT) argues financial institutions and other economic agents have vital roles in decoupling GDP from environmental destruction (Dryzek 2013). Schmidt-Traub and Shah (2015) pointed out that the sustainable development goals will require an additional annual investment of US$2.4 trillion in the area of low-carbon infrastructure, education, energy, agriculture, and other sustainability sectors globally.

Over the years, research on financing-growth-environmental outcomes has gained more popularity across the globe (Omri et al. 2015; Bekhet et al. 2017; Zaidi et al. 2019; Zakaria and Bibi 2019; Charfeddine and Kahia 2019; Destek and Sinha 2020) but with little focus on SSA region. Many SSA scholars have focused on either finance-growth (Bandura and Dzingirai 2019; Ntarmah et al. 2019; Manu et al. 2020) or drivers of environmental outcomes (Mensah et al. 2021; Adzawla et al. 2019; Kong et al. 2020), placing less emphasis on the role of financing in growth-environmental outcomes (Al-mulali and Binti Che Sab 2012; Acheampong 2019; Ntarmah et al. 2021).

A critical review of the studies that attempted financing-growth-environmental outcomes in SSA suffers from some common limitations. First, they only introduced financing in the model as a direct causal variable but failed to examine its role in mitigating/worsening growth-environmental challenges (Ntarmah et al. 2021). Another major weakness found in the literature is the fact that many researchers applied a conditional mean-based approach (CMBA) to examine the data drawn from heterogeneous samples in SSA countries. As a result, there are variations in research outcomes from those studies since the approaches do not appropriately account for regional heterogeneity (Ehigiamusoe and Lean 2019). The SSA is sub-divided into four geographical and economic regions (Central, Eastern, Southern, and West Africa) regulated by their respective economic and financial blocs not limited to Economic Community of West African State (ECOWAS), Southern African Development Community (SADC), Economic and Monetary Community of Central Africa (CEMAC), and East African Community (EAC). These regions vary in growth and environmental challenges (World Bank 2020). Considering the variations in regional economies in growth-environmental challenges, using a heterogeneous sample from SSA without accounting for these variations may result in unreliable findings and policy outcomes (Ahmad et al. 2019).

To address this gap identified in the literature, this study examines the role of bank financing (BF) in GDP environmental outcomes from the perspectives of SSA economies. Specifically, the study aims to explore the (1) effect of BF on GDP and the environment and (2) moderating the role BF plays in growth-environmental outcomes taking into consideration SSA economies. It tries to analyze the objectives from the whole sample and regional sample perspectives to account for regional variations in SSA and provide reliable outcomes suitable to the regions. (3) It also tries to test the existence of the EKC hypothesis in SSA.

The current study contributes to the literature in many ways. Firstly, this study adds to the financing-growth-environmental literature, specifically in SSA, where the topic is underdeveloped. Unlike earlier studies, which focused on direct causal links between finance, GDP, and environment but instead extend the research to establish whether BF improves/worsens growth-environmental harm. Secondly, this study accounts for regional variations in SSA by investigating the topic from the four sub-regional economies in SSA. This will not only provide a basis for regional comparison but also offer results that are a true reflection of these regions to guide regional policies. Since respective regional blocs regulate economic activities in SSA, studies that focus on the entire region and provide general policies based on the results may not be implemented by the countries given that variations exist among them and different economic blocs regulate them. Finally, the study dwells on its findings to offer practicable policy recommendations exclusive to SSA and the various economic regions.

The rest of the paper is organized as follows: “Literature review” focuses on a literature review comprising a literature review. “Methodology” highlights the methodology for investigating the topic. “Results and discussion” presents the results and discussion, while “Conclusion and policy recommendations” presents the conclusion and recommendations.

Literature review

The relationship between bank financing and economic growth

The relationship between the bank system and GDP has been widely researched (Eddien and Ananzeh 2016; Zhang et al. 2019; Ntarmah et al. 2019; Vo and Ho 2020), yet, varied results. Some scholars focused on single-country studies. For instance, Eddien and Ananzeh (2016) investigated the relationship between bank development and the GDP of Jordan over the period 1993–2014. The results from the vector error correction model revealed that bank development plays a significant role in the GDP of Jordan. Similarly, Olowofeso et al. (2015) studied the impact of private sector credit by the Central Bank on the GDP of Nigeria. They employed Gregory and Hansen’s (1996) cointegration test on quarterly data from 2000 to 2014. The results show that private sector credit had a positive impact on the GDP of Nigeria while a higher prime lending rate hinders growth. These authors focused on Jordan and Nigeria as single countries. As a result, findings and policy implications drawn from their study are limited to the specific countries studied but cannot be generalized to reflect the perspective of other countries. Considering the linkages and close ties among countries through trade and socioeconomic activities, analyzing the topic from SSA countries as a whole while accounting for cross-sectional linkages may reveal unique findings. Thus, Olowofeso et al. and Eddie and Ananzeh’s studies do not enhance the understanding of finance-growth outcomes among countries. The works of Awad and Al Karaki (2019), Chen et al. (2020), Vo and Ho (2020), and Ibrahim and Alagidede (2020) share similar limitations.

To account for earlier weaknesses, other scholars investigated the topic using a panel of countries. Ibrahim and Alagidede (2018) used the system GMM approach to explore the link between financial development (FD) and GDP in SSA. The authors discovered a direct positive association between FD and GDP with increasing elasticity under a balanced sectoral growth. Using 27 SSA countries, Bandura and Dzingirai (2019) established that extra finance upsurges GDP and lower finance decline GDP. They also revealed a strong link between finance and GDP subject to well-developed financial institutions. Although these scholars considered cross-sectional analysis of the topic, their focus was on the entire financial sector. Hence, their findings better reflect the overall impact of the financial sector on GDP. Therefore, it is difficult to accurately point out the role the banking system plays in the economy. Banks play a major role in the money creation and financing of economic activity in developing countries like SSA (Kong et al. 2020). Consequently, studying bank-growth in SSA is crucial. Ntarmah et al. (2019) revealed that bank credit to the private sector has mixed influence on economic sustainability on some selected developing economies, BRICS, and Asian economies. It is evident from Ntarmah et al.’s study that the focus was not on SSA. Therefore, studying the topic from the perspective of SSA countries may reveal different outcomes.

From a global perspective, Zhang et al. (2019) used the dynamic panel threshold effect model to analyze the relationship between bank lending and GDP in the global market from 2006 to 2016. The empirical results revealed a positive impact of an increase in bank loans on GDP. In contrast, Cheng et al. (2021) investigated the relationship between financial development and GDP using panel data involving 72 countries from 2000 to 2015. Interestingly, the empirical results from the dynamic GMM estimation model show that financial development is unfavorable for GDP, with a greater marginal impact found in high-income countries. These inconclusive findings among the studies may arise due to endogeneity problems. For instance, the authors failed to account for the heterogeneity problem in using large samples. In a situation like this, the problem of heterogeneity among the panels may influence the results making it unreliable. Therefore, a study that accounts for heterogeneity in large panels may reveal different results.

The relationship between bank financing and the environment

From the perspective of SSA, Acheampong (2019) studied FD and CO2 using a sample of 46 countries from SSA from 2000 to 2015. The study revealed that FD upsurges CO2 among the SSA countries sampled. Awan et al. (2020), Saud et al. (2020), and Khan et al. (2021) also established a positive relationship between financial development and environmental degradation. However, the authors focused on whole sample analysis but failed to consider regional variations and the role of economic blocs across regions. As indicated earlier, the SSA has four main regions regulated by economic blocs such as ECOWAS for West Africa (WA), SADC for Southern Africa (SA), CEMAC for Central Africa (CA), and EAC for East Africa (EA) regions. The regulations and policies such as different bank policies implemented by these sub-regions influence the group and environmental outcomes that are unique to the region. Hence, a study that considers these variations in SSA may reveal useful and reliable outcomes.

Banhalmi-Zakar (2016) studied the impact of BF on environmental outcomes in Australia and Europe, focusing on the pre-Global Financial Crisis (GFC) period. The study revealed that banks play a key role in environmental outcomes through diverse ways of financing commercial, residential, social, and industrial infrastructural developments. It is important to emphasize that the findings are limited to the pre-GFC period but not post-GFC. As a result, the post-GFC initiatives and policies in the banking system when factored into their study may lead to different outcomes. Tsaurai (2019) explored the relationship between domestic credit to the private sector and CO2 among West African countries. The study employed econometric estimators of fixed effects, random effects, and pooled ordinary least squares (OLS) on data drawn from 2003 to 2014. The pooled OLS results show that domestic credit had a significant increase in CO2 among West African countries. It is clear in the literature that the fixed effects, rand effects, and pooled OLS are the basic econometric models that do not account for reverse causalities during the estimation process. Consequently, using heterogeneous panel data models that account for reverse causalities may provide more convincing evidence.

In terms of the banking system and the environment, the results have been mixed. Omri et al. (2015), for example, found that loans to the private sector had a neutral effect on CO2 in 12 MENA nations, but Bekhet et al. (2017) found mixed findings for the six Gulf Cooperation Council (GCC) countries from 1980 to 2011. Charfeddine and Kahia (2019) used a panel vector autoregressive (PVAR) model to examine the influence of private-sector lending on CO2 in MENA countries from 1980 to 2015. The findings indicate that financing to the private sector has a minor impact on CO2 emissions in the MENA area. Some shortcomings in previous studies can be blamed for the equivocal results published in the literature. First, these studies employed conditional mean-based models such as the panel autoregressive distributed lag model, the error-correction model, and the dynamic ordinary least square models, which are best known for estimating results using averages and do not allow the series to be observed over time. In such cases, inconclusive results may come from the different periods utilized by these writers since the mean approach (i.e., mean values) that these estimators rely on varies with time length.

The moderating role of bank financing in economic growth and environmental outcomes

Katircioglu and Taşpinar (2017) investigated the role of finance in the environmental Kuznets curve from the perspective of Turkey. The study revealed that finance (indexed by credit to GDP ratio) negatively moderates the relationship between GDP and CO2 of Turkey in the short run but positively in the long run. Their study reported mixed findings signifying that financial resources given to the private sector contribute to successful environmental performance in the shorter periods but worsen growth and environmental outcomes in the longer period. Ehigiamusoe (2020) studied drivers of environmental degradation in ASEAN as well as the moderating role of credit to the private sector within the relationship. The study revealed that private sector credit plays a positive moderating role in energy consumption and environmental outcomes in ASEAN but a negative moderating role in ASEAN China, given that China is a high-pollution country. This study points to the fact that the role of financing in the environment and its determinants vary across regions. Hence, studying the role of financing in the relationship between drivers and environmental outcomes by drawing a sample from varied regions with different financial development without considering variations in SSA regions may provide misleading outcomes (Ehigiamusoe and Lean 2019). Therefore, this study approaches the role of BF in growth-environmental outcomes from sub-regional economies (economies governed by common regional economic and financial blocs) in SSA.

Another group of scholars (Yang et al. 2015; Katircioglu and Taşpinar 2017; Rjoub et al. 2021) has reported inconclusive results regarding the moderating role of financing in growth-environmental outcomes. Yang et al. (2015) revealed that financial interrelations ratio and financial efficiency moderate the relationship between GDP and CO2 of China indicating that China’s financial sector has contributed to the improvement in China’s environmental quality. Using system generalized method of moments approach, Tsaurai (2018) found financial development to have a moderating role in GDP and Greenhous Gas Emissions in Africa. Katircioglu and Taşpinar (2017) could not reveal any moderating effects of financial development in “GDP and energy consumption” and CO2 in Turkey. On the other hand, Acheampong (2019) established a moderating role of financial development in GDP and energy consumption to worsen CO2. Generally, the moderating role of the financial sector spanning through the banking system and other financial institutions has attracted research across the globe, yet studies have reported mixed results. Such inconclusive findings necessitated further research in the field to clearly understand the moderating role of the banking system in growth-environmental outcomes while considering the local characteristics of the economies. As a result, the current study tries to fill gaps in previous research by investigating the effect of BF, growth-environmental consequences in SSA by subdividing the sample economies into economic areas. This work makes use of quantile regression and the GMM style PVAR model, which is known for its ability to account for endogeneity and heterogeneity in panels. The model’s impulse response function (IRF) permits series to be examined across time, as well as the dynamic interactions among variables during the period investigated.

EKC

Environmental Kuznets Curve (EKC) is one of the most well‐known hypotheses that explain the relationship between GDP and the environment. EKC theory argues that the growth-environmental relationship is an inverted u-shape, such that economic development initially leads to environmental degradation until a certain threshold where it begins to decrease environmental degradation. Because of this, many scholars have attempted to establish the link between GDP and environmental degradation using the EKC hypothesis. Apergis and Ozturk (2015) tested the EKC hypothesis using panel data of 14 Asian countries from 1990 to 2011. The results from the generalized method of moments (GMM) estimator confirmed the existence of EKC among the selected countries. Similarly, Ajanaku and Collins (2021) established EKC among African countries. Although the studies confirmed the existence of EKC among Asian and African countries, the authors did not consider the regional variations within these areas. As a result, further studies that account for regional variation are needed to provide a clearer understanding of EKC. The work of Tenaw and Beyene (2021) suffers from similar limitations. From a broader perspective, Li et al. (2021) discovered the presence of EKC among 89 Belt and Road Initiative (BRI) countries but found mixed results of EKC across countries of different geographic regions. As a result, conclusions drawn from whole sample results may not reflect different regional samples involved in BRI. From the literature, it is clear that due to the different periods, sample, and methodological frameworks, the EKC results are inconclusive.

Methodology

Theoretical rationale and model construction

We implemented heterogeneous panel econometric models to explore the role of BF in the growth-environmental outcomes of SSA. In this study, GDP and environment are the response variables. GDP per capita is used as the index of GDP. The theoretical arguments underlying GDP per capita as GDP index have been widely proven by GDP theories (i.e., Neoclassical, Endogenous growth theories) and supported by researchers including Ntarmah et al. (2019), Manu et al. (2020), and Sarkodie (2020). CO2 is used as the index of the environment. The theoretical arguments underlying CO2 as one of the best environmental indexes have been widely proven by Mensah et al. (2019), Musah et al. (2020), and Sarkodie (2020) among others.

Globally, the financial sector is placed at the heart of transition into sustainable growth and a low-carbon economy (Nieto 2017). This is in line with the full implementation Paris Agreement.Footnote 1 The banking system, which is an important component of the financial system, is responsible for money creation and supply in many economies (McLeay et al. 2014). Banks finance the production and consumption activities of firms and individuals, which influences the growth of the economy. In addition, banks finance environmentally friendly projects through green financing and corporate social responsibilities (Nieto 2017; Acheampong 2019). BF, through lending, trading, and investment practices, influences GDP and environmental outcomes. This usually occurs when banks reallocate financial resources toward environmentally friendly production and consumption. Likewise, banks could finance production and consumption activities that are detrimental to the environment. Therefore, we used BF as a key determinant of GDP and CO2 of developing economies in SSA.

In addition, we controlled for REC and POP, which have been jointly found to be significant determinants of the environment. According to the literature, controlling these variables in environmental studies is key to reducing endogeneity problems (omitted variable bias) and model uncertainty as well as improving statistical accuracy (Bekhet et al. 2017; Hanif 2018; Destek and Sinha 2020). Based on economic theory and literature (Mensah et al. 2019; Topcu et al. 2020; Yasmeen et al. 2021), we control for labor, capital stock, and natural resources for the GDP equation. Apart from these control variables, the literature points out the need to control for GDP and CO2 in the environment and GDP models respectively. The link between the environment and GDP can be explained in a manifold. On the positive side, the environment provides resources (i.e., natural resources) that serve as inputs for production and consumption activities. On the negative side, poor environmental quality affects wellbeing and economic development due to health impacts, reduction in the quality and quantity of the resources needed for production and consumption activities. Increased use of non-renewable energy, higher levels of emissions, global warming, and environmental biodiversity opportunities are part of the environmental effects of economic development. However, the world does not only suffer from these aspects of economic development. When actual revenues rise, people can commit more money to environmental protection and offset the negative impacts of pollution. In addition, better technology-led GDP will allow higher production and fewer emissions. Based on the theoretical arguments, we model BF as a function of GDP and environment as:

where CO2 and GDP are outcome variables representing environment and GDP respectively. BF is the explanatory variable representing bank financing, X and M represent the set of control variables for GDP and environment respectively. i(I = 1,2,3…39) represents the sampled country while t represents the year. In Eq. 1, LAB, CO2, NR, and KT are the control variables. In Eq. 2, REC, POP, and GDP are the control variables. Equations 1 and 2 can be converted into log-linear econometric models as

where GDP, CO2, BF, X, M, i, and t remain as defined in Eqs. 1 and 2. α0 represents the intercept, and ε represents the error term; α1 and β represent parameters to be estimated. In 1997, a report presented to the European Commission by Delph International Limited in collaboration with Ecologic GMBH argued that banks play multiple roles in the environmental sustainability agenda. The argument put forward in the report can be summarized as banks (1) play a role as investors by providing investments needed for sustainable development, (2) serve as innovators by developing new financial products (i.e., energy efficiency) to influence consumer behavior and environmental sustainability, (3) help in pricing risks and estimating returns for business and projects in response to environmental outcomes, and (4) act as powerful stakeholders and lenders which have considerable influence on the management of businesses and environmental outcomes. In line with this argument, World Energy Council (2017) and Dafermos et al. (2018) point out that the banking system is a mechanism to mitigate growth-environmental harm. Scholars such as Acheampong (2019) and Ehigiamusoe (2020) supported this argument by establishing that banking sector development plays a key role in the growth-environmental relationship. To move this argument from the theoretical to the empirical stage, we expand Eq. 4 to include the moderating role of BF in growth-environmental outcomes as

where lnBFGDP represents the interaction between BF and GDP; lnPOP and lnREC represent the control variables. Other variables remained as defined previously. In Eq. 5, BF is the moderator variable, and the moderating effect of BF in growth-environmental outcome is represented as BFGDP. If the coefficient of BFGDP is positive, then BF worsens growth-environmental challenges. On the other hand, if the estimated coefficient of BFGDP is negative, then BF mitigates growth-environmental outcomes. As put forward by the EKC hypothesis, growth-emissions relationships could take the form of an inverted U-shape. Hence, it is important to test for the existence of EKC in this study. The general EKC hypothesis can be represented mathematically as:

Equation 6 represents the EKC model where lngGDP2 signifies the quadratic form of GDP. The coefficients \({\alpha_2}\) and \({\alpha_3}\), respectively, are to be positive and negative for EKC to be validated. Table 1 presents the variables and data source for this study.

This research included 39 SSA nations from four different regions. The World Bank’s World Development Indicators database was used to gather annual statistics for each of the nations from 1990 to 2018. To reduce heteroskedasticity in the data, we converted the variables into their natural logarithm. This is a normal practice in econometrics (Charfeddine and Kahia 2019).

At the initial stage, preliminary analyses were conducted. First, the datasets were grouped into two groups: whole sample and regional sample datasets. Second, we examined the properties of each dataset. We found the whole sample dataset (comprising all the 39 SSA countries) to have short panel data (number of countries is greater than time) properties. We also found the regional sample (SSA countries sub-grouped into regional economies) to have long panel data (number of countries in each region is less than the period) properties. Table 2 presents the summary of the datasets. Based on the type of dataset and the preliminary analysis, recommended panel econometric models were used to estimate the results.

Descriptive statistics

Table 3 shows the descriptive statistics for the variables for the entire sample and the regional samples. This contributes to knowledge of the overall description of the factors and sub-regional differences in terms of GDP and environmental challenges in SSA, including a solid foundation for comprehending the variances in the findings. Table 3 demonstrates that GDP, CO2, BF, REC, and POP differ among sub-regions on average. For example, in SSA, SA nations had the greatest average score for BF (M = 2.730, SD = 0.940) while CA countries, on average, reported the lowest BF (M = 1.795, SD = 0.832). In terms of POP, the highest average mean value was established in SA countries (M = 16.247, SD = 1.125), whereas CA countries had the lowest average score (M = 15.489, SD = 1.398).

Similarly, SA nations had the greatest GDP on average (M = 7.012, SD = 0.999), whereas WA countries had the lowest GDP per capita (M = 6.449, SD = 0.702). Similarly, SA nations had the greatest average CO2 score (M = − 0.422, SD = 1.345), whereas EA countries had the lowest (M = − 1.609, SD = 1.579). In general, descriptive statistics suggest that SA nations contribute the most to the region’s growth and emissions. CA nations had the highest average REC score in the area (M = 4.173, SD = 0.814), while EA countries had the lowest (M = 3.808, SD 1.380). Across samples, the data varies from − 4.536 (Min.) to 19.093 (Max.). The descriptive statistics reveal regional differences. As a result, when researching this issue, the authors must place SSA nations within their unique economic and geographical features to give trustworthy and correct data for policy choices.

Table 3 also presents skewness, kurtosis, Jacque-Bera, and their probabilities as a first step to establish the normality of the data. CO2 is positively skewed in all the regions except the WA region which is negatively skewed. BF is negatively skewed in the sub-regions except for EA regions. Both REC is negatively skewed in all the regions while GDP is positively skewed in all the regions. POP is negatively skewed in EA and SA but positively skewed in CA and WA. In terms of kurtosis, the data exhibit platykurtic distribution for the SA region. In CA and EA regions, GDP, CO2, and POP exhibit platykurtic distribution while BF and REC exhibit leptokurtic distribution. In WA, GDP and CO2 exhibit platykurtic distribution while BF, POP, and REC exhibit leptokurtic distribution. The skewness and kurtosis results show that the data is not normally distributed. This is further supported by the Jacque-Bera and probability results.

In terms of correlation, the results in Table 4 show that the variables correlate among themselves (especially with the GDP and CO2) for the whole sample and the sub-regions. BF positively correlated with CO2 and GDP across the sample, suggesting that higher BF is associated with higher CO2 and GDP.

In addition to the correlation results, we estimated the multicollinearity results to identify whether there is potential multicollinearity in the data. The collinearity statistics presented in Table 4 show that the variance inflation factor (VIF) is less than 5 and the tolerance (Tol) value is greater than 0.2 for the whole sample and sub-samples. The findings satisfy the VIF and tolerance value threshold of less than five (5) and greater than 0.2 respectively. Therefore, we conclude that there is no presence of potential multicollinearity in our study (Table 5).

Econometric Approaches

Since there are two datasets (whole sample and regional sample) for this study, this study used two main suitable econometric models to investigate the topic. The first model is Method of Moments Quantile Regression (MMQREG) with fixed effects. The MMQREG is a short panel data model used to estimate the results for heterogeneous panels such as the whole sample for this study. The second model is the PVAR model. Its long panel data model was used to estimate the results for the regional samples. It is important to emphasize that the application of a long panel data model requires initial checks (slope homogeneity, cross-sectional dependency, panel unit root, and panel cointegration). These checks are recommended as standard preliminary tests to perform before estimating unknown parameters (Mensah et al. 2021). This section of the work presents the econometric approaches used to explore the topic.

Slope homogeneity and CD tests

Countries are linked to one another in one way or another as a result of socioeconomic activities between them. These close ties between countries may result in cross-sectional linkages. As a result, cross-sectional dependency (CD) and variable homogeneity serve as the first steps in determining which econometric tests, such as unit roots and cointegration tests, are appropriate for the study. Neglecting CD and slope homogeneity could result in erroneous panel data model selection, compromising the validity and reliability of the results (Musah et al., 2020). Therefore, the Pesaran (2004) CD test was used to evaluate CD, and the Pesaran and Yamagata (2008) homogeneity test was employed to check slope homogeneity in the data. These tests have proven to be useful methods in testing for CD and homogeneity in panel data.

Unit Root Tests

The unit root test is very useful in establishing the stationarity properties of the series. In the existence of CD in the series, the second-generation unit root tests are found to be the most appropriate and reliable for testing for unit roots (Pesaran 2007). In line with this, the present study utilized Pesaran’s (2003, 2007) panel unit root tests in the presence of CD to check the stationarity of the series. CADF and CIPS represent Pesaran (2003 and 2007)’s panel unit root tests respectively. These tests account for heterogeneity and CD in the panels, which make them superior to other unit root tests (Mensah et al. 2021).

Panelcointegration test

Checking for the existence of cointegration among the variables is the next PVAR estimation. This study used two main panel cointegration tests that consider cross-sectional dependency and heterogeneity. First, Westerlund’s (2007) cointegration test was used to test for cointegration among the variables. The method is superior to other cointegration methods, including the Johansen test due to its ability and appropriateness in testing for cointegration in the presence of CD as revealed by the CD test. Westerlund (2007) used the bootstrap approach to investigate cointegration. The panel cointegration test runs four sub-tests: Pt (between panels), Pa (between panels), Gt (intergroup), and Ga. (between groups). Gt and Ga demonstrate the mean group test based on the t-test statistics and calculated coefficients, whereas Pt and Pa demonstrate the full panel test. These tests take CD and slope factors into account when recommending high p-values and incorporate special short-term dynamics for unity. Second, the Durbin-Hausman Panel Cointegration test by Westerlund (2008) was also used. This test is considered more suitable for modeling cointegration when variables are of a different order of integration. The Durbin-Hausman Panel Cointegration test presents two different test statistics — Durbin-Hausman panel (DHp) and Durbin-Hausman group (DHg) (Westerlund 2008).

Method of moments quantile regression with fixed effects

Considering the number of countries involved in the study and how skewed the data is, especially for the whole sample dataset, it is necessary to employ a heterogeneous panel data model that can handle the variations within the sampled countries used for the study. In such a highly skewed dataset, conditional mean-based models such as the OLS model which relies on normality assumption lead to bias estimates. To analyze the whole sample results, this research used Machado and Santos Silva (2019)’s latest MMQREG to estimate the outcomes on different quintiles of the distribution to resolve conditional mean-based limitation and provide heterogeneous responses. Unlike earlier quantile regression methods, MMQREG is used to estimate results through moment conditions (Machado and Santos Silva 2019; Ntarmah et al. 2020) that do not assume the presence of the moment function or make distribution assumptions (Sherwood and Wang 2016; Zhu et al. 2016). Apart from the ability of MMQREG to estimate complex models, another important feature of the estimator used in this study is that it leads to an estimation of quantile regression that does not cross important conditions that are often ignored in empirical applications (Chernozhukov et al. 2010; Rios-Avila 2020).

Therefore, this study considers estimating conditional quantiles \({Q_Y}\left( {\tau |X} \right)\) for location-scale in the form

with \(P\{ {\delta_i} + Z{^{\prime}_{i,t}}\gamma > 0\} = 1.\) The individual fixed effect is captured by the parameters \(\left( {{\alpha_i},{\delta_i}} \right)\), and Z is a k-vector of known differentiable (with probability 1) changes of the mechanisms of X. The sequence \(\{ {X_{i,t}}\}\) is i.i.d. for any fixed i and independent across t. \({U_{i,t}}\) is i.i.d. (across i and t), statistically independent of \({X_{i,t}}\), and standardized to satisfy the moment conditions. However, the model proposed in Eq. 7 suffers from incidental parameter problems and in this case has no advantages over alternative approaches. To avoid this problem of fixed effects that affect the entire distribution, the jackknife bias correction is introduced in the model and applies a bias-correction version of the model based on split panel jackknife (Dhaene and Jochmans 2015):

where the scalar coefficient \({\alpha_i}\left( \tau \right) \equiv \,\,{\alpha_i} + {\delta_i}q\left( \tau \right)\) is a quantile-τ fixed-effect for the individual i, or the distributional effect at τ. The effect of distribution varies from the normal fixed effect in that it is not a change in place in general. In other words, the effects of the distribution reflect the effects of the individual characteristics of the invariant time that, like other variables, are allowed to have different effects on the different regions of the conditional distribution of Y. The fact that \(\int_0^1 {q\left( \tau \right)d\tau \, = \,0}\) implies that \({\alpha_i}\) can be understood as the average outcome for individual i, the jackknife correction introduced in Eq. 8 essentially eliminates the bias without a significant loss of precision (Machado and Santos Silva 2019). In addition, the conditions established in Eq. 8 do not imply strict exogeneity and therefore minimize endogeneity problems. Relying on Eq. 7, the specific quantile regression model implemented to estimate the impact of BSS on ES for the whole sample can be written as:

Qτ denotes quantile regression parameters of the τth distributional point, τ indicates the distributional point for the independent variables while \({\alpha_\tau }\) represents fixed effects. ln represents the natural log of the variables. All the variables remain as defined already. To obtain detailed results from the quantile regression estimates, three different quantiles (25th, 50th, and 75th) are used. In line with Eq. 6, Eq. 12 represents the EKC model where lngGDP2 signifies the quadratic form of GDP.

Panel vector autoregressive model

Following the studies of Ntarmah et al. (2021), and Abrigo and Love (2016), we implemented the PVAR model to estimate the results. The PVAR model proposed by Love and Zicchino (2006) allows for estimating the results through the generalized method of moments (GMM) framework. The PVAR model, according to Canova and Ciccarelli (2013), introduces fixed effects to enhance consistency and coherence to address heterogeneity (variations) in cross-sectional data. Another critical aspect of the PVAR is the IRF. It estimates the effects of orthogonal changes by means of explaining the impact of a change of variable to another while maintaining the rest of the variables as invariant. The model also handles both endogenous and exogenous changes, which is a critical aspect of econometric analysis. Here, the model treats all the variables as endogenous and does not distinguish endogenous variables from exogenous ones (Love and Zicchino 2006; Abrigo and Love 2016). The general PVAR formula put forward by Love and Zicchino (2006) is represented as

Yit represents endogenous variables; A(L) denotes the matrix polynomial in the lag operator with A(L) = A1L1 + … + Ap−1Lp−1 + ApLp. ui represents country-specific fixed effects; δt signifies the country’s specific time dummy variables; ai represents individual fixed-effects/heterogeneity among cross-sectional units. ɛi,t signifies idiosyncratic errors, with \(E(\,{\varepsilon_{i,t}})\,\, = \,0,\,E(\varepsilon_{i,t}^{\prime}{\varepsilon_{i,t}})\, = \,\sum {}\) and \(E(\,\varepsilon_{i,t}^{\prime})\,\, = \,0\) for t > j. i = 1,2,…,N t = 1,2,…,T.

Equation 11 can be expanded to capture the variables of this study as

\(\beta\),\(\phi\),\(\varphi\),\(\theta\), \(\lambda\) and \(\eta\) represent parameters to be estimated. lnCO2, lnGDP, lnREC, lnBF, lnPOP, lnLAB, lnNR, and lnKT represent the variables of this study. lnBFGDP represents the interaction between BF and GDP. ui, ai, δt, and ɛi,t are defined in Eq. 13. “j” represents optimal lag-length to be selected. Equations 14 and 15 illustrate the causal links between the variables with their respective outcome variables — CO2 and GDP while Eq. 16 illustrates an interactive effect of BF and GDP on CO2. In Eq. 16, BF is introduced as a moderator variable to establish how BF moderates the relationship between GDP and the environment. With reference to Eq. 6, Eq. 17 depicts the EKC model.

VD and IRF

The next step after estimating the PVAR results is to estimate the forecast error variance decomposition (VD) and impulse response function (IRF). The VD and IRF provide detailed explanations for the PVAR estimates by presenting the results over 10 periods. The VD results aid in forecasting the error variance percentage that a variable (BF) explains of another variable (CO2 or GDP) that has been subjected to a shock/innovation, the time required for a variable to attain equilibrium, and the contribution of each variable to this end. IRF also aids in disclosing the behavior of one variable when confronted with a shock or innovation in another variable, as well as the time required for the variable to return to equilibrium after the shock/innovation happened. The IRFs estimate their confidence intervals using Gaussian approximation. The orthogonalized IRF of shocks and VD are calculated across ten periods using Cholesky decomposition (Sims 1980; Abrigo and Love 2016).

Results and discussion

This section presents the results of the study. It starts with the preliminary tests, followed by the main results. It is important to state that the preliminary results (slope homogeneity, cross-sectional dependency, unit root, and cointegration) are presented for the panels. The findings of slope homogeneity and cross-sectional dependence are presented in Tables 7 and 6, respectively. Table 6 shows that the null hypothesis of homogeneity in slope coefficients is rejected across panels, implying that panel econometric methods that are resilient to the issue of heterogeneity should be used for the study.

Table 7 shows the cross-sectional dependency results for the different sub-regions. The results in Table 7 reject the null hypothesis of cross-sectional independence at a 1% significance level for all variables (excluding CO2 in Central Africa) in all the panels under the null hypothesis of cross-sectional independence. This implies that cross-sectional dependency exists among the variables in all the panels.

Unit root results

The unit root findings are shown in Table 8. Table 8 shows that GDP is stagnant at a level in EA and SA while BF is stationary at a level in SA and WA. POP is stationary at a level in CA, WA, and the whole sample while REC is stationary at the level in WA. The results reveal that certain variables are stationary at I(0) levels, whereas others are stationary first difference I levels (1).

Panel cointegration results

Table 9 shows the cointegration results from Westerlund (2007, 2008) for the samples. Table 9 shows that the results favor the null hypothesis of no cointegration across samples. The findings confirm the MMQREQ and PVAR model’s suitability for this investigation.

Hausman test results

Since the recommended estimators (MMQREG and PVAR) use incorporate fixed effects in the estimation procedure, it is appropriate to use the Hausman test to determine whether fixed effects are the most suitable for the analysis. Based on the Hausman test results presented in Table 10, the null hypothesis is rejected suggesting the fixed effects are most suitable for the analysis. Thus, MMQREG and PVAR are suitable for estimating the results of the study.

OLS and MMQREG results of the impact of bank financing on economic growth and environment for SSA countries

This section presents the results of the impact of banking financing on GDP and the environment from the perspective of all the sampled SSA countries. Tables 11 and 12 present the OLS and MMQREG results for GDP and environment equations. For this study, interpretation of the results focuses on BF as the key variable of interest. From Table 11, the OLS and MMQREG results show a positive impact of BF on GDP suggesting that that BF increases GDP among SSA countries. This revelation confirms the conclusions of Bandura and Dzingirai (2019) and Zhang et al. (2019) but contradicts the results of Cheng et al. (2021). In this study, the strongest marginal impacts are found in high-growth countries (75th quantile). Banks contribute to an increase in the aggregate rate of investment in the economy through enhancing savings incentives and mobilizing public money. When BF is employed for productive purposes, it significantly increases output and investment, therefore encouraging GDP. In addition, the results in Table 11 show that CO2, LAB, NR, and KT had controlling effects on GDP.

Similarly, the results in Table 12 show a positive impact of BF on CO2, but the impact varies across quantiles with the strongest impact established at high emission countries. The results suggest that the SSA environment becomes more polluted as banks make more financial resources available to businesses and individuals. This is reasonable when banks focus on financing production and consumption businesses and individuals whose activities pollute the environment. This finding is documented in Acheampong (2019), Awan et al. (2020), and Khan et al. (2021) studies that found a positive association between financial development and CO2.

The findings based on location and scale clearly show that BF has higher positive dispersion across quantiles for both GDP and CO2 estimates. This implies that BF has an increased variance across quantiles as illustrated in Figs. 1 and 2 (see Appendix 31) for GDP and CO2 respectively.

Results of the impact of bank financing on economic growth and environment for SSA countries by regions

PVAR estimates

As indicated earlier, this study implemented a PVAR model in estimating sub-regional results. We chose lag order (j) one based on Andrews and Lu’s (2001) criteria — Akaike information criteria (MAIC), Quinn information criteria (MQIC), and Bayesian information criteria (MBIC) for determining optimal lag. Following the publications of Acheampong (2019), Charfeddine and Kahia (2019), and Ntarmah et al. (2021), we implemented a PVAR model with variables in their stationary state. During the estimate procedure, variables that were stationary at first difference were converted into first difference. This is a requirement in PVAR estimations. Table 13 presents the first-order lag PVAR estimates.

The results in Table 13 show that BF had a positive and significant influence on CO2 of CA, EA, and SA countries but varies in terms of magnitude and statistical significance. The findings suggest that BF expansion is detrimental to the environment of CA, EA, and SA countries since it increases CO2. The marginal impact of BF on the environment via CO2 is higher in the CA region suggesting a strong link between its banking system and the environment compared to the other regions. Therefore, an increase in BF will cause more environmental damage in the CA region than in SA and EA countries. In contrast, BF had a negative and significant impact on the CO2 of WA countries. Hence, an increase in BF will improve the environment of the WA region by reducing CO2. While the findings in the WA area corroborate Ganda’s (2019) findings that bank funding decreases greenhouse gas and carbon emissions in OECD nations, the findings in the SA, CA, and EA regions verify Zakaria and Bibi’s (2019) findings that lending to the private sector dampens the environment. The changing environmental effect of BF might suggest that WA banks are focusing on supporting eco-friendly ventures, or that as more credit is made available to the private sector, firms/individuals participate in eco-friendly creative production techniques. This, however, may not be the case in other locations. In contrast to the findings in the WA area, which corroborate EMT’s theoretical thesis that funding is a crucial component required to minimize environmental damages, the outcomes in the other regions imply otherwise (Majeed and Mazhar 2019).

Similarly, the study reveals that BF had a substantial positive effect on the GDP of the EA, CA, and SA areas, implying that BF assists businesses and individuals in these regions in expanding and producing more to enhance the economy’s growth. BF, on the other hand, has a considerable negative impact on the GDP of nations in the WA area, showing that BF stifles GDP in the WA region. The findings highlight the differences in the bank and financial development and structure across SSA regions. Variations in the soundness of the financial system across regions, according to Boyd and Smith (1992), account for different influences on economic growth. Furthermore, the negative impact of BF on GDP in WA suggests that the region’s banking sector expansion emanates at a high cost to GDP due to supporting hazardous and economically unviable enterprises (Ibrahim and Alagidede 2020). This study’s outcome also complements the conclusions of Ntarmah et al. (2019), who discovered that bank loans to the private sector have a diverse impact on the economic sustainability of regional economies and groupings such as the BRICS and Asian economies.

Except for the CO2 equation for the SA area, POP was shown to have a substantial impact in all estimations. Except for the GDP and BF calculations for the EA and WA areas, and the CO2 equation for the SA, REC had a major effect in all computations. This finding implies that POP and REC are important factors in CO2. The findings back up the findings of Mensah et al. (2019) who discovered that energy use and POP impact GDP and environmental consequences.

Variance decomposition results of the direct relationships

We proceed to estimate the variance decomposition to determine the extent to which the explanatory variables (including the lagged outcome variables) explain the outcome variable over the sample period. The variance decomposition breaks the sample period (1990–2018) into 10 periods with period one (1) being the initial year and period 10 being the final year. This allows the impacts of explanatory variables on the outcome variable to be observed throughout the period. In this study, we interpret the results focusing on the variable of interest (BF) and at the 10th period (with almost all variables having the highest explaining power). Table 14 presents the variance decomposition results.

The VD results throw more light on the earlier PVAR estimates. The results in Table 14 show that BF explains approximately 2.33%, 1.59%, 1.01%, and 0.69% of the variation in CO2 of CA, EA, SA, and WA regions, respectively. Although the explanatory power of BF in CO2 is low across sub-regions, it had the highest explanatory power in the CA region providing further supports for the PVAR estimates. This finding is congruent with the revelations of Banhalmi-Zakar (2016) and Acheampong (2019).

The results in Table 14 show that BF explains approximately 2.20%, 14.40%, 20.40%, and 16.90% of the variation in GDP of CA, EA, SA, and WA regions, respectively. Comparatively, BF has a higher explanatory power of the variations in GDP than CO2 among the sub-regional economies. This depicts a strong link between the banking system and GDP than the environment. This is reasonable since the activities of the banking system directly revolve around economically productive sectors in the economy. The findings of this study are consistent with the studies of Olowofeso et al. (2015) and Eddien and Ananzeh (2016) who revealed that bank development plays a significant role in GDP. Other variables such as CO2, POP, and REC account for the variations in GDP and CO2 among the sub-regional economies in SSA suggesting that these variables contribute to GDP and environment in addition to BF.

The results in Table 14 show that GDP and CO2 largely depend on their prior innovations (past values). It is important to state that the degree to which GDP and CO2 respond to their innovations decreases over time. That is to say, their explanatory power decreased while the explanatory power of BF increased throughout the period. This suggests that the effectiveness of BF in GDP and the environment will be felt more in the future. The finding validates the effectiveness of recent initiatives in the banking system to strengthen the link between the banking system, GDP, and the environment. Ntarmah et al. (2019), Charfeddine and Kahia (2019), and Manu et al. (2020) also reached similar conclusions.

Impulse response function for the effect of bank financing on economic growth and the environment

We estimate the IRFs in addition to the VD. On the estimation procedure, we used Monte Carlo simulations with 500 replications with error margins of 5%. We concentrate on the interpretation of results for the variable of interest (BF), as well as how it affects GDP and CO2.

Figures 3–6 depict the IRF findings of the impact of BF on GDP for the CA, EA, SA, and WA areas (see Appendix 32). The results in Fig. 3 demonstrate that the impact of a one standard deviation rise (shock) in BF on the CA region’s GDP is positive but modest throughout the timeframe. This suggests that the CA region’s GDP responds favorably to BF shocks, showing that boosting financial resources to the private sector raises GDP. The findings also indicate that banks in the CA area are making strides in growth-induced lending. The results in Fig. 4 show that the impact of a one standard deviation shock in BF on the GDP of the EA area was positive and grew with time. This suggests that BF is becoming increasingly important in East African GDP, and its dominance is expected to grow in the future. Furthermore, the results in Fig. 5 show that the impact of a one standard deviation increase in BF on the GDP of the SA area was positive and rose over time. In addition, a one standard deviation shock in the growth of BF on the GDP of the West African sub-region was positive across the years in Fig. 6. The strong link between BF and GDP and a weak link between BF and the environment suggests that bank lending in EA focuses on productive sectors without considering the environmental outcomes of the lending decisions. The findings are in contradiction with the study of Cheng et al. (2021) who reveal financial development to be unfavorable for GDP. According to the statistics, the elasticity of BF to GDP varies over time and between areas. The findings complement the findings of Ibrahim and Alagidede (2018), Charfeddine and Kahia (2019), Ahmad et al. (2019), and Shoaib et al. (2020), who discovered that the elasticity of macroeconomic variables to one another varies in magnitude under balanced sectoral growth.

Figures 7–10 depict the IRF findings of the impact of BF on CO2 for the CA, EA, SA, and WA areas (see Appendix 33). From Fig. 7, the effect of a one standard deviation shock of BF on CO2 in the CA region was unstable but positive for the first three periods before stabilizing. Concerning Fig. 8, the impact of a one standard deviation shock in BF on CO2 in the EA region, on the other hand, was almost zero for the first five periods and then became positive but modest. Although BF can be detrimental to EA’s environment, the finding better illustrates a weak link between the banking system and the environment. Similarly, the effect of a one standard deviation increase in BF on CO2 in the SA region was positive over time (Fig. 9). The data reveal a pattern of BF’s boosting impacts on GDP and its negative consequences on the environment via CO2. Furthermore, the impact of a one standard deviation increase in BF on CO2 in the WA region was negative for the first two periods but approached zero toward the end of the period (Fig. 10). According to the statistics, the IRF findings provide new light on previous econometric estimations. The finding validates the recent studies that revealed variations in the elasticity of BF to the environment across different countries over time (Zhang et al. 2019; Khan et al. 2021; Ntarmah et al. 2021).

EKC results

The EKC results are presented in Tables 15 and 16 for the whole sample and sub-samples respectively. The OLS and MMQREG results in Table 15 depict evidence of the EKC hypothesis among SSA countries as a whole. However, such evidence was not found in low-emission countries in SSA (25th Quantile). While the results generally validate the study of Li et al. (2021) found EKC for the whole sample but not sub-groups.

The findings in the EA and SA sub-regions show the coefficient of GDP and GDP2 are positive and negative respectively. Thus, the findings demonstrate that the relationship between GDP and CO2 is an inverted U-shape relationship validating the EKC hypothesis among EA and SA regions. This finding supports Hanif (2018) and Ajanaku and Collins (2021) who validated the EKC hypothesis in SSA. Thus, future economic expansion in EA and SA through financial opportunities, environmentally friendly, and technologies in the sub-regions could decrease CO2 (Choi et al. 2010). In contrast, the findings in CA and WA did not provide any evidence of the EKC hypothesis, rejecting the existence of the EKC hypothesis. While GDP has no significant effect in the WA sub-region, a significant U-shaped relationship was established in the CA sub-region.

The finding in the CA region contradicts the EKC hypothesis but rather supports the study of Yusuf et al. (2020) that found a U-shaped relationship among the variables. The result suggests the non-existence of the EKC hypothesis in these two sub-regions thereby supporting the studies of Mehdi et al. (2014) and Adzawla et al. (2019) who found no evidence to support the existence of the EKC hypothesis among SSA countries. Generally, the mixed findings of this study throw more light on Tenaw and Beyene’s (2021) study that revealed mixed findings of EKC between resource-intensity SSA countries and non-resource-intensity SSA countries.

Moderating effect of bank financing in growth-environmental outcomes

This study further analyzed the moderating effect of BF (moderator variable) in growth and environmental outcomes using OLS and MMQREG for whole sample analysis and the PVAR approach for regional sample analysis. The purpose is to establish whether banking financing improves or worsens growth-environmental consequences in SSA. The moderating effect is represented by the interaction between BF and GDP (lnBFGDP). Table 17 presents the results of the moderating effect of banking financing in growth-environmental outcomes for SSA countries as a whole.

The MMQREG results presented in Table 17 show that BF has a significant moderating influence on growth-environmental outcomes but varies in terms of magnitude and elasticities. For low CO2–emission countries, BF negatively moderates growth-environmental outcomes; BF mitigates growth-environmental outcomes. This seems to suggest that the countries’ banking system has contributed to reducing growth-induced emissions. Conversely, BF positively moderates the growth-environmental outcomes of median and high emission countries. The results suggest that BF creates more environmental damages by stimulating large-scale production and consumption, which creates more pollution. The findings support the study of Bui (2020) that found financial development to have both beneficial and detrimental effects on environmental quality. Similarly, the findings of this study collaborate with Jiang and Ma’s (2019) study that established the dominance of the detrimental effect of financial development on the environment compared with the benefits. The location and scale results concisely show that BF has a higher negative dispersion in growth-environmental outcomes suggesting that BF has an increased variance across quantiles.

In terms of the sub-sample analysis, the PVAR results in Table 18 show that the coefficient of the interaction term of BF and GDP is significant for all the regional economies indicating that BF plays moderating role in growth-environmental outcomes in all the regional economies in SSA. BF positively influences the relationship between GDP and CO2 of CA and EA regions. This indicates that BF worsens growth-environmental outcomes by increasing CO2 of CA and EA regions. This revelation supports the conclusion made by Acheampong (2019). The results signify that BF can stimulate large-scale production and consumption and cause more pollution. Hence, increasing BF will lead to degradation of the environment of CA and EA regions. In contrast, BF negatively influences the relationship between GDP and CO2 of SA and WA regions, suggesting that BF mitigates growth-environmental challenges by decreasing CO2 of SA and WA regions. The findings of this study validate the studies of Yang et al. (2015), Katircioglu and Taşpinar (2017). The finding in SA and WA regions supports the theory of modernization that says that banks could be an important mechanism to decouple GDP from the environmental outcomes. Banks can help control global warming by channeling more capital into environmental-friendly projects, or by funding research and development aiming at discovering new ways of preserving the environment. These actions will result in lower CO2 rates and a better environment.

Generally, the findings of this study agree with Ehigiamusoe (2020) who established a positive moderating role of credit to the private sector in the relationship between environmental quality and its drivers, but a negative moderating role in ASEAN China, given that China is a high-pollution country.

Variance decomposition of the moderating role of bank financing

Table 19 presents the VD to illustrate the extent to which the interaction between BF and GDP explains the CO2 of the sub-regional economies over the sample period. The results in Table 19 show that the interaction between BF and GDP explains approximately 2.44%, 21.11%, 0.03%, and 1.86% of the variation in CO2 of CA, EA, SA, and WA regions respectively. Compared with earlier econometric estimates, variance decomposition results show that while GDP partly explains the variance in CO2, GDP’s explanatory power increases when moderated by BF. Interestingly, the moderating effect of BF accounted for a little of one-fifth of environmental damage in the EA region. The results through more light to support the PVAR estimate that BF plays a moderating role in GDP and environmental outcomes.

Impulse response function for the moderating effect of bank financing

We proceed to estimate the IRFs for the moderating effect of BF in growth-environmental outcomes for the four sub-regional economies in SSA. Figures 7–10 present the results of the IRFs for the CA, EA, SA, and WA regions Figures 11, 12, 13 and 14 (see Appendix 34).

Examining the function of BF as a moderator in growth-environmental outcomes, the IRF results in Fig. 7 reveal that the impact of a one standard deviation shock in the BF and GDP interaction term (lnBFGDP) on CO2 in the CA area was positive for the first four periods and thereafter declined. Similarly, the results in Fig. 8 demonstrate that the impact of a one standard deviation shock in the interaction term of BF and GDP on the EA region’s environmental outcomes was positive throughout the time. The IRF results in Figs. 7 and 8 further support the PVAR results that revealed the positive moderating effect of BF on growth-environmental outcomes indicating that BF worsens environmental outcomes in the CA and EA regions by increasing CO2 in the regions. This implies that growth in the banking system stimulates business opportunities by providing cheaper loans for productive ventures that also stimulate economic activity and energy consumption, which degrades the quality of the natural environment (Shahbaz et al. 2020).

On the other hand, the results in Fig. 9 show that that the moderating effect of BF on growth-environmental outcomes in the SA region was initially zero and become positive for the first four periods and negative afterward. It must be emphasized that the impact is weak in magnitude. Additionally, the results in Fig. 10 show that the moderating effect BF was negative but unstable from the first period to the eighth period and become zero afterward. This supports the initial revelation that BF improves growth-environmental outcomes in SA and WA regions by reducing CO2 in these regions. This usually happens when businesses with greater access to bank funding import green technologies and cut CO2 emissions by internalizing the negative externality. By doing so, businesses not only preserve the environment by implementing stronger pollution control systems but also help governments create green economies by pushing low-carbon commercial operations. Tamazian et al. (2009), Katirciolu, and Taşpinar’s findings corroborate their findings (2017).

Conclusion and policy recommendations

The present study examined the role of BF in GDP and environmental outcomes from the perspectives of SSA over the period 1990–2018. We employed the econometric models of slope homogeneity, cross-sectional independence, panel unit root, panel cointegration, MMQREG, and PVAR model within the GMM framework to estimate the results. The preliminary results revealed that the countries are heterogeneous, and there exists cross-sectional dependency. However, there was no evidence of cointegration among the variables.

Our empirical results revealed that conditioning on other environmental determinants, BF positively influences GDP and CO2 among SSA countries distributed across quantiles. We also established that the positive influence is strongest among high growth and emission countries. Concerning sub-regional analysis, BF had a significant positive influence on CO2 of EA, CA, and SA countries while a negative but unstable influence on CO2 was found among WA countries. Similarly, the results show that BF had a significant positive impact on the GDP of EA and CA regions but a negative influence on the GDP of countries in the WA region. The IRF results show that the impact of one standard deviation shock in the rise of BF on GDP and CO2 varies among the regional economies in terms of elasticities and magnitude.

In terms of the moderating effect of BF on growth-environmental outcomes, the study revealed that BF mitigates growth-environmental harm for low carbon–emitting countries but worsens growth-environmental challenges for median and high carbon–emitting countries. Furthermore, BF worsens growth-environmental damages of CA and EA regions but mitigates growth-environmental challenges of SA and WA regions. The VD and IRFs provide additional support for this finding and further reveal that the moderating effect of BF on growth-environmental outcomes varies across regions for the sample period.

Based on the findings, we offer the following policy recommendations for the economies to strengthen the role of BF in GDP and environmental outcomes in the region.

-

1.

Since BF positively influences GDP, we encourage SSA countries to continually use the banking system to achieve greater economic growth especially CA and EA. However, economic blocs in SA and WA regions such as SADC and ECOWAS should introduce bank-specific policies that will redirect BF toward economically viable businesses and projects in the regions.

-

2.

The positive relationship between BF CO2 among SSA countries distributed across regions implies that policymakers in SSA should introduce stricter BF policies and initiatives that will ensure that environmental issues are integrated into future financings. In addition, banks should finance environmentally friendly projects through green financing and corporate social responsibilities.

-

3.

For banks to be able to mitigate growth-environmental challenges, we recommend that policymakers in the EA, CA, and SA regions encourage banks to reconsider their credit allocations and develop a comprehensive financing framework that will stimulate credit allocation and financing of economically viable and environmentally friendly projects. To decouple GDP from environmental damages, sub-regional blocs might depend on market-based tools such as eco-taxes and use the “polluter pays” concept to prevent environmentally destructive activities and producers from hurting the environment and reward eco-efficient activities.

-

4.

Regional economic blocs such as SADC, CEMAC, ECOWAS, and EAC should invest in research and innovative ways to strengthen and improve the banking system to improve GDP and environmental outcomes. Here, policy directions focusing on restructuring the banking system to provide funds to aid research and development in efficient and clean production technologies that encourage growth and lower CO2 are highly recommended for all the regional economies. In this way, how financial and technological advancement decouples GDP from environmental harms could be established.

-

5.

Since EKC was not verified in CA and WA, we recommend CEMAC and ECOWAS should guide countries in these regions strengthen their environmental regulatory institutions and invest in environmentally friendly technologies to ensure that future economic expansion relies on the use of energy-efficient and eco-friendly technologies as well as engaging in climate change mitigation activities. This will ensure that future economic expansion will improve the environment.

Although the findings of this study are reliable, this study is not without a limitation. It is important to state that the study focused on SSA as a whole and the four regions in SSA. Hence, the conclusions drawn from the research are limited to the SSA and the regions but not individual countries. Therefore, future research could consider investigating macro prudential policies for improving the role of BF on GDP and environmental outcomes unique to individual SSA countries.

Data availability

The datasets generated and/or analyzed during the current study are available in the World Development Indicators repository, https://data.worldbank.org/

Notes

The Paris Agreement is a legally binding international treaty on climate change. The Paris Agreement provides a framework for financial, technical, and capacity building support to those countries that need it.

References

Abrigo MRM, Love I (2016) Estimation of panel vector autoregression in Stata: a package of programs. Working Papers 201602, University of Hawaii at Manoa, Department of Economics.

Acheampong AO (2019) Modelling for insight: does financial development improve environmental quality? Energy Econ 83:156–179

Adzawla W, Sawaneh M, Yusuf AM (2019) Greenhouse gasses emission and economic growth nexus of sub-Saharan Africa. Sci Afr 3:e00065

Ahmad M, Zhao ZY, Irfan M, Mukeshimana MC (2019) Empirics on influencing mechanisms among energy, finance, trade, environment, and economic growth: a heterogeneous dynamic panel data analysis of China. Environ Sci Pollut Res 26(14):14148–14170

Ajanaku BA, Collins AR (2021) Economic growth and deforestation in African countries: is the environmental Kuznets curve hypothesis applicable? For Policy Econ 129:102488

Al-mulali U, Binti Che Sab CN (2012) The impact of energy consumption and CO2 emission on the economic growth and financial development in the Sub Saharan African countries. Energy 39(1):180–186

Andrews DWK, Lu B (2001) Consistent model and moment selection procedures for GMM estimation with application to dynamic panel data models. J Econ 101(1):123–164

Apergis N, Ozturk I (2015) Testing environmental Kuznets curve hypothesis in Asian countries. Ecol Ind 52:16–22

Awad IM, Al Karaki MS (2019) The impact of bank lending on Palestine economic growth: an econometric analysis of time series data. Financ Innov 5:14

Awan AM, Azam M, Saeed IU, Bakhtyar B (2020) Does globalization and financial sector development affect environmental quality? A panel data investigation for the Middle East and North African countries. Environ Sci Pollut Res 27(36):45405–45418

Bandura WN, Dzingirai C (2019) Financial development and economic growth in sub-Saharan Africa: The role of institutions. PSL Q Rev 72(291):315–334

Banhalmi-Zakar Z (2016) The impact of bank lending on the environmental outcomes of urban development. Australian Planner 53(3):221–231

Bekhet HA, Matar A, Yasmin T (2017) CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: dynamic simultaneous equation models. Renew Sustain Energy Rev 70:117–132

Boyd JH, Smith BD (1992) Intermediation and the equilibrium allocation of investment capital: implications for economic development. J Monet Econ 30(3):409–432

Bui DT (2020) Transmission channels between financial development and CO2 emissions: A global perspective. Heliyon 6(11)

Canova F, Ciccarelli M (2013) Panel vector autoregressive models: a survey ☆ The views expressed in this article are those of the authors and do not necessarily reflect those of the ECB or the Eurosystem. In VAR Models in Macroeconomics–New Developments and Applications: Essays in Honor of Christopher A. Sims. Emerald Group Publishing Limited, pp 205–246

Charfeddine L, Kahia M (2019) Impact of renewable energy consumption and financial development on CO2 emissions and economic growth in the MENA region: a panel vector autoregressive (PVAR) analysis. Renewable Energy. https://doi.org/10.1016/j.renene.2019.01.010

Chen H, Hongo DO, Ssali MW, Nyaranga MS, Nderitu CW (2020) The asymmetric influence of financial development on economic growth in Kenya: Evidence from NARDL. SAGE Open 10(1):2158244019894071

Cheng CY, Chien MS, Lee CC (2021) ICT diffusion, financial development, and economic growth: An international cross-country analysis. Economic modelling 94:662–71

Chernozhukov V, Fernandez-Val I, Galichon A (2010) Quantile and probability curves without crossing. Econometrica 78(3):1093–1125

Choi E, Heshmati A, Cho Y (2010) An empirical study of the relationships between CO2 emissions, economic growth and openness (IZA Discussion Paper No. 5304). The Institute for the Study of Labor, Bonn

Dafermos Y, Nikolaidi M, Galanis G (2018) Climate change, financial stability and monetary policy. Ecol Econ 152:219–234

Destek MA, Sinha A (2020) Renewable, non-renewable energy consumption, economic growth, trade openness and ecological footprint: evidence from organisation for economic Co-operation and development countries. J Clean Prod 242:118537

Dhaene G, Jochman K (2015) Split-panel jackknife estimation of fixed-effect models. Rev Econ Stud 82:991–1030

Dryzek JS (2013) The politics of the earth: Environmental discourses. Oxford University Press

Eddien I, Ananzeh N (2016) Relationship between bank credit and economic growth: evidence from Jordan. Int J Financ Res 7(2):1923–4031

Ehigiamusoe KU (2020) The drivers of environmental degradation in Aseanþchina: do financial development and urbanization have any moderating effect? World Scientific Publishing Company, The Singapore Economic Review

Ehigiamusoe KU, Lean HH (2019) Effects of energy consumption, economic growth and financial development on carbon emissions: evidence from heterogeneous income groups. Environ Sci Pollut Res 25(23):22829–22841

Ganda F (2019) The environmental impacts of financial development in OECD countries: a panel GMM approach. Environ Sci Pollut Res 26(7):6758–6772

Gregory AW, Hansen BE (1996) Residual-based tests for cointegration in models with regime shifts. J Econ 70(1):99–126

Hanif I (2018) Impact of economic growth, nonrenewable and renewable energy consumption, and urbanization on carbon emissions in Sub-Saharan Africa. Environ Sci Pollut Res 25(15):15057–15067

Ibrahim M, Alagidede P (2018) Nonlinearities in financial development–economic growth nexus: evidence from sub-Saharan Africa. Res Int Bus Financ 46(C):95–104

Ibrahim M, Alagidede IP (2020) Asymmetric effects of financial development on economic growth in Ghana. J Sustain Financ Invest 10(4):371–387

Jiang C, Ma X (2019) The impact of financial development on carbon emissions: a global perspective. Sustainability 11(19):5241

Katircioglu ST, Taşpinar N (2017) Testing the moderating role of financial development in an environmental Kuznets curve: empirical evidence from Turkey. Renew Sustain Energy Rev 68:572–586

Khan S, Khan MK, Muhammad B (2021) Impact of financial development and energy consumption on environmental degradation in 184 countries using a dynamic panel model. Environ Sci Pollut Res 28:9542–9557. https://doi.org/10.1007/s11356-020-11239-4

Kong Y, Ntarmah AH, Cobbinah J, Menyah MV (2020) Banking system stability and sustainable development: conditional mean-based and parameter heterogeneity approaches. Int J Manag Account Econ 7(9):482–505

Li W, Qiao Y, Li X, Wang Y (2021) Energy consumption, pollution haven hypothesis, and environmental Kuznets curve: examining the environment–economy link in belt and road initiative countries. Energy 8:122559

Love I, Zicchino L (2006) Financial development and dynamic investment behavior: evidence from PVAR. Q Rev Econ Finance 46(2):190–210

Machado JAF, Santos Silva JMC (2019) Quantiles via moments. J Econ 213(1):145–173

Majeed MT, Mazhar M (2019) Financial development and ecological footprint: a global panel data analysis. Pak J Commer Soc Sci 13(2):487–514

Manu EK, Xuezhou W, Paintsil IO, Gyedu S, Ntarmah AH (2020) Financial development and economic growth nexus in Africa. Bus Strateg Dev. https://doi.org/10.1002/bsd2.113

McLeay M, Radia A, Thomas R (2014) Money creation in the modern economy. Bank of England Quarterly Bulletin, Q1