Abstract

As much as energy supply remains a major challenge in most of the African countries, the compounding environmental effect of energy consumption has continued to be a serious concern to policymakers and environmental stakeholders. On this note, this study seeks to investigate the coal-led growth hypothesis for South Africa by incorporating employment as a control variable for the first time. The incorporation of the employment in investigating the coal-led growth hypothesis especially for the case of South Africa is novel given that the World Coal Association (2016) reported that the country is the sixth largest exporter and seventh largest producer of coal globally. The study implemented an Autoregressive Distributed Lag (ARDL) bound testing to cointegration for the data spanning from 1970 to 2017. As such, the empirical result revealed that coal usage is the highest emitter of carbon, suggesting that a 1% increase in coal consumption account for about 68% emission in the short run, and 56% in the long run, respectively. On the other hand, foreign direct investment (FDI) inflow discourages carbon emission in the short-run and long run so that a 1% increase in FDI inflow causes a reduction in CO2 by about 0.003% and 001%. The novelty of this study is proven in the estimation of the interaction between employment and coal consumption. However, employment induced by economic growth and coal consumption both have significant tendencies of inflicting adverse environmental impacts in the short-run and long run. Thus, this study put forward relevant policy and for onward recommendation for the government to woo new foreign investors and to switch to renewable energy as an alternative sources as a possible approach of energy efficiency and environmental sustainability with a view to achieving sustainable development goals.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The debate on the relationship between coal consumption and economic growth has sparked a serious concern in recent time arising from the importance of the contribution of coal usage to economic growth, especially of the coal-intensive economies. These economies derive most of their source of power from coal consumption because it is cheaper and more economical. The implication is that if coal usage is not properly managed, it could pose environmental degradation through emission. Report has it that in 2005 about 25.1% of the world’s total energy generation is sourced from coal consumption only beaten by oil which constitutes 34.3% (World Energy Council, WEC, 2016). It is worthy to note that this achievement is never static but keeps increasing significantly year by year with potentials to overtake other sources in the nearest future due to its availability at a cheaper cost. The above description is not different from the case of South Africa at micro level. South Africa is known to be the largest producer of coal in Africa and 6th in the world energy council (WEC, 2016). However, it is imperative to state clearly that the need to carry out more research on the subject matter is born out of the fact that the topic is still subject to empirical debate because of the conflicting interest and views from the previous studies. Moreover, the United States energy information administration (EIA, 2010) submits that South Africa account for the highest emission in the Africa continent. Importantly, coal sector is significantly contributing to the economic growth or expansion of South Africa. Precisely, no less than 70% of the primary energy demand and more than 90% of domestic electricity output in South Africa are achieved from the coal sector (World Coal Association, 2016). Accordingly, the multiplier effect of the coal industry in South Africa is that it generates hundreds of thousands of employment opportunities for the citizens, thus reducing unemployment and aiding economic growth (Beg et al.,2002; Saint Akadiri et al., 2019a). Therefore, the current study seeks to revisit the aforementioned hypothesis by incorporating employment as an intervening variable in a novel approach thereby closing a relevant gap in the literature. In essence, this study objectively hypothesized whether coal consumption as induced by employment drives environmental degradation in a significant manner. The incorporation of employment, foreign direct investment inflow, and total resource rent in the functional model defines the uniqueness of this study from the previous studies. In essence, the findings from this study is expected to exceptionally contribute to the ongoing debates, thus providing policy direction to the South African government, stakeholders, and the concerned counterpart around the world. The other part of this study is arranged as follows: The upcoming section (Sect. 2) presents the theoretical underpinning of coal, foreign direct investment, and environmental sustainability nexus in a stylized pattern. The data and methodological approach are presented in Sect. 3. Subsequently, Sect. 4 presents the result, interpretation, and discussion of the study. In conclusion, the concluding remarks as well as policy recommendation are also illustrated in Sect. 5.

Relevant studies

Coal-led growth and environmental degradation

Many previous studies assert that coal consumption drives economic advancement accordingly, while others hold the opposite view. Some studies maintained neutral observations, while others support the idea of a feedback relationship between the variables. For instance, the recent study of Joshua et al. (2020) examined the relation between coal consumption and economic growth in South Africa using the dynamic ARDL bound test. The findings confirmed the existence of cointegration between the variables of interest as well as coal-induced growth hypothesis. The study concludes that conservation policy is not healthy for the South Africa economy. Adedoyin et al. (2020) examine the relationship between coal rent, carbon emission, and economic expansion in the BRICS economies. The findings revealed that coal rent exhibits significantly negative impact on carbon emission, while control on coal rent demonstrates significant and positive impact on carbon emission. In the same circumstance, Jinke et al. (2008) opines that coal usage is a consequence of economic advancement. The study observed that when an economy expands, the demand for coal as source of power will follow naturally as noted empirically in China and India. The case is the same in the former Soviet Union according to Reynolds and Kolodziej (2008) and Govindaraju and Tang (2013) for India. Similarly, the work of Fatai et al. (2004) submits that economic expansion will drive the demand for coal consumption normally in Australia. This assertion is equally supported by the works of Jinke et al. (2008) and Wolde-Rufael (2010) in the case of China, as well as the work of in Italy, and for the Malawian economy. Also, the submissions of Wolde-Rufael (2010) show that the economies of India and Japan are driven in part by coal consumption, similar to the study of Wolde-Rufael (2010). These studies (see Shiu and Lam, 2004; Yuan et al. 2007) found the causal effect of electricity consumption on economic progress of China, different from the work of Destek and Sarkodie (2019). Wolde-Rufael (2010) carried out an empirical study and found that coal consumption is a promoter of economic advancement in line with the work of Ziramba (2009). Additionally, the study of Ewing et al. (2007) supports the contribution of coal usage to the industrial productivity in the US as supported by Sari et al. (2008). Other studies that support the coal-led growth and related energy hypothesis include (see: Thomas, 2004; Erol and Yu, 1987; Bekun et al.,2019a; Bekun et al.,2019b and Narayan and Smyth, 2005). Furthermore, Bekun et al. (2019b) employed the dynamic ARDL bound test and posited that energy consumption is one of the driving force behind the economic prosperity of South Africa in particular. They found an unidirectional interaction only from coal usage to economic expansion. This is consistent with the work of Saint Akadiri et al. (2019b) for the case of South Africa that opined that coal consumption serves as a key driver for economic prosperity of South Africa. The ARDL bound testing to cointegration reveals that the series under investigation converged in the long run, while the Granger causality test revealed a one way causal effect running from coal consumption to economic advancement as supported by the work of Shahbaz et al. (2013a) in the case of China. This is similar to the work of Bekun et al. 2019a for 16 EU economies as well as the studies of Alola et al. (2019a), Alola et al. (2019b), Akadiri et al. (2019), Wang et al. (2018), and Sarkodie and Adams (2018) that considered the environmental sustainability in the concept of energy consumption varieties.

FDI and environmental degradation

Shahbaz et al. (2019) examined the interaction between FDI inflow and carbon emission couple with other relevant variables for the MENA region from 1990 to 2015. The GMM method was adopted which validated both the pollution heaven hypothesis and the N-shape link between FDI inflow and carbon emission. The causality flow was found running from FDI inflow to carbon emission suggesting that the former is an emitter, while a two way interaction was found between economic expansion and carbon emission in support of growth hypothesis. The suggested policies targeted at cleaner energy production and pure trade free from pollution. Zafar et al. (2019) which is consistent with the work of Zafar et al. (2018). Emir and Bekun (2019) examine the relationship between energy intensity, carbon emission, renewable energy, and economic expansion in Romania adopting ARDL bound test. The study revealed a future co-movement between the variables of interest. The findings further revealed a feedback link between energy intensity and economic prosperity and a unidirectional causal flow running from renewable energy consumption to economic expansion which applies that the later depends on former for acceleration in support of the energy-induced growth. Furthermore, the study of Balsalobre-Lorente et al. (2018) for the European Union 5 (EU-5). The study revealed an N-shape connection between carbon emission and economic acceleration. Findings from the study indicate that the environmental quality of the case study is improved by renewable electricity consumption, natural resources, and energy innovation, while trade openness and the interaction between economic expansion and renewable electricity consumption exhibits positively influence on carbon emission. In a related study, Bekun and Agboola (2019) investigate the relationship between electricity consumption, real gross domestic product per capital, and carbon emission in Nigeria using the dynamic ordinary least square and the fully modified ordinary least square. The study confirmed a long run cointegration between the variables incorporated in the model. The TY Granger revealed the energy-induced growth for the economy of Nigeria implying that energy is a driving force behind economic expansion in Nigeria. Saidi et al. (2018) investigated the effect of transport energy and transport infrastructure on economic expansion in the MENA region. Using the GMM method, the findings revealed the positive impact of transport energy and transport infrastructure on economic advancement in the studied area on the overall. In like manner, the work of Shahbaz and Rahman (2012) examine the relationship between financial development, import, FDI, and economic expansion in Pakistan using quarterly data from 1990 to 2008. The dynamic ARDL bound test revealed the presence of cointegration among the variables as well as a bidirectional link connecting the series. Further revelation shows that financial development, import, and FDI promote economic expansion positively and significantly. Alvarez-Herranz et al. (2017) carried out a similar study in 17 OECD economies which confirmed the same shape of EKC as revealed by Balsalobre-Lorente et al. (2018). The study submits that energy innovation process is of great benefits to the ecosystem of the study area and that renewable energy promotes air quality. In other investigations in the literature, the impact of economic growth, tourism development, energy consumption, and other socio-economic factors such as fertility have been considered in recent time (Alola & Alola, 2018; Alola, 2019a; Alola, Alola & Saint Akadiri, 2019a; Alola & Kirikkaleli, 2019; Alola, 2019b; Alola et al., 2019a; Alola et al., 2019d; Alola, Bekun & Sarkodie, 2019b; Saint Akadiri, Alola, Akadiri, and Alola, 2019b; Saint Akadiri et al., 2019a).

Theoretical insight: coal-led growth hypothesis

There are four hypotheses put forth as basis to support the investigation of traditional coal-led hypothesis. The first one is the growth hypothesis which claimed that a conservative policy that is targeted at the reducing coal usage will subsequently hinder economic expansion especially in a coal-intensive economy. This is because the hypothesis asserts that coal is a key driving force behind economic prosperity. This asserts the reason to the study of Joshua and Bekun (2020) which revealed a two way interaction between coal usage and economic expansion in South Africa, thus predicting the potential harm of the regulatory policy to the economy. Thus, the study recommended an efficient energy mix policy for the economy. Similarly, Adedoyin et al. (2020) investigated the link between coal rent, economic expansion, and carbon emission in the BRICS economies where a cointegration was found between the series. The study further indicates that coal rent exerts a significant negative influence on carbon emission. On the contrary, control on coal rent triggered significant positive impact on carbon emission. The study of Balsalobre-Lorente et al. (2018) aligned with the above studies as well as the followings studies (see Akadiri et al. 2019; Alola, 2019a; Bekun et al., 2019a; Saint Akadiri et al., 2019c; Wang et al. 2018; Sarkodie and Adams 2018; Ulucak and Bilgili, 2018). Other studies in support of this hypothesis include Shahbaz et al., 2013b; Wolde-Rufael, 2010; Erol and Yu, 1987. The second hypothesis holds the opposite view, claiming that economic growth derives the demand for coal usage; thus, conservation policy cannot cause a breakdown on the path of economic progress. This is also backed by some empirical findings which include the work of Reynolds and Kolodziej (2008). The study revealed that economic expansion is the cause of coal consumption in the case of the former Soviet Union which is similar to Govindaraju and Tang (2013). Govindaraju and Tang (2013) examine the same case for India and found that the economic expansion of India is responsible for the drive demand for coal consumption. Studies such as Jinke et al. (2008), Wolde-Rufael (2010), and Yuan et al. (2007) also confirmed the conservative policy. The feedback hypothesis on the other hand formed the third view which established a bidirectional link between the variables of interest. This hypothesis opined that these variables of interest drive each other such that the conservation policy would rather pose a danger to the path of economic prosperity as opined by Joshua and Bekun (2020). This was closely supported by Wolde-Rufael, 2010; Yuan et al., 2007. Finally, the fourth hypothesis remains uncertain or neutral in regard to the impact of coal consumption on economic progress implying that conservation policy would be healthy for economic expansion. Some studies also lent their supports to this hypothesis which includes Wolde-Rufael (2010), Ziramba (2009), Jinke et al. (2008), and Fatai et al. (2004). Furthermore, Wolde-Rufael (2010) examines the said relationship and found that the impact of coal consumption on economic expansion is not feasible in China and South Korea. While the Granger causality test revealed a non-causal effect between coal usage and economic progress in South Africa which is consistence with the work of Yuan et al. (2007). The study revealed that coal consumption does not in any way drive economic expansion in the Chinese economy. Fatai et al. (2004) carried out similar research and submits that there is no causal effect between coal consumption and economic expansion in New Zealand. The work of Jinke et al. (2008) proves no causal effect otherwise, stressing the existence of no causal effect between coal usage and productivity for South Africa. Ziramba (2009) examines the hypothesis for the case of South Africa and discovered that there is no causal direction between the series as supported by the work of Payne (2011). Stern (1993) examines the relation between coal consumption and economic expansion and found non-causal effect between series for the US economy.

Research data and procedures

This study investigates the relationship between economic expansion, coal consumption, FDI inflow employment, pollutant emissions, and total natural resource rent (TNR). The time series data of the employed variables all but one were retrieved from the World Development Indicator of the World Bank database (World Bank, 2019). However, data for coal consumption were generated from the British petroleum (BP, 2019) database ranging from 1970–2017. The variables under investigation includes real GDP which represents economic expansion (constant 2010, US$), total natural resource rent (%GDP) in US dollars, FDI inflow, employment, coal consumption (Mtoe), and CO2 in (Kt) emissions. Thus, achieving the growth effect was possible by converting the variables into natural log form. The modification of the environmental degradation function to suite the current study takes the form of

The above expression (eq. 1) mimics several recent empirical studies in the literature that have incorporated economic growth (GDP), the FDI, and TNR such as Adedoyin, Alola & Bekun (2020), Asongu et al. (2020), and Eluwole et al. (2020).

Stationary Tests

It is no longer news that in most cases time series data cannot be estimated in their raw form due to their inability to be stationary until they are subjected to stationarity test Gujarati (2009). Until proven otherwise, time series data in its natural form will always result to spurious regression if estimated empirically. To this end this study resorts to adopting the widely known ADF and PP proposed by Dickey and Fuller (1981) and Phillips and Perron (1988), and the result indicates a mixed order of integration for the series under investigation. This suggests the application of the ARDL bound test as the most suitable method of estimation. The generalized expression is presented as follows:

Where, Gaussians white noise that is assumed to have a mean value of zero is represented byεt, and possible autocorrelation represents series to be regressed on the time t.

ARDL bounds testing

As earlier stated above, the outcome of the stationarity test which indicates a mixed order of integration informed the adoption of the ARDL bound test as developed by Pesaran et al. (2001). The advantage and the superiority of this method over the traditional method is the ability of the method to estimate both the short and long run relationship between the variables at the same time. Secondly, its can still be applied for estimation irrespective of the order of integration, whether a mixed order of integration or otherwise. The method is majorly adopted to determine the co-movement of the variables of interest. The equation is stated as follow:

Where the rejection of H0 indicates a proof that the series converged in the long run to correct any initial short-run disturbance.

Empirical result, interpretation and discussion

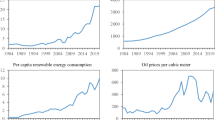

This section presents the findings and the discussion of this study. It begins with the time series plot of the examined variables (see Fig. 1) which shows the trend of the variables of interest. This is followed by the summary statistics (see Table 1) which illustrated that employment has the largest relative mean. The findings further prove that the variables are highly dispersed from their mean as indicated by the standard deviation and that the variables are negatively skewed except for GDP and the TNR. The probability of the Jargue-Bera indicates that exactly half of the series demonstrate normality in their distribution, while half are not. This is not a serious issue as there are still other empirical tests to confirm the normalcy of the series. The correlation coefficient (see Table 2) indicates an overall result of a strong connection between the series. However, all series except for TNR are strongly correlated with the CO2 which further suggests the possibility of a co-movement between the series of interest, thus paving way for the investigation of an empirical evidence that coal usage causes carbon emission. The connection between FDI inflow and employment is empirically valid especially for the case of South Africa where FDI is believed to significantly contribute to the country’s employment history.

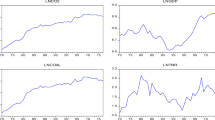

Most time series data are not stationary at their level which necessitated the need to carry out stationarity test in others to establish the order of integration of the series (Gujarati, 2009). This is a critical step especially as a way of avoiding spurious regress which is capable of yielding to a misleading result. The second benefit of stationarity test is to determine which method would be suitable for the study at hand. Thus, this study leverages on the ADF and PP unit root tests for the stationarity test and the results presented in Table 3 below. For the PP unit root test, only CO2, FDI, and TNR were stationary at level. However, all variables turn out to be stationary at the first difference. Similarly, except for GDP all other variables were stationary at level in the case of the ADF unit root test. But at first difference, all variables with the exception of EMP turn out to be stationary. The overall result shows a mixed order of integration of the variables in the model which suggests the adoption of the dynamic ARDL bound testing to cointegration to determine the long term relationship between the variables. Furthermore, the model was subjected to diagnostic test which prove that the functional model of this study is normally distributed as reported by the normality test. The result also proves that the model of this study is free from variable omission error and is homoscedastic in form, therefore, satisfied to be applied as an instrument for policy guide. The stability test of CUSUM and CUSUMSQ presented in Figs. 2 and 3 shows clearly that the fitted model is stable since the blue line fall within the critical box through the period of interest. This claim is supported by (Emir & Bekun 2019; Okunola, 2016).

Following the mixed order of integration of the series, this study adopted the ARDL bound test to determine whether or not the series co-move in the long run. The result as presented in the Table 4 and 5 below show that the variables of interest converged in the distant future. On the other hand, the ECT which determined the speed of adjustment proves that the series of interest corrected the short run-disequilibrium to co-move in the future with a high speed of about 96%. This implies that it take little time for the short-run disequilibrium to be corrected between the variable as an important feature of a working economic system like that of South Africa. More importantly, the results further revealed that coal consumption exerts positive and significant impact on CO2 both in the short run and in the long run. About 68% increase in the carbon emission is cause by the a 1% change in coal consumption, while 56% account for the long run which is significant as well. Interestingly, the result also revealed that in the last previous year, the impact of coal consumption on the CO2 remained positive and significant accounting for about 53% of the increase that occurred in the dependent variable. On the other hand, GDP contributes to carbon emission significantly only in the short run. About 37% of the increase in carbon emission is caused by economic expansion in South Africa. In the long run, the tide turned out to be insignificant though positive. In the long run, GDP causes about 5% change in carbon emission. This means that on the average, coal usage and economic advancement are the key contributors to carbon emission in the economy of South Africa which suggest that a suitable policy mixed must be put in place to avoid a reversal reaction through environmental degradation caused by emission in a bid to achieving economic progress. This is instructive to the authority concern. Interestingly, the result revealed that FDI inflow to South Africa is anti-carbon emission in nature. About 3% of the reduction in carbon emission is brought about by FDI inflow in the short run and 1% for the long run significantly in both terms. Additionally, the impact of employment on the carbon emission is observed to be elastic and significant. About 123% increase in CO2 is caused by employment in the short distance, time while 54% occurs in the long run. This implies that the labor force activity in the various sector of the economy contributes significantly to carbon emission. The result added that natural resources (TNR) contribute significantly to the carbon emission in South Africa only in the last two previous years both in the short and long run. The impact is insignificant in the current year. In the last 2 years, about 3% of the increase in the carbon emission is caused by the TNR, while 3% account the past immediate year both in the short run. In the long run, TNR is responsible for the 3% increase in the CO2. This means that the extraction of the natural resources in South Africa is contributing to the environmental degradation through emission. The attention of the authority concern must be drawn to this reality for appropriate action to be taken otherwise the natural resources which supposed to be a blessing to the nation may turn out to be a curse through environmental degradation occasioned by carbon emission.

Moreover, this study went further to apply the block exogeneity Granger causality test to ascertain which variable drives which. The result is presented in Table 6 below shows a feedback link between coal usage and CO2 which is consistent with our apriori expectation and closely supported by the work of Bekun et al. (2018&2019). This implies that the consumption of coal as a source of power generation has its consequences which if not properly managed could result to environmental degradation. The findings also revealed a one way interaction flowing from GDP to CO2 suggesting that carbon emission in South Africa is in part the consequences of economic expansion which is worthy to note by the government and the stakeholders. This further implies that some key economic factors that influence the economic expansion of South Africa are emitters for which their usage or extraction process must be subjected to efficient and effective management control; otherwise in the long term, their negative effects are capable to reverse economic progress through environmental degradation occasioned by incessant carbon emission. The result further found a bidirectional interaction between employment generation and CO2. The economic intuition behind this is that employment generation which means the supplies or engagement of human labor informs is responsible in part to promoting carbon emission in South Africa. This implies that the labor force contributes indirectly to carbon emission through the involvement in the economic activities that promote emission. Interestingly, the findings revealed a bidirectional interaction between employment generation and coal consumption as earlier expected and as backed by the claim made by Beg et al. (2002). According to him coal consumption contributes significantly to employment generation to the citizens of South Africa at least by 250,000 equivalents. This implies that coal consumption is not without economic benefits despite its negative contribution to carbon emission which is presumed to be a threat to the healthy environment in the nearest future. The findings from this study indicate a mutual benefit between employment (labor force) and economic growth confirming the traditional stand which asserts that human capital is a fundamental factor needed by any economy to facilitate growth process. This call for the attention of the South Africa’s economic managers to device the means of harnessing the surplus human capital by revitalizing the educational system to a minimum threshold in an attempt to improving human capital development. The well-trained labor force could then be properly engage in the gainful and productive sector of the economy to contribute their quotas for the achievement of the overall desire and goal of economic expansion. This study revealed that FDI inflow does not drive economic expansion which is consistent with the work of Joshua (2019). This study also provides an interesting revelation which proves that all the series but for TNR drive employment generation, respectively. This means that coal usage, economic expansion, and FDI inflow are contributors to the fight against the well-known menace of unemployment in South Africa. The policy implication is that the way to increase employment opportunity is to achieve economic advancement, attraction of more foreign investor into the economy, and to expand the consumption of coal. Finally, this study revealed a one way link only from GDP and employment to natural resources. This implies that well-developed workforces coupled with economic progress are crucial factor needed to properly harness the natural resources of the nation.

Concluding remark

This study primarily sets out to investigate the coal-led growth hypothesis by incorporating employment as an intervening variable for the first time to ascertain whether or not coal consumption significantly drives employment generation in South Africa as submitted by Beg et al. (2002). The revelation proves that coal is not a drive of economic expansion in South Africa rather it is the later that determine the demand for the former as supported by conservation hypothesis and further backed by empirical evidence such as Govindaraju and Tang (2013). Thus, since coal usage does not drive economic expansion but drive CO2 which is capable of posing environmental danger in the future, it is adviced that the authority concern should subscribe for conservation policy to reduce the consumption of coal. Alternatively, the economy would resort more to the alternative sources of renewable energy like the solar energy which is believed to be cleaner than the traditional source from coal consumption and could promotes economic expansion without causing harm to the quality of environment as submitted by Emir and Bekun (2019). Putting it differently, this study recommends the replacement of the traditional energy source with the renewables as a way of maintaining environmental sanity. More effectively, the economy could as well adopt energy innovation process as a modern way of increasing the efficiency of energy which will transcend to economic expansion while maintaining a pure ecosystem as supported by the work of Alvarez-Herranz et al. (2017). This may be done gradually over time through policy mixed which is perceived to save the nation from the pending danger of environment degradation degenerated from incessant emission. The alternative source is preferred to be cleaner, safer, and less emission inherent relatively, thus, suitable for building a dynamic and healthy economic rather than developing a vibrant but environmental prone economic where the economic earnings may turn out to be spend on environmental cleansing, therefore, causing a reversal outcome along the path of economic progress. The findings from both Granger causality and the short/long run estimation shows that FDI inflow to South Africa is pure and free from emission a development that prove to be healthy for the economy of South Africa. Thus, the one way drive from FDI inflow to employment generation is a great lesson to the government of South Africa. This implies that the government must do everything possible within its ambit to woo new investors into the economy through macroeconomic policies such as tax holidays, ensuring a stable economic and political environment. In essence, openness and business incentives are keys to generating economic expansion in South Africa as it will allow free flow of FDI which in turn will generate employment opportunity to the citizens through it spillover effect. On the domestic scene, a direct mutual interaction exists between employment generation and economic growth which suggest that the quest for economic expansion is not an option for the South African government if the nation must be liberated from one of the economic chief evils called unemployment. Furthermore, the economic managers should ensure that the hard earnings of the nation must be reinjected into the productive sector of the economic where it generates high returns. The idea is that re-circling the resources in this unique pattern will automatically generate employment for the country’s labor force, thus, reducing unemployment in the country appropriately. There are policy implications associated with the current study. Since the result indicates a two-way drive between CO2 and employment which suggests that human labor (human economic activities) contributes significantly to CO2, thus it is essential that the South African economy shifts from labor-intensive form of production to a capital-intensive mode of production in an attempt to mitigate carbon emission (and curbing future environmental degradation). However, this must be done with care as employment is reported by this study to be a key driver of economic expansion. Adequate strategy such as entrepreneurship skill development center must be put in place to avoid high rate of unemployment that may result from the process of switching to capital-intensive form of production; otherwise the economy will suffer setback in future. Alternatively, government should further put in place strategic policies such special social security and retirement scheme to capture affected workforce in an attempt to avoid adding to the current challenge of unemployment which could transcend to a wide spread economic distress for the citizens.

References

Adedoyin FF, Alola AA, Bekun FV (2020) An assessment of environmental sustainability corridor: the role of economic expansion and research and development in EU countries. Sci Total Environ 136726

Alola AA (2019a) The trilemma of trade, monetary and immigration policies in the United States: accounting for environmental sustainability. Sci Total Environ 658:260–267

Alola AA (2019b) Carbon emissions and the trilemma of trade policy, migration policy and health care in the US. Carbon Manage 10(2):209–218

Alola AA, Alola UV (2018) Agricultural land usage and tourism impact on renewable energy consumption among coastline Mediterranean countries. Energy Environ 29(8):1438–1454

Alola AA, Alola UV, Saint Akadiri S (2019a) Renewable energy consumption in coastline Mediterranean countries: impact of environmental degradation and housing policy. Environ Sci Pollut Res 26(25):25789–25801

Alola AA, Bekun FV, Sarkodie SA (2019b) Dynamic impact of trade policy, economic growth, fertility rate, renewable and non-renewable energy consumption on ecological footprint in Europe. Sci Total Environ 685:702–709

Alola AA, Kirikkaleli D (2019) The nexus of environmental quality with renewable consumption, immigration, and healthcare in the US: wavelet and gradual-shift causality approaches. Environ Sci Pollut Res 26(34):35208–35217

Alvarez-Herranz A, Balsalobre-Lorente D, Shahbaz M, Cantos JM (2017) Energy innovation and renewable energy consumption in the correction of air pollution levels. Energy Policy 105:386–397

Akadiri SS, Bekun FV, Taheri E, Akadiri AC (2019) Carbon emissions, energy consumption and economic growth: a causality evidence. International Journal of Energy Technology and Policy 15(2–3):320–336

Asongu SA, Agboola MO, Alola AA, Bekun FV (2020) The criticality of growth, urbanization, electricity and fossil fuel consumption to environment sustainability in Africa. Sci Total Environ 136376

Balsalobre-Lorente D, Shahbaz M, Roubaud D, Farhani S (2018) How economic growth, renewable electricity and natural resources contribute to CO2 emissions? Energy Policy 113:356–367

Beg N, Morlot JC, Davidson O, Afrane-Okesse Y, Tyani L, Denton F, Parikh K (2002) Linkages between climate change and sustainable development. Clim Pol 2(2–3):129–144

Bekun FV, Agboola MO (2019) Electricity consumption and economic growth nexus: evidence from Maki cointegration. Eng Econ 30(1):14–23

Bekun FV, Alola AA, Sarkodie SA (2019a) Toward a sustainable environment: nexus between CO2 emissions, resource rent, renewable and nonrenewable energy in 16-EU countries. Sci Total Environ 657:1023–1029

Bekun FV, Emir F, Sarkodie SA (2019b) Another look at the relationship between energy consumption, carbon dioxide emissions, and economic growth in South Africa. Sci Total Environ 655:759–765

British Petroleum (BP),(2019). https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html. Accessed 20 November 2019.

Destek MA, Sarkodie SA (2019) Investigation of environmental Kuznets curve for ecological footprint: the role of energy and financial development. Sci Total Environ 650:2483–2489

Dickey DA, Fuller WA (1981) Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica: Journal of the Econometric Society 1057–1072

Eluwole KK, Saint Akadiri S, Alola AA, Etokakpan MU (2020) Does the interaction between growth determinants a drive for global environmental sustainability? Evidence from world top 10 pollutant emissions countries. Sci Total Environ 705:135,972

Emir F, Bekun FV (2019) Energy intensity, carbon emissions, renewable energy, and economic growth nexus: new insights from Romania. Energy Environ 30(3):427–443

Energy Information Administration (EIA), 2010. Country Analysis Brief South Africa. Retrieved 2018, from South Africa Energy Data, Statistics and Analysis - Oil, Gas, Electricity, Coal: https://www.eia.gov/beta/international/analysis_includes/countries_long/south_africa/archive/pdf/south_africa_2010.pdf

Erol U, Yu ES (1987) On the causal relationship between energy and income for industrialized countries. The Journal of Energy and Development:113–122

Ewing BT, Sari R, Soytas U (2007) Disaggregate energy consumption and industrial output in the United States. Energy Policy 35(2):1274–1281

Fatai K, Oxley L, Scrimgeour FG (2004) Modelling the causal relationship between energy consumption and GDP in New Zealand, Australia, India, Indonesia, The Philippines and Thailand. Math Comput Simul 64(3–4):431–445

Govindaraju VC, Tang CF (2013). The dynamic links between CO2 emissions, economic growth and coal consumption in China and India. Appl Energy 104:310–318

Gujarati DN (2009) Basic econometrics. Tata McGraw-Hill Education, New York City

Jinke L, Hualing S, Dianming G (2008) Causality relationship between coal consumption and GDP: difference of major OECD and non-OECD countries. Appl Energy 85(6):421–429

Joshua U (2019) An ARDL approach to the government expenditure and economic growth nexus in Nigeria. Academic Journal of Economic Studies 5(3):152–160

Joshua U, Bekun FV, Adedoyin FF (2020) Modeling the nexus between coal consumption, FDI inflow and economic expansion: does industrialization matter in South Africa? Environ Sci Pollut Res. https://doi.org/10.1007/s11356-020-07691-x

Joshua U, Bekun FV (2020) The path to achieving environmental sustainability in South Africa: the role of coal consumption, economic expansion, pollutant emission, and total natural resources rent. Environ Sci Pollut Res:1–9

Narayan PK, Smyth R (2005) Electricity consumption, employment and real income in Australia evidence from multivariate Granger causality tests. Energy Policy 33(9):1109–1116

Okunola AM (2016) Nigeria: Positioning rural economy for implementation of sustainable development goals. Turkish Journal of Agriculture-Food Science and Technology 4(9):752–757

Payne JE (2011) US disaggregate fossil fuel consumption and real GDP: an empirical note. Energy Sources Part B 6(1):63–68

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econom 16(3):289–326

Phillips PC, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75(2):335–346

Reynolds DB, Kolodziej M (2008) Former Soviet Union oil production Granger causality and the multi-cycle Hubbert curve. Energy Econ 30(2):271–289

Saidi S, Shahbaz M, Akhtar P (2018) The long-run relationships between transport energy consumption, transport infrastructure, and economic growth in MENA countries. Transp Res A Policy Pract 111:78–95

Saint Akadiri S, Alola AA, Akadiri AC (2019a) The role of globalization, real income, tourism in environmental sustainability target. Evidence from Turkey. Sci Total Environ 687:423–432

Saint Akadiri S, Alola AA, Akadiri AC, Alola UV (2019b) Renewable energy consumption in EU-28 countries: Policy toward pollution mitigation and economic sustainability. Energy Policy 132:803–810

Saint Akadiri S, Bekun FV, Sarkodie SA (2019c) Contemporaneous interaction between energy consumption, economic growth and environmental sustainability in South Africa: and GDP decline: What drives what? Sci Total Environ 686:468–475

Sarkodie SA, Adams S (2018) Renewable energy, nuclear energy, and environmental pollution: accounting for political institutional quality in South Africa. Sci Total Environ 643:1590–1601

Sari R, Ewing BT, Soytas U (2008) The relationship between disaggregate energy consumption and industrial production in the United States: an ARDL approach. Energy Econ 30(5):2302–2313

Shahbaz M, Balsalobre-Lorente D, Sinha A (2019) Foreign direct Investment–CO2 emissions nexus in Middle East and North African countries: Importance of biomass energy consumption. J Clean Prod 217:603–614

Shahbaz M, Khan S, Tahir MI (2013a) The dynamic links between energy consumption, economic growth, financial development and trade in China: fresh evidence from multivariate framework analysis. Energy Econ 40:8–21

Shahbaz M, Rahman MM (2012) The dynamic of financial development, imports, foreign direct investment and economic growth: cointegration and causality analysis in Pakistan. Glob Bus Rev 13(2):201–219

Shahbaz M, Tiwari AK, Nasir M (2013b) The effects of financial development, economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Policy 61:1452–1459

Shiu A, Lam PL (2004) Electricity consumption and economic growth in China. Energy Policy 32(1):47–54

Stern DI (1993) Energy and economic growth in the USA: a multivariate approach. Energy Econ 15(2):137–150

Thoma M (2004) Electrical energy usage over the business cycle. Energy Econ 26(3):463–485

Ulucak R, Bilgili F (2018) A reinvestigation of EKC model by ecological footprint measurement for high, middle and low income countries. J Clean Prod 188:144–157

Wang Q, Su M, Li R (2018) Toward to economic growth without emission growth: The role of urbanization and industrialization in China and India. J Clean Prod 205:499–511

Wolde-Rufael Y (2010) Coal consumption and economic growth revisited. Appl Energy 87(1):160–167

World Bank (2019). Development indicators. http://databank.worldbank.org, Accessed. Date: July 2019.

World Coal Association (2016). Coal in the energy mix of South Africa. https://www.worldcoal.org/coal-energy-mix-south-africa. Accessed January 2019.

World Energy Council, 2016.World Energy Resources 2016. Retrieved from https://www.worldenergy.org/data/resources/resource/coal/.

Yuan J, Zhao C, Yu S, Hu Z (2007) Electricity consumption and economic growth in China: cointegration and co-feature analysis. Energy Econ 29(6):1179–1191

Zafar, M. W., Shahbaz, M., Hou, F., & Sinha, A. (2018). ¬¬¬¬¬¬ From nonrenewable to renewable energy and its impact on economic growth: silver line of research & development expenditures in APEC countries.

Zafar MW, Shahbaz M, Hou F, Sinha A (2019) From nonrenewable to renewable energy and its impact on economic growth: the role of research & development expenditures in Asia-Pacific Economic Cooperation countries. J Clean Prod 212:1166–1178

Ziramba E (2009) Disaggregate energy consumption and industrial production in South Africa. Energy Policy 37(6):2214–2220

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Muhammad Shahbaz

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Joshua, U., Alola, A.A. Accounting for environmental sustainability from coal-led growth in South Africa: the role of employment and FDI. Environ Sci Pollut Res 27, 17706–17716 (2020). https://doi.org/10.1007/s11356-020-08146-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-08146-z