Abstract

Green credit plays a crucial role in reducing energy consumption and environmental degradation in China. Using data on China’s new energy listed companies from 2007 to 2018, this study explores the impact of green credit on new energy firms’ value, as well as the mediating effects of financing constraints and external supervision on the relationship between green credit and new energy companies’ economic benefits. Our results suggest that green credit significantly improved new energy firms’ value, and this positive impact can last over the long term. The above result is robust to using alternative measures, replacement of fixed effects, exclusion of abnormal samples, and placebo test. Additional tests reveal that green credit improves new energy companies’ value by alleviating financing constraints and strengthening external supervision. Finally, green credit’s value-enhancement effect is heterogeneous, depending on corporate property rights, business life cycle, implementation of Green Credit Guideline policy, and the firms’ geographical location. Our conclusions suggest that government should not only pay attention to the continuity of green credit commitment but also the mitigation of financing constraints and improvement of external supervision for new energy companies. Moreover, heterogeneous factors should be considered to formulate and calibrate related policy rather than a one-size-fits-all policy.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Over the past decade, China’s rapid economic growth, which accounts for more than 30% of the world’s economic growth, has become an important driving force of the global economy (Freeman 2019). However, its growth has been accompanied by a sharp increase in energy consumption (Bai et al. 2020). As the world’s largest energy consumer and producer (Zhou et al. 2020), China accounted for 23.2% of global energy consumption in 2017 (BP Energy Outlook 2018), leading to significant greenhouse gas emissions and acute environmental pollution (Aizawa and Yang 2010; Li and Ramanathan 2018; Li et al. 2019; Song et al. 2020). Therefore, it is imperative for China to reduce environmental pollution and develop new energy companies (NECs)including solar, hydrogen, wind power, biomass, and geothermal energy to facilitate domestic and global green development.

Although NECs can generate environmental benefits and are pivotal to achieving the objective of the economy’s green development, related long-term development not only requires the advancement of NECs to foster environmental benefits but also to enhance profitability, as the firm is essentially the “economic man” (Smith 1776). Boosting NECs’ profitability can provide a feasible path toward achieving a win–win situation between environmental performance and economic benefit.

One of the crucial criteria for evaluating NECs’ profitability is the long-term growth in firm value. Thus, it is vital to study the determining factors of NECs’ value to achieve the dual objectives of economic performance and environmental protection. Among these factors, debt financing can be an essential element influencing NECs’ value. Based on Modigliani and Miller (MM) theory, due to the tax shield effect of debt financing, the higher the debt of a firm, the lower its weighted average cost of capital, which can significantly promote the growth of firm value (Modigliani and Miller 1963). In China, the bank-led indirect financing system has always been the primary mean for enterprises to obtain external financing, indicating that increasing bank credit to NECs can be employed as an important measure to increase their firm value. However, traditional bank credit provides loans to enterprises based on their economic performance; environmental performance has been largely neglected by banks. This can lead to severe financing constraints for NECs due to their high financial and business risks.

To address the financial resource scarcity experienced by NECs and other eco-friendly companies, green credit (GC)-related policies,Footnote 1 which encourage banks to give more loans to the environmental protection industries in China (Xu and Li 2020), were enacted to simultaneously achieve economic growth and environmental protection (Wang et al. 2020). Extensive research has been conducted to examine the impact of GC on firms’ economic or environmental performance (Zhang et al. 2011; He and Liu 2018; Kang et al. 2020), including the pollution-abatement effect of GC from the perspective of environmental benefits (Wang et al. 2019; Li and Gan 2021) and the influences of GC on firms’ investment decisions, financing activities, and innovation behaviors from the perspective of economic benefit (Geddes et al. 2018; Liu et al. 2019; Guo et al. 2019).

However, there are still gaps in the previous literature. First, there is a dearth of research on the impact of GC on NECs’ value; second, the underlying mechanism between GC and NECs’ value has not been clearly identified by prior studies. Although studies have explored the intermediary paths between GC and firm value (Ge et al. 2016; He et al. 2019a, 2019b; Liu et al. 2017; Wang et al. 2020), they have not examined the internal and external mechanisms in a unified analytical framework simultaneously. This limits a more comprehensive understanding of the influencing mechanism of GC on NECs’ value, which is conducive to improving the efficiency of GC resource allocation; third, GC does not enhance the value of all NECs; however, existing research has largely ignored the heterogeneous effect of GC on NECs’ value (Li et al. 2018a, 2018b; Wang et al. 2020), facilitating the optimal distribution of GC resources.

This study, therefore, seeks to address the following three questions: first, can GC enhance NECs’ profitability? Second, if GC can promote NECs’ value, what are the underlying mechanisms through which GC influences NECs’ value? Third, does the value-enhancement effect of GC on NECs vary based on corporate characteristics and the external environment? To answer the above questions, we use the data on 175 new energy listed companies in China’s A-shares, from 2007 to 2018, as a sample to explore the correlation between GC and NECs’ value.

We are motivated to conduct this research owing to the continuing interest in GC. In recent years, the Chinese government has attached great strategic importance to GC development to achieve low carbon transformation. Previous studies have frequently been conducted to evaluate the effectiveness of GC development, including its environmental benefits (Zhou et al. 2010; Sun et al. 2019) as well as the economic effects (Guo et al. 2019). We are particularly interested in its influence on NECs’ value growth because their sustained value growth can achieve both environmental and economic benefits. The growth of firm value is a crucial indicator to assess whether the company can obtain long-term economic benefits; moreover, NECs can generally generate environmental benefits due to their green attributes. Therefore, analyzing the relationship between GC and NECs’ value can help determine whether GC can achieve the win–win situation between environmental and economic benefits.

China provides a suitable setting for our research for the following two reasons: first, at present, China’s GC policy is basically in line with international GC standards (Wen et al. 2021). Between 2013 and 2018, the GC balance of 21 major Chinese banks rose from RMB 5.20 trillion to RMB 9.66 trillion, according to the “China Green Finance Development Report (2018)” published by the People’s Bank of China. China, therefore, provides a robust setting to investigate the role of GC in enhancing NECs’ value. Given the similar environmental deterioration issue faced by other emerging market countries and the vital role GC plays in improving the natural environment, our results can serve as a reference for other countries that are actively promoting GC development. Second, the development of new energy has gained a national strategic significance in China for energy transition and reducing carbon emissions. President Xi proposed that China aimed to hit the CO2 emissions peak before 2030 and achieve carbon neutrality before 2060 at the 75th session of the UN General Assembly. Since NECs play a critical role in achieving low-carbon development owing to their advantages of energy conservation and environmental enhancement, our findings can be generalized to other emerging countries attempting to achieve low-carbon development through NECs.

The contributions of this paper are as follows: first, this study complements the prior literature on the environmental and economic effects of GC. While previous studies examine the environmental benefits (Zhou et al., 2010; Sun et al., 2019) and the economic consequences (Guo et al. 2019) of GC, they do not answer whether GC can enable NECs to realize economic and environmental benefits simultaneously. We fill this research gap by linking GC with NECs’ value. Firm value can evaluate corporate economic benefits; besides, NECs have the property of generating environmental benefits themselves; therefore, exploring the association between GC and the value of NECs can explain whether GC contributes to the co-development of the environment and economy.

Second, we examine the internal and external intermediary mechanisms between GC and NECs’ value simultaneously in a unified analytical framework, facilitating a more comprehensive understanding of the influencing path between them. Although studies have explored the intermediary between them (Ge et al. 2016; He et al. 2019a, 2019b; Liu et al. 2017; Wang et al. 2020), internal and external factors are considered at the same time, thus presenting an incomplete picture of how GC affect NECs’ value, which may diminish the efficiency of GC allocation. This study examines two mediators including easing internal financing constraints and strengthening the external supervision, which can more comprehensively elaborate the mechanisms between GC and NECs’ value, thereby strengthening the financial resource allocation function of GC.

Third, we fully analyze the heterogeneous effect of GC in enhancing NECs’ value, which is important for the government to promote GC development and enable GC to better contribute to NECs’ value enhancement. Factors including corporate internal characteristics and external environment may make GC produce significant variation in the process of promoting the firm value of NECs, which are largely ignored in prior studies. We incorporate ownership properties, growth stages, policy environment, and geographic location into the heterogeneity analysis, which can identify which categories of NECs benefit from GC development, facilitating policymakers to promote the development of GC.

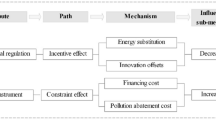

The rest of this paper is organized as follows: “Literature review and hypothesis development” section reviews relevant literature and hypothesis development; “Empirical methodology and data” section presents the research design and data description; “Empirical results and analysis” section discusses the empirical results, including baseline regression, underlying mechanism, and heterogeneity analysis (Fig. 1 summarizes the relationship between GC and NECs’ valueFootnote 2); and “Conclusions, policy implications, and future research directions” section summarizes the conclusions and provides policy implications.

Literature review and hypothesis development

Literature review

From a theoretical perspective, previous studies have demonstrated that the financial system is the main source of external funds for companies and profoundly affects corporate financing decisions (Faulkender and Petersen 2006; Lemmon and Roberts 2010). The history of global economic development has also verified the importance of the financial system’s role in easing firms’ financing constraints. Especially for China, the bank-led indirect financing system has always been the primary source for enterprises to obtain external funds. According to data from the People’s Bank of China, bank-led RMB loans accounted for 66.15% of the social financing scale in 2019, while corporate bond and stock financing represented only 14.04%. Banks may increase NECs’ value because they monitor and supervise firms’ financial performance before and after the loans are granted (He et al. 2019a, 2019b). However, the value growth of NECs has been plagued by financing difficulties because NECs, as capital- and technology-intensive enterprises, are different from other enterprises due to their need for vast research and development (R&D) funds, high failure risk of technological innovation, and long payback period.

Fortunately, governments worldwide began introducing an array of policy initiatives to promote GC development and address the increasingly serious consequences of energy consumption and environmental pollution. The environmental and economic benefits offered by GC have also been widely discussed by many scholars.

Research on GC’s environmental benefits mainly focuses on the reduction in pollutant emissions, the establishment of a green management system, and improvement of the regional ecological environment (Zhou et al. 2010; Sun et al. 2019; Xing et al. 2020). For example, Wang et al. (2019) suggested that heavy-polluting enterprises would be compelled to reduce pollution and improve their environmental performance since GC policy makes it clear that banks should evaluate companies’ environmental performance before credit funds are approved. Moreover, Xing et al. (2020) found that GC policy can also stimulate enterprises to employ green management, as companies with green management are more likely to obtain bank credit. Some research looked beyond firm level to the regional level, finding that GC cannot only improve the local ecological environment but also of surrounding areas due to spatial spillover effect (Li and Gan 2021). Overall, GC is of great significance to the development of low-carbon and green economy (Soundarrajan and Vivek 2016) because it requires banks to make loan decisions not only based on the firms’ economic performance but also their environmental performance, which can effectively force enterprises to take measures to reduce environmental pollution.

Research on GC’s economic benefits mainly emphasizes its impact on firms’ investment behavior (Geddes et al. 2018), debt financing (Hu et al. 2020), and innovation activities (Guo et al. 2019). For example, Liu et al. (2017) introduced a financial computable general equilibrium model and reported that the high interest rate imposed on energy-intensive industries by GC policy can significantly inhibit their investment activities. This shows that, with the backdrop of GC-related policies, banks may exert influence on firms’ financing cost by applying differential interest rate to pollution-intensive enterprises and environmental protection companies. Specifically, taking pollution-intensive firms as a sample, Liu et al. (2019) claimed China’s GC policy implemented in 2012 imposed long-term credit constraints on high-pollution enterprises. Using data on environmental protection enterprises, Xu and Li (2020) reported that the development of GC can reduce their debt financing cost. Additionally, the injection of GC funds into environmental protection enterprises can ease their financing bottleneck and provide cash flow for R&D, thereby promoting green technology innovation (Chen et al. 2019). In sum, while GC effectively impedes the development of high-pollution and high-emission enterprises, it provides financial support for environmental protection enterprises to generate economic benefits.

Although GC’s environmental and economic benefits have been recognized, as the main GC implementation entities, financial institutions cannot fully develop GC without economic incentives (Biswas 2011). This is because GC has both “green” and “finance” attributes, which has a complex impact on both financial institutions and green firms (He et al. 2019a, 2019b). From the perspective of “green” attributes, GC guides capital flows to environmental protection companies and promotes green economic development; however, from the perspective of “finance” attributes, financial institutions, who are the providers of GC, also pursue the objective of maximizing profit. Due to the long investment cycle and strong uncertainty of returns from new energy-related projects, GC providers are more likely to consider “finance” (profit maximization) than the “green” attributes. Therefore, the development of GC policy is still at an initial phase (He et al. 2019a, 2019b), and its implementation efficiency is far below anticipation (Zhang et al. 2011), resulting in the insufficient financing of green companies, which may ultimately be detrimental to the enhancement of firm value.

Undoubtedly, the current literature provides extensive evidence on the relationship between GC and economic or environmental benefits. However, as an important part of green environmental protection enterprises, the association between GC and NECs’ value has been under-researched. Moreover, intermediary mechanisms of GC, which play an important role in promoting the implementation of GC and NECs’ value growth, on NECs’ value have been largely neglected in the existing literature. Lastly, heterogeneity studies on the effect of GC on NECs’ corporate value are scant as well.

In response to the above research gap, we used the data on 175 new energy listed enterprises on the Shanghai and Shenzhen Stock Exchanges from 2007 to 2018 to explore the relationship between GC and the value of NECs. To the best of our knowledge, no research has been conducted thus far exploring how GC impacts NECs’ value.

Hypothesis development

The MM theory provides a theoretical foundation for our research. In 1958, Modigliani and Miller proposed that, in the absence of income taxes, the firm’s overall weighted average cost of capital and corporate value is not influenced by changes in its capital structure (Modigliani and Miller 1958). In 1963, Modigliani and Miller considered the existence of the corporate income tax and developed a modified MM theory, which argues that after taking into account the income tax, the higher a firm’s debt, the lower its weighted average cost of capital due to the tax shield effect (Modigliani and Miller 1963). In other words, as the level of gearing increases, the larger proportion of debt in the capital structure means that there is a larger proportion of lower-cost finance, thereby exerting a favorable effect on corporate value growth. GC, as a loan service carried out by commercial banks, aims to provide low interest debts to green companies. It has not only the property of debt but also the feature of low interest rate, which can further strengthen the tax shield benefit brought by debt and thus exerting a significant positive impact on the enhancement of NECs’ value.

GC may improve NECs’ value by reducing their financing constraints. First, GC can increase NECs’ access to debt finance. In recent years, the Chinese government has been actively advocating the concept of green development and has promulgated a battery of policies and regulations, such as “Opinions on Implementing Environmental Protection Policies and Regulations to Prevent Credit Risks” and “Green Credit Guidelines (GCGs),” to guide commercial banks to increase loan scale for NECs and other environmentally friendly enterprises. The development of new energy industries is usually accompanied by intensive technological upgrading, which has considerable uncertainty and requires substantial up-front R&D funds, making it difficult for them to obtain financing from the traditional financial sector. GC, as an important supplement to traditional financing sources, can provide additional capital for NECs’ innovation activities, promoting their value creation. Furthermore, GC development restricts the credit limits of traditional finance to high-pollution and high-emission enterprises, which triggers the restructuring of the bank credit and helps to direct part of the traditional credit funds to NECs, further alleviating the NECs’ financing constraints, which is conducive for their value growth.

In addition to the value-enhancing effect of the reduced financing constraint imposed by GC on firm value of NECs, GC may also contribute to the value growth of NECs through strengthened external oversight. As NECs’ access to GC is often seen as a positive investment signal, financial market analysts, as the information-advantaged party, can capture information about GC as well as NECs more quickly and provide advisory services to investors, thereby reducing the information asymmetry between NECs and investors (O’Brien and Bhushan 1990; Cheng et al. 2016). The strong external supervision created by these analysts’ continuous tracking can effectively prevent NECs from using GC funds for non-environmental activities and may force NECs to operate in compliant and efficient manner. Meanwhile, this external supervision can also reduce the profit-seeking behavior and moral risk of the managers of NECs, thus improving the corporate governance environment, which can ultimately facilitate the value growth of NECs. Based on the above analysis, we propose the following hypothesis:

Hypothesis 1: GC can significantly promote NECs’ value.

Empirical methodology and data

Regression modeling

To test the impact of GC on the value of NECs, the following ordinary least squares (OLS) linear regression model was setFootnote 3:

In Eq. (1), the dependent variable FVit is the market value of firm i in year t; the primary independent variable GCit represents the GC scale of the province where firm i is located in year t; CVs are the control variables; and αj represents the coefficients of the control variable groups (CVs), which reflect the effect of each control variable on the value of NECs. _consit and εit represent the constant and the residuals, respectively. Additionally, year fixed effect (Year) and industry fixed effect (Industry) are also controlled. α1 denotes the coefficient on GCit. If α1 is positive and significant, it suggests that GC can effectively improve NECs’ value.

Variable definition

Dependent variables

Consistent with prior literature, we use Tobin Q, which is calculated as the stock market capitalization plus book value of liabilities as a ratio of total assets, as a proxy for firm value (FV). Tobin Q reflects external stakeholders’ evaluation on corporate operation and management activity and has been widely used in empirical research related to firm value (MacKay and Moeller 2007; Nekhili et al. 2017; Aboud and Diab 2018; Gerged et al. 2021).

Main independent variables

GCitFootnote 4 is the primary explanatory variable of our study, which is calculated as Eq. (2):

Here, GC0t is the basic indicator of the measurement of GC and gauged using the “loan balance of project and service of energy conservation and environmental protection” data disclosed by the former China Banking Regulatory Commission (CBRC).Footnote 5FIit refers to the number of financial institution branches in province i in year t, and FIt refers to the total number of financial institution branches in China in year t.

Control variables

To further improve the regression accuracy and minimize the endogenous bias caused by missing variables, we introduce the following control variables: firm size (Size) is measured using the natural logarithm of total assets; leverage ratio (Lev) represents the ratio of total liabilities to total assets; return on assets (ROA) is calculated as net profits divided by total assets; intuitional shareholding (Ins_hold) indicates the proportion of institutional shareholding; independent director ratio (Independent) denotes the ratio of number of independent directors to total number of directors; based on Amihud (2002), stock liquidity (Fluidity) is calculated as Eq. (3):

Here, ritd is the returns of stock i on day d of year t, Vitd represents the trading volume of RMB (in millions) of stock i on day d of year t, and Dit is the number of trading days of stock i in year t; operating cost ratio (Cost) is computed as the ratio of operating costs to revenue from operating activities; level of economic development (GDP) is defined as the logarithm of GDP per person. In addition, time fixed effect (Year) and industry fixed effect (Industry) are also added to our baseline model. The descriptive statistics of the main variables are shown in Table 1.

Data source

We used the NECs listed on the Shanghai and Shenzhen Stock Exchanges in China from 2007 to 2018 as a research sample. The sample period of 2007–2018 was selected to cover the longest available time period due to data availability. In 2007, the CBRC issued the “Opinions on Implementing Environmental Protection Policies and Regulations to Prevent Credit Risks,” and in the same year, commercial banks began to disclose GC-related data in their Social Responsibility Reports such as loan balance of project and service of energy conservation and environmental protection. Hence, we chose 2007 as the starting point of the period. The reason for setting 2018 as the cut-off point is that the data on GC of major banking institutions in the China Stock Market & Accounting Research (CSMAR) database ends in June 2019; annual GC data for 2019 has not yet been disclosed. Thus, we finally set the study period as 2007–2018.

Companies whose operating activities or products involve new energy vehicles, wind energy, solar energy, biomass energy, geothermal energy, lithium power, and other new energy-related fields are defined as NECs. A total of 175 NECs were finally selected by examining their annual reports. These 175 NECs are considered highly representative because their operation is stable and their growth speed and changes in profitability are primarily synchronized with the overall new energy industry. Additionally, the information and data disclosed by listed NECs are more accurate and complete and also easier to obtain. The data we used was acquired from the CSMAR database, Wind database, and the website of the National Bureau of Statistics of China. To ensure the reliability of the empirical test, special treatment (ST)Footnote 6 firms and delisted firms or with initial public offerings from 2007 to 2018 are excluded from the sample. Variables are winsorized at the top and bottom 1% levels to eliminate the impact of extreme values.

Correlation coefficient matrix

The correlation coefficient matrix of the main variables is reported in Table 2. The correlation coefficient between GC and FV is 0.021, which suggests that GC is positively associated with NECs’ value. Meanwhile, the absolute values of the correlation coefficients range from 0.001 to 0.456, implying that there is no serious multicollinearity between the variables in the regression model.

Empirical results and analysis

Preliminary test results

Baseline results

Table 3 reports the baseline regression results. Column (1) of Table 3 reports the estimation results of Eq. (1) without control variables. Column (2) of Table 3 exhibits the regression results of Eq. (1) with all control variables added. The coefficients of GC in both columns are positive at a 1% significance level (β = 0.403 and 0.121, respectively), suggesting that GC has a significant and positive impact on the improvement of NECs’ value, which validates the above hypothesis 1.

There are two possible explanations for the above results. First, GC cannot only increase the availability of external financing for NECs but also reduce their financing cost because of low-interest GC capital which can provide funding support for NECs’ value growth. Lyon and Maxwell (2011) argue that if a company lacks socially responsible behavior, it is likely to be targeted by regulators and environmentalists, which may exert a negative impact on firm image, reducing their access to environmental subsidy granted by government and capital provided by environmental participants in the capital market. In contrast, since GC aims at providing loans to environmentally friendly companies (Chen et al. 2019), the acquisition of GC can deliver a positive signal about corporate social responsibility. Thus, it is likely that government subsidies and environmental investments gained by NECs would increase, which can reduce NECs’ financing constraints, thereby driving their value growth.

Second, in recent years, the Chinese government has incorporated “green development” into its national development strategy, and NECs, as one of the major entities implementing this strategy, receive lots of attention from market investors and regulators. This attention would be further strengthened after obtaining GC funds, which can create adequate external market supervision, reducing the information asymmetry between enterprises and investors (Li et al. 2021). The mitigated information asymmetry can improve the corporate governance environment (Cornett et al. 2007), mitigating the adverse selection concern and reduce the moral hazard arisen from agency conflict (Smith and Warner 1979), which would ultimately enhance the firm value of NECs.

Dynamic effects

The baseline regression results demonstrate the positive impact of GC on enhancing NECs’ value, but it is unclear whether the impact we observe endures over a long period of time.

To test the dynamic effect of GC on NECs’ corporate value, we investigate the nexus between current year GC with the preceding 1-period dependent variable (F. FV), 2-period dependent variable (F2. FV), 3-period dependent variable (F3. FV), and 4-period dependent variable (F4. FV), respectively. The empirical results are shown in Table 4. The coefficients of GC in columns (1) to (4) are all positive at the 1% significance level (β = 0.048, 0.053, 0.055, and 0.216, respectively), indicating that GC has a significant and positive effect on NECs’ value during all four periods. This indicates that, by issuing GC, banks cannot only provide financial support for NECs’ short-term development but also help NECs increase their long-term firm value.

External supervision and internal incentives are two important reasons for GC’s long-term positive impact on NECs’ value. First, bank credit is the main source for enterprises to obtain external financing in China’s bank-led indirect financing system. However, due to the scarcity of credit resources, banks often strictly review and scrutinize companies’ financial and non-financial positions before providing funds to the company, thereby forming effective external supervision of NECs. This continuous external supervision will not only contribute to the accumulation of credit data of NECs by banks but also reduce the information asymmetry between banks and NECs. As a result, stable GC business transactions can be formed between banks and NECs, which is favorable for increasing the availability of financing for NECs and reducing their financing cost, providing financial impetus for the value growth of NECs. Second, to obtain low-cost GC funds and prevent them from being excluded from the banks’ loan list, NECs have strong internal incentives to invest GC funds into green practices and take an array of measures to ensure the implementation effectiveness of their green practices, which is beneficial to the enhancement of NECs’ value.

To ensure the robustness of the dynamic effects results and for further comprehension of the impact of GC on NECs’ value, we also added GC time lags to the regression models: 1 year (L1. GC), 2 years (L2. GC), 3 years (L3. GC), and 4 years (L4. GC). The results in columns (5) to (8) show that the regression coefficients of these four lagged GC are all significantly positive at the 1% level, confirming the above conclusion about the positive impact of GC on the firm value of NECs.

Robustness tests

To verify the robustness of the conclusions of the baseline regression results, the following tests are conducted.

Alternative measures of GC

Variable measurement bias may interfere with our findings. The explanatory variable of this study, firm value (FV), is measured by the Tobin Q indicator, which has been widely recognized and used by researchers (e.g., Desai and Dharmapala 2009; Servaes and Tamayo 2013; Li et al. 2018a, 2018b); we therefore focus on the alternative measures of green credit (GC). First, based on Wen et al. (2021), we use the ratio of “the sum of borrowings of environmental enterprises of province i in year to the sum of borrowings of enterprises of all industries in province i in year t” as a proxy for GC (GC2); second, green finance index is used as the alternative measure of GC.Footnote 7 Following Zhou et al. (2020), global principal component analysis (GPCA) method is employed to measure the development of green finance (GC3), six indicators regarding green credit (total liabilities of listed companies in environmental protection industry), green securities (total stock market value of listed companies in environmental protection industry), green investment (total energy and environmental protection expenditures, total investment in pollution control, total equity investment of listed companies in environmental protection industry), and carbon finance (transaction volume of carbon finance) are selected to measure the green finance development level in various regions of China. The estimation results are reported in Table 5; the regression coefficients of GC2 and GC3 are significantly positive at significance level of 5%, suggesting GC has a significant positive impact on NECs’ value, which is in line with our main findings.

The replacement of fixed effect

To further mitigate the interference of provincial factors on the robustness of our results, we further control the province fixed effects in addition to year and industry fixed effects, and the results are shown in column (1) of Table 6. Additionally, since the industry in which a firm is located may also change over time, we also substitute year fixed effects (Year FE) and industry fixed effects (Industry FE) with industry-by-year fixed effects (Year × Industry FE), the results are shown in column (2) of Table 6. The coefficients of GC on NECs’ value remain positive and significant, indicating that GC significantly promotes NECs’ value, further confirming the baseline results.

The exclusion of abnormal samples

The international financial crisis in 2007–2008 and the “stock market crash” that occurred in the Chinese capital market in 2015 not only had a significant impact on the capital market but also posed great challenges to the business environment of many listed companies, which may affect the enhancement of the NECs’ value. To exclude the sample from these special periods, we remove the data from the three years of 2007, 2008, and 2015; the results are shown in column (1) of Table 7. In addition, the four municipalities in China (Beijing, Shanghai, Tianjin, and Chongqing) and the major provincial capitals have greater economic and political specificities than other cities, and there may be significant differences in the number of GC funds and government subsidies. To avoid the possible interference of these factors on the value of NECs, we also exclude the sample of NECs in provincial capitals and municipalities, and the results are shown in column (2) of Table 7. It is found that the regression coefficients of GC on NECs’ value in columns (1) and (2) are still significantly positive at the 1% level, which verifies the baseline regression findings.

The placebo test

Drawing on the approach used by Li et al. (2016), we use the placebo test to mitigate the concern of omitted variables. Specifically, the order of CVs is kept constant and GC is randomly disrupted to generate a set of random numbers (Random-GC), which is used as the proxy for GC; we then conduct the baseline regression and the results are shown in Table 8. If Random-GC still has a significant effect on the primary explanatory variable (FV), it implies that there may be a serious omitted variable problem. Conversely, if the effect of the random variable (Random-GC) on the explanatory variable (FV) is not significant, it means that GC has an impact on the value of NECs. The coefficient of Random-GC in Table 8 is − 0.001, which is close to 0 and does not pass the significance test, indicating that the placebo effect does not exist, which suggests that the baseline regression results are robust.

Mediating effect analysis

The above findings demonstrate that GC can improve NECs’ short- and long-term value; however, the underlying mechanisms of this impact are unclear. To reveal these mechanisms, this study draws on the method proposed by Baron and Kenny (1986) and sets up the following ordinary least squares (OLS) linear regression models:

In Eq. (4) and (5), where FVit represents the dependable variable, GCit denotes the level of regional GC development, and Mediator indicates the mediating variable, definitions of the remaining variables are consistent with the above description in the model (1). Based on the hypothesis development and the analysis of baseline regression results, we chose two possible mediators to study: financing constraint (SA) and external market supervision (Ex_sup).

First, concerning the mediator of financing constraints, based on the method used by Hadlock and Pierce (2010), financing constraint is quantified using the SA index, which is calculated as Eq. (6):

where LnSize is the natural logarithm of total assets and Age is the number of years since the company was established.

Second, following Chen et al. (2016), we use the natural logarithm of the number of following analysts to represent the degree of firms’ external market supervision (Ex_sup). The data on the number of tracing analysts is obtained from CSMAR database. In the capital market, analysts play an important role in monitoring and processing financial information; the reports published by them can increase investors’ access to information for decision-making. The greater the number of analysts tracking, the greater the accessibility and transparency of the corporate information. Thus, a higher level of attention paid by analysts indicates stronger external market supervision.

Table 9 reports the mediating results of financing constraints and external market supervision. Column (1) and column (2) reveal the mediating effect of financing constraints on the nexus between GC and firm value of NECs. Column (1) of Table 9 shows the coefficient of GC on financing constraints (SA) as − 0.041 at the 1% significance level; column (2) of Table 9 exhibits the coefficient of financing constraints (SA) on firm value as − 0.730 at the 1% significance level. These results indicate that financing constraint negatively mediates the relationship between GC and corporate value of NECs, which means GC can reduce NECs’ value partly through reducing NECs’ financial constraint.

There are two possible explanations for the mediating role of financing constraint. First, the new energy industry is capital-intensive, characterized by a large amount of investment in innovation, production, and operation activities. GC, as an important supplement to traditional financing sources, can provide additional capital for NECs’ value creation. Second, the new energy industry also features strongly in intensive technological upgrading, which has considerable uncertainty and requires a large number of up-front R&D funds, making it difficult for new energy industries to obtain financing from the traditional financial sector. Loans and funds provided by GC can ease financing constraint, thereby providing assistance for NECs’ R&D activities and ultimately achieving the objective of value growth.

Columns (3) and (4) in Table 9 validate the mediating effect of external market supervision on the association between GC and NECs’ value. As mentioned above, the level of external market supervision is measured by the natural logarithm of the number of following analysts. The results in column (3) shows that there is a positive and significant nexus between GC and external market supervision (Ex_sup) (β = 0.181, ρ = 1%), and the results in column (4) suggest that external market supervision (Ex_sup) and NECs’ value are positively and significantly correlated (β = 0.119, ρ = 1%). These estimation results suggest that external market supervision positively mediates the relationship between GC and firm value of NECs. In other words, approving GC funds to NECs can strengthen external market supervision (Ex_sup), which can lead to corporate value appreciation.

One of the possible reasons for the above results is that analysts collect and interpret information about corporate decisions, policies, and governance, which can help reduce information asymmetry between companies and investors (O’Brien and Bhushan 1990; Cheng et al. 2016). The strong external supervision formed by analysts’ continuous following can generate tremendous pressure on NECs because negative news about any violations of laws and regulations would severely negatively affect NECs’ image (Ball and Shivakumar 2008). Therefore, the increased external supervision resulting from analysts can compel NECs to comply with regulations and operate efficiently, which helps drive their value growth.

Heterogeneity analysis

To further examine the impact of GC on NECs’ value, a heterogeneity analysis was conducted by clustering the sample on the basis of internal (property rights and life cycle) and external factors (implementation of GCGs policy and geographical location). The estimated results are shown in Table 10 and Table 11.Footnote 8

Property rights

As indicated in panel A in Table 10, the sample is divided into state-owned enterprises (SOEs) and non-state-owned enterprises (NSOEs). The coefficients of GC shown in columns (1) and (2) are significantly positive, indicating that GC has a positive impact on firm value of both SOEs and NSOEs. Compared with NSOEs, the positive relationship between GC and NECs’ value is more significant in SOEs (0.233 > 0.126), suggesting that GC has a more obvious value-enhancing effect on SOEs than NSOEs.

A possible explanation is that SOEs undertake the political responsibility of developing new energy businesses to actively advocate the green development emphasized by the Chinese government; moreover, under the indirect financing system dominated by the Chinese banking sector, SOEs have implicit government assurance, so they enjoy more abundant credit resources than NSOEs (Song et al. 2011). Given that GC has the characteristic of low interest rate, driven by the profit-seeking motive, SOEs would prefer to mobilize government resources to obtain more GC funds, which provides capital reserves for SOEs’ value-creation process. Compared with SOEs, NSOEs may take advantage of the concept of “new energy” to boost their stock prices. After GC is approved and obtained, they may bypass bank supervision and engage in other unrelated business activities because new energy-related operating activities usually require a substantial amount of initial investment, with a long capital recovery period and high levels of uncertainty about the return. They may use the obtained GC to invest in financial assets because they are likely to yield higher returns in the short term. This may expose NECs to higher business risks because their management is unlikely to have enough expertise to invest in non-core business projects. As a result, their market share and competitiveness may be reduced, making GC less effective in enhancing NSOEs’ firm value.

Life cycle

Panel B of Table 10 reports variant impacts of GC on NECs’ value during the growth, maturity, and shakeout period.Footnote 9 The results show that GC has a positive influence on NECs’ value during the growth and maturity stages (the regression coefficients of GC in column (3) and column (4) are 0.140 at a 1% significance level and 0.185 at a 5% significance level, respectively). However, the coefficient of GC in column (5) is not significant, indicating that the value-adding effect of GC is not obvious for NECs during the shakeout period. This shows that the economic benefits of GC vary greatly across different life cycle stages of NECs. Specifically, GC has the most obvious effect on the value growth of NECs in the mature period, followed by companies in the growth stage, and no significant influence on those in the shakeout period.

Berger and Udell (1998) suggest that firms adopt different financing modes at various life cycle stages. Venture capital and debt financing are the main financing modes for firms at the growth stage. NECs, as technology-intensive firms, have relatively small amounts of tangible assets, which means that NECs during the growth stage probably have severe financing constraints due to insufficient eligible collateral to pledge as security for bank loans and higher operational risks. As an important supplement to firms’ lending sources, GC can provide funds for innovation activities and promote NECs’ value appreciation. When NECs enter the maturity stage, they usually have higher operational efficiency, improved corporate governance, effective internal control, and a thorough risk management system. Thus, GC capital can be utilized more efficiently and generate a higher return, enhancing NECs’ value. However, when NECs are in the shakeout period, product competitiveness, profit margins, and internal organizational flexibility are likely to diminish, leading to lower capital utilization efficiency. Even if GC funds are obtained, the return generated may not be as much as in the maturity period; consequently, the positive effect of GC on NECs’ value enhancement may be significantly reduced.

The implementation of GCGs policy

In addition to a company’s internal attributes, the external environment may also have a significant impact on the relationship between GC and NECs’ value; therefore, we included external factors (implementation of GCGs policy and geographical locations) into our heterogeneity analysis. In 2012, CBRC issued the GCGs policy, indicating that the banking sector needs to implement it from a strategic and operational level. Therefore, we divided the sample into two periods, before and after 2012, to examine whether the implementation of GCGs policy would influence the correlation of GC and NECs’ value.

Panel A of Table 11 presents the heterogeneity study regarding the implementation of GCGs policy. Column (1) (Year < 2012) of Table 11 shows the estimated coefficient of GC as 0.013 before the implementation of GCGs policy, failing the significance test; however, the coefficient of GC in column (2) (Year ≥ 2012) is significantly positive (β = 0.181) at the 1% significance level, indicating that implementation of GCGs policy is conductive to the improvement of NECs’ value.

There may be two reasons for the above results. First, from the regulatory perspective, the implementation of GCG policy results in more low-interest GC capital is allocated to NECs. NECs can deploy this capital in green R&D activities, thus improving their green technology innovation capability, which is important for improving their competitive advantage in the market and thus achieving value growth. Second, from the perspective of NECs, after the implementation of GCGs policy, whether companies can obtain GC finance may depend on whether they comply with environmental protection laws and regulations and engage in operating activities related to environmental protection (Sun et al. 2019). This can provide motivation for them to upgrade their production lines, invest in green innovation, and improve their environmental performance, increasing competitiveness and exerting a positive impact on NECs’ value.

Regional differences

Panel B of Table 11 presents the heterogeneity study regarding different regions.Footnote 10 Based on the estimation results of column (3) in Table 11, the regression coefficient of GC on NECs’ value is 0.189 at the 5% significance level in the developed eastern regions. In contrast, in the less developed central and western regions (column (4) in Table 11), the impact of GC on NECs’ corporate value is not significant.

A possible explanation is that the level of economic and financial development in the eastern region is much higher than that in the central and western regions (Zhang et al. 2021). China’s eastern region has an open and favorable investment environment and significant human capital; additionally, technology and other production factors are also concentrated in the eastern region. Thus, NECs in the eastern region have more comparative advantages and higher labor productivity. After acquiring GC from banks, NECs in these areas can introduce more advanced management practices and systems, which can improve the efficiency of GC capital utilization and reduce firms’ redundancy costs, contributing to corporate value growth. Meanwhile, NECs of eastern regions are able to employ abundant human capital and technology accumulation to conduct production and investment activities. Hence, the economic performance of NECs in the eastern region is likely to be better than those in the central and western regions. (In fact, among 175 NECs in our sample, 129 of them are located in 11 eastern provinces, while only 46 NECs are located in 20 central and western provinces. This reflects a possible preference among NECs for the eastern region as their corporate site due to various regional advantages, including human capital, technology and finance sources, etc.).

Conclusions, policy implications, and future research directions

Currently, GC has become an important means for NECs to obtain economic benefits. Previous literature related to the impact of GC on NECs’ economic performance mainly focuses on their investment decisions, financing behaviors, and innovation activities. However, in reality, behind these economic behaviors, the long-term objective of NECs is to increase firm value, and that has not been sufficiently scrutinized. Therefore, this study examined whether GC can promote NECs’ value using data on 175 new energy listed companies from 2007 to 2018 as a research sample. The empirical results show the following conclusions: first, GC can significantly improve NECs’ value, and the effect of this improvement can last for a long period of time. These empirical results remain robust to using alternative measures, replacement of fixed effects, exclusion of abnormal samples, and placebo test, supporting the aforementioned hypothesis 1. Second, the positive impact of GC on the corporate value of NECs is negatively mediated by internal financing constraints and positively by external market supervision. Third, a heterogeneity study from the perspective of internal factors manifests that GC has a more positive impact on NECs’ value for SOEs and NECs in the growth and maturity stages. Fourth, from the point of view of NECs’ external environment, the results of the heterogeneity analysis suggest that GC exerts a more positive influence on NECs’ value after the implementation of GCGs policy and has a more obvious effect on the value enhancement of NECs located in the eastern region.

Based on the above conclusions, the following policy implications are put forth to ensure reasonable allocation of GC funds and promote NECs value growth:

First, long-term incentives should be established to advance GC development. The new energy industry is capital- and technology-intensive and with high innovation risk, which may reduce the commercial banks’ motivation to issue GC to NECs, thus hindering the sustainable improvement of NECs’ value. Therefore, it is necessary to set long-term incentives from the following aspects: first, the central bank can incentivize commercial banks to actively engage in GC services by developing measures, such as reducing reserve ratio and granting interest discounts for GC. Second, local governments should make full use of their administrative functions to build a big data platform that collects NECs’ credit data from the environmental protection authorities, the industrial and commercial sectors, and the taxation authority to reduce the information asymmetry between commercial banks and NECs, thereby facilitating NECs with good credit to obtain GC funds. Third, commercial banks should increase the application of digital technologies, such as artificial intelligence and big data in GC approval, fund allocation management and post-credit management, reducing the cost of GC service and improving the risk control of GC products; besides, differentiated GC products based on different types of NECs can be designed to provide diversified financing modes for NECs’ value growth. Fourth, as far as regulators are concerned, policies aimed to improve the quality of NECs’ environmental information disclosure should also be developed to enhance information transparency, thereby strengthening external market supervision and promoting NECs’ value growth.

Second, the government should increase fiscal investment in the new energy industry. The development of the new energy industry not only requires GC from the financial market but also needs fiscal funds to be distributed from the government to form a continuous economic stimulus. Firstly, special assistance funds for the new energy industry can be created to provide financial support for the new energy industry’s value-creation activities. Secondly, government departments should actively establish and improve the development of regional new energy industry incubators, which focus on cultivating the head enterprises in the new energy field; this would guide the head NECs to undertake supply-chain finance business and enhance the new energy industrial chain’s financing security, thereby providing a superior financing environment for NECs’ value growth. Thirdly, the government should guide financial institutions, social capital, and international capital to cooperate with NECs to optimize investment portfolios in the new energy field, continuously improving the supportive policies for investment and financing of NECs, and ultimately boosting their sustainable development.

Third, the development of GC policies should fully consider regional differences and corporate characteristics, avoiding a “one-size-fits-all” pattern of GC allocation. For starters, the government should formulate differentiated GC policies based on regional divergence. Central and western regions of China have relatively scarce traditional financial resources; NECs in these regions may suffer from more severe financing constraints, impeding their value enhancement. As an important supplement to traditional financial sources, government departments should moderately loosen the GC threshold for NECs located in central and western regions to support their sustainable value growth. Furthermore, GC allocation should also consider NECs’ life cycle stages. For NECs in the growth and maturity stages, credit limits for their green projects should be increased; measures should be taken to guide commercial banks to provide long-term financial support to promote their value growth.

Our study also has some limitations and offers new avenues for future research. This study mainly focuses on listed Chinese NECs, which does not cover unlisted Chinese NECs or those in other countries. Future studies can expand the sample to obtain more generalized findings. Furthermore, the heterogeneous analysis in this research is not sufficiently comprehensive. Although we included corporate property rights, business life cycle, the implementation of GCGs policy, and firms’ geographical location in the analysis, other factors, such as firm size, corporate profitability, and local government behavior, can also affect GC’s impact on NECs’ value. Thus, future studies can focus on additional factors to gain a deeper understanding of the impact of GC. Lastly, due to the limitation of data and the dominance of China’s indirect financing system, we only examined the role of GC in promoting NECs’ value; therefore, it is recommended to consider other types of green finance, such as green funds and green bonds, for a more comprehensive understanding of the influence of green finance on NECs’ value.

Data availability

The datasets used during the current study are available from the corresponding author on reasonable request.

Notes

Taking into account the shortage of financial resources in the development of the green industry and urging microeconomic entities to pay more attention to environmental benefits, the Chinese government has formulated a series of green credit development policies to make banks incorporate environmental factors into the credit decision-making process. One of the most representative policies, named “Opinions on Implementing Environmental Protection Policies and Regulations and Preventing Credit Risks,” jointly promulgated by China’s Environmental Protection Administration (renamed Ministry of Ecology and Environment of the People’s Republic of China in 2018), the People’s Bank of China, and the China Banking and Insurance Regulatory Commission in 2007, was used as an important market tool for environmental protection, energy conservation, and emission reduction, marking the official launch of the green credit policy. Green Credit Guidelines policy, which is issued by the China Banking and Insurance Regulatory Commission in 2012, formulated the detailed standards and norms for financial institutions to implement green credit policy, signifying a leap in the strategic level of GC development.

Figure 1 includes the following contents: first, the “Overall effect” part shows the results of the baseline regression and dynamic effect of GC on NECs’ value, aiming to explore the influence of GC on NECs’ value and the duration of this effect. The second part is “Intermediary mechanisms,” which examines the influencing mechanism of GC on NECs’ value, including internal financing constraints and external monitoring. Thirdly, the section of “Heterogeneity factors” analyzes the heterogeneous effect of GC on firm value of NECs, including the internal factors (property rights and life cycle) and external factors (the implementation of Green Credit Guidelines policy and geographic attributes) to identify which types of NECs’ value are more likely to be enhanced by GC.

We choose to use the OLS regression method based on the following two considerations: first, referring to the previous studies on firm value, e.g., Desai and Dharmapala (2009), Tambe (2014), Servaes and Tamayo (2013), and Li et al. (2018a, 2018b), we find that OLS regression method is widely used to analyze the influencing factors of enterprise value, which provides important clues and reference basis for our choice of OLS method; second, dependent variables (FV), core explanatory variables (GC), and control variable (CVs) of this study are all continuous variables, which makes classical OLS estimation method in linear regression models may be more appropriate than the truncated tail regression with a right-skewed data structure (e.g., Tobit model) and logit regression with dummy variables (e.g., Probit model).

The distribution of GC funds to provinces is executed by financial institutions, but the number of financial institutions in different regions of China varies greatly. For example, among the 31 provinces and municipalities in China, Tibet had only 723 financial institution branches as of 2019, whereas Guangdong Province, the province with the largest number of financial institution branches, has 16,959. It is generally believed that GC resources obtained by NECs located in areas with more financial institution branches tend to have more abundant GC financing than firms in other areas.

The former China Banking Regulatory Commission (CBRC) has been renamed as China Banking and Insurance Regulatory Commission in 2018. In addition, the “Report on Corporate Social Responsibility of the Banking Industry in China” began disclosing GC data in 2013. Before 2013, only data on the national “loan balance of energy conservation and environmental protection project and service” can be obtained, which accounts for an important part of the GC balance (in recent years, the proportion of loan balance of energy conservation and environmental protection project and service in GC has been consistently maintained at about 70%), which can reasonably reflect the GC development situation.

ST stands for special treatment and refers to listed companies that have had two consecutive years of negative net profits.

China’s financial system is mainly dominated by indirect financing. Direct financing accounts for a relatively small share. In 2020, the share of direct financing such as stocks and bonds in the scale of social financing in China’s capital market was only 12.59%, implying that the indirect financing system dominated by commercial banks has become the primary way of corporate external financing. This not only determines that the GC business conducted by commercial banks dominates the overall green financial system (which is an important reason why this study uses GC as the main explanatory variable), but also reflects the close correlation between GC and green finance. Therefore, we use the green finance indicator (GC3) as a proxy for GC in robustness tests.

The basis for the heterogeneity clustering is as follows: as far as the attributes of enterprises are concerned, given the widespread presence of “credit discrimination” in banking institutions, SOEs are likely to have easier access to bank loans than NSOEs because SOEs possess lower default risk due to their government-related attribute. Additionally, because of the profit-driven nature of capital, banks and other financial institutions tend to allocate credit resources to companies in growth stage due to their better development prospects and companies in mature stage as a result of their high repayment capabilities. Meanwhile, those companies in the shakeout stage usually are deemed as having high financial risk and thereby have difficulty in obtaining bank loans. These conjectures are only on a theoretical level. Whether GC has different impacts on NECs’ value for NECs with different property rights and life cycles need to be verified through empirical evidence.

Regarding the external environment of enterprises, the CBRC issued the “Green Credit Guidelines” in 2012, which detailed the standards and principles for banks carrying out GC. The implementation of this policy encouraged the concentration of bank credit resources to environmentally friendly enterprises (Xing et al. 2020), but whether it can strengthen the value-enhancement effect of GC on NECs is still unknown. Moreover, there is a serious spatial misallocation of credit resources in the developed eastern regions and the less-developed areas, including central and western regions; thus, it is valuable to examine whether the differences in geographic attributes produce significant differences in the relationship between “GC and NECs’ value.”.

Regarding the division of companies’ life cycle, drawing on the practice employed by Dickinson (2011), cash flow pattern is used to capture the cycle, considering the characteristics of listed companies in China. “Introduction stage” and “growth stage” are deemed as the “growth stage”; the definition of the maturity stage is the same as that of Dickinson (2011); the “shakeout stage” and “decline stage” are merged as the “shakeout period.” The whole life cycle is finally displayed as three stages of growth, mature, and shakeout periods.

Drawing on the National Bureau of Statistics of China, Hebei, Beijing, Tianjin, Shandong, Jiangsu, Shanghai, Zhejiang, Fujian, Guangdong, and Hainan are classified as the eastern region. The remaining provinces of mainland China are categorized as the central and western regions.

References

Aboud A, Diab A (2018) The impact of social, environmental and corporate governance disclosures on firm value: evidence from Egypt. J Account Emerg Econ 8(4):442–458. https://doi.org/10.1108/JAEE-08-2017-0079

Aizawa M, Yang C (2010) Green credit, green stimulus, green revolution? China’s mobilization of banks for environmental cleanup. J Environ Dev 19(2):119–144. https://doi.org/10.1177/1070496510371192

Amihud Y (2002) Illiquidity and stock returns: cross-section and time-series effects. J Financ Mark 5(1):31–56. https://doi.org/10.1016/S1386-4181(01)00024-6

Bai C, Feng C, Du K, Wang Y, Gong Y (2020) Understanding spatial-temporal evolution of renewable energy technology innovation in China: evidence from convergence analysis. Energ Policy 143:111570. https://doi.org/10.1016/j.enpol.2020.111570

Ball R, Shivakumar L (2008) Earnings quality at initial public offerings. J Account Econ 45(2–3):324–349. https://doi.org/10.1016/j.jacceco.2007.08.002

Baron RM, Kenny DA (1986) The moderator-mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. J Pers Soc Psychol 51(6):1173–1182. https://doi.org/10.1037//0022-3514.51.6.1173

Berger AN, Udell GF (1998) The economics of small business finance: the roles of private equity and debt markets in the financial growth cycle. J Bank Financ 22(6–8):613–673. https://doi.org/10.1016/S0378-4266(98)00038-7

Biswas N (2011) Sustainable green banking approach: the need of the hour. Bus Spectr 1(1):32–38

BP Energy Outlook (2018) BPP L C. https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/energy-outlook/bp-energy-outlook-2018.pdf. Accessed 20 Feb 2018

Chen H, Liu C, Xie F, Zhang T, Guan F (2019) Green credit and company R&D level: empirical research based on threshold effects. Sustain 11(7):1918. https://doi.org/10.3390/su11071918

Chen J, Cumming D, Hou W, Lee E (2016) Does the external monitoring effect of financial analysts deter corporate fraud in China? J Bus Ethics 134:727–742. https://doi.org/10.1007/s10551-014-2393-3

Cheng Q, Du F, Wang X, Wang Y (2016) Seeing is believing: analysts’ corporate site visits. Rev Account Stud 21(4):1245–1286. https://doi.org/10.1007/s11142-016-9368-9

Cornett MM, Marcus AJ, Saunders A, Tehranian H (2007) The impact of institutional ownership on corporate operating performance. J Bank Financ 31(6):1771–1794. https://doi.org/10.1016/j.jbankfin.2006.08.006

Desai MA, Dharmapala D (2009) Corporate tax avoidance and firm value. Rev Econ Stat 91(3):537–546. https://doi.org/10.1162/rest.91.3.537

Dickinson V (2011) Cash flow patterns as a proxy for firm life cycle. Account Rev 86(6):1969–1994. https://doi.org/10.2308/accr-10130

Faulkender M, Petersen MA (2006) Does the source of capital affect capital structure? Rev Financ Stud 19(1):45–79. https://doi.org/10.1093/rfs/hhj003

Freeman R (2019) Doubling the global workforce: the challenges of integrating China, India, and the former Soviet block into the world economy. Doubling the Global Work Force.

Ge L, Huang HF, Wang MC (2016) Research on the credit risk of the green credit for new energy and high pollution industry-based on empirical data test of KMV model. Math Practice Theory 46(1):18–26 ((in Chinese))

Geddes A, Schmidt TS, Steffen B (2018) The multiple roles of state investment banks in low-carbon energy finance: an analysis of Australia, the UK and Germany. Energ Policy 115:158–170. https://doi.org/10.1016/j.enpol.2018.01.009

Gerged AM, Beddewela E, Cowton CJ (2021) Is corporate environmental disclosure associated with firm value? A multicountry study of Gulf Cooperation Council firms. Bus Strateg Environ 30:185–203. https://doi.org/10.1002/bse.2616

Guo Q, Zhou M, Liu N, Wang Y (2019) Spatial effects of environmental regulation and green credits on green technology innovation under low-carbon economy background conditions. Int J Environ Res Public Health 16(17):3027. https://doi.org/10.3390/ijerph16173027

Hadlock CJ, Pierce JR (2010) New evidence on measuring financial constraints: moving beyond the KZ index. Rev Financ Stud 23(5):1909–1940. https://doi.org/10.1093/rfs/hhq009

He L, Liu R, Zhong Z, Wang D, Xia Y (2019a) Can green financial development promote renewable energy investment efficiency? A consideration of bank credit. Renew Energy 143:974–984. https://doi.org/10.1016/j.renene.2019.05.059

He L, Liu L (2018) Stand by or follow? Responsibility diffusion effects and green credit. Emerg Mark Financ Trade 54(8):1740–1760. https://doi.org/10.1080/1540496X.2018.1430566

He L, Zhang L, Zhong Z, Wang D, Wang F (2019b) Green credit, renewable energy investment and green economy development: empirical analysis based on 150 listed companies of China. J Clean Prod 208:363–372. https://doi.org/10.1016/j.jclepro.2018.10.119

Hu Y, Jiang H, Zhong Z (2020) Impact of green credit on industrial structure in China: theoretical mechanism and empirical analysis. Environ Sci Pollut Res 27(10):10506–10519. https://doi.org/10.1007/s11356-020-07717-4

Kang H, Jung SY, Lee H (2020) The impact of green credit policy on manufacturers’ efforts to reduce suppliers’ pollution. J Clean Prod 248:119271. https://doi.org/10.1016/j.jclepro.2019.119271

Lemmon M, Roberts MR (2010) The response of corporate financing and investment to changes in the supply of credit. J Financ Quant Anal 45:555–587. https://doi.org/10.1017/S0022109010000256

Li C, Gan Y (2021) The spatial spillover effects of green finance on ecological environment-empirical research based on spatial econometric model. Environ Sci Pollut Res 28. https://doi.org/10.1007/s11356-020-10961-3

Li J, Shan Y, Tian G, Hao X (2020) Labor cost, government intervention, and corporate innovation: evidence from China. J Corp Financ 64:101668. https://doi.org/10.1016/j.jcorpfin.2020.101668

Li K, Fang L, He L (2019) How population and energy price affect China’s environmental pollution? Energ Policy 129:386–396. https://doi.org/10.1016/j.enpol.2019.02.020

Li P, Lu Y, Wang J (2016) Does flattening government improve economic performance? Evidence from China. J Dev Econ 123:18–37. https://doi.org/10.1016/j.jdeveco.2016.07.002

Li R, Ramanathan R (2018) Exploring the relationships between different types of environmental regulations and environmental performance: evidence from China. J Clean Prod 196:1329–1340. https://doi.org/10.1016/j.jclepro.2018.06.132

Li W, Cui G, Zheng M (2021) Does green credit policy affect corporate debt financing? Evidence from China. Environ Sci Pollut R. https://doi.org/10.1007/s11356-021-16051-2

Li Y, Gong M, Zhang X, Koh L (2018a) The impact of environmental, social, and governance disclosure on firm value: the role of CEO power. Brit Account Rev 50(1):60–75. https://doi.org/10.1016/j.bar.2017.09.007

Li Z, Liao G, Wang Z, Huang Z (2018b) Green loan and subsidy for promoting clean production innovation. J Clean Prod 187:421–431. https://doi.org/10.1016/j.jclepro.2018.03.066

Liu J, Xia Y, Fan Y, Lin S, Wu J (2017) Assessment of a green credit policy aimed at energy-intensive industries in China based on a financial CGE model. J Clean Prod 163:293–302. https://doi.org/10.1016/j.jclepro.2015.10.111

Liu X, Wang E, Cai D (2019) Green credit policy, property rights and debt financing: quasi-natural experimental evidence from China. Financ Res Lett 29:129–135. https://doi.org/10.1016/j.frl.2019.03.014

Lyon TP, Maxwell JW (2011) Greenwash: corporate environmental disclosure under threat of audit. J Econ Manag Strat 20(1):3–41. https://doi.org/10.1111/j.1530-9134.2010.00282.x

MacKay P, Moeller SB (2007) The value of corporate risk management. J Finance 62(3):1379–1419. https://doi.org/10.1111/j.1540-6261.2007.01239.x

Modigliani F, Miller MH (1958) The cost of capital, corporation finance and the theory of investment. Am Econ Rev 48(3):261–297

Modigliani F, Miller MH (1963) Corporate income taxes and the cost of capital: a correction. Am Econ Rev 53(3):433–443. https://doi.org/10.2307/1809167

Nekhili M, Nagati H, Chtioui T, Rebolledo C (2017) Corporate social responsibility disclosure and market value: family versus nonfamily firms. J Bus Res 77:41–52. https://doi.org/10.1016/j.jbusres.2017.04.001

O’Brien PC, Bhushan R (1990) Analyst following and institutional ownership. J Account Res 28(3):55–82. https://doi.org/10.2307/2491247

Servaes H, Tamayo A (2013) The impact of corporate social responsibility on firm value: the role of customer awareness. Manage Sci 59(5):1045–1061. https://doi.org/10.1287/mnsc.1120.1630

Smith A (1776) An inquiry into the nature and causes of the wealth of nations. University of Chicago Press.

Smith C, Warner J (1979) On financial contracting-an analysis of bond covenants. J Financ Econ 7:117–161. https://doi.org/10.1016/0304-405X(79)90011-4

Song Y, Yang T, Li Z, Zhang X, Zhang M (2020) Research on the direct and indirect effects of environmental regulation on environmental pollution: empirical evidence from 253 prefecture-level cities in China. J Clean Prod 269:122425. https://doi.org/10.1016/j.jclepro.2020.122425

Song Z, Storesletten K, Zilibotti F (2011) Growing like China. Am Econ Rev 101(1):196–233. https://doi.org/10.1257/aer.101.1.196

Soundarrajan P, Vivek N (2016) Green finance for sustainable green economic growth in India. Agric Econ (Czech Republic) 62(1): 35–44. https://doi.org/10.17221/174/2014-AGRICECON

Sun J, Wang F, Yin H, Zhang B (2019) Money talks: the environmental impact of China’s green credit policy. J Policy Anal Manag 38(3):653–680. https://doi.org/10.1002/pam.22137

Tambe P (2014) Big data investment, skills, and firm value. Manage Sci 60(6):1452–1469. https://doi.org/10.1287/mnsc.2014.1899

Wang E, Liu X, Wu J, Cai D (2019) Green credit, debt maturity, and corporate investment-evidence from China. Sustain 11(3):583. https://doi.org/10.3390/su11030583

Wang Y, Lei X, Long R, Zhao J (2020) Green credit, financial constraint, and capital investment: evidence from China’s energy-intensive enterprises. Environ Manage 66:1059–1071. https://doi.org/10.1007/s00267-020-01346-w

Wen H, Lee CC, Zhou F (2021) Green credit policy, credit allocation efficiency and upgrade of energy-intensive enterprises. Energy Econ 94:105099. https://doi.org/10.1016/j.eneco.2021.105099

Xing C, Zhang Y, Wang Y (2020) Do banks value green management in China? The perspective of the green credit policy. Financ Res Lett 35:101601. https://doi.org/10.1016/j.frl.2020.101601

Xu X, Li J (2020) Asymmetric impacts of the policy and development of green credit on the debt financing cost and maturity of different types of enterprises in China. J Clean Prod 264:121574. https://doi.org/10.1016/j.jclepro.2020.121574

Zhang B, Yang Y, Bi J (2011) Tracking the implementation of green credit policy in China: top-down perspective and bottom-up reform. J Environ Manage 92(4):1321–1327. https://doi.org/10.1016/j.jenvman.2010.12.019

Zhang W, Hong M, Li J, Li F (2021) An examination of green credit promoting carbon dioxide emissions reduction: a provincial panel analysis of China. Sustain 13:7148. https://doi.org/10.3390/su13137148

Zhou X, Tang X, Zhang R (2020) Impact of green finance on economic development and environmental quality: a study based on provincial panel data from China. Environ Sci Pollut Res 27:19915–19932. https://doi.org/10.1007/s11356-020-08383-2

Zhou Y, Tupper L, Chowdhury M, Klotz L (2010) Green credits versus environmentally sustainable traffic operations: comparison of contributions to energy and emissions reductions. Transp Res Rec 2163(1):103–111. https://doi.org/10.3141/2163-12

Acknowledgements

The authors are grateful to the Editor, as well as the anonymous referees for valuable suggestions and comments that helped us improve our paper significantly.

Funding

This study was supported by the Humanities and Social Science Foundation of the Ministry of Education of China (grant number 20YJA790085), National Natural Science Foundation of China (grant number 71503039), Social Science Fund of Jiangsu Province (grant number 17GLB008), the Major Project of Philosophy and Social Science Research Funds for Jiangsu Universities (grant number 2020SJZDA059).

Author information

Authors and Affiliations

Contributions

Xiaobing Lai: conceptualization, methodology, data curation, writing—review and editing. Shujing Yue: conceptualization, formal analysis, methodology, validation. Hongtao Chen: conceptualization, writing—original draft.

Corresponding author

Ethics declarations

Ethics approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Eyup Dogan

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Lai, X., Yue, S. & Chen, H. Can green credit increase firm value? Evidence from Chinese listed new energy companies. Environ Sci Pollut Res 29, 18702–18720 (2022). https://doi.org/10.1007/s11356-021-17038-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-17038-9