Abstract

Green credit policy is the primary means for financial institutions to fulfill their environmental responsibilities. It is an issue worthy of attention whether green credit policy can achieve the effect of energy conservation, efficiency improvement, pollution reduction, and carbon reduction. This study uses the difference-in-difference method to test the impact of green credit policy on energy efficiency. The results show that green credit policy led to a significant decrease in energy intensity of green credit–restricted sectors while impeding the advancement of green total factor energy efficiency. The heterogeneity results show that the energy efficiency of large-scale, light textile manufacturing, resource processing industries, and clean industries are more significantly affected. Green credit policy can achieve energy conservation and has a linkage effect on pollution and carbon reduction. Although the constraint effect of green credit policy has effectively suppressed energy intensity, it also leads some industries to face a vicious cycle of “enhanced financing constraints-weakened innovation impetus,” which in turn makes it challenging to improve green total factor energy efficiency. The above findings confirm the effectiveness of green credit policy in energy conservation and emission reduction. Also, they indicate the necessity of further improvement of the green financial policy system.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

To promote climate and environmental governance and sustainable development, China explicitly stated the objectives of “carbon peaking” and “carbon neutrality.” Therefore, China’s economic development is facing the dual challenges of energy structure adjustment and green transformation of industrial structure. While strengthening the real economy, it is also necessary to actively promote its energy conservation, efficiency improvement, pollution reduction, and carbon reduction. Based on this, it is necessary to establish an economic system that integrates green industry, green R&D, and green manufacturing. As an important means to connect the real economy and financial institutions, green credit policy is one of the critical green financial tools used to solve environmental problems. On one hand, it provides external financing channels for manufacturing development; on the other hand, it is an incentive and constraint mechanism to effectively achieve synergy in reducing pollution and carbon dioxide emissions (Nasir et al. 2021; Tan et al. 2022a, b). Green credit policy has a deterrent effect on industries with high pollution and energy consumption. It promotes credit structure transferring to clean and low-carbon industries through environmental regulations and credit quota control (Tan et al. 2022a, b). Besides, it increases the merger and reorganization of industries with serious overcapacity, integrates excess capacity, promotes industrial transformation, adjusts product structure, and transforms traditional technologies. Energy utilization efficiency is a crucial carrier of the transition to a low-carbon, environmentally friendly economy that involves decreasing energy consumption and maximizing the benefits of energy utilization (Song et al. 2021; Wu et al. 2021). It is a crucial theoretical and practical issue whether green credit policy can help the realization of “carbon peaking and carbon neutrality” by improving energy utilization efficiency or not. And it is a new task to overcome resource and environmental constraints, to achieve sustainable high-quality development.

Compared to the previous research, this article attempts to integrate green credit policy and energy efficiency into a unified analytic framework, takes 29 manufacturing sub-industries from 2004 to 2019 as research samples, and uses difference-in-difference method to test the impact of China’s GCG2012 on energy intensity and green total factor energy efficiency. Based on previous studies, this paper may have three marginal contributions. First, we investigate the “energy conservation and efficiency improvement” effect of green credit policy more comprehensively from the theoretical and empirical perspectives and further enrich the research of environmental economic policy. Second, in an attempt to grant additional evidence for understanding the link between green credit policy and energy efficiency, we employ the difference-in-difference approach to empirically assess the influence of green credit policy on energy intensity and green total factor energy efficiency in the manufacturing industry. Third, we verify the transmission mechanism and heterogeneity analysis of the impact of green credit policy on energy efficiency and further investigate the linkage effect of green credit policy on energy efficiency, which is to test whether the green credit policy has the synergistic effect of reducing pollution and carbon, to perfect the green financial policy system.

The remaining contents are categorized into five parts. The literature review is presented in Part 2, the fundamental mechanism and hypothesis are presented in Part 3, the model approach and data interpretation are shown in Part 4, the estimate findings are presented and discussed in Part 5, and some policy implications are summarized and drawn in Part 6.

Literature review

Green credit policy intends to stop blind growth and minimize energy consumption by restricting the financial exposure of enterprises with excess capacity and “high pollution and high energy consumption” (Wu et al. 2021, 2022; Tan et al. 2022a, b). It is a specific form of environmental regulation (Cui et al. 2022). In terms of implementation effects, green credit policy has significant binding and punitive impacts on green credit–restricted industries. This is reflected by increasing the cost of financing, reducing investment, and making the allocation of bank credit in these industries less efficient (Wen et al. 2021; Yao et al. 2021). Green credit policy has also demonstrated a noticeable improvement effect, which has benefited heavy-polluting enterprises significantly move ahead in green innovation (Hu et al. 2021; Chen et al. 2022). It promotes the emission reduction of sulfur dioxide and wastewater and plays a positive effect on environmental quality improvement (Zhang et al. 2021). Besides, it also significantly reduces the industrial carbon emission intensity (Zhang et al. 2022), while the latter reflects the green innovation effect and the pollution reduction and carbon reduction effect of green credit policy. Additionally, other researchers investigated the connection between green credit and energy use. Using the spatial measurement approach, Song et al. (2021) examined the beneficial effects of green credit on China’s energy use under environmental restrictions. Tan et al. (2022a, b) verified that green credit policy has effectively improved the total factor energy efficiency of China’s “two high and one surplus” industries.Footnote 1

There are still some shortcomings although previous articles provided references and research perspectives. First, there is a lack of a more comprehensive assessment of the impact of green credit policy on energy efficiency from the perspective of energy intensity and green total factor energy efficiency. It should be noted that energy intensity, i.e., energy consumption per unit of economic output, belongs to single-factor energy efficiency, while green total factor energy efficiency belongs to multifactor energy efficiency covering labor, capital, energy, desirable output, and undesirable output. Therefore, the impact of green credit policy on energy intensity and green total factor energy efficiency may be different. Second, energy efficiency, as a critical factor that directly affects resource utilization, pollution reduction, and carbon emissions, is still to be supplemented in terms of direct, indirect, and linkage effects of green credit policy. Pollutants and carbon dioxide have the same source and process in terms of emission; the same frequency, effect, and path in terms of governance; and the synchronization and same goal in management. Their root cause is all in the whole process of energy production and consumption. Third, the manufacturing industry is the primary production sector of production and living materials required for economic development and social operation; a large number of high-energy-consuming industries are concentrated. Consequently, it is crucial to research the impact effect, transmission mechanism, and heterogeneity analysis of green credit policy on energy efficiency in the manufacturing industry.

Theoretical mechanisms and research hypotheses

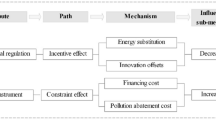

Direct effect of GCP on EE

GCP takes compliance with environmental testing standards, pollution control effects, and ecological protection as essential preconditions for credit approval. It sets differential pricing in the loan amount and interest rate to guide the allocation of funds, thereby affecting the environmental behavior of enterprises in pollution reduction and EE improvement (Wen et al. 2021). As a binding policy, the role of GCP on EE is mainly reflected in signal transmission and dynamic supervision (Chang et al. 2019; Yao et al. 2021; Zhang et al. 2022).

From signal transmission standpoint, GCP serves as a “warning” to “two high” industries, which is reflected in the implementation of punitive loan interest rates by commercial banks to stimulate production technology innovation in the two high industries. GCP can also transmit the “signal” to the market about the country’s adherence to green development, thus directing private investments into green sectors (Tian et al. 2022), and optimizing the financial distribution of resource management (Luo et al. 2021). Furthermore, GCP promotes environmental disclosures and information-sharing mechanism improvement. It helps to weaken the information asymmetry between the government, financial institutions, and enterprises and can further increase the attention of cleaner production in the two high industries. Based on the signal transmission effect of GCP, the two high enterprises are motivated to shift from end-of-pipe treatment to cleaner production. This helps to reduce financing costs and maintain their market reputation, which stimulates them to increase investment in R&D and boosts innovation output. The two high enterprises promote cleaner production and green manufacturing through green technology innovation, so that they can regain more market share and obtain the innovation compensation effect, which can also further stimulate enterprises to develop green technologies. This virtuous cycle process is bound to optimize the allocation of capital, energy, and other factors and improve EE.

From credit supervision standpoint, financial institutions, as external creditors, restrict enterprises’ adverse selection and moral hazard while increasing their investment efficiency. Whenever two highs firms request fresh investment loans from financial institutions, they will be subject to a stringent environmental evaluation and multiple supervision of media and capital market. Moreover, pollution charges and fines will also reduce the investment available to enterprises. These external uncertainties may encourage two highs industries to optimize the investment structure and improve investment efficiency (Zhang et al. 2021). The information communication and dynamic tracking mechanism will promote the production and operation of enterprises to become more standardized. Once environmental problems occur, financial institutions will not grant credit, suspend credit, or even terminate credit (Hu et al. 2021). If so, enterprises will face difficulties in financing, as well as the risk that previous investments may be converted into sunk costs, and be forced to reduce production or even withdraw from the market.

From the theoretical analysis above, it is indeed clear that GCP has a considerable constraining effect, which can prevent the unchecked growth of high energy–consuming industries and significantly lower EI. Besides, it is also clear that GCP has an improvement effect, which encourages the development of green technologies and optimizes resource allocation. However, due to the increasing financing costs, the difficulty of green technology innovation and resource allocation also increases. The enterprise will seek benefit maximization between production costs and innovation compensations. Therefore, it is difficult for GCP to improve GTFEE including the capital, energy, labor, and other factors in the short term. Based on this, the following research hypotheses are proposed.

-

Hypothesis H1a. GCP promotes the reduction of EI in green credit–restricted industries.

-

Hypothesis H1b. GCP inhibits the improvement of GTFEE in green credit–constrained industries.

Indirect effect of GCP on EE

Financing constraints

As far as financing cost is concerned, GCP has both constraint and incentive effects. GCP will reduce credit support or adopt high-interest rate credit for two high industries, or even stop new credit support. These practices raise the credit financing threshold and transaction cost (Yu et al. 2021) and produce a “punitive effect” to curb their blind development (Yao et al. 2021; Wu et al. 2022). It also forces two high industries to carry out technological innovation and product upgrading to promote green transformation. Meanwhile, GCP provides looser financing constraints and more convenient financing channels for green, low-carbon, and environmental protection industries (Cui et al. 2022). It provides financial support for technological innovation in green industries, and also disperses the risks of enterprises’ energy-saving and environmental protection technological innovation. It is conducive to optimizing resource allocation, promoting R&D efforts, and boosting the transformation and application of scientific and technological achievements. The GCP’s incentive and constraint effects will steer capital towards eco-friendly, low-carbon businesses, support the two high sectors’ greening, improve the social and economic structure, and promote EE.

-

Hypothesis H2. GCP affects the allocation of credit resources through financing constraints, which in turn affects EE.

Innovation impetus

As an incentive-based environmental regulation tool, GCP heartens enterprises to engage in technological innovation. Enterprises will obtain innovation compensation effect after technological innovation, which can offset the additional costs brought by GCP financing constraints (Porter 1991). Technological innovation can enable enterprises to improve their market competitiveness while achieving energy conservation and efficiency improvement. Additionally, GCP’s assistance helps ease the lack of innovation investment, particularly for small-to-medium businesses with financial issues (Zhang et al. 2021). On another scale, the technological innovation of enterprises promotes the generation of cleaner production technologies, which can improve green performance of enterprise. With the acceleration of technological progress and the promotion of equipment upgrading, the green transformation of enterprises will be promoted. It will create conditions for obtaining green credit support. For green, low-carbon, and environmental protection industries, green credit from financial institutions is tilted to these industries and can effectively allocate credit resources and inject a steady stream of impetus into their development. For “two high and one surplus” industries, GCP’s supervision effect curbs their blind expansion, and the signaling effect of GCP also makes them face stricter pressure on environmental protection and public opinion. Therefore, the stress of cleaner production weakens the driving force of technological innovation.

-

Hypothesis H3. GCP limits the industry’s innovation impetus by affecting green credit, which in turn affects EE.

Linkage effect of GCP on EE

Energy usage is the principal cause of CO2 and pollutant emissions, with some studies suggesting that 88.4% of China’s CO2 emissions in 2020 come from fossil energy combustion. In terms of major sources of air pollutant emissions, sulfur dioxide in the industrial sector is also generated by energy combustion and the chemical reactions driven by it. Therefore, the energy utilization is the key and focus of achieving the synergistic reduction of pollution and carbon emissions. As previous research shows, energiewende and strict implementation of end-of-pipe controls can collaborate to reduce air pollution and CO2 emissions (Yuan et al. 2022); besides, financial policies which promote renewable energy sources can also assist in lowering CO2 emissions and boosting environmental quality (Wang et al. 2022a, b). High-quality energy development not only directly restrains CO2 emissions, but also indirectly stems CO2 emissions, improving EE (Wang et al. 2022a, b). Based on this, it can be inferred that EE improvement is a viable path to promote the synergy of pollution and carbon reduction. When GCP has a significant impact on EE, whether it can have a linkage effect on pollution reduction and carbon reduction remains to be verified.

-

Hypothesis H4. GCP not only affects EE, but also has a linkage effect on pollution and carbon reduction (Fig. 1).

Research methods and data analysis

Model specification

DID model

The difference-in-difference (DID) model is used to test the effect of GCP on EE. China Banking Regulatory Commission (CBRC) first launched the GCP in 2007. However, GCP has not been properly carried out due to the ambiguity of the implementation standards and the stress of economic growth (Guo 2014; Wen et al. 2021). Since then, CBRC has formally put forward Green Credit Guidelines (GCG2012). At the same time, the banking industry has indeed promoted green credit as a strategy, which is regarded as a milestone of China’s GCP (Liu et al. 2019). Therefore, 2012 is chosen as the policy implementation year in this study. The model is constructed as

In Eq. (1), \({Y}_{it}\) refers to EE, including EI and GTFEE, and i and t refer to industry and year.

\({DID}_{it}={treat}_{it}\times {post}_{it}\) is the primary explanatory variable, where treat is used to evaluate whether the industry belongs to GCP or not. And the green credit restriction industry is set as 1; otherwise, it is 0; post is used to judge whether the period is affected by GCP. After the implementation of GCG2012, it is 1; otherwise, it is 0. Control is the control variable. \({\mu }_{i}\) is the time-fixed effect and \({\delta }_{t}\) is the industry-fixed effect. \({\varepsilon }_{it}\) represents a random error term.

Dynamic effect model

Due to periodical and non-equilibrium characteristics of GCP implementation, the dynamic effect model is utilized to further investigate the dynamic impact of GCP on EE. Not only can we explore whether the EE is related to the impact time of GCP, but also verify the parallel trend hypothesis of DID. The model is constructed as

In Eq. (2), \({D}_{pre\_s}\), \({D}_{current}\), \({D}_{post\_s}\) represent the cross product of the year dummy variables and the policy dummy variables before, at the time and after the implementation of GCG2012. \({\alpha }_{pre\_s}\), \({\alpha }_{current}\), \({\alpha }_{post\_s}\) denote the corresponding estimated values. The rest of the variables are the same as Eq. (1).

Variable design

Explained variables

-

1.

Energy intensity (EI) is expressed by the energy consumption per unit sales value of the manufacturing industry.

-

2.

Green total factor energy efficiency (GTFEE) is computed using Global-Malmquist-Luenberger (GML) method according to Chen and Wang (2022). The base period of 2004 is set to 1 and multiply them to get the specific GML index from 2004 to 2019. The indicators used are shown in Table 1.

Explanatory variables

Considering that CBRC formally proposed GCG in 2012, 2012 is regarded as the year of policy impact. The DID variables are constructed by taking the industries with two high and one surplus as the treatment group, which is covered by the “Key Indicators of Green Credit Performance,” and the rest of the industries as the control group.

Mechanism variables

Financing constraint (Constraint) is measured by the industrial asset-liability ratio, and innovation impetus (Innovation) is assessed by the proportion of industrial R&D investment in the primary business income (Tan et al. 2022a, b). Carbon dioxide intensity (CI) and sulfur dioxide intensity (SI) are selected as the dependent variables to verify the linkage effect of GCP on pollution and carbon reduction.

Control variables

According to the relevant research in the existing literature, we select the following control variables. (1) Fuel price index (FP): Select the industry-wide fuel price index and establish a fixed-base index with 2004 as the base period (Tan et al. 2022a, b). (2) Environmental regulation (ER): It is measured by the proportion of wastewater and waste gas treatment operation costs in industrial sales (Wang et al. 2020a, b). (3) Internal financing (IF): The growth rate of self-financing among the sources of fixed asset investment in each industry is chosen to measure IF (Wu et al. 2022). (4) Industry size (IS): It is measured by the logarithm of the number of industrial enterprises above the scale (Wang et al. 2020a, b). (5) Ownership structure (OS): The ratio of total assets of state-owned enterprises above the scale to that of industrial enterprises above the scale is selected to measure OS (Wang et al. 2020a, b). (6) Foreign investment (FI): This paper selects the proportion of foreign capital used by each industry in the investment capital of the industry to measure FI (Wang et al. 2020a, b; Zhang et al. 2022). (7) Labor productivity (LP): The ratio of industrial sales output to employees is used to calculate LP (Zhang et al. 2022). (8) Growth potential (GP): The growth rate of the primary business income of industrial enterprises above the designated size is selected to measure GP (Wang et al. 2020a, b).

Data source

According to National Economical Industry Classification (GB/T 4754–2017), the manufacturing industry is further divided into 29 sub-industries. According to this, we select 29 manufacturing sub-industries from 2004 to 2019 as the research objects. According to Key Indicators of Green Credit Performance, and on the basis of availability of data, the quartile industries involving two high and one surplus are merged into two sub-industries.

Since the industrial sales output value data is only available up to 2016, the geometric mean method is used to estimate the industrial sales output value from 2017 to 2019. Table 2 is variable descriptive statistics.

Empirical findings and analysis

Benchmark results

The average effect of GCP on EI and GTFEE is shown in Table 3. Columns (1) and (2) show that after controlling for industry and year fixed effects, the DID regression coefficient of the impact of GCP on EI is notably negative, regardless of the addition of control variable. It indicates that the implementation of GCP can effectively reduce EI. Column (3) demonstrates that after controlling for industry and year fixed effects, the DID regression coefficient of the impact of GCP on GTFEE is notably negative. After the control variable is included, the DID regression coefficient in column (4) is still negative, indicating that the implementation of GCP has suppressed the advancement of GTFEE.

The above results show that GCP has significantly reduced EI, and the possible reason is that GCP restricts the blind expansion of the two high and one surplus industry by setting the financing threshold, forcing enterprises to save energy. Those effectively control energy consumption and contribute to the reduction of EI. Thus, Hypothesis H1a is verified. GCP has significantly suppressed GTFEE for the following reasons. First, GCP has restricted the credit financing of the two high and one surplus, resulting in capital investment limitation and production scale reduction. Moreover, the “signal transmission” role of GCP has weakened the ability of the restricted industries to attract social capital, making it difficult to play the scale economy effect. Second, GCP has restricted the financing of the two high and one surplus industry, resulting in the lack of financial support for technological innovation, especially for enterprises with high reliance on external financing. This makes it difficult to play the Porter effect. Consequently, it causes a reduction in GTFEE. Therefore, Hypothesis H1b is confirmed.

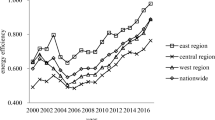

Dynamic effect analysis

Figure 2 demonstrates the dynamic effect of GCP on EI and GTFEE, which is also a parallel trend test. As can be seen from Fig. 2, the DID coefficients of EI are insignificant before and in the year of adoption of GCP, and the regression coefficients are around 0. After the implementation of GCP for 1 year, the DID coefficients pass the significance test, and the significance has an increasing trend, and the impact of GCP on EI has a time-lag effect. The reason is that it takes some time for the implementation of GCP to take effect, and enterprises will adjust their production and reduce EI only when the financing constraints and threshold effects of GCP take effect, thus promoting the reduction of EI. The DID coefficients of GTFEE in the 2 years before the implementation of GCP are not significant; however, the DID coefficients achieved the significance test in the previous year. Those demonstrate that the impact of GCP on GTFEE has an expected effect. The reason is that although GCP has not been fully implemented, the signal transmission effect of GCP has begun to control the production scale of the two high and one surplus industry, and the difficulty of attracting social capital has increased, resulting in the decline of the GTFEE of the two high and one surplus industry ahead of schedule.

Robustness estimations

Placebo test

To further test whether the effect of GCP on EE in the manufacturing industry is induced by other unobservable factors, this study builds on the research of Chetty et al. (2009) and uses the non-parametric substitution approach to conduct a placebo test. The mean values of the estimated coefficients derived from 500 random samplings are close to zero, and the empirical cumulative distribution of the coefficients from the placebo test in Fig. 3 shows that the estimated coefficients in columns (2) and (4) of Table 3 (− 0.1387 and − 0.1024, respectively) are located in the low tails in the permutation test. It means that the benchmark regression results pass the placebo test.

PSM-DID estimation

Considering that DID method is prone to “selective bias,” this study further uses the PSM-DID method to screen samples from restricted industries (treatment group) and non-restricted industries (control group). Firstly, the characteristic variables of restricted industries and non-restricted industries are regressed, and the predicted value is taken as the score. Secondly, for matching, the nearest neighbor matching approach is utilized. Finally, the regression is carried out according to Eq. (1). Columns (1) and (2) of Table 4 demonstrate that GCP has effectively weakened EI; however, it also has a restraint effect on the advancement of GTFEE. This indicates the robustness of the conclusions in this study.

Change the experimental group

Since the transportation equipment manufacturing industry covers metal ship manufacturing and green transportation projects, there may be two opposite directions of restriction and support. Therefore, the transportation manufacturing industry is excluded from the treatment group to verify the impact of GCP on EE. As shown in columns 3 and 4 of Table 4, after changing the experimental group, the effects of GCP on EI and GFTEE still match the results of the benchmark regression. It means that the conclusions of this study are reliable.

Exclude data from 2017 to 2019

The industrial sales output value data from 2017 to 2019 are obtained by estimation. To exclude possible errors in the research sample data, the data for these 3 years are dropped. The data sample ranges from 2004 to 2016, and the remaining research methods and steps are unchanged. In columns (5) and (6) of Table 4, it can be observed that after changing the sample period, the impact of GCP on EI and GFTEE remains consistent with the findings of the benchmark regression.

Heterogeneity analysis

Heterogeneity analysis of industrial scale

Considering the differences in business scope, operating efficiency, and financing ability, different scale industries will make different choices in end-of-pollution treatment, technological innovation and upgrading, and curtailment of production to exit the market. Therefore, there are also differences in EE of GCP for different scale industries. According to the median of total industrial assets in 2012, the sample is divided into large-scale and small-scale industries, and the heterogeneity analysis is carried out.

The impact of GCP on EI of large-scale and small-scale industry is negative, as shown by the test results from the standpoint of industrial scale heterogeneity in Table 5. And the absolute value of the former coefficient is greater than the latter, indicating there is an inhibition effect of GCP on EI of large-scale industries. The possible reason is that the production and operation of large-scale industries need to invest a large amount of energy and capital. GCP has led to more obvious restrictions on financing in large-scale industries, and the reduction of energy input and production output has weakened EI. From the perspective of GTFEE, the impact of GCP on GFTEE of large-scale industries is negative; however, the impact on small-scale industries is not significant. The possible reason is that GCP not only dramatically reduces the energy and capital investment of large-scale industries, but also affects the investment in green technology innovation, further inhibiting the improvement of GFTEE.

Heterogeneity analysis of industrial category

Due to the differences in the development stage, production characteristics, market scale, and other aspects of the manufacturing industry segments, there are differences in profitability and innovation efficiency among different categories of industries. It will make the impact effect of GCP vary depending on the industry categories. With reference to GB/T 4754–2017, this paper divides 13 sectors including agricultural and sideline food processing industry into light textile manufacturing industry; 9 sectors including petroleum processing, coking, and nuclear fuel processing industry into resource processing industry; and 7 sectors including metal products industry into machinery and equipment manufacturing industry.

Table 6 shows the results of industrial category heterogeneity. The impact of GCP on EI of light textile manufacturing industry and resource processing industry is negative, and the absolute value of the latter coefficient is greater than the former; however, the impact on EI of machinery and equipment manufacturing industry is not obvious. The reason may be that it is a technology-intensive industry, and its own resource consumption is relatively low, leading the effect of GCP on its EI is not significant. However, light textile manufacturing industry belongs to labor-intensive industry, while resource processing industry belongs to resource-intensive industry. Those two are high labor input and resource-dependent industries. They are restricted by GCP and effectively reduce EI. In terms of GTFEE of the subsectors, the effect of GCP on GTFEE of the light textile manufacturing industry is negative, while that of the resource processing industry and the machinery and equipment manufacturing industry is positive. Therefore, in the former, GCP inhibits GTFEE, while opposite in the latter. The reason is that the light textile manufacturing industry belongs to low and medium technology-added fields. There is a little technical barrier within this field, and the enterprises are highly substitutable for each other’s imitation. Therefore, under the constraint of GCP, there is no incentive for technological innovation to improve GTFEE. The resource processing industry, which is highly dependent on resources, is subject to the constraining effect of GCP. It makes the cost of energy consumption rise, and therefore promotes the rise of GTFEE by actively promoting R&D investment and the transformation and application of R&D results. The machinery and equipment manufacturing industry itself belongs to the high-technology field and has obtained more convenient financing under the incentive effect of GCP, which has promoted technological innovation and equipment renewal, and therefore, enhanced GTFEE.

Heterogeneity analysis of element type

The heterogeneity of policy effects may arise from the differences in pollution intensity among industries. The sunk cost of the clean industry in the production process is relatively low, and the upgrading of technology and equipment is relatively easy, while the environmental technology cost of the pollution-intensive industry is relatively high, and the impact of policy may be more significant. According to the median of pollution intensity in 2012, the sample is divided into clean industry and pollution-intensive industry for heterogeneity analysis.

Table 7 shows the results of pollution degree heterogeneity. GCP has a significant inhibitory effect on the EI and GFTEE of clean industries, but has no significant effect on the energy efficiency of pollution-intensive industries. The reason is that the cleaning industry is more motivated by the policy to upgrade equipment to promote the reduction of EI, while GFTEE needs the drive of technological innovation, which is difficult to be effectively improved in the short term. For pollution-intensive industries, they may choose to scale down rather than focus on technological innovation and equipment upgrading at the initial stage, so they will not be significantly affected by policies.

Transmission mechanism and linkage effect of GCP

Transmission mechanism analysis

In accordance with the findings of the benchmark results research, GCP decreases EI and GFTEE. On this foundation, further clarifying the transmission mechanism is conducive to a clearer understanding of the relationship between GCP and EE. Through the preceding theoretical mechanism analysis, it is found that GCP affects EI and GFTEE through financing constraints and innovation impetus. Taking financing constraints (constraint) and innovation impetus (innovation) as dependent variables, the DID approach is employed to estimate the impact of GCP on these factors. Table 8 shows the results of the transmission mechanism of GCP.

As illustrated in Table 8, the financing constraint coefficient is notably positive regardless of the inclusion of control variables. It indicates that the implementation of GCP has strengthened the financing constraint of the industry. The possible reason for this is that GCP is still in the exploratory stage. It has increased the financing constraints encountered by firms because of a shortage in implementation standards and rules, as well as the “one vote veto” system for environmental protection in the credit approval. In columns (3) and (4), the coefficients of innovation impetus are notably negative. That is, the implementation of GCP has weakened innovation impetus of the industry. The reason is that GCP has reduced the credit resources and business reputation of the two highs industries and cannot obtain sufficient funds to carry out technological R&D and innovation. This is inconsistent with the Potter effect, thereby verifying hypothesis H2 and hypothesis H3.

Linkage effect analysis

Pollutants and carbon dioxide have the same root and process in terms of emissions, and both are directly tied to the production and consumption of energy. Therefore, GCP not only has a significant impact on EE, but also may have a linkage effect on pollution reduction and carbon reduction. Given this, this research investigates the linkage effect of GCP on pollution and carbon reduction.

As illustrated in Table 9, the DID regression coefficients of the effects of GCP on CI and SI are significantly negative. It means the implementation of GCP can effectively reduce CI and SI and realize the synergistic effect of pollution reduction and carbon dioxide reduction. The above results indicate that GCP is an effective tool for environmental regulation, which can achieve energy conservation, efficiency improvement, pollution reduction, and carbon reduction, and is an essential guarantee for attaining “carbon peaking and carbon neutrality.” Thus, hypothesis H4 is verified.

Research conclusions and policy implications

Main conclusions

This study takes 29 manufacturing sub-industries from 2004 to 2019 as research samples, and uses difference-in-difference method to test the impact of China’s GCG2012 on energy intensity and green total factor energy efficiency. The conclusions are as follows: First, green credit policy has been proven to dramatically lower energy intensity of green credit–restricted businesses while simultaneously impeding the advancement of green total factor energy efficiency. Second, the heterogeneity results show that the energy efficiency of large-scale, light textile manufacturing, resource processing industries, and clean industries are more significantly affected. Third, through the evaluation of the policy effect of green credit policy, it is found that there is a linkage effect of green credit policy on energy conservation, pollution reduction, and carbon reduction. Finally, through the transmission mechanism analysis of green credit policy, although the constraint effect of green credit policy has effectively suppressed energy intensity, it also leads some industries to face a vicious cycle of “enhanced financing constraints-weakened innovation impetus,” which in turn makes it challenging to improve green total factor energy efficiency.

It can be seen from the above research conclusion that, unlike the study by Tan et al. (2022a, b), which indicates that GCP significantly improves the total factor energy efficiency of the two high and one surplus industrial sector, this study finds that GCP has a significant inhibitory effect on the green total factor energy efficiency of the manufacturing sector. One of the reasons is that the manufacturing industry, which is the most restricted by green credit, is the subject of this study. The second reason is that Tan et al. (2022a, b) only consider carbon emissions as undesirable output, while in fact, GCP not only has a constraining effect on carbon emissions, but also has a weakening effect on pollutants, thus CO2, COD, NH3-N, and industrial SO2 emissions are considered as undesirable outputs in this study.

Policy implications

The above research conclusions provide us with many policy recommendations.

First, it is recommended that the incentive and constraint effects of green credit policy be brought into play to enhance the incentive for industrial innovation. The financial structure should formulate more scientific and detailed green credit standards and green credit products during credit approval. Through this way, it can provide sufficient financial support for the growth of the manufacturing industry, promote enterprises to increase R&D investment, and improve green technology.

Second, it is recommended to improve the supporting system of green credit policy and promote the perfect implementation of the policy, improve the level of financial marketization, and increase the strength of green credit policies to transmit green signals to enterprises through financial markets and product markets. Through the evaluation of green credit policy, it has effects of energy conservation, pollution reduction, and carbon reduction. Therefore, it is vital to strengthen the coordination and collaboration between green credit policy and energy and environment and climate policies and continuously improve the green financial system.

Third, it is recommended to formulate green credit policy that is more in line with the specific characteristics based on the scale and category of the industry and more detailed standards for different industries in terms of financing threshold and interest rate differences, to improve the use efficiency of green credit funds.

Fourth, it is recommended to improve the evaluation system of green credit policy, scientifically evaluate and timely update the key evaluation indicators of green credit, and reduce the uncertainty risk in the process of green credit.

Limitations and future research directions

Energy efficiency of enterprises is the key to energy conservation and consumption reduction. However, it is difficult to measure total factor energy efficiency due to the difficulty of obtaining energy-related data at the micro-enterprise level. Although Zhang and Tu (2022) first tried to measure the total factor energy efficiency of micro-enterprises in China from 2001 to 2007, however, green financial policies are concentrated after 2012, so it is difficult to examine the impact of green financial policies on total factor energy efficiency. However, some studies have been conducted to measure enterprise energy intensity (Su et al. 2022), so it is also possible to examine the policy effects of green credit at the level of enterprise energy intensity. This is the limitation of this study and also the direction of future research.

Data availability

The data in this paper comes from the China Energy Statistical Yearbook, China Industrial Statistical Yearbook, China Environmental Statistical Yearbook and EPS database.

Notes

“Two high and one surplus” refers to high pollution, high energy consumption, and overcapacity industries.

Abbreviations

- GCP:

-

Green credit policy

- EE:

-

Energy efficiency

- EI:

-

Energy intensity

- GTFEE:

-

Green total factor energy efficiency

- DID:

-

Difference-in-difference

- FE:

-

Fixed effect model

References

Chang K, Zeng YH, Wang WH, Wu X (2019) The effects of credit policy and financial constraints on tangible and research & development investment: firm-level evidence from China’s renewable energy industry. Energy Pol 130:438–447. https://doi.org/10.1016/j.enpol.2019.04.005

Chen LF, Wang KF (2022) The spatial spillover effect of low-carbon city pilot scheme on green efficiency in China’s cities: evidence from a quasi-natural experiment. Energy Econ. 110:106018. https://doi.org/10.1016/j.eneco.2022.106018

Chen ZG, Zhang YQ, Wang HS, Ouyang X, Xie YX (2022) Can green credit policy promote low-carbon technology innovation? J Clean Prod. 359:132061. https://doi.org/10.1016/j.jclepro.2022.132061

Chetty R, Looney A, Kroft K (2009) Salience and taxation: theory and evidence. Am Econ Rev 99:1145–1177

Cui X, Wang PP, Ahemet S, Duc KN, Pan YY (2022) Green credit policy and corporate productivity: evidence from a quasi-natural experiment in China. Technol Forecast Soc Chang. 177:121516. https://doi.org/10.1016/j.techfore.2022.121516

Guo PY (2014) Financial policy innovation for social change: a case study of China’s green credit policy. Int Rev Sociol 24:69–76. https://doi.org/10.1080/03906701.2014.894347

Hu GQ, Wang XQ, Wang Y (2021) Can the green credit policy stimulate green innovation in heavily polluting enterprises? Evidence from a quasi-natural experiment in China. Energy Econ. 98:105134. https://doi.org/10.1016/j.eneco.2021.105134

Liu XH, Wang EX, Cai DT (2019) Green credit policy, property rights and debt financing: Quasi-natural experimental evidence from China. Finance Res Lett 29:129–135. https://doi.org/10.1016/j.frl.2019.03.014

Luo SM, Yu SH, Zhou GY (2021) Does green credit improve the core competence of commercial banks? Based on quasi-natural experiments in China. Energy Econ. 100:105335. https://doi.org/10.1016/j.eneco.2021.105335

Nasir MA, Canh NP, Lan Le, TN (2021) Environmental degradation & role of financialisation, economic development, industrialisation and trade liberalisation. J EnvironManag. 277, 111471. https://doi.org/10.1016/j.jenvman.2020.111471

Porter ME (1991) Towards a dynamic theory of strategy. Strateg Manag J 12:95–117. https://doi.org/10.1002/smj.4250121008

Song ML, Xie QJ, Shen ZY (2021) Impact of green credit on high-efficiency utilization of energy in China considering environmental constraints. Energy Pol 153:112267. https://doi.org/10.1016/j.enpol.2021.112267

Su ZF, Guo QQ, Lee HT (2022) Green finance policy and enterprise energy consumption intensity: evidence from a quasi-natural experiment in China. Energy Econ. 115:106374. https://doi.org/10.1016/j.eneco.2022.106374

Tan XJ, Xiao ZW, Liu YS, Farhad TH, Wang BB, Dong HM (2022) The effect of green credit policy on energy efficiency: evidence from China. Technol Forecast Soc Chang. 183:121924. https://doi.org/10.1016/j.techfore.2022.121924

Tan XJ, Yan YX, Dong YY (2022) Peer effect in green credit induced green innovation: an empirical study from China’s green credit guidelines. Resour Pol 76:102619. https://doi.org/10.1016/j.jenvman.2021.113159

Tian C, Li XQ, Xiao LM, Zhu BZ (2022) Exploring the impact of green credit policy on green transformation of heavy polluting industries. J Clean Prod. 335:130257. https://doi.org/10.1016/j.jclepro.2021.130257

Wang KL, Pang SQ, Ding LL, Miao Z (2020) Combining the biennial Malmquist-Luenberger index and panel quantile regression to analyze the green total factor productivity of the industrial sector in China. Sci Total Environ. 739:140280. https://doi.org/10.1016/j.scitotenv.2020.140280

Wang H, Sun H, Xiao HY, Xin L (2020b) Relationship between environmental policy uncertainty, two-way FDI and low-carbon TFP. China Popul Resour Environ 30:75–86 (in Chinese)

Wang B, Zhao J, Dong KY, Jiang QZ (2022) High-quality energy development in China: comprehensive assessment and its impact on CO2 emissions. Energy Econ. 110:106027. https://doi.org/10.1016/j.eneco.2022.106027

Wang ZH, Pham TLH, Sun KN, Wang B, Bui Q, Hashemizadeh A (2022) The moderating role of financial development in the renewable energy consumption-CO2 emissions linkage: the case study of Next-11 countries. Energy. 254:124386. https://doi.org/10.1016/j.energy.2022.124386

Wen H, Lee CC, Zhou F (2021) Green credit policy, credit allocation efficiency and upgrade of energy-intensive enterprises. Energy Econ. 94:105099. https://doi.org/10.1016/j.eneco.2021.105099

Wu HT, Hao Y, Ren SY, Yang XD, Xie G (2021) Does internet development improve green total factor energy efficiency? Evidence from China. Energy Pol 153:112247. https://doi.org/10.1016/j.enpol.2021.112247

Wu S, Wu LP, Zhao XL (2022) Impact of the green credit policy on external financing, economic growth and energy consumption of the manufacturing industry. Chinese J Popul Resour Environ 20:59–68. https://doi.org/10.1016/j.cjpre.2022.03.007

Yao SY, Pan YY, Ahme S, Gazi SU, Cheng FY (2021) Green credit policy and firm performance: what we learn from China. Energy Econ. 101:105415. https://doi.org/10.1016/j.eneco.2021.105415

Yu CH, Wu XQ, Zhang DY, Chen S, Zhao JS (2021) Demand for green finance: resolving financing constraints on green innovation in China. Energy Pol 153:112255. https://doi.org/10.1016/j.enpol.2021.112255

Yuan RX, Ma Q, Zhang QQ, Yuan XL, Wang QS, Luo C (2022) Coordinated effects of energy transition on air pollution mitigation and CO2 emission control in China. Sci Total Environ. 841:156482. https://doi.org/10.1016/j.scitotenv.2022.156482

Zhang PD, Tu XW (2022) Manufacturing agglomeration, technological progress and enterprise total factor energy efficiency. China Industrial Economics 412:103–121 (in Chinese)

Zhang J, Wu GY, Zhang JP (2004) The estimation of China’s provincial capital stock: 1952–2000. Econ Res J 10:35–44 (in Chinese)

Zhang SL, Wu ZH, Wang Y, Hao Y (2021) Fostering green development with green finance: An empirical study on the environmental effect of green credit policy in China. J Environ Manage. 296:113159. https://doi.org/10.1016/j.jenvman.2021.113159

Zhang AX, Deng RR, Wu YF (2022) Does the green credit policy reduce the carbon emission intensity of heavily polluting industries Evidence from China’s industrial sectors. J Environ Manage 311:114815. https://doi.org/10.1016/j.jenvman.2022.114815

Funding

This work was supported by the National Social Science Foundation of China (No. 21BJY111), Humanities and Social Science Research Fund project of Ministry of Education (No. 20YJA790038), and Basic Research Project of Zhongnan University of Economics and Law (No. 2722022EK081).

Author information

Authors and Affiliations

Contributions

All the authors contributed to the conception and design of this study. The conceptualization, writing—review, and funding acquisition were provided by Liangwen Luo. The empirical work and the manuscript’s first draft were performed by Yanqin Ma; the writing—review, validation, and supervision were provided by Qian Zhou. All the authors have read and agreed to the published version of the manuscript.

Corresponding author

Ethics declarations

Ethics approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Luo, L., Ma, Y. & Zhou, Q. The impact and transmission mechanism of green credit policy on energy efficiency: new evidence from China. Environ Sci Pollut Res 30, 56879–56892 (2023). https://doi.org/10.1007/s11356-023-26376-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-26376-9