Abstract

In most nations across the world, the fundamental goal of economic policy is to achieve sustainable economic growth. Economic development, on the other hand, may have an influence on climate change and global warming, which are major worldwide concerns and problems. Thus, this research offers a new perceptive on the influence of renewable and nonrenewable energy consumption on CO2 emissions in Argentina utilizing data from the period between 1965 and 2019. The current research applied the wavelet tools to assess these interconnections. The outcomes of these analyses reveal that the association between the series evolves over both frequency and time. The current analysis uncovers notable wavelet coherence and significant lead and lag connections in the frequency domain, while in the time domain, contradictory correlations are indicated among the variables of interest. From an economic perspective, the outcomes of the wavelet analysis affirm that in the medium and long term, renewable energy consumption contributes to environmental sustainability. Furthermore, in the medium term, trade openness mitigates CO2, although in the long term, no significant connection was found. Moreover, both nonrenewable energy and economic growth contribute to environmental degradation in the short and long term. Finally, the frequency domain causality outcomes reveal that in the long term, economic growth, trade openness, and nonrenewable energy can predict CO2 emissions. The present analysis offers an innovative insight into the interconnection and comovement between CO2 and trade openness, renewable energy utilization, and GDP in the Argentinean economy. The findings from this research should be of interest to economists, researchers, and policymakers.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Energy is regarded as an economy’s backbone. Increasing economic expansion leads to greater production of products and services, and, as a result, expanded energy consumption. To maintain present levels of energy production and meet energy demands, most nations rely on fossil fuels, which are largely imported. This accounts for a significant portion of a country’s international trade imbalance (Adebayo and Kirikkaleli 2021; Akinsola et al. 2021b). However, the increasing use of nonrenewable energy poses a threat to the ecosystem. Since the volatility of fossil fuel prices has the largest influence on investment decisions, the growing degree of environmental degradation and externalities is mostly attributable to the widespread usage of fossil fuels (Alola 2019; Wang et al. 2021a; Xue et al. 2021; Zhang et al. 2020).

Price fluctuations in fossil fuels and energy exacerbate ecological issues (Adebayo and Kirikkaleli 2021; Akinsola et al. 2021a; Su et al. 2021b). As a result, most nations are engaged in initiatives that are focused on reducing their reliance on fossil fuels, thereby reducing environmental strain. To achieve this, the first goal should be to increase the percentage of renewable energy in the energy mix, which will help to reduce environmental concerns. Renewable energy sources, in particular, are an urgent option for increasing energy security and reducing the reliance on imported fossil fuels. Furthermore, because renewable energy is a clean source of energy, it can help to decrease ecological damage (Alola et al. 2019; Awosusi et al. 2021; Shan et al. 2021). As a result, a sensible strategy is required to reduce the reliance on fossil fuel use while maintaining economic development. CO2 emissions in emerging countries have recently grown due to economic expansion.

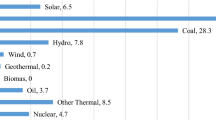

Why Argentina? Argentina is a developing nation whose GDP and GDP per capita amounted to US$9912.28 and US$4445.4 billion respectively in 2019 (World Bank 2020). The demand for electricity per capita is approximately 2800 kWh/cap (2019). Argentina produced 199.4 million tons of CO2 in 2019 and its CO2 increased from 88.8 million tons in 1970 to 199.4 million tons in 2019, an annual rise of 1.76%. Since 2016, overall consumption has decreased by 1.5% yearly, reaching 82 Mtoe in 2019. From 2010 to 2016, it increased at an annual rate of 1.6% (BP 2021). Renewable energy accounts for more than a quarter of Argentina’s electricity generation. In 2015, the government established a scheme to encourage the utilization of renewable energy for the generation of electricity, which included the establishment of a trust fund that would provide incentives and financial guarantees. The total energy supply (TES) by source (Ktoe) and electricity generation source (GWh) in Argentina from 1990 to 2019 are depicted in Figs. 1 and 2, respectively (IEA 2021).

Increased usage of renewable energy might also have several advantages, such as a reduction in global CO2 emissions. In light of this, a number of nations with significant levels of emissions have taken efforts to reduce CO2, including reforestation and lowering fossil fuel usage. Renewable energy (such as solar, geothermal, and wind) is anticipated to expand at a rate of 6.7% between 2005 and 2030, making it the fastest-growing form of energy (IEA 2021). As a result, renewable energy appears to be a viable remedy for the issues of climate change and energy security. Previous research has examined the effects of nonrenewable and renewable energy as well as economic growth on CO2 emissions (Ahmed et al. 2021a, b; Dogan and Inglesi-Lotz 2020; Li et al. 2021; Sarkodie and Strezov 2018; Solarin et al. 2017; Tian et al. 2021).

Nonrenewable energy use is mostly responsible for environmental degradation, whereas renewable energy enhances environmental sustainability (Odugbesan et al. 2021; Orhan et al. 2021; Pata 2021; Soylu et al. 2021). The bulk of these studies indicate that renewable energy reduces CO2, whereas nonrenewable triggers degradation of the environment. Nevertheless, as wealth rises, nonrenewable energy use may also rise, thereby reducing the input of renewable energy in the energy mix (Dogan and Inglesi-Lotz 2020). With the increasing usage of nonrenewable fuels, increased economic growth diminishes the positive impact of renewable energy on sustainability and causes CO2 emissions to rise. Thus, the present research intends to capture the connection between CO2 and energies (nonrenewable and renewable energy), economic growth, and trade openness in Argentina in both time and frequency.

The study adds to the existing body of knowledge by offering a novel methodological approach to assess the influence of GDP, renewable energy, energy utilization, and trade openness on CO2. The current research contributes to the literature in the following ways. Firstly, to the best of the investigators’ understanding, this is the first research to assess the heterogeneous effects of energy (renewable and nonrenewable) and trade openness on CO2 emissions in both time and frequency. Secondly, over the years, numerous studies have been conducted in an attempt to create awareness about the determinants of CO2. Nevertheless, their findings are often constrained to traditional empirical methodologies and generalized step measures (Adebayo and Acheampong 2021; Sharif et al. 2021). Recognizing these concerns, Sharif et al. (2021) stated that methodologies are critical in producing impartial analysis results and emphasized the importance of employing novel econometric techniques. Based on this information, this research utilizes an innovative time–frequency approach to assess the effect of energy usage, trade openness, economic growth, and renewable energy use on CO2 emissions in Argentina. The major advantage of this technique is that it distinguishes between long-, medium-, and short-run dynamics over the sample period. Furthermore, this technique establishes the correlation and lead/lag association between series (Rjoub et al. 2021). The concluding parts of the study are organized as follows: theoretical and empirical sections are presented in the next section. This is followed by the data and methodology in “Data and methodology.” The findings and discussion are presented in “Findings and discussion,” which is followed by the conclusion and policy direction in “Conclusion and policy suggestions.”

Theoretical framework and empirical review

This section is divided into two parts, namely theoretical framework and the empirical review which discusses prior studies conducted regarding these associations.

Theoretical framework

The world economy has grown tremendously over the last two decades, including an upsurge in nonrenewable energy usage. Regrettably, rapid economic expansion and rising consumption of energy have had negative ecological effects. Kraft and Kraft (1978) were the first to show an interrelation between economic growth and the utilization of energy. This approach has been used by environmental economists such as Panayotou (1997) and Grossman and Krueger (1991) to analyze connections between environmental degradation and economic expansion. According to them, economic growth is divided into three phases: scale effect, technical effect, and composite effect phases. The ecosystems will suffer in the early stages of growth until a specific threshold (the turning point) is achieved; growth will increase the degradation of the environment at this period. The initial phase is recognized as the scale effect phase, while the turning point and the time after the turning point are recognized as the composite and structural effect stages. The scale effect phase is associated with developing nations such as Argentina where nonrenewable energy sources support economic and production activities. The composite and structural effect stages, on the other hand, are associated with developed nations such as Germany, Canada, Sweden, and the USA, where technological innovation and services dominate economic activities.

Renewable energy is the purest kind of energy and does not result in emissions or depletion of the resource; thus, its usage benefits the environment. Solar, hydro, and wind energy are the most environmentally friendly sources of energy. Renewable energy, unlike fossil fuels, is unlimited. Nonrenewable energy sources, on the other hand, are finite and unsustainable, and their widespread use hastens climate change and global warming escalating greenhouse gas (GHG) emissions. This simply means that utilization of nonrenewable energy increases CO2 emissions while renewable energy (REC) mitigates CO2.

If the scale effect of trade is determined to be dominant over the composite/technical effects, net negative ecological consequences are predicted; in the opposite case, net positive ecological benefits are anticipated. Furthermore, trade openness might have asymmetrical impacts on emissions, because rising trade openness does not always have the same magnitude and sign as declining trade openness. Second, growing trade leads to increased consumption of energy and emissions as a nation’s GDP rises. Due to the ratchet effect, nevertheless, reducing trade does not always imply a reduction in energy use. The ratchet effect shows that when income falls, consumption does not fall in the same manner.

The research theoretical model is formulated based on the above discussions as follows:

where GDP, EC, REC, CO2, and TO stand for economic growth, utilization of energy, renewable energy, CO2 emissions, and trade openness respectively. The period of study is illustrated by t.

Empirical review

This section of the paper discusses the prior works conducted on the connection between CO2 nonrenewable energy (EC), GDP, REC, and TO. This section is therefore divided into four distinct sections to present a clear summary of studies on these interconnections.

Impact of economic growth and nonrenewable energy use on CO2 emissions

More energy is needed as industrial output increases, leading to higher GHG emissions via burning. Nevertheless, as the economy grows, a shift from industrial and manufacturing output to service-based sectors will occur. Several studies have reported different outcomes on GDP, CO2 emissions (CO2), and EC due to different method(s) applied, timeframe, and country(s) of study. For example, applying the dual gap and ARDL approaches, He et al. (2021) investigated the CO2-GDP-EC connection in Mexico. The outcomes from the research disclosed that both GDP and EC add to the degradation of the environment. The research of Awosusi et al. (2021) in South Korea on the GDP-CO2-EC association using the novel wavelet revealed positive coherence among CO2, GDP, and EC. Similarly, utilizing datasets from 1970 to 2016, Adebayo (2020) assessed the association between CO2, GDP, and EC. The investigator applied the ARDL and wavelet and their outcome disclosed that both GDP and EC trigger CO2 in Mexico. The study of Zhang et al. (2021b) in Malaysia also reported that an upsurge in EC and GDP contributes to the deterioration of the ecosystem. In Thailand, Kihombo et al. (2021) study on the CO2-GDP-EC interrelationship using data between 1980 and 2018 reported positive CO2-GDP association. On the contrary, Umar et al. (2020) in their research on the CO2-GDP-EC association in the USA disclosed CO2-GDP negative association. Likewise, Dogan et al. (2016) assessed the CO2-GDP-EC connection in the USA by utilizing a dataset from 1960 to 2010. The authors applied the ARDL and their outcomes disclosed that GDP improves the sustainability of the environment. Likewise, the research of Sarkodie and Strezov (2018) found that economic expansion in the USA does not contribute to environmental degradation due to strict environmental rules and technological advancements that lower the intensity of energy use. Furthermore, the studies of Bibi et al. (2021) for the USA; Su et al. (2021a) for China; Ji et al. (2021) for the USA; Tao et al. (2021) for E7 economies; Umar et al. (2020) for the USA; Umar et al. (2020) for China; and Zhang et al. (2021a) established that an upsurge in growth mitigates the quality of the environment.

Impact of trade openness and renewable energy on CO2 emissions

If the scale effect of trade openness is dominant over the composite/technical effects, net negative ecological consequences are predicted; in the opposite case, net positive ecological benefits are anticipated. Furthermore, trade openness might have asymmetrical impacts on emissions, because rising trade openness does not always have the same magnitude and sign as declining trade openness. Orhan et al. (2021) in their study looked into the CO2-TO connection in India utilizing data from 1965 to 2018. The investigators applied the novel wavelet tools to assess this connection and their outcomes unveiled CO2-TO positive linkage in the medium term; however, no evidence of CO2-TO connection was established in the short and long term. Likewise, in France, utilizing data from 1960 to 2013, the research of Mutascu (2018) reported no CO2-TO coherence in the short term which supports the neutrality hypothesis; nonetheless, in the medium term, there is evidence of positive CO2-TO coherence. In a bid to assess the CO2-TO interconnection in 49 high-emission countries in Belt and Road regions, Dong et al. (2018) applied the panel techniques and their outcomes disclosed both negative and positive effects on CO2, but the effect is dissimilar across the nations. Using EU nations as a case study, the study of Jamel and Maktouf (2017) reported a feedback causal connection between CO2 and TO. The impacts of TO on CO2 were examined by Gao et al. (2021) utilizing data from 182 nations between 1990 and 2015. Their findings reveal that TO reduced CO2 in high- and upper-middle-income nations while having no effect on CO2 in lower-middle-income nations; worse, TO exacerbated CO2 in low-income nations. The research of Shahbaz et al. (2017) found that TO triggers CO2 for global, middle-income, high-income, and low-income panels, although the impact differs among these different sets of nations. The causality outcomes show a two-way causal connection in the middle and global nations, but TO causes CO2 in high- and low-income nations.

Renewable energy is the purest kind of energy and does not result in emissions or depletion of the resource; thus, its usage is anticipated to mitigate CO2 emissions. In India, Kirikkaleli and Adebayo (2021) study on REC-CO2 interconnection utilizing global dataset disclosed negative REC-CO2 connection while the causality result unveiled one-way causal interconnection from REC to CO2. Likewise, the study of Shan et al. (2021) utilizing CS-ARDL and AMG techniques in the top seven fiscally decentralized economies reported a negative REC-CO2 connection. Similarly, utilizing quarterly data from 1990 to 2015, Adebayo and Kirikkaleli (2021) assessed the CO2-REC interaction in Japan using wavelet tools. Their outcomes disclosed that in all frequencies, there is evidence of negative CO2-REC coherency which implies that in the long run, REC aids in mitigating CO2. The research of Hasanov et al. (2018) on the CO2-REC interaction in BRICS countries from 1990 to 2017 unveiled CO2-REC negative association. The study of Adedoyin et al. (2021) in Brazil between 1990 and 2018 utilizing the ARDL approach disclosed negative CO2-REC association. In the study of Musa et al. (2021), it was reported that REC enhance environmental quality. Furthermore, the study of Usman et al. (2020b) in the USA established that an upsurge in REC enhances the sustainability of the environment. Similarly, Ike et al. (2020) using the G-7 economies established that decrease in CO2 is caused by increase in REC.

In summary, the majority of the extant studies have focused on the carbon emission perspectives of the environmental degradation. Hence, the present study distinguishes itself by providing a robust analysis of the impact of nonrenewable energy use, economic growth, trade openness, and renewable energy use on carbon emissions using time–frequency techniques (e.g., wavelet correlation, wavelet coherence, partial wavelet, multiple wavelet coherence, and frequency domain causality). The advantage of these techniques is that they can capture information between two time series at different frequencies, i.e. short, medium, and long term respectively. Moreover, this study is distinct from the study of Yuping et al. (2021) by exploring the impact of nonrenewable energy use, economic growth, trade openness, and renewable energy use on carbon emissions at different frequencies and time periods. To the understanding of the investigators, no existing studies on Argentina have been done utilizing the combined wavelet tools utilized in this empirical analysis. Therefore, assessing the combination of these methodologies helps to tap into the novelty of the approaches, thereby informing robust estimates that support proactive policy directions.

Data and methodology

Data

The time–frequency analyses were assessed utilizing yearly data covering the period 1965 to 2019 (55 observations). The dependent variable is carbon emission (CO2) which is calculated as CO2 emissions metric tons that was obtained from a database of British Petroleum (BP). The independent variables are trade openness (TO) which is calculated as trade % of GDP, renewable energy (REC) which is calculated as renewables per capita (kWh), nonrenewable energy use which is calculated as fossil fuel (TWh), and economic growth (GDP) which is calculated as GDP per capita US$. The annual data for this study were changed into the natural log to reduce skewness and ensure its stationarity. Furthermore, Table 1 illustrates the data description. The outcomes from Table 1 disclosed that GDP mean is the highest, which is accompanied by EC, TO, CO2, and REC respectively. The standard deviation is used to determine which variables had more constant scores. The standard deviation of CO2 is the lowest, implying that CO2 scores are less spread out from the mean. Therefore, the score of CO2 is more consistent which is accompanied by EC, GDP, TO, and REC. The skewness disclosed that CO2 and REC are skewed negatively while TO, EC, and GDP are skewed positively. Moreover, the kurtosis value disclosed that CO2 does not affirm to normality while GDP, EC, REC, and TO align with normality. Furthermore, Fig. 3 presents the flow of analysis.

Methodology

Wavelet coherence

Wavelet coherence is employed to detect the time–frequency dependence of renewable energy use, trade openness, nonrenewable energy use, and economic growth on CO2 emissions. Time–frequency dependence takes into account the changes overtime and how the relationship varies from one frequency to another becomes essential and strategic in the formulation of policies (Adebayo 2020; Mutascu 2018). The Morlet wavelet function was employed since it brings balance between phase and amplitude. Morlet wavelet function is defined as follows:

Note: non-dimensional frequency was used by \(\mathcal{w}\); i denotes \(\sqrt{-1p\left(\mathcal{n}\right)}\). Using the time and space, with \(\mathcal{n}\) = 0, 1, 2, 3… N − 1, the time series continuous wavelet transformation (CWT) is defined as:

where k and f symbolize time and frequency, respectively. CWT helps the cross wavelet analysis to interrelate between two variables (Jiang et al. 2021; Shen et al. 2020, 2021). The CWT equation is written below as follows:

The local variance was revealed using the wavelet power spectrum (WPS). The equation defining the WPS is as follows:

To examine the comovement between two time series, the wavelet coherence approach (WTC) was used, which is defined in the equation below:

where the smoothing operator to both time and scale with 0 ≤ R2(k,f) ≤ 1 is denoted as S. WTC can also detect the phase difference \({\phi }_{pq}\) of the two time series, and it is defined in this form:

where \(L\) denotes an imaginary operator while \(O\) stands for a real part operator.

Partial wavelet coherence

The partial wavelet coherence (PWC) is a technique that is comparable to PC. The wavelet transfiguration approach is utilized to analyze PWC. The method catches WC for x1 and x2 series after canceling the x3 effect. The PWC is illustrated by the equations as follows:

The PWC is predicated on a linear connection (by eradicating x3 impact). The PC is depicted as follows:

As stated by Sharif et al. (2021), when the effect of x3 is removed, a low PWC implies that series x2 has minimal influence on x1.

Multiple wavelet coherence

The multiple wavelet coherence (MWC) technique is adequate for assessing the coherency of many variables with other control parameters (Orhan et al. 2021). The equation below depicts the MWC as follows:

Frequency domain causality

The present research takes a step further by assessing the causal linkage between CO2 and the regressors (REN, TI, GDP, and GLO) in the long and short term in the frequency domain. The frequency causality test, contrary to the conventional time domain Granger causality test, provides crucial information on causality between two series at different frequencies (Breitung and Candelon 2006). As a result, it is useful for evaluating time-dependent shocks in a certain frequency domain (Kirikkaleli and Adebayo 2020). The basis of the test is a recreated VAR between x and y, represented as:

The Akaike information criterion (AIC) is utilized in lag \(l\) selection. Centered on Geweke (1982), null hypothesis (M) is \({M}_{y\to x}\left(\omega \right)=0\), where the frequency is \(\omega \varepsilon \left(0,\pi \right)\), and adjusted null hypothesis (H) is formulated as follows:

The vector linked to y coefficients is denoted by \(\beta\).

The null hypothesis pinpoints that at frequency \({\omega }_{0}\), X does not cause Y. Breitung and Candelon (2006) propose 5% and 10% significance values for all frequencies in the interval (0,π). Frequency ω is linked to period t as \(t=2\pi /\omega\).

Findings and discussion

Findings

The present research commenced by exploring the correlation between CO2 and the regressors. In doing so, we applied the wavelet correlation (WC) test. The advantage of the WC is that it can detect the correlation between CO2 and GDP, REC, EC, and TO at different frequencies (i.e., short and long term). The WC between CO2 and GDP, EC, REC, and TO at different scales is depicted in Figure 4a–d. The Monte Carlo method is utilized to perform the WC. The graphs show the correlation between CO2 and GDP, EC, TO, and REC at various levels. If the value of correlation between two variables is close to 0, it indicates no dependency between the series. However, if the correlation coefficient is close to 1, there is dependency between the series. In addition, a negative correlation denotes that two series move in different paths, while a positive correlation means movement in the same direction. Thus, we applied the WC to eliminate the fundamental concealed information in the data associated with the time domain correlation technique. The outcomes from the WC show that:

-

a.

In all the scales, there is a CO2-GDP positive connection, though the coefficient of the correlation is stronger in the medium and long term compared to the short term.

-

b.

As anticipated, the CO2-EC correlation is positive in all the scales (0–8). In the short term, the CO2-EC correlation is positive; however, as we move to the medium and long term, the CO2-EC correlation is more significant.

-

c.

In the short and medium term, there is a negative correlation between CO2 and REC where the negative correlation is stronger in the medium term. Nonetheless, as we move into the long term, the CO2-REC becomes weak and positive. This implies that in the long term, REC and CO2 move in the same direction.

-

d.

The correlation between CO2 and TO is negative and significant in the short and medium term. Nonetheless, in the long term, there is evidence of positive CO2-TO connection. This implies that in the short and medium term, CO2 and TO move in opposite directions whereas in the long term, they move in the same direction.

The present research applied wavelet coherence (WTC) to catch the series comovement and lead/lag association at different frequencies and periods between series. This approach is crafted from mathematics and is utilized to acquire previously unnoticed information. As a result, the study looks at the association between series at different frequencies. The white cone where discourse takes place in the WTC is known as the cone of impact (COI). The black boundary depicts a significance level predicated on simulations. The short, medium, and long periods are illustrated by 0–4, 4–8, and 8–16, respectively, in Fig. 5a–d. Furthermore, the figure’s horizontal and vertical axes represent time and frequency respectively. The colors blue and yellow represent low and high interdependence between the series. The leftward and rightward arrows represent out-of-phase and in-phase connections, respectively. Moreover, the rightward-down (leftward-up) signifies that the first series lead (cause) the second series, whereas the rightward-up (leftward-down) signifies that the second series lead (cause) the first series. The outcomes of the WTC are illustrated as follows:

-

a.

Fig. 5a depicts the WTC between GPD and CO2 in Argentina from 1965 to 2019. The WCT identifies regions in which there is coherence between GDP and CO2 in the time and frequency domains. The results of Fig. 3a show impressive outcomes. The WTC results unveiled that between 1970 and 1985 at different periods of scales 0–16, CO2 and GDP are in-phase (positive coherence) with GDP leading (GDP has a positive causal influence on CO2). In addition, in the medium and long term, there is an in-phase (positive connection) between CO2 and GDP at a period of scales 4–16 between 2005 and 2015 with GDP CO2 leading (CO2 has a positive causal influence on GDP).

-

b.

Fig. 5b depicts the WTC between CO2 and EC. At a different period of scales 0–16, the majority of the arrows are pointing to the right which signifies positive comovement between EC and CO2 between 1975 and 2005. During this period, majority of the arrows are rightward-up signifying that EC is leading (EC has a positive causal influence on CO2).

-

c.

The WTC between CO2-REC in Argentina between 1965 and 2019 is depicted in Fig. 5c. In the long term, at a period of scales 8–16, the arrows are leftward-down between 1985 and 1995 which signifies negative coherence between CO2 and REC with REC leading (REC has a negative causal influence on CO2). The findings unveiled that in the medium frequency (medium term) at a period of scales 4–8, the arrows are facing left and down which illustrate a negative coherence between REC and CO2 from 1997 to 2005 with REC leading (REC has a negative causal influence on CO2).

-

d.

The WTC between CO2-TO in Argentina between 1965 and 2019 is depicted in Fig. 5d. In the medium term at period of scales 4–8, between 1997 and 2007, the arrows are leftward-up which mirror CO2-TO negative coherency with CO2 leading (CO2 has a negative causal influence on TO).

The research applied the PWC to identify the effect of the second variable (x2) on the first variable (x1) after removing the third series (x3) effect. Figure 6a presents the PWC between CO2 and REC after EC effect is annulled. The circular black line that encloses the main power areas denotes the COI. On the horizontal and vertical axes, time and frequency (year) are displayed, accordingly. The degrees of correlation between the series are shown by the colors in the color bar. The yellow and blue colors denote a high and low level of coherence respectively. In the period of scale 4–8 years, from 1990 to 1992, and 2003 to 2007, REC has a weak effect on CO2 with the EC effect canceled. Figure 7b displays the PWC between REC and CO2 after TO impact has been eliminated. At the period of scale 8–16 years, between 1985 and 2000, the impact of REC on CO2 is weak with the TO effect eliminated. Figure 7c shows the PWC between CO2 and REC with GDP impact eradicated. Moreover, from 2000 to 2006, at the middle frequency and period of scale 4–8 years, there is coherency between CO2 and REC after the influence of GDP is removed. The impact of EC on CO2 after annulling the effect of REC is depicted in Fig. 6d. There is a significant coherency between CO2 and EC after REC influence is eradicated at different frequencies between 1980 and 2015. Moreover, the EC influence on CO2 after annulling the TO effect is presented in Fig. 6e. At all frequencies, EC impact on CO2 is strong between 1975 and 2015 with the TO influence neglected. Figure 7f presents the EC effect on CO2 after GDP impact is eradicated. The outcome disclosed no proof of significant coherence between CO2 and EC after GDP effect is eradicated.

Furthermore, Fig. 6g portrays the TO effect on CO2 after REC impact is eradicated. The outcome disclosed no proof of significant coherence between CO2 and EC after GDP effect is eradicated. The impact of TO on CO2 after annulling the effect of EC is depicted in Fig. 6h. There is a significant coherency between CO2 and TO after REC influence is eradicated at different frequencies between 1995 and 2010. Figure 6i depicts the PWC between TO and CO2 with GDP influenced annulled. At different medium frequencies, between 2000 and 2005, the effect of TO on CO2 is significant with GDP impact dismissed. Also, the impact of GDP on CO2 after annulling the effect of REC is presented in Fig. 7j with significant coherence observed at all frequencies from 1975 to 1985, and from 2000 to 2015. Figure 6k portrays the GDP effect on CO2 after EC impact is eradicated. The outcome disclosed no proof of significant coherence between CO2 and GDP after EC effect is eradicated. Also, the impact of GDP on CO2 after annulling the effect of TO is presented in Fig. 6l with significant coherence observed at all frequencies from 1970 to 1985, and from 2005 to 2015.

The current research also assesses the influence of the second variable (x1) and third variable (x3) on the first variable (x1) by applying the multiple wavelet coherence (MWC). Figure 7a–f presents the MWC for Spain for the period 1980 to 2018. Figure 8a presents the MWC depicting the effect of REC on CO2 without eradicating EC impact. At different frequencies, from 1970 to 2015, REC has a strong influence on CO2 by taking into account the impact of EC. Figure 8b signifies the MWC depicting the effect of REC on CO2 considering TO impact. In the long term, from 1970 to 2015, REC has a strong influence on CO2 when TO is considered. Figure 8c illustrates the MWC depicting the effect of REC on CO2 considering GDP influence. At different frequencies from 1970 to 1975 and from 2000 to 2015, there is strong coherency between REC and CO2 with GDP impact considered. Figure 8d signifies the MWC depicting the effect of EC on CO2 considering TO impact. In the long term, from 1970 to 2015, EC has a strong influence on CO2 when TO is considered. Figure 8e illustrates the MWC depicting the effect of EC on CO2 considering GDP influence. At different frequencies from 1970 to 2015, there is strong coherency between EC and CO2 with GDP impact considered. Figure 7f depicts the MWC illustrating the effect of GDP on CO2 considering TO impact. At various frequencies, the GDP effect on CO2 considering TO influence is strong from 1970 to 2015.

The study also applied the frequency domain causality (FDC) test to capture the causal linkage from EC, REC, TO, and GDP to CO2 emissions at different frequencies. The novelty of the FDC causality test is that it can detect causality between two series at various frequencies. Figure 8a shows that in the long term, nonrenewable energy utilization causes CO2. This implies that the utilization of nonrenewable energy is a significant predictor of CO2 in Argentina. Also, in the long and medium term, there is evidence of causality from TO to CO2, suggesting that TO is an important indicator in predicting CO2 (see Fig. 8b). Moreover, in the long and medium term, GDP does not Granger cause CO2; however, in the short term, GDP Granger causes CO2 (see Fig. 8c). Finally, in the long term, REC causes CO2, suggesting that REC can predict CO2 (see Fig. 8d). These outcomes are significant, which will be helpful for policymakers in Argentina.

Discussion of findings

A discussion on the findings of the current study is presented in this section. The current research employed the novel wavelet coherence (WTC) analysis to capture the coherence and lead/lag connection between CO2 and energy use (EC), renewable energy use (REC), trade openness (TO), and economic growth (GDP) at different frequencies and periods. The WTC outcomes revealed a positive coherence between CO2 and GDP, primarily in the medium and long term, which illustrates that an upsurge in GDP is followed by an upsurge in CO2 in Argentina. The positive CO2-GDP relationship may be explained by the fact that fossil fuels are the major inputs for industry and agriculture, which impact both environmental deterioration and CO2 (Alola et al. 2019). The rise in CO2 is caused by economic expansion in Argentina connected to trade development, economic capitalization, investment, and the development of infrastructure, which has a positive influence on economic activity and, as a result, boosts the consumption of energy (Kihombo et al. 2021; Lin et al. 2021). Furthermore, it can largely be ascribed to fundamental economic shifts, including the shift from rural to industrial activities. Another potential reason for this influence is that increased economic growth results in more environmental degradation (CO2) at high income levels owing to increased industrial companies. Consequently, during an economic boom, people and businesses will have more income and, as a result, will consume more energy from transportation, appliances, and electric gadgets among many other things, thus contributing to a rise in emissions. This study finding complies with the works of Shan et al. (2021) for highly decentralized nations, Akinsola et al. (2021a) for Indonesia, and Tufail et al. (2021) for highly decentralized economies.

In the short and long term, there is a positive and significant coherence between CO2 and nonrenewable energy utilization, which suggests that the utilization of nonrenewable energy induces CO2 in Argentina, whereas at the medium and low frequencies (medium and long term), CO2 and renewable energy consumption are out of phase (negative association). This demonstrates that cleaner and greener energy sources lower emission levels in the atmosphere. This is not an unexpected outcome and it complies with prior studies (Fatima et al. 2021; Ibrahim and Ajide 2021; Mohsin et al. 2021).

In the medium term, there is a negative connection between CO2 and trade openness, although in the long term, there is no significant connection between CO2 and TO. This implies that in the medium term, trade openness in Argentina aids in mitigating CO2 emissions. The scale effect may all be used to justify the connection between trade openness and CO2. The scale effect postulates that trade liberalization increases a nation’s volume of exports, resulting in increased growth in the economy. This increase in economic growth raises the economy’s income level, prompting the nation to import environmentally friendly technologies to boost production levels (i.e., technique effect). Furthermore, trade openness creates rivalry among local manufacturers, encouraging them to adopt modern technology to reduce per-unit costs and, as a result, mitigate emissions during production. This outcome complies with the study of Mutascu (2018) and Wang et al. (2021b), who established a negative TO-CO2 association.

Furthermore, the outcomes of the partial wavelet coherence support the outcomes of the wavelet coherence. The outcomes of the PWC revealed that when the effect of the third variable is neglected, the coherence between the first and second variables is weak. In order to capture the influence of the two variables on CO2, the study applied the multiple wavelet coherence (MWC) and the outcomes showed that when the third variable is considered, the influence of the second and third variables is strong and significant. Lastly, we applied the frequency domain causality test to validate the causality between CO2 and the regressors at various frequencies. The outcomes disclosed that in the long term, economic growth, energy utilization, and trade openness can predict CO2 emissions.

Conclusion and policy suggestions

Conclusion

In the present study, we applied the wavelet correlation, multiple and partial wavelet coherence, and wavelet coherence to assess the comovements over time and frequency between CO2 and the regressors using a dataset from 1965 to 2019. As previously mentioned, the wavelet method in the spectral context was utilized in the present research to assess the comovements between CO2 emissions and regressors over time and different frequency bands, as well as to elucidate the lead/lag connection. The research’s main contribution is that it matches with prior studies and stresses the use of the wavelet technique in investigating connections between CO2 and GDP, REC, TO, and EC. The research also sought to elucidate how the interconnectedness between the variables under consideration evolves over time and at various frequencies. To the best of the researchers’ knowledge, this is the first study to apply the wavelet tools to assess the connection between CO2 and EC, REC, TO, and GDP in Argentina. Thus, we fill a gap in the ongoing research.

The findings reveal a new perspective on the time and frequency interconnections between CO2 and EC, REC, TO, and GDP in Argentina. The outcomes show how coherence between CO2 and EC, REC, TO, and GDP has evolved and progressed in the time and frequency domain. This investigation demonstrates notable wavelet coherence and strong lead/lag correlations in terms of frequency. From a time perspective, the present analysis demonstrates strong but heterogeneous associations between CO2 and EC, REC, TO, and GDP. Furthermore, research on the phases demonstrates that these comovements are not equal across time scales and are most significant in the short, medium, and long term. The outcomes from the wavelet coherence demonstrated that in the medium term, renewable energy and trade openness decrease CO2 emissions, while in the short, medium, and long term, energy use and economic growth contribute to CO2 emissions.

Policy recommendation

Due to Argentina’s long-term economic ambitions, sustainable development and cleaner growth are a priority. Environmental degradation, on the other hand, may serve as a roadblock to attaining sustainable development objectives. As a result, to decrease pollution, Argentina should launch public awareness campaigns and implement the necessary structural reforms so that income levels can rise without an increase in emissions. Ultimately, our research supports the findings of earlier studies and suggests that cleaner energy and renewable sources could be used as a policy instrument to minimize pollution and harm to the environment. We can draw some useful conclusions for a greener and more sustainable environment based on the aforementioned empirical results for Argentina. These policy consequences may also aid Argentina in meeting the United Nations’ Sustainable Development Goals, which include a greener and cleaner environment as well as increased energy efficiency. According to the conclusions of this research, to lower air pollution levels, authorities should establish stringent regulations, stimulate investment in renewable energy sources, and enhance energy innovation.

Renewable energy consumption improves people’s well-being. Additional energy from economic expansion must be converted into renewable energy sources, necessitating a technical shift, which is an efficient way of reducing CO2. Argentina should make strategic investments and increase research and innovation funds for renewable energy generation. As a result of the increasing growth in the economy, Argentina’s energy demand has also grown, while the proportion of renewable energy in the energy mix has decreased. To stimulate a decrease in the share of fossil fuels in overall energy use, investment in clean energy sources is necessary. Improvements in renewable infrastructure can also be aided by economic growth and income levels. As a result, policymakers should pay special attention to this issue and encourage investment in greener, cleaner technology. Furthermore, companies that rely on fossil fuels and nonrenewable energy sources for production and transportation should find alternative energy sources (renewables).

Limitation of study

A caveat to the present study is that the empirical investigation is subjective toward the influence of energy, economic growth, renewable energy use, and trade openness on CO2 emissions and does not incorporate foreign direct investment, globalization, urbanization, and other determinants of environmental degradation. Furthermore, future studies should also utilize other environmental degradation proxies such as ecological footprint, load factor, and consumption-based carbon emissions to assess these associations.

Data availability

Data is readily available at https://data.worldbank.org/country/Argentina.

References

Adebayo TS (2020) Revisiting the EKC hypothesis in an emerging market: an application of ARDL-based bounds and wavelet coherence approaches. SN Appl Sci 2(12):1945. https://doi.org/10.1007/s42452-020-03705-y

Adebayo TS, Acheampong AO (2021) Modelling the globalization-CO2 emission nexus in Australia: evidence from quantile-on-quantile approach. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-16368-y

Adebayo TS, Kirikkaleli D (2021) Impact of renewable energy consumption, globalization, and technological innovation on environmental degradation in Japan: application of wavelet tools. Environ Dev Sustain. https://doi.org/10.1007/s10668-021-01322-2

Adedoyin FF, Adebayo TS, Kirikkaleli D (2021) Toward a sustainable environment: nexus between consumption-based carbon emissions, economic growth, renewable energy and technological innovation in Brazil. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-14425-0

Ahmed Z, Nathaniel SP, Shahbaz M (2021a) The criticality of information and communication technology and human capital in environmental sustainability: evidence from Latin American and Caribbean countries. J Clean Prod 286:125529. https://doi.org/10.1016/j.jclepro.2020.125529

Ahmed Z, Zhang B, Cary M (2021b) Linking economic globalization, economic growth, financial development, and ecological footprint: evidence from symmetric and asymmetric ARDL. Ecol Ind 121:107060. https://doi.org/10.1016/j.ecolind.2020.107060

Akinsola GD, Adebayo TS, Kirikkaleli D, Bekun FV, Umarbeyli S, Osemeahon OS (2021a) Economic performance of Indonesia amidst CO2 emissions and agriculture: a time series analysis. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-13992-6

Akinsola GD, Awosusi AA, Kirikkaleli D, Umarbeyli S, Adeshola I, Adebayo TS (2021b) Ecological footprint, public-private partnership investment in energy, and financial development in Brazil: a gradual shift causality approach. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-15791-5

Alola AA (2019) The trilemma of trade, monetary and immigration policies in the United States: accounting for environmental sustainability. Sci Total Environ 658:260–267. https://doi.org/10.1016/j.scitotenv.2018.12.212

Alola AA, Bekun FV, Sarkodie SA (2019) Dynamic impact of trade policy, economic growth, fertility rate, renewable and non-renewable energy consumption on ecological footprint in Europe. Sci Total Environ 685:702–709. https://doi.org/10.1016/j.scitotenv.2019.05.139

Awosusi AA, Kirikkaleli D, Akinsola GD, Adebayo TS, Mwamba MN (2021) Can CO2 emissions and energy consumption determine the economic performance of South Korea? A time series analysis. Environ Sci Pollut Res 28(29):38969–38984. https://doi.org/10.1007/s11356-021-13498-1

Bibi A, Zhang X, Umar M (2021) The imperativeness of biomass energy consumption to the environmental sustainability of the United States revisited. Environ Ecol Stat. https://doi.org/10.1007/s10651-021-00500-9

BP (2021) British Petroleum. https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2019-china-insights.pdf. Accessed on 30 May 2021. https://www.bp.com/en/global/corporate/careers/professionals/locations/sweden.html#/

Breitung J, Candelon B (2006) Testing for short- and long-run causality: a frequency-domain approach. J Econ 132(2):363–378. https://doi.org/10.1016/j.jeconom.2005.02.004

Dogan E, Inglesi-Lotz R (2020) The impact of economic structure to the environmental Kuznets curve (EKC) hypothesis: evidence from European countries. Environ Sci Pollut Res 27(11):12717–12724. https://doi.org/10.1007/s11356-020-07878-2

Dogan E, Sebri M, Turkekul B (2016) Exploring the relationship between agricultural electricity consumption and output: new evidence from Turkish regional data. Energy Policy 95:370–377. https://doi.org/10.1016/j.enpol.2016.05.018

Dong K, Sun R, Jiang H, Zeng X (2018) CO2 emissions, economic growth, and the environmental Kuznets curve in China: what roles can nuclear energy and renewable energy play? J Clean Prod 196:51–63. https://doi.org/10.1016/j.jclepro.2018.05.271

Fatima T, Shahzad U, Cui L (2021) Renewable and nonrenewable energy consumption, trade and CO2 emissions in high emitter countries: does the income level matter? J Environ Planning Manage 64(7):1227–1251. https://doi.org/10.1080/09640568.2020.1816532

Gao C, Ge H, Lu Y, Wang W, Zhang Y (2021) Decoupling of provincial energy-related CO2 emissions from economic growth in China and its convergence from 1995 to 2017. J Clean Prod 297:126627. https://doi.org/10.1016/j.jclepro.2021.126627

Grossman GM, Krueger AB (1991) Environmental impacts of a North American free trade agreement. In Papers (No. 158; Papers). Princeton, Woodrow Wilson School - Public and International Affairs. https://ideas.repec.org/p/fth/priwpu/158.html

Hasanov FJ, Liddle B, Mikayilov JI (2018) The impact of international trade on CO2 emissions in oil exporting countries: territory vs consumption emissions accounting. Energy Econ 74:343–350. https://doi.org/10.1016/j.eneco.2018.06.004

He X, Adebayo TS, Kirikkaleli D, Umar M (2021) Consumption-based carbon emissions in Mexico: an analysis using the dual adjustment approach. Sustain Prod Consump 27:947–957. https://doi.org/10.1016/j.spc.2021.02.020

Ibrahim RL, Ajide KB (2021) Nonrenewable and renewable energy consumption, trade openness, and environmental quality in G-7 countries: the conditional role of technological progress. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-13926-2

IEA (2021) International Energy Association. https://www.iea.org/countries/sweden. Accessed 23 Feb 2021

Ike GN, Usman O, Alola AA, Sarkodie SA (2020) Environmental quality effects of income, energy prices and trade: the role of renewable energy consumption in G-7 countries. Sci Total Environ 721:137813. https://doi.org/10.1016/j.scitotenv.2020.137813

Jamel L, Maktouf S (2017) The nexus between economic growth, financial development, trade openness, and CO2 emissions in European countries. Cogent Econ Financ 5(1):1341456. https://doi.org/10.1080/23322039.2017.1341456

Ji X, Zhang Y, Mirza N, Umar M, Rizvi SKA (2021) The impact of carbon neutrality on the investment performance: evidence from the equity mutual funds in BRICS. J Environ Manag 297:113228. https://doi.org/10.1016/j.jenvman.2021.113228

Jiang L, Zhang B, Han S, Chen H, Wei Z (2021) Upscaling evapotranspiration from the instantaneous to the daily time scale: assessing six methods including an optimized coefficient based on worldwide eddy covariance flux network. J Hydrol 596:126135. https://doi.org/10.1016/j.jhydrol.2021.126135

Kihombo S, Vaseer AI, Ahmed Z, Chen S, Kirikkaleli D, Adebayo TS (2021) Is there a tradeoff between financial globalization, economic growth, and environmental sustainability? An advanced panel analysis. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-15878-z

Kirikkaleli D, Adebayo TS (2020) Do renewable energy consumption and financial development matter for environmental sustainability? New global evidence. Sustain Dev 2(4). https://doi.org/10.1002/sd.2159

Kirikkaleli D, Adebayo TS (2021) Do public-private partnerships in energy and renewable energy consumption matter for consumption-based carbon dioxide emissions in India? Environ Sci Pollut Res 28(23):30139–30152. https://doi.org/10.1007/s11356-021-12692-5

Kraft J, Kraft A (1978) On the relationship between energy and GNP. J Energy Dev 3(2):401–403

Li X, Zhang K, Gu P, Feng H, Yin Y, Chen W, Cheng B (2021) Changes in precipitation extremes in the Yangtze River Basin during 1960–2019 and the association with global warming, ENSO, and local effects. Sci Total Environ 760:144244. https://doi.org/10.1016/j.scitotenv.2020.144244

Lin X, Zhao Y, Ahmad M, Ahmed Z, Rjoub H, Adebayo TS (2021) Linking innovative human capital, economic growth, and CO2 emissions: an empirical study based on Chinese provincial panel data. Int J Environ Res Public Health 18(16):8503. https://doi.org/10.3390/ijerph18168503

Mohsin M, Kamran HW, Atif Nawaz M, Sajjad Hussain M, Dahri AS (2021) Assessing the impact of transition from nonrenewable to renewable energy consumption on economic growth-environmental nexus from developing Asian economies. J Environ Manage 284:111999. https://doi.org/10.1016/j.jenvman.2021.111999

Musa MS, Jelilov G, Iorember PT, Usman O (2021) Effects of tourism, financial development, and renewable energy on environmental performance in EU-28: does institutional quality matter? Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-14450-z

Mutascu M (2018) A time-frequency analysis of trade openness and CO2 emissions in France. Energy Policy 115:443–455. https://doi.org/10.1016/j.enpol.2018.01.034

Odugbesan JA, Adebayo TS, Akinsola GD, Olanrewaju VO (2021) Determinants of environmental degradation in Thailand: empirical evidence from ARDL and wavelet coherence approaches. Pollution 7(1):181–196. https://doi.org/10.22059/poll.2020.309083.8853

Orhan A, Adebayo TS, Genç SY, Kirikkaleli D (2021) Investigating the linkage between economic growth and environmental sustainability in India: do agriculture and trade openness matter? Sustainability 13(9):4753. https://doi.org/10.3390/su13094753

Ozturk I, Acaravci A (2016) Energy consumption, CO2 emissions, economic growth, and foreign trade relationship in Cyprus and Malta. Energy Sources Part B 11(4):321–327. https://doi.org/10.1080/15567249.2011.617353

Panayotou T (1997) Demystifying the environmental Kuznets curve: turning a black box into a policy tool. Environ Dev Econ 2(4):465–484. https://doi.org/10.1017/S1355770X97000259

Pata UK (2021) Renewable and non-renewable energy consumption, economic complexity, CO2 emissions, and ecological footprint in the USA: testing the EKC hypothesis with a structural break. Environ Sci Pollut Res 28(1):846–861. https://doi.org/10.1007/s11356-020-10446-3

Rjoub H, Akinsola GD, Oladipupo SD, Adebayo TS (2021) The asymmetric effects of renewable energy consumption and trade openness on carbon emissions in Sweden: new evidence from quantile-on-quantile regression approach. Environ Sci Pollut Res 1–12. https://doi.org/10.1007/s11356-021-15706-4

Sarkodie SA, Strezov V (2018) Empirical study of the environmental Kuznets curve and environmental sustainability curve hypothesis for Australia, China, Ghana and USA. J Clean Prod 201:98–110. https://doi.org/10.1016/j.jclepro.2018.08.039

Shahbaz M, Shafiullah M, Papavassiliou VG, Hammoudeh S (2017) The CO2–growth nexus revisited: a nonparametric analysis for the G7 economies over nearly two centuries. Energy Economics 65:183–193. https://doi.org/10.1016/j.eneco.2017.05.007

Shan S, Ahmad M, Tan Z, Adebayo TS, Man Li RY, Kirikkaleli D (2021) The role of energy prices and non-linear fiscal decentralization in limiting carbon emissions: tracking environmental sustainability. Energy 234:121243. https://doi.org/10.1016/j.energy.2021.121243

Sharif A, Bhattacharya M, Afshan S, Shahbaz M (2021) Disaggregated renewable energy sources in mitigating CO2 emissions: new evidence from the USA using quantile regressions. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-13829-2

Shen X, Jiang M, Lu X, Liu X, Liu B, Zhang J, Wang X, Tong S, Lei G, Wang S, Tong C, Fan H, Tian K, Wang X, Hu Y, Xie Y, Ma M, Zhang S, Cao C, Wang Z (2021) Aboveground biomass and its spatial distribution pattern of herbaceous marsh vegetation in China. Sci China Earth Sci 64(7):1115–1125. https://doi.org/10.1007/s11430-020-9778-7

Shen X, Liu B, Jiang M, Lu X (2020) Marshland loss warms local land surface temperature in China. Geophys Res Lett 47(6):e2020GL087648. https://doi.org/10.1029/2020GL087648

Solarin SA, Al-Mulali U, Musah I, Ozturk I (2017) Investigating the pollution haven hypothesis in Ghana: an empirical investigation. Energy 124:706–719. https://doi.org/10.1016/j.energy.2017.02.089

Soylu ÖB, Adebayo TS, Kirikkaleli D (2021) The imperativeness of environmental quality in China amidst renewable energy consumption and trade openness. Sustainability 13(9):5054. https://doi.org/10.3390/su13095054

Su C-W, Song Y, Umar M (2021a) Financial aspects of marine economic growth: from the perspective of coastal provinces and regions in China. Ocean Coast Manag 204:105550. https://doi.org/10.1016/j.ocecoaman.2021.105550

Su Z-W, Umar M, Kirikkaleli D, Adebayo TS (2021b) Role of political risk to achieve carbon neutrality: evidence from Brazil. J Environ Manage 298:113463. https://doi.org/10.1016/j.jenvman.2021.113463

Tao R, Umar M, Naseer A, Razi U (2021) The dynamic effect of eco-innovation and environmental taxes on carbon neutrality target in emerging seven (E7) economies. J Environ Manage 299:113525. https://doi.org/10.1016/j.jenvman.2021.113525

Tian P, Li D, Lu H, Feng S, Nie Q (2021) Trends, distribution, and impact factors of carbon footprints of main grains production in China. J Clean Prod 278:123347. https://doi.org/10.1016/j.jclepro.2020.123347

Tufail M, Song L, Adebayo TS, Kirikkaleli D, Khan S (2021) Do fiscal decentralization and natural resources rent curb carbon emissions? Evidence from developed countries. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-13865-y

Umar M, Ji X, Kirikkaleli D, Xu Q (2020) COP21 roadmap: do innovation, financial development, and transportation infrastructure matter for environmental sustainability in China? J Environ Manag 271:111026. https://doi.org/10.1016/j.jenvman.2020.111026

Usman O, Akadiri SS, Adeshola I (2020a) Role of renewable energy and globalization on ecological footprint in the USA: implications for environmental sustainability. Environ Sci Pollut Res Int 30681–30693

Usman O, Alola AA, Sarkodie SA (2020b) Assessment of the role of renewable energy consumption and trade policy on environmental degradation using innovation accounting: evidence from the US. Renewable Energy 150:266–277. https://doi.org/10.1016/j.renene.2019.12.151

Wang K-H, Liu L, Adebayo TS, Lobon O-R, Claudia MN (2021a) Fiscal decentralization, political stability and resources curse hypothesis: a case of fiscal decentralized economies. Resour Policy 72:102071. https://doi.org/10.1016/j.resourpol.2021.102071

Wang Z, Ben Jebli M, Madaleno M, Doğan B, Shahzad U (2021b) Does export product quality and renewable energy induce carbon dioxide emissions: evidence from leading complex and renewable energy economies. Renewable Energy 171:360–370. https://doi.org/10.1016/j.renene.2021.02.066

World Bank (2020) World Development Indicators. http://data.worldbank.org/country. Accessed 16 Apr 2021

Xue Y, Lu H, Guan Y, Tian P, Yao T (2021) Impact of thermal condition on vegetation feedback under greening trend of China. Sci Total Environ 785:147380. https://doi.org/10.1016/j.scitotenv.2021.147380

Yuping L, Ramzan M, Xincheng L, Murshed M, Awosusi AA, Bah SI, Adebayo TS (2021) Determinants of carbon emissions in Argentina: the roles of renewable energy consumption and globalization. Energy Rep 7:4747–4760. https://doi.org/10.1016/j.egyr.2021.07.065

Zhang J, Dai Y, Su C-W, Kirikkaleli D, Umar M (2021a) Intertemporal change in the effect of economic growth on carbon emission in China. Energy Environ 0958305X211008618. https://doi.org/10.1177/0958305X211008618

Zhang L, Li Z, Kirikkaleli D, Adebayo TS, Adeshola I, Akinsola GD (2021b) Modeling CO2 emissions in Malaysia: an application of Maki cointegration and wavelet coherence tests. Environ Sci Pollut Res 28(20):26030–26044. https://doi.org/10.1007/s11356-021-12430-x

Zhang L, Zheng J, Tian S, Zhang H, Guan X, Zhu S, Zhang X, Bai Y, Xu P, Zhang J, Li Z (2020) Effects of Al3+ on the microstructure and bioflocculation of anoxic sludge. J Environ Sci 91:212–221. https://doi.org/10.1016/j.jes.2020.02.010

Author information

Authors and Affiliations

Contributions

TSA collected data and HR analyzed it. The introduction and literature review sections are written by TSA and he also constructed the methodology section and empirical outcomes in the study. HR contributed to the interpretation of the outcomes and policymaking. All the authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval

This study follows all ethical practices during writing.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Roula Inglesi-Lotz

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Adebayo, T.S., Rjoub, H. A new perspective into the impact of renewable and nonrenewable energy consumption on environmental degradation in Argentina: a time–frequency analysis. Environ Sci Pollut Res 29, 16028–16044 (2022). https://doi.org/10.1007/s11356-021-16897-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-16897-6