Abstract

Institutional quality largely influences the ways in which economic agents align their production and operational behaviors towards expanding the share of renewable energy in the total energy mix and enhancing environmental performance. This study therefore explores the panel data for the EU-28 countries to assess the dynamic effects of institutional quality, tourism development, financial development, and renewable energy on environmental performance over the period 2002 to 2014. Using a two-step dynamic system generalized method of moments (GMM), the empirical results broadly suggest that institutional quality can be explored to dampen the potential negative effects of tourism and economic growth on environmental performance. In addition, financial development and renewable energy are positively related to environmental performance. This suggests that financial stability and energy consumption transition to renewable energy are necessary requirements to improve environmental performance. The policy implication for this study is that strengthening of institutional quality, financial stability, and adjusting to alternative and clean energy systems are the surest ways to achieve a cleaner and sustainable environment in the EU region.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

One of the major goals of the European Union member countries (EU-28) in recent times is to mitigate environmental consequences of carbon dioxide (CO2) accumulation and other greenhouse gasses (GHGs), which led to global warming and climate change. Following the Kyoto Treaty, the Paris Climate Conference (COP 21), and other wider global initiative to reduce the country-level greenhouse gasses (GHGs) emissions, EU countries as signatories to these agreements and conferences, have initiated a series of environmental policies and energy use strategies to reduce the usage of fuel oil and other traditional energy consumption patterns related to environmental issues in the region (see Ummalla et al. 2019; Apergis and Garcia 2019; Usman et al. 2019; Balsalobre-Lorente et al. 2018; Paramati et al. 2020; Dogan et al. 2019; Dogan and Inglesi-Lotz 2020; Ali et al. 2021).

Several studies have considered rapid worldwide tourism development, financial development, and energy use as the major driving forces behind environmental pollution (See Mavragani et al. 2016; Azam et al. 2018; Usman et al. 2020a, b; Agbanike et al. 2019; Destek and Sarkodie 2019; Iorember et al. 2020a; Usman et al. 2020d). The rapid development of tourism and the financial sector may lead to an upsurge in environmental degradation through an increase in energy consumption in the areas of transport, restaurant, and hotels, recreational centers, information technology, and so on and hence economic growth (Mamirkulova et al. 2020; Aman et al. 2019). However, the degree of their effects may be dependent on the quality of the institutions. For example, Bhattacharya et al. (2017) argue that the accumulation of carbon emission across countries is determined by the efficiency of institutions. A weak institution creates a fertile ground for environmental degradation, while a strong institution strengthens environmental improvement through total compliance with environmental laws. Usman et al. (2020a) reveal that the level of environmental performance is positively dependent on institutional quality such as good governance, degree of democratization and accountability, rule of law, corruption control, and political stability. This is because institutions normally exert pressure on economic agents to operate in a manner that does not harm the environment severely. Similarly, a recent study by Ali et al. (2019) and Azam et al. (2020) submits that institutional quality measured in terms of political stability, administrative capacity, and democratic accountability has improved the quality of the environment through its negative effect on the ecological footprint. The argument here is that institutional quality, such as market-based instruments (carbon taxes and subsidies), largely influences the ways in which economic agents align their production and operational behaviors towards enhancing environmental performance. In addition, Azam et al. (2020) show a positive relationship between institutional quality and fossil fuel-based energy use, suggesting that an increase in institutional quality increases CO2 emission and declines environmental performance. This reaffirms the major conclusion in Mavragani et al. (2016) and Ozturk et al. (2019) that environmental performance responds positively to the reduction in corruption.

The European Union region is considered as an interesting case following its commitments to improving environmental quality in the region amidst several policies, which have aggressively increased tourism and financial sectors in the region over the years. According to the statistics reported by the United Nations World Tourism Organization (UNWTO) (2019), the growth of the international tourist arrivals to Europe in 2019 was 3.6% while the travel and tourism sectors generated roughly 14.4 million direct jobs in 2018 with about 2155.5 billion USD contribution to the gross domestic product (GDP) of the region. Moreover, the region has promoted renewable energy consumption over the years. As shown by the European Commission (2020), in 2019, the total primary production of renewables from all sources amounts to 1029 terawatt hours (TWh). This forms about 37.5% of the total primary energy production in 2019. Also, the share of renewable energy consumption in 2018 was 18.9% with the expectation that it will rise to 27% by 2030 based on the present commitments particularly in the area of investment in renewable energy research and development. This agrees with the position of literature that increasing the share of renewable energy in the energy mix improves the quality of the environment through a reduction in CO2 emissions (Paramati et al. 2017; Zoundi 2017; Hanif 2018; Iorember et al. 2020a, b; Usman et al. 2020d).

To underpin the contributions of tourism and financialization to a sustainable environmental quality system, institutions should be strengthened to moderate the environmental effects of tourism and development. Theoretically, institutions can increase energy efficiency, which in turn improves environmental quality. Given this background, the main objective of the current study is to assess the effects of tourism development, financial development, renewable energy, and economic growth on environmental performance while controlling for institutional quality in the EU-28 countries Therefore, in this study, we do not only contribute to the literature by assessing the effects of tourism, financial development, and renewable energy on the EU environment as it is typical of other studies (see Usman et al. 2020a), but also we account for the role of institutional quality on environmental quality. In addition, we measure environmental quality by using the Environmental Performance Index (EPI), a policy-oriented dataset that evaluates comprehensively a country’s environmental performance. The EPI is calculated as the weighted scores from an individual country’s environmental performance based on 24 indicators, 10 issue categories, and 2 broad policy objectives as revealed in Appendix Table 7. Furthermore, our study combines five core measures of institutional quality indicators published by the Worldwide Governance Indicators (WGI) via the principal component approach in analyzing the moderating role of institutions in the tourism–financialization–renewable energy and environmental performance nexus in EU-28 countries. Methodologically, to circumvent serial correlation and heterogeneity problems, a two-step generalized method of moments (GMM) estimation approach is applied. All these constitute a clear departure from the extant literature.

The remaining sections of the paper are as follows: “Literature review” deals with the literature. “Data and methodology of research” presents and discusses the methodology of the study. “Empirical results and discussion” presents and analyzes the empirical results, and “Conclusion” concludes the paper and makes policy recommendations.

Literature review

The extant literature indicates mixed findings regarding the influence that tourism exerts on the environment. For instance, using the augmented autoregressive distributed lag (ARDL), Anser et al. (2020) found that inbound tourism decreases environmental performance through an increase in carbon emissions. Ahmad et al. (2018) examine the effect of tourism on environmental pollution from the One Belt One Road provinces of Western China using the fully modified ordinary least square (FMOLS) and the Gregory–Hansen test for robustness check. Findings from the study show a negative effect of tourism on the environment for Ningxia, Qinghai, Gansu, and Shanxi while improving the environmental quality of Xinjiang. In another study, Cadarso et al. (2015) established a strong positive relationship between tourism and carbon emission, suggesting that both domestic and international trips contribute to decreasing the quality and performance of the environment through an increased level of CO2 emission. Applying Granger causality based on the vector error correction model (VECM), Ben Jebli and Hadhri (2018) found evidence supporting the negative effect of tourism on CO2 emission, suggesting that tourism improves environmental quality despite its huge contribution to economic growth. Similarly, the study of Sghaier et al. (2019) reveals a decreasing effect between tourism and environmental quality in Egypt while increasing and neutral effects are established in Tunisia and Morocco, respectively. Using a battery of econometric tests that are robust to heterogeneity and cross-sectional dependence, Danish and Wang (2018) examined the dynamic nexus among tourism, economic growth, and CO2 emissions for Brazil, Russia, India, China, and South Africa (BRICS) countries. The empirical results reveal that tourism degrades environmental quality via economic growth.

Regarding the effect of financial development, the existing literature in support of the influence of financialization on the environment establishes that a vibrant financial system creates investment opportunities in environment-friendly energy projects by offering low-interest loans and providing incentives to environmental compliance energy firms (see Iorember et al. 2020b; Destek and Sarkodie 2019; Adams and Klobodu 2018). Financial development also influences the environment through economic growth (Shahbaz et al. 2020; Iorember et al. 2020a; Jelilov et al. 2020; Goshit and Iorember 2020; Abbas et al. 2019a; Hussain et al. 2021; Abachi and Iorember 2017; Dalis et al. 2020). That is, an increase in economic growth due to financialization is closely linked to an increase in energy use, and it may contribute to environmental deterioration.

Furthermore, the literature is active regarding the roles that institutions play in ensuring a sustainable environment. Accordingly, Usman et al. (2020a), Ali et al. (2019), stated that institutional quality (good governance, the extent of democratization, rule of law, corruption control, effective tax system, political stability, etc.) has a positive influence on economic agents in adhering to environmental laws and operating in ways that do not harm the environment severely. More recently, studies by Azam et al. (2020) and Ali et al. (2019) found that institutional quality measured in terms of political stability, administrative capacity, and democratic accountability has a positive and significant effect on the environmental quality expressed in terms of ecological footprint. This is because institutional frameworks such as market-based instruments (carbon taxes and subsidies) to a large extent influence how economic agents align their production and operational behaviors towards enhancing environmental performance. Similarly, Ozturk et al. (2019) and Mavragani et al. (2016) reveal that environmental performance responds positively to the reduction in corruption. Further, the study of Azam et al. (2020) shows a positive relationship between institutional quality and CO2 through fossil energy use, thereby suggesting a decline in environmental performance. Also, studies by Iorember et al. (2019) and Abbasi et al. (2021a, b; Abbas et al. 2021) show that a sustainable energy mix with a reasonable proportion of renewable energy leads to economic and environmental sustainability. Further related literature is summarily presented in Table 1.

Data and methodology of research

Data for the study

The data used in the estimations consist of a balanced panel drawn from different data sources over the period 2002 to 2014 based on 28 European countries (EU-28). The starting period for the study, which is 2002, and the ending period, which is 2014, are influenced by data availability. Particularly, the EPI dataset begins in 2002, and it is available on a yearly basis until 2014, after which it ceases to be computed on a yearly basis by the data provider. Therefore, to avoid measurement errors due to the interpolation of data, we limit our study to the period 2002–2014. The variables in the estimations include the Environmental Performance Index (EPI) which is the dependent variable. The independent variables include institutional quality index (IQ), economic expansion measured by real gross domestic product (EG), tourism development (TRD), broad-based financial development index (FD), and renewable energy (RENE) as tabulated as shown in Appendix Table 8: real GDP, tourism, financial development, and renewable energy are in their natural logarithms while EPI and IQ are not.

Theoretical framework and model specification

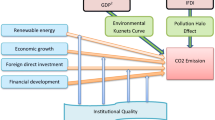

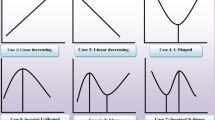

Theoretically, the link between economic growth and environmental quality has been well-established in the literature following the empirical works of Grossman and Krueger (1991) (see Ozturk et al., 2016; Dogan and Turkekul 2016; Apergis 2016; Ike et al. 2020a, b; Rafindadi and Usman 2019). According to Grossman and Krueger (1991), the first stage of economic development is such that the income level increases with the level of carbon emissions, leading to environmental degradation until a certain level of income is reached, after which the level of environmental degradation will begin to decline through a decline in the level of carbon emissions. This hypothesis is known as the environmental Kuznets curve (EKC) in the literature of energy economics. As mentioned in the introductory section, over the years, EU countries have attracted huge tourism inflow than any other region. This region has also experienced an energy transition from fossil fuel energy consumption to renewable energy consumption as well as the development of financial institutions and markets. These may cause drastic changes in their efforts towards achieving the sustainability development goals of the United Nations by 2030. Therefore, in this study, to capture the economic and social aspects, we incorporate institutional quality, tourism, financial development, and renewable energy into the environment–economic growth nexus for EU-28 countries. Our empirical model is specified as follows:

where EPI denotes the Environmental Performance Index.Footnote 1IQ represents institutional quality and lTRD and lFD are the log of tourism and financial development, respectively, while X represents the vector of additional controlled variables that have been found relevant in determining environmental performance such as renewable energy (RENE) and economic growth (EG). Hence, the functional relation with natural logarithm expression of Eq. (1) is given as

where α in the equation is referred to as the constant. TRD, FD, RENE, and EG are in their natural logarithms to help stabilize variances. ε is the error term invariably assumed to have a zero mean. The i and t subscripts represent countries (cross-sectional units) and time where i is the ith series (i = 1, …, 28) and t = 2002, …, 2014.

A two-step system generalized method of moments (GMM) developed by Blundell and Bond (1998) is explored to examine the contagious effects of tourism and financial development on environmental performance based on Eq. (2). The scope of this study is in agreement with the motivation for the study, while the corresponding period for the study is contingent on the availability of data.Footnote 2 The decision to make use of the GMM approach is informed mainly by the following factors: first, a two-step GMM estimator controls for the serial correlation and heterogeneity, which remain as major weaknesses of the panel data modeling. Second, the number of our countries in our study is larger than the number of years considered in this study, allowing for the application of the GMM model. Third, the issue of cross-country variations in the panel is greatly controlled for in the GMM regressions. Fourth, the issue of simultaneity bias in the independent variables is accounted for by using the appropriate instruments, which are time invariant. Fifth, it corrects for inherent biases in the difference-based estimation (Baltagi 2008; Roodman 2009; and Asongu 2018).

The GMM estimation employed in this study is an extension of the Arellano and Bover (1995) model of difference GMM advanced by Roodman (2009). This approach accounts for cross-sectional dependence as demonstrated by Baltagi (2008), Asongu (2018), Usman and Yakubu (2019) and Mubeen et al. (2020). The procedure of the system GMM estimation is summarized as follows:

where EPI, IQ, lTRD, lFD, and lX retain the definition given in Eqs. (1) and (2). The coefficient of autoregression is denoted by τ, while ξt is the time-specific constant in the model. We capture the country-specific effect by ηt, while the residual term is represented by εt. The subscripts i and t are the countries and time period in the GMM model. Theoretically, increases in tourism development and economic growth are expected to reduce environmental sustainability and increase CO2 emission, while increases in institutional quality and renewable energy are expected to increase environmental sustainability and reduce CO2 emission. The effect of financial development can be either positive or negative depending on the effective management of the environment.

Empirical results and discussion

Preliminary analysis

We begin the analysis by reporting the summary statistics of the variables employed in this study as shown in Table 2. Evidently, the mean score of EPI is the largest, while IQ and lFD are not only small but also negative. The standard deviation values, apart from EPI, tend to be small, which suggests a low level of volatility in the variables. The correlation matrix of the variables as reported in Table 3 indicates environmental performance is positively and insignificantly correlated with institutional quality. The environmental performance also correlates positively with tourism, financial development, and economic growth with evidence of statistical significance. The correlation between renewable energy and economic growth is negative and statistically significant. Similarly, the correlation between all other variables with renewable energy is negative and only significant in the cases of environmental performance and financial development.

Empirical results

The results of the Pesaran (2004) test for cross-sectional dependence are presented in Appendix Table 9. The result reveals that the null hypothesis of cross-sectional independence is rejected at a 1% level of significance for all the variables except the institutional quality index. This, therefore, means that there is a cross-sectional dependence in the variables except for institutional quality. Furthermore, we conduct a unit root test as shown in Table 4.Footnote 3 The result indicates that Environmental Performance Index, tourism development, and financial development are all integrated of order zero, that is, I(0); while institutional quality, renewable energy consumption, economic growth, and carbon dioxide emissions are only stationary after taking their first differences. This implies that these variables are I(1).

Table 5 presents the empirical results based on the dynamic system GMM regression. The results indicate that the effect of institutional quality on environmental performance is positive and statistically significant (α1 = 0.4116, p < 0.01). This implies that an increase in institutional quality would stimulate environmental improvement. The effect of financial development on environmental performance is positive and significant, (α3 = 8.1308, p < 0.01). The result also finds an increase in renewable energy to exert upward pressure on environmental performance, that is, (α4 = 1.6450, p < 0.01); while tourism development and economic growth impede environment performance as shown by their coefficients, that is, (α2 = − 0.9025, p < 0.05) and (α3 = − 4.9491, p < 0.01).

To examine the robustness of our estimated results, we repeat the analysis by considering carbon dioxide (CO2) emissions as a dependent variable. The empirical results as reported in Table 6 reveal that while renewable energy helps reduce CO2 emissions, tourism development and economic growth exert positive pressure on CO2 emissions. This finding is therefore robust to our earlier result when environmental performance is used as a dependent variable. Furthermore, the positive effects of institutional quality and financial development are not robust to our earlier finding, and as such, contrary to theoretical expectations as mentioned under model specification in “Data and methodology of research.” Therefore, our finding is consistent with Usman et al. (2020b) and Alhassan et al. (2020) who aver that the Environmental Performance Index provides more reliable results compared to other measures of environmental degradation.

To check the validity of the GMM model, we employ two principal informational criteria. In the first place, we present the second-order autocorrelation test (AR[2]) suggested by Arellano and Bover (1995). This is more powerful to detect autocorrelation in the GMM than the corresponding first-order autocorrelation test (see Asongu and Nwachukwu 2016; Usman et al. 2019; Usman et al. 2020a). Secondly, we test for the validity of the instruments in the system GMM using the Sargan and Hansan tests. Unlike the Hansen test, the Sargan test for the validity of the instrument is not weakened by the instruments. As shown in the bottom of Table 5 and in its robustness checking in Table 6, the Sargan and Hansen tests of overidentification restrictions could not reject the null hypothesis that overidentification restrictions are valid in both models. This suggests that the instrumental variables are not correlated with the error term. In the same manner, the instruments in the estimations show that they are not overidentified as the number of instruments in each specification is less than the corresponding number of cross sections. Also, the results of the Arellano–Bond test for zero autocorrelation in first-differenced errors show that the null hypothesis of no autocorrelation could not be rejected. Overall, the system GMM models employed in this study are adequate as there are no overidentification restrictions and autocorrelations. Furthermore, we applied the predictive margins with a 95% confidence interval as shown in Fig. 1 and Fig. 2 (see Appendix D1 and Appendix D2, respectively). The plot displays high predictive margins of the GMM model estimations. The result shows that the model is adequate.

Discussion of empirical results

The results reveal that institutional quality, financial development, and renewable energy stimulate environmental performance, while tourism development and economic growth impede environmental performance. There is a plausible reason for the positive relationship between institutional quality and environmental performance. One of these reasons is that a strong institutional quality could put pressure on the economic agents to operate in line with the existing legal framework as shown by Usman et al. (2020a). Secondly, an environment where economic and political institutions are adequately performing could influence firms that are the major emitters of carbon dioxide and greenhouse gases to adhere to stringent environmental laws through market-based instruments such as carbon taxes and subsidies. Institutional quality could also enhance environmental improvement through a fall in the level of corruption. Therefore, our finding is consistent with Mavragani et al. (2016) and Ozturk et al. (2019) who attribute a decline in environmental pollution to a decline in corruption due to improvement in environmental quality. The results also concur with Usman et al. (2020a) who found environmental quality as an impetus for improving environmental performance in the EU countries. However, our results disregard the recent finding documented by Azam et al. (2020) that institutional quality increases fossil-based energy consumption.

The positive relationship between financial development and environmental performance indicates that financial stability is an essential condition required for improving environmental performance by lowering CO2 emissions. This becomes obvious in a regional economy such as EU countries where the region has heavily invested in renewable energy in the past two decades. Therefore, the energy growth effect of financial development is pollutant free because the share of renewable energy in the total energy consumed by this region is high. This finding is in line with Dogan and Seker (2016) who reported that financial development improves the quality of the environment in the top countries listed in the renewable energy attractiveness index. Our finding is similar to Nasreen and Anwar (2015) and Shahbaz et al. (2016, 2018) who documented that financial development is inversely related to environmental degradation. On the contrary, Usman et al. (2020c) reported financial development to have stimulated ecological footprint in the USA.

The results also provide that renewable energy promotes environmental improvement. This is because the region has spent a huge amount on research and development in modern renewable energy and technologies over the years. As reported by the European Commission (2020), the primary production of renewable energy from all sources in the EU countries accounts for about 1029 TWh, that is, 37.5% of its total primary energy production in 2019. Therefore, our result is consistent with Usman et al. (2020c) that renewable energy reduces environmental degradation through a decrease in the ecological footprint of the USA. It is also consistent with Ike et al. (2020a) that renewable energy promotes environmental quality in G7 countries. Our results also concur with Paramati et al. (2020) that increasing renewable energy would reduce CO2 emission in the EU member countries in the long run. On the contrary, this finding is in disagreement with Apergis et al. (2010) who submitted that renewable energy has no substantial role in reducing environmental pollution in 19 advanced and emerging economies. We also find our result to be different from Ben Jebli et al. (2015) that the role of renewable energy on carbon emissions for sub-Saharan African countries is mixed.

Furthermore, our results provide that tourism and economic growth mount negative pressure on environmental performance by stimulating demand for energy consumption in tourist attraction management, hotel and restaurant, recreational centers, and hence economic growth. This finding is consistent with Katircioğlu (2014); Katircioğlu et al. (2014); Usman et al. (2020a, b, e); Dogan et al. (2019); and Dogan and Inglesi-Lotz (2020) who found that tourism demand would deteriorate the environmental quality through its positive effect on economic growth. Generally, the implication for the finding is that the pursuit of tourism and economic growth hurts the environment and consequently hinders the realization of sustainable development goal (SDG) targets by the United Nations in the EU region by 2030.

Conclusion

Given the rapid development of tourism, financial development, and renewable energy and economic growth in the EU-28 countries, this study assesses not only the effects of the growth of these variables on the regional environmental performance but also consider whether institutional quality matter within the limit of resources to attain cleaner environment in this region. In achieving this, we employ a two-step system GMM regression, which is capable of addressing the endogeneity problem in the environmental performance function. In this paper, we contribute to the literature by using an Environmental Performance Index, which is more comprehensive as it measures 24 indicators of environmental quality, 10 issue categories, and 2 broad policy objectives. The results reveal that while tourism and economic growth cause downward pressure on environmental performance, financial development, renewable energy, and institutional quality cause upward pressure on environmental performance if all other factors remain unchanged. Moreover, the negative effects of tourism and economic growth on environmental performance can be dampened by the quality of the institutions. These findings are not totally robust when CO2 emission is applied to measure environmental quality.

Policy recommendations

Based on the findings of this paper, we recommend several policy measures to achieve environmental improvement in the region. First, the consumption of fossil-based fuels which has been the major driver of tourism development and economic growth in the region should be reduced. To this effect, government and energy policymakers need to adopt alternative and clean energy systems such as renewables and other alternative uses of energy to sustain environmental quality in the EU region. Second, the quest to stimulating the tourism sector should be carried out with caution so as not to jettison the long-term target of achieving carbon-free economies in the region. Third, in transitioning to renewable-based energy consumption, it is recommended that the principle of comparative advantage should be considered as a priority to minimize the cost of acquiring renewable energy.

Finally, we suggest that future research in this area should consider quantile regression-based models which would make use of the entire distribution of the environmental performance. This will provide policymakers with information about the entire conditional distribution of the environmental performance. Chances are that the effects of the explanatory variables on the environment performance may differ at lower, middle, and upper quantiles.

Notes

The Environmental Performance Index (EPI) is a comprehensive measurement of environmental quality computed based on 24 indicators, 10 issue categories, and 2 broad policy objectives.

The starting period is influenced by the availability of data for institutional quality, while the ending period is due to the availability of the EPI dataset on a consecutive yearly basis.

An anonymous referee has suggested the need to test for cross-sectional dependence and unit root among the variables in the model.

References

Abachi PT, Iorember PT (2017) Macroeconomic and household welfare impact of minimum wage increase in Nigeria: a computable general equilibrium model. American Journal of Economics, Scientific and Academic Publishing 7(5):249–258

Abbas J, Mahmood S, Ali H, Ali Raza M, Ali G, Aman J, Bano S, Nurunnabi M (2019a) The effects of corporate social responsibility practices and environmental factors through a moderating role of social media marketing on sustainable performance of business firms. Sustainability 11(12):3434 https://www.mdpi.com/2071-1050/11/12/3434

Abbas J, Mubeen R, Iorember PT, Raza S, Mamirkulova G (2021) Exploring the impact of COVID-19 on tourism: transformational potential and implications for a sustainable recovery of the travel and leisure industry. Current Research in Behavioral Sciences 2:100033

Abbasi KR, Abbas J, Tufail M (2021a) Revisiting electricity consumption, price, and real GDP: a modified sectoral level analysis from Pakistan. Energy Policy 149:112087. https://doi.org/10.1016/j.enpol.2020.112087

Abbasi RK, Hussain K, Abbas J, Fatai Adedoyin F, Ahmed Shaikh P, Yousaf H, Muhammad F (2021b) Analyzing the role of industrial sector's electricity consumption, prices, and GDP: a modified empirical evidence from Pakistan. AIMS Energy 9(1):29–49. https://doi.org/10.3934/energy.2021003

Acheampong AO (2019) Modelling for insight: does financial development improve environmental quality? Energy Econ 83:156–179

Adams S, Klobodu EKM (2018) Financial development and environmental degradation: does political regime matter?. J Clean Prod 197:1472–1479

Agbanike TF, Nwani C, Uwazie UI, Anochiwa LI, Onoja TGC, Ogbonnaya IO (2019) Oil price, energy consumption and carbon dioxide (CO2) emissions: insight into sustainability challenges in Venezuela. Latin America Economic Review 28:8. https://doi.org/10.1186/s40503-019-0070-8

Ahmad F, Draz MU, Su L, Ozturk I, Rauf A (2018) Tourism and environmental pollution: evidence from the one belt one road provinces of Western China. Sustainability 10(10):1–22

Alhassan A, Usman O, Ike GN, Sarkodie SA (2020) Impact assessment of trade on environmental performance: accounting for the role of government integrity and economic development in 79 countries. Heliyon 6(9):e05046

Ali HS, Zeqiraj V, Lin WL, Law SH, Yusop Z, Bare UAA, Chin L (2019) Does quality institutions promote environmental quality? Environ Sci Pollut Res 26:10446–10456

Ali A, Usman M, Usman O, Sarkodie SA (2021) Modeling the effects of agricultural innovation and biocapacity on carbon dioxide emissions in an agrarian-based economy: evidence from the dynamic ARDL simulations. Front Energy Res 8:592061

Aman J, Abbas J, Mahmood S, Nurunnabi M, Bano S (2019) The influence of Islamic religiosity on the perceived socio-cultural impact of sustainable tourism development in Pakistan: a structural equation modeling approach. Sustainability 11(11). https://doi.org/10.3390/su11113039

Anser MK, Yousaf Z, Awan U, Nassani AA, Qazi Abro MM, Zaman K (2020) Identifying the carbon emissions damage to international tourism: turn a blind eye. Sustainability 12:1937. https://doi.org/10.3390/su12051937

Apergis N (2016) Environmental Kuznets curves: new evidence on both panel and country-level CO2 emissions. Energy Econ 54:263–271

Apergis N, Garcia C (2019) Environmentalism in the EU-28 context: the impact of governance quality on environmental energy efficiency. Environ Sci Pollut Res 26:37012–37025

Apergis N, Payne JE, Menyah K, Wolde-Rufael Y (2010) On the causal dynamics between emissions, nuclear energy, renewable energy, and economic growth. Ecol Econ 69(11):2255–2260

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error components models. J Econ 68(1):29–52. https://doi.org/10.1016/0304-4076(94)01642-D

Asongu SA (2018) ICT, openness and CO2 emissions in Africa. Environ Sci Pollut Res 25:9351–9359

Asongu S, Nwachukwu J (2016) Globalization and inclusive human development in Africa. Available at: https://mpra.ub.uni-muenchen.de/78140/1/MPRA_paper_78140.pdf

Azam M, Alam M, Hafeez MH (2018) Effect of tourism on environmental pollution: further evidence from Malaysia, Singapore and Thailand. J Clean Prod 190:330–338

Azam M, Liu L, Ahmad N (2020) Impact of institutional quality on environment and energy consumption: evidence from developing world. Environ Dev Sustain 23:1646–1667. https://doi.org/10.1007/s10668-020-00644-x

Balsalobre-Lorente D, Shahbaz M, Roubaud D, Farhani S (2018) How economic growth, renewable electricity and natural resources contribute to CO2 emissions? Energy Policy 113:356–367

Baltagi BH (2008) Forecasting with panel data. Journal of Forecast 27(2):153–173. https://doi.org/10.1002/for.1047

Ben Jebli M, Hadhri W (2018) The dynamic causal links between CO2 emissions from transport, real GDP, energy use and international tourism. Int J Sustain Dev World Ecol 25(6):568–577

Ben Jebli M, Ben Youssef S, Ozturk I (2015) The role of renewable energy consumption and trade: environmental Kuznets curve analysis for sub-Saharan Africa countries. Afr Dev Rev 27(3):288–300

Bhattacharya M, Churchill SA, Paramati SR (2017) The dynamic impact of renewable energy and institutions on economic output and CO2 emissions across regions. Renew Energy 111:157–167

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econom 87(1):115–143

Cadarso MÁ, Gómez N, López LA, Tobarra MÁ, Zafrilla JE (2015) Quantifying Spanish tourism's carbon footprint: the contributions of residents and visitors: a longitudinal study. J Sustain Tour 23(6):922–946

Dalis TD, Iorember PT, Danjuma SY (2020) Stock market returns, globalization and economic growth in Nigeria: evidence from volatility and cointegrating analyses. J Public Aff https://onlinelibrary.wiley.com/doi/abs/10.1002/pa.2393

Danish, Wang Z (2018) Dynamic relationship between tourism, economic growth, and environmental quality. J Sustain Tour 26(11):1928–1943

Destek MA, Sarkodie SA (2019) Investigation of environmental Kuznets curve for ecological footprint: the role of energy and financial development. Sci Total Environ 650:2483–2489

Dogan E, Inglesi-Lotz R (2020) The impact of economic structure to the environmental Kuznets curve (EKC) hypothesis: evidence from European countries. Environ Sci Pollut Res:1–8

Dogan E, Seker F (2016) The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renew Sust Energ Rev 60:1074–1085

Dogan E, Turkekul B (2016) CO2 emissions, real output, energy consumption, trade, urbanization and financial development: testing the EKC hypothesis for the USA. Environ Sci Pollut Res 23(2):1203–1213

Dogan E, Taspinar N, Gokmenoglu KK (2019) Determinants of ecological footprint in MINT countries. Energy & Environment 30(6):1065–1086

Dogan E, Altinoz B, Madaleno M, Taskin D (2020) The impact of renewable energy consumption to economic growth: a replication and extension of Inglesi-Lotz (2016). Energy Econ. https://doi.org/10.1016/j.eneco.2020.104866

Goshit GG, Iorember PT (2020) Measuring the asymmetric pass-through of monetary policy rate to unemployment in Nigeria: evidence from nonlinear ARDL. Nigerian Journal of Economic and Social Studies 62(3):369–387

Grossman MG, Krueger AB (1991). Environmental impacts of a North American free trade agreement (No. 3914), National Bureau of Economic Research

Haldar A, Sethi N (2020) Effect of institutional quality and renewable energy consumption on CO2 emissions−an empirical investigation for developing countries. Environ Sci Pollut Res 28:15485–15503. https://doi.org/10.1007/s11356-020-11532-2

Hanif I (2018) Impact of economic growth, non-renewable and renewable energy consumption, and urbanization on carbon emissions in sub-Saharan Africa. Environ Sci Pollut Res 25:15057–15067

Hussain T, Abbas J, Wei Z, Ahmad S, Xuehao B, Gaoli Z (2021) Impact of urban village disamenity on neighboring residential properties: empirical evidence from Nanjing through hedonic pricing model appraisal. Journal of Urban Planning and Development 147(1):04020055. https://doi.org/10.1061/(asce)up.1943-5444.0000645

Ike GN, Usman O, Alola AA, Sarkodie SA (2020a) Environmental quality effects of income, energy prices and trade: the role of renewable energy consumption in G-7 countries. Sci Total Environ 721:137813

Ike GN, Usman O, Sarkodie SA (2020b) Fiscal policy and CO2 emissions from heterogeneous fuel sources in Thailand: evidence from multiple structural breaks cointegration test. Sci Total Environ 702:134711

Iorember PT, Usman O, Jelilov G (2019) Asymmetric effects of renewable energy consumption, trade openness and economic growth on environmental quality in Nigeria and South Africa, Retrieved from: https://econpapers.repec.org/paper/pramprapa/96333.htm

Iorember PT, Goshit GG, Dabwor DT (2020a) Testing the nexus between renewable energy consumption and environmental quality in Nigeria: the role of broad-based financial development. Afr Dev Rev 32(2):163–175

Iorember PT, Jelilov G, Usman O, Isik A, Celik B (2020b) The influence of renewable energy use, human capital, and trade on environmental quality in South Africa: multiple structural breaks cointegration approach. Environ Sci Pollut Res 28:13162–13174. https://doi.org/10.1007/s11356-020-11370-2

Jelilov G, Iorember PT, Usman O, Yua PM (2020) Testing the nexus between stock market returns and inflation in Nigeria: does the effect of COVID-19 pandemic matter? J Public Aff. https://doi.org/10.1002/pa.2289

Katircioğlu ST (2014) Testing the tourism-induced EKC hypothesis: the case of Singapore. Econ Model 41:383–391

Katircioğlu ST, Feridun M, Kilinc C (2014) Estimating tourism-induced energy consumption and CO2 emissions: the case of Cyprus. Renew Sust Energ Rev 29:634–640

Mahjabeen N, Shah SZ, Chughtai S, Simonetti B (2020) Renewable energy, institutional stability, environment and economic growth nexus of D-8 countries. Energy Strategy Reviews 29:2020

Mamirkulova G, Mi J, Abbas J, Mahmood S, Mubeen R, Ziapour A (2020) New silk road infrastructure opportunities in developing tourism environment for residents better quality of life. Global Ecology and Conservation 24:e01194. https://doi.org/10.1016/j.gecco.2020.e01194

Mavragani A, Nikolaou IE, Tsagarakis KP (2016) Open economy, institutional quality, and environmental performance: a macroeconomic approach. Sustainability 8:601

Mikayilov JI, Mukhtarov S, Mammadov J, Azizov M (2019) Re-evaluating the environmental impacts of tourism: does EKC exist? Environ Sci Pollut Res 26:19389–19402

Mubeen R, Han D, Abbas J, Hussain I (2020) The effects of market competition, capital structure, and CEO duality on firm performance: a mediation analysis by incorporating the GMM model technique. Sustainability 12(8). https://doi.org/10.3390/su12083480

Nasreen S, Anwar S (2015) The impact of economic and financial development on environmental degradation: an empirical assessment of EKC hypothesis. Stud Econ Financ 32:485–502

Ozturk I, Al-Mulali U, Saboori B (2016) Investigating the environmental Kuznets curve hypothesis: the role of tourism and ecological footprint. Environ Sci Pollut Res 23(2):1916–1928

Ozturk I, Al-Mulali U, Solarin SA (2019) The control of corruption and energy efficiency relationship: an empirical note. Environ Sci Pollut Res 26:17277–17283

Paramati SR, Sinha A, Dogan E (2017) The significance of renewable energy use for economic output and environmental protection: evidence from the Next 11 developing economies, Retrieved from: https://www.researchgate.net/publication/315829015

Paramati SR, Alam S, Hammoudeh S, Hafeez K (2020) Long-run relationship between R&D investment and environmental sustainability: evidence from the European Union member countries. Int J Financ Econ. https://doi.org/10.1002/ijfe.2093

Pesaran MH (2004) General diagnostic tests for cross section dependence in panels. https://doi.org/10.17863/CAM.5113

Rafindadi AA, Usman O (2019) Globalization, energy use, and environmental degradation in South Africa: startling empirical evidence from the Maki-cointegration test. J Environ Manag 244:265–275

Rasekhi S, Mohammadi S (2015) The relationship between tourism and environmental performance: the case of Caspian Sea nations. Iranian Journal of Economic Studies 4(2):51–80

Roodman D (2009) A note on the theme of too many instruments. Oxf Bull Econ Stat 71(1):135–158. https://doi.org/10.1111/j.1468-0084.2008.00542.x

Sadorsky P (2009) Renewable energy consumption, CO2 emissions and oil prices in the G-7 countries. Energy Econ 31(3):456–462. https://doi.org/10.1016/j.eneco.2008.12.010

Sarkodie SA, Adams S (2018) Renewable energy, nuclear energy, and environmental pollution: accounting for political institutional quality in South Africa. Sci Total Environ 643:1590–1601

Sghaier A, Guizani A, Jabeur SB, Nurunnabi M (2019) Tourism development, energy consumption and environmental quality in Tunisia, Egypt and Morocco: A trivariate analysis. GeoJournal 84(3):593–609

Shahbaz M, Shahzad SJH, Ahmad N, Alam S (2016) Financial development and environmental quality: the way forward. Energy Policy 98:353–364

Shahbaz M, Nasir MA, Roubaud R (2018) Environmental degradation in France: the effects of FDI, financial development, and energy innovations. Energy Econ 74:843–857. https://doi.org/10.1016/j.eneco.2018.07.020

Shahbaz M, Haouas I, Sohag K, Ozturk I (2020) The financial development-environmental degradation nexus in the United Arab Emirates: the importance of growth, globalization and structural breaks. Environ Sci Pollut Res 27:10685–10699

Ummalla M, Samal A, Goyari P (2019) Nexus among the hydropower energy consumption, economic growth, and CO2 emissions: evidence from BRICS countries. Environ Sci Pollut Res 26:35010–35022

Usman O, Yakubu UA (2019) An investigation of the post-privatization firms’ financial performance in Nigeria: the role of corporate governance practices. Corporate Governance: The International Journal of Business in Society 19(3):404–418

Usman O, Iorember PT, Olanipekun IO (2019) Revisiting the environmental Kuznets curve (EKC) hypothesis in India: the effects of energy consumption and democracy. Environ Sci Pollut Res 26(13):13390–13400

Usman O, Elsalih O, Koshadh O (2020a) Environmental performance and tourism development in EU-28 countries: the role of institutional quality. Curr Issue Tour 23(17):2103–2108

Usman O, Bekun FV, Ike GN (2020b) Democracy and tourism demand in European countries: does environmental performance matter? Environ Sci Pollut Res 27(30):38353–38359

Usman O, Alola AA, Sarkodie SA (2020c) Assessment of the role of renewable energy consumption and trade policy on environmental degradation using innovation accounting: evidence from the US. Renew Energy 150:266–277

Usman O, Olanipekun IO, Iorember PT, Goodman MA (2020d) Modelling environmental degradation in South Africa: the effects of energy consumption, democracy, and globalization using innovation accounting tests. Environ Sci Pollut Res 27:8334–8349

Usman O, Iorember PT, Jelilov G (2020e). Exchange rate pass-through to restaurant and hotel prices in the United States: the role of energy prices and tourism development. Journal of Public Affairs https://onlinelibrary.wiley.com/doi/abs/10.1002/pa.2214

Zoundi Z (2017) CO2 emissions, renewable energy and the environmental Kuznets curve, a panel cointegration approach. Renew Sust Energ Rev 72:1067–1075

Availability of data and materials

The datasets generated and/or analyzed during the current study are available in the repositories:

-

Environmental Performance Index: The index is available on a yearly basis at Socioeconomic Data and Application Centre (SEDAC): http://www.ciesin.columbia.edu/indicators/ESI/.

-

Renewable energy per capita is available in the OECD database.

-

Institutional quality index: The variables are available at the Worldwide Governance Indicators.

-

Financial development index is available at the International Monetary Fund (IMF) database.

-

GDP per capita and tourism development are available at the World Development Indicators (WDI, 2019).

Author information

Authors and Affiliations

Contributions

Muhammad Sani Musa: conceptualization and writing—original draft, supervision, validation, and visualization. Ojonugwa Usman: conceptualization, data curation, formal analysis, investigation, and methodology. Gylych Jelilov: writing—original draft, Writing—review and editing, validation, visualization, and supervision. Paul Terhemba Iorember: data curation, writing—original draft, Writing—review and editing and formal analysis.

Corresponding author

Ethics declarations

Ethical approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Eyup Dogan

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

Appendix 2

Appendix 3

Appendix 4 Predictive margins plot of SYS-G (with EPI as the dependent variable)

Appendix 4: Predictive margins plot of SYS-G (CO2 as the dependent variable)

Rights and permissions

About this article

Cite this article

Musa, M.S., Jelilov, G., Iorember, P.T. et al. Effects of tourism, financial development, and renewable energy on environmental performance in EU-28: does institutional quality matter?. Environ Sci Pollut Res 28, 53328–53339 (2021). https://doi.org/10.1007/s11356-021-14450-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-14450-z