Abstract

We employ the new Method of Moments Quantile Regression approach to expose the role of natural resources, renewable energy, and globalization in testing Environment Kuznets Curve (EKC) in MINT panel covering the years 1995–2018. The outcome validates the EKC curve between economic progress and carbon emissions from the third quantile to the extreme highest quantile. The result also shows that natural resources increase CO2 emissions at the lowest quantile and then turn insignificant from the middle to the highest quantiles due to the potential utilization of resources in a sustainable manner. The renewable energy mitigates CO2 emissions at the lower half quantiles. Still, for upper quantiles, the results are unexpected and imply that the countries’ total energy mix depends heavily on fossil fuels. As far as globalization is concerned, the significant results from medium to upper quantiles reveal that as globalization heightens due to foreign direct investment or trade, energy consumption also expands, leading to the worst environment quality. Thus, the present study’s consequences deliver guidelines for policymakers to utilize natural resources sustainably and opt technologies based on clean energy, which may offset environmental degeneration.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Environmental degradation is one of the most precarious challenges faced by the contemporary world. The issue of environmental degradation has attained enormous attention from researchers and academia. In the previous few decades, the world has been experiencing considerable economic growth due to progress and development (Dong et al. 2018; Scherer et al. 2018). As per World Bank, the world GDP has doubled to the US $73.73 trillion from the US $37.88 trillion (constant 2010 US$) over the period 1990 to 2014. Globally, energy usage in the same period has also risen to 1922.5 kg of oil equivalent from 1662.93 kg (World Bank 2019). The growing utilization of energy triggers many environmental concerns (Huaman and Jun 2014). In 2018, the total world emissions of carbon upraised to 33,890.80 million tons, i.e., 1.37 times more than those reported in the 1970s (British Petroleum 2018). These concerns are currently the core subject matters for environmental specialists and economists. These emissions alter the environment and pose serious health issues for human beings, along with the disruption of infrastructure and depletion of natural resources.

Natural resource depletion due to intensive economic development is the primary cause of environmental deterioration (Sarkodie 2018). The natural resources’ extraction has tripled over half-past dozen years, such as the gas, coal, and oil extraction enlarged from 6 to 15 billion tons. The yield of biomass rose from 9 to 24 billion tons, and further resources of minerals also extended to fivefold (Global IRP 2019). According to Giljum et al. (2009), annually, approximately 60 billion tons of natural resources are being grabbed by human beings, 50% more than the situation happened 30 years back. Moreover, social development also leads to the overconsumption of resources that is more than the world’s potential for regenerating resources (Global Footprint Network 2017). So, it is imperative to take into consideration the concerns regarding the overconsumption of natural resources.

Furthermore, the expansion of economic growth by countries’ collaboration increases countries’ interdependency, which endorses competition. But such competition occurs at the cost of environmental pollution throughout the globe (Shahbaz et al. 2017). Though globalization facilitates the transmission of innovative technology from developed to developing economies, expands productivity by increasing international trade, and boosts investment opportunities through FDI but at the cost of jeopardizing environmental sustainability (Simas et al. 2015; Audi and Ali 2018). The reason is that the developed countries cut back their dirty production of goods by taking benefit of globalization, which ends in sturdy and high-energy demands in emerging economies and results in global warming, biodiversity loss, and natural resources depletion in emerging economies (Shahbaz et al. 2018a, b; You and Lv 2018).

Generally, developed countries are more liable to emit the bulk of gases worldwide, but the emissions in developing countries in recent years are also increased (IEA 2014). In developing economies, the world had immensely given attention to Brazil, Russia, India, China, and South Africa, called the BRICS economies, a potent emergent bloc worldwide. But in 2013, other rising markets such as Mexico, Indonesia, Nigeria, and Turkey (MINT) were also recognized by Jim Eugene Gladstone O’Neill (O’Neill 2013). According to O’Neill, MINT countries are individually yielding about 1 to 2% of the world economy and have the probability of distinguishing themselves as technologically and economically the world’s largest economies in forthcoming decades. According to Gold Sachs, a stable growth trend for MINT countries is predicted across 2020, but a 5% growth rate for each of MINT countries globally is also forecasted by the USA (Ghosh 2002; Wright 2014). Now the question arises, does economic nations like MINT countries maintain sustainable development with natural resources and globalization without damaging the environment? To answer this question, the current study is conducted to validate the hypothesis of the Environment Kuznets Curve (EKC). EKC’s concept validates the U-shaped curve between income and pollutants (Grossman and Krueger 1991).

In recent years, the EKC hypothesis has generally attained substantial importance in understanding how to retain economic development and simultaneously preserve environmental quality (Sarkodie and Strezov 2018; Aziz et al. 2020a). But it is also pertinent to highlight the theoretical and methodological censures raised up against the EKC in the former studies. Different EKC studies have applied diverse methods, used different data, and eventually resulted in different findings with contradictory explanations (Cavlovic et al. 2000; Grossman and Krueger 1995; Stern 2017). It is claimed that the quality of the environment is not easy to be measured correctly, and EKC cannot be generalized to all pollutants (Harbaugh et al. 2002). For instance, Cole et al. (1997) evidenced that EKCs exist only for contaminants such as SO2, suspended particulates, carbon monoxide (CO), and nitrous oxides (NOx). In contrast, Shafik and Bandyopadhyay (1992) demonstrated that the global environmental indicators like CO2 emissions increase perpetually following per capita income. Stern et al. (1996) also argued that for specific indicators such as SO2 and NOx emissions and deforestation, future per capita income levels would weaken environmental degradation in the future. However, this assumption is argued as income is not normally distributed but very skewed, as massive number of people live below the mean income per capita. Consequently, it is not the mean income but median (IBRD 1992).

Moreover, the bulk of studies examined the EKC hypothesis by using cross-sectional data for a panel of countries by supposing that all countries in the group would follow the same economic development route. This notion is critiqued as countries in the panel own diverse social-economic and political variations that may alter environmental conditions. In the last few decades, transformations are also observed in EKC studies from econometric perspectives, i.e., from OLS to broad dynamic models such as fixed effect model (Heil and Wodon 1997; Lee and Oh (2015), random effect (Brajer et al. 2011), CGE model (Copeland and Taylor 2005), dynamic models (Agras and Chapman 1999; Coondoo and Dinda 2008), and panel Spatial Durbin models (Huang 2018). Consequently, EKC studies’ displayed significant heterogeneity such as the curve of N-shape or inverted U-shape in response to different methods, used. Even several studies have not endorsed EKC.

So keeping in view the above critics, in our analysis, we focus on CO2 emissions, which are viewed to be the most critical global pollutant contributing to 72% of the global warming effects. Nonetheless, the empirical support for the EKC for CO2 emissions is not found globally; some significant associations have been seen between income and CO2 (Dijkgraaf and Vollebergh 1998). As the bulk of studies in the prevailing literature have found the EKC model enduring econometric misspecification. So it is supposed that the application of appropriate methods may specify higher turning points or even show a monotonic curve for the pollutant. Moreover, It is also presumed that the speedy growth and globalization of MINT economies cause substantial resources’ depletion and expedite the environmental concerns (Satoglu 2017). In this vein, various former studies have explored the natural resources’ association with CO2 such as Kwakwa et al. (2018) in Germany, Balsalobre-Lorente et al. (2018) in 5 EU countries, Mudakkar et al. (2013) in Pakistan, Danish et al. (2019) in BRICS countries, Shahbaz et al. (2018a, b) in the USA, Ahmed et al. (2016) in Iran, but no study considered the same phenomenon for MINT economies. Therefore, the study is the pioneer one that explores the EKC nexus among the desired variables in MINT panel.

Therefore, the current research investigates the EKC notion by including natural resources, globalization, and renewable energy in MINT economies by primarily employing the diverse estimation approaches of fixed effect ordinary least square (FE-OLS), fully modified ordinary least square (FMOLS), and dynamic ordinary least square (DOLS) to control the heterogeneity as well as cross-sectional dependence. The study further employs methods of the moment of quantile regression (MMQR) by Machado and Silva (2019) as earlier studies using panel data have assessed regression quantiles under conditional mean and deals with merely mean estimates of the complete panel data and ignores the individual’s distributional heterogeneity of the panel data, which may lead to inexplicit regression results (Sarkodie and Strezov 2019). This study attempts to put forth additional consistent results by including both the conditional mean estimates and the distributional heterogeneity by revealing the latent effects of independent variables across dependent variables’ conditional distribution. Recently, Aziz et al. (2020b) in BRICS panel and An et al. (2020) in Belt and Road host countries also used the same approach. It is believed that this exploration will possibly recommend policymakers to form their policies based on the findings obtained through this analysis.

The paper’s remaining structure is organized below. The subsequent “Literature review” section reviewed the potential existing studies on the topic focused in the present study. Data sources and analytical strategies are presented in the “Data sources and methodology” section. The results based on estimations are presented in the “Estimation results” section and conclusion with possible policy recommendations is revealed in the “Conclusion and policy recommendations” section.

Literature review

Various studies have used globalization, natural resources, renewable energy, and the environment in different countries in the existing literature. Therefore, the next subsections are an attempt to unveil the previous efforts of the researchers. We split the literature into subsections based on variables employed in the study.

Natural resources and CO2 emissions

Natural resource extraction refers to the move out of the solid, liquid, and gaseous materials in raw form from the environment by anthropogenic activities (Genty et al. 2012). In this vein, Danish et al. (2019), in the context of natural resources in BRICS nations, investigated the natural resources’ effects on CO2 emissions over the period 1990 to 2015. The research infers that the CO2 can be mitigated by the adequate availability of natural resources in Russia, while in South Africa, the results are inverse as natural resources exploitation can end in pollution. The desirable natural resources’ coefficient in Russia accredits to its extensive availability. Simultaneously, in South Africa, unmaintainable and conventional energy sources exert stress on the environment. Balsalobre-Lorente et al. (2019b) in 5 European Union countries expounded that natural resources, renewable energy, and economic growth are crucial factors of CO2 emission. They have found that the abundance availability of natural resources and reliance on renewable energy counterbalance the quality of environment. Shahabadi and Feyzi (2016) explored the linkage of abundant natural resources with carbon emissions by counting foreign direct investment. The outcome demonstrated that abundant natural resources appeal to foreign direct investment, which regenerates the environment by executing energy-efficient technologies. Other studies have also examined the environmental effects of natural resources (Dadasov et al. 2017). In research of Wu et al. (2017), it is determined that the utilization of natural resources during the era of advanced economic progress arouses severe environmental concerns. Pao and Tsai (2010) used the gray prediction model (GM) to explore the association between energy, economic growth, and CO2 emissions from 1980 to 2007. They showed that with economic growth, both energy and environment degradation primarily trigger, then stead, and at last decline. In the study of Kwakwa et al. (2018), the natural resources’ extraction effects on Ghana’s environment for the period 1971–2013 commenced that urbanization, resource depletion, and economic growth contribute to Ghana’s CO2 emissions due to increased utilization of energy.

Renewable and CO2 emissions

In the available literature, the linkage of renewable energy with the environment has been observed by several studies (see Bélaïd and Youssef 2017; Irandoust 2016, Sharif et al. 2020). In emerging countries, Zafar et al. (2019) probed the association between both renewable and non-renewable energy under the EKC hypothesis. The study confirmed that renewable energy negatively impacts CO2 emission, but non-renewable energy impacts the CO2 positively with the confirmation of the EKC. Qiao et al. (2019) also established the EKC curve for G20 economies by elaborating on the nexus between renewable energy, agriculture, and CO2. The results found that agriculture induces CO2 emission, but renewable energy reduces CO2 emission. It accredits that developed nations have been significantly progressing and increasing their renewable and clean energy in their overall energy consumption. Danish et al. (2019) found that renewable energy’s coefficient in Brazil, China, Russia, and India is negatively significant because technologies allied with renewable energy are inevitable and viable. But the positive and insignificant coefficient in South Africa reflects the heavy utilization of fossil fuels in the respective region. Many other researchers have also studied the same phenomenon, such as Balsalobre-Lorente and Shahbaz (2016), in their study, reported that renewable energy supports CO2 mitigation. Gill et al. (2018), in their research in Malaysia, also confirmed that renewable energy and CO2 emissions have a significant negative association, but they could not establish EKC’s existence.

Globalization and CO2

There are much researches carried out during the last decade, expounding the link between globalization and CO2 emissions in the perspective of a single country or group of countries in the panel. Shahbaz et al. (2015b) revealed that globalization is useful in the Australian economy. But, in the Indian economy, Shahbaz et al. (2015a) did not catch any beneficial environmental effects. Khan et al. (2019a, b) proved the same positive outcome in Pakistan. They inferred that as Pakistan’s relationship with other countries increases, the developed countries are motivated to invest in Pakistan and results in the emergence of pollution by shifting their pollution-created industries. Some other authors also explored the same phenomenon in the panel data set and found mixed results such as Salahuddin et al. (2019) in countries of Sub-Saharan African evidenced that globalization’s effect on the environment is not significant; however, urbanization exacerbates the environmental quality. Kalaycı and Hayaloğlu (2019) though validated the Environmental Kuznets Curve for the NAFTA countries but revealed a positive association and entailed that higher energy demand due to growing trade activities increases the CO2 emissions as like Saint Akadiri et al. (2019). In perspectives of the lower, middle-, and higher income economies, Shahbaz et al. (2019) illustrated that higher and middle-income countries encourage investments, both domestic and foreign, for more massive output but at the expense of their sustainable environmental quality. You and Lv (2018) interestingly found that economic globalization impacts the CO2 emissions indirectly. The indirect effects mean the effects brought by the neighboring country’s economic globalization. As the economic development in all adjacent countries increases, the CO2 emissions also increase in the local region. Haseeb et al. (2018) evidenced an insignificant negative association of globalization with emissions in BRICS countries. The insignificant relationship accredits to the fact that countries’ social and environmental situation is unsustainable and Shahbaz et al. (2017) claimed in their study that social as well as environmental sustainability acts as globalization’s preconditions. An additional explanation may be industrial development, as industrial development demands more energy, then globalization also triggers more emissions (Shahbaz et al. 2015c). Zaidi et al. (2019) in Asia Pacific Economic Cooperation countries found the negative association of globalization on CO2 emission. The negative association is due to the strong international ties through which green technologies can be imported under existing environment protection rules and regulations. Liu et al. (2020) also found the same outcome for the G7 countries. The results validated the EKC hypothesis and state that globalization helps to recover environmental quality through transparency towards markets and new forms of trading partners.

By reviewing the literature, it is found that there is a dearth of studies exploring the role of natural resources, globalization, and renewable energy in testing EKC in the MINT panel. Given the clear picture of the importance of globalization and natural resources and clarifying CO2 emissions is necessary to identify strategies for emissions reduction and reasonable development, and this association should be considered means for devising strategies to keep a balance between economic growth and environmental sustainability.

Data sources and methodology

To meet the objectives of the study, variables such as CO2 emissions measured in metric tons (mt), economic growth (GDP) measured in dollars (constant US $), renewable energy (RE) measured in percentage of consumption of energy, and globalization as an index (KOF index) are involved in the empirical analysis. The data spanning from 1995 to 2018 for panel countries is collected from the World Development Indicators (WDI) data bank.Footnote 1 Moreover, the data for CO2 assembled from the British Petroleum database, and the globalization data gathered from the KOF globalization index managed by the KOF Swiss Economic Institute. The description of the variables is clarified in Table 1.

Descriptive statistics

Primarily, we portray the variables’ descriptive statistics in Table 2. The findings show that the minimum and maximum value of CO2 for MINT countries ranges between 35,199 and 637,078. The GDP based on all countries’ mean values is approximately 491, with a standard deviation of 362. Moreover, MINT countries’ natural resources have a mean value of 6.97, and a standard deviation of 6.74, with the smallest and largest value ranges from 0.123 to 31.81. Renewable energy’s mean value is 39.54, with the smallest and largest values are 8.96 and 88.832, respectively, with a standard deviation of 30.203. Finally, globalization has a mean value of 58.83 with a standard deviation of 6.67.

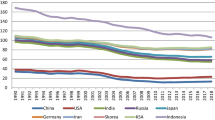

The visual representation of the trend of variables concerning mint countries is illustrated in the figure presented below. Figure 1 shows the emission of CO2 in MINT countries over the period 1995–2018 exhibits an ascending trend in the panel. It demonstrates that MINT panel is among the nations flourishing to keep pace with economic growth and development but with rising in CO2 emission. The previous few years show descending trend but not much. In the context of natural resources, the graph shows a mix of ascending and descending trends but overall, a descending trend is shown that illustrates that with countries’ development, the consumption of natural resources is faster than it can be replenished. It infers that economic growth in the mint countries initiates industrial development that increases natural resource extraction. Especially in the last few years, natural resources are being unsustainably consumed in the panel. The results in the context of renewable energy show the descending trend and reflect the relying on fossil fuels to keep pace with economic growth and development. The MINT countries are increasing collaboration to keep pace with economic growth. The figure shows that though the trend is ascending and the difference is not quite much. However, the results still explicitly portray the interdependency of MINT countries, which is slightly increasing with time.

Techniques of panel estimation

The techniques such as fully modified ordinary least squares (FMOLS), dynamic ordinary least squares (DOLS), and the fixed effect ordinary least squares (FE-OLS) are used in the present study. FE-OLS technique is compounded with standard errors of Driscoll and Kraay, which are vigorous in forming broad autocorrelation and cross-sectional dependency up to a definite lag. The main reason behind estimating the dynamic cointegrated panels is heterogeneity (Pedroni 2004), as mean differences within cross-sections and variations in cross-sections alter to the cointegrating equilibrium. Pedroni’s FMOLS model solves these problems effectively by embedding properties of intercepts of entity-specific and endorsing heterogeneous characteristics of the errors’ serial correlation through the individual members in the panel. The DOLS model was applied by Kao and Chiang (2001) to the panel setups concerning the effect of Monte Carlo simulations and noticed unbiased as compared to models of OLS and FMOLS in the finite samples. The endogeneity problem can also be tackled via the lead and lagged adjustments.

According to Sarkodie and Strezov (2019), to observe the heterogeneous and distributional effects, the flaws of previous classic analytical techniques have led to the method being applied across quantiles. Koenker and Bassett introduced the practice of quantile regression to the panel in 1978. The quantile regressions are usually used to estimate the conditional mean or variance of the quantiles of outcome variable arbitrary to the explanatory parameters compared to the regression of the least squares. The quantile regression is far more rigorous to the incidence of outliers in estimates. Furthermore, in scenarios where the linkage between two variables’ conditional means is insignificant, it is the practical approach (Binder and Coad 2011).

Nonetheless, the fixed effect Method of Moments Quantile Regression (MMQR) by Machado and Silva (2019) is used in this analysis. Although quantile regression is resilient to outliers, it fails to recognize the possible non-observed individual heterogeneity within the panel. This approach inevitably examines the effect of covariance of the conditional heterogeneous CO2 indicators by triggering the individual effect to impact the overall distribution instead of merely changing means, as stated by Canay (2011), Koenker (2004), and some others. This approach is entirely valid in situations where individual effects engulf the panel data model and that there are endogenous properties of the explanatory variables. Because of generating regression quantiles in non-crossing estimates, it is very insightful. The conditional quantiles estimate Qy(τ|X) of the model of the location-scale variant is written in the equation mentioned below:

where the probability \( P\left\{{\delta}_I+{Z}_{it}^{\hbox{'}}\gamma >0\right\}=1.{\left(\alpha, {\beta}^{\hbox{'}},\delta, {\gamma}^{\hbox{'}}\right)}^{\hbox{'}} \) and parameters are to be assessed. The individual i fixed effects are designated by (αi, δi), i = 1, …, n and k-vector of known elements of X is signified by Z, which are differentiable conversions with component l mentioned below:

Xit is distributed identically and independently across time (t) for any fixed i. Uit is also distributed the same way through time (t) across individuals (i) and are orthogonal to Xit and generalized to fulfill momentary conditions while other variables do not entail rigorous exogenous patterns. Equation (1) denotes by the equation given below:

In Eq. (3), independent variables’ vectors are defined by \( {X}_{it}^{\hbox{'}} \), i.e., natural log form (LGDP) is used to describe GDP, natural log form (LGDP2) is used for GDP squared, the same with natural resources (LNR), renewable energy (LREN), and globalization (LGLO). The quantile distribution of the explained variable (CO2 emissions per capita) is signified by QY(τ| Xit)and its natural log is symbolized by Yit, which is conditional on explanatory variables’ location and \( {X}_{it}^{\hbox{'}}-{\alpha}_i\left(\tau \right)\equiv {\alpha}_i+{\delta}_iq\left(\tau \right) \) displays the scalar coefficient, i.e., visual illustration of the individual i at quantile τ fixed effect. Unlike the typical fixed least-squares effects, the individual effect shows no intercept change. Such parameters are time-invariant whose heterogonous effects are appropriate to diverge along the conditional distributional quantiles of the endogenous variables. The τ-th sample quantile is symbolized by q (τ), which is evaluated by addressing the resulting problem of optimization;

where ρτ(A) = (τ − 1)AI{A ≤ 0} + TAI{A > 0} implies the check function.

Estimation results

Cross dependence and unit root test of the second generation

In the analysis of panel data, cross dependence (CD) test along with augmented cross-sectional IPS (CIPS) tests given by Pesaran (2007) are encouraged to employ (Ahmad and Zhao 2018) as these tests are performed for assessing the series’ heterogeneity and cross-sectional dependence to get more robust results which are likely to remain unnoticed in Levin, Lin and Chu, Im, Pesaran, and Shin’ first-generation test (Raza and Shah 2017; Phillips and Hansen 1990). In Table 3, the findings of CD and CIPS are shown. The test assumes the null hypothesis, i.e., the variables have unit root. In contrast, the alternative hypothesis assumes that the series’ variables are stationary as they do not have a unit root. The CD test rejects the cross-sectional independence null hypothesis, i.e., cross-sectional dependency exists. However, according to CIPS findings, the null hypothesis, i.e., variables at level are not stationary, is rejected. In contrast, the alternative hypothesis is accepted which means that these variables are stationary and unveiling the cointegration in the long run.

Unit root test of the first generation

According to the tests of unit root presented by Im, Pesaran, and Shin, the variables at level unveil the unit root issue. The outcome, including both with and without trend terms, is displayed in Table 3. From the first difference results in Table 4, it is clear that the variables’ series at first difference are integrated.

Panel cointegration test

From unit root results, it is ensured that the series’ variables are integrated, and now the panel cointegration and bootstrapped cointegration test are valid to employ (Pedroni 2004; Westerlund 2007) to avoid the spurious long-run results. Pedroni’s (2004) test of panel cointegration involves two steps. The first step monitors the parameters of the short-run and deterministic trends of individual-specific to control the heterogeneity. Under this approach, seven different test statistics based on estimated residuals are derived, i.e., pooled or within-dimension to assume a standard process and grouped or between-dimension to assume individual functions. The within-dimensions approach includes four statistics, such as panel v, panel ρ, panel PP, and panel ADF.

In comparison, between-dimension includes the other three statistics, such as group ρ, group PP, and group ADF. Table 5 displays the panel cointegration test of Pedroni findings and depicts that the alternative hypothesis at a 1% significance level is accepted, revealing the variable’s cointegration. The statistics of three tests within the measurement and two tests between the dimensions approach support this finding and unveil the long-run cointegration of variables.

The structural breaks seeming for the countries are displayed in Table 6 using Westerlund and Edgerton (2008) approach. Presently, if we take a gander at the primary breaks showing up in the information for nations, at that point, we can see that those years are somewhat connected with raw petroleum costs developments, which are mainly related to Asian financial crisis, energy issues, and natural resource extraction for MINT countries. Besides, having a major fall in 1997 because of Asian financial crisis. On the other hand, in 2009, costs climbed in 2010, trailed by a decrease in 2011. This was the year when the Arab Spring issue appeared, and it influenced the worldwide raw energy gracefully. Besides, it affected the international situation. These occasions had affected globalization, renewable energy, and natural resources examples of such creating economies from international and energy supply aspects. Consequently, these occasions have a significant effect on energy costs. During these break periods, for accumulating growth, globalization, resources, and energy have established the acknowledgment merely accessible to the countries for their processes.

Under Westerlund (2007), the no-cointegration hypothesis with four additional tests is also implemented as a cointegration test of second generation. This method can offer far more reliable results by decreasing the distortional effects of cross-sections. The test of bootstrapped cointegration can offer more vigorous support by keeping the number of replications at 500. The results are shown in Table 7, which confirms the alternative hypothesis acceptance and null hypothesis rejection, inferring that desired variables have cointegration in the long run.

Panel estimation results

The study illustrates FMOLS, DOLS, and FE-OLS outcomes in Table 8 to identify the impact of GDP, GDP2, natural resources, renewable energy, and globalization on CO2 emissions. In a natural log, the coefficient of variables is taken to express the long-run elasticity. The result displays that the statistical significance estimates of all three models are close enough. The findings depict that at a 1% significance level, all explanatory variables have a significant effect on CO2 emissions in all three model’s specifications, i.e., FMOLS and DOLS and FE-OLS. The hypothesis of EKC is also verified in all the models as the GDP coefficients show the positive results and the GDP2 shows the negative result. Across the model specifications, the results of GDP2 depict that a 1% rise of GDP2 negatively impacts the emissions by ~ 18% in DOLS estimator and 15% in the FE-OLS estimator. The outcome recommends that income after reaching a certain threshold starts to contribute to CO2 emission mitigation. The result of the current study is consistent with several other panel studies (see Balsalobre et al. 2015; Pata 2018; Rafindadi and Usman 2019; Sapkota and Bastola 2017; Sarkodie 2018; Shahbaz et al. 2018a, b; Usman et al. 2019). In recent years in MINT countries, other scholars’ econometric findings corroborated the hypothesis of EKC (see Dogan et al. 2019; Öztürk and Yildirim 2015). The current study’s outcome implies that emerging countries are now flourishing economically and are less relying on coal-based energy sources by opting technologies more inclined to environment friendly.

Moving forward to the natural resources perspectives, natural resources’ environmental influence is significant in MINT nations. In Table 8, the results of natural resources (NAR) depict that 1% exploitation in natural resources escalates the emissions by 28%, 30%, and 27% in the case of FMOLS, DOLS, and FE-OLS, respectively. In our study, the natural resources’ positive coefficient attributes the unsustainable consumption of natural resources and lesser renewable energy share in the energy mix. Our findings are consistent with the recent study of Hussain et al. (2020), who states that increased natural resource depletion leads to CO2 emissions in sample countries of belt and road projects. Wu et al. (2017), in their study for BRICS panel, believe that about one-third of worldwide resources pulled out to meet the needs of which China had the highest footprint. Our results contradict the studies of Balsalobre-Lorente et al. (2018), who state that the application of private natural resources curtails fossil fuel import, which yields fewer emissions. Moreover, the recent study of Danish et al. (2019) infers that natural resource abundance alleviates CO2 emission in Russia and boosts pollution in South Africa. Shahabadi and Feyzi (2016), in their study, probe that natural resources improve environmental quality by attracting foreign direct investment cum efficient-energy technologies.

Various research related to the impact of renewable energy on the environment is available in the economic literature. Our outcomes align with the surplus of empirical studies that are evidence that environmental quality can be improved by switching to clean sources based on renewable energies (Sharif et al. 2019b; Bekhet and Othman 2018; Attiaoui et al. 2017). Likewise, the negatively significant renewable energy’s coefficient substantiates renewable energy as a practicable measure to decrease carbon emissions (Attiaoui et al. 2017; Mert et al. 2019). Gill et al. (2018), in their research for the case of Malaysia, found that renewable energy and CO2 are negatively associated. Mehmet et al. (2015) found the same result and assured that renewable energy could be utilized as a substitute to reduce GHG emissions. Balsalobre-Lorente et al. (2019a) in MINT countries also confirmed that renewable energies are more efficient to lessen the ecological footprint in the long term. Many other studies focusing on the causal interactions among different variables such as renewable energy use, income growth, and environmental degradation are available in the literature (AlFarra and Abu-Hijleh 2012; Apergis et al. 2010a, b; El Fadel et al. 2013; Sbia et al. 2014).

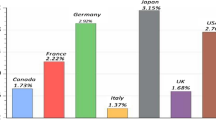

In Table 8, the results of globalization describe that rise in globalization upturns the CO2 emission by 17%, 29%, and 40% in FMOLS, DOLS, and FE-OLS, respectively. It is aligned with Ahmed et al. (2015), Danish et al. (2019), and Khan et al. (2019a, b), who pointed out that globalization causes environmental degradations by the exploitation of natural resources. Additionally, the industrialized nations of the world are interested in investing in developing countries by taking advantage of globalization that result in industries creating pollution (Kolcava et al. 2019). Our results contradict the findings of Shahbaz et al. (2017), who examined globalization’s impact on China’s CO2 emissions for 1970–2012. The finding reveals that globalization general index and sub-indexes (social, economic, and political globalization) decrease CO2 emissions in China. Haseeb et al. (2018) also revealed that globalization has a negative but non-significant association with CO2 in BRICS economies. Liu et al. (2020) strongly supported the EKC hypothesis between globalization and CO2. Sharif et al. (2019a) found that the extent of the relationship among variables depends upon countries as their empirical results exposed that in perspectives of Belgium, Sweden, Norway, the Netherlands, Denmark, Switzerland, Portugal, and Canada, the globalization’s effect on the ecological footprints is positive in the long run while in context of France, UK, Germany, and Hungary, the effect is negative. Correspondingly in a recent study of Zaidi et al. (2019), it has been shown that globalization significantly reduced emissions in APEC economies.

Method of Moments of Quantile Regression results

The current study discusses the association of natural resources, renewable energy, economic growth, globalization, and CO2 for MINT Panel by focusing on the MMQR approach. The outcome reveals that income effect in GDP form is significantly positive for emissions of CO2 across all quantiles, and it is evident that more economic growth leads to more pollution by depending on traditional fuels for the production of goods. A mainstream of studies, such as the study conducted by de Vita et al. (2015), Katircioǧlu (2014), and Lee and Brahmasrene (2013), also proved the same results. But in the case of GDP2, the study affirms the EKC hypothesis from 1st to 7th quantiles as the coefficient is negative and infers that upsurge in economic growth reduces the CO2 emissions after passing through the threshold level. It is consistent with many other previous studies conducted by numerous researchers in various countries such as Ali et al. (2015) in Pakistan; Saboori and Sulaiman et al. (2013) in ASEAN countries; Shahbaz et al. (2017) in China; Shahbaz et al. (2016) in African countries; Shahbaz et al. (2013) in Turkey; and Solarin et al. (2017) in Ghana. The results further provide shocking results that the results turn insignificant at the higher quantiles and not endorse the EKC. The reason could be that a further increase in income does not help countries to conserve their environment. The results at upper quantiles are aligned with the study of Taguchi (2012), Shafik (1994), Zencey (2012), and Stern (2017), who invalidates the EKC hypothesis and affirms that CO2 increases with increased income.

The NAR significantly increases CO2 emissions at the lower half quantiles. The positive coefficient indicates the emission of CO2 emissions in MINT nations by NAR. It shows that CO2 emissions can be increased with the exploitation of natural resources. Our outcome provides the possible reason that natural resources’ role in rising emissions in industrialized economies is attributed to the economic growth with excessive natural resource withdrawal and unsustainable use. In addition to this, the country’s reliance on importing fossil fuel also leads to the emission of gases and worsens the environment.

The significant and negative coefficient of renewable energy at lowest quantiles implies that renewable energy decreases the CO2 emissions at the lowest quantiles but later became insignificant from medium to upper quantiles which posited that emerging economies are experiencing a considerable change in energy demand due to economic changes, so more dependency on non-renewable energy exerts pressure on the ecosystem and elevates the quantity of the pollutant in the environment. The renewable energy life span in mitigating CO2 emissions is considerably less compared to fossil fuels as renewable energy belongs to clean energy and is pervasive and sustainable (Evans et al. 2009). Therefore, the use of renewable energy is deliberated as a most significant factor contributing to lessen the carbon emissions, which corresponds well with the former findings (Bélaïd and Youssef 2017; Ben Jebli et al. 2016; Mahmood et al. 2019).

For globalization, positive and significant coefficients imply that globalization leads to more carbon emissions across medium to highest quantiles. The reason could be that certain emerging countries are not taking into account environmental issues. To seek additional profits from the trade, they permit the developed countries’ pollution-intensive industry to carry out their activities. Moreover, industrial development, as industrial development, exerts more pressure on energy demand, so fossil sources at a high rate are utilized, thereby inducing more carbon emissions (Shahbaz et al. 2015a). So, in a nutshell, it is clear that these regions are progressing towards natural resources and globalization-induced releases of pollution. The consequence provokes that effective environmental policies are required to reduce pollution (Table 9).

By looking at each panel estimation model’s results such as DOLS, FMOLS, and FE-OLS and MMQR, it is evident that for all variables, the MMQR coefficient is varied throughout the quantiles and proves that MMQR is distinct from DOLS, FMOLS, and FE-OLS for all variables. Unlike the other estimators, in MMQR, the GDP increases CO2 emissions from lowest to highest quantile, demonstrating that GDP produces more emissions across quantiles and entails that the liaison hugely depends on quantiles. As anticipated, the GDP2 results certify the EKC curve and show a reduction of CO2 emission from lower to higher quantiles, but at the higher quantile, the results turn insignificant. The results in the context of natural resources portray that in DOLS, FMOLS, and FE-OLS estimations, the results are not much different across all specifications. Still, in MMQR, the natural resources’ consumption highly and significantly degenerates the environment. The result additionally adverts exciting findings that the natural resources increases CO2 emissions at the lowermost quantile and reduces at median to upper quantile, which means emissions of carbon are at their minimum levels at quantiles where effects of natural resources on CO2 emissions are maximum and then become insignificant at upper half quantile. Besides, the coefficient of renewable energy in all estimators of panel data is someway adjacent, but in MMQR, the results also demonstrate that through renewable energy recovers the environment and reduces CO2 emission but from lowest to highest quantiles, the coefficient not only minimizes but also becomes insignificant which points to the fact that the renewable energy portion in total energy portfolio in developing economies is not increasing with the increase of economic growth. In the case of globalization, the results in the context of MMQR provide a clear depiction that globalization does not induce CO2 emissions at initial quantiles but increases emission from 4th to uppermost quantiles, and the coefficient also significantly increases from 18 to 42%. When the effects of all estimations are compared, it is apparent that the MMQR is the optimal and the better approach to examine the transparent and comprehensive representation of the combination of variables. It is proper at measuring both the value of coefficients and the significance of the impact of variables.

Test of heterogeneous panel causality

The selection of structure that supports the model’s heterogeneity by exploring the bivariate causal association of desired variables such as GDP, GDP2, NAR, REN, GLO, and CO2 in the short run along the cross-sections is vital. In this context, Dumitrescu and Hurlin (2012) have implemented the heterogeneous causality technique based on the useful panel data that allows all coefficients to remain to diverge throughout cross-sections. Furthermore, the prerequisite of this test is that all variables are obligatory to be stationary. The finding associated with the panel causality test is offered in Table 10. The bi-directional causality is found between all variables taken in the study, i.e., natural resources, renewable energy and globalization, and economic growth cause CO2 emissions. In return, CO2 also influences these variables that point to the increased level of CO2 emission in MINT economies both ways.

Conclusion and policy recommendations

The current study examines the EKC hypothesis for natural resources, economic growth, renewable energy, and globalization and CO2 panel in MINT from 1995 to 2018. As per the author’s knowledge, only a few former studies have explored the causal relationship between the selected variables. In the existing literature, Danish et al. (2019) studied the natural resources’ role for BRICS and Balsalobre-Lorente et al. (2018) for five countries of EU. But this study incorporated natural resources with additional variable globalization for MINT countries and found that natural resources and globalization causes environmental pollution. We may argue that unsustainable natural resource consumption and the share of fossil and other too contaminated energy mix sources are the major factors responsible for environmental pollution in emerging MINT nations.

Moreover, it is the first study that used methods moment of quantile regression to elaborate the association between parameters under EKC. All conclusions and goals of this study are well focused. Since the GDP effect on CO2, in the long run, is positive, and the long-run GDP2 effects on CO2 is negative, so the EKC hypothesis is verified in the sample regions but not certified at the highest quantiles from the MMQR outcome. It has been revealed that NAR increases CO2 emissions at the extreme lowermost quantiles to middle quantiles and does not affect CO2 emissions at upper quantiles (7th–9th). And it is plausible that at the early and intermediary phases, the emerging economies exploit the natural resources to keep pace with the economic growth. Then, the implementation of more environmentally friendly technologies, later on, enables them to maintain balance. In renewable energy, the results are unexpectedly insignificant at higher quintiles, i.e., renewable energy increases CO2 emissions at upper quantiles. It entails that when economies require a rise in energy requirements, the renewable energy share decreases, which imply that an increase in environmental pollution occurs from fossil sources.

Although the globalization effects on CO2 are insignificant at low quantiles, the impact gets more robust from the middle to highest quantiles, which indicates the sharp boost in CO2 by globalization from middle to highest quantiles. The causality findings also suggested a bi-directional association between all parameters and CO2 emissions, proposing that MINT countries should work efficiently in such a sustainable way and impose environmental policies in association with CO2 reduction. Moreover, the significant results for EKC portray the potential of MINT nation to reduce CO2. Sustaining economic development without causing environmental degradation is one of the significant challenges for emerging MINT economies. Governments should enforce environmental rules and promote new consumer influxes to use renewable energy as their prime energy source and implement cleaner production processes to lessen polluting input supplies from developed countries. Investors from developed countries should be stimulated to invest in green energy projects to balance sustainable economic growth and the ecosystem.

Data availability

Not applicable.

Notes

The data used in this study can be provided upon request to the corresponding author of this paper.

References

Agras J, Chapman D (1999) A dynamic approach to the Environmental Kuznets Curve hypothesis. Ecol Econ 28:267–277

Ahmad M, Zhao Z-Y (2018) Empirics on linkages among industrialization, urbanization, energy consumption, CO2 emissions and economic growth: a heterogeneous panel study of China. Environ Sci Pollut Res 25:30617–30632

Ahmed K, Shahbaz M, Qasim A, Long W (2015) The linkages between deforestation, energy and growth for environmental degradation in Pakistan. Ecol Indic 49:95–103. https://doi.org/10.1016/j.ecolind.2014.09.040

Ahmed K, Mahalik MK, Shahbaz M (2016) Dynamics between economic growth, labor, capital and natural resource abundance in Iran: an application of the combined cointegration approach. Resour Policy 49:213–221. https://doi.org/10.1016/j.resourpol.2016.06.005

AlFarra HJ, Abu-Hijleh B (2012) The potential role of nuclear energy in mitigating CO2 emissions in the United Arab Emirates. Energy Policy 42:272–285

Ali S, Waqas H, Ahmad N (2015) Analyzing the dynamics of energy consumption, liberalization, financial development, poverty and carbon emissions in Pakistan. J Appl Env Biol Sci 5:166–183

An H, Razzaq A, Haseeb M, Mihardjo LW (2020) The role of technology innovation and people’s connectivity in testing environmental Kuznets curve and pollution heaven hypotheses across the Belt and Road host countries: new evidence from Method of Moments Quantile Regression. Environ Sci Pollut Res 1–17. https://doi.org/10.1007/s11356-020-10775-3

Apergis N, Payne J, Menyah K, Yemane W-R (2010a) On the causal dynamics between emissions, nuclear energy, renewable energy, and economic growth. Ecol Econ 69:2255–2260

Apergis N, Payne JE, Menyah K, Wolde-Rufael Y (2010b) On the causal dynamics between emissions, nuclear energy, renewable energy, and economic growth. Ecol Econ 69:2255–2260

Attiaoui I, Toumi H, Ammouri B, Gargouri I (2017) Causality links among renewable energy consumption, CO2 emissions, and economic growth in Africa: evidence from a panel ARDL-PMG approach. Environ Sci Pollut Res 24:13036–13048. https://doi.org/10.1007/s11356-017-8850-7

Audi M, Ali A (2018) Determinants of environmental degradation under the perspective of globalization: a panel analysis of selected MENA nations. Retrieved from https://mpra.ub.uni-muenchen.de/85776/

Aziz N, Sharif A, Raza A, Rong K (2020a) Revisiting the role of forestry, agriculture, and renewable energy in testing environment Kuznets curve in Pakistan: evidence from Quantile ARDL approach. Environ Sci Pollut Res 27:10115–10128. https://doi.org/10.1007/s11356-020-07798-1

Aziz N, Mihardjo LWW, Sharif A, Jermsittiparsert K (2020b) The role of tourism and renewable energy in testing the environmental Kuznets curve in the BRICS countries: fresh evidence from methods of moments quantile regression. Environ Sci Pollut Res 27:39427–39441. https://doi.org/10.1007/s11356-020-10011-y

Balsalobre D, Álvarez A, Cantos JM (2015) Public budgets for energy RD&D and the effects on energy intensity and pollution levels. Environ Sci Pollut Res 22:4881–4892

Balsalobre-Lorente D, Shahbaz M (2016) Energy consumption and trade openness in the correction of GHG levels in Spain. Bull Energy Econ 4:310–322

Balsalobre-Lorente D, Shahbaz M, Roubaud D, Farhani S (2018) How economic growth, renewable electricity and natural resources contribute to CO2 emissions? Energy Policy 113:356–367. https://doi.org/10.1016/j.enpol.2017.10.050

Balsalobre-Lorente D, Driha OM, Bekun FV, Osundina OA (2019a) Do agricultural activities induce carbon emissions? The BRICS experience. Environ Sci Pollut Res 26:25218–25234. https://doi.org/10.1007/s11356-019-05737-3

Balsalobre-Lorente D, Gokmenoglu KK, Taspinar N, Cantos-Cantos JM (2019b) An approach to the pollution haven and pollution halo hypotheses in MINT countries. Environ Sci Pollut Res 26:23010–23026. https://doi.org/10.1007/s11356-019-05446-x

Bekhet HA, Othman NS (2018) The role of renewable energy to validate dynamic interaction between CO2 emissions and GDP toward sustainable development in Malaysia. Energy Econ 72:47–61

Bélaïd F, Youssef M (2017) Environmental degradation, renewable and non-renewable electricity consumption, and economic growth: assessing the evidence from Algeria. Energy Policy 102:277–287. https://doi.org/10.1016/j.enpol.2016.12.012

Ben Jebli M, Ben Youssef S, Ozturk I (2016) Testing environmental Kuznets curve hypothesis: the role of renewable and non-renewable energy consumption and trade in OECD countries. Ecol Indic 60:824–831. https://doi.org/10.1016/j.ecolind.2015.08.031

Binder M, Coad A (2011) From average Joe’s happiness to miserable Jane and Cheerful John: using quantile regressions to analyze the full subjective well-being distribution. J Econ Behav Organ 79:275–290. https://doi.org/10.1016/j.jebo.2011.02.005

Brajer V, Mead RW, Xiao F (2011) Searching for an environmental Kuznets curve in China’s air pollution. China Econ Rev 22:383–397. https://doi.org/10.1016/j.chieco.2011.05.001

British Petroleum (2018) BP statistical review of world energy. British Petroleum, London

Canay IA (2011) A simple approach to quantile regression for panel data. Econom J 14:368–386

Cavlovic TA, Baker KH, Berrens RP, Gawande K (2000) A meta-analysis of Environmental Kuznets Curve studies. Agric Resour Econ Rev 29(1):32–42

Cole MA, Rayner AJ, Bates JM (1997) The environmental Kuznets curve: an empirical analysis. Environ Dev Econ 2(4):401–416

Coondoo D, Dinda S (2008) Carbon dioxide emission and income: a temporal analysis of cross-country distributional patterns. Ecol Econ 65:375–385. https://doi.org/10.1016/j.ecolecon.2007.07.001

Copeland BR, Taylor MS (2005) Free trade and global warming: a trade theory view of the Kyoto protocol. J Environ Econ Manage 49:205–234. https://doi.org/10.1016/j.jeem.2004.04.006

Dadasov R, Hefeker C, Lorz O (2017) Natural resource extraction, corruption, and expropriation. Rev World Econ 153:809–832. https://doi.org/10.1007/s10290-017-0288-y

Danish, Baloch MA, Mahmood N, Zhang JW (2019) Effect of natural resources, renewable energy and economic development on CO 2 emissions in BRICS countries. Sci Total Environ 678:632–638. https://doi.org/10.1016/j.scitotenv.2019.05.028

de Vita G, Katircioglu S, Altinay L, Fethi S, Mercan M (2015) Revisiting the environmental Kuznets curve hypothesis in a tourism development context. Environ Sci Pollut Res 22:16652–16663. https://doi.org/10.1007/s11356-015-4861-4

Dijkgraaf E, Vollebergh HRS (1998) Growth and environment—is there a Kuznets curve for carbon emissions? In: 2nd ESEE conference, University of Geneva

Dogan E, Taspinar N, Gokmenoglu KK (2019) Determinants of ecological footprint in MINT countries. Energy Environ 30:1065–1086. https://doi.org/10.1177/0958305X19834279

Dong K, Hochman G, Zhang Y, Sun R, Li H, Liao H (2018) CO2 emissions, economic and population growth, and renewable energy: empirical evidence across regions. Energy Econ 75:180–192. https://doi.org/10.1016/j.eneco.2018.08.017

Dumitrescu C, Hurlin C (2012) Testing for Granger non-causality in heterogeneous panels. Econ Model 29:1450–1460

El Fadel M, Rachid G, El-Samra R, Boutros GB, Hashisho J (2013) Emissions reduction and economic implications of renewable energy market penetration of power generation for residential consumption in the MENA region. Energy Policy 52:618–627

Evans A, Strezov V, Evans TJ (2009) Assessment of sustainability indicators for renewable energy technologies. Renew Sust Energ Rev 13:1082–1088

Genty A, Arto I, Neuwahl F (2012) Final database of environmental satellite accounts: technical report on their compilation. WIOD Deliv 4(6):1–69

Ghosh S (2002) Electricity consumption and economic growth in India. Energy Policy 30:125–129

Giljum S, Hinterberger F, Bruckner M, Burger E, Frühmann J, Lutter S, Pirgmaier E, Polzin C, Waxwender H, Kernegger L, Warhurst M (2009) Overconsumption? Our use of the world’s natural resources. Retrieved from https://inis.iaea.org/search/search.aspx?orig_q=RN:41132213

Gill AR, Viswanathan KK, Hassan S (2018) A test of environmental Kuznets curve (EKC) for carbon emission and potential of renewable energy to reduce green house gases (GHG) in Malaysia. Environ Dev Sustain 20:1103–1114. https://doi.org/10.1007/s10668-017-9929-5

Global Footprint Network (2017) Annual Report Global Footprint Network. Reterived from https://www.footprintnetwork.org/content/uploads/2018/07/GFN_AR_2017_FINAL_lores.pdf

Global IRP (2019) Resources outlook 2019: natural resources for the future we want

Grossman GM, Krueger AB (1991) Environmental impacts of a North American free trade agreement. Natl Bur Econ Res Work Pap Ser No 3914:1–57. https://doi.org/10.3386/w3914

Grossman GM, Krueger AB (1995) Economic growth and the environment. Q J Econ 110(2):353–377

Harbaugh W, Levinson A, Wilson DM (2002) Re-examining the empirical evidence for an environmental Kuznets curve. Rev Econ Stat 84:541–551

Haseeb A, Xia E, Danish, Baloch MA, Abbas K (2018) Financial development, globalization, and CO2 emission in the presence of EKC: evidence from BRICS countries. Environ Sci Pollut Res 25:31283–31296. https://doi.org/10.1007/s11356-018-3034-7

Heil MT, Wodon QT (1997) Inequality in CO2 emissions between poor and rich countries. J Environ Dev 6:426–452. https://doi.org/10.1177/107049659700600404

Huaman RNE, Jun TX (2014) Energy related CO2 emissions and the progress on CCS projects: a review. Renew Sustain Energy Rev 31:368–385

Huang J-T (2018) Sulfur dioxide (SO2) emissions and government spending on environmental protection in China - evidence from spatial econometric analysis. J Clean Prod 175:431–441

Hussain J, Khan A, Zhou K (2020) The impact of natural resource depletion on energy use and CO2 emission in Belt & Road Initiative countries: a cross-country analysis. Energy 199:117409. https://doi.org/10.1016/j.energy.2020.117409

IBRD (1992) World Development Report 1992. Development and the environment. Oxford University Press, New York

IEA (International Energy Agency) (2014) CO2 emissions from fuel combustion. Retrieved from https://www.iea.org/reports/co2-emissions-from-fuel-combustion-overview

Irandoust M (2016) The renewable energy-growth nexus with carbon emissions and technological innovation: evidence from the Nordic countries. Ecol Indic 69:118–125. https://doi.org/10.1016/j.ecolind.2016.03.051

Kalaycı C, Hayaloğlu P (2019) The impact of economic globalization on CO2 emissions: the case of NAFTA countries. Int J Energy Econ Policy 9:356–360. https://doi.org/10.32479/ijeep.7233

Kao C, Chiang M-H (2001) On the estimation and inference of a cointegrated regression in panel data. In: Nonstationary panels, panel cointegration, and dynamic panels. Emerald Group Publishing Limited

Katircioǧlu ST (2014) Testing the tourism-induced EKC hypothesis: the case of Singapore. Econ Model 41:383–391. https://doi.org/10.1016/j.econmod.2014.05.028

Khan MK, Teng JZ, Khan MI, Khan MO (2019a) Impact of globalization, economic factors and energy consumption on CO2 emissions in Pakistan. Sci Total Environ 688:424–436. https://doi.org/10.1016/j.scitotenv.2019.06.065

Khan MTI, Yaseen MR, Ali Q (2019b) Nexus between financial development, tourism, renewable energy, and greenhouse gas emission in high-income countries: a continent-wise analysis. Energy Econ 83:293–310. https://doi.org/10.1016/j.eneco.2019.07.018

Koenker R (2004) Quantile regression for longitudinal data. J Multivar Anal 91(1):74–89

Kolcava D, Nguyen Q, Bernauer T (2019) Does trade liberalization lead to environmental burden shifting in the global economy? Ecol Econ 163:98–112

Kwakwa PA, Alhassan H, Adu G (2018) Effect of natural resources extraction on energy consumption and carbon dioxide emission in Ghana. University Library of Munich, Germany

Lee JW, Brahmasrene T (2013) Investigating the influence of tourism on economic growth and carbon emissions: evidence from panel analysis of the European Union. Tour Manag 38:69–76. https://doi.org/10.1016/j.tourman.2013.02.016

Lee S, Oh D-W (2015) Economic growth and the environment in China: empirical evidence using prefecture level data. China Econ Rev 36:73–85. https://doi.org/10.1016/j.chieco.2015.08.009

Liu M, Ren X, Cheng C, Wang Z (2020) The role of globalization in CO2 emissions: a semi-parametric panel data analysis for G7. Sci Total Environ 718:137379. https://doi.org/10.1016/j.scitotenv.2020.137379

Machado J, Silva JS (2019) Quantiles via moments. J Econom 213:145–173. https://doi.org/10.1016/j.jeconom.2019.04.009

Mahmood N, Wang Z, Hassan ST (2019) Renewable energy, economic growth, human capital, and CO2 emission: an empirical analysis. Environ Sci Pollut Res 26:20619–20630. https://doi.org/10.1007/s11356-019-05387-5

Mehmet M, Bölük G, Büyükyilmaz A (2015) Fossil & renewable energy consumption, GHGs and economic growth: evidence from a ridge regression of Kyoto annex countries. Akdeniz Üniversitesi İktisadi ve İdari Bilim. Fakültesi Derg 15:45–69

Mert M, Bölük G, Çağlar AE (2019) Interrelationships among foreign direct investments, renewable energy, and CO 2 emissions for different European country groups: a panel ARDL approach. Environ Sci Pollut Res 26:21495–21510

Mudakkar SR, Zaman K, Khan MM, Ahmad M (2013) Energy for economic growth, industrialization, environment and natural resources: living with just enough. Renew Sust Energ Rev 25:580–595. https://doi.org/10.1016/j.rser.2013.05.024

O’Neill J (2013) Who you calling a BRIC? Bloom. View 12:63–79

Öztürk Z, Yildirim E (2015) Environmental kuznets curve in the mint countries: evidence of long-run panel causality test. Int J Econ Soc Res 11(1):175–183

Pao HT, Tsai CM (2010) CO 2 emissions, energy consumption and economic growth in BRIC countries. Energy Policy 38:7850–7860. https://doi.org/10.1016/j.enpol.2010.08.045

Pata UK (2018) Renewable energy consumption, urbanization, financial development, income and CO2 emissions in Turkey: testing EKC hypothesis with structural breaks. J Clean Prod 187:770–779. https://doi.org/10.1016/j.jclepro.2018.03.236

Pedroni P (1999) Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxf Bull Econ Stat 61(S1):653–670

Pedroni P (2004) Panel cointegration: asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Economic Theory 20:597–625. https://doi.org/10.1017/S0266466604203073

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econ 22:265–312

Phillips PCB, Hansen BE (1990) Statistical inference in instrumental variables regression with I (1) processes. Rev Econ Stud 57:99–125

Qiao H, Zheng F, Jiang H, Dong K (2019) The greenhouse effect of the agriculture-economic growth-renewable energy nexus: evidence from G20 countries. Sci Total Environ 671:722–731. https://doi.org/10.1016/j.scitotenv.2019.03.336

Rafindadi AA, Usman O (2019) Globalization, energy use, and environmental degradation in South Africa: startling empirical evidence from the Makicointegration test. J Environ Manag 265–275:265–275. https://doi.org/10.1016/j.jenvman.2019.05.048

Raza SA, Shah N (2017) Tourism growth and income inequality: does Kuznets Curve hypothesis exist in top tourist arrival countries. Asia Pacific J Tour Res 22:874–884

Saint Akadiri S, Lasisi TT, Uzuner G, Akadiri AC (2019) Examining the impact of globalization in the environmental Kuznets curve hypothesis: the case of tourist destination states. Environ Sci Pollut Res 26:12605–12615

Salahuddin M, Ali MI, Vink N, Gow J (2019) The effects of urbanization and globalization on CO 2 emissions: evidence from the Sub-Saharan Africa (SSA) countries. Environ Sci Pollut Res 26:2699–2709

Sapkota P, Bastola U (2017) Foreign direct investment, income, and environmental pollution in developing countries: panel data analysis of Latin America. Energy Econ 64:206–212

Sarkodie SA (2018) The invisible hand and EKC hypothesis: what are the drivers of environmental degradation and pollution in Africa? Environ Sci Pollut Res 25:21993–22022. https://doi.org/10.1007/s11356-018-2347-x

Sarkodie SA, Strezov V (2018) Empirical study of the environmental Kuznets curve and environmental sustainability curve hypothesis for Australia, China, Ghana and USA. J Clean Prod 201:98–110

Sarkodie SA, Strezov V (2019) Effect of foreign direct investments, economic development and energy consumption on greenhouse gas emissions in developing countries. Sci Total Environ 646:862–871

Satoglu EB (2017) Emerging through foreign investment: investment development path estimation of MINT economies. Adv Econ Bus 5:256–264

Sbia R, Shahbaz M, Hamdi H (2014) A contribution of foreign direct investment, clean energy, trade openness, carbon emissions and economic growth to energy demand in UAE. Econ Model 36:191–197

Scherer L, Behrens P, de Koning A, Heijungs R, Sprecher B, Tukker A (2018) Trade-offs between social and environmental Sustainable Development Goals. Environ Sci Pol 90:65–72

Shafik N (1994) Economic development and environmental quality: an econometric analysis. Oxford Econ 46:757–773

Shafik N, Bandyopadhyay S (1992) Economic growth and environmental quality: time series and cross country evidence. Background Paper for the World Development Report 1992. The World Bank, Washington, DC

Shahabadi A, Feyzi S (2016) The relationship between natural resources abundance, foreign direct investment and environmental performance in selected oil and developed countries during 1996–2013. Retrieved from https://ideas.repec.org/a/trd/journl/v4y2016i3p101-116.html

Shahbaz M, Ozturk I, Afza T, Ali A (2013) Revisiting the environmental Kuznets curve in a global economy. Renew Sust Energ Rev 25:494–502. https://doi.org/10.1016/j.rser.2013.05.021

Shahbaz M, Bhattacharya M, Ahmed K (2015a) Growth-globalisation-emissions nexus: the role of population in Australia. Monash Bus Sch Discuss Pap 23:1–33

Shahbaz M, Mallick H, Mahalik MK, Loganathan N (2015b) Does globalization impede environmental quality in India? Ecol Indic 52:379–393

Shahbaz M, Dube S, Ozturk I, Jalil A (2015c) Testing the environmental Kuznets curve hypothesis in Portugal. Int J Energy Econ Policy 5(2):475–481

Shahbaz M, Mahalik MK, Shah SH, Sato JR (2016) Time-varying analysis of CO2 emissions, energy consumption, and economic growth nexus: statistical experience in next 11 countries. Energy Policy 98:33–48. https://doi.org/10.1016/j.enpol.2016.08.011

Shahbaz M, Khan S, Ali A, Bhattacharya M (2017) The impact of globalization on CO2 emissions in China. Singapore Econ Rev 62:929–957

Shahbaz M, Lahiani A, Abosedra S, Hammoudeh S (2018a) The role of globalization in energy consumption: a quantile cointegrating regression approach. Energy Econ 71:161–170. https://doi.org/10.1016/j.eneco.2018.02.009

Shahbaz M, Naeem M, Ahad M, Tahir I (2018b) Is natural resource abundance a stimulus for financial development in the USA? Resour Policy 55:223–232. https://doi.org/10.1016/j.resourpol.2017.12.006

Shahbaz M, Kumar Mahalik M, Jawad Hussain Shahzad S, Hammoudeh S (2019) Testing the globalization-driven carbon emissions hypothesis: international evidence. Int Econ 158:25–38. https://doi.org/10.1016/j.inteco.2019.02.002

Sharif A, Afshan S, Qureshi MA (2019a) Idolization and ramification between globalization and ecological footprints: evidence from quantile-on-quantile approach. Environ Sci Pollut Res 26:11191–11211. https://doi.org/10.1007/s11356-019-04351-7

Sharif A, Raza SA, Ozturk I, Afshan S (2019b) The dynamic relationship of renewable and non-renewable energy consumption with carbon emission: a global study with the application of heterogeneous panel estimations. Renew Energy 133:685–691. https://doi.org/10.1016/j.renene.2018.10.052

Sharif A, Mishra S, Sinha A, Jiao Z, Shahbaz M, Afshan S (2020) The renewable energy consumption-environmental degradation nexus in top-10 polluted countries: fresh insights from quantile-on-quantile regression approach. Renew Energy 150:670–690

Simas M, Wood R, Hertwich E (2015) Labor embodied in trade: The role of labor and energy productivity and implications for greenhouse gas emissions. J Ind Ecol 19(3):343–356

Solarin SA, Al-Mulali U, Musah I, Ozturk I (2017) Investigating the pollution haven hypothesis in Ghana: an empirical investigation. Energy 124:706–719

Stern D (2017) The environmental Kuznets curve after 25 years. J Bioecon 19:7–28

Stern DI, Common MS, Barbier EB (1996) Economic growth and environmental degradation: a critique of the environmental Kuznets curve. World Dev 24:1151–1160

Sulaiman J, Azman A, Saboori B (2013) The potentialof renewable energy: using the environmental kuznets curve model. Am J Environ Sci 9:103–112. https://doi.org/10.3844/ajessp.2013.103.112

Taguchi H (2012) The environmental Kuznets curve in Asia: the case of sulphur and carbon emissions. Asia-Pacific Development Journal 19(2):77–92

Usman O, Iorember PT, Olanipekun IO (2019) Revisiting the environmental Kuznets curve (EKC) hypothesis in India: the effects of energy consumption and democracy. Environ Sci Pollut Res 26:13390–13400. https://doi.org/10.1007/s11356-019-04696-z

Westerlund J (2007) Testing for error correction in panel data. Ox Bull Econ Stat 69(6):709–748

Westerlund J, Edgerton DL (2008) A simple test for cointegration in dependent panels with structural breaks. Oxf Bull Econ Stat 70(5):665–704

World Bank (2019) World Development Report 2019 retrieved from https://www.worldbank.org/en/publication/wdr2019

Wright C (2014) After the BRICS are the MINTs, but can you make any money from them? Forbes, January 6. Retrieved from https://www.forbes.com/sites/chriswright/2014/01/06/after-the-brics-the-mints-catchy-acronym-but-can-you-make-any-money-from-it/

Wu R, Geng Y, Liu W (2017) Trends of natural resource footprints in the BRIC (Brazil, Russia, India and China) countries. J Clean Prod 142:775–782. https://doi.org/10.1016/j.jclepro.2016.03.130

You W, Lv Z (2018) Spillover effects of economic globalization on CO2 emissions: a spatial panel approach. Energy Econ 73:248–257. https://doi.org/10.1016/j.eneco.2018.05.016

Zafar MW, Mirza FM, Zaidi SAH, Hou F (2019) The nexus of renewable and non-renewable energy consumption, trade openness, and CO2 emissions in the framework of EKC: evidence from emerging economies. Environ Sci Pollut Res 26:15162–15173. https://doi.org/10.1007/s11356-019-04912-w

Zaidi SAH, Zafar MW, Shahbaz M, Hou F (2019) Dynamic linkages between globalization, financial development and carbon emissions: evidence from Asia Pacific Economic Cooperation countries. J Clean Prod 228:533–543. https://doi.org/10.1016/j.jclepro.2019.04.210

Zencey E (2012) The other road to serfdom and the path to sustainable democracy. University Press of New England, Boston

Author information

Authors and Affiliations

Contributions

Noshaba Aziz: conceptualization, writing – original draft

Arshian Sharif: writing methodology and data analysis

Ali Raza: writing – original draft

Kittisak Jermsittiparsert: writing – review and editing

Corresponding author

Ethics declarations

Ethical approval

Not applicable.

Consent to participate

Not applicable.

Consent to publish

Not applicable.

Competing interests

The authors declare that they have no competing interests.

Additional information

Responsible Editor: Eyup Dogan

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Aziz, N., Sharif, A., Raza, A. et al. The role of natural resources, globalization, and renewable energy in testing the EKC hypothesis in MINT countries: new evidence from Method of Moments Quantile Regression approach. Environ Sci Pollut Res 28, 13454–13468 (2021). https://doi.org/10.1007/s11356-020-11540-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-11540-2