Abstract

Recent economic and environmental literature suggests that the current state of energy use in South Africa amidst rapid growing population is unsustainable. Researchers in this area mostly focus on the effect of fossil energy use on carbon (CO2) emission, which represents only an aspect of environmental quality. In contrast, the current study evaluates the influence of renewable energy use, human capital, and trade on ecological footprint––a more comprehensive measure of environmental quality. To this end, the study employs multiple structural breaks cointegration tests (Maki cointegration tests), dynamic unrestricted error correction model through Autoregressive Distributed Lag (ARDL) model, and VECM Granger causality tests. The results of the Maki cointegration tests reveal the existence of a cointegration between the variables in all the models with evidence of multiple structural breaks. Further, the ARDL results divulge that an increase in renewable energy use, human capital, and trade improves environmental quality through a decrease in ecological footprint, while an increase in income stimulates ecological footprint. Moreover, causal relationship is found, running from all the variables to renewable energy and trade flow in the long run, while in the short run, economic growth causes ecological footprint. Trade is found to Granger-cause human capital, while human capital causes renewable energy. Additionally, human capital, renewable energy, and economic growth are predictors of trade. The study therefore recommends South African policymakers to consider the importance of renewable energy, human capital development, and trade as a policy option to reduce ecological footprint and improve environmental quality.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Recent developments in the global economy and the environment suggest that the current state of the economy fueled by the consumption of energy from non-renewables, rapid population growth, and trade is unsustainable. A direct consequence of this development is that economies are growing at the cost of substandard environment. This development is being influenced by the transformation in the global energy systems from both supply and demand perspectives. While the supply side effects may be attributed to the push for renewables given their potency to improve environmental quality (Usman et al. 2020a; Iorember et al. 2020; Alvarez-Herranz et al. 2017; Sinha et al. 2017; Zoundi 2017; Allard et al. 2018; Balsalobre-Lorente et al. 2018), the demand side effects are due to emerging economies’ growth and massive trade flows, both of which are extremely energy intensive. Regarding economies’ growth, the demand side effect supports a positive link between economic growth and fossil energy consumption, which suggests that economic expansion translates into higher energy consumption and consequently, higher carbon emissions (Dogan and Turkekul 2016; Usman et al. 2020a; Asongu et al. 2019; Iorember et al. 2019; Aboagye 2017).

Relatedly, linking global trade with environmental quality is important because economic expansion thrives on globally intertwined markets and many of the environmental consequences of the exploitation of natural resources are global in nature (Hassan et al. 2019). Studies that support the positive impact of trade on environmental quality (Dogan and Turkekul 2016; Hanif 2018; Hasson and Masih 2017; Rafindadi 2016; Shahbaz et al. 2013a, b; Shafik and Bandyopadhyay 1992) argue that expanding trade from domestic markets to international market does not only increase market share of the trading countries but also introduce competition among the countries and improves efficiency in the utilization of scarce resources which improves environmental quality. This suggests that a country that is open to trade will observe less pollution because higher levels of competition due to openness will results into investment in new and efficient technologies that can abate emission or pollution. On the contrary, Halicioglu and Ketenci (2018), Copeland and Taylor (2001), and Khalil and Inam (2006) observe that expansion of trade to international markets is associated with depletion of natural resources and increase in carbon emissions which ultimately deteriorates environmental quality. According to Hassan et al. (2019), global trade is detrimental to the environment because it encourages location of polluting industries in countries with low environmental regulations such as South Africa where the recently formulated CO2 emission tax is yet to be fully implemented.

Regarding the role of human capital, little attention has been paid to the relationship between human capital and environmental quality in South Africa in particular, and Africa in general. However, the rapid population growth in South Africa implies not only additional pressure on the environment but also more public investment on human capital (e.g., education and health). A few of the studies on this relationship in other countries (see Ahmed et al. 2020; Shujah-ur-Rahman et al. 2019; Wang et al. 2019; Mahmood et al. 2019; Ahmed and Wang 2019; Bano et al. 2018; and Yang et al. 2017;) concur that development in human capital plays a crucial role in environmental sustainability through reduction in fossil energy consumption.

More so, researches on the growth-energy-environment nexus have mostly employed carbon emission (CO2) to measure environmental degradation, despite the fact that CO2 emissions is limited and represents only one aspect of environmental quality—air pollution (see Usman et al. 2020a; Saud et al. 2020; Iorember et al. 2020; Alola 2019; Shahbaz et al. 2019; Usman et al. 2019; Rafindadi and Usman 2019; Yilanci et al. 2019; Ulucak and Lin 2017; Shahbaz et al. 2016; Apergis and Payne (2012). In order to produce a reliable result, ensure a comprehensive measurement of environmental quality, and track the impact of climate change policy (Bekum et al. 2020; Usman et al. 2020b; Usman et al. 2020c; Alola et al. 2019; Ahmed and Wang 2019; Haider and Akram 2019; Uddin et al. 2017), we use ecological footprint as a proxy for environmental quality. Originally developed by Rees (1992) and Rees and Wackernagel (1996), “the ecological footprint is the only metric that measures how much nature we have and how much nature we use” Global Footprint Network (2018). In other words, it is an indicator of human demand on natural resources (Ulucak and Lin 2017; Hassan et al. 2019). As noted by Rudolph and Figge (2017), the ecological footprint is an aggregate indicator determined on the basis of six sub-components of biodiversity land-use types, namely, crop land, grazing land, forest land, fishing grounds, built-up land, and carbon footprint. The ecological footprint index entails built-up land, grazing land, cropland, forestland, carbon footprint, and fishing grounds.

The choice of South Africa for this study is influenced on the basis that as the second largest economy on the African continent (See WDI 2015), the country is heavily dependent on fossil energy (coal) to drive growth, and it is a major emitter of carbon dioxide in Africa. As reported by the British Petroleum Statistical Review (2017), over 70% of the total primary energy consumption comes from coal in South Africa. This makes the country to constitute about 42% of the total carbon dioxide (CO2) emissions in Africa, more than 1% of the total world CO2 emissions, and 7th largest emitters of greenhouse gas (GHG) in the world. Specifically, the GHG emissions in South Africa stood at 510.2377 (MtCO2e) in 2014, accounting for 1.13% of the world total and the fossil fuel CO2 emissions in 2015 stood at 417,161.(kilo tones), accounting for 1.16% emissions of CO2 in the globe. Moreover, South Africa is also one of the leading countries on the continent to initiate the implementation of the carbon dioxide (CO2) tax laws and other policies and strategies to reduce GHG emissions. For example, in 2003 the country introduced a strategy to control exhaust emission from road-going vehicles as well as integrated clean household energy strategy. The country, also in 2004, implemented the climate change response strategy and energy efficiency strategy in 2005 as well as cleaner energy production strategy in 2005––all targeting to reduce environmental pollution and climate change in South Africa. Furthermore, the country also has sound education system for human capital development, and it is open to international trade participation.

To the best of our knowledge, studies that use ecological footprint as a proxy for environmental quality, in the context of renewable energy, human capital, and global trade, are scarce in South Africa. To fill this research gap, the current study contributes to the literature of environmental and energy economics by exploring the economic growth-renewable energy-ecological footprint nexus, while accounting for other plausible regressors such as human capital and trade flows in South Africa. Unlike the previous literature, we employ index of human capital, based on years of schooling and returns to education. This is more comprehensive and robust to the econometric techniques employed.

The rest of the paper is organized as follows: the “Data and model specification” section focuses on the data and methodology which discusses sources of data, model specification, and estimation techniques. The “Empirical results and discussion” section presents the empirical results and discussions. The “Conclusion and policy recommendations” section 4 concludes the paper and discusses policy implications.

Data and model specification

Data

The variables used include ecological footprint per capita, real gross domestic product (GDP) per capita, renewable energy per capita, human capital development, and trade flows. Table 1 presents sources and measurement of data for this study.

Multiple structural breaks cointegration test

It has been extensively argued in the recent literature that the conventional cointegration tests may poorly perform due to structural breaks, which are inherently associated with economic and financial time series data. To avoid this situation, the current study applies multiple structural breaks cointegration tests proposed by Maki (2012). This test provides results that are robust to structural breaks. To execute the test, four regression models are considered with the underlying condition that the series integrated of the same order, i.e., I(1). These models are as follows:Footnote 1

where Di, t perhaps denotes dummy variable, which simply means Di, t = 1 if t > TBi, and 0 if otherwise. TBi is simply the breakpoints, and μt represents the residual term. zt and yt = (y1t, y2t, …, ymt)′ are assumably I(1) variables. We test the null hypothesis of no cointegration in the presence of structural break.

Model specification

We model the ecological footprint sensitivity to economic growth, renewable energy, human capital development, and trade flows in South Africa from 1990 to 2016. The general form of the ecological footprint function for South Africa is represented by the following equation:

where the ecological footprint (EFP) is the dependent variable, while economic growth renewable energy use, human capital development, and trade flows are explanatory variables. The log-log specification of Eq. (5) provides efficient empirical results as compared to a specification in a simple linear form. The reason as given in Usman et al. (2020a, b) is that the log-log form helps to stabilize variance and as such interpret the estimated results in elasticities. Therefore, the log-log specification is as follows:

where lnEFP, lnGDP, lnRE, lnHC, and TRF are the natural logarithms of ecological footprint, gross domestic product, renewable energy use, and human capital development, but trade flow is not in its natural logarithm.Footnote 2μ is the error term, assumed to be normally distributed. We obtain the long-run and short-run effect of the independent variables on the dependent variable by estimating a dynamic unrestricted error correction model (UECM) through the Autoregressive Distributed Lag (ARDL) modeling approach as follows:

where p and q are the optimal lag length and the other variables remain as previously defined. If lnEFP, lnGDP, lnRE, lnHC, and TRF are cointegrated, it invariably implies that they will maintain level relationships specified via long-run coefficients. To this extent, these variables can be presented through an error correction model (ECM), while the long-run coefficients are obtained based on the following regression:

where Δ is the first differenced operator, which is defined generically as Δyt = yt − yt − 1. We obtain the long-run coefficients of the variables as \( {\beta}_i={\partial}_i/\left(1-{\sum}_{j=1}^q{\Phi}_j\right), \) i = 1, 2, 3, 4. The long-run coefficients are expressed in elasticities because the variables are already in their natural logarithms while the error correction term (ECT) is defined as ect = lnefpt − β1lngdpt − β2lnret − β3lnhct − β4trft, where the coefficients β1, β2, β3, and β4represent the long-run estimates of the economic growth, renewable energy, human capital development, and international trade flow. If there is a short-run disequilibrium, the ECM captures the speed of adjustment to the long-run equilibrium level path. Therefore, the ECM equation can be expressed as:

where the coefficients Φi, α1, α2, α3,and α4represent the short-run effect of ecological footprint inertia, economic growth, renewable energy, human capital development, and international trade flow, respectively. This method of modeling is suitable for a situation whereby the integrating properties of the series are I(1) or I(0) or mutually cointegrated. The model is flexible and can be used even though the period of study is small as in our case. Another important advantage of using the ARDL model is that it simultaneously estimates both long-run and short-run effects. Before model estimation, the integrating properties of the series are checked so as to avoid integrating order higher than one as indicated in Pesaran et al. (2001). In doing this, we apply the conventional unit root tests such as Augmented Dickey-Fuller (ADF) and Phillips-Perron (PP) unit root tests. However, the fact that these tests do not capture structural breaks in the series, which could lead to their poor performance, we move further to perform a robustness test based on Zivot and Andrews (1992) unit root tests.

VECM causality tests

In this paper, we apply the vector error correction model (VECM) causality tests to determine the long- and short-run causal relationship between the variables. This approach is suitable if a long-run cointegration is established. To perform this test, we follow Iorember et al. (2020) and Usman et al. (2020c) by specifying the framework of VECM as follow:

where the differenced operator is represented by (1 − L)and one-period lag of residual from the long-run model is represented by ECTt − 1. ε1, ε2, ε3, ε4 and ε5 are the residual terms, invariably assumed to have zero means and distributed normally. If ECTt − 1 is statistically significant, it therefore suggest a long-run causal relationship between the variables. In addition, we used F-statistic of the first differenced variables to test whether there is a short-run causal relationship between the variables. Specifically, a causal relationship flows from lnEFPt to TRFt if Φ15j ≠ 0∀j. Conversely, a causality flows from TRFt to lnEFPt if ρ51j ≠ 0∀j.

Empirical results and discussion

Visual properties of the variables

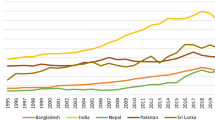

Figure 1 depicts the visual properties of the series with respect to the existence or otherwise of trend, seasonality, structural breaks, and drift. Evidently, the time plots show absence of trend, and seasonality in all the variables except for the log of human capital (LNHC) which maintains a constant upward movement over the study period. However, there is evidence to suggest the existence of structural breaks in the series given their upward and downward movements. The breaks are associated with periods of political and economic phenomena in the country such as the apartheid era, trade policies as well as the global efforts towards efficient energy use and environmental sustainability. Particularly, the rising of lnEFP from 1998 afterwards could be attributed to steady growth following the transition of the political landscape of the country to a more democratic regime while the decline of lnEFP from 2008 could be traceable to sound environmental policies and strategies to combat environmental pollution as a result of economic growth in South Africa. The sharp decrease of lnEFP could be explained by the shock to oil price in 2014 which reduced growth rate in South Africa.

Descriptive statistics

Table 2 shows the descriptive statistics of the series. The results show that the log of renewable energy (LNRE) has the highest mean value 9.390694, followed by the log of RGDP (LNRGDP) with 8.776783. The series with the lowest mean value is the log of human capital (LNHC) with 0.808052. Further, the results show that all the series have low standard deviations except trade flows. This implies that, with the exception of trade flow, other variables are less volatile. Turning to correlation analysis, the results indicate positive and significant correlation between ecological footprint and all the variables except the correlation between ecological footprint and renewable energy which is positive but not statistically significant.

Unit root tests

Precursory to the application of the Maki cointegration and the ARDL long-run and short-run analysis, we check for the unit root properties of the variables. The results establish that all the variables (LNEFP, LNRGDP, LNRE, LNHC, and TRF) are stationary at I(1) processes for both ADF and PP tests using intercept as shown in Table 3. Similarly, the results of the ZA unit root test with structural breaks in Table 4 confirms stationarity at first difference with clear evidence of structural breaks in all the variables.

Cointegration analysis

Table 5 presents results of the Maki cointegration tests with the trimming parameter of 0.05. Based on the results, we conclude that there is existence of cointegration among the variables in all the models with evidence of structural breaks. Particularly, in the first model with level shifts, the test statistic is greater than the critical value at 1% level. Equally, in a model with level shifts and trend, we also find evidence of cointegration. This is also applied to the model with regime shifts as well as model with regime shifts and trend. Overall, since the calculated test statistics exceed the critical values at 10%, 5%, and 1% levels in all the models, we conclude that there is a long-run relationship between the variables. Furthermore, we apply the ARDL bounds testing approach to cointegration to check the robustness of the cointegration tests by Maki (2012). The results presented in Table 6 show that the calculated F-statistics are greater than the upper critical bounds at 5% levels when all the variables are treated as forcing variables except GDP. This implies that there are four cointegrating vectors confirming the presence of long-run relationship among the series over the sample period.

Table 7 presents results of the ARDL long-run and short-run estimates. Evidently, the results show that renewable energy use has elastic, negative, and statistically significant short-run effect on ecological footprint at 5% level of significant. The coefficient of renewable energy use indicates that 1% increase in renewable energy use enhances environmental quality by decreasing 1.25% ecological footprint. This finding concurs with the findings of Dogan and Seker (2016); Usman et al. (2020a), Iorember et al. (2020); Alvarez-Herranz et al. (2017); Sinha et al. (2017); Zoundi (2017); Allard et al. (2018); Balsalobre-Lorente et al. (2018), Dogan et al. (2019); and Apergis and Payne (2012) who establish that renewable energy use supports improvement in environmental quality. This finding points to the fact that even though it is impossible to stop the use of energy from fossil fuels, particularly, from coal which is the dominant source of energy and a major ingredient of economic growth in South Africa, the country can improve its environmental quality by enhancing consumption of energy from renewable sources. Similarly, the results show that human capital and trade flows have statistically significant contribution to decreasing ecological footprint in the short run. The coefficient of human capital entails that 1% development in human capital improves the environmental quality by reducing 1.04% ecological footprint in South Africa. This finding is consistent with the findings of Shujah-ur-Rahman et al. (2019) and Bano et al. (2018) and inconsistent with that of Danish and Wang et al. (2019) which establish a weak and insignificant relationship between human capital and ecological footprint. Given that the unsustainable human activities contribute majorly to environmental degradation, South Africa has over the years devoted attention towards human capital development as a tool to achieving sustainable environment as evidenced by the recent introduction of the carbon tax. Also, the coefficient of trade flows reveals that 1% increase in international trade enhances environmental quality by declining 0.33% ecological footprint in the short run. This finding is in line with the findings of Iorember et al. (2019), Hanif (2018), Hasson and Masih (2017), and Rafindadi (2016). The implications for this finding is that higher levels of competition due to trade openness will results into investment in new energy efficient technologies that improve environmental quality. Regarding the effect of economic growth on environmental quality, the coefficient of gross domestic product indicates that a rise in economic growth deteriorates environmental quality by increasing 1.47% ecological footprint in the short run. This finding agrees with the findings of Iorember et al. (2019), Usman et al. (2020b), and Shujah-ur-Rahman et al. (2019). This is expected since South Africa’s economy is driven largely by coal which is a significant influencer of ecological footprint.

Turning to the long-run effect, the results in Table 7 establish that renewable energy use and human capital have negative and statistically significant effect on ecological footprint. This suggests that 1% increase in renewable energy use will decrease 1.05% ecological footprint and 1% rise in human capital development will decrease 0.87%. More so, the effect of international trade on ecological footprint is a decreasing one but statistically not significant. The coefficient of trade flows reveals that 1% rise in international trade reduces 0.0016% ecological footprint in the long run. Similar to the short run, the coefficient of the long-run economic growth reveals that 1% increase in economic growth degrades the environment by increasing 1.23% ecological footprint.

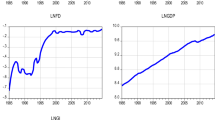

Furthermore, we check for the validity and stability of the estimates using Breusch-Godfrey LM test for serial correlation, ARCH test for heteroscedasticity, Ramsey RESET test for functional form, and Jarque-Bera tests for normality (see Table 7). Evidently, all the tests report probability values of greater than 0.05, suggesting that the estimates are valid and reliable. Similarly, the tests for the residuals (CUSUM and CUSUM Square) also show that the estimates are stable and good for policy issues (see Fig. 2).

Table 8 presents the results of the Chow forecast test. This test primarily examines whether the structural breaks identified by the Maki cointegration tests are attributed to implementation of various energy and environmental policies in South Africa, particularly during the post-apartheid era. During this period, the government of South Africa has paid more attention towards achieving environmental improvement and sustainability by aligning its energy and environmental policies with the Kyoto Protocol agenda to overcome the greenhouse effects. As displayed in Table 8, the F-statistics calculated indicate that there is no significant structural break in the South African economy over the period of study. In other words, the structural breaks identified are not statistically significant. This test as shown by Shahbaz et al. (2016) is more reliable than the use of graphs. Therefore, since the structural breaks are not significant, it implies that the ARDL estimates are efficient and as such reliable.

VECM Granger causality

Table 9 presents results of the VECM Granger causality for both the long- and short-run causality. Regarding the long-run causality, the results show that the coefficient of the (ECMt − 1) is significant for renewable energy use and trade flows equations, suggesting that in the long run, ecological footprint, economic growth, human capital, and trade flows Granger cause renewable energy, use while ecological footprint, economic growth, renewable energy use, and human capital Granger cause trade flows. This result is consistent with Ike et al. 2020a, b) that economic growth Granger causes trade. Our result is also similar to Usman et al. (2020b) who find evidence of causal relationship between economic growth and renewable energy for the USA. Turning to the short-run causality, the results divulge that economic growth Granger causes ecological footprint and trade flows. This finding is expected given the fact that South Africa economy is driven largely by fossil energy (coal energy) which is a major source of environmental degradation (high ecological footprint), hence the need for increasing the share of renewable energy use in the total energy mix to reduce ecological footprint and improve the quality of the environment. This finding is consistent with Shujah-ur-Rahman et al. (2019), Iorember et al. (2020), and Usman et al. (2020a) who establish a causal relationship between economic growth and environmental degradation. We also find evidence of a one-way causal relationship running from human capital to renewable energy. Furthermore, we find evidence in support of a unidirectional causal relationship running from economic growth, renewable energy, and human capital to trade flows. This concurs with Ike et al. (2020c) who suggest a causal relationship between renewable energy and trade for G-7 countries.

Conclusion and policy recommendations

The present study analyzes the influence of renewable energy use, human capital, and trade flows in reducing ecological footprint in South Africa using multiple cointegration analysis, flexible Autoregressive Distributed Lag approach, Chow forecast, and VECM granger causality for the period covering 1990 to 2016. The study employs ADF and PP as conventional unit root tests and ZA test as one structural break test. The results indicate that all the variables are of I(1) processes, suggesting that all the variables are stationary at first difference. Also, the results of the Maki cointegration tests with the trimming parameter of 0.05 reveal the existence of cointegration among the variables in all the models with evidence of multiple structural breaks. Furthermore, the results of the ARDL bounds testing approach confirm the presence of long-run relationship among the series. The empirical results further divulge that increase in renewable energy use improves environmental quality by decreasing ecological footprint both in the long-run and short-run. Similarly, human capital ensures environmental quality by decreasing ecological footprint both in the long and short run, while the effect of trade flows in reducing ecological footprint is not significant. As expected, the results show that a rise in economic growth deteriorates environmental quality by increasing ecological footprint both in the short run and long run. To validate our findings, we estimate the Chow forecast test, and the results indicate that the findings of the ARDL estimates are robust (efficient and reliable) since the identified structural breaks are statistically not significant. More so, the findings of the VECM Granger causality test suggest that in the long run, ecological footprint, economic growth, human capital, and trade flows Granger cause renewable energy use, while ecological footprint, economic growth, renewable energy use, and human capital Granger cause trade flows. In addition, we find that economic growth Granger causes ecological footprint and trade flows in the short run, while human capital Granger causes renewable energy. Similarly, we find evidence of unidirectional causality from economic growth, renewable energy, and human capital to trade flows.

These findings present the need for policies that bring about increase in the share of renewable energy use in the total energy output of South Africa in order to reduce ecological footprint and improve the quality of the environment. Some of these policies include strengthening the implementation of the carbon tax laws, which is at the early stage of implementation in the country. This should be implemented in a manner that will not scare both domestic and foreign investors in energy. Energy and environmental policies should target increasing the capacity of the investors and households to enable them adopt new and cleaner energy technologies in their businesses and homes. In this case, the government and its managers should create a conducive environment so that cleaner energy can be affordable by the investors and households. Furthermore, international trade should be enhanced particularly investments in the area of renewable energy through the removal of obnoxious trade restrictions, and ensuring investors’ confidence by way of reducing trade tensions between the host communities and investors as well as guaranteeing energy investment security.

Data availability

The datasets generated and/or analyzed during the current study are available in the repositories:

- Ecological Footprint per capita is available at Global Footprint Network (GFN 2018)

- Renewable Energy per capita is available at International Energy Agency (IEA 2018)

- Human Capital Development is available at Penn World Table (PWT 9.1 2019)

- Trade and GDP per capita are available at World Development Indicators (World Bank 2018)

Change history

03 December 2020

A Correction to this paper has been published: https://doi.org/10.1007/s11356-020-11860-3

Notes

“Trade flow is already in percentage. Generally, log of a variable measured in percentage is not preferred in empirical studies when other variables are in log levels” ( Balcilar et al. 2020).

References

Aboagye S (2017) Economic expansion and environmental sustainability nexus in Ghana. Afr Dev Rev 29(2):155–168

Ahmed Z, Wang Z (2019) Investigating the impact of human capital on ecological footprint in India: an empirical analysis. Environ Sci Pollut Res 26(26):26782–26796

Ahmed Z, Zafar MW, Ali S (2020) Linking urbanization, human capital, and the ecological footprint in G7 countries: an empirical analysis. Sustain Cities Soc 55:102064

Allard A, Takman J, Uddin GS, Ahmed A (2018) The N-shaped environmental Kuznets curve: an empirical evaluation using a panel quantile regression approach. Environ Sci Pollut Res 25:5848–5861

Alola AA (2019) Carbon emissions and the trilemma of trade policy, migration policy and health care in the US. Carbon Manag. https://doi.org/10.1080/17583004.2019.1577180

Alola AA, Bekun FV, Sarkodie SA (2019) Dynamic impact of trade policy, economic growth, fertility rate, renewable and non-renewable energy consumption on ecological footprint in Europe. Sci Total Environ 685:702–709

Alvarez-Herranz A, Balsalobre-Lorente D, Shahbaz M, Cantos JM (2017) Energy innovation and renewable energy consumption in the correction of air pollution levels. Energy Policy 105:386–397

Apergis N, Payne JE (2012) Renewable and non-renewable energy consumption-growth nexus: evidence from a panel error correction model. Energy Econ 34(3):733–738

Asongu S, Iheonu C, Odo K (2019) The conditional relationship between renewable energy and environmental quality in Sub-Saharan Africa. Environ Sci Pollut Res 26(36):36993–37000

Balcilar M, Usman O, Musa MS (2020) The long-run and short-run exchange rate pass-through during the period of economic reforms in nigeria: is it complete or incomplete? Rom J Econ Forecast 23(1):151–172

Balsalobre-Lorente D, Shahbaz M, Roubaud D, Farhani S (2018) How economic growth, renewable electricity and natural resources contribute to CO2 emissions? Energy Policy 113:356–367

Bano S, Zhao Y, Ahmad A, Wang S, Liu Y (2018) Identifying the impacts of human capital on carbon emissions in Pakistan. J Clean Prod 183:1082–1092

Bekum FV, Yalçiner K, Etokakpan MU et al (2020) Renewed evidence of environmental sustainability from globalization and energy consumption over economic growth in China. Environ Sci Pollut Res 27:29644–29658

BP (2017) Statistical reviews. https://www.bp.com/content/dam/bp/en/corporate/pdf/energy-economics/statistical-review-2017/bp-statistical-review-of-world-energy-2017-full-report.pdf. Accessed 4 June 2020

Copeland B, Taylor MS (2001) International trade and the environment: a frame-work for analysis. NBER Working Paper no. 8540, Washington.

Dogan E, Seker F (2016) The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renew Sust Energ Rev 60:1074–1085

Dogan E, Turkekul B (2016) CO2 emissions, real output, energy consumption, trade, urbanization and financial development: testing the EKC hypothesis for the USA. Environ Sci Pollut Res 23(2):1203–1213

Dogan E, Taspinar N, Gokmenoglu KK (2019) Determinants of ecological footprint in MINT countries. Energy Environ 30(6):1065–1086

Global Footprint Network (GFN) (2018) Advancing the science of sustainability. http://data.footprintnetwork.org/#/exploreData. Accessed 10 June 2020

Haider S, Akram V (2019) Club convergence analysis of ecological and carbon footprint: evidence from a cross-country analysis. Carbon Manag 10(5):451–463

Halicioglu F, Ketenci N (2018) Output, renewable and non-renewable energy production, and international trade: Evidence from EU-15 countries. Energy 159:995–1002

Hanif I (2018) Impact of economic growth, nonrenewable and renewable energy consumption, and urbanization on carbon emissions in Sub-Saharan Africa. Environ Sci Pollut Res 25:15057–15067

Hassan ST, Xia E, Khan NH, Shah SMA (2019) Economic growth, natural resources, and ecological footprint: evidence from Pakistan. Environ Sci Pollut Res 26(3):2929–2938

Hasson A, Masih M (2017) Energy consumption, trade openness, economic growth, carbon dioxide emissions and electricity consumption: evidence from South Africa based on ARDL. Online at https://mpra.ub.uni-muenchen.de/79424/MPRAPaperNo.79424, posted 31 May 2017 04:37 UTC. Accessed 4 June 2020

IEA (2018) International Energy Agency data services. http://wds.iea.org/wds/ReportFolders/ReportFolders.aspx. Accessed 10 June 2020

Ike GN, Usman O, Alola AA, Sarkodie SA (2020a) Environmental quality effects of income, energy prices and trade: the role of renewable energy consumption in G-7 countries. Sci Total Environ 721:137813

Ike GN, Usman O, Sarkodie SA (2020b) Fiscal policy and CO2 emissions from heterogeneous fuel sources in Thailand: evidence from multiple structural breaks cointegration test. Sci Total Environ 702:134711

Ike GN, Usman O, Sarkodie SA (2020c) Testing the role of oil production in the environmental Kuznets curve of oil producing countries: new insights from Method of Moments Quantile Regression. Sci Total Environ 711:135208

Iorember PT, Usman O, Jelilov G (2019) Asymmetric effects of renewable energy consumption, trade openness and economic growth on environmental quality in Nigeria and South Africa, Retrieved from:https://econpapers.repec.org/paper/pramprapa/96333.htm. Accessed 16 May 2020

Iorember PT, Goshit GG, Dabwor DT (2020) Testing the nexus between renewable energy consumption and environmental quality in Nigeria: the role of broad-based financial development. Afr Dev Rev 32(2):163–175

Khalil S, Inam Z (2006) Is Trade Good for Environment? A Unit Root Cointegration Analysis. Pakistan Econ Rev 45(4 Part II (Winter 2006)):1187–1196

Mahmood N, Wang Z, Hassan ST (2019) Renewable energy, economic growth, human capital, and CO2 emission: an empirical analysis. Environ Sci Pollut Res 26:20619–20630 1-12

Maki D (2012) Tests for cointegration allowing for an unknown number of breaks. Econ Model 29(5):2011–2015

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16(3):289–326

PWT 9.1 (2019) The database | Penn World Table | Productivity | University of Groningen. https://www.rug.nl/ggdc/productivity/. Accessed 10 June 2020

Rafindadi AA (2016) Does the need for economic growth influence energy consumption and CO2 emissions in Nigeria? Evidence from the innovation accounting test. Renew Sust Energ Rev 62:1209–1225

Rafindadi AA, Usman O (2019) Globalization, energy use, and environmental degradation in South Africa: startling empirical evidence from the Maki-cointegration test. J Environ Manag 244:265–275

Rees WE (1992) Ecological footprints and appropriated carrying capacity: what urban economics leaves out. Environ Urban 4(2):121–130

Rees WE, Wackernagel M (1996) Our ecological footprint: reducing human impact on earth. New Society Publishers, Gabriola Island

Rudolph A, Figge L (2017) Determinants of ecological footprints: what is the role of globalization? Ecol Indic 81:348–361

Saud S, Chen S, Haseeb A, Sumayya (2020) The role of financial development and globalization in the environment: accounting ecological footprint indicators for selected onebelt-one-road initiative countries. J Clean Prod 250:119518

Shafik N, Bandyopadhyay S (1992) “Economic growth and environmental quality: time series and cross-country evidence”, Background Paper for the World Development Report 1992. The World Bank, Washington

Shahbaz M, Mutascu M, Azim P (2013a) Environmental Kuznets curve in Romania and the role of energy consumption. Renew Sust Energ Rev 18:165–173

Shahbaz M, Tiwari AK, Nasir M (2013b) The effects of financial development, economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Policy 61:1452–1459

Shahbaz M, Solarin SA, Ozturk I (2016) Environmental Kuznets curve hypothesis and the role of globalization in selected African countries. Ecol Indic 67:623–636

Shahbaz M, Mahalik MK, Shahzad SJH, Hammoudeh S (2019) Testing the globalization-driven carbon emissions hypothesis: International evidence. Int Econ 158:25–38

Shujah-ur-Rahman, Chen S, Saud S, Saleem N, Bari MW (2019) Nexus between financial development, energy consumption, income level, and ecological footprint in CEE countries: do human capital and biocapacity matter? Environ Sci Pollut Res 26:31856–31872

Sinha A, Shahbaz M, Balsalobre D (2017) Exploring the relationship between energy usage segregation and environmental degradation in N-11 countries. J Clean Prod 168:1217–1229

Uddin GA, Salahuddin M, Alam K, Gow J (2017) Ecological footprint and real income: panel data evidence from the 27 highest emitting countries. Ecol Indic 77:166–175

Ulucak R, Lin D (2017) Persistence of policy shocks to ecological footprint of the USA. Ecol Indic 80:337–343

Usman O, Iorember PT, Olanipekun IO (2019) Revisiting the environmental Kuznets curve (EKC) hypothesis in India: the effects of energy consumption and democracy. Environ Sci Pollut Res 26(13):13390–13400

Usman O, Olanipekun IO, Iorember PT, Goodman MA (2020a) Modelling environmental degradation in South Africa: the effects of energy consumption, democracy, and globalization using innovation accounting tests. Environ Sci Pollut Res 27:8334–8349

Usman O, Alola AA, Sarkodie SA (2020b) Assessment of the role of renewable energy consumption and trade policy on environmental degradation using innovation accounting: Evidence from the US. Renew Energy 150:266–277

Usman O, Akadiri SS, Adeshola I (2020c) Role of renewable energy and globalization on ecological footprint in the USA: implications for environmental sustainability. Environ Sci Pollut Res 27:30681–30693

Wang Z, Rasool Y, Asghar MM, Wang B (2019) Dynamic linkages among CO2 emissions, human development, financial development, and globalization: Empirical evidence based on PMG long-run panel estimation. Environ Sci Pollut Res 26(36):36248–36263 1-16

WDI (2015) World development indicators 2015. World Bank, Washington. https://openknowledge.worldbank.org/handle/10986/21634

World Bank (2018) World development indicators (WDI) database archives (beta) DataBank. https://www.databank.banquemondiale.org/data/reports.aspx?source = WDI Database Archives (beta). Accessed 10 June 2020

Yang L, Wang J, Shi J (2017) Can China meet its 2020 economic growth and carbon emissions reduction targets? J Clean Prod 142:993–1001

Yilanci V, Gorus MS, Aydin M (2019) Are shocks to ecological footprint in OECD countries permanent or temporary? J Clean Prod 212:270–301

Zivot E, Andrews D (1992) Further evidence of great crash, the oil price shock and unit root hypothesis. J Bus Econ Stat 10:251–270

Zoundi Z (2017) CO2 emissions, renewable energy and the environmental Kuznets curve, a panel cointegration approach. Renew Sust Energ Rev 72:1067–1075

Author information

Authors and Affiliations

Contributions

Paul Terhemba Iorember: data curation, writing—original draft, and formal analysis. Ojonugwa Usman: conceptualization, formal analysis, investigation, and methodology. Gylych Jelilov: writing, original draft; writing—review and editing. Abdurrahman Işık: writing—review and editing, validation, visualization, and supervision. Bilal Celik: writing—original draft, supervision, validation, and visualization

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no competing interests.

Ethical approval

Not applicable.

Consent to participate

Not applicable.

Consent to publish

Not applicable.

Additional information

Responsible Editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The original article was revised: The correct 1st sentence of the Abstract is “Recent economic and environmental literature suggests that the current state of energy use in South Africa amidst rapid growing population is unsustainable.”.

Rights and permissions

About this article

Cite this article

Iorember, P.T., Jelilov, G., Usman, O. et al. The influence of renewable energy use, human capital, and trade on environmental quality in South Africa: multiple structural breaks cointegration approach. Environ Sci Pollut Res 28, 13162–13174 (2021). https://doi.org/10.1007/s11356-020-11370-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-11370-2