Abstract

This study contributes to the literature by estimating the interaction effects of economic growth and renewable energy consumption on carbon dioxide (CO2) emissions with the inclusion of human capital. The interaction between economic growth and renewable energy consumption suggests how income level affects energy consumption and CO2 emissions. The study applies three-stage least square and ridge regression methods with Pakistani data from 1980 to 2014. The empirical findings show that the interaction effect of income and renewable energy contributes to CO2 emissions. Besides, trade openness also increases CO2 emissions, while the human capital mitigates CO2 emissions. Furthermore, the moderating effect of economic growth helps to form the environmental Kuznets curve (EKC) hypothesis in Pakistan.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The fast-growing energy use brings remarkable challenges related to the environment such as massive CO2 emissions, a fundamental cause of climate change. Due to high environmental and health concerns of CO2 emissions, clean energy such as renewable energy has been emerging as an effective alternative to traditional fossil fuels (Wang et al. 2018). Renewable energy sources have been identified as an important action to reduce CO2 emissions and tackle climate change inclusion of more renewable energy in the energy mix has become a crucial part of energy policies around the world (Dong et al. 2018).

Over the last several decades, Pakistan has experienced high economic growth. Its gross domestic product (GDP) has risen from 236.9 billion US dollars in 1980 to 3049.5 billion US dollars in 2017 (World Bank 2017). Simultaneously, the rapid economic growth has led to an expanse of primary energy consumption with a 13% average annual increase rate (BP Statistical Review 2015). This increasing energy use generates two critical issues in Pakistan: severe energy crisis and tremendous CO2 emissions (Shoaib 2013). Accordingly, there is a growing demand in this country for controlling over CO2 emissions from fossil fuel consumption. With these rising concerns, clean energy such as renewable energy has been involved in the energy mix in Pakistan like many other countries.

Existing studies have analyzed the role of renewable and non-renewable energy consumption on CO2 emissions (Ito 2017; Zoundi 2016); they noticed the potential income and renewable energy nexus and that between renewable energy and CO2 emissions. However, little literature investigates the impact of interaction between economic growth and renewable energy consumption, on CO2 emissions. This study is an attempt to fill this gap by analyzing the interaction effect of renewable energy and economic growth on CO2 emissions taking non-renewable energy, trade openness, and human capital into account in Pakistan. This study is an extension of Danish et al. (2017a) who examined the role of renewable and non-renewable energy in CO2 emissions which is found due to the omission of relevant variables. This issue is covered by the inclusion of additional dependent variables such as trade openness, human capital, and the interaction between economic growth and renewable energy.

This study contributes to the existing literature in the following three aspects. First, we empirically explore the interaction between economic growth, renewable energy consumption, and CO2 emissions. Second, we consider several potential variables in the analyzing framework. Existing studies have ignored these potential variables which may lead to specification bias. This effort would benefit the policymakers to control rising environmental stress and the vulnerability of the Pakistani economy caused by climate change. Third, this study uses a three-stage simultaneous (3SLS) equation model, instead of cointegration and causality approaches for that it could tackle potential correlations between the regressor and stochastic error term, and enhance the reliability of results (Bakhsh et al. 2017).

The rest of the study is organized in the following pattern. “Literature review” gives a review of related studies. “Data source, theoretical framework, and econometric methods” provides information about the data source, theoretical framework, and the econometric techniques used. Empirical results are shown in “Results”. Further the results are discussed in “Discussions”, and finally, we conclude this study in “Conclusions”.

Literature review

The environmental Kuznets curve (EKC) hypothesis

The Enviromental Kuznets curve (EKC) was firstly introduced by Grossman and Krueger (1991) as EKC says that the curve showing the income- pollution nexus is inverted U-shaped. In literature, most studies using EKC models do not include any explanatory variable (Grossman and Krueger 1991; Krueger 1995; Moomaw and Unruh 1997). Generally, they support the inverted U-shaped relationship between income and pollution. The EKC hypothesis states that in early stage in an increase in income, pollution increases but crossing threshold level income reduces pollution. The hypothesis of EKC categorizes the intensity of pollution into three stages such as pre-industrialization phase, industrial economies, and post-industrialization stage. Each stage agrees to a step in the growth process (Zoundi 2016). In the pre-industrialization era, environmental pollution increases with lower income per capita, explaining the use of dirty technology for economic activities and prioritizing the growth of income and profits at the early stage of development. Then, with the rising income and improvement in social indicators and investment on cleaner technology, the middle stage symbolizes the turning point to reduce pollution (Sarkodie and Strezov 2018). As the economy gets through the industrialization stage and transfers to the post-industrialization stage, reduction in environmental depletion occurs (Munasinghe 1999; Sarkodie and Strezov 2019). The EKC insight is summarized in Fig. 1.

Renewable and non-renewable energy and economic growth

Concerning the linkage between renewable and non-renewable energy and economic growth, current researches can be divided into two groups. One group agrees that renewable and non-renewable energy plays a key role in the promotion of economic growth (Apergis and Payne 2010, 2012; Tansel et al. 2012). For instance, Kocak and Sarkgunesi (2017) examined the impact of renewable energy on economic growth in the Black Sea and Balkan countries. Empirical results have concluded that renewable energy stimulates economic growth. The heterogeneous panel causality test recommends the feedback hypothesis for said variables. Also, Alper and Oguz (2016) suggested that there exists a long-run relationship between the mentioned variables in EU countries. Rafindadi and Ozturk (2016) found that consumption of renewable energy boosts German economic growth. Another group suggests that a causal relationship exists between renewable and non-renewable energy and economic growth. Likewise, Pao and Fu (2013) supported the feedback hypothesis for Brazil. Yildirim et al. (2012) used a Toda–Yamamoto procedure and bootstrap-corrected causality to reveal the neutrality hypothesis for the USA. Similar results can be found in Destek (2016) for the newly industrialized countries. Besides, Destek and Aslan (2017) confirmed growth, conservation, feedback, and neutrality hypothesis in 19 emerging economies. Brini et al. (2017) found that bidirectional causality exists between trade and renewable energy. Wang et al. (2018) estimated the effect of renewable energy and GDP on human development in the case of Pakistan. The results inferred from the simultaneous equation models confirm that both GDP and renewable energy do not influence human development index due to several hidden factors.

Renewable and non-renewable energy and CO2 emissions

To analyze the role of energy consumption in increasing CO2 emissions, the majority of existing literature can be categorized into three groups. One group focuses on total energy consumption to establish the linkage between energy consumption, economic growth, and CO2 emissions. They agree that energy consumption mainly contributes to the growing CO2 emissions (Baloch et al. 2018, 2019a, 2019b; Bekhet et al. 2017; Danish et al. 2017b, 2018a, b; Dogan and Aslan 2017; Esso and Keho 2016; Katircioglu 2014; Ozcan 2013; Wang et al. 2017). In addition, several studies estimate the role of fossil fuel and renewable energy in CO2 emissions with verification of the EKC hypothesis. Most of them agree that renewable energy exerts a significantly negative impact on CO2 emissions, while non-renewable energy contributes to emission growth (Cerdeira Bento and Moutinho 2016; Dogan and Seker 2016; Imran 2018; Inglesi-Lotz and Dogan 2018; Jebli et al. 2016; (Xu et al. 2018; Zoundi 2016). For instance, Sinha and Shahbaz (2018) provided support for the EKC hypothesis in the significance of renewable energy. But, Ben Jebli and Ben Youssef (2015) did not support the EKC hypothesis and stated that trade openness exerts a significant positive impact on CO2emissions.

However, few have empirically explored the interaction among economic growth, renewable energy consumption, and CO2 emissions. Besides, existing studies ignore some relevant variables such as human capital that may cause specification bias. Our study aims to fill the highlighted research gaps.

Data source, theoretical framework, and econometric methods

Data description

This study covers the annual data for the period 1980–2014.Footnote 1 The selection of this period is the availability of data. CO2 is measured as CO2 emissions metric tons per capita. Wind, hydro, and nuclear energy sources are used as a proxy for renewable energy consumption (REC). Coal, oil, and gas are used as a proxy for non-renewable energy consumption (NREC). Economic growth is measured by the real GDP per capita. Human capital (HC) is an index based on years of schooling and returns to education. Finally, the trade openness (TR) is estimated as the sum of export (% of GDP) and import (% of GDP). The data for CO2 emissions, export, and import are collected from World Development Indicator from the World Bank (World Bank 2018). The renewable and non-renewable energy consumptions data are extracted from the BP Statistical Review (BP 2018). Economic growth (GDP per capita) and human capital data are taken from the Penn World Table version 9.0. The choice and measurement of variables are based on previous literature (Wang et al. 2018).

Theoretical framework

The EKC hypothesis suggests that pollution level increases at earlier when income increases in a country, and then after income (represented by GDP) reaches the optimum level the pollution level starts decreasing. The econometric form of EKC model incorporating REC and NREC based on Jebli et al. (2016) is given below:

-

Model 1:

Recently, several studies have incorporated variables such as trade openness into the model (Al-Mulali et al. 2016; Dogan and Seker 2016; Ben Jebli and Ben Youssef 2015; Jebli et al. 2016). They argue that trade openness could be an important factor influencing the level of pollution. Accordingly, with the inclusion of trade openness, the modified version of Eq. (1) is:

-

Model 2:

Some have found that human capital may influence the level of CO2 emissions in an economy (Bano et al. 2018). Human capital may control the level of high-energy consumption which leads to CO2 emission mitigation (Fang and Chang 2016; Ouedraogo 2013; Salim et al. 2017). Human activities most significant have great pressure on the environment (Danish et al. 2019), in which extortions to biodiversity are human actions that potentially harm the nature (Venter et al. 2016). Human capital denotes the ratio of years of schooling and returns to education, as education is required if a country’s people are to understand environmental risks (Ulucak and Bilgili 2018). To take the effect of human capital on CO2 emissions into account, Eq. (2) can be extended as follows:

-

Model 3:

We extend the existing model of Danish et al. (2017a) in the context of existing literature about Pakistan by including trade openness and human capital. The present study proposes a novel methodological approach that makes it possible to explain the CO2 function and explore the effect of interaction between economic growth and renewable energy consumption. It is argued that energy consumption increases with a rise in economic growth may reduce the contribution of renewable energy in the energy mix. On the other hand, it may be possible that the share of non-renewable energy would also be increased in the energy mix (Balsalobre-lorente et al. 2018). So, we develop Eq. (4) as an extension of Eq. (3), adding a novel variable, the interaction between economic growth and renewable energy consumption (GDP*REC):

-

Model 4:

where t represents time and ω is the normally distributed error term. β1, β2, β3, β4, β5, β6, and β7 are the coefficient estimates of GDP, the square of GDP, REC, NREC, TR, HC, and (GDP*REC), respectively. The reason for taking the interaction between renewable energy consumption and economic growth into the function is to investigate whether the growing economy fulfills the rising energy demand by decreasing the share of renewable energy and increasing that of non-renewable energy in total energy consumption. It is a common perception that energy demand increases with the growing economy. Therefore, more consumption of non-renewable energy would abolish the positive effect of renewable energy and causes increasing environmental pressure.

Econometric methodology

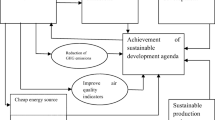

This study uses a simultaneous equation model (SEM) for empirical estimation. For the case of a short period, the econometric methods (e.g., cointegration model) may produce spurious results. The empirical model in the study includes several macroeconomic variables that may be highly correlated, and there may be correlation between regressor and disturbance error term, which may cause multicollinearity. Also, ordinary least square (OLS) regression model and other cointegration models may produce unreliable estimates. Accordingly, it has suggested a two-stage least square (2SLS) regression (Cumby et al. 1983) and three stages least square (3SLS) methods to tackle those problems. These methods are the extended versions of the OLS method. They are applicable when regressor is correlated with the disturbance term. For the estimation of SEM, 3SLS is more preferred as it takes the correlation between unobserved disturbances across various equations into consideration (Bakhsh et al. 2017), and it is more consistent and asymptotically normally disturbed, enhancing the efficiency compared to single equation estimates. So, we employ the 3SLS method with correction for endogeneity in this empirical research. The flow chart of the econometric estimation applied in the study can be seen in Fig. 2.

Results

The summary statistics and correlation between the variables are reported in Table 1. Economic growth (GDP) is more volatile than CO2. The standard deviation of renewable energy (RE) is small, and all the variables display a considerable degree of standard deviation. Besides, the Jarque-Bera test exhibits that we do not reject the null hypothesis normality of the normal distribution, implying that the series show normal distributions. The correlation matrix reveals a high correlation among variables. This may lead to multicollinearity which leads to unreliable parameter estimates.

This study uses the unit root tests (Ng and Perron 2001) to check the stationary level. The null hypothesis of the unit root test here is that the variables are stationary. The results are presented in Table 2. It can be seen that we do not reject the null hypothesis of stationary at level. All variables become stationary at first order. In other words, all variables are integrated at first order I (1), and the series is stationary at the same order.

The descriptive analysis and unit root test results show parameters estimated through regression method. We use the 3SLS method that can counter the effect of correlation between the regressor and stochastic error term. The results obtained by the 3SLS method are reported in Table 3. The coefficients are statistically significant at 1% and 5% levels. Concerning the environmental impact of economic growth, it can be found that the coefficient of GDP is positive, while the coefficient of the square of GDP is negative with different magnitudes across four models.

Regarding the environmental impact of REC and NREC, the empirical results show that an increase of REC mitigates CO2 emissions, while the increase of NREC deteriorates environmental quality through contribution in the acceleration of CO2 emissions. Concerning the key focus of the study that the interaction between economic growth and REC, the results in Table 2 demonstrate that economic growth exerts a significant moderating effect on the nexus between renewable energy use and CO2 emissions. The positive sign of the coefficient of GDP*REC indicates that economic growth diminishes the positive effect of GDP*REC on environmental quality.

The effect of trade on CO2 emissions is found to be positive and significant, implying that trade in Pakistan is not beneficial for the environment. Besides, the expanding size of the economy through scale effect may increase environmental degradation. Regarding human capital, the contribution of this study offers useful insights into the environment improvement (Bano et al. 2018; Sapkota and Bastola 2017). Consistent with the literature, results shown in Table 2 recommend that the environmental impact of human capital, the coefficient is negative and significant, implies that the increase of human capital could mitigate CO2 emissions.

Further for the validity of the model, we estimate the similar model 1, model 2, model 3, and model 4 with the inclusion of additional variables of taking first time lag of GDP as robust check for endogeneity. The time lag of GDP is included as explanatory variables for model validation. The result of the robust check is reported in Table 4. It can be observed that the effect of all response variables remains the same after the inclusion of additional variables, which confirms the validity of our model.

For the reliability of the model, we have provided several tests at the bottom of Tables 3 and 4. The root means square of error (RMSE) is the square root of the variance of the residuals. The RMSE shows the absolute fitness of the model, while the R-square shows the relative degree of fitness. The RMSE is a suitable measure to predict the response of the model accurately, and it is an important criterion for fitness when the main purpose of the model is a prediction. The F-value is used to check model fitness, if the probability value of F-test is below the significance level, and then model provides a better fit. But, if the value of F-statistic is higher than significance level that represents weak instrument, the result produced would be biased. So, from result of both Tables 4 and 5, it can be seen that the F-value is below the significance level (P < 0.1), the null hypothesis can be rejected and indicate better model, and the results produced are unbiased and reliable.

Further for model validation and reliability of results, this study uses ridge regression. The method is capable to produce reliable estimate in the presence of multicollinearity. In principle, ridge regression tries to estimate predictor’s coefficient to eliminate collinearity. In short, the result produced by ridge regression is unbiased and efficient as compared to simple linear regression method. The results of ridge regression are noted down in Table 5. From result, it can be observed that inverted U-shaped is approved. Further, non-renewable energy and trade ratio increases pollution. However, renewable energy and human capital reduce pollution. The findings are in line with those of 3SLS method.

The regression estimate does not guide for policy recommendations, and how causality analysis is used in the literature to guide regarding the direction of relation among study variables. Therefore, the study uses vector error correction (VECM) causality method to estimate casual relation among study variables. VECM involves two step methods, in the first method study run simple regression for variables to calculate error correction term (ect). In the step, ect is added to the model and runs the model again. The negative and significant value of ect confirms of long run causality. Further Wald statistic is used for short run causality analysis. The result of causality results are shown in Table 6. The negative and significant value of ecm directed toward confirmation of long run bidirectional among study variables. For short run causal relation, we found bidirectional causality between human capital and CO2 emissions. Moreover, unidirectional causality is detected from CO2 emissions toward trade. Finally, no causality is found between renewable energy and CO2 emissions.

Discussions

According to our findings, the inverted U-shaped relationship is observed between economic growth and CO2 emissions in Pakistan. This phenomenon suggests that an increase in income leads to environmental improvements. The benefits of economic growth for reducing environmental stress can be achieved after a certain time or a turning point. It is worth noting that for the developing countries, the turning points might lie outside the sample period, and then environmental pollution continues to rise after they achieve economic growth (Iwata et al. 2011). Like other developing economies, Pakistan’s economy has not reached to achieve the status industrial economy. Therefore, Pakistan’s economy is driven by agriculture, transport, and service sectors. The results of the study correspond to the findings of Al-Mulali et al. (2016), Danish et al. (2017b), Dogan and Seker (2016).

The key findings of this study suggest that the interaction between renewable energy and economic growth exerts significant and positive impacts on CO2 emission growth. This shows that economies with economic growth meet their energy demands through reducing the share of renewable energy and increase that of non-renewable energy in energy mix accordingly, which could stimulate the environmental pressure through increased CO2 emissions (Balsalobre-Lorente et al. 2018; Bölük and Mert 2015). Due to the high rate of economic growth, the problem of energy security emerges, and the share of non-renewable energy in the energy mix is increased to meet energy demands—consequently, pollution level increases in this country.

The energy import dependence of Pakistan is quite high, and about 74% of the energy used is imported. The import of fossil fuels increases not only the environmental stress but also the economic burden. Due to the high amount of energy imports, Pakistan has experienced the circular debts of almost 2000 million US dollars in the energy sector. Immediate steps are needed to control the high dependence on energy imports. The key solution may include promoting investments on the renewable energy sector, especially the hydropower, while the northern part of Pakistan has enormous potential for hydropower. Besides, Sindh Province of Pakistan is capable of generating energy from abundant local wind power. Another possible solution is to develop people’s awareness regarding energy efficiency. With growing income, the public energy R&D funding can support clean energy technology development and even the costs are higher compared to other technologies. To encourage clean energy, additional privileges are required for the related R&D activities.

Trade in Pakistan is found to be one of the factors that worsen environmental quality. Being a relatively poor developing economy, the technology transfer through trade usually means the transfer of outdated technologies, which are not environmental friendly. Outdated technologies not only contribute to massive CO2 emissions but also consume a significant amount of energy and increasing environmental pollution. Besides, the polluting industries in developed countries have been moved to Pakistan due to weak environmental standards. Another possibility could be that exported oriented industries are either producing polluting goods or using outdated technology in the export production. One possible solution could be stimulating high technology production to lessen the necessities of highly polluting inputs. Environmental standards are also needed to upgrade to control emissions from the technology spillover effect. Those findings stand with Al-Mulali et al. (2016), Balsalobre-Lorente et al. (2018).

Expansion of human capital, such as more highly educated labor input, may boost the adoption of cleaner production technology and then decrease the pollution (Sapkota and Bastola 2017). The government of Pakistan has initiated an environmental awareness program in the educational institute to raise people’s awareness regarding the environment and energy security. However, the current share of education in the annual budget is still the lowest among the developing world. Thus, we could say that the government is required to allocate more budgets in the education sector so that people could become aware of the sustainable use of resources and energy. Overall, it can be summarized that not only renewable energy but also human capital could be effective tools to reduction CO2 emission. However, growing income reduces the share of renewable energy into energy mix. In other words, the conventional resource consumption increases.

Conclusions

This paper analyses the linkage between renewable and non-renewable energies, economic growth, and CO2 emissions with the consideration of human capital. A diverse econometric approach against the literature is introduced to examine the moderating effect of economic growth in the context of Pakistan during 1980–2014.

The main findings of this study show that the EKC hypothesis holds in Pakistan. Non-renewable energy consumption worsens the environmental quality by releasing high CO2 emissions, while renewable energy consumption mitigates the level of pollution. Trade openness has a positive and significant impact on CO2 emissions growth in Pakistan and increases environmental pressure. Lastly, human capital helps to control pollution.

The moderating effect of renewable energy and economic growth shows that an increase in non-renewable energy consumption produces more pollution. The key solution may include promoting investments in the renewable energy sector. Also, R&D programs need to be initiated to explore renewable energy sources to counter the ever-rising energy demands with rising income, especially for wind power generation projects in the coastal region of Sindh and canal systems generating clean energy from small dams in Punjab. In particular, the government needs to launch an awareness education program on the efficient use of energy in the communities. Other policy implications include progress in the innovation of new technology and well-designed environmental standards.

Human capital could be the better option along with investment in renewable energy projects, because results of our study are directed toward the clean role of human capital in cleaning the environment. Those people lack knowledge to keep the environment clean for this, the government should include lesson curriculum and arrange workshop in educational institutions regarding how environment should be kept clean.

Notes

The data can be provided upon request.

Abbreviations

- CO2 :

-

carbon dioxide

- 3SLS:

-

three-stage least square

- EKC:

-

environmental Kuznets curve

- GDP:

-

gross domestic product

- NRE:

-

non-renewable energy

- OECD:

-

Organization for Economic Co-operation and Development

- OLS:

-

ordinary least square

- RMSE:

-

root means square of error

- SEM:

-

simultaneous equation model

- USA:

-

United States of America

- WDI:

-

World Development Indicator

References

Al-Mulali U, Ozturk I, Solarin SA, Adebola S (2016) Investigating the environmental Kuznets curve hypothesis in seven regions: the role of renewable energy. Ecol Indic 67:267–282. https://doi.org/10.1016/j.ecolind.2016.02.059

Alper A, Oguz O (2016) The role of renewable energy consumption in economic growth: evidence from asymmetric causality. Renew Sust Energ Rev 60:953–959. https://doi.org/10.1016/j.rser.2016.01.123

Apergis N, Payne JE (2010) Renewable energy consumption and economic growth: evidence from a panel of OECD countries. Energy Policy 38:656–660. https://doi.org/10.1016/j.enpol.2009.09.002

Apergis N, Payne JE (2012) Renewable and non-renewable energy consumption-growth nexus: evidence from a panel error correction model. Energy Econ 34:733–738. https://doi.org/10.1016/j.eneco.2011.04.007

Bakhsh K, Rose S, Ali MF, Ahmad N, Shahbaz M (2017) Economic growth, CO2emissions, renewable waste and FDI relation in Pakistan: new evidence from 3SLS. J Environ Manag 196:627–632. https://doi.org/10.1016/j.jenvman.2017.03.029

Baloch MA, Danish, Meng F, et al (2018) Financial instability and CO2 emissions: the case of Saudi Arabia. Environ Sci Pollut Res 25:26030–26045. https://doi.org/10.1007/s11356-018-2654-2

Baloch MA, Danish, Meng F (2019a) Modeling the non-linear relationship between financial development and energy consumption: statistical experience from OECD countries. Environ Sci Pollut Res 26. https://doi.org/10.1007/s11356-019-04317-9

Baloch MA, Zhang J, Iqbal K, Iqbal Z (2019b) The effect of financial development on ecological footprint in BRI countries: evidence from panel data estimation. Environ Sci Pollut Res 26:6199–6208. https://doi.org/10.1007/s11356-018-3992-9

Balsalobre-lorente D, Shahbaz M, Roubaud D, Farhani S (2018) How economic growth, renewable electricity and natural resources contribute to CO2emissions? Energy Policy 113:356–367. https://doi.org/10.1016/j.enpol.2017.10.050

Bano S, Zhao Y, Ahmad A, Wang S, Liu Y (2018) Identifying the impacts of human capital on carbon emissions in Pakistan. J Clean Prod 183:1082–1092. https://doi.org/10.1016/j.jclepro.2018.02.008

Bekhet HA, Matar A, Yasmin T (2017) CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: dynamic simultaneous equation models. Renew Sust Energ Rev 70:117–132. https://doi.org/10.1016/j.rser.2016.11.089

Ben Jebli M, Ben Youssef S (2015) The environmental Kuznets curve, economic growth, renewable and non-renewable energy, and trade in Tunisia. Renew Sust Energ Rev 47:173–185. https://doi.org/10.1016/j.rser.2015.02.049

Bölük G, Mert M (2015) The renewable energy, growth and environmental Kuznets curve in Turkey: an ARDL approach. Renew Sust Energ Rev 52:587–595. https://doi.org/10.1016/j.rser.2015.07.138

BP Statistical Review (2015) Statistical Review of World Energy. http://www.bp.com/productlanding.do?categoryId=6848&contentId=7033471 1–6. https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html

BP (2018) BP Statistical Review of World Energy 1–56. http://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy/downloads.html

Brini R, Amara M, Jemmali H (2017) Renewable energy consumption, international trade, oil price and economic growth inter-linkages: the case of Tunisia. Renew Sust Energ Rev 76:620–627. https://doi.org/10.1016/j.rser.2017.03.067

Cerdeira Bento JP, Moutinho V (2016) CO2 emissions, non-renewable and renewable electricity production, economic growth, and international trade in Italy. Renew Sust Energ Rev 55:142–155. https://doi.org/10.1016/j.rser.2015.10.151

Charfeddine L (2017) The impact of energy consumption and economic development on ecological footprint and CO 2 emissions: evidence from a Markov switching equilibrium correction model. Energy Econ 65:355–374. https://doi.org/10.1016/j.eneco.2017.05.009

Cumby RE, Huizinga J, Obstfeld M (1983) Two-step two-stage least squares estimation in models with rational expectations. J Econ 21:333–355. https://doi.org/10.1016/0304-4076(83)90049-0

Danish, Zhang B, Wang B, Wang Z (2017a) Role of renewable energy and non-renewable energy consumption on EKC: evidence from Pakistan. J Clean Prod 156:855–864. https://doi.org/10.1016/j.jclepro.2017.03.203

Danish, Zhang B, Wang Z, Wang B (2017b) Energy production, economic growth and CO2 emission: evidence from Pakistan. Nat Hazards 90:1–24. https://doi.org/10.1007/s11069-017-3031-z

Danish, Baloch MA, Suad S (2018a) Modeling the impact of transport energy consumption on CO2emission in Pakistan: evidence from ARDL approach. Environ Sci Pollut Res 25:9461–9473. https://doi.org/10.1007/s11356-018-1230-0

Danish, Wang B, Wang Z (2018b) Imported technology and CO2emission in China: collecting evidence through bound testing and VECM approach. Renew Sust Energ Rev 82:4204–4214. https://doi.org/10.1016/j.rser.2017.11.002

Danish, Hassan ST, Baloch MA, Mehmood N, Zhang J (2019) Linking economic growth and ecological footprint through human capital and biocapacity. Sustain Cities Soc 47:101516. https://doi.org/10.1016/j.scs.2019.101516

Destek MA (2016) Renewable energy consumption and economic growth in newly industrialized countries: evidence from asymmetric causality test. Renew Energy 95:478–484. https://doi.org/10.1016/j.renene.2016.04.049

Destek MA, Aslan A (2017) Renewable and non-renewable energy consumption and economic growth in emerging economies: evidence from bootstrap panel causality. Renew Energy 111:757–763. https://doi.org/10.1016/j.renene.2017.05.008

Dogan E, Aslan A (2017) Exploring the relationship among CO2 emissions, real GDP, energy consumption and tourism in the EU and candidate countries: evidence from panel models robust to heterogeneity and cross-sectional dependence. Renew Sust Energ Rev 77:239–245. https://doi.org/10.1016/j.rser.2017.03.111

Dogan E, Seker F (2016) The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renew Sust Energ Rev 60:1074–1085. https://doi.org/10.1016/j.rser.2016.02.006

Dong K, Sun R, Jiang H, Zeng X (2018) CO2emissions, economic growth, and the environmental Kuznets curve in China: what roles can nuclear energy and renewable energy play? J Clean Prod 196:51–63. https://doi.org/10.1016/j.jclepro.2018.05.271

Esso LJ, Keho Y (2016) Energy consumption, economic growth and carbon emissions: cointegration and causality evidence from selected African countries. Energy 114:492–497. https://doi.org/10.1016/j.energy.2016.08.010

Fang Z, Chang Y (2016) Energy, human capital and economic growth in Asia Pacific countries - evidence from a panel cointegration and causality analysis. Energy Econ 56:177–184. https://doi.org/10.1016/j.eneco.2016.03.020

Grossman GM, Krueger AB (1991) Environmental impacts of a north American free trade agreement. Natl Bur Econ Res Work Pap Ser No 3914:1–57. https://doi.org/10.3386/w3914

Imran H (2018) Impact of economic growth, nonrenewable and renewable energy consumption, and urbanization on carbon emissions in sub-Saharan Africa. Environ Sci Pollut Res 1–11:15057–15067. https://doi.org/10.1007/s11356-018-1753-4

Inglesi-Lotz R, Dogan E (2018) The role of renewable versus non-renewable energy to the level of CO2emissions a panel analysis of sub- Saharan Africa’s Βig 10 electricity generators. Renew Energy 123:36–43. https://doi.org/10.1016/j.renene.2018.02.041

Ito K (2017) CO2 emissions, renewable and non-renewable energy consumption, and economic growth: evidence from panel data for developing countries. Int Econ 151:1–6. https://doi.org/10.1016/j.inteco.2017.02.001

Iwata H, Okada K, Samreth S (2011) A note on the environmental Kuznets curve for CO2: a pooled mean group approach. Appl Energy 88:1986–1996. https://doi.org/10.1016/j.apenergy.2010.11.005

Jebli MB, Youssef SB, Ozturk I (2016) Testing environmental Kuznets curve hypothesis: the role of renewable and non-renewable energy consumption and trade in OECD countries. Ecol Indic 60:824–831. https://doi.org/10.1016/j.ecolind.2015.08.031

Katircioglu ST (2014) International tourism, energy consumption, and environmental pollution: the case of Turkey. Renew Sust Energ Rev 36:180–187. https://doi.org/10.1016/j.rser.2014.04.058

Kocak E, Sarkgunesi A (2017) The renewable energy and economic growth nexus in black sea and Balkan Countries. Energy Policy 100:51–57. https://doi.org/10.1016/j.enpol.2016.10.007

Krueger G (1995) Economic Growth and the Environment Author ( s ): Gene M . Grossman and Alan B . Krueger Published by : Oxford University Press Stable URL : http://www.jstor.org/stable/2118443 JSTOR is a not-for-profit service that helps scholars , researchers , and stud 110, 353–377

Moomaw WR, Unruh GC (1997) Are environmental Kuznets curves misleading us? The case of CO2 emissions. Environ Dev Econ 2:451–463. https://doi.org/10.1017/S1355770X97000247

Munasinghe M (1999) Is environmental degradation an inevitable consequence of economic growth: tunneling through the environmental Kuznets curve 29, 89–109

Ng BYS, Perron P (2001) Lag length selection and the construction of unit root tests with good size and power author ( s ): Serena Ng and Pierre Perron published by : the econometric society stable URL : http://www.jstor.org/stable/2692266 . Econometrica 69:1519–1554

Ouedraogo NS (2013) Energy consumption and human development: evidence from a panel cointegration and error correction model. Energy 63:28–41. https://doi.org/10.1016/j.energy.2013.09.067

Ozcan B (2013) The nexus between carbon emissions, energy consumption and economic growth in Middle East countries: a panel data analysis. Energy Policy 62:1138–1147. https://doi.org/10.1016/j.enpol.2013.07.016

Pao HT, Fu HC (2013) Renewable energy, non-renewable energy and economic growth in Brazil. Renew Sust Energ Rev 25:381–392. https://doi.org/10.1016/j.rser.2013.05.004

Rafindadi AA, Ozturk I (2016) Impacts of renewable energy consumption on the German economic growth: evidence from combined cointegration test. Renew Sust Energ Rev 75:0–1. https://doi.org/10.1016/j.rser.2016.11.093

Salim R, Yao Y, Chen GS (2017) Does human capital matter for energy consumption in China? Energy Econ 67:49–59. https://doi.org/10.1016/j.eneco.2017.05.016

Sapkota P, Bastola U (2017) Foreign direct investment, income, and environmental pollution in developing countries: panel data analysis of Latin America. Energy Econ 64:206–212. https://doi.org/10.1016/j.eneco.2017.04.001

Sarkodie SA, Strezov V (2018) Empirical study of the environmental Kuznets curve and environmental sustainability curve hypothesis for Australia, China, Ghana and USA. J Clean Prod 201:98–110. https://doi.org/10.1016/j.jclepro.2018.08.039

Sarkodie SA, Strezov V (2019) Effect of foreign direct investments, economic development and energy consumption on greenhouse gas emissions in developing countries. Sci Total Environ 646:862–871. https://doi.org/10.1016/j.scitotenv.2018.07.365

Shoaib (2013) Economic Survey of Pakistan,Finance Division, Economic, Advisor’s Wing. Government of Pakistan, Islamabad. http://www.finance.gov.pk/survey_1213.html

Sinha A, Shahbaz M (2018) Estimation of environmental Kuznets curve for CO2emission: role of renewable energy generation in India. Renew Energy 119:703–711. https://doi.org/10.1016/j.renene.2017.12.058

Tansel C, Ozturk I, Aslan A, Tugcu CT, Ozturk I, Aslan A (2012) Renewable and non-renewable energy consumption and economic growth relationship revisited: evidence from G7 countries. Energy Econ 34:1942–1950. https://doi.org/10.1016/j.eneco.2012.08.021

Ulucak R, Bilgili F (2018) A reinvestigation of EKC model by ecological footprint measurement for high, middle and low income countries. J Clean Prod 188:144–157. https://doi.org/10.1016/j.jclepro.2018.03.191

Venter O, Sanderson EW, Magrach A, Allan JR, Beher J, Jones KR, Possingham HP, Laurance WF, Wood P, Fekete BM, Levy MA, Watson JEM (2016) Sixteen years of change in the global terrestrial human footprint and implications for biodiversity conservation. Nat Commun 7:1–11. https://doi.org/10.1038/ncomms12558

Wang S, Li G, Fang C (2017) Urbanization, economic growth, energy consumption, and CO 2 emissions: empirical evidence from countries with different income levels. Renew Sust Energ Rev 81:1–16. https://doi.org/10.1016/j.rser.2017.06.025

Wang Z, Danish, Zhang B, Wang B (2018) Renewable energy consumption, economic growth and human development index in Pakistan: evidence form simultaneous equation model. J Clean Prod 184:1081–1090. https://doi.org/10.1016/j.jclepro.2018.02.260

World Bank (2017) The World Bank Group’s mission consists of two ambitious, but achievable, goals. World Bank Annual Report 2017. http://pubdocs.worldbank.org/en/908481507403754670/Annual-Report-2017-WBG.pdf

World Development Indicator (WDI), World Bank (2018) https://databank.worldbank.org/data/reports.aspx?source=world-development-indicators

Xu Z, Baloch MA, Danish, et al (2018) Nexus between financial development and CO2 emissions in Saudi Arabia: analyzing the role of globalization. Environ Sci Pollut Res 25:28378–28390. https://doi.org/10.1007/s11356-018-2876-3

Yildirim E, Saraç Ş, Aslan A (2012) Energy consumption and economic growth in the USA: evidence from renewable energy. Renew Sust Energ Rev 16:6770–6774. https://doi.org/10.1016/j.rser.2012.09.004

Zoundi Z (2016) CO2 emissions, renewable energy and the Environmental Kuznets Curve, a panel cointegration approach. Renew Sust Energ Rev 72:0–1. https://doi.org/10.1016/j.rser.2016.10.018

Funding

The study is completed under National Science Fund for Distinguished Young Scholars (Reference No. 71625003), Yangtze River Distinguished Professor of MOE, National Key Research and Development Program of China (Reference No. 2016YFA0602504), National Natural Science Foundation of China (Reference No. 91746208, 71573016,71403021, 71521002, 71774014), National Social Sciences Foundation (Reference No.17ZDA065). Humanities and Social science Fund of Ministry of Education of China (Reference No.17YJC630145), and China Postdoctoral Science Foundation (Reference No. 2017M620648). The authors are grateful to Kai Tang an associte professor at Guangdong university and foreign studies Guangzhou China and Yuantao Yang Phd Scholar at Beijing Institute and Technology for helping in editing and language correction.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Philippe Garrigues

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Mahmood, N., Wang, Z. & Hassan, S.T. Renewable energy, economic growth, human capital, and CO2 emission: an empirical analysis. Environ Sci Pollut Res 26, 20619–20630 (2019). https://doi.org/10.1007/s11356-019-05387-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-019-05387-5