Abstract

This study aims to re-examine the impacts of monetary and fiscal policy on environmental quality in ASEAN countries from 1990 to 2019. We utilized the panel and time series NARDL approach to explore the long-run and short-run estimates at a regional level and country level. ASEAN regional-wise analysis shows that contractionary monetary policy reduces the CO2 emissions, while expansionary monetary policy enhances CO2 emissions in the long run. The long-run coefficient further confirms that expansionary fiscal policy mitigates CO2 emissions in ASEAN. The impact of expansionary monetary and fiscal policy on CO2 emissions is positive and significant, while contractionary monetary and fiscal policy have an insignificant impact on CO2 emissions in the short run. ASEAN country-wise analysis also reported the country-specific estimates for the short and long run. Some policies can redesign in light of these novel findings in ASEAN economies.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

In the current era, developing economies are confronted with two major challenges of economic growth and environmental quality. In the perspective of economic growth, among the major challenge that raises the core issue is the degradation of the environment in developing countries. Merely China’s population, 1.32% lives in not vulnerable ecosystem (He et al. 2018; He et al. 2021). Consequently, sustainability of the environment needs mutual efforts of fiscal and monetary policies towards adaption and aggravating strategies. The imperative question arises how central banks improve the balance between sustainability of the environment and economic growth. The numerous determinations of the central bank—containing financial and monetary stability—fundamentally involve allocating, managing, and mobilizing resources in a way that pursues balance; therefore, central banks play role in combating environmental change in numerous economies. The fiscal policy is also contributing to improving quality of environment in numerous top pollution emission economies like India, the USA, and China in quality of the environment. However, due to a matter of fact, both policies are very imperative in an environment in developing countries.

In worldwide, fiscal policy is a vital component of the demand side of the economy through public expenditure, taxation, and revenue (Halkos and Paizanos 2013). The instruments of fiscal policy, taxes, and government expenditures are indirectly and directly linked with quality of environment, aggregate consumption of energy, industrial, agricultural, and service output level, and economic size, respectively. Instruments of fiscal policy have several dimensions to influence the quality of the environment. The fiscal deficit of the economy boosts the gross capital accumulation and formation, demand level of energy consumption, and business activities (Balcilar et al. 2016). Subsequently, the tax instrument of fiscal policy can increase the effectiveness of energy, and tax incentives positively and significantly influence the quality of the environment (Dongyan 2009; and Liu et al. 2017). Fiscal policy leads to acceleration of incomes of government by the imposition of pollution taxes on the energy, transportation, and industrial sector (Rausch 2013). However, Yuelan et al. (2019) in case of China and Halkos and Paizanos (2016) in case of the USA found that fiscal instruments significantly influence pollution emissions.

It is worth mentioning to disclose the process through which instruments of fiscal policy disturb the quality of the environment. For example, government expenditures hurt the quality of the environment by differentiating the causes of carbon emissions (McAusland 2008). For the supply side, Lopez et al. (2011) discriminate the several instruments through which the government spending level may affect quality of environment, as government spending on the health and education sector enhances current and future level of consumer income that may enhance quality of environment, generating the income effects. Conversely, government consumption at a larger scale leads the administration, formation, and environment control effectiveness that in turn enhance the stability of institutions that improves quality of environment. This infers that government spending exerts a positive and significant influence on environmental pollution.

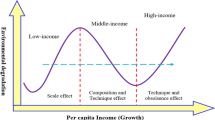

Certain imperative techniques of fiscal policy instruments are identified as technique effect, income effect, and composition effect, respectively. For example, first, the technique effect: this channel leads to diminishing pollution of environment by better efficiency of labor that is connected with higher levels of public spending on health and education sectors. Second, the income effect: it is explained as the increasing level of income increases the demand for good quality of the environment. Thirdly, the composition effect: public spending enhanced the economic activities that are connected with human capital that is less damaging to the environmental quality than physical capital (Lopez et al. 2011).

Correspondingly, Halkos and Paizanos, 2013, b) segregate the effects indirect and direct effects of government expenditures on pollution emissions. Government expenditures indirectly and directly reduce emissions of sulfur; however, the influence of government spending remains inconclusive on pollution emissions. Adewuyi (2016) reported indirect and direct negative effects on pollution emissions and government expenditure. Conversely, in the case of US economy, Halkos and Paizanos (2016) reported that greater government expenditure results in reducing pollution emissions created from the consumption and production side. Similarly, for the Turkish economy, Katircioglu and Katircioglu (2018) reported that in the long run, government expenditure exerts a negative influence on carbon emissions. Lopez and Palacios (2010) noted that government spending is negatively associated with carbon emissions as the European government spends more on public sector transport as compared to private sector transport that is energy relatively less pollutant and more energy-efficient thus results in reducing the environmental pollution.

In view of prior findings, various macroeconomic factors of pollution emissions have been reported in previous literature, for instance, innovation (Khattak et al., 2020), financial development (Dar & Asif, 2017), population growth rate (Harper, 2013), fiscal policy instruments (Yuelan et al., 2019 and Ullah et al. 2020), urbanization (Wang et al., 2018), international trade (Lv & Xu, 2019), globalization (Shahbaz et al., 2016 and Chishti et al. 2020), energy consumption and foreign direct investment (Mirzaei and Bekri, 2017 and Usman et al. 2020), national income (Grossman & Krueger, 1995 and Zhao et al. 2021), aggregate domestic demand consumption (Ahmad et al., 2019), and inflow of remittances (Ahmad et al., 2019). Beyond these determinants, this paper also considers monetary policy as a novel and unexplored determinant of pollution for the following reasons. Commonly, central banks design a monetary policy to manage and control the money supply in the economy, in addition to, maintaining the interest rates and controlling inflation. Fluctuations in interest rates influence the patterns of industrial innovation activities, energy consumption, financial development, aggregate domestic demand, and income per capita, thus triggering environmental pollution. In response to contractionary monetary policy, policymakers can interrupt foreign direct investments and green innovations. Industrialists prefer to use traditional technologies for the production process if loans are available at a higher interest rate for innovation purposes. The increasing consumption of less eco-friendly technologies leads to an upsurge in pollution emissions.

Furthermore, the literature related to inflation and financial stability postulates that monetary policies directly influence economic growth and indirectly influence quality of environment through the consumption of fossil fuel (Jalil and Feridun 2011 and Aslam et al., 2021a, b). Due to the contraction in monetary policy, producers and consumers improve environmental pollution by reducing aggregate demand. However, Chan (2020) concluded that a higher discount rate set by the state bank encourages consumers to save more and consume less, while producers also invest at a small scale in the current period. As a result, investment and consumption fall with a reduction in aggregate demand for services and goods. In response, pollution emissions decline. The study further concluded that monetary policy alleviates the pollution emissions level in the economy as compared to fiscal policy. By employing the New Keynesian pollutant emissions model, Annicchiarico and Di Dio (2017) revealed that monetary policy is not impartial in environmental carbon emissions. The optimum response of the monetary policy towards environmental pollution emissions is highly countercyclical. Furthermore, inflation instability is also hindering environmental pollution. Energy supply and demand matching ability is relatively low (Zhao et al., 2020; Zuo et al., 2020). Although the shock of monetary policy produces an upsurge in the discount rate, that results in lower aggregate demand and in turn, aggressive quality of environment achieved.

Annicchiarico and Di Dio (2017) also investigated that the central bank plays a significant role in determining the influences of quality of the environment. Chen and Pan (2020) highlighted that the central bank is more interested in green financing and the study constructed an environmental dynamic stochastic general equilibrium (E-DSGE) model in consideration of pollution emissions and monetary policy. The results of the model concluded that the dynamic of monetary policy is significantly affected by environmental and climatic regulation. Decentralized encroachment helps to uplift the environmental performance (Li, Hu, Shi, and Wang, 2021a). Numerous academicians and policymakers have assumed that monetary and fiscal policy changes exert a symmetric effect on quality of environment (Lopez et al. 2011; Katircioglu and Katircioglu 2018; Chan 2020); however, monetary and fiscal policy instrument variables behave in asymmetric manner. Conversely, the asymmetric ARDL method results in producing more reliable and detailed findings as compared to symmetric ARDL. Technology and policy instruments will improve the influencing parameters of the real-world groundwater (He, Shao and Ren, 2020).

The main objective of this study is to explore the effect of fiscal and monetary policy on pollution emissions for the Association of Southeast Asian Nations (ASEAN) economies. The novelty of the study is that it empirically determines the effect of fiscal and monetary policy on environmental pollution in ASEAN. This study demonstrates how various policy implementation scenarios stimulate the economy that influences environmental pollution. To the best of our knowledge, no study has yet explored the asymmetric effect of fiscal and monetary policy instruments on pollution emissions involving ASEAN countries. This study fills the gaps by investigating the asymmetric association between monetary and fiscal policy instruments and pollution emissions. The study elaborates the asymmetric effect of monetary and fiscal policy instruments, monetary policy rate, and government expenditures, on quality of environment in ASEAN economies

Model, methodology, and data

Few empirical studies in the past have examined the fiscal and monetary policy–CO2 nexus (Ullah et al. 2020). To maintain a clean environment, fiscal policy instruments have a notable impact on environmental quality (Lopez et al. 2011). Another aspect is that monetary policy instruments have also a unique feature to correct the environment (Ullah et al. 2021 and Chishti et al. 2021). Based on the environmentalist argument that monetary and fiscal have nonlinear impacts on environments in ASEAN, we embrace the specification of Ullah et al. (2020); therefore, the basic form is:

where subscripts t indicate years and i indicates country; φ0, φ1, φ2, and φ3 are parameters for estimation; CO2, t denotes carbon dioxide emissions; DRt denotes discount rate; GEt government expenditure; GDPt denotes gross domestic product; and εt is an error term, respectively. Similarly, increased discount rate leads to less CO2 emissions, and we expect estimates of φ1to be negative, while increased government expenditure may be a positive or negative impact on CO2 emissions. Next, we turn Eq. (1) to the error-correction model so that we can only assess the short-run impacts of monetary and fiscal policy. In doing so, Pesaran et al. (2001) announce a new method that describes short- and long-run estimates in one step as follows:

The short-run impacts are revealed in form of “first-differenced” variables, and long-run impacts are yielded by the estimates of ω2-ω4 normalized on ω1 in Eq. (2). Pesaran et al. (2001) propose two tests for the confirmation of the results as one is F-test and the other is t-test or ECM. Both tests have used non-standard distributions as well as employ new critical for testing. A key assumption of the ARDL is that model variables must have different integrating properties, i.e., I (0) or I (1) and even a mixture of both. A key assumption in Eq. (2) is that the effect of monetary and fiscal policy on CO2 emissions is symmetric. Therefore, we have modified Eq. (2) so that we can estimate the asymmetric impact effects of monetary and fiscal policy on CO2 emissions. Our modification follows the Shin et al. (2014) asymmetric error correction modeling approach. Regarding this approach, we must decompose “DRt and GEt” into two time series variables, one signifying increased monetary and fiscal policy and one signifying declines in monetary and fiscal policy. This is done using the partial sum approach as follows:

where DR+t and GE+t variables are the partial sum of positive changes in the discount rate and government expenditure which infers contractionary monetary and expansionary fiscal policy. Similarly, DR−t and GE−t variables are the partial sum of negative changes in the discount rate and government expenditure which infers expansionary monetary and contractionary fiscal policy. Thus we move back to Eq. (2) to replace DRt (GEt) by DR+t and DR−t (GE+t and GE−t), and our extended error-correction model is as follows:

A model like Eq. (4) is normally called the nonlinear ARDL model, whereas an equation like Eq. (2) is labeled linear ARDL models. Nonlinearity in Eq. (4) is incorporated by the method of constructing the partial sum variables. We also estimate the panel nonlinear ARDL through the pooled mean group (PMG) or mean group (MG) estimators, and thereafter we assess the appropriate estimators through the Hausman test. This approach is the workhorse of the modern time series dataset. The main edge of this approach is that it allows us to incorporate the nonlinear variables in our analysis and estimates the short and long run in a single step. After estimating the model, a few additional asymmetry assumptions will be tested. First, the monetary and fiscal policy will have short-run asymmetric impacts on CO2 if at any given lag (k), estimate attached to ∆DR+t − k(∆GE+t − k) is dissimilar to one attached to ∆DR−t − k(∆GE+t − k). Similarly, we also confirm the long- and short-run cumulative or impact asymmetries by using the Wald test.

Data

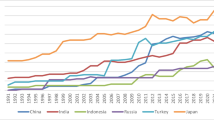

The empirical analysis is based on ASEAN countries, namely Indonesia, Malaysia, the Philippines, Singapore, and Thailand. Due to the unavailability of data for other ASEAN economies, we have selected only five ASEAN countries, while the study covers the data period between 1990 and 2019. The dependent variable, CO2 emissions, is measured in kilotons to quantify environmental pollution (Aslam et. al, 2021; Li et. al., 2021b; Sun et al., 2020). Moreover, we used a discount rate that is central bank policy rates by annually as a proxy of monetary policy instrument and government expenditure that is the percentage of GDP as a proxy of fiscal policy instrument. The choice of model is selected based on previous literature (Yuelan et al. 2019; Ullah et al. 2021). The dataset is extracted from IMF and World Bank by covering the period 1990 to 2019 (International Monetary Fund, 2019). In Table 1, the mean of CO2, DR, GE, and GDP is 171956.7 kt, 5.506%, 10.97%, and 11482%, respectively, although the standard deviation (S.D) is 129303 kt, 4.859%, 2.363%, and 5382%, respectively. Our model correlation estimates are also free from multicollinearity problems.

Results and discussion

Preliminary analysis

In the “Results and discussion” section, we estimate the asymmetric or nonlinear panel ARDL model for ASEAN economies using annual data over the period 1990–2019. As a preliminary analysis, to confirm the validity of nonlinear cointegrating autoregressive distributed lag (NARDL) model, the study has used IPS, ADF, and LLC methods of unit root testing. The results of unit root statistics are described in Table 2. The unit root tests are used to investigate the order of integration of the variables to be used in regression analysis. The outcomes of IPS test confirm that carbon emissions and DR are integrated at level; however, GE and per capita GDP are stationary at I(1). NARDL approach satisfies the combination of level stationary and first difference stationary variables; therefore, we adopted this approach. Similar results have been found in ADF and LLC unit root tests.

Group-wise analysis

Table 3 provides results of ASEAN group-wise estimates of NARDL for the short run and long run including diagnostic tests. The group-wise long-run findings of ASEAN economies reveal that the coefficient of discount rate is negative for positive shock of discount rate, whereas coefficient estimate of discount rate is positive for negative shock of discount rate. The positive component of the discount rate (i.e., contractionary monetary policy) significantly decreases the pollution emissions, suggesting that a 1% increase in the positive component of the discount rate decreases pollution emissions by 0.177%. This finding is also reliable with Ullah et al. (2021), who reported that contractionary monetary policy has a favorable impact on environmental quality. This finding infers that government can easily control dirty economic activities via a high discount rate. Our finding also contradicts with Chishti et al. (2021), who suggest that contractionary monetary policies improve the environmental quality by reducing CO2 emissions in BRICS.

However, the results of a negative component of the discount rate (i.e., expansionary monetary policy) reveal that in response to a 1% increase in DR_NEG, the pollution emissions increase by 0.615%. The findings validate the existence of an asymmetric relationship between the discount rate and pollution emissions. For fiscal policy, the coefficient estimates of expansionary fiscal policy (i.e., GE_POS) result in decreasing pollution emission in group-wise ASEAN economies; however, the coefficient estimate of contractionary fiscal policy (i.e., GE_NEG) is statistically insignificant. The result of the positive component of government expenditure reveals that due to a unit increase in government spending, pollution emissions decrease by 0.794%. In case of GDP, the result implies that in response to a 1% increase in per capita GDP, pollution emissions increase by 2.127%. This finding is also consistent with Ullah et al. (2021), who noted that a positive shock in fiscal policy has a significant positive impact on environmental quality in Pakistan in the long run.

The short-run findings of group-wise ASEAN economies reveal that positive component of discount rate has no impact on pollution emissions as the coefficient estimate is statistically insignificant. However, in the case of short-run coefficient estimates of negative component of discount rate, the effect is positive on pollution emissions. The short-run coefficient estimates of government spending reveal that in response to a unit increase in positive component of government spending, pollution emission increases significantly; however, in the case of negative component of government spending, the results are statistically insignificant. The short-run coefficient estimate of per capita GDP is also statistically insignificant.

Table 3 also reports diagnostic tests for group-wise ASEAN economies NARDL model. The short-run and long-run asymmetries between discount rate, government spending, and per capita GDP are tested by employing Wald test. The findings of Wald test reported that discount rate and government spending have an asymmetric association with CO2 emissions in short and long run except one. The F-statistics is also significant and confirms that cointegration exists among the variables in the model. The ECM term holds a negative sign and also statistically significant at 5% level. The coefficient estimate of ECT term is −0.544 which suggests that almost 54% error will be corrected within a year.

Country-wise analysis

Table 3 also provides short-run and long-run coefficient estimates of country-wise analysis of ASEAN economies. In the case of monetary policy shock in the long run, the positive component of discount rate exerts negative effect on pollution emissions in the case of Malaysia and Thailand and significantly positive influence on pollution emissions in the Philippines. However, in the case of Indonesia and Singapore, discount rate exerts no influence on pollution emissions as the coefficient estimates of both countries are statistically insignificant. In response to 1% increase in positive component of discount rate, pollution emissions decreases by 0.110% in Malaysia and 0.160% in Thailand; however, it results in increased pollution emissions by 0.280% in the case of the Philippines. The long-run coefficient estimates of negative component of discount rate are statistically significant and positive in the case of the Philippines and Thailand; however, the effect is negative and significant in the case of Malaysia. Again, the results are statistically insignificant in the case of Indonesia and Singapore. Findings reveal that due to 1% increase in negative component of discount rate, pollution emissions increase by 0.066% in the Philippines and 0.191% in Thailand; however it results in decreasing pollution emissions in Malaysia by 0.096%. The findings of per capita GDP reveal that the effect on pollution emissions is statistically significant only in Malaysia and Thailand, and the effect is statistically insignificant in the remaining economies. The coefficient estimates infer that due to 1% increase in per capita GDP, pollution emissions increase by 1.866% in Malaysia and 2.300% in the case of Thailand.

In the case of fiscal policy shock, the long-run coefficient estimates of positive component of government spending are positive in the case of Indonesia, the Philippines, and Thailand; however, the coefficient estimates are statistically insignificant in the case of Malaysia and Singapore. The findings reveal that in response of a 1% increase in positive component of government spending, pollution emissions increase by 0.063% in Indonesia, 0.127% in the Philippines, and 0.345 in the case of Thailand. However, the long-run negative component of government spending reveals significant and negative influence in the case of Indonesia, the Philippines, and Singapore and significant positive influence in the case of Malaysia. Government subsidy as an incentive policy for waste reduction (Liu, Yi, and Wang, 2020; Tian et al., 2020). However, the coefficient estimate of Thailand is statistically insignificant which postulates that government spending negative shock exerts no influence on pollution emissions in Thailand. The findings reveal that due to 1% increase in negative component of government spending, pollution emissions decrease by 0.176% in Indonesia, by 0.055% in the Philippines, and by 0.459% in Singapore. However, a unit increase in negative component of government spending results in increasing pollution emissions by 0.115% in the case of Malaysia.

The short-run findings of positive components of discount rate reveal a significantly negative influence on pollution emissions in the case of the Philippines and Thailand. However, the negative components of the discount rate exert significantly positive influence on pollution emissions in the case of the Philippines, Singapore, and Thailand. In the short run, positive component of government spending positively and significantly influences pollution emissions in all ASEAN economies except Malaysia; however, the negative components of government spending negatively and significantly influence carbon emissions only in Malaysia and the Philippines. In the end, the short-run coefficient estimates of per capita GDP reveal a significantly positive influence on pollution emissions in the case of Malaysia and Thailand only.

The third panel of Table 3 demonstrates the outcomes of diagnostic tests. The coefficient of the Lagrange multiplier (LM) is statistically insignificant in all models except the Philippines; however, the Ramsey RESET test and Hetero test results are statistically insignificant in all models of ASEAN economies. The findings of Ramsey RESET test, Hetero test, and LM tests (except the Philippines) support autocorrelation-free residuals and appropriate forms of models. The findings of Wald test reported that fiscal and monetary policy shocks have an asymmetric association with pollution emissions in most ASEAN economies. The F-statistics is confirming that cointegration exists among the variables in all models of ASEAN economies except the Philippines. The ECT term holds negative signs and also statistically significant at 5% level for Thailand and 1% level for remaining ASEAN economies. The coefficient estimate of ECM term is −0.442% for Indonesia, −0.486% for Malaysia, −0.684% for the Philippines, −0.791% for Singapore, and −0.725% in case of Thailand. In the end, the findings of CUSUM and CUSUM-2 confirm the stability of all the models except the Philippines in case of CUSUM. Finally, the cumulative multiplier for monetary and fiscal policy shocks and CO2 emissions is presented in Fig. 1 for ASEAN economies.

Conclusion and policy implications

Considering the debate over the reasons for environmental pollution, this study re-examines the dynamic impact of monetary and fiscal policy on CO2 emissions in the case of ASEAN-five countries for the period 1990 to 2019. This study contributes to the existing literature by empirically testing via panel and time series nonlinear ARDL approach. Regarding ASEAN region, our estimated long-run coefficient from panel ARDL shows that contractionary monetary policy mitigates CO2 emissions, while expansionary monetary policy enhances CO2 emissions in the long run. However, expansionary fiscal policy enhances CO2 emissions, whereas contractionary fiscal policy decreases carbon emissions in the long run. The results show that contractionary monetary policy enhances CO2 emissions, but expansionary fiscal policy enhances CO2 emissions in the short run. Additionally, GDP is increasing CO2 emissions in ASEAN region.

Findings also show that contractionary monetary policy had a negative effect on CO2 emissions in Malaysia and Thailand, while it is a positive impact on CO2 emissions in the case of the Philippines in the long run. Findings also revealed that expansionary monetary policy enhances CO2 emissions of the Philippines and Thailand and negatively significant on carbon emissions in case of Malaysia. As far as the long-run effects of expansionary fiscal policy on CO2 emissions in ASEAN economies are concerned, they are positive and significant for Indonesia, the Philippines, and Thailand. Findings also show that contractionary fiscal policy has negative and significant impact on CO2 emissions for Indonesia, the Philippines, and Singapore and positively significant in the case of Malaysia. Our short-run findings are also country-specific in economy-wise analysis.

Our outcomes are also applicable to other regional economies. Our study highlights a more efficient way of reducing carbon pollution through the instruments of monetary and fiscal policy. ASEAN authorities should extensively adopt monetary and fiscal policies to cope with environmental quality. For policy implications, our findings raise the significance of monetary and fiscal policy coordination in the energy and environment. ASEAN economies spend more on clean sectors of the economy such as education, health, environmental protection, green transportation, and green infrastructure. ASEAN should devote public expenditures to green goods which are entirely environment-friendly. A joined monetary policy is required to green finance for ASEAN regions. The authorities encourage environmentally favorable finance to contain better access in low-carbon projects. Regarding policies, monetary and fiscal policy coordination is more significant and extensively adopted in the environmental quality process in ASEAN economies.

This study has some possible limitations for upcoming research. This study is only conducted for ASEAN; future studies can overcome this limitation by examining the monetary and fiscal policy’s impact on CO2 emissions in other heavily populated regions. Authors are encouraged to include other monetary and fiscal instruments to test the current model for ASEAN. Upcoming studies should be analyzed by using nonlinear ARDL approach for contractionary and expansionary shocks of monetary and fiscal policies.

Data availability

The datasets/materials used and/or analyzed for the present manuscript are available from the corresponding author on reasonable request.

References

Adewuyi AO (2016) Effects of public and private expenditures on environmental pollution: a dynamic heterogeneous panel data analysis. Renew Sust Energ Rev 65:489–506

Ahmad M, Ul Haq Z, Khan Z, Khattak SI, Rahman ZU, Khan S (2019) Does the inflow of remittances cause environmental degradation? Empirical evidence from China. Economic research-Ekonomska istraživanja 32(1):2099–2121

Annicchiarico B, Di Dio F (2017) GHG emissions control and monetary policy. Environ Resour Econ 67(4):823–851

Aslam B, Hu J, Hafeez M, Ma D, AlGarni TS, Saeed M, Abdullah MA, Hussain S (2021a) Applying environmental Kuznets curve framework to assess the nexus of industry, globalization, and CO2 emission. Environ Technol Innov 21:101377

Aslam B, Hu J, Majeed MT, Andlib Z, Ullah S (2021b) Asymmetric macroeconomic determinants of CO 2 emission in China and policy approaches. Environ Sci Pollut Res:1–14

Balcilar M, Ciftcioglu S, Gungor H (2016) The effects of financial development on Investment in Turkey. Singap Econ Rev 61(4):1650002–16500018

Chan YT (2020) Are macroeconomic policies better in curbing air pollution than environmental policies? A DSGE approach with carbon-dependent fiscal and monetary policies. Energy Policy 141:111454–111468

Chen C, Pan D (2020) The OptimalMix ofMonetary and Climate Policy. MPRA Paper No 97718

Chishti MZ, Ullah S, Ozturk I, Usman A (2020) Examining the asymmetric effects of globalization and tourism on pollution emissions in South Asia. Environ Sci Pollut Res 27:27721–27737

Chishti MZ, Ahmad M, Rehman A, Khan MK (2021) Mitigations pathways towards sustainable development: assessing the influence of fiscal and monetary policies on carbon emissions in BRICS economies. J Clean Prod 292:126035

Dar JA, Asif M (2017) Is financial development good for carbon mitigation in India? A regime shift-based cointegration analysis. Carbon Management 8(5-6):435–443

Dongyan L (2009) Fiscal and tax policy support for energy efficiency retrofit for existing residential buildings in China’s northern heating region. Energy Policy 37(6):2113–2118

Grossman GM, Krueger AB (1995) Economic growth and the environment. Q J Econ 110(2):353–377

Halkos GE, Paizanos EΑ (2013) The effect of government expenditure on the environment: an empirical investigation. Ecol Econ 91:48–56

Halkos GE, Paizanos EΑ (2016) The effects of fiscal policy on CO2 emissions: evidence from the USA. Energy Policy 88:317–328

Harper S (2013) Population–environment interactions: European migration, population composition and climate change. Environ Resour Econ 55(4):525–541

He L, Shen J, Zhang Y (2018) Ecological vulnerability assessment for ecological conservation and environmental management. J Environ Manag 206:1115–1125. https://doi.org/10.1016/j.jenvman.2017.11.059

He L, Shao F, Ren L (2020) Sustainability appraisal of desired contaminated groundwater remediation strategies: an information-entropy-based stochastic multi-criteria preference model. Environ Dev Sustain 23:1759–1779. https://doi.org/10.1007/s10668-020-00650-z

He X, Zhang T, Xue Q, Zhou Y, Wang H, Bolan NS, Jiang R, Tsang DCW (2021) Enhanced adsorption of Cu(II) and Zn(II) from aqueous solution by polyethyleneimine modified straw hydrochar. Sci Total Environ 778:146116–146116

International Monetary Fund (2019) International Featured Standards 2019. International Monetary Fund Publications

Jalil A, Feridun M (2011) The impact of growth, energy and financial development on the environment in China: a cointegration analysis. Energy Econ 33(2):284–291

Katircioglu S, Katircioglu S (2018) Testing the role of fiscal policy in the environmental degradation: the case of Turkey. Environ Sci Pollut Res 25(6):5616–5630

Khattak SI, Ahmad M, Khan ZU, Khan A (2020) Exploring the impact of innovation, renewable energy consumption, and income on CO2 emissions: new evidence from the BRICS economies. Environ Sci Pollut Res:1–16

Li J, Hu Z, Shi V, Wang Q (2021a) Manufacturer’s encroachment strategy with substitutable green products. Int J Prod Econ 235:108102. https://doi.org/10.1016/j.ijpe.2021.108102

Li X, Yu Z, Salman A, Ali Q, Hafeez M, Aslam MS (2021b) The role of financial development indicators in sustainable development-environmental degradation nexus. Environ Sci Pollut Res:1–12

Liu Y, Han L, Yin Z, Luo K (2017) A competitive carbon emissions scheme with hybrid fiscal incentives: the evidence from a taxi industry. Energy Policy 102:414–422

Liu J, Yi Y, Wang X (2020) Exploring factors influencing construction waste reduction: a structural equation modeling approach. J Clean Prod 123185:123185. https://doi.org/10.1016/j.jclepro.2020.123185

Lopez R E, Palacios A (2010) Have government spending and energy tax policies contributed to make Europe environmentally cleaner? Working paper no 1667-2016-136345

Lopez R, Galinato GI, Islam A (2011) Fiscal spending and the environment: theory and empirics. J Environ Econ Manag 62(2):180–198

Lv Z, Xu T (2019) Trade openness, urbanization and CO2 emissions: dynamic panel data analysis of middle-income countries. The Journal of International Trade & Economic Development 28(3):317–330

McAusland C (2008) Trade, politics, and the environment: Tailpipe vs. smokestack. J Environ Econ Manag 55(1):52–71

Mirzaei M, Bekri M (2017) Energy consumption and CO2 emissions in Iran, 2025. Environ Res 154:345–351

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16(3):289–326

Rausch S (2013) Fiscal consolidation and climate policy: an overlapping generation’s perspective. Energy Econ 40:S134–S148

Shahbaz M, Mallick H, Mahalik MK, Sadorsky P (2016) The role of globalization on the recent evolution of energy demand in India: implications for sustainable development. Energy Econ 55:52–68

Shin Y, Yu B, Greenwood-Nimmo M (2014) Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In: Festschrift in honor of Peter Schmidt. Springer, New York, pp 281–314

Sun G, Yuan C, Hafeez M, Raza S, Jie L, Liu X (2020) Does regional energy consumption disparities assist to control environmental degradation in OBOR: an entropy approach. Environ Sci Pollut Res 27(7):7105–7119

Tian P, Lu H, Feng W, Guan Y, Xue Y (2020) Large decrease in streamflow and sediment load of Qinghai–Tibetan Plateau driven by future climate change: a case study in Lhasa River Basin. Catena (Giessen) 187:104340. https://doi.org/10.1016/j.catena.2019.104340

Ullah S, Majeed MT, Chishti MZ (2020) Examining the asymmetric effects of fiscal policy instruments on environmental quality in Asian economies. Environ Sci Pollut Res 27(30):38287–38299

Ullah S, Ozturk I, Sohail S (2021) The asymmetric effects of fiscal and monetary policy instruments on Pakistan’s environmental pollution. Environ Sci Pollut Res 28(6):7450–7461

Usman A, Ullah S, Ozturk I, Chishti MZ, Zafar SM (2020) Analysis of asymmetries in the nexus among clean energy and environmental quality in Pakistan. Environ Sci Pollut Res 27(17):20736–20747

Wang S, Li G, Fang C (2018) Urbanization, economic growth, energy consumption, and CO2 emissions: empirical evidence from countries with different income levels. Renew Sust Energ Rev 81:2144–2159

Yuelan P, Akbar MW, Hafeez M, Ahmad M, Zia Z, Ullah S (2019) The nexus of fiscal policy instruments and environmental degradation

Zhao X, Gu B, Gao F, Chen S (2020) Matching model of energy supply and demand of the integrated energy system in coastal areas. J Coast Res 103(sp1):983. https://doi.org/10.2112/SI103-205.1

Zhao W, Hafeez M, Maqbool A, Ullah S, Sohail S (2021) Analysis of income inequality and environmental pollution in BRICS using fresh asymmetric approach. Environ Sci Pollut Res:1–11

Zuo X, Dong M, Gao F, Tian S (2020) The modeling of the electric heating and cooling system of the integrated energy system in the coastal area. J Coast Res 103(sp1):1022. https://doi.org/10.2112/SI103-213.1

Author information

Authors and Affiliations

Contributions

The idea was given by Nafeesa Mughal and Maryam Kashif. Maryam Kashif, Asma Arif, John William Grimaldo Guerrero, Wilson C. Nabua, and Gniewko Niedbala have done the data acquisitions and analysis and written the whole draft. Nafeesa Mughal and Maryam Kashif read and approved the final version.

Corresponding author

Ethics declarations

Ethical approval

Not applicable

Consent to participate

I am free to contract any of the people involved in the research to seek further clarification and information.

Consent to publish

Not applicable

Conflict of interest

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Mughal, N., Kashif, M., Arif, A. et al. Dynamic effects of fiscal and monetary policy instruments on environmental pollution in ASEAN. Environ Sci Pollut Res 28, 65116–65126 (2021). https://doi.org/10.1007/s11356-021-15114-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-15114-8