Abstract

This study explores the interaction among coal consumption, pollutant emissions, and real income for South Africa in a multivariate setting. To achieve this objective, annual frequency data spanning from 1965 to 2017 is used for analysis. A series of econometrics tests were conducted ranging from stationarity and non-stationarity tests for unit root properties of the variables under consideration. Empirical evidence finds support for the inverted U-shaped pattern between energy consumption and environmental degradation in South Africa. The Toda-Yamamoto Granger causality test shows a feedback causality between economic growth and carbon dioxide emissions, as well as between GDP and coal consumption. All these highlighted findings have inherent environmental implications. Based on these outcomes, policy directions such as diversification of the South Africa energy mix to renewables and cleaner energy sources and also the adoption of carbon capturing and storage techniques were suggested to engender a cleaner and friendlier environment.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

A major challenge facing any country of the world endowed with nonrenewable energy resources is the ability to formulate energy and environmental strategic policies such that safe and secured energy is produced to meet energy needs while reducing significantly carbon dioxide (CO2) emissions (WCA 2019). This challenge requires growing attention as demand for energy is rising (EIA 2018). The primary priority of players in this sector is to diversify energy sources and discover secure and stable energy supply (Gnansounou 2008; Ferguson 2007; Toth and Rogner 2006). Majority of the endowment reserve (i.e., crude oil and natural gas) sources are found around a certain geographical region of the world, and specifically about 68% and 67%, respectively, are located in Middle East and Russia. This suggests high risk to countries that depend significantly on importation of energy as there may be instability, and the supply of these resources would not be guaranteed. Ensuring the sustainability of crude oil supply has been of top priority to countries bringing in oil especially after the crisis of 1973. Safeguarding the supply of oil in the oil-importing countries of the world has necessitated the search for an alternative source of domestic energy. This motivated the quest for another source of low-priced energy supply from many energy-importing countries, as it is captured in their policy and strategy documents (Toth and Rogner 2006).

Coal is globally abundant and most cheap in respect of fossil fuel. With the need for cheap alternative energy supply source, coal has the capability of providing adequate demand for secured energy (WCA, 2018). Current world deposit of coal is projected to be available for about 136 years ahead, whereas the projection for natural gas and crude oil is for about 30 and 52 years, respectively (IEA 2017). By the year 2030, it is expected that coal becomes the second largest main fuel or energy source (Shafiee and Topal 2008). In 2005, coal accounted for the share of world energy as follows: 72% in South Africa, 63.4% in China, 38.7% in India, 23.8% in USA, 23.1% in South Korea, and 21.1% in Japan (Shafiee and Topal 2008). Also, the total electricity generation from coal sources is accounted in the following ways: 95% in South Africa, 79% in China, 69% in India, 51% in the USA, 38% in South Korea, and 29% in Japan.

Although coal enjoy acceptance as a creditable source of energy due to the earlier factors mentioned, there is also a group of persons that believe that global warming can be trace to high consumption of coal which usually result in the carbon dioxide (CO2) emission increase from burning coal. This study therefore explores the interaction among coal consumption, pollutant emission, and real income for South African economy using the multivariate framework.

Even with the overwhelming evidence supporting coal consumption as an important energy source for many countries, there are scanty studies that have engaged recent and advance econometric techniques in testing the nexus between coal consumption and economic growth (Jinke et al. 2008). Hence, this study will further explore the importance of coal in energy supply as well as validate the source of global warming by using adequate and recent econometric methodologies. The dynamic relationship between coal consumption, pollutant emissions, and real income will be explored and established.

One of the goals of the United Nations (UN) in terms of its sustainable development growth (SDGs) is access to energy, which is resonated in the goal 7 of the SDG. Across the globe, economies are also confronted with climate change issues that are aggravated by the greenhouse gas as results of CO2 emissions, which is SDGs 13. All the above highlights inform the choice of this study’s variables as well as investigate the relationship between energy (coal) consumption and economic growth in South Africa.

The theme under considerations has received great attention in the energy economics literature for developed and emerging economies. However, very few studies exist for sub-Saharan African countries that explore the nexus among energy, income and environment (Mapapu and Phiri 2018; Amuakwa-Mensah and Adom 2017; Khobai and Le Roux 2017; Ben Jebli et al. 2015; Bildirici and Bakirtas 2014; Kohler 2013; Shahbaz et al. 2013; Menyah and Wolde-Rufael 2010). Thus, this study seeks to bridge this gap for the case of South Africa, where only few studies exist (Balcilar et al. 2010; Odhiambo 2009; Ziramba 2009). The South African economy has a very rich and dynamic energy mix which is worthy of investigation. This study aims to investigate Environmental Kuznets Curve (EKC) by incorporating coal consumption for South Africa.

The rest of the study takes the following sequence: section 2 provides some stylized facts. Section 3 briefly reviews the related literature. Section 4 examines data methodology used for the study, while section 5 focuses on empirical results and discussion. Finally, section 6 gives concluding remarks together with plausible indications of policy.

A synopsis on energy mix in South Africa

South African economy is largely dependent on coal resources. The major leading sectors are related to the electricity: liquid fuels manufacture, basic iron, and steel, which collectively account for more than 80% of domestic coal demand in terms of value and 70% in terms of volume. Recent statistics reveal that about 90% of the country power is generated by using coal, followed by nuclear with about 5.2%, and 3.2% from natural gas (EIA 2017). South Africa remains one of the biggest players in the production of coal with 6th position in terms of ranking in the world (Ratshomo and Nembahe 2018). Coal is the primary driver of energy production in South Africa, and it is known that its energy production and supply chain is well organized. Inasmuch as South Africa is naturally and abundantly endowed with coal energy production and consequently importation, there is lack of such abundance in natural gas and crude oil. South Africa is also endowed with reasonable amount of renewable energy sources. DEM (2016) reported the contribution of the renewable energy exploited for electricity power generation for industrial and residential consumption. According to Beg et al. (2002), approximately 250,000 jobs opportunities have been created by South African energy sector to its citizenry, and this account for about 15% of the total output of the economic activities in the country.

Literature review

In recent times, energy consumption and real income nexus have dominated literature, and this discussion is ongoing (Balcilar et al. 2019; Gong et al. 2019; Nathaniel et al. 2019; Zhang et al. 2018; Kurniawan and Managi 2018; Hao et al. 2016; Mohiuddin et al. 2016; Kim and Yoo 2016; Caraiani et al. 2015). Despite the extensive and robust discussion on the subject matter, consensus has not been reached with regard to causality direction between these two variables. There are three distinct yet competing hypotheses postulated with sufficient evidence to support the relationship between energy consumption and economic growth. Bi-directional causality (with a feedback mechanism) is observed in some countries, whereas in other countries there is no causality observed in any direction (neutrality hypothesis). In another evidence, there is one-way causality interaction from economic growth toward energy consumption while in several papers emerge an opposite causality flow, from energy to economic growth (Magazzino 2016b).

Parallel to the nexus between aggregate energy consumption and real income, there is contradiction when examining the empirical relationship between coal consumption and economic growth. Raza and Shah (2019) examined the causal relationship between coal consumption and economic growth by including fiscal deficit, rural-urban population, and unemployment for Pakistan over the period 1981–2017. Their results posit that there is a short-run and long-run bi-directional causal relationship between coal consumption and economic growth. Abuoliem et al. (2019) evaluated the relationship between domestic, international macroeconomic indicators, and financial sector index in a frontier market (Amman Stock Exchange, ASE). Their findings indicate that the deposit interest rate positively influences the financial sector in the short and long run, while the producer price index and the global oil price have significant negative impacts on the financial sector. However, Al-mulali and Che Sab (2018) showed that there is no short-run and long-run Granger causality between coal consumption and economic growth for panel countries. Bekhet et al. (2017) examined the energy-financial development-growth nexus for GCC countries. The empirical results show that economic growth is associated with increased CO2 emissions in Saudi Arabia, Oman, Qatar, and Bahrain; furthermore, financial development is identified as a driver of energy emissions reduction. Shahbaz et al. (2016) employed a time-varying Granger causality technique to detect the direction of causality among economic growth, energy consumption and CO2 for Next 11 countries. They found that economic growth causes energy consumption in the Vietnam, Turkey and Philippines while bi-directional time-varying causal association between economic growth and energy consumption in South Korea. Matar and Bekhet (2015) assessed the empirical dynamic relationship among the electrical consumption, economic growth, export, and financial development in Jordan over the 1976–2011 period, providing evidence of a long-run equilibrium relationship between electricity consumption and the economic growth and a unidirectional relationship from real GDP to electrical consumption. Bildirici and Bakirtas (2014) disaggregated energy consumption into coal, natural gas, and oil consumption to detect causal relationship among coal, natural gas, oil consumption, and economic growth for BRICTS countries. Their results also confirmed that bi-directional causality between coal consumption and economic growth for China and India. These findings are in line with the results of Lin et al. (2018). Nasiru (2012) for Nigeria found one-way directional causality flowing from economic growth to coal consumption. Li and Leung (2012) investigated the relationship between coal consumption and economic growth using provincial level panel data for the case of China. Their findings were conflicting as coastal region revealed a bi-directional causal interaction between, whereas for central region the causal relationship was unidirectional, from economic growth toward coal consumption. The bi-directional causality implies both coal consumption and economic growth can have lasting impact on each other. Take for instance, should policies of energy conservation be adopted as the policy direction, this may retard coal consumption, and this will impact economic growth. Likewise, an expansionary energy policy will accelerate economic growth and induce more coal consumption. Wolde-Rufael (2010) and Li et al. (2008) examined causal relationship between coal consumption and GDP in China. They found unidirectional causal relationship running from economic growth to coal consumption. Reynolds and Kolodziej (2008) investigated the energy-economic growth nexus in the case of former Soviet Union, discovering a unidirectional causal relationship from economic growth to coal consumption. A similar study was conducted by Jinke et al. (2008), and their finding revealed a one-way directional causality flow from economic output toward coal consumption in Japan and China, whereas in South Africa, South Korea, and India, there was no evidence of causality in any. Yuan et al. (2008) examined the relationship between economic growth and coal consumption in China and found no causality. Yoo (2006) in his investigation for South Korea discovered a bi-directional causality from coal consumption to economic growth. Soytas and Sari (2006) investigated the relationship between energy consumption and economic growth in China using aggregated and disaggregated levels of energy consumption. They found no causal relationship between total energy consumption and economic growth. Zhou and Chau (2006) found unidirectional causal relationship from oil consumption to economic growth in the short run, whereas in the long run, a bi-directional causal relationship was found. Wolde-Rufael (2004) discovered for Shanghai a unidirectional link from coal consumption to real GDP. Lee and Chang (2005) found evidence of bi-directional causal relationship between coal consumption and economic growth in Taiwan. Fatai et al. (2004) did not find any causality link between coal consumption and economic growth in the case of New Zealand. Fatai et al. (2004) for Pacific Rim countries of Australia and New Zealand found a unidirectional causal relationship from economic growth to coal consumption for Australia, using Johansen-Juselius and Toda-Yamamoto tests; however, any causality nexus emerges when the ARDL model is used. Magazzino and Cerulli (2019) examined the relationship among carbon dioxide emissions, GDP, and energy in the MENA countries by using a Responsiveness Scores approach, over the period 1971–2013. The empirical findings suggest that GDP per capita and energy consumption show positive RSs, while trade and urban population negative ones. Moreover, energy consumption and urban population reveal moderate increasing returns to scale, while GDP per capita exhibits decreasing positive returns. Magazzino (2019) investigated the stationarity and convergence of CO2 emissions series in MENA countries. The author finds that relative per capita CO2 emissions in the 19 MENA countries are a mixture of I(0) and I(1) processes and there is a weak evidence to support the stationarity of CO2 emissions. After having verified the presence of cross-sectional dependence in the series, the panel unit root tests in presence of cross-section dependence show strong evidence in favor of non-stationarity. In addition, after performing tests for ß-convergence, it is also found that per capita CO2 emissions are converging on average in 11 out of 19 sample’s countries.

From the previous studies, we can observe contradictory outcomes with regard to the interactions and causal relationship between coal consumption and real income, and this have serious implications on policy directions. Suppose there is one-way directional causality flowing from real income to coal consumption, this would suggest that policies that is targeted at reducing coal consumption, if executed, will have little or no negative impact on the economic growth. But, if the unidirectional causal effect is opposite of the aforementioned, then policies that are targeted at reducing coal consumption could be detrimental and may result to less economic growth. Alternatively, where there is absence of causality between the variables under investigation, neutrality hypothesis is taken into account, and measures taken by policymakers and stakeholders to reduce coal consumption may have no significant impact on economic output or income. On the other hand, where there is bi-directional causal relationship flowing from coal consumption toward economic growth and vice versa, coal consumption is capable of stimulating economic growth, and the increase in real income further induces more demand for coal. This situation therefore allows both coal consumption and economic growth to serve as perfect complement for each other. This further implies that coal conservative policies are very likely to be injurious to economic growth. Hence, this study aims to contribute to the existing literature in three different fronts: (a) investigating the EKC for South Africa, (b) the exploration of role of coal consumption on its economic output over the investigated period, and (c) the adoption of recent and more robust econometric procedures (Maki 2012; Toda and Yamamoto 1995).

Data and empirical strategy

This study uses annual time series over the period 1965–2017Footnote 1 to address the nexus between carbon dioxide emission (CO2) (kt), real per capita gross domestic product (GDP) (constant 2010$), the square of real per capita gross domestic product (GDP2), and coal consumption (COAL) (kt) in South Africa. We derived data on GDP and CO2 from the World Development Indicators (WDI 2019) database, while COAL series was retrieved from US Energy Information Administration (EIA database). CO2 variable is used as a proxy for environmental degradation, while GDP is used as a proxy of economic growth. We follow the empirical works of Magazzino (2016a) and Balcilar et al. (2019):

where α denotes the constant term, δ′s are the slope parameters, and εt is the error term with zero mean and constant variance, i.e., εt~IN(0, σ2). Also, all variables are taken in their natural logarithm form.

The first investigation of the selected series pertains their stationarity properties. Among the battery of tests proposed in the econometric literature, we applied the augmented Dickey and Fuller (ADF, 1979), the Leybourne (1995), the Dickey and Fuller generalized least squares (DF-GLS), the Elliott et al. (ERS, 1996), the Phillips and Perron (PP, 1988), the Kapetanios et al. (KSSUR, 2003), the Kapetanios and Shin (KSUR, 2008), the Ng-Perron (NP, 2001), and the Kwiatkowski, Phillips, Schmidt, and Shin (KPSS, 1992) tests. These tests are also used to identify the maximum integration order of the variables. However, the aforementioned unit root and stationarity tests are not reliable to decide the order of integration of the variables in the presence of structural break(s). Thus, to consider a possible structural break in the series, we also employ the Zivot and Andrews (ZA, 1992) unit root test, which suggests three different specifications as follows:

Specification 1: Structural break in the intercept term

Specification 2: Structural break in the trend

Specification: Structural break in the intercept term and trend

where DUt = 1 and DTt = t − Tb if t > Tb, otherwise, it will be 0. Tb represents the possible break point, and r stands for the upper limit of the lag length of the independent variables.

To examine the existence of long-run equilibrium relationship among the non-stationary series, we applied the Maki (2012) cointegration test under consideration of multiple structural breaks. Unlike other traditional cointegration tests – as Johansen (1991), Johansen and Juselius (1990), and Engle and Granger (1987) – this technique accounts for existence of structural break(s) in the series. Subsequently, most of finance and economic series have jumps and break due to the economic or financial crisis in the country. That is major argument canvassed by Maki (2012), Gregory and Hansen (1996), and Gregory et al. (1996). In this regard, Maki (2012) cointegration test is superior to the other conventional test to avoid from spurious or biased results. The only condition for employing this technique is that all the examined series are integrated of order 1, i.e., I(1). Four different models exist to apply the Maki (2012) cointegration techniques. These models are given as follows:

Model 1: With break in intercept and without trend

Model 2: With break in intercept and coefficients and without trend

Model 3: With break in intercept and coefficients and with trend

Model 4: With break in intercept, coefficients and trend

The causality term refers to existence of predictability power of one series on the other one. Toda-Yamamoto (TY, Toda and Yamamoto 1995) causality test is carried out to investigate the presence and direction of causal relationship between the variables in this study. The TY causality is a modified version of Wald test that has superior traits than the conventional Granger causality test. This superiority ranges from its resilient and robust nature. In addition, this test can be performed irrespective to the integration order of the analyzed series (Amiri and Ventelou 2012). The TY technique is conducted on Vector AutoRegressive (VAR) with (k+dmax) lags, where k denotes the optimum lag order. The equations can be formulated as follow:

Empirical results and discussions

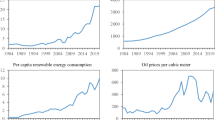

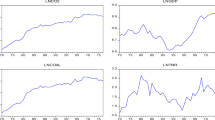

This section focuses on the empirical results and their discussion. Preliminary analyses such as graphical plot, summary statistics, and correlation matrices are the first point in data analysis. This enables us have to have a glimpse of the variables under consideration (Magazzino 2017a, 2017b). Figure 1 depicts the evolution of the series. All variables show positive trend over the investigated period. Thus, this study investigates dynamic interactions within the variables. Table 1 presents the summary statistics and correlation matrices for the variables. Economic growth has the highest mean, while coal consumption exhibits the lowest mean. All variables show significant departure from their mean as reported by the standard deviation. In terms of symmetry, all series are negatively skewed. The relationship between the variables is reviewed with the correlation analysis in the last column of Table 1. We observed strong and significant positive correlation coefficients. Thus, the need to further validate or refute the above assertion is needed given that correlation analysis is not sufficient.

The next step is to check the integration order of the series to avoid spurious and biased results (Magazzino 2017a, 2017b). Hence, the study conducts several stationarity and unit root tests. We applied time-series techniques on stationarity and unit root processes. Table 2 gives the results, to determine the order of integration.

All tests lean toward the conclusion that the original series (CO2, COAL, and GDP) are non-stationary. However, their first-differences can be considered as stationary processes. Thus, the carbon dioxide emissions, coal consumption, and real GDP are integrated of order one or I(1). This leads to the question whether these series are cointegrated. In fact, starting from multiple series that alone are non-stationary, we can discover a linear combination of them that is stationary. This is the case when the original series share a common trend in the long run.

Moreover, also the NP and KPSS tests indicate that the series are integrated of order 1, at the 1% statistical significance level. This implies that all the variables are first-difference stationary.

Subsequently, given the integration property of the series, the need to conduct cointegration test is vital to examine the long-run relationship among the variables. This study applies the novel and recent Maki cointegration test under multiple structural breaks (SBs). Table 3, 4, and 5 reports the Maki cointegration test results for five SBs. The test statistics were rejected for several SBs models. This means that these series converges to a long-run equilibrium path over the sample period.Footnote 2

Table 6 renders the long-run coefficients and magnitudes of the variables. This study found statistical significance positive relationship for GDP and negative for its squared term (GDP2) on CO2. This outcome is in line with Environmental Kuznets Curve (EKC) hypothesis in the energy literature. The EKC hypothesis postulates a trade-off relationship between environmental degradation and economic growth. This means that an economy at the early stage of its growth trajectory focuses more on economic growth rather than on the quality of its environment. This is the current position for South Africa as it is still at the scaled stage of its growth path (Bekun et al. 2019a; Bekun et al. 2019b; Saint Akadiri et al. 2019). The scale stage of the Southern economy is insightful to government official and energy administrators. Thus, policies to stimulate the economy are welcome with caution on the quality of the environment (Shahbaz and Sinha 2019). There exists a positive relationship between energy consumption (COAL) and CO2. A 1% increase in coal consumption increases environmental degradation by 0.76%. This reflects the current energy position of South Africa as it ranks seventh largest greenhouse gas (GHG) top in coal consumption, which is in nonrenewable energy source (Winkler 2007). The coal-driven economy is laudable in South Africa. However, there is a need for policy mix by government administrators to match the breaks on the excessive pollutant emission (CO2) from emanating from the exploration of coal. As such, South African energy administrators need to diversify the energy portfolio to renewable energy like biomass, hydro, and solar energy sources (Emir and Bekun 2019).

The fitted model passes conveniently the 0.05 threshold of stability test as reported in the CUSUM and CUSUMsq plots in Fig. 2.

In order to detect the causality relationship between variables, we employed the TY causality method as reported in Table 7. We observe a two-way causality relationship between GDP and CO2. This implies that there is a trade-off between economic growth and environmental degradation for South Africa.

This result supports the study of Tang and Tan (2013), Zhou and Chau (2006), and Wolde-Rufael (2004). Also, a feedback causality emerges between GDP and COAL. This is also consistent with the study of Bekun et al. (2019a), Li and Leung (2012), Yoo (2006), and Yang (2000). These results are insightful for government administrative in South Africa since the economy strives on its energy sector. Hence, these outcomes are indicative to the decision-makers in energy market. Attempt to implement energy conservative policies will hurt economic growth.

Conclusions and policy implications

The present study applies recent and up-to-date econometrics procedure to explore the relationship among coal consumption, economic growth, and carbon dioxide emissions in the case of South Africa. This is in a bid to arm decision-makers for better decision-making.

Empirical results show statistical relationship among coal consumption, economic growth, and CO2 emissions. This means that all variables are critical for economic growth as an equilibrium relationship is observed among them. However, there is a trade-off with the quality of the environment. Our empirical results highlight that as the South African economy grows, there is an increase in the environment pollutant to a certain threshold (turning point), after which a decline is experienced. This pattern is known as the EKC phenomenon, validated here in the long run. In addition, the coefficient of GDP is statistically significant and positive, with its square term negative. This is indicative and put caution for South Africa to strengthen its environmental treaty agreement implementation. As a matter of urgency and deliberately on the South Africa government official’s other local environmental regulation are needed, like the Action Plan for Energy, Climate for the City of Cape Town as well as the adoption of renewable technologies in its energy mix. Thus, the need for synergy between sustainable and efficient energy consumption and environmental consciousness with key macroeconomic objectives is pivotal for robust and sound policy formulation. Departure from the already itemize trajectory will not only jeopardize economic progress but also increase environmental degradation in the country.

Based on the highlighted findings, focus is on environmental sustainability for nations across the globe and South Africa is no exception. Thus, pragmatic joint efforts on the part of government and private sector is needed to attain the SDG’s. The following policy direction will aid to attain the SDGs:

- (a)

The need for adoption of more efficient, cleaner, and cheaper energy technologies. This entails the transition from fossil fuel-based energy sources to renewables in the energy portfolio. This is a foundational prerequisite for sustainable economic growth without threat for environmental quality.

- (b)

Government administrators should reinforce commitment to both national and international energy and environmental treaties. For instance, the South Africa government has made stride with the Action Plan for Energy, the Climate for the City of Cape Town, and the adoption of renewable technologies in its energy mix. Nevertheless, more is required to attain the SDGs on climate change and access to energy. It is also worthy to mention that South Africa is a signatory of the Kyoto Protocol agreement.

Conclusively, findings from this study serve as a blueprint for other economies on the continent to curb environmental issues. As line of further studies, more investigation might be needed to ascertain if asymmetry exists on the nexus among energy consumption, economic growth, and environment degradation.

Notes

The data span is selected based on data availability.

This study is also conducted the ARDL Bounds testing for robustness check. The result is consistent with Maki cointegration results. See Appendix for the ARDL Bounds test results.

References

Abuoliem N, Nor SM, Matar A, Hallahan T (2019) Crude oil prices, macroeconomic indicators and the financial sector in Jordan: dynamic causes and responses. J Int Stud 12(3):131–146

Al-mulali U, Che Sab CNB (2018) The impact of coal consumption and CO2 emission on economic growth. Energy Sources, Part B: Economics, Planning, and Policy 13(4):218–223

Amiri A, Ventelou B (2012) Granger causality between total expenditure on health and GDP in OECD: evidence from the Toda-Yamamoto approach. Econ Lett 116(3):541–544

Amuakwa-Mensah F, Adom PK (2017) Quality of institution and the FEG (forest, energy intensity, and globalization) – environment relationships in sub-Saharan Africa. Environ Sci Pollut Res Int 24(21):17455–17473

Balcilar M, Ozdemir ZA, Arslanturk Y (2010) Economic growth and energy consumption causal nexus viewed through a bootstrap rolling window. Energy Econ 32(6):1398–1410

Balcilar M, Bekun FV, Uzuner G (2019) Revisiting the economic growth and electricity consumption nexus in Pakistan. Environ Sci Pollut Res 26(12):12158–12170

Beg N, Morlot JC, Davidson O, Afrane-Okesse Y, Tyani L, Denton F, Parikh K (2002) Linkages between climate change and sustainable development. Clim Pol 2(2–3):129–144

Bekhet HA, Matar A, Yasmin T (2017) CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: dynamic simultaneous equation models. Renew Sust Energ Rev 70:117–132

Bekun FV, Emir F, Sarkodie SA (2019a) Another look at the relationship between energy consumption, carbon dioxide emissions, and economic growth in South Africa. Sci Total Environ 655:759–765

Bekun FV, Alola AA, Sarkodie SA (2019b) Toward a sustainable environment: Nexus between CO2 emissions, resource rent, renewable and nonrenewable energy in 16-EU countries. Sci Total Environ 657:1023–1029

Ben Jebli M, Ben Youssef S, Ozturk I (2015) The role of renewable energy consumption and trade: environmental Kuznets curve analysis for sub-Saharan Africa countries. Afr Dev Rev 27(3):288–300

Bildirici ME, Bakirtas T (2014) The relationship among oil, natural gas and coal consumption and economic growth in BRICTS (Brazil, Russian, India, China, Turkey and South Africa) countries. Energy 65:134–144

Caraiani C, Lungu CI, Dascălu C (2015) Energy consumption and GDP causality: a three-step analysis for emerging European countries. Renew Sust Energ Rev 44:198–210

Department of Minerals and Energy (DEM) (2016) Digest of South African Energy Statistics. Republic of South Africa Available at https://unstats.un.org/oslogroup/meetings/og-06/docs/6th%20mtg%20DAY_3_Paper_Energy_Accounts_Statistics_South_Africa.pdf (Access date 15.02.2019)

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74:427–431

Elliott G, Rothenberg TJ, Stock JH (1996) Efficient tests for an autoregressive unit root. Econometrica 64:813–836

Emir F, Bekun FV (2019) Energy intensity, carbon emissions, renewable energy, and economic growth nexus: new insights from Romania. Energy & Environment 30(3):427–443

Energy Information Administration (EIA) (2018) Annual Energy Outlook 2019 (access date 04.03.2019)

Engle RF, Granger CWJ (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica 55:251–276

Farhani S, Shahbaz M, Ozturk I (2014) Coal consumption, industrial production and CO2 emissions in China and India. Department of Research – Ipag Business School Working Papers:2014–2225

Fatai K, Oxley L, Scrimgeour FG (2004) Modelling the causal relationship between energy consumption and GDP in New Zealand, Australia, India, Indonesia, the Philippines, and Thailand. Math Comput Simul 64:431–445

Ferguson CD (2007) Nuclear energy: balancing benefits and risks. Council of Foreign Relations 28

Gnansounou E (2008) Assessing the energy vulnerability: the case of industrial countries. Energy Policy 36:3734–3744

Gong B, Zheng X, Guo Q, Ordieres-Meré J (2019) Discovering the patterns of energy consumption, GDP, and CO2 emissions in China using the cluster method. Energy 166:1149–1167

Gregory AW, Hansen BE (1996) Residual-based tests for cointegration in models with regime shifts. J Econ 70(1):99–126

Gregory AW, Nason JM, Watt DG (1996) Testing for structural breaks in cointegrated relationships. J Econ 71(1–2):321–341

Hao Y, Liu Y, Weng JH, Gao Y (2016) Does the environmental Kuznets curve for coal consumption in China exist? New evidence from spatial econometric analysis. Energy 114:1214–1223

International Energy Agency (IEA) (2017) World energy outlook (access date 10.03.2019)

Jinke L, Hualing S, Dianming G (2008) Causality relationship between coal consumption and GDP: difference of major OECD and non-OECD countries. Appl Energy 85:421–429

Johansen S (1991) Estimation and hypothesis testing of cointegration vectors in Gaussian vector autoregressive models. Econometrica:1551–1580

Johansen S, Juselius K (1990) Maximum likelihood estimation and inference on cointegration – with applications to the demand for money. Oxf Bull Econ Stat 52(2):169–210

Kapetanios G, Shin Y (2008) GLS detrending-based unit root tests in nonlinear STAR and SETAR models. Econ Lett 100:377–380

Kapetanios G, Shin Y, Snell A (2003) Testing for a unit root in the nonlinear STAR framework. J Econ 112:359–379

Khobai H, Le Roux P (2017) The relationship between energy consumption, economic growth and carbon dioxide emission: the case of South Africa. Int J Energy Econ Policy 7(3):102–109

Kim HM, Yoo SH (2016) Coal consumption and economic growth in Indonesia. Energy Sources, Part B: Economics, Planning, and Policy 11(6):547–552

Kohler M (2013) CO2 emissions, energy consumption, income and foreign trade: a south African perspective. Energy Policy 63:1042–1050

Kurniawan R, Managi S (2018) Coal consumption, urbanization, and trade openness linkage in Indonesia. Energy Policy 121:576–583

Kwiatkowski D, Phillips PC, Schmidt P, Shin Y (1992) Testing the null hypothesis of stationarity against the alternative of a unit root: how sure are we that economic time series have a unit root? J Econ 54(1–3):159–178

Lee CC, Chang CP (2005) Structural breaks, energy consumption and economic growth revisited: evidence from Taiwan. Energy Econ 27:857–872

Leybourne SJ (1995) Testing for unit roots using forward and reverse Dickey-Fuller regressions. Oxf Bull Econ Stat 57:559–571

Li R, Leung GCK (2012) Coal consumption and economic growth in China. Energy Policy 40:438–443

Li J, Song H, Geng D (2008) Causality relationship between coal consumption and GDP: difference of major OECD and non-OECD countries. Appl Energy 85:421–429

Lin FL, Inglesi-Lotz R, Chang T (2018) Revisit coal consumption, CO2 emissions and economic growth nexus in China and India using a newly developed bootstrap ARDL bound test. Energy Explor Exploit 36(3):450–463

Magazzino C (2016a) The relationship between CO2 emissions, energy consumption and economic growth in Italy. Int J Sustain Energy 35(9):844–857

Magazzino C (2016b) The relationship between real GDP, CO2 emissions and energy use in the GCC countries: a time-series approach. Cogent Econ Finance 4:1

Magazzino C (2017a) Stationarity of electricity series in MENA countries. Electr J 30(10):16–22

Magazzino C (2017b) The relationship among economic growth, CO2 emissions, and energy use in the APEC countries: a panel VAR approach. Environment Systems and Decisions 37(3):353–366

Magazzino C (2019) Testing the stationarity and convergence of CO2 emissions series in MENA countries. International Journal of Energy Sector Management 13(4):977–990

Magazzino C, Cerulli G (2019) The determinants of CO2 emissions in MENA countries: a responsiveness scores approach. International Journal of Sustainable Development & World Ecology 26(6):522–534

Maki D (2012) Tests for cointegration allowing for an unknown number of breaks. Econ Model 29(5):2011–2015

Mapapu B, Phiri A (2018) Carbon emissions and economic growth in South Africa: a quantile regression analysis. Int J Energy Econ Policy 8(1):195–202

Matar A, Bekhet HA (2015) Causal interaction among electricity consumption, financial development, exports and economic growth in Jordan: dynamic simultaneous equation models. Int J Energy Econ Policy 5(4):955–967

Menyah K, Wolde-Rufael Y (2010) Energy consumption, pollutant emissions and economic growth in South Africa. Energy Econ 32:1374–1382

Mohiuddin O, Asumadu-Sarkodie S, Obaidullah M (2016) The relationship between carbon dioxide emissions, energy consumption, and GDP: a recent evidence from Pakistan. Cogent Engineering 3(1):1210491

Nasiru I (2012) Coal consumption and economic growth in Nigeria: a two-step residual-based test approach to cointegration. Eur Sci J 8(9):140–155

Nathaniel S, Nwodo O, Adediran A, Sharma G, Shah M, Adeleye N (2019) Ecological footprint, urbanization, and energy consumption in South Africa: including the excluded. Environ Sci Pollut Res 26(26):27168–27179

Odhiambo NM (2009) Electricity consumption and economic growth in South Africa: a trivariate causality test. Energy Econ 31(5):635–640

Pesaran MH, Shin Y, Smith R (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16(3):289–326

Phillips PC, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75(2):335–346

Ratshomo K, Nembahe R (2018) South African energy sector report. Department of Energy – Republic of South Africa, November

Raza MY, Shah MTS (2019) Analysis of coal-related energy consumption in Pakistan: an alternative energy resource to fuel economic development. Environment, Development and Sustainability, pp 1–22

Reynolds DB, Kolodziej M (2008) Former Soviet Union oil production and GDP decline: Granger-causality and the multi-cycle Hubert curve. Energy Econ 30:271–289

Saint Akadiri S, Bekun FV, Sarkodie SA (2019) Contemporaneous interaction between energy consumption, economic growth and environmental sustainability in South Africa: what drives what? Sci Total Environ 686:468–475

Shafiee S, Topal E (2008) An econometric view of worldwide fossil fuel consumption and the role of US. Energy Policy 36:775–786

Shahbaz M, Sinha A (2019) Environmental Kuznets curve for CO2 emissions: a literature survey. J Econ Stud 46(1):106–168

Shahbaz M, Tiwari A, Nasir M (2013) The effects of financial development, economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Policy 61:1452–1459

Shahbaz M, Mahalik MK, Shah SH, Sato JR (2016) Time-varying analysis of CO2 emissions, energy consumption, and economic growth nexus: statistical experience in next 11 countries. Energy Policy 98:33–48

Soytas U, Sari R (2006) Energy consumption and income in G-7 countries. J Policy Model 28(7):739–750

Tang CF, Tan EC (2013) Exploring the nexus of electricity consumption, economic growth, energy prices and technology innovation in Malaysia. Appl Energy 104:297–305

Toda HY, Yamamoto T (1995) Statistical inference in vector autoregressions with possibly integrated processes. J Econ 66(1–2):225–250

Toth FL, Rogner HH (2006) Oil and nuclear power: past, present, and future. Energy Economy 28:1–25

WDI (2019) World Bank Development Indicator. https://data.worldbank.org/ (access date March, 2019)

Winkler H (2007) Long term mitigation scenarios technical report. Available at https://www.africaportal.org/documents/9813/07-Winkler-LTMS-Technical_Report.pdf (access date 15.02.2019)

Wolde-Rufael Y (2004) Disaggregated industrial energy consumption and GDP: the case of Shanghai, 1952–1999. Energy Econ 26:69–75

Wolde-Rufael Y (2010) Coal consumption and economic growth revisited. Appl Energy 87:160–167

World Coal Association (WCA) (2019) Available at https://www.worldcoal.org/coal (access data 08.03.2019)

Yang HY (2000) Coal consumption and economic growth in Taiwan. Energy Sources 22(2):109–115

Yoo SH (2006) Causal relationship between coal consumption and economic growth in Korea. Appl Energy 83:1181–1189

Yuan JH, Kang JG, Zhao CH, Hu ZG (2008) Energy consumption and economic growth: evidence from China at both aggregated and disaggregated levels. Energy Econ 30:3077–3094

Zhang M, Bai C, Zhou M (2018) Decomposition analysis for assessing the progress in decoupling relationship between coal consumption and economic growth in China. Resour Conserv Recycl 129:454–462

Zhou G, Chau KW (2006) Short and long-run effects between oil consumption and economic growth in China. Energy Policy 34:3644–3655

Ziramba E (2009) Disaggregate energy consumption and industrial production in South Africa. Energy Policy 37(6):2214–2220

Zivot E, Andrews D (1992) Further evidence on the great crash, the oil price shock, and the unit-root hypothesis. J Bus Econ Stat 10:251–270

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Muhammad Shahbaz

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Magazzino, C., Bekun, F.V., Etokakpan, M.U. et al. Modeling the dynamic Nexus among coal consumption, pollutant emissions and real income: empirical evidence from South Africa. Environ Sci Pollut Res 27, 8772–8782 (2020). https://doi.org/10.1007/s11356-019-07345-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-019-07345-7