Abstract

Improving energy conservation efficiency is one of the prerequisites for China’s manufacturing industry to transform and upgrade. Jiangsu province which presents the maximum economic volume in manufacturing and its economic status in eastern China is comparable to Shanghai. Research on the sustainable development capacity of Jiangsu’s manufacturing industry gives important guidance for upgrading the manufacturing industry all over China. The core of China’s manufacturing transition to a manufacturing power is to enhance its independent innovation capabilities to improve energy efficiency and its position in the global value chain. Therefore, it is important to study the impact of technological factor on energy conservation potential and the transformation and upgrading of manufacturing. In this paper, multivariate regression research method combined with risk analysis is developed to explore the influence of the research and development factor on energy conservation while introducing macroeconomic variables. Additionally, energy conservation of manufacturing in Jiangsu province in 2020 and 2025 based on historical data from 1985 to 2015 is predicted. Compared with the business-as-usual scenario, the advanced scenario could reduce by 44.07 Mtce and 87.60 Mtce in 2020 and 2025, respectively. Thus, the results indicate that there is much room for improvement in terms of the energy efficiency for Jiangsu province.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Since the reform and opening up, China has become the world’s largest manufacturing economy. From the China Statistical Yearbook (http://www.stats.gov.cn/tjsj/ndsj/), manufacturing has created 1/3 of GDP. Hu et al. (2019) point out that a comprehensive and independent industrial system has been established in China, which is vigorously promoting China’s industrialization and modernization. Hence, manufacturing is not only an important part of the national economy, but also an engine of repid economic development.

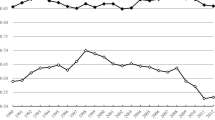

However, the direct pressure comes from rapid economic development based on the manufacturing industry is energy consumption. With the acceleration of China’s industrialization and urbanization, the development of the national economy is increasingly dependent on energy (Du et al. 2019). According to the China Energy Statistical Yearbook (http://data.stats.gov.cn/easyquery.htm?cn=C01), the proportion of energy consumed by the manufacturing industry accounted for about half of the total energy consumption; the details of which can be seen in Fig. 1. Meanwhile, China’s energy consumption is dominated by coal, which is not a clean form of energy and the main source of air pollution (Ahmed and Stater 2017). Therefore, with the purposes of resource constraints and sustainable development, it is urgent to promote energy conservation and improve energy efficiency.

The indirect pressure comes from the adjustment of China’s development strategy. The Chinese government emphasizes that the Chinese economic progress has entered a “new era,” in which the development feature is shifting from a high speed growth rate to a high-quality development stage based on technological innovation. The adjusted strategy requires the transformation of China’s manufacturing industry from one of quantity to one of quality. Research and development (R&D) is one of the most effective indicators to measure the level of technological innovation development. Unfortunately, compared with developed countries, Chinese manufacturing industry is at the low end of the global value chain. By 2015, the ratio of R&D expenditure to GDP was 2.07% (China Statistical Yearbook http://www.stats.gov.cn/tjsj/ndsj/). German spending on R&D accounted for 3% of their GDP in 2015. By contrast, China’s research capacity needs to be improved. Combining the direct and indirect pressures of China’s manufacturing industry, the research on the impact of R&D investments on energy consumption is distinctly important and significant.

The Chinese government has recognized the pressures on the manufacturing industry. They have adopted a series of measures, such as selecting pilot demonstration cities and implementing smart manufacturing strategies. The performance of chosen pilot demonstration cities is the most representative with the characteristics of being strong in processing and manufacturing but being weak in technology, which could be a typical microcosm of China’s manufacturing industry. Our research focus on Jiangsu province which presents the maximum economic volume in manufacturing, and its economic status in eastern China is comparable to Shanghai’s economic status. From the perspective of energy consumption, the Jiangsu provincial manufacturing industry has a significant impact on the regional economic growth and is also the main power for the regional economic development. Its manufacturing sector (accounting for more than 94%) has long maintained its contribution to the regional GDP at more than 50%, adjusted to 46% to 48% in the last two years (Jiangsu Province Statistical Yearbook http://www.jssb.gov.cn/tjxxgk/tjsj/tjnq/nj2017/index1508.html). The continuous development of the manufacturing industry consumes significant amounts of energy. According to the China Energy Statistical Yearbook (http://data.stats.gov.cn/easyquery.htm?cn=C01), the energy consumption of Jiangsu provincial manufacturing in 2015 was eight times that of 1985. However, energy resources are scarce in the Jiangsu province and the total energy consumption has been increasing in recent years. Therefore, how exactly to improve the energy efficiency has become an important issue in Jiangsu and throughout all of China. From the perspective of R&D investments, Jiangsu provincial R&D expenditure is 1801.23 billion China Yuan (CNY) and the ratio of R&D expenditure to GDP is 2.57% (Jiangsu Province Statistical Yearbook http://www.jssb.gov.cn/tjxxgk/tjsj/tjnq/nj2017/index1508.html). Under the context of intelligent manufacturing, the Jiangsu provincial government in 2015 issued an action plan, which was aimed at proposing a development plan based on innovation.

In the critical moment of economic transformation and industrial upgrading, research on the sustainable development capacity of Jiangsu’s manufacturing industry has an important guiding meaning for upgrading the manufacturing industry of China. Based on this scenario, the analysis of technological innovation in the manufacturing industry of Jiangsu province for energy conservation and the transformation and upgrading of the manufacturing industry is conducive to improving the energy efficiency of Jiangsu province and providing a reference for the transformation and upgrading of China’s manufacturing industry. In this paper, first, considering the influence of the R&D factor on energy conservation while introducing the macroeconomic variables, we will explore the new mode and new path of transformation and upgrading the manufacturing industry in the “new era,” and give relevant policy recommendations. Additionally, it could also help to improve the productivity and competitiveness in the manufacturing area. Second, fully understand the current energy demand situation of the manufacturing industry in Jiangsu province, and predict the future energy conservation potential, providing a reference for government departments to formulate future energy policies.

The contents and structures of this paper are as follows: Section 2 presents literature reviews on the different research methods used to study the energy efficiency of various industries. Section 3 outlines the methodology and data sources. Section 4 offers the multivariate regression results. Section 5 analyzes the energy conservation potential. Finally, Section 6 summarizes the findings and gives some policy suggestions.

Literature review

An increasing number of researchers have been attracted to energy efficiency and energy-saving potential with the global climate and environmental problems being given more attention by many nations (Shao et al. 2017). Early research method for energy conservation potential was mainly conservation supply curves. Worrell et al. (2000) employed the conservation supply curves to present the potential of energy efficiency improvement and CO2 emission reduction of the steel industry in the United States. The energy conservation potential of the cement industry was evaluated by He et al. (2010) and Hasanbeigi et al. (2010) utilized the conservation supply curves method. This research method was also employed for assessing the energy efficiency potential of the industrial motor system (Ghosh and Blackhurst 2014). Additionally, Hasanbeigi et al. (2013) used conservation supply curves to study the cumulative power saving potential of China’s steel industry. Chen et al. (2017) employed a bottom-up approach combines the conservation supply curves approach and break-even analysis to analyze the costs and potentials of energy conservation in China’s coal-fired industry. By summing up the previous research literatures, we know that this research method is to calculate the energy-saving potential by recalculating the relationship between existing technology development and economic expenditure. Lin et al. (2012) pointed out this research has its own advantage, which is considered the relationship between energy cost and energy-saving potential. However, the conservation supply curves method does not consider the dynamic changes in the future, this research method based on existing energy technologies only. Hence, this research method cannot predict the future energy conservation potential.

Energy demand could be estimated by the data envelopment analysis (DEA) model. Li and Lin (2016) adopted the three-stage DEA to study thirty counties in China and their energy efficiency. Yang and Yang (2016) employed the DEA research method to evaluate and compare the different energy-intensive industries in the period from 2000 to 2001. Huang et al. (2019) used the DEA research method to analyze the energy demand in Sichuan-Chongqing region between the 2005–2016 period. The results indicate that an improvement in total factor productivity plays a positive but insignificant role in decreasing energy demand. Zaim (2004) utilized the DEA to measure the environmental performance of state manufacturing through changes in the pollution intensities. Lundgren et al. (2016) estimated the firm level energy demand and energy efficiency for 14 sectors in Swedish manufacturing by employing this research method. DEA considers the optimal input and output options. Nevertheless, the DEA is applicable to the validity of multiple-input and multiple-output evaluation, but it cannot be used for forecasting.

Regression analysis is often used to study the relationship between variables, such as technology, GDP, energy price, and economic structure, as well as energy structure. Using this method, the relationship between variables is analyzed first, and then the energy demand and energy-saving potential are predicted on the basis. For example, Lin et al. (2012) used the multivariate regression model to evaluate the energy-saving potential of the Chinese steel industry. The results found that R&D intensity, energy-saving investment, labor productivity, and industry concentration are all important variables that affect energy intensity. Mi et al. (2017) employed this research method, noted that China’s carbon dioxide emissions will peak in 2026. An improved C-D production function model was developed by Handgraaf et al. (2013) to explore the relationship between energy consumption, economic growth, and carbon emissions in China from 1991 to 2009. Yuan et al. (2009) employed the Cobb-Douglas production function to find the nexus among energy intensity, labor, capital, and technologies. Lin and Chen (2018) utilized the co-integration method to test the relationship among energy consumption and three explanatory variables during the period 1980–2013. Lin and Lin (2017) used the co-integration method to explore the relationship between energy consumption of the heating industry and the factors including GDP, urban population density, central heating supply areas, and fuel price. Results indicate that GDP has a positive relationship with the energy consumption, and urban population density and central heating areas have both negative relationships with energy consumption. This research method is based on a time series to discover the casual linkages between variables; however, the downside of this research method relies on the quality and availability of historical data. Compared with other regression analysis, the co-integration research method overcomes the pseudo correlation of the time series, but the data also need to be tested for stability.

In summary, the previous researches and literatures on energy demand, as well as energy-saving potential, are vast, but these researches could be divided into two categories: energy efficiency perspective and relative relationships between variables. In this study, we mainly focus on the topic on the relative relationships between variables. In the context of the development of the new era, the Chinese government has put forward new requirements for the transformation and upgrading of the manufacturing industry. In this study, we take the manufacturing industry in Jiangsu province as research object to analyze the impact of R&D factors on energy conservation potential while introducing macroeconomic variables. Considering the stability of the model and the credibility of the experimental results, we use multivariate linear regression to avoid pseudo-regression to explore the long-term equilibrium relationship between energy consumption and its influencing factors. In addition, risk analysis is employed to verify the credibility of prediction results.

Methodology and data sources

Methodology

In reality, economic variables are non-stationary and pseudo-regression will be likely to occur, but their linear combination may be stationary. Based on this, the co-integration proposed by Granger and Engle in 1987, they pointed out that there exists a co-integration relationship between the time series data. They revealed that independent series are integrated of the same order, i.e., the time series should first be I (1) to implement the co-integration. Therefore, before co-integration analysis, it is necessary to ensure whether the time series are I (1). For the purpose, it is required to employ the unit root test. In this study, the Augmented Dickey-Fuller test (ADF) and the Phillips-Perron test (PP) are utilized.

The Augmented Dickey-Fuller unit root test is derived based on the following ordinary least squares (OLS) regression:

In this formula, yt is the variable in period t; Δyt − 1 is yt − 1 − yt − 2; μt is the independent identically distributed disturbance with the mean 0 and variance 1; t is the linear time trend and m denotes the lags. If a1 is significantly less than 0, the null hypothesis of the unit root should be reject. The PP test is similar to the ADF test, but is remarkably insensitive to the heteroscedasticity and the autocorrelation of the residual errors. To ensure the validity of the unit root test, ADF test and PP test are both adopted in this paper.

If all the time series in this paper are I(1), then we can continue to test whether a co-integration relationship exists. Two most popular methods to test for the existence of co-integration relationship between variables are the two-step procedure and maximum likelihood method (Johansen and Juselius) (Lin and Chen 2018). Two-step procedure provided by Engle and Granger (1987), it can only test single equation. Maximum likelihood method is provided by Johansen and Juselius (1990) and Johansen (1995); this research method could test the co-integration relationship between variables, and also determine the number of co-integration vectors. Considering this study includes more than two variables, Johansen maximum likelihood method is employed to explore the long-term equilibrium relationship between all variables.

Risk analysis

In order to make sure the forecast results are reliable, the risk analysis model is introduced to verify the co-integration model, and to describe the changing trend of annual growth rate from the perspective of probability theory. In this study, the block bootstrap method is adopted to implement the risk analysis to test the reliability of prediction results, which could overcome the shortcomings of the static prediction process.

The block bootstrap method is a simulation sampling statistical inference method based on the historical data, and it is a standard method for bootstrapping time series (Paparoditis and Politis 2002). The bootstrap method is suitable for a small size sample, which the sample volume is expanded by the resampling, and the empirical distribution of the sample sequence statistics is obtained. The basic principle of the bootstrap method is to consider a random sampling sequence with a length n from a fully uncertain P: S0 = {x1, x2, …, xn}. Among them, xi is the independent random sampling of the distribution, which is the basic requirement of the bootstrap method. Let tn denote the value of a specific sample statistics T. The bootstrap method resamples the original samples repeatedly and extracts random samples of B with a capacity of n from sampleS0, which is represented by \( {S}_i^{\hbox{'}} \) (the subscript i means i resampling iterations). The order \( {S}_i^{\hbox{'}}=\left\{{x}_1^{\hbox{'}},{x}_2^{\hbox{'}},\dots, {x}_n^{\hbox{'}}\right\} \) represents a simple random replacement sample extracted from S0, which is called the bootstrap sample. For each subsample\( {S}_i^{\hbox{'}} \), the T value is calculated, presented by\( \left\{{t}_1^{\hbox{'}},{t}_2^{\hbox{'}},\dots, {t}_B^{\hbox{'}}\right\} \). The distribution of these T values is called the empirical distribution of the bootstrap. If B is sufficiently large, through repeated sampling from S0, an approximation value for statistic T is provided. In this paper, Matalab is used to do the block bootstrap simulation process for 5000 times.

Scenario design

Scenario analysis is a method of describing and simulating various scenarios that will occur on the premise that certain phenomena and trends can continue to develop in the future. It is an analytical method with more emphasis on technology development and innovation (Amer et al. 2013). As one of the forecasting methods, the main purpose of the scenario analysis is to deal with the uncertain future, and the key step of the scenario analysis is to identify the uncertainty effectively (Dong et al. 2018). Lin and Lin (2017) also pointed out that scenario analysis is an adaptive and mature method for illustrating the development potential of highly complex systems in the future.

There is a lot of discussion and literature on scenario analysis, such as Lin and Ouyang (2014), Lin and Xie (2015), and Lin and Tan (2017), but past experience has shown that about three options are the best for further discussion, as more solutions will lead to unclear analysis. Therefore, in this paper, three scenario analysis will be considered: business-as-usual (BAU) scenario, moderate scenario, and advanced scenario. The BAU scenario is based on the average annual growth rate during the period of 1985–2015 to set the future annual growth rate of the variables. This scenario is set assuming that future development trends will maintain the current high growth model. The scenario setting and forecasting time point is based on the government’s development plan and related policies. The advanced scenario is that the government has implemented a strict set of policies according to the development goals set by the government, so that each of the influencing factors is developed in such a way that can save the most energy in the economic reality. The moderate scenario is between the BAU scenario and the advanced scenario, which is based on realistic economic development programs, that is 13th Five-year Plan. Based on this, in this paper, we selected 2020 and 2025 as the specific year to predict the manufacturing energy conservation. 2020 is the end of the 13th Five-Year Plan. According to relevant government policies, the goal of the 13th Five-Year Plan is to achieve industrialization and industrial energy consumption and emissions of pollutants decreased significantly. In order to move from being a big manufacturer to a strong manufacturer, the government implement the first 10-year plan (2016–2025). The development goal of 2025 is to build on the basis of technological innovation and applications; the industrial added value, energy consumption, and pollutant emissions of key industries will reach world advanced levels; and the status of manufacturing in the global value chain will be significantly improved.

Data presentation

In this paper, the research object is the Jiangsu manufacturing industry. Considering the availability of data, and the actual economic cycle of China (Five-Year Plan), the research period is from 1985 to 2015. First of all, we are attempting to study whether there is a long-term equilibrium between energy consumption, GDP, industry structure, energy price, and R&D. Then, we will further explore the future energy-saving potential of the Jiangsu provincial manufacturing industry.

Energy consumption of the Jiangsu manufacturing industry

The energy consumption of the Jiangsu provincial manufacturing is the explanatory variable, which includes the raw coal, coke, crude oil, gasoline, petroleum, diesel, fuel oil and liquefied petroleum gas. Figure 2 presents the energy consumption trend of the manufacturing industry in Jiangsu during the study period. Annual data of the manufacturing industry over 1985–2015 are collected from Jiangsu Province Statistical Yearbook.

Gross domestic product

Generally, economic growth is usually regarded as an important explanatory variable of the energy consumption (Wang and Wang 2015). Kasman and Duman (2015) noted that there is panel causality running from the gross domestic product (GDP) to energy consumption. As shown in Fig. 3, the energy consumption and the GDP are both on the rise during the research period. Thus, we assume that there is a positive relationship between the energy consumption and GDP. The GDP data can be obtained from the Jiangsu Province Statistical Yearbook and the data is calculated at 1990 constant price.

Energy price

In China, the energy price is more sensitive as is partially or completely controlled by the government in China. In recent years, energy price reform has been a top priority for government. Generally, if energy demand is high, energy prices will be high and vice versa. Lin and Chen (2018) pointed out that energy price is a main determinant of energy demand. Gamtessa and Olani (2018) found that the relationship between the energy-output ratio and the real energy price is negative, which means the energy price could mitigate the energy consumption. Therefore, energy price should be considered in this model. As we mentioned before, the energy consumption includes all energy forms: raw coal, coke, crude oil, gasoline, petroleum, diesel, fuel oil, and liquefied petroleum gas. Lin and Chen (2018) stated that enterprises purchase raw materials and energy resource in the market; the fuel and power purchasing price index could reflect the extent and direction or raw materials, fuel and electric power in the resource market. Hence, considering the availability of data and could better reflect the annual changes, we select the fuel and power purchasing price index instead of real energy price. The data is obtained from the Jiangsu Province Statistical Yearbook. We convert them into base-year price of 1990 by using the GDP deflator.

Industry structure

The manufacturing industry is the main driving force of the national economic development. China should reduce the proportion of industrial added value in GDP, and encourage technological progress to continuously reduce energy intensity (Li and Lin 2014). Figure 4 shows details from the enterprise level to demonstrate that the manufacturing enterprises occupied almost all of the industry enterprises. In terms of the total output in Jiangsu, from Fig. 5, we can obtain that the manufacturing industry output occupies half of the second industry output. In other words, manufacturing is the main component of the secondary industry in Jiangsu province. Hence, we assume that the manufacturing demand energy in Jiangsu has a positive relationship with the second industry. The industry structure refers to the proportion of secondary industry, and the data could be obtained from the Jiangsu Province Statistical Yearbook.

Research and development

Li and Lin (2014) noted that technical progress has either a negative impact on the energy efficiency or it could help to reduce energy intensity. We will explore what exactly is the impact on the energy demand in this article. Thus, we take the research and development (R&D) expenditure as the variable to analyze the effect of the technical progress on the energy consumption. The R&D expenditure data can be collected from the Jiangsu Province Statistical Yearbook and the data converted into 1990 constant price. Table 1 summarizes all the variables used in this study and lists data sources. Besides, in order to avoid heteroscedasticity, all the variables in this study use the logarithmic form.

Model results

Results of unit root test

In this study, we use the ADF test and the PP test for the stability test. The unit root test results can be seen in Table 2.

From Table 2, the results show that lnE, lnIS, and lnP reject the null hypothesis, and lnGDP and lnRD fail to reject the null hypothesis. After the first difference, all the variables reject the null hypothesis and become stationary. Next, the co-integration test will be conducted.

Johansen co-integration

The VAR model is first built in the co-integration test, according to the sequential-modified LR test statistic (LR), Final prediction error (FPE), Akaike information criterion (AIC), Schwarz information criterion (SC), and Hannan-Quinn information criterion (HQ) to select the optimal lag order. As presented in Table 3, the optimal lag order is 2 according to the criteria.

Then, the co-integration test determines whether there is a co-integration relationship between the variables. The results of the unrestricted co-integration rank test are shown in Table 4 and Table 5.

Table 4 and Table 5 present the trace test and max-eigenvalue test, and the results both indicate that there are 2 integration equations at the significant level of 0.05. Thus, the manufacturing energy consumption, industry structure, GDP, R&D expenditure, and the energy price have a long-run equilibrium relationship.

Hence, the co-integration equation can be obtained as follows:

Among them, the standard error in parentheses, and the corresponding co-integration vectors are:

After an empirical analysis, the co-integration model has significant coefficients, which are all tested by t-statistic.

By analyzing the results of the model, several conclusions can be drawn. First, a long-run equilibrium relationship exists between all the variables from 1985 to 2015. Second, the elasticity coefficients indicate that a 1% growth of the GDP and the industry structure will lead to a 0.3% and 1.1% increase in the energy consumption of manufacturing, respectively. Put another way, the GDP and industry structure both have positive nexuses with the energy demand of the Jiangsu province’s manufacturing industry. The results are in line with the expectations of the relevant economic theories.

Third, the energy price and R&D both have negative relationships with the energy demand. The elasticity coefficient indicates that an increase in the R&D investment of 1% will reduce the energy consumption of the manufacturing industry by 0.6%. The energy price elasticity is − 2.8, which shows that energy price fluctuations in Jiangsu province are the most sensitive to changes in energy consumption. The energy consumption will decrease by − 2.8% with a 1% increase in the energy price. China’s energy price is affected by government control policy, so it incentivizes the manufacturing industry to save energy. To make ensure the co-integration model stability, next we will conduct a stability test with the results as below.

Model stability

Because the co-integration equation obtained by the VAR model does not guarantee that the estimated coefficients are stable, in order to ensure that the co-integration relationship of our choice is in good form, a stability test should be conducted.

The stability test results are presented in Fig. 6 and Table 6. The results show that no root lies outside the unit circle and all eigenvalues of the adjoint matrix are smaller than 1. Hence, the VAR satisfies the stability condition. Figures 7 and 8 illustrate that the plots of the CUSUM and CUSUMSQ statistics are confined within the 5% critical bounds of parameter stability. Thus, it can be concluded that the co-integration model is stable and the results are reliable.

Analysis on energy-saving potential of manufacturing industry

Risk analysis of reasonable prediction results

The aim of this study is to explore the energy conservation of the Jiangsu provincial manufacturing industry. Therefore, three energy conservation scenarios are constructed: BAU scenario, moderate scenario, and advanced scenario. Before predicting the energy conservation, we first must evaluate the average annual growth trend of all variables from previous years. Figure 9 presents the tendency of all independent variables: the Jiangsu provincial manufacturing of the energy consumption, GDP, industry structure, R&D, as well as the energy price index. Through an analysis of the historical data, we obtain the average annual growth rate of Jiangsu’s GDP, industry structure, energy price index, and R&D, which is 9.6%, − 2.8%, 3.6%, and 2.1%, respectively.

We assume that Jiangsu’s economy will keep in the current annual growth trend in the future. The BAU scenario can be set as content, based on the average annual rate of change in previous years. Therefore, according to the measurement of the current level of economic development and combined with Eq. (2), under the BAU condition, we can calculate that the manufacturing energy consumption in 2020 and 2025 will be 368.38 Mtce and 397.95 Mtce, respectively.

The BAU scenario results are based on the annual growth rate of the historical data. However, along with the development of the Chinese economy, every independent variable of the annual growth rate in the future is uncertain. Therefore, multiple probabilities and their corresponding consequences should be considered in a reasonable prediction. Hence, a risk analysis is adopted to explore whether the results are reasonable and stable. The block bootstrap will be employed to perform the risk analysis.

Our research period is during 1985 to 2015, and the block bootstrap research method is suited for a limited sample. China formulated and implemented the first Five-Year Plan (FYP) in 1953, having completed a total of 12 Five-Year Plans by the end of 2015. The FYP has been closely integrated with the development of China’s past for more than 60 years. In this study, the data covers 1985 to 2015 with five-year segments according to the FYP; in other words, the length of the data block is 5. The block bootstrap will be adopted to generate random numbers to project the energy consumption space about the manufacturing industry in 2020. Therefore, based on the random segments of the historical data and the resampling of it, multiple groups of random numbers can be obtained.

Figure 10 represents all the possible linear distributions of the energy demand of the manufacturing industry from 2016 to 2020. Through the block bootstrap simulated analysis, based on the historical data, the energy consumption presents an increasing trend, with the growth interval between 100 and 500 Mtce. By 2020, the main distribution intervals will be concentrated between 300 and 400 Mtce. As mentioned before, under the BAU scenario, the energy demand in 2020 will be 368.38 Mtce. The rationality of the prediction is verified when compared with the results obtained from the block bootstrap.

The other two scenarios, the moderate scenario and advantaged scenario, will consider the economic growth model and the energy-saving policy. Next, we will present the results and the analysis of the energy conservation potential of manufacturing in Jiangsu province for different saving scenarios.

Energy conservation potential prediction

The characteristics of China’s economic development are changing from a high-speed growth to a medium-high growth, as well as, it is in the key point of changing the method of development and optimizing the economic structure. Our forecast period is from 2016 to 2025. As mentioned before, the BAU scenario is based on the average growth rate of all the variables during 1985 to 2015. A moderate scenario and advanced scenario are set to take a relatively stricter economic development policy.

Considering that the five-year plan is the framework guidance by the Chinese government for macroeconomic activities, it is essential to set goals and directions for the national economic development vision. Hence, the moderate scenario average annual growth rate is based on the 13th Five-Year Plan. Compared with the moderate scenario, the advanced scenario will be given a more stringent policy to achieve the sustainable economic development.

Therefore, regarding the GDP, on the basis of the 13th Five-Year Plan, the economy will continue to grow at a medium-to-high speed and the GDP is expected to increase at an average annual growth rate of 6.5%. Meanwhile, Jiangsu province actively adjusts its structure and promotes industrial transformation, and the growth rate of industrial production has declined somewhat. Thus, according to the target, we set the moderate scenario goal at 6.5%. As China’s economy is still in the stage of rapid development, the demand for energy is still high, so the government should take a strict policy to constraint on energy demand and ensure a sustainable economic development; thus, the advanced scenario is set at 5.5%.

In light of economic theory and Eq. (2), the energy price is negative with the energy demand. Additionally, a number of studies conducted by scholars have been noted that one of the most effective ways of achieving energy conservation is raising the energy price. For instance, Lin and Ouyang (2014), as well as Andor and Fels (2018), support this view. Energy prices are affected by government policies, therefore, the government will continue to play an important role in setting the energy price in the future. In addition, with the recent energy shortage in Jiangsu province, and for the purpose of maintaining sustainable development, the energy price should continue to increase to improve the energy efficiency. The historical data shows that the energy prices show a trend of fluctuation, with an average annual growth rate of 3.6%. Hence, under the moderate scenario, we set the average annual growth of the energy price at 6% and the advanced scenario at 8%.

As proposed in 13th Five-Year-Plan, China’s industrial structure is adjusted, which reduce the proportion of secondary production and increased the proportion of tertiary industry. According to the Jiangsu provincial Statistic Yearbook, at the end of the 12th Five-Year Plan, the proportion of the tertiary was 46.5%, and the second industry proportion was 51.8%. The historical data shows that the proportion of the second industry has presented a declining trend of − 2.8%. Thus, under the influence of sustainable development policies, in the moderate scenario and advanced scenario, the average annual growth rate of the industry structure is − 4% and − 8%, respectively.

Intelligent manufacturing adheres to the basic principles of being innovation-driven. Yuan et al. (2010) analyzed the effect of the technological progress on the energy intensity, with the results showing that there is a negative relationship between them. In other words, technological advancements can reduce the use of energy. Recently, the Jiangsu provincial government’s investment in R&D presented an increasing trend. Based on the historical data, the investment in R&D in 2015 was three times as high as that in 2006. The government has increased investment in research and development of innovative drive to save energy. Under this context, the average annual growth rate is 2.1%. Therefore, the moderate scenario and the advanced scenario are 4% and 6%, respectively. The three scenarios for all the variables are summarized in Table 7.

Under the different scenarios, the results we calculate the energy demand of manufacturing in the Jiangsu province are demonstrated in Table 8. The energy demand of manufacturing of the Jiangsu province will be 348.14 Mtce in 2020 and 331.92 Mtce in 2025 under the moderate scenario. Compared with the BAU scenario, the demand of energy in the moderate scenario and advanced scenario will reduce by 20.24 Mtce and 66.03 Mtce, respectively, which are 5.5% and 16.6% of the energy consumption under the BAU scenario in the same period. Under the advanced scenario, the energy demand is 324.31 Mtce and 310.35 Mtce in 2020 and 2025, respectively. Compared with the BAU scenario, they will reduce by 44.07 Mtce and 87.60 Mtce in 2020 and 2025, respectively, which is 12.0% and 22.0% of the energy demand in the BAU scenario, respectively.

Conclusions and policy implications

Conclusions

In this study, the effect of R&D on energy conservation is explored while introducing other macroeconomic variables, such as the GDP, energy price index, and the industry structure during 1985 to 2015. The co-integration research method is employed in this study and a block bootstrap adopted to verify the stability of the equation. The energy-saving potential in 2020 and 2025 are calculated by the scenario analysis.

The empirical results show that a long-term stable relationship exists between the variables, and all the explanatory variables are factors affecting the manufacturing industry energy demand. The results indicate that the GDP and industry structure both have positive relationships with the energy consumption. One percent GDP growth and industry structure adjustment would lead to a 0.3% and 1.1% increase in the energy consumption of manufacturing, respectively. Fuel price and R&D are both negative with the energy consumption, in which a 1% increased investment in R&D and rising energy price would result in a 2.8% and 0.6% decrease in the manufacturing industry’s energy consumption, respectively.

In the past three decades, China has been in a fast developing stage of economic development, industrialization, and urbanization. If the current speed of development is maintained, the energy demand of the Jiangsu province’s manufacturing industry will reach 368.38 Mtce in 2020 and 397.95 Mtce in 2025. If the government takes the relevant policies to constraint the energy consumption and improve the energy efficiency, the energy consumption will be less. Under the moderate energy-saving scenario, the energy need is 348.14 Mtce in 2020 and 331.92 Mtce in 2025, which is less than the BAU scenario by 20.24 Mtce and 66.03 Mtce in the same period, respectively. If the government undertakes strict policies for development, the energy demand will be 324.31 Mtce and 310.35 Mtce in 2020 and 2025 under the advanced scenario, respectively.

Policy implications

The relationships between the energy consumption, industrial structure, energy price, and the R&D is obtained form the Eq. (2). One percent GDP growth will lead to increase 0.3% energy consumption. This result further highlights the dependence of GDP on energy consumption. At present, the manufacturing industry in Jiangsu province is dominated by the real economy, and the model of economic growth is too extensive. The high-speed economic growth is at the cost of consuming of a large amount of resources. According to the Jiangsu Statistical Yearbook, the contribution rate of industrial production to regional production in Jiangsu has remained above 50% for a long time, and 46% to 48% in the past two years. At the same time, in 2011–2015, the added value of manufacturing industry accounted for an average of 40% of the regional GDP, which is nearly 10% higher than the national level of 31%. This shows that Jiangsu’s manufacturing industry has a pivotal impact on regional economic growth and is the core driving force for sustained economic development and healthy development of the region. Therefore, it is necessary to accelerate the transformation of Jiangsu’s economic development pattern, optimize the economic structure, and promote industrial technology upgrading. In addition, the government can effectively use taxation or subsidies policies to encourage the upgrading of the manufacturing industry, and guide enterprises to use advanced technology to develop new products, and transform the value chain from manufacturing to service-oriented, so as to achieve save energy and improve the energy efficiency.

On the grounds of China Statistical Yearbook, Jiangsu’s economy has continued to grow and has maintained a leading position in the country. According to the long-run equilibrium relationship listed in Eq. (2), 1% increase in the secondary industry, energy consumption will increase by 1.1%. It can be seen that the industrial structure has a great impact on energy consumption. According to the Jiangsu Industrial Statistical Yearbook, from 1990 to 2014, the proportion of total output value of heavy industry in Jiangsu province increased from 45.35% in 1990 to 73.42% in 2014, which inevitably led to an increase in energy consumption. Therefore, Jiangsu province needs to adjust its industrial structure, vigorously promote industrial upgrading, actively promote manufacturing service, and promote the value chain to the middle and high end. At the same time, the government must firmly grasp the window of transformation and upgrading to support the development of leading enterprises, and promote the transformation and upgrading of heavy industrial enterprises in line with the direction of transformation to achieve the control of the total energy consumption as soon as possible.

Energy price has the significant impact on energy consumption in Jiangsu province. 1% increase in energy price will reduce energy consumption by 2.8%. Jiangsu is an energy-deficient province, and external energy supply is the main channel. The government should give full play to the role of energy price regulation and improve energy efficiency, in addition to that, actively develop and utilize renewable energy, optimize energy structure, and achieve sustainable development of the economic environment.

The elasticity coefficient of R&D is the negative, which means the input of 1% R&D will reduce the consumption of energy by 0.6%. Jiangsu province has been granted an important contributor status to national economic growth, the government should increase the technological transformation and upgrading of heavy industry and reduce the demand for energy consumption. Thus, we give the policy implications as follows:

First, give full play to the decisive role of the market in resource allocation and the government’s macrocontrol functions, and realize the joint efforts of the market and the government. Fuel price is negative with energy consumption, which is the main factor that influenced the energy demand. Thus, the government should continue to play the control role on the price mechanism so that energy prices can reflect the laws of the market economy, which are the main means of energy conservation and can curb the excessive consumption of energy in the manufacturing industry. In addition, reasonably increase energy prices to achieve energy conservation and environmental protection. From the results we obtained that the GDP is the influencing factor of the energy demand, where the faster the economy develops, the greater the energy consumption will be. China’s economic development is now entering a “new era,” where the basic feature is that China’s economy has shifted from a high speed growth stage to a high quality development stage. As is known, manufacturing occupies a central position in the secondary industry, while the results indicate that the industry structure has a huge effect on the energy demand; thus, it is imperative to optimize the industrial structure and increase the proportion of tertiary industry.

Second, in order to achieve a transformation from a manufacturing industry of quantity to one of quality, energy conservation driven by technological innovation should be considered. Currently, the development characteristics of the Jiangsu manufacturing industry are extensive, low value-added, and with a high energy demand and low energy efficiency. From the results, we determined that R&D could help reduce the energy demand and indirectly improve the energy use efficiency. Therefore, increasing investment in R&D expenditure to improve the capacity of independent research, and promote the rate of transformation and industrialization of scientific and technological achievements. In addition to that, adjusting industrial structure and promote the upgrading of Jiangsu industry to the middle and high-end.

It should be noticed that there are some limitations in this study: although the stability test notes the robustness of Eq. (2), a certain standard error exists because of the characteristics of multiple variables and small samples. Thus, further studies are needed for longer time series and larger samples. Additionally, manufacturing varies in energy efficiency from industry to industry, so the potential of energy conservation should be analyzed according to the characteristics of each industry.

References

Ahmed R, Stater M (2017) Is energy efficiency underprovided? An analysis of the provision of energy efficiency in multi-attribute products. Resour Energy Econ 49:132–149

Amer M, Tugrul UD, Antonie J (2013) A review of scenario planning. Futures 46:23–40

Andor AM, Fels MK (2018) Behavioral economics and energy conservation—a systematic review of non-price interventions and their causal effects. Ecol Econ 148:178–210

Chen H, Kang J, Liao H, Tang B, Wei Y (2017) Costs and potentials of energy conservation in China’s coal-fired power industry: a bottom-up approach considering price uncertainties. Energy Policy 104:23–32

Dong K, Sun S, Hochman G, Li H (2018) Energy intensity and energy conservation potential in China: a regional comparison perspective. Energy 155:782–795

Du Q, Li Z, Li Y, Bai LB, Li XH (2019) Rebound effect of energy efficiency in China’s construction industry: a general equilibrium analysis. Environ Sci Pollut Res 26(12):12217–12226

Engle RF, Granger CWJ (1987) Co-integration and erro correction: representation, estimation, and testing. Econometrica 55(2):251–276

Gamtessa S, Olani AB (2018) Energy price, energy efficiency, and capital productivity: empirical investigations and policy implications. Energy Econ 72:650–666

Ghosh NK, Blackhurst MF (2014) Energy savings and the rebound effect with multiple energy services and efficiency correlation. Ecol Econ 105:55–66

Handgraaf MJJ, Van lidth de Jeude MA, Appelt KC (2013) Public praise vs. private pay: effects of rewards on energy conservation in the workplace. Ecol Econ 86:86–92

Hasanbeigi A, Menke C, Therdyothin A (2010) The use of conservation supply curves in energy policy and economic analysis: the case study of Thai cement industry. Energy Policy 38(1):392–405

Hasanbeigi A, Morrow W, Sathaye J, Masanet E, Xu TF (2013) A bottom-up model to estimate the energy efficiency improvement and CO2 emission reduction potentials in the Chinese iron and steel industry. Energy 50:315–325

He AWW, Kwok JTK, Wan ATK (2010) An empirical model of daily highs and lows of West Texas Intermediate crude oil prices. Energy Econ 32(6):1499–1506

Hu WQ, Jin T, Liu Y (2019) Effects of environmental regulation on the upgrading of Chinese manufacturing industry. Environ Sci Pollut Res 26(26):27087–27099

Huang JB, Yang TC, Jia J (2019) Determining the factors driving energy demand in the Sichuan–Chongqing region: an examination based on DEA-Malmquist approach and spatial characteristics. Environ Sci Pollut Res 26(31):131654–131666

Johansen S (1995) Likelihood-based inference in cointegrated vector autoregressive models. General Inf 14:517–524

Johansen S, Juselius K (1990) Maximum likelihood estimation and inference on cointegration-with applications to the demand for money. Oxf Bull Econ Stat 52:169–210

Kasman A, Duman YS (2015) CO2 emissions, economic growth, energy consumption, trade and urbanization in new EU member and candidate countries: a panel data analysis. Econ Model 44:97–103

Li K, Lin B (2014) The nonlinear impacts of industrial structure on China’s energy intensity. Energy 69:258–265

Li K, Lin B (2016) Impact of energy conservation policies on the green productivity in China’s manufacturing sector: evidence from a three-stage DEA model. Appl Energy 168:351–363

Lin B, Lin J (2017) Evaluating energy conservation in China’s heating industry. J Clean Prod 142:501–502

Lin B, Chen G (2018) Energy efficiency and conservation in China’s manufacturing industry. J Clean Prod 174:492–501

Lin B, Ouyang X (2014) Electricity demand and conservation potential in the Chinese nonmetallic mineral products industry. Energy Policy 68:243–253

Lin B, Tan R (2017) Estimating energy conservation potential in China’s energy intensive industries with rebound effect. J Clean Prod 156:899–910

Lin B, Xie X (2015) Energy conservation potential in China’s petroleum refining industry: evidence and policy implications. Energy Convers Manag 91:377–386

Lin B, Zhang L, Wu Y (2012) Evaluation of electricity saving potential in China’s chemical industry based on co-integration. Energy Policy 44:320–330

Lundgren T, Marklund P, Zhang S (2016) Industrial energy demand and energy efficiency—evidence from Sweden. Resour Energy Econ 43:130–152

MacKinnon JG, Haug AA, Michelis L (1999) Numerical distribution functions of likelihood ratio tests for cointegration. J Appl Econ 14(5):563–577

Mi Z, Wei Y, Wang B et al (2017) Socioeconomic impact assessment of China’s CO2 emissions peak prior to 2030. J Clean Prod 142:2227–2236

Paparoditis E, Politis D (2002) The tapered block bootstrap for general statistics from stationary sequences. J Econ 5:131–148

Shao Q, Schaffartzik A, Mayer A, Krausmann F (2017) The high ‘price’ of dematerialization: a dynamic panel data analysis of material use and economic recession. J Clean Prod 167:120–132

Wang A, Wang G (2015) S-curve model of relationship between energy consumption and economic development. Nat Resour Res 24(1):53–64

Worrell E, Martin N, Price L (2000) Potentials for energy efficiency improvement in the US cement industry. Energy 25(12):1189–1214

Yang M, Yang F (2016) Energy-efficiency policies and energy productivity improvements: evidence from China’s manufacturing industry. Emerg Mark Financ Trade 52(6):1395–1404

Yuan C, Liu S, Wu J (2009) Research on energy-saving effect of technological progress based on Cobb–Douglas production function. Energy Policy 37(8):2842–2846

Yuan C, Liu S, Wu J (2010) The relationship among energy prices and energy consumption in China. Energy Policy 38(1):197–207

Zaim O (2004) Measuring environmental performance of state manufacturing through changes in pollution intensities: a DEA framework. Ecol Econ 48:37–47

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Cheng, M. Energy conservation potential analysis of Chinese manufacturing industry: the case of Jiangsu province. Environ Sci Pollut Res 27, 16694–16706 (2020). https://doi.org/10.1007/s11356-020-08084-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-08084-w