Abstract

China has set ambitious targets to reduce its carbon intensity by 2020. Improved energy efficiency is an important strategy to achieve this goal. However, the rebound effect may act as a major obstacle to fully realizing the potential for energy savings. As one of three major energy consumption sectors in China, the construction industry is vital to reducing carbon emissions. This paper established a static computable general equilibrium (CGE) model to study the rebound effect of different energy sources used in the construction industry. The main energy sources used in the construction industry are coal, oil, natural gas, and electricity, and the conclusions show that the largest rebound effect was found for improvements in natural gas efficiency, with an average of 99.20%, while the lowest was for improvements in electricity efficiency, with an average of 83.47%. Moreover, the rebound effect of the primary energy sources (coal, oil, natural gas) was greater than the rebound effect of the secondary energy source (electricity). Our conclusions indicate that improving the energy efficiency in the construction industry will have a positive impact on GDP and on the mitigation of carbon emissions, and the presence of the rebound effect is significant, especially with regard to electricity sources. The implications of the results are that policymakers should primarily focus on improving the efficiency of electricity. In addition, this paper suggests that the rebound effect can be reduced by removing fossil fuel subsidies and imposing a carbon tax.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

With the process of industrialization and urbanization in China, industrial demand for energy continues to increase, and the country’s economic development is increasingly dependent on energy sources. However, excessive use of fossil energy, such as coal and crude oil, has led to high amounts of carbon emissions. As a result, China’s carbon emissions surpassed America as the world’s largest carbon emitter in 2006 (Yuan et al. 2018). In 2017, China’s primary energy consumption increased by 2.6% over the previous year, reaching 3.13 million tons of oil equivalent, accounting for 27.6% of global energy consumption (BP 2018). Faced with this problem, the 13th (2016–2020) Five-Year Plan has established goals to reduce the country’s energy intensity (energy consumed per unit of GDP) by 15% and its carbon intensity (CO2 emissions per unit of GDP) by 40–45% compared with the levels set in 2005 (Zhang and Lin 2018). Additionally, in the USA-China Joint Announcement on climate change, 2014 (Jiang et al. 2016), the Chinese government has promised that its carbon emissions would peak in approximately 2030. To achieve the goal of reducing emissions and saving energy, the government is eager to find ways to save energy, maintain its high economic growth rates, and ensure environmental sustainability (Lin and Tian 2016). In addition, Lin and Zhao (2015) found that energy conservation is crucial to slowing the growth of overall energy consumption and achieving energy efficiency through energy-saving technologies is often one of the most popular measures that the government considers.

However, China’s improvements in energy efficiency have not always reached expectations because increasing the country’s energy efficiency through an energy transition stimulates the use of new sources of energy. This so-called the rebound effect can partially or entirely neutralize the potential for energy conservation and can even exceed the energy-saving effect in the worst cases (Broberg et al. 2015), which is referred to as “backfire” (Sorrell et al. 2009). China’s economic development requires substantial energy inputs; thus, research is necessary on the rebound effect in the construction industry-one of the economy’s key sources of energy consumption and carbon emissions (Huang et al. 2017).

The construction industry consumes a substantial amount of energy while generating significant carbon emissions. Chang et al. (2010) estimated that CO2 emissions in the China’s construction industry accounted for 25% of the total national CO2 emissions. In 2015, the construction industry’s total energy consumption was 857 million tons of standard coal, reaching 20% of the national energy consumption. In the context of the country’s increasing energy shortages and the need for sustainable development, the construction industry is facing considerable energy constraints. The Chinese construction industry has a major challenge for efficient resource allocation and maximizing energy efficiency. The need to improve energy conservation and improve energy efficiency is unavoidable. However, the existence of the rebound effect may hinder the effectiveness of technological progress, and it therefore should be considered when formulating energy conservation and emission reduction policies.

The energy rebound effect research in specific industries is mainly focused on econometric models (e.g., Ouyang et al. 2010; Chen et al. 2011; Freire-González 2011; Wang and Lu 2014; Dasgupta and Roy 2015; Moshiri and Aliyev 2017; Sorrell and Stapleton 2018). However, due to the limitations of these models, they cannot simulate the impact of policies on the macroeconomic and the economy-wide rebound effect, nor can they distinguish the rebound effect of different energy types. To address this research gap, this paper uses the computable general equilibrium (CGE) model to simulate the macroeconomic, environmental impacts of different energy efficiency improvement and the economy-wide rebound effect in construction industry. Based on previous research (Lu et al. 2017; Zhou et al. 2018), this study identified four energy sources, separately as coal, oil, natural gas, and electricity, and simulated the macroeconomy and the economy-wide rebound effect of the construction industry.

The remainders of this study proceed as follows: the literature on the rebound effect is provided in “Literature review.” We describe the CGE model and the calculation of the rebound effect in “Methodology.” “Simulation results and analysis” presents the results and discussion, while “Discussion” provides a discussion, then “Conclusions and policy suggestions” presents the conclusions and policy suggestions.

Literature review

Jevons was the first observer to the phenomenon of the rebound effect in The Coal Question (Jevons 1865). He proposed that energy efficiency improvements can be achieved through technological progress, but energy consumption had not necessarily decreased due to the rebound effect. Specifically, when energy efficiency caused by technological advances is increased by 1%, energy consumption is not reduced by 1% due to the rebound of energy consumption. Khazzoom was the first to investigate this phenomenon (Khazzoom 1980). He argued that the anticipated reduction in energy consumption through improved energy efficiency may change consumers’ consumption habits and led to increased energy consumption. Brookes further concluded that energy efficiency increases may lead to economic growth, and economic growth returns to stimulate the increase in energy consumption, this so-called Khazzoom-Brookes (KB) hypothesis (Brookes 1990). Based on the KB hypothesis, the number of scholars studying the rebound effect has increased sharply (Sorrell 2007; Madlener and Alcott 2009; van den Bergh 2011; Gillingham et al. 2016).

Greening et al. (2000) proposed the classification to the rebound effect; the four types are the direct rebound effect, the secondary fuel use effect, the economy-wide effect, and the transformational effect. Subsequently, more scholars have examined the mechanism of the rebound effect (Sorrell and Dimitropoulos 2008; Gillingham et al. 2013). Currently, the most accepted classification of the rebound effect divides the mechanism into three categories. The direct rebound effect is the first category, which refers to the decline of effective energy prices caused by the advancement of energy conservation technologies, and is divided into income effect and substitution effect. The direct rebound can be calculated by quasi-experimental research or econometric analysis (Sorrell and Dimitropoulos 2008; Zhang et al. 2015; Stapleton et al. 2016). The indirect rebound effect, which can be explained as follows. The price of the overall commodity declines as the energy price decreases, and the household becomes relatively affluent and can consume more commodities, which in turn stimulates an increase in energy use during production and transportation. The indirect rebound effect can be addressed using input-output models (Kok et al. 2006; Thomas and Azevedo 2013a, b). The economy-wide rebound effect refers to that after energy efficiency increased, the investment in energy is reduced, and the cost is reduced, thereby increasing the profit of high-energy consumption industries, stimulating the development of energy-intensive industries, and increasing energy demand; at the same time, energy efficiency improvement may also drive the growth of the macroeconomic; it will in turn increase energy consumption; this rebound effect includes the direct and indirect rebound effect (Sorrell 2007). The CGE model is widely used in analyses of the economy-wide or macro-level rebound effect (Washida 2004; Allan et al. 2009; Hanley et al. 2009) because in this context, the CGE model can reflect their multi-sectoral nature of the issue and the fully specified supply side, which makes it easier to analyze the effects of economic and environmental policies (Hanley et al. 2009).

China’s energy rebound effect has examined since in approximately 2005. Glomsrød and Wei (2005) established a CGE model to study the impact of improvements in coal’s energy efficiency improvement on carbon emissions and found that the rebound effect was greater than 100%. Zha and Zhou (2010) used the CGE model to simulate the energy efficiency increased 4% in seven sectors and found the rebound effect to be 32–33%. Shao et al. (2014) estimated the China’s rebound effect over the period from 1954 to 2010; the average rebound effect between these periods was 39.73% and it decreased yearly. Zhang et al. (2015) found that the energy efficiency improvement of the transportation industry would mitigate energy consumption and the rebound effect. Li et al. (2016) used an output distance function to estimate the rebound effect in various industries, and found the average rebound effect between the periods from 1998 to 2011 was 88.42%.

Based on the analysis of the existing literature for the rebound effects in Chinese various industries, there is lack of research in China’s construction industry, with the exception of the empirical study by Du et al. (2017). This method was used for studying the direct rebound effect. However, the direct rebound effect is only one category of the rebound effect, which consists of the direct rebound, the indirect rebound, and the economy-wide rebound effects, and the economy-wide rebound effect includes the direct, indirect, and macroeconomic rebound effects (Wei and Liu 2017). As a result, given its substantial energy consumption and the status of the construction industry in China’s economy, it is necessary to calculate the economy-wide rebound effect in the construction sector and propose policy suggestions to balance economic growth and energy conservation.

Therefore, this paper establishes a static CGE model to study the economy-wide rebound effect in China’s construction industry; the contribution of the literature is in the following aspects. First, we use the CGE model to study the impacts of technological progress in China’s construction industry on macroeconomics and the environmental. Second, this paper distinguishes the rebound effect of different energy types including coal, oil, natural gas, and electricity through three simulation scenarios, and it targets energy conservation policies for China’s construction industry.

Methodology

Calculation of the rebound effect

Following previous studies (Turner 2009; Hanley et al. 2009), the CGE model can be used to present of the measurement specification for the rebound effect because it distinguishes the physical unit and the efficiency unit from the energy measured. Therefore, with an efficiency improvement of ρ, the economy-wide rebound coefficient RE can be calculated as:

\( \dot{E=\frac{\Delta E}{E}} \) denotes the percentage change of energy corresponding to the energy efficiency improvement ρ. If RE < 0, the energy savings due to technological progress are more than theoretical energy savings. If RE = 0, there is no rebound; the expected energy consumption is equal to the actual consumption. When 0 < RE < 1, the energy savings are indeed effective but do not achieve the expected results. Thus, if the energy efficiency improved by 5%, and it leads to a 3% reduction in the energy input, then the corresponding rebound is 40%. RE = 1implies that the energy savings are fully offset by the rebound mechanism. Finally, if RE > 1, which is called a “backfire,” the higher energy efficiency stimulates consumption and increases energy use.

The CGE model description

To assess the impact of energy efficiency improvements on the macroeconomy and the economy-wide rebound effect of the construction industry, a CGE model is established. The economy is divided into 9 sectors, as shown in Table 1, and four basic modules: the production module, income and expenditure module, trade module, and equilibrium module.

Production module

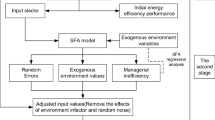

In order to reflect and deal with the substitution relationship between various inputs, this paper uses a constant elasticity of substitution (CES) function, and a six-layered nested structure represents different substitution relationships between various inputs. Figure 1 shows the production module. At the first level, the total output consists of an energy-capital-labor composite and a non-energy intermediate input. The second layer of energy-capital-labor composite consists of labor and energy-capital bundles. The third layer consists of intermediate inputs of energy composite and capital. The next layer is consists of fossil energy bundles and electricity. The fifth layer is coal and oil and natural gas. In the last layer, oil and natural gas bundles are divided into specific resources.

Income and expenditure module

There are four types of agents described in the income and expenditure module, including households, enterprises, government, and foreign countries.

Household’s revenues are form labor income as well as government, enterprises, and foreign transfer payments. After tax payment, they are free to distribute revenue for consumption or savings.

The enterprises’ income comes from the return on investment and the government’s transfer payment. After paying the income tax and transferring it to the household, the company’s income can be used for expenses.

The government’s income comes from households, enterprises, and other various taxes and customs duties; its expenditures include subsidies, transfer payments, and consumption, with the remainder saved.

Foreign countries’ income comes from China’s investment endowments and exports to china; their expenditures are used to purchase imported product and the remainder for savings.

Trade module

Domestic goods come from domestic production and import channels. In order to save cost, rational consumers will optimize the combination of domestic products and imported goods when purchasing goods. Therefore, the Armington assumption is adopted in the model, the imported products are not completely replaced with the domestic products, and the CES function is also used to construct the domestic sales. In this model, the assumption of a small country is adopted, the price of an imported commodity is given exogenously, determined by the world price of the commodity, and the importer is the recipient of the price.

Domestic goods have two flows, domestic sales or exports. In order to maximize sales revenue, producers choose the optimal sales ratio between domestic sales and exports. Under the assumption of small countries, exports of goods only account for a small part of the world market, and the export prices of goods are determined by world market prices.

Equilibrium module

In this model, including product market equilibrium, factor market equilibrium, and government budget equilibrium. Revenues from other parts of the world come from China’s imports and China’s transfer payments to these regions, including spending on Chinese exports, transfers to Chinese residents, and savings. Domestically sold goods come from domestic production and imports, and commodities are used for intermediate inputs, government and household consumption, total social fixed inventory, and investment.

Data and scenario design

The main data sources of social accounting matrix (SAM) used in this model are based on the 2012 input-output table (National Bureau of Statistics of China 2016). The other data are derived from the China Energy Statistics Yearbook 2013 and the China Financial Statistics Yearbook 2013. The substitution and Armington elasticity in this paper come from He et al. (2002), Ma et al. (2008), and Bao et al. (2013).

Energy efficiency can be set to exogenous and no cost. Previous studies by scholars have also used this exogenous energy efficiency to represent a pure energy rebound effect (Wei and Liu 2017). So, in this model, we assume the costless energy efficiency improvement is ε, and incorporates ε into the CES production function, indicating that in the case of energy efficiency improvement, the same energy input will affect the production and will bring more output. We specify four energy sources: coal, oil, natural gas, and electricity. The different scenarios are shown in Table 2.

These three scenarios are compared with the benchmark scenario with unchanged energy efficiency. Then, we calculate the macroeconomic impact and the energy rebound effect.

Simulation results and analysis

Macroeconomic impacts and environmental impacts

Under different scenarios, as deviations from the baseline, Table 3 shows the main macroeconomic results from simulations of illustrative 1%, 3%, and 5% exogenous increases in energy efficiency for China’s construction industry. Efficiency improvements within all energy types generate positive environmental impacts in Table 4.

The simulation shows that an improvement in the efficiency of each energy type has a significant influence on not only reducing energy consumption but also mitigating carbon emissions. For example, compared with scenarios 1, 2, and 3, a reduction in carbon emissions is positively related to an improvement in energy efficiency, and an increase in electricity efficiency has a strong impact on carbon emissions. In scenario 3, the carbon emissions of the four energy sources are reduced by 0.4%, 0.02%, 0.3%, and 1.3%. In addition, with improved energy efficiency, the energy intensity and carbon intensity generally decrease, and increased coal efficiency has a significant effect on reducing the energy intensity, and for carbon intensity, the efficiency of oil and natural gas plays a positive role.

Furthermore, the influences of macroeconomic factors are investigated because energy efficiency improvements not only have significant impacts on mitigating energy consumption and its associated carbon emissions but also help to stimulate the macroeconomics due to energy efficiency investments.

First, improved energy efficiency is equivalent to technological progress and therefore has a positive impact on GDP. The three scenarios have positive impacts on economic activities in China’s construction industry, but the third scenario has the most positive effect on GDP. In this scenario, increased oil efficiency will produce the fastest economic growth because the construction industry has the greatest demand for oil, as oil accounts for approximately 48% of the construction industry’s total energy consumption (2013 China Energy Statistics Yearbook). The economic stimulus from natural gas is minimal because natural gas is the least important source of energy in China’s construction industry.

Second, total exports and total imports are decreasing because energy resources are the most important commodities of the construction industry. When energy efficiency increases, the demand for energy sources decreases, and energy-intensive products become more competitive, which helps to reduce imports. Furthermore, due to economic expansion, capital and labor become more expensive and costs increase and exports therefore decrease. Nevertheless, natural gas and oil are exceptions, as improving the energy efficiency of oil and natural gas has a positive impact on exports. However, this does not mean that an increase in production costs from the use of oil and natural gas to increase their efficiency makes construction goods uncompetitive. In addition, all of the scenarios show that investments in the construction industry will reduce, and this impact becomes more apparent when energy efficiency increases.

Rebound effect in the construction industry

The simulation results from the last subsection show that the impact of improving energy efficiency on energy consumption is not obvious. To further compare the ratio of actual to expect energy savings, the rebound effect for different energy sources is discussed.

Energy rebound effect for different energy types

The energy rebound effect under different levels of efficiency improvements and energy types are shown in Table 5. This result shows that the energy demand of the construction industry shows a slight rebound effect. The difference in rebound effect depends on the level of improving energy efficiency and the results infer a non-linear relationship between the autonomous energy efficiency improvement parameter and the rebound effect. The efficiency improvement gain of different energy sources for specific energy sources does not always decrease or increase with efficiency. In addition, for different energy types, the energy rebound effect varies from 51.82 to 164.10%, and the results show that coal and natural gas generally have larger rebound effect. While the “backfire” effect indeed exists, for example, with improvements in oil efficiency, the rebound effect of using coal and natural gas exceeds 100%.

Improved energy efficiency reduces energy consumption. Through our simulation, there are three rebound mechanisms to stimulate new energy demand and promote energy consumption. First, increased energy efficiency will reduce energy prices and thereby increase energy consumption to replace other energy inputs, which is the so-called substitution effect. Second, the income effect means that cheaper energy prices will lead to more commodity products due to cost savings. Third, energy efficiency improvement will drive the growth of the macroeconomic; it will in turn simulate new energy demand.

The alternatives between energy sources make a dramatic difference in the rebound effect. Based on the analysis, the oil used in the construction industry can be replaced by coal and natural gas and also stimulate the consumption of more coal and natural gas. However, given the small amount of natural gas used in total energy consumption in the construction industry, a huge rebound effect of the natural gas supply may not have a significant impact on the total amount. Therefore, the substitutability of energy sources in the construction industry is a key factor in the rebound effect.

Energy rebound effect for the construction industry

The energy rebound effect for the construction industry is shown in Fig. 2. The results infer a non-linear relationship between the autonomous energy efficiency improvement parameter and the rebound effect. At the macro level, due to the rebound effect, in some cases improving energy efficiency can effectively reduce energy consumption in the construction sector. The rebound effect in Chinese construction industry is fluctuating between 83.20 and 99.22%, and the rebound effect between different energy types varies widely. Among them, the rebound effect caused by improvements in natural gas efficiency is the largest, with an average of 99.20%, and the rebound effect caused by improvements in electricity efficiency is the smallest, with an average of 83.47%.

Furthermore, we can conclude that the rebound effect of the secondary energy (electricity) is less than the rebound effect of the primary energy (coal, natural gas, oil). In addition, the rebound effect of the primary energy is generally larger than the secondary energy’s rebound effect because the primary energy accounts for a large share of the intermediate inputs in the final energy production; thus, the more efficient use of the primary energy increases the production of the final energy and in turn increases the primary energy demand. On the other hand, economic expansion increases the demand for the final energy, which in turn increases the demand for the primary energy. Therefore, the rebound effect for electricity is larger than the rebound effect for the other energy types.

For the same energy sources, different efficiency improvements lead to slight differences. The magnitude of the rebound effect caused by improvements in electricity efficiency is 0.54%, while the magnitudes of the energy rebound effect across the other energy types are 0.20% for oil, 0.03% for natural gas, and 0.25% for coal. At the same time, the results show that with the improvements in oil energy efficiency, the rebound effect tends to increase, which indicates that in the construction industry, improving the efficiency of oil is not necessarily an active energy conservation measure. With regard to electricity, natural gas, and coal, the rebound effect declines with improvements in energy efficiency, especially for electricity. Therefore, it is possible to consider increasing the efficiency of these types of energy, particularly the efficiency of electricity.

Discussion

In the construction industry, when energy efficiency is improved, it has a positive impact on GDP while reducing carbon emissions; however, the energy rebound effect indeed exists and cannot be ignored. Based on the simulation, the minimum rebound effect is 83.2%. Compared with the previous studies that estimate the energy rebound effect in Western countries (Moshiri and Aliyev 2017; Freire-González 2017), this result indicates that the rebound effect in China’s construction industry is more remarkable than those in the construction industries of Western countries. Considering that China is still in the development stage of urbanization and industrialization, compared with some developed countries, its energy-saving technology is still in the beginning stages; therefore, these results are reasonable. In addition, Li et al. (2016) found that the average rebound effect in 36 industrial sectors in China from 1998 to 2011 was 88.42%, which also confirms the credibility of our simulation results.

Furthermore, we found that the smallest rebound effect average is 83.5%, and the rebound effect from improved natural gas efficiency is the largest, with an average of 99.2%. These results indicate that the primary energy (coal, oil, natural gas) rebound effect is larger than the secondary energy (electricity) rebound effect, which is close to the results obtained by Lu et al. (2017), who explored the average rebound effect in 135 sectors in the context of 5% improvements in energy efficiency. The conclusions showed that in scenarios in which inter-fuel substitutability between energy sources was allowed or not allowed, natural gas efficiency improvement had the largest rebound effect in the short term, at 51.2%. This result is due to the natural gas supply and other energy inputs have larger substitution, which is the main reason for its larger rebound effect.

Moreover, this result is larger than that found by Du et al. (2017) for China’s construction industry, which was 59.5% during the period from 1991 to 2014. The authors found that the energy rebound effect varied tremendously over the study period, ranging from 10 to 96%. The reason for the difference in the results of this study is that conducting simulations using the CGE method reflects economy-wide rebound effect that take into account the impacts of various sectors on the overall macroeconomy. The empirical analysis used in the former study is only for direct rebound effect in the construction industry. Wei and Liu (2017) argues that economy-wide rebound effect refers to the sum of direct, indirect, and macroeconomic rebound effects.

In addition, our results are close to those of Li et al. (2017), who found that the rebound effect to China’s energy input has a partial rebound effect, and the rebound coefficient is approximately 83.3–95.8%. However, considering that the construction industry is one of the top three energy-consuming sectors in China, its huge size should indicate good energy-savings potential, but our results show that the construction industry has a large rebound effect. To explain this reason, we propose several analyses as follows:

(1) We believe this is related to the position of the construction industry in the industry. Although the energy consumed by the construction industry’s production activities produces little carbon dioxide emissions, according to Du et al. (2018), the indirect carbon emissions of the construction industry increased from 375,859/104 in 2005 to 1,266,768/104 t in 2014; the construction industry consumes huge energy resources in other industries has a strong industrial driving effect. Therefore, the overall industry’s energy efficiency is improved; the energy consumption of various industries will increase to a certain extent. Due to the construction sector is a key industry in the network, the construction industry is more sensitive to changes in energy consumption of other industries, and thus consume more energy.

(2) We believe that this is inseparable from the national-level policy on the construction industry. Since the government began constructing commercial housing in 1998, the construction industry, which is closely tied to real estate, has developed rapidly. The expansion of the construction industry has increased the demand for energy and promoted technological changes. Although technological changes in the construction industry that improve energy efficiency will play a positive role in energy conservation and low carbon development, the construction industry is huge, and the country’s investment in the industry is increasing. Since the 2008 financial crisis, the Chinese government has invested 4 trillion RMB. The market has further stimulated the development of the construction industry. In recent years, the development of the construction industry has increased further due to urban industrialization. At the same time, in economic downturns, local governments rely heavily on real estate to develop the local economy. In such an environment, China cannot simply rely on improving the country’s energy efficiency to reduce its energy consumption and carbon emissions. Instead, the government must combine energy efficiency policies with other policies. As van den Bergh (2011) argued, China’s rebound effect cannot be ignored; it requires carefully designed energy efficiency policies and the resulting macroeconomic impacts.

Conclusions and policy suggestions

The impact of energy rebound effect needs to be considered when developing energy efficiency policies. This paper estimates the economy-wide rebound effect of China’s construction sector and contributes to the literature in two respects. First, we use the CGE model to simulate the macroeconomic impact and rebound effect of China’s construction industry. Second, we distinguished among different energy sources (i.e., coal, oil, natural gas, and electricity) in the model.

Through this simulation, it is shown that the energy efficiency improvement of the four energy sources will promote the improvement of GDP, and the effect of improving oil efficiency is most obvious. Increasing the efficiency of gas and oil will provide positive shocks to exports, while imports will decrease in all scenarios, but mostly for improvements in the efficiency of electricity. All the scenarios lead to reduced investment, with the strongest effect for oil, followed by electricity, coal, and natural gas. Improved energy efficiency will have positive effects on energy use and carbon emissions. Improvements in electricity efficiency have the greatest effect on reducing energy consumption, followed by oil, coal, and natural gas. The same results apply to carbon emissions. With regard to energy intensity, coal has the greatest weakening effect, followed by electricity, oil, and natural gas. However, improvements in the efficiency of oil in particular as well as natural gas play a positive role in reducing carbon intensity.

With the rebound effect, there exists a “backfire” effect; however, with improvements in coal efficiency, the gas rebound effect is the highest, followed by oil, electricity, and coal. With improvements in natural gas efficiency, the rebound effect of coal is greater than 100%, which is so-called tempering effect, followed by electricity, oil, and natural gas. With increases in oil efficiency, the rebound effect of coal and natural gas is greater than 100%. With increases in electricity efficiency, the rebound effect of natural gas is the highest, followed by coal, oil, and electricity. Rebound effect in China’s construction industry is between 83.20 and 99.22%. The same energy but energy efficiency increase in different proportions, the rebound effect is almost close, but the difference in rebound effect due to different energy efficiencies is especially large. Among them, the rebound effect caused by improvements in natural gas efficiency is the largest, with an average of 99.20%, while the rebound effect caused by improvements in electricity efficiency is the smallest, with an average of 83.47%.

Therefore, when formulating and implementing energy conservation and emission reduction policies, the government should consider the rebound effect. Moreover, face with macroeconomic and policy changes, China’s construction industry should seriously address the contradiction between energy conservation and economic growth. Based on the above results, we can make the following recommendations to the construction industry.

First, increasing the efficiency of different energy sources will have different economic impacts and rebound effect. In our research, improving power efficiency seems to be a better policy choice because it has the least rebound effect and the best energy saving effect, and it will also promote GDP. This implies that the type of energy is a key factor in the effectiveness of energy efficiency policies. Therefore, to reduce energy consumption by improving the level of energy efficiency, the secondary energy should be the first choice.

Second, reducing the rebound effect can be achieved by removing fossil fuel subsidies and applying carbon taxes. Increased energy efficiency leads to lower energy service prices, which are the origin of the energy rebound effect. Policies such as removing fossil fuel subsidies and implementing carbon taxes can be used to increase energy costs, and thus offset the energy rebound effect.

References

Allan G, Gilmartin M, McGregor PG, Swales JK, Turner K (2009) Modelling the economy-wide rebound effect. In: Herring H, Sorrell S (eds) Energy efficiency and sustainable consumption. Energy, climate and the environment series. Palgrave Macmillan, London

Bao Q, Tang L, Zhang ZX, Wang SY (2013) Impacts of border carbon adjustments on China’s sectoral emissions: simulations with a dynamic computable general equilibrium model. China Econ Rev 24(1):77–94

British Petroleum (BP) (2018) Statistical review of world energy for 2007-2017. https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2018-full-report.pdf Accessed 1 Aug 2018

Broberg T, Berg C, Samakovlis E (2015) The economy-wide rebound effect from improved energy efficiency in Swedish industries–a general equilibrium analysis. Energy Policy 83:26–37

Brookes L (1990) The greenhouse effect: the fallacies in the energy efficiency solution. Energy Policy 18(2):199–201

Chang Y, Ries RJ, Wang YW (2010) The embodied energy and environmental emissions of construction projects in China: an economic input–output LCA model. Energy Policy 38(11):6597–6603

Chen K, Shi HL, Yan B (2011) Rebound effect of energy consumption due to technological progress-empirical test for Chinese steel sector. J Ind Technol Econ 4:24–30 (in Chinese)

Dasgupta S, Roy J (2015) Understanding technological progress and input price as drivers of energy demand in manufacturing industries in India. Energy Policy 83:1–13

Du Q, Li Y, Bai LB (2017) The energy rebound effect for the construction industry: empirical evidence from China. Sustainability 9(5):803

Du Q, Xu YD, Wu M, Sun Q, Bai LB, Yu M (2018) A network analysis of indirect carbon emission flows among different industries in China. Environ Sci Pollut Res 25(24):24469–24487

Freire-González J (2011) Methods to empirically estimate direct and indirect rebound effect of energy-saving technological changes in households. Ecol Model 223:32–40

Freire-González J (2017) Evidence of direct and indirect rebound effect in households in EU-27 countries. Energy Policy 102:270–276

Gillingham K, Kotchen MJ, Rapson DS, Wagner G (2013) The rebound effect is overplayed. Nature 493(7433):475–476

Gillingham K, Rapson D, Wagner G (2016) The rebound effect and energy efficiency policy. Rev Environ Econ Policy 10(1):68–88

Glomsrød S, Wei TY (2005) Coal cleaning: a viable strategy for reduced carbon emissions and improved environment in China? Energy Policy 33(4):525–542

Greening LA, Greene DL, Difiglio C (2000) Energy efficiency and consumption-the rebound effect-a survey. Energy Policy 28(6-7):389–401

Hanley N, McGregor PG, Swales JK, Turner K (2009) Do increases in energy efficiency improve environmental quality and sustainability? Ecol Econ 68:692–709

He HJ, Shen KT, Xu SL (2002) CGE model for carbon tax and carbon dioxide emission reduction. J Quant Tech Econ 10:39–47 (in Chinses)

Huang LZ, Krigsvoll G, Johansen F, Liu YP, Zhang XL (2017) Carbon emission of global construction sector. Renew Sust Energ Rev 81:1906–1916

Jevons WS (1865) The coal question: an inquiry concerning the progress of the nation, and the probable exhaustion of our coal-mines. Macmillan and Co, London

Jiang JJ, Ye B, Xie DJ, Li J, Miao LX, Yang P (2016) Sector decomposition of China’s national economic carbon emissions and its policy implication for national ETS development. Renew Sust Energ Rev 75:855–867

Khazzoom JD (1980) Economic implications of mandated efficiency in standards for household appliances. Energy J 1(4):21–40

Kok R, Benders RMJ, Moll HC (2006) Measuring the environmental load of household consumption using some methods based on input–output energy analysis: a comparison of methods and a discussion of results. Energy Policy 34(17):2744–2761

Li K, Zhang N, Liu YC (2016) The energy rebound effects across China’s industrial sectors: an output distance function approach. Appl Energy 184:1165–1175

Li H, Bao Q, Ren XS, Xie YT, Ren JZ, Yang YK (2017) Reducing rebound effect through fossil subsidies reform: a comprehensive evaluation in China. J Clean Prod 141:305–314

Lin BQ, Tian P (2016) The energy rebound effect in China’s light industry: a translog cost function approach. J Clean Prod 112:2793–2801

Lin BQ, Zhao HL (2015) Energy efficiency and conservation in China’s chemical fiber industry. J Clean Prod 103:345–352

Lu YY, Liu Y, Zhou MF (2017) Rebound effect of improved energy efficiency for different energy types: a general equilibrium analysis for China. Energy Econ 62:248–256

Ma HY, Oxley L, Gibson J, Kim B (2008) China’s energy economy: technical change, factor demand and interfactor/interfuel substitution. Energy Econ 30(5):2167–2183

Madlener R, Alcott B (2009) Energy rebound and economic growth: a review of the main issues and research needs. Energy 34(3):370–376

Moshiri S, Aliyev K (2017) Rebound effect of efficiency improvement in passenger cars on gasoline consumption in Canada. Ecol Econ 131:330–341

National Bureau of Statistics of China (2016) 2012 Input–output table of China. China Statistics Press, Beijing

Ouyang J, Long E, Hokao K (2010) Rebound effect in Chinese household energy efficiency and solution for mitigating it. Energy 35(12):5269–5276

Shao S, Huang T, Yang LL (2014) Using latent variable approach to estimate China’s economy-wide energy rebound effect over 1954–2010. Energy Policy 72:235–248

Sorrell S (2007) The rebound effect: an assessment of the evidence for economy-wide energy savings from improved energy efficiency, UK Energy Research Centre. http://www.ukerc.ac.uk/Publications/the-rebound-effect-an-assessment-of-the-evidence-for-economy-wide-energy-savings-from-improved-energy-efficiency.html. Accessed 5 Aug 2018

Sorrell S, Dimitropoulos J (2008) The rebound effect: microeconomic definitions, limitations and extensions. Ecol Econ 65(3):636–649

Sorrell S, Stapleton L (2018) Rebound effects in UK road freight transport. Transport Res Part D-Transport Environ 63:156–174

Sorrell S, Dimitropoulos J, Sommerville M (2009) Empirical estimates of the direct rebound effect: a review. Energy Policy 37(4):1356–1371

Stapleton L, Sorrell S, Schwanen T (2016) Estimating direct rebound effects for personal automotive travel in Great Britain. Energy Econ 54:313–325

Thomas BA, Azevedo IL (2013a) Estimating direct and indirect rebound effects for U.S. households with input–output analysis part 1: theoretical framework. Ecol Econ 86(1):199–210

Thomas BA, Azevedo IL (2013b) Estimating direct and indirect rebound effects for U.S. households with input–output analysis part 2: simulation. Ecol Econ 86(1):188–198

Turner K (2009) Negative rebound and disinvestment effects in response to an improvement in energy efficiency in the UK economy. Energy Econ 31(5):648–666

van den Bergh JCJM (2011) Energy conservation more effective with rebound policy. Environ Resour Econ 48(1):43–58

Wang ZH, Lu ML (2014) An empirical study of direct rebound effect for road freight transport in China. Appl Energy 133(6):274–281

Washida T (2004) Economy-wide model of rebound effect for environmental efficiency. International workshop on sustainable consumption, University of Leeds

Wei TY, Liu Y (2017) Estimation of global rebound effect caused by energy efficiency improvement. Energy Econ 66:27–34

Yuan R, Behrens P, Rodrigues JFD (2018) The evolution of inter-sectoral linkages in China's energy-related CO2 emissions from 1997 to 2012. Energy Econ 69:404–417

Zha DL, Zhou DQ (2010) The research on China’s energy efficiency rebound effect based on CGE model. J Quant Tech Econ 12(5):39–53 (in Chinese)

Zhang S, Lin B (2018) Investigating the rebound effect in road transport system: empirical evidence from China. Energy Policy 112:129–140

Zhang YJ, Peng HR, Liu Z, Tan WP (2015) Direct energy rebound effect for road passenger transport in China: a dynamic panel quantile regression approach. Energy Policy 87:303–313

Zhou MF, Liu Y, Feng SH, Liu Y, YY L (2018) Decomposition of rebound effect: an energy-specific, general equilibrium analysis in the context of China. Appl Energy 221(1):280–298

Funding

The research work was financially supported by the National Social Science Foundation of China [Grant No. 16CJY028]. The Fundamental Research Funds for the Central Universities [Grant No. 300102238303].

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Muhammad Shahbaz

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Du, Q., Li, Z., Li, Y. et al. Rebound effect of energy efficiency in China’s construction industry: a general equilibrium analysis. Environ Sci Pollut Res 26, 12217–12226 (2019). https://doi.org/10.1007/s11356-019-04612-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-019-04612-5