Abstract

This study aims to investigate the validity of pollution haven hypothesis for the period from 1982 to 2013 in ten newly industrialized countries. For this purpose, we examine the relationship between real income, foreign direct investment, energy consumption, and ecological footprint using second-generation panel data methodology to take into account the cross-sectional dependence among newly industrialized countries. In doing so, the possible nonlinear relationship between foreign direct investment and environmental degradation is also searched. The results show that increased energy consumption and economic growth lead to increase in ecological footprint. Moreover, the U-shaped relationship between foreign direct investment and ecological footprint is confirmed in newly industrialized countries.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

In recent decades, although developing countries have experienced financing constraints in infrastructure investments triggering economic growth, they have overcome this problem through foreign capital investments and achieved high growth performances. Therefore, foreign direct investment (FDI, hereafter) inflows are considered a blessing for developing countries that have a resource shortage in financing high-cost investment projects. Furthermore, the fact that it is less prone to crises due to a long-term investment perspective and that it offers international technology access and know-how management makes foreign direct investment inflows more attractive for developing countries (Nunnenkamp 2001).

Even if developing countries implement many policies to host foreign direct investments, the driving forces and economic consequences of foreign capital inflows are still a matter of debate. For instance, excessive increases in foreign capital investment inflows of developing countries have been generally explained with the cheap labor and natural resource abundance facility for multinational corporations. However, one of the most recent arguments called as pollution haven hypothesis (PHH) associates the FDI attractiveness of developing countries with looser environmental regulations of these countries compared to developed countries. According to this hypothesis, as a result of loose environmental regulations, the developing countries have gained the competitive advantage and dirty industries of developed countries have migrated to developing countries in order to reduce the production costs. On the other hand, the opposite hypothesis which is called as pollution halo hypothesis argues that the production structure of these multinational corporations is generally based on clean technology. Therefore, increasing mentioned investments spread out own modern technology to developing countries and reduce the pollution level in the developing countries. However, both hypotheses assume that there is increasing or decreasing linear relationship between FDI and environmental degradation. In fact, a possible nonlinear association between the mentioned variables is generally ignored.

Based on the above reasons, the main motivation of this study is to investigate the possible nonlinear relationship between foreign direct investment and environmental degradation to detect the validity of pollution haven hypothesis for the period from 1982 to 2013 in 10 newly industrialized countries. There are some reasons for choosing this country group. In the last three decades, the economic performances of newly industrialized countries (Brazil, China, India, Indonesia, Mexico, Malaysia, Philippines, South Africa, Thailand, and Turkey) have rapidly increased compared with the rest of the world. Namely, the share of the national output of these countries in the global output has risen from 10.7 to 23.1% over the observed period. In addition, the strong economic performance of these countries is mostly associated with foreign investment inflows of the countries because the FDI inflows of the selected countries have risen approximately 20 times in the last 30 years (WDI, 2017).

The contribution of this study is threefold: (i) this is the first study to examine the validity of the pollution haven hypothesis through an ecological footprint indicator instead of carbon emission as an indicator of environmental degradation in newly industrialized countries. The reason why we prefer the ecological footprint is that this indicator represents environmental degradation more accurately than carbon emissions (Ozturk et al. 2016; Destek et al. 2018; Ozcan et al. 2018; Ahmed et al. 2019). (ii) Unlike the linear assumption, this study examines the validity of possible nonlinear relationship between foreign direct investment and ecological footprint. Because, the empirical findings from the nonlinear empirical model allows for more detailed policy implications. (iii) Since the ignorance of the possible cross-sectional dependence may lead to invalid findings, this study employs the second-generation panel data methodologies that take into account the cross-sectional dependence among newly industrialized countries.

Literature review

The pollution haven hypothesis argues that developing countries may attract the multinational corporations from developed countries to lower production costs because of their cheap labor, abundant natural resources, and relax environmental regulations. In addition, the governments of developing countries stimulate these firms to reduce investment-saving deficit, to provide the required external capital, and to reduce the foreign trade deficit. However, it is also assumed that increased foreign direct investment inflows may cause environmental degradation by loose environmental regulations in the host country. This argument is confirmed for some developing or least-developed countries by many empirical studies. For instance, Omri et al. (2014) utilized GMM approach to test the relationship between CO2 emissions, FDI, capital stock, GDP, trade openness, urbanization, financial development, and real exchange rate of the period spanning from 1990 to 2011 in 54 countries. The results confirmed the existence of PHH in these countries. Shahbaz et al. (2015) probed the linkage between CO2 emission, foreign direct investment, GDP, and energy consumption in 99 countries from 1975 to 2012. The results of FMOLS approach confirmed the PHH for 99 countries. In addition, they found an inverted U-shaped relationship between foreign direct investment and CO2 emissions.

It is seen that many studies examining the PHH have focused on eastern Asian countries; Merican et al. (2007) utilized ARDL approach to probe the impacts of FDI on CO2 emissions in five ASEAN (Malaysia, Thailand, Indonesia, Singapore, and the Philippines) countries spanning from the period 1970 to 2001. They found that the PHH is valid in Malaysia, Thailand, and Philippines. Lau et al. (2014) attempted to investigate the linkage between CO2 emission, GDP, the square of GDP, FDI, and trade openness over the period of 1980–2008 in Malaysia using ARDL bounds test. As results of this study, FDI increased environmental pollution in Malaysia. Bakhsh et al. (2017) applied the three-stage least square method to analyze the relationship between environmental degradation, foreign direct investment, and GDP for the period of 1980–2014 in Pakistan. The results showed that FDI increases environmental degradation in Pakistan. Behera and Dash (2017) probed the link between CO2 emission, primary energy consumption, fossil fuel energy consumption, urbanization, and FDI during the period 1980–2012 in 17 countries from South and Southeast Asian (SSEA) region and for three income-based panels (namely, high-, middle-, and low-income panels) using panel data methods. They found that FDI has significant impacts on CO2 emissions in total, and high- and middle-income SSEA region. Baek (2016) used panel data method to investigate the validity of PHH for the period of 1981–2010 in five ASEAN countries utilizing FDI, GDP, energy consumption, and CO2 emission data. According to PMG estimator results, the PHH does exist in these ASEAN countries.

Some studies focused on the developing countries that have cheap labor facility; Kivyiro and Arminen (2014) used ARDL approach to analyze the linkage between carbon emissions, GDP, GDP square, energy consumption, and FDI over the period of 1971–2007 in six sub-Saharan African countries: the Republic of the Congo, the DRC (Democratic Republic of the Congo), Kenya, South Africa, Zambia, and Zimbabwe. The results of ARDL approach indicated that FDI increases CO2 emissions in Kenya and Zimbabwe. Solarin et al. (2017) examined the relationship between CO2 emission, GDP, GDP square, energy consumption, renewable energy consumption, fossil fuel consumption, foreign direct investment, institutional quality, urbanization, and trade openness to test the PHH for Ghana from 1980 to 2012. According to ARDL method, the PHH exists for Ghana. He (2006) aimed to explore the relationship between SO2 emissions, FDI, and industrial output over the period of 1994–2001 in China’s 29 provinces using panel data method. The results of the analysis provided significant evidence for the PHH in China’s 29 provinces. Cole et al. (2011) used data for 112 Chinese cities between 2001 and 2004 to examine the relationship between FDI, economic growth, four industrial water pollution emissions, and four industrial air pollution emissions as environmental pollution indicators. The obtained results validate the PHH because FDI increases environmental pollution in China. Wang and Chen (2014) analyzed the impacts of FDI and institutional development on industrial SO2 emissions for the period of 2002–2009 in 287 Chinese cities. The study showed that FDI generally induces environmental pollution. Ren et al. (2014) explored the effects of trade openness, exports, imports, GDP, and FDI on CO2 emissions over the period of 2000–2010 in China’s industrial sectors using the two-step GMM estimation. The results suggested that FDI increases China’s CO2 emission. Sun et al. (2017) utilized the ARDL approach to investigate the PHH for the period 1980–2012 in China using CO2 emission, GDP, GDP square, energy consumption, foreign direct investment, economic freedom, urbanization, financial development, and trade openness. The results of the ARDL method revealed that the PHH is valid in China.

In addition, some researchers focused on high-income emerging countries; Pao and Tsai (2011) investigated the relationship between CO2 emission, GDP, GDP square, energy consumption, and FDI in BRIC (Brazil, Russia, India, and China) countries for the period between 1980 and 2007, except for Russia (1992–2007). The result of the empirical analysis is consistent with the PHH. Zakarya et al. (2015) examined the relationship between CO2 emissions, energy consumption, GDP, and FDI over the period of 1990 to 2012 in BRICS (Brazil, Russian Federation, India, China, and South Africa) countries. According to the analysis, FDI increases CO2 emissions in BRICS countries; thus, this result is consistent with the PHH. Moreover, Al-Mulali (2012) examined the link between CO2 emissions, GDP, energy consumption, total trade, and FDI for the period of 1990–2009 in 12 Middle Eastern countries which have abundant natural resource using with panel data methods. The results of the analysis validate the PHH in these countries.

On the other hand, some studies found that the pollution halo hypothesis is valid for developing countries. The pollution halo hypothesis argues that environmental degradation will be reduced along with eco-friendly technology transfer from developed countries to developing countries by foreign direct investment inflow. This hypothesis is also confirmed by some studies; Tamazian and Rao (2010) employed GMM approach to determine the impacts of GDP, inflation, FDI, financial liberalization, trade openness, price liberalization, forex and trade liberalization, institutional quality, energy consumption, and energy imports on CO2 emissions in 24 transitional countries for the period of 1993–2004. The results indicated that higher levels of FDI help to achieve lower CO2 per capita emissions in these countries so the pollution halo hypothesis is valid. Kirkulak et al. (2011) purposed to test the impacts of FDI on SO2 emissions in 286 Chinese cities from 2001 to 2007 utilizing annual data of FDI, GDP, population, proportion of people working for science in the total population, proportion of FDIs’ output value in gross industrial output value, and SO2 emissions. The regression results indicated that FDI has negative effect on SO2 emission suggesting that the pollution halo hypothesis is valid. Al-Mulali and Tang (2013) employed the cointegration test of Pedroni (1999) and FMOLS method to estimate the effects of FDI, energy consumption, and GDP on CO2 emissions over the period 1980–2009 in the Gulf Cooperation Council (GCC) countries. The researchers found that FDI has negative impact on CO2 emissions; thus, the pollution halo hypothesis is confirmed in the GCC countries. Tang and Tan (2015) purposed to determine the effects of energy consumption, GDP, and FDI on CO2 emission spanning from the period 1976 to 2009 in Vietnam. The results of the analysis revealed that FDI reduces carbon emission in Vietnam; thus, the pollution halo hypothesis is supported in Vietnam. Zhu et al. (2016) looked the effects of FDI, economic growth, energy consumption, on carbon emissions for the period of 1980–2010 in five ASEAN countries employing the panel quantile regression method. According to results of the analysis, the pollution halo hypothesis is supported in the five ASEAN countries. Zhang and Zhou (2016) aimed to determine the effect of FDI on CO2 emission from 1995 to 2010 in 29 Chinese provinces using STIRPAT model. The results of the panel data confirmed that FDI decreases CO2 emissions; thus, the pollution halo hypothesis is confirmed.

Similar to our study, some studies used the ecological footprint as an indicator environmental degradation to observe the validity of pollution haven hypothesis. For instance, Solarin and Al-Mulali (2018) employed the Augmented Mean Group (AMG) estimation procedure to observe the nexus between FDI and environmental degradation for the period from 1982 to 2013 in 20 countries and found that there is not significant relationship between foreign investments and environment. However, Baloch et al. (2019) investigated the nexus between FDI inflows and ecological footprint in 50 Belt and Road countries spanning from the period 1990 to 2016 and utilized the Driscoll-Kraay panel regression model. The results of this study reveal that pollution haven hypothesis is valid for the observed countries. Similarly, Fakher (2019) used the Bayesian model to observe the validity of PHH in developing countries for the period 1996–2016 and confirmed the validity of PHH.

Although different results are obtained according to the used methodology and observed countries, it is seen that most of previous studies focused on carbon dioxide emission as an indicator of environmental degradation. It is known that multinational corporations producing in developing countries do not only increase carbon dioxide emissions but also exploit the various environmental wealth of these countries. Based on this reason, this study employed ecological footprint developed by Wackernagel and Rees (1998) which includes cropland, grazing land, fishing grounds, forest land, built-up land, and carbon footprint as indicators of environmental degradation instead of carbon dioxide emission. In addition, the limited number of studies that used the ecological footprint as an indicator of environmental degradation ignored the possible quadratic relationship between FDI and ecological footprint.

Data and methodology

This study aims to examine the effect of foreign direct investment on environmental degradation in ten newly industrialized countries for the period 1982–2013. For this purpose, we investigate the relationship between ecological footprint, economic growth, foreign direct investment, and energy consumption. Following Shahbaz et al. (2015), we also utilized the square of foreign direct investment to take into account the nonlinear term of foreign direct investment. The panel version of the empirical model is as follows:

where lnEF, lnY, lnFDI, lnFDI2, and lnEC are the natural log of the ecological footprint per capita, real GDP per capita, foreign direct investment per capita, the square of per capita foreign direct investment inflow, and energy consumption per capita. In addition, i, t, and eit indicate cross-section, time period, and residual term, respectively. The ecological footprint per capita is measured in the sum of cropland, grazing land, fishing grounds, forestland, carbon, and built-up land footprints; the real GDP and the real foreign direct investment are measured in 2010 constant US dollars; and energy consumption per capita is measured in kilogram of oil equivalent. The data of real GDP per capita, FDI per capita, and energy consumption per capita are obtained from World Development Indicators, and ecological footprint data is retrieved from Global Footprint Network. In regard to the examined hypothesis, the pollution haven hypothesis is confirmed if FDI has monotonically increasing effect on ecological footprint (a2 > 0 and a3 > 0); the pollution halo hypothesis is supported in case if the FDI has monotonically decreasing effect on environmental degradation (a2 < 0 and a3 < 0); the U-shaped curve is confirmed in case of a2 < 0 and a3 > 0 and the inverted U-shaped curve is valid if a2 > 0 and a3 < 0.

Ignoring the cross-sectional dependence for panel data may lead to wrong estimations due to the high integration all over the world. Therefore, we first test the validity of cross-sectional dependence among newly industrialized countries using with Pesaran’s (2004) cross-sectional dependence (CD hereafter) test. The CD test is constructed as follows:

where N and T state respectively the cross-sectional dimension and the time period. In addition, \( {\hat{\rho}}_{ij} \) is the sample estimate of the pairwise correlation of the residuals.

In order to consider the cross-sectional dependence, we used well-known and frequently used unit root test developed by Pesaran (2007). The computation of the cross-sectional ADF (CADF) regression is as follows:

where ai is the deterministic term, k is the lag order, and \( {\overline{y}}_t \) is the cross-sectional mean of time t. Following the above equation, t statistics are obtained with the computation of individual ADF statistics. Furthermore, CIPS is retrieved from the average of CADF statistic for each i as follows:

The critical values of CIPS for different deterministic terms are given by Pesaran (2007).

To test the validity of the long-run relationship between variables, we used error correction–based cointegration method developed by Westerlund (2007). In the testing procedure, there are four statistics (Gt, Gα, Pt, Pα) to test the null hypothesis if there is no cointegration. The test can be performed by testing the significance of the error correction term in the constrained panel error correction model. The main error correction model of the test can be written as follows:

where dt refers to the deterministic terms; and dt = 0 (no deterministic term), dt = 1 (with constant term), and dt = (1, t)′ (with constant term and trend). Moreover, ai determines the speed at which the system returns to the equilibrium, after an unpredictable shock.

Pesaran (2006) developed a new estimator that takes into account the cross-sectional dependence. Based on Eq. 1, the residual term (eit) is a multifactor residual term and is constructed as follows:

where UFt is the m x 1 vector of unobserved common factors. In addition, Pesaran (2006) utilizes cross-sectional averages to deal with cross-sectional dependence of residuals as observable proxies for common factors.

Empirical results

In the first step, we examine the possible cross-sectional dependence among newly industrialized countries by using the CD test of Pesaran (2004). As a seen in Table 1, the null hypothesis if there is no cross-sectional dependence is rejected; thus, we confirm the cross-sectional dependency among the selected countries. This means a shock in one of the newly industrialized countries may easily be transmitted to the other countries. In this direction, we should use the second-generation panel data methodologies which take into account the cross-sectional dependence among countries.

In the second step, we investigate the stationary properties of the variables using augmented IPS (CIPS) unit root test of Pesaran (2007). As a shown in Table 2, the null hypothesis of unit root is not rejected for the level form of variables. However, the null hypothesis is rejected and all variables have become stationary for first differenced forms of variables. This finding means all variables are integrated of order one.

In the next step, we examine the existence of the long-run relationship between variables. In doing so, we utilized the cointegration test of Westerlund (2007). The results are illustrated in Table 3. When we evaluated the results of error correction–based cointegration test of Westerlund (2007), we found that Gt and Ga statistics do not reject the null hypothesis. On the other hand, Pt and Pa statistics confirm the long-run relationship between variables. These conflicting results may be sourced from that while Gt and Ga statistics are computed with the assumption of unit-specific error correction parameters and accepted as mean-group tests. However, Pt and Pa tests are calculated under the assumption of common error–correction parameter across cross-sectional units. Based on these reasons, our results can be interpreted as the existence of the long-run relationship between ecological footprint, real income, foreign direct investment, and energy consumption is supported with the assumption of common error–correction parameters. Fortunately, the finding of weak cointegration does not pose a problem in that the CCE estimator can be used without the need for pre-testing procedure such as cointegration.

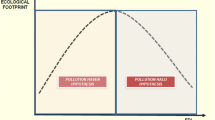

Next, we used common correlated effect (CCE) estimator of Pesaran (2006) to obtain the coefficients of variables. In case of the panel results, as a seen in Table 4, CCE-mean group estimation results show that increasing real income per capita increases environmental degradation. This finding shows that the increase in economic activity still accelerates environmental degradation and is consistent with the studies of Ahmed et al. (2019) and Baloch et al. (2019) which found the ecological footprint increasing impact of economic growth. Moreover, the environmental degradation increasing impact of energy consumption is also validated. These findings mean that the energy portfolio of newly industrialized countries is still predominantly composed of fossil energy sources, and this finding is consistent with Solarin and Al-Mulali (2018). In addition, the significant signs of the coefficient of foreign direct investment and the coefficient of the square of foreign direct investment are found opposite. Therefore, the validity of pollution haven hypothesis and pollution halo hypothesis is rejected and the existence of nonlinear form is confirmed. The negative sign of the coefficient of the foreign direct investment and the positive sign of the square of foreign direct investment imply the U-shaped relationship between foreign direct investment and ecological footprint. This finding is inconsistent with the work of Shahbaz et al. (2015) which found the inverted U-shaped relationship between foreign direct investment and environmental degradation. This inconsistency may be sourced from used environmental degradation indicator. Namely, Shahbaz et al. (2015) utilized with CO2 emission as an indicator of environmental degradation, but this study used ecological footprint which covers carbon footprint as well as different degradation indicators.

In case of country-specific results, it can be seen that the U-shaped relationship between foreign direct investment and ecological footprint is found in Brazil, China, Malaysia, Thailand, and Turkey. In addition, increased real income per capita increases the ecological footprint per capita in China, Indonesia, Philippines, South Africa, Thailand, and Turkey. Similarly, increasing energy consumption increases the ecological footprint in China, India, South Africa, Thailand, and Turkey. However, based on the finding of cross-sectional dependence among countries, the group-mean results are more reliable for policy implications.

Conclusions and policy implications

This paper examines the validity of the pollution haven hypothesis by investigating the relationship between real income, foreign direct investment, energy consumption, and ecological footprint for the period from 1982 to 2013 in ten newly industrialized countries: Brazil, China, India, Indonesia, Malaysia, Mexico, Philippines, South Africa, Thailand, and Turkey. In addition, the square of foreign direct investment is used as explanatory variable to take into account the possible nonlinear relationship between foreign direct investment and ecological footprint. In doing so, the second-generation panel data methodologies are employed to consider the cross-sectional dependence among the selected countries.

In case of group mean results, we found that increased energy consumption and economic growth lead to increase in ecological footprint. Moreover, we found that the significant signs of the coefficients of foreign direct investment and the square of the foreign direct investment are opposite; thus, the validity of both pollution haven hypothesis and pollution halo hypothesis is rejected and the U-shaped relationship between foreign direct investment and ecological footprint is confirmed. This finding means that environmental degradation decreases to a certain level with increasing foreign direct investment, and after this level, increasing foreign direct investment increases environmental degradation. In case of individual country results, the results show that the sign of the coefficient of foreign direct investment is negative and the sign of the coefficient of the square of foreign direct investment is positive in Brazil, China, Malaysia, Thailand, and Turkey. Therefore, the U-shaped relationship between foreign direct investment and ecological footprint is found for these countries. In addition, we found that increased energy consumption increases ecological footprint in China, India, South Africa, Thailand, and Turkey and economic growth leads to increase in ecological footprint in China, Indonesia, Philippines, South Africa, Thailand, and Turkey.

The existence of the U-shaped relationship between foreign direct investment and environmental degradation may be sourced from the production structure of foreign firms. It is a well-known fact that the production structure of the mentioned countries is mainly based on fossil energy consumption and the energy efficiency level of domestic companies is lower than that of foreign companies. Therefore, the clean technology–based production activities of foreign companies initially reduce the environmental degradation in newly industrialized countries because of the relatively modern production structure. However, in the later stages, the loose environmental regulations of the host country led foreign companies to aim low-cost production instead of considering environmental quality. This situation creates a difficult dilemma for governments of these countries because the foreign investments have a key role on economic development processes of these countries.

In regard to policy implications, this study suggests that the laws which mandate the use of clean technology should be applied to the domestic investors who are producing with fossil energy consumption in order not to reduce the domestic competitive power of foreign investors. In addition, the governments should provide tax incentives and subsidies for foreign investors to use eco-friendly technology instead of taking prohibitive measures. Moreover, the implementation of these laws should not only focus on the targets of reducing carbon emission but also prevent the activities causing damage to water resources, forest areas, and agricultural lands.

References

Ahmed Z, Wang Z, Mahmood F, Hafeez M, Ali N (2019) Does globalization increase the ecological footprint? Empirical evidence from Malaysia. Environ Sci Pollut Res:1–18

Al-Mulali U (2012) Factors affecting CO2 emission in the Middle East: a panel data analysis. Energy 44(1):564–569

Al-mulali U, Tang CF (2013) Investigating the validity of pollution haven hypothesis in the gulf cooperation council (GCC) countries. Energy Policy 60:813–819

Baek J (2016) A new look at the FDI–income–energy–environment nexus: dynamic panel data analysis of ASEAN. Energy Policy 91:22–27

Bakhsh K, Rose S, Ali MF, Ahmad N, Shahbaz M (2017) Economic growth, CO2 emissions, renewable waste and FDI relation in Pakistan: New evidences from 3SLS. J Environ Manag 196:627–632

Baloch MA, Zhang J, Iqbal K, Iqbal Z (2019) The effect of financial development on ecological footprint in BRI countries: evidence from panel data estimation. Environ Sci Pollut Res 26(6):6199–6208

Behera SR, Dash DP (2017) The effect of urbanization, energy consumption, and foreign direct investment on the carbon dioxide emission in the SSEA (South and Southeast Asian) region. Renew Sust Energ Rev 70:96–106

Cole MA, Elliott RJ, Zhang J (2011) Growth, foreign direct investment, and the environment: evidence from Chinese cities. J Reg Sci 51(1):121–138

Destek MA, Ulucak R, Dogan E (2018) Analyzing the environmental Kuznets curve for the EU countries: the role of ecological footprint. Environ Sci Pollut Res 25(29):29387–29396

Fakher HA (2019) Investigating the determinant factors of environmental quality (based on ecological carbon footprint index). Environ Sci Pollut Res:1–16

He J (2006) Pollution haven hypothesis and environmental impacts of foreign direct investment: the case of industrial emission of sulfur dioxide (SO2) in Chinese provinces. Ecol Econ 60(1):228–245

Kirkulak B, Qiu B, Yin W (2011) The impact of FDI on air quality: evidence from China. Jrnl of Chinese Econ and Frgn Tr Studies 4(2):81–98

Kivyiro P, Arminen H (2014) Carbon dioxide emissions, energy consumption, economic growth, and foreign direct investment: causality analysis for Sub-Saharan Africa. Energy 74:595–606

Lau LS, Choong CK, Eng YK (2014) Investigation of the environmental Kuznets curve for carbon emissions in Malaysia: do foreign direct investment and trade matter? Energy Policy 68:490–497

Merican Y, Yusop Z, Noor ZM, Hook LS (2007) Foreign direct investment and pollution in five ASEAN nations. Int Jrnl of Econ and Man 1(2):245–261

Nunnenkamp P (2001). Foreign direct investment in developing countries: what policymakers should not do and what economists don’t know (No. 380). Kieler Diskussionsbeiträge.

Omri A, Nguyen DK, Rault C (2014) Causal interactions between CO2 emissions, FDI, and economic growth: evidence from dynamic simultaneous-equation models. Econ Model 42:382–389

Ozcan B, Apergis N, Shahbaz M (2018) A revisit of the environmental Kuznets curve hypothesis for Turkey: new evidence from bootstrap rolling window causality. Environ Sci Pollut Res 25(32):32381–32394

Ozturk I, Al-Mulali U, Saboori B (2016) Investigating the environmental Kuznets curve hypothesis: the role of tourism and ecological footprint. Environ Sci Pollut Res 23(2):1916–1928

Pao HT, Tsai CM (2011) Multivariate Granger causality between CO2 emissions, energy consumption, FDI (foreign direct investment) and GDP (gross domestic product): evidence from a panel of BRIC (Brazil, Russian Federation, India, and China) countries. Energy 36(1):685–693

Pedroni P (1999) Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxf Bull Econ Stat 61:653–670

Pesaran MH (2004) General diagnostic tests for cross section dependence in panels, Cambridge Working Papers in Economics 35 Faculty of Economics. University of Cambridge

Pesaran MH (2006) Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica 74(4):967–1012

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econ 22(2):265–312

Ren S, Yuan B, Ma X, Chen X (2014) International trade, FDI (foreign direct investment) and embodied CO2 emissions: a case study of Chinas industrial sectors. China Econ Rev 28:123–134

Shahbaz M, Nasreen S, Abbas F, Anis O (2015) Does foreign direct investment impede environmental quality in high-, middle-, and low-income countries? Energy Econ 51:275–287

Solarin SA, Al-Mulali U, Musah I, Ozturk I (2017) Investigating the pollution haven hypothesis in Ghana: an empirical investigation. Energy 124:706–719

Solarin SA, Al-Mulali U (2018) Influence of foreign direct investment on indicators of environmental degradation. Environ Sci Pollut Res 25(25):24845–24859

Sun C, Zhang F, Xu M (2017) Investigation of pollution haven hypothesis for China: an ARDL approach with breakpoint unit root tests. J Clean Prod 161:153–164

Tamazian A, Rao BB (2010) Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies. Energy Econ 32(1):137–145

Tang CF, Tan BW (2015) The impact of energy consumption, income and foreign direct investment on carbon dioxide emissions in Vietnam. Energy 79:447–454

Wackernagel M, Rees W (1998) Our ecological footprint: reducing human impact on the earth (No. 9). New Society Publishers

Wang DT, Chen WY (2014) Foreign direct investment, institutional development, and environmental externalities: evidence from China. J Environ Manag 135:81–90

Westerlund J (2007) Testing for error correction in panel data. Oxf Bull Econ Stat 69:709–748

Zakarya GY, Mostefa B, Abbes SM, Seghir GM (2015) Factors affecting CO2 emissions in the BRICS countries: a panel data analysis. Proc Econ and Fin 26:114–125

Zhang C, Zhou X (2016) Does foreign direct investment lead to lower CO2 emissions? Evidence from a regional analysis in China. Renew Sust Energ Rev 58:943–951

Zhu H, Duan L, Guo Y, Yu K (2016) The effects of FDI, economic growth and energy consumption on carbon emissions in ASEAN-5: evidence from panel quantile regression. Econ Model 58:237–248

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Philippe Garrigues

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Destek, M.A., Okumus, I. Does pollution haven hypothesis hold in newly industrialized countries? Evidence from ecological footprint. Environ Sci Pollut Res 26, 23689–23695 (2019). https://doi.org/10.1007/s11356-019-05614-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-019-05614-z