Abstract

This study examines the relation between CO2 emissions, income, non-renewable, and renewable energy consumption in Algeria during the period extending from 1980 to 2011. Our work gives particular attention to the validity of environmental Kuznets curve (EKC) hypothesis. The autoregressive distributed lag (ARDL) with break point method outcome demonstrates the positive effect of non-renewable type of energy on CO2 emissions consumption. On the contrary, the results reveal an insignificant effect of renewable energy on environment improvement. Moreover, the results accept the existence of EKC hypothesis but the highest gross domestic product value in logarithm scale of our data is inferior to the estimated turning point. Consequently, policy-makers in Algeria should expand the ratio of renewable energy and should decrease the quota of non-renewable energy consumption.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

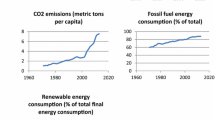

The last few decades have witnessed an increased awareness of environmental problems. The accumulation of environmental problems caused by human activity has raised the question of the possibility of economic growth that respects the environment and the achievement of a sustainable development that would not be harmful for the future generation. Since the Kyoto Protocol, the substitution of the energy category for fossil fuels by renewable energy one is seen as a response to reduce CO2 emissions. In 2015, 164 countries have adopted at least one class of renewable energy target (International Renewable Energy Agency). The primary aim of this paper is to look at the link among renewable sort of energy consumption, non-renewable energy consumption, CO2 emissions, and output in Algeria. The choice of Algeria is explained by different reasons. First, Algeria is highly dependent on fossil fuel energy. According to the World Bank, natural gas rents, oil rents, and total natural resource rents contributed by 6.11, 23.65, and 30.17%, respectively, to gross domestic product (GDP) in 2012. Its consumption of oil and natural gas tripled during the 1980–2012 period. Oil consumption increased from 120 to 371 in thousand barrels per day and natural gas consumption jumped from 11.4 to 31 in billion cubic meters (see Table 1).

Second, the dependence on fossil fuel energy has been accompanied by a decrease in its production in recent years. Oil production (in thousand barrels per day) decreased from 1689 in 2010 to 1537 in 2012. Natural gas production (in billion cubic meters) declined from 84.4 in 2000 to 81.5 in 2012 (see Table 1).

Third, the evolution of the consumption of non-renewable energy leads to the degradation of the environment by increasing CO2 emissions. As indicated by US Energy Information Administration, the carbon dioxide emissions (in million metric tons) doubled during the period from 1980 to 2012, jumping from 67 to 134. Furthermore, according to the Environmental Performance Index (http://epi.yale.edu/country-rankings), Algeria was ranked 86 on the list of 132 nations for their ecological result. Fourth, aware of this environmental problem, Algeria has drawn some programs to reduce CO2 emissions by 7–22% by 2030 (United Nations Paris Climate Agreement). Algeria has adopted a national program to raise its portion of the use of renewable energy consumption. This share was lower than 1% over the period 1990–2012. Algeria hopes to integrate a renewable capacity of 22,000 MW into its energy mix by 2030 and to minimize energy consumption by 9% by 2030.

The linkage among energy consumption, CO2 emission, and output has been the research topic of several papers, but only a few of them have differentiated between renewable and non-renewable energy consumption. In the literature, this topic has attracted little attention from researchers interested in the relationship between energy consumption, CO2 emissions, and economic growth. Moreover, these previous studies have given contradictory results.

To the best of the author’s knowledge, our review is the first to inspect the connection among carbon dioxide emissions, income, and energy consumption in Algeria by disaggregating electricity consumption into both sources, i.e., non-renewable and renewable sources over 1980–2012 period. Moreover, our study is the first to inspect the environmental Kuznets curve (EKC) hypothesis in Algeria by using the ARDL model with break points. In addition, we apply unit root tests with one break-point and with two-break points. Furthermore, our review expands the writing related to the oil-exporting countries for which there are still few reviews.

This document is orchestrated as follows. Section 2 gives a brief literature review. Section 3 describes methodology and analysis. Section 4 provides the main results and debates, and Section 5 integrates conclusions and policy implications.

A brief literature review

The literature that scrutinizes the connections among CO2 emissions, output, and energy consumption can be summed up into three topics.

The first topic focuses on the linkage between output and energy consumption (Ozturk 2010; Payne 2010; Magazzino 2014a, 2014b, 2016). In this case, the majority of studies have considered the non-renewable category of energy as a proxy of energy consumption (Alshehry and Belloumi 2015; Caraiani et al. 2015; Tang et al. 2016). Other types of studies have been interested in the linkage among renewable category of energy consumption and output (Omri et al. 2015; Bhattacharya et al. 2016; Wesseh and Lin 2016; Amri 2017). More recent studies have shed the light on the same link by integrating the two categories of energy consumption as determinants of economic growth (Amri 2016; Dogan 2016). Four distinguishable hypotheses are deduced from this topic of studies: the feedback hypothesis, the growth hypothesis, the neutrality hypothesis, and the conservation hypothesis (Magazzino 2014a, b, 2016). The studies that looked into the link among output and energy consumption in Algeria are limited (see Table 2). Belaid and Abderrahmani (2013) and Fuinhas and Marques (2013) demonstrated the presence of the first hypothesis. Wolde-Rufael (2009) showed the presence of the second one. Wolde-Rufael (2006) accepted the third one. Wolde-Rufael (2005) and Cherfi and Kourbali (2012) confirmed the fourth hypothesis.

The second topic focuses on the veracity of environmental Kuznets curve hypothesis (EKC) (Bo 2011; Magazzino 2014a, b, 2016). The EKC hypothesis is confirmed by Jalil and Mahmud (2009), Apergis and Payne (2010), Nasir and Rehman (2011), Hamit-Haggar (2012), Babu and Datta (2013), Shahbaz et al. (2013), Apergis and Ozturk (2015), Baek (2015), and Tutulmaz (2015). Yet, the EKC hypothesis is rejected by Pao et al. (2011), Wang (2012), Ozcan (2013), Robalino-López et al. (2014), and Ozturk and Al-Mulali (2015). In the case of Algeria, the mentioned hypothesis is confirmed by Saboori et al. (2016) who are interested in a study on the Organization of Petroleum Exporting Countries between 1977 and 2008, and by Lematouch et al. (2014) between 1965 and 2009. Whereas Lacheheb et al. (2015) demonstrates the absence of the EKC assumption by estimating an ARDL model.

The third topic investigates the linkage among carbon footprint, output, and energy consumption. This literature is interested not only in the validity of EKC hypothesis but also focuses on the possible relationship between all the variables such as causality relationship, short-run, and long-run relationship. These studies produce mixed results (Alshehry and Belloumi 2015; Begum et al. 2015). With regard to the Algerian case (see Table 2), Bouznit and Pablo-Romero (2016) considered gross domestic product, gross domestic product squared, imports, exports, and energy use as determinants of CO2 emissions. The ARDL (Autoregressive Distributed Lag) model outcome indicates the presence of Environmental Kuznets Curve assumption although the rupture outcome level was not reached between 1970 and 2010. Furthermore, pollution is affected positively by the energy use and import variables while negatively affected by the export one.

Within the third topic, there are a few papers which have integrated the renewable energy as additional variable by examining the nexus among economic growth, CO2 emissions, and non-renewable and renewable categories of energy consumption (Al-Mulali et al. 2015a; Ben Jebli and Ben Youssef 2015; Bento and Moutinho 2016; Ben Jebli et al. 2016). From the abovementioned studies, there is no study that has assessed the linkage among energy consumption by sources, economic growth, and CO2 emissions in Algeria.

Methodology and analysis

Model

For our purpose, we use model 1 which is introduced by different studies such as Farhani et al. (2014) and Dogan and Seke (2016). This model has the advantage to test the EKC hypothesis by comparing the signs of the coefficient of GDP and the coefficient of square of gross domestic product. The EKC is accepted when the first parameter is positive, and the second one is negative. Moreover, it allows detecting the impact of the two categories of energy consumption on dioxide carbon emissions.

Where CO2 is the dioxide carbon emissions, GDP is the gross domestic product per capita, GDP2 is the square of gross domestic product per capita, RE is the renewable energy use per capita, NRE is the non-renewable one expressed in per capita form, ε denotes the statistical error element, and α i (i = 1, … , 4) denotes the parameters of each variable.

Methodology

In this paper, we adopt the following steps: firstly, we look into the stationarity proprieties of the time series variables. We utilize the traditional unit root tests, i.e., augmented Dickey–Fuller (ADF)(Dickey and Fuller 1979), Dickey–Fuller GLS (DF-GLS), Elliott-Rothenberg-Stock (ERS), Phillips–Perron (PP)(Phillips and Perron 1988), and Kwiatkowski-Phillips-Schmidt-Shin (KPSS)(Kwiatkowski et al. 1992). In addition, we exploit the unit root tests with one structural break such as Zivot and Andrews (1992) and Perron (1997). Moreover, we perform the Clemente et al. (1998) unit root test with two breaks.

Secondly, to uncover the long-run connections among the variables, we carry out the technique developed by Pesaran et al. (2001) to test the cointegration, namely, ARDL (autoregressive distributed lag). This methodology is appropriate for time series data which are stationary in levels or in first differences.

Whither Δ constitutes the first-difference of series, ε represents the error term, ω 0 represents the constant coefficient, break represents the dummy variable, n 1 – n 5 represent the lag length which is selected by the Akaike criteria (AIC).

The no cointegration assumption (H0:ϕ 1 = ϕ 2 = ϕ 3 = ϕ 4 = ϕ 5 = 0) which is tested against the alternative assumption of cointegration (H1:ϕ 1 = ϕ 2 = ϕ 3 = ϕ 4 = ϕ 5 = 0).

Pesaran et al. (2001) developed two critical bound values (lower and upper bound values). By comparing these values to the computed F-statistic, Pesaran et al. (2001) identified three situations. The first one is the presence of the cointegration linkage and realized when the upper value is weaker than the computed F-statistic. The second one is the absence of cointegration linkage and realized when the computed F-statistic is weaker than the lower value. The third one is the inconclusive relationship between the variables and realized when the computed F-statistic is between the two levels of values.

Thirdly, some diagnostic tests (heteroscedasticity, normality, serial correlation) are used to ascertain the validity of the ARDL model. In addition to this, we control the model stability by employing two tests related to recursive residuals. The first one is the cumulative sum (CUSUM). The second one is the cumulative sum of square (CUSUMQ).

Data

We concentrate on Algerian annual data between 1980 and 2011 which is the longest period of series data of all the variables collected. CO2 is dioxide carbon emissions in metric tons. GDP is in US dollars (2005 the base year), RE is electricity consumption from renewable sources in billions of kilowatt-hours. NRE is electricity consumption from non-renewable sources in billion of kilowatt-hours. The CO2 and GDP statistics are gathered from the World Bank Indicators (World development indicators 2015). The RE and NRE are gathered from the US Energy Information Administration.

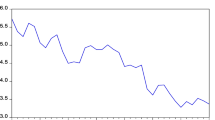

The description will be made in three steps. First, we examine the evolution of data by a visual presentation. As seen in Fig. 1, gross domestic product, non-renewable energy consumption, and CO2 emissions underwent a comparable trend between 1980 and 2011.

Second, we are interested in presenting the correlation matrix of the data. As shown in Table 3, the non-renewable energy has the higher correlation with GDP. Moreover, the result proves that non-renewable energy and output have a significant role in damaging the environment.

Third, we focus on some descriptive statistics of the four variables such as the values of mean, median, inter-quartile range, skewness, kurtosis, standard deviation, maximum, minimum, and range. As presented in Table 4, CO2 emissions and output have positive averages. The mean and median have comparable values for all variables; this holds true for standard deviation and pseudo-standard deviation statistics. The negative values of skewness for both CO2 emission and renewable energy consumption variables prove the presence of left-skewed distributions. The inter-quartile range (IQR) demonstrates the lack of outliers in the considered data.

Results and discussions

Integration process

The results of traditional unit root tests (see Table 5) reveal that except Co2 emission variable which is I(0), all other series are non-stationary at the level form, but become stationary at their first difference.

Moreover, the stationary of each variable is detected by Zivot and Andrews (1992) unit root test (Ben Jebli and Ben Youssef 2015; Dogan 2015; Iyke 2015). The main advantage of this test is to comprise the presence of break point in the data.

The Zivot and Andrews (1992) unit root test is founded on the following models:

Where DI t reflects a mean shift dummy variable coming from every prospective break date (TB), DT t reflects trend shift dummy variable. Models 1, 2, and 3 are with intercept change, with trend change, and with both intercept and trend changes, respectively.

Zivot and Andrews (1992) tested the unit root test hypothesis against the one-break hypothesis. The outcome of Zivot and Andrews (1992) unit root test, which is given in Table 6, indicated that our series are integrated I(0) or I(1). The variables which are integrated at I(0) mean that they are stationary at their level whereas integrated I(1) series are stationary at first difference. The result of Zivot and Andrews (1992) unit root test indicated different break points for CO2 emissions variable. This period encompasses the 1986 oil shock and the structural reforms adopted by Algeria in 1988. This result is confirmed by applying Perron (1997) (Table 7) unit root tests with one-break point and Clemente et al. (1998) with two-break points (Table 8).

These outcomes allow looking into the long-run relationship among explored variables by using the ARDL method.

ARDL cointegration process

We used the break dates recovered after applying the Zivot and Andrews (1992), Perron (1997) and Clemente et al. (1998) unit root tests on dioxide carbon emissions variable. We integrated a dummy variable (BREAK) assuming the value one throughout the period 1985–1989 and zero elsewhere. The real GDP growth was −0.2, −0.7, and −1.9 in 1986, 1987, and 1988, respectively.

The ARDL cointegration test with a break is applied to look into the long-run linkage between the variables. The obtained F-statistic (Table 9) exceeds the upper critical bound mentioned by Pesaran et al. (2001). Consequently, we accept the cointegration hypothesis among the series. This result does not confirm the finding of Magazzino (2014a) which demonstrates the absence of cointegration among CO2 emissions, energy use, and gross domestic product in Italy in the period stretching from 1970 to 2006. Moreover, this outcome confirms the result of Magazzino (2016) in the case of Oman.

Short-run and long-run results

The outcome of ARDL model (Table 10) can be summarized as follows:

firstly, contrary to Magazzino (2014a, 2016) we are interested in the EKC relationship by focusing on the signs of parameters related to GDP and GDP2 variables. In both short- and long-run analyses, the results indicate a positive sign of GDP and a negative sign of GDP2. This means that EKC hypothesis is accepted in the case of Algeria’s economy. But, this latter has not yet reached the turning point output that allowed it to get environmental benefits. The highest value of ln GDP (8.09) is less than the turning point (9.275 in the long run or 10.27 in the short run) which has been computed by the ratio of GDP parameter to the absolute value of the double of the estimate GDP2 parameter. This conclusion implies that Algerian economy remains a creator of pollution. This results from the low real GDP per capita growth (1.10%) recorded during the considered period. The slow growth in Algeria is related to the lack of growth of total factor productivity growth and to the accumulation of capital (IMF 2013). This implies that Algerian policy-makers must promote economic growth in order to achieve a reduction in CO2 emissions. A higher growth can be realized by enhancing the accumulations of capital and knowledge (IMF 2013).

This outcome is in accordance with the Algerian studies about environmental Kuznets curve, for example, Bouznit and Pablo-Romero (2016) who indicated the presence of EKC hypothesis, but the threshold level of income per capita has not been reached yet by applying an ARDL model with break point during the period between 1970 and 2010. Their model considered GDP, GDP square, and energy consumption as determinants of CO2 emissions. This result does not conform to the findings of Lacheheb et al. (2015) which demonstrate the absence of EKC assumption in Algerian data between 1971 and 2009. The comparison between the short- and long-run GDP parameters is used to test the EKC hypothesis. The model integrated GDP and energy use as factors of CO2 emissions.

This outcome is in accordance with the paper of Bölük and Mert (2015) in Turkey, which is interested in the impact of renewable energy, GDP, and GDP square on CO2 emissions.

This result is consistent with that of Halicioglu (2009), Kohler (2013), Farhani and Shahbaz (2014), Shafiei and Salim (2014), and Al-Mulali et al. (2016) in Turkey, South Africa, MENA countries, OECD countries, and Kenya, respectively.

This result does not conform to the study of Balaguer and Cantavella (2016) in the case of Spain, which supported the EKC hypothesis, and the turning point is reached.

This result does not conform with the findings of past studies for other countries which rejected the EKC hypothesis, for example, Begum et al. (2015) in Malaysia, Robalino-López et al. (2014) in Ecuador, Ozturk and Al-Mulali (2015) in Cambodia, and Ben Jebli and Ben Youssef (2015) in Tunisia. This discrepancy is due to different reasons. First, the method used to test the cointegration relationship. Begum et al. (2015) applied the ARDL method without breaking point. Ozturk and Al-Mulali (2015) used the Generalized Method of Moments and the Two-stage Least Squares methods. Second, the data used. Robalino-López et al. (2014) considered the period from 1980 to 2025. Third, the groups of countries investigated. Narayan et al. (2016) demonstrated that EKC hypothesis is more displayed in developed countries compared to less developed ones. Yang et al. (2015) demonstrated the presence of M-shaped and N-shaped models in the case of highly developed countries while the presence of inverted U-shaped curves, inverted N-shaped, and monotonically increasing curve in the developing countries.

Secondly, we focus on the impact of non-renewable energy on CO2 emissions. An increase at the rate of 1% in non-renewable energy consumption per capita will inflate CO2 emissions per capita by 0.347% in the long run against 0.204% in the short run. This means that intensification in non-renewable energy consumption gives a reason for the increase in CO2 emissions. This is likely to occur in light of the fact that Algeria is highly dependent on fossil fuel energies that have affected negatively the environment during extraction and consumption. The Algerian fossil fuels energy consumption accounted for more than 99% of the total energy consumption in 2012 (US Energy Information Administration 2015). This big share is dedicated to residential and transportation sector. Consequently, to reduce CO2 emissions, Algeria should implement an energy saving program. Mirzaei and Bekri (2017) demonstrated that 10% of energy reduction would decrease CO2 emissions by 17.8% from 2010 to 2025 in Iran.

This outcome is in accordance with Al-mulali et al. (2015b) by using GMM panel data in the case of four groups of countries differing by their income classes (high, upper middle, lower middle, and low). It is also in conformity with Ben Jebli et al. (2016) by performing panel cointegration methods in OECD countries from 1980 to 2010. It is in line with Ertugrul et al. (2016) by exploiting cointegration and VECM causality techniques in some developing countries between 1971 and 2011, and with Begum et al. (2015) by utilizing ARDL and dynamic ordinary least square estimators in the case of Malaysia between 1970 and 2009.

Moreover, this result is in line with those of Bento and Moutinho (2016) by using ARDL model in Italy during the 1960–2011 period, Ozturk and Al-Mulali (2015) by using Two-stage least squares and GMM techniques in the case of Cambodia from 1996 to 2012, Farhani et al. (2014) by exploiting panel data methods in the case of ten MENA countries between 1990 and 2010, and Shahbaz et al. (2013) by applying panel cointegration tests in a Romanian study.

This is likely to occur in light of the fact that fossil fuel consumption accounts for more than 67% total energy consumption worldwide.

Thirdly, we shed the light on the effect of renewable energy consumption on CO2 emissions. The short- and long-run parameters of renewable category of energy are positive and statistically insignificant. This means its inability to affect the CO2 emissions. This is prone to happen on the grounds that the share of renewable energy consumption is very small, representing only 0.1% from total energy consumption which is weak compared to the total primary energy worldwide accounting for 13.2% in 2012 recorded (US Energy Information Administration 2015). This implies that renewable energy can be a solution to reduce CO2 emissions by enhancing its level contribution of total energy consumption. It represented 25.4% in 2014 in the case of European Union. According to Chiu and Chang (2009), to reduce CO2 emissions, the share of renewable energies should be greater than 8.3889%. For this reason, Algeria has adopted a program to boost its production in renewable energy by 25% between 2015 and 2030. Bonneuil and Boucekkine (2016) demonstrated that the adoption of renewable energy program must be gradual over time.

The results from this work are in line with the result of Bilgili et al. (2016) in the case of Italy in the long term. However, there are mixed associations (positive or negative) between renewable energy and CO2 emissions in 16 other countries.

This outcome is in line with Ben Jebli and Ben Youssef (2015) who demonstrate an insignificant impact of renewable kind of energy consumption on pollution variable in Tunisia from 1980 to 2009. This conformity is due to the weak proportion of renewable energy use in Algeria and Tunisia.

Our result is in conformity with Al-Mulali et al. (2015a) who show the incapacity of renewable energy in reducing the level of pollution in Vietnam between 1981 and 2011. This affirmation is correlated to the Vietnam weakness in renewable energy consumption which accounts for 1% in the total energy consumption.

This long-term result is inconsistent with the finding of Bölük and Mert (2015) which proves the importance of the types of renewable energy in reducing pollution in Turkey between 1961 and 2010. In the short-term, our results are in contradiction with the latter study which indicates a positive effect of renewable energy on CO2 emissions. Furthermore, this outcome is in contradiction with the study about Italy by Bento and Moutinho (2016) which establishes a negative impact of renewable energy in CO2 emissions on both short and long terms. This difference is attributed to the high share of renewable energy in Italy which represents more than a quarter of the total energy. Our findings are in contradiction with the results of Dogan and Seke (2016) in the case of 40 countries indicating a positive contribution of renewable energy to the environmental protection in the long time. These countries are figured from the highest renewable energy ones. Our outcome is in contradiction with the study of Ben Jebli et al. (2016) which illustrates an environment improvement after renewable energy enhancement.

The value of equilibrium correction mechanism parameter (ECM) is greater than −1 and less than 0. The outcome indicates that the adjustment from the short- to the long-run equilibrium is equal to 5.89% during one-time period.

The results at the bottom of Table 10 have validated the hypothesis of no serial correlation, the absence of heteroscedasticity, and the normality presence of the error term. The CUSUM and CUSUMQ statistics which are presented in Fig. 2 demonstrate the stability of coefficients of error correction model given that they are inside the limits of 5%.

Conclusion and policy implications

The objective of our work is to examine the linkage between non-renewable energy consumption, renewable energy consumption, economic growth, and Co2 emissions in Algeria during the period stretching from 1980 to 2011.

The outcomes from this review suggest a variety of results and policy implications:

First, the ARDL results indicate the validity of EKC hypothesis since we obtain a positive sign of GDP parameter and a negative sign of GDP square parameter. But, the estimated GDP turning point is not inside the 1980–2011 period. This suggests that CO2 emissions could begin with the increase in the Algerian GDP.

Second, the increase of non-renewable energy consumption in Algeria contributes to the environment deterioration. It implicates that Algeria ought to make attempts to lessen its consumption from non-renewable energy category with a specific end goal; to diminish CO2 outflows. In this context, Algerian authorities should establish an energy strategy based on energy saving and energy efficiency. This strategy will focus on the energy-intensive sectors; namely, transport, households, and tertiary, whose energy consumption represents 80% in Algeria nationwide. This model will reduce internal energy through the modernization of infrastructures, the integration of technological innovations, and the organization of campaigns to sensitize the people to reduce the consumption of energy. Moreover, this strategy should be accompanied by different actions. Firstly, the implementation of energy rationalization programs through applying technical regulations for equipment and vehicles which consume a lot of energy. According to the International Energy Agency, this type of program launched in OECD countries would have saved 60% of energy.

Secondly, the gradual revision of energy prices would be suggested by focusing on energy-intensive sectors that have a significant impact on energy demand. Thirdly, over-production and unnecessary consumption should be avoided, and the pace of growth in demand ought to be controlled in order to better conserve energy and to benefit from improved energy efficiency. Fourthly, authorities should adopt new legislations and incentives in order to reduce consumption of fossil fuels.

Third, the results related to the ARDL estimates reveal an insignificant impact of renewable energy consumption on Co2 emissions. To reduce CO2 emissions, Algerian authorities should invest in renewable energy consumption and should adopt measures to encourage the consumption of renewable energy. Therefore, it is important to initiate a strategy based on the implementation of related investments, the modification of production standards, and the training of necessary human capital. The development of renewable energies faces an enormous high-cost challenge. Thus, seeing the high costs, renewable energies can only be developed through subsidies granted by the government.

Moreover, policy-makers should promote the attraction of foreign direct investment by removing the obstacles linked to the weakness of governance, the bureaucratic procedures, and the lack of tax incentives.

References

Al-Mulali U, Saboori B, Ozturk I (2015a) Investigating the environmental Kuznets curve hypothesis in Vietnam. Energy Policy 76:123–131

Al-mulali U, Weng-Wai C, Sheau-Ting L, Mohammed AH (2015b) Investigating the environmental Kuznets curve (EKC) hypothesis by utilizing the ecological footprint as an indicator of environmental degradation. Ecol Indic 48:315–323

Al-Mulali U, Solarin SA, Ozturk I (2016) Investigating the presence of the environmental Kuznets curve(EKC) hypothesis in Kenya: an autoregressive distributed lag (ARDL) approach. Nat Hazards 80(3):1729–1747

Alshehry AS, Belloumi M (2015) Energy consumption, carbon dioxide emissions and economic growth: the case of Saudi Arabia. Renew Sust Energ Rev 41:237–247

Amri F (2016) The relationship amongst energy consumption, foreign direct investment and output in developed and developing countries. Renew Sust Energ Rev 64:694–702

Amri F (2017) Intercourse across economic growth, trade and renewable energy consumption in developing and developed countries. Renew Sust Energ Rev 69:527–534

Apergis N, Ozturk I (2015) Testing environmental Kuznets curve hypothesis in Asian countries. Ecol Indic 52:16–22

Apergis N, Payne JE (2010) The emissions, energy consumption, and growth nexus: evidence from the commonwealth of independent states. Energy Policy 38:650–655

Babu SS, Datta SK (2013) The relevance of environmental Kuznets curve (EKC) in a framework of broad-based environmental degradation and modified measure of growth-a 15 pooled data analysis. Int J Sust Devel World Ecol 20:309–316

Baek J (2015) Environmental Kuznets curve for CO2 emissions: the case of Arctic countries. Energy Econ 50:13–17

Balaguer J, Cantavella M (2016) Estimating the environmental Kuznets curve for Spain by considering fuel oil prices (1874–2011). Ecol Indic 60:853–859

Begum RA, Sohag K, Abdullah SMS, Jaafar M (2015) CO2 emissions, energy consumption, economic and population growth in Malaysia. Renew Sust Energy Rev 41:594–601

Belaid F, Abderrahmani F (2013) Electricity consumption and economic growth in Algeria: a multivariate causality analysis in the presence of structural change. Energy policy 55:286–295

Ben Jebli M, Ben Youssef S (2015) The environmental Kuznets curve, economic growth, renewable and non-renewable energy, and trade in Tunisia. Renew Sust Energy Rev 47:173–185

Ben Jebli M, Ben Youssef S, Ozturk I (2016) Testing environmental Kuznets curve hypothesis: the role of renewable and non-renewable energy consumption and trade in OECD countries. Ecol Indic 60:824–831

Bento JPC, Moutinho V (2016) CO2 emissions, non-renewable and renewable electricity production, economic growth, and international trade in Italy. Renew Sust Energy Rev 55:142–155

Bhattacharya M, Paramati SR, Ozturk I, Bhattacharya S (2016) The effect of renewable energy consumption on economic growth: evidence from top 38 countries. Appl Energy 162:733–741

Bilgili F, Kocak E, Bulut U (2016) The dynamic impact of renewable energy consumption on CO2 emissions: a revisited environmental Kuznets curve approach. Renew Sust Energy Rev 54:838–845

Bo S (2011) A literature survey on environmental Kuznets curve. Energy Procedia 5:1322–1325

Bölük G, Mert M (2015) The renewable energy, growth and environmental Kuznets curve in Turkey: an ARDL approach. Renew Sust Energy Rev 52:587–595

Bonneuil N, Boucekkine R (2016) Optimal transition to renewable energy with threshold of irreversible pollution. Eur J Oper Res 248:257–262

Bouznit M, Pablo-Romero MDP (2016) CO2 emission and economic growth in Algeria. Energy Policy 96:93–104

BP statistical review of world energy. http://www.bp.com; 2015

Caraiani C, Lungu CI, Dascălu C (2015) Energy consumption and GDP causality: a three-step analysis for emerging European countries. Renew Sust Energ Rev 44:198–210

Cherfi SE, Kourbali B (2012) Energy consumption and economic growth in Algeria: Cointegration and causality analysis. Int J Energy Econ Policy 2:238–249

Chiu C-L, Chang T-H (2009) What proportion of renewable energy supplies is needed to initially mitigate CO2 emissions in OECD member countries?. Renew Sust Energy Rev 13(6-7):1669–1674

Clemente J, Montanes A, Reyes M (1998) Testing for a unit root in variables with a double change in the mean. Econ Lett 59:175–182

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74:427–431

Dogan E (2015) The relationship between economic growth and electricity consumption from renewable and non-renewable sources: a study of Turkey. Renew Sust Energy Rev 52:534–546

Dogan E (2016) Analyzing the linkage between renewable and non-renewable energy consumption and economic growth by considering structural break in time-series data. Renew Energy 9:1126–1136

Dogan E, Seke F (2016) The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renew Sust Energy Rev 60:1074–1085

Ertugrul HM, Cetin M, Seker F, Dogan E (2016) The impact of trade openness on global carbon dioxide emissions: evidence from the top ten emitters among developing countries. Eco Indic 67:543–555

Farhani S, Shahbaz M (2014) What role of renewable and non-renewable electricity consumption and output is needed to initially mitigate CO2 emissions in MENA region? Renew Sust Energ Rev 40:80–90

Farhani S, Mrizak S, Chaibi A, Rault C (2014) The environmental Kuznets curve and sustainability: a panel data analysis. Energy Policy 71:189–198

Fuinhas JA, Marques AC (2013) Rentierism, energy and economic growth: the case of Algeria and Egypt (1965–2010). Energy policy 62:1165–1171

Halicioglu F (2009) An econometric study of C02 emissions, energy consumption, income and foreign trade in Turkey. Energy Policy 37:1156–1164

Hamit-Haggar M (2012) Greenhouse gas emissions, energy consumption and economic growth: a panel cointegration analysis from Canadian industrial sector perspective. Energy Econ 34:358–364

International Monetary Fund http://www.imf.org. 2013

Iyke BN (2015) Electricity consumption and economic growth in Nigeria: a revisit of the energy-growth debate. Energy Econ 51:166–176

Jalil A, Mahmud SF (2009) Environment Kuznets curve for CO2 emissions: a Cointegration analysis for China. Energy Policy 37:5167–5172

Kohler M (2013) CO2 emissions, energy consumption, income and foreign trade: a south African perspective. Energy Policy 63:1042–1050

Kwiatkowski D, Phillips PCB, Schmidt P, Shin Y (1992) Testing the null hypothesis of stationarity against the alternative of a unit root. J Econometrics 54:159–178

Lacheheb MS, Rahim ASA, Sirag A (2015) Economic growth and carbon dioxide emissions: Investigating the environmental Kuznets curve hypothesis in Algeria. Int J Energy Econ Policy 5:1125–1132

Lematouch L, Yang KJ, Xu RR (2014) Economic growth and CO2 emissions nexus in ALGERIA: a CO-integration analysis of the environmental Kuznets curve. Int J Econ Com Res 4:1–14

Magazzino C (2014a) The relationship between CO2 emissions, energy consumption and economic growth in Italy. Int J Sust Energy. doi:10.1080/14786451.2014.953160

Magazzino C (2014b) A panel VAR approach of the relationship among economic growth, CO2 emissions, and energy use in the ASEAN-6 countries. Int J Energy Econ Policy 4:546–553

Magazzino C (2016) The relationship between real GDP, CO2 emissions and energy use in the GCC countries: a time-series approach. Cogent Econ Finance 4. doi:10.1080/23322039.2016.1152729

Mirzaei M, Bekri M (2017) Energy consumption and CO2 emissions in Iran, 2025. Environ Res 154:345–335

Narayan PK, Saboori B, Soleymani A (2016) Economic growth and carbon emissions. Econ Model 53:388–397

Nasir M, Rehman FU (2011) Environmental kuznets curve for carbon emissions in Pakistan: an empirical investigation. Energy Policy 39:1857–1864

Omri A, Ben Mabrouk N, Sassi-Tmar A (2015) Modeling the causal linkages between nuclear energy, renewable energy and economic growth in developed and developing countries. Renew Sust Energ Rev 42:1012–1022

Ozcan B (2013) The nexus between carbon emissions, energy consumption and economic growth in Middle East countries: a panel data analysis. Energy Policy 62:1138–1147

Ozturk I (2010) A literature survey on energy-growth nexus. Energy Policy 38:340–349

Ozturk I, Al-Mulali U (2015) Investigating the validity of the environmental Kuznets curve hypothesis in Cambodia. Ecol Indic 57:324–330

Pao HT, Yu HC, Yang YH (2011) Modeling the CO2 emissions, energy use, and economic growth in Russia. Energy 36:5094–5100

Payne JE (2010) A survey of the electricity consumption growth literature. Appl Energy 87:723–731

Perron P (1997) Further evidence on breaking trend functions in macroeconomic variables. J Econometrics 80:355–385

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16:289–326

Phillips PCB, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75:335–346

Robalino-López A, García-Ramos JE, Golpe AA, Mena-Nieto Á (2014) System dynamics modelling and the environmental Kuznets curve in Ecuador (1980–2025). Energy Policy 67:923–931

Saboori B, Al-mulali U, Baba MB, Mohammed AB (2016) Oil-induced environmental Kuznets curve in organization of petroleum exporting countries (OPEC). Int J Green Energy 13:408–416

Shafiei S, Salim RA (2014) Non-renewable and renewable energy consumption and CO2 emissions in OECD countries: a comparative analysis. Energy Policy 66:547–556

Shahbaz M, Mutascu M, Azim P (2013) Environmental Kuznets curve in Romania and the role of energy. Renew Sust Energy Rev 18:165–173

Tang CF, Tan BW, Ozturk I (2016) Energy consumption and economic growth in Vietnam. Renew Sust Energ Rev 54:1506–1514

Tutulmaz O (2015) Environmental Kuznets curve time series application for Turkey: why controversial results exist for similar models? Renew Sust Energy Rev 50:73–81

U.S. Energy Information Administration. http://www.eia.gov; 2015

Wang KM (2012) Modelling the nonlinear relationship between CO2 emissions from oil and economic growth. Econ Model 29:1537–1547

Wesseh PK, Lin B (2016) Can African countries efficiently build their economies on renewable energy? Renew Sust Energ Rev 54:161–173

Wolde-Rufael Y (2005) Energy demand and economic growth: the African experience. J Policy Model 27:891–903

Wolde-Rufael Y (2006) Electricity consumption and economic growth: a time series experience for 17 African countries. Energy policy 34:1106–1114

Wolde-Rufael Y (2009) Energy consumption and economic growth: the experience of African countries revisited. Energy Econ 31:217–224

World development indicators. http://data.worldbank.org/country/algeria; 2015

Yang G, Sun T, Wang J, Li X (2015) Modeling the nexus between carbon dioxide emissions and economic growth. Energy Policy 86:104–117

Zivot E, Andrews D (1992) Further evidence of great crash, the oil price shock and the unit root hypothesis. J Bus Econ Stat 10:251–270

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Philippe Garrigues

Rights and permissions

About this article

Cite this article

Amri, F. Carbon dioxide emissions, output, and energy consumption categories in Algeria. Environ Sci Pollut Res 24, 14567–14578 (2017). https://doi.org/10.1007/s11356-017-8984-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-017-8984-7