Abstract

This study explores the role of foreign direct investment (FDI), financial development (FD), and globalization (GLO) in environmental degradation (ED) through the channel of energy consumption (EC) for the selected panel of belt and road initiative (BRI) countries for 1990–2017. The study applies appropriate panel unit root tests, the Westerlund cointegration test, the dynamic seemingly unrelated regression (DSUR) long-run panel estimation approach, and the Dumitrescu–Hurlin panel causality test. Results of panel unit root test ascertain variables are interred either at a level or after first difference and long-run association documents by implementing conventional and error correction. Study findings with DSUR, in the long run, reveal that energy consumption and economic growth expose positive statistically significant association with environmental degradation, implying intensity in energy consumption and aggregate output level shall augment the present state of environmental degradation. While negative statistically significant effects reveal running from FDI, financial development, and globalization to environmental degradation, implying that energy efficiency technology, the scope of green financing through financial development, and cross country effects help the economy reduce environmental consequences with lesser carbon emission. Results of directional causality unveiled feedback hypothesis available in explaining the causality between environmental degradation and energy consumption [ED←➔EC] and FDI and environmental degradation [FDI←➔ED], moreover, unidirectional effects running from financial development, globalization, and economic growth to environmental degradation, i.e., [FD➔ED; GLO➔ED; Y➔ED]. The finding reveals the need to formulate energy policies that promote belt and road (BR) country energy efficiency.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

As a consequence of global warming, environmental degradation has risen to a serious issue for both industrialized and developing countries. Following the transition of world economies from crude tools to more complex machines during the Industrial Revolution, global economies began experiencing an acceleration in their economic growth and development pace in the late nineteenth century. It is an established belief in the literature that the industrial revolution is responsible for greenhouse gas accumulation and eventually plays a destructive role in degrading the state of the environment. Over the past decades, research in empirical investigations have been trying to figure out the root causes of environmental dilapidation (Kaufmann et al. 1998; Tamazian et al. 2009; Kochi and López 2013; Audi and Ali 2018); however, a consensus about the responsible factors is yet to be reached. Moreover, according to existing literature, growing researchers establish a group of macro fundamentals that are responsible for environmental degradation, either direct or indirect association, including factors such as fossil energy consumption (Bölük and Mert 2014; Ali et al. 2020a), foreign direct investment (Shahbaz et al. 2018; Adamu et al. 2019; Nadeem et al. 2020), financial development (Al-mulali et al. 2015; Adams and Klobodu 2018), trade openness (Al-Mulali and Ozturk 2015; Gulistan et al. 2020), and gross capital formation (Rahman and Ahmad 2019; Rjoub et al. 2021).

The motivation of the study is to seek the potential impacts of foreign direct investment (FDI, hereafter), financial development (FD, hereafter), and globalization (GLO, hereafter) on environmental degradation (ED, hereafter) with the presence of energy consumption (EC, hereafter) in empirical estimation for a panel of B&R initiative countries for the period 1990–2017. This study contributes in the following two ways: First, numerous time series and panel studies have investigated such relationships (Sadorsky 2010; Sadorsky 2011; Islam et al. 2013; Ozturk and Acaravci 2013; Solarin et al. 2013; Qamruzzaman and Jianguo 2020) but to the author’s knowledge, it is scant, and studies have not yet been undertaken in the context of B&R initiative countries, which is potentially an important panel for such kind of investigation. Second, prior empirical literature used panel data analysis techniques and combined country analysis. In contrast, this study used a unique set of country-wise long-run estimations. This study used the second generation DSUR estimator approach and took the longest data available for the analyzed variables. This study assists both China and other B&R initiative countries in knowing and detecting the potential adverse impacts of the initiative, which will assist in providing practical information for policymakers.

The debate over environmental degradation, energy consumption, FDI, globalization, and financial development will clarify the controversy surrounding the belt and road initiative (BRI), which China first suggested in 2013. The B&R initiative comprises two routes, the Silk Road Economic Belt and the 21st Century Maritime Silk Road. This initiative intends to connect infrastructure networks and build trade among Asia with Europe and Africa along the ancient Silk Road routes. Therefore, it is one of the main priorities and important pillars of the B&R initiative activities to strengthen the energy cooperation along the B&R routes (Framework 2015). The B&R initiative about the energy sector is not without controversy. It might also have productive impacts, such as a rise in financial provision and infrastructure development. Further, it is expected that the B&R initiative will enhance energy security in China along with partner countries through enhancing production, energy supply, and energy efficiency gain.

In contrast, the international community believes that China’s outdated industries will transfer to the rest of the countries through this initiative, resulting in a decline in their environmental quality and energy consumption (Jelinek 2017). This opposing view will prevent or discourage various economies from participating in this initiative. This will also stop those countries from induction of technological advancement, finance, and expertise-related activities in their countries (Han et al. 2018).

In the current era of globalization, the debate on energy policy and its regulation are considered a critical research area among practitioners and academics. Energy consumption is an important part of economic development (Belke et al. 2011), social, and sustainable development (Kahouli 2017). Due to the rise in the world’s economic growth, the gap between the demand and supply of energy has increased rapidly over the past years, increasing energy insecurity as today’s world economy grew rapidly, affecting the energy consumption level. Therefore, an appropriate level of energy supply is also a challenge for world economies. For instance, the global economy grew 22.9 times from 1971 to 2015. Along with economic growth, total energy consumption levels in 2015 rose about 2.2 times to their 1971 levelFootnote 1.

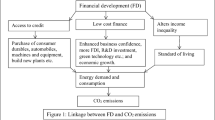

Over the last few decades, several studies have investigated the relationship between energy and economic development. In most of these studies, an increase in energy consumption has been linked to economic growth (Saud et al. 2018). Thus, it is also possible to find a link between energy consumption and financial development (Çoban and Topcu 2013). The financial sector performs a crucial role in the stability and development of an economy. Meanwhile, the term financial development mostly refers to an increase in the financial activities of a country for instance, an increase in foreign direct investment (FDI), increase in the provision of credit to the private sector, financial sector, private sector by the bank, or an increase in an economy’s stock market activities. Financial development performs a crucial role in a country’s financial systems, increasing economic efficiency and energy consumption (Sadorsky 2011). Three different channels are existing through which the financial development and energy consumption nexus could be explained. First, financial development encourages more FDI inflows, which leads to enhancing energy consumption and economic growth. Second, financial development causes financial sector development, which leads to efficient financial intermediation approaches to more consumer credits which surge in the purchases of big-ticket items. Third, the development of the capital markets and financial markets facilitates more reserves in economies, enhancing energy consumption (Zhang 2011).

Financial development may facilitate investments such as providing more funds to new firms, bringing more opportunities to establish and/or upgrade the renewable energy sector newly. Financial development attracts more FDI, leading to technological innovations and reducing energy consumption (Chang 2015a, b). It has the fact that FDI is one of the reliable sources that boost domestic production capacities and bring upgraded technologies and increase investment through finance provisions (Sirin 2017). Therefore, the researchers believe that only superior knowledge and management practices can sustain and give international enterprises an edge on foreign soil, probably through FDI (Doytch and Narayan 2016). Further, there is ample literature that explored the nexus between FDI and energy consumption. FDI can enhance energy consumption by developing and expanding the industrial, logistics and manufacturing sectors, where energy is considered the backbone of the industrialized process. The nexus between FDI and energy consumption is less highlighted but the essential area which needs further investigation through updated data and advances econometrics techniques (Abidin et al. 2015).

The novelty of the study lies in the following aspects. First, even though empirical literature has been produced, a growing number of studies concentrating on environmental degradation by taking time series and panel data, but so far our best knowledge, this is the first ever empirical study conducted by taking account of BRI centuries. The study firmly believes that the new data set with empirical assessment will open a new avenue for restructuring and rethinking environmental development and environmental policy formulation in BRI nations, which eventually supports long-run sustainable economic integration. Second, for detecting the impact of financial development on environmental degradation, the study has considered both proxy measures for financial development, which allows investigating the respective agent role in environmental issues. Moreover, support to make policy formulation and implementation of the green environment is considered. Third, the study applied newly introduced panel regression, DSUR, to explore the magnitudes of explanatory variables on environmental degradation. In empirical estimation, DSUR can be performed with heterogeneous sets of regressors joining the regressions and when equilibrium errors are associated through cointegration regressions.

The rest of the paper is organized as follows. Section 2 explains the literature review. Section 3 discusses the data and methodology. Section 4 provides the estimated results along with its discussion. The final section concludes the paper.

Literature review

Environmental degradation and energy consumption

Energy is a critical aspect in the growth of an economy and the provision of essential services that considerably enhance the well-being of persons. Traditionally, energy has been seen as a driving force behind economic development and advancement. However, its manufacture, usage, and byproducts have led to significant environmental demands, both in resource use and environmental degradation (Rehman and Rashid 2017). The decoupling of energy use and production presents significant obstacles in the pursuit of sustainable development. Gains in energy efficiency and a shift toward the environmentally responsible usage of renewable resources should be the long-term aim of wealth and ongoing growth, rather than the other way around. However, in many emerging and underdeveloped nations, inadequate access to environmentally acceptable energy supplies is a severe barrier. The destruction of the environment is one of the most significant concerns that the world is now experiencing, for the simple reason that it has negative consequences for human health, biodiversity, the ozone layer, air quality and natural resources (water, soil, and forest), as well as the economy as a whole. Among the variables contributing to environmental degradation, the growing worldwide trend in CO2 emissions is the most significant. It is linked to an increase in energy demand.

The nexus between environmental adversity and macro factors have immensely attracted and grew interested among researchers, academicians, and international development agencies. The underlying motivation is to figure out the key determinants and the possible preventive measures for lessening the speed of environmental degradation. Energy intensity, especially fossil sources of energy consumption for the aggregate production process, emerged as the prime responsible actor for environmental adversity due to a higher degree of carbon emission (Naradda Gamage et al. 2017). Excessive carbon and greenhouse gas emissions from various economic activities into the environment result in global warming, temperature increase, and abrupt ecosystem behavior, which are the direct results of environmental degradation (Lashof and Ahuja 1990). A growing number of members of empirical studies have accused energy consumption as primarily responsible for environmental degradation, see for instance Nasir and Ur Rehman (2011), Saboori and Sulaiman (2013), Shahbaz et al. (2013a), Dabachi et al. (2020), and Usman et al. (2020). Economic growth with excessive conventional energy consumption accelerates overall economic progress at the cost of environmental degradation (Bastola and Sapkota 2015).

Rahman (2020) investigates the role of energy consumption, economic growth, and global environmental degradation by taking 10 highly electricity-consuming countries for 1992–2013. Study documents that electricity consumption intensifies the speed of environmental degradation. However, the impact of globalization establishes negative statistically significant environmental degradation, implying the role of environmental improvement. The enhancement in globalization and cross-country industrialization has constantly been supporting a higher level of output, indicating the direct linkage with energy consumption (as (such as electricity, coal, gas, and oil) and carbon emission (Rahman and Kashem 2017). Adebayo and Kirikkaleli (2021) document that global integration assists the economy for effective implementation of environmental protective measures, and environmental adversity on the socio-economic state can be reduced substantially. Alam et al. (2007) gauge the impact of energy consumption on environmental degradation for sustainable development in Pakistan. They suggest that to secure the long-term growth of the economy, environmental deterioration should not rise over time but should instead be mitigated or at the very least maintained at a constant level. If it continues to rise, the economy will be forced to move even far away from sustainability. Akhmat et al. (2014) document that energy integration boosts economic drivers for causing the environmental pollutants in SARAC nations.

Financial development is considered one of the most important drivers of energy consumption and carbon emissions. It is thought that they have significant interrelationships with one another. According to Shahbaz et al. (2013a), the results regarding the nexus between financial development and energy usage are still in the early stages. However, the results regarding the nexus between carbon emissions and financial development have produced wildly disparate results (Mahdi Ziaei 2015). According to existing literature, energy consumption can be intensified in two different channels, i.e., the first positive augmentation due to financial development, see for an instant Sadorsky 2010, Zaman and Moemen (2017). Literature suggests that by making it easier for consumers and businesses to obtain access to financing resources for large-ticket purchases, financial development promotes energy consumption during manufacturing and daily life. This leads to an increase in energy consumption in both production and daily life usage. Second, the inhibitory effects are an adverse association between financial development and energy consumption (Topcu and Payne 2017; Gómez and Rodríguez 2019).

Energy consumption and macro fundaments

The Chinese government proposed the belt and road initiative (BRI) in late 2013, attracting world attention (Godement and Kratz 2015; Palit 2017). There is no doubt that the BR Initiative will have a significant impact on the world economies in all areas such as financial, environmental, economic, energy, educational, and political (Shahbaz et al. 2013b). Like the significance of other economic variables, financial development can also positively stimulate and brings several changes within an economy, such as it assists the easy availability of financial capital, stimulates global investments, facilitating the easy availability of energy-efficient appliances, minimizes financial risks, reducing borrowing cost, and enhances transparent economic transactions between borrowers and lenders. All such stimulation of economic activities can affect energy consumption with fixed investment of businesses in different economies (Saud et al. 2018). The financial development provides liquidity for the establishment of energy-efficient projects.

On the other hand, energy also plays an integral part in the financial sector’s smooth running. Development in the financial sector can boost its liquidation for investment activities, industrial expansion, facilitating new infrastructure, and significantly affecting energy consumption (Islam et al. 2013). Hence, this study categorizes the empirical literature based on two strands, i.e., the first part comprises the strand that employs time series data, and the second part is composed of the strand which has used the panel county data framework.

Shahbaz et al. (2018) probe energy-finance nexus in Tunisia for 1971–2008. The ARDL and Johansen cointegration tests were adopted for data analysis. The results specify the presence of a long-run relationship between energy consumption and finance. Moreover, the bidirectional causal relationship between two variables was also detected. Similarly, another study concluded that financial development, population, and economic growth drive energy consumption. In addition, the feedback effect between financial development and energy consumption is detected in Malaysia. In the short run, energy consumption Granger causes by financial development (Tang and Tan 2014). A similar study probes the presence of a long-run association between FDI, relative price, economic growth, FD, and energy consumption while applying the Johansen and Juselius cointegration approach. This study presented a bidirectional link between growth and energy consumption and a unidirectional causal link from financial development toward economic growth. Another study investigated the long-run relationship between energy and finance for Pakistan for 1972–2012 (Kumar et al. 2016). The finding of this empirical work revealed the significant positive influence of financial development on energy consumption. More recently, Saudi Arabia examines the energy-finance nexus from 1971 to 2011 (Anser et al. 2020). The study’s finding explored the presence of a one-way causal link from financial development to energy demand. Similarly, Kahouli specified that escalation in financial development accelerates energy consumption, which adversely stimulates Israel’s real output growth (Kahouli 2017).

In panel country analysis, we perceived a direct relationship between energy and financial development for a panel of 22 developing countries for 1990–2006 (Shahbaz et al. 2016). The finding of the study reveals the positive relationship between the explanatory variables. In another study, Sadorsky (2011) explored the influence of financial energy nexus using data of 9-CEEF economies. The findings show that financial development (FD) enhances the energy demand when the FD measures used as the financial system deposits to GDP, bank deposit and bank assets to GDP, stock market capitalization, and liquid liabilities to GDP. Xu probes the finance and energy relationship for 29 provinces of China during the period 1999–2009. This study employed the GMM approach. The finding showed a positive relationship between the consumption of energy and financial development (Xu 2012).

Another similar study focusing on a panel of GCC countries investigates the long-run association between economic growth, trade openness, financial development, urbanization, and energy consumption by applying the Pedroni cointegration approach (Al-mulali and Lee 2013). The study’s findings uncovered that trade openness, financial development, urbanization, and economic growth positively impact energy consumption. Furthermore, the two-way causality exists between financial development and growth, energy consumption and growth, trade openness and economic growth, openness and financial development, openness, and urbanization. Furthermore, a one-way causal relationship is detected from financial development toward energy consumption and urbanization toward energy consumption. Ilam examines the effects of financial development on energy consumption from 1971 to 2009 (Tang and Tan 2014). The finding discovered the existence of a bidirectional causal link between energy and financial development. Chang’s deliberate that financial development can bring opportunities regarding renewable energy sector expansions by providing more funds for innovative firms (Chang 2015a, b). Besides, FDI may bring more technological advancement result in a reduction of energy consumption.

Further, Furuoka (2015) studied the association between finance and energy consumption in Asia from 1980 to 2012 by employing a panel cointegration test. The finding confirms the long-run association between finance and energy consumption. Besides, the one-way causality relationship is noticed running toward financial development from energy consumption. Hence, the rise in energy consumption might motivate the acceleration of financial development in Asia. Furthermore, it confirms that financial development in the financial sector development reduces energy consumption in BRICS countries (Alsaman et al. 2017). In another study, Fan et al. offer that high energy efficiency can minimize energy consumption, increasing China’s financial development (Fan et al. 2017).

Material and methods

The analysis of this study is based on the fifty-nine belt and road initiative (BRI) countriesFootnote 2. The Chinese State Information Center hosted seventy-one BRI countries (Saud et al. 2019a, b). However, the selection of countries and the choice of the period (1990–2017) were constrained by the data appropriateness and accessibility, which reduced our sample size to only fifty-nine BRI countries. The main variables of the study are environmental degradation (ED), energy consumption (EC), financial development (FD), foreign direct investment (FDI), and globalization (GEO). The data is collected from the World Development Indicator (WDI, 2017).

Environmental degradation is measured by tons of CO2 emission per capita (Rehman and Rashid 2017). The FDI is measured by the net inflow of foreign direct investment (% of GDP), financial development is gauged by domestic credit to the private sector (% of GDP), domestic credit provided to the private sector by banks (% of GDP), and domestic credit provided by the financial sector (% of GDP) (Pohekar and Ramachandran 2004; Qamruzzaman and Jianguo 2018; Qamruzzaman and Wei 2018; Qamruzzaman and Wei 2019; Sun et al. 2020). GDP per capita (constant 2010 US$) represents economic growth. Energy consumption denotes energy use (kg of oil equivalent per capita). Globalization has expressed the globalization index (Kearney and Policy 2006; Ahmed and Le 2020; Aluko et al. 2021). The choice of selecting the variables for the study is based on several prior empirical works of literature. To facilitate the interpretation of the estimated coefficient, we transformed the variables into their logarithm. It will also control the heteroskedasticity issue and will reduce the differences in the heterogeneous panel data. The variables, along with their measure, data sources, and frequency, are presented in Table 1.

The methodology of the study

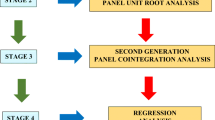

This study empirically explores the nexus among the analyzed variables, i.e., financial development, FDI, growth, energy consumption, and globalization for a heterogeneous panel of B&R initiative countries. Base on prior empirical work, Shahbaz et al. 2016, Alsaman et al. (2017) study assumed the following energy consumption function:

where ED stands for environmental degradation, EC for energy consumption, FD represents financial development, FDI shows foreign direct investment; Y is economic growth; GLO indicates globalization. The analyzed variable is taken in their natural logarithm so that to acquire consistent results. The log-linear form can be a rewrite of Eq. (1) as follows:

T represents the number of periods, I indicates several countries; and λ represents the error term. β0 shows the slope-intercept, β1t, β2t, β3t, and β4t are the coefficient estimates of FD, GDP, FDI, and GLO.

Cross-sectional dependency test

The cross-section dependency test is essential in panel date empirical research, especially when representative nations have comparable economic characteristics, such as developing nations, rising economies, and transition nations. Because of trade internationalization, financial integration, and globalization, a comparable economy is susceptible to the effects of any shock in other nations. As a result, analysis of cross-sectional dependence is most often required in empirical research using panel data. The Lagrange multiplier (LM) test was proposed by Breusch and Pagan (1980), which is preferred in a situation when the cross-section (N) is smaller than time (T). Base on the following equation, we can construct LM test statistics as follows:

where yit denotes a dependent variable, xit are the independent variable and the subscript of t, and i represents cross-section and period, respectively. The coefficients of αi and βi respectively represent the country-specific intercept and slope in the equation. In the contest of LM cross-section dependency test, the null hypothesis of cross-section independence - HO= COV(uitujt)=0 for all t, and t≠j, against the alternative hypothesis of cross-sectional dependence - - HO= COV(uitujt)≠0 for at least t≠j. Moreover, the LM test statistics can be computed with the following equation:

where \( {\hat{\rho}}_{ij} \) represents the pairwise correlation of the residuals.

The LM test is not suitable in a situation with a larger cross-section (N), therefore overcoming this limitation. Pesaran (2004) suggests the following Lagrange multiplier (CDlm) that is the scaled version of the LM test:

Under cross-sectional independence of the null hypothesis with t➔ ∞ and then N➔ ∞, CDlm test statistics follow an asymptotic normal distribution (see, (Nazlioglu et al. 2011; Menyah et al. 2014; Wolde-Rufael 2014). In the case of larger N relative to T, CDlm estimation is subject to size dissertation. Therefore, Pesaran (2006) proposed the following CD test, which is suitable in a situation when N is larger than T shows as follows:

The CD test followed an asymptotically standard normal distribution of investigation of the null hypothesis of cross-sectional interdependency with t➔ ∞ and then N➔ ∞ in any order (Nazlioglu et al. 2011). Furthermore, the CD test might produce distorted information when the population average pairwise correlation is zero. The individual pairwise correlation is non-zero. Limiting the negative effect, Pesaran et al. (2008) proposed the bais-adjusted LM test. LMadj utilized the exact mean and variance of the LM statisitcs in case of the large panel first t➔ ∞ and then N➔ ∞. The bias-adjusted LM statistics can be computed with the following equation:

where k refers to the number of regresses, uTij and \( {\upsilon}_{Tij}^2 \) specify the mean and variance of \( \left(T-K\right){\hat{\rho}}_{ij}^2 \), respectively.

Dumitrescu and Hurlin’s (2012) panel causality test

Non-granger causality test is proposed by Dumitrescu and Hurlin (2012) with the extension and modification of the conventional non-Granger causality test. The following causality equation is to be implemented for investigating directional association in the empirical assessment.

This test has a special feature: it will consider the differing degrees of dependence and variability in the results. To allow for the concept of Granger causality, the examination relies on the Wald statistics of the different cross-sectional groups. It thus considers all of the coefficients to be unique over the cross-sectional data. The test forms the average statistic linked with the null Homogeneous Non- Causality (HNC) hypothesis as follows:

This experiment contains two hypotheses: the null hypothesis that a single process is the only trigger and the alternate hypothesis that a community of processes is the cause. This approach suggests that the null hypothesis of no association between time and some statistical measure is placed fourth to compare the alternative hypothesis of correlation to a subset of the time sequence. The main aim is to investigate the overt and indirect impact of multiple indicators on one another. This test reveals that the harmonized Z-test statistic, adjusted for fixed T samples, also has a standard normal distribution as shown here:

Results and discussions

Before checking and analyzing the stationarity of the data, it is imperative to check it for cross-sectional dependence in the context of heterogeneous panels. To this end, the Pesaran 2004, Pesaran (2007) CD tests have been implied, which is more consistent and reliable for panel data. The CD test outcomes are noted in Table 2, which confirms cross-sectional dependence in the panel data since the probability value is below 0.09. Hence, the findings show cross-sectional dependency for foreign direct investment, energy consumption, economic growth, globalization, and financial development.

Panel unit root test

The econometric analysis starts with the panel unit root test to check the data’s stationarity. Several panel unit root tests proposed by prior literature, such as the first generation panel unit root tests, i.e., Levin Lin Chu (LLC) familiarize Levin et al. (2002), and Hadri (2000), Breitung (2001) and the second generation panel unit root tests (i.e., IM Pesaran Shin, Fisher PP, Fisher ADF test, and CIPS and CADF initiates by Pesaran (2007)). The results of the first-generation unit root tests are displayed in Table 2. However, the first generation estimator may not appropriate reliable results due to the test’s low power (O'Connell 1998) (Table 3).

Therefore, this study prefers to employ the CIPS and CADF tests established by Pesaran and Yamagata (2008) for panel unit root confirmation. The results of panel unit root tests are present in Table 4, showing that the evaluated variables become stationary at first differences [I(1)] and unit root at levels.

Padroni and Westerlund panel cointegration test

After confirmation of the stationarity in the data at the first differences, next to find out the cointegration among the analyzed variables, this study applied panel cointegration test following Pedroni (1999), Pedroni (2004), and Westerlund panel cointegration test proposed by Westerlund (2007). The results of the Pedroni panel cointegration test are displayed in Table 5. Referring to the test statistics, it is obvious that out of 11 test statistics, the majorities are statistically significant at a 1% significance level. This suggests that the availability of long-run association in the empirical equation.

This method is useful to detect heterogeneity in the data and provides more consistent and robust results. The Westerlund cointegration results, see Table 6, infer that both group and probability statistics are significant at a 1% significance level. The finding suggests that the null hypothesis of no cointegration is rejected. Thus, cointegration exists among the analyzed variables, i.e., ED, EC, FDI, FD, Y, and GLO.

Baseline estimation with OLS, fixed effects, and random effects model

Before implementing the empirical target models with advanced econometrical methodology, we understand the sign of association by implementing conventional panel regression, including ordinary least square, random effects (RE, hereafter), and fixed effects (FE, hereafter). The Hausman test’s associated p value ascertain that the empirical model coefficient with FE is robust compared with the other two estimations.

Referencing model estimation with financial development measured by domestic credit by the financial sector. See model – [1] with column 3. The study finding reveals a positive statistically significant nexus between energy consumption and environmental degradation (a coefficient of 0.122), which aligns with Rehman and Rashid (2017). Study findings suggest that a higher production scale consumes more energy, thus allowing higher greenhouse gas emissions. A negative statistically significant impact of financial development on environmental degradation (a coefficient of −0.447) is in line with Tamazian et al. (2009). This suggests that the demand for energy consumption will be subsidies due to shifting from conventional energy to green energy. Similar effects also expose that is the impact of globalization on environmental degradation (a coefficient of 0.221) indicates that global economic integration induces pressure forces in the economy to utilize environmentally friendly energy to lessen greenhouse gas emissions. On the other hand, the positive injection was established from inflows of FDI (a coefficient of 0.566) and economic growth (a coefficient of 0.681) to environmental degradation. These findings suggest that economic progress through increased aggregate production causes a high degree of investment in production and industrialization, thus augmenting the present state of energy consumption and eventually additional carbon emission for excessive fossil energy consumption.

Empirical model results with financial development proxy by credit by bank are displayed in column [6] of Table 4. Study documents a positive statistically significant association between energy consumption and environmental degradation (a coefficient of 0.127). Moreover, the association between financial development (a coefficient of −0.244) and globalization (a coefficient of −0.199) with environmental degradation is negative and statistically significant at a 1% level. Findings suggested that the application of green energy is the outcome of financial development and financial and economic integration worldwide. In contrast, a positive, statistically significant association establishes between inflows of FDI (a coefficient of 0.472) and economic growth (a coefficient of 0.114) with environmental degradation.

Based upon the baseline estimation, it is convincingly revealed that energy consumption plays a critical role in environmental degradation in B&T countries. Thus, as a policy implication concern, countries for mitigating the environmental issues should have concentrated on energy application and integration for aggregated production and industrialization. Furthermore, globalization and foreign capital flow play a constructive role in environmental improvements, implying that technological advancement and green energy consumption can intensify the economy with foreign investment and broader association.

DSUR long-run estimation results

The key inference of empirical work is to analyze the long-run estimations among the analyzed variables. This study implied the second generation estimator DSUR established by Mark et al. (2005). The DSUR estimator is a good predictor and provides consistent normal distribution, even if N’s value is smaller than the value of T. This approach is used to estimate the long-run coefficient of ED, EC, FDI, Y, FD, and GLO. Along with the DSUR approach for panel data analysis, the DOLS approach is employed for country-wise analysis. The DSUR panel long-run estimation and DOLS approach results are presented in Tables 6 and 7, respectively.

DSUR long-run estimates

The key empirical results of DSUR long-run estimation are displayed in Table 5. It is worth mentioning that referring to the probability values and t-statistics values, all the explanatory variables’ coefficient estimates are statistically significant.

The nexus between energy consumption and environmental degradation, the study disclosed positive statistically significant association in both model estimations, specifically in model -1 (a coefficient of 0.214) and in model -2 (a coefficient of 0.179), while is in line with Acheampong (2018), Kivyiro and Arminen (2014), Bozkurt and Akan (2014), and Eyuboglu and Uzar (2021). Study finding suggests that a 10% augmentation of energy consumption shall intensify the process of environmental degradation by releasing carbon in the atmosphere by 2.14% and 1.79%, respectively. Energy application in various economic activities is the cost of environmental pollution (Ali et al. 2020b) since all the energies are not produced from renewable sources.

For the FDI role in environmental degradation, study documents deterring role, implying that FDI inflows decrease the speed of carbon emission in B&R initiative countries. Particularly, FDI has highly significant (at 1% level) and negative effects on environmental degradation. The magnitude of −0.116 and −0.125 suggests that a 10% progress in FDI can increase environmental adversity by −1.16% and −1.25%, respectively, in models 1 and 2. Our empirical result is consistent with the prior empirical literature, for instance, Lee (2013) for G20, Ozturk and Acaravci (2013) for Malaysia, and Alam et al. (2015)) for SAARC countries but disprove the empirical findings of Shahbaz et al. (2018) for France, and Farhani and Solarin (2017) for the USA. Study finding suggests that those FDI inflows are the key factor behind causing the lower degree of fossil energy consumption in the initiative regions and encourage renewable energy consumption (Emre Caglar 2020). The FDI inflows motivate foreign investors to set up new businesses or expand their existing businesses in the host country, resulting in high energy demand and consumption in the region. Moreover, FDI inflows bring efficient technology, knowledge sharing of the advanced production processes, and human skill enhancement, resulting from less reliance on fossil energy (Chang 2015a, b). FDI inflows, therefore, are negatively connected with environmental degradation in the B&R initiative countries.

Financial development connection with environmental degradation has exposed negative statistical significance in both empirical estimations. It implies that financial development does impede environmental degradation by reducing carbon emissions. More precisely, a 10% rise in financial development can intensify the process of environmental degradation by −1.77% and −1.41%, respectively, in models 1 and 2. Study findings support the existing literature, such as Tamazian and Bhaskara Rao (2010) Tamazian et al. (2009), and Saud et al. (2019a, b). The negative estimated coefficient shows that financial development has a marginal impact on aggregated economic activities with reducing energy consumption in these countries. Environmental quality relies on access to and effective financial resources linked to economic growth (Khan et al. 2017). The proxies used for financial development measure significantly the negative effects of environmental degradation in B&R initiative countries. However, the growth of financial resources may have a deterministic effect on environmental performance. A highly developed financial sector can permit greater finance at cheaper prices, which may be used for a variety of purposes, including investment in environmental initiatives. The capacity to obtain such money may be particularly crucial for governments—at the local, state, and national levels—because a large portion of environmental protection will be carried out by the public sector. It, on the other hand, pertained to private sector investments in environmentally beneficial activities that were mandated by law. Furthermore, it has been shown that companies with superior governance are more ready to take environmental factors into account. As a result, increased environmental performance may be achieved via enhanced governance in the financial sector growth.

The relationship between economic growth and environmental degradation exposes positive statistically significant associateship, which is established in model 1 (a coefficient 0.514) and model 2 (a coefficient of 0.441) that keeping other things constant. More specifically, a 10% rise in economic growth can cause environmental deterioration by 5.14% and 4.41%, respectively. This empirical finding is similar to the finding reached for India (Tamazian et al. 2009). In contrast, this result is not similar to the US’s finding (Farhani and Solarin 2017). High growth requires more energy consumption, as energy is an essential factor in producing goods and services (Pohekar and Ramachandran 2004). Our result is also similar to Qamruzzaman et al. (2020). The expansion of industrial activities and economic activities such as investment, production, purchasing, shopping, and consumption required more energy contributing to the gross domestic product. Further, the use of old technologies, lack of skills, old methods of production, the absence of knowledge, and no diversity in energy sources cause high energy consumption in the BRI countries.

The coefficient estimate of globalization with environmental degradation is negative and highly significant at a 1% significance level. The coefficients −0.485 and −0.255 infers that a 10% increase in globalization decreases the propensity of environmental adversity by 4.85% and 2.55%, respectively. The result infers that globalization hurts environmental issues in the long run. This result is in line with Qamruzzaman and Jianguo (2020) for India, and Saud et al. (2018) for China and not in line with Dogan and Deger (2016) for Brazil, and Shahbaz et al. (2013b) for Singapore. Globalization is a slow process that reduces carbon emissions in the B&R initiative with the positive integration of green and renewable energy consumption. The negative link may be due to the use of advanced energy-efficient technologies in the production processes or due to unsuitable improvement in the total production factor and economic growth. The high economic growth determines high energy demand for the production of goods and services if advance or energy-efficient technologies are not implied in the production process (Solarin et al. 2013).

Further, globalization assists the transfer of innovative technologies from cross-border, i.e., from developed countries, toward developing countries. It brings an innovative production method rather than the traditional production methods and increases the comparative advantages among different nations. It boosts trade and economic activities boosting financial markets and brings innovation and fresh knowledge to the regions.

This study’s reported results are reliable and robust since this study employed different tests along with second-generation long-run estimators. The results drawn from different models used are robust. The results are similar across both models used with different financial development measures. Further, this study uses the longest available dataset for the explanatory variables for the B&R initiative panel countries, providing robust results (Table 8).

Results from DOLS (country-wise analysis)

After analyzing the long-run estimation for panel data, it is imperative to comprehend the dynamic nexus between FDI, EC, and FD across individual countries. The fully modified ordinary least square model (FMOLS) is applied to analyze the data’s long-run country-wise analysis. The results of DOLS estimations are presented in Table 7.

The association between energy consumption and environmental degradation study reveals both positive and negative statistical associations. For positive, a list of 44 (forty-four) countries including Tajikistan, Bosnia and Her-Panama, Slovenia, Kuwait, Romania, Philippines, Azerbaijan, Bulgaria, Qatar, Malaysia, Israel, Poland, Albania, Turkey, India, Saudi Arabia, Singapore, Yemen Rep., Pakistan, Kyrgyz Rep., Vietnam, Jordan, Colombia, Estonia, Morocco, Slovak Rep., Armenia, Mongolia, Croatia, Ethiopia, China, Bahrain, Bangladesh, Macedonia, Czech Rep., Moldova, Myanmar, Thailand, Egypt, Hungary, Indonesia, Sri Lanka, and Cambodia. While, for the negative association, study documents 15 (fifteen) countries, namely, South Africa, New Zealand, Ukraine, Korea Rep., Nepal, Lebanon, UAE, Georgia, Russia, Iraq, Iran, Brunei Daru- Belarus, Kazakhstan, and Oman.

Study findings focusing on foreign direct investment impacts on environmental degradation detects positive statistically significant connection in (forty countries) Malaysia, Armenia, New Zealand, Bosnia and Her-, Israel, Croatia, India, Lebanon, Georgia, Qatar, Colombia, Yemen Rep., Slovenia, Azerbaijan, China, Nepal, Iran, Iraq, Morocco, Macedonia, Ukraine, Thailand, UAE, Russia, Turkey, Kazakhstan, Tajikistan, Brunei Daru-, Bangladesh, Panama, Singapore, Ethiopia, Bulgaria, Egypt, Romania, Jordan, Oman, Indonesia, Philippines, and Czech Rep. Moreover, a group of countries that has exposed negative statistically significant interlinkage with environmental degradation is Mongolia, Moldova, Myanmar, Albania, South Africa, Kyrgyz Rep., Poland, Bahrain, Korea Rep., Sri Lanka, Saudi Arabia, Cambodia, Vietnam, Kuwait, Slovak Rep., Pakistan, Hungary, Belarus, and Estonia. Study finding suggests the positive role of FDI in improving the environmental consequences due to excessive carbon emission. It is apparent that though FDI assists in technological advancement, knowledge sharing and higher output with industrialization at the cost of the environment are observed. Heavy equipment utilization demands a higher level of energy consumption, and eventually, the pressure for excessive CO2 emissions happened. Therefore, countries in BRI have to put considerable efforts into managing the destructive effects of FDI and channelizing the positive impact for the betterment of socio-economic development.

The finding infers that financial development has a positive and significant impact on environmental degradation in (thirty-three countries) Pakistan, Yemen Rep., Myanmar, Thailand, Jordan, India, Qatar, Albania, Bulgaria, Bosnia and Her, Panama, Ethiopia, Kyrgyz Rep., New Zealand, Colombia, Georgia, Cambodia, Kazakhstan, Poland, Hungary, Slovak Rep., Nepal, Indonesia, Saudi Arabia, Korea Rep., Czech Rep., Belarus, Brunei Daru-, Iraq, Ukraine, Azerbaijan, UAE, and Moldova. This finding infers that financial development positively stimulates the consumption of energy in these countries. It is recommended regarding policy implications in these countries to enhance the induction of high energy-efficient technology through financial development in the financial and banking sectors. Further, financial institutions should invest more in energy-efficient projects and R&D to boost efficient production and consumption of energy. While, on the other hand, it is observed that financial development has an adverse influence on energy consumption in (twenty-six countries) Vietnam, Estonia, Philippines, Russia, Macedonia, Lebanon, Morocco, Turkey, Tajikistan, Egypt, China, Singapore, Oman, Iran, Bangladesh, Romania, Bahrain, Slovenia, Mongolia, Armenia, South Africa, Malaysia, Israel, Croatia, Kuwait, and Sri Lanka. The development of the financial sector positively contributes to the efficient use of energy or energy conservation policies. The policymaker needs to keep constant or to further improve such energy conservation policies in the future.

The coefficient of foreign direct investment has a significant positive impact on environmental degradation in ten BRI countries like Armenia, Azerbaijan, Bahrain, China, Egypt, Kazakhstan, Korea Republic, Myanmar, Tajikistan, and Yemen. This result infers that high energy consumption encourages more investments and growth activities, which call for further financial development in the regions. To reduce high energy consumption, strict rules and policies regarding FDI inflow are needed in the above countries. The high tariff on the induction of old and high energy consumption technology can reduce high energy consumption in these economies, unlike the negative and significant impact of FDI on energy consumption found in eleven BRI countries, including Albania, Belarus, Bosnia and Herzegovina, Brunei Darussalam, Estonia, Georgia, Indonesia, Iran, Jordan, Poland, and UAE. It means that FDI inflow in these countries brings energy-efficient technology, knowledge, and skills to the host country. At the same time, the insignificant impact was observed in thirty-eight BRI countries, including Bangladesh, Bulgaria, Colombia, Cambodia, Croatia, Czech Republic, Ethiopia, Hungary, India, Iraq, Israel, Kuwait, Kyrgyz Republic, Lebanon, Malaysia, Macedonia, Mongolia, Moldova, Morocco, New Zealand, Nepal, Oman, Panama, Pakistan, Philippines, Qatar, Russia, Romania, Singapore, Saudi Arabia, Slovenia, Slovak Republic, Sri Lanka, South Africa, Turkey, Thailand, Ukraine, and Vietnam.

Regarding the estimated coefficient of globalization concerning environmental degradation found significant and positive in thirty BRI countries, i.e., Ethiopia, Turkey, Czech Rep., Malaysia, New Zealand, Nepal, China, Albania, Croatia, Kuwait, Pakistan, Bahrain, Sri Lanka, Kazakhstan, Georgia, Belarus, Morocco, UAE, Poland, Slovak Rep., Panama, Cambodia, Singapore, Oman, Vietnam, Yemen Rep., Israel, Azerbaijan, Moldova, Egypt, Tajikistan, Macedonia, Estonia, and Saudi Arabia. This finding infers that an increase in globalization causes high energy consumption. The possibility can be due to inefficient energy consumption technology transfer through globalization. It is urged that the government should take initiative steps to establish strict policies regarding FDI inflows and trade. Further, high taxes on old and outdated high energy consumption technologies are required to reduce energy consumption. Unlike the above finding, globalization also has a negative and significant impact on environmental degradation in twenty BRI countries, including Brunei, South Africa, Lebanon, Indonesia, Colombia, Iraq, Armenia, Slovenia, Bangladesh, Philippines, Thailand, Bosnia and Her, Ukraine, Myanmar, Bulgaria, Kyrgyz Rep., Iran, Russia, Hungary, India, Korea Rep., Qatar, Jordan, Romania, and Mongolia.

The economic growth has a significant positive impact on environmental degradation in forty-five BRI countries, including Nepal, Croatia, Armenia, Moldova, Bulgaria, Philippines, Romania, Israel, Estonia, Slovak Rep., Mongolia, Jordan, Sri Lanka, Belarus, Panama, Oman, Qatar, Ethiopia, Russia, New Zealand, Bangladesh, Thailand, Turkey, Lebanon, Bosnia, Slovenia, India, Indonesia, Georgia, Iraq, Saudi Arabia, Pakistan, Brunei Daru, Hungary, Czech Rep., Poland, China, Azerbaijan, Colombia, Yemen Rep, UAE, Albania, Macedonia, Korea Rep, and Kyrgyz Rep. This result implies that the above B&R initiative countries are energy-dependent. Therefore, energy conservation policies are needed to preserve high energy consumption. High energy consumption leads to high economic growth; consequently, efficient energy utilization is required to maintain high economic growth with low energy consumption. Hence, the escalation in energy consumption leads to high growth and investments in the regions. Unlike the above result, economic growth also has an adverse influence on the environmental aspect in fourteen BRI countries like Nepal, Croatia, Armenia, Moldova, Bulgaria, Philippines, Romania, Israel, Estonia, Slovak Rep, Mongolia, Jordan, Sri Lanka, Belarus, Panama, Oman, Qatar, Ethiopia, Russia, New Zealand, Bangladesh, Thailand, Turkey, Lebanon, Bosnia, Slovenia, India, Indonesia, Georgia, Iraq, Saudi Arabia, Pakistan, Brunei Daru, Hungary, Czech Rep., Poland, China, Azerbaijan, Colombia, Yemen Rep, UAE, Albania, Macedonia, Korea Rep, and Kyrgyz Rep (Table 9).

Dumitrescu Hurlin (DH) panel causality

The DSUR panel long-run estimation results are not appropriate to offer sufficient evidence about the causal relationship between the analyzed variables for appropriate policymaking. Knowledge about the causal link between environmental degradation, energy consumption, foreign direct investment, globalization, and financial development can help craft appropriate environmental strategies and policies in the regions that guarantee sustainable economic development. This study implied the panel causality approach for testing the null hypothesis of the homogeneous non-causality counter to the alternative hypothesis of heterogeneous non-causality (Dumitrescu and Hurlin 2012). The significance of using this approach is that it permits having heterogeneous unrestricted coefficients through CD and dissimilar log structures. This technique, composed of two statistics, i.e., Z bar-statistics, demonstrates the standard normal distribution of the test. The W bar statistics demonstrate the average statistics. The DH panel causality test results are stated in Table 8. The panel causality test exposes several direction associations in the empirical model. However, the study intended to investigate the directional effects of environmental degradation from target-independent variables.

For a bidirectional association that is supporting the presence of feedback hypothesis, study documents bidirectional effects are running between environmental degradation and energy consumption [ED←➔EC] which is in line with Zheng et al. (2018), Wang et al. (2007), and foreign direct investment and environmental degradation [FDI←➔ED], it is in the line with study of Muhammad et al. (2021), Cheng et al. (2019), and Yuan et al. (2016). Furthermore, unidirectional causality runs from financial development to environmental degradation [FD➔ED], globalization to environmental degradation [GLO➔ED], and economic growth to environmental degradation [Y➔ED], respectively.

The empirical results imply the presence of a feedback hypothesis between FD and EC. Prior empirical works also find a similar result, for instance, Farhani and Solarin (2017) for the USA, Dogan and Aslan (2017) for GCC countries, and Shahbaz et al. (2013b) for Malaysia. It offers FD assistance in providing easy loans or debts to establish new businesses, investment activities, or purchasing durable energy consumption goods. The rise in energy consumption enhances economic expansions resulting in a rise in demand for financial services that further guarantee financial development. The finding infers that both FD and EC are complementary (Islam et al. 2013). Our study supports a two-way causal link between GDP and EC. This finding is similar to Sadorsky (2010) for Malaysia, Kahouli (2017) for SMCs, and Alsaman et al. (2017) for BRICS. It infers that both EC and GDP impact each other, suggesting that EC and GDP-related policies should be implanted mutually. The causality results indicate a mutually reinforcing (feedback) effect between FD and GDP. This finding validates both the demand–supply side hypothesis and is similar to the finding reached by Solarin et al. (2013). The FD enhances capital formation, opens opportunities for entrepreneurs, stimulates trade, and offers financial resources with low costs, motivating foreign investors to invest in the home country, enhancing domestic output. Thus, escalation of economic growth occurs (Shahbaz et al. 2017b). Two-way causal association is detected between GDP and FD. Similar results are also found by Al-mulali and Lee (2013) for GCC countries and Islam, Islam et al. (2013) for Malaysia.

Furthermore, the bidirectional causal relationship is observed between globalization and FD, globalization and GDP, GDP and FDI, FDI and FD, and globalization and EC. However, it differs concerning a unidirectional causal link detected from EC toward FD. This result is similar to the finding reached by Furuoka (2015) and Tan and Tang (2016); they illustrate that the energy conservation policy should be implanted. Similarly, a one-way causal relationship was detected running from energy consumption to foreign direct investment (Table 10).

Discussion

The role of macro-fundamentals on environmental degradation has been extensively investigated with policy assessment and strategic development for mitigating the persistent flows of carbon emission n by taking time series and panel data with the application of various econometrical tools. The motivation of the study is to explore fresh insights through the assessment of energy consumption (EC), foreign direct investment (FDI), financial development (FD), and globalization (GLO) on environmental degradation by taking a panel of 59 countries from B&R initiative for the period from 1990–2017. Several econometrical tools apply for association evaluation purposes, and the key findings are as follows.

First, before empirical model estimation, the study initiates elementary basement by performing cross-sectional dependency, heterogeneity, and variable order of integration through panel unit root tests. The result of cross-sectional dependency tests confirms the sharing of common dynamic properties by the research units. Panel unit root tests reveal that variables are integrated in mixed order, indicating few variables are stationary at level. Few variables become stationary after the first difference neither variables exposed integration after the second difference. Moreover, second-generation unit root tests, commonly known as CIPS and CAFD, can handle cross-sectional dependency issues and similar document line of variables integration found in conventional unit root tests.

Second, long-run cointegration in empirical model is evaluated by implementing panel cointegration tests offered by Pesaran and Shin (1998) and error correction-based cointegration test introduced by Westerlund (2008). Conventional panel cointegration test reveals that the majority of the test statistics are statistically significant at a 1% level, implying the availability of long-run relationships among ED. EC, FDI, FD, GLO, and Y. Furthermore, Westerlund cointegration test results show the presence of long-run cointegration among the analyzed variables.

Third, for empirical model estimation with DSUR, study finding establishes positive statistically significant effects running from energy consumption to environmental degradation. It is in line with existing literature, for instance, Sehrawat et al. (2015) and Raza et al. (2019). Intense energy consumption, especially reliance on fossil energy, produces detrimental effects for the environment by augmenting carbon emissions. In the recent period, the transition from fossil energy to renewable energy becomes the key strategic decision taken by the countries to lessening the adverse consequence on environment by eliminating CO2 emission (Adebayo and Kirikkaleli 2021). Energy consumption transition to renewable energy reliance assists the economy is two-fold: environmental destruction mitigation with less CO2 injection and reduction of production cost by decreasing environmental protection, the green economy adaptation (Ben Mbarek et al. 2018). FDI inflows exposed a negative statistically significant association with environmental degradation, indicating that technological advancement with energy efficiency and efficient industrial processes based on renewable energy helps the economy take environmental preventive measures. Qamruzzaman and Jianguo (2020) advocate that foreign capital flows augment the energy transition process from fossil to renewable energy, indicating that industrial output with energy efficiency can positively impact environmental quality improvement. Thus, emerging economies have to shift in energy efficiency. Industrialization and aggregate activities have to be based on renewable sources rather than conventional energy sources. Doytch and Narayan (2016) postulate the FDI focusing service industry continuously seeking energy-efficient operation, encouraging the economy to formulate energy policies favoring renewable energy growth over conventional sources.

Referring to globalization impacts on environmental degradation, the study discloses a negative statistically significant association, indicating that global integration plays a positive role in enhancing environmental quality in the long run (Balsalobre-Lorente et al. 2020). When it comes to promoting clean technology (technological effect), globalization may be considered to have an influence. It also encourages the adoption of required regulatory measures to promote competitiveness and efficiency. Study finding disproves the earlier researcher findings, see for instance Shahbaz et al. (2017a).

Fourth, the directional causality between environmental degradation, energy consumption, FDI, financial development, globalization, and economic growth by implementing the panel Granger causality test is familiarized by Dumitrescu and Hurlin (2012). Study findings reveal feedback hypothesis hold for explaining the causal effects running between environmental degradation and energy consumption [ED←--EC] and FDI and environmental degradation [ED←➔FDI]. Study findings suggest that in the long run, the improvement of environmental quality is caused by the application and integration of energy sources in the economy; on the other side, environmental quality concerns shall guide industries for the transition from fossil energy to renewable energy in the production process. Furthermore, the role of FDI that is energy-efficient technological development and knowledge sharing shall play a critical role in environmental development. Side by side, protective measures for environmental cost shall discourage foreign investors’ reliance on fossil energy rather than entice them to integrate renewable energy. Study documents unidirectional causal effects running from financial development to environmental degradation [FD➔ED], globalization to environmental degradation [GO➔ED], and economic growth to environmental degradation [[Y➔ED].

In order to reduce energy consumption in the long run, the high energy consumption countries should need to specialize in their production of non-energy intensive products. Efficient energy use will enhance the production activities along with economic growth in the selected B&R initiative countries. The energy-intensive industries and firms should be forced by strict energy consumption regulations. The financial institution should invest more in energy-efficient technology, efficient energy consumption projects, and research and development-related programs. Further, the encouragement of advanced technology through foreign investments and an increase in tariff on old and outdated technologies will also reduce high energy consumption in these countries. Public awareness regarding the efficient utilization of energy is also an important step to mitigate energy consumption.

Conclusion

The purpose of the study is to gauge the impact of financial development, foreign direct investment, and globalization on environmental degradation in BRI nations through the channel of energy consumption for the period 1990–2017. Several econometrical tools were considered for empirical assessment that variable stationary properties were detected by performing panel unit root test including CADF and CIPS following Pesaran (2007), the test of heterogeneity following Pesaran and Yamagata (2008). The long-run cointegration was evaluated through the implementation of panel cointegration test following Pedroni (2001), Pedroni (2004), ADF test following Kao (1999), and Westerlund (2008) error correction-based cointegration test. For exploring the long-run elasticity of explanatory variables on environmental degradation, the study applied dynamic seemingly uncorrelated regression (DSUR) and directional causality documented through Dumitrescu and Hurlin (2012) causality test. The key findings of the study are stated below.

First, the variable stationary properties study documented that all the variables are stationary after the first difference; moreover, the CSD tests confirmed the sharing of common attributes among the research units. Second, according to test statistics of the panel cointegration test, it is ascertained the long-run cointegration an empirical equation. Third, considering the long-run magnitudes estimated with DSUR, the study documented the positive statistically significant effects of energy consumption on environmental degradation. It is suggested that heavily relying on fossil fuel by BRI nations have been augmenting environmental adversity by injecting carbon dioxide. Whereas, the coefficient of FDI, financial developments, and globalization exposed negative statistically significant linkage with environmental degradation, suggesting an improvement in environmental correction. More specifically, technological advancement and energy-efficient operations with clean energy integration at the aggregate level prompt an environmentally friendly ecosystem by lowering the level of carbon emission. Fourth, for the results of directional causality test, study findings reveal that feedback hypothesis holds for explaining the causal effects running between environmental degradation and energy consumption [ED←➔EC] and FDI and environmental degradation [ED←➔FDI].

In a nutshell, study findings suggest improving the environmental discomfort due to excessive carbon emission due to fossil fuel integration in industrial output in BRI nations. However, capital adequacy resulting from financial development and energy-efficient technological integration with clean energy applications has emerged as an important factor in improving environmental adversity. Thus as far as policy formulation and implementation are concerned, it is suggested with appreciating the empirical findings that environmental policy formulation and effective implementation in BRI nations have to be initiated. The following policy suggestion is derived from the study findings.

First, clean energy integration through motivating the energy investment in the renewable energy sector with capital assistance. Financial sector expansion can play a critical role in capital accumulation and allocation in renewable energy output and support initial investment. Second, foreign investment inflows should be encouraged with effective environmental policies for adopting the green environment concept with clean energy. Availability of energy-efficient technologies through FDI can enhance carbon emission reduction in the economy and transit into an eco-friendly environment. Third, the global economic and financial integration creates an ambiance for energy efficiency that is external effects motivate countries to transform fossil fuel-based economy to renewable energy integration.

Even though the study tried to explore the role of FDI, financial development, and globalization for environmental degradation through energy consumption, this study is not out of limitation. Thus, it is suggested that future studies can be initiated with asymmetric assessment. The positive and negative shocks’ impacts on the environment might open a new avenue for policy makers to rethink the process in formulating environmental policies.

Data availability

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

Notes

IEA. World Energy Statistics and Balances. Paris: International Energy Agency; 2017.

Albania, Azerbaijan, Armenia, Bahrain, Belarus, Bangladesh, Bosnia and Herzegovina, Bulgaria, Brunei, Cambodia, Colombia, China, Czech Republic, Croatia, Egypt Arab Rep., Ethiopia, Estonia, Georgia, Hungary, Indonesia, India, Iran Iraq, Islamic Rep., Israel, Jordan, Kazakhstan, Kuwait, Kyrgyz Rep., Korea Rep., Lebanon, Macedonia, Mongolia, Malaysia, Moldova, Myanmar, Morocco, New Zealand, Nepal, Oman, Panama, Pakistan, Poland, Philippines, Qatar, Russian Federation, Romania, Singapore, Saudi Arabia, Slovak Republic, South Africa, Slovenia, Sri Lanka, Thailand, Tajikistan, Turkey, United Arab Emirates, Ukraine, Vietnam, Yemen Republic.

References

Abidin ISZ, Haseeb M, Azam M, Islam R (2015) Foreign direct investment, financial Development, international trade and energy consumption: panel data evidence from selected ASEAN Countries. Int J Energy Econ Policy 5(3)

Acheampong AO (2018) Economic growth, CO2 emissions and energy consumption: what causes what and where? Energy Econ 74:677–692

Adams S, Klobodu EKM (2018) Financial development and environmental degradation: does political regime matter? J Clean Prod 197:1472–1479

Adamu TM, Haq IU, Shafiq M (2019) Analyzing the impact of energy, export variety, and FDI on environmental degradation in the context of environmental Kuznets curve hypothesis: a case study of India. Energies 12(6):1076

Adebayo TS, Kirikkaleli D (2021) Impact of renewable energy consumption, globalization, and technological innovation on environmental degradation in Japan: application of wavelet tools. Environment, Development and Sustainability

Ahmed Z and Le HP (2020) "Linking information communication technology, trade globalization index, and CO2 emissions: evidence from advanced panel techniques." Environ Sci Pollut Res: 1-12.

Akhmat G, Zaman K, Shukui T, Irfan D, Khan MM (2014) Does energy consumption contribute to environmental pollutants? Evidence from SAARC countries. Environ Sci Pollut Res 21(9):5940–5951

Al-mulali U, Lee JY (2013) Estimating the impact of the financial development on energy consumption: evidence from the GCC (Gulf Cooperation Council) countries. Energy 60:215–221

Al-Mulali U, Ozturk I (2015) The effect of energy consumption, urbanization, trade openness, industrial output, and the political stability on the environmental degradation in the MENA (Middle East and North African) region. Energy 84:382–389

Al-mulali U, Tang CF, Ozturk I (2015) Does financial development reduce environmental degradation? Evidence from a panel study of 129 countries. Environ Sci Pollut Res 22(19):14891–14900

Alam A, Malik IA, Abdullah AB, Hassan A, Awan U, Ali G, Zaman K, Naseem I (2015) Does financial development contribute to SAARC′ S energy demand? From energy crisis to energy reforms. Renew Sust Energ Rev 41:818–829

Alam S, Fatima A, Butt MS (2007) Sustainable development in Pakistan in the context of energy consumption demand and environmental degradation. J Asian Econ 18(5):825–837

Ali MU, Gong Z, Ali MU, Wu X and Yao C (2020a) "Fossil energy consumption, economic development, inward FDI impact on CO2 emissions in Pakistan: testing EKC hypothesis through ARDL model." International Journal of Finance & Economics n/a(n/a).

Ali W, Sadiq F, Kumail T, Li H, Zahid M, Sohag K (2020b) A cointegration analysis of structural change, international tourism and energy consumption on CO2 emission in Pakistan. Curr Issue Tour 23(23):3001–3015

Alsaman AS, Askalany AA, Harby K, Ahmed MS (2017) Performance evaluation of a solar-driven adsorption desalination-cooling system. Energy 128:196–207

Aluko OA, Opoku EEO, Ibrahim M (2021) Investigating the environmental effect of globalization: Insights from selected industrialized countries. J Environ Manag 281:111892

Anser MK, Yousaf Z, Nassani AA, Vo XV, Zaman K (2020) Evaluating ‘natural resource curse’hypothesis under sustainable information technologies: a case study of Saudi Arabia. Res Policy 68:101699

Audi M and Ali A (2018) "Determinants of environmental degradation under the perspective of globalization: a panel analysis of selected MENA nations."

Balsalobre-Lorente D, Driha OM, Shahbaz M, Sinha A (2020) The effects of tourism and globalization over environmental degradation in developed countries. Environ Sci Pollut Res 27(7):7130–7144

Bastola U, Sapkota P (2015) Relationships among energy consumption, pollution emission, and economic growth in Nepal. Energy 80:254–262

Belke A, Dobnik F, Dreger C (2011) Energy consumption and economic growth: new insights into the cointegration relationship. Energy Econ 33(5):782–789

Ben Mbarek M, Saidi K, Rahman MM (2018) Renewable and non-renewable energy consumption, environmental degradation and economic growth in Tunisia. Qual Quant 52(3):1105–1119

Bölük G, Mert M (2014) Fossil & renewable energy consumption, GHGs (greenhouse gases) and economic growth: Evidence from a panel of EU (European Union) countries. Energy 74:439–446

Bozkurt C, Akan Y (2014) Economic growth, CO2 emissions and energy consumption: the Turkish case. Int J Energy Econ Policy 4(3):484

Breitung J (2001) The local power of some unit root tests for panel data. Nonstationary panels, panel cointegration, and dynamic panels, Emerald Group Publishing Limited: 161-177.

Breusch TS, Pagan AR (1980) The Lagrange multiplier test and its applications to model specification in econometrics. Rev Econ Stud 47(1):239–253

Chang S-C (2015a) Effects of financial developments and income on energy consumption. Int Rev Econ Financ 35:28–44

Chang S-C (2015b) Threshold effect of foreign direct investment on environmental degradation. Port Econ J 14(1):75–102

Cheng C, Ren X, Wang Z, Yan C (2019) Heterogeneous impacts of renewable energy and environmental patents on CO2 emission - evidence from the BRIICS. Sci Total Environ 668:1328–1338

Çoban S, Topcu M (2013) The nexus between financial development and energy consumption in the EU: A dynamic panel data analysis. Energy Econ 39:81–88

Dabachi UM, Mahmood S, Ahmad AU, Ismail S, Farouq IS, Jakada AH, Kabiru K (2020) Energy consumption, energy price, energy intensity environmental degradation, and economic growth nexus in african OPEC countries: evidence from simultaneous equations models. J Environ Treat Tech 8(1):403–409

Dogan B, Deger O (2016) How globalization and economic growth affect energy consumption: panel data analysis in the sample of BRIC countries. Int J Energy Econ Policy 6(4)

Dogan E, Aslan A (2017) Exploring the relationship among CO2 emissions, real GDP, energy consumption and tourism in the EU and candidate countries: evidence from panel models robust to heterogeneity and cross-sectional dependence. Renew Sust Energ Rev 77:239–245

Doytch N, Narayan S (2016) Does FDI influence renewable energy consumption? An analysis of sectoral FDI impact on renewable and non-renewable industrial energy consumption. Energy Econ 54:291–301

Dumitrescu E-I, Hurlin C (2012) Testing for Granger non-causality in heterogeneous panels. Econ Model 29(4):1450–1460

Emre Caglar A (2020) The importance of renewable energy consumption and FDI inflows in reducing environmental degradation: bootstrap ARDL bound test in selected 9 countries. J Clean Prod 264:121663

Eyuboglu K, Uzar U (2021) A new perspective to environmental degradation: the linkages between higher education and CO2 emissions. Environ Sci Pollut Res 28(1):482–493

Fan L, Pan S, Liu G, Zhou P (2017) Does energy efficiency affect financial performance? Evidence from Chinese energy-intensive firms. J Clean Prod 151:53–59

Farhani S, Solarin SA (2017) Financial development and energy demand in the United States: new evidence from combined cointegration and asymmetric causality tests. Energy 134:1029–1037

Framework I (2015) "Vision and actions on jointly building silk road economic belt and 21st-century maritime silk road."

Furuoka F (2015) Electricity consumption and economic development in Asia: new data and new methods. Asian-Pac Econ Lit 29(1):102–125

Godement F and Kratz A (2015) One Belt, One Road’: China’s great leap outward. European Council on Foreign Relations.

Gómez M, Rodríguez JC (2019) Energy consumption and financial development in NAFTA Countries, 1971–2015. Appl Sci 9(2):302

Gulistan A, Tariq YB, Bashir MF (2020) Dynamic relationship among economic growth, energy, trade openness, tourism, and environmental degradation: fresh global evidence. Environ Sci Pollut Res 27(12):13477–13487

Hadri K (2000) Testing for stationarity in heterogeneous panel data. Econ J 3(2):148–161

Han L, Han B, Shi X, Su B, Lv X, Lei X (2018) Energy efficiency convergence across countries in the context of China’s Belt and Road initiative. Appl Energy 213:112–122

Islam F, Shahbaz M, Ahmed AU, Alam MM (2013) Financial development and energy consumption nexus in Malaysia: a multivariate time series analysis. Econ Model 30:435–441

Jelinek JA (2017) Shifting relations in South-East Asia: the changing Philippine-Sino-American foreign relations in the early era of the Duterte administration, Central European University.

Kahouli B (2017) The short and long run causality relationship among economic growth, energy consumption and financial development: evidence from South Mediterranean Countries (SMCs). Energy Econ 68:19–30

Kao C (1999) Spurious regression and residual-based tests for cointegration in panel data. J Econ 90(1):1–44

Kaufmann RK, Davidsdottir B, Garnham S, Pauly P (1998) The determinants of atmospheric SO2 concentrations: reconsidering the environmental Kuznets curve. Ecol Econ 25(2):209–220

Kearney A, Policy F (2006) Globalization index. Foreign Policy 157:74–81

Khan MTI, Yaseen MR, Ali Q (2017) Dynamic relationship between financial development, energy consumption, trade and greenhouse gas: comparison of upper middle income countries from Asia, Europe, Africa and America. J Clean Prod 161:567–580

Kivyiro P, Arminen H (2014) Carbon dioxide emissions, energy consumption, economic growth, and foreign direct investment: causality analysis for Sub-Saharan Africa. Energy 74:595–606