Abstract

Based on the time series data of the Yangtze River Delta region from 1993 to 2015, this paper uses the state space model and the mediating effect model to investigate the time-varying effect and its mechanism of financial development (measured by two indicators: financial scale and financial efficiency), urbanization on carbon emissions. The results show a positive in the short term and negative in the long-run impact of financial scale on carbon emissions, while the impact of financial efficiency on carbon emissions is negative in the short term and positive in the long term, and the impact of urbanization on carbon emissions is always positive. Moreover, the results of mediating effect test demonstrate that urbanization is a positive partial mediating effect in the path of financial scale and financial efficiency influencing carbon emissions, and the mediating effect accounts for 71.64% and 61.69% of the total effect, respectively. The mediating effect of financial development includes chain effect and parallel effect; in the chain mediating effect, financial scale has a negative mediating effect with 27.40% of the total effect in the path of urbanization affecting carbon emissions, whereas financial efficiency plays a positive role with 2.07%; in the parallel mediating effect, the individual effect of financial scale and financial efficiency accounts for 24.39% and 1.05%, respectively.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Under the background of global climate change and increasing greenhouse effect, low-carbon economy has become a new trend of economic development. As the biggest carbon emitter, China’s energy saving and emission reduction play a decisive role in governing global environmental pollution and controlling greenhouse gas emissions. In order to realize the goal of CO2 emissions per unit of GDP will be 40% to 45% lower than in 2005 by 2020, developing low-carbon economy has become an inevitable trend. Meanwhile, it is also a hot academic topic about how to achieve carbon emission reduction approaches and low-carbon economy. There are many factors affecting carbon emissions, such as economic growth, energy consumption, and trade. High economic growth rates and flourishing trades have led to increasing energy consumption, and fossil fuel energy consumption is one of the most significant contributors to carbon emissions. With the development of economy, the financial industry is more and more prosperous. Financial development has two types of impacts on carbon emissions. Firstly, the use of advanced technology in financial development can effectively improve the efficiency of energy use; at the same time, the environmental protection regulations can be formulated by increasing the attractiveness of financial and technological support. In this way, the negative impacts of financial development on environmental pollution can be reduced (Adom et al. 2018). However, financial development can lead to economic growth and rapid development of various human activities, which may increase carbon emissions (Cetin et al. 2018). Furthermore, an increased urbanization rates will contribute to residential energy consumption and then affect the emissions of greenhouse gas (Fan et al. 2017).

With the improvement of urbanization level, China’s carbon emissions have increased by about 45.80% from 131 million tons in 2005 to 192 million tons in 2015, which indicates urbanization has an important impact on carbon emissions. By the end of 2015, the urbanization rate of the core area in the Yangtze River Delta had reached 68%, which was significantly higher than the national average. The total GDP accounted for 20.3% of the whole country, and the per capita GDP was 100.01 thousand yuan. The deposits of financial institutions exceeded 30 trillion yuan, and loans amounted to 21,102.3 billion yuan. Financial development can adjust the industrial structure and allocate resources, which will further affect carbon emissions. With the acceleration of urbanization and economic development, energy consumption and environmental pollution in the Yangtze River Delta urban agglomeration are also increasing, becoming a highly concentrated and intensified sensitive zone of a series of ecological and environmental problems (Fang 2014). As one of the most developed regions in China, the Yangtze River Delta is expected to play a leading role in China’s low-carbon development (Jia et al. 2018). Therefore, this paper studies the balanced and unbalanced effects of financial development and urbanization on carbon emissions from the perspective of the Yangtze River Delta urban agglomeration and explores the mechanism of financial development and urbanization in the process of influencing carbon emissions, that is, the mediating effect, and hopes to provide guidance for the government to make decisions.

The main contributions of this research in the current literature are as follows: (i) it examines the dynamic time-varying effects of financial development, urbanization on carbon emissions in the Yangtze River Delta for the period of 1993–2015 applying state space model and mediating effect model; many important policy implications can be inferred by the results of the research; (ii) unlike the previous studies, this paper has explored the impact of financial development and urbanization on carbon emissions from the perspective of urban agglomeration, which is more related to the regional development of environmental research; and (iii) the empirical results of this study will provide policymakers a better understanding of financial development, urbanization and CO2 emissions to formulate energy saving, and reduction policies to ameliorate the pressure of environmental pollution.

The rest of the paper is as follows: the “Literature review” section presents literature review, the “Data and methodology” section highlights methodology, the “Results and discussions” section discusses and analysis the empirical results, and the “Conclusions and policy implications” section presents the conclusions and policy implications.

Literature review

Finance is the core of the modern market economy, clarifying the relationship between financial development and carbon emissions is of great significance for realizing energy saving and emission reduction. In the early literature, scholars often implied the impact of financial development on carbon emissions in the process of influencing economic growth, believed that financial development could promote economic growth and reduce environmental pollution (Acaravci and Ozturk 2010; Frankel and Romer 1999). With the development of environmental finance, more and more scholars have begun to research the direct relationship between finance and environment, such as Boutabba (2014), Dogan and Seker (2016), and Shahbaz et al. (2013a) found that financial development has a long-term positive impact on carbon emissions, which means that financial development increases environmental pollution. Similarly, Abbasi and Riaz (2016) found that financial development did not aid in mitigating CO2 emissions rather it increased it in a small emerging economy. Whereas, some scholars held different opinions and pointed out that financial development had a negative effect on carbon emissions (Al-Mulali et al. 2015; Shahbaz et al. 2013b; Salahuddin et al. 2018). Specifically, Jalil and Feridun (2011) believed that an efficient and orderly financial market would improve the efficiency of energy use to a certain extent, so as to restrain the increase of carbon emissions and protected the environment; Ghosh (2010) and Zhang (2011) who studied the mechanism of indirect and direct impact of financial development on carbon emissions and believed that financial development would increase the industrial level, and then indirectly affected the level of carbon emissions. In addition, some researches had proved that financial development had no significant effect on carbon emissions (Ozturk and Acaravci 2013; Salahuddin et al. 2018). Besides, there is also nonlinear relationship between financial development and carbon emissions in addition to the direct linear relationship. According to Kong and Wei (2017), financial development efficiency and carbon emission showed an inverted U-shaped relationship in Eastern regions in China, but the financial development scale in Central and Western regions had a U-shaped relationship between carbon emissions.

In addition, the relevant researches on the relationship between urbanization and carbon emissions also provide a reference for this paper. By 2015, the urbanization rate is as high as 56.1% in China. Although it is lower than the level of urbanization in developed countries, China’s urbanization will increase by 1% every year and quickly enter the ranks of highly urbanized countries according to the viewpoint of Jian and Huang (2010). Generally, higher urbanization level often means more energy consumption. Satterthwaite (2009) found the increasing consumption level and consumption scale caused by population urbanization had a stronger impact on carbon emissions than population growth itself. Poumanyvong and Kaneko (2010) revealed that the increase of urbanization rate had increased energy consumption, which led to the increase of carbon emissions. Similarly, many scholars studied the relationship between urbanization and carbon emissions, and agreed that urbanization had a positive effect on carbon emissions (Xu et al. 2018; Wang et al. 2016, 2018c; Wu et al. 2016). Contrary to these findings, some researchers believe that the development of urbanization will not increase carbon emissions. Liddle (2004) and Chen et al. (2008) considered that the population density had increased with the development of urbanization; the increasing population density enhanced the utilization efficiency of public facilities. Therefore, per capita energy consumption and carbon emissions would gradually decrease with the increase of urbanization level. Zhang et al. (2016) believed that urbanization would restrain carbon emissions through human capital accumulation and cleaner production technology promotion. Zhang and Xu (2017) analyzed the panel data for Chinese provinces and demonstrated that land urbanization could make contribution to reducing carbon emissions. Furthermore, Yao et al. (2018) explored the question of whether urbanization process could be harmonious with carbon emission abatement and proved that urbanization can contribute to declines in carbon emissions, but the abatement effect of urbanization on carbon emissions weakens with a deepening urbanization. In addition, there is also a nonlinear relationship between urbanization and carbon emissions. Zhang et al. (2017) and Bekhet and Othman (2017) found that there was an inverted U-shaped relationship between urbanization and carbon emissions; whereas Li et al. (2018) and Shahbaz et al. (2016) thought there was a U-curve relationship between CO2 emissions and urbanization.

Although most scholars tend to study the relationship between financial development, urbanization, and carbon emissions separately, some have conducted comprehensive analyses. Saidi and Ben Mbarek (2017) examined the impact of urbanization, income, trade, and financial development on CO2 emissions in 19 emerging economies, the results showed urbanization decreased the CO2 emissions, and financial development had a long-run negative impact on carbon emissions. Charfeddine and Ben Khediri (2016) investigated the relationship between carbon emissions, financial development, and urbanization for the UAE, there was an inverted U-shaped relationship between financial development and CO2 emissions, urbanization declined carbon emissions. Asumadu-Sarkodie and Owusu (2017) found that a 1% increase in financial development would increase carbon emissions by 0.7%, while a 1% increase in urbanization would decrease carbon emissions by 0.2%. Haseeb et al. (2018) revealed that energy consumption and financial development contributed to the carbon dioxide emissions, whereas urbanization had a negative effect on carbon dioxide emissions. Farhani and Ozturk (2015) examined the casual relationship between CO2 emissions, financial development and urbanization in Tunisia, the results showed a positive relationship, suggesting that the financial development and urbanization in Tunisia had taken place at the expense of environmental pollution. Pata (2018) explored the short- and long-run dynamic relationship between CO2 emissions, financial development, and urbanization in Turkey, found that there was a long-run relationship between the three variables, and urbanization and financial development positively affected CO2 emissions. In China’s Yangtze River Economic Belt, financial agglomeration had a significant positive impact on population urbanization and economic urbanization (Ye et al. 2018), then urbanization and income growth could lead to increased CO2 emissions (Ma et al. 2017). Salahuddin et al. (2015) found that economic growth caused the greater increases in CO2 emissions, followed by urbanization and financial development.

Based on the above literature, it can be seen that most of the current research has been conducted from the perspective of national level or provincial level to explore the relationship between financial development, urbanization, and carbon emissions, while fewer studies have been done from the perspective of urban agglomerations, which are the main form of future regional development and new urbanization construction. In addition, the existing literature generally uses a single method to analyze the relationship between financial development, urbanization, and carbon emissions, whereas lacks of further research on the time-varying effect and its mechanism of financial development and urbanization on carbon emissions. Therefore, this paper uses quantitative method to discuss the time-varying effect of financial development, urbanization on carbon emissions, and the mediating effect of financial development and urbanization in the Yangtze River Delta urban agglomeration.

Data and methodology

Data

This study covers annual frequency data over the period of 1992–2016 for the case of the Yangtze River Delta including Jiangsu, Zhejiang, and Shanghai province. The data on financial development (FS and FE), urbanization (UR), and carbon emissions (CE) are from the Statistical Yearbook of China, the Statistical Yearbook of Jiangsu, the Statistical Yearbook of Zhejiang, the Statistical Yearbook of Shanghai, China Energy Statistical Yearbook, and Statistical Bulletin of National Economic and Social Development.

Variables description

Financial development: financial development increases carbon emissions through scale expansion and reduces carbon emissions by improving technology and optimizing structure. Referring to relevant literature, we use the two variables of financial scale and financial efficiency to measure financial development (Huang and Zhao 2018; Zhang et al. 2015). Specifically, Financial Scale (FS) = deposits and loans of financial institutions/GDP × 100%; Financial Efficiency (FE) is calculated by stochastic efficiency frontier model (Wang et al. 2018a), which the output variable is the added value of financial industry and input variables are the number of employees (labor input) and the loan balance (capital input) in financial industry.

Urbanization (UR) includes population urbanization, land urbanization, economic urbanization, and social urbanization. In fact, the most important feature of urbanization is population urbanization; the development of population urbanization will directly cause the changes of employment urbanization and life urbanization, then affect the regional economic, trade, energy consumption, and technological level, and ultimately affect carbon emissions. Therefore, this paper selects population urbanization (urban population/household registration population) to measure the level of urbanization. Due to the lack of urban population data, it is replaced by non-agricultural population data.

Carbon emissions (CE): equal to multiply the carbon emission coefficient after calculating the actual energy consumption according to the coefficient of various energy sources converted into standard coal. We choose eight main energy sources, the conversion coefficients of eight energy sources into standard coal are from the China Energy Statistics Yearbook, and the carbon emission coefficients of various energy sources refer to the requirement of Intergovernmental Panel on Climate Change (IPCC 2006) of the United Nations. The specific coefficients are shown in Table 1.

Methodology

State space model

Taking carbon emissions (CE) as the dependent variable, financial scale (FS), financial efficiency (FE), and urbanization (UR) as independent variables, and the variable parameters model is constructed as follows.

Among them, Formula (1) is the “measurement equation,” which shows the relationship between carbon emissions and financial scale, financial efficiency, and urbanization. Coefficient vectors b1t, b2t, and b3t are state vectors, represent the elasticity values of carbon emissions to financial scale, financial efficiency, and urbanization at different time points; a1 is constant term, μt is disturbance term, which the mean value is 0, variance is a normal distribution; Formula (2), (3), and (4) are the “state equation,” describing the process of generating state variables; b1t, b2t, and b3t are variable parameters, change with time, and they are non-observable variables and can be expressed as first-order Markov process. In this paper, we use the recursive form to define the state space model, ϕ and ε are recursive coefficients. The value of variable parameters b1t, b2t, and b3t can be calculated by KALMAN filtering algorithm.

Mediating effect test

Referring to the relevant research (Cao et al. 2017), we need to use three measurement equations to test the mediating effect, taking the mediating conduction path of financial scale (FS) → urbanization (UR) → carbon emissions (CE) as an example. Three corresponding state space models are constructed in Formula (5) to (7).

State space model 1:

State space model 2:

State space model 3:

Among them, SV1 is the total effect of FS on CE, and SV3 is the direct effect of FS on CE, SV2 and SV4 are the mediating effect through the mediating variable UR. The specific testing steps are shown in Fig. 1.

Results and discussions

The results of unit root and co-integration test

Unit root test

To avoid the pseudo regression problem, it is necessary to test the stability and co-integration of variables before analyzing the state space model. In this paper, the ADF (Dickey and Fuller 1979) method is used to test the stability, and the results are shown in Table 2. The original sequences of FS, FE, UR, and CE are all non-stationary time series data. After the first order difference of non-stationary variables, all the variables pass the significance test. Therefore, co-integration test can be conducted.

Co-integration test

According to AIC (Akaike 1970) criterion and SC (Schwarz 1976) criterion, the optimal lag order of variables is 2, we continue to explore the co-integration relationship of FS, FE, UR, and CE. As shown in Table 3, the trace statistic value is 3.84, which is significant at the level of 10%, indicating that there is a long-term stable equilibrium relationship between FS, FE, UR, and CE.

The dynamic time-varying effect of financial development, urbanization on carbon emissions

Taking carbon emissions as dependent variable, financial scale, financial efficiency, and urbanization as independent variables, the estimation results of state space model are shown in Formula (8):

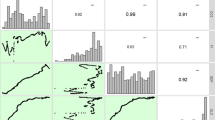

Among them, the Z values of the variable parameters are − 1.8527, 3.5589, and 5.5310, respectively, and the corresponding P values are 0.0639, 0.0004, and 0, respectively. Therefore, b1t has passed the significance test at the level of 10%, b2t and b3t are significant at the level of 1%. The specific changes of time-varying parameters in each year are shown in Table 4, and the trend chart is shown in Fig. 2.

According to the results of Table 4 and Fig. 2, we can see that: (1) The coefficient of financial scale ranges from 2.1206 in 1994 to − 1.0171 in 2015, of which the values in 1993–1997 are positive, whereas, there are always negative since 1998. The impact of financial scale on carbon emissions in the Yangtze River Delta changes from positive effect to negative effect. This is because in the initial stage, the financial resources are continuously gathering in the Yangtze River Delta region, expanding the financial scale and eventually forming a financial agglomeration area. The number of financial institutions and employees in the agglomeration area has increased substantially, which results the increase of energy demand, thus further increases carbon emissions. With the strengthening of the financial competitiveness in the Yangtze River Delta, depending on the advantages of scale, capital, and technology, the financial industry realizes the industrial structure optimization and technological advancement, and effectively promotes carbon emissions reduction. (2) The coefficient of financial efficiency ranges from − 1.5315 in 1995 to 0.9569 in 2015, the financial efficiency in the Yangtze River Delta has a negative effect on carbon emissions in the short term, but there is a positive effect in the long run. Because in the short term, the improvement of financial efficiency will result the reduction of energy consumption of unit output value. However, in the long run, the improvement of financial efficiency will attract the agglomeration of financial resources such as personnel and capital, which will have a “siphon effect” on enterprises,Footnote 1 and ultimately increase carbon emissions in the Yangtze River Delta. (3) The coefficient of urbanization ranges from 0.4051 in 1994 to 15.973 in 2015. The impact of urbanization on carbon emissions shows a strong positive effect. On the one hand, the daily life of cities and towns needs to consume more energy sources such as coal, oil, and natural gas; on the other hand, the growing urban construction increases the energy demand of steel and cement, which generates more carbon emissions. According to the research of Guo et al. (2018), construction of buildings is China’s key sector for energy consumption and CO2 emissions, so it is critical for China to realize the sectional energy conservation and emission reduction goals. Therefore, in the process of urbanization, we should pay more attention to the energy saving and environmental protection of urban construction, use green building materials and develop green buildings.

The mediating effect of urbanization

All variables are integrated of same order and have a stable long-term equilibrium relationship. Therefore, we can continue to test the mediating effect of urbanization in the path of financial development affecting carbon emissions. The results are shown in Table 5: Under the premise of controlling the urbanization factors, financial scale has a significant positive effect on carbon emissions (SV1 = 1.5849), while financial efficiency has a significant negative effect on carbon emissions (− 0.6945).

Adding the urbanization variable, there is a significant negative effect of financial scale on carbon emissions (SV3 = − 1.0384), whereas financial efficiency has a positive effect on carbon emissions (1.1369) at 1% significance level. The expand of financial scale will increase carbon emissions in the short term, while financial scale will have a mitigating effect on environmental pollution in the long run; furthermore, the improvement of financial efficiency will decrease CO2 emissions in the short term, but in the long run, the development of financial efficiency will increase carbon emissions, which are consistent with the above empirical results on time-varying effect. In the path of financial scale (FS) → urbanization (UR) → carbon emissions (CE), urbanization has a significant positive effect on carbon emissions (SV4 = 16.0635). There also is a significant positive effect (10.2685) of urbanization on carbon emissions in the path of financial efficiency (FE) → urbanization (UR) → carbon emissions (CE). In addition, financial scale has a significant positive impact on urbanization (SV2 = 0.1633), and financial efficiency has a significant negative impact on urbanization (− 0.1783). Therefore, financial scale has a negative direct effect on carbon emissions in the intermediary transmission path of FS → UR → CE, and urbanization has a partial mediating effect. In the intermediary transmission path of FE → UR → CE, urbanization also plays a partial mediating effect, that is, financial efficiency will ultimately affect carbon emissions by affecting the urbanization rate. According to the ratio formula of mediating effect to total effect (SV2 × SV4)/(SV2 × SV4+| SV3| ) (Mackinnon et al. 2002), we calculate that the mediating effect of urbanization is 71.64% in the path of financial scale and 61.69% in the path of financial efficiency. Therefore, the mediating effect of urbanization is the important way for financial scale to affect carbon emissions, and it is also a main path for financial efficiency to reduce carbon emissions. It is critical to play the mediating effect of urbanization, through the development of green and effective finance to achieve a new type of urbanization and then realize carbon emission reduction goals. The specific mediating path is shown in Fig. 3.

The mediating effect of financial development

The chain mediating effect of financial scale and financial efficiency

In this part, we construct the chain intermediary transmission paths of UR → FS → CE and UR → FE → CE on the premise that all variables are integrated of first order and there is a stable long-term equilibrium relationship, we make a regression analysis of the mediating effect. The results are shown in Table 6. Not considering the financial scale, urbanization has a significant positive impact on carbon emissions (SV1 = 10.0023), the development of urbanization will increase carbon emissions by population migration, industrial structure transformation, and urban environment change. Adding the financial scale variable, urbanization still has a significant positive effect on carbon emissions (SV3 = 16.0635), while financial scale has a negative effect on carbon emissions (SV4 = -1.0384). In addition, urbanization has a positive effect on financial scale (SV2 = 5.8372) at the 1% level of significance, which indicates that the regions with high urbanization rates tend to have a large financial scale. In conclusion, in the intermediary transmission path of UR → FS → CE, there is a positive direct effect of urbanization on carbon emissions, while financial scale has a negative mediating effect, and the mediating effect accounts for 27.40% of the total effect. This indicates that urbanization will reduce carbon emissions by the expand of financial scale, but the negative effect does not play a leading role. Therefore, it should pay attention to the role of financial scale in reducing carbon emissions in the path of urbanization affecting CO2 emissions and pursue scale effect.

Similarly, without considering financial efficiency, urbanization has a significant positive impact on carbon emissions (SV1 = 10.0023). Adding the financial efficiency variable, urbanization and financial efficiency all have negative effects on carbon emissions (SV3 = − 3.2670, SV4 = − 0.2952) at the 1% level of significance, and urbanization also has a significant negative effect on financial efficiency (SV2 = − 0.2341). Therefore, in the chain intermediary transmission path of UR → FE → CE, financial efficiency has a partial positive mediating effect, and the mediating effect accounts for 2.07% of the total effect. The urbanization will eventually reduce carbon emissions, while the mediating effect of financial efficiency will increase carbon emissions, although the positive effect is weak. This shows that the agglomeration of financial activities caused by the improvement of financial efficiency will aggravate the environmental pressure, so it is necessary to design economic activities scientifically and orderly, which is helpful to play the role of financial efficiency.

The parallel mediating effect of financial scale and financial efficiency

Financial scale and financial efficiency are two indicators to measure financial development, and the empirical results above show that there are intermediary transmission paths of financial scale and financial efficiency. In order to further comprehensively analyze the mediating effect of financial development, it is necessary to test the mediating effect of financial development. Moreover, the result of correlation coefficient test shows that financial scale is not related to financial efficiency. Therefore, it can be considered that there is no chain intermediary transmission path of UR → FS ⇔ FE → CE, and there may be a parallel mediating effect path.

Referring to the research results of Liu and Tang (2013) and Van den Bossche (2011), we set a state space–parallel mediating effect model, and an unknown parallel mediating effect needs four measurement equations, so we construct four corresponding state space models in Formula (9) to (12).

State space model 1:

State space model 2:

State space model 3:

State space model 4:

Among them, SV1 is the total effect of UR on CE, SV4 is the direct effect of UR on CE, SV2*SV5 and SV3*SV6 represent the individual mediating effects of FS and FE, respectively. On the premise of all variables are integrated of first order and each state space model has a long-term stable equilibrium relationship, the regression results are shown in Table 7. Firstly, the overall mediating effect of the model is 10.0023 at the 1% level of significance; urbanization has a significant positive effect on carbon emissions. Secondly, the individual mediating effects of FS and FE are − 4.9635 and − 0.2109, respectively, indicating that both financial scale and financial efficiency can reduce carbon emissions through partial mediating effects. Thirdly, according to the formula of mediating effect/(mediating effect + direct effect), we calculate that the mediating effects of financial scale and financial efficiency account for 24.39% and 1.05% of the total effects, respectively. This is, the partial mediating effect of financial scale is far greater than financial efficiency, but the mediating effect is not the main path of urbanization to affect carbon emissions. In conclusion, the development of urbanization will increase urban carbon emissions, both financial scale and financial efficiency can alleviate the adverse effect of urbanization on carbon emissions, but compared with financial efficiency, the emission reduction benefits of financial scale are stronger and more direct. The specific parallel mediating effect path is shown in Fig. 4.

Conclusions and policy implications

The main objective of the present paper is to research the impact of financial scale, financial efficiency, and urbanization on carbon emissions in the Yangtze River Delta region including Jiangsu, Shanghai, and Zhejiang province during 1993 to 2015 by using state space model and mediating effect model. Some findings and policy implications can be drawn from this work.

Firstly, the time-varying effect of financial scale shows that the development of financial scale has a positive impact on carbon emissions in the short term. Therefore, weakening the scale effect of financial industry and realizing the coordinated development of financial industry among regions is an important way to reduce carbon emissions, based on the various resource endowments, developing regional and sectoral potential for energy cooperation, energy saving, and CO2 emissions reduction (Zhang et al. 2018). In this respect, the government should formulate a strategy of regional coordinated development while continuing to encourage the inflow of high-end financial resources, to achieve the relative coordinated development of financial resources, and to avoid the waste of resources caused by the excessive concentration of financial scale (Wang et al. 2018b). Moreover, we also should strengthen the management of financial enterprises and transfer the financial enterprises with high energy consumption. On the other hand, there is a significant negative effect of financial scale on carbon emissions in the long run, so it is possible to achieve the goal of energy saving and emission reduction by developing the structural effect of financial scale in the Yangtze River Delta. This requires standardizing the direction of financial scale expansion, strengthening the management of the flow of commercial bank loans, and making capital flow to new energy saving enterprises. The government should also promote the communication and cooperation between the financial industry and the secondary industry to promote the upgrading of the industrial structure.

Secondly, the raise of financial efficiency will increase carbon emissions. In order to achieve energy saving and emission reduction, the financial industry needs to form the awareness of energy saving and environmental protection, and develop green finance. Meanwhile, financial institutions need to strengthen financial innovation, develop technological effects. Specifically, financial institutions can reduce the occupation of financial business on the number of labor by strengthening staff training and introducing high-quality talents, and ultimately achieve energy saving and emission reduction through the indirect way of improving the employees’ quality and efficiency and the direct way of perfecting the layout of physical network and improving the operating efficiency of machine and equipment. In addition, financial institutions should constantly innovate green financial products, encourage enterprises to decrease carbon emissions by reducing loan interest rate or conditions, strengthening financial support for technological enterprises, and reducing energy consumption of unit output value of enterprises by technological progress (Zhou et al. 2018).

Thirdly, urbanization has a positive impact on carbon emissions and the impact is gradually increasing with time in the Yangtze River Delta region. The realization of energy saving and emission reduction in this region needs to enhance the awareness of environmental protection of urban residents by the implementation of stage pricing method of electric power and the establishment of community environmental protection publicity column. Furthermore, it is necessary to accelerate the upgrading of urban industrial structure, encourage the development of tertiary industries such as financial services.

Notes

Siphon effect is a physical term originally, referring to liquid water will flow from the side of high pressure to the side of low pressure because of the existence of siphon effect. Using this physical principle to explain economic phenomenon. In this case, a large number of enterprises tend to invest and set up factories in economically advanced areas, and talents and capital are siphoned to cities with rapid financial development.

References

Abbasi F, Riaz K (2016) CO2 emissions and financial development in an emerging economy: an augmented VAR approach. Energy Policy 90:102–114. https://doi.org/10.1016/j.enpol.2015.12.017

Acaravci A, Ozturk I (2010) On the relationship between energy consumption, CO2 emissions and economic growth in Europe. Energy 35(12):5412–5420. https://doi.org/10.1016/j.energy.2010.07.009

Adom PK, Kwakwa PA, Amankwaa A (2018) The long-run effects of economic, demographic, and political indices on actual and potential CO2 emissions. J Environ Manag 218:516–526. https://doi.org/10.1016/j.jenvman.2018.04.090

Akaike H (1970) Statistical predictor identification. Ann Inst Stat Math 22:203–217

Al-Mulali U, Tang CF, Ozturk I (2015) Does financial development reduce environmental degradation? Evidence from a panel study of 129 countries. Environ Sci Pollut Res 22(19):14891–14900. https://doi.org/10.1007/s11356-015-4726-x

Asumadu-Sarkodie S, Owusu PA (2017) A multivariate analysis of carbon dioxide emissions, electricity consumption, economic growth, financial development, industrialization, and urbanization in Senegal. Energy Sources Part B 12(1):77–84. https://doi.org/10.1080/15567249.2016.1227886

Bekhet HA, Othman NS (2017) Impact of urbanization growth on Malaysia CO2 emissions: evidence from the dynamic relationship. J Clean Prod 154:374–388. https://doi.org/10.1016/j.jclepro.2017.03.174

Boutabba MA (2014) The impact of financial development, income, energy and trade on carbon emissions: evidence from the Indian economy. Econ Model 40:33–41. https://doi.org/10.1016/j.econmod.2014.03.005

Cao WB, Wang H, Ying HH (2017) The effect of environmental regulation on employment in resource-based areas of China—an empirical research based on the mediating effect model. Int J Environ Res Public Health 14(12). https://doi.org/10.3390/ijerph14121598

Cetin M, Ecevit E, Yucel AG (2018) The impact of economic growth, energy consumption, trade openness, and financial development on carbon emissions: empirical evidence from Turkey. Environ Sci Pollut Res 25(36):36589–36603. https://doi.org/10.1007/s11356-018-3526-5

Charfeddine L, Ben Khediri K (2016) Financial development and environmental quality in UAE: cointegration with structural breaks. Renew Sust Energ Rev 55:1322–1335. https://doi.org/10.1016/j.rser.2015.07.059

Chen H, Jia B, Lau SSY (2008) Sustainable urban form for Chinese compact cities: challenges of a rapid urbanized economy. Habitat Int 32:28–40. https://doi.org/10.1016/j.habitatint.2007.06.005

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with unit root. J Am Stat Assoc 74:427–431

Dogan E, Seker F (2016) The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renew Sust Energ Rev 60:1074–1085. https://doi.org/10.1016/j.rser.2016.02.006

Fan JL, Zhang YJ, Wang B (2017) The impact of urbanization on residential energy consumption in China: an aggregated and disaggregated analysis. Renew Sust Energ Rev 75:220–223. https://doi.org/10.1016/j.rser.2016.10.066

Fang CL (2014) Progress and the future direction of research into urban agglomeration in China. Acta Geograph Sin 69(8):1130–1144. https://doi.org/10.11821/dlxb201408009 (in Chinese)

Farhani S, Ozturk I (2015) Causal relationship between CO2 emissions, real GDP, energy consumption, financial development, trade openness, and urbanization in Tunisia. Environ Sci Pollut Res 22(20):15663–15676. https://doi.org/10.1007/s11356-015-4767-1

Frankel J, Romer D (1999) Does trade cause growth? Am Econ Rev 89(3):379–399. https://doi.org/10.1257/aer.89.3.379

Ghosh S (2010) Examining carbon emissions-economic growth nexus for India: a multivariate co-integration approach. Energy Policy 38:2613–3130. https://doi.org/10.1016/j.enpol.2010.01.040

Guo J, Zhang YJ, Zhang KB (2018) The key sectors for energy conservation and carbon emissions reduction in China: evidence from the input-output method. J Clean Prod 179:180–190. https://doi.org/10.1016/j.jclepro.2018.01.080

Haseeb A, Xia EJ, Danish et al (2018) Financial development, globalization, and CO2 emission in the presence of EKC: evidence from BRICS countries. Environ Sci Pollut Res 25(31):31283–31296. https://doi.org/10.1007/s11356-018-3034-7

Huang LY, Zhao XL (2018) Impact of financial development on trade-embodied carbon dioxide emissions: evidence from 30 provinces in China. J Clean Prod 198:721–736. https://doi.org/10.1016/j.jclepro.2018.07.021

IPCC, 2006. 2006 IPCC guidelines for national greenhouse gas inventories

Jalil A, Feridun M (2011) The impact of growth, energy and financial development on the environment in China: a co-integration analysis. Energy Econ 33(2):284–291. https://doi.org/10.1016/j.eneco.2010.10.003

Jia PR, Li K, Shao S (2018) Choice of technological change for China’s low-carbon development: evidence from three urban agglomerations. J Environ Manag 206:1308–1319. https://doi.org/10.1016/j.jenvman.2017.08.052

Jian XH, Huang K (2010) Empirical analysis and forecast of the level and speed of urbanization in China. Economic Research Journal 3:28–39 (in Chinese)

Johansen S, Juselius K (1990) Maximum likelihood estimation and inferences on cointegration with applications to the demand for money. Oxf Bull Econ Stat 52:169–210

Kong Y, Wei F (2017) Financial development, financial structure and carbon emission. Environ Eng Manag J 16(7):1609–1622

Li J, Huang X, Kwan MP, Yang H, Chuai X (2018) The effect of urbanization on carbon dioxide emissions efficiency in the Yangtze River Delta, China. J Clean Prod 188:38–48. https://doi.org/10.1016/j.jclepro.2018.03.198

Liddle B (2004) Demographic dynamics and per capita environmental impact: using panel regressions and household decompositions to examine population and transport. Popul Environ 26:23–39

Liu C, Tang CY (2013) A state space model approach to integrated covariance matrix estimation with high frequency data. Stat Interface 6:463–475. https://doi.org/10.4310/SII.2013.v6.n4.a5

Ma XR, Ge JP, Wang W (2017) The relationship between urbanization, income growth and carbon dioxide emissions and the policy implications for China: a cointegrated vector error correction (VEC) analysis. Nat Hazards 87(2):1017–1033. https://doi.org/10.1007/s11069-017-2807-5

Mackinnon DP, Lockwood CM, Hoffman JM, West SG, Sheets V (2002) A comparison of methods to test mediation and other intervening variables effects. Psychol Methods 7(1):83–104. https://doi.org/10.1037/1082-989X.7.1.83

Ozturk I, Acaravci A (2013) The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ 36:262–267. https://doi.org/10.1016/j.eneco.2012.08.025

Pata UK (2018) Renewable energy consumption, urbanization, financial development, income and CO2 emissions in Turkey: testing EKC hypothesis with structural breaks. J Clean Prod 187:770–779. https://doi.org/10.1016/j.jclepro.2018.03.236

Poumanyvong P, Kaneko S (2010) Does urbanization lead to less energy use and lower CO2 emissions? A cross-country analysis. Ecol Econ 70:434–444. https://doi.org/10.1016/j.ecolecon.2010.09.029

Saidi K, Ben Mbarek M (2017) The impact of income, trade, urbanization, and financial development on CO2 emissions in 19 emerging economies. Environ Sci Pollut Res 24(14):12748–12757. https://doi.org/10.1007/s11356-016-6303-3

Salahuddin M, Gow J, Ozturk I (2015) Is the long-run relationship between economic growth, electricity consumption, carbon dioxide emissions and financial development in Gulf Cooperation Council Countries robust? Renew Sust Energ Rev 51:317–326. https://doi.org/10.1016/j.rser.2015.06.005

Salahuddin M, Alam K, Ozturk I, Sohag K (2018) The effects of electricity consumption, economic growth, financial development and foreign direct investment on CO2 emissions in Kuwait. Renew Sust Energ Rev 81:2002–2010. https://doi.org/10.1016/j.rser.2017.06.009

Satterthwaite D (2009) The implications of population growth and urbanization for climate change. Environ Urban 21(2):545–567. https://doi.org/10.1177/0956247809344361

Schwarz G (1976) Estimating the dimension of a model. Ann Stat 6(2):461–464

Shahbaz M, Hye QMA, Tiwari AK, Leitao NC (2013a) Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew Sust Energ Rev 25:109–121. https://doi.org/10.1016/j.rser.2013.04.009

Shahbaz M, Kumar Tiwari A, Nasir M (2013b) The effects of financial development, economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Policy 61:1452–1459. https://doi.org/10.1016/j.enpol.2013.07.006

Shahbaz M, Loganathan N, Muzaffar AT, Ahmed K, Ali Jabran M (2016) How urbanization affects CO2 emissions in Malaysia? The application of STIRPAT model. Renew Sust Energ Rev 57:83–93. https://doi.org/10.1016/j.rser.2015.12.096

Van den Bossche FAM (2011) Fitting state space models with EViews. J Stat Softw 41(8):1–16

Wang Y, Li L, Kubota J, Han R, Zhu XD, Lu GF (2016) Does urbanization lead to more carbon emission? Evidence from a panel of BRICS countries. Appl Energy 168:375–380. https://doi.org/10.1016/j.apenergy.2016.01.105

Wang QW, Hang Y, Hu JL, Chiu CR (2018a) An alternative metafrontier framework for measuring the heterogeneity of technology. Nav Res Logist 65(5):427–445. https://doi.org/10.1002/nav.21815

Wang QW, Hang Y, Su B, Zhou P (2018b) Contributions to sector-level carbon intensity change: an integrated decomposition analysis. Energy Econ 70:12–25. https://doi.org/10.1016/j.eneco.2017.12.014

Wang SJ, Zeng JY, Huang YY, Shi CY, Zhan PY (2018c) The effects of urbanization on CO2 emissions in the Pearl River Delta: a comprehensive assessment and panel data analysis. Appl Energy 228:1693–1706. https://doi.org/10.1016/j.apenergy.2018.06.155

Wu YZ, Shen JH, Zhang XL, Skitmore M, Lu WS (2016) The impact of urbanization on carbon emissions in developing countries: a Chinese study based on the U-Kaya method. J Clean Prod 135:589–603. https://doi.org/10.1016/j.jclepro.2016.06.121

Xu Q, Dong YX, Yang R (2018) Urbanization impact on carbon emissions in the Pearl River Delta region: Kuznets curve relationships. J Clean Prod 180:514–523. https://doi.org/10.1016/j.jclepro.2018.01.194

Yao XL, Kou D, Shao S, Li XY, Wang WX, Zhang CT (2018) Can urbanization process and carbon emission abatement be harmonious? New evidence from China. Environ Impact Assess Rev 71:70–83. https://doi.org/10.1016/j.eiar.2018.04.005

Ye CH, Sun CW, Chen LT (2018) New evidence for the impact of financial agglomeration on urbanization from a spatial econometrics analysis. J Clean Prod 200:65–73. https://doi.org/10.1016/j.jclepro.2018.07.253

Zhang YJ (2011) The impact of financial development on carbon emissions: an empirical analysis in China. Energy Policy 39(4):2197–2203. https://doi.org/10.1016/j.enpol.2011.02.026

Zhang WJ, Xu HZ (2017) Effects of land urbanization and land finance on carbon emissions: a panel data analysis for Chinese provinces. Land Use Policy 63:493–500. https://doi.org/10.1016/j.landusepol.2017.02.006

Zhang CS, Zhu YT, Lu Z (2015) Trade openness, financial openness, and financial development in China. J Int Money Financ 59:287–309. https://doi.org/10.1016/j.jimonfin.2015.07.010

Zhang TF, Yang J, Sheng PF (2016) The impacts and channels of urbanization on carbon dioxide emissions in China. China Popul Resour Environ 26(2):47–57. https://doi.org/10.3969/j.issn.1002-2104.2016.02.007 (in Chinese)

Zhang N, Yu KR, Chen ZF (2017) How does urbanization affect carbon dioxide emissions? A cross-country panel data analysis. Energy Policy 107:678–687. https://doi.org/10.1016/j.enpol.2017.03.072

Zhang YJ, Jin YL, Shen B (2018) Measuring the energy saving and CO2 emissions reduction potential under China’s belt and road initiative. Comput Econ, in press. https://doi.org/10.1007/s10614-018-9839-0

Zhou DQ, Zhou XY, Xu Q, Wu F, Wang QW, Zha DL (2018) Regional embodied carbon emissions and their transfer characteristics in China. Struct Chang Econ Dyn 46:180–193. https://doi.org/10.1016/j.strueco.2018.05.008

Funding

This study was supported by the National Natural Science Foundation of China (Grant No. 71673270; No. 71403268), and China Scholarship Council Project (Grant No. 201806425016).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Responsible editor: Philippe Garrigues

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Wang, F., Fan, W., Chen, C. et al. The dynamic time-varying effects of financial development, urbanization on carbon emissions in the Yangtze River Delta, China. Environ Sci Pollut Res 26, 14226–14237 (2019). https://doi.org/10.1007/s11356-019-04764-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-019-04764-4